Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - UNITED NATURAL FOODS INC | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - UNITED NATURAL FOODS INC | exhibit312q2fy15.htm |

| EX-32.1 - EXHIBIT 32.1 - UNITED NATURAL FOODS INC | exhibit321q2fy15.htm |

| EX-32.2 - EXHIBIT 32.2 - UNITED NATURAL FOODS INC | exhibit322q2fy15.htm |

| EX-10.2 - EXHIBIT 10.2 - UNITED NATURAL FOODS INC | exhibit102leasethirdamend.htm |

| EX-3.2 - EXHIBIT 3.2 - UNITED NATURAL FOODS INC | exhibit32amendedandrestate.htm |

| EX-3.1 - EXHIBIT 3.1 - UNITED NATURAL FOODS INC | exhibit31articlesofincorpo.htm |

| EX-10.1 - EXHIBIT 10.1 - UNITED NATURAL FOODS INC | exhibit101leasesecondamend.htm |

| 10-Q - 10-Q - UNITED NATURAL FOODS INC | unfi10q1312015.htm |

| EX-31.1 - EXHIBIT 31.1 - UNITED NATURAL FOODS INC | exhibit311q2fy15.htm |

Exhibit 10.3

FOURTH AMENDMENT TO OFFICE LEASE

THIS FOURTH AMENDMENT TO OFFICE LEASE (the “Amendment”) is entered into as of the 20th day of October, 2014, by and between ALCO CITYSIDE FEDERAL, LLC, a Rhode Island limited liability company (“Landlord”), and UNITED NATURAL FOODS, INC., a Delaware corporation (“Tenant”).

WITNESSETH:

WHEREAS, Landlord and Tenant entered into that certain Office Lease, dated October 16, 2008, as amended by that certain First Amendment to Office Lease by and between Landlord and Tenant, dated as of May 12, 2009, as further amended by that certain Second Amendment to Lease by and between Landlord and Tenant, dated as of May 10, 2011, and as further amended by that certain Third Amendment to Lease by and between Landlord and Tenant, dated as of August 7, 2013 (collectively, the “Lease”), whereby Landlord has demised to Tenant certain space consisting of approximately 69,855 rentable square feet in the aggregate on the first (1st) and second (2nd) floors of Building #52 and the second (2nd) floor of Building #51 (the “Current Leased Premises”) of the American Locomotive Works complex located at 315 Iron Horse Way, Providence, Rhode Island (the “Property”);

WHEREAS, the Current Leased Premises are referred to in the Lease as the Premises;

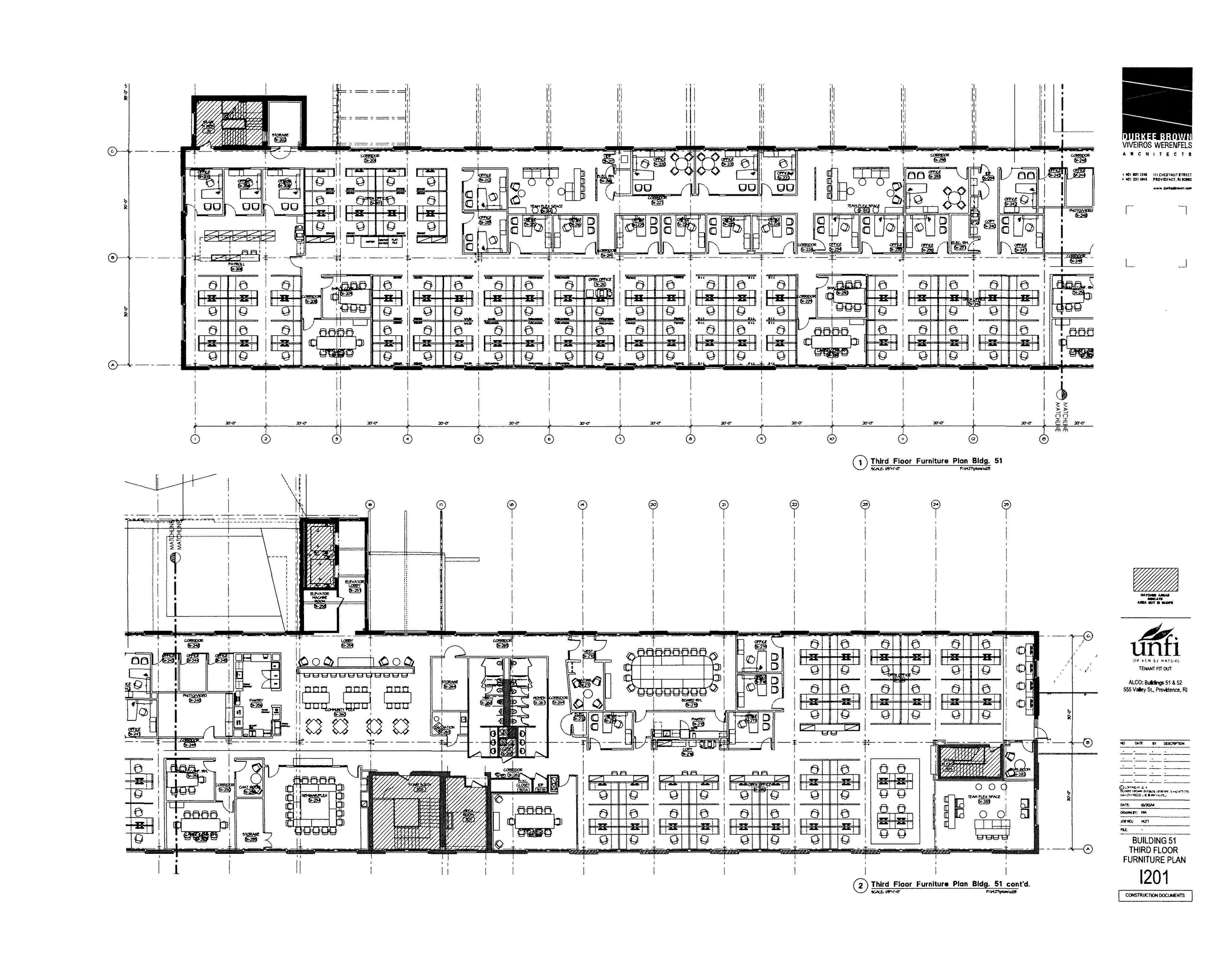

WHEREAS, Tenant desires to additionally lease from Landlord approximately 1,542 rentable square feet on the first (1st) floor of Building #52 on the Property and 30,753 rentable square feet on the third (3rd) floor of Building #51 on the Property (for a total of 32,295 rentable square feet), which additional space is shown on the plan attached hereto as Exhibit A (collectively, the “Additional Leased Premises”);

WHEREAS, the Current Leased Premises and the Additional Leased Premises are hereafter sometimes collectively defined as the “Leased Premises”;

WHEREAS, in connection with the lease of the Additional Leased Premises, Landlord and Tenant have agreed to amend and modify the Lease in certain respects as more particularly set forth in this Amendment; and

WHEREAS, Landlord and Tenant desire to confirm their understanding and agreement with respect to the foregoing matters pursuant to the terms and provisions of this Amendment.

NOW, THEREFORE, in consideration of the foregoing and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto agree as follows:

1.Capitalized Terms. Any capitalized terms used in this Amendment but not defined herein shall have the definition set forth in the Lease.

2.Additional Leased Premises. Tenant agrees to lease from Landlord, and Landlord agrees to lease to Tenant, the Additional Leased Premises.

3.Commencement Date of the Additional Leased Premises. The commencement date for the inclusion of the Additional Leased Premises as part of the Premises, and the date on which the terms of this Amendment shall supersede all previous terms and conditions of the Lease, as applicable, shall be the date that is the earlier to occur of: (i) May 1, 2015 (the “Fixed Date”), (ii) the date Landlord delivers the Additional Leased Premises to Tenant with the Landlord’s Work Substantially Complete (as those terms are hereinafter defined), or (iii) the date Tenant occupies the Additional Leased Premises (the earlier to occur of the foregoing events is hereinafter referred to as the “New Lease Term Commencement Date”). The parties shall promptly confirm the New Lease Term Commencement Date in writing. The above provision with respect to the determination of the New Lease Term Commencement Date under clause (ii) above in this Section 3 is subject to modification as provided in Section 10(F) below, and the Fixed Date provision is subject to Section 10(G) below. Commencing on and after the New Lease Term Commencement Date, the Leased Premises will be deemed to contain 102,150 rentable square feet in the aggregate for all purposes under the Lease.

4.Term. Upon the occurrence of the New Lease Term Commencement Date, the Term of the Lease shall be for a period of ten (10) years.

5.Commencement Date of Base Rent. The commencement date for the payment of Base Rent for the Leased Premises (including both the Current Leased Premises and the Additional Leased Premises) shall be the New Lease Term Commencement Date.

6.Base Rent. Until the New Lease Term Commencement Date, Tenant shall continue to pay minimum Base Rent, additional rent for Taxes, Operating Costs and other charges payable by Tenant with respect to the Current Leased Premises as presently set forth in the Lease. From and after the New Lease Term Commencement Date, the Base Rent for the Leased Premises (including both the Current Leased Premises and the Additional Leased Premises) shall be as follows:

Period | Yearly Base Rent | Monthly Base Rent |

1st, 2nd & 3rd Years | $2,298,205.00 | $191,517.08 |

4th & 5th Years | $2,474,990.00 | $206,249.16 |

6th & 7th Years | $2,576,010.00 | $214,667.50 |

8th, 9th & 10th Years, | $2,677,030.00 | $223,085.83 |

Each annual period shall commence on and as of the New Lease Term Commencement Date, and the parties shall promptly confirm the final rent schedule in a letter agreement executed by both parties. The failure to execute such a confirmatory letter agreement shall not, however, delay the occurrence of the New Lease Term Commencement Date.

2

7.Additional Rent.

A.Tenant’s Proportionate Share. Based upon the Leased Premises containing 102,150 rentable square feet and the Property containing 201,088 rentable square feet of space, commencing on and as of the New Lease Term Commencement Date, “Tenant’s Proportionate Share” (as defined in Section 1.1 of the Lease) shall be 50.80%.

B.Real Estate Taxes & Operating Costs. Tenant shall continue to pay escalations in Operating Costs and Taxes (as such terms are defined in the Lease) on the Current Leased Premises in accordance with the terms and provisions of the Lease. Commencing on the New Lease Term Commencement Date, for purposes of calculating the additional rent to be paid for Operating Costs with respect to the Additional Leased Premises only, the Base Year for Operating Costs shall be calendar year 2015. For purposes of calculating the Taxes to be paid with respect to the Additional Leased Premises only, the Base Taxes shall be Taxes payable by Landlord during the 2015 calendar year on the real estate comprising the Project including, without limitation, the Building and all other improvements thereon. For the avoidance of doubt, Tenant’s Proportionate Share with respect to the payment by Tenant of Tenant’s Share of Increased Operating Costs and Tenant’s Share of Increased Taxes as provided in the existing Lease with respect to the Current Leased Premises is 34.98% and Tenant’s Proportionate Share with respect to payment by Tenant of Tenant’s Share of Increased Operating Costs and Tenant’s Share of Increased Taxes payable as provided in the Lease (as amended hereby) with respect to the Additional Leased Premises is 15.82%.

8.Electricity. Tenant shall pay for electricity serving the Leased Premises during the Term based upon the existing Lease provisions.

9.HVAC. The HVAC operating hours and performance specifications for the Leased Premises shall be in accordance with the existing terms and provisions of the Lease.

10.Construction of Additional Leased Premises.

A. Landlord’s Work. The Landlord shall, at its sole cost and expense (except as set forth herein), diligently complete the improvements to the Additional Leased Premises in a good and workmanlike manner, in accordance with all applicable laws and governmental requirements and in accordance with the Final Plans (as hereinafter defined), as well as the scope of work and specifications attached hereto as Exhibit B-1 (hereinafter collectively referred to as the “Landlord’s Work”). Landlord shall provide Tenant with as-built CAD files for the Additional Leased Premises after completion of Landlord’s Work. Landlord recognizes that Landlord’s Work is being done primarily on the third floor of a building, the first two floors of which are in use by Tenant, and Landlord shall conduct Landlord’s Work with minimal disruption to Tenant’s operations, including without limitation all reasonable protection of Tenant’s second floor work spaces. Any damage to the Current Leased Premises arising from Landlord’s Work shall be repaired at Landlord’s sole cost and expense and shall not be reimbursed from the Tenant Allowance.

3

B. Tenant’s Work. Tenant shall be obligated to provide its own office furniture, computers and other personal property in order to use and occupy the Additional Leased Premises. Tenant may commence installing its personal property as soon as the Landlord’s Work is sufficiently complete to permit such access.

C. Landlord’s Contribution to Landlord’s Work. Landlord agrees to contribute the amount of $1,706,265.00 (the “Tenant Allowance”) toward the cost of Landlord’s Work. Tenant acknowledges that Tenant is solely responsible for the timely payment of all costs and expenses in connection with Landlord’s Work in excess of the Tenant Allowance, including, without limitation, all costs and expenses for labor and materials. Once it has been established based upon the final construction contract that the cost of Tenant’s Work, including, without limitation, in connection with any change order is in excess of the Tenant Allowance, Tenant acknowledges and agrees that the funds necessary to pay for same shall be disbursed by Landlord, in the case of the Tenant Allowance, and Tenant, in the case of the amount in excess of the Tenant Allowance, based upon the percentage that the amount to be paid by each such party bears to the total amount. By way of illustration, if the Tenant Allowance is $1,706,265.00 and the cost of Landlord’s Work in excess thereof is $200,000 (for a total cost of $1,906,265.00), Landlord will pay 89.51% of each requisition and Tenant will pay 10.49% of the same using its own funds. Landlord will be entitled to make monthly requisitions for payments from Tenant for its applicable share as aforesaid based upon the requisitions Landlord receives from the general contractor hired by Landlord. Tenant shall pay such requisitions (as additional rent) within ten (10) days of its receipt of an invoice from Landlord, which invoice shall have attached a copy of the requisition from the general contractor and set forth Landlord’s calculation of the amount payable by Tenant. Anything herein to the contrary notwithstanding, Landlord shall, at its own expense, without any reduction in the Tenant Allowance, complete the following work in the Additional Leased Premises: (1) install plywood subflooring, and (2) stub the hot and cold water conduits as well as the HVAC system conduit to the Additional Leased Premises (it being understood and agreed, however, that the additional piping, duct work and heat pumps, together with the distribution of such systems in the Additional Leased Premises, is part of the Landlord’s Work which will be paid for utilizing the Tenant Allowance).

D. Plans and Specifications; Change Orders.

1. Landlord shall cause the preparation of all architectural and engineering drawings, plans and any applicable specifications for Landlord’s Work as promptly as possible using due diligence. Tenant has previously approved the fee proposal letter (the “Fee Letter”), dated August 14, 2014, issued by Durkee, Brown, Viveirous & Werenfels as the architect. The Fee Letter sets froth the amount of $156,500 as the proposed fee. Due to the fact that the architect preparing the aforesaid plans and any applicable specifications requires input from Tenant with respect to the floor plan and design of the Additional Leased Premises, Tenant agrees to work with the aforesaid architect as diligently as possible in order that the architect can propose an initial draft of the proposed plans and applicable specifications for review and approval as hereinafter provided. The parties have agreed to the preliminary floor plan (the “Draft Floor Plan”) for the Additional Leased Premises attached hereto as Exhibit B-2. At Tenant’s request, the architect will design the interior of the Additional Leased Premises to a LEED Silver standard, so-called, but Tenant acknowledges that the Additional Leased Premises will not obtain

4

LEED Silver certification. Landlord shall submit to Tenant the proposed final plans and any applicable specifications for Landlord’s Work for Tenant’s review and approval which will be based upon the Draft Floor Plan, which approval shall be in accordance with the procedures and time frames set forth below. Due to the fact that a number of plans (electrical, plumbing, and other applicable plans), which must be complete as part of the Final Plans, and which are the responsibility of the Landlord to prepare, have not been prepared, Landlord agrees to work as diligently as possible with its architect and other necessary third parties provide such plans to Tenant in proper form for review. The quality of materials and architectural details for the Additional Leased Premises shall be substantially the same as in the Current Leased Premises. Tenant will be deemed to have approved any such plans and specifications submitted by Landlord to Tenant unless Tenant provides Landlord with Tenant’s written objections thereto within a period of fifteen (15) days from Tenant’s receipt of such plans and specifications. Tenant shall not be obligated to respond to incomplete documents. In the event Tenant provides its objections on a timely basis, Landlord and Tenant shall use good faith and diligent efforts to agree to revisions to the plans and specifications for Landlord’s Work and the above process will continue, except that Tenant shall have a period of ten (10) days to respond to any complete revised plans and specifications, or Tenant will be deemed to have approved same. The final, agreed upon plans referenced above in this Section 10(D)(1) and any applicable specifications shall be defined as the “Final Plans”. The cost for the Final Plans shall be paid out of the Tenant Allowance (or shall be deducted from the Tenant Allowance as to the amount already paid by Landlord with respect thereto) once the Final Plans have been agreed to in writing (including by email), but in no event shall such cost be greater than ten percent (10%) of the Tenant Allowance. As of the date hereof, Landlord has paid the above-referenced architect the amount of $11,062.82 with respect to the architect fee and is processing a second invoice for payment to the architect in the amount of $52,691.75.

2. Tenant shall submit in writing any request for additional work or improvements or any changes or modifications to the Landlord’s Work in a timely manner and prior to Landlord having commenced the applicable work with respect thereto, which shall be subject to Landlord’s approval, not to be unreasonably withheld or delayed. If Landlord estimates that such additions, changes or modifications will increase the cost of Landlord’s Work (“Tenant Excess”), result in a delay caused by Tenant or otherwise delay the Landlord’s Work, then Landlord shall advise Tenant in writing within five (5) business days of Tenant’s request of the cost of such change order and/or the anticipated delay in the Landlord’s Work that is due to the change order and, subject to Tenant’s right to revoke or continue with such request as provided hereinafter, the cost relating to such change order shall be Tenant's sole responsibility. Tenant shall have five (5) business days following receipt of such information from Landlord to elect to (a) revoke such request, or (b) continue with the requested modifications (it being agreed that Tenant’s failure to respond within such five (5) business day period shall be deemed an election to continue with the modifications). Notwithstanding anything to the contrary herein, Landlord and Tenant may submit modifications to Landlord’s Work costing less than $5,000 upon oral notice to the Tenant’s Construction Contact and Landlord’s Construction Contact (as hereinafter defined), as applicable. Such modifications shall be documented in writing within five (5) calendar days after such oral request. Tenant shall be responsible for the payment of any Tenant Excess on a monthly basis as and when billed. Tenant has designated Thomas Dziki to be Tenant’s construction contact (“Tenant’s Construction Contact”), who shall be entitled to field

5

verify for Tenant the existing status of the Additional Leased Premises, inspect the construction work, attend the periodic job-site meetings, and otherwise act on Tenant's behalf during construction. Landlord shall provide Tenant’s Construction Contact with prior notice of all project meetings and copies of all material status reports. Landlord agrees that it shall cooperate, and shall cause its contractor and Landlord's construction manager to cooperate, with Tenant's Construction Contact. Tenant may designate a substitute Tenant's Construction Contact by written notice to Landlord. Landlord has designated Thomas F. Guerra to be Landlord’s construction contact (“Landlord’s Construction Contact”), who shall be Landlord’s liaison and be authorized to act on Landlord's behalf during construction. Tenant agrees that it shall cooperate with Landlord’s Construction Contact and Landlord’s construction manager. Landlord's Construction Contact shall have full authority to make all decisions on behalf of Landlord with respect to material or design changes and change orders (to be documented and submitted to the construction manager prior to completion), and any decisions made in the field by such construction contact shall be binding upon Landlord. Landlord may designate a substitute Landlord's Construction Contact by written notice to Tenant.

E. Determining the Cost of the Landlord’s Work.

1. Upon receipt of the Final Plans, Landlord shall promptly obtain at least two (2) complete written bids from general contractors, utilizing bid documents and a list of bidders provided to Tenant (and with Tenant having previously approved the proposed list of bidders), for the completion of Landlord’s Work, based on the Final Plans. Landlord expects to receive the bids within a period of not more than three (3) weeks. The cost of the Landlord’s Work to be paid out of the Tenant Allowance shall include any applicable payment and performance bonds required by either party. Upon receipt of said bids, Landlord shall provide Tenant with all applicable information relative to said bids, including a copy thereof, and Landlord shall then choose the lowest qualified bid received. Landlord shall provide Tenant with a copy of the executed construction contract.

2. If the bids for Landlord’s work exceed $2,200,000.00, then Tenant, rather than accepting such contract price may reduce the scope of the Landlord’s Work provided the Tenant gives Landlord the final reduced scope of the Landlord’s Work in writing within a period of thirty (30) days from the date Tenant is provided a copy of the aforesaid bids.

3. Without limiting the generality of Tenant’s rights under the Lease, as amended: (i) all of Landlord’s rights to enforce the terms of the construction contract against the general contractor in the event Landlord fails to do so shall be assigned to Tenant at Tenant’s request but subject to the prior rights of Landlord’s lender with respect thereto, it being understood and agreed that Landlord’s lender shall have the first right to determine whether or not such lender shall require that the contractor complete the Landlord’s Work on lender’s behalf as a result of any default by Landlord under the loan documents with such lender, and (ii) no change order which has not been requested by Tenant shall be approved without Tenant’s prior written consent, which consent shall not be unreasonably withheld, conditioned or delayed.

F. Completion of Landlord’s Work; New Lease Commencement Date.

6

1. If the Final Plans are agreed to by the parties by November 1, 2014, then Landlord shall substantially complete Landlord’s Work by April 1, 2015, subject to any circumstances beyond the Landlord’s reasonable control (including any action by any third party, including without limitation any governmental entity or other entity not under Landlord’s control, whose consent is required for Landlord’s Work, any change orders mutually agreed upon by Landlord and Tenant, any delay in the completion of Landlord’s Work caused by Tenant and any delay in the completion of Landlord’s Work caused by Landlord or Landlord’s general contractor or any other parties not under Landlord’s control. For purposes of this Amendment, “Substantial Completion” or “Substantially Complete”) means that at least a temporary certificate of occupancy has been issued for the Additional Leased Premises and the Landlord’s Work has been completed except for the customary punchlist items which Landlord and Tenant agree are of such a nature that they can be completed within a period of twenty (20) days without interfering with Tenant’s use and enjoyment of the Additional Leased Premises. Landlord agrees to cause the punchlist items to be completed within such twenty (20) day period. If the Final Plans are not agreed to by November 1, 2014, then the April 1, 2015 date referenced above shall be extended on a day-to-day basis by the number of days between November 1, 2014 and the date the Final Plans are agreed to. Notwithstanding the foregoing, the parties are attempting to agree to the Final Plans by October 20, 2014.

2. Notwithstanding anything contained herein to the contrary, if Substantial Completion of the Landlord’s Work is delayed by Tenant’s delay in approving plans and specifications beyond the time frames set forth in Subsection (D) above in this Section 10, or change orders, then the New Lease Commencement Date shall be deemed to have commenced without regard to such delays if the result thereof is to cause the New Lease Term Commencement Date to occur prior to the Fixed Date. For example, if the Landlord’s Work is substantially complete on April 15, 2015, but substantial completion was delayed for fifteen (15) days due to Tenant’s delay in approving plans and specifications beyond the time frames set forth in said Subsection (D) above or change orders (“Tenant Delay”), then the New Lease Commencement Date shall be deemed to be April 1, 2015. Tenant will not be deemed to have caused any delay under Section 10(E)(2) hereof as long as Tenant provides Landlord with the final reduced scope of the Landlord’s Work within the thirty (30) day period referred to in said section.

G. Landlord Delay.

In the event the New Lease Term Commencement Date is triggered as a result of the Fixed Date being the earlier to occur of the three events set forth in Section 3 which are potential triggers of the New Lease Term Commencement Date, and if on the Fixed Date the Landlord’s Work is not Substantially Complete due to any reason other than a Tenant Delay, the Fixed Date shall be extended on a day-for-day basis for each day of the delay in the Substantial Completion of the Landlord’s Work caused by any reason other than a Tenant Delay. The provisions of this Section 10(G) shall not affect, postpone or delay a triggering of the New Lease Term Commencement Date under Section 3 due to Tenant having occupied the Additional Leased Premises. In addition, Tenant acknowledges that Landlord shall not be able to commence the performance of the Landlord’s Work until the Final Plans have been agreed to by the parties pursuant to Section 10(D) and Landlord acknowledges that Tenant cannot review plans until they have been provided by the Landlord. It is the parties’ intent that while the Landlord shall have

7

no penalties for any delay which is the fault of Landlord or any reason beyond the parties’ reasonable control, neither shall Tenant be obligated to pay rent if Substantial Completion is delayed for any delay which is not a Tenant Delay.

11.Option to Extend. Notwithstanding anything contained in the Lease to the contrary, Tenant is hereby given the option to extend the Term of the Lease for the Leased Premises (comprising both the Current Leased Premises and the Additional Leased Premises) for two (2) option terms of five (5) years each (each an “Extension Term” and together the “Extension Terms”). Tenant shall provide Landlord with prior written notice of at least fifteen (15) months of its intention to exercise an Extension Term. The foregoing is in lieu of the existing Lease extension or renewal provisions.

All terms and provisions of the Lease shall apply to the Extension Terms (including, but not limited to, additional rent for Operating Costs, Taxes and the like), except for the amount of Base Rent, which shall be equal to ninety-five percent (95%) of the then fair market rental value of the Leased Premises determined as provided for below, and shall be paid in equal monthly installments equal to one-twelfth (1/12) the annual amount. In no event, however, shall the Base Rent for an Extension Term be less than the Base Rent payable for the prior lease year in the prior Term.

Upon Tenant’s exercising its option to extend the Lease for an Extension Term, Tenant and Landlord shall attempt to agree in writing upon the fair market rental value for the Leased Premises. In the event that Tenant and Landlord cannot for any reason agree in writing to such fair market rental value on or before the date which is twelve (12) months prior to the then applicable termination date of the Lease (the “Adjustment Date”), the fair market rental value for the applicable Extension Term shall be determined by binding appraisal as follows:

A.Either of Landlord or Tenant may give the other written notice after the Adjustment Date designating an independent appraiser (“First Appraiser”). The other party shall within thirty (30) days thereafter designate a second independent appraiser (“Second Appraiser”) and the First Appraiser and Second Appraiser so designated or appointed shall meet within thirty (30) days after the date that the Second Appraiser is appointed. If, within ninety (90) days after the date that the Second Appraiser is appointed, the First Appraiser and Second Appraiser do not for any reason agree in writing upon the then fair market rental value of the Leased Premises, they shall themselves appoint a “Third Appraiser” who shall be a competent and impartial person; and in the event of their being unable to agree upon such appointment within twenty (20) days after the time aforesaid, the Third Appraiser shall be selected by the parties themselves if they can agree thereon within a further period of twenty (20) days. If the parties do not so agree then either party, on behalf of both, may request such appointment by the then Chairman of the Rhode Island Board of Real Estate Appraisers or any similar Board.

B.In the event of the failure, refusal or inability of any appraiser to act, a new appraiser shall be appointed in his stead, which appointment shall be made by the same party and in the same manner as hereinbefore provided for the appointment of such appraiser so failing, refusing or being unable to act. Each party shall pay the fees and expenses of the one of the two original appraisers appointed by such party, or in whose stead, as above provided, such

8

appraiser was appointed, and one-half of the fees and expenses of the Third Appraiser, and all other expenses, if any, shall be borne equally by both parties. Any appraiser designated to serve in accordance with the provisions of this option to extend shall be disinterested, shall be qualified to appraise commercial real estate in Providence, Rhode Island of the type covered by this option to extend, shall be a member of the American Institute of Real Estate Appraisers (or any successor association or body of comparable standing if such Institute is not then in existence), and shall have been actively engaged in the appraisal of commercial office real estate in Rhode Island for a period of not less than five (5) years immediately preceding his appointment. Each party will also pay their own attorneys’ fees.

C.The appraisers shall determine in writing the fair market rental value of the Leased Premises as of the date of appraisal, taking into consideration the condition of the Leased Premises and Building, the available parking and other Common Areas and appurtenant rights and other applicable factors. A written decision joined in by two of the three appraisers shall be the decision of the appraisers and shall be binding on the parties. After reaching a written decision, the appraisers shall give written notice thereof to Landlord and Tenant.

D.If the appraisers fail for any reason to reach a written decision within forty-five (45) days after the appointment of the Third Appraiser, the appraisers shall average the three appraisals if no appraisal is more than ten (10%) percent in variation from the other two (2) appraisals and such average shall be the fair market rental value of the Leased Premises. If there is any such variation of more than ten (10%) percent, the fair market rental value shall be the average of the two closest appraisals.

Notwithstanding the foregoing, the Landlord and the Tenant may at any time terminate the aforesaid appraisal process should they agree in writing on a fair market rental value for the Leased Premises for the Extension Term. In the event for any reason whatsoever the parties have not executed a written instrument setting forth the Base Rent for the Extension Term by the originally scheduled termination date for the then current Term (including, without limitation, as a result of any dispute or disagreement as to the Base Rent for the Extension Term), Tenant shall continue pay the Base Rent payable for the last year of the then current Term (together with all additional rent), and when the new Base Rent for the Extension Term has been determined, Tenant shall pay to Landlord any underpayment within a period of thirty (30) days. Such adjustment shall be made and calculated effective as of the first day of the Extension Term. Landlord and Tenant shall execute an amendment to this Lease within five (5) business days after the determination of the Base Rent for the applicable Extension Term. Said amendment shall be prepared by Landlord. Except as set forth above, the Extension Term shall be subject to all of the terms and conditions of this Lease; provided, however, that Tenant shall have no further extension rights once it has exercised its option to extend for the second Extension Term.

12.Right of First Offer. Should Landlord desire to lease to any third party any office and/or retail space in Buildings 51 and 52 located on the Project land and described on Exhibit C attached hereto and incorporated herein by reference (the “ROFO Additional Space”), Landlord shall notify Tenant in writing (referred to herein as the “ROFO Notice”) of its intention to lease such space. The ROFO Notice shall contain a plan showing the applicable ROFO Additional Space and set forth the rentable square footage thereof, the proposed base rent

9

and additional rent for Taxes and Operating Costs (including any applicable base year for purposes of the calculation thereof), the proposed amount of any tenant improvement allowance, security deposit, lease term and options to extend (the foregoing items are collectively referred to herein as the “Minimum Terms”) and any additional provisions desired by Landlord. Notwithstanding the foregoing, Landlord may execute a new lease or extend or modify any existing lease with any existing tenant for the premises then leased by such tenant under its existing lease that if vacant would be deemed ROFO Additional Space without triggering Tenant’s rights under this Section or Landlord’s obligation to provide Tenant with a ROFO Notice. Tenant shall also not be entitled to a ROFO Notice if Tenant is in default under this Lease. Upon receipt of the ROFO Notice, Tenant shall have twenty (20) days to notify Landlord in writing that Tenant is: (a) exercising its right of first offer pursuant to the terms of this Section, (b) declining its right of first offer pursuant to the terms of this Section, or (c) seeking modifications to the proposed terms which Tenant would accept. Tenant’s failure to respond within such period shall be deemed to be a decline of the right of first offer. If Tenant seeks modifications to the proposed terms, Landlord shall respond within ten (10) days of receipt of Tenant’s proposed modifications as to which modifications Landlord will and will not accept, Tenant agreeing, however, that Landlord is not obligated to agree to any such modifications. Tenant shall have ten (10) days from receipt of Landlord’s response to accept or reject the terms of Landlord’s response. If Tenant fails for any reason to agree in writing to accept Landlord’s response within such ten (10) day period, Tenant will conclusively be deemed to have rejected same. Landlord’s failure to provide any response within Landlord’s aforesaid ten (10) day period to provide a response shall be deemed a rejection by Landlord of Tenant’s proposed modifications. If Tenant exercises its right of first offer in a timely manner and within the initial forty-eight (48) months of the initial eleven (11) year Term described in Section 4 hereof, Tenant shall lease the applicable ROFO Additional Space pursuant to all of the terms and provisions of the Lease, as modified by this Amendment, including, without limitation, with respect to the Term, Base Rent and additional rent; provided, however, the Base Year for Operating Costs and the Base Taxes amount shall be the same as applies to the Additional Leased Premises. In addition, the Tenant Allowance will be proportionately reduced based on the remaining months of the initial eleven (11) year Term. If, however, Tenant exercises its right of first offer in a timely manner subsequent to the initial forty-eight (48) months of the Term, the annual Base Rent for the ROFO Additional Space shall be the rental rate and other terms, including the amount of any tenant improvement allowance and the length of the lease term, as specified by Landlord in the ROFO Notice.

Upon Tenant sending such notice to Landlord, Tenant will be deemed to have agreed to lease the ROFO Additional Space upon the terms set forth above. If Tenant fails to for any reason accept Landlord’s offer as set forth in the ROFO Notice pursuant to written notice given on a timely basis, Landlord shall thereupon be free for a period of one hundred eighty (180) days to lease the applicable ROFO Additional Space covered by the ROFO Notice to a third party on terms no more favorable to such party than the Minimum Terms proposed to Tenant in the ROFO Notice; provided, however, Landlord may discount the annual Base Rent and other economic terms by up to 10% and increase any tenant improvement allowance by up to 10%. If Landlord intends to discount the annual Base Rent by more than 10% or increase any tenant improvement allowance by more than 10%, Tenant shall again have the right of first offer to lease the applicable ROFO Additional Space covered by the ROFO Notice as provided herein. If

10

Landlord fails to execute a lease as of the expiration of said one hundred eighty (180) day period (the “Revival Date”), Tenant’s first offer rights shall again apply. The annual base rent and additional rent, including, but not limited to, additional rent for taxes and operating expenses as defined and described in Landlord’s ROFO Notice to Tenant after the aforesaid initial forty-eighth (48th) months of the Initial Term as well as the other Minimum Terms and additional provisions contained therein (including the amount of any tenant improvement allowance), shall be the amounts to be paid by Tenant and the other applicable lease provisions for the applicable ROFO Additional Space, even if the additional rent is to be paid without a base year and covers a broader category of items. Tenant and Landlord shall, within ten (10) business days after the date of Tenant’s notice to Landlord that it has exercised its right of first offer hereunder with respect to the applicable ROFO Additional Space, execute an amendment to the Lease, which amendment shall confirm the foregoing agreement of Tenant and add the applicable ROFO Additional Space to the Lease as part of the Leased Premises for all purposes including the calculation of the Tenant’s Proportionate Share and the payment of additional rent for Taxes and Operating Costs. In the case of an exercise by Tenant of its rights under this Section subsequent to the initial forty-eight (48) months of the initial eleven (11) year Term, if the proposed initial term for the ROFO Additional Space to be leased by Tenant pursuant to the exercise of the foregoing right of first offer extends beyond the end of the Term of the Lease, Tenant’s exercise of the within right of first offer shall be conditioned upon Tenant’s exercising its option to extend the Term of the Leased Premises to the extent necessary so as to make it coterminous with the proposed initial term with respect to the ROFO Additional Space as set forth in the ROFO Notice. In such event the annual base rent during such extension of the Term beyond the initial Term for the Leased Premises (excluding the ROFO Additional Space, the base rent for which shall be the amount specified in the ROFO Notice) shall be the fair rental value determined pursuant to the procedure set forth in Section 11 hereof with Tenant being deemed for such calculation purposes to have exercised its option to extend on the first day of the last year of the Term. Upon the expiration of such new Term for the Leased Premises (including the ROFO Additional Space), Tenant shall have the option to extend set forth in Section 11 hereof; provided, however, if the Term of the Lease has been extended for five (5) or more years as provided above in order to cause the Lease to be coterminous with the initial term of the first offer with respect to the ROFO Additional Space, Tenant will be deemed to have exercised one (1) of its options to extend under Section 11. The term “Leased Premises” as used in the Lease shall be deemed to refer to each applicable ROFO Additional Space leased by Tenant pursuant to this Section.

Notwithstanding anything contained herein to the contrary, this Section and the within right of first offer as well as the right to lease the ROFO Additional Space as aforesaid may not be assigned apart from the Lease and shall automatically expire on the date of the expiration of such right or the earlier termination of the Lease.

13.Security Deposit. If Tenant fails to timely exercise its right to extend the Term for either of the two (2) Extension Terms; or if Tenant does elect to exercise both Extension Terms, but fails for any reason to enter into a written lease extension agreement with Landlord for the period subsequent to the end of the Second (2nd) Extension Term by the date which is not later than the expiration of the first year of the Second (2nd) Extension Term, Tenant shall be

11

required to post a security deposit with Landlord equal to one (1) months then applicable Base Rent.

14.Parking. Notwithstanding anything contained in the Lease to the contrary, Tenant shall have the right, at no additional cost, to four (4) non-exclusive parking spaces per 1,000 rentable square feet of the Leased Premises, which parking ratio shall include visitor and handicap spaces.

15.Signage. In addition to the signage rights granted to Tenant pursuant to the terms of the Lease, the parties agree subsequent to the date hereof to reasonably negotiate a modification to the existing pylon signs for the Project. The modified pylon signs would permit Tenant to install, at its cost, a replacement panel for Tenant, which replacement panel shall also be reasonably negotiated by the parties. Tenant shall also have the right to relocate its primary entrance sign located at the Current Leased Premises to the area above the main entrance of Building #51 located on the Project, which removal and relocation shall be approved in advance and in writing by Landlord. Any required modification to the existing pylon structures and all removal and/or installation of signage by Tenant shall be performed at Tenant’s sole cost and expense and in a diligent and good and workmanlike manner and in accordance with all applicable laws, ordinances and regulations. Tenant shall also reimburse Landlord for Tenant’s pro rata share of the cost to modify the pylon signs, with such pro rata share to be based upon the percentage that the square footage of the panel for Tenant on each pylon bears to the total square footage of all tenant panels which can be installed in each pylon. Tenant shall be solely responsible to obtain at Tenant’s cost any permits or approvals required for any such signage.

16.Restoration of the Leased Premises. Notwithstanding anything contained in the Lease to the contrary, Tenant shall not be required to remove any improvements at the Leased Premises at the expiration of the Term, as the same may be extended, that have been approved by Landlord in writing to remain at the Leased Premises. In conjunction with such written approval, Landlord may specifically list items that are to be removed from the Leased Premises by Tenant. Tenant shall, at Landlord’s request, remove all low-voltage cabling in the Leased Premises upon the expiration of the Term, as the same may be extended.

17.Superior Lease. Tenant acknowledges that Landlord is the tenant with respect to that certain Amended and Restated Lease, dated February 28, 2007, as amended pursuant to that certain First Amendment to Amended and Restated Lease, dated November 9, 2007, a notice of which was recorded in the Office of the Recorder of Deeds of the City of Providence in Book 8570, Page 93, and with an amended notice thereof having been recorded in said Recorder of Deeds Office in Book 8911, Page 209 pursuant to which the prior owner and holder of fee simple title, American Locomotive HH LLC, a Delaware limited liability company (the “Prior ALCO Fee Owner”) master leased the Project to the Landlord (the foregoing Amended and Restated Lease, as amended, is hereinafter collectively referred to as the “Superior Lease”. The Superior Lease is the lease referenced in Section 16.4 of the Lease. This Section 17 replaces said Section 16.4. The interest of the Prior ALCO Fee Owner under the Superior Lease was assigned by such party to Foundry ALCO Members, LLC, a Rhode Island limited liability company (the “Successor Landlord”) pursuant to an assignment document, dated October 16, 2013. The Successor Landlord has joined in the execution of this Lease for purposes of this Section.

12

Tenant agrees that, upon the expiration or earlier termination of the Superior Lease, this Lease shall thereupon automatically become a direct lease by and between the Successor Landlord (and its successors and assigns) and Tenant. Tenant agrees to execute any document reasonably requested by the Successor Landlord to confirm the foregoing.

18.Broker. Subject to the execution of this Amendment by Landlord and Tenant, Landlord shall pay a brokerage commission to CB Richard Ellis - N.E. Partners, LP (“CBRE”) in accordance with a separate agreement between Landlord and CBRE. Landlord and Tenant each represent that it has only dealt with CBRE in connection with this Amendment.

19.Time of the Essence. The parties agree that time is of the essence in the Lease.

20.Ratification. Except as amended hereby, Landlord and Tenant hereby ratify, confirm and approve of the Lease as a binding and enforceable document in accordance with its terms. The parties agree that time is of the essence for all purposes of the Lease.

[Remainder of Page Intentionally Left Blank]

13

IN WITNESS WHEREOF, the parties have executed this Amendment as a sealed

instrument as of the date set forth above.

LANDLORD

ALCO CITYSIDE FEDERAL, LLC,

a Rhode Island limited liability company

By its non-member manager,

FOUNDRY ALCO MANAGER, LLC,

A Rhode Island limited liability company

By: /s/ Thomas F. Guerra

Name: Thomas F. Guerra

Title: Managing Member

TENANT

UNITED NATURAL FOODS, INC.,

a Delaware corporation

By: /s/ Thomas A. Dziki

Name: Thomas A. Dziki

Title: CHRSO

The undersigned Successor Landlord joins in the execution of this Lease to consent to Section

17.

FOUNDRY ALCO MEMBERS, LLC, a Rhode Island limited liability company

By its managing member,

The Foundry Associates, L.P., a Rhode Island limited partnership

By: /s/ Thomas F. Guerra

Thomas F. Guerra

Managing General Partner

14

EXHIBIT A

(Plan Showing the Additional Leased Premises)

EXHIBIT B-1

Landlord’s Work

Project Manual and Specifications for Bid & Construction, dated October 22, 2014, prepared by Durkee Brown Viveiros Werenfels Architects (“Durkee Brown”).

Construction Documents, including Drawings, dated October 20, 2014, prepared by Durkee Brown. See the attached list of drawings.

EXHIBIT B-2

Existing Draft of the Floor Plan

See Exhibit B-1.

EXHIBIT C - PARCEL 1

(Project Land)

PROPERTY DESCRIPTION

A.P. 27, Lot 262(A)

Valley Street & Hemlock Street

Providence, Rhode Island

That certain tract or parcel of land situated on the southerly side of Valley Street and the westerly side of Hemlock Street, in the City of Providence, Providence County, State of Rhode Island and Providence Plantations, more particularly bounded and described as follows;

Beginning at an iron rod marking the intersection of the southerly street line of Valley Street with the westerly street line of Hemlock Street, said point being the most northeasterly corner of the parcel herein-described;

thence proceeding S 0207’03” W, by and with the westerly street line of said Hemlock Street, a distance of two hundred fifty six and 04/100 (256.04’) feet to land now or formerly of American Locomotive HH, L.L.C. and the most southeasterly corner of the parcel herein-described;

thence proceeding S 8928’48” W, bounded southerly by the said American Locomotive land, a distance of four hundred eighty four and 03/100 (484.03’) feet, to land now or formerly owned by Precision Industries, Inc.;

thence proceeding N 1904’08” E, bounded westerly by the said Precision Industries, Inc. land, a distance of eighty four and 17/100 (84.17’) feet to an angle point;

thence proceeding N 0639’22” W, bounded westerly by the said Precision Industries, Inc. land, a distance of one hundred twenty one and 76/100 (121.76’) feet to a corner;

thence proceeding westerly along the arc of a curve deflecting to the left having a central angle of 26°26’39”, and a radius of 220.00’, an arc distance of one hundred one and 54/100 (101.54’) feet to a point of tangency;

thence proceeding S 7713’28” W, bounded southerly by the said Precision Industries, Inc. land, a distance of twenty seven and 05/100 (27.05’) feet to a point of curvature;

thence proceeding westerly along the arc of a curve deflecting to the left having a central angle of 16°11’51”, and a radius of 200.00’, an arc distance of fifty six and 54/100 (56.54’) feet to land now or formerly of the City of Providence;

thence proceeding N 1336’22” W, bounded westerly by the said City of Providence land, a distance of forty seven and 11/100 (47.11’) feet to the said southerly street line of Valley Street;

thence proceeding N 8320’38” E, by and with the said southerly street line of Valley Street , a distance of three hundred four and 07/100 (304.07’) feet to an angle point;

thence proceeding N 89°24’43” E, by and with the said southerly street line of Valley Street, a distance of three hundred sixty eight and 86/100 (368.86’) feet to the westerly street line of Hemlock Street and the point and place of beginning.

The above-described parcel contains 126,345 square feet (2.900 acres) of land.

EXHIBIT C - PARCEL 2

PROPERTY DESCRIPTION

A.P. 27, Lot 262(B)

Valley Street

Providence, Rhode Island

That certain tract or parcel of land situated on the southerly side of Valley Street, in the City of Providence, Providence County, State of Rhode Island and Providence Plantations, more particularly bounded and described as follows;

Beginning at a point in the southerly street line of Valley Street, said point being the most northwesterly corner of land now or formerly of the City of Providence and the most northeasterly corner of the parcel herein-described;

thence proceeding S 1336’22” E, bounded easterly by the said City of Providence land, a distance of fifty one and 38/100 (51.38’) feet to land now or formerly of Precision Industries, Inc.;

thence proceeding along the arc of a curve deflecting to the left having a central angle of 06°50’43”, and a radius of 160.00’, an arc distance of nineteen and 12/100 (19.12’) feet to a point of non-tangency;

thence proceeding S 1904’18” W, bounded easterly by the said Precision Industries, Inc. land, a distance of fifty three and 59/100 (53.59’) feet to land now or formerly of the City of Providence;

thence proceeding S 2919’13” W, bounded easterly by the said City of Providence land, a distance of thirty four and 96/100 (34.96’) feet to land now or formerly of American Locomotive HH, L.L.C.;

thence proceeding S 7343’54” W, bounded southerly by the said American Locomotive land, a distance of seventy and 58/100 (70.58’) feet to land now or formerly of Waterfire Providence;

thence proceeding N 3824’13” E, bounded westerly by the said Waterfire Providence land, a distance of forty nine and 78/100 (49.78’) feet to an angle point;

thence proceeding N 3513’13” E, bounded westerly by the said Waterfire Providence land, a distance of sixty two and 80/100 (62.80’) feet to an angle point;

thence proceeding N 1903’23” E, bounded westerly by the said Waterfire Providence land, a distance of fifty four and 00/100 (54.00’) feet to an angle point;

thence proceeding N 2556’12” W, bounded westerly by the said Waterfire Providence land, a distance of nineteen and 23/100 (19.23’) feet to the said southerly street line of Valley Street;

thence proceeding N 8320’38” E, by and with the said southerly street line of said Valley Street, a distance of twenty nine and 58/100 (29.58’) feet to the point and place of beginning.

The above-described parcel contains 5,853 square feet (0.134 acres) of land.

EXHIBIT C - PARCEL 3

PROPERTY DESCRIPTION

A.P. 27, Lot 278

Valley Street & Hemlock Street

Providence, Rhode Island

That certain tract or parcel of land situated on the westerly side of Hemlock Street, southerly of Valley Street, in the City of Providence, Providence County, State of Rhode Island and Providence Plantations, being delineated as “Lot 1” on that plan entitled “American Locomotive Works Minor Subdivision Plan A.P. 27 / Lot 85, 68 Hemlock Street, Providence, Rhode Island, Proj. No.: 2005 188 S17, Date: August 22, 2006 by Waterman Engineering Co. Richard S. Lipsitz, P.L.S. No. 1837,” which is recorded as Document No. 1000453 in the Land Evidence Records at the City of Providence, Rhode Island in Plat Book 76, Page 85.

EXHIBIT C - PARCEL 4

PROPERTY DESCRIPTION

A.P. 27, Lot 279

Valley Street & Hemlock Street

Providence, Rhode Island

That certain tract or parcel of land situated on the westerly side of Hemlock Street and southerly side of Valley Street, in the City of Providence, Providence County, State of Rhode Island and Providence Plantations, being delineated as “Lot 2” on that plan entitled “American Locomotive Works Minor Subdivision Plan A.P. 27 / Lot 85, 68 Hemlock Street, Providence, Rhode Island, Proj. No.: 2005 188 S17, Date: August 22, 2006 by Waterman Engineering Co. Richard S. Lipsitz, P.L.S. No. 1837,” which is recorded as Document No. 1000453 in the Land Evidence Records at the City of Providence, Rhode Island in Plat Book 76, Page 85.