Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - DAKOTA PLAINS HOLDINGS, INC. | Financial_Report.xls |

| EX-31.2 - CERTIFICATION OF CFO PURSUANT TO SECTION 302 - DAKOTA PLAINS HOLDINGS, INC. | dakota150892_ex31-2.htm |

| EX-32.1 - CERTIFICATION OF CEO/CFO PURSUANT TO SECTION 906 - DAKOTA PLAINS HOLDINGS, INC. | dakota150892_ex32-1.htm |

| EX-31.1 - CERTIFICATION OF CEO PURSUANT TO SECTION 302 - DAKOTA PLAINS HOLDINGS, INC. | dakota150892_ex31-1.htm |

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - DAKOTA PLAINS HOLDINGS, INC. | dakota150892_ex23-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

|

|

|

(Mark One) |

|

|

þ |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

or |

|

|

o |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-36493

|

|

|

|

|

|

Dakota Plains Holdings, Inc. |

|

|

|

(Exact Name of Registrant as Specified in its Charter) |

|

|

|

|

|

|

Nevada |

|

20-2543857 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

incorporation or organization) |

|

Identification No.) |

|

|

|

|

|

|

|

|

|

294 Grove Lane East |

|

|

|

Wayzata, Minnesota |

|

55391 |

|

(Address of principal executive offices) |

|

(Zip Code) |

|

|

|

|

|

|

(952) 473-9950 |

|

|

|

(Registrant’s telephone number, including area code) |

|

|

|

|

|

|

|

(Former name, former address and former fiscal year, |

|

|

|

if changed since last report) |

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act: |

None |

|

|

Securities registered pursuant to Section 12(g) of the Act: |

Common Stock, par value $0.001 per share |

|

|

|

|

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933. |

|

|

|

Yes o No þ |

|

|

|

|

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. |

|

|

|

Yes o No þ |

|

|

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. |

|

|

|

Yes þ No o |

|

|

|

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). |

|

|

|

Yes þ No o |

|

|

|

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. |

|

|

|

þ |

|

|

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company (as defined in Rule 12b-2 of the Exchange Act). |

|

|

|

|

|

|

|

Large Accelerated Filer o |

Accelerated Filer þ |

|

|

Non-accelerated Filer o (Do not check if a smaller reporting company) |

Smaller Reporting Company o |

|

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). |

Yes o No þ |

The aggregate market value of common stock held by non-affiliates of the registrant as of June 30, 2014, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $140,871,115, based on the closing sale price for the registrant’s common stock on that date. For purposes of determining this number, all officers and directors of the registrant are considered to be affiliates of the registrant. This number is provided only for the purpose of this report and does not represent an admission by either the registrant or any such person as to the status of such person.

As of March 16, 2015, the registrant had 54,926,227 shares of common stock issued and outstanding.

Documents Incorporated By Reference

Portions of the Registrant’s Proxy Statement for its 2015 Annual Meeting of Shareholders are incorporated by reference in Part III of this report.

Forward-Looking Statements

This report contains “forward-looking statements” within the meaning of the federal securities laws. Statements contained in this annual report that are not historical fact should be considered forward-looking statements. Forward-looking statements include, but are not limited to, statements regarding plans and objectives of management for future operations or economic performance, or assumptions. Words such as “anticipate,” “believe,” “continue,” “estimate,” “expect,” “intend,” “may,” “should,” “will,” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements.

Such forward-looking statements are subject to various risks and uncertainties that could cause actual results to differ materially from those anticipated as of the date of the filing of this report. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, no assurance can be given that these expectations will prove to be correct. Important factors that could cause our actual results to differ materially from the expectations reflected in these forward-looking statements include, among other things, those set forth in Part I, Item 1A: “Risk Factors” in this report. That list of factors is not exhaustive, however, and these or other factors, many of which are outside of our control, could have a material adverse effect on us and our results of operations. Therefore, you should consider these risk factors with caution and form your own critical and independent conclusions about the likely effect of these risk factors on our future performance.

All forward-looking statements included in this report are based on information available to us on the date of this report. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. You should carefully review the disclosures and the risk factors described in this and other documents we file from time to time with the Securities and Exchange Commission (the “SEC”), including our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained throughout this report.

Jumpstart Our Business Startups Act Disclosure

Our Company qualifies as an “emerging growth company,” as defined in Section 2(a)(19) of the Securities Act of 1933, as amended (the “Securities Act”), as amended by the Jumpstart Our Business Startups Act (the “JOBS Act”). An issuer qualifies as an “emerging growth company” if it has total annual gross revenues of less than $1.0 billion during its most recently completed fiscal year, and will continue to be deemed an emerging growth company until the earliest of:

|

|

|

|

|

|

• |

the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1.0 billion or more; |

|

|

|

|

|

|

• |

the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement; |

|

|

|

|

|

|

• |

the date on which the issuer has, during the previous three-year period, issued more than $1.0 billion in non-convertible debt; or |

|

|

|

|

|

|

• |

the date on which the issuer is deemed to be a “large accelerated filer,” as defined in Section 240.12b-2 of the Securities Exchange Act of 1934 (the “Exchange Act”). |

As an emerging growth company, we are exempt from various reporting requirements. Specifically, Dakota Plains Holdings, Inc. is exempt from the following provisions:

|

|

|

|

|

|

• |

Section 404(b) of the Sarbanes-Oxley Act of 2002, which requires evaluations and reporting related to an issuer’s internal controls; |

|

|

|

|

|

|

• |

Section 14A(a) of the Exchange Act, which requires an issuer to seek shareholder approval of the compensation of its executives not less frequently than once every three years; and |

i

|

|

|

|

|

|

• |

Section 14A(b) of the Exchange Act, which requires an issuer to seek shareholder approval of its so-called “golden parachute” compensation, or compensation upon termination of an employee’s employment. |

Under the JOBS Act, emerging growth companies may delay adopting new or revised accounting standards that have different effective dates for public and private companies until such time as those standards apply to private companies. We have elected to use the extended transition period for complying with these new or revised accounting standards. Since we will not be required to comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for other public companies, our financial statements may not be comparable to the financial statements of companies that comply with public company effective dates. If we were to elect to comply with these public company effective dates, such election would be irrevocable pursuant to Section 107 of the JOBS Act.

ii

PART I

|

|

|

|

Item 1. |

Business |

BUSINESS

Overview

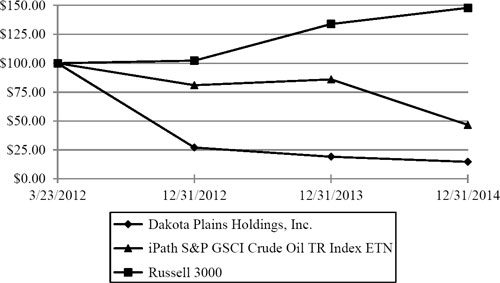

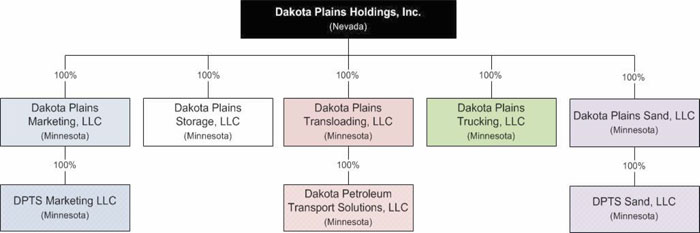

Dakota Plains Holdings, Inc. (“we,” “us,” “our,” or “our Company”) is an integrated midstream energy company operating the Pioneer Terminal, with services that include outbound crude oil storage, logistics and rail transportation and inbound fracturing (“frac”) sand logistics. The Pioneer Terminal is located in Mountrail County, North Dakota, where it is uniquely positioned to exploit opportunities in the heart of the Bakken and Three Forks plays of the Williston Basin. The Williston Basin of North Dakota and Montana is the largest onshore crude oil production source in North America where the lack of available pipeline capacity provides a long-term and increasing surplus of crude oil available for the core business of our Company. Our frac sand business provides services for UNIMIN Corporation (“UNIMIN”), a leading producer of quartz proppant and the largest supplier of frac sand to exploration and production operating companies in the Williston Basin. Our Company is headquartered in Wayzata, Minnesota. Below is an organizational chart of our Company.

Because current crude oil production in North Dakota exceeds existing pipeline takeaway capacity, we have adopted a crude by rail model. According to the North Dakota Pipeline Authority, as of December 2014, the crude by rail industry was transporting approximately 59% of the total crude oil takeaway. Current pipeline constraints are limiting the amount of crude oil takeaway from the Bakken oil fields. As such, rail transloading facilities are necessary to efficiently capture an increasing demand for transportation of supplies and products to and from the oil fields. The Pioneer Terminal has given us the ability to support the expected increases in demand for the loading and transporting of crude oil and related products to and from the Bakken oil fields.

On March 22, 2012, DP Acquisition Corporation, a wholly owned subsidiary of our Company, merged with and into Dakota Plains, Inc. (the “Initial Merger”). Dakota Plains, Inc. was originally incorporated under the laws of the State of Nevada in 2008 under the name Dakota Plains Transport, Inc. In June 2011, it merged with and into Dakota Plains, Inc., a Minnesota corporation, for purposes of reincorporating under the laws of Minnesota.

As of March 23, 2012, Dakota Plains, Inc., the surviving corporation from the Initial Merger and then a wholly owned subsidiary of our Company, merged with and into MCT Holding Corporation (the “Second Merger”). Pursuant to the plan of merger governing the Second Merger, we changed our name from “MCT Holding Corporation” to “Dakota Plains Holdings, Inc.”

On November 24, 2014, we sold our 50% ownership interest in the trucking joint venture, Dakota Plains Services, LLC (“DPS”) to our former trucking joint venture partner, JPND II, LLC (“JPND”). In addition, on December 5, 2014, we acquired from our then-joint venture partner, Petroleum Transport Solutions, LLC (“PTS”), all of the remaining ownership interests in the transloading joint venture, Dakota Petroleum Transport Solutions, LLC (“DPTS”), the frac sand transloading joint venture, DPTS Sand, LLC (“DPTSS”), and the crude oil marketing joint venture, DPTS Marketing LLC (“DPTSM”).

1

Transloading Business Segment

In 2009, we completed the acquisition and build-out of our New Town, North Dakota transloading facility, which is fully operational and consists of four rail tracks situated on approximately 27.46 acres serviced by Soo Line Railroad Company, doing business as Canadian Pacific. We extended the lengths of the rail tracks during 2010 and completed excavation and grading sufficient to allow for the construction of two additional rail tracks. We then completed the construction of the third and fourth tracks in the summer of 2011. In December 2011 and 2012, we acquired an additional 164 acres of property adjacent to the existing facility. We now own approximately 192 contiguous acres in New Town, North Dakota accessible by rail.

In March 2013, we and PTS, an indirect wholly owned subsidiary of World Fuel Services Corporation (“WFS”), announced the construction of the Pioneer Terminal. The Pioneer Terminal represents a significant expansion of the New Town transloading facility located in the heart of the Williston Basin. Crude oil supplying the transloading facility is currently sourced primarily from the Bakken formation that underlies parts of Montana, North Dakota, and Saskatchewan. The Pioneer Terminal provides two 8,300 foot loop tracks that can accommodate two 120 rail car unit trains and increases the throughput capacity to 60,000 barrels of crude oil per day, 180,000 barrels of crude oil storage, a high-speed loading facility that accommodates 10 rail cars simultaneously, and transfer stations to receive crude oil from local gathering pipelines and trucks. In October 2013, the first gathering system pipeline was connected to the Pioneer Terminal and began transporting crude oil to our 90,000 barrel crude oil storage tanks. The original four ladder tracks will be utilized for inbound delivery and storage for commodities such as frac sand, aggregate, chemicals, diesel, and pipe.

The Pioneer Terminal was commissioned in December 2013 and began loading cars and sending trains in January 2014. The total cost of the project was approximately $50 million and was initially funded equally by us and PTS. Our 50% share of the initial cost was funded with approximately $17.5 million cash on hand and by a $7.5 million credit facility drawdown.

In June 2014, our wholly owned subsidiary, Dakota Plains Sand, LLC, entered into a joint venture with PTS, DPTSS. We and PTS each owned 50% of the outstanding member units of DPTSS, which was formed to engage in the operation of a frac sand transloading facility near New Town, North Dakota and any other lawful activities as the board of governors may determine from time to time. The operations of DPTSS commenced in June 2014. The initial term of the joint venture was until December 31, 2026. Effective November 30, 2014, we acquired the remaining ownership interest in DPTSS from PTS.

In August 2014, we announced the execution of an interconnection agreement with Hiland Crude, LLC, a wholly owned subsidiary of Hiland Partners, LP (“Hiland”), that would link the Pioneer Terminal with Hiland’s Market Center Gathering System crude oil pipeline network (the “gathering system”). Construction for the final link was completed on November 4, 2014, and the gathering system was commissioned on November 5, 2014. Hiland’s gathering system is the largest in the Bakken oil fields, traversing through the heart of the oil field in Divide, Dunn, Mountrail, McKenzie and Williams counties in North Dakota, as well as Richland and Roosevelt counties in Montana. It has multiple connection points into pipeline outlets and crude by rail terminals with the Pioneer Terminal being the only Canadian Pacific Railway origin. The connection to the Pioneer Terminal is expected to have an initial capacity of greater than 15,000 barrels of crude oil per day and can be easily expanded to supply up to approximately 60,000 barrels of crude oil per day.

In September 2014, we announced the expansion of our on-site crude oil storage at the Pioneer Terminal, and the construction of a third 90,000 barrel crude oil storage tank began almost immediately. Regulatory permits and engineering designs have been completed, and we expect the storage tank to be operational in the summer of 2015. The addition of a third storage tank, the connection to Hiland’s gathering system, and the anticipated expanded rail service will facilitate increasing the sustainable throughput rate to a unit train per day, which is equivalent to 80,000 barrels of crude oil per day.

We continue to develop our inbound oilfield products business at the Pioneer Terminal. Construction was completed in mid-2014 on the $15.0 million frac sand terminal funded by UNIMIN. The frac sand terminal has a throughput capacity of approximately 750,000 tons per year and is composed of 8,000 tons of fixed frac sand storage, an enclosed transloading facility, twin high-speed truck loadouts, and four ladder tracks. The frac sand terminal supplies energy service companies with hydraulic frac sands sourced directly from UNIMIN’s newest and largest proppant production facility, in Tunnel City, Wisconsin. The frac sands are being transported on Canadian Pacific’s rail network. Under terms of the agreements between the parties, UNIMIN provides a direct marketing service to oilfield service companies and funded the construction of the four new ladder tracks, frac sand storage and transloading facility. We provided a land lease to UNIMIN for up to 30 years and receive monthly lease payments of $10,000 through December 2023, with an annual increase of 3.0% starting January 2016. DPTS has provided fee-based transloading services at the frac sand terminal since the operations began in June 2014.

2

New Town Facility

Our facility in New Town, North Dakota is centrally located in the heart of the Parshall Oil Field in Mountrail County, North Dakota. The facility transloaded approximately 14.2 million barrels of crude oil in 2014 (or approximately 20,800 rail cars), which represented a 64% increase over the volume transloaded in 2013. In 2014, our facility experienced a daily average throughput of approximately 38,800 barrels of crude oil transloaded compared to a daily average throughput of approximately 23,600 barrels of crude oil in 2013. Our facility provides easy access to the railway via a spur that Canadian Pacific has constructed.

The facility became fully operational in 2009 and currently includes the following features:

|

|

|

|

|

|

• |

Private spur connecting the property to the Canadian Pacific Railway; |

|

|

|

|

|

|

• |

Approximately 192 acre site with two 8,300 foot loop tracks each capable of 120 car unit trains, 180,000 barrels of crude oil storage, a high-speed loading facility that can accommodate 10 rail cars simultaneously, two active gathering system pipelines and transfer stations to receive crude oil from 10 trucks simultaneously; |

|

|

|

|

|

|

• |

Fire suppression system, spill remediation and backup power generation solutions; |

|

|

|

|

|

|

• |

Automated terminal metering and accounting systems; |

|

|

|

|

|

|

• |

Four fully operational ladder tracks that can be utilized for inbound delivery and storage for commodities such as frac sand, aggregate, chemicals, diesel and pipe; |

|

|

|

|

|

|

• |

Fully enclosed electrical system between the existing tracks to provide maximum flexibility when powering transloading equipment; and |

|

|

|

|

|

|

• |

72 acres of industrial zoned land within the double loop tracks that provide the option to add storage or various industrial uses to the facility at any time. |

We have commenced construction on a third 90,000 barrel crude oil storage tank that should be operational in the summer of 2015. The facility also can accommodate significant storage of tanker-trucks, drilling equipment and other crude oil exploration equipment. We continue to conceptualize future stages of expansion of the facility, which will be designed to increase on-site rail car traffic.

Oil well operators are currently hauling crude oil via semi-truck as far as 100 miles one way from New Town to various crude by rail facilities to load crude oil produced from wells located in the Parshall Oil Field onto railway systems at significant additional cost compared to the services offered by our facility. In December 2014, North Dakota produced 1.2 million barrels of crude oil per day. We estimate crude oil production within approximately a 75 mile radius of our facility to represent 80% of the volume, or over 981,000 barrels of crude oil per day.

New Town is located at the entrance to a large peninsula in the heart of the Parshall Oil Field, and our facility straddles the only road providing access to and from the peninsula. One of the geographic advantages to our site is the Four Bears Bridge, which represents the only means to cross Lake Sakakawea for approximately 90 miles in either direction. The peninsula is approximately 150 square miles of land with 168 spacing units due to their water access to Lake Sakakawea. One spacing unit is the equivalent of one square mile and has the expectation for 12 to 16 wells. 168 spacing units would equate to over 2,000 wells.

Transloading Joint Venture

In November 2009, we entered into a joint venture, DPTS, with PTS. Each member of DPTS was required to make an initial capital contribution of $50,000 in exchange for 1,000 member units, representing their respective 50% ownership interests of the newly formed entity. There were a total of 2,000 membership units outstanding until we acquired the remaining 50% ownership interest in DPTS from PTS, effective November 30, 2014.

3

We own the transloading facility and certain equipment acquired and lease the property to DPTS.

Under provisions of the member control agreement, the profits and losses of DPTS were split 50/50, pro rata based on the number of member units outstanding. The cash payments from the joint venture were also paid pro rata based on the number of member units outstanding.

In December 2011, our predecessor, Dakota Plains, Inc., transferred all of its assets and liabilities, excluding its equity interest in its wholly owned subsidiaries and its real property, to Dakota Plains Transloading, LLC (“DPT”). DPT is a wholly owned subsidiary of our Company that was formed in August 2011. The purpose of DPT is to participate in the ownership and operation of the transloading facility near New Town, North Dakota through which producers, transporters and marketers may transload crude oil and related products from and onto the Canadian Pacific Railway.

We accounted for our investment in DPTS using the equity method of accounting through the end of business on December 31, 2013. Our share of income from DPTS is included in other income on the consolidated statements of operations for the years ended December 31, 2013 and 2012. The operations of DPTS for the year ended December 31, 2014 are incorporated into our consolidated statement of operations, and the balance sheets of DPTS are included in our consolidated balance sheets as of December 31, 2014 and 2013.

DPT acts as manager of the transloading facility and coordinates and manages the day-to-day operations. DPT is reimbursed on a monthly basis for costs associated with the Facility Management Activities as approved by the board of governors. Beginning in January 2014, $12,500 per month was paid to DPT in order to defray expenses related to the employment of the Chief Operating Officer of our Company, in recognition of his contribution to the Facility Management Activities.

Beginning in July 2011, DPTSM assumed the rail car leasing liability. PTS coordinated and managed all accounting and bookkeeping functions in connection with the operations of the transloading facility and charged a monthly accounting fee to DPTS $5,000 through December 31, 2013. The annual accounting fee paid to PTS was $190,000 for the year ended December 31, 2014. Prior to our purchase of PTS’s ownership interest in DPTS, PTS also coordinated and managed the trucking and rail logistics for the transloading facility, including the scheduling and monitoring of trains and trucks arriving to and departing from the transloading facility. After payment of the aforementioned fees, the rental fee to DPT and other monthly operating expenses, DPT shared all profits equally with PTS.

PTS and DPT were also required to assist DPTS through their respective contacts with producers, marketers, transporters, refiners and other end-users. The marketing joint venture was the sole client of DPTS in 2013. In January 2014, DPTS began transloading third party crude oil in order to supplement the joint venture marketed volumes. The Pioneer Terminal will be able to receive increased third party volumes going forward.

Under the terms of the joint venture agreement, PTS, our Company and all affiliates were restricted from participating as an owner, investor, manager or consultant in any crude oil transloading facility, anywhere in North Dakota, except through DPTS.

Effective November 30, 2014, we acquired the remaining ownership interest in DPTS from PTS. We will continue to review and analyze other opportunities in order to expand our footprint within the Williston Basin’s crude oil market. We believe the vertical integration of this business line has the potential to provide for increased profits as we continue to develop the business.

Crude Oil Marketing Business Segment

Our crude oil marketing business segment was comprised of our wholly owned subsidiary, Dakota Plains Marketing, LLC (“DPM”). In April 2011, DPM entered into a joint venture with PTS pursuant to which DPM acquired 50% of the outstanding ownership interests of a newly formed entity, DPTSM, and PTS acquired the remaining 50% ownership interest. DPTSM was formed to engage in the purchase, sale, storage, transport and marketing of hydrocarbons produced within North Dakota to or from refineries and other end-users or persons and to conduct trading activities.

Each member of DPTSM was required to make an initial capital contribution of $100 and received 1,000 member units, for a total of 2,000 member units.

4

Each member of DPTSM was also required to make an initial Member Preferred Contribution of $10 million to support the trading activities of DPTSM. All Member Preferred Contributions made entitled the member to receive a cumulative preferred return of 5% per annum, which was payable in cash on a quarterly basis subject to cash availability. DPM received a payment of $1.1 million related to the cumulative preferred return in September 2013. The payment represented the cumulative preferred return from the date of the initial $10 million contribution through June 30, 2013. The cumulative preferred return for the period from October 1, 2013 through November 30, 2014 and the initial $10 million contribution were distributed to DPM as part of its purchase of the 50% ownership interest of PTS that was effective on November 30, 2014.

DPTSM commenced operations in May 2011. Under provisions of the member control agreement, the profits and losses of DPTSM were allocated in proportion to the number of member units held by each member, or 50/50. Distributions from the marketing joint venture were also payable pro rata based on the number of member units held by each member. The Company received its only priority cash distribution payments in April and June 2013.

In the context of the petroleum industry, “marketing” is the process of purchasing crude oil from the wellhead, or in the “field,” and delivering it to the refinery. DPTSM began purchasing crude oil in July 2011 and ended the month with 56,192 barrels of crude oil purchased. DPTSM sold 7.5 million barrels of crude oil in 2014 compared to 9.4 million barrels of crude oil sold in 2013, a 20% decrease. Average daily barrels of crude oil sold in 2014 were approximately 22,000 compared to 25,800 in 2013.

PTS agreed to manage the marketing of crude oil on behalf of DPTSM. DPM shared expenses and profits equally with PTS after payment by DPTSM of a per-barrel trading and accounting fee to PTS.

Effective November 30, 2014, we acquired the remaining ownership interest in DPTSM from PTS and immediately discontinued the purchase and sale of crude oil. We plan to maintain the current fleet of rail cars with the intent to sublease the cars and/or charge a throughput fee for utilizing the tank cars to transport crude oil. The rail car sublease agreements are being accounted for as operating leases.

Trucking Business Segment

In August 2012, we, through our wholly owned subsidiary Dakota Plains Trucking, LLC, entered into a joint venture with JPND II, LLC (“JPND”). We and JPND each owned 50% of the outstanding member units of the new joint venture, Dakota Plains Services, LLC (“DPS”). DPS engaged in the transportation by road of hydrocarbons and materials used or produced in the extraction of hydrocarbons to or from refineries and other end-users or persons, wherever located, and any other lawful activities as the board of governors may determine from time to time. The initial term of the agreement was through December 31, 2021, unless earlier terminated.

JPND made an initial capital contribution of approximately $650,000 to DPS. Dakota Plains Trucking, LLC was not required to make a capital contribution. Each member received 1,000 member units, for a total of 2,000 member units.

The member control agreement of DPS included a provision that JPND would receive all distributions until the aggregate amount of distributions received was equal to its initial capital contribution. The cash distributions would be split in proportion to the number of member units outstanding after JPND had received distributions equal to its capital contribution. Dakota Plains Trucking, LLC received a tax distribution from DPS in June 2013. Under provisions of the member control agreement, the profits and losses of DPS were allocated in proportion to the number of member units outstanding.

DPS commenced operations in September 2012 and ended the year transporting approximately 400,000 barrels of crude oil, or approximately 3,200 barrels of crude oil per day. DPS transported approximately 5.9 million barrels of crude oil during the period from January 1, 2014 through November 24, 2014 compared to 5.7 million barrels of crude oil transported in 2013; a 5% increase. The average daily barrels of crude oil transported in 2014 were approximately 18,100 compared to 15,500 in 2013.

On November 24, 2014, we sold our 50% ownership interest in DPS to JPND for $1.15 million.

5

Gathering System Opportunity

In addition to the transloading operations, we continue to pursue other opportunities relating to the transportation of crude oil and related products within the Williston Basin. We anticipate investing in other ventures and assets in addition to our current transloading operations. In particular, we have been approached by several third parties interested in constructing a feeder pipeline, also known as a gathering system, to transport crude oil from wells directly to our facility. A gathering system would allow us to capture a significant volume of crude oil for our facility because we anticipate it would be more cost-effective to transport crude oil through a gathering system pipeline than utilizing semi-truck tankers. In October 2013, our first gathering pipeline was placed into service and provides approximately 5,000 barrels of crude oil per day to the Pioneer Terminal.

In August 2014, we announced the execution of an interconnection agreement with Hiland Crude, LLC, a wholly owned subsidiary of Hiland Partners, LP (“Hiland”), that would link the Pioneer Terminal with Hiland’s Market Center Gathering System crude oil pipeline network (the “gathering system”). Construction for the final link was completed on November 4, 2014, and the gathering system was commissioned on November 5, 2014. Hiland’s gathering system is the largest in the Bakken oil field traversing through the heart of the oil field in Divide, Dunn, Mountrail, McKenzie and Williams counties in North Dakota as well as Richland and Roosevelt counties in Montana. Hiland’s gathering system has multiple connection points into pipeline outlets and crude by rail terminals, with the Pioneer Terminal being the only Canadian Pacific Railway origin. The connection to the Pioneer Terminal is expected to have an initial capacity of greater than 15,000 barrels of crude oil per day and can be easily expanded to supply up to approximately 60,000 barrels of crude oil per day.

We are currently in discussions with several midstream firms in order to secure additional gathering lines into the Pioneer Terminal.

Gathering systems require onsite storage tanks. We believe our two 90,000 barrel crude oil storage tanks and the current construction of our third 90,000 barrel crude oil storage tank will provide three primary benefits:

|

|

|

|

|

|

• |

Increased consistency of delivery timing and significantly reduced risk of weather impacting our ability to operate the facility; |

|

|

|

|

|

|

• |

Increased demand for use of the facility by parties considering gathering systems to enter the facility and trunk pipelines exiting the facility; and |

|

|

|

|

|

|

• |

Increased opportunity to capitalize on short-term market conditions and other marketing opportunities. |

Our Company’s Strengths

Low Overhead Business Model

The transloading operations are structured in a manner that minimizes overhead and leverages the experience and expertise of third parties to identify and develop appropriate opportunities. Utilizing third parties also gives us the ability to fully understand the tasks being outsourced so that we are better prepared if we deem it more cost effective to bring the service in-house. We believe that most operational and financial responsibilities can be handled by our current officers as well as the use of outside consultants.

Strategically Located

According to the U.S. Geological Survey, or “USGS,” the Bakken Shale play in North Dakota and Montana has an estimated 3.0 to 4.3 billion barrels of undiscovered, technically recoverable crude oil. The Bakken Formation estimate is larger than all other current USGS crude oil assessments in the lower 48 states and is the largest “continuous” crude oil accumulation ever assessed by the USGS. The North Dakota Industrial Commission (“NDIC”) Department of Mineral Resources reports that December 2014 daily crude oil production approximated 1.2 million barrels compared to approximately 927,000 barrels in December 2013; a 32% increase. In addition, there were 12,124 producing wells at the end of December 2014 compared to 10,042 producing wells at the end of December 2013; a 21% increase. As of the end of December 2014, in North Dakota, there were 173 completed wells, 181 wells being drilled, and approximately 750 wells awaiting completion services. The NDIC also reported that drilling permit activity was up in December 2014 as operators began positioning themselves for various 2015 budget scenarios.

Every horizontal drilling rig and well site in the Bakken oil field consumes numerous rail cars of inbound products each month. On average, approximately 40 railcars of materials are required to drill and complete a well. With several thousand drilling locations within 15 miles of our facility, we believe we have the opportunity to steadily grow our business organically while maintaining the flexibility to constantly pursue accretive investment opportunities. We anticipate investing in other ventures and assets in addition to our expanded facility, which will allow us to capture more volume from operators and marketers by making their crude oil transportation more cost-effective.

6

Significant Volume Growth

We believe that our deep market knowledge and strategic position will enable us to benefit from growth opportunities in the Bakken oil field transloading market by increasing current volumes of business with existing clients and building new relationships with leading local producers. As such, the recent completion of the Pioneer Terminal will enable us to market its increased capacity accordingly.

Continue to Grow Operating Profitability

We remain focused on profitable growth and believe we can continue to generate positive returns on invested funds by maintaining our focus on providing greater value to our customers, gaining contracts from leading producers and efficiently managing costs through our low overhead business model. As Williston Basin production continues to increase over the next several years, we expect that management’s focus on growing our market position by exploiting our strong geographic positioning will allow for our Company’s expansion and ability to meet the diverse crude oil transportation needs of our customers.

Our Customers

DPTS transloaded approximately 14.2 million barrels of crude oil in 2014, a 64% increase from 2013 volumes. DPTS exclusively transloaded crude oil for DPTSM until it began transloading crude oil for third parties in January 2014.

DPTSS initiated operations in June 2014 and transloaded approximately 170,000 tons of frac sand in 2014. UNIMIN was the sole customer of DPTSS in 2014.

Competition

The transportation industry is highly competitive. In mid-2012, companies began acquiring and finalized construction of transloading facilities in order to compete with our Company. According to the North Dakota Pipeline Authority, in December 2014 crude by rail accounted for 59% of the total takeaway of crude oil, down from approximately 73% in December 2013. We intend to initially focus on transporting crude oil via the Canadian Pacific system and compete directly with other parties transporting crude oil using Canadian Pacific, the Burlington Northern Railway, various trucking and similar concerns, the Enbridge and Tesoro pipeline and various other pipelines that are constructed and operated in North Dakota.

Thirteen crude by rail sites are currently operational with two additional terminals under construction. All thirteen terminals are capable of accepting and originating unit trains. A “unit train” carries only one commodity and consists of 81 to 120 rail cars. The thirteen terminals have an aggregate daily takeaway capacity of 1.4 million barrels of crude oil with on-site storage of approximately 4.3 million barrels of crude oil. The Bakken Oil Express in Dickinson, Savage Companies in Trenton, and Crestwood in Epping are three of the largest facilities currently operational. At full capacity, we believe their sites represent an additional 0.5 million barrels of crude oil per day in consistent takeaway capacity. The facilities also represent approximately 2.0 million barrels in on-site crude oil storage. Bakken Oil Express, the largest player as of December 2014, is capable of moving approximately 0.2 million barrels of crude oil per day with 0.65 million barrels in on-site crude oil storage. With Hess and EOG handling a great majority of their own crude oil and due to the distances between New Town and the Crestwood (Crestwood in Epping is the closest of the three to New Town and is approximately 85 miles away), Savage and Bakken Oil Express sites, Plains All American is the closest competitor and has .065 million barrels of crude oil takeaway capacity and 0.3 million barrels on site crude oil storage. We expect the Pioneer Terminal to provide a total solution, which will allow us to be competitive and capture much of the volume in the target geography.

Crude by rail also competes with pipeline infrastructure. The existing North Dakota and Montana Williston Basin pipeline infrastructure is capable of handling approximately 723,000 barrels of crude oil per day. The pipelines incorporated in this estimate are owned by Enbridge, Plains All American, Tesoro and True Companies (Butte Pipeline). In December 2014, the North Dakota Pipeline Authority reported that 35% of the Williston Basin crude oil transport was via pipeline, with an incremental 5% going through Tesoro’s system. The total North Dakota production is estimated to have been approximately 1.2 million barrels of crude oil per day for December 2014, for an aggregate pipeline infrastructure utilization of 430,000 barrels of crude oil per day for the same period. While pipeline projects continue to be contemplated, only two new pipelines were completed in 2014; the Plains Bakken North with a daily capacity of 40,000 barrels of crude oil per day and the Butte Expansion with a daily capacity of 100,000 barrels of crude oil per day. The Kinder Morgan Double H is the only pipeline scheduled to come online in 2015 and recently initiated operations with a capacity of 84,000 barrels of crude oil per day. With the increase in pipeline capacity in 2014 and 2015, pipelines continue to experience underutilization.

7

Additionally, other transportation companies may compete with us from time to time in obtaining capital from investors or in funding joint ventures with our prospective partners. Competitors include a variety of potential investors and larger companies, which, in particular, may have access to greater resources, may be more successful in the recruitment and retention of qualified employees and may conduct their own refining and petroleum operations, which may give them a competitive advantage. In addition, actual or potential competitors may be strengthened through the acquisition of additional assets and interests. If we are unable to compete effectively or adequately respond to competitive pressures, it may have a material adverse effect on our results of operation and financial condition.

Regulatory and Compliance Matters

Our operations are subject to extensive federal, state and local environmental laws and regulations concerning, among other things, emissions to the air; discharges to waters; the generation, handling, storage, transportation and disposal of waste and hazardous materials; and the cleanup of hazardous material or petroleum releases. Changes to or limits on carbon dioxide emissions could result in significant capital expenditures required to comply with these regulations with respect to our equipment, vehicles and machinery. Emission regulations could also adversely affect fuel efficiency and increase operating costs. Further, permit requirements or concerns regarding emissions and other forms of pollution could inhibit our ability to build facilities in strategic locations necessary to facilitate growth and increase the efficiency of our operations. Environmental liability can extend to previously owned or operated properties, leased properties and properties owned by third parties, as well as to properties currently owned and used by our subsidiaries. An accidental release of hazardous materials could result in a significant loss of life and extensive property damage. In addition, insurance premiums charged for some or all of the coverage currently maintained by us could increase dramatically or certain coverage may not be available to us in the future if there is a catastrophic event related to the transportation of hazardous materials. We could incur significant expenses to investigate and remediate environmental contamination and maintain compliance with licensing or permitting requirements related to the foregoing, any of which could adversely affect our operating results, financial condition or liquidity.

Employees

We currently have fourteen full-time employees but may hire additional employees to support the growth of the business. We believe that most operational responsibilities can be handled by our current employees as well as the use of independent consultants. We recently announced that we will be bringing our crude oil and frac sand transloading operations in-house effective June 1, 2015 and August 1, 2015, respectively.

|

|

|

|

Item 1A. |

Risk Factors |

RISK FACTORS

Investing in our common stock involves risks. You should carefully consider the risks described below, in addition to the other information contained in this report, before investing in our common stock. Realization of any of the following risks, or adverse results from any matter listed under “Forward-Looking Statements,” could have a material adverse effect on our business, financial condition, cash flows and results of operations and could result in a decline in the trading price of our common stock. If you invest in our common stock, then you might lose all or part of your investment. This report also contains forward-looking statements, estimates and projections that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements, estimates and projections as a result of specific factors, including the risks described below.

Risks Related to Our Business

We are a company with limited operating history for you to evaluate our business.

We are engaged in the primary business of developing and operating a transloading facility and other means to support the loading and transporting of crude oil and related products from and into the North Dakota Williston Basin. We have limited operating history for you to consider in evaluating our business and prospects.

8

Our operations are subject to all of the risks, difficulties, complications and delays frequently encountered in connection with the formation of any new business, as well as those risks that are specific to the transportation and oil industries. Investors should evaluate us in light of the delays, expenses, problems and uncertainties frequently encountered by companies developing markets for new products, services and technologies. We may never overcome these obstacles.

Our business is speculative and dependent on the implementation of our business plan and our ability to enter into agreements with third parties for transloading and the leasing of our facility on terms that will be commercially viable for us. Our dependence on third parties also creates significant risks that such third parties may not fulfill their obligations under appropriate contracts and arrangements or may not be sufficiently staffed or funded to properly fulfill such obligations consistent with our needs and expectations.

Our lack of diversification increases the risk of an investment in our Company, and our financial condition and results of operations may deteriorate if we fail to diversify.

Our business has initially focused on a single rail car transloading facility in New Town, North Dakota. Since inception, we have focused solely on generating income through transloading at the facility. We intend to continue to pursue additional business lines, including the additional business of transporting and storing frac sand, and other drilling-related products from and into the Williston Basin. Our ability to diversify our investments will depend on our access to additional capital and financing sources and the availability of real property and other assets required to allow us to load and transport crude oil and related products.

Larger companies have the ability to manage their risk by diversification. However, we lack diversification, in terms of both the nature and geographic scope of our business. As a result, we will likely be impacted more acutely by factors affecting the transportation and crude oil industries or the regions in which we operate than we would if our business were more diversified, enhancing our risk profile. If we cannot diversify our operations, our financial condition and results of operations could deteriorate.

Strategic relationships upon which we may rely are subject to change, which may diminish our ability to conduct our operations.

Our ability to successfully operate our transloading of crude oil and frac sand depends on developing and maintaining close working relationships with industry participants and on our ability to select and evaluate suitable business arrangements and to consummate transactions in a highly competitive environment. These relationships are subject to change and may impair our ability to grow.

We are dependent on independent third parties to provide trucking and rail services and to report certain events to us including delivery information. We do not own or control the transportation assets that deliver our customer’s products.

Our reliance on third parties could cause delays in reporting certain events, including recognizing revenue and claims. If we are unable to secure sufficient equipment or other transportation services to meet our commitments to our customers, our operating results could be materially and adversely affected, and our customers could switch to our competitors temporarily or permanently. These risks include:

|

|

|

|

|

• equipment shortages in the transportation industry, particularly among rail carriers and parties that lease rail cars transporting crude oil products; |

|

|

|

|

|

• potential substantial additional capital improvements required to maintain facility; |

|

|

|

|

|

• interruptions in service or stoppages in transportation as a result of labor or other issues; |

|

|

|

|

|

• Canadian Pacific’s capacity constraints; |

|

|

|

|

|

• competing facilities being constructed in close proximity; |

|

|

|

|

|

• impact of weather at origin (e.g. snow, flooding, cold temperatures) on all operations; |

|

|

|

|

|

• impact of weather at destinations (e.g. hurricanes, tornadoes, flooding); |

|

|

|

|

|

• congestion at offloading sites; |

|

|

|

|

|

• inadequate storage facilities; |

|

|

|

|

|

• changes in regulations impacting transportation; and |

|

|

|

|

• unanticipated changes in transportation rates. |

9

Competition for the loading and transporting of crude oil and related products may impair our business.

The transportation industry is highly competitive. Per the Association of American Railroads September 2014 Moving Crude Oil by Rail report, in 2008, U.S. Class I railroads originated 9,500 carloads of crude oil. In 2012, Class I railroads originated nearly 234,000 carloads of crude oil, and in 2013 they originated 407,000 carloads of crude oil. In 2014, 530,000 carloads of crude oil were delivered, which is the equivalent of 1,040,000 barrels of crude oil per day moving by rail. According to rail industry statistics, in 2008, a train of 100 rail cars full of crude oil departed a terminal in North Dakota once every four days. By 2013, a unit train of crude oil was departing every 2.5 hours. As a result of the increase in crude oil moved via rail, other companies have recently acquired and constructed transloading facilities to compete with our Company. This competition is expected to become increasingly intense as the demand to transport crude oil in North Dakota has risen in recent years. We intend initially to focus on transporting crude oil through the Canadian Pacific system. We will also compete directly with other parties transporting crude oil using Canadian Pacific, the Burlington Northern Railway, various trucking and similar concerns, the Enbridge, Tesoro, PAA and Butte pipelines and any other pipelines that are constructed and operated in North Dakota. Any material increase in the capacity and quality of these alternative methods or the passage of legislation granting greater latitude to them could have an adverse effect on our results of operations, financial condition or liquidity. In addition, a failure to provide the level of service required by our customers could result in loss of business to competitors. Our ability to defend, maintain or increase prices for our products and services is in part dependent on the industry’s capacity relative to customer demand, and on our ability to differentiate the value delivered by our products and services from our competitors’ products and services.

Additionally, other transportation companies may compete with us from time to time in obtaining capital from investors or in funding joint ventures with our prospective partners. Competitors include a variety of potential investors and larger companies, which, in particular, may have access to greater resources, may be more successful in the recruitment and retention of qualified employees and may conduct their own refining and petroleum marketing operations, which may give them a competitive advantage. In addition, actual or potential competitors may be strengthened through the acquisition of additional assets and interests. If we are unable to compete effectively or adequately respond to competitive pressures, this inability may materially adversely affect our results of operation and financial condition.

We may be subject to claims, costs and liabilities as a result of events resulting from the transportation of crude oil by or on behalf of our subsidiaries.

We and our subsidiaries may be subject to claims, costs and liabilities relating to events that may occur while the crude oil is en route to its destination. Such claims, costs and liabilities may result from actions of third parties outside our control and may include releases of crude oil and resulting environmental liabilities and damage to property, injury or loss of life resulting from exposure or ignition of crude oil in transit. In addition, we, our subsidiaries, and their affiliates contract from time to time with additional third parties in connection with the transportation of crude oil, including arrangements with third party rail carriers, road transportation providers, and railcar leasing companies.

On July 6, 2013, a freight train operated by Montreal, Maine and Atlantic Railway (“MMA”) with 72 tank cars carrying approximately 50,000 barrels of crude oil derailed in Lac-Mégantic, Quebec. The derailment resulted in significant loss of life, damage to the environment from spilled crude oil and extensive property damage. DPTSM, a crude oil marketing joint venture in which, at the time of the derailment, we indirectly owned a 50% membership interest, subleased the tank cars involved in the incident from an affiliate of our former joint venture partner. A different affiliate of our former joint venture partner owned title to the crude oil being carried in the derailed tank cars. DPTS, a crude oil transloading joint venture in which we also, at the time of the derailment, indirectly owned a 50% membership interest, arranged for the transloading of the crude oil for DPTSM into tank cars at DPTS’s facility in New Town, North Dakota. An affiliate of our former joint venture partner also contracted with Canadian Pacific Railway (“CPR”) for the transportation of the tank cars and the crude oil from New Town, North Dakota to a customer in New Brunswick, Canada. CPR subcontracted a portion of that route to MMA.

We, certain of our subsidiaries, DPTSM and DPTS, along with a number of third parties, including CPR, MMA and certain of its affiliates, as well as several manufacturers and lessors of tank cars, were named as defendants in lawsuits and proceedings related to the incident.

10

As a result of the Lac-Mégantic derailment, the Canadian Transportation Safety Board is conducting an investigation into the cause of the derailment and the events surrounding it. In addition, the Quebec police conducted a criminal investigation in conjunction with Canadian and U.S. law enforcement authorities.

Additional claims, lawsuits, proceedings, investigations and orders may be filed, commenced or issued with respect to the incident, which may involve civil claims for damages or governmental investigative, regulatory or enforcement actions against us. The adverse resolution of any proceedings related to these events could subject us and/or DPTSM or DPTS to monetary damages, fines and other costs, which could have a negative and material impact on our business, prospects, results of operations and financial condition.

While we and our joint ventures, DPTSM and DPTS, maintain insurance to mitigate the costs of environmental releases as well as other results of unexpected events, including loss of life, property damage and defense costs, there can be no guarantee that our insurance will be adequate to cover all liabilities that may be incurred as a result of this incident.

We are also evaluating potential claims that we may assert against third parties to recover costs and other liabilities that may be incurred as a result of this incident. We can provide no guarantee that any such claims, if brought by us, will be successful or, if successful, that the responsible parties will have the financial resources to address any such claims. Any losses not covered by insurance or otherwise not recoverable from third parties, if significant, could have a material adverse effect on our business, financial condition, results of operations or cash flows.

The train derailment in Lac-Mégantic may result in increased governmental regulation of shipments of crude oil and other fuel products and additional costs.

We rely in part on rail shipments to move crude oil and other fuel products in both the United States and Canada. The accident in Lac-Mégantic and its aftermath has led and could lead to additional governmental regulation of rail shipments of crude oil and other fuel products in Canada and the United States and to increased safety standards for the tanker-cars that transport these products. We cannot predict with any certainty what form any additional regulation or limitations would take. Any increased regulation that arises out of this incident could result in higher operating costs, which could adversely affect our operating results.

We may be unable to obtain additional capital that we will require to implement our business plan, which could restrict our ability to grow.

We likely will require additional capital to continue operating our business beyond our current opportunities. Future facility expansions will require additional capital and cash flow. There is no guarantee that we will be able to generate sufficient cash flow from our current operations to fund our proposed business opportunities.

Future arrangements with other crude oil marketing firms and operators will require us to expand our facility to meet the logistical and storage needs that accompany larger throughput commitments. Any additional capital raised through the sale of equity may dilute the ownership percentage of our shareholders. This could also result in a decrease in the fair market value of our equity securities because our assets would be owned by a larger pool of outstanding equity. Given the attractive return profiles of our potential customer arrangements, we expect that any additional capital required to fulfill our transloading commitments would be funded through our current debt or cash flow. The terms of securities we issue in future capital transactions may be more favorable to our new investors, and may include preferences, superior voting rights and the issuance of warrants or other derivative securities, and issuances of incentive awards under equity employee incentive plans, which may have a further dilutive effect.

Our ability to obtain additional financing may be impaired by such factors as the capital markets (both generally and in the oil industry in particular), the single location near New Town, North Dakota that we currently operate (which limits our ability to diversify our activities) and/or the loss of key management. Further, if crude oil prices or the commodities markets continue to experience significant volatility or stagnation, such market conditions will likely adversely impact our income by decreasing demand for our services and simultaneously increasing our requirements for capital. If the amount of capital we are able to raise from financing activities, together with our income from operations, is not sufficient to satisfy our capital needs (even if we reduce our operations), we may be required to cease our operations entirely.

We may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which may adversely impact our financial condition.

11

We may not be able to effectively manage our growth, which may harm our profitability.

Our strategy envisions continued expansion of our business. If we fail to effectively manage our growth, our financial results could be adversely affected. Growth may place a strain on our management systems and resources. We must continue to refine and expand our business development capabilities, our systems and processes and our access to financing sources. As we grow, we must continue to hire, train, supervise and manage new employees. We cannot assure you that we will be able to:

|

|

|

|

|

• meet our capital needs; |

|

|

|

|

|

• expand our systems effectively or efficiently or in a timely manner; |

|

|

|

|

|

• allocate our human resources optimally; |

|

|

|

|

|

• identify and hire qualified employees or retain valued employees; or |

|

|

|

|

|

• incorporate effectively the components of any business that we may acquire in our effort to achieve growth. |

If we are unable to manage our growth, our operations and our financial results could be adversely affected by inefficiency, which could diminish our profitability.

Our business may suffer if we do not attract and retain talented personnel.

Our success will depend in large measure on the abilities, expertise, judgment, discretion, integrity and good faith of our management and other personnel in conducting our business. We have a small management team, and the loss of a key individual or inability to attract suitably qualified staff could materially adversely impact our business.

Our success depends on the ability of our management and employees to interpret market data correctly and to interpret and respond to economic market and other conditions in order to locate and adopt appropriate investment opportunities, monitor such investments, and ultimately, if required, to successfully divest such investments. Further, no assurance can be given that our key personnel will continue their association or employment with us or that replacement personnel with comparable skills can be found. We will seek to ensure that management and any key employees are appropriately compensated; however, their services cannot be guaranteed. If we are unable to attract and retain key personnel, our business may be adversely affected.

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act.

Under the JOBS Act, emerging growth companies may delay adopting new or revised accounting standards that have different effective dates for public and private companies until such time as those standards apply to private companies. We have elected to use the extended transition period for complying with these new or revised accounting standards and as such we are not required to have auditor attestation on our internal control over financial reporting (ICFR). As an accelerated filer, we would otherwise be required to have auditor attestation of ICFR. Since we will not be required to comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for other public companies, our financial statements may not be comparable to the financial statements of companies that comply with public company effective dates. If we were to elect to comply with these public company effective dates, such election would be irrevocable pursuant to Section 107 of the JOBS Act.

12

Risks Related to Our Industry

Building and operating a transloading facility is risky and may not be commercially successful, and the advanced technologies we use cannot eliminate competition and environmental risk, which could impair our ability to generate income from our operations.

Our future success depends on our ability to manage and operate the Pioneer Terminal. We will be almost entirely dependent on the demand to transport crude oil from wells in relatively close proximity to New Town, North Dakota.

Our ability to generate a return on our investments, income and our resulting financial performance are significantly affected by the prices oil exploration and production companies receive for crude oil produced from their wells.

Especially in recent years, the prices at which crude oil trade in the open market have experienced significant volatility, including the expansion of the West Texas Intermediate to both the Brent and Light Louisiana Sweet spread, and will likely continue to fluctuate in the foreseeable future due to a variety of influences including, but not limited to, the following:

|

|

|

|

|

• domestic and foreign demand for crude oil by both refineries and end users; |

|

|

|

|

|

• the introduction of alternative forms of fuel to replace or compete with crude oil; |

|

|

|

|

|

• domestic and foreign reserves and supply of crude oil; |

|

|

|

|

|

• competitive measures implemented by our competitors and domestic and foreign governmental bodies; |

|

|

|

|

|

• political climates in nations that traditionally produce and export significant quantities of crude oil (including military and other conflicts in the Middle East and surrounding geographic region) and regulations and tariffs imposed by exporting and importing nations; |

|

|

|

|

|

• weather conditions; and |

|

|

|

|

|

• domestic and foreign economic volatility and stability. |

Demand for crude oil and crude oil related products is subject to factors beyond our control, which may adversely affect our operating results. Changes in the global economy, changes in the ability of our customers to access equity or credit markets and volatility in crude oil prices could impact our customers’ spending levels and our revenues and operating results.

The past slowdown in global economic growth and recession in the developed economies resulted in reduced demand for crude oil, increased spare productive capacity and lower energy prices. Weakness or deterioration of the global economy or credit market could reduce our customers’ spending levels and reduce our revenues and operating results. Incremental weakness in global economic activity will reduce demand for crude oil and result in lower crude oil prices. Incremental strength in global economic activity will create more demand for crude oil and support higher crude oil prices. In addition, demand for crude oil could be impacted by environmental regulation, including “cap and trade” legislation, carbon taxes and the cost for carbon capture and sequestration related regulations.

Volatility in crude oil prices can also impact our customers’ activity levels and spending for our products and services. Current energy prices are important contributors to cash flow for our customers and their ability to fund exploration and development activities. Expectations about future prices and price volatility are important for determining future spending levels.

Lower crude oil prices generally lead to decreased spending by our customers. While higher crude oil prices generally lead to increased spending by our customers, sustained high energy prices can be an impediment to economic growth, and can therefore negatively impact spending by our customers. Any of these factors could affect the demand for crude oil and could have a material adverse effect on our results of operations. Prolonged periods of low crude oil prices could cause crude oil exploration and production to become economically unfeasible. Decreased drilling and/or production activities by crude oil exploration and production companies could reduce demand for transportation of crude oil and adversely impact our business. A decrease in crude oil prices could also adversely impact our ability to raise additional capital to pursue future diversification and expansion activities.

Our operations may be adversely affected by competition from other energy sources.

Crude oil competes with other sources of energy, some of which may be less costly on an equivalent energy basis. In addition, we cannot predict the effect that the development of alternative energy sources might have on our operations.

13

Our inability to obtain necessary facilities could hamper our operations.

Transloading crude oil and related products is dependent on the availability of real estate adjacent to railways and roadways, construction materials and contractors, transloading equipment, transportation methods, power and technical support in the particular areas where these activities will be conducted. Our access to these facilities may be limited. Demand for such limited real estate, equipment, construction materials and contractors or access restrictions may affect the availability of such real estate and equipment to us and may delay our business activities. The pricing and grading of appropriate real estate may also be unpredictable and we may be required to make efforts to upgrade and standardize our facilities, which may entail unanticipated costs and delays. Shortages and/or the unavailability of necessary construction materials, contractors and equipment may impair our activities, either by delaying our activities, increasing our costs or otherwise.

We may have difficulty obtaining crude oil to transport, which could harm our financial condition.

In order to transport crude oil, we depend on our ability to secure customers. We also rely on local infrastructure and the availability of transportation for storage and shipment of crude oil to our facility, but infrastructure development and storage and transportation facilities may be insufficient for our needs at commercially acceptable terms in the localities in which we operate. Customers may also decide to utilize one or more of our competitors for a variety of reasons, and any lack of demand for use of our facility and related services would be particularly problematic.

Furthermore, weather conditions or natural disasters, actions by companies doing business in one or more of the areas in which we operate, or labor disputes may impair the distribution of crude oil and in turn diminish our financial condition or ability to maintain our operations.

Supplies of crude oil are subject to factors beyond our control, which may adversely affect our operating results.

Productive capacity for crude oil is dependent on our customers’ decisions to develop and produce crude oil reserves. The ability to produce crude oil can be affected by the number and productivity of new wells drilled and completed, as well as the rate of production and resulting depletion of existing wells. Advanced technologies, such as horizontal drilling and hydraulic fracturing, improve total recovery but also result in a more rapid production decline.

Increases in our operating expenses will impact our operating results and financial condition.

Real estate acquisition, construction and regulatory compliance costs (including taxes) will substantially impact the net income we derive from the crude oil and frac sand that we transload. These costs are subject to fluctuations and variation in different locales in which we will operate, and we may not be able to predict or control these costs. If these costs exceed our expectations, this may adversely affect our results of operations. In addition, we may not be able to earn net income at our predicted levels, which may impact our ability to satisfy our obligations.

A downturn in the economy or change in government policy could negatively impact demand for our services.

Significant, extended negative changes in economic conditions that impact the producers and consumers of the commodities transloaded by us may have an adverse effect on our operating results, financial condition or liquidity. In addition, changes in United States and foreign government policies could change the economic environment and affect demand for our services. For example, changes in clean air laws or regulation promoting alternative fuels could reduce the demand for crude oil. Also, United States and foreign government agriculture tariffs or subsidies could affect the demand for crude oil.

Penalties we may incur could impair our business.

Failure to comply with government regulations could subject us to administrative, civil or criminal penalties, could require us to forfeit property rights, and may affect the value of our assets. We may also be required to take corrective actions, such as installing additional equipment or taking other actions, each of which could require us to make substantial capital expenditures. We could also be required to indemnify our third-party contractors and employees in connection with any expenses or liabilities that they may incur individually in connection with regulatory action against them. As a result, our future business prospects could deteriorate due to regulatory constraints, and our profitability could be impaired by our obligation to provide such indemnification to our employees.

14

We and the oil and gas transportation industry in general are subject to stringent environmental laws and regulations, which may impose significant costs on its business operations.