Attached files

| file | filename |

|---|---|

| 10-K - FORM 10-K - AMPCO PITTSBURGH CORP | d836471d10k.htm |

| EX-21 - EX-21 - AMPCO PITTSBURGH CORP | d836471dex21.htm |

| EX-32.2 - EX-32.2 - AMPCO PITTSBURGH CORP | d836471dex322.htm |

| EX-31.2 - EX-31.2 - AMPCO PITTSBURGH CORP | d836471dex312.htm |

| EX-31.1 - EX-31.1 - AMPCO PITTSBURGH CORP | d836471dex311.htm |

| EX-23.1 - EX-23.1 - AMPCO PITTSBURGH CORP | d836471dex231.htm |

| EX-32.1 - EX-32.1 - AMPCO PITTSBURGH CORP | d836471dex321.htm |

| EX-10.(G) - EX-10.(G) - AMPCO PITTSBURGH CORP | d836471dex10g.htm |

| EX-10.(I) - EX-10.(I) - AMPCO PITTSBURGH CORP | d836471dex10i.htm |

| EXCEL - IDEA: XBRL DOCUMENT - AMPCO PITTSBURGH CORP | Financial_Report.xls |

| EX-23.2 - EX-23.2 - AMPCO PITTSBURGH CORP | d836471dex232.htm |

Exhibit 10(h)

William K. Lieberman

Director and Chair of Compensation Committee

November 25, 2014

Mr. John Stanik

234 East Edgewood Drive

McMurray, PA 15317

Dear John:

I am pleased to extend to you this offer of employment for the position of Chief Executive Officer of Ampco-Pittsburgh Corporation, effective January 1, 2015. This position is an exempt salaried position and will report to the Board of Directors of the Corporation.

Should you accept this offer, your initial base salary will be $550,000 per year. Your salary in year 1 will either be reduced by the cost of the Corporation issuing you 2,000 shares or you will purchase 2,000 shares in the open market, subject to advice of counsel. The shares will be issued or purchased as soon as practical after January 1, 2015 when there is no black-out period in effect. The Corporation’s current practice is to evaluate salaries on an annual basis; however, you will be evaluated on the six month anniversary of your start date and annually thereafter or such other review period policy that may be in effect from time to time and at the Corporation’s discretion. It is understood that you will be an employee at will, the same as all members of the corporate staff, which means that there is not a contract for employment for any period of time.

In addition to the base salary above, you will participate in or be entitled to receive the following:

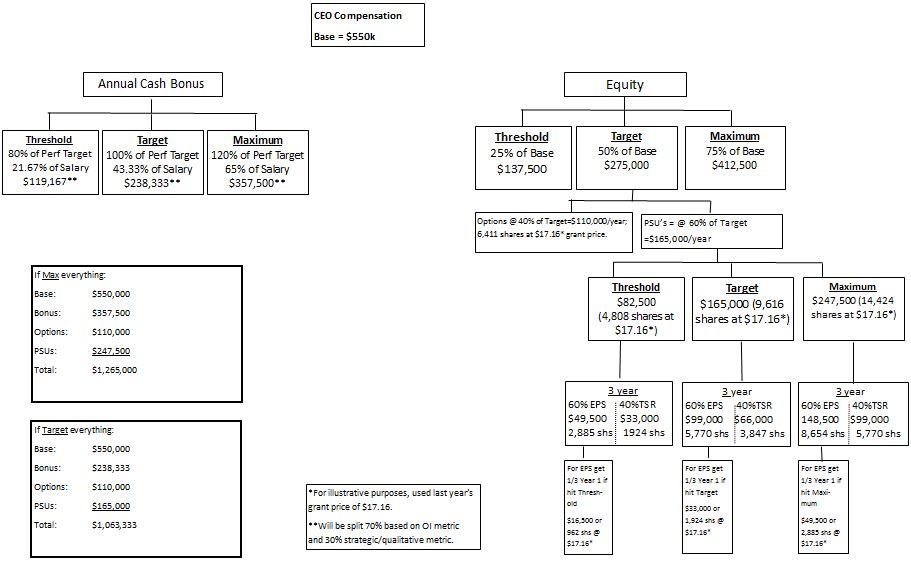

| • | An annual cash bonus incentive plan and long-term equity performance plan as outlined on the flow chart enclosed with this letter; |

| • | Annual Duquesne Club membership; |

| • | Leased company automobile and employer provided parking; |

Page 2

November 24, 2014

| • | Change of Control agreement similar to the agreements currently in place which provide for three times your annual compensation in the event of a “change in control”. For more information, see page 21 of the Corporation 2014 Proxy Statement which is also enclosed; and |

| • | Severance Agreement for termination, other than “for cause” or for circumstances covered by the Change of Control agreement, which will provide for 12 months of base compensation. |

The Board will elect you as a Director of the Corporation effective January 1, 2015, and it is contemplated that the Board will nominate you to be reelected at the 2015 annual meeting of shareholders for a three (3) year term. In accordance with the Corporation’s policies, as an employee of the Corporation, you will not receive separate compensation in connection with your service as a member of the Board.

As a salaried employee, you will be eligible to participate in various benefit programs. A Summary of Benefits currently available is enclosed for your information and you will receive a complete explanation of these benefits as part of your initial orientation. Generally, as a salaried employee, you will be able to participate in various insurance programs. You will be eligible for Corporate-designated paid holidays and starting in 2015, paid vacation in accordance with the Corporation’s policy as it pertains to senior executives.

Additionally, the Corporation currently maintains a Defined Benefit Pension Plan for its salaried employees and you may voluntarily elect to participate in the 401(k) Savings Program.

The nature and extent of the above outlined and any subsequent benefit programs and/or coverage amounts may change from time to time and at the Corporation’s discretion.

This offer of employment is conditioned upon successful completion of all post-employment offer screening procedures including a physical examination, drug screening, confidential background investigation and approval of this offer by the Board of Directors on December 16th. It is anticipated that you will be able to commence your employment with Ampco-Pittsburgh on January 1, 2015. As a further condition of employment, you will be required to sign Confidentiality and other Corporate Policy Agreements.

Please review the enclosed information and return to me the signed acceptance employment offer as soon as possible but no later than November 30, 2014. Once I have your acceptance and the necessary forms, I will arrange the background investigation and work with you to schedule the physical.

Page 3

November 24, 2014

I hope you are able to accept this offer and join the Ampco-Pittsburgh Corporation staff. If you have any questions, please do not hesitate to contact me.

| Sincerely, |

| s/ William K. Lieberman |

| William K. Lieberman |

I, John Stanik, accept the Offer of

Employment contained in this letter.

| s/John Stanik |

| John Stanik |

| Date: | 11/26/14 |

Page 4

November 24, 2014

2015 BENEFITS SUMMARY

| Benefit |

Aetna | |||

| Monthly Pretax Contribution | Base Plan $ 71 – employee only $149 – employee + one dependent* $206 – employee + two or more dependents*

Buy-up Plan $135 – employee only $284 – employee + one dependent* $392 – employee + two or more dependents* * An additional $60 spousal surcharge may apply. | |||

| Base | Buy Up | |||

| Lifetime Maximum | Unlimited | |||

| Annual Deductible | $2,000 per individual $4,000 per family |

$1,000 per individual $2,000 per family | ||

| Annual Out-of-Pocket Maximum Does not apply to copayments, amounts over the allowable charge, preadmission penalties, or non-covered services. |

$3,000 per individual $6,000 per family |

$1,500 per individual $3,000 per family | ||

| Annual Total Maximum Out-of-Pocket Includes deductibles, coinsurance, copayments |

$6,600 Individual $13,200 Family |

$6,600 Individual $13,200 Family | ||

| Preventive Care and Women’s Preventive Care Services | Plan pays 100% of covered preventive care services. See medical plan for details. | Plan pays 100% of covered preventive care services. See medical plan for details. | ||

| Office Visits includes lab tests/bloodwork; excludes x-rays, diagnostic tests, surgeries |

$25 copayment PCP $35 copayment Specialist |

$20 copayment PCP $20 copayment Specialist | ||

| Hospital Services Including diagnostic testing |

20% of covered benefits after deductible is satisfied | 10% of covered benefits after deductible is satisfied | ||

| Emergency Room Care including accidental injuries |

$125 copayment If admitted, copayment waived |

$75 copayment If admitted, copayment waived | ||

| Prescription Drug must be medically necessary |

$15 each generic prescription, $30 each preferred brand name prescription and $60 each non-preferred brand name prescription. $100 specialty (first prescription fill at any retail drug facility. Subsequent fills must be through Aetna Specialty Pharmacy). Difference in cost required if brand is purchased when generic is available. Limited to 30 day supply.

90 day supply available via mail order: $37.50 for generic, $75 for preferred brand name or $150 for non-preferred brand name | |||

Page 5

November 24, 2014

| Dental www.deltadentalins.com |

Only services that conform to generally accepted dental practices are covered. The plan pays up to the contract allowance. | |

| Diagnostic and Preventive Care |

Plan pays 100% of allowable charge with no deductible – cleanings, examinations, x-rays, and other diagnostic care. Exams and cleanings are limited to one exam every six months. Other limitations may apply. | |

| Annual Deductible |

$100 individual and $200 per family. Deductible does not apply to preventive and diagnostic care. | |

| Basic Restorative |

Plan pays 80% after deductible – amalgam and composite fillings | |

| Periodontics, Oral Surgery, Endodontics |

Plan pays 80% after deductible – treatment of gums and supporting structures of teeth; extraction; pulpal therapy and root canal filling | |

| Major Restorative |

Plan pays 50% after deductible – inlays, onlays, crowns | |

| Prosthodontics |

Plan pays 50% after deductible – construction, repair of bridges and partial or complete dentures, implants | |

| Orthodontics |

Plan pays 50% after deductible – procedures for straightening teeth. Limited to $1,000 per person per lifetime. | |

| Annual Maximum |

$1,250 – maximum benefit paid per individual per calendar year | |

| OTHER BENEFITS The following benefits are available to you regardless of whether you enroll in the medical/dental plan or waive your benefits. | ||

| Life Insurance and Accidental Death & Dismemberment | An amount equal to 125% of your base annual salary will be paid to your beneficiary upon your death. Your beneficiary will receive twice this amount if you die as the result of an accidental injury. If you should lose a limb as the result of an accidental injury, a portion of this benefit will be paid directly to you. | |

| Short Term Disability | 60% to 100% of your salary for up to 26 weeks, depending upon your years of service. | |

| Long Term Disability | 60% of your salary to a maximum of $10,000 less any other income. This benefit begins paying when you are disabled for 26 weeks. | |

| Flexible Spending Account | Annual limit is $2,500 for the Medical Reimbursement option and $5,000 for the Dependent Care Reimbursement option. | |

| Retirement Savings 401(k) www.principal.com |

You may contribute up to $17,500 to the 401(k) plan plus an additional $5,500 if you are age 50 or older. | |

| Retirement Plan | Monthly benefit at age 65 equal to the greater of $24 multiplied by your years of service or 1.1% of your final average monthly earnings multiplied by your years of service. | |

The description of benefits described in this letter replaces any language in your summary plan description. For detailed information about your medical plan, refer to the enrollment package or the member handbook provided by your medical insurer. If there is any difference between this summary, the plan, and or the insurance contract, the language in the insurance contract or plan will determine your benefits.

|

CEO Compensation Base = $550k Annual Cash Bonus Equity Threshold Target Maximum Threshold 80% of Perf Target 21.67% of Salary $119,167** Target 100% of Perf Target 43.33% of Salary $238,333** Maximum 120% of Perf Target 65% of Salary $357,500** If Max everything: Base: $550,000 Bonus: $357,500 Options: $110,000 PSUs: $247,500 Total: $1,265,000 If Target everything: Base: $550,000 Bonus: $238,333 Options: $110,000 PSUs: $165,000 Total: $1,063,333 Threshold 25% of Base $137,500 Target 50% of Base $275,000 Maximum 75% of Base $412,500 Options @ 40% of Target=$110,000/year; 6,411 shares at $17.16* grant price. PSU’s = @ 60% of Target =$165,000/year Threshold $82,500 (4,808 shares at $17.16*) Target $165,000 (9,616 shares at $17.16*) Maximum $247,500 (14,424 shares at $17.16*) 3 year 60% EPS 40%TSR $49,500 $33,000 2,885 shs 1924 shs 3 year 60% EPS 40%TSR $99,000 $66,000 5,770 shs 3,847 shs 3 year 60% EPS 40%TSR 148,500 $99,000 8,654 shs 5,770 shs For EPS get 1/3 Year 1 if hit Threshold $16,500 or 962 shs @ $17.16* For EPS get 1/3 Year 1 if hit Target $33,000 or 1,924 shs @ $17.16* For EPS get 1/3 Year 1 if hit Maximum $49,500 or 2,885 shs @ $17.16* *For illustrative purposes, used last year’s grant price of $17.16. **Will be split 70% based on OI metric and 30% strategic/qualitative metric.