Attached files

| file | filename |

|---|---|

| EX-14.1 - EXHIBIT 14.1 - Nobilis Health Corp. | exhibit14-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Nobilis Health Corp. | Financial_Report.xls |

| EX-31.1 - EXHIBIT 31.1 - Nobilis Health Corp. | exhibit31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Nobilis Health Corp. | exhibit31-2.htm |

| EX-32.2 - EXHIBIT 32.2 - Nobilis Health Corp. | exhibit32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Nobilis Health Corp. | exhibit32-1.htm |

| EX-21.1 - EXHIBIT 21.1 - Nobilis Health Corp. | exhibit21-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended

December 31, 2014

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from [ ] to [ ]

Commission file number 000-55274

NOBILIS HEALTH CORP.

(Exact name of registrant as specified in its charter)

| British Columbia | 98-1188172 |

| (State or other jurisdiction of incorporation or | (I.R.S. Employer Identification No.) |

| organization) |

| 4120 Southwest Freeway, Suite 150, Houston, Texas | 77027 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (713) 355-8614

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange On Which Registered |

| N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, No par value

(Title of class)

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 the Securities Act.

Yes

[ ] No [ x ]

Indicate by check mark if the registrant is not required

to file reports pursuant to Section 13 or Section 15(d) of the Act

Yes [ ] No [ x ]

Indicate by check mark whether the registrant: (1) has

filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period

that the registrant was required to file such reports) and (2) has been subject

to such filing requirements for the last 90 days.

Yes [ x ] No

[ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Website, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-K (§229.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

Yes [ x ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [ x ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [ x ]

The aggregate market value of Common Stock held by non-affiliates of the Registrant on June 30, 2014 was $23,254,102 based on a $0.98 average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Indicate the number of shares outstanding of each of the

registrant’s classes of common stock as of the latest practicable date.

61,135,631 common shares as of March 25, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

PART I

| Item 1. | Business |

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors" that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

All dollar amounts are expressed in United States dollars as "$" and "C$" refers to Canadian dollars. The financial statements and summaries of financial information contained in this annual report are also reported in United States dollars unless otherwise stated. All such financial statements have been prepared in accordance with United States Generally Accepted Accounting Principles ("US GAAP"), unless expressly stated otherwise.

All references to "common shares" refer to the Common Shares in our capital stock.

As used in this current report and unless otherwise indicated, the terms "we", "us" and "our" and "our company" mean Nobilis Health Corp. and our subsidiaries, unless otherwise stated. References to "Nobilis" refer to Nobilis Health Corp. excluding our subsidiaries.

General Overview

Nobilis Health Corp. was incorporated on March 16, 2007 under the name "Northstar Healthcare Inc." pursuant to the provisions of the British Columbia Business Corporations Act ("BCBCA"). On December 5, 2014, Northstar Healthcare Inc. changed its name to Nobilis Health Corp. Our registered office is located at Suite 400, 570 Granville Street, Vancouver, British Columbia V6C 3P1 and our corporate office is located at 4120 Southwest Freeway, Suite 150, Houston, Texas 77027. Our common shares are and have been publicly traded on the Toronto Stock Exchange under the symbol "NHC" since May 2007.

We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act, referred to as the "JOBS Act".

Inter-corporate Relationships

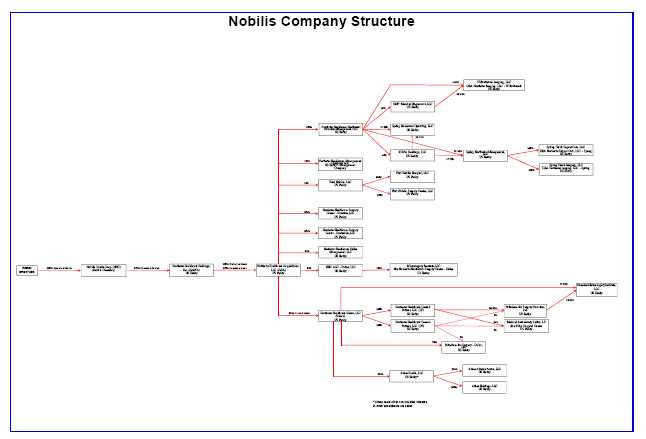

The following chart illustrates our corporate structure as at January 1, 2015.

Investors own and/or manage nine healthcare facilities (the "Nobilis Facilities") in Texas and Arizona; two MRI centers, an urgent care center, one hospital and five ambulatory surgery centers, referred to as the "Nobilis ASCs" of which three are located in Houston, Texas, one in Dallas, Texas and one in Scottsdale, Arizona.

First Nobilis Hospital is a 19 bed acute-care hospital, with four operating rooms and one procedure room. We have an investment in the Oak Bend Medical Center.

The Nobilis ASCs are licensed ambulatory surgery centers that provide scheduled surgical procedures in a limited number of clinical specialties, which enables them to develop routines, procedures and protocols to maximize operating efficiency and productivity while offering an enhanced healthcare experience for both physicians and patients.

The Nobilis ASCs consist of the NHSC-H ASC, the MSID ASC, the NHSC-S ASC, the Kirby ASC, and the First Nobilis Surgery Center. We have investments in two other ASCs, the Elite Orthopedic Spine & Surgery Center and the Elite Sinus Spine and Ortho.

Together as of December 31, 2014, the First Nobilis Hospital and the Nobilis ASCs have 22 surgical suites, 6 procedure or treatment rooms typically used by pain management specialists or for colonoscopies, 39 pre-operation beds, 36 post-operation or recovery beds, 27 overnight beds, and 476 physicians with medical staff privileges (198 of whom performed surgeries in 2013).

The Nobilis ASCs do not offer the full range of services typically found in traditional hospitals, but instead focus on certain clinical specialties, including orthopedic surgery, podiatric surgery, ENT, pain management, gastro- intestinal, gynecology, and general surgery. First Nobilis Hospital focuses on these same specialties with the ability to take on more complex cases and cases that may require an overnight stay.

General Development of the Business

The following presents a summary of the general development of our business over the past five years. For a complete chart of the subsidiaries and entities referred to in this section, please refer to the diagram above which illustrates the various inter-corporate relationships in greater detail.

Pre-2010 Developments

At the time of completion of our company's initial public offering in 2007, we acquired a 70% controlling partnership interest in the The Palladium for Surgery – Houston, Ltd. (the "Palladium Partnership" or "PFSH") and a 60% partnership interest in the Medical Ambulatory Surgical Suites, L.P. (the "Kirby Partnership"). PFSH and the Kirby Partnership operated two ASCs, located in Houston, Texas.

In February 2009, Dr. Donald Kramer, our current director who was then Chief Executive Officer and also a director of our company, tendered his resignation from both positions.

2010 Developments

On September 30, 2010, we completed a private placement of common shares which resulted in a change of control. Pursuant to this private placement, we issued 14,583,417 shares of our common stock to Canada Healthcare Acquisitions, Inc. ("CHA") for C$5 million and 4,195,029 shares of our common stock to Healthcare Ventures, Ltd. ("Ventures") in exchange for all of its Class B Units in Northstar Healthcare Subco, LLC ("Northstar Subco") and Northstar Healthcare Acquisitions, LLC ("NHA"), along with the forgiveness of the related liabilities. Both CHA and Ventures were at the time indirectly controlled by Donald Kramer, M.D. In conjunction with the closing of the private placement, our company's then board of directors resigned and was replaced with a new board of directors. The newly appointed board named Dr. Kramer as Chairman. On October 27, 2010, our company's board announced that Dr. Kramer and Ms. Donna Alexander rejoined our senior management team in their previous capacities as Chief Executive Officer and Chief Operating Officer, respectively. The appointments took effect immediately.

On November 1, 2010, we formed a joint venture with certain physician partners, known as The Houston Microsurgery Institute, LLC ("MSIH"). As of November 1, 2010, the PFSH Partnership ceased performing cases and entered into a lease agreement with MSIH pursuant to which MSIH utilized the PFSH Partnership’s facility and equipment in exchange for 25% interest in the equity of MSIH.

2011 Developments

In January 2011, our company acquired Palladium for Surgery – Dallas ("PFSD") for $2.2 million. In conjunction with the acquisition the Company formed Microsurgery Institute, LLC ("MSID") to operate the ASC controlled by PFSD. PFSD became a 25% owner of MSID and subleased the ASC facility to MSID. MSID was syndicated with physician investors who owned the remaining 75%.

In January 2011, we also purchased 18% of the 27.5% non-controlling interest in the PFSH Partnership from Dr. Donald Kramer for $0.3 million, thereby increasing our interest in the PFSH Partnership to 90.5% . In August, 2011, we purchased additional non-controlling interests from two limited partners and as a result of these transactions, our interest in MSIH increased to 22.9% from 18.1% . In February 2011, we formed Gulf Coast Toxicology, LLC ("GCT") in partnership with Pioneer Laboratories, LLC. We have a 20% ownership interest in GCT, a Dallas-based drug screening laboratory. The laboratory screens and quantifies narcotics and other drugs in urine samples. GCT has partnered with a number of physicians in Houston who will supply the urine samples to be tested in the GCT’s laboratory. GCT commenced operations in early May 2011.

In November, 2011, two limited partners in the Kirby Partnership forfeited their ownership interests due to violations of the partnership agreement. The ownership percentages were distributed to the remaining partners, effectively increasing our interest in the Kirby Partnership to 65.5% from 60%.

2012 Developments

In January 2012, the Company issued 2,000,000 common shares to Dr. Kenneth Alo at a price of C$0.20 under a private placement agreement. Dr. Alo serves as a Medical Director of North American Spine (“NAS”), a subsidiary of Athas Health, LLC. The total purchase price approximated $0.4 million.

In February 2012, the Company acquired additional ownership interests from all of the physician limited partners at Houston Microsurgery Institute, LLC (“MSIH”), effectively increasing the Company’s ownership interest to 90.6% .

In March 2012, the Company sold 18.4% of its ownership interest in the Kirby Partnership to existing physician limited partners, effectively decreasing the Company’s ownership interest to 47.1% .

In April 2012, the Company returned partner capital contributions to all physician limited partners of South Texas Procedure Suites, LLC (“STPS”). The transaction effectively increased the Company’s ownership interest in STPS to 100.0% . STPS ceased operations and the Company abandoned the procedure suites model.

In August 2012, the Company purchased ownership interests from all of the physician limited partners at MSID, increasing the Company’s ownership interest to 100.0% . The Company then facilitated the closing of a private placement offering for equity at MSID to a physician group. The net result of these transactions is that Nobilis has increased its equity ownership in MSID from 25.0% to 50.0% . In conjunction with this transaction, Northstar ASC Management, LLC (“NASC”) was created to provide management services to the re-syndicated partnership. The Company’s ownership interest in NASC is 50.0% .

In November 2012, the Company sold 6.9% of its ownership interest in the Kirby Partnership to one existing physician limited partner and one new physician limited partner, effectively decreasing the Company’s ownership interest to 40.1% .

In December 2012, the Company facilitated the closing of a private placement offering for equity at MSID to three new physician limited partners, effectively decreasing the Company’s ownership interest to 36.5% .

2013 Developments

In March 2013, the Company redeemed the remaining equity interests held by physician limited partners at MSIH, effectively increasing the Company’s ownership interests to 97.7% . In August 2013, the Company formed a limited liability company, Northstar Healthcare Surgery Center – Houston, LLC (“NHSC-H”), which is owned 100% by Northstar Healthcare Acquisitions, LLC. In October 2013, MSIH ceased operating as an ASC and NHSC-H took over all existing operations of MSIH.

In July of 2013, the Company formed a limited liability company, NHC ASC – Dallas, LLC (“NHC ASC – Dallas”) which is owned 100% by NHA. In August 2013, the Company purchased ownership interest from all of the physician limited partners at MSID, increasing the Company’s ownership interest to 100%. In October 2013, the Company syndicated a partnership with certain physician partners for NHC ASC – Dallas. The Company assigned 100% of its equity interest in MSID to NHC ASC – Dallas, of which the Company owns 35% as a result of syndication.

In November 2013, the Company sold 15.1% of its ownership interest in the Kirby Partnership to existing physician limited partners, effectively decreasing the Company’s ownership interest to 25%.

In December 2013, NHA formed a wholly owned limited liability company, Northstar Healthcare Surgery Center – Scottsdale, LLC (“NHSC-S”), to operate as and ASC utilizing assets purchased from a former Brown Hand Center outpatient surgery center. These Assets (the “Scottsdale Assets”) were acquired through a business combination in December of 2013. Operations commenced subsequent to December 31, 2013.

In December 2013, the Company completed a capital raise through the private placement of common shares and warrants (the “Units”). The Company issued 5,862,500 Units, at a price of C$0.80 per Unit. Each Unit consists of one common share in the capital of the Company and one-half of one common share purchase warrant exercisable for one additional share at a price of C$1.10. Through the private placement, the Company raised $4.1 million, net of offering costs of $0.3 million. The Company utilized some of the proceeds to acquire the Scottsdale Assets.

2014 Developments

In January 2014, the Company invested in two imaging centers and one urgent care clinic in Houston. The aggregate investment was comprised of $0.3 million in cash, net of acquired cash, and 431,711 shares of NHC stock representing a combined value of $0.9 million, net of acquired cash.

On October 2, 2014 the Company’s shareholders approved a special resolution changing the name of the Company to “Nobilis Health Corp.”, and in December the Company amended its Articles of Incorporation.

On September 26, 2014, the Company closed a brokered private placement, with PI Financial Corp. as the Company’s Agent, of up to 6,153,846 Units at a price of C$1.30 per unit, for gross proceeds of $8,000,000, with the potential to raise a total of up to $10,000,000 (the “Private Placement”). . Each Unit consists of one common share in the capital of the Company and one-half of one common share purchase warrant exercisable for one additional share at a price of C$1.80 for 24 months from the closing date. The warrants are subject to an early acceleration provision in the event that, at any time following four months from the Closing date, the ten day volume weighted average price of the common shares equals or exceeds C$2.20. The proceeds of the Private Placement were used for general working capital purposes in connection with an agreement with First Surgical Partners Holdings, Inc. (“First Surgical”).

On September 29, 2014, the Company executed an agreement with First Surgical. Per the Agreement, the Company and First Surgical formed a new limited liability company, owned 51% by Nobilis and 49% by First Surgical, to jointly own and operate a hospital and surgical center. NHA manages the operations of the hospital and surgical center under a management agreement. The Company contributed $7.5 million to the new entity, which was raised by the Private Placement.

On December 1, 2014 the Company closed an agreement in which the Company would acquire all the individual member interests of Athas Health, LLC ("Athas") for a total consideration of approximately $31.2 million to expand the Company’s marketing services. The “aggregate consideration” for the Athas ownership interests consisted of $3 million in cash upon closing, the issuance of a promissory note by Company to the sellers for $12 million, the issuance at closing of 6,666,666 shares of Nobilis common stock that are subject to a lock up of up to 2 years, and the issuance of an additional 4,666,666 shares of Nobilis common stock issued over two years with half issued on the first anniversary of the closing and the remaining stock issued on the second anniversary of the closing. After the purchase, Chris Lloyd, Athas’ CEO, was named CEO of Company.

Competition

Within the Texas market, we currently compete with traditional hospitals, specialty hospitals and other ASCs to attract both physicians and patients. Hospitals generally have an advantage over ASCs with respect to the negotiation of insurance contracts and competition for physicians’ inpatient and outpatient practices. Hospitals also offer a much broader and specialized range of medical services (enabling them to service a broader patient population) and generally have longer operating histories and greater financial resources, and are better known in the general community.

The competition among ASCs and hospitals for physicians and patients has intensified in recent years. As a result, some hospitals have been acquiring physician practices and employing the physicians to work for the hospital. These hospitals incentivize these physicians to utilize the hospitals' facilities. Further, some traditional hospitals have recently formed joint ventures with physicians whereby the hospital manages, but the hospital and physicians jointly own, an ASC.

In addition, there are several large, publicly traded companies, divisions or subsidiaries of large publicly traded companies, and several private companies that develop and acquire ASCs and hospitals. These companies include United States Surgical Partners, Inc., AmSurg Corp., and Surgical Care Affiliates, Inc. These companies may compete with our company in the acquisition of additional ASCs and hospitals. Further, many physician groups develop ASCs without a corporate partner, using consultants who typically perform corporate services for a fee and who may take a small equity interest in the ongoing operations of such ASCs. See "Risk Factors – Risks Relating to Our Business – We Face Significant Competition From Other Healthcare Providers."

Cycles

Net patient service revenues are slightly seasonal in nature. Generally, revenues have been highest from October to December as physicians return from summer vacations and patients attempt to maximize the benefits afforded by third-party payors that renew health insurance deductibles at the beginning of each calendar year.

Facility Operations

-

Northstar Healthcare Surgical Center – Houston, LLC

Northstar Healthcare Surgical Center – Houston, LLC ("NHSC-H") operates an ASC located at 4120 Southwest Freeway, Suite 200, in Houston, Texas, within minutes of the Texas Medical Center. Operations at this location began in December 2003 with specialties in pain management, ENT, podiatry, orthopedics, general surgery, gastrointestinal and chiropractic medicine. As of December 31, 2013, 45 physicians had staff privileges at NHSC-H (22 of which performed surgeries in 2013). MSIH and PFSH each previously operated the ASC at this location. As of January 1, 2015, NHA directly held a 100% interest in NHSC-H. -

PFSD/MSID/NHC ASC-Dallas, LLC

The MSID ASC is located at 5920 Forest Park Road, Suite 700, in Dallas, Texas. The facility was acquired on January 1, 2011 with specialties in pain management, ENT, podiatry, orthopedics and general surgery. As of December 31, 2013, 170 physicians had staff privileges at MSID ASC (46 of which performed surgeries in 2013). The facility is operated by NHC ASC - Dallas. As of January 1, 2015, Northstar Subco, held an indirect 35.0% interest in the NHC ASC - Dallas. PFSD and MSID each previously operated the ASC at this location.

-

Medical Ambulatory Suites, LP

The Kirby Partnership owns and operates an ASC located at 9300 Kirby Drive, in Houston, Texas, less than four miles from the Texas Medical Center. Operations at this location began in June 2003 and, as of December 31, 2013, 30 physicians had staff privileges (14 of which performed surgeries in 2013). As of January 1, 2015, Northstar Subco held an indirect 25.0% interest in the Kirby Partnership while the remaining 75.0% is owned by Kirby's Physician Limited Partners. -

Northstar Healthcare Surgical Center – Scottsdale, LLC

NHSC-S is located at 9377 E Bell Rd, Suite 201, Scottsdale, Arizona 85260. The facility was acquired in December, 2013. Operations at the facility began in early 2014. As of January 1, 2015, Northstar Acquisitions directly held a 100% interest in NHSC-S. -

First Nobilis Surgical Center, LLC

First Nobilis Surgical Center, LLC (“FNSC”) operates and ASC located at 411 North 1st Street, Bellaire, Texas 77401. The facility began as part of the joint venture with First Surgical. FNSC is a wholly owned subsidiary of First Nobilis, LLC, the joint venture entity owned 51% by NHA and 49% by First Surgical. As of January 1, 2015, Northstar Acquisitions held 51% of First Nobilis Surgical Center’s parent company First Nobilis, LLC. -

First Nobilis Hospital, LLC

First Nobilis Hospital, LLC (“FNH”) operates a hospital at 4801 Bissonnet St, Bellaire, Texas 77401. The facility began as part of the joint venture with First Surgical. FNH is a wholly owned subsidiary of First Nobilis, LLC, the joint venture entity owned 51% by NHA and 49% by First Surgical. As of January 1, 2015, Northstar Acquisitions held 51% of First Nobilis Surgical Center’s parent company First Nobilis, LLC. -

Spring Northwest Management, LLC ("SNWM") Spring Creek Urgent Care, LLC ("SCUC") and Spring Creek Imaging LLC ("SCI")

The Company independently owns 31.78% of SNWM of derived through both a direct and indirect investment. The Company also indirectly owns 31.78% interest in both of SNWM’s wholly owned subsidiaries, Spring Creek Urgent Care, LLC ("SCUC") and Spring Creek Imaging LLC ("SCI"), which operate urgent care facilities. -

Willowbrook Imaging, LLC ("WIM")

WIM operates a diagnostic imaging facility located at 13652 Breton Ridge Street, Suite B, Houston, Texas 77070. The Company directly and indirectly owns a 22.22% interest in WIMt. -

Elite Orthopedic Spine & Surgery Center LLC

Elite Orthopedic Spine & Surgery Center LLC is located at 1605 Airport Freeway Bedford, Texas 76021. The Company indirectly owns thirty-five (35) membership interest units, which represents 35% of Elite Orthopedic Spine & Surgery Center LLC’s anticipated outstanding membership interest units (this private offering remains open). -

Elite Sinus Spine and Ortho LLC

Elite Sinus Spine and Ortho LLC operates and ASC located at 4120 Southwest Freeway, Suite 100, Houston, Texas 77027. The Company owns fifteen (15) membership interest units, which represent approximately 15% of Elite Sinus Spine and Ortho LLC’s outstanding membership interest units.

Employees

As of March 25, 2015, we had approximately 452 employees, of which 322 are full time.

Intellectual Property

| Mark | Type | Owner | Status | App./Reg. # |

| NOBILIS HEALTH |

Service Mark |

Nobilis Health |

Application Pending |

App. No. 86375409 |

| Mark | Type | Owner | Status | App./Reg. # |

| NORTHSTAR HEALTHCARE |

Service Mark |

Nobilis Health Corp. |

Registered |

App. No. 77892043 |

|

Service Mark |

Northstar Healthcare Acquisitions, LLC |

Registered | Reg. No. 3444878 |

|

Service Mark | Nobilis Health Corp. | Registered | Reg. No. 4,555,939 |

| NUESTEP | Service Mark | Nobilis Health Corp. | Registered | Reg. No. 4,555,938 |

| STEP AWAY FROM FOOT PAIN |

Service Mark |

Nobilis Health Corp. |

Registered |

Reg. No. 4,555,937 |

| AccuraScope | Trade Mark | Athas Health, LLC | Registered | Reg. No. 4,041,538 |

Enforcement of Civil Liabilities

Our subsidiaries are organized under the laws of the states of Arizona, Delaware and Texas. Substantially all of our assets and all of the assets of our subsidiaries are located in the United States. Furthermore, all of our current officers and directors reside in the United States. As a result, investors should not find it difficult to effect service of process within the United States upon us or these persons or to enforce judgments obtained against us or these persons in U.S. courts, including judgments in actions predicated upon the civil liability provisions of the U.S. federal securities laws. It may, however, be difficult for an investor to bring an original action or an action to enforce a judgment obtained in a U.S. court in a Canadian or other foreign court predicated upon the civil liability provisions of the U.S. federal securities laws against us or these persons. Conversely, it may be difficult for an investor to bring an original action or an action to enforce a judgment obtained in a Canadian or other foreign court predicated upon the civil liability provisions of the U.S. federal securities laws against us or these persons. There is uncertainty as to whether Canadian courts would: (i) enforce judgments of United States courts obtained against our company or our directors and officers predicated upon the civil liability provisions of the United States federal securities laws, or (ii) entertain original actions brought in Canadian courts against our company or such persons predicated upon the federal securities laws of the United States, as such laws may conflict with Canadian laws. In Canada, such rights are within the legislative jurisdiction of the Provinces and Territories. The Province of British Columbia, where our company is domiciled, does not have laws for the reciprocal enforcement of judgments of United States courts.

Emerging Growth Company

We are an Emerging Growth Company as defined in the JOBS Act.

We will continue to be deemed an emerging growth company until the earliest of:

| (A) |

the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more; |

| (B) |

the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement under this title; |

| (C) |

the date on which such issuer has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or |

| (D) |

the date on which such issuer is deemed to be a ‘large accelerated filer’, as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto. |

As an emerging growth company we are exempt from Section 404(b) of Sarbanes Oxley. Section 404(a) requires companies to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting as well as an assessment of the effectiveness of such internal controls and procedures.

Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting.

As an emerging growth company we are exempt from Section 14A and B of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes.

We have elected not to opt out of the extended transition period for complying with any new or revised accounting standards pursuant to Section 107(b) of the JOBS Act.

Research and Development

We have incurred $Nil in research and development expenditures over the last two fiscal years.

| Item 1A. | Risk Factors |

Our business operations are subject to a number of risks and uncertainties, including, but not limited to those set forth below:

We are impacted by general economic conditions

Our business is subject to general economic risks incident to the U.S. healthcare market and the U.S. and Canadian capital markets. The majority of our patients obtain health insurance through their employers, thus factors impacting the employment rate can increase or decrease our potential patient population. Further, because many health insurance plans require patients to pay co-insurance and/or a deductible, the ability of a patient to pay these portions impacts the patient's decision to undergo the elective surgical procedures we provide in many of our facilities. The continuing recovery from the global recessionary economic conditions that existed in 2012 had a positive financial impact on our business in 2013 which continued throughout 2014.

Because we have relied on, and will continue to rely on, outside investors and lenders for capital used for our operational capital, capital expenditures and strategic acquisitions, the general market conditions in the U.S. and Canada, such as interest rates, availability of credit, inflation rates, economic uncertainty, changes in laws and regulations, and national and international political circumstances impact our business.

We are subject to general business risks in the ASC industry

We are subject to general business risks inherent in the ASC industry, including changing physician and patient preferences, adverse changes in reimbursement by third-party payors, the inability to collect a profitable level of fees, increases in labor costs and other operating costs, possible future changes in labor relations, competition from or the oversupply of other similar surgical facilities, changes in neighborhood or location conditions and general economic conditions, health related risks (including liability for the provision of health care services), disease outbreaks and control risks, the imposition of increased taxes or new taxes, capital expenditure requirements, changes in interest rates, and changes in the availability and cost of long-term financing. Moreover, there is no assurance that the performance achieved to date at the Nobilis Facilities and expected in the future will continue or be achieved. Any one of, or a combination of, these factors may adversely affect our business, results of operations and financial condition.

We are subject to fluctuations in revenues and payor mix

We depend on payments from third-party payors, including private insurers, managed care organizations and government healthcare programs. We are dependent on private and, to a lesser extent, governmental third-party sources of payment for the procedures performed in our facilities. Our competitive position has been, and will continue to be, affected by reimbursement and co-payment initiatives undertaken by third-party payors, including insurance companies, and, to a lesser extent, employers, and Medicare and Medicaid.

As an increasing percentage of patients become subject to healthcare coverage arrangements with managed care payors, our success may depend in part on our ability to negotiate favorable contracts on behalf of our facilities with managed care organizations, employer groups and other private third-party payors. There can be no assurances that we will be able to enter into these arrangements on satisfactory terms in the future. Also, to the extent that our facilities have managed care contracts currently in place, there can be no assurance that such contracts will be renewed or the rates of reimbursement held at current levels.

Managed care plans often set their reimbursement rates based on Medicare and Medicaid rates and consequently, although only a small portion of our revenues are from Medicare and Medicaid, the rates established by these payors may influence our revenues from private payors.

As with most government reimbursement programs, the Medicare and Medicaid programs are subject to statutory and regulatory changes, possible retroactive and prospective rate adjustments, administrative rulings, freezes and funding reductions, all of which may adversely affect our revenues and results of operations. The Centers for Medicare and Medicare Services ("CMS") introduced substantial changes to reimbursement and coverage in early 2007. While the ASC final rule expanded the types of procedures eligible for payment in the ASC setting and excluded from eligibility only those procedures that pose a significant safety risk to patients or are expected to require active medical monitoring at midnight when furnished in an ASC, rule also provided a 4-year transition to the fully implemented revised ASC payment rates. Beginning with the November 2007 OPPS/ASC final rule with comment period (CMS-1392-FC), the annual update OPPS/ASC final rule with comment period provides the ASC payment rates and lists the surgical procedures and services that qualify for separate payment under the revised ASC payment system. As a result, reimbursement levels decreased but coverage expanded. These rates remain subject to change, thus our operating margins may continue to be under pressure as a result of changes in payor mix and growth in operating expenses in excess of increases in payments by third-party payors. In addition, as a result of competitive pressures, our ability to maintain operating margins through price increases to privately insured patients is limited. This could have a material adverse effect on our business, operating results and financial condition.

Net patient service revenue is reported at the estimated net realizable amounts from patients, third-party payors, and others for services rendered and is recognized upon performance of the patient service. In determining net patient service revenue, management periodically reviews and evaluates historical payment data, payor mix and current economic conditions and adjusts, as required, the estimated collections as a percentage of gross billings in subsequent periods based on final settlements and collections.

Management continues to monitor historical collections and market conditions to manage and report the effects of a change in estimates. While we believe that the current reporting and trending software provides us with an accurate estimate of net patient service revenues, any future methods of improving these estimates could have a material adverse effect on our operating results and financial condition.

Out-of-network reimbursement and contract negotiations

One of the complexities of our business navigating the increasingly hostile environment for entities that are not participants in the health insurance companies' ("Third Party Payers") provider networks (also referred to as an "out-of-network provider or facility"). Third Party Payers negotiate discounted fees with providers and facilities in return for access to the patient populations which those Third Party Payers cover. The providers and facilities that contractually agree to these rates become part of the Third Party Payer's "network". The Nobilis Facilities are currently out-of-network as to most Third Party Payers.

There are several risks associated with not participating in Third Party Payer networks. First, not all Third Party Payers offer coverage to their patients for services rendered by non-participants in that Third Party Payer's network. Further, it is typically the case that a patients with so-called "out-of-network benefits" will be obliged to pay a higher co-pays, a higher deductibles, and a larger percentage of co-insurance payments. In addition, because the out-of-network coverage often mandates payment at a "usual and customary rate", the determination of the amounts payable by the Third Party Payer can fluctuate. Healthcare providers and facilities that choose not to participate in a Third Party Payer's often face longer times for their claims to be processed and paid. Further, many Third Party Payers aggressively audit claims from out-of-network providers and facilities and continuously change their benefit policies in various ways that restrict the ability of beneficiaries to access out-of-network benefits, and to restrict out-of-network providers from treating their beneficiaries.

Consequently, it may become necessary for the Nobilis Facilities to change their out-of-network strategy and join Third Party Payer networks. This may require us to negotiate and maintain numerous contracts with various Third Party Payers. In either case, our performance is greatly dependent upon decisions that Third Party Payers make regarding their out-of-network benefits and alternatively, our ability to negotiate profitable contracts with Third Party Payers. If it becomes necessary for the Nobilis Facilities to become in-network facilities, there is no guarantee that we will be able to successfully negotiate these contracts. Further, we may experience difficulty in establishing and maintaining relationships with health maintenance organizations, preferred provider organizations, and other Third Party Payers. Out-of-network reimbursement rates are typically higher than in-network reimbursement rates, so our revenue would likely decline if we move to an in-network provider strategy and fail to increase our volume of business sufficiently to offset reduced in-network reimbursement rates. These factors could adversely affect our revenues and our business.

We depend on our physicians and other key personnel

Our success depends, in part, on our ability to attract and retain quality physicians. There can be no assurance that we can continue to attract high quality physicians, facility staff and technical staff to our facilities. In addition, notwithstanding contractual commitments given by certain of our physicians who were selling Physicians Limited Partners under the Partnership Interests Purchase Agreements to maintain certain specified volume levels, there can be no assurances that our current physicians will continue to practice at our facilities at their current levels, if at all. An inability to attract and retain physicians may adversely affect our business, results of operations and financial condition.

The Physician Limited Partners in the Kirby Partnership have agreed not to compete with Nobilis pursuant to the terms of the Kirby Partnership Interests Purchase Agreements and the partnership agreements. These covenants, however, only restrict ownership in a competing ASC, and do not prevent a Physician Limited Partner from performing procedures (and receiving remuneration for the performance of such procedures in the form of professional fees) at competing ASCs.

Our success also depends on the efforts and abilities of our management, as well as our ability to attract additional qualified personnel to manage operations and future growth. Although we have entered into employment agreements with certain of our key employees, we cannot be certain that any of these employees will not voluntarily terminate their employment. We have employment contracts with Donald Kramer (Chairman of the Board), Harry Fleming (President), and Chris Lloyd (CEO). Also, at this time, we do not maintain any key employee life insurance policies on any management personnel or Physician Limited Partners, but may do so in the future. The loss of a member of management, other key employee, Physician Limited Partners or other physicians who use our facilities could have an adverse effect on our business, operating results and financial condition.

Our business is not highly diversified

As of December 31, 2013, our only business was the ownership and operation of the three Nobilis ASCs located in Texas. Therefore, we were entirely dependent on the success of these facilities for all of our revenues. In January of 2014, we acquired ownership interests in two imaging centers and an urgent care clinic in the Houston, Texas area. Additionally, since the first of the year, we have started operations at NHSC-S in Arizona. These developments have provided some degree of diversification to our business. However, investors will not have the benefit of further diversification of operations or risk until such time, if ever, that we acquire or develop additional facilities, manage additional facilities, or undertake other related business opportunities. As a result of our geographic concentration, we are particularly susceptible to downturns in the local and regional economy, regional inclement weather, changes in local or state regulation, or to reductions in Texas’ Medicaid and/or Medicare payments to healthcare providers.

In addition, approximately 65.6% of the cases performed at the Nobilis ASCs in 2013 were concentrated among three major private insurance companies and workers' compensation payors. At December 31, 2013, more than 55.4% of the cases performed at the Nobilis ASCs were on an "out of network" basis, without any reimbursement rate protection or consistent in-network patient enrollments typically seen from an in-network agreement. Accordingly, we are susceptible to changes in reimbursement policies and procedures by third-party insurers and patients’ preference of utilizing their out of network benefits. In an effort to stabilize its payor mix, Kirby Partnership signed a multi-year in-network contract with one of the major private insurance companies commencing the first quarter of 2009 and another in-network contract with one of the major private insurance companies commencing the second quarter of 2012. These agreements have reduced the percentage of procedures performed at the Nobilis ASCs on an "out-of network" basis.

We face significant competition from other healthcare providers

We compete with other facilities and hospitals for patients, physicians, nurses and technical staff. Some of our competitors have long-standing and well-established relationships with physicians and third-party payors in the community. Some of our competitors are also significantly larger than us, may have access to greater marketing, financial and other resources and may be better known in the general community. The competition among facilities and hospitals for physicians and patients has intensified in recent years. Some hospitals have imposed restrictions on the credentials of their medical staff (called conflict of interest credentialing) where these physicians hold an ownership in a competing facility. The Nobilis Facilities face competition from other facilities and from hospitals that perform similar outpatient services, both inside and outside of the Nobilis Facilities’ primary service areas. Further, some traditional hospitals have recently begun forming joint ventures with physicians whereby the hospital manages and the hospital and physicians jointly own the facility. Patients may travel to other facilities for a variety of reasons. These reasons include physician referrals or the need for services the Nobilis Facilities do not offer. Patients and their physicians who seek services from these other facilities may subsequently shift their preferences to those facilities and away from the Nobilis Facilities.

Some of these competing facilities offer a broader array of outpatient surgery services than those available at the Nobilis Facilities. In addition, some of the Nobilis Facilities’ direct competitors are owned by non-profit or governmental entities, which may be supported by endowments and charitable contributions or by public or governmental support. These hospitals can make capital expenditures without paying sales tax, may hold the property without paying property taxes and may pay for the equipment out of earnings not burdened by income taxes. This competitive advantage may affect the Nobilis Facilities’ inability to compete effectively with these non-profit or governmental entities. There are several large, publicly traded companies, divisions or subsidiaries of large publicly held companies, and several private companies that develop and acquire multi-specialty facilities, and these companies compete with us in the acquisition of additional facilities. Further, many physician groups develop facilities without a corporate partner, using consultants who typically perform these services for a fee and who may take a small equity interest in the ongoing operations of a facility. We can give no assurances that we can compete effectively in these areas. If we are unable to compete effectively to recruit new physicians, attract patients, enter into arrangements with managed care payors or acquire new facilities, our ability to implement our growth strategies successfully could be impaired. This may have an adverse effect on our business, results of operations and financial condition.

The industry trend toward value-based purchasing may negatively impact our revenues.

We believe that value-based purchasing initiatives of both governmental and private payers tying financial incentives to quality and efficiency of care will increasingly affect the results of operations of our hospitals and other health care facilities and may negatively impact our revenues if we are unable to meet expected quality standards. The Affordable Care Act contains a number of provisions intended to promote value-based purchasing in federal health care programs. Medicare now requires providers to report certain quality measures in order to receive full reimbursement increases for inpatient and outpatient procedures that were previously awarded automatically. In addition, hospitals that meet or exceed certain quality performance standards will receive increased reimbursement payments, and hospitals that have "excess readmissions" for specified conditions will receive reduced reimbursement.

There is a trend among private payers toward value-based purchasing of health care services, as well. Many large commercial payers require hospitals to report quality data, and several of these payers will not reimburse hospitals for certain preventable adverse events. We expect value-based purchasing programs, including programs that condition reimbursement on patient outcome measures, to become more common, to involve a higher percentage of reimbursement amounts and to spread to reimbursement for ASCs and other ancillary services. We are unable at this time to predict how this trend will affect our results of operations, but it could negatively impact our revenues if we are unable to meet quality standards established by both governmental and private payers.

There are many federal, state and local laws that regulate our business.

The Nobilis Facilities are subject to numerous federal, state and local laws, rules and regulations. Regulations that may have the most significant effect on our business are:

Licensure and Accreditation

Healthcare facilities, such as the Nobilis ASCs, are subject to professional and private licensing, certification and accreditation requirements. These include, but are not limited to, requirements imposed by Medicare, Medicaid, state licensing authorities, voluntary accrediting organizations and third-party private payors. Receipt and renewal of such licenses, certifications and accreditations are often based on inspections, surveys, audits, investigations or other reviews, some of which may require affirmative compliance actions by the Nobilis ASCs that could be burdensome and expensive. We believe that the Nobilis ASCs are currently in material compliance with all applicable licensing, certification and accreditation requirements.

However, the applicable standards may change in the future. There can be no assurance that each of the Nobilis ASCs will be able to maintain all necessary licenses or certifications in good standing or that they will not be required to incur substantial costs in doing so. The failure to maintain all necessary licenses, certifications and accreditations in good standing, or the expenditure of substantial funds to maintain them, could have an adverse effect on our business, results of operations and financial condition.

In addition, in order to perform medical and surgical procedures in Texas, physicians must be licensed by the Texas Medical Board. Professional nurses and technical staff must also be licensed under state law. There can be no assurance that any particular physician, nurse or technical staff member who has medical staff privileges at the Nobilis ASCs will not have his or her license suspended or revoked by the Texas Medical Board or be sanctioned by the Department of Health and Human Services ("DHHS"), Office of Inspector General ("OIG"), for violations of federal Medicare laws. If a license is suspended or revoked, or if such physician, nurse or technical staff member is sanctioned by the OIG and excluded from the Medicare program, such physician, nurse or technical staff member may not be able to perform surgical procedures at the Nobilis ASCs, which may have an adverse affect on our operations and business.

Anti-Kickback Statute

The United States Medicare/Medicaid Fraud and Abuse Anti-kickback Statute (the "Anti-Kickback Statute") prohibits "knowingly or willfully" paying money or providing remuneration of any sort in exchange for federally-funded referrals. Because the Physician Limited Partners are in a position to generate referrals to the Nobilis Facilities, distributions of profits to these Limited Partners could come under scrutiny under the Anti-Kickback Statute. While the DHHS has issued regulations containing "safe harbors" to the Anti-Kickback Statute, including those specifically applicable to ASCs, our operations and arrangements do not comply with all of the requirements. As we do not have the benefit of the safe harbors, we are not immune from government review or prosecution. However, we believe that the business operations of the Nobilis Facilities are structured to substantially comply with applicable anti-kickback laws. To the extent safe harbour protection is not available, the agreements governing the structure and operations of the Nobilis Facilities include provisions to mitigate against alleged kickbacks or other inducements.

The State of Texas and the State of Arizona each maintain its own version of the Anti-Kickback Statute (the "Non-solicitation Laws"). In Texas the relevant law is called the Texas Patient Solicitation Act (“TPSA”). The TPSA prohibits payment of remuneration for referrals and violations can result in state criminal and civil penalties. Because the TPSA is based on the federal Anti-Kickback Statute, the risks described above also arise under this state law except that the TPSA arguably is not limited to claims for treatment of federal program beneficiaries. In Arizona, A.R.S §13-3713 makes it unlawful for a person to knowingly offer, deliver, receive, or accept any rebate, refund, commission, preference or other consideration in exchange for a patient, client or customer referral to any individual, pharmacy, laboratory, clinic or health care institution providing medical or health-related services or items under A.R.S. § 11-291 et seq., providing for indigent care, or A.R.S. § 36-2901 et seq., or providing for the Arizona Health Care Cost Containment System, other than specifically provided under those sections. A violator of the relevant Arizona laws is guilty of: a class 3 felony for payment of $1,000 or more; a class 4 felony for payment of more than $100 but less than $1,000; or a class 6 felony for payment of $100 or less.

The Non-solicitation Laws parallel in many respects the federal Anti-Kickback Statute, but they apply more broadly because they are not limited only to providers participating in federal and state health care programs. The Texas statute specifically provides that it permits any payment, business arrangement, or payment practice that is permitted under the federal Anti-Kickback Statute and regulations promulgated under that law, although failure to fall within a safe harbor does not mean that the arrangement necessarily violates Texas law. Arizona takes the same approach.

Some of the various arrangements that our company enters into with providers may not fit into a safe harbor to the federal Anti-Kickback Statute and thus may not be exempt from scrutiny under the Non-solicitation Laws. Although an arrangement that fits a federal safe harbor may also be excepted from the prohibitions of the Non-solicitation Laws, the burden is on the medical provider to prove that the questioned arrangement fits one of the federal safe harbors. Additionally, even if that burden is met, the provider must still comply with the law’s requirements to disclose to the patient the financial relationship involved.

A failure by our company to comply with the Anti-Kickback Statute, TPSA or Arizona laws could have an adverse effect on our business, results of operations and financial condition.

False Claims Legislation

Under the United States Criminal False Claims Act, individuals or entities that knowingly file false or fraudulent claims that are payable by the Medicare or Medicaid programs are subject to both criminal and civil liability. While the Nobilis Facilities have a compliance program and policies to create a corporate culture of compliance with these laws, failure to comply could result in monetary penalties (up to three times the amount of damages), fines and/or imprisonment, which could have an adverse effect on our business, results of operations and financial condition.

HIPAA

The Nobilis Facilities are subject to the Health Insurance Portability and Accountability Act ("HIPAA"), which mandates industry standards for the exchange of protected health information, including electronic health information. While we believe that we have implemented privacy and security systems to bring us into material compliance with HIPAA, we cannot ensure that the business associates to whom we provide information will comply with HIPAA standards. In addition, because Congress continues to amend HIPAA to keep pace with evolving recordkeeping technologies, we cannot guarantee compliance with future amendments. If we, for whatever reasons, fail to comply with the standards, or any state statute that governs an individual’s right to privacy that are not pre-empted by HIPAA, we could be subject to criminal penalties and civil sanctions, which could have an adverse effect on our business, financial condition and results of operations.

Patient Protection and Affordable Care Act

The Nobilis Facilities may be affected by the Patient Protection and Affordable Care Act ("PPACA"), which began taking effect June, 21, 2010. The impact on Nobilis Facilities remains uncertain. By mandating that residents obtain minimum levels of health insurance coverage, the PPACA has expanded the overall number of insured patients. However, it remains to be seen whether the cost born by employers of providing insurance coverage will result in a shift away from the types of policies that have historically provided the coverage that Nobilis has relied upon in the past. Further, as discussed above, the impact that value-based purchasing initiatives could have on Nobilis' revenues remains unclear. Nobilis continues to review the potential impact of PPACA’s provisions on its business as the out-of-network reimbursement under the policies issued by the state exchange might be substantially lower than those by the employer-sponsored polices.

Antitrust

Federal and state antitrust laws restrict the ability of competitors, including physicians and other providers, to act in concert in restraint of trade, to fix prices for services, to allocate territories, to tie the purchase of one product to the purchase of another product, or to attempt to monopolize a market for services.

Notwithstanding the Nobilis entities’ efforts to fully comply with all antitrust laws, a significant amount of ambiguity exists with respect to the application of these laws to healthcare activities. Thus, no assurance can be provided that an enforcement action or judicial proceeding will not be brought against the Nobilis Facilities or that the facilities will not be liable for substantial penalties, fines and legal expenses.

Environmental Laws and regulations

Typical health care provider operations include, but are not limited to, in various combinations, the handling, use, treatment, storage, transportation, disposal and/or discharge of hazardous, infectious, toxic, radioactive and flammable materials, wastes, pollutants or contaminants. As such, health care provider operations are particularly susceptible to the practical, financial, and legal risks associated with the obligations imposed by applicable environment laws and regulations. Such risks may (i) result in damage to individuals, property, or the environment; (ii) interrupt operations and/or increase their cost; (iii) result in legal liability, damages, injunctions, or fines; (iv) result in investigations, administrative proceedings, civil litigation, criminal prosecution, penalties, or other governmental agency actions; and (v) may not be covered by insurance. There can be no assurance that we will not encounter such risks in the future, and such risks may result in material adverse consequences to our operations or financial results.

Other regulations

In addition to the regulatory initiatives described above, healthcare facilities, including the Nobilis Facilities, are subject to a wide variety of federal, state, and local environmental and occupational health and safety laws and regulations that may affect their operations, facilities, and properties. Violations of these laws could subject us to civil penalties and fines for not investigating and remedying any contamination by hazardous substances, as well as other liability from third parties.

Although we believe the Nobilis Facilities are currently in material compliance with all applicable environmental laws and regulations, and expect such compliance will continue in the future, there can be no assurance that the Nobilis Facilities will not violate the requirements of one or more of these laws or that we will not have to expend significant amounts to remediate or ensure compliance.

We may be unable to implement our organic growth strategy

Future growth will place increased demands on our management, operational and financial information systems and other resources. Further expansion of our operations will require substantial financial resources and management resources and attention. To accommodate our anticipated future growth, and to compete effectively, we will need to continue to implement and improve our management, operational, financial and information systems and to expand, train, manage and motivate our workforce. Our personnel, systems, procedures or controls may not be adequate to support our operations in the future. Further, focusing our financial resources and management attention on the expansion of our operations may negatively impact our financial results. Any failure to implement and improve our management, operational, financial and information systems, or to expand, train, manage or motivate our workforce, could reduce or prevent our growth. We can give you no assurances that our personnel, systems, procedures or controls will be adequate to support our operations in the future or that our financial resources and management attention on the expansion of our operations will not adversely affect our business, result of operations and financial condition. In addition, direct-to-consumer marketing may not be a suitable means to attract case volume as patients may not directly seek our services, but instead may choose to consult with a non-Nobilis-affiliate physician. We can offer no guarantees that the financial resources expended on direct-to-consumer marketing campaigns will result in the expansion of our business.

We may be unable to implement our acquisition strategy

Our efforts to execute our acquisition strategy may be affected by our ability to identify suitable candidates and negotiate and close acquisition transactions. We may encounter numerous business risks in acquiring additional facilities, and may have difficulty operating and integrating these facilities. Further, the companies or assets we acquire in the future may not ultimately produce returns that justify our investment. If we are not able to execute our acquisition strategy, our ability to increase revenues and earnings through external growth will be impaired.

In addition, we will need capital to acquire other centers, integrate, operate and expand the Nobilis Facilities. We may finance future acquisition and development projects through debt or equity financings and may use Common Shares for all or a portion of the consideration to be paid in future acquisitions. To the extent that we undertake these financings or use Common Shares as consideration, our shareholders may experience future ownership dilution. To the extent debt is incurred, we may incur significant interest expense and may be subject to covenants in the related debt agreements that affect the conduct of business. In the event that our Common Shares do not maintain a sufficient valuation, or potential acquisition candidates are unwilling to accept our Common Shares as all or part of the consideration, we may be required to use more of our cash resources, if available, or to rely solely on additional financing arrangements to pursue our acquisition and development strategy. However, we may not have sufficient capital resources or be able to obtain financing on terms acceptable to us for our acquisition and development strategy, which would limit our growth. Without sufficient capital resources to implement this strategy, our future growth could be limited and operations impaired. There can be no assurance that additional financing will be available to fund this growth strategy or that, if available, the financing will be on terms that are acceptable to us.

We may incur unexpected, material liabilities as a result of acquiring ASCs or other healthcare facilities

Although we intend to conduct due diligence on any future acquisition, we may inadvertently invest in facilities or other healthcare facilities that have material liabilities, arising from, for example, the failure to comply with government regulations or other past activities. Although the Nobilis Facilities have the benefit of professional and general liability insurance, we do not currently maintain and are unlikely to acquire insurance specifically covering every unknown or contingent liability that may have occurred prior to our investment in the Nobilis Facilities, particularly those involving prior civil or criminal misconduct (for which there is no insurance). Incurring such liabilities as a result of future acquisitions could have an adverse effect on our business, operations and financial condition.

We may be subject to professional liability claims

As a healthcare provider, we are subject to professional liability claims both directly and vicariously through the malpractice of members of our medical staff. As a healthcare facility, each Nobilis Facility has direct responsibility and legal liability for the standard of care provided in its facility by its staff. The Nobilis Facilities have legal responsibility for the physical environment and appropriate operation of equipment used during surgical procedures. In addition, each Nobilis Facility has vicarious liability for the negligence of its credentialed medical staff under circumstances where it either knew or should have known of a problem leading to a patient injury. The physicians credentialed by the Nobilis Facilities are involved in the delivery of healthcare services to the public and are exposed to the risk of professional liability claims. Although the Nobilis Facilities neither control the practice of medicine by physicians nor have responsibility for compliance with certain regulatory and other requirements directly applicable to physicians and their services, as a result of the relationship between each Nobilis Facility and the physicians providing services to patients in the Nobilis Facilities, the Registrant’s other subsidiaries or even the Registrant may become subject to medical malpractice claims under various legal theories. Claims of this nature, if successful, could result in damage awards to the claimants in excess of the limits of available insurance coverage. Insurance against losses related to claims of this type can be expensive and varies widely from state to state. The Nobilis Facilities maintain and require the physicians on the medical staff of the Nobilis Facilities to maintain liability insurance in amounts and coverages believed to be adequate, presently $1 million per claim to an aggregate of $3 million per year.

In 2003, Texas passed legislation that reformed its laws related to professional liability claims by setting caps on non-economic damages in the amount of $250,000 per claimant to a per claim aggregate of $750,000 for physicians and other providers, including ASCs. Punitive damages are excluded from this cap. This tort reform legislation has resulted in a reduction in the cost of malpractice insurance because of the reduction in malpractice claims. However, there can be no assurances that this trend will continue into the future.

Most malpractice liability insurance policies do not extend coverage for punitive damages. While extremely rare in the medical area, punitive damages are those damages assessed by a jury with the intent to "punish" a tortfeasor rather than pay for a material loss resulting from the alleged injury. We cannot assure you that we will not incur liability for punitive damage awards even where adequate insurance limits are maintained. We also believe that there has been, and will continue to be, an increase in governmental investigations of physician-owned facilities, particularly in the area of Medicare/Medicaid false claims, as well as an increase in enforcement actions resulting from these investigations. Investigation activity by private third-party payors has also increased with, in some cases, intervention by the states’ attorneys general. Also possible are potential non-covered claims, or "qui tam" or "whistle blower" suits.

Although exposure to qui tam lawsuits is minimal since Medicare and Medicaid comprises less than 5.0% of our revenue and an even smaller percentage of our profit, many plaintiffs’ lawyers have refocused their practices on "whistle blower" lawsuits given the reduction in awards from medical malpractice claims. These whistle blower lawsuits are based on alleged violations of government law related to billing practice and kickbacks. Under federal Medicare law, these whistle blowers are entitled to receive a percentage of recoveries made if the federal government takes on the case. However, a whistle blower may pursue direct action against the healthcare entity under the applicable statutes and seek recoveries without federal government intervention. Many malpractice carriers will not insure for violations of the law although they may cover the cost of defense. Any adverse determination in a legal proceeding or governmental investigation, whether currently asserted or arising in the future, could have a material adverse effect on our financial condition. In this regard, the Registrant notes that the billing practices of one of its facilities were investigated in 2006 based upon a complaint with the CMS finding no basis to take any action, and with the complaint being dismissed.

The Nobilis Facilities may, in the ordinary course of their business, be subject to litigation claims. In particular, the Nobilis Facilities can be subject to claims, among others, relating to actions of medical personnel performing services at the Nobilis Facilities. Historically, the Nobilis Facilities have been able to obtain what we believe is adequate insurance to cover these risks. However, the cost of this insurance may increase and there can be no assurance that we will be able to obtain adequate insurance against medical liability claims in the future on economically reasonable terms, or at all. In addition, claims of this nature, if successful, could result in damage awards to the claimants in excess of the limits of any applicable insurance coverage. If the insurance that we have in place from time to time is not sufficient to cover claims that are made, the resulting shortfall could have a material adverse affect on our business and operations.

The Nobilis Facilities’ insurance coverages might not cover all claims against them or be available at a reasonable cost, if at all. If the Nobilis Facilities are unable to maintain insurance coverage, if judgments are obtained in excess of the coverage the Nobilis Facilities maintain, or if the Nobilis Facilities are required to pay uninsured punitive damages or pay fines under "qui tam" lawsuits, the Nobilis Facilities would be exposed to substantial additional liabilities. The Registrant cannot assure that each Nobilis Facility will be able to maintain insurance coverage at a reasonable premium, or at all, that coverage will be adequate to satisfy adverse determinations against the Nobilis Facilities, or that the number of claims will not increase.

Malpractice insurance premiums or claims may adversely affect our business

Should the Nobilis Facilities experience adverse risk management claims or should the market for medical malpractice dictate a large increase in rates, our business and financial results could be adversely affected.

We rely on technology

The medical technology used in our facilities is ever changing and represents a significant cost of doing business. There can be no assurance that the equipment purchased or leased by our facilities will not be enhanced or rendered obsolete by advances in medical technology, or that our facilities will be able to finance or lease additional equipment necessary to remain competitive should its medical staff physicians request such modern equipment or its existing equipment become obsolete. This could have an adverse effect on our business, operations and financial condition.

We are subject to rising costs

The costs of providing our services have been rising and are expected to continue to rise at a rate higher than that anticipated for consumer goods as a whole. Our business, operating results or financial condition could be adversely affected if we are unable to implement annual private pay increases due to market conditions, otherwise increase our revenues or, to a lesser extent, if reimbursement rates from Medicaid and Medicare sources are not adjusted to cover increases in labor and other costs.

We depend on referrals

Our success, in large part, is dependent upon referrals to our physicians from other physicians, systems, health plans and others in the communities in which we operate, and upon our medical staff’s ability to maintain good relations with these referral sources. Physicians who use our facilities and those who refer patients are not our employees and, in many cases, most physicians have admitting privileges at other hospitals and (subject to any non-competition arrangements that may have been entered into in connection with the Partnership Agreements) may refer patients to other providers. If we are unable to successfully cultivate and maintain strong relationships with our physicians and their referral sources, the number of procedures performed at our facilities may decrease and cause revenues to decline. This could adversely affect our business, results of operations and financial condition.

We may be subject to changes in current law or the enactment of future legislation

In recent years, a variety of legislative and regulatory initiatives have occurred on both the federal and state levels concerning physician ownership of healthcare entities to which physicians refer patients, third-party payment programs and other regulatory matters concerning ASCs. We anticipate that federal and state legislatures will continue to review and assess alternative healthcare delivery and payment systems. Potential approaches that have been considered include mandated basic health care benefits, controls on health care spending through limitations on the growth of private health insurance premiums and Medicare and Medicaid spending, the creation of large insurance purchasing groups, pay for performance systems, and other fundamental changes to the health care delivery system. Private sector providers and payors have embraced certain elements of reform, resulting in increased consolidation of health care providers and payors as those providers and payors seek to form alliances in order to provide cost effective, quality care. Legislative debate is expected to continue in the future, and the Company cannot predict what impact the adoption of any federal or state health care reform measures or future private sector reform may have on its business.

It is not possible to predict what federal or state initiatives, if any, may be adopted in the future or how such changes might affect us. If a federal or state agency asserts a different position or enacts new legislation regarding ASCs, we may experience a significant reduction in our revenues, be excluded from participation in third-party payor programs, or be subject to future civil and criminal penalties.

We may face a shortage of nurses

The United States is currently experiencing a shortage of nursing staff. The failure of the Nobilis Facilities to hire and retain qualified nurses could have a material adverse effect on our business operations and financial condition.

We are subject to general litigation risks

Litigation could potentially be brought against us by various individuals or entities including, but not limited to federal, state, or local governments, potential competitors, investors and current and former employees. Any such lawsuits could have an adverse effect on our operations and financial results.

We do not have control of the day-to-day medical affairs and certain other affairs of the Nobilis Facilities