Attached files

| file | filename |

|---|---|

| EX-21 - EX-21 - UTi WORLDWIDE INC | d849038dex21.htm |

| EX-23 - EX-23 - UTi WORLDWIDE INC | d849038dex23.htm |

| EX-32.1 - EX-32.1 - UTi WORLDWIDE INC | d849038dex321.htm |

| EX-31.2 - EX-31.2 - UTi WORLDWIDE INC | d849038dex312.htm |

| EX-10.37 - EX-10.37 - UTi WORLDWIDE INC | d849038dex1037.htm |

| EX-10.22 - EX-10.22 - UTi WORLDWIDE INC | d849038dex1022.htm |

| EX-10.39 - EX-10.39 - UTi WORLDWIDE INC | d849038dex1039.htm |

| EX-10.38 - EX-10.38 - UTi WORLDWIDE INC | d849038dex1038.htm |

| EX-10.35 - EX-10.35 - UTi WORLDWIDE INC | d849038dex1035.htm |

| EX-10.33 - EX-10.33 - UTi WORLDWIDE INC | d849038dex1033.htm |

| EX-10.40 - EX-10.40 - UTi WORLDWIDE INC | d849038dex1040.htm |

| EX-10.36 - EX-10.36 - UTi WORLDWIDE INC | d849038dex1036.htm |

| EXCEL - IDEA: XBRL DOCUMENT - UTi WORLDWIDE INC | Financial_Report.xls |

| 10-K - FORM 10-K - UTi WORLDWIDE INC | d849038d10k.htm |

| EX-12.1 - EX-12.1 - UTi WORLDWIDE INC | d849038dex121.htm |

| EX-32.2 - EX-32.2 - UTi WORLDWIDE INC | d849038dex322.htm |

| EX-31.1 - EX-31.1 - UTi WORLDWIDE INC | d849038dex311.htm |

Exhibit 10.32

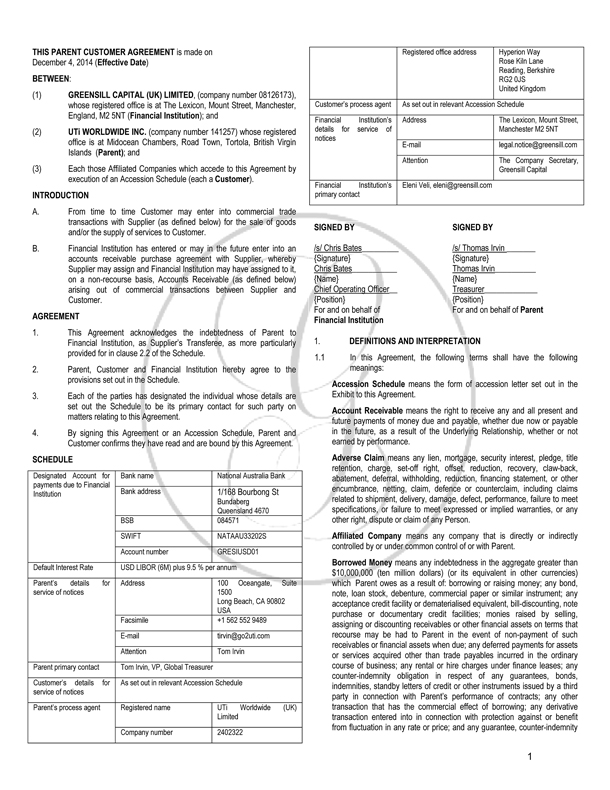

THIS PARENT CUSTOMER AGREEMENT is made on

December 4, 2014 (Effective Date)

BETWEEN:

(1) GREENSILL CAPITAL (UK) LIMITED, (company number 08126173), whose registered office is at The Lexicon, Mount Street, Manchester, England, M2 5NT (Financial Institution); and

(2) UTi WORLDWIDE INC. (company number 141257) whose registered office is at Midocean Chambers, Road Town, Tortola, British Virgin Islands (Parent); and

(3) Each those Affiliated Companies which accede to this Agreement by execution of an Accession Schedule (each a Customer).

INTRODUCTION

A. From time to time Customer may enter into commercial trade transactions with Supplier (as defined below) for the sale of goods and/or the supply of services to Customer.

B. Financial Institution has entered or may in the future enter into an accounts receivable purchase agreement with Supplier, whereby Supplier may assign and Financial Institution may have assigned to it, on a non-recourse basis, Accounts Receivable (as defined below) arising out of commercial transactions between Supplier and Customer.

AGREEMENT

1. This Agreement acknowledges the indebtedness of Parent to Financial Institution, as Supplier’s Transferee, as more particularly provided for in clause 2.2 of the Schedule.

2. Parent, Customer and Financial Institution hereby agree to the provisions set out in the Schedule.

3. Each of the parties has designated the individual whose details are set out the Schedule to be its primary contact for such party on matters relating to this Agreement.

4. By signing this Agreement or an Accession Schedule, Parent and Customer confirms they have read and are bound by this Agreement.

SCHEDULE

Designated Account for payments due to Financial Institution

Bank name

National Australia Bank

Bank address

1/168 Bourbong St

Bundaberg

Queensland 4670

BSB

084571

SWIFT

NATAAU33202S

Account number

GRESIUSD01

Default Interest Rate

USD LIBOR (6M) plus 9.5 % per annum

Parent’s details for service of notices

Address

100 Oceangate, Suite 1500

Long Beach, CA 90802

USA

Facsimile

+1 562 552 9489

tirvin@go2uti.com

Attention

Tom Irvin

Parent primary contact

Tom Irvin, VP, Global Treasurer

Customer’s details for service of notices

As set out in relevant Accession Schedule

Parent’s process agent

Registered name

UTi Worldwide (UK) Limited

Company number

2402322

Registered office address

Hyperion Way

Rose Kiln Lane

Reading, Berkshire

RG2 0JS

United Kingdom

Customer’s process agent

As set out in relevant Accession Schedule

Financial Institution’s details for service of notices

Address

The Lexicon, Mount Street, Manchester M2 5NT

legal.notice@greensill.com

Attention

The Company Secretary, Greensill Capital

Financial Institution’s primary contact

Eleni Veli, eleni@greensill.com

SIGNED BY

/s/ Chris Bates

{Signature}

Chris Bates

{Name}

Chief Operating Officer

{Position}

For and on behalf of

Financial Institution

SIGNED BY

/s/ Thomas Irvin

{Signature}

Thomas Irvin

{Name}

Treasurer

{Position}

For and on behalf of Parent

1. DEFINITIONS AND INTERPRETATION

1.1 In this Agreement, the following terms shall have the following meanings:

Accession Schedule means the form of accession letter set out in the Exhibit to this Agreement.

Account Receivable means the right to receive any and all present and future payments of money due and payable, whether due now or payable in the future, as a result of the Underlying Relationship, whether or not earned by performance.

Adverse Claim means any lien, mortgage, security interest, pledge, title retention, charge, set-off right, offset, reduction, recovery, claw-back, abatement, deferral, withholding, reduction, financing statement, or other encumbrance, netting, claim, defence or counterclaim, including claims related to shipment, delivery, damage, defect, performance, failure to meet specifications, or failure to meet expressed or implied warranties, or any other right, dispute or claim of any Person.

Affiliated Company means any company that is directly or indirectly controlled by or under common control of or with Parent.

Borrowed Money means any indebtedness in the aggregate greater than $10,000,000 (ten million dollars) (or its equivalent in other currencies) which Parent owes as a result of: borrowing or raising money; any bond, note, loan stock, debenture, commercial paper or similar instrument; any acceptance credit facility or dematerialised equivalent, bill-discounting, note purchase or documentary credit facilities; monies raised by selling, assigning or discounting receivables or other financial assets on terms that recourse may be had to Parent in the event of non-payment of such receivables or financial assets when due; any deferred payments for assets or services acquired other than trade payables incurred in the ordinary course of business; any rental or hire charges under finance leases; any counter-indemnity obligation in respect of any guarantees, bonds, indemnities, standby letters of credit or other instruments issued by a third party in connection with Parent’s performance of contracts; any other transaction that has the commercial effect of borrowing; any derivative transaction entered into in connection with protection against or benefit from fluctuation in any rate or price; and any guarantee, counter-indemnity

or other assurances against financial loss that Parent has given for any of the items referred above of this definition incurred by any Person.

Business Day means any day that is not a Saturday, Sunday or other day on which banks in London are required or permitted to close.

Certified Amount means, with respect to any Payment Obligation, an amount equal to the gross amount of the related Account Receivable as specified in the relevant PAUF.

Customer means each of Parent and each Affiliated Company who has acceded to this Agreement by execution of an Accession Schedule.

Default Interest Rate means the interest rate set out in the table above.

Designated Account means the bank account of the intended recipient of the relevant payment, the details of which have been provided by that recipient to Parent or Customer from time to time, and which in the case of Financial Institution may be specified in the Schedule or as otherwise notified in writing by Financial Institution.

Event of Insolvency shall be deemed to have occurred with respect to a Person if such Person shall generally not pay its debts as such debts become due, or shall admit in writing its inability to pay its debts generally, or shall make a general assignment for the benefit of creditors; or any proceeding shall be instituted by or against such Person seeking to adjudicate it a bankrupt or insolvent, or seeking liquidation, winding up, reorganization, arrangement, adjustment, protection, relief, or composition of it or its debts under any law relating to bankruptcy, insolvency or reorganization or relief of debtors, or seeking the entry of an order for relief or the appointment of a receiver, trustee, custodian or other similar official for it or for any substantial part of its property and, in the case of any such proceeding instituted against it (but not instituted by it), either such proceeding shall remain undismissed or unstayed for a period of 30 days, or any of the actions sought in such proceeding (including, without limitation, the entry of an order for relief against, or the appointment of a receiver, trustee, custodian or other similar official for, it or for any substantial part of its property) shall occur; or such Person shall take any action to authorize any of the actions set forth above in this definition; or any event or circumstance occurs which under the law of any relevant jurisdiction has an analogous or equivalent effect to any of the events listed above.

Indebtedness Default Event shall be deemed to have occurred if any Borrowed Money is not paid when due or within any originally applicable grace period; or any Borrowed Money becomes due, or capable or being declared due and payable prior to its stated maturity by reason of an event of default howsoever described; any commitments for Borrowed Money is cancelled or suspended by a creditor of Parent by reason of an event of default howsoever described; or any creditor of Parent becomes entitled to declare any Borrowed Money due and payable prior to its stated maturity by reason of an event of default (howsoever described).

Maturity Date means, in relation to a Payment Obligation, the settlement date of that Payment Obligation, being (a) the date set out against the corresponding Account Receivable as the “maturity date” in the relevant PAUF or, if such date is not a Business Day, the preceding Business Day or (b) such earlier date on which such amount becomes immediately due and payable in accordance with the provisions of clause 2.2.

PAUF means a payment assurance upload file, in the agreed format, which is created in respect of each Account Receivable, setting out details of Supplier, invoice number, Certified Amount and Maturity Date and any other details agreed by the parties and which Customer may provide to Financial Institution from time to time.

Payment Obligation means the benefit of Parent’s obligation to pay as provided by the provisions of clause 2.2.

Person means an individual, partnership, corporation (including a business trust), limited liability company, limited partnership, joint stock company, trust, unincorporated association, joint venture or other entity, or a government or any political subdivision or agency thereof.

Supplier means any Person together with its successors and permitted assigns with whom a Supplier Agreement is at the relevant time in force.

Supplier Agreement means the agreement between Financial Institution and Supplier that regulates Transfers to Financial Institution.

Supplier’s Transferee means, in relation to Supplier, any Person, to whom an Account Receivable has been Transferred.

Transfer Notice means a written notice provided to Parent and/or Customer from Supplier or Supplier’s Transferee that an Account Receivable (or part thereof) has been sold by Supplier or Supplier’s Transferee.

Transfer, Transferred or Transfers means the sale, assignment or transfer or purported sale, assignment or transfer of an Account Receivable (whether in whole or in part).

Underlying Relationship means a business relationship between Customer and Supplier.

2. THE PAUF AND PAYMENT OBLIGATION

2.1 Customer as agent for Parent may, but is not obliged to, submit PAUFs. Where Customer elects to send a PAUF, it shall do so, together with an authorising letter.

2.2 Parent creates and assumes, in respect of the Account Receivables set out in each PAUF, an independent, irrevocable, unconditional, legal, valid, transferable and binding obligation of Parent in favour of Supplier (or, in the event of a Transfer, in favour of the Supplier’s Transferee) to pay or procure the payment to the relevant Designated Account by 12:00 noon London time on the relevant Maturity Date an amount equal to and in the same currency as the relevant Certified Amount without deduction, withholding or counterclaim and without exercising any right of set-off under the Underlying Relationship or otherwise, and such amount shall be due and payable by Parent on the Maturity Date, irrespective of any non- or partial performance by Supplier under the Underlying Relationship. In the event of any failure by Parent to make any payment, or to cause payment to be made, when due under this Agreement where such failure is not remedied within 5 Business Days, or if an Event of Insolvency or an Indebtedness Default Event occurs with respect to Parent, then all Certified Amounts then unpaid shall become immediately due and payable without any further action by Supplier’s Transferee. If any withholding or deduction is required by applicable law Parent shall, when making or procuring the payment to which the withholding or deduction relates, pay such additional amount as will ensure that Supplier (or, in the event of a Transfer, the Supplier’s Transferee) receives the same total amount that it would have received if no such withholding or deduction had been required.

2.3 Nothing in this Agreement (including Parent’s obligation to make payments in accordance with clause 2.2) shall constitute a release or waiver of, or limitation on, any rights Customer may have against Supplier, including any right to seek damages or a refund from Supplier of amounts paid pursuant to clause 2.2. The parties acknowledge that this clause does not create rights against Financial Institution or Supplier’s Transferee.

2.4 For the avoidance of doubt, the obligation of Parent to pay Certified Amounts on the relevant Maturity Dates shall survive the termination or expiry of this Agreement or the Supplier Agreement or the default by any party under this Agreement.

2.5 Parent and Customer acknowledge and agree that:

2.5.1 while Parent’s payment of a Certified Amount to Supplier or a Supplier’s Transferee, as applicable, will reduce Parent’s

obligation to pay the related Account Receivable by an amount equal to such Certified Amount, all other sums owed to Supplier by virtue of the Underlying Relationship shall remain outstanding; and

2.5.2 Financial Institution shall have no responsibility or liability for disputes that arise between Customer and Supplier, any Supplier’s Transferee or any other third party, including disputes with respect to any Adverse Claims.

2.6 All payments made by Parent pursuant to this Agreement shall be made in the currency of the relevant Account Receivable. Parent shall comply with all applicable foreign exchange regulations and shall assume all exchange differences and charges incurred with respect to the payment of the relevant Certified Amount on the relevant Maturity Date.

2.7 If any payment made by any party hereunder is made erroneously, including a payment to an incorrect payee or in an incorrect amount, Parent and Customer shall provide such assistance as Financial Institution and Supplier or Supplier’s Transferee may reasonably require to correct such error without delay, including returning any incorrect payments received by it.

2.8 Customer accepts and consents to the Transfer of each Account Receivable, to and by Financial Institution and thereafter by any Person to whom such Account Receivable or part thereof has been Transferred. Parent and Customer each acknowledge that it shall treat each Transfer Notice it receives at its address provided in accordance with clause7.1, by any means as being given by or on behalf of Supplier or Supplier’s Transferee.

2.9 If Parent fails to make any payment, or to cause payment to be made, when due under this Agreement where such failure is not remedied within 5 Business Days, interest on the unpaid amount shall accrue daily, from and including the due date of payment to but excluding the date of actual payment (both before and after judgment, as a separate and independent obligation), at the Default Interest Rate. Default payment interest accruing under this clause 2.9 will be immediately payable by Parent on demand.

3. RECORDS

3.1 Parent shall ensure that Customer shall only deliver PAUFs in respect of genuine and lawful trade transactions arising in the ordinary course of business for the sale, supply and purchase of goods and/or services between Customer and Supplier. Parent shall ensure that Customer shall not deliver PAUFs for investment or arbitrage functions or purposes, or for any money laundering purpose, or in contravention of any applicable law.

3.2 Parent shall ensure that Customer shall maintain sufficient records of all transactions with respect to the Underlying Relationship (or associated disputes) to which it is a party, and with respect to compliance of such transactions with applicable law (“Records”). Customer shall retain each Record required to be maintained under this clause 3 during the longer of (i) the term of this Agreement (iii) as may be required by applicable law.

3.3 Parent shall ensure that Customer shall provide Financial Institution with copies of such Records as Financial Institution may require and shall allow Financial Institution to examine and take copies of the Records, or any part of them, which are reasonably required in order to comply with an order, instruction or request from any authority of competent jurisdiction, or to ensure Parent’s and Customer’s compliance with the terms of this Agreement.

3.4 Financial Institution shall be entitled to rely upon without further enquiry, any communication which Financial Institution believes in good faith to be given or made by Parent or Customer irrespective of any error or fraud contained in the communication or the identity of the individual who sent the communication or by whom it was purported to be sent.

4. REPRESENTATIONS AND WARRANTIES

4.1 Parent represents and warrants to Financial Institution and each Supplier’s Transferee, at the Effective Date and on each date on which it submits a PAUF, as if made on such date with reference to the facts and circumstances then existing, that:

4.1.1 this Agreement is a legal, valid and binding obligation of Parent enforceable in accordance with its terms, and the execution and delivery of this Agreement by Parent, and performance of this Agreement by Parent has been duly authorised (pursuant to its constitutional documents and applicable law) by all necessary corporate or other action required of Parent;

4.1.2 each Person who purports to provide a PAUF on behalf of Parent has been duly authorised by Customer and each PAUF is duly authorised by and is binding on Parent;

4.1.3 the obligation set out in clause 2.2 is an irrevocable, legal, valid and binding obligation of Parent that is fully enforceable against Parent by the relevant Supplier’s Transferee;

4.1.4 each Account Receivable Transferred by Supplier or Supplier’s Transferee will be recognised by Parent and Customer as having been validly sold and assigned to the relevant Supplier’s Transferee, free of any set off or Adverse Claim;

4.1.5 the goods and services purchased by Customer from Supplier which give rise to each Payment Obligation do not include any goods or services the supply or receipt of which is contrary to applicable law (including without limitation applicable national and international export control, trade sanction and embargo laws, regulations, treaties and conventions); and

4.1.6 it shall comply with all applicable laws relevant to the conduct of its obligations under this Agreement.

4.2 Financial Institution represents and warrants, at the Effective Date and on each date on which it acknowledges receipt of a PAUF, as if made on such date with reference to the facts and circumstances then existing, that:

4.2.1 this Agreement is legal, valid and binding on Financial Institution and any obligation expressed to be assumed by Financial Institution under this Agreement is enforceable in accordance with its terms;

4.2.2 the execution, delivery and performance of this Agreement by Financial Institution has been duly authorised by all necessary corporate or other action required by Financial Institution; and

4.2.2 Financial Institution shall comply with all applicable laws relevant to the conduct of its obligations under this Agreement.

4.3 Except as expressly set forth in clause 4.2, no representations or warranties, whether express or implied are made by Financial Institution.

5. INDEMNITY

5.1 Parent shall defend and indemnify Financial Institution and each Supplier’s Transferee against any claims, liabilities, damages, costs and expenses (including reasonable attorney’s fees) awarded against or incurred by Financial Institution and each Supplier’s Transferee

arising out of any breach by the Parent of this Agreement or in connection with clause 2.5.2 of this Agreement.

6. TERMINATION

6.1 Subject to clauses 2.2, 6.2, 6.3 and 6.4, the term of this Agreement shall commence on the Effective Date for a period of 3 years, and shall continue thereafter unless or until either the Parent and Customer (acting together) or the Financial Institution gives the other(s) not less than ninety (90) days’ written notice at any time.

6.2 Either the Parent and Customer (acting together) or the Financial Institution may terminate this Agreement immediately upon notice to the other(s) if such other(s) commit(s) a material breach of this Agreement and fails to cure such breach within fifteen (15) days following written notice from the non-breaching party to the breaching party, specifying such breach.

6.3 Financial Institution may terminate this Agreement forthwith by notice in writing to Parent and Customer: (a) if necessary to prevent or protect against fraud or illegal conduct; or (b) if Parent fails to pay amounts when due.

6.4 On termination or expiry of this Agreement, in addition to any outstanding Payment Obligation, the following clauses shall continue in force: 2, 4, 5, 6.4, 8 and 9 along with any other provisions of this Agreement that expressly or by implication is intended to come into or continue in force on or after termination or expiry. Termination or expiry of this Agreement shall not affect any rights, remedies, obligations or liabilities of the parties that have accrued up to the date of termination or expiry, including the right to claim damages in respect of any breach of the Agreement that existed at or before the date of termination or expiry.

7. NOTICES

7.1 Any notice (which term shall in this clause 7 include any other communication) required to be given under or in connection with this Agreement shall, except where otherwise provided, be in writing, in the English language and sent to the relevant party at the address set out in the table above. Any party to this Agreement may notify the other party of any change to this address by written notice.

7.2 Parent and Customer agrees that Financial Institution may, acting in good faith, presume the authenticity, genuineness, accuracy, completeness and due execution of any email or fax communication bearing a facsimile or scanned signature resembling a signature of an authorized representative or officer of Parent or Customer without further verification or inquiry by Financial Institution. Notwithstanding the foregoing, Financial Institution in its sole discretion may elect not to act or rely upon such a communication and shall be entitled (but not obligated) to make inquiries or require further Parent or Customer action to authenticate any such communication.

7.3 A copy of any notice served by Parent or Customer in accordance with the preceding clauses shall be sent by email to: legal.notice@greensill.com.

8. GENERAL

8.1 This Agreement represents the final agreement of the parties with respect to the subject matter hereof and supersedes all prior and contemporaneous understandings and agreements with respect to such subject matter. No provision of this Agreement may be amended or waived except by a writing signed by the parties hereto. This Agreement shall bind and inure to the benefit of the respective successors and permitted assigns of each of the parties; provided, however, that neither Parent nor Customer may assign any of its rights hereunder without Financial Institution’s prior written consent, given or withheld in Financial Institution’s sole discretion. Financial Institution shall have the right without the consent of or notice to either Parent or Customer to sell, transfer, negotiate, or grant participations in all or any part of, or any interest in, Financial Institution’s obligations, rights and benefits hereunder.

8.2 Financial Institution shall keep information provided to it by Parent or Customer which is of a confidential nature with respect to the Parent or respective Customer and is not (a) public information or (b) information already known by Financial Institution prior to the date the information is provided to Financial Institution by Parent or Customer or (c) information obtained by Financial Institution after the date it was provided by Parent or Customer, in each case for (b) and (c) which has, as far as Financial Institution is aware, not been obtained in breach of, or otherwise subject to, any obligation of confidentiality, confidential, provided that Financial Institution may disclose any information about Parent, Customer, this Agreement or Supplier as Financial Institution shall consider appropriate to: (i) any Person to (or through) whom it assigns all or any of its rights or transfers all or any of its obligations (or may potentially assign its rights or transfer its obligations) under this Agreement; (ii) any Person with (or through) whom Financial Institution enters into (or may potentially enter into) any participation in relation to, or any other transaction under which payments are to be made by reference to, this Agreement (in each case for (i) and (ii), provided that the recipient has entered into a non-disclosure/confidentiality agreement with or provided a non-disclosure/confidentiality undertaking in favour of Financial Institution); (iii) any Person to whom, and to the extent that, information is required to be disclosed by any applicable law or regulation; or (iv) or its professional advisers, bankers or investors who are obligated to maintain confidentiality.

8.3 If any provision of this Agreement shall be held to be illegal, void, invalid or unenforceable under the laws of any jurisdiction, the legality, validity and enforceability of the remainder of this Agreement in that jurisdiction shall not be affected, and the legality, validity and enforceability of the whole of this Agreement in any other jurisdiction shall not be affected.

8.4 This Agreement may be executed in two or more counterparts, which together shall constitute one Agreement.

8.5 Subject to clause 8.6, no Person who is not a party to this Agreement shall have any rights under the Contracts (Rights of Third Parties) Act 1999 to enforce any term of this Agreement.

8.6 Supplier and each Supplier’s Transferee shall benefit from and be entitled to enforce clauses 2, 3, 4 and 5 with respect to each Payment Obligation and related Account Receivable in relation to which it is Supplier or Supplier’s Transferee, regardless of whether the transfer was in whole or in part, and any such Transfer shall be constituted as a separate legal claim in respect of its part of the Payment Obligation and Transferred Account Receivable distinct and separate from any claims in respect of the remaining Payment Obligation and Transferred Account Receivable(s). A Supplier’s Transferee may at any time assign the rights conferred upon it by this clause 8.6 to another Supplier’s Transferee.

9. GOVERNING LAW

9.1 This Agreement and rights and obligations (whether contractual, quasi-contractual or non-contractual) arising out of or in connection with it shall be governed by and construed in accordance with the laws of England and Wales. Each party irrevocably submits to the non-exclusive jurisdiction of the courts of England and Wales.

9.2 If Parent or Customer is not a company registered in England and Wales it hereby authorises and appoints the person whose details are set out in the Schedule (or such other person as it may from time to time substitute by not less than fifteen days written notice to Financial Institution) to accept service of all legal process arising out of or connected with this Agreement and service upon such person (or substitute) shall be deemed to be service on Parent or Customer (as applicable). Except upon such a substitution, Parent or Customer (as

applicable) shall not revoke any such authority or appointment and shall at all times maintain an agent for service of process in England and Wales, and if any such agent ceases for any reason to be an agent for this purpose, shall forthwith appoint another agent and advise Financial Institution accordingly.

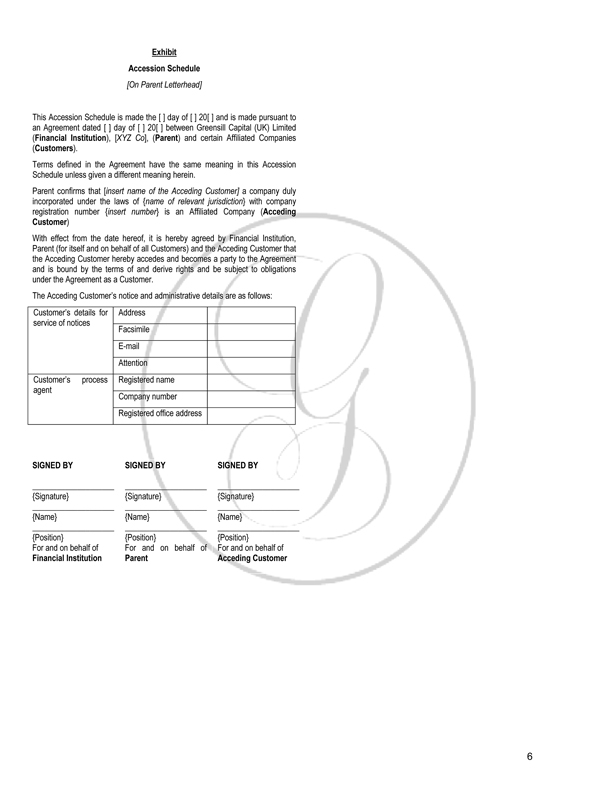

Exhibit

Accession Schedule

[On Parent Letterhead]

This Accession Schedule is made the [ ] day of [ ] 20[ ] and is made pursuant to an Agreement dated [ ] day of [ ] 20[ ] between Greensill Capital (UK) Limited (Financial Institution), [XYZ Co], (Parent) and certain Affiliated Companies (Customers).

Terms defined in the Agreement have the same meaning in this Accession Schedule unless given a different meaning herein.

Parent confirms that [insert name of the Acceding Customer] a company duly incorporated under the laws of {name of relevant jurisdiction} with company registration number {insert number} is an Affiliated Company (Acceding Customer)

With effect from the date hereof, it is hereby agreed by Financial Institution, Parent (for itself and on behalf of all Customers) and the Acceding Customer that the Acceding Customer hereby accedes and becomes a party to the Agreement and is bound by the terms of and derive rights and be subject to obligations under the Agreement as a Customer.

The Acceding Customer’s notice and administrative details are as follows:

Customer’s details for service of notices

Address

Facsimile

Attention

Customer’s process agent

Registered name

Company number

Registered office address

SIGNED BY

{Signature}

{Name}

{Position}

For and on behalf of

Financial Institution

SIGNED BY

{Signature}

{Name}

{Position}

For and on behalf of Parent

SIGNED BY

{Signature}

{Name}

{Position}

For and on behalf of

Acceding Customer