Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - F&M BANK CORP | Financial_Report.xls |

| EX-31.2 - CERTIFICATE - F&M BANK CORP | fmbm_exh312.htm |

| EX-31.1 - CERTIFICATE - F&M BANK CORP | fmbm_exh311.htm |

| EX-32.1 - CERTIFICATE - F&M BANK CORP | fmbm_exh321.htm |

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - F&M BANK CORP | fmbm_exh231.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For fiscal year ended December 31, 2014

Commission file number: 0-13273

F & M BANK CORP.

(Exact name of registrant as specified in its charter)

| Virginia | 54-1280811 | |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) | |

| incorporation or organization) |

P. O. Box 1111, Timberville, Virginia 22853

(Address of principal executive offices) (Zip Code)

(540) 896-8941

(Registrant’s telephone number including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock - $5 Par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Sarbanes Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

|

Large accelerated filer o

Non-accelerated filer o (Do not check if a smaller reporting company)

|

Accelerated filer o

Smaller reporting Company þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The registrant’s Common Stock is traded Over-the-Counter under the symbol FMBM. The aggregate market value of the 2,949,938 shares of Common Stock of the registrant issued and outstanding held by non-affiliates on June 30, 2014 was approximately $52,213,903 based on the closing sales price of $17.70 per share on that date. For purposes of this calculation, the term “affiliate” refers to all directors and executive officers of the registrant.

As of the close of business on March 20, 2015, there were 3,293,909 shares of the registrant's Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Part III: Proxy Statement for the Annual Meeting of Shareholders to be held on May 9, 2015 (the “Proxy Statement”).

Table of Contents

| Page | ||

| PART I | ||

| Item 1 |

Business

|

2 |

| Item 1A | Risk Factors | 6 |

| Item 1B | Unresolved Staff Comments | 11 |

| Item 2 | Properties | 12 |

| Item 3 | Legal Proceedings | 12 |

| Item 4 | Mine Safety Disclosures | 12 |

| PART II | ||

|

Item 5

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

13 |

| Item 6 | Selected Financial Data | 15 |

|

Item 7

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

16 |

| Item 8 | Financial Statements and Supplementary Data | 38 |

| Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 80 |

| Item 9A | Controls and Procedures | 80 |

| Item 9B | Other Information | 80 |

| PART II | ||

| Item 10 | Directors, Executive Officers and Corporate Governance | 81 |

| Item 11 | Executive Compensation | 81 |

| Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 81 |

| Item 13 | Certain Relationships and Related Transactions and Director Independence | 81 |

| Item 14 | Principal Accounting Fees and Services | 81 |

| Item 15 | Exhibits and Financial Statement Schedules | 82 |

| Signatures | 83 | |

PART I

Item 1. Business

General

F & M Bank Corp. (the “Company” or “we”), incorporated in Virginia in 1983, is a one bank holding company pursuant to section 3(a)(1) of the Bank Holding Company Act of 1956, and owns 100% of the outstanding stock of its affiliate, Farmers & Merchants Bank (Bank). TEB Life Insurance Company (TEB) and Farmers & Merchants Financial Services, Inc. (FMFS) are wholly owned subsidiaries of Farmers & Merchants Bank. Farmers & Merchants Bank also holds a majority ownership in VBS Mortgage LLC, (VBS).

Farmers & Merchants Bank was chartered on April 15, 1908, as a state chartered bank under the laws of the Commonwealth of Virginia. TEB was incorporated on January 27, 1988, as a captive life insurance company under the laws of the State of Arizona. FMFS is a Virginia chartered corporation and was incorporated on February 25, 1993. VBS (formerly Valley Broker Services, Inc.) was incorporated on May 11, 1999. The Bank purchased a majority interest in VBS on November 3, 2008.

The Bank offers all services normally offered by a full-service commercial bank, including commercial and individual demand and time deposit accounts, repurchase agreements for commercial customers, commercial and individual loans, internet and mobile banking, drive-in banking services, ATMs at all branch locations and several off-site locations, as well as a courier service for its commercial banking customers. TEB was organized to re-insure credit life and accident and health insurance currently being sold by the Bank in connection with its lending activities. FMFS was organized to write title insurance but now provides brokerage services, commercial and personal lines of insurance to customers of the Bank. VBS originates conventional and government sponsored mortgages through their offices in Harrisonburg and Woodstock.

The Bank makes various types of commercial and consumer loans and has a large portfolio of residential mortgages and a concentration in development lending. The local economy is relatively diverse with strong employment in the agricultural, manufacturing, service and governmental sectors.

The Company’s and the Bank’s principal executive office is at 205 South Main Street, Timberville, VA 22853, and its phone number is (540) 896-8941.

Filings with the SEC

The Company files annual, quarterly and other reports under the Securities Exchange Act of 1934 with the Securities and Exchange Commission (“SEC”). These reports are posted and are available at no cost on the Company’s website, www.FMBankVA.com, as soon as reasonably practicable after the Company files such documents with the SEC. The Company’s filings are also available through the SEC’s website at www.sec.gov.

Employees

On December 31, 2014, the Bank had 156 full-time and part-time employees; including executive officers, loan and other banking officers, branch personnel, operations personnel and other support personnel. None of the Company’s employees is represented by a union or covered under a collective bargaining agreement. Management of the Company considers their employee relations to be excellent. No one employee devotes full-time services to F & M Bank Corp.

Competition

The Bank's offices face strong competition from numerous other financial institutions. These other institutions include large national and regional banks, other community banks, nationally chartered savings banks, credit unions, consumer finance companies, mortgage companies, loan production offices, mutual funds and life insurance companies. Competition for loans and deposits is affected by a variety of factors including interest rates, types of products offered, the number and location of branch offices, marketing strategies and the reputation of the Bank within the communities served.

2

PART I, Continued

Item 1. Business, continued

Regulation and Supervision

General. The operations of F & M Bank Corp. and the Bank are subject to federal and state statutes, which apply to bank holding companies and state member banks of the Federal Reserve System. The stock of F & M Bank Corp. is registered pursuant to and subject to the periodic reporting requirements of the Securities Exchange Act of 1934 (the “Exchange Act”). These include, but are not limited to, the filing of annual, quarterly and other current reports with the Securities and Exchange Commission (the “SEC”). As an Exchange Act reporting company, the Company is directly affected by the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”), which is aimed at improving corporate governance and reporting procedures. The Company believes it is in compliance with SEC and other rules and regulations implemented pursuant to Sarbanes-Oxley and intends to comply with any applicable rules and regulations implemented in the future.

F & M Bank Corp., as a bank holding company, is subject to the provisions of the Bank Holding Company Act of 1956, as amended (the "Act") and is supervised by the Federal Reserve Board. The Act requires F & M Bank Corp. to secure the prior approval of the Federal Reserve Board before F & M Bank Corp. acquires ownership or control of more than 5% of the voting shares or substantially all of the assets of any institution, including another bank.

As a bank holding company, F & M Bank Corp. is required to file with the Board of Governors of the Federal Reserve System (the “Federal Reserve Board”) an annual report and such additional information as it may require pursuant to the Act. The Federal Reserve Board may also conduct examinations of F & M Bank Corp. and any or all of its subsidiaries. Under Section 106 of the 1970 Amendments to the Act and the regulations of the Federal Reserve Board, a bank holding company and its subsidiaries are prohibited from engaging in certain tie-in arrangements in connection with an extension of credit, provision of credit, sale or lease of property or furnishing of services.

Federal Reserve Board regulations limit activities of bank holding companies to managing or controlling banks or non-banking activities closely related to banking. These activities include the making or servicing of loans, performing certain data processing services, and certain leasing and insurance agency activities. Since 1994, the Company has entered into agreements with the Virginia Community Development Corporation to purchase equity positions in several Low Income Housing Funds; these funds provide housing for low-income individuals throughout Virginia. Approval of the Federal Reserve Board is necessary to engage in any of the activities described above or to acquire interests engaging in these activities.

The Bank as a state member bank is supervised and regularly examined by the Virginia Bureau of Financial Institutions and the Federal Reserve Board. Such supervision and examination by the Virginia Bureau of Financial Institutions and the Federal Reserve Board is intended primarily for the protection of depositors and not the stockholders of F & M Bank Corp.

Payment of Dividends. The Company is a legal entity, separate and distinct from its subsidiaries. A significant portion of the revenues of the Company result from dividends paid to it by the Bank. There are various legal limitations applicable to the payment of dividends by the Bank to the Company. Under the current regulatory guidelines, prior approval from the Federal Reserve Board is required if cash dividends declared in any given year exceed net income for that year, plus retained net profits of the two preceding years. A bank also may not declare a dividend out of or in excess of its net undivided profits without regulatory approval. The payment of dividends by the Bank or the Company may also be limited by other factors, such as requirements to maintain capital above regulatory guidelines.

Bank regulatory agencies have the authority to prohibit the Bank or the Company from engaging in an unsafe or unsound practice in conducting their businesses. The payment of dividends, depending on the financial condition of the Bank, or the Company, could be deemed to constitute such an unsafe or unsound practice. Based on the Bank’s current financial condition, the Company does not expect that any of these laws will have any impact on its ability to obtain dividends from the Bank.

The Company also is subject to regulatory restrictions on dividends to its shareholders. Regulators have indicated that bank holding companies should generally pay dividends only if the organization’s net income available to common shareholders over the past year has been sufficient to fully fund the dividends and the prospective rate of earnings retention appears consistent with the organization’s capital needs, asset quality, and overall financial condition. Further, a bank holding company should inform and consult with the Federal Reserve Board prior to declaring a dividend that exceeds earnings for the period (e.g., quarter) for which the dividend is being paid or that could result in a material adverse change to the organization’s capital structure.

3

PART I, Continued

Item 1. Business, continued

Regulation and Supervision, continued

Capital Requirements. The Federal Reserve has issued risk-based and leverage capital guidelines applicable to United States banking organizations. In addition, regulatory agencies may from time to time require that a banking organization maintain capital above the minimum levels because of its financial condition or actual or anticipated growth. Under the risk-based capital requirements, the Company and Bank are required to maintain a minimum ratio of total capital to risk-weighted assets of at least 8%. At least half of the total capital is required to be “Tier 1 capital”, which consists principally of common and certain qualifying preferred stockholders’ equity (including Trust Preferred Securities), less certain intangibles and other adjustments. The remainder (“Tier 2 capital”) consists of a limited amount of subordinated and other qualifying debt (including certain hybrid capital instruments) and a limited amount of the general loan loss allowance. The Tier 1 and total capital to risk-weighted asset ratios of the Company as of December 31, 2014 were 16.09% and 17.35%, respectively, significantly above the minimum requirements.

In addition, each of the federal regulatory agencies has established a minimum leverage capital ratio (Tier 1 capital to average adjusted assets) (“Tier 1 leverage ratio”). These guidelines provide for a minimum Tier 1 leverage ratio of 4% for banks and bank holding companies that meet certain specified criteria, including that they have the highest regulatory examination rating and are not contemplating significant growth or expansion. The Tier 1 leverage ratio of the Company as of December 31, 2014, was 12.88%, which is significantly above the minimum requirements. The guidelines also provide that banking organizations experiencing internal growth or making acquisitions will be expected to maintain strong capital positions substantially above the minimum supervisory levels, without significant reliance on intangible assets.

In 2013, the Federal Reserve, the FDIC and the OCC approved a new rule that will substantially amend the regulatory risk-based capital rules applicable to us. The final rule implements the "Basel III" regulatory capital reforms and changes required by the Dodd-Frank Act. The final rule includes new minimum risk-based capital and leverage ratios which was effective for us on January 1, 2015, and refines the definition of what constitutes "capital" for purposes of calculating these ratios. The new minimum capital requirements will be: (i) a new common equity Tier 1 ("CET1") capital ratio of 4.5%; (ii) a Tier 1 to risk-based assets capital ratio of 6%, which is increased from 4%; (iii) a total capital ratio of 8%, which is unchanged from the current rules; and (iv) a Tier 1 leverage ratio of 4%. The final rule also establishes a "capital conservation buffer" of 2.5% above the new regulatory minimum capital ratios, and when fully effective in 2019, will result in the following minimum ratios: (a) a common equity Tier 1 capital ratio of 7.0%; (b) a Tier 1 to risk-based assets capital ratio of 8.5%; and (c) a total capital ratio of 10.5%. The new capital conservation buffer requirement would be phased in beginning in January 2016 at 0.625% of risk-weighted assets and would increase each year until fully implemented in January 2019. An institution will be subject to limitations on paying dividends, engaging in share repurchases, and paying discretionary bonuses if its capital level falls below the buffer amount. These limitations will establish a maximum percentage of eligible retained income that can be utilized for such activities

The Gramm-Leach-Bliley Act. Effective on March 11, 2001, the Gramm-Leach-Bliley Act (the “GLB Act”) allows a bank holding company or other company to certify status as a financial holding company, which will allow such company to engage in activities that are financial in nature, that are incidental to such activities, or are complementary to such activities. The GLB Act enumerates certain activities that are deemed financial in nature, such as underwriting insurance or acting as an insurance principal, agent or broker; dealing in or making markets in securities; and engaging in merchant banking under certain restrictions. It also authorizes the Federal Reserve to determine by regulation what other activities are financial in nature, or incidental or complementary thereto.

USA Patriot Act of 2001. In October 2001, the USA Patriot Act of 2001 was enacted in response to the terrorist attacks in New York, Pennsylvania and Northern Virginia which occurred on September 11, 2001. The Patriot Act is intended to strengthen U.S. law enforcements’ and the intelligence communities’ abilities to work cohesively to combat terrorism on a variety of fronts. The continuing and potential impact of the Patriot Act and related regulations and policies on financial institutions of all kinds is significant and wide ranging. The Patriot Act contains sweeping anti-money laundering and financial transparency laws, and imposes various regulations, including standards for verifying client identification at account opening, and rules to promote cooperation among financial institutions, regulators and law enforcement entities in identifying parties that may be involved in terrorism or money laundering.

4

PART I, Continued

Item 1. Business, continued

Regulation and Supervision, continued

Community Reinvestment Act. The requirements of the Community Reinvestment Act are also applicable to the Bank. The act imposes on financial institutions an affirmative and ongoing obligation to meet the credit needs of their local communities, including low and moderate income neighborhoods, consistent with the safe and sound operation of those institutions. A financial institution’s efforts in meeting community needs currently are evaluated as part of the examination process pursuant to twelve assessment factors. These factors are also considered in evaluating mergers, acquisitions and applications to open a branch or facility.

Dodd-Frank Wall Street Reform and Consumer Protection Act. The Dodd-Frank Act was signed into law on July 21, 2010. Its wide ranging provisions affect all federal financial regulatory agencies and nearly every aspect of the American financial services industry. Among the provisions of the Dodd-Frank Act that directly impact the Company is the creation of an independent Consumer Financial Protection Bureau (CFPB), which has the ability to write rules for consumer protections governing all financial institutions. All consumer protection responsibility formerly handled by other banking regulators is consolidated in the CFPB. It will also oversee the enforcement of all federal laws intended to ensure fair access to credit. For smaller financial institutions such as the Company and the Bank, the CFPB will coordinate its examination activities through their primary regulators.

The Dodd-Frank Act contains provisions designed to reform mortgage lending, which includes the requirement of additional disclosures for consumer mortgages. In addition, the Federal Reserve has issued new rules that have the effect of limiting the fees charged to merchants for debit card transactions. The result of these rules will be to limit the amount of interchange fee income available explicitly to larger banks and indirectly to us. The Dodd-Frank Act also contains provisions that affect corporate governance and executive compensation.

Although the Dodd-Frank Act provisions themselves are extensive, the ultimate impact on the Company of this massive legislation is unknown. The Act provides that several federal agencies, including the Federal Reserve and the Securities and Exchange Commission, shall issue regulations implementing major portions of the legislation, and this process is ongoing.

Mortgage Lending. In 2013, the CFPB adopted a rule, effective in January 2014, to implement certain sections of the Dodd-Frank Act requiring creditors to make a reasonable, good faith determination of a consumer’s ability to repay any closed-end consumer credit transaction secured by a 1-4 family dwelling. The rule also establishes certain protections from liability under this requirement to ensure a borrower’s ability to repay for loans that meet the definition of “qualified mortgage.” Loans that satisfy this “qualified mortgage” safe harbor will be presumed to have complied with the new ability-to-repay standard.

Forward-Looking Statements

Certain information contained in this report may include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. These forward-looking statements are generally identified by phrases such as “we expect,” “we believe” or words of similar import. Such forward-looking statements involve known and unknown risks including, but not limited to:

|

●

|

Changes in the quality or composition of our loan or investment portfolios, including adverse developments in borrower industries, declines in real estate values in our markets, or in the repayment ability of individual borrowers or issuers;

|

|

●

|

The strength of the economy in our target market area, as well as general economic, market, or business conditions;

|

|

●

|

An insufficient allowance for loan losses as a result of inaccurate assumptions;

|

|

●

|

Our ability to maintain our “well-capitalized” regulatory status;

|

|

●

|

Changes in the interest rates affecting our deposits and our loans;

|

|

●

|

Changes in our competitive position, competitive actions by other financial institutions and the competitive nature of the financial services industry and our ability to compete effectively against other financial institutions in our banking markets;

|

|

●

|

Our ability to manage growth;

|

|

●

|

Our potential growth, including our entrance or expansion into new markets, the opportunities that may be presented to and pursued by us and the need for sufficient capital to support that growth;

|

5

PART I, Continued

Item 1. Business, continued

Forward looking statements, continued

|

●

|

Our exposure to operational risk;

|

|

●

|

Our ability to raise capital as needed by our business;

|

|

●

|

Changes in laws, regulations and the policies of federal or state regulators and agencies; and

|

|

●

|

Other circumstances, many of which are beyond our control.

|

Although we believe that our expectations with respect to the forward-looking statements are based upon reliable assumptions within the bounds of our knowledge of our business and operations, there can be no assurance that our actual results, performance or achievements will not differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements.

Item 1A. Risk Factors

General economic conditions in our market area could adversely affect us.

We are affected by the general economic conditions in the local markets in which we operate. Since the recession began in 2008, our market has experienced a significant downturn in which we have seen falling home prices, rising foreclosures and an increased level of commercial and consumer delinquencies. Although economic conditions have improved, many businesses and individuals are still experiencing difficulty as a result of the recent economic downturn and protracted recovery. If economic conditions in our market do not improve, we could experience further adverse consequences, including a decline in demand for our products and services and an increase in problem assets, forecloses and loan losses. Future economic conditions in our market will depend on factors outside of our control such as political and market conditions, broad trends in industry and finance, legislative and regulatory changes, changes in government, military and fiscal policies and inflation, any of which could negatively affect our performance and financial condition.

Our allowance for loan losses may prove to be insufficient to absorb losses in the loan portfolio.

Like all financial institutions, we maintain an allowance for loan losses to provide for loans that our borrowers may not repay in their entirety. We believe that we maintain an allowance for loan losses at a level adequate to absorb probable losses inherent in the loan portfolio. Through a periodic review and consideration of the loan portfolio, management determines the amount of the allowance for loan losses by considering general market conditions, credit quality of the loan portfolio, the collateral supporting the loans and performance of customers relative to their financial obligations with us. At December 31, 2014, our non-performing loans were $6.9 million, compared to $12.6 million at December 31, 2013. Our provision for loan losses was $2.3 million for the year ended December 31, 2014, and our loan loss allowance was $8.7 million, or 1.68% of total loans held for investment at December 31, 2014.

The amount of future losses is susceptible to changes in economic, operating and other conditions, including changes in interest rates, which may be beyond our control, and these losses may exceed current estimates. Although we believe the allowance for loan losses is a reasonable estimate of known and inherent losses in the loan portfolio, it cannot fully predict such losses or that the loss allowance will be adequate in the future. While the risk of nonpayment is inherent in banking, we could experience greater nonpayment levels than we anticipate. In addition, we have loan participation arrangements with several other banks within the region and may not be able to exercise control of negotiations with borrowers in the event these loans do not perform. Additional problems with asset quality could cause our interest income and net interest margin to decrease and our provisions for loan losses to increase further, which could adversely affect our results of operations and financial condition.

Federal and state regulators periodically review our allowance for loan losses and may require us to increase our provision for loan losses or recognize further loan charge-offs, based on judgments different than those of management. Any increase in the amount of the provision or loans charged-off as required by these regulatory agencies could have a negative effect on our operating results.

6

PART I, Continued

Item 1A. Risk Factors, Continued

Our loan concentrations could, as a result of adverse market conditions, increase credit losses which could adversely impact earnings.

We offer a variety of secured loans, including commercial lines of credit, commercial term loans, real estate, construction, home equity, consumer and other loans. Many of our loans are secured by real estate (both residential and commercial) in our market area, which could result in adverse consequences to us in the event of a prolonged economic downturn in our market. As of December 31, 2014, approximately 84% of our loans had real estate as a primary or secondary component of collateral. A further significant decline in real estate values in our market would mean that the collateral for many of our loans would provide less security. As a result, we would be more likely to suffer losses on defaulted loans because our ability to fully recover on defaulted loans by selling the real estate collateral would be diminished. In addition, our consumer loans (such as automobile loans) are collateralized, if at all, with assets that may not provide an adequate source of repayment of the loan due to depreciation, damage or loss.

In addition, we have a large portfolio of residential mortgages and a concentration in development lending, both of which could be adversely affected by a decline in the real estate markets. Construction and development lending entails significant additional risks, because these loans, which often involve larger loan balances concentrated with single borrowers or groups of related borrowers, are dependent on the successful completion of real estate projects. Loan funds for construction and development loans often are advanced upon the security of the land or home under construction, which value is estimated prior to the completion of construction. The deterioration of one or a few of these loans could cause a significant increase in the percentage of non-performing loans. An increase in non-performing loans could result in a loss of earnings from these loans, an increase in the provision for loan losses and an increase in charge-offs, all of which could have a material adverse effect on our financial condition.

Our small-to-medium sized business target market may have fewer financial resources to weather continued downturn in the economy.

We target our commercial development and marketing strategy primarily to serve the banking and financial services needs of small and medium sized businesses. These businesses generally have less capital or borrowing capacity than larger entities. If general economic conditions negatively impact this major economic sector in the markets in which we operate, our results of operations and financial condition may be adversely affected.

Our inability to maintain adequate sources of funding and liquidity may negatively impact our current financial condition or our ability to grow.

Our access to funding and liquidity sources in amounts adequate to finance our activities on terms which are acceptable to us could be impaired by factors that affect us specifically or the financial services industry or economy in general. In managing our balance sheet, a primary source of funding asset growth and liquidity historically has been deposits, including both local customer deposits and brokered deposits. If the level of deposits were to materially decrease, we would have to raise additional funds by increasing the interest that we pay on certificates of deposit or other depository accounts, seek other debt or equity financing, or draw upon our available lines of credit. Our access to these funding and liquidity sources could be detrimentally impacted by a number of factors, including operating losses, rising levels of non-performing assets, a decrease in the level of our business activity as a result of a downturn in the markets in which our loans or deposits are concentrated or regulatory restrictions. In addition, our ability to continue to attract deposits and other funding or liquidity sources is subject to variability based upon additional factors including volume and volatility in the securities markets and the relative interest rates that we are prepared to pay for these liabilities. We do not maintain significant additional sources of liquidity through potential sales in our investment portfolio or liquid assets at the holding company level. Our potential inability to maintain adequate sources of funding or liquidity may, among other things, inhibit our ability to fund asset growth or negatively impact our financial condition, including our ability to pay dividends or satisfy our obligations.

7

PART I, Continued

Item 1A. Risk Factors, Continued

If we do not maintain our capital requirements and our status as a “well-capitalized” bank, there could an adverse effect on our liquidity and our ability to fund our loan portfolio.

We are subject to regulatory capital adequacy guidelines. If we fail to meet the capital adequacy guidelines for a “well-capitalized” bank, it could increase the regulatory scrutiny for the Bank and the Company. In addition, if we failed to be “well capitalized” for regulatory capital purposes, we would not be able to renew or accept brokered deposits without prior regulatory approval and we would not be able to offer interest rates on our deposit accounts that are significantly higher than the average rates in our market area. As a result, it would be more difficult for us to attract new deposits as our existing brokered deposits mature and do not roll over and to retain or increase existing, non-brokered deposits. If we are prohibited from renewing or accepting brokered deposits and are unable to attract new deposits, our liquidity and our ability to fund our loan portfolio may be adversely affected. In addition, we would be required to pay higher insurance premiums to the FDIC, which would reduce our earnings.

We may be subject to more stringent capital requirements, which could adversely affect our results of operations and future growth.

In 2013, the Federal Reserve, the FDIC and the OCC approved a new rule that will substantially amend the regulatory risk-based capital rules applicable to us. The final rule implements the “Basel III” regulatory capital reforms and changes required by the Financial Reform Act. The final rule includes new minimum risk-based capital and leverage ratios which was effective for us on January 1, 2015, and refines the definition of what constitutes “capital” for purposes of calculating these ratios. The new minimum capital requirements will be: (i) a new common equity Tier 1 (“CET1”) capital ratio of 4.5%; (ii) a Tier 1 to risk-based assets capital ratio of 6%, which is increased from 4%; (iii) a total capital ratio of 8%, which is unchanged from the current rules; and (iv) a Tier 1 leverage ratio of 4%. The final rule also establishes a “capital conservation buffer” of 2.5% above the new regulatory minimum capital ratios, and when fully effective in 2019, will result in the following minimum ratios: (a) a common equity Tier 1 capital ratio of 7.0%; (b) a Tier 1 to risk-based assets capital ratio of 8.5%; and (c) a total capital ratio of 10.5%. The new capital conservation buffer requirement would be phased in beginning in January 2016 at 0.625% of risk-weighted assets and would increase each year until fully implemented in January 2019. An institution will be subject to limitations on paying dividends, engaging in share repurchases, and paying discretionary bonuses if its capital level falls below the buffer amount. These limitations will establish a maximum percentage of eligible retained income that can be utilized for such activities. In addition, the final rule provides for a number of new deductions from and adjustments to capital and prescribes a revised approach for risk weightings that could result in higher risk weights for a variety of asset categories.

The application of these more stringent capital requirements for us could, among other things, result in lower returns on equity, require the raising of additional capital, adversely affect our future growth opportunities, and result in regulatory actions such as a prohibition on the payment of dividends or on the repurchase shares if we were unable to comply with such requirements.

New regulations could adversely impact our earnings due to, among other things, increased compliance costs or costs due to noncompliance.

The Consumer Financial Protection Bureau has issued a rule, effective as of January 14, 2014, designed to clarify for lenders how they can avoid monetary damages under the Dodd-Frank Act, which would hold lenders accountable for ensuring a borrower’s ability to repay a mortgage. Loans that satisfy this “qualified mortgage” safe-harbor will be presumed to have complied with the new ability-to-repay standard. Under the Consumer Financial Protection Bureau’s rule, a “qualified mortgage” loan must not contain certain specified features, including but not limited to:

|

●

|

excessive upfront points and fees (those exceeding 3% of the total loan amount, less “bona fide discount points” for prime loans);

|

|

●

|

interest-only payments;

|

|

●

|

negative-amortization; and

|

|

●

|

terms longer than 30 years.

|

8

PART I, Continued

Item 1A. Risk Factors, Continued

Also, to qualify as a “qualified mortgage,” a borrower’s total monthly debt-to-income ratio may not exceed 43%. Lenders must also verify and document the income and financial resources relied upon to qualify the borrower for the loan and underwrite the loan based on a fully amortizing payment schedule and maximum interest rate during the first five years, taking into account all applicable taxes, insurance and assessments. The Consumer Financial Protection Bureau’s rule on qualified mortgages could limit our ability or desire to make certain types of loans or loans to certain borrowers, or could make it more expensive and/or time consuming to make these loans, which could adversely impact our growth or profitability.

Additionally, on December 10, 2013, five financial regulatory agencies, including our primary federal regulator, the Federal Reserve, adopted final rules implementing a provision of the Dodd-Frank Act, commonly referred to as the Volcker Rule. The Final Rules prohibit banking entities from, among other things, engaging in short-term proprietary trading of securities, derivatives, commodity futures and options on these instruments for their own account; or owning, sponsoring, or having certain relationships with hedge funds or private equity funds, referred to as “covered funds.” On January 14, 2014, the five financial regulatory agencies, approved an adjustment to the final rule by allowing banks to keep certain collateralized debt obligations (“CDOs”) acquired the bank before the Volcker Rule was finalized, if the CDO was established before May 2010 and is backed primarily by trust preferred securities issued by banks with less than $15 billion in assets established. The rules were effective April 1, 2014, but the conformance period has been extended from its statutory end date of July 21, 2014 until July 21, 2015. We are currently evaluating the Volcker Rule; if we are required to divest any securities in our portfolio as a result of the Volcker Rule, it could result in impairments that could adversely impact our financial condition and results of operations.

Difficult market conditions have adversely affected our industry.

Dramatic declines in the housing market, with falling home prices and increasing foreclosures, unemployment and under-employment, have negatively impacted the credit performance of real estate related loans and resulted in significant write-downs of asset values by financial institutions. These write-downs, initially of asset-backed securities but spreading to other securities and loans, have caused many financial institutions to seek additional capital, to reduce or eliminate dividends, to merge with larger and stronger institutions and, in some cases, to fail. Reflecting concern about the stability of the financial markets generally and the strength of counterparties, many lenders and institutional investors have reduced or ceased providing funding to borrowers, including to other financial institutions. This market turmoil and tightening of credit have led to an increased level of commercial and consumer delinquencies, lack of consumer confidence, increased market volatility and widespread reduction of business activity generally. The resulting economic pressure on consumers and lack of confidence in the financial markets has adversely affected our business and results of operations. Market developments may affect consumer confidence levels and may cause adverse changes in payment patterns, causing increases in delinquencies and default rates, which may impact our charge-offs and provision for credit losses. A worsening of these conditions would likely exacerbate the adverse effects of these difficult market conditions on us and others in the financial institutions industry.

Our future success is dependent on our ability to effectively compete in the face of substantial competition from other financial institutions in our primary markets.

We encounter significant competition for deposits, loans and other financial services from banks and other financial institutions, including savings and loan associations, savings banks, finance companies, and credit unions in our market area. A number of these banks and other financial institutions are significantly larger than us and have substantially greater access to capital and other resources, larger lending limits, more extensive branch systems, and may offer a wider array of banking services. To a limited extent, we compete with other providers of financial services, such as money market mutual funds, brokerage firms, consumer finance companies, insurance companies and governmental organizations any of which may offer more favorable financing rates and terms than us. Most of these non-bank competitors are not subject to the same extensive regulations that govern us. As a result, these non-bank competitors may have advantages in providing certain services. This competition may reduce or limit our margins and our market share and may adversely affect our results of operations and financial condition.

9

PART I, Continued

Item 1A. Risk Factors, Continued

Changes in market interest rates could affect our cash flows and our ability to successfully manage our interest rate risk.

Our profitability and financial condition depend to a great extent on our ability to manage the net interest margin, which is the difference between the interest income earned on loans and investments and the interest expense paid for deposits and borrowings. The amounts of interest income and interest expense are principally driven by two factors; the market levels of interest rates, and the volumes of earning assets or interest bearing liabilities. The management of the net interest margin is accomplished by our Asset Liability Management Committee. Short term interest rates are highly sensitive to factors beyond our control and are effectively set and managed by the Federal Reserve, while longer term rates are generally determined by the market based on investors’ inflationary expectations. Thus, changes in monetary and or fiscal policy will affect both short term and long term interest rates which in turn will influence the origination of loans, the prepayment speed of loans, the purchase of investments, the generation of deposits and the rates received on loans and investment securities and paid on deposits or other sources of funding. The impact of these changes may be magnified if we do not effectively manage the relative sensitivity of our earning assets and interest bearing liabilities to changes in market interest rates. We generally attempt to maintain a neutral position in terms of the volume of earning assets and interest bearing liabilities that mature or can re-price within a one year period in order that we may maintain the maximum net interest margin; however, interest rate fluctuations, loan prepayments, loan production and deposit flows are constantly changing and greatly influence this ability to maintain a neutral position.

Generally, our earnings will be more sensitive to fluctuations in interest rates the greater the difference between the volume of earning assets and interest bearing liabilities that mature or are subject to re-pricing in any period. The extent and duration of this sensitivity will depend on the cumulative difference over time, the velocity and direction of interest rate changes, and whether we are more asset sensitive or liability sensitive. Additionally, the Asset Liability Management Committee may desire to move our position to more asset sensitive or more liability sensitive depending upon their expectation of the direction and velocity of future changes in interest rates in an effort to maximize the net interest margin. Should we not be successful in maintaining the desired position, or should interest rates not move as anticipated, our net interest margin may be negatively impacted.

Our inability to successfully manage growth or implement our growth strategy may adversely affect our results of operations and financial condition.

We may not be able to successfully implement our growth strategy if we are unable to identify attractive markets, locations or opportunities to expand in the future. Our ability to manage growth successfully also depends on whether we can maintain capital levels adequate to support our growth, maintain cost controls, asset quality and successfully integrate any businesses acquired into the organization.

As we continue to implement our growth strategy, we may incur increased personnel, occupancy and other operating expenses. We must absorb those higher expenses while we begin to generate new deposits, and there is a further time lag involved in redeploying new deposits into attractively priced loans and other higher yielding earning assets. Thus, our plans to branch could depress earnings in the short run, even if we efficiently execute a branching strategy leading to long-term financial benefits.

Our exposure to operational risk may adversely affect us.

Similar to other financial institutions, we are exposed to many types of operational risk, including reputational risk, legal and compliance risk, the risk of fraud or theft by employees or outsiders, unauthorized transactions by employees or operational errors, including clerical or record-keeping errors or those resulting from faulty or disabled computer or telecommunications systems.

10

PART I, Continued

Item 1A. Risk Factors, Continued

Our operations rely on certain external vendors.

We are reliant upon certain external vendors to provide products and services necessary to maintain our day-to-day operations. Accordingly, our operations are exposed to risk that these vendors will not perform in accordance with the contracted arrangements under service agreements. Although we maintain a system of comprehensive policies and a control framework designed to monitor vendor risks, the failure of an external vendor to perform in accordance with the contracted arrangements under service agreements could be disruptive to our operations, which could have a material adverse impact on our business and, in turn, our financial condition and results of operations.

Our operations may be adversely affected by cyber security risks.

In the ordinary course of business, we collect and store sensitive data, including proprietary business information and personally identifiable information of its customers and employees in systems and on networks. The secure processing, maintenance and use of this information is critical to operations and our business strategy. We have invested in accepted technologies and review processes and practices that are designed to protect our networks, computers and data from damage or unauthorized access. Despite these security measures, our computer systems and infrastructure may be vulnerable to attacks by hackers or breached due to employee error, malfeasance or other disruptions. A breach of any kind could compromise systems and the information stored there could be accessed, damaged or disclosed. A breach in security could result in legal claims, regulatory penalties, disruption in operations, and damage to our reputation, which could adversely affect our business.

Legislative or regulatory changes or actions, or significant litigation, could adversely impact us or the businesses in which we are engaged.

We are subject to extensive state and federal regulation, supervision and legislation that govern almost all aspects of our operations. Laws and regulations may change from time to time and are primarily intended for the protection of consumers, depositors and the deposit insurance funds. The impact of any changes to laws and regulations or other actions by regulatory agencies may negatively impact us or our ability to increase the value of our business. Additionally, actions by regulatory agencies or significant litigation against us could cause us to devote significant time and resources to defending ourselves and may lead to penalties that materially affect us. Future changes in the laws or regulations or their interpretations or enforcement could be materially adverse us and our shareholders.

Changes in accounting standards could impact reported earnings.

The accounting standard setters, including the FASB, SEC and other regulatory bodies, periodically change the financial accounting and reporting standards that govern the preparation of our consolidated financial statements. These changes can be hard to predict and can materially impact how we record and report our financial condition and results of operations. In some cases, we could be required to apply a new or revised standard retroactively, resulting in the restatement of prior period financial statements.

The Company does not have any unresolved staff comments to report for the year ended December 31, 2014.

11

PART I, Continued

Item 2. Properties

The locations of F & M Bank Corp., Inc. and its subsidiaries are shown below.

| Timberville Branch and Administrative Offices | Elkton Branch |

| 205 South Main Street | 127 West Rockingham Street |

| Timberville, VA 22853 | Elkton, VA 22827 |

| Broadway Branch | Port Road Branch |

| 126 Timberway | 1085 Port Republic Road |

| Broadway, VA 22815 | Harrisonburg, VA 22801 |

| Bridgewater Branch | Edinburg Branch |

| 100 Plaza Drive | 120 South Main Street |

| Bridgewater, VA 22812 | Edinburg, VA 22824 |

| Woodstock Branch | Crossroads Branch |

| 161 South Main Street | 80 Cross Keys Road |

| Woodstock, VA 22664 | Harrisonburg, VA 22801 |

| Luray Branch | Dealer Finance Division |

| 700 East Main Street | 4759 Spotswood Trail |

| Luray, VA 22835 | Penn Laird, VA 22846 |

| Fishersville Loan Production Office | |

| 1842 Jefferson Hwy | |

| Fishersville, VA 22939 |

With the exception of the Edinburg Branch, Port Road Branch, Luray Branch, Dealer Finance Division and the Fishersville Loan Production Office the remaining facilities are owned by Farmers & Merchants Bank. ATMs are available at all branch locations.

Through an agreement with Nationwide Money ATM Services, the Bank also operates cash only ATMs at five Food Lion grocery stores, one in Mt. Jackson, VA and four in Harrisonburg, VA. The Bank also has an agreement with Welch ATM to operate five cash only ATMs in Rite Aid Pharmacies in Augusta County, VA.

VBS’ offices are located at:

| Harrisonburg Office | Woodstock Office |

| 2040 Deyerle Avenue | 161 South Main Street |

| Suite 107 | Woodstock, VA 22664 |

| Harrisonburg, VA 22801 | |

Item 3. Legal Proceedings

In the normal course of business, the Company may become involved in litigation arising from banking, financial, or other activities of the Company. Management after consultation with legal counsel, does not anticipate that the ultimate liability, if any, arising out of these matters will have a material effect on the Company’s financial condition, operating results or liquidity.

Item 4. Mine Safety Disclosures

None.

12

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Stock Listing

The Company’s Common Stock trades under the symbol “FMBM” on the OTC QB Market. The bid and asked price of the Company’s stock is not published in any newspaper. Although several firms in both Harrisonburg and Richmond, Virginia occasionally take positions in the Company stock, they typically only match buyers and sellers.

Transfer Agent and Registrar

Registrar & Transfer Company

10 Commerce Drive

Cranford, NJ 07016

Stock Performance

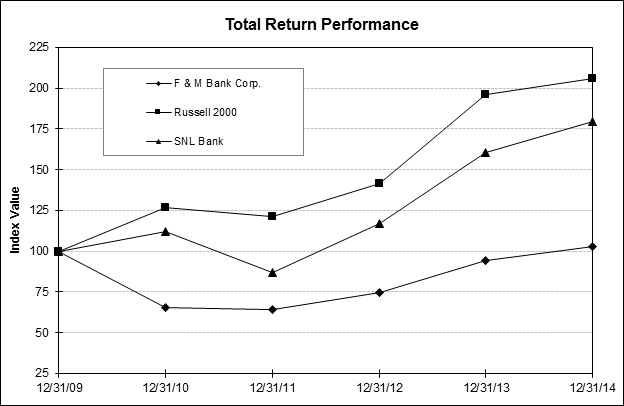

The following graph compares the cumulative total return to the shareholders of the Company for the last five fiscal years with the total return of the Russell 2000 Index and the SNL Bank Index, as reported by SNL Financial, LC, assuming an investment of $100 in the Company’s common stock on December 31, 2009, and the reinvestment of dividends.

| Period Ending | ||||||

|

Index

|

12/31/09

|

12/31/10

|

12/31/11

|

12/31/12

|

12/31/13

|

12/31/14

|

|

F & M Bank Corp.

|

100.00

|

65.53

|

64.26

|

74.50

|

94.04

|

102.84

|

|

Russell 2000

|

100.00

|

126.86

|

121.56

|

141.43

|

196.34

|

205.95

|

|

SNL Bank

|

100.00

|

112.05

|

86.78

|

117.11

|

160.79

|

179.74

|

13

PART II, Continued

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities, Continued

Recent Stock Prices and Dividends

Dividends to shareholders totaled $2,232,000 and $1,706,000 in 2014 and 2013, respectively. Regular quarterly dividends have been declared for sixty four consecutive quarters. The payment of dividends depends on the earnings of the Company and its subsidiaries, the financial condition of the Company and other factors including capital adequacy, regulatory requirements, general economic conditions and shareholder returns. The ratio of dividends per share to net income per share was 37.36% in 2014, compared to 36.17% in 2013.

Refer to Payment of Dividends in Item 1. Business, Regulation and Supervision section above for restrictions on dividends.

Stock Repurchases

As previously reported, on September 18, 2008, the Company’s Board of Directors approved an increase in the number of shares of common stock that the Company can repurchase under the share repurchase program from 150,000 to 200,000 shares. Shares repurchased through the end of 2014 totaled 164,132 shares; of this amount, none were repurchased in 2014.

The number of common shareholders of record was approximately 1,853 as of March 20, 2015. This amount includes all shareholders, whether titled individually or held by a brokerage firm or custodian in street name.

Quarterly Stock Information

These quotes include the terms of trades transacted through a broker. The terms of exchanges occurring between individual parties may not be known to the Company.

|

2014

|

2013

|

|||||||||||||||||||||||

|

Stock Price Range

|

Per Share

|

Stock Price Range

|

Per Share

|

|||||||||||||||||||||

|

Quarter

|

Low

|

High

|

Dividends Declared

|

Low

|

High

|

Dividends Declared

|

||||||||||||||||||

|

1st

|

17.21 | 18.00 | $ | .17 | 15.00 | 17.73 | $ | .17 | ||||||||||||||||

|

2nd

|

17.27 | 19.90 | .17 | 17.00 | 18.25 | .17 | ||||||||||||||||||

|

3rd

|

17.70 | 19.08 | .17 | 16.98 | 18.15 | .17 | ||||||||||||||||||

|

4th

|

17.83 | 19.73 | .17 | 16.90 | 19.00 | .17 | ||||||||||||||||||

|

Total

|

$ | .68 | $ | .68 | ||||||||||||||||||||

14

PART II, Continued

Item 6. Selected Financial Data

Five Year Summary of Selected Financial Data

|

(Dollars in thousands, except per share data)

|

2014

|

2013

|

2012

|

2011

|

2010

|

|||||||||||||||

|

Income Statement Data:

|

||||||||||||||||||||

|

Interest and Dividend Income

|

$ | 26,772 | $ | 25,966 | $ | 27,225 | $ | 27,680 | $ | 27,870 | ||||||||||

|

Interest Expense

|

3,648 | 4,773 | 6,294 | 7,719 | 9,005 | |||||||||||||||

|

Net Interest Income

|

23,124 | 21,193 | 20,931 | 19,961 | 18,865 | |||||||||||||||

|

Provision for Loan Losses

|

2,250 | 3,775 | 4,200 | 4,000 | 4,300 | |||||||||||||||

|

Net Interest Income after Provision for Loan Losses

|

20,874 | 17,418 | 16,731 | 15,961 | 14,565 | |||||||||||||||

|

Noninterest Income

|

3,485 | 3,925 | 3,627 | 3,118 | 3,249 | |||||||||||||||

|

Securities Gains (Losses)

|

- | - | - | 1,024 | 349 | |||||||||||||||

|

Noninterest Expenses

|

15,656 | 14,720 | 13,362 | 12,892 | 12,741 | |||||||||||||||

|

Income before Income Taxes

|

8,703 | 6,623 | 6,996 | 7,211 | 5,422 | |||||||||||||||

|

Income Tax Expense

|

2,901 | 1,907 | 2,095 | 2,523 | 1,681 | |||||||||||||||

|

Net Income

|

$ | 5,802 | $ | 4,716 | $ | 4,901 | $ | 4,688 | $ | 3,741 | ||||||||||

|

Per Share Data:

|

||||||||||||||||||||

|

Net Income – basic

|

$ | 1.82 | $ | 1.88 | $ | 1.96 | $ | 1.91 | $ | 1.63 | ||||||||||

|

Net Income - diluted

|

$ | 1.80 | $ | - | $ | - | $ | - | $ | - | ||||||||||

|

Dividends Declared

|

.68 | .68 | .64 | .60 | .60 | |||||||||||||||

|

Book Value

|

21.20 | 21.56 | 19.76 | 18.53 | 18.31 | |||||||||||||||

|

Balance Sheet Data:

|

||||||||||||||||||||

|

Assets

|

$ | 605,308 | $ | 552,788 | $ | 596,904 | $ | 566,734 | $ | 538,855 | ||||||||||

|

Loans Held for Investment

|

518,202 | 478,453 | 465,819 | 451,570 | 445,147 | |||||||||||||||

|

Loans Held for Sale

|

13,382 | 3,804 | 77,207 | 60,543 | 23,764 | |||||||||||||||

|

Securities

|

22,305 | 38,486 | 18,807 | 22,108 | 24,144 | |||||||||||||||

|

Deposits

|

491,505 | 464,149 | 453,796 | 435,947 | 425,051 | |||||||||||||||

|

Short-Term Debt

|

14,358 | 3,423 | 34,597 | 18,539 | 5,355 | |||||||||||||||

|

Long-Term Debt

|

9,875 | 21,691 | 47,905 | 57,298 | 58,979 | |||||||||||||||

|

Stockholders’ Equity

|

77,798 | 54,141 | 49,384 | 46,180 | 42,229 | |||||||||||||||

|

Average Common Shares Outstanding – basic

|

3,119 | 2,504 | 2,496 | 2,450 | 2,299 | |||||||||||||||

|

Average Common Shares Outstanding – diluted

|

3,230 | - | - | - | - | |||||||||||||||

|

Financial Ratios:

|

||||||||||||||||||||

|

Return on Average Assets1

|

1.00 | % | .82 | % | .86 | % | .84 | % | .69 | % | ||||||||||

|

Return on Average Equity1

|

8.65 | % | 9.11 | % | 10.26 | % | 10.41 | % | 9.22 | % | ||||||||||

|

Net Interest Margin

|

4.30 | % | 4.02 | % | 3.95 | % | 3.87 | % | 3.77 | % | ||||||||||

|

Efficiency Ratio 2

|

58.51 | % | 58.15 | % | 54.03 | % | 55.43 | % | 57.23 | % | ||||||||||

|

Dividend Payout Ratio

|

37.36 | % | 36.17 | % | 32.65 | % | 31.41 | % | 36.81 | % | ||||||||||

|

Capital and Credit Quality Ratios:

|

||||||||||||||||||||

|

Average Equity to Average Assets1

|

11.59 | % | 9.00 | % | 8.35 | % | 8.14 | % | 7.46 | % | ||||||||||

|

Allowance for Loan Losses to Loans3

|

1.68 | % | 1.71 | % | 1.75 | % | 1.54 | % | 1.30 | % | ||||||||||

|

Nonperforming Loans to Total Assets4

|

1.15 | % | 2.28 | % | 2.24 | % | 2.61 | % | 2.94 | % | ||||||||||

|

Nonperforming Assets to Total Assets5

|

1.73 | % | 2.75 | % | 2.73 | % | 3.15 | % | 3.22 | % | ||||||||||

|

Net Charge-offs to Total Loans3

|

.33 | % | .78 | % | .64 | % | .63 | % | .53 | % | ||||||||||

1 Ratios are primarily based on daily average balances.

|

2

|

The Efficiency Ratio equals noninterest expenses divided by the sum of tax equivalent net interest income and noninterest income. Noninterest expenses exclude intangible asset amortization. Noninterest income excludes gains (losses) on securities transactions.

|

|

3

|

Calculated based on Loans Held for Investment, excludes Loans Held for Sale.

|

|

4

|

Calculated based on 90 day past due and non-accrual to Total Assets.

|

5 Calculated based on 90 day past due, non-accrual and OREO to Total Assets

15

PART II, Continued

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion provides information about the major components of the results of operations and financial condition, liquidity and capital resources of F & M Bank Corp. and its subsidiaries. This discussion and analysis should be read in conjunction with the Consolidated Financial Statements and the Notes to the Consolidated Financial Statements presented in Item 8, Financial Statements and Supplementary Information, of this Form 10-K.

Capital Activities

The Company raised an additional $12 million in common equity in a private placement offering in March of 2014. In addition they raised $9.4 million in a new preferred stock offering in December 2014. Both amounts are net of fees related to the offering.

Lending Activities

Credit Policies

The principal risk associated with each of the categories of loans in our portfolio is the creditworthiness of our borrowers. Within each category, such risk is increased or decreased, depending on prevailing economic conditions. In an effort to manage the risk, our loan policy gives loan amount approval limits to individual loan officers based on their position and level of experience and to our loan committees based on the size of the lending relationship. The risk associated with real estate and construction loans, commercial loans and consumer loans varies, based on market employment levels, consumer confidence, fluctuations in the value of real estate and other conditions that affect the ability of borrowers to repay indebtedness. The risk associated with real estate construction loans varies, based on the supply and demand for the type of real estate under construction.

We have written policies and procedures to help manage credit risk. We have a loan review policy that includes regular portfolio reviews to establish loss exposure and to ascertain compliance with our loan policy.

We use a management loan committee and a directors’ loan committee to approve loans. The management loan committee is comprised of members of senior management, and the directors’ loan committee is composed of any four directors, of which at least three are independent directors. Both committees approve new, renewed and or modified loans that exceed officer loan authorities. The directors’ loan committee also reviews any changes to our lending policies, which are then approved by our board of directors.

Construction and Development Lending

We make construction loans, primarily residential, and land acquisition and development loans. The construction loans are secured by residential houses under construction and the underlying land for which the loan was obtained. The average life of a construction loan is approximately 12 months, and it is typically re-priced as the prime rate of interest changes. The majority of the interest rates charged on these loans float with the market. Construction lending entails significant additional risks, compared with residential mortgage lending. Construction loans often involve larger loan balances concentrated with single borrowers or groups of related borrowers. Another risk involved in construction lending is attributable to the fact that loan funds are advanced upon the security of the land or home under construction, which value is estimated prior to the completion of construction. Thus, it is more difficult to evaluate accurately the total loan funds required to complete a project and related loan-to-value ratios. To mitigate the risks associated with construction lending, we generally limit loan amounts to 75% to 90% of appraised value, in addition to analyzing the creditworthiness of our borrowers. We also obtain a first lien on the property as security for our construction loans and typically require personal guarantees from the borrower’s principal owners.

16

PART II, Continued

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, Continued

Commercial Real Estate Lending

Commercial real estate loans are secured by various types of commercial real estate in our market area, including multi-family residential buildings, commercial buildings and offices, shopping centers and churches. Commercial real estate lending entails significant additional risks, compared with residential mortgage lending. Commercial real estate loans typically involve larger loan balances concentrated with single borrowers or groups of related borrowers. Additionally, the payment experience on loans secured by income producing properties is typically dependent on the successful operation of a business or a real estate project and thus may be subject, to a greater extent, to adverse conditions in the real estate market or in the economy in general. Our commercial real estate loan underwriting criteria require an examination of debt service coverage ratios and the borrower’s creditworthiness, prior credit history and reputation. We also evaluate the location of the security property and typically require personal guarantees or endorsements of the borrower’s principal owners.

Business Lending

Business loans generally have a higher degree of risk than residential mortgage loans but have higher yields. To manage these risks, we generally obtain appropriate collateral and personal guarantees from the borrower’s principal owners and monitor the financial condition of our business borrowers. Residential mortgage loans generally are made on the basis of the borrower’s ability to make repayment from his employment and other income and are secured by real estate whose value tends to be readily ascertainable. In contrast, business loans typically are made on the basis of the borrower’s ability to make repayment from cash flow from its business and are secured by business assets, such as real estate, accounts receivable, equipment and inventory. As a result, the availability of funds for the repayment of business loans is substantially dependent on the success of the business itself. Furthermore, the collateral for business loans may depreciate over time and generally cannot be appraised with as much precision as residential real estate.

Consumer Lending

We offer various consumer loans, including personal loans and lines of credit, automobile loans, deposit account loans, installment and demand loans, and home equity lines of credit and loans. Such loans are generally made to clients with whom we have a pre-existing relationship. We currently originate all of our consumer loans in our geographic market area.

The underwriting standards employed by us for consumer loans include a determination of the applicant’s payment history on other debts and an assessment of their ability to meet existing obligations and payments on the proposed loan. The stability of the applicant’s monthly income may be determined by verification of gross monthly income from primary employment and additionally from any verifiable secondary income. Although creditworthiness of the applicant is of primary consideration, the underwriting process also includes an analysis of the value of the security in relation to the proposed loan amount. For home equity lines of credit and loans, our primary consumer loan category, we require title insurance, hazard insurance and, if required, flood insurance.

Residential Mortgage Lending

The Bank makes residential mortgage loans for the purchase or refinance of existing loans with loan to value limits ranging between 80 and 90% depending on the age of the property, borrower’s income and credit worthiness. Loans that are retained in our portfolio generally carry adjustable rates that can change every three to five years, based on amortization periods of twenty to thirty years.

17

PART II, Continued

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, Continued

Loans Held for Sale

The Bank makes fixed rate mortgage loans with terms of typically fifteen or thirty years through its subsidiary VBS Mortgage. These loans are typically on the Bank’s books for two to three weeks prior to being sold to investors in the secondary market. Similarly, the Bank also has a relationship with Gateway Savings Bank in Oakland, CA and NorthPointe Bank in Grand Rapids, MI where it purchases fixed rate loans for short periods of time pending those loans being sold to investors in the secondary market. These loans have an average life of ten days to two weeks, but occasionally remain on the Bank’s books for up to 60 days. The Bank has maintained a relationship with Gateway Bank since 2003 and began its relationship with NorthPointe Bank in 2014. This relationship allows the Bank to achieve a higher rate of return than it would on other short term investment opportunities.

Dealer Finance Division

On September 25, 2012, the Bank began operations of a loan production office in Penn Laird, VA which specializes in providing automobile financing through a network of automobile dealers. The new Dealer Finance Division was staffed with three officers that have extensive experience in Dealer Finance. This office is serving the automobile finance needs for customers of dealers throughout the existing geographic footprint of the Bank. Approximately forty dealers have signed contracts to originate loans on behalf of the Bank.

Critical Accounting Policies

General

The Company’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The financial information contained within the statements is, to a significant extent, financial information that is based on measures of the financial effects of transactions and events that have already occurred. The Company’s financial position and results of operations are affected by management’s application of accounting policies, including estimates, assumptions and judgments made to arrive at the carrying value of assets and liabilities and amounts reported for revenues, expenses and related disclosures. Different assumptions in the application of these policies could result in material changes in the Company’s consolidated financial position and/or results of operations.

In addition, GAAP itself may change from one previously acceptable method to another method. Although the economics of these transactions would be the same, the timing of events that would impact these transactions could change. Following is a summary of the Company’s significant accounting policies that are highly dependent on estimates, assumptions and judgments.

Allowance for Loan Losses

The allowance for loan losses is an estimate of the losses that may be sustained in the loan portfolio. The allowance is based on two basic principles of accounting: (i) ASC 450 (formerly SFAS No. 5) “Contingencies”, which requires that losses be accrued when they are probable of occurring and estimable and (ii) ASC 310 (formerly SFAS No. 114), “Receivables”, which requires that losses be accrued based on the differences between the value of collateral, present value of future cash flows or values that are observable in the secondary market and the loan balance. The Company’s allowance for loan losses is the accumulation of various components that are calculated based on independent methodologies. All components of the allowance represent an estimation performed pursuant to either ASC 450 or ASC 310. Management’s estimate of each ASC 450 component is based on certain observable data that management believes are most reflective of the underlying credit losses being estimated. This evaluation includes credit quality trends; collateral values; loan volumes; geographic, borrower and industry concentrations; seasoning of the loan portfolio; the findings of internal credit quality assessments and results from external bank regulatory examinations. These factors, as well as historical losses and current economic and business conditions, are used in developing estimated loss factors used in the calculations.

18

PART II, Continued

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, Continued

Allowance for Loan Losses, continued

Allowances for loans are determined by applying estimated loss factors to the portfolio based on management’s evaluation and “risk grading” of the loan portfolio. Specific allowances are typically provided on all impaired loans in excess of a defined loan size threshold that are classified in the Substandard or Doubtful risk grades. The specific reserves are determined on a loan-by-loan basis based on management’s evaluation of the Company’s exposure for each credit, given the current payment status of the loan and the value of any underlying collateral.

While management uses the best information available to establish the allowance for loan and lease losses, future adjustments to the allowance may be necessary if economic conditions differ substantially from the assumptions used in making the valuations or, if required by regulators, based upon information available to them at the time of their examinations. Such adjustments to original estimates, as necessary, are made in the period in which these factors and other relevant considerations indicate that loss levels may vary from previous estimates.

Goodwill and Intangibles

In June 2001, the Financial Accounting Standards Board issued ASC 805 (formerly SFAS No. 141), Business Combinations and ASC 350 (formerly SFAS No. 142), Intangibles. ASC 805 requires that the purchase method of accounting be used for all business combinations initiated after June 30, 2001. Additionally, it further clarifies the criteria for the initial recognition and measurement of intangible assets separate from goodwill. ASC 350 was effective for fiscal years beginning after December 15, 2001 and prescribes the accounting for goodwill and intangible assets subsequent to initial recognition. The provisions of ASC 350 discontinue the amortization of goodwill and intangible assets with indefinite lives. Instead, these assets are subject to an annual impairment review and more frequently if certain impairment indicators are in evidence. ASC 350 also requires that reporting units be identified for the purpose of assessing potential future impairments of goodwill.

The Company adopted ASC 350 on January 1, 2002. Goodwill totaled $2,639,000 at January 1, 2002. As of December 31, 2008, the Company recognized $30,000 in additional goodwill related to the purchase of 70% ownership in VBS Mortgage. The goodwill is not amortized but is tested for impairment at least annually. Based on this testing, there were no impairment charges for 2014, 2013 or 2012. Application of the non-amortization provisions of the Statement resulted in additional net income of $120,000 for each of the years ended December 31, 2014, 2013 and 2012.

Core deposit intangibles are amortized on a straight-line basis over a ten year life. The Company adopted ASC 350 on January 1, 2002 and determined that the core deposit intangible will continue to be amortized over its estimated useful life. The core deposit intangible was fully amortized during 2011.

Securities Impairment