Attached files

| file | filename |

|---|---|

| EX-32 - CERTIFICATION - Propel Media, Inc. | f10k2014ex32_propelmedia.htm |

| EX-4.1 - SPECIMEN COMMON STOCK CERTIFICATE. - Propel Media, Inc. | f10k2014ex4i_propelmedia.htm |

| EX-10.11 - STOCK OPTION AGREEMENT - Propel Media, Inc. | f10k2014ex10xi_propelmedia.htm |

| EX-31.2 - CERTIFICATION - Propel Media, Inc. | f10k2014ex31ii_propelmedia.htm |

| EX-10.19 - EMPLOYMENT AGREEMENT - Propel Media, Inc. | f10k2014ex10xix_propelmedia.htm |

| EX-10.21 - EMPLOYMENT AGREEMENT - Propel Media, Inc. | f10k2014ex10xxi_propelmedia.htm |

| EX-10.18 - EMPLOYMENT AGREEMENT - Propel Media, Inc. | f10k2014ex10xviii_propelmedi.htm |

| EX-21 - SUBSIDIARIES OF THE REGISTRANT - Propel Media, Inc. | f10k2014ex21_propelmedia.htm |

| EX-14.1 - FORM OF CODE OF ETHICS - Propel Media, Inc. | f10k2014ex14i_propelmedia.htm |

| EX-31.1 - CERTIFICATION - Propel Media, Inc. | f10k2014ex31i_propelmedia.htm |

| EX-10.20 - EMPLOYMENT AGREEMENT - Propel Media, Inc. | f10k2014ex10xx_propelmedia.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to ______________

Commission File Number 000-55360

PROPEL MEDIA, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 47-2133177 | |

| (State

or Other Jurisdiction of Incorporation or Organization) |

(I.R.S.

Employer |

525 Washington Blvd., Suite 2620 Jersey City, New Jersey |

07310 | |

| (Address of Principal Executive Offices) | (Zip Code) |

(201) 539-2200

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $.0001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirement for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☐ No ☐

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| (Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2014, the aggregate market value of the common stock held by non-affiliates of the registrant was $0.

As of April 10, 2015, there were 250,010,162 shares of common stock, $.0001 par value per share, outstanding.

Documents Incorporated by Reference: The section entitled “Risk Factors” contained in the registrant’s prospectus filed on January 23, 2015 pursuant to Rule 424(b)(3) (SEC File No. 333-199892) is incorporated into Part 1, Item 1A.

PROPEL MEDIA, INC.

FORM 10-K

TABLE OF CONTENTS

FORWARD LOOKING STATEMENTS AND INTRODUCTION

All statements other than statements of historical fact included in this Annual Report on Form 10-K (this “Form 10-K”) including, without limitation, statements under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” regarding our financial position, business strategy and the plans and objectives of management for future operations, are forward looking statements. When used in this Form 10-K, words such as “anticipate,” “believe,” “estimate,” “expect,” “intend” and similar expressions, as they relate to us or our management, identify forward looking statements. Such forward looking statements are based on the beliefs of management, as well as assumptions made by, and information currently available to, our management. Actual results could differ materially from those contemplated by the forward looking statements as a result of certain factors detailed in our filings with the Securities and Exchange Commission. All subsequent written or oral forward looking statements attributable to us or persons acting on our behalf are qualified in their entirety by this paragraph.

In assessing forward-looking statements contained herein, readers are urged to carefully read those statements. Among the factors that could cause actual results to differ materially are: inability to protect our intellectual property; inability to comply with the covenants in our credit facility; inability to obtain necessary financing; inability to effectively manage our growth; failure to effectively integrate the operations of acquired businesses; competition; loss of key personnel; increases of costs of operations; continued compliance with government regulations; and general economic conditions.

Unless the context otherwise requires:

| ● | references to “Propel,” “New Holdco” or the “Company” and to “we,” “us” or “our” are to Propel Media, Inc., formerly known as Kitara Holdco Corp., a Delaware corporation, and its subsidiaries; |

| ● | references to “Kitara” are to Kitara Media Corp., a Delaware corporation that became a wholly owned subsidiary of the Company on January 28, 2015, and its subsidiaries; |

| ● | references to “Kitara Media” are to Kitara Media, LLC, a Delaware limited liability company that is a wholly owned subsidiary of Kitara; |

| ● | references to “NYPG” are to New York Publishing Group, Inc., a Delaware corporation that is a wholly owned subsidiary of Kitara; |

| ● | references to “Health Guru Media” are to Health Guru Media, Inc., a Delaware corporation that is a wholly owned subsidiary of Kitara; and |

| ● | references to “Future Ads” are to Future Ads LLC, a California limited liability company that became a wholly owned subsidiary of the Company on January 28, 2015. |

| 1 |

| ITEM 1. | BUSINESS. |

Propel is a Delaware corporation formed for the purpose of being a holding company of both Future Ads and Kitara from and after completion of the Transactions (as defined below). Prior to the completion of the Transactions on January 28, 2015, Propel had no assets and had not conducted any material activities other than those incidental to its formation. However, upon the consummation of the Transactions, Propel became the parent company of Future Ads and Kitara.

Propel's principal executive office is located at 525 Washington Blvd, Suite 2620, Jersey City, New Jersey 07310 (telephone number: (201) 539-2200).

On February 4, 2015, Propel’s common stock began trading on the Over-the-Counter Bulletin Board (“OTCBB”) under the trading symbol “PROM”.

The Transactions with Future Ads and Kitara

On January 28, 2015, Propel consummated the transactions (the “Transactions”) contemplated by (i) the Agreement and Plan of Reorganization (the “Merger Agreement”), dated as of October 10, 2014, by and among Kitara, Propel, which was previously a wholly-owned subsidiary of Kitara, and Kitara Merger Sub, Inc. (“Merger Sub”), which was previously a wholly-owned subsidiary of Propel, and (ii) the Unit Exchange Agreement (the “Exchange Agreement”), dated as of October 10, 2014 and amended as of December 23, 2014, by and among Kitara, Propel, Future Ads and the former members of Future Ads (the “Members”). Upon the closing of the Transactions, Propel became the new public company and Kitara and Future Ads became wholly-owned subsidiaries of Propel.

The Transactions have been treated as a reverse merger under the purchase method of accounting in accordance with United States Generally Accepted Accounting Principles (“GAAP”). For accounting purposes, Future Ads is considered to have acquired Kitara in the Transactions. Under the purchase method of accounting, the assets and liabilities of Kitara have been recorded at their respective fair values and added to those of Future Ads in our financial statements.Pursuant to the Merger Agreement, Merger Sub merged with and into Kitara (the “Merger”), with Kitara surviving the merger as a wholly-owned subsidiary of Propel. In the Merger, each outstanding share of Kitara common stock was converted into one share of Propel common stock.

In addition, Propel assumed Kitara’s existing 2012 Long-Term Incentive Equity Plan (the “2012 Plan”) and its 2013 Long-Term Incentive Equity Plan (the “2013 Plan”), and all outstanding stock options thereunder. However, Propel has amended the plans so that no further awards may be issued thereunder. Propel also assumed the other outstanding options and warrants of Kitara, in each case in accordance with the terms of the respective securities.

Immediately following the Merger and as part of a single integrated transaction, pursuant to the Exchange Agreement, the Members exchanged all of the outstanding Future Ads limited liability company interests for (i) $80,000,000 in cash, (ii) 154,125,921 shares of Propel common stock, (iii) the right to receive performance-based “earn out” payments that will enable the Members to receive up to an additional $40,000,000 in cash or stock consideration based on Future Ads reaching certain EBITDA levels during the 2015 to 2018 fiscal years, (iv) on or prior to June 30, 2016, $10,000,000 in cash and/or shares of Propel common stock, and (v) immediately after the payment of certain fees to Highbridge (as defined below) on or about the fourth anniversary of the closing, $6,000,000 in cash (the “Exchange”). The consideration payable to the Members is subject to a post-closing adjustment based on the working capital and indebtedness of Future Ads and the working capital of Kitara.

| 2 |

Furthermore, Propel has reimbursed the members for all transaction expenses paid by Future Ads, its subsidiaries or the Members on or before the consummation of the Transactions, and has assumed all of their unpaid transaction expenses as of such date. Propel estimates that the aggregate transaction expenses reimbursed or assumed by it were approximately $1.0 million.

As a result of the Transactions, the Members own 154,125,921 shares of Propel common stock, representing approximately 61.7% of Propel’s outstanding common stock, and the former stockholders of Kitara own the remaining 95,884,241 shares of Propel common stock, representing approximately 38.3% of Propel’s outstanding common stock.

Subsidiaries of Propel Media, Inc.

Future Ads

Future Ads is a diversified online advertising company. Future Ads generates revenues through the sale of advertising to advertisers who want to reach consumers in the United States and internationally to promote their products and services. Future Ads delivers advertising through its real-time, bid-based, online advertising platform called Trafficvance. This technology platform allows advertisers to target audiences and deliver text, display and video based advertising. The Future Ads business and its Trafficvance platform provide advertisers with an effective way to serve, manage and maximize the performance of their online advertising purchasing. Future Ads offers both a self-serve platform and a managed services option that give advertisers diverse solutions to reach online audiences and acquire customers. Future Ads has over 1,400 advertiser customers and serves millions of ads per day.

Future Ads LLC was formed in September 2008 as a California limited liability company. Upon completion of the Transactions (as described above), Future Ads became a wholly owned subsidiary of Propel.

Kitara

Kitara is a digital media and technology company providing video solutions to advertisers, digital publishers, and video content providers. With hundreds of millions of monthly video advertising views, Kitara delivers precise targeting and engagement for advertisers, accretive monetization and engaging video content for publishers, and expanded distribution for video content providers. Kitara’s internally developed proprietary technology platform PROPEL+ enables the automation and optimization of video advertising, video content and digital publishing spaces, while enhancing the video experience for consumers.

Kitara was formed on December 5, 2005 as a Delaware corporation under the name “Ascend Acquisition Corp.” From Kitara’s inception until February 29, 2012, it was a blank check company and did not engage in active business operations other than the search for, and evaluation of, potential business combination opportunities.

On December 30, 2011, Kitara entered into a Merger Agreement and Plan of Reorganization with Andover Games LLC (“Andover Games”) and the members of Andover Games. On February 29, 2012, pursuant to such agreement, Andover Games became a wholly-owned subsidiary of Kitara. As a result, Kitara’s business became the business of Andover Games. Andover Games’ principal business was focused on developing mobile games for iPhone and Android platforms prior to June 30, 2013.

On June 12, 2013, Kitara entered into a Merger Agreement and Plan of Reorganization, as amended on July 1, 2013, with Kitara Media, NYPG and the former holders of all of the outstanding membership interests of Kitara Media and all of the outstanding shares of common stock of NYPG. On July 1, 2013, pursuant to such agreement, Kitara Media and NYPG became wholly owned subsidiaries of Kitara. In connection with the transactions, Kitara ceased the operations of Andover Games. On July 1, 2013, Kitara’s operations became entirely those of Kitara Media and NYPG.

| 3 |

On August 19, 2013, Kitara filed with the Secretary of State of the State of Delaware an amendment to its certificate of incorporation to change its name to “Kitara Media Corp.” to better reflect its current operations.

On December 3, 2013, Kitara entered into a Merger Agreement and Plan of Reorganization with Health Guru Media and the holders of a majority of the outstanding shares of capital stock of Health Guru Media, and simultaneously consummated the transactions contemplated thereby. At the closing, Health Guru Media became Kitara’s wholly-owned subsidiary.

Upon completion of the Transactions (as described above), Kitara and Future Ads became wholly owned subsidiaries of Propel. For accounting purposes, the transactions were accounted for as a reverse business combination and recapitalization of Future Ads since the former owners of Future Ads will control the post-merger company. Future Ads will be deemed the acquirer and Kitara the acquired company for accounting purposes.

Financing Agreement and Related Agreements

On January 28, 2015, in connection with the closing of the Transactions, Propel, Kitara and Future Ads as “Borrowers” and certain of their subsidiaries as “Guarantors” entered into a financing agreement (“Financing Agreement”) with certain financial institutions as “Lenders,” Highbridge Principal Strategies, LLC (“Highbridge”), as collateral agent for the Lenders (“Collateral Agent”), and PNC Bank, National Association (“PNC”), as a Lender and administrative agent for the Lenders (“Administrative Agent”).

The Financing Agreement provided the Borrowers with (a) a term loan in the aggregate principal amount of $81,000,000 (the “Term Loan”) and (b) a revolving credit facility in an aggregate principal amount not to exceed $15,000,000 at any time outstanding (the “Revolving Loan” and, together with the Term Loan, the “Loans”). The Loans will mature on January 28, 2019 (“Final Maturity Date”).

Upon the closing of the Financing Agreement, the Term Loan was borrowed in full and $7,500,000 was made available to the Borrowers under the Revolving Loan. The proceeds of the Loans were or will be used (a) to pay off and refinance the Credit and Security Agreement (the “Wells Fargo Credit Agreement”), dated as of November 1, 2013, by and between Kitara Media Corp. and Wells Fargo Bank, National Association (“Wells Fargo”), as amended and other existing indebtedness of the Borrowers, (b) to pay fees and expenses related to the Financing Agreement, (c) to finance the cash consideration under the Exchange Agreement and (d) for general working capital purposes of the Borrowers.

The outstanding principal amount of the Term Loan shall be repayable in consecutive quarterly installments in equal amounts of $1,750,000 on the last day of each March, June, September and December commencing on March 31, 2015, except that the payment due on March 31, 2015 was $1,219,000. The remainder of the Term Loan and the Revolving Loans are due and payable on the maturity date, except in certain limited circumstances.

The Borrowers may borrow, repay and reborrow the Revolving Loan prior to the Final Maturity Date, subject to the terms, provisions and limitations set forth in the Financing Agreement. The outstanding principal amount of advances may not at any time exceed the lesser of the $15,000,000 or the borrowing base.

Subject to the terms of the Financing Agreement, the Term Loan or any portion thereof shall bear interest on the principal amount thereof from time to time outstanding, from the date of the Term Loan until repaid, at a rate per annum equal to the London Interbank Offered Rate (“LIBOR”) Rate (but not less than 1% and not more than 3%) for the interest period in effect for the Term Loan (or such portion thereof) plus 9.00%.

| 4 |

Subject to the terms of the Financing Agreement, each Revolving Loan shall bear interest on the principal amount thereof from time to time outstanding, from the date of such Loan until repaid, at a rate per annum equal to the LIBOR rate for the interest period in effect for such Loan plus 6.00%.

The obligations of the Borrowers under the Financing Agreement are secured by first priority security interests granted to the Lenders on all of the Borrowers’ and Guarantors’ tangible and intangible property, including accounts receivable, intellectual property and shares and membership interests of the Borrowers (other than Propel) and the Guarantors.

The Financing Agreement and other loan documents provide for certain customary fees and other amounts to be paid to the Lenders at the closing of the Financing Agreement (approximately $3,000,000), during the term of the Financing Agreement (approximately $800,000) and on the fourth anniversary of the closing date of the Financing Agreement ($12,500,000).

The Financing Agreement and other loan documents contain customary representations and warranties and affirmative and negative covenants, including covenants that restrict the Borrowers’ ability to, among other things, create certain liens, make certain types of borrowings and engage in certain mergers, acquisitions, consolidations, asset sales and affiliate transactions. The Financing Agreement provides for customary events of default, including, among other things, if a change of control of Propel occurs. The Loans may be accelerated upon the occurrence of an event of default.

Post-Merger Strategy

Propel Media participates in the online advertising market where advertisers reward providers who can deliver performance and return on advertising investment. The fundamental strategy of the business is to drive advertiser performance across all mediums and geographies. Key elements of the Propel Media strategy include:

| 1. | Increasing quality inventory from supply sources that deliver improved advertiser performance. This includes increasing the Company’s proportion of inventory coming from its owned and operated network through increased investment in media buying to acquire inventory. We also intend to provide sophisticated analytics that will allow us to score the quality of inventory in order to provide increasingly effective advertiser campaigns. |

| 2. | Expanding revenues that come from video advertisers. As more advertiser budget moves from television to online, we see great opportunities to build on the video platforms that have been previously developed by our Kitara Media unit. |

| 3. | Migrating into the mobile market to take advantage of advertiser demand for this segment of the market. |

| 4. | Expand globally. |

In addition to the above strategies, we will be focused on ensuring effective integration of the Future Ads, Kitara Media and Healthguru businesses. We believe the benefits of this integration will include not only creating certain cost synergies, but more importantly allowing the leveraging of talent and business opportunities across all divisions of the business.

All business entities utilize a data driven management approach through operational key performance indicators (KPIs).

| 5 |

Business

Future Ads

Future Ads’ three synergistic functional groups work together to cost-effectively help advertisers, application developers and other partners drive performance and revenues. They are:

| ● | Advertiser Sales and Account Management |

| ● | Audience Development |

| ● | Technology Solutions and Services |

Industry Overview

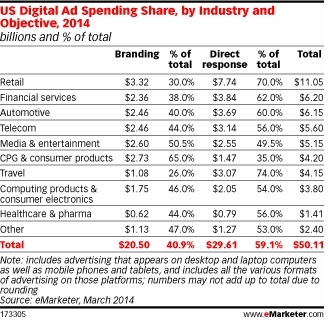

The online advertising space is comprised of many segments. However, it is clear that advertising dollars are very focused on direct response advertising. Of the $50 billion in U.S. online ad spend for 2014 as projected by eMarketer, almost 60%, or approximately $30 billion will be spent on direct response.

| 6 |

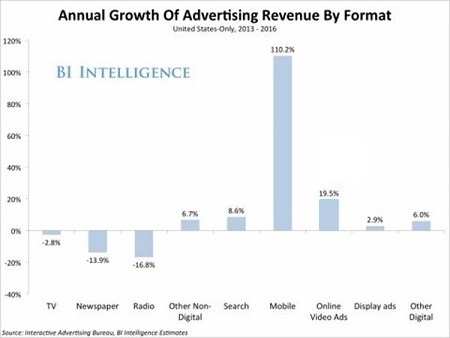

Additionally, online video and mobile advertising revenue is also growing rapidly, at annual growth rates of 19.5% and 110.2%, respectively, as estimated by the Interactive Advertising Bureau and Business Insider.

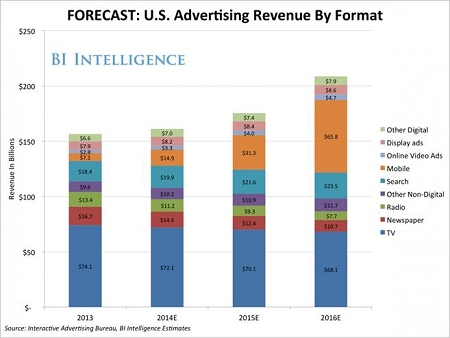

The Interactive Advertising Bureau and Business Insider further estimate the combined advertising revenue for mobile and online video to be approximately $18 billion in 2014.

In summary, the digital media ecosystem is changing the landscape of advertiser spend over all, and within the digital media environment, direct response advertising is a dominant force with mobile and video ad solutions representing huge growth opportunities.

Currently Future Ads is predominantly serving the Direct Response segment of the online advertising space. Future Ads is established in video with approximately 13% of revenues coming from video during 2014. Mobile represents a future opportunity for the business.

| 7 |

Advertiser Sales and Account Management

Future Ads is focused on building relationships with digital advertisers.

Future Ads currently services over 1,400 active advertisers and its advertiser clients include, but are not limited to, direct advertisers, affiliate advertisers, lead generation advertisers and leading advertising agencies and advertising networks representing premium brands.

Future Ads’ direct sales team and account management organization are comprised, collectively, of 22 people. They call on and support advertisers and their advertising campaigns. The sales team is responsible for developing campaign goals and strategies with advertisers or their agents and they work with the clients to establish the ad formats that will run. They are also responsible for developing the return on investment metrics with the advertiser that will be used to help the account management organization or the advertiser understand performance as the campaign is running and will allow account management, the salesperson and the advertiser to optimize campaigns to meet campaign goals.

Campaigns are set up and managed by either the salesperson, account manager or the advertiser themselves. These activities are executed through the Trafficvance platform. This platform allows Future Ads to work with advertisers to:

| ● | Process advertiser applications; |

| ● | Accept or reject advertiser applications; |

| ● | Record advertiser information, payment terms and semi-automate the advance payment process through credit card or wire transfer, if required; |

| ● | Set up campaigns including: |

| o | Specifying the ad units to be employed for the campaign, which include: |

| ¡ | Textlink ads – Ads that appear when the consumer mouses over the targeted keyword. If the user clicks on the ad, the user is taken to the advertiser’s offer landing page that provides more information. The advertiser is only charged if the consumer clicks on the ad (this is referred to as Cost Per Click, or CPC). |

| ¡ | Display ads – These are traditional box ads combining graphical images with ad copy. These ads are served based on targeted keywords. The advertiser is charged when the ad is displayed (this is referred to as Cost Per View, or CPV). |

| ¡ | Video ads –Video ads are served to its audience and the advertiser is charged when the ad is displayed (this is priced on a Cost Per Thousand, or CPM, basis). |

| o | Establishing targeting parameters by keywords and URLs that the advertiser chooses. As Trafficvance is a bid-based platform, the advertiser’s ad will generally be displayed if their bid price wins over other advertisers who are also bidding to serve their ads. |

| o | Establishment of bid price for keywords and URLs. |

| o | Establish links to ad creative that will run in each campaign. |

| ● | Generate reports and metrics that allow real time campaign performance management |

Future Ads’ advertisers and their campaign requirements are met through its sales team, account managers and the utilization of its Trafficvance platform.

| 8 |

Audience Development

Future Ads’ advertisers’ campaigns are dependent on having an audience to receive the advertising. Future Ads’ model is to reach its audience either directly or via partners.

Future Ads reaches audiences for its advertisers through two different methods:

| ● | Future Ads develops and/or syndicates a number of casual gaming sites. Future Ads buys media and advertises these games on various online gaming and social media portals and Future Ads partners with other software distributors to offer its applications to audiences who are downloading third party software. Future Ads provides its audience with access to its premium games for free in exchange for giving Future Ads permission to serve advertising to them while they peruse content on the web. Future Ads incurs media costs to acquire audiences in this manner. |

| ● | Future Ads partners with application developers who have their own audience base and are seeking to serve advertising to them. In this instance, Future Ads partners with these application developers to increase the total audience that its advertisers can reach with their advertisements. Future Ads operates under a revenue share model with its partners in this distribution model. |

Solutions, Technology & Services

Future Ads offers advertisers the ability to reach audiences in which performance is measured by their willingness to click through to the advertisers landing page for more information or a conversion action as defined by the advertiser. Typical conversions might include, for example, making a purchase, filling out an automobile test drive form, taking a survey or filling out a request for more information from online education providers. Superior performance is achieved by having engaging ad units that target the right audiences and are served at the right scale and frequency. Although most creative work is done by the client, Future Ads offers design services as required to help improve campaign performance through more impactful creative ads and landing pages. Future Ads offers text link, display and video ad units that are designed for maximum impact and conversions.

Audience targeting is achieved through keywords and URLs. Advertisers bid on keyword and URL targets which they believe will be relevant to the content that their audiences will be consuming. An advertiser will bid on anywhere from a few to thousands of keywords and URLs at varying bid prices based on the importance of the keyword or URL and the competition from other advertisers for that same keyword or URL. Advertisers may raise or lower keyword or URL bid prices as they see how effective various keywords perform for their campaign. If a keyword target is performing well for an advertiser, the advertiser may want to increase the number of individuals clicking on the advertiser’s advertisements. This is accomplished by raising the bid price the advertiser is willing to pay to have the advertiser’s ad served, which in turn will generate more impressions and, hopefully, increased conversions. Conversely, if a keyword is not performing, bid prices might be lowered in order to not spend advertising budget on underperforming keywords.

Future Ads proprietary ad serving technologies are geared toward optimizing direct response advertiser campaigns to ensure that the desired performance criteria are generated within advertiser defined cost parameters. It is through Future Ads’ ad serving technologies that Future Ads matches advertisers with targeted audiences in a real time auction environment. Future Ads’ ad serving technology determines if there are relevant keywords or URLs on the webpage that an audience member is perusing and that an advertiser or advertisers are targeting. It then evaluates the parameters for serving, including the number of times an audience member has been exposed to a particular ad, the time intervals between ads, the competitive bid prices, the conversion data, time of day parameters that the advertiser has chosen to show ads and other relevant segmenting options. The ad server then decides which advertiser’s ad to serve to a particular audience member. This all takes place in the 150 milliseconds that generally takes a webpage to load on a computer and occurs approximately 26 million times a day.

| 9 |

Trafficvance is the Future Ads advertiser interface platform that registers campaign input parameters that drive its ad serving to carry out campaigns as defined by the advertiser. The Trafficvance interface platform allows the advertisers to establish and direct what and where creative assets (ads) are to be found, the keyword and URL targets for each campaign, the bid price for each keyword and URL target, day part serving parameters, serving intervals between ad impressions, budget parameters on a daily basis and frequency caps on ad appearances.

Key benefits of the platform are:

| ● | Comprehensive – Self-serve platform, with managed account solutions |

| ● | Cost Effective – Bid Based, Cost per Click (CPC), Cost per View (CPV) and Cost Per Thousand (CPM) pricing |

| ● | Targeted Data – Capable of targeting based on a variety of attributes, such as frequency caps and time of day |

| ● | Performance Goal Oriented – Designed for direct response, performance driven advertisers and brand marketers based on defined event results |

| ● | Diverse Solutions – Interactive Advertising Bureau (IAB) standard Display and Video formats available |

| ● | Scalable – Capable of handling thousands of advertisers and billions of ad impressions monthly |

The Trafficvance platform provides an easy to use self-service interface to begin building customized ad campaigns with contextually targeted ads. The platform allows easy performance traffic and budget management capabilities to meet key goals.

The platform is currently servicing over 1,400 advertisers. Future Ads’ solutions deliver effective results for advertisers that allow them to target and reach mass audiences with high performance results across text, display and video formats. The reporting and analytics interface allows advertisers to see campaign performance in real-time. Campaign optimization and management is all performed through the Trafficvance interface.

Kitara

Kitara is focused on delivering a set of comprehensive solutions supported by industry leading services and a proven video advertising technology platform. In addition, Kitara manages an expanded video portfolio and media portfolio that further compliment the business.

Advertising Solution

The Kitara Ad+ Solution provides video advertisers enhanced performance by delivering the desired target audience with well-positioned video ads that offer highly relevant and engaging video content experiences.

Kitara’s objective is to ensure that every online advertising campaign dynamically achieves key performance metrics through safe delivery with the right audience against relevant content in the most engaging interactive video format. We believe video offers the best medium for Kitara to achieve these objectives across desktops and mobile devices. We believe consumers are spending more time online watching video content and advertisers are increasingly shifting budgets from television to online as video has become attractive across desktop and mobile platforms.

| 10 |

The Kitara Ad+ Solution is designed to address the needs of traditional direct relationships with brands and their agencies as well as the expanding evolution of programmatic advertisers. We believe that regardless of how online advertising campaigns are executed, whether by traditional media buying or through the programmatic automation, the same elements of relevant content, audiences and performance are required to optimize brand value.

Kitara continues to focus and see growth in building solid direct relationships with brands and their agencies. Kitara offers unique and customized video advertising and data solutions to address its key objectives. Kitara engages directly with advertisers to improve their understanding of video as a medium and showcases ways to utilize video to differentiate their campaign to meet their target audiences and objectives.

Kitara has built a solid reputation with the programmatic marketplace by safely fulfilling advertising campaigns and optimizing brand performance. Evolving Kitara’s historical expertise with banner and display exchange advertising, Kitara is applying its understanding of programmatic technology and best practices with video advertising.

Kitara’s portfolio of owned-and-operated media sites combined with an advanced network of syndicated publishers allows Kitara to support advertisers across a range of verticals including health, lifestyle, and casual gaming. Leveraging the PROPEL+ technology platform and Kitara’s suite of products, Kitara provides advertisers reporting and access to the data intelligence it utilizes to optimize campaign performance.

Audience Performance Optimization

Kitara understands the value of safely targeting the right audience for the right campaign. Advertisers and publishers rely on engaging consumers to deliver performance and expand monetization. Utilizing both proprietary and third party data intelligence tools, the Kitara Audience+ Analyzer is a toolkit that integrates and analyzes data to report on key metrics associated with the audience of a campaign, including:

| ● | Demographic and Psychographic Audience Metrics |

| ● | Viewability and Engagement Metrics |

| ● | Brand Safety Metrics |

Using the PROPEL+ platform and Kitara’s suite of products, we believe that Kitara has proven best practices that enhance audience engagement to meet campaign objectives.

Brand Safety

Kitara values brand security with every advertising placement. Advertisers must manage risks at every stage of a campaign. Keys to brand safety are placement on relevant inventory, premium video content and a highly qualified audience. The Kitara PROPEL+ Platform maximizes efforts to ensure both ad performance and brand protection. Kitara’s solution is designed to monitor and protect brand-marketing investments by:

| ● | Maximizing value with tested and validated inventory of relevant options for ad placements. |

| ● | Ensuring complimentary content accompanies and enhances ad placements. |

| ● | Protecting ad performance by cleansing and verifying target audiences. |

| ● | Minimizing risks associated with bots, auto-clicking server farms and other compromising performance issues. |

| ● | Providing consistent protection with proven technology, solid metrics and deep analytics. |

| 11 |

Kitara is committed to strict standards for consumer privacy. Accordingly, Kitara strictly adheres to all industry guidelines and will continue to review and improve its privacy policy and procedures to ensure the safety and protection of its consumers’ information.

Publisher Solution

Online media must be highly engaging and responsive with today’s active consumers. To meet those needs, we believe video offers the best medium for storytelling and enhances engagement across desktops and devices.

The Kitara Publisher+ Solution offers online media publishers a full video solution, including technology, content and monetization. Kitara enhances publisher monetization and improve site audience engagement by combining contextually relevant video content with branded video advertising on a site through one simple embedded integration.

Kitara’s PROPEL+ contextual semantic technology dynamically matches relevant video content to the page text context and packages it together in an interactive video experience. We believe this marriage enhances publisher monetization, audience engagement and content diversity.

Leveraging the PROPEL+ technology platform and Kitara’s Video+ Portfolio, Kitara provides publishers full reporting and access to the data intelligence to optimize engagement and expand monetization.

Video Content Solution

The Kitara Content+ Solution offers video content providers expanded reach for their content libraries with a highly engaged syndicated target audience by aligning video content with relevant publishers. Kitara has formed content partnerships with independent producers, premier media companies and content syndication networks.

We believe video offers the best medium for storytelling and enhances brand reach across desktops and devices. Leveraging the PROPEL+ technology platform and Kitara’s complimentary services, Kitara makes it simple to curate, match and distribute video content to relevant audiences. Kitara provides content marketers full reporting and access to the data intelligence it utilizes to optimize engagement and track video content distribution.

PROPEL+ Technology Platform

During 2013, Kitara developed its own proprietary video content and ad delivery solution called PROPEL+. This technology can leverage campaign performance data for optimization and delivery and is directly integrated with many video advertising partners. PROPEL+ is an innovative video solution that combines efficient delivery and optimization into one video platform to deliver strong engagement for advertisers and high revenues for publishers, as well as improve user experience. Powered by real time data input, PROPEL+ optimizes up to 30 video advertising sources to select the right advertising source at the right time for the right user.

PROPEL+ has given Kitara the ability to grow video ad revenues. The platform was developed to automate optimization and operational process and has allowed for scalability of video ad delivery. In addition, the platform’s strong analytical tools have allowed Kitara to react in real time to campaign trends, which we believe will maximize Kitara’s gross margins. The acquisition of Heath Guru further enhanced the PROPEL+ Platform with advanced content management and syndication capabilities. Integrated functionalities and combined development efforts further allow for improvements in performance.

| 12 |

Video Portfolio

We believe all videos are not created equal and different video story formats appeal to different audiences and objectives. Kitara’s focus is to provide interactive video narratives that improve a brand’s storytelling ability with consumers. Working closely with both advertisers and publishers, Kitara has developed the Kitara Video+ Portfolio of video story formats that enhances audience engagement, campaign performance and advertising monetization, including:

| ● | Video Slideshows |

| ● | Video Surveys |

| ● | Video Quizzes |

| ● | Video Q&A |

Kitara customizes campaigns with one or more video story formats to leverage the right video content with the right video advertisements while contextually complimenting editorial placement. Independently, Kitara has developed its own library of nearly 5,000 premium videos and continue to produce videos on a monthly basis.

Proprietary Site Portfolio

Kitara owns and operates a portfolio of popular sites across multiple markets including lifestyle, health, games, technology and business. Such sites include but are not limited to Healthguru.com and Adotas.com. Kitara provides video advertising space on these properties to the benefit of its advertisers. Kitara’s focus is to use audiences across its media properties and enhance ways Kitara collects data intelligence that evolve its optimization solutions.

Kitara’s Clients

Kitara is focused on building relationships with digital advertisers, digital publishers and video content providers across multiple verticals including lifestyle, health, gaming, technology and business.

Digital Advertisers

Kitara’s advertiser clients include both direct advertisers with leading advertising agencies and brands as well as programmatic advertisers who utilize exchanges such as Adap.tv, LiveRail, BrightRoll, SpotXchange, YuMe or Tremor Video to automate campaigns. Overall, Kitara supports video, display and mobile advertising strategies with hundreds of millions of monthly video advertising and content views. With every ad campaign, Kitara establishes a set of brand objectives and establish metrics accordingly.

Digital Publishers

Kitara’s focus with digital publishers is to both engage on ways to improve their business through the addition of video as well as expand Kitara’s reach for digital advertising campaigns. Kitara defines with each publisher how to expand monetization and content through the delivery of relevant video advertisements.

In addition, Kitara makes an effort to educate publishers on how video enhances experience by aligning audiences with relevant content in a highly engaging format. Through an embedded video experience supported by Kitara’s PROPEL+ Platform, Kitara contextually aligns video advertisements and content with editorial. Terms and conditions vary per publishers based on whether Kitara provides both content and ad inventory or if customization is required.

| 13 |

Video Content Providers

Kitara engages and develops partnerships with video content producers and providers seeking to syndicate or distribute video content. Partnership terms vary per content owner based on type and amount of video inventory. Video advertising requires video content that engages a target audience in order for the advertisement to run. Kitara has established relationships with premium publishers to ensure access to a wide range of relevant content across verticals, as well as with independent content producers on a more customized basis. Syndication or content distribution terms vary and are dependent on a range of conditions, whether for ad campaign or supplemental content for digital media properties.

In addition, Kitara also produces and maintains its own Video+ Portfolio of nearly 5,000 premium videos. Kitara partners with syndicated content partners to license and distribute premium videos. Terms for each partnership vary based on demand for relevant content Kitara owns.

Seasonal Nature of Business

Many advertisers devote a disproportionate amount of their advertising budgets to the fourth quarter of the calendar year to coincide with increased holiday purchasing. Accordingly, our revenue tends to be seasonal in nature with the fourth quarter of each calendar year historically representing the largest percentage of our total revenue for the year. Our operating cash flows could also fluctuate materially from period to period as a result of these seasonal fluctuations.

Opportunity

Future Ads

We believe the online advertising market is well positioned for growth with expanded ways audiences can connect to the Internet with a variety of cross screen devices. Future Ads’ investment in technology has further enabled new ways advertisers can engage with audiences with multiple ad formats. In addition to traditional display advertising, the online advertising industry is experiencing strong growth in video and mobile. According to the IAB, online video is growing faster than most other advertising formats and mediums. Video ad revenue will increase at a three-year compound annual growth rate of 19.5% through 2016, according to the IAB. That's faster than any other medium other than mobile. And much faster than traditional online display advertising, which will only grow at a 3% annual rate.

Spending on ads served to internet-connected devices, including desktop and laptop computers, mobile phones and tablets will reach $137.53 billion in 2014, according to eMarketer’s latest estimates of worldwide paid media spending. Digital spend will be up 14.8% in 2014 over 2013 levels, according to the forecast, and will make up just over one-quarter of all paid media spending worldwide.

The online advertising industry is advancing performance measurement and technology platforms are offering streamlined ways to benchmark diversified campaigns. Future Ads is focused on helping advertisers, application developers and other partners benchmark user engagement and monetization opportunities with Future Ads’ automated Trafficvance technology.

| 14 |

Kitara

For nearly two decades since the introduction of online advertising, the industry has evolved across emerging channels and in different mediums impacted by audience behaviors and brand performance objectives. Technology has been a catalyst to the advancement of the online advertising industry and is starting to drive competition within the overall advertising market that incorporates television, print and other traditional media. As the online advertising industry enters a third decade, we believe the following are some of the key shifts in the market that provide opportunity for Kitara’s growth:

Online Advertising Market Continues Expanded Growth with Video

eMarketer has projected U.S. spending on digital video ads will reach $8.3 billion in 2016, or double the $4.15 billion spent in 2013. Brands are embracing the highly engaging experience of video with sight, sound and motion. Furthermore, mobile advertising trends reinforce that video is embraceable across desktops and devices.

Native Advertising Offers Opportunity for Brand Storytelling

Because online video is not restricted by the traditional limitations of television advertising, companies are producing video content with a heavy focus on storytelling. Content marketers are embracing video to expand narratives and engage audiences. Native advertising contextually aligns editorial with complimentary content to create a custom branded experience. According to eMarketer, native ad spending will exceed $4.5 billion by 2017. Publishers are trying to take advantage of this increase in spending with nearly 75% now offering online native ads across their sites.

Audiences Spending More Time Online with Video

The average time spent with digital media per-day surpassed television viewing for the first time in 2013, according to eMarketer’s latest estimate of media consumption among U.S. adults. The average adult spends over 5 hours per day online compared to 4 hours and 31 minutes watching television. In addition, in January 2014, Comscore reported that 85.1% of the U.S. Internet audience viewed online video. Video ads accounted for 35.6% of all videos viewed and 4.5% of all minutes spent viewing video online.

Enhanced Data Intelligence Raising the Bar on Brand Performance Metrics

The online advertising industry continues to evolve standards to measure and benchmark brand performance. Integrating more data intelligence and analytics is helping brands identify and influence target audiences more effectively. In addition, user engagement is more easily being tracked and benchmarked for viewability and other performance outcomes. Overall brand safety initiatives continue to be enhanced as advertisers gain a better understanding of campaign metrics and the overall performance of online marketing investments.

Technology Diversifying Brand Marketing Investments

As online advertising technologies continue to evolve, more and more brands are diversifying management and distribution of ads through direct and programmatic channels. Online advertising platforms are being developed to integrate systems, maximize resources and automate processes. Advertising technology is helping brands make smarter decisions and improve return on investments.

Strategy

Future Ads

As the online advertising market advances and publishers diversify ways to engage users, Future Ads will evolve the business to align growth opportunities with the following strategies:

| ● | Continue to expand reach to grow high quality audiences across demographics that appeal to a growing spectrum of advertisers. |

| ● | Grow direct advertiser and advertising agency relationships across text, display and video. |

| ● | Expand beyond the desktop to mobile and cross-screen reach that supports mobile audiences and advertisers. |

| ● | Expand globally in prioritized geographies to expand Future Ads’ audience and advertiser base. |

| ● | Optimize Future Ads’ advertising platform technologies with further enhanced data targeting, optimization and reporting capabilities. |

| 15 |

Kitara

As the demand and consumption of online video grows, Kitara will seek to grow its position in online video advertising and content by pursuing the following strategies:

| ● | Increase investment in Kitara’s PROPEL+ online video advertising technology platform to enable the automation and optimization of video advertising, video content and publishing space. |

| ● | Evolve and deliver an advanced video native advertising platform. |

| ● | Acquire new advertising customers through both direct and programmatic channels. |

| ● | Expand Kitara’s Video+ Portfolio with additional content syndication partners, unique video formats and premium video content. |

| ● | Increase Kitara’s digital publishing partnerships to expand advertising reach and improve monetization. |

| ● | Continue to advance Kitara’s audience targeting, data intelligence and analytics capabilities with its Audience+ Analyzer tools. |

| ● | Pursue strategic acquisitions. |

Competition

Future Ads

The display, video, desktop application and online advertising solutions market is highly competitive, with many companies providing competing solutions. Future Ads competes with Google, RocketFuel, Tremor, IAC, Facebook, Vibrant and many other demand side advertiser platforms, supply side advertising platforms, ad networks and desktop and mobile application networks that are influenced by evolving trends across multiple industries, including the online advertising industry, application market, and the digital publishing industry. Competition will continue to intensify in the future as a result of industry consolidation and new competitors entering the market.

We believe that Future Ads competes favorably with an emphasis on key competitive factors, including strong relationships with online advertisers and application developers, an advanced and scalable technology platform, effective audience engagement and goal-based performance, data driven benchmarks for advertising campaigns and proven performance. With respect to all of these factors, we believe that Future Ads’ effective, scalable and stable goal based performance platform well positions Future Ads as an independent provider of online advertising solutions. Nevertheless, many of Future Ads’ competitors possess greater technical, human and/or other resources than Future Ads does and Future Ads’ financial resources are relatively limited when compared to many of its competitors. Any of these factors could place Future Ads at a competitive disadvantage to such entities.

Kitara

Kitara operates in a dynamic and competitive market, influenced by trends across multiple industries, including the digital video advertising industry, video content marketing industry and the digital publishing industry. We expect that competition in Kitara’s industry will continue to intensify in the future as a result of industry consolidation, the continuing maturation of the industry and low barriers to entry.

| 16 |

We believe the principal competitive factors in Kitara’s industry include proven and scalable technologies, effective audience targeting capabilities, brand and campaign metrics, brand safety, relationships with leading brand advertisers and their respective agencies, relationships with digital publishers and premium video content. We believe that Kitara competes favorably with respect to all of these factors and that Kitara is well positioned as an independent provider of digital video advertising solutions.

Technology and Development

Future Ads

Future Ads’ technology and development efforts are focused on investing in its Trafficvance technology platform and a suite of complimentary services. Much of its technology and development is conducted through a consulting arrangement with Bravo Studio d.o.o., which arrangement dates back to 2009. Pursuant to the consulting arrangement, Bravo Studio d.o.o. provides Future Ads with ongoing software and technology development services and support. Any intellectual property that is created within the scope of the consulting arrangement is owned by Future Ads. The consulting arrangement is terminable by either party upon 15 days’ prior written notice to the other party. Future Ads has incurred approximately $3,029,000 and $2,433,000 in technology and development expenditures during the years ended December 31, 2014 and 2013, respectively.

Future Ads continues to develop a robust platform to enable automation and optimization of online advertising. Future Ads’ strategy incorporates enhanced optimization management capabilities with industry standard formats. Capitalizing on proprietary and third-party data tools and reporting functionality, Future Ads will continue to analyze audience insights and advance reporting functionalities for a transparent understanding with advertisers and application developers on Future Ads’ performance.

Kitara

Kitara’s technology and development efforts are focused on investing in its PROPEL+ technology platform and a suite of complimentary services. Kitara continues to develop a robust platform to enable the matching, automation and optimization of video advertising, video content and publishing video inventory. Kitara’s strategy incorporates unique video formats and enhanced performance management capabilities. Capitalizing on third party and proprietary built data tools and reporting functionality, Kitara will continue to analyze audience insights and advance reporting functionalities for a transparent understanding with advertisers and publishers on Kitara’s performance.

Intellectual Property

Future Ads

Future Ads’ ability to protect its intellectual property, including its technologies, will be an important factor in the success and continued growth of its business. Future Ads has established business procedures designed to maintain the confidentiality of its proprietary information such as the use of license agreements with customers and its use of confidentiality agreements and intellectual property assignment agreements with its employees, consultants, business partners and advisors where appropriate. These methods, however, may not afford complete protection for Future Ads’ intellectual property and there can be no assurance that others will not independently develop technologies similar or superior to that of Future Ads’.

Future Ads currently has secured one patent which expires on July 16, 2033 and multiple trademarks protecting its intellectual property and its brands.

| 17 |

Kitara

Kitara’s ability to protect its intellectual property, including its technologies, will be an important factor in the success and continued growth of its business. Kitara has established business procedures designed to maintain the confidentiality of its proprietary information, such as the use of its license agreements with customers and its use of its confidentiality agreements and intellectual property assignment agreements with its employees, consultants, business partners and advisors where appropriate. These methods, however, may not afford complete protection for Kitara’s intellectual property and there can be no assurance that others will not independently develop technologies similar to Kitara’s.

Government Regulation

Future Ads

Future Ads is subject to numerous U.S. and foreign laws and regulations that are applicable to companies engaged in the online advertising business. In addition, many areas of law that apply to Future Ads’ business are still evolving, and could potentially affect its business to the extent they restrict its business practices or impose a greater risk of liability. We are aware of several ongoing lawsuits filed against companies in Future Ads’ industry, such as Google, alleging various violations of privacy or data security related laws.

Kitara

Kitara is subject to numerous U.S. and foreign laws and regulations that are applicable to companies engaged in the online video advertising business, including video advertising on mobile devices. In addition, many areas of law that apply to Kitara’s business are still evolving and could potentially affect its business to the extent they restrict its business practices or impose a greater risk of liability. We are aware of several ongoing lawsuits filed against companies in Kitara’s industry, such as Google, alleging various violations of privacy or data security related laws.

Privacy

Future Ads

Privacy and data protection laws and regulations play a significant role in Future Ads’ industry. In the United States, at both the state and federal level, there are laws that govern activities, such as the collection, use and disclosure of data by companies like Future Ads.

Future Ads does not collect any personally identifiable information (PII) from its audience.

Online advertising activities in the United States have primarily been subject to regulation by the Federal Trade Commission, or the FTC, which has regularly relied upon Section 5 of the Federal Trade Commission Act, or Section 5, to enforce against unfair and deceptive trade practices. Section 5 has been the primary regulatory tool used to enforce against alleged violations of consumer privacy interests. In addition, as Future Ads continues expanding into other foreign countries and jurisdictions, Future Ads increasingly becomes subject to additional laws and regulations that may affect how it conducts business. In particular, European data protection laws can be more restrictive regarding the collection, use and disclosure of data than those in the United States.

Additionally, U.S. and foreign governments have enacted, considered or are considering legislation or regulations that could significantly restrict industry participants' ability to collect, augment, analyze, use and share anonymous data, such as by regulating the level of consumer notice and consent required before a company can employ cookies or other electronic tools to track people online. The European Union, or EU, and some EU member states have already implemented legislation and regulations requiring advertisers to obtain specific types of notice and consent from individuals before using cookies or other technologies to track individuals and their online behavior and deliver targeted advertisements. It remains a possibility that additional legislation and regulations may be passed or otherwise issued in the future. Future Ads also participates in industry self-regulatory programs under which, in addition to other compliance obligations, it provides consumers with notice about its use of cookies and its collection and use of data in connection with the delivery of its offerings and allows them to opt-out by easily uninstalling its software. The rules and policies of the self-regulatory programs that Future Ads participates in are updated from time to time and may impose additional restrictions upon it in the future.

| 18 |

Any failure, or perceived failure, by Future Ads to comply with U.S. federal, state, or international laws or regulations pertaining to privacy or data protection, or other policies, self-regulatory requirements or legal obligations could result in proceedings or actions against it by governmental entities or others.

Kitara

Privacy and data protection laws and regulations play a significant role in Kitara’s business. In the United States, at both the state and federal level, there are laws that govern activities such as the collection, use and disclosure of data by companies like Kitara. Online advertising activities in the United States have primarily been subject to regulation by the Federal Trade Commission, or the FTC, which has regularly relied upon Section 5 of the Federal Trade Commission Act, or Section 5, to enforce against unfair and deceptive trade practices. Section 5 has been the primary regulatory tool used to enforce against alleged violations of consumer privacy interests. In addition, as we consider expanding Kitara’s business into other foreign countries and jurisdictions, Kitara may be subject to additional laws and regulations that may affect how it conducts business. In particular, European data protection laws can be more restrictive regarding the collection, use, and disclosure of data than those in the United States.

Additionally, U.S. and foreign governments have enacted, considered or are considering legislation or regulations that could significantly restrict industry participants’ ability to collect, augment, analyze, use and share anonymous data, such as by regulating the level of consumer notice and consent required before a company can employ cookies or other electronic tools to track a person’s online activity. The European Union, or EU and some EU member states have already implemented legislation and regulations requiring advertisers to obtain specific types of notice and consent from individuals before using cookies or other technologies to track individuals and their online behavior and deliver targeted advertisements. It remains a possibility that additional legislation and regulations may be passed or otherwise issued in the future. Kitara also participates in industry self-regulatory programs under which, in addition to other compliance obligations, it provides consumers with notice about its use of cookies and its collection and use of data in connection with the delivery of targeted advertising and allows them to opt-out from the use of data it collects for the delivery of targeted advertising. The rules and policies of the self-regulatory programs that Kitara participates in are updated from time to time and may impose additional restrictions upon it in the future.

Any failure, or perceived failure, by Kitara to comply with U.S. federal, state, or international laws or regulations pertaining to privacy or data protection, or other policies, self-regulatory requirements or legal obligations could result in proceedings or actions against it by governmental entities or others.

Advertising

Future Ads

Even though Future Ads’ advertisers create the content of their ads and Future Ads receives contractual protections from its advertisers in which they are required to agree to its terms and conditions, Future Ads may nevertheless be subject to regulations concerning the content of their ads. Federal and state laws governing intellectual property or other third-party rights could apply to the content of ads Future Ads places even if it has no part in the creation of the ad. Laws and regulations regarding unfair and deceptive advertising, sweepstakes, advertising to children and other consumer protection regulations, may also apply to the ads Future Ads places on behalf of clients.

| 19 |

Kitara

Even though Kitara receives contractual protections from its advertising business partners with respect to their ads, it may nevertheless be subject to regulations concerning the content of ads. Federal and state laws governing intellectual property or other third-party rights could apply to the content of ads Kitara places. Laws and regulations regarding unfair and deceptive advertising, sweepstakes, advertising to children and other consumer protection regulations, may also apply to the ads Kitara places on behalf of clients.

Employees

Future Ads

As of December 31, 2014, Future Ads had 42 full-time employees and 2 part-time employees. None of Future Ads’ employees are represented by a labor union or covered by a collective bargaining agreement. We consider our relationship with Future Ads’ employees to be good.

Kitara

As of December 31, 2014, Kitara had 42 employees. None of Kitara’s employees are represented by a labor union or covered by a collective bargaining agreement. We consider our relationship with Kitara’s employees to be good.

Internet Address/Availability of Reports

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), will be available free of charge on our website at http://www.propelmedia.com as soon as reasonably practicable after we electronically file such material with, or otherwise furnish it to, the SEC.

| ITEM 1A. | RISK FACTORS |

For relevant risk factors related to our business, see the section entitled “Risk Factors” contained in our prospectus dated January 23, 2015 and incorporated by reference herein.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS. |

None.

| ITEM 2. | PROPERTIES. |

Propel and Kitara share principal executive offices in New Jersey. This office is located at 525 Washington Blvd, Suite 2620, Jersey City, New Jersey. On September 29, 2014, upon the expiration of its existing lease, the Company entered into a new lease with its landlord. The new lease, which commenced on September 30, 2014, is for a total of 10,000 square feet of space and has an initial lease term of 66 months with the Company occupying the initial 7,500 square feet of space on September 30, 2014 at an initial monthly rent of approximately $22,000 with a plan to occupy the remaining 2,500 square feet of space some time after the first quarter of 2015, at an additional monthly rent of approximately $8,000. Under each lease component, the lease provides for $0 cash rental payments for the first five months of their respective terms.

Future Ads’ office is located at 2010 Main Street, Suite 900, Irvine, CA. It leases 19,594 square feet at this location, at a rate of approximately $45,000 per month, pursuant to a lease that expires on July 31, 2018.

We believe that our current facilities are suitable and adequate to meet our current needs and we believe that additional space is available, on commercially reasonable terms, as needed.

| 20 |

| ITEM 3. | LEGAL PROCEEDINGS. |

From time to time, we may be involved in litigation relating to claims arising out of our operations in the normal course of business. Other than as set forth below, at December 31, 2014, there were no material pending legal proceedings to which the Company was a party or to which any of its property was subject that were expected, individually or in the aggregate, to have a material adverse effect on us.

In December 2013, an action entitled Intrepid Investments, LLC (“Intrepid”) v. Selling Source, LLC (“Selling Source”), et al., Index No. 65429/2013 was filed in the Supreme Court of the State of New York, County of New York. This is an action commenced by Intrepid to collect on a Junior Secured Promissory Note signed by Selling Source in the original principal sum of $28,700,000 (the “Note”). The Company is not a signatory to the Note but Kitara Media did sign an August 31, 2010 Security Agreement (“Security Agreement”) pledging all of its accounts, cash and cash equivalents, chattel paper, contracts, deposit accounts, documents, equipment, fixtures, general intangibles, all other goods, all shares of capital stock of any companies it owned, all instruments including all promissory notes, all intellectual property, all insurance policies and all proceeds thereof, all inventory, all other investment property, all letter of credit rights, all other tangible and intangible personal property and all proceeds of any of the foregoing, as security for the Note. At the time Kitara Media signed the Security Agreement, it was wholly-owned by Selling Source. On July 1, 2013, Kitara Media merged with one of Kitara’s then wholly-owned subsidiaries, with Kitara Media surviving the merger and becoming a wholly-owned subsidiary of Kitara. Accordingly, it is no longer wholly-owned by Selling Source, although it is still an affiliate of Selling Source. In the action, Intrepid seeks to foreclose on the security interest. Both Selling Source’s and Kitara Media’s obligations to Intrepid under the Note and Security Agreement were subordinate to obligations Selling Source had to two groups of prior lenders (“Senior Lenders”). The right of Intrepid to compel payments under the Note and/or foreclose the lien created by the Security Agreement was subject to an Intercreditor Agreement by and between the Senior Lenders and Intrepid. Under the terms of the Intercreditor Agreement, Intrepid could not take steps to compel Selling Source to make payment on the Note or foreclose the Security Agreement so long as the obligations to the Senior Lenders remained outstanding. In addition, under the terms of the Intercreditor Agreement, the Senior Lenders had the right to have the lien released on any of the collateral pledged as security under the Security Agreement. In connection with the merger with Kitara Media, the first priority Senior Lenders released the lien on Kitara Media’s assets which were pledged as collateral under the Security Agreement and the obligation of Kitara Media to Intrepid was released (since Kitara Media was not a borrower or an obligor under the Note but was simply a grantor pledging its assets as security on behalf of Selling Source). In addition, Selling Source’s obligations to the Senior Lenders remains outstanding.

The second matter is Intrepid Investments, LLC v. Selling Source, LLC et al., Index No. 654309/2013, which was filed in the Supreme Court of the State of New York, County of New York. This matter was originally limited to claims asserted by Intrepid against Selling Source regarding an earn-out calculation entered into between it and Selling Source, and confirmed by an arbitrator earlier this year. In August, 2014, Intrepid amended its complaint to include various breach of contractor claims against a variety of those defendants, including Kitara. The new defendants, including Kitara, answered the amended complaint on November 7, 2014, denying liability for all claims. On February 19, 2015, the Court entered an order granting Selling Source’s motion to affirm the arbitration results. On March 3, 2015, Selling Source filed a motion for partial summary judgment seeking dismissal of eleven of Intrepid’s remaining claims. The claims asserted against Kitara are not among those addressed in Selling Source’s motion.

| 21 |

Based on these facts, Kitara Media believes Intrepid’s claims are without merit and intend to defend them vigorously. In any event, Selling Source has acknowledged an obligation to indemnify and defend Kitara Media from any liability to Intrepid arising out of the Note and Security Agreement. The parties have exchanged pleadings and Selling Source has provided documents and written interrogating responses to Intrepid.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

| 22 |

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Market Information

Propel’s common stock commenced trading on the OTCBB under the symbol “PROM” on February 4, 2015. The following table sets forth the high and low closing sales prices for the common stock for the periods indicated.

| Common Stock | ||||||||

| High | Low | |||||||

| Fiscal year ended December 31, 2015: | ||||||||

| First Quarter | $ | 3.00 | $ | 0.02 | ||||

| Second Quarter* | $ | 0.60 | $ | 0.60 | ||||

| * | Through April 8, 2015. |

Holders

As of April 8, 2015, there were 118 holders of record of our common stock. We believe we have significantly more beneficial holders.

Dividends

We have not paid dividends on our common stock. We intend to retain earnings to finance the growth of our business. As a result, we do not anticipate paying cash dividends on our common stock for the foreseeable future. The determination to pay dividends in the future, if any, will be based upon our revenues and earnings, if any, capital requirements and our general financial condition, as well as the limitations on dividends and distributions that exist under the terms of the Financing Agreement and the laws and regulations of the state of Delaware. Under the terms of the Financing Agreement, Propel can only pay dividends in the form of common equity interests, such as shares of stock or warrants, options, or rights on stock.

| ITEM 6. | SELECTED FINANCIAL DATA. |

Not applicable.

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our financial statements and the related notes to those statements included elsewhere in this annual report. In addition to historical financial information, the following discussion and analysis contains forward-looking statements that involve risks, uncertainties and assumptions. The Company’s actual results and timing of selected events may differ materially from those anticipated in these forward-looking statements as a result of many factors, including those discussed under the section entitled “Risk Factors” contained in our prospectus dated January 23, 2015 and incorporated by reference in Part 1, Item 1A.

| 23 |

Certain of the matters discussed under the captions “Business and Properties,” “Legal Proceedings,” “Management's Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere in this annual report may constitute “forward-looking” statements for purposes of the Securities Act of 1933, and the Securities Exchange Act of 1934 and, as such, may involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied, by such forward-looking statements. When used in this report, the words “anticipates,” “estimates,” “plans,” “believes,” “continues,” “expects,” “projections,” “forecasts,” “intends,” “may,” “might,” “could,” “should,” and similar expressions are intended to be among the statements that identify forward-looking statements. Various factors that could cause the actual results, performance or achievements to differ materially from our expectations are disclosed in this report (“Cautionary Statements”), including, without limitation, those statements made in conjunction with the forward-looking statements included under the captions identified above and otherwise herein. All written and oral forward-looking statements attributable to us are expressly qualified in their entirety by the Cautionary Statements. Certain prior-year amounts have been reclassified and adjusted to present the operations of Turkey, Hungary and Romania as discontinued operations.

Propel was formed solely for the purpose of being a holding company of both Future Ads and Kitara, from and after completion of the Transactions between these two companies, which were completed on January 28, 2015. Prior to these Transactions, Propel had no assets and had not conducted any material activities other than those incidental to its formation. However, upon the consummation of the Transactions, Propel became the parent company of Future Ads and Kitara.

The following is a discussion of the financial condition, results of continuing operations, and liquidity and capital resources of Propel Media, Inc. and it subsidiaries. This discussion should be read in conjunction with financial statements and the notes thereto included in this Form 10-K.

Propel

General