Attached files

| file | filename |

|---|---|

| 10-K - ANNUAL REPORT ON FORM 10K FOR THE YEAR ENDED DECEMBER 31, 2014 - HII Technologies, Inc. | hiit2014annualreportonform10.htm |

| EX-21 - SUBSIDIARIES - HII Technologies, Inc. | exhibit21hii10k.htm |

| EX-23 - CONSENT OF MALONEBAILEYLLP - HII Technologies, Inc. | exhibit23hii10k.htm |

| EX-32 - 906 CERTIFICATION - HII Technologies, Inc. | ex32.htm |

| EX-31 - 302 CERTIFICATION OF THE CEO - HII Technologies, Inc. | ex311.htm |

| EX-31 - 302 CERTIFICATION OF THE CFO - HII Technologies, Inc. | ex312.htm |

| EX-10 - EMPLOYMENT AGREEMENT WITH ACIE PALMER - HII Technologies, Inc. | exhbit1045hiiemploymentapalm.htm |

| EX-10 - SALE AGREEMENT WITH HYDROFLOW HOLDINGS USA - HII Technologies, Inc. | exhibit1046distributoragreem.htm |

SECOND MODIFICATION AGREEMENT

This Second Modification Agreement (this “Amendment”) is dated effective as of October ___, 2014, by and among HII TECHNOLOGIES, INC., a Delaware corporation (“HII”), APACHE ENERGY SERVICES, LLC, a Nevada limited liability company (“Apache Energy Services”), AQUA HANDLING OF TEXAS, LLC, a Texas limited liability company (“Aqua Handling”), HAMILTON INVESTMENT GROUP, an Oklahoma corporation (“HIG”), KMHVC, INC., a Texas corporation (“KMHVC”; and with HII, Apache Energy Services, Aqua Handling and HIG, the “Borrower”), HEARTLAND BANK, an Arkansas state bank, as administrative agent (in such capacity, “Agent”) on behalf of the Lenders (as defined in the Credit Agreement).

W I T N E S S E T H:

WHEREAS, pursuant to that certain Credit Agreement (Term Loan) dated August 12, 2014 (as the same may have been or may hereafter be modified, renewed or amended, the “Credit Agreement”), Lender has made a term loan to Borrower in the amount of $12,000,000 (the “Term Loan”);

WHEREAS, defined terms used but not otherwise defined herein shall have the meanings ascribed to such terms in the Credit Agreement;

WHEREAS, the Term Loan is secured, in part, by those certain Security Agreements executed by each Borrower in favor of Agent, for the benefit of the Lenders (the “Security Agreement”);

WHEREAS, Borrower has requested that Lenders (a) consent to the sale of certain Collateral (the “Permitted Sale”) more particularly described in, and pursuant to the terms of, that certain [Asset Purchase Agreement] in the form attached hereto as Exhibit A (the “Purchase Agreement”), and (b) amend and restate Schedule 8.19 of the Credit Agreement regarding approved Capital Expenditures; and

WHEREAS, the Lenders have agreed to the foregoing, subject to the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the premises and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Borrower, Agent and Lenders hereby agree as follows:

ARTICLE I

CONSENT AND AMENDMENT

Section 1.01.

Permitted Sale. Subject to the terms hereof, Agent, with the consent of the Majority Lenders, hereby consents to the Permitted Sale and agrees that, upon the consummation of the Permitted Sale, to release, at Borrower’s sole cost and expense, Agent’s security interest in and to the assets set forth in the Purchase Agreement; provided, that at the time of the Permitted Sale, no Event of Default has occurred and is continuing or would exist after giving effect to the Permitted Sale.

Section 1.02.

Amendment to Schedule 8.19. Schedule 8.19 to the Credit Agreement is hereby deleted and replaced in its entirety with the form of Schedule 8.19 attached hereto as Exhibit B. For the sake of clarity, Borrower acknowledges and agrees that, notwithstanding the amendment and restatement of Schedule 8.19, pursuant to the terms Section 8.19(c) of the Credit Agreement, Borrower is prohibited from making any Capital Expenditure payment if a Default or Event of Default is occurring or would

SECOND MODIFICATION AGREEMENT (HII Technologies – Credit Agreement)

Page 1

result from such payment, including, but not limited to, under the Fixed Charge Coverage Ratio set forth in Section 8.19(a) of the Credit Agreement.

ARTICLE II

GENERAL PROVISIONS

Section 2.01.

Closing Conditions. As conditions precedent to the effectiveness of this Amendment, all of the following shall have been satisfied:

(a)

Borrower shall have executed and delivered to Agent this Amendment; and

(b)

Agent shall have received all resolutions, certificates or other documents as Agent may request relating to the formation, existence and good standing of Borrower, corporate authority for the execution and validity of this Amendment, and all other documents, instruments and agreements and any other matters relevant hereto or thereto, all in form and substance satisfactory to Agent.

Section 2.02.

Payment of Expenses. Borrower agrees to provide to Agent, upon demand, the reasonable attorneys’ fees and expenses of Agent’s counsel and other reasonable expenses incurred by Agent in connection with this Amendment in the amount of $1,000.

Section 2.03.

Ratification. Borrower hereby ratifies its Obligations and each of the Transaction Documents to which it is a party, and agrees and acknowledges that the Credit Agreement and each of the other Transaction Documents to which it is a party shall continue in full force and effect after giving effect to this Amendment. Nothing in this Amendment extinguishes, novates or releases any right, claim, Lien, security interest or entitlement of Lenders created by or contained in any of such documents nor is Borrower released from any covenant, warranty or obligation created by or contained therein except as specifically provided for herein.

Section 2.04.

No Defenses. Borrower hereby declares, as of the date hereof, it has no set-offs, counterclaims, defenses or other causes of action against Agent or Lenders arising out of the Facility, this Amendment or by any documents mentioned herein or otherwise; and, to the extent any such setoffs, counterclaims, defenses or other causes of action may exist, whether known or unknown, such items are hereby waived by Borrower.

Section 2.05.

Nonwaiver of Events of Default. Neither this Amendment nor any other document executed in connection herewith constitutes or shall be deemed (a) a waiver of, or consent by Lenders to, any default or event of default which may exist or hereafter occur under any of the Transaction Documents, (b) a waiver by Lenders of any of Borrower’s obligations under the Transaction Documents except as specifically provided for herein, or (c) a waiver by Lenders of any rights, offsets, claims, or other causes of action that Lenders may have against Borrower.

Section 2.06.

Further Assurances. The parties hereto shall execute such other documents as may be reasonably necessary or as may be reasonably required, in the opinion of counsel to Agent, to effect the transactions contemplated hereby and to protect the liens and security interests of Lenders under the Transaction Documents, the insurance thereof and the liens and/or security interests of all other collateral instruments, all as modified by this Amendment. Borrower also agrees to provide to Agent such other documents and instruments as Agent reasonably may request in connection with the modification of the Facility effected hereby.

SECOND MODIFICATION AGREEMENT (HII Technologies – Credit Agreement)

Page 2

Section 2.07.

Binding Agreement. This Amendment shall be binding upon, and shall inure to the benefit of, the parties hereto and their respective heirs, representatives, successors and assigns.

Section 2.08.

Severability. Borrower, Agent and Lenders intend and believe that each provision in this Amendment comports with all applicable local, state or federal laws and judicial decisions. However, if any provision or provisions, or if any portion of any provision or provisions, in this Amendment is found by a court of law to be in violation of any applicable local, state or federal ordinance, statute, law, administrative or judicial decision or public policy, and if such court should declare such portion, provision or provisions of this Amendment to be illegal, invalid, unlawful, void or unenforceable as written, then it is the intent of Borrower, Agent and Lenders that such portion, provision or provisions shall be given force to the fullest possible extent that they are legal, valid and enforceable, that the remainder of this Amendment shall be construed as if such illegal, invalid, unlawful, void or unenforceable portion, provision or provisions were not contained herein and that the rights, obligations and interests of Borrower, Agent and Lenders under the remainder of this Amendment shall continue in full force and effect.

Section 2.09.

Counterparts. For the convenience of the parties, this Amendment may be executed in multiple counterparts, each of which for all purposes shall be deemed to be an original, and all such counterparts shall together constitute but one and the same agreement. Delivery of an executed counterpart of a signature page of this Amendment by telecopy, e-mail, facsimile or other electronic means shall be effective as a delivery of a manually executed counterpart of this Amendment.

Section 2.10.

Choice of Law. THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK AND APPLICABLE UNITED STATES FEDERAL LAW.

Section 2.11.

ENTIRE AGREEMENT. THIS AMENDMENT CONSTITUTES THE ENTIRE AGREEMENT BETWEEN THE PARTIES HERETO WITH RESPECT TO THE SUBJECT HEREOF. FURTHERMORE, IN THIS REGARD, THIS AMENDMENT AND THE OTHER WRITTEN TRANSACTION DOCUMENTS REPRESENT, COLLECTIVELY, THE FINAL AGREEMENT AMONG THE PARTIES THERETO AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS, OR SUBSEQUENT ORAL AGREEMENTS OF SUCH PARTIES.

THERE ARE NO UNWRITTEN ORAL AGREEMENTS AMONG SUCH PARTIES.

SECOND MODIFICATION AGREEMENT (HII Technologies – Credit Agreement)

Page 3

IN WITNESS WHEREOF, this Amendment is executed effective as of the date first written above.

BORROWER:

HII TECHNOLOGIES, INC.,

a Delaware corporation

/s/ Matthew C. Flemming

By:

Matthew C. Flemming

Chief Executive Officer

APACHE ENERGY SERVICES, LLC,

a Nevada limited liability company

/s/ Matthew C. Flemming

By:

Matthew C. Flemming

Chief Executive Officer

AQUA HANDLING OF TEXAS, LLC,

a Texas limited liability company

/s/ Matthew C. Flemming

By:

Matthew C. Flemming

Chief Executive Officer

HAMILTON INVESTMENT GROUP,

an Oklahoma corporation

/s/ Matthew C. Flemming

By:

Matthew C. Flemming

Chief Executive Officer

KMHVC, INC.,

a Texas corporation

/s/ Matthew C. Flemming

By:

Matthew C. Flemming

Chief Executive Officer

[SIGNATURES CONTINUE ON FOLLOWING PAGE]

SECOND MODIFICATION AGREEMENT (HII Technologies – Credit Agreement)

Page 4

AGENT:

HEARTLAND BANK,

an Arkansas state bank

/s/ Phil Thomas

By:

Phil Thomas, Executive Vice President

[END OF SIGNATURE PAGE]

SECOND MODIFICATION AGREEMENT (HII Technologies – Credit Agreement)

Page 5

EXHIBIT A

Form of Asset Purchase Agreement

[See Attached}

SECOND MODIFICATION AGREEMENT (HII Technologies – Credit Agreement)

Page 6

SECOND MODIFICATION AGREEMENT (HII Technologies – Credit Agreement) Page 7

SECOND MODIFICATION AGREEMENT (HII Technologies – Credit Agreement) Page 8

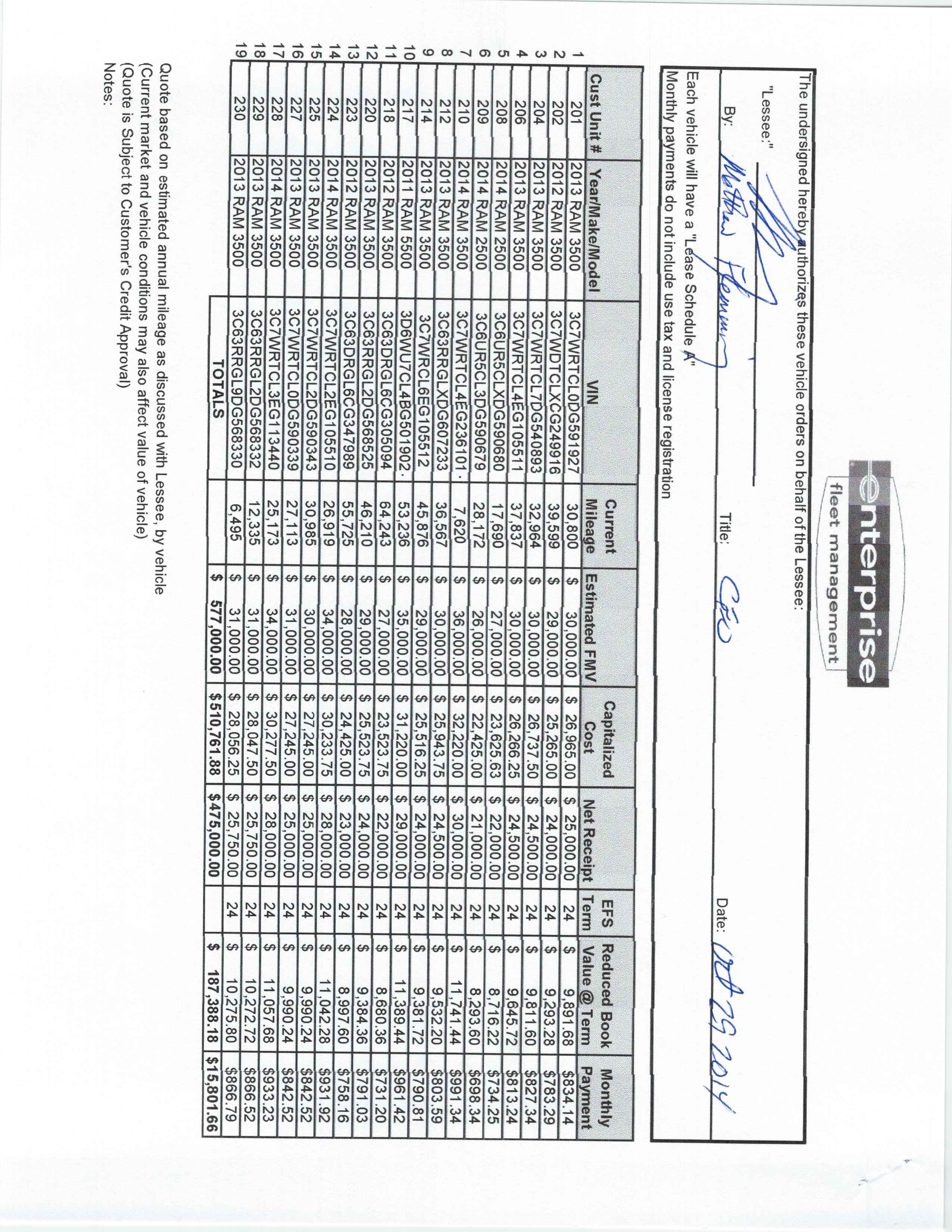

EXHIBIT B

Schedule 8.19 – Capital Expenditures

SECOND MODIFICATION AGREEMENT (HII Technologies – Credit Agreement)

Page 9

SCHEDULE 8.19

Capital Expenditures

In August 2014, HII Technologies, Inc. entered into a side letter agreement with S&M Assets to purchase the equipment/trucks listed below for an aggregate purchase price of $1,516,000 by August 12, 2015:

a. 13 ½ miles of 10” and 12” layflat and aluminum hose valued at $1,516,100.

Equipment Lease with Nations Fund I, LLC for equipment with an invoice cost of $1,099,212.88 resulting of 36-monthtly base lease payments of $30,228.35.

11447289v.3

SECOND MODIFICATION AGREEMENT (HII Technologies – Credit Agreement)

Page 10