Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - Juhl Energy, Inc | ex21.htm |

| EX-31.2 - EXHIBIT 31.2 - Juhl Energy, Inc | ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Juhl Energy, Inc | ex32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Juhl Energy, Inc | ex32-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Juhl Energy, Inc | ex31-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Juhl Energy, Inc | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE EXCHANGE ACT OF 1934

Commission file number: 000-54080

JUHL ENERGY, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

20-4947667 |

|

(State or other jurisdiction of |

(I.R.S. Employer |

|

incorporation or organization) |

Identification No.) |

|

1502 17th Street SE |

|

|

Pipestone, Minnesota 56164 |

(507) 777-4310 |

|

(Address of principal executive offices) |

(Registrant's telephone number) |

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE EXCHANGE ACT:

None

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE EXCHANGE ACT:

Common Stock, Par Value $0.0001 Per Share

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 of Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).*

Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

Non-accelerated filer |

☐ |

Smaller reporting company |

☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes ☐ No ☒

The aggregate market value of the 9,631,339 shares of common equity stock held by non-affiliates of the registrant was $2,793,088 on the last business day of the Registrant’s most recently completed second fiscal quarter, based on the last sales price ($0.29) of the registrant’s common stock on the most recent date on which a trade in such stock took place prior thereto. As of March 27, 2015 the registrant’s outstanding common stock consisted of 36,424,826 shares.

TABLE OF CONTENTS

|

PART I |

|

|

|

ITEM 1 |

BUSINESS |

4 |

|

ITEM 1A |

RISK FACTORS (NOT APPLICABLE) |

29 |

|

ITEM 1B |

UNRESOLVED STAFF COMMENTS (NOT APPLICABLE) |

29 |

|

ITEM 2 |

PROPERTIES |

29 |

|

ITEM 3 |

LEGAL PROCEEDINGS |

30 |

|

ITEM 4 |

MINE SAFETY DISCLOSURES (NOT APPLICABLE) |

30 |

|

|

|

|

|

PART II |

|

|

|

ITEM 5 |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

30 |

|

ITEM 6 |

SELECTED FINANCIAL DATA (NOT APPLICABLE) |

32 |

|

ITEM 7 |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

32 |

|

ITEM 7A |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK (NOT APPLICABLE) |

46 |

|

ITEM 8 |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

46 |

|

ITEM 9 |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

79 |

|

ITEM 9A |

CONTROLS AND PROCEDURES |

79 |

|

ITEM 9B |

OTHER INFORMATION |

80 |

|

|

|

|

|

PART III |

|

|

|

ITEM 10 |

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

80 |

|

ITEM 11 |

EXECUTIVE COMPENSATION |

86 |

|

ITEM 12 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

89 |

|

ITEM 13 |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE |

92 |

|

ITEM 14 |

PRINCIPAL ACCOUNTANT FEES AND SERVICES |

92 |

|

|

|

|

|

PART IV |

|

|

|

ITEM 15 |

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES |

92 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INDUSTRY DATA

This report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties, many of which are beyond our control. Our actual results could differ materially and adversely from those anticipated in such forward-looking statements as a result of certain factors, including those set forth in this report. Important factors that may cause actual results to differ from projections include, but are not limited to, for example: adverse economic conditions, inability to raise sufficient additional capital to operate our business, delays, cancellations or cost overruns involving the development or construction of our wind farms, the vulnerability of our wind farms to adverse meteorological and atmospheric conditions, unexpected costs, lower than expected sales and revenues, and operating defects, adverse results of any legal proceedings, the volatility of our operating results and financial condition, inability to attract or retain qualified senior management personnel, expiration of certain governmental tax and economic incentives, and other specific risks that may be referred to in this report. It is not possible for management to predict all of such factors, nor can it assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained or implied in any forward-looking statement. All statements, other than statements of historical facts, included in this current report regarding our expectations, objectives, assumptions, strategy, future operations, financial position, estimated revenue or losses, projected costs, prospects and plans and objectives of management are forward-looking statements. When used in this report, the words “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” “plan” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. All forward-looking statements speak only as of the date of this report. We undertake no obligation to update any forward-looking statements or other information contained herein. Stockholders and potential investors should not place undue reliance on these forward-looking statements. Although we believe that our plans, intentions and expectations reflected in or suggested by the forward-looking statements in this report are reasonable, we cannot assure stockholders and potential investors that these plans, intentions or expectations will be achieved. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf. Information regarding market and industry statistics contained in this report is included based on information available to us that we believe is accurate, as of the date of this report. It is generally based on academic and other publications that are not produced for purposes of securities offerings or economic analysis. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services.

Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

DEFINITIONS

| DEFINITIONS | |||

| “We,” “Our,” “us” and similar expressions refer to the Company and its subsidiaries as the context requires: | |||

|

Juhl Energy or the Company |

Juhl Energy, Inc., a Delaware corporation (formerly known as Juhl Wind, Inc. name change effective January 2, 2013) and MH & SC Incorporated (change effective June 20, 2008) | ||

| Juhl Energy Development | Juhl Energy Development, Inc., a Minnesota corporation | ||

| Juhl Energy Services | Juhl Energy Services, Inc., | ||

| a Minnesota corporation (formerly known as DanMar and Associates, Inc.) | |||

| Juhl Energy Development and Juhl Energy Services are referred to separately prior to our share exchange transaction on June 24, 2008, in which Juhl Energy Development and Juhl Energy Services became wholly-owned subsidiaries and Juhl Energy (formerly known as Juhl Wind) became successor to the business of Juhl Energy Development and Juhl Energy Services, after giving effect to the share exchange transaction | |||

| NextGen | Next Generation Power Systems, Inc., | ||

| a South Dakota corporation, which we acquired on October 31, 2008 and which is now our wholly-owned subsidiary | |||

| Juhl Renewable Assets | Juhl Renewable Assets, Inc., | ||

| a Delaware corporation (formerly known as Juhl Wind Asset Investment, Inc. and Juhl Wind Project Lending, Inc.), our wholly-owned subsidiary formed on May 19, 2010 | |||

| Juhl Renewable Energy Systems | Juhl Renewable Energy Systems, Inc., | ||

| a Delaware corporation, our wholly-owned subsidiary formed on February 2, 2012 | |||

| Juhl Tower Services | Juhl Tower Services, Inc. | ||

| a Delaware corporation, a wholly-owned subsidiary of Juhl Energy Services formed on February 8, 2013, which we have discontinued operations, and dissolved the entity in February 2015. | |||

| Valley View | Valley View Transmission, LLC, | ||

| a Minnesota limited liability company, of which Juhl Renewable Assets, Inc. indirectly holds a 32.6% interest | |||

| Woodstock Hills | Woodstock Hills, LLC, | ||

| a Delaware limited liability company, of which we acquired a 99.9% interest on April 28, 2011, and which is now a subsidiary of Juhl Renewable Assets, Inc. | |||

| Winona Wind | Winona Wind Holdings, LLC, | ||

| a Minnesota limited liability company which we acquired on October 13, 2011, and which is now a wholly-owned subsidiary of Juhl Energy Development, Inc. and which owns 100% of Winona County Wind, LLC (“Winona County”), the operator of the wind farm; | |||

| PEC or Power Engineers Collaborative | Power Engineers Collaborative, LLC, | ||

| an Illinois limited liability company, which we acquired on April 30, 2012 and which is now our wholly-owned subsidiary | |||

| Iowa Wind Farms | 5045 Wind Partners, LLC | ||

| an Iowa limited liability company acquired on August 11, 2014 of which Juhl Renewable Assets, Inc. directly holds a 100% interest, which owns two Iowa wind projects comprised of two 1.6 MW wind turbines in the Central Iowa region | |||

ELECTRICAL POWER ABBREVIATIONS

|

Kw |

kilowatt or 1,000 watts of electrical power |

|

MW |

megawatt or 1,000 kW of electrical power |

|

GW |

gigawatt or 1,000 MW of electrical power |

|

TW |

terawatt or 1,000 GW of electrical power; |

|

kWh MWh GWh TWh |

An hour during which 1kW, MW, GW or TW, as applicable, of electrical power has been continuously produced. |

|

Capacity |

Rated capacity |

|

NCF |

Net capacity factor, or the measure of a wind energy project’s actual production expressed as a percentage of the amount of power the wind energy project could have produced running at full capacity for a particular period of time |

|

PTC |

Production tax credit under the American Recovery and Reinvestment Act |

|

REC |

Renewable energy certificate or other renewable energy attribute, as the context requires |

PART I

ITEM 1 BUSINESS

BUSINESS OVERVIEW

Juhl Energy is an established leader in the clean and renewable-energy industry and provides a full range of clean energy solutions with a focus on wind, solar, biomass and natural gas systems. Juhl Energy historically focused on community wind power development, management and ownership, throughout the United States. We are one of the few companies other than utility based conglomerates that handle all aspects of wind project development, through our operating subsidiaries, including full development and ownership of wind farms, general consultation on wind projects, construction management of wind farm projects and system operations and maintenance for completed wind farms, which results in multiple revenue streams. The primary focus of our wind power development business has been to build 5 MW to 80 MW wind farms jointly owned by local communities, farm owners, environmentally-concerned investors, and our Company. The wind farms are connected to the general utility electric grid to produce clean, environmentally-sound wind power. Our development of community wind power systems generally results in landowners owning a portion of the long-term equity in the wind farm that resides on their land. We pioneered community wind power systems in developing the currently accepted financial, operational and legal structure providing local ownership of medium to large scale wind farms. Since 1999, we have completed 24 wind farm projects, accounting for approximately 260 MW of wind power that currently operate in the Midwest region of the United States (which are over approximately $510 million in value), and we provide operation management and oversight to wind generation facilities generating approximately 88 MW, through our subsidiary, Juhl Energy Services. Currently, we have 21 projects in various stages of development with an aggregate wind power generating capacity of approximately 445 MW (4 of which we are actively developing with an aggregate wind power generating capacity of approximately 176 MW and 17 of which are mid to early stage wind development opportunities, which includes projects undergoing feasibility analysis, with an aggregate wind power generating capacity of approximately 269 MW). The 21 wind farm projects, all of which are onshore type projects, are located in the United States and make up our development pipeline.

Historically, our wind power projects are based on the formation of partnerships with the local owners upon whose land the wind turbines are installed. Over the years, this type of wind power has been labeled “community wind power” because the systems are locally owned by the landowners (often farmers). Community wind power is a specialized sector in the wind energy industry that differs from the large, utility-owned wind power systems also being built in the United States. Community wind power is a form of community-based energy development (C-BED). Various states, including Minnesota and Nebraska (where we have projects in development), have enacted C-BED initiatives, which include mechanisms to support community wind power and are intended to make it easier for community wind power projects to be successful without placing an excessive burden on utilities. This results in community wind power being not only environmentally sustainable but also serving as an economic stimulus for the rural areas that it encompasses. Community wind projects generally sell power to utilities. We are striving to expand our model nationally where we can take advantage of higher energy rates, and our currently evaluating projects in Indiana, Oregon and South Dakota.

As community wind projects have become more difficult to develop due in part to difficulty in obtaining contracts with utilities, Juhl Energy has begun to develop projects for end customers, such as Honda Transmission Manufacturing of America (“Honda”) as described below and small utility companies, which are examples of projects that fit our distributed generation model. Generally, distributed generation allows for small and mid-sized wind and solar projects to be constructed at the site of the energy user (such as a manufacturing facility or university), which eliminates the build out of new transmission networks. Such distribution model differentiates from the centralized utility model which often requires electricity to be transmitted over long distances.

As part of our innovative role in renewable energy development services, we partnered with Honda to serve as the primary developer on a project to construct the first ever on-site industrial wind project for the automotive company, with a generation capacity of 3.4 MW. In January 2014, Honda finalized installation and began operation of two power producing wind turbines at its automotive manufacturing facility in Russells Point, Ohio, where it is the first such facility in the United States to obtain a portion of its electricity directly from wind turbines located on its property. The two wind turbines will supply approximately 10 percent of the plant’s electricity. Based on the location of the two wind turbines and actual wind speeds, combined output from the two wind turbines is estimated at 10,000 megawatt hours (MWH) per year, which will supply approximately 10 percent of the facility’s electricity. The Honda wind project represents a growing niche within our renewable energy development services, which includes installing wind and solar facilities for large industrial electricity users and corporate clients. Our goal is to continue to grow this sector of our business by providing quality development services to companies that are looking to utilize renewable energy at their planned or existing facilities.

To continue to build on the Honda project model, we plan to pursue additional distributed generation projects that consist of wind, solar or other technologies, or in combination, to fulfill the need of manufacturers and other institutions seeking to reduce their carbon footprint and meet some of their own electricity demand.

Our nationally-diverse development pipeline of wind projects (as exemplified above) continues to be our springboard in the clean and energy industry and allows us to capitalize our relationships in the industry. Development fees from wind projects have historically been the foundation of our revenue generation. In December 2014, we worked with a financing partner to complete a 20 MW wind farm project in South Dakota, where we were able to collect a $1,500,000 development services fee. To further our revenue generation from the development of wind farms, our goal is to use capitalization from the Company’s financing partners and possibly money derived from our other diverse operating subsidiaries (as discussed below) to have the ability to pre-fund development costs. This will allow us to bring projects through the early development and construction stages more quickly by pre-funding development costs to secure the successful completion of projects and alleviate the uncertainty related to securing lender and third party financing commitments. We believe that this will lead to sustainable revenue growth from development fees.

As mentioned above, significant to our overall role in the clean energy industry, as discussed in more detail below, we continue to expand the scope of our business to include other alternative energy sources in addition to wind. Two illustrations of the Company’s broadening base of our services include (1) our acquisition of Power Engineers Collaborative to provide engineering services in the renewable energy field and (2) the expansion of Juhl Renewable Energy Systems to encompass small scale renewables in solar and small wind turbines to provide offerings to additional end customers. While we continue to leverage our experience as leaders in the wind energy industry, we will look for opportunities for expansion in the broader arena of alternative energy.

One of the unique aspects at Juhl Energy is the diversity and integration of its subsidiaries which make up our business model. The Company operates through the following subsidiaries (with further description set forth below):

|

Juhl Renewable Assets |

renewable assets ownership |

|

Juhl Energy Development |

wind farm development |

|

Juhl Energy Services |

wind farm management and turbine maintenance services |

|

Juhl Renewable Energy Systems |

small scale renewable systems |

|

Next Generation Power Systems |

refurbished turbines and maintenance support |

|

Power Engineers Collaborative |

engineering services |

Diversifying Strategy and Execution

Beyond wind, Juhl Energy’s diversification strategy to become a diverse and balanced clean energy company focuses upon the delivery of sustainable revenue growth to augment our wind farm development and construction fee revenue. As such, the acquisition of additional energy assets (including complimentary, higher margin, industry service providers) remains a meaningful part of our focus on the growth of our revenue and net income. Thus, we continue to focus on recurring, repeatable and strong base of annual revenue contracts with a focus on: (i) ownership of wind farms and other forms of renewable energy ownership and operations (Juhl Renewable Assets); (ii) operations and services (Juhl Energy Services); (iii) engineering expertise (Power Engineers Collaborative); and (iv) the distributive solar market (Juhl Renewable Energy Systems).

In addition to development, we position our growth through targeted acquisitions of ownership positions in wind farms and invest in other renewable energy assets through our preferred renewable asset equity vehicle, Juhl Renewable Assets. To date, we have funded three wind farms. In August 2014, we added to our portfolio of wind farms through Juhl Renewable Assets’ purchase of the 100% membership interest in 5045 Wind Partners, LLC, an Iowa limited liability company which in turn owns 100% of two Iowa wind projects, Windwalkers, LLC and Roeder Family Wind Farm, which is each comprised of one 1.6 MW wind turbine in the central Iowa region.

One of our strategies for growth is to acquire complementary, higher-margin industry service providers. Notably, in 2012, we acquired Power Engineers Collaborative, LLC (“PEC”), which is an engineering services company. We believe that the expansion into engineering consulting services with the acquisition of PEC in 2012 has significantly increased our ability to grow our revenues beyond development and construction of community wind projects into the full range of clean energy projects including natural gas, biomass, waste-to-energy, medium-to-large on-site solar, and support to larger wind farm construction. We have experienced growth in revenues for PEC and expect this to continue, complimented by our experience in wind farm development and construction. As our engineering arm, PEC participates as the Owner's Engineer throughout the development and execution of projects utilizing biomass, waste products, and other renewable sources including both wind and solar.

In the first quarter of 2014, we acquired the assets of PVPower, Inc., a business focused on the sale of solar power products, through non-traditional sales channels, specifically through an online distributor network, in which Juhl Renewable Assets had made an investment in the third quarter of 2011. This allows us to augment our offerings in solar. We will now distribute solar-related system products through Juhl Renewable Energy Systems to consumers and small businesses using the online system developed by PVPower.

As we experience growth in small-scale solar through our acquisition of PV Power, the Company announced in July 2014 that Juhl Renewable Energy Systems was named as lead contractor for all rooftop installations completed through the “Solar Chicago Program”. The “Solar Chicago Program” provides affordable and efficient renewable energy solutions for its residential property owners throughout the Chicago metro area. Juhl Renewable Energy Systems has completed approximately eleven projects as of March 2015 and expects to complete up to 30 more projects in the first half of 2015, using the assistance of two qualified subcontractors. Further, PEC, our engineering subsidiary, will support the Company’s project management efforts including energy modeling, and the design and installation of the solar projects. In addition to the PVPower Platform and the design and installation of rooftop solar in Chicago, Juhl Renewable Energy Systems offers small wind and solar products for onsite energy generation and battery backup, such as SolarBank®, and is exploring additional battery storage partnerships, and intend to pioneer new wind/solar/storage hybrid renewable systems. Juhl Renewable Energy Systems has approximately 285 kw of projects with a contract value of approximately $1.1 million, including the Solar Chicago program and other projects in Minnesota.

Overall, Juhl Energy’s diverse business strategy has allowed us to remain well-positioned for future growth despite the uncertainty surrounding federal policy with respect to tax incentives which have impacted businesses operating in the wind industry. Our business and operating strategy, among other things, is to continue to develop into an innovative, diverse and balanced clean energy company. We will work to leverage our portfolio of existing community wind power projects, develop new wind farm projects, including at industrial plants to help reduce the carbon footprint of manufacturers, and take equity ownership positions in existing community-based wind farms. Further, we are continuing to diversify our business operations by expanding our product offerings to energy conscious consumers with the development of our small scale renewables, including wind turbines and solar products, and expanding our services offerings to provide engineering services for our clients. More recently, we expanded our maintenance services capabilities to include cellular towers but due to lack of profitability and inability to generate positive cash flows, we discontinued operations in the fourth quarter of 2014, and such entity is now dissolved.

Our evolving business and operating strategy relies heavily on the expertise of our management team. Our Chairman and Principal Executive Officer, Daniel J. Juhl has been involved in the wind industry since 1978 and was one of the creators of community wind power projects in the United States. He is one of the most sought after wind energy developers by land owners and potential investors of wind projects in the United States. In addition to Mr. Juhl’s expertise, John Mitola, our President, is also considered an expert in the energy field having focused his career on energy efficiency, demand side management and independent power development. Mr. Mitola has significant experience in the energy industry and electric industry regulation, oversight and governmental policy. The prominence of Mr. Juhl and Mr. Mitola in the wind industry will maximize the quantity and quality of projects available for consideration.

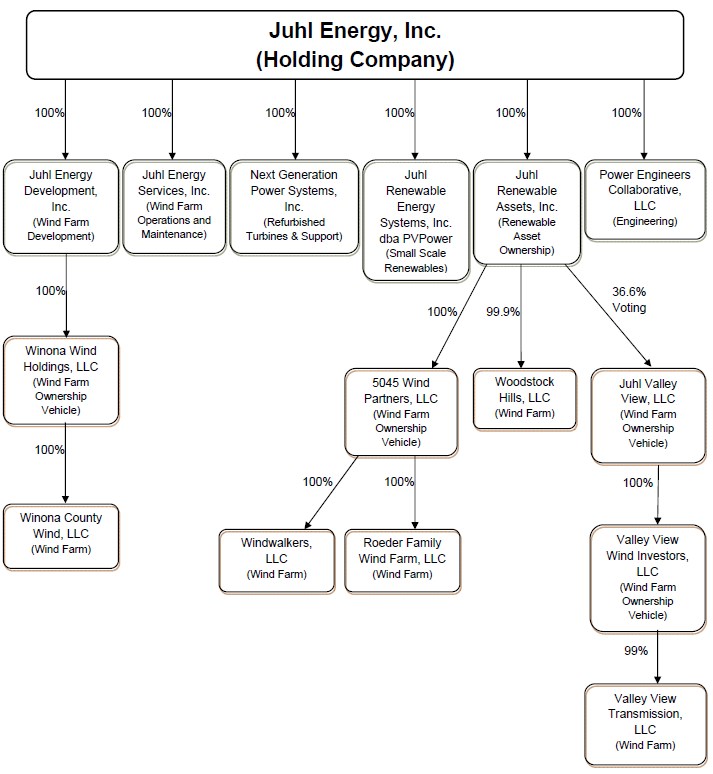

Corporate Organizational Diagram:

Juhl Energy, Inc. is a holding company whose subsidiaries and affiliates are organized as set forth in the corporate organizational diagram below:

OVERVIEW OF OPERATING SUBSIDIARIES

As discussed in detail throughout this report, we provide the following portfolio of services and products, through our operating subsidiaries identified below, which allows us to diversify our offerings and benefit from tiered revenue streams, as well as integrate our operations:

Juhl Renewable Assets – Renewable Assets Ownership

Juhl Renewable Assets focuses on the acquisition of ownership positions in new and existing wind farms and investment in other renewable energy assets, thus building an asset base with predictable cash flows. Through Juhl Renewable Assets, we also look for revenue contribution through acquisition of related business services that provide strong operating margins, such as engineering, consulting and related facilities. As discussed herein, Juhl Renewable Assets has taken an ownership position in the following wind farms: the 10 MW Valley View wind farm (February 2011), the 10.2 MW Woodstock Hills wind farm (April 2011) and the Iowa Wind Farms (August 2014).

Our business and operating strategy is to take equity ownership positions in existing community-based wind farms and other renewable assets, such as solar projects. We select projects where the following important conditions exist for successful projects that provide predictable revenue: acceptable wind resources, suitable transmission access, an appropriate regulatory framework providing acceptable power purchase agreements and long-term utility agreements. Further, we believe that there are existing wind farms that are or will become available for sale by equity owners who have fully utilized the tax attributes or no longer have the desire to continue ownership.

We continue to evolve our strategy and increase our portfolio capacity through acquisitions that build recurring annual revenue streams, and take advantage of the growth occurring in the wind industry. As the renewable asset acquisition vehicle for our parent company, we focus on acquisitions that strengthen our balance sheet, allowing us to continue to actively seek additional project acquisitions.

Juhl Energy Development - Wind Farm Development

Through Juhl Energy Development, we provide our core development services for community wind farms, including the following: initial feasibility studies and project design; formation of required land rights agreements to accommodate turbine placement on each project’s specific farm land, assistance in the application process to obtain environmental, zoning and building permits for the project; studies, design and agreements with utilities; turbine selection and delivery coordination; negotiation and execution of power purchase agreements; access and consultation regarding construction financing; coordination of vendor terms, including vendor financing; introduction to equity and debt project financing services; construction oversight and complete balance of plant construction services; and project commissioning.

Since 1999, we have completed 24 wind farm projects, accounting for approximately 260 MW of wind power that currently operate primarily in the Midwest region of the United States. Currently, we have 21 projects in various stages of development with an aggregate wind power generating capacity of approximately 445 MW of wind power generating capacity (4 of which we are actively developing with an aggregate wind power generating capacity of approximately 176 MW and 17 of which are early stage wind development opportunities with an aggregate wind power generating capacity of approximately 269 MW). The 21 wind farm projects, all of which are on-shore type projects, are located in the United States and Canada and make up our development pipeline.

Juhl Energy Services - Wind Farm Operations, Management and Maintenance Services

Through Juhl Energy Services, we earn revenue through administrative, management, maintenance and warranty services agreements with wind generation facilities, and such revenues are recognized as the in-field services are provided. We can either provide services to wind farms that we have developed or contract with existing wind farms developed by others. Currently, Juhl Energy Services provides operations management and oversight to wind generation facilities generating approximately 111 MW of wind farm projects, together with turbine maintenance services to 71 MW of wind farm projects.

As previously reported, Juhl Energy Services, in early 2013, formed a wholly-owned subsidiary, Juhl Tower Services, which performed implementation and maintenance activities on cellular communication towers. In late 2014, the Company discontinued operations for Juhl Tower Services, due to lack of profitability and not meeting our expectations for generating cash flows to support our operations.

Juhl Renewable Energy Systems - Small Scale Renewables

Through Juhl Renewable Energy Systems, we specialize in advanced conservation technologies focused on smaller scale wind and solar energy systems to the energy consumer, including farming operations, small to medium sized businesses and municipalities. Juhl Renewable Energy Systems is focused on the sales and installation of on-site renewable energy systems in the Upper Midwest. In the first quarter of 2014, we acquired the assets of PVPower, Inc., a business focused on the sale of solar power products, through non-traditional sales channels, specifically through an online distributor network. This allows us to augment our offerings in solar by distributing solar-related system products to consumers and small businesses using the online system developed by PVPower, including Solarbank® an on-site solar system; and Powerbank®, a simple onsite backup power system. Juhl Renewable Energy Systems handles projects from start to finish, including design, sales, financing and service. Juhl Renewable Energy Systems offers several financing structures through independent third parties. Juhl Renewable Energy Systems is reviewing its business strategy on moving into additional target markets offering opportunities for revenue growth, including possible acquisition of existing service providers in those markets.

Power Engineers Collaborative – Engineering Services

Through our wholly-owned subsidiary, Power Engineers Collaborative, we provide engineering services to clients, which primarily consist of electric utilities, independent power producers and large electricity users who operate central plant systems. PEC's core business includes assisting clients in site selection, environmental permitting, equipment studies, preparation of contract documents, bid evaluation, contract awards, preparation of detailed construction documents, design of auxiliary facilities, engineering services during construction and training of operating and maintenance personnel.

PEC’s clients and target clientele encompass primarily the utility industry and central power plants of large institutions or commercial/industrial enterprises to which it provides consulting services. PEC has designed a consulting program to help utility clients work within their resource planning initiatives in order to address the requirements of their existing resource plan, need for clean power that can be cost-effectively dispatched, and maintenance of transmission and distribution system integrity.

Next Generation Power Systems – Refurbished Turbines and Maintenance Support

Next Generation Power Systems is in the business of refurbishing turbines and maintaining this fleet. We do not expect to sell additional refurbished turbines, but periodically we are requested to perform work on turbines previously sold to customers.

INDUSTRY AND MARKET OVERVIEW

This report includes market and industry data that we have developed from publicly available information, various industry publications and other published industry sources, and our internal data and estimates (as of the date of this report). Although we believe the publications and reports are reliable, we have not independently verified the data. Our internal data, estimates, and forecasts are based upon information obtained from trade and business organizations and other contacts in the market in which we operate, as well as our management’s understanding of industry conditions.

Governmental Programs and Incentives

In keeping with the government’s efforts to reduce fossil fuel emissions, the Environmental Protection Agency (EPA) proposed the Clean Power Plan (the “Plan”) in June 2014. The Plan, which the EPA hopes to finalize by mid-summer 2015, aims to cut carbon pollution from power plants. The Plan sets state-specific, rate-based goals for carbon dioxide emission in the power sector. The proposed guidelines are based on and would reinforce the actions already being taken by states and utilities to upgrade aging electricity infrastructure with twenty-first century technologies. Under the Plan: (i) each state must develop a plan to achieve an emission performance level that corresponds to the state goal; and (ii) the state plans must establish standards of performance for the affected Electric Utility Generating Units (EGUs) and include measures that implement and enforce those standards. We believe that wind power will be a key tool for states to utilize in order to comply with the EPA’s first-ever proposed rule to reduce carbon pollution at existing power plants while maintaining an affordable, reliable energy system.

Substituting wind energy and other renewable energy sources for traditional fossil fuel-fired generation would help reduce carbon dioxide emissions due to their environmentally-friendly attributes. According to the U.S. Department of Energy, U.S. Energy Information Administration (EIA) annual report “Emissions of Greenhouse Gases in the United States 2009,” published in March 2011 (which was the final publication of this report), the electric power sector (which consists of those companies whose primary business is the generation of electricity) is the largest source of all energy-related carbon dioxide emissions; this report also stated, however, that emissions from the electric power sector declined in 2009 by 9.0%. The EIA’s International Energy Outlook (2014) found that although generation in the electric power sector will increase by 25% from 2012 to 2040, the sector’s carbon dioxide emissions are expected to increase by only 11% over the same period. In general, the growth of renewable generation is associated with an increase in electric power generation coinciding with a reduction in carbon dioxide emissions.

Another example of the national trend toward renewable energy sources is evidenced in the growth of jobs in the renewable energy sector. According to the EIA’s December 19, 2014 “Today in Energy,” the electric power generation sector lost more than 5,800 jobs from January 2011 through June 2014, coinciding with a period in which the United States has experienced declining year-over-year electricity sales, driven, among other things, by energy efficiency improvements and the growth in wind and solar energy production. This loss was offset somewhat by 1,800 jobs gained in the renewable electricity generation industry. According to the EIA’s Short Term Energy Outlook, published February 2015, the EIA projects that total renewables used for electricity and heat generation will grow by 3.8% in 2015. Conventional hydropower generation is expected to increase by 5.7%, while there is an anticipated 2.9% increase in non-hydropower renewables generation. In 2016, total renewables consumption for electric power and heat generation is predicted to increase by 2.9% as a result of an expected 3.2% decline in hydropower and a 6.0% increase in non-hydropower renewables.

State and federal legislation designed to encourage the development and deployment of renewable energy technologies is also driving the growth in the United States’ wind energy market and other renewable energy markets (as described generally above) by guaranteeing revenues and reducing costs of projects. This support includes:

Renewable Portfolio Standards (RPS)

In response to the push for cleaner power generation and more secure energy supplies, many states have enacted RPS programs. A RPS program (sometimes called a Renewable Energy Standard, or RES), is a program that either: (i) requires state-regulated electric utilities and other retail energy suppliers to produce or acquire a certain percentage of their annual electricity consumption from renewable power generation resources or, (ii) as in the case of New York, designate an entity to administer the central procurement of Renewable Energy Certificates (“RECs”) for the state. Typically, utilities comply with such standards by qualifying for renewable energy credits evidencing the share of electricity that was produced from renewable sources. These standards have spurred significant growth in the wind energy industry and a corresponding demand for our services. The enactment of renewable energy portfolio standards in additional states or changes to existing renewable energy portfolio standards may impact the demand for our services. Similar to federal incentives discussed below, the elimination of, or reduction in, state governmental policies that support renewable energy could have a material adverse impact on our business, results of operations, financial performance, and future development efforts.

According to the RPS Summary Map (which provides information about state RPS programs), published by the U.S. Department of Energy Database of State Incentives for Renewables & Efficiency (DSIRE), as of September 2014, 29 states, plus the District of Columbia and two territories, have legislated renewable energy portfolio standards, and nine more states and two territories have adopted voluntary renewable portfolio goals. Almost every state that has implemented an RPS program will need considerable additional renewable energy capacity to meet its RPS requirements.

Renewable Energy Certificates (REC)

A REC is a stand-alone tradable instrument representing the attributes associated with one megawatt hour of energy produced from a renewable energy source. These attributes typically include reduced air and water pollution, reduced greenhouse gas emissions, and increased use of domestic energy sources. Many states use RECs to track and verify compliance with their RPS programs. Retail energy suppliers can meet the requirements by purchasing RECs from renewable energy generators, in addition to producing or acquiring the electricity from renewable sources. Under many RPS programs, energy providers that fail to meet RPS requirements are assessed a penalty for the shortfall, usually known as an alternative compliance payment. Because RECs can be purchased to satisfy the RPS requirements and avoid an alternative compliance payment, the amount of the alternative compliance payment effectively sets a cap on REC prices. In situations where REC supply is short, REC prices approach the alternative compliance payment, which in several states reach approximately $50 per megawatt hour. As a result, REC prices can rival the price of energy and RECs can represent a significant additional revenue stream for wind energy generators.

Federal Tax and Economic Incentives

U.S. federal, state, and local governments have established various incentives and financial mechanisms to reduce the cost of wind and solar energy and to accelerate the adoption of renewable energy. These mechanisms have been established in response to the stated intent by the U.S. Department of Energy to double renewable energy generation by 2020. These incentives include tax credits, accelerated depreciation, rebates, and net metering programs. These incentives help catalyze private sector investments in energy projects, such as utility scale wind farm and solar projects as well as smaller scale projects such as small wind turbines and residential and commercial solar energy systems.

Federal Production Tax Credits and Investment Tax Credits

Wind energy. The federal government provides economic incentives to the owners of wind energy facilities, including the PTC, or alternatively, an investment tax credit ("ITC"). The credit represents tax savings of $0.023 per KWh generated from wind, geothermal, and closed-loop biomass systems and $0.011 per KWh from other eligible renewable technologies. The PTC was extended by the American Recovery and Reinvestment Act in February 2009, and further extended by the American Taxpayer Relief Act (“ATRA”) in January 2013. The Tax Increase Prevention Act of 2014, passed into law on December 19, 2014, extended the PTC expiration date to December 31, 2014. It provides the owner of a qualifying wind energy facility under construction before the end of 2014 (or alternatively meeting safe harbor provisions such as incurring at least 5% of total project costs by such date) with a ten-year tax credit against the owner's federal income tax obligations based on the amount of electricity generated by the facility and sold to unrelated third parties. Alternatively, eligible projects are allowed to elect a 30% ITC in lieu of the PTC. The ITC may be taken after the plant has commenced commercial operation.

Solar energy. The federal government provides an uncapped investment tax credit, or Federal ITC, that allows a taxpayer to claim a credit of 30% of qualified expenditures for a residential or commercial solar energy system that is placed in service on or before December 31, 2016. This credit is scheduled to be reduced to 10% effective January 1, 2017.

Accelerated Tax Depreciation. Tax depreciation is a non-cash expense meant to approximate the loss of an asset’s value over time and is generally the portion of an investment in an asset that can be deducted from taxable income in any given tax period. Current federal income tax law requires taxpayers to depreciate most tangible personal property placed in service after 1986 using the modified accelerated cost recovery system, or MACRS, under which taxpayers are entitled to use the 200% or 150% declining balance method depending on the class of property, rather than the straight line method. Under MACRS, a significant portion of wind farm assets is deemed to have depreciable life of five years which is substantially shorter than the 15 to 25 year depreciable lives of many non-renewable power supply assets. This shorter depreciable life and the accelerated and bonus depreciation methods result in a significantly accelerated realization of tax depreciation for wind farms compared to other types of power projects. For 2013, bonus depreciation was 50% of the eligible basis. This bonus depreciation was extended retroactively throughout 2014 by the Tax Increase Prevention Act of 2014. Wind energy generators with insufficient taxable income to benefit from this accelerated depreciation often monetize the accelerated depreciation, along with the PTCs, through forming a limited liability company with third parties.

Extension of the Federal Tax Incentives

For the immediate short term, we believe that the PTC will allow continued growth of wind energy, based on the number of wind power projects under construction at the end of 2014, and will help to propel wind energy as a major source of electricity generation through 2017. However, we recognize that the PTC expiration on December 31, 2014, creates financial uncertainty for new development projects going forward. The uncertainty around the tax credit will likely make mid- and long-term planning in the renewable energy industry difficult because the tax credit has such a significant impact on the financial viability of projects. This uncertainty is exacerbated by the PTC’s erratic extension history. That being said, higher electricity prices have made wind and solar technologies economically attractive alternatives, especially as their technology costs have come down in recent years.

We recognize that the uncertainty of a permanent national energy policy focusing on renewable energy may have an adverse effect for our business, results of operation, financial performance and future development efforts of wind energy projects. Thus, we believe it is necessary to evolve and diversify in our asset, product and service portfolio to reduce our exposure to the uncertainty of future renewals of tax incentives and other favorable governmental policies currently supporting the U.S. wind industry and renewable energy sector. However, even without the PTC, demand for all forms of renewable energy continues to rise in the U.S., according to the EIA. As a result of this increased demand and lower costs, the market for wind energy will survive the expiration of the PTC.

The expiration of the PTC creates an additional opportunity for income generation as well. As credits expire and depreciation schedules run their course, many current wind farm owners will be looking to exit the industry. Juhl Energy’s experience and expertise for operating small wind farms may provide opportunities for financially viable acquisition transactions in the next three years. There are an estimated 500 small wind farms under 50MW in the U.S. that are financially viable. By acquiring some of these small farms from motivated sellers, we can avoid installation costs, minimize operating costs, and scale our investment arm strategically.

Energy Demand and Sources for Electricity Generation

Demand for electricity in the U.S. is expected to increase on an average 0.9% per year from 2012 through 2040 according to the Reference Case in the Annual Energy Outlook 2014 published by the EIA (the “EIA 2014 Outlook”). New capacity for electricity generation will be required to meet this anticipated demand. According to the EIA 2014 Outlook, 37% of all electricity produced in the United States in 2012 was generated by coal, which is the largest source of carbon dioxide emissions in the atmosphere. Other major sources of electricity in 2012 were natural gas (30%), renewables (12%), nuclear (19%) and oil and other liquids (1%).

By their very nature, fossil fuels are nonrenewable resources that are depleted faster than they can be replenished. Coal, natural gas, and oil will eventually be depleted beyond economic viability. Based on research completed by the EIA and EPA, as the supply of nonrenewable resources diminishes, prices will rise. Renewable energies like solar and wind, on the other hand, are not depleted when harvested. As prices of production and technology continually decrease and demand for energy persists, we believe the market for renewable resources will expand. In addition to the economic benefits, renewable energy is environmentally superior because it produces far less greenhouse gases than the production of nonrenewable electricity via fossil fuels.

In 2015, we believe that higher natural gas market share may occur as a result of lower prices in the past year, inventory levels and heavy production involving hydraulic fracturing methods. In EIA’s “Short Term Energy Outlook” published February 2015, natural gas is expected to provide 28.4% of power generation during 2015, 1.2% higher than 2014, as a result of decreasing natural gas prices. The availability of cheaper natural gas creates steep competition for renewable energy generation. We believe that the push in governmental mandates and initiatives to source energy from renewables lessens the competitive edge of non-renewables, such as natural gas.

According to the EIA Reference Case detailed in the EIA 2014 Outlook, total coal consumption is projected to increase from 17.3 quadrillion BTU in 2012 to 18.75 quadrillion BTU in 2040. Even with consumption of fossil fuels rising and prices falling (such as natural gas), the EIA specifically discredits theories that increased oil availability will damage the renewable energy sector. Instead, because of governmental support lasting for at least the next decade, renewable and nonrenewable energy are not in direct competition with one another in most sectors.

Wind Power Generation

Because of uncertainty regarding extension of the federal wind energy PTC in 2013 and again in 2014, developers waited to see whether Congress would extend the PTC. The credit was extended for projects that began construction by December 31, 2013 and by December 31, 2014, respectively. Due to the timing of the late extensions of the PTCs by Congress (January 2014 and December 2014, respectively), we believe such extensions did little to spur significant additional development activity beyond what developers had already planned. However, the wind industry is gradually establishing its independence from government incentives. This is evidenced by the continual growth in the industry despite uncertainties about the availability of future tax credits. According to the EIA Short Term Energy Outlook, published February 2015, wind capacity grew 7.7% in 2014, and the rate of increase is expected to more than double in 2015, from 7.7% to 16.1%. In the aftermath of the 2013 wind development standstill caused by PTC renewal uncertainty, this level of growth we believe is a positive trajectory for the renewable energy industry.

Wind is intermittent and electricity generated from wind power can be highly variable. Good site selection and advantageous positioning of turbines on a selected site are critical to the economic production of electricity by wind energy. In our experience, the primary cost of producing wind-powered electricity is the turbine equipment and construction cost, which cost has been on the decline in recent years (as discussed more fully below). Wind energy itself has no fuel costs and relatively low maintenance costs. As an intermittent resource, wind power must be carefully positioned into the electric grid along with other generation resources, and we believe Juhl Energy has demonstrated the expertise necessary to work with local electric utilities to create viable integration plans. Therefore, we intend to continue to identify new sites to produce wind energy through the community wind model throughout the United States and Canada as well as look for opportunities to acquire wind projects and other renewable assets that meet our criteria.

Turbine Costs & Wind Project Costs Decreasing

Since 2008, the cost of wind turbines has declined, and the decline has been accompanied by improved turbine technology and more favorable terms for turbine purchasers (such as reduced turbine delivery lead times, longer initial operations and management contracts and improved warranty terms), according to the U.S. Department of Energy’s “2013 Wind Technologies Market Report.” The U.S. Department of Energy’s “Wind Technologies Market Report” also predicted that all of the foregoing is expected, over time, to exert downward pressure on total wind project costs and wind power prices. Installed project costs are found to exhibit some economies of scale, at least at the low end of the project size range.

The declining prices are significant because lower equipment prices make wind energy more competitive with fossil fuels, such as coal and gas, on a dollar-per-megawatt-hour basis. As evidence of more competitive pricing, the Department of Energy’s “2013 Wind Technologies Market Report” reports that the capacity-weighted average levelized price for projects with power purchase agreements signed in 2011 was $35/MWh, as compared to $59/MWh for projects with agreements signed in 2010 and $72/MWh in 2009. These price drops accelerated in 2013 when prices decreased to $22/MWh for the Interior Region of the U.S., the geographic Midwest below the Great Lakes and between the Coasts, as shown in the 2013 Wind Technologies Report. Falling project prices increase demand for renewable energy generation by making it more affordable to purchase and install.

As reported in the U.S. Department of Energy’s “2013 Wind Technologies Market Report,” among a large sample of wind power projects installed in 2013, the capacity-weighted average installed cost of $1,940/KW, down almost $200/KW from the reported average cost in 2011 and down almost $300/KW from the reported average cost in both 2009 and 2010. With respect to specific regions in the U.S., the “2013 Wind Technologies Market Report” stated that the U.S. interior was the lowest-cost region for wind power projects, while the west coast was the highest-cost region.

Solar Power Generation

We believe that increased global demand for electricity in connection with modern technology and emerging market industrialization has placed a significant burden on the world’s available electricity supply, focusing international attention on solutions to maintain access to adequate energy supplies. Solar photovoltaic modules have no moving parts, operate quietly without carbon or other emissions and are capable of short and long-term use with minimal maintenance. Solar energy is renewable and creates no short-term waste and uses almost no water. We believe the “environmental footprint” of solar energy is negligible, as the energy it takes to make a solar power system is typically recouped by the energy costs saved over a period of one to three years. We believe that solar energy, like wind energy, has the potential to advance the goals of reducing the world’s dependence on conventional fuels, satisfying the growing demand for energy, enhancing national security by reducing dependence on imported fossil fuels, and reducing greenhouse gas emissions.

Solar energy, like wind energy, provides several advantages over fossil fuel, nuclear and other forms of renewable power generation. One fundamental benefit is that sunlight, the source of the electricity, is available without any mining or transportation. If sufficient sunlight is available, a solar power generation facility can be located where the power is needed, thus avoiding the need for, and cost of, lengthy distribution and transmissions lines along with other upgrades to the grid. Solar energy is also a scalable technology, able to produce power according to load demand and available land or space. It is also delivered on-peak, generating the most power during the time of the day when load typically demands it.

As with wind power generation, the primary potential disadvantage to solar power is that it relies upon an intermittent resource. Unlike some generators, it cannot increase or decrease its productivity at the request of grid operators. It also does not generate power when the modules are not receiving light at certain levels such as night time. Further, solar power requires space for the arrays of solar photovoltaic modules, which can limit its use in urban areas. We believe innovations in energy storage solutions, the type of service offered by Juhl Renewable Energy Systems, could resolve some of these issues. Also, unlike wind, the intermittent production of solar power naturally coincides with peak demand for residential power usage, thereby creating value in increasing available power during such peak periods.

We have seen a recent decline in photovoltaic solar costs. The price decline in photovoltaic equipment reflects a more competitive environment, an increase in efficiency of the solar cells, improvements in technology and economies of scale. We view the shifts in the solar industry as an opportunity for us to develop solar power projects that can generate power at prices which are lower than the retail prices charged by utilities and provide solutions using solar energy as a back-up power source in the case of a power outage.

In the EIA Short Term Energy Outlook, published February 2015, the EIA projects continued rapid growth of utility-scale solar generation through 2016. A projected 80 GWh per day will be produced solely by solar arrays by 2016. Although solar capabilities have historically been concentrated in residential and spot-use areas, utility-scale solar arrays are projected to dramatically increase by up to 60% between the end of 2014 and the end of 2016. We are uniquely positioned to capitalize on this rapid growth in both demand and capacity, given that our installation capabilities are already in place. In capturing a portion of this expanding market share, solar installation will become a central product offering.

According to the U.S. Department of Energy’s “SunShot Initiative,” a program launched in 2011 aimed at increasing solar power use and innovation in the U.S., the U.S. is the world’s second largest consumer of electricity, but also has the largest solar resource of any industrialized country. The SunShot Initiative aims to reduce the total installed cost of solar energy systems by 75% by 2020 through reduction of solar technology costs, reduction of grid integration costs and acceleration of solar deployment.

The SunShot Initiative’s SunShot Vision Study (published in February 2012) stated that, in 2010, solar energy provided less than only 0.1% of the U.S. electricity demand. Technical potential, however, for solar energy’s contribution to the U.S. energy demand is enormous. For example, one estimate suggested that the area required to supply an amount of electricity equivalent to all end-use electricity in the United States using solar power is only about 0.6% of the country’s total land area.

According to the Sunshot Initiative’s Photovoltaic System Pricing Trends Report, published in September 2014, every utilized projection methodology demonstrates that the pricing of photovoltaic systems will dramatically decrease between 2014 and 2016. This enhances the viability of photovoltaic systems for use both residentially and on the utility-scale. Since 1998, photovoltaic system pricing has dropped an average of 6-8% per year. This trend has only accelerated in recent years, dropping 12% for small systems and 15% for large systems in 2012-2013.

According to the Department of Energy’s Interactive Chart entitled “The Falling Price of Utility-Scale Solar Photovoltaic (PV) Projects”, just as the popularity of photovoltaic (“PV”) systems is rising, the price of utility-scale PV projects has been precipitously declining since 2010. In 2010, the cost of electricity, in cents per kilowatt hours, was 21.4 c/kwh, nearly four times as much as the 2020 goal of 6 c/kwh. As of 2013, the cost of electricity nearly halved, at 11.2 c/kwh.

Solar power is also gaining in popularity in the individual U.S. states and cities, as rooftop solar power systems are becoming more prevalent as energy choices for residences and businesses. According to “Solar and the City,” an article posted on the U. S. Department of Energy’s website, in 2007 San Francisco developed an online “solar map,” and New York developed one in 2011. The “solar maps” are tools that allow people to determine the solar potential of their homes and businesses and have played a big part in supporting residents interested in solar power. When San Francisco first developed its solar map in 2007, for example, there were only 554 solar installations marked on the map. As of July 22, 2014, there were 3,747 PV systems installed in San Francisco, according to the San Francisco Department of the Environment’s Solar Map. Even President Obama is taking notice of the brisk growth of the solar industry, indicating in his most recent State of the Union address that every three weeks, more solar power is brought online in the U.S. than was built in all of 2008 (as reported in the Department of Energy’s January 29, 2015 press release, entitled “Energy Department Announces More Than $59 Million Investment in Solar”)(the “DOE’s January 29, 2015Announcement”). This rapid growth is indicative of a major shift towards solar power in the U.S. We believe our solar products, focused on storage solutions and solar installations, are ideally positioned to take advantage of the attention solar energy is receiving in urban environments where wind projects are not practical.

As mentioned above, U.S. federal, state and local governments have established various incentives and financial mechanisms to reduce the cost of solar energy and to accelerate the adoption of solar energy. These incentives include tax credits, cash grants, tax abatements, rebates, and net energy metering, or net metering, programs. These incentives help catalyze private sector investments in solar energy, energy efficiency and energy storage measures, including the installation and operation of residential and commercial solar energy systems. Further, the federal government provides an uncapped investment tax credit, or Federal ITC, that allows a taxpayer to claim a credit of 30% of qualified expenditures for a residential or commercial solar energy system that is placed in service on or before December 31, 2016. This credit is scheduled to be reduced to 10% effective January 1, 2017. Solar energy systems that began construction prior to the end of 2011 are eligible to receive a 30% federal cash grant paid by the U.S. Treasury Department under Section 1603 of the American Recovery and Reinvestment Act of 2009, or the U.S. Treasury grant, in lieu of the Federal ITC. The federal government also provides accelerated depreciation for eligible solar energy systems.

Solar power installation has in fact been on the incline in the past several years. According to the U.S. Department of Energy, the amount of solar power installed in the U.S. increased from 1.2 gigawatts (GW) in 2008 to an estimated 17.5 GW as of the end of the third quarter of 2014. On January 29, 2015, the U.S. Department of Energy announced a $59 million funding award to support solar energy innovation, comprising of the following: (i) $45 million in funding to bring innovative solar manufacturing technologies to the marketplace, with the goal of reducing the costs of photovoltaics and power electronics and (ii) $14 million in funding to 15 selected projects through the Solar Market Pathways project, as reported in the DOE’s January 29, 2015 Announcement. . As provided in that announcement, the Solar Market Pathways program provides funding support to its recipients, including, for example, not for profits, utilities, industry associations, universities, and state and local jurisdictions in California, Illinois, Minnesota, among others, to further its own development plan to install solar electricity over a multi-year period for residential, community and commercial properties. Through its selected projects, the Solar Market Pathways program focuses on “soft costs” of solar, including permitting, financing, and connecting to the electric grid, and to utilize the results and experiences from these projects to eventually provide similar jurisdictions with a road map for implementing solar projects in a faster, simpler and more cost-effective manner throughout the country. Ultimately, we believe these Department of Energy programs promote the overall advancement of solar energy as a viable source of electricity.

COMPETITIVE ADVANTAGES/STRENGTHS

Our Company is a fully-diversified clean energy company built upon our roots as a pioneer in the wind farm development industry with particular expertise in the community wind sector. We believe that we have a number of competitive advantages in the clean renewable energy sector in addition to our nationally-recognized community wind development:

Tiered Service Offering Results in Multiple Revenue Streams. One of our key advantages is that we generate revenue from our operating subsidiaries offering diversified products and services in all segments of the renewable clean energy sector rather than relying solely on one operating subsidiary to produce revenue:

|

|

● |

Juhl Renewable Assets focuses on the acquisition of ownership positions in wind farms and investment in other renewable energy assets which provide highly predictable revenues and strong operating margins. Capitalizing on the unique knowledge base of our parent company, Juhl Renewable Assets acquires new and existing wind farms and other renewable assets, thus building an asset base with predictable cash flows. |

|

|

● |

Juhl Energy Development is our wind farm development subsidiary, where revenue is generated from development, service and construction fees earned from each of the wind farms that we develop. |

|

|

● |

Juhl Energy Services is our wind farm operations and maintenance subsidiary, where revenue is earned from administrative, management and maintenance services agreements. |

|

|

● |

Juhl Renewable Energy Systems is our small scale renewable subsidiary, where revenue is contributed through the sale and installation of renewable energy systems, including solar products and small scale wind turbines, to the energy consumer (including agricultural-related businesses and municipalities) which provide modern options in terms of cost effectiveness, performance, and reliability. |

|

|

● |

Power Engineers Collaborative expands our professional capacities beyond wind and into the full range of clean energy sectors including natural gas, biomass, waste-to-energy, medium-to-large on-site solar, and support to larger wind farm construction. |

Proven Record in Developing Wind Farm Projects. One of our key advantages is that we have completed 24 community wind farm projects to date, representing approximately 260 MW of generating capacity of electricity, and currently have projects in various stages of development, amounting to a total of 445 MW of wind power generating capacity of electricity. Due to our strength in development, revenue from development has been a strong cash revenue generator for the Company. However, we continue to strive to diversity our sources of revenue through our operational subsidiaries so that we are not dependent solely on a revenue stream from development.

For community wind projects to be completed successfully, projects must be constructed in a cost-effective manner. In the course of completing 24 wind projects to date, we have been able to demonstrate to project owners, equity investors and lenders that we can build wind farms on a cost-effective basis. To further our development of wind farms, our goal is to use capitalization from the Company’s other diverse operating subsidiaries to have the ability to pre-fund development costs. By pre-funding development costs, we would be able to alleviate dependence on third party financing and lenders to pre-fund the development costs of the project. Securing financing for the development of our wind farm projects is critical, and having the ability to pre-fund such development costs with our own capital helps ensure that such project will come to fruition, resulting in a development fee on the project.

With the fluctuating renewable energy industry, experienced participants with comprehensive offerings (such as Juhl Energy) are more likely to prosper in the long term especially considering the uncertainty of a long-term federal energy policy. Our expansion into a fully-diversified clean energy company while continuing as a leading participant in the community wind niche provides a broad base to support growth, maintain agility and achieve longevity.

Experienced Management Team. Led by an industry leader, Dan Juhl, we believe our development team is highly qualified in its experience, credibility and track record.

Mr. Juhl is an expert in the wind power field and is considered a pioneer in the wind industry having been active in this field since 1978. He was a leader in the passage of specific legislation supporting wind power development in the states of Minnesota and Nebraska, as well as contributing to the development of the currently accepted, financial, operational and legal structure providing local ownership of medium-to-large scale wind farms. John Mitola, our President, is also considered an expert in the energy field having focused his career on energy efficiency, demand side management and independent power development. He has significant experience in the energy industry and electric industry regulation, oversight and government policy. As such, Currently Dan Juhl is one of the most sought after wind energy developers by land owners and potential investors of wind projects in the U.S. The rest of our management team has collectively been involved in the wind power industry for more than 30 years.

We believe that our experience in developing community wind farms in new market areas and operating energy companies will enable us to continue to successfully expand our development portfolio. Further, we believe our management’s understanding of deregulated energy markets enables us to maximize the value of our development portfolio. Our team has experience in site selection, market analysis, land acquisition, community relations, permitting, financing, regulation and construction.

As we build on our diverse renewable energy business through strategic acquisitions or joint ventures with other industry partners on specific renewable energy projects, our experienced management team’s position in the industry will be elevated which will enhance our ability to secure projects that meet our criteria and move forward on those renewable energy projects.

Established Local Presence and Credibility. In the Midwest U.S. markets where we are active, our management team maintains a local presence and promotes community stakeholder involvement. By maintaining our principal office in Pipestone, Minnesota and satellite offices in Minneapolis, Minnesota, Milwaukee, Wisconsin and Chicago, Illinois, and becoming involved in local community affairs, we develop a meaningful local presence, which we believe provides us with a significant advantage when working through the local permitting processes and helps to enlist the support of our local communities for wind farms. We believe that our local approach has enabled us to secure approvals and support for our projects in regions that have historically voiced opposition and has given us a significant advantage over competitors, who are not as active in the local communities in which we are developing wind farms. Our management’s active participation in the state and local regulatory and legislative processes has led to the growth of community wind across the Midwest.

We plan to use the credibility that has been built in the local communities to expand our presence outside of the Midwest U.S. market, where we can take advantage of higher electricity rates. Currently, we are providing development services to a project in upstate New York to capitalize on higher electricity rates, which we expect to be completed during 2015, and evaluating development and acquisition wind projects in Oregon, South Dakota and Indiana.

Turbine Access. We maintain good working relationships with most turbine suppliers who are actively marketing turbine equipment in our market area with extensive experience to determine suitability of turbine technologies for our projects. In order to continue to survive long term in this industry, we need to continue to control costs. Thus, the ability to purchase turbines in bulk, possibly through a frame agreement, provides access to the lowest price. Further, in many of our wind farm projects, we have been willing to use technology of new turbine manufacturing entrants which provides reliability and favorable access to the supply chain and provides lenders with comfort in terms of financing a project. Further, newer wind turbine models are more efficient and offer improved capacity factors with prices continuing to fall to record levels.

Ownership-Sharing Structure with Land Owners. Through our community wind approach, we involve local stakeholders (such as farmers) by working with them to establish a limited liability company that extends ownership to the participants along with the initial equity investor. Landowners are critical to any wind farm because wind turbines must be placed in open areas requiring a large amount of land necessary to “harvest the wind.” Turbines are typically placed on a small plot of land, and less than one acre is removed from normal use (such as farming or grazing) for each 50 acres of wind resource captured. Turbines must be spaced a certain minimum distance apart to avoid “shadowing” each other and reducing power output. By integrating the land owners into the land rights and ownership structures, we can allow a wind-enabled farm to more than double the annual net income from cultivation or grazing. As a project developer, we assist in finding financing, securing the contract with a utility to buy the electricity produced, negotiating a turbine supply agreement, constructing the system, and operating the wind farm.

As an established leader of community wind power, we have been able to offer what we believe is a unique ownership-sharing formula to landowners and local communities that affords us an ongoing competitive advantage in this large and open sector of the wind energy arena. The advantages of our development of medium-sized projects include lower installation costs, quicker construction, benefits to the local community, simpler land aggregation, less expensive power transmission, easier regulatory compliance and availability of financing.