Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VERINT SYSTEMS INC | apr1420158-kxverintfye1312.htm |

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. April 2015 Actionable Intelligence®

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. Disclaimers Forward Looking Statements This presentation contains "forward-looking statements," including statements regarding expectations, predictions, views, opportunities, plans, strategies, beliefs, and statements of similar effect relating to Verint Systems Inc. These forward-looking statements are not guarantees of future performance and they are based on management's expectations that involve a number of risks, uncertainties, and assumptions, any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. Important risks, uncertainties, assumptions, and other factors could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. The forward-looking statements contained in this presentation are made as of the date of this presentation and, except as required by law, Verint assumes no obligation to update or revise them, or to provide reasons why actual results may differ. For a more detailed discussion of how these and other risks, uncertainties, and assumptions could cause Verint’s actual results to differ materially from those indicated in its forward-looking statements, see Verint’s prior filings with the Securities and Exchange Commission. Non-GAAP Financial Measures This presentation includes financial measures which are not prepared in accordance with generally accepted accounting principles (“GAAP”), including certain constant currency measures. For a description of these non-GAAP financial measures, including the reasons management uses each measure, and reconciliations of these non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with GAAP, please see the Appendices to this presentation, Verint’s earnings press releases, as well as the GAAP to non-GAAP reconciliation found under the Investor Relations tab on Verint’s website. 2

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. A Smarter World with Actionable Intelligence® 3

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. 4 Crucial insights that enable decision-makers to anticipate, respond and take action Actionable Intelligence

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. Global Market Leader 5 10,000+ Customers in Over 180 Countries $1 Billion+ Actionable Intelligence Company 4,800 Verint Professionals Worldwide More Than 80% of the Fortune 100

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. 6 • Over $1B R&D investment in last 10 years Non-GAAP revenue for year ending 1/31, see appendices for reconciliation. • 700+ patents & applications • 1,500 R&D professionals • Advanced Actionable Intelligence Platform Culture of Innovation Revenue Growth Innovation Driving Growth and Leadership

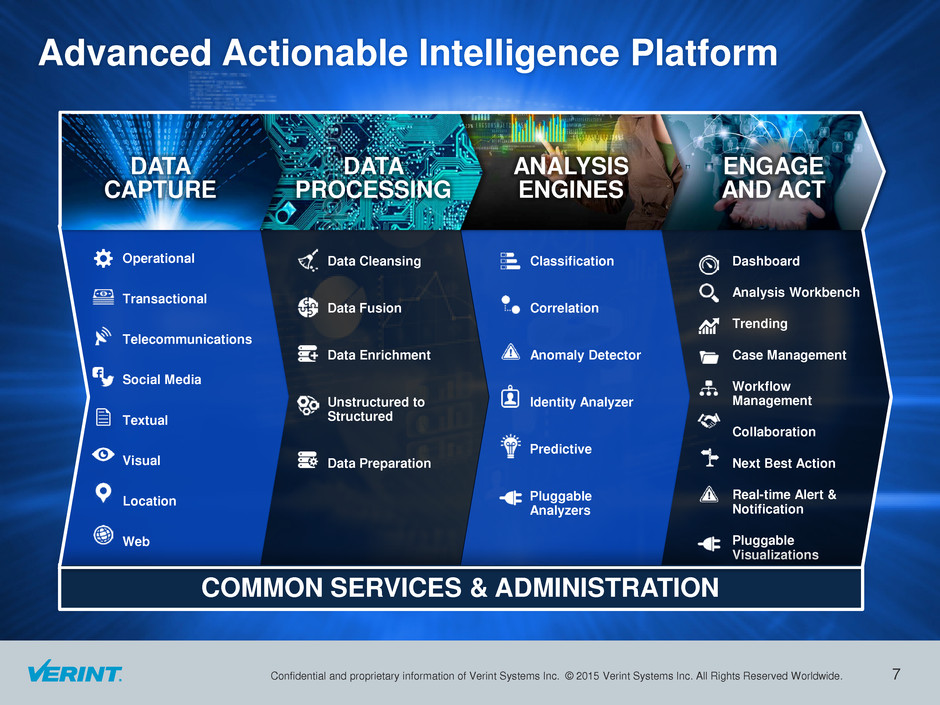

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. Advanced Actionable Intelligence Platform 7 Classification Correlation Anomaly Detector Identity Analyzer Predictive Pluggable Analyzers Dashboard Analysis Workbench Trending Case Management Workflow Management Collaboration Next Best Action Real-time Alert & Notification Pluggable Visualizations Data Cleansing Data Fusion Data Enrichment Unstructured to Structured Data Preparation Operational Transactional Telecommunications Social Media Textual Visual Location Web COMMON SERVICES & ADMINISTRATION ANALYSIS ENGINES ENGAGE AND ACT DATA PROCESSING DATA CAPTURE

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. Amazing Things Happen When You Gain Insights From Data 8 Customer Engagement Optimization Fraud, Risk and Compliance Security Intelligence Advanced Actionable Intelligence Platform Expanding Addressable Market

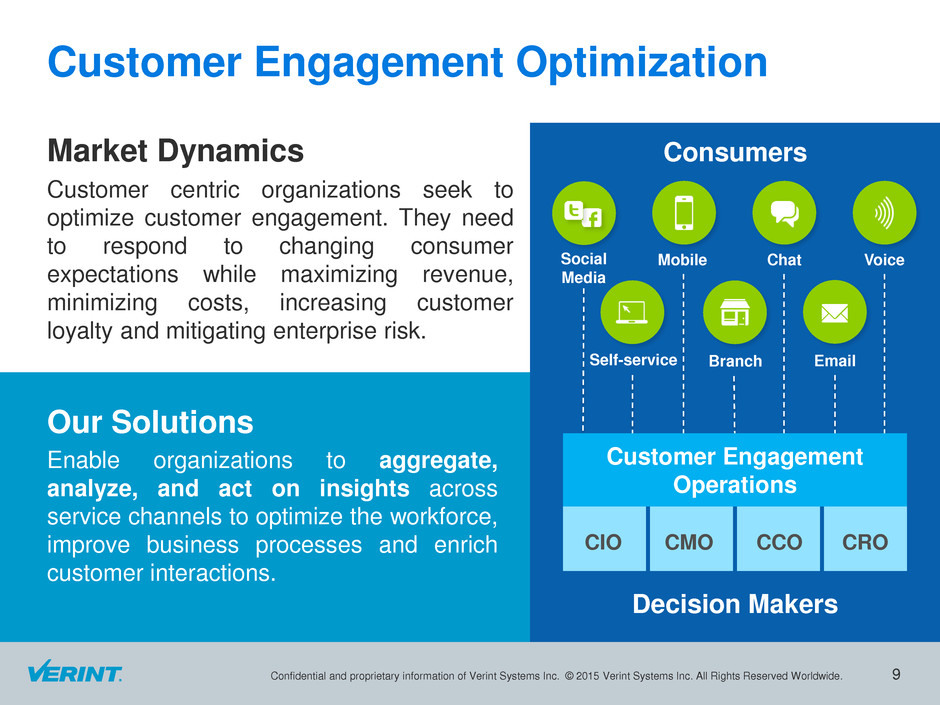

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. Enable organizations to aggregate, analyze, and act on insights across service channels to optimize the workforce, improve business processes and enrich customer interactions. 9 Customer centric organizations seek to optimize customer engagement. They need to respond to changing consumer expectations while maximizing revenue, minimizing costs, increasing customer loyalty and mitigating enterprise risk. Market Dynamics Our Solutions Customer Engagement Operations CRO Consumers CCO CIO Decision Makers Customer Engagement Optimization CMO Mobile Social Media Self-service Branch Chat Email Voice

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. Our Solutions Enable organizations to aggregate, analyze, and act on insights from a wide range of sources to enhance security in a cost-effective manner. 10 Government and enterprises seek innovative solutions to effectively address terrorism, criminal activities, cyber- attacks, and physical security threats. Market Dynamics Security Intelligence Communication Intelligence Situational Awareness Cyber Security Actionable Intelligence Platform r l ti

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. Enable organizations to aggregate, analyze, and act on insights to identify and prevent fraud and help mitigate enterprise risk, helping to ensure compliance with legal, regulatory, and internal requirements. Organizations must address ongoing fraud intensified by new vulnerabilities and sophisticated cyber crimes as well as evolving compliance requirements across many industries. Market Dynamics Our Solutions Fraud, Risk & Compliance 11 Call Center Fraud and Compliance Financial Service Fraud and Compliance Retail Fraud Actionable Intelligence Platform

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. 12 Strategic Consulting Managed Services Implementation Training Hosted Support Partnering for Customer Success SaaS

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. Financial Highlights 13

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. Non-GAAP Revenue Trends FYE Jan 2005 FYE Jan 2006 FYE Jan 2007 FYE Jan 2008 FYE Jan 2009 FYE Jan 2010 FYE Jan 2011 FYE Jan 2012 FYE Jan 2013 FYE Jan 2014 FYE Jan 2015 APAC EMEA Americas $1,158 $214 $279 $369 $572 $675 $704 $727 $796 Note: Financial data is non-GAAP. See appendices for reconciliation. ($ in millions) $848 $910 14

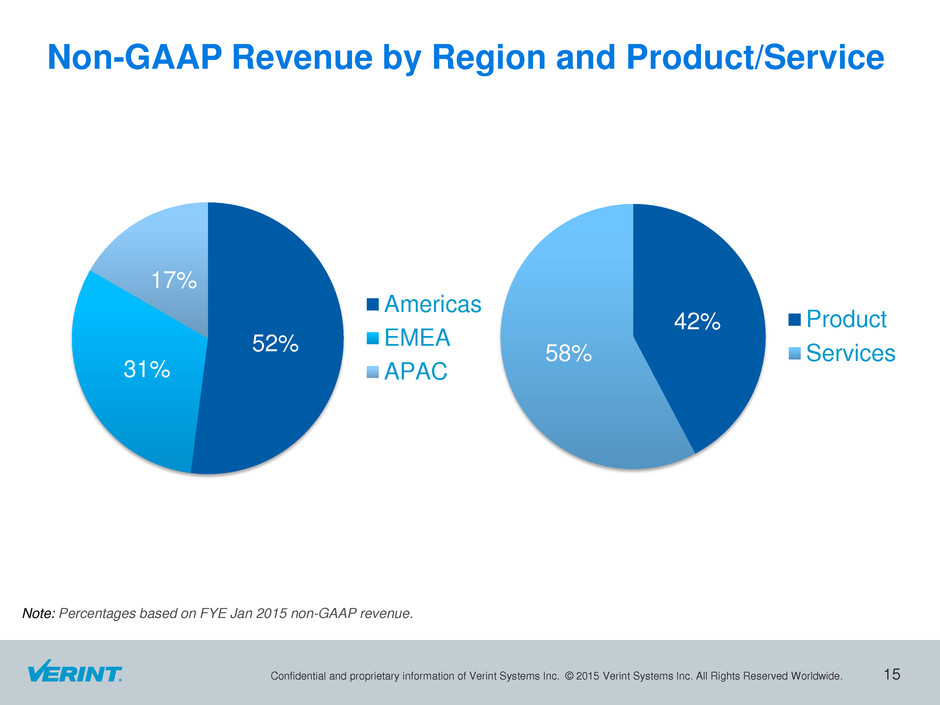

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. Non-GAAP Revenue by Region and Product/Service Note: Percentages based on FYE Jan 2015 non-GAAP revenue. 15 42% 58% Product Services52% 31% 17% Americas EMEA APAC

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. Non-GAAP Quarterly Trends Note: Financial data is non-GAAP. See appendices for reconciliation. FYE 2015 Actual Q1 Q2 Q3 Q4 Year Revenue $269.3 $284.7 $288.5 $315.6 $1,158.2 Gross Profit $178.5 $192.1 $195.6 $218.2 $784.3 Gross Margin 66.3% 67.5% 67.8% 69.1% 67.7% Operating Profit $51.0 $58.6 $64.7 $88.6 $262.9 Operating Margin 18.9% 20.6% 22.4% 28.1% 22.7% EBITDA $56.0 $63.6 $69.5 $94.0 $283.2 EPS $0.72 $0.72 $0.84 $1.06 $3.35 16 ($ in millions, except per share data)

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. Non-GAAP Annual Trends and Outlook Revenue Note: Financial data is non-GAAP. See appendices for reconciliation. FYE Jan 2016 is based on mid-point of guidance. ($ in millions, except per share data) 17 Diluted EPS $2.47 $2.64 $2.84 $3.35 $3.65 FYE Jan 2012 FYE Jan 2013 FYE Jan 2014 FYE Jan 2015 Mid-point Jan 2016 Guidance $796 $848 $910 $1,158 $1,225 FYE Jan 2012 FYE Jan 2013 FYE Jan 2014 FYE Jan 2015 Mid-point Jan 2016 Guidance

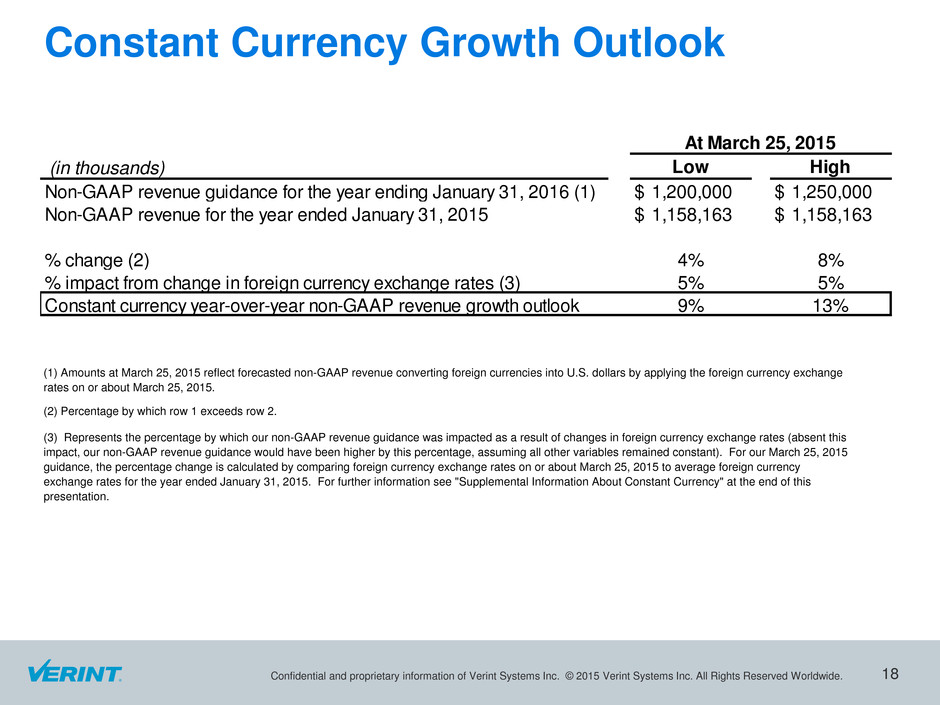

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. Constant Currency Growth Outlook 18 (in thousands) Non-GAAP revenue guidance for the year ending January 31, 2016 (1) $ 1,200,000 $ 1,250,000 Non-GAAP revenue for the year ended January 31, 2015 $ 1,158,163 $ 1,158,163 % change (2) % impact from change in foreign currency exchange rates (3) Constant currency year-over-year non-GAAP revenue growth outlook (2) Percentage by which row 1 exceeds row 2. At March 25, 2015 Low High (1) Amounts at March 25, 2015 reflect forecasted non-GAAP revenue converting foreign currencies into U.S. dollars by applying the foreign currency exchange rates on or about March 25, 2015. (3) Represents the percentage by which our non-GAAP revenue guidance was impacted as a result of changes in foreign currency exchange rates (absent this impact, our non-GAAP revenue guidance would have been higher by this percentage, assuming all other variables remained constant). For our March 25, 2015 guidance, the percentage change is calculated by comparing foreign currency exchange rates on or about March 25, 2015 to average foreign currency exchange rates for the year ended January 31, 2015. For further information see "Supplemental Information About Constant Currency" at the end of this presentation. 9% 13% 4% 8% 5% 5%

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. Highly Diversified Portfolio COMMUNICATIONS & CYBER INTELLIGENCE SOLUTIONS Engagement Analytics Speech Analytics Text Analytics Enterprise Feedback Management Identity Authentication and Fraud Detection Employee Desktop Case Management Knowledge Management Email and Whitemail Management Web Self-Service Live Chat and Co-Browse Social Engagement Customer Communities Quality Management Recording Workforce Management Desktop and Process Analytics Performance Management eLearning and Coaching Situational Awareness Platform Enterprise Video Management Software Video Analytics EdgeVMS Public Safety Media Recorder Actionable Intelligence Solutions Cyber Security Threat Protection Network Intelligence Tactical Intelligence Web, Cloud and Open Source Intelligence Service Provider Compliance VIDEO & SITUATION INTELLIGENCE SOLUTIONS ENTERPRISE INTELLIGENCE SOLUTIONS 19 59% 31% 10% Note: Percentages based on FYE Jan 2015 non-GAAP revenue.

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. Efficient Capital Structure ($ in millions) Net Debt Capital Structure Highlights Net Debt/EBITDA As of January 31, Fiscal year ended January 31, Notes: -Financial data is non-GAAP. See appendices for reconciliation. -Average interest rate excludes the impact of amortization of discounts and deferred financing fees. -Net debt excludes convertible note and other unamortized discounts associated with our debt, which are required under GAAP. See appendices for reconciliation. 20 $523 $501 $431 $400 $437 $344 $228 $453 2008 2009 2010 2011 2012 2013 2014 2015 5.5x 3.5x 2.0x 2.0x 2.2x 1.7x 1.0x 1.6x 2008 2009 2010 2011 2012 2013 2014 2015 Capital Structure • $400 million of term loans • $400 million of convertible notes • Rating Agencies • Moody’s: Ratings improved from B1 to Ba3 • S&P: Ratings improved from BB- to BB Track Record of De-Levering • Net Debt/EBITDA ratio as of 1/31/15: ~1.6x Low Cost Debt with Long Maturity • Average Interest: ~2.5% • Average Duration: ~6 years Equity • Expect ~63.1 million average diluted shares for FYE January 2016

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. Summary • Verint’s strong market presence in Actionable Intelligence provides a solid foundation for delivering continued growth • Large install base provides stability and recurring revenue • Strong economy: Opportunity to accelerate adoption of applications • Weak economy: Maintenance stream, compliance and high value ROI • Track record of growth • Strong earnings growth and cash generation • Efficient capital structure • Long-term model • Opportunity to accelerate growth as addressable market continues to expand • Opportunity to expand margins with scale 21

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. Appendices 22

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. About Non-GAAP Financial Measures The following tables include a reconciliation of certain financial measures for closed periods prepared in accordance with Generally Accepted Accounting Principles (“GAAP”) to the most directly comparable financial measures not prepared in accordance with GAAP (“non-GAAP”). Non-GAAP financial measures should not be considered in isolation or as a substitute for comparable GAAP financial measures. The non-GAAP financial measures we present in the following tables have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP, and these non-GAAP financial measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP financial measures. These non- GAAP financial measures do not represent discretionary cash available to us to invest in the growth of our business, and we may in the future incur expenses similar to the adjustments made in these non-GAAP financial measures. We believe that the non-GAAP financial measures we present in the following tables provide meaningful supplemental information regarding our operating results primarily because they exclude certain non-cash charges or items that we do not believe are reflective of our ongoing operating results when budgeting, planning and forecasting, determining compensation and when assessing the performance of our business with our individual operating segments or our senior management. We believe that these non-GAAP financial measures also facilitate the comparison by management and investors of results between periods and among our peer companies. However, those companies may calculate similar non-GAAP financial measures differently than we do, limiting their usefulness as comparative measures. Our non-GAAP financial measures reflect adjustments to the corresponding GAAP financial measure based on the items set forth below. 23

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. About Non-GAAP Financial Measures • Revenue adjustments related to acquisitions. We exclude from our non-GAAP revenue the impact of fair value adjustments required under GAAP relating to acquired customer support contracts which would have otherwise been recognized on a standalone basis. We exclude these adjustments from our non-GAAP financial measures because these are not reflective of our ongoing operations. • Amortization of acquired intangible assets, including acquired technology. When we acquire an entity, we are required under GAAP to record the fair values of the intangible assets of the acquired entity and amortize those assets over their useful lives. We exclude the amortization of acquired intangible assets, including acquired technology, from our non-GAAP financial measures. These expenses are excluded from our non-GAAP financial measures because they are non-cash charges. In addition, these amounts are inconsistent in amount and frequency and are significantly impacted by the timing and size of acquisitions. Thus, we also exclude these amounts to provide better comparability of pre- and post-acquisition operating results. • Stock-based compensation expenses. We exclude stock-based compensation expenses related to stock options, restricted stock awards and units, stock bonus plans and phantom stock from our non-GAAP financial measures. These expenses are excluded from our non-GAAP financial measures because they are primarily non-cash charges. In prior periods, we also incurred (and excluded from our non-GAAP financial measures) significant cash-settled stock compensation expense due to our previous extended filing delay and restrictions on our ability to issue new shares of common stock to our employees. • M&A and other adjustments. We exclude from our non-GAAP financial measures legal fees, other professional fees, and certain other expenses associated with business acquisitions, whether or not consummated, and certain other costs directly related to consummated business acquisitions, including costs incurred to integrate the acquired businesses into our operations, legal fees and settlements associated with litigation assumed in connection with business acquisitions, and changes in the fair values of contingent consideration liabilities associated with business acquisitions. We also exclude costs associated with the reorganization or restructuring of our operations, whether in connection with business acquisitions, internal factors, or external market factors. All of these expenses are excluded from our non-GAAP financial measures because we believe that they are not reflective of our ongoing operations. 24

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. About Non-GAAP Financial Measures • Amortization of convertible note discount. Under GAAP, certain convertible debt instruments that may be settled in cash upon conversion are required to be bifurcated into separate liability (debt) and equity (conversion option) components in a manner that reflects the issuer’s non-convertible debt borrowing rate. As a result, for GAAP purposes, we are required to recognize imputed interest expense in amounts significantly in excess of the coupon rate on our $400.0 million of 1.50% convertible notes. The difference between the imputed interest expense and the coupon interest expense is excluded from our non-GAAP financial measures because we believe that this non-cash expense is not reflective of ongoing operations. • Unrealized (gains) losses on derivatives, net. We exclude from our non-GAAP financial measures unrealized gains and losses on interest rate swaps and foreign currency derivatives not designated as hedges. These gains and losses are excluded from our non- GAAP financial measures because they are non-cash transactions which are highly variable from period to period and which we believe are not reflective of our ongoing operations. • Losses on early retirements of debt. We exclude from our non-GAAP financial measures losses on early retirements of debt attributable to refinancing or repaying our debt because we believe it is not reflective of our ongoing operations. • Non-cash tax adjustments. We exclude from our non-GAAP financial measures non-cash tax adjustments, which represent the difference between the amount of taxes we expect to pay related to current year income and our GAAP tax provision on an annual basis. On a quarterly basis, this adjustment reflects our expected annual effective tax rate on a cash basis. • In-process research and development. For periods ended prior to February 1, 2009, we excluded from our non-GAAP financial measures the fair value of any incomplete in-process research and development project of an acquired company that had not yet reached technological feasibility and had no known alternative future use, and was therefore charged to our operating results in the period of the acquisition, under then-applicable accounting guidance. These expenses were excluded from our non-GAAP financial measures because they were non-cash charges that we did not believe were reflective of our ongoing operations. 25

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. About Non-GAAP Financial Measures • Impairments of goodwill and other acquired intangible assets. Goodwill represents the excess of the purchase price in a business combination over the fair value of net tangible and identifiable intangible assets acquired. We exclude from our non-GAAP financial measures charges relating to impairment of goodwill and acquired identifiable intangible assets. These expenses are excluded from our non-GAAP financial measures because they are non-cash charges. • Expenses related to our previous extended filing delay. We exclude from our non-GAAP financial measures expenses related to our restatement of previously filed financial statements and our extended filing delay. These expenses included professional fees and related expenses as well as expenses associated with a special cash retention program. These expenses are excluded from our non-GAAP financial measures because they are not reflective of our ongoing operations. • Settlement with OCS. In the year ended January 31, 2007, we recorded a charge related to our July 31, 2006 settlement with the Office of Chief Scientist in Israel (“OCS”), pursuant to which we exited a royalty-bearing program and the OCS accepted a settlement of our royalty obligations under this program. We exclude from our non-GAAP financial measures expenses associated with exiting this program because they are not reflective of our ongoing operations. • Gain on sale of land. We exclude from our non-GAAP financial measures the gain from the sale of a parcel of land. This gain is excluded from our non-GAAP financial measures because it is not reflective of our ongoing operations. 26

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. Supplemental Information About Constant Currency Because we operate on a global basis and transact business in many currencies, fluctuations in foreign currency exchange rates can affect our consolidated U.S. dollar operating results. To facilitate the assessment of our performance excluding the effect of foreign currency rate fluctuations, we calculate our non-GAAP revenue, cost of revenue, and operating expenses on both an as- reported basis and a constant currency basis, allowing for comparison of results between periods as if foreign currency exchange rates had remained constant. We perform our constant currency calculations by translating current-period foreign currency revenues and expenses into U.S. dollars using prior-period average foreign currency exchange rates or hedge rates, as applicable, rather than current period exchange rates. Our financial outlook for revenue and diluted earnings per share, which is provided on a non-GAAP basis, reflects foreign currency exchange rates approximately consistent with rates in effect when the outlook is provided. Percentage growth rates in revenue provided in our financial outlook are expressed on a constant currency basis, and are calculated by translating projected foreign currency revenue for the current period into U.S. dollars using prior-period average foreign currency exchange rates, and comparing the result to actual revenue reported for the prior period. We believe that constant currency growth rates, which exclude the impact of foreign currency exchange rate changes, facilitate the assessment of underlying business trends. 27

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. GAAP to Non-GAAP Reconciliation 28 Note: Prior to FYE January 31, 2006, there were no adjustments between GAAP and Non-GAAP results. ($ in millions) FYE January 31, 2006 2007 2008 2009 2010 2011 2012 2013 2014 April 30, 2014 July 31, 2014 October 31, 2014 January 31, 2015 2015 Revenue Reconciliation GAAP Revenue 278.8$ 368.8$ 534.5$ 669.5$ 703.6$ 726.8$ 782.6$ 839.5$ 907.3$ 257.4$ 276.8$ 282.6$ 311.7$ 1,128.4$ Revenue Adjustments Related to Acquisitions - - 37.3 5.9 - - 13.6 8.5 2.7 11.9 7.9 5.9 3.9 29.8 Non-GAAP Revenue 278.8$ 368.8$ 571.8$ 675.4$ 703.6$ 726.8$ 796.2$ 848.1$ 910.0$ 269.3$ 284.7$ 288.5$ 315.6$ 1,158.2$ Gross Profit Reconciliation GAAP Gross Profit 144.1$ 177.5$ 304.5$ 411.3$ 463.7$ 488.5$ 514.3$ 557.5$ 600.9$ 154.6$ 174.3$ 181.5$ 203.0$ 713.3$ Revenue Adjustments Related to Acquisitions - - 37.3 5.9 - - 13.6 8.5 2.7 11.9 7.9 5.9 3.9 29.8 Amortization and Impairment of Acquired Technology and Backlog 5.0 7.7 8.0 9.0 8.0 9.1 12.4 14.8 12.3 6.4 8.6 8.1 8.0 31.0 Settlement with OCS - 19.2 - - - - - - - - - - - - Stock-Based Compensation Expenses - 1.7 4.5 5.4 5.9 6.2 3.3 2.9 2.4 1.1 1.2 1.2 2.8 6.2 M&A and Other Adjustments - - - - - - 0.4 0.5 3.0 4.5 0.1 (1.1) 0.5 4.0 Expenses Related to Restatement and Extended Filing Delay - - 2.4 - - - - - - - - - - Non-GAAP Gross Profit 149.1$ 206.0$ 356.7$ 431.6$ 477.6$ 503.8$ 544.0$ 584.3$ 621.3$ 178.5$ 192.1$ 195.6$ 218.2$ 784.3$ Three Months Ended

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. GAAP to Non-GAAP Reconciliation 29 Note: Prior to FYE January 31, 2006, there were no adjustments between GAAP and Non-GAAP results. ($ in millions) FYE January 31, 2006 2007 2008 2009 2010 2011 2012 2013 2014 April 30, 2014 July 31, 2014 October 31, 2014 January 31, 2015 2015 Operating Income (Loss) Reconciliation GAAP Operating Income (Loss) 4.1$ (47.3)$ (114.6)$ (15.0)$ 65.7$ 73.1$ 86.5$ 99.6$ 122.3$ 1.0$ 11.5$ 24.4$ 42.3$ 79.1$ Revenue Adjustments Related to Acquisitions - - 37.3 5.9 - - 13.6 8.5 2.7 11.9 7.9 5.9 3.9 29.8 Amortization and Impairment of Acquired Technology and Backlog 5.0 7.7 8.0 9.0 8.0 9.1 12.4 14.8 12.3 6.4 8.6 8.1 8.0 31.0 Amortization of Other Acquired Intangible Assets 1.3 3.2 19.7 25.2 22.3 21.5 22.9 24.4 24.7 11.2 11.6 11.4 11.0 45.2 Settlement with OCS - 19.2 - - - - - - - - - - - - Impairments of Goodwill and Other Acquired Intangible Assets - 21.1 22.9 26.0 - - - - - - - - - - In-process Research and Development 2.9 - 6.7 - - - - - - - - - - - Stock-Based Compensation Expenses 1.2 18.8 31.1 36.0 44.2 46.8 27.9 25.2 35.0 11.5 14.4 12.6 15.9 54.4 Expenses Related to Restatement and Extended Filing Delay - 3.7 41.4 28.7 54.5 28.9 1.0 - - - - - - - Gain on Sale of Land - (0.8) - - - - - - - - - - - - M&A and Other Adjustments 2.6 - 23.0 4.7 0.9 5.2 12.3 16.6 13.0 9.0 4.6 2.3 7.5 23.4 Non-GAAP Operating Income 17.1$ 25.5$ 75.4$ 120.4$ 195.6$ 184.6$ 176.6$ 189.2$ 210.0$ 51.0$ 58.6$ 64.7$ 88.6$ 262.9$ EBITDA Reconciliation Non-GAAP Operating Income 17.1$ 25.5$ 75.4$ 120.4$ 195.6$ 184.6$ 176.6$ 189.2$ 210.0$ 51.0$ 58.6$ 64.7$ 88.6$ 262.9$ GAAP Depreciation & Amortization (1) 17.8 19.3 45.3 53.5 47.8 46.8 51.0 54.9 53.8 22.6 25.2 24.3 24.4 96.5 Amortization and Impairment of Acquired Technology and Backlog (5.0) (7.7) (8.0) (9.0) (8.0) (9.1) (12.4) (14.8) (12.3) (6.4) (8.6) (8.1) (8.0) (31.0) Amortization of Other Acquired Intangible Assets (1.3) (3.2) (19.7) (25.2) (22.3) (21.5) (22.9) (24.4) (24.7) (11.2) (11.6) (11.4) (11.0) (45.2) Other Adjustments - - - (0.2) - (0.8) (0.2) (0.1) - - - - - - Non-GAAP Depreciation & Amortization 11.5 8.4 17.6 19.0 17.5 15.4 15.4 15.6 16.8 5.0 5.0 4.8 5.4 20.3 Non-GAAP EBITDA 28.5$ 34.0$ 93.0$ 139.5$ 213.2$ 200.0$ 192.0$ 204.8$ 226.8$ 56.0$ 63.6$ 69.5$ 94.0$ 283.2$ (1) Adjusted for patent and financing fee amortization. Three Months Ended

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. GAAP to Non-GAAP Reconciliation 30 Note: Prior to FYE January 31, 2006, there were no adjustments between GAAP and Non-GAAP results. ($ in millions, except share and per share data) FYE January 31, 2006 2007 2008 2009 2010 2011 2012 2013 2014 April 30, 2014 July 31, 2014 October 31, 2014 January 31, 2015 2015 Other Income (Expense) Reconciliation GAAP other expense, net 8.0$ 7.8$ (55.2)$ (43.9)$ (41.5)$ (34.6)$ (40.3)$ (31.8)$ (59.0)$ (14.3)$ (16.3)$ (8.1)$ (19.0)$ (57.7)$ Loss on extinguishment of debt - - - - - - 8.1 - 9.9 7.1 5.5 - - 12.5 Unrealized (gains) losses on derivatives, net - - 26.7 (1.8) (8.0) (6.0) (0.4) 0.1 (0.7) 0.7 (0.9) (1.6) 1.6 (0.1) Amortization of convertible note discount - - - - - - - - - - 1.1 2.4 2.4 6.0 M&A and other adjustments - - - - - - 0.1 1.2 13.8 0.1 - (0.1) 0.6 0.5 Non-GAAP other income (expense), net 8.0$ 7.8$ (28.5)$ (45.7)$ (49.5)$ (40.6)$ (32.5)$ (30.5)$ (36.0)$ (6.4)$ (10.6)$ (7.4)$ (14.4)$ (38.8)$ Tax Provision Reconciliation GAAP provision for (benefit from) income taxes 9.6$ 0.1$ 27.7$ 19.7$ 7.1$ 9.9$ 5.5$ 9.0$ 4.5$ (42.1)$ 5.5$ 4.8$ 16.8$ (15.0)$ Non-cash tax adjustments (5.4) 3.2 (23.6) (16.4) 4.6 (1.4) 11.1 9.2 11.2 46.4 (1.2) (0.1) (10.5) 34.6 Non-GAAP provision for income taxes 4.2$ 3.3$ 4.1$ 3.3$ 11.7$ 8.5$ 16.6$ 18.2$ 15.7$ 4.3$ 4.3$ 4.7$ 6.3$ 19.6$ Net Income (Loss) Attributable to Verint Systems Inc. Reconciliation GAAP net income (loss) attributable to Verint Systems Inc. 1.7$ (40.5)$ (198.6)$ (80.4)$ 15.6$ 25.6$ 37.0$ 54.0$ 53.8$ 28.0$ (12.3)$ 10.7$ 4.6$ 30.9$ Total GAAP net income (loss) adjustments 18.4 69.6 240.4 150.0 117.4 106.9 86.8 81.7 99.5 11.5 54.1 41.0 61.5 168.1 Non-GAAP net income attributable to Verint Systems Inc. 20.1$ 29.1$ 41.8$ 69.6$ 133.0$ 132.5$ 123.8$ 135.7$ 153.3$ 39.5$ 41.8$ 51.7$ 66.1$ 199.0$ Net Income (Loss) Attributable to Verint Systems Inc. Common Shares GAAP net income (loss) attributable to Verint Systems Inc. common shares 1.7$ (40.5)$ (207.3)$ (93.5)$ 2.0$ 11.4$ 22.2$ 38.5$ 53.6$ 28.0$ (12.3)$ 10.7$ 4.6$ 30.9$ Total GAAP net income (loss) adjustments 18.4 69.6 240.4 150.0 117.4 106.9 86.8 81.7 99.5 11.5 54.1 41.0 61.5 168.1 Non-GAAP net income attributable to Verint Systems Inc. common shares 20.1$ 29.1$ 33.1$ 56.5$ 119.4$ 118.3$ 109.0$ 120.2$ 153.1$ 39.5$ 41.8$ 51.7$ 66.1$ 199.0$ Non-GAAP diluted net income per common share attributable to Verint Systems Inc. 0.62$ 0.88$ 1.00$ 1.65$ 3.09$ 2.79$ 2.47$ 2.64$ 2.84$ 0.72$ 0.72$ 0.84$ 1.06$ 3.35$ Shares used in computing non-GAAP diluted net income per common share 32,620 32,979 33,035 42,298 42,963 47,402 50,123 51,355 54,001 55,018 58,179 61,492 62,081 59,374 Three Months Ended

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. Table of Reconciliation from Gross Debt to Net Debt 31 ($ in millions) As of January 31, 2008 2009 2010 2011 2012 2013 2014 2015 Current maturities of long-term debt -$ 4.1$ 22.7$ -$ 6.2$ 5.9$ 6.6$ -$ Long-term debt 610.0 620.9 598.2 583.2 591.2 570.8 635.8 736.8 Unamortized debt discounts - - - - 2.7 2.2 2.8 74.4 Gross debt 610.0 625.0 620.9 583.2 600.1 578.9 645.2 811.2 Less: Cash and cash equivalents 83.2 115.9 184.3 169.9 150.7 210.0 378.6 285.1 Restricted cash and bank time deposits 3.6 7.7 5.3 13.6 12.9 11.1 6.4 36.9 Short-term investments - - - - - 13.6 32.0 35.8 Net debt 523.2$ 501.4$ 431.3$ 399.7$ 436.5$ 344.2$ 228.2$ 453.4$

Confidential and proprietary information of Verint Systems Inc. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. © 2015 Verint Systems Inc. All Rights Reserved Worldwide. Thank You