Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period fromto

Commission file number: 001-34637

ANTHERA PHARMACEUTICALS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

20-1852016

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(I.R.S. Employer

Identification No.)

|

|

25801 Industrial Boulevard, Suite B

Hayward, California

(Address of Principal Executive Offices)

|

94545

(Zip Code)

|

(510) 856-5600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|

Common Stock, par value $0.001 per share

|

The NASDAQ Global Market

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by a check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this FORM 10-K or any amendment to this FORM 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer x

|

Non-accelerated filer o

(Do not check if a

smaller reporting company)

|

Smaller reporting company o

|

Indicateby check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).Yes o No x

The aggregate market value of the registrant’s common stock held by non-affiliates as of June 30, 2014 was approximately $76.1 million based upon the closing sales price of the registrant’s common stock as reported on the NASDAQ Global Market. Shares of common stock held by each executive officer and director and by each person who owns 10 percent or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for any other purpose.

As of February 28, 2015, the number of outstanding shares of the registrant’s common stock, par value $0.001 per share, was 29,091,773.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for the registrant’s 2015 Annual Meeting of Stockholders will be filed with the Securities and Exchange Commission within 120 days after the registrant’s fiscal year ended December 31, 2014 and are incorporated by reference in Part III of this report.

1

ANTHERA PHARMACEUTICALS, INC.

FORM 10-K FOR THE FISCAL YEAR ENDED

|

Page

|

||

|

PART I

|

||

|

5

|

||

|

33

|

||

|

49

|

||

|

50

|

||

|

50

|

||

|

50

|

||

|

PART II

|

||

|

51

|

||

|

52

|

||

|

53

|

||

|

63

|

||

|

64

|

||

|

65

|

||

|

65

|

||

|

66

|

||

|

PART III

|

||

|

67

|

||

|

67

|

||

|

67

|

||

|

67

|

||

|

67

|

||

|

PART IV

|

||

|

68

|

||

|

94

|

||

Unless the context otherwise requires, we use the terms “Anthera Pharmaceuticals,” “Anthera,” “we,” “us,” “the Company” and “our” in this Annual Report on Form 10-K refer to Anthera Pharmaceuticals, Inc. and its subsidiaries. We use various trademarks, service marks and trade names in our business, including without limitation “Anthera Pharmaceuticals” and “Anthera.” This report also contains trademarks, services marks and trade names of other businesses that are the property of their respective holders.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, including the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains forward-looking statements regarding future events and our future results that are subject to the safe harbors created under the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements relate to future events or our future financial performance. We generally identify forward-looking statements by terminology such as “may,” “will,” “would,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “assume,” “intend,” “potential,” “continue” or other similar words or the negative of these terms. These statements are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described in “Risk Factors” and elsewhere in this report. Accordingly, you should not place undue reliance upon these forward-looking statements. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur, the timing of events and circumstances and actual results could differ materially from those projected in the forward looking statements. Forward-looking statements contained in this report include, but are not limited to, statements about:

|

•

|

the progress of, timing of and amount of expenses associated with our research, development and commercialization activities;

|

|

•

|

the timing, conduct and success of our clinical studies for our product candidates;

|

|

•

|

our ability to obtain U.S. and foreign regulatory approval for our product candidates and the ability of our product candidates to meet existing or future regulatory standards;

|

|

•

|

our expectations regarding federal, state and foreign regulatory requirements;

|

|

•

|

the therapeutic benefits and effectiveness of our product candidates;

|

|

•

|

the accuracy of our estimates of the size and characteristics of the markets that may be addressed by our product candidates;

|

|

•

|

our ability to manufacture sufficient amounts of our product candidates for clinical studies and products for commercialization activities;

|

|

•

|

our intention to seek to establish strategic collaborations or partnerships for the development or sale of our product candidates;

|

|

•

|

our expectations as to future financial performance, expense levels and liquidity sources;

|

|

•

|

the timing of commercializing our product candidates;

|

|

•

|

our ability to compete with other companies that are or may be developing or selling products that are competitive with our product candidates;

|

|

•

|

anticipated trends and challenges in our potential markets;

|

|

•

|

our ability to attract and retain key personnel; and

|

|

|

•

|

other factors discussed elsewhere in this report.

|

The forward-looking statements made in this report relate only to events as of the date on which the statements are made. We have included important factors in the cautionary statements included in this report, particularly in the section entitled “Risk Factors” that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make. Except as required by law, we do not assume any intent to update any forward-looking statements after the date on which the statements are made, whether as a result of new information, future events or circumstances or otherwise.

PART I

Overview

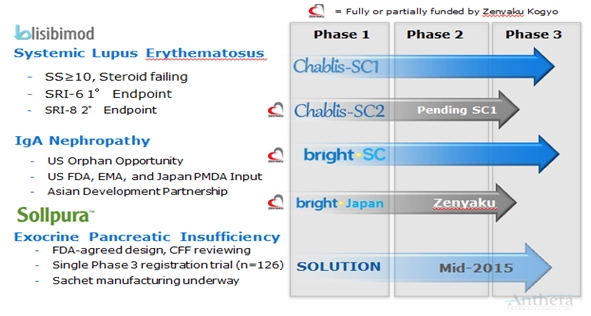

Anthera Pharmaceuticals, Inc. is a biopharmaceutical company focused on advancing the development and commercialization of innovative medicines that benefit patients with unmet medical needs. Our first Phase 3 product candidate, blisibimod, licensed from Amgen in December 2007, targets B-cell activating factor, or BAFF, which has been shown to be elevated in a variety of B-cell mediated autoimmune diseases, including systemic lupus erythematosus (“SLE”), or lupus, Immunoglobulin A nephropathy, or IgA nephropathy, lupus nephritis, and others. Our second Phase 3 product candidate, liprotamase, licensed from Eli Lilly & Co (“Eli Lilly”) in July 2014, is a novel non-porcine investigational Pancreatic Enzyme Replacement Therapy (“PERT”) intended for the treatment of patients with Exocrine Pancreatic Insufficiency (“EPI”), often seen in patients with cystic fibrosis and other conditions.

Figure 1. Summary of Product Portfolio

Our BAFF Antagonism Portfolio

BAFF, or B-cell Activating Factor, (also known as B lymphocyte stimulator or BLyS), is a member of a tumor necrosis family of natural human proteins and is critical to the development, maintenance and survival of multiple B-cell families as well as plasma cells – all of which are critical to the human immune response. B-cells and plasma cells are a vital part of the human immune system, producing natural antibody responses to invading pathogens such as viruses, bacteria and other dangerous antigens. Abnormally high elevations of BAFF, B-cells and plasma cells have been associated with several autoimmune diseases, including lupus and IgA nephropathy. BAFF is primarily expressed by macrophages, monocytes and dendritic cells and interacts with three different receptors on B-cells and plasma cells including BAFF receptor, or BAFF-R, B-cell maturation antigen, or BCMA, and transmembrane activator and cyclophilin ligand interactor, or TACI. The potential role of BAFF inhibition and associated reductions in B-cell and plasma cell numbers in lupus and rheumatoid arthritis has been validated in multiple clinical studies with blisibimod and other BAFF antagonists.

Based on data from our Phase 2b clinical study, we have advanced the clinical development of our BAFF inhibitor, blisibimod, to exploit its potential clinical utility in a number of autoimmune diseases. Blisibimod, a peptibody directed against BAFF, was developed as an alternative to antibodies and is produced in Escherichia coli bacterial culture, as opposed to antibodies that are typically produced in mammalian cell culture. A peptibody is a novel fusion protein that is distinct from an antibody with several potential advantages, including ease of manufacture, potency and relatively small molecular weight. Blisibimod inhibits both soluble and membrane-bound BAFF.

In 2012, we completed the PEARL-SC Phase 2b clinical study, which evaluated the efficacy and safety of multiple doses of subcutaneous blisibimod versus placebo in patients with active and seropositive lupus. Lupus patients suffer from a chronic autoimmune disease, where an inappropriate or abnormal immune response often leads to severe skin rash, fatigue, joint pain, ulceration, major kidney complications, including proteinuria, and cardiovascular disease. Inhibition of BAFF is believed to reduce survival of B-cells and plasma cells and autoantibodies, leading to a reduction in severity of disease and resolution of lupus symptoms.

The development program for blisibimod is focused on evaluating the efficacy and safety of blisibimod in patients with lupus, and IgA nephropathy for which we believe current treatments are either inadequate or non-existent. Our current plan includes continuing the ongoing CHABLIS-SC1 registration clinical study in patients with active lupus and the BRIGHT-SC phase 2/3 clinical study in patients with IgA nephropathy, and evaluating the potential of blisibimod in hematological diseases through clinical and nonclinical investigations. We have successfully manufactured blisibimod at launch-scale quantities. The blisibimod product is designed for at-home, self-administration and is presented as a pre-filled syringe for subcutaneous administration.

Our Pancreatic Enzyme Replacement Therapy Portfolio

Liprotamase is a novel non-porcine PERT that contains three biotechnology-derived digestive enzymes: a lipase, a protease and an amylase. The lipase in liprotamase is more stable than the porcine derived lipase in the low pH environment of the stomach and therefore liprotamase does not have an enteric polymer coating, nor does it contain porcine proteins or purines that may be associated with a risk of viral transmission or allergic reaction to proteins of porcine origin. The individual enzyme components of liprotamase are formulated at a fixed ratio of lipase, protease, and amylase. The liprotamase enzyme dose ratio was selected from preclinical efficacy studies conducted using a canine model of pancreatic insufficiency which demonstrated that the lipase enzyme in liprotamase was efficacious when administered at >500 units/kg per meal, and the protease doses >1000 units/kg per meal (Borowitz et al. 2006). This finding is further supported by the similar efficacy observed between liprotamase and Creon in pigs with surgically-induced pancreatic insufficiency.

Pancreatic enzyme replacement therapy is currently the mainstay of treatment for nutrient malabsorption in patients with digestive enzyme deficiencies known as exocrine pancreatic insufficiency, or EPI. EPI occurs when diseases such as cystic fibrosis, or CF, and chronic pancreatitis impede or destroy the exocrine function of the pancreas. Orally delivered porcine PERTs have been available for many years for the treatment of EPI. Unmet medical needs for the treatment of EPI remain. For example, as the porcine-derived proteins contained in the PERTs pass through the low pH environment of the stomach, enzyme activity rapidly diminishes and, as a consequence, large doses of porcine enzymes are often required. Since protease and lipase can become irreversibly inactivated in an acid environment, most products are provided as enteric-coated microbeads. Patient-to-patient variability in acidification of the intestine makes dissolution variable. Poor stability and variability in terms of potency and pharmaceutical properties have also been identified as important factors contributing to a poor response of some patients to PERTs.

Figure 2. Difference Between Liprotamase and Current PERT Treatments

Summary of Product Development Programs

|

Product Candidate

|

Study Name

|

Development Stage

|

Indication

|

Next Milestone(s)

|

|

Blisibimod

|

CHABLIS-SC1

|

Phase 3 (1)

|

Lupus

|

· Complete recruitment in mid-2015

|

|

Blisibimod

|

CHABLIS-SC2

|

Phase 3 (2)

|

Lupus

|

· Finalize study design and initiate regulatory submission process in the second half of 2015

|

|

Blisibimod

|

BRIGHT-SC

|

Phase 2/3 (1)

|

IgA Nephropathy

|

· Complete interim analysis in first half of 2015

· Complete recruitment in first half of 2016

|

|

Liprotamase

|

SOLUTION

|

Phase 3 (2)

|

EPI

|

· Initiate patient enrollment in the second half of 2015

|

|

(1)

|

ongoing

|

|

(2)

|

planned for initiation

|

Our Systemic Lupus Erythematosus (Lupus) Development Program

In the third quarter of 2012 at an End of Phase 2 meeting with the United States Food and Drug Administration, or FDA, we presented the results of the PEARL-SC study and our plans for Phase 3 registration studies in patients with active lupus. As a result of this meeting we initiated patient enrollment in the initial Phase 3 CHABLIS-SC1 study in March 2013.

CHABLIS-SC1 is a multicenter, randomized, double-blind, placebo-controlled study designed to evaluate the efficacy, safety, tolerability and immunogenicity of blisibimod in patients with seropositive, clinically-active lupus (SELENA-SLEDAI ≥ 10) who require corticosteroid therapy in addition to standard-of-care for treatment of their disease. The study is currently enrolling in 12 countries across Asia, Eastern Europe and Latin America. The study plans to randomize up to 400 patients to receive either 200mg of blisibimod or placebo in addition to their standard-of-care medication for 52 weeks. We expect to complete enrollment in mid-2015 and receive topline data after the last enrolled patient completes 52 weeks of treatment in mid-2016. The primary endpoint of the CHABLIS-SC1 will be clinical improvement in the SRI-6 response at 52 weeks. Key secondary outcomes from the study, including SRI-8, reduction in the number of lupus flares and steroid use, are intended to further differentiate blisibimod from currently available therapies. To date, enrolled patient demographics and disease characteristics for the CHABLIS-SC1 study are consistent with our goal to enroll patients with higher levels of lupus activity and positive biomarkers despite the stable use of corticosteroids. These characteristics were associated with improved outcomes in both our previous Phase 2 clinical study as well as in two large Phase 3 studies conducted with other BAFF-inhibitors, belimumab (Benlysta) and, more recently, tabalumab.

We believe the CHABLIS development program for blisibimod may offer a number of potential opportunities for differentiation versus the currently marketed BAFF antagonist and other novel B-cell directed therapies, including:

|

|

o

|

Clinical differentiation:

|

|

|

Ÿ

|

Potential for improved clinical response due to enriched patient selection;

|

|

|

Ÿ

|

A requirement that patients are receiving steroid therapy at time of randomization;

|

|

|

Ÿ

|

An improved clinical efficacy endpoint which requires a larger six-point reduction in the SELENA-SLEDAI;

|

|

|

Ÿ

|

Restricting background medications sooner and therefore demonstrating an earlier clinical benefit;

|

|

|

Ÿ

|

Potential to demonstrate reductions in lupus flares;

|

|

|

o

|

Patient convenience: A convenient, at-home, patient-administered subcutaneous product;

|

|

|

o

|

Mechanism of action: Blisibimod is able to inhibit the activity of both membrane-bound and soluble BAFF;

|

|

|

o

|

Potential labeling differentiation: A second study (CHABLIS-SC2) will also aim to enroll patients with stable renal disease (lupus nephritis);

|

|

|

o

|

Manufacturing and peptibody design: Blisibimod represents a novel molecular structure, which confers manufacturing benefits and lower cost of goods based on a bacterial fermentation manufacturing process and utilizes multiple binding sites to achieve highest reported affinity for inhibition of BAFF;

|

|

|

o

|

4 BAFF binding domains, compared to the typical 2 domains in a monoclonal antibody; and

|

|

|

o

|

1 picomolar affinity for BAFF, compared to the 120-350 picomolar reported for anti-BAFF monoclonal antibodies.

|

An independent Data Safety Monitoring Board (“DSMB”) meets regularly over the course of the study to assess patient safety. During these regular meetings, the DSMB reviews un-blinded safety data which include adverse events, suspected unexpected serious adverse reactions or SUSARs, deaths, laboratory data, and withdrawal data and compares trends between treatments. After the most recent scheduled meeting in October 2014, the DSMB recommended continuing the CHABLIS-SC1 and BRIGHT-SC clinical studies.

In February 2015, an interim analysis of CHABLIS-SC1 was conducted by an independent un-blinded statistician, who evaluated at a pre-specified time point, the proportion of responders to the systemic lupus erythematous SRI-6 responder index, and recommended the study to continue to completion as planned. This futility analysis was not intended to provide any rules for stopping for overwhelming efficacy, for a change in study sample size, or for an alteration of the study design. Rather, the analysis suggests that the observed data conforms with the assumptions upon which the trial was designed. The systemic lupus erythematosus response index is a recognized endpoint by the FDA for previously approved therapeutics. Prior to the interim analysis and in response to input from our Scientific Advisory Board who evaluated the published clinical data from other recent lupus studies with BAFF inhibitors, we modified the primary endpoint of CHABLIS-SC1 from a comparison of the proportion of responders to the SRI-8 responder index to a comparison of the proportion of responders to the SRI-6 responder index (previously a secondary endpoint of the study). The available data suggests an improved consistency of the SRI-6 endpoint across multiple trials. Response rates to the SRI-8 responder index will remain a key secondary endpoint of the study. In addition to serving as a registration study for a potential lupus indication, observations in this study are intended to be included in marketing applications for blisibimod in IgA nephropathy and other indications.

In the first quarter of 2014, we submitted the protocol to the FDA for our second lupus registration study, CHABLIS-SC2. In light of the emerging publication of data from completed clinical trials with SLE, the study design of the CHABLIS-SC2 study is currently being refined with a panel of lupus clinical experts and we plan to finalize the design in the second half of 2015. These two pivotal studies are anticipated to form the basis of submission for blisibimod as a treatment for active SLE that is not controlled by current-best-practice-standard-of-care, including corticosteroids

Our Immunoglobulin A Nephropathy Development Program

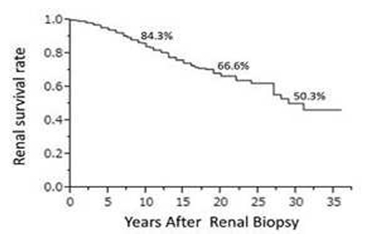

We are currently investigating blisibimod as a therapy for IgA nephropathy (also known as Berger’s disease). According to the National Organization of Rare Disease, IgA nephropathy, an orphan indication, is believed to affect approximately 130,000 people annually in the United States. In Asia, a similar prevalence to the United States would be estimated to affect over 500,000 people annually. In Asia, routine urinalyses are often performed for school children, and renal biopsies are performed for any patients with asymptomatic hematuria, thus raising the reported prevalence of the disease. According to the National Kidney and Urologic Diseases Information Clearinghouse, 25% of adults with IgA nephropathy eventually develop total kidney failure. IgA is a human antibody that helps the body fight infections. IgA nephropathy may occur when plasma B-cells express excessive amounts of abnormal IgA and subsequent immune complexes containing this immunogenic protein are deposited in the kidneys. These IgA deposits build up inside the small blood vessels of the kidney and as a result kidney glomeruli become inflamed and damaged, leading to leakage of blood and protein into urine. According to a recent publication in the New England Journal of Medicine (Wyatt & Julian, 2013), primary IgA nephropathy occurs at any age, most commonly with clinical onset in the second and third decades of life, and a large number of cases eventually progress to renal failure.

Figure 3. Progression to Renal Failure Amongst Patients with IgA Nephropathy

Figure 3 - Data for the cumulative renal survival rate observed from the time of renal biopsy until a diagnosis of end-stage renal disease in 1,012 patients with IgA nephropathy (Presented by Moriyama and colleagues at the American Society of Nephrology, 2013).

Similar to patients with other autoimmune diseases such as lupus, in IgA nephropathy, elevated levels of BAFF are associated with severity of disease activity. In patients with IgA nephropathy, levels of BAFF are significantly higher than in healthy patients. In IgA nephropathy, increased plasma B-cells express immunogenic IgA that forms immune complexes that deposit in renal tissue and lead to renal inflammation and damage that can progress to renal failure and end-stage renal disease. Significant reductions in plasma B-cells were observed in previous clinical studies of patients with lupus with another BAFF inhibitor antibody, belimumab. In our PEARL-SC Phase 2b study, significant reductions in total B-cells as well as significant improvements in proteinuria and increases in complement C3 were observed with blisibimod in lupus patients. We believe inhibition of BAFF may reduce proliferative B-cells and plasma B-cells, reduce serum levels of IgA and therefore reduce progressive renal damage in patients with IgA nephropathy.

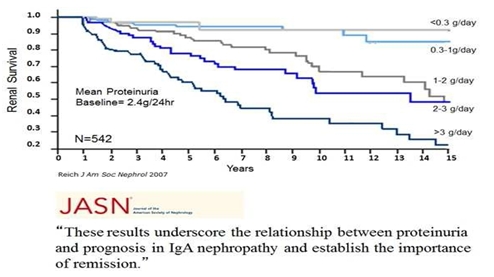

Figure 4: Effect of Proteinuria on Renal Survival in IgA Nephropathy

The BRIGHT-SC study is a Phase 2/3 multicenter, randomized, double-blind, placebo-controlled study to evaluate the efficacy, safety, tolerability and immunogenicity of blisibimod in IgA nephropathy. We intend to enroll up to 200 patients with biopsy-proven IgA nephropathy who have proteinuria greater than one gram per 24 hours (1g/24hr) and are receiving standard of care medication including angiotensin converting enzyme inhibitors and angiotensin receptor blockers. We initiated our BRIGHT-SC study in the second quarter of 2013. Patients enrolled in the BRIGHT-SC study receive 300mg weekly blisibimod or placebo subcutaneously during the first 8 weeks of therapy, the induction phase, followed by a minimum of 24 weeks of 200mg weekly blisibimod or placebo, the maintenance phase. The BRIGHT-SC clinical study is currently recruiting patients primarily in Southeast Asia. We intend to expand the study in the EU, North America and Latin America in 2015 with the goal to complete enrollment by the first half of 2016. We plan to conduct an interim futility analysis in the first quarter of 2015 to determine the effect of blisibimod on proteinuria after a minimum of eight weeks of treatment.

In September 2013, we met with the FDA who agreed to consider accepting proteinuria as an endpoint for Subpart E approval for blisibimod in IgA nephropathy. In April 2014, we met with the Japan Pharmaceuticals and Medical Devices Agency (“PMDA”) to discuss our registration program for blisibimod in IgA nephropathy. In this meeting we gained the PMDA’s agreement on the acceptability of proteinuria as the primary efficacy endpoint to support marketing approval in Japan and have amended the BRIGHT-SC study to include the specific data requirements of the PMDA. In December 2014 we met with the European Medicines Agency (“EMA”) as part of the scientific advice process for blisibimod. We reached an agreement with the EMA on the acceptability of proteinuria as the primary efficacy variable as well as the requirement for a single study to support a Conditional Marketing Authorization Application (“CMAA”) provided that confirmatory evidence from a second study, would be available post approval. The EMA also recommended the protocol to provide information on the required duration of treatment, duration of response and need for re-treatment. The BRIGHT SC protocol will be amended to reflect these recommendations from the EMA, along with other recommendations from the FDA and PMDA.

Our Liprotamase Development Program: a Novel Pancreatic Enzyme replacement Therapy (PERT)

Liprotamase is a novel PERT intended for the treatment of EPI. The exocrine pancreas is responsible for synthesis and secretion of digestive enzymes, including lipase, protease, and amylase. EPI occurs when diseases such as cystic fibrosis (“CF”) and chronic pancreatitis (“CP”) impede or destroy the exocrine function of the pancreas. A reduction in, or absence of the normally secreted pancreatic digestive enzymes, causes lipids, proteins, and carbohydrates to enter the distal gastrointestinal (“GI”) tract in unabsorbable forms, leading to GI pain and distention, maldigestion, and steatorrhea. Without appropriate therapy, patients with EPI may experience malnutrition, poor growth or weight loss, reduced quality of life, and, in severe cases, increased morbidity and early death.

We believe liprotamase is potentially the first soluble, stable and non-porcine derived enzyme product to offer a novel solution to patients who are unable to maintain appropriate nutritional health with existing enzyme therapies. Liprotamase’s chemical characteristics, unlike currently available PERTs, make it ideal for powder formulation as either a capsule or sachet product, which can be conveniently co-administered with a small volume of water.

Upon completion of the development and manufacture of liprotamase in sachet formulation, we plan to initiate the SOLUTION study in the second half of 2015. SOLUTION is a Phase 3, randomized, open-label, assessor-blind, non-inferiority, active-comparator study evaluating the efficacy and safety of liprotamase in patients with cystic fibrosis-related exocrine pancreatic insufficiency. This pivotal study is intended to evaluate the non-inferiority of liprotamase compared with other commercially available PERT in a population enriched for PERT responders. We believe the SOLUTION study may offer a number of potential opportunities for differentiation versus the currently marketed PERTs, including:

|

|

•

|

solubility and reduced pill burden: liprotamase is a powder which can be easily dissolved into water, or swallowed as capsules;

|

|

|

•

|

patient convenience: a sachet formulation of liprotamase, as a water soluble product, may offer convenience and advantages to patients currently using capsules; for example, patients unwilling or unable to swallow large capsules or large quantities of capsules at every snack or meal would likely prefer a sachet formulation that replaces the capsule burden, which is especially true with young children who find large capsules intolerable;

|

|

|

•

|

potential to provide an option to patients and caregivers a non-porcine, non-enterically coated biotechnology-derived PERT; and

|

|

|

•

|

lower pill burden given a larger concentration of lipase per capsule: adult patients who may prefer liprotamase capsules will be able to take fewer capsules and smaller capsules in order to attain the same enzyme dosage. The size of the capsule can be smaller than comparable procine-PERTs since a relatively high dose (lipase units) of non-enterically-coated liprotamase enzymes can be packed into small capsules compared to the large capsules necessary for the crude procine pancrease enterically-coated extract.

|

Market Opportunity

Blisibimod for the treatment of Systemic Lupus Erythematosus

Lupus is an autoimmune disorder that involves inflammation that causes swelling, pain and tissue damage throughout the body. Lupus can affect any part of the body, but especially the skin, heart, brain, lungs, joints and kidneys. The course of the disease is unpredictable, with periods of illness, called flares, alternating with remission. Although lupus may affect people of either sex, women are 10 times more likely to suffer from the disease than men, according to the Lupus Foundation of America. According to the Alliance for Lupus Research, it is estimated that up to 1.5 million people have lupus in the United States. Lupus Europe estimates that one in 750 women suffers from lupus in Europe and that lupus is a worldwide disease more common in some races than others. It is estimated that approximately 10% of people with lupus are treated in the United States. These patients are further categorized into three disease categories ranging from mild, moderate, to severe. Based on the results from our PEARL-SC study, we believe patients in the moderate to severe disease categories, approximately 30,000 to 40,000 people, are likely to benefit most from treatment with blisibimod and this is the population we are enrolling in our Phase 3 CHABLIS-SC studies.

Patients with active lupus may have a broad range of symptoms related to an abnormally active immune response in one or more organs. In the brain, lupus may cause seizures and other neurologic abnormalities. In the heart, lupus may cause heart failure or sudden death. Lung inflammation in the lung may cause shortness of breath, pleurisy and chest pain. Lupus may also cause swollen joints, arthritis, muscle aches, proteinuria, severe rash, oral ulcers and alopecia. In addition, patients with lupus nephritis may require kidney dialysis or eventual transplantation.

Although the cause of lupus is still not completely understood, B-cell activation and autoantibody production are known to be central to the process. Evidence has emerged that over-expression of BAFF plays an important role in this disease process. In preclinical studies, transgenic mice created to over-express BAFF begin to exhibit symptoms similar to lupus. In addition, treatment of lupus-prone mice with blisibimod ameliorates the disease.

Blisibimod for the treatment of IgA Nephropathy

Immunoglobulin A (IgA) is a human antibody that plays a critical role in mucosal immunity, which is a portion of the immune system that provides protection to an organism’s various mucous membranes from invasion by infections. IgA nephropathy (also known as IgA nephritis or Berger's disease) is the most common form of primary glomerulonephritis (inflammation of the glomeruli of the kidney) throughout the world and a principal cause of end-stage renal disease. The prevalence of IgA nephropathy varies throughout the world, with the highest prevalence in Asia (Singapore, Japan and China), Australia, Finland and southern Europe (20 to 40% of all glomerulonephritis). IgA nephropathy occurs when too much of this protein, especially aberrant and immunogenic forms of IgA, is deposited in the kidneys. These immunogenic IgA immune complexes deposit inside the small blood vessels of the kidney and, as a result kidney glomeruli become inflamed and damaged, leading to leakage of blood and protein into urine. The classic presentation (in 40-50% of the cases) of signs and symptoms in patients with IgA nephropathy is episodic frank hematuria which usually starts within a day or two of a non-specific upper respiratory tract infection or (less commonly) gastrointestinal or urinary infection. All of these infections have in common the activation of mucosal defenses and hence IgA antibody production.

According to the National Organization for Rare Diseases, primary IgA nephropathy occurs at any age, most commonly with clinical onset in the second and third decades of life and a large number of cases eventually progress to renal failure. Men are affected three times as often as women. There is also a striking geographic variation in the prevalence of IgA nephropathy throughout the world. In the United States, IgA nephropathy is considered an orphan disease as it is believed to affect approximately 130,000 people annually, although this number might prove to be higher with more robust screening. In Asia, routine urinalyses are performed for school children, and renal biopsies are performed for patients with asymptomatic hematuria and the reported prevalence of the disease is much higher. For example, in Japan, IgA nephropathy is estimated to affect over 350,000 people annually. According to the National Kidney and Urologic Diseases Information Clearinghouse, 25% of adults with IgA nephropathy eventually develop total kidney failure.

Sollpura (Liprotamase) for the treatment of Exocrine Pancreatic Insufficiency

According to IMS Health, EPI is a disease that affects an estimated 250,000 patients in the United States. The most common causes of EPI are chronic pancreatitis and cystic fibrosis, the former a longstanding inflammation of the pancreas altering the organ's normal structure and function that can arise as a result of malnutrition, heredity, or (in the western world especially), behavior (alcohol use and smoking), and the latter a recessive hereditary disease most common in Europeans and Ashkenazi Jews where the molecular culprit is an altered, CFTR-encoded chloride channel. In children, another common cause is Shwachman-Bodian-Diamond syndrome, a rare autosomal recessive genetic disorder resulting from mutation in the SBDS gene.

Blisibimod Manufacturing Strategy

In December 2011, we completed the manufacturing site transfer from Amgen Inc., or Amgen, to our contract manufacturing organization (“CMO’), Fujifilm Diosynth Bioservices (“Fujifilm”). We also scaled up manufacturing from 300 liters up to 3,000 liters. Two batches of blisibimod produced under U.S. and EU good manufacturing procedures (“GMPs”), at the 3,000 liter scale passed all physical quality specifications and comparability assessments.

We have successfully manufactured blisibimod at launch scale volumes to support the CHABLIS-SC1 and BRIGHT-SC studies. We are currently evaluating an auto injector strategy for the product presentation.

Regulatory Strategy

Lupus

The Phase 3 program for blisibimod was presented to the European Medicines Agency (EMA, Scientific Advice) in the second quarter of 2012, to the FDA in the third quarter of 2012 (End-of-Phase 2 meeting) and to the FDA in a follow-up advice procedure in the third quarter of 2013 (Type C request to which the FDA provided written responses in lieu of a meeting). The Phase 3 CHABLIS-SC program incorporates feedback and advice obtained from both regulatory agencies. The Phase 3 studies (CHABLIS-SC1 and CHABLIS-SC2) are planned to be multicenter, placebo-controlled, randomized, double-blind studies intended to evaluate the efficacy, safety, tolerability and immunogenicity of blisibimod in patients with clinically active lupus (SELENA-SLEDAI > 10) who require corticosteroid therapy in addition to standard of care for treatment of their disease. The design of the second Phase 3 study, CHABLIS-SC2, will be based on input from clinical experts as well as evaluation from recently reported data with tabalumab. The study design is expected to be finalized in the second half of 2015.

IgA Nephropathy

An Investigational New Drug application, or IND, submitted to the Division of Cardiovascular and Renal Products of the FDA for the investigation of blisibimod in IgA nephropathy, is now in effect. The Phase 3 program for blisibimod in IgA nephropathy builds on the SLE program and the CHABLIS studies. A single pivotal study (BRIGHT-SC) evaluating the change in proteinuria as a surrogate endpoint to support an accelerated (Subpart E) or Conditional Approval in US and EU, respectively, was presented to the FDA, EMA, and PDMA. Each agency provided separate concurrence on the willingness to consider proteinuria as a surrogate endpoint, with varying points of view on the degree of change in proteinuria to predict a treatment effect, and the timing for completion of enrollment of the post marketing confirmatory study. The BRIGHT-SC protocol has been amended to best address the recommendations of the FDA, EMA and PDMA.

Liprotamase

In 2013, our licensor, Eli Lilly, gained agreement from the FDA on the design of a Phase 3 trial that would provide adequate evaluation of efficacy and safety of liprotamase to respond to the FDA’s 2011 complete response letter. The Phase 3 study (SOLUTION) is a randomized, open-label, assessor-blind, non-inferiority, active-comparator study intended to evaluate the non-inferiority of liprotamase compared with another commercially available PERT. The SOUTION design also addresses the 2005 EMA protocol assistance comments, which were consistent with the FDA’s request for an active comparator trial.

Blisibimod Development History

To date, four randomized, placebo-controlled clinical studies have been conducted with blisibimod in patients with lupus: two Phase 1 dose-ranging studies in which a total of 104 patients were enrolled by our licensor, Amgen, a Phase 2b double-blind placebo-controlled dose-ranging clinical outcomes study in which 547 subjects were enrolled, and a Phase 2 Open-Label Extension study (OLE) which evaluated the long-term safety of blisibimod in subjects previously enrolled in the Phase 2b PEARL-SC study, both conducted by us. As expected for a BAFF inhibitor, statistically significant reductions in total B-cells were observed in patients treated with blisibimod compared with placebo in all three of the placebo-controlled studies.

Phase 2b Study PEARL-SC Study in Patients with Lupus

Based on positive results among 104 lupus patients in Amgen’s Phase 1a and 1b clinical studies, we conducted the PEARL-SC study, a Phase 2b randomized, double- blind, placebo-controlled study to evaluate the efficacy and safety of various subcutaneous doses of blisibimod in patients with seropositive lupus and active disease defined as SELENA-SLEDAI >6 at enrollment, which ran from mid-2010 to April 2012. The study enrolled 547 patients in 11 countries at 72 clinical sites. All patients completed the PEARL-SC study when the final enrolled patient completed six months of therapy.

In June and July of 2012 we announced results from the Phase 2b PEARL-SC study, which we believe support the initiation of a differentiated Phase 3 registration plan utilizing a 200mg weekly dose of blisibimod in patients with active lupus, despite the concomitant use of corticosteroids.

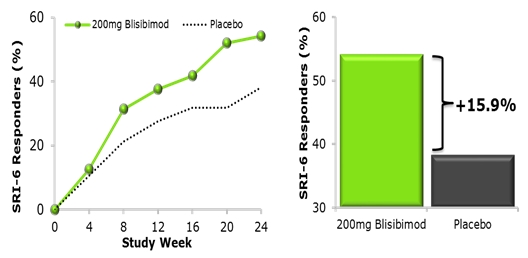

The primary endpoint of the PEARL-SC study was a clinical improvement at the lupus responder index, or SRI-5, at week 24 for the pooled blisibimod dose groups versus placebo groups. SRI-5 is defined as a five-point improvement in the SELENA-SLEDAI score, no new BILAG 1A or 2B scores, and no new increase in Physician’s Global Assessment of more than 0.3 points. The primary endpoint of this study was not met due to the lack of efficacy in the two lowest dose groups. However, the primary endpoint SRI-5 responder rates were numerically higher in subjects receiving blisibimod 200mg weekly (QW) compared with pooled placebo, from Week 16 (∆SRI 5 for blisibimod-placebo=8%, p= 0.14), through Week 24 (∆SRI 5=8.2%, p=0.15), reaching statistical significance at Week 20 (∆SRI 5=13.4%, p = 0.02). Treatment benefit was greater still when compared with the regimen-matched (QW) placebo. In pre-specified secondary analyses, benefit was observed at Week 24 with the 200mg QW group compared with matched placebo using modified SRI analyses in which responders attained SELENA-SLEDAI improvements of ≥7 or ≥8 (∆SRI 5 = 8.7% p=0.23; ∆SRI-7 =16.3% p=0.003; ∆SRI-8 =17.4% p=0.001). Blisibimod was also effective in a subgroup of patients with severe lupus with baseline SELENA- SLEDAI ≥10 and receiving corticosteroids at any dose (n=278) utilizing more stringent response thresholds (∆SRI-5=13.8%, p=0.18; ∆SRI-6=15.9%, p=0.12; ∆SRI-7=28.9%, p=0.002; ∆SRI- 8=31.1%, p<0.001, Figure 5 and Table 1). Based on SELENA SLEDAI definitions, 76 subjects (13.9%) had renal involvement at baseline and 54 subjects had proteinuria equivalent ≥1g/24hr. Compared with baseline, decreases in proteinuria were observed with blisibimod from Week 12 through Week 52 in the subgroup of subjects with proteinuria equivalent ≥1 g/24hr at enrollment (Figure 6). Similarly, decreases in proteinuria were observed in subjects with proteinuria equivalent ≥0.5 g/24hr through Week 44. Significantly greater reductions in proteinuria were also observed in a subgroup of subjects with active inflammation (i.e. low C3) and high anti-double-stranded DNA (anti-dsDNA).

Secondary endpoints included safety, improvements in variant forms of the SRI (e.g. defined by greater improvements in SELENA-SLEDAI), effects on clinical response in subgroup of patients with greater baseline disease severities, time to lupus disease flare, improvements in proteinuria, improvements in biomarkers of inflammation (e.g. anti-dsDNA, complement C3 and C4), and changes in B-cell counts. In June of 2012 we completed dosing in the PEARL-SC study.

Using a higher treatment threshold of an eight-point reduction in the SELENA-SLEDAI, or an SRI-8 endpoint, in this enhanced subgroup population, the 200mg blisibimod treatment group demonstrated a 15.6% treatment difference compared to pooled placebo (41.7% versus 26.1%, p≤0.05) and 31.1% treatment difference compare to regimen-matched placebo (41.7% versus 10.6%, p<0.001) at 24 weeks. In this “severe” subgroup, separation of clinical response was evident as early as Week 8 and numerical improvements relative to placebo were maintained beyond Week 24. This “severe” subgroup is the population that we believe will benefit most from treatment with blisibimod, and is the population we are enrolling in our Phase 3 CHABLIS-SC studies. Significant and early decreases in proteinuria were also observed with blisibimod as early as Week 8 in subjects with baseline proteinuria equivalent ≥1g/24 hrs. All doses of blisibimod demonstrated consistent serological response including reductions of B-cells, double-stranded-DNA antibodies and improvement in complement levels. Blisibimod was safe and well-tolerated at all dose levels with no meaningful imbalances in serious adverse events. In addition to publications in earlier abstracts at key international rheumatology conferences, the efficacy and safety data from the PEARL-SC study were published by Dr Richard Furie and colleagues (Ann Rheum Dis. 2014). Additional information and publications from the PEARL-SC study can be found at http://www.anthera.com/pipeline/clinical-studies/past-studies/pearl-sc.html The information found on our website is not part of this or any other report we file or furnish with the SEC.

Figure 5. Systemic Lupus Erythematosus Responder Index-6 (SRI-6) in Subjects with Baseline SELENA-SLEDAI ≥10 and Receiving Steroids

In Figure 5, an SRI-6 responder achieved all of the following: ≥6 point improvement in SELENA-SLEDAI, and no new BILAG 1A or 2B organ domain scores, and no worsening (<0.3 increase) in Physician’s Global Assessment. In a subgroup analysis of patients with severe lupus disease (SELENA–SLEDAI≥10 and receiving steroid at baseline, n=278), the percent of subjects achieving the SRI-5 was higher in subjects receiving the highest dose of blisibimod (200mg QW) compared with placebo. The graph shows data for blisibimod (200mg QW) and regimen matched placebo administered subcutaneously for 24 weeks (Furie et al., Ann Rheum Dis. 2014).

Table 1. The Proportion of Subjects with Severe Lupus Who Attained the Criteria for the SLE Responder Index at Week 24

|

Pooled

Placebo

|

200mg QW

Placebo

|

200mg QW

blisibimod

|

Real Difference versus

Pooled Placebo

|

Real Difference

versus 200mg QW

Placebo |

|

|

Total Study N

|

N=269

|

N=92

|

N=92

|

||

|

Subgroup N

|

N=138

|

N=47

|

N=48

|

||

|

SRI-5

|

47.1%

N=65

|

40.4%

N=19

|

54.2%

N=26

|

+7.1%

p=0.48

|

+13.8%

p=0.18

|

|

SRI-5 + No Increase in Steroid Dose

|

43.5%

N=60

|

38.3%

N=18

|

52.1%

N=25

|

+8.6%

p=0.377

|

+13.8%

p=0.18

|

|

SRI-6 (Primary Endpoint of the CHABLIS –SC Clinical Study)

|

46.4%

N=64

|

38.3%

N=18

|

54.2%

N=26

|

+7.8%

p=0.43

|

+15.9%

p=0.12

|

|

SRI-7

|

28.3%

N=39

|

12.8%

N=6

|

41.7%

N=20

|

+13.4%

p=0.11

|

+28.9%

p = 0.002

|

|

SRI-8

|

26.1%

N=36

|

10.6%

N=5

|

41.7%

N=20

|

+15.6%

p=0.05

|

+31.1%

p < 0.001

|

Analyses were conducted in the subgroup of subjects with more severe lupus (SELENA-SLEDAI score ≥10) at enrollment. SLE Responder Index (SRI) is defined as patients who respond to treatment and achieve a reduction in SELENA-SLEDAI equal to or greater than the number indicated, no new BILAG 1A or 2B organ domain scores, and no increase in Physician's Global Assessment (PGA) of greater than 0.3 on a three point scale.

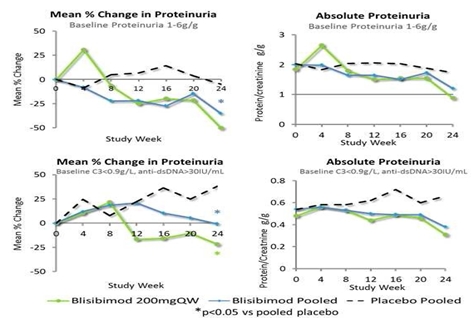

In subjects with baseline urinary protein excretion equivalent to 1-6g/24hrs, treatment with blisibimod resulted in significantly greater reductions in proteinuria compared to placebo from Week 8 through Week 24. Furthermore, the observed treatment-related decreases in proteinuria resulted in near normalization of the proteinuria to ≤1g/24hrs in those subjects receiving blisibimod. The graph shows data from subgroups of patients defined by baseline proteinuria for blisibimod. Separately, data are shown for the subgroup of subjects with high inflammatory biomarker status at enrollment, defined by low C3 and high anti-dsDNA autoantibodies at baseline. Data are plotted for all pooled blisibimod dose levels as well as 200mg once-weekly and placebo administered subcutaneously for 24 weeks in the PEARL-SC trial. See data presented by Dr. Richard Furie at the European League Against Rheumatology Annual Conference, Madrid, Spain 2013 in Figure 6.

Figure 6. Effects of Blisibimod on Proteinuria in Subjects with SLE Enrolled in the PEARL-SC Study

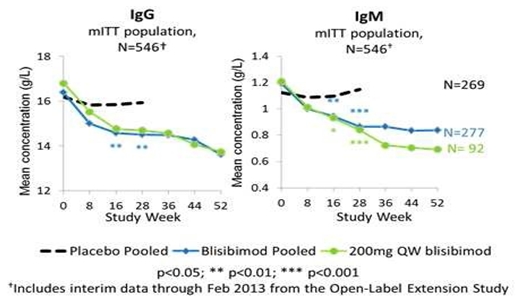

In this study, statistically significant reductions in total B-cells were observed in patients treated with blisibimod compared with placebo due to its mechanism of BAFF inhibition. In addition, treatment with blisibimod was associated with significant improvements in lupus disease activity and lupus biomarkers, including anti-dsDNA antibodies, proteinuria, immunoglobulins including IgG and IgM, and complement components C3 and C4. Blisibimod was safe and well-tolerated at all dose levels evaluated in this study, with no meaningful imbalances in serious adverse events or infections compared with placebo (see Table 2 in the next section).

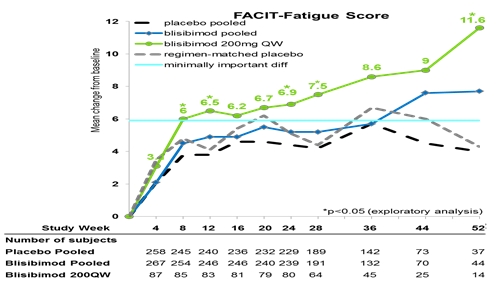

The effects of blisibimod on patient-reported fatigue were evaluated in the PEARL-SC study using the Functional Assessment of Chronic Illness Therapy (FACIT)-Fatigue scale, and reported by Dr Michelle Petri at the American College of Rheumatology Annual Conference, Boston MA, 2014. Improvements in patient self-reported fatigue were observed amongst subjects randomized to blisibimod based on the FACIT-Fatigue scale (Figure 7), especially in the 200mg QW group (N=80) where favorable effects of blisibimod compared with placebo were observed as early as Week 8, and a mean 6.9-point improvement from baseline was reported at Week 24 compared to 4.4 with placebo (N=229). These effects meet the criteria for minimal clinically-important improvement difference of 5.9 defined by Goligher and colleagues (2008) for patients with SLE.

Figure 7. Effects of Blisibimod on Patient-Reported Fatigue in the PEARL-SC Study in Subjects with Lupus

Open-Label Extension Study in Patients Enrolled in PEARL-SC Study (“OLE”)

In order to evaluate longer-term safety of blisibimod, patients with lupus who completed the PEARL-SC study were able to participate in an OLE study in which they were treated with an active drug (blisibimod). The OLE study was opened in Q2 2012 and closed in Q2 2013 after subjects had completed a minimum of one year of continuous therapy with blisibimod. Interim data from the combined PEARL-SC and OLE studies were presented at the 2013 Annual Scientific Meeting of the American College of Rheumatology and Association of Rheumatology Health Professionals (ACR/ARHP). In addition, a case report was published summarizing observations in a patient who was randomized to placebo in the PEARL-SC study then experienced a rapid improvement in serum cryoglobulins upon initiation of blisibimod therapy in the OLE study (Golima et al., Rheumatology, 2013).

The emerging data for the OLE study corroborate the effects of 24-week therapy with blisibimod observed in the PEARL-SC study. Specifically, the improvements in proteinuria observed in the subgroup of patients with abnormal proteinuria at enrollment (Figure 8), were maintained over 52 weeks of continuous blisibimod therapy. In addition, the effects observed with blisibimod on peripheral B-cells, anti-dsDNA autoantibodies, and complement C3 and C4 and immunoglobulins IgG and IgM observed over 24 weeks of dosing in the PEARL-SC study were found to be durable over 52 weeks of therapy through the OLE study (Figures 8 and 9). Blisibimod was safe and well-tolerated at all dose levels through the PEARL-SC and OLE studies, with no associated increase in risk of severe infection (Table 2).

Table 2. Adverse Events and Serious Adverse Events Reported in the Phase 2 Placebo-controlled and OLE trials with Blisibimod in Patients with Lupus

|

PEARL-SC

|

Open-Label

|

||

|

Placebo

|

Blisibimod

|

Blisibimod

|

|

|

N=266

|

N=280

|

N=380

|

|

|

Overview (% incidence )

|

|||

|

AEs

|

85

|

82.5

|

81.3

|

|

Serious AEs

|

15.8

|

11.1

|

10.8

|

|

AEs Related to Study Drug

|

37.2

|

40

|

33.9

|

|

AEs Leading to Withdrawal

|

7.9

|

5.7

|

5.0

|

|

AEs Leading to Death

|

1.1

|

1.4

|

0

|

|

Severe Infection AEs

|

1.1

|

1.4

|

1.6

|

|

Severe Injection Site Reactions

|

0

|

0

|

0

|

|

Serious Adverse Events Occurring in >1 Subject, n(%)

|

|||

|

Herpes zoster

|

2 (0.8)

|

2 (0.7)

|

1(0.3)

|

|

Pneumonia

|

4 (1.5)

|

3 (1.1)

|

1 (0.3)

|

|

Urinary tract infections

|

2 (0.8)

|

2 (0.7)

|

0

|

|

SLE

|

3 (1.1)

|

2 (0.7)

|

0

|

|

Deep vein thrombosis

|

2 (0.8)

|

3 (1.1)

|

0

|

|

Cellulitis

|

0

|

0

|

4 (1.1)

|

|

Intervertebral disc protrusion

|

0

|

0

|

2 (0.5)

|

|

Abortion spontaneous

|

0

|

0

|

4 (1.1)

|

|

Nephrolithiasis

|

0

|

0

|

2 (0.5)

|

The data from the Phase 2 program with blisibimod support the ongoing exploration of blisibimod’s efficacy and safety in the Phase 3 study in patients with lupus (CHABLIS-SC1) as well as the Phase 2 study in patients with IgA nephropathy (BRIGHT-SC1). Additional information for the OLE clinical studies can be found at http://www.anthera.com/pipeline/clinical-studies/past-studies/open-label-extension-study.html. The information found on our website is not part of this or any other report we file or furnish with the SEC.

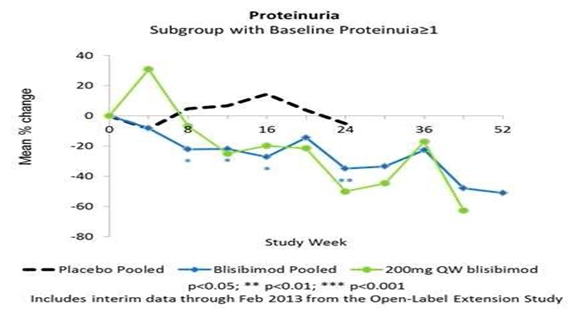

According to data presented by Dr. Richard Furie at the American College of Rheumatology Annual Conference, San Diego 2013, in Figure 11, the significant improvements in proteinuria in patients with lupus randomized to blisibimod compared with placebo observed in the PEARL-SC study were found to be durable through their continuing exposure to blisibimod in the OLE study. The graph shows data for blisibimod (all pooled dose levels as well as 200mg once-weekly) and placebo administered subcutaneously for 24 weeks in the PEARL-SC trial, and interim data for subjects who continued to receive blisibimod through the OLE trial are presented through Week 52.

Figure 8. Durable Effects of Blisibimod on Proteinuria in the PEARL-SC and OLE Studies in Subjects with Lupus

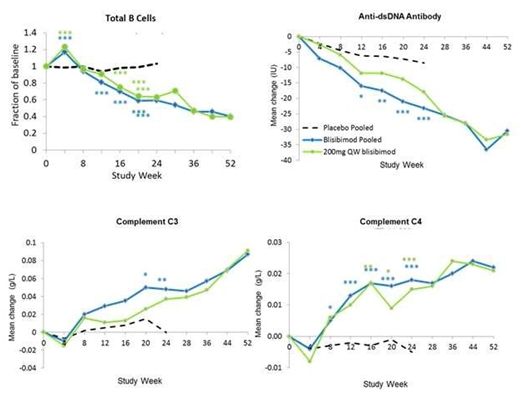

According to data presented by Dr. Richard Furie at the American College of Rheumatology Annual Conference, San Diego 2013 in Figure 9, with its mechanism of BAFF inhibition, blisibimod treatment was associated with significant reductions in the numbers of total B-cells, anti-dsDNA antibodies, as well as significant increases in complement components C3 and C4. The graphs shows data for blisibimod (all pooled dose levels as well as 200mg once-weekly) and placebo administered subcutaneously for 24 weeks in the PEARL-SC trial, and interim data for subjects who continued to receive blisibimod through the OLE trial are presented through Week 52.

Figure 9. Effects of Blisibimod on Lupus Biomakers in the Phase 2 PEARL-SC and Open-Label Extension Trials

According to data presented by Dr. Richard Furie at the American College of Rheumatology Annual Conference, San Diego 2013 in Figure 10, significant reductions in immunoglobulins IgG and IgM were observed with blisibimod compared with placebo during the placebo-controlled PEARL-SC study. These effects were found to be durable in subjects who continued to receive blisibimod through the OLE study. The effects on immunoglobulins were not associated with infection risk, nor were alterations in white blood cells, monocytes, or neutrophils associated with blisibimod. The graphs show data for blisibimod (all pooled dose levels as well as 200mg once- weekly) and placebo administered subcutaneously for 24 weeks in the PEARL-SC study, and interim data for subjects who continued to receive blisibimod through the OLE trial are presented through Week 52.

Figure 10. Effects of Blisibimod on Serum Immunoglobulins

Historical Clinical Studies By Licensor - Blisibimod

Blisibimod, a peptibody directed against BAFF, was developed as an alternative to antibodies and is produced in Escherichia coli bacterial culture as opposed to antibodies that are typically produced in mammalian cell culture. Prior to our in-licensing of blisibimod, our licensor, Amgen, completed two Phase 1 clinical studies of blisibimod in lupus patients to evaluate the safety and pharmacokinetics of single and multiple doses of the drug using intravenous and subcutaneous formulations. The randomized, placebo-controlled, dose-escalation Phase 1a clinical study evaluated blisibimod as a single intravenous or subcutaneous therapy among 56 lupus patients. Intravenous doses included 1, 3 and 6mg/kg, and subcutaneous doses included 0.1, 0.3, 1 and 3mg/kg. The primary endpoint was to assess the safety and tolerability of single dose administrations of blisibimod. Secondary endpoints were designed to assess the plasma pharmacokinetic profile and immunogenicity of blisibimod. Results from this clinical study indicated the safety and tolerability of blisibimod administered as a single intravenous or subcutaneous dose was comparable to placebo. Single doses of blisibimod exhibited linear pharmacokinetics after both intravenous and subcutaneous administration. There were comparable adverse events between the blisibimod and placebo groups with no deaths reported. In addition, no neutralization antibodies were seen across all doses. The most common adverse events were nausea (15%), headache (10%), upper respiratory tract infection (10%) and diarrhea (8%).

Blisibimod was evaluated in a randomized, placebo-controlled, multi-dose Phase 1b clinical study as an intravenous or subcutaneous therapy among 63 lupus patients. The intravenous dose was 6mg/kg, and subcutaneous doses included 0.3, 1 and 3 mg/kg. Patients received their doses of blisibimod or placebo once-weekly for four weeks. The primary endpoint was to assess the safety and tolerability of multiple dose administrations of blisibimod. Secondary endpoints were designed to assess the plasma pharmacokinetic profile and immunogenicity of blisibimod after multiple doses. Results showed that multiple doses of blisibimod exhibited dose-proportional pharmacokinetics after both intravenous and subcutaneous administration. Further, results demonstrated a significant decrease in total B-cells as early as 15 days after beginning treatment, and total B-cell reduction (up to approximately 60-70% of baseline) reached its nadir after about 160 days of therapy. By six months after beginning treatment, the B-cell populations had returned to baseline levels. Further analyses of B-cell subsets found that naïve B-cells and activated B-cells were significantly decreased while memory B-cells were transiently significantly increased following treatment with blisibimod, consistent with a correction of the B-cell abnormalities reported in lupus patients.

There were no deaths reported between the blisibimod and placebo groups. Few neutralization antibodies were seen, and all resolved in subsequent visits. Based on these results and published data from competitor studies, we conducted a Phase 2b clinical study evaluating blisibimod in lupus patients from the second half of 2010 to the third quarter of 2012.

Historical Clinical Studies By Licensor - Liprotamase

Liprotamase was studied from 2002 to 2009 in seven clinical trials, in which a total of 492 unique subjects received at least 1 dose of liprotamase. Three Phase 1 trials were conducted, 1 in healthy volunteers and 2 in subjects with EPI due to CF. Two short-term trials, the Phase 2 Study TC 2A, and the Phase 3 Study 726 evaluated the efficacy of liprotamase in subjects ≥7 years of age with EPI due to CF. Two long-term Phase 3 safety and tolerability trials were also conducted: Study 767 in subjects with EPI due to CF and Study 810 in subjects with EPI due to CP/pancreatectomy. Completed clinical trials demonstrated that dietary fat and nitrogen (protein) absorption are significantly increased in patients with cystic fibrosis and EPI who received liprotamase. In 2013, Eli Lilly gained agreement from the FDA on the design of a pivotal trial that would provide adequate evaluation of efficacy and safety.

The dose-ranging Phase 1 study TC-1B evaluated five dose levels across a 50-fold range, from 100-to-5000 units (U) per kg per meal in CF-EPI subjects. In this study, greater improvements in nutrients absorption, as measured using the percent change from baseline in the coefficient of fat absorption (CFA) and coefficient of nitrogen absorption (CNA), were observed at doses of 500 U per kg per meal and higher.

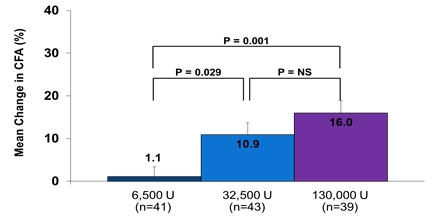

Study TC-2A, a Phase 2, randomized, double-blind, parallel group, dose-finding trial, was conducted in 125 pediatric and adult subjects with CF-related EPI who were treated with liprotamase in one of three dosing regimens containing 6,500 U, 32,500 U, and 130,000 U lipase administered per meal or snack. Observed mean CFAs at the end of study were 56.2%, 67.0%, and 69.7% in the 6,500, 32,500, and 130,000 U dose groups, respectively (one-way ANOVA p = 0.0032) with significant improvements in mean changes from baseline (one-way ANOVA p = 0.0005). Pairwise comparison of the CFA values showed that statistically greater improvements were observed at the higher doses of liprotamase compared with the lowest dose of 6,500 U (Figure 14). Similar improvements in the CNA, were observed with liprotamase at the two highest dose levels.

Figure 11: Mean Change from Baseline CFA (ITT) in the Phase II TC-2A Study

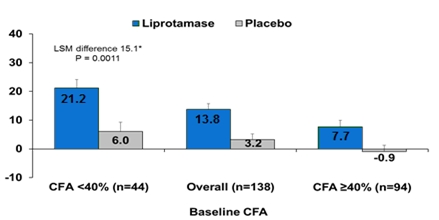

Study 726, a Phase 3, placebo-controlled, parallel design, multinational clinical, evaluated the effects of a single capsule of liprotamase (containing 32,500 U lipase, with protease and amylase in fixed ratios) or placebo administered with every meal or snack on severe EPI defined as baseline CFA < 40% in the absence of PERT. There was a protocol-specified dose increase to two capsules per meal and one capsule per snack allowed in cases of involuntary weight loss, steatorrhea, or lack of weight gain. Amongst the 138 subjects enrolled in this study, treatment with liprotamase resulted in a statistically significant improvement in the change from baseline in the CFA of 21.2% with liprotamase compared with 6.0% with placebo (p = 0.0011, Figure 15).

Figure 12: Mean Change from Baseline CFA in Study 726

Two long-term studies were conducted to evaluate the safety and effects on nutritional status of liprotamase. Study 810 evaluated adult subjects with EPI due to CP or after pancreatectomy. Amongst the 214 subjects who were treated, an average dose of 5.5 capsules (containing 32,500 U lipase, with protease and amylase in fixed ratios) of liprotamase per day maintained nutritional status as assessed by serial measurement of height and weight, including age-appropriate growth and weight gain in children. Mean BMI z-scores for subjects in Study 767 were maintained over time on study (mean BMI z-score at baseline, Months 3, 6, and 12 were -0.503,-0.637, -0.688, and -0.655, respectively).

Research and Development

Since our inception in 2004, we have focused primarily on developing our product candidates, blisibimod, liprotamase, varespladib and varespladib sodium. The two latter product candidates were terminated in March 2012. We currently focus our development efforts on blisibimod, which is being developed for autoimmune disease, including lupus and IgA nephropathy, and liprotamase, as an enzyme replacement therapy for EPI. In the years ended December 31, 2014, 2013 and 2012, we incurred $21.8 million, $21.7 million and $49.2 million, respectively, of research and development expense.

Our Strategy

In December 2014, we entered in an exclusive license agreement with Zenyaku Kogyo Co., Ltd (“Zenyaku”) for the development and commercialization of blisibimod in Japan and potentially other countries throughout Asia (“the Zenyaku Agreement”). We retain full development and commercialization rights of blisibimod for all other global territories including North America and the European Union and we are actively pursuing partnerships with pharmaceutical and biotech companies to develop and commercialize blisibimod in these territories.

Our objective is to develop and commercialize our product candidates to treat serious diseases associated with inflammation, including autoimmune diseases and enzyme replacement therapies. To achieve these objectives, we intend to initially focus on the following activities.

Advancing Clinical Development of Blisibimod and Liprotamase

We are advancing the development of blisibimod to evaluate the broad potential clinical utility of BAFF antagonism. We have completed a Phase 2b clinical study with blisibimod in patients with lupus and plan to continue the advancement of blisibimod in our ongoing Phase 3 registration program in lupus and development in IgA nephropathy in 2015. We intend to initiate the development of liprotamase in a Phase 3 registration program in the second half of 2015 in patients with cystic fibrosis-related Exocrine Pancreatic Insufficiency. We may opportunistically enter into collaborations with third parties for development of blisibimod in lupus or for the development of liprotamase, including securing corporate partners whose capabilities complement ours.

Developing Commercial Strategies Designed to Maximize Our Product Candidates’ Market Potential

Our product candidates are focused on highly-specialized physician segments, such as rheumatologists, nephrologists and cystic fibrosis specialists. We believe that we can build a small, focused sales force capable of marketing our products effectively in acute care and orphan indications. In other chronic indications, we intend to seek commercial collaborations with companies that have a large, dedicated sales force focused on general practitioners and we plan to seek commercialization partners for products in non- specialty and international markets.

Competition

Our industry is highly competitive and subject to rapid and significant technological change. Our potential competitors include large pharmaceutical and biotechnology companies, specialty pharmaceutical and generic drug companies, academic institutions, government agencies and research institution. Our primary competitors are described in further detail below, under “Approved Categories of Drugs” and “B-Cell Targeting Drugs Under Late-Stage Clinical Development”. We believe that key competitive factors that will affect the development and commercial success of our product candidates are efficacy, safety and tolerability profile, reliability, convenience of dosing, price and reimbursement.

Many of our potential competitors have substantially greater financial, technical and human resources than we do and significantly greater experience in the discovery and development of product candidates, obtaining FDA and other regulatory approvals of products and the commercialization of those products. Accordingly, our competitors may be more successful than we may be in obtaining FDA approval for drugs and achieving widespread market acceptance. Our competitors’ drugs may be more effective, or more effectively marketed and sold, than any drug we may commercialize and may render our product candidates obsolete or non-competitive before we can recover the expenses of developing and commercializing our product candidates. We anticipate that we will face intense and increasing competition as new drugs enter the market and advanced technologies become available. Finally, the development of new treatment methods for the diseases we are targeting could render our drugs non-competitive or obsolete.

Approved Categories of Drugs

Lupus

Human Genome Sciences, Inc. and partner GlaxoSmithKline plc (GSK) obtained FDA approval for Benlysta® (belimumab) in 2011 for the treatment of lupus. Benlysta®, the first novel therapy approved in the last 50 years, was acquired by GSK in July 2012. Other current therapies such as non-steroidal anti-inflammatory drugs, or NSAIDs, corticosteroids, anti-malarials and immunosuppressants generally act to hold back broadly the proliferation of many types of cells, including white blood cells. However, use of these agents is often associated with limited efficacy or significant adverse events and broad immune suppression.

Emerging data from 2 large Phase 3 trials with the BAFF-targeted monocloncal antibody, tabalumab, were presented by Professor David Isenberg at the American College of Rheumatology Annual Conference, Boston, MA, November 2014. These data demonstrate that targeting BAFF remains an effective strategy for improving chronic disease activity in SLE. Several other agents under development target other B-cell related pathways or other inflammatory mechanisms for the treatment of lupus. These product candidates include atacicept, or TACI-Ig, from ZymoGenetics Inc. and epratuzumab from Immunomedics, Inc. Other pathways targeting both B-cell and non-B-cell mechanisms are in earlier-phase clinical trials, such as Lupuzor from ImmuPharma plc; anti-inhibitors of interferon (IFN) alpha, sifalimumab, MEDI-545 and rontalizumab; the anti-IFN gamma antibody AMG 811; toll-like receptor inhibitors; the anti-interleukin 6 antibodies sirukumab and PF-04236921; the phosphodiesterase 4 inhibitor CC-10004; the anti-CD74 monocloncal antibody milatuzumab; and inhibition of B7 related protein (B7RP-1) pathway with AMG 557. We believe that blisibimod may offer potential differentiation from these agents, including demonstrated dosing flexibility with both subcutaneous and intravenous delivery; selective modulation and reduction of relevant B-cell types in lupus patients; the ability to inhibit the activity of both membrane-bound and soluble BAFF; the use of a bacterial expression platform which is expected to translate to lower manufacturing costs compared with therapeutic antibodies; and distinct patent protection based on a novel and proprietary technology developed and commercialized by Amgen.

Exocrine Pancreatic Insufficiency

There are currently several marketed products for EPI caused by cystic fibrosis, including Creon marketed by AbbVie, Inc., Pancreaze by Janssen Pharmaceuticals, Inc., Pertzye by Cornestone Therapeutics, Inc., and Ultresa and Zenpep by Aptalis Pharma US. Inc. We are also aware of companies with other products in development that are being tested for potential treatment of EPI caused by cystic fibrosis: Johnson and Johnson Research and Development LLC recently completed a Phase 3 study to assess the effectiveness and safety of oral pancrelipase MT in the treatment of adult and pediatric/adolescent cystic fibrosis patients with clinical symptoms of EPI; and Nordmark Arzneimittel GmbH & Co. KG’s compound, Burlulipase, is being tested in a Phase 3 study in patients with EPI.

B-Cell Targeting Drugs Approved or Under Late-Stage Clinical Development in lupus (other than blisibimod)

|

Compound

|

Stage

|

Company

|

Indications

|

Notes

|

|

Benlysta®

|

Approved

|

GlaxoSmithKline plc

|

Lupus (approved),

|

• Monoclonal antibody against soluble BAFF

|

|

(intravenous and

|

Phase 2/3

|

Lupus Nephritis,

|

• Positive results reported in two Phase 3 clinical

|

|

|

subcutaneous)

|

Myasthenia

|

studies

|

||

|

Gravis,

|

• Phase 3 trials in lupus (evaluating subcutaneous

|

|||

|

Idiopathic

|

administration) and lupus nephritis ongoing

|

|||

|

Membranous

|

• Phase 2 open-label trial in membranous

|

|||

|

Nephropathy

|

nephropathy ongoing

|

|||

|

Vasculitis,

|

||||

|

Pediatric Lupus

|

||||

|

Epratuzumab

|

Phase 3

|

Immunomedics, Inc./UCB S.A.

|

Lupus,

|

• Humanized antibody against CD-22, an agent that

|

|

(intravenous)

|

Non-Hodgkin’s

|

specifically targets B-cells and leads to decrease

|

||

|

Lymphoma

|

activity of peripheral B-cells

|

|||

|

Acute

|

• Improvements in disease activity reported in

|

|||

|

Lymphoblastic

|

placebo-controlled as well as longer-term OLE

|

|||

|

Leukemia

|

studies

|

|||

|

• Phase 3 clinical studies in severe lupus ongoing

|

|

Atacicept

|

Phase 2

|

ZymoGenetics Inc./Merck Serono S.A.

|

Lupus

|

• Decreased incidence of lupus flares in patients

|

|

(intravenous and

|

Phase 3

|

with severe lupus reported from Phase 2/3 trial

|

||

|

subcutaneous)

|

PERT Drugs Approved or Under Late-Stage Clinical Development (other than liprotamase)

|

Compound

|

Stage

|

Company

|

Indications

|

Notes

|

|

Creon

|

Approved

|

Abbvie

|

EPI, CF and other

|

• Porcine, enteric coated

|

|

Zenpep

|

Approved

|

Actavis

|

EPI, CF and other

|

• Porcine, enteric coated

|

|

Ultrase

|

Approved

|

Actavis

|

EPI, CF and other

|

• Porcine, enteric coated

|

|

Pancreaze

|

Approved

|

Janssen/J&J

|

EPI, CF and other

|

• Porcine, enteric coated

|

|

Pertzye

|

Approved

|

Digestive care, Inc.

|

EPI, CF and other

|

• Porcine, enteric coated

|

|

Viokase

|

Approved

|

Actavis

|

EPI, chronic pancreatitis or

pancreatectomy only |

• Porcine, non-enteric coated

• In combination with proton pump inhibitor

|

|

Burlulipase

|

Phase 2

|

Nordmark Arzneimittel GmbH & Co. KG

|