Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Glori Energy Inc. | Financial_Report.xls |

| EX-32.1 - EXHIBIT 32.1 - Glori Energy Inc. | gloriexhibit3211.htm |

| EX-31.1 - EXHIBIT 31.1 - Glori Energy Inc. | gloriexhibit3111.htm |

| EX-32.2 - EXHIBIT 32.2 - Glori Energy Inc. | gloriexhibit3221.htm |

| EX-31.2 - EXHIBIT 31.2 - Glori Energy Inc. | gloriexhibit3121.htm |

| EX-14.1 - EXHIBIT 14.1 - Glori Energy Inc. | a141codeofethics.htm |

| EX-99.2 - EXHIBIT 99.2 - Glori Energy Inc. | a992cobbreport01-01x15.htm |

| EX-23.2 - EXHIBIT 23.2 - Glori Energy Inc. | gloriholdingsconsentletter.htm |

| EX-23.1 - EXHIBIT 23.1 - Glori Energy Inc. | a231fy2014gloriauditconsent.htm |

| EX-99.2 - EXHIBIT 99.2 - Glori Energy Inc. | a991collarinireport01-01x15.htm |

| EX-23.3 - EXHIBIT 23.3 - Glori Energy Inc. | a233consentofcobb.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

Form 10-K

(Mark One)

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the Fiscal Year Ended December 31, 2014

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

Commission File Number: 000-55261

GLORI ENERGY INC.

(Exact name of registrant as specified in its charter)

Delaware | 46-4527741 | |

(State or Other Jurisdiction of | (I.R.S. Employer | |

Incorporation or Organization) | Identification No.) | |

10350 Richmond Avenue, Suite 850 | ||

Houston, Texas 77042 | 77042 | |

(Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code (713) 237-8880

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

Common stock, par value $0.0001 per share | The NASDAQ Capital Market LLC |

Warrants | Other OTC |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

o Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

þ Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

þ Yes o No

Indicate by check mark if the disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer þ | Non-accelerated filer o | Smaller reporting company þ | |||

(Do not check if a smaller reporting company.) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12-b2 of the Exchange Act). o Yes þ No

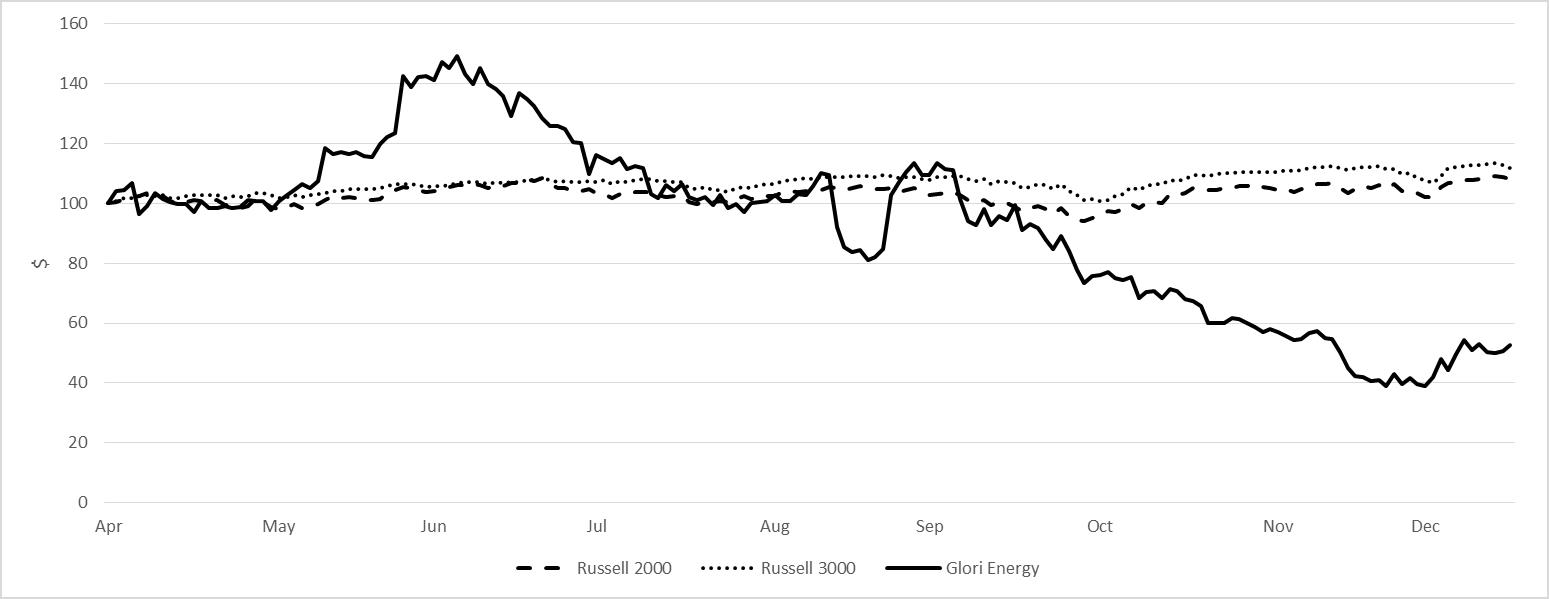

The aggregate market value of Common Stock held by non-affiliates of the Registrant on June 30, 2014 was approximately $146,974,000.

There were 31,571,357 $0.001 par value common shares outstanding on March 09, 2015.

Documents Incorporated By Reference

Portions of the registrant’s definitive proxy statement for its 2015 annual meeting of the stockholders, which proxy statement will be filed no later than 120 days after the close of the registrant’s fiscal year ended December 31, 2014, are hereby incorporated by reference into Part III of this Annual Report on Form 10-K.

INDEX TO FORM 10-K

Page | ||

As used in this report, “we,” “us,” “our,” the “Company” and “Glori” mean Glori Energy Inc. and our subsidiaries, unless the context indicates otherwise. | ||||

1

PART I

Item 1. Business

This Annual Report on Form 10-K and the documents incorporated herein by reference contain forward-looking statements based on expectations, estimates, and projections as of the date of this filing. These statements by their nature are subject to risks, uncertainties, and assumptions and are influenced by various factors. As a consequence, actual results may differ materially from those expressed in the forward-looking statements. See the risk factors set forth in Item 1A of this Annual Report on Form 10-K, Part II, Item 7A—Quantitative and Qualitative Disclosures About Market Risk and Part II and Item 7A—Special Note Regarding Forward-Looking Statements.

Overview

Glori Energy is a Houston-based energy technology and oil production company that deploys its proprietary AERO Technology to increase the amount of oil that can be produced from conventional fields at a substantially lower cost than traditional enhanced oil recovery methods ("AERO System"). Only about one-third of the oil discovered in a typical reservoir is recoverable using conventional oil production technology, leaving the remaining two-thirds trapped in the reservoir rock. Our AERO System technology stimulates the native microorganisms that reside in the reservoir to improve the recoverability of this trapped oil. The AERO System can reverse production declines and significantly increase ultimate reserve recovery at a low incremental cost per barrel. Glori owns and operates oil fields onshore in the U.S. where it deploys its technology, and additionally markets the AERO System as a technology service to exploration and production ("E&P") companies globally. Glori derives revenues from fees earned as a service provider of our technology to third party E&P companies, and also uses its technology to increase oil production in fields that we acquire and operate in the United States.

We intend to acquire and redevelop additional mature oil fields with historically long-lived, predictable production profiles that fit our criteria for the AERO System. We target mature sandstone assets onshore in the United States with good permeability and production supported by waterflood or waterdrive systems, or with clear potential for waterflooding. We believe our acquisition strategy can enhance the revenues, cash flows and returns from such oil fields through waterflood optimization and implementation of our AERO System of enhanced oil recovery. We believe this strategy will enable us to further demonstrate the efficacy of our AERO System while allowing us to capture the increase in revenues and ultimate recovery. We believe the acquisition of principally proved producing oil reserves, with production and cash flow history, is an economically attractive, low-risk complement to our service business which is dependent on customer adoption of the AERO System technology. Further, by owning our own oil properties, we can manage the implementation of AERO System in a controlled environment and accelerate the industry adoption of our technology.

Glori Energy Technology Inc., a Delaware corporation (formerly Glori Energy Inc.) ("GETI"), was incorporated in November 2005 (as successor in interest to Glori Oil LLC) to increase production and recovery from mature oil wells using state of the art biotechnology solutions.

In January 2014, GETI entered into a merger and share exchange agreement with Infinity Cross Border Acquisition Corporation ("INXB") and certain of its affiliates, Glori Acquisition Corp., Glori Merger Subsidiary, Inc., and Infinity-C.S.V.C. Management Ltd., as INXB Representative (such transaction, the "Merger"). On April 14, 2014, the Merger and share exchange agreement was closed and the merger was consummated. As part of the Merger, Infinity Cross Border Acquisition Corporation merged with and into Glori Acquisition Corp., with Glori Acquisition Corp. surviving the merger. Following that merger, Glori Merger Subsidiary, Inc. merged with and into GETI, with GETI surviving the merger. Following the Merger, GETI became the wholly-owned subsidiary of Glori Acquisition Corp., and Glori Acquisition Corp. adopted the name "Glori Energy Inc."

In March 2014, GETI incorporated Glori Energy Production Inc., a wholly-owned subsidiary of Glori Holdings Inc., to purchase the Coke Field Assets (as defined below) and incur the associated acquisition debt, as described in detail in NOTE 4 in Item 15 to Part IV of this Annual Report on Form 10-K.

Glori Energy Inc., GETI, Glori Oil (Argentina) Limited, Glori Oil S.R.L., Glori Canada Ltd., Glori Holdings Inc., Glori California Inc., OOO Glori Energy and Glori Energy Production Inc. are collectively referred to as the “Company”, "Glori", "Glori Energy", "we", "us", and "our" in this Annual Report on Form 10-K.

2

Glori's common stock is publicly traded on the National Association of Securities Dealers Automatic Quotation System (NASDAQ). Our corporate headquarters is located at 10350 Richmond Ave., Suite 850, Houston, Texas 77042. As of December 31, 2014, we had a total of 42 active employees consisting of 10 employees engaged in research and development, 23 employees in operations and 11 employees in management, business development and administrative positions. We make our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, filed or furnished pursuant to section 13(a) or 15(d) of the Securities Exchange Act of 1934, available free of charge on or through our website, www.glorienergy.com, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Additionally, we maintain our code of ethics and business conduct, audit committee charter, compensation committee charter, policy governing director qualifications and nominations, policy governing related person transactions, insider trading policy and corporate governance guidelines in the corporate governance section of our website. The SEC also maintains a website, www.sec.gov, which contains our reports, proxy and information statements and other information we have filed.

Glori Technology Services

Glori’s AERO System incorporates a dedicated field deployment unit designed to work with existing waterflood operations. Waterflooding is a commonly used process of injecting water into the reservoir in order to increase oil recovery. The AERO System does not have any significant new impact on the environment because it utilizes existing production equipment and infrastructure, and does not change the nature of the customer’s oil production operations. In an existing waterflooded oil field, implementation of the AERO System does not require the drilling of new wells nor does it require other significant new capital investment.

Glori believes its AERO System increases the oil production rate and the ultimate quantity of oil recovered over the life of the oil field, and extends the life of the field by integrating sophisticated biotechnology with traditional oil production techniques. Glori has performed extensive laboratory and field testing to validate, integrate and advance technology transferred from three different scientific groups that collectively represent decades of funded research and development. Glori’s technology is protected by several patents and patent applications. Glori and its collaborators, Statoil Petroleum AS, or Statoil, in Norway, The Energy and Resources Institute, or "TERI", in India, and Bio Topics S.A., in Argentina, have collectively applied AERO and predecessor technologies in more than 100 wells throughout the world. Glori estimates that these technology implementations have recovered over six million barrels of oil that would not have otherwise been recovered. Glori anticipates continuing to demonstrate results with its AERO System technology and expand its customer base as well as utilizing AERO System technology on its own oil fields.

Glori Market Opportunity

Glori’s market for its AERO System consists of domestic and international oil production from sandstone reservoirs with permeability greater than 75 milli-darcies which are under waterflood or are waterflood candidates.

Glori believes its AERO System represents the most cost effective enhanced oil recovery method from both a capital expenditure and an operating cost perspective. Glori believes that its primary competition for this sizable market is from traditional enhanced oil recovery technologies, such as gas injection and chemical injection, as well as from other microbial enhanced oil recovery methods. Glori believes that its AERO System is superior to traditional enhanced oil recovery technologies both economically and environmentally and that the AERO System is able to recover oil that traditional enhanced oil recovery methods cannot recover on an economic basis. Because the AERO System works with naturally occurring microbes in the reservoir, Glori believes its processes do not cause any damage to the environment. Glori also views its AERO System as presenting a lower capital expenditure profile than traditional enhanced oil recovery technologies because it requires no new meaningful infrastructure investment when deployed in an operating waterflood.

Technology

Oil Production

During the primary recovery stage, oil is produced through natural drive mechanisms. Recovery factor during this stage is low, typically about 10%. Secondary production generally begins once the pressure in the reservoir is insufficient to force the oil to the surface and is performed by adding external energy to the reservoir through injection of fluids, water or gas, to increase the reservoir pressure. Typical recovery factors in secondary production can reach 30%, depending on the properties of oil and the characteristics of the reservoir rock. About two thirds of the original oil in place remains trapped in the reservoir even after waterflooding.

3

Glori’s Technology

The AERO System acts to improve the performance of secondary production water floods by stimulating the native micro-organisms that reside in the reservoir to improve the recoverability of this trapped oil. Glori does not introduce specific microbes selected for its purposes, nor does it rely upon genetically-engineered microorganisms. Instead Glori adds customized nutrients to the reservoir to grow the existing indigenous microbes in that reservoir. Microbes residing in oil reservoirs have the natural ability to use oil as a food source to facilitate growth given the right conditions. Growth of microbes on the oil is a fundamental requirement for AERO System functionality. Because the oil acts as a food source, the bulk of ingredients to fuel the AERO System are already in the reservoir, limiting the externally added components to the specific nutrients Glori introduces and the injected water that constitutes the waterflood. The microbial growth and activities occur only where the oil is trapped. This process is complex and depends on several distinct groups of microbes performing specialized tasks in the chain of biological reactions. The complexity of the process makes it vulnerable to disruption from external changes in the surrounding environment. Glori leverages its knowledge of how to establish a consistent environment with the right characteristics for effective deployment of the AERO System in order to mobilize trapped oil.

As part of the implementation of the AERO System process, Glori scientists analyze the injection water and water treatment system at the candidate oil field to determine if the water quality is compatible with AERO System requirements. Glori does not need potable water for the AERO System to be successful, but it does need the water to be non-detrimental to the microbe’s desired activities.

When the analysis and process development for the candidate field have been completed, the project moves into the field deployment phase. Glori has designed its deployment systems to integrate with current oil field waterflood equipment to simplify installation. This has resulted in modular field units that can be customized for continuous input of nutrients to the reservoir. Glori’s field units are equipped with sensors to monitor performance remotely, which allows us to service oil fields efficiently in remote locations. The oil that is produced from the utilization of the AERO System is delivered to market using the existing wells and pipelines that are already available to the oil producer. The additional oil that is captured by the AERO System is not altered in the process. Glori has verified this process by continuous operation of an oil field pilot project for more than three years during which no significant change in the n-alkane distribution could be detected.

Depending on the amount of oil trapped in the reservoir, Glori expects the production benefits from AERO System deployment to be sustained over many years until the field becomes uneconomic. At this point, Glori believes up to an additional 20% of the previously trapped oil will have been produced. Although Glori currently applies the technology primarily to mature waterfloods, Glori anticipates further performance improvements when its AERO System process is initiated at an earlier stage of oil recovery.

Research and Development

Glori has made significant investments in the development of the AERO System and will continue to fund further technology development in the future. Deployment of the AERO System enables and activates key microbial functionalities within an oil reservoir. These functionalities mobilize otherwise trapped oil resulting in increased production of oil. The functionalities required for successful deployment of the AERO System will be analogous between different reservoir conditions, but the microbes performing them and the nutrients required to best stimulate their growth may be different. To understand this complex system of diverse microbes and their interactions requires understanding the molecular mechanisms at work. As Glori’s knowledge of the biochemistry of oil mobilization by the AERO System develops, it expects to have the ability to both improve current deployment strategies and deploy the AERO System in a greater range of reservoir conditions.

Glori’s research and development strategy seeks to extend the reach and effectiveness of the AERO System. Efforts towards this goal are focused on 1) continued optimization of implementation primarily focused on biology and chemistry of water used in injection systems Glori continues to make significant progress in developing a system to treat reservoir water for optimum performance, 2) exploring the limits of permeability, viscosity, and other key parameters to afford continued enhancements in field performance and increase the range of suitable projects, and 3) understanding the mechanism of residual oil release which will suggest areas for further improvements as well as afford data to build models to better predict field outcomes.

Glori’s research and development programs are designed to drive down costs per incremental barrel of oil produced by increasing oil yield and production rates as well as by increasing both the number of candidate oil fields and the scale of deployment.

In 2009, Glori entered into a technology cooperation agreement with Statoil, which has been replaced by an updated 2011 agreement, further extended in 2014. The collaboration agreements incorporates intellectual property and know-how that Statoil has been developing for many years.

4

In July 2014, Glori was awarded U.S. Patent 8,783,345, Microbial Enhanced Oil Recovery Delivery Systems and Methods, which provides patent coverage for additional methodologies in the successful implementation of the AERO technology. In September 2014, Glori was awarded U.S. Patent 8,826,975, Systems and Methods of Microbial Enhanced Oil Recovery, which affords key intellectual property protection for Glori's AERO technology. Glori owns the intellectual property (IP) rights of these patents and inventors include personnel from both Glori and Statoil.

Glori’s Competitive Strengths

• | Disruptive and proven technology: Glori believes that the AERO System is a transformative and disruptive innovation that manipulates the existing reservoir microbial communities to improve the recovery of oil in waterflood or water drive oil fields. Glori believes its AERO System is applicable in more oil fields than other existing enhanced oil recovery technologies. |

• | Attractive returns from acquisition of oil fields: Glori intends to acquire additional mature oil fields which are under waterdrive, waterflood or are good candidates for waterflood. By acquiring oil fields and implementing the AERO System technology, Glori can capture 100% of the increase in production, revenues and ultimate oil recovery, resulting in the potential for superior acquisition returns. Additionally, by acquiring its own fields, Glori expects to accelerate the industry adoption of its technology. |

• | Established commercial contracts: Glori customers include international oil companies and independent oil and gas companies in North America and Brazil. Glori's business does not depend on any particular customer. See also the discussion included in Item 1A under the heading "Our revenue to date has been derived from a limited number of customers, and the loss of any of these customers could materially harm our business, financial condition and results of operations." |

• | Profitable stand-alone economics: Glori’s current commercial application of the AERO System is profitable on a project level basis. The total operating cost per barrel, excluding minimal upfront capital costs, attributed to the use of Glori’s technology is minimal. Unlike many other emerging clean-energy technologies, successful commercialization of the AERO System does not depend on the availability of government subsidies or mandates. |

• | Capital-light technology: Unlike other enhanced oil recovery processes, the AERO System can be deployed to waterflood reservoirs with very little capital expenditure. The AERO System is applied to a reservoir by utilizing Glori’s field deployment module, which requires relatively minor capital investment. Glori believes its technology has the potential to create a sustainable source of additional economic oil production that will extend the lives of oil fields and related infrastructure for many years. |

• | Clean alternative to traditional enhanced oil recovery: Glori’s AERO System increases the oil recoverable from an existing field using infrastructure already in place. When deployed in a waterflood reservoir, no new wells need to be drilled, no new pipelines are laid, no new significant energy input is required into the process and there is no new disruption to the environment. Furthermore, because the activity is biological and occurs in the reservoir, there is minimal consequent carbon dioxide or greenhouse gas footprint. Once the application of the AERO System ends, the microbes in the reservoir are no longer supplied with nutrients and the reservoir will return to its pre-treatment status. By way of comparison, other enhanced oil recovery techniques require significant energy input, such as thermal injection, or significant additional infrastructure to implement, such as gas injection. In addition, other enhanced oil recovery techniques introduce new environmental impacts, in particular gas injection and chemical injection techniques, which result in a sizable carbon dioxide or greenhouse gas footprint or the addition of a large quantity of chemicals or polymers into the reservoir. |

• | Intellectual property position: Glori’s intellectual property, consisting of substantial know-how and trade secrets, is the result of decades of research and development by Glori, Statoil Petroleum AS, or Statoil, in Norway, The Energy and Resources Institute, or TERI, in India, and Bio Topics S.A., or Biotopics, in Argentina. Glori also has multiple patents and patent applications. Glori believes its intellectual property and decades of research provide it with a strong competitive advantage and creates a high barrier to entry. |

• | Experienced management and technical team: Glori’s management and technical team’s expertise includes microbiology, chemistry and biochemistry, microbial genomics, engineering, geology and geosciences, petroleum engineering, reservoir engineering and production management, and in their respective careers, Glori’s team members played key roles in the commercialization of dozens of successful large-scale industrial biotechnology and traditional oil field acquisition and development projects. |

5

Milestones and Commercialization Strategy

Technology Milestones

Confirmation of microbial activity: Glori has determined through field sampling and laboratory testing that essentially all hydrocarbon bearing reservoirs either contain microbes or can be injected with source water that does contain microbes that are capable of utilizing the residual hydrocarbon to grow, and in doing so create biomass as biofilms. Glori is continuously refining its methodologies to grow these microbes and Glori’s criteria for selection of nutrients to facilitate certain functionalities in the process. Below is a table that shows, from the sample set Glori has tested, 80% of hydrocarbon bearing reservoirs contain microbes suitable for enhanced recovery. For those that do not show evidence of viable microbes, there is associated “source water” (usually from a subterranean reservoir at a different depth from the target reservoir) that does contain viable microbes.

Improvement in oil recovery factors: Over the past five years, Glori has achieved a number of significant advances in its research and development effort. Glori’s application of technology progressed from small, discreet application at producing wells under a “huff and puff” process (whereby the nutrient mix is injected into a producer well which is then shut-in for a period of days to allow the microbes to grow before the well is re-opened to production), to full scale application at injection wells under a continuous injection process. In addition, Glori added microbial genomics and bioinformatics capabilities in its laboratory facilities to further advance Glori understanding of the microbial processes involved in oil mobilization.

Development of Glori’s AERO System technology: In 2010, Glori implemented its pilot commercial AERO System project in the field. In April 2011, Glori applied for patent protection of this technology. In 2012, Glori applied for two additional patents associated with exploitation of the AERO mechanism.

Commercialization Milestones

Demonstration of commercial application: First deployed in 2010 and subsequently deployed in multiple field projects, the AERO System has demonstrated improvements in oil production and decrease in decline rates in commercial demonstration projects in the USA and Canada. These AERO System implementations build on predecessor technology implementations that collectively account for over 100 treatments in different wells in multiple locations around the world. The AERO System performance is presented in SPE paper 144205 and has won recognition with multiple industry awards including winner of the Energy Institute 2013 Innovation Award, finalist in the World Oil Award for New Horizons, runner up for World Petroleum Congress Excellence in Innovation, winner Corporate LiveWire 2015 Innovations and Excellence in Oil and Gas and was named to the Global Cleantech Group 2013 Cleantech 100 report.

Commercialization Strategy

Glori’s mission is to use microbiology to efficiently recover large quantities of oil currently trapped in reservoirs using existing oil wells. To achieve this Glori intends to:

• | Acquire and operate oil fields: Deployment of the AERO System technology to its own oil fields will enable Glori to capture 100% of the revenues and cash flow benefit from the increased production and to generate enhanced acquisition returns. In October 2010, Glori acquired the North Etzold field to test and further develop the AERO System. To accelerate adoption of the AERO System, Glori plans to strategically acquire and develop additional mature oil fields in geographies that it expects will improve its portfolio of field successes. |

• | Expand Glori’s project portfolio: As of December 31, 2014, Glori had five customer projects in the Field Deployment stage and another seven projects in the Reservoir Analysis and Treatment Design phase. Glori expects to add additional projects that are currently in various stages of evaluation. Glori expects industry adoption to grow over time and as acceptance and recognition increases, it expects its AERO System revenues to grow significantly. |

• | Optimize Glori’s performance and expand the applicability of the AERO System: While Glori is already active on a commercial scale, it intends to continue to improve its performance and predictability of the AERO System additional customer projects and assets Glori acquires. Glori believes that in the future it will develop additional capabilities that will expand the types of fields to which it can apply its technology, such as expanding the applicability of Glori’s technology to heavier oils and carbonate reservoirs. |

6

AERO System Service Offering

Glori employs a two-step process to screen and evaluate an oil field for AERO System suitability, whether for an oil field to be acquired or for a customer. This process ensures a systematic, engineered and customized approach to technology deployment in each reservoir. The same process is used to screen an oil field acquisition.

Reservoir Analysis and Treatment Design Phase (Analysis Phase): Glori obtains representative oil and water samples from the reservoir as part of its screening process to evaluate AERO System potential. Samples are taken to Glori’s Houston laboratory where detailed geochemical analysis is performed. The heart of the Analysis Phase deals with microbiological activities, where the indigenous formation microbes are analyzed for functionality. The general activities for the Analysis Phase are:

• | Review field characteristics data; |

• | Perform a geological suitability analysis of the target structure; |

• | Collect samples from targeted wells; |

• | Conduct geochemical characterization of oil and water; |

• | Determine the presence of indigenous microbes in the reservoir fluids. |

• | Incubate and study indigenous microbes; and |

• | Develop an optimal nutrient package for field application including any needed modifications to the field injection water. |

Tests are performed at Glori’s Houston laboratory using microbes from the reservoir and nutrient media with the formation water and oil to verify AERO System performance under simulated reservoir conditions. Several iterations of tests are often performed to optimize the system compositions to achieve the optimal AERO System activity. If microbial growth appropriate for economical oil recovery can be demonstrated, the project then moves forward to the Field Deployment Phase. The Reservoir Analysis and Treatment Design phase typically takes an aggregate of two months to complete.

Field Deployment Phase: Once the viability of the AERO System is demonstrated in the Analysis Phase, a detailed project development plan is finalized, and the project proceeds to the Field Deployment Phase where the AERO System is initiated in the oil field to stimulate the indigenous microbes in the oil bearing reservoir.

Glori mobilizes skid-mounted injection equipment to the field location. This equipment has been specially designed and tested by Glori at its Houston facility, and may be manufactured by select third parties. The equipment is continuously monitored and operated remotely from Glori’s project command center in Houston. The equipment remains on the lease throughout the duration of AERO System activities. It is usually installed near the waterflood water injection plant where Glori’s microbial nutrient media are injected into waterflood flowlines for delivery to the reservoir.

Once initiated, Glori and its customer continually evaluate the technical, operational and economic results of the Field Deployment Phase activity. Assuming the project meets the desired criteria, Glori will work with the customer to prepare a project expansion plan, up to and including full-field deployment of the AERO System.

Typically, Glori starts the Field Deployment Phase as an initial field validation in a small section of a producing field. Results from the AERO System are typically detected within two to three months after it initiates the Field Deployment Phase. After the initial Field Deployment Phase field validation is complete, Glori may enter into a longer term contract with its customer to continue or expand the use of the AERO System throughout the oil field.

Oil field Acquisition Strategy

Glori intends to acquire and redevelop mature oil fields with historically long-lived, predictable production profiles. Glori believes it can enhance the revenues, cash flows and acquisition returns from such oil fields through well recompletions, secondary recovery, waterflood optimization and implementation of its AERO System of enhanced oil recovery. Glori also plans to selectively acquire fields which may have low current production but have (i) excellent reservoir qualities, (ii) significant original oil in place remaining, and (iii) provide opportunities to re-enter existing wells, return them to production, and deploy the AERO System to capture significant economic quantities of oil. Glori believes this strategy will enable it to further demonstrate the efficacy of its AERO System while allowing it to capture the increase in revenues and ultimate recovery. Often these mature fields have not been fully exploited and have not been exposed to enhanced oil recovery technologies.

7

Additionally, by owning its own oil properties Glori will be able to manage the implementation of the AERO System in a controlled environment and accelerate the industry adoption of the technology. Glori has assembled a team of oil industry professionals with extensive experience in all facets of acquiring and managing oil properties. Glori is seeking and evaluating acquisitions that fit its criteria for the AERO System. These fields are mature active waterdrive or waterflood fields, or assets with clear waterflood potential, sandstone reservoirs with good permeability and are located onshore in the United States. Glori’s acquisition team is developing a “pipeline” of potential acquisitions, both through direct private negotiations as well as the public bid process.

The AERO System and the efficiency it brings to oil production is central to the future of the combined business, as it gives Glori its competitive advantage in the field of enhanced oil recovery. As a result, Glori has taken steps to protect the underlying intellectual property.

The AERO System is based on intellectual property and know-how developed by Statoil (a multinational Norwegian company), and has been further developed and expanded through a collaboration agreement by Statoil and Glori scientists and engineers. Glori’s access to this underlying intellectual property includes access to certain key U.S. patents granted by a technology cooperation agreement with Statoil, dated April 11, 2011. This agreement gives Glori perpetual, irrevocable, royalty free licenses to U.S. patent 5,163,510 (Method of microbial enhanced oil recovery, issued 11/17/1992, expiration date 2/21/2011), U.S. patent 6,546,962 (Introduction of air into injection water, issued 4/15/2003, expected expiration 7/7/2020), and U.S. patent 7,124,817 (Method of treating a hydrocarbon bearing formation, issued 10/24/2006, expiration 11/3/2020). Glori holds three U.S. patents, US Patent 7,681,638 (Wellbore treatment for reducing wax deposits, expiration 6/12/2028), US Patent 8,783,345 (Microbial enhanced oil recovery delivery systems and methods, issued 7/22/2014, expected expiration in 2032), and US Patent 8,826,975 (Systems and methods of microbial enhanced oil recovery, issued 9/9/2014, expected expiration in 2032). US Patent 8,826,975 affords key intellectual property coverage for Glori’s AERO technology and effectively extends both the scope and coverage time of certain of the Statoil patents. In addition, Glori has filed two active U.S. patent applications, including U.S. Appl. No. 13/826827 (Ultra Low Concentration Surfactant Flooding, filed 3/14/13) and U.S. Appl. No. 13/827639 (Optimizing Enhanced Oil Recovery by the Use of Oil Tracers, filed 3/14/13).

Glori’s Properties

The following is a description of the meanings of some of the oil and gas industry terms used in Glori's Properties section of this Annual Report on Form 10-K and throughout the remainder of this Annual Report on Form 10-K.

Bbl | Barrels of oil or other liquid hydrocarbons. One barrel is 42 gallons of liquid volume. | |

Boe | Barrel of oil equivalent, determined by using the ratio of 6 Mcf of natural gas to one Bbl of oil. | |

MBbls | Thousand barrels of crude oil or other liquid hydrocarbons. | |

Mcf | Thousand cubic feet of natural gas. | |

MBoe | Thousand barrels of oil equivalent, determined by using the ratio of 6 Mcf of natural gas to one Bbl of oil. | |

Mmcf | Million cubic feet of natural gas. | |

In the fourth quarter of 2010, Glori acquired the North Etzold field, an oil field in Kansas, and in September 2012 Glori acquired the contiguous South Etzold field. The Etzold field is located in Seward County, Kansas and includes total acreage of 760 acres with an average Working Interest (as defined below) percentage of 100%. Current net production is approximately 10 Bbl per day. "Working Interest" means the right granted to the lessee of a property to explore for and to produce and own natural gas or other minerals. The Working Interest owners bear the exploration, development, and operating costs on either a cash, penalty or carried basis.

On March 14, 2014, Glori Energy Production Inc. closed the acquisition of the Coke Field Assets for a purchase price of approximately $40 million as described in detail in NOTE 4 in item 15 to part IV of this Annual Report on Form 10-K. In September 2014, Glori acquired three additional leases at Coke Field from a private seller for $2 million. For the month ended December 2014, the average net daily production associated with the Coke Field Assets was 505 Boe per day (approximately 99% oil and 1% natural gas). The Coke Field Assets are located in the East Texas basin in Wood County, Texas and include total acreage of 2,446, and have an average Working Interest percentage of 98.7% (the average of producing well Working Interest).

The Coke Field Assets are comprised of the majority of the Coke Field along with three leases in the Quitman Field. All leases are operated by the Company. The Coke Field is a salt dome structure discovered in 1942.

8

The primary oil producing zone has been the upper Paluxy formation at about 6,300 ft. which has a natural water drive. Glori became the operator of the Coke Field Assets on March 14, 2014. Glori’s Working Interest is 100% in all the Paluxy wells. The Sub-Clarksville formation occurs at about 4,100 ft and a unit has been formed across the whole field. Glori’s Working Interest in the Sub-Clarksville unit is 87.82%. Glori’s Working Interest is 100% in the three Quitman Field leases.

How Glori Evaluates Its Operations

Glori uses a variety of financial and operational metrics to assess the performance of its oil operations, including:

• | production volumes; |

• | realized prices on the sale of oil; |

• | lease operating expenses; and |

• | operating cash flow |

Oil and Natural Gas Production Volumes, Prices and Production Costs

Glori’s oil and natural gas production data presented below is based on the proved reserve reports as of January 1, 2013, 2014 and 2015 by William M. Cobb & Associates, Inc. for the Coke Field Assets and Collarini Associates for the Etzold field. Copies of the January 1, 2015 proved reserve reports prepared with respect to these properties are included as exhibits to this Annual Report on Form 10-K.

The following table sets forth our production volumes, net production prices and production costs of oil and natural gas produced by Glori for the years ended December 31, 2012, 2013 and 2014:

Year Ended December 31, | |||||||||||

2012 | 2013 | 2014 | |||||||||

Production data: | |||||||||||

Oil (MBbls) | 5 | 6 | 133 | ||||||||

Natural Gas (MMcf) | — | — | 72 | ||||||||

Total (MBoe) (1) | 5 | 6 | 145 | ||||||||

Average sales price per Bbl/Mcf: | |||||||||||

Oil | $ | 87 | $ | 92 | $ | 87 | |||||

Natural gas | — | — | $ | 2.43 | |||||||

Average production costs per Boe: | |||||||||||

Lease operating expense | $ | 96 | $ | 69 | $ | 46 | |||||

Production taxes | 4 | 4 | 4 | ||||||||

Depreciation, depletion and amortization | 19 | 28 | 27 | ||||||||

Impairment | $ | — | $ | 348 | $ | 91 | |||||

(1) Assumes a ratio of 6 Mcf of natural gas per barrel of oil.

Over time, production from a given well or formation decreases. Growth in Glori’s future production and reserves will depend on its ability to implement the AERO System and to continue to add proved reserves in excess of its production. Accordingly, one of Glori’s key focuses is on adding reserves through acquisitions. Glori’s ability to add reserves through development projects and acquisitions is dependent on many factors, including its ability to borrow or raise capital, obtain regulatory approvals, procure necessary equipment, materials, and personnel and successfully identify and consummate acquisitions. Please read “Risk Factors— Risks Related to our Business” in Item 1A in this Form 10K for a discussion of these and other risks affecting Glori’s proved reserves and production.

Drilling and Other Exploratory and Development Activities

Productive wells are producing wells plus other wells mechanically capable of production. As of December 31, 2014, Glori had 29 total gross and net productive wells. During 2012 and 2013, there was one productive well drilled at the Etzold Field and no exploratory wells drilled.

9

Delivery Commitments

Glori does not have any long-term commitments to provide a fixed and determinable quantity of oil under existing contracts or agreements.

Third Party Commitments

Subsequent to the purchase of the Coke Field, Glori hired a third party broker to secure a new first purchaser that would yield the highest price per barrel. Effective July 1, 2014, Glori entered into an agreement to sell all net oil production from its Coke Field Assets to a new third-party oil purchaser secured by this broker. Pursuant to this agreement, Glori owes the third party broker a 50% commission on the sales price difference between the two purchasers for one year. The new first purchaser agreement came into effect on August 1, 2014 through August 31, 2014 and continued month to month thereafter.

Oil and Natural Gas Data

Proved Reserves

Evaluation and Review of Proved Reserves. Glori has retained William M. Cobb and Associates, Inc., independent petroleum engineers, to provide an estimate of proved reserves for the Coke Field Assets as of January 1, 2014 and 2015 and Collarini Associates, independent petroleum engineers, to provide an estimate of proved reserves at the Etzold property as of January 1, 2013, 2014 and 2015.

Neither Collarini Associates nor William M. Cobb and Associates, Inc. own interests in any of Glori’s properties, nor are they employed by Glori on a contingent basis. A copy of the independent petroleum engineering firms’ proved reserve reports at January 1, 2015 are included as an exhibits to this Annual Report on Form 10-K.

The technical persons responsible for preparing Glori’s proved reserve estimates meet the requirements with regard to qualifications, independence, objectivity and confidentiality set forth in the Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserves Information promulgated by the Society of Petroleum Engineers.

Glori maintains an internal staff of petroleum engineers and geoscience professionals who work closely with its independent reserve engineers to ensure the integrity, accuracy and timeliness of the data used to calculate its proved reserves relating to its assets. Glori’s internal technical team members meet with its independent reserve engineers periodically during the period covered by the proved reserve report to discuss the assumptions and methods used in the proved reserve estimation process. Glori provides historical information to its independent petroleum engineers for its properties, such as ownership interest, oil and natural gas production, well test data, commodity prices and operating and development costs. Mr. Tor Meling, Glori’s Vice President of Reservoir Engineering, is primarily responsible for overseeing the preparation of all of Glori’s reserve estimates. Mr. Meling is a petroleum engineer with over 25 years of reservoir and operations experience, and Glori’s geoscience staff has an average of approximately 30 years of energy industry experience per person.

The preparation of Glori’s proved reserve estimates are completed in accordance with its internal control procedures. These procedures, which are intended to ensure reliability of reserve estimations, include the following:

• | review and verification of historical production data, which data is based on actual production as reported by Petro-Hunt L.L.C. (the prior owner and operator of the Coke Field Assets); |

• | preparation of reserve estimates by Mr. Meling or under his direct supervision; |

• | review by Glori’s Chief Executive Officer of all of its reported proved reserves at the close of each quarter, including the review of all significant reserve changes and new PUDs additions, if any; |

• | direct reporting responsibilities by Mr. Meling to Glori’s Chief Executive Officer; and |

• | verification of property ownership by competent legal counsel or individuals under counsel’s direct supervision prior to an acquisition. |

Estimation of Proved Reserves. Under SEC rules, proved reserves are those quantities of oil and natural gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible—from a given date forward, from known reservoirs and under existing economic conditions, operating methods and government regulations—prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. If deterministic methods are used, the SEC has defined reasonable certainty for proved reserves as a “high degree of confidence that the quantities will be recovered.”

10

All of Glori’s proved reserves as of December 31, 2014 were estimated using a deterministic method. The estimation of reserves involves two distinct determinations.

The first determination results in the estimation of the quantities of recoverable oil and natural gas and the second determination results in the estimation of the uncertainty associated with those estimated quantities in accordance with the definitions established under SEC rules. The process of estimating the quantities of recoverable oil and natural gas reserves relies on the use of certain generally accepted analytical procedures. These analytical procedures fall into four broad categories or methods: (i) production performance-based methods; (ii) material balance-based methods; (iii) volumetric-based methods; and (iv) analogy. These methods may be used singularly or in combination by the reserve evaluator in the process of estimating the quantities of reserves. Reserves for proved developed producing ("PDP") wells were estimated using production performance methods for the vast majority of properties. Certain new producing properties with very little production history were forecast using a combination of production performance and analogy to similar production, both of which are considered to provide a relatively high degree of accuracy. Non-producing reserve estimates, for developed and undeveloped properties, were forecast using either volumetric or analogy methods, or a combination of both. These methods provide a relatively high degree of accuracy for predicting proved developed non-producing and PUDs for Glori’s properties, due to the mature nature of the properties targeted for development and an abundance of subsurface control data.

To estimate economically recoverable proved reserves and related future net cash flows, Collarini Associates and William M. Cobb and Associates, Inc. considered many factors and assumptions, including the use of reservoir parameters derived from geological, geophysical and engineering data which cannot be measured directly, economic criteria based on current costs and the SEC pricing requirements and forecasts of future production rates.

Under SEC rules, reasonable certainty can be established using techniques that have been proven effective by actual production from projects in the same reservoir or an analogous reservoir or by other evidence using reliable technology that establishes reasonable certainty. Reliable technology is a grouping of one or more technologies (including computational methods) that has been field tested and has been demonstrated to provide reasonably certain results with consistency and repeatability in the formation being evaluated or in an analogous formation. To establish reasonable certainty with respect to our estimated proved reserves, the technologies and economic data used in the estimation of our proved reserves have been demonstrated to yield results with consistency and repeatability, and include production and well test data, downhole completion information, geologic data, electrical logs, radioactivity logs, core analyses, available seismic data and historical well cost and operating expense data.

Summary of Oil and Natural Gas Reserves.

The following table presents Glori’s proved oil and natural gas reserves as of December 31, 2012, 2013, and 2014 based on the proved reserve reports as of January 1, 2013, 2014 and 2015 by William M. Cobb & Associates Inc., Glori's independent petroleum engineering firm for the Coke Field Asses and Collarini Associates, Glori’s independent petroleum engineering firm for the Etzold field. All of Glori’s proved reserves are located in the United States. Glori’s estimates of net proved reserves have not been filed with or included in reports to any federal authority or agency other than the SEC in connection with this offering. Future exploration, exploitation and development expenditures, as well as future commodity prices and service costs, will affect the reserve volumes attributable to the acquired properties. The reserve estimates shown below were determined using a 12-month average price for oil and natural gas for the years ended December 31, 2013 and 2014.

December 31, | |||||

2013 | 2014 | ||||

Estimated Proved Reserves: | |||||

Oil (MBbls) | 18 | 1,402 | |||

Natural Gas (MMcf) | — | 54 | |||

Total (MBoe) (1) | 18 | 1,411 | |||

Estimated Proved Developed Reserves: | |||||

Oil (MBbls) | 18 | 1,402 | |||

Natural Gas (MMcf) | — | 54 | |||

Total (MBoe) (1) | 18 | 1,411 | |||

Estimated Proved Undeveloped Reserves: | |||||

Oil (MBbls) | — | — | |||

Natural Gas (MMcf) | — | — | |||

Total (MBoe) (1) | — | — | |||

(1) Assumes a ratio of 6 Mcf of natural gas per barrel of oil.

11

The changes from December 31, 2013 estimated proved reserves to December 31, 2014 estimated proved reserves reflect production during this period of approximately 145 MBoe. The increase in proved developed reserves is due to the purchase of the Coke Field Assets of approximately 1,792 MBoe. The change also includes the downward revision of PDP reserves due to an increase in costs incurred over our prior year reserve report.

Reserve engineering is and must be recognized as a subjective process of estimating volumes of economically recoverable oil and natural gas that cannot be measured in an exact manner. The accuracy of any reserve estimate is a function of the quality of available data and of engineering and geological interpretation. As a result, the estimates of different engineers often vary. In addition, the results of drilling, testing and production may justify revisions of such estimates. Accordingly, reserve estimates often differ from the quantities of oil and natural gas that are ultimately recovered. Estimates of economically recoverable oil and natural gas and of future net revenues are based on a number of variables and assumptions, all of which may vary from actual results, including geologic interpretation, prices and future production rates and costs. For risks associated with proved reserves see “Risk Factors” in Item 1A of this Annual Report on Form 10-K. Additional information regarding our proved reserves can be found in the notes to Glori’s financial statements included in Item 15 to Part IV of this Form 10-K and the proved reserve reports as of January 1, 2015, which are included as exhibits to this Annual Report on Form 10-K.

Oil & Gas Properties, Wells, Operations, and Acreage

Productive wells consist of producing wells and wells capable of production, including natural gas wells awaiting pipeline connections to commence deliveries and oil wells awaiting connection to production facilities. Gross wells are the total number of producing wells in which Glori has a Working Interest, and net wells are the sum of its fractional Working Interests owned in gross wells. As of December 31, 2014, Glori owned an average 99.2% Working Interest in 29 gross and 28.8 net productive wells.

Coke Field Assets

On March 14, 2014, Glori Energy Production, a newly created subsidiary of Glori Holdings Inc., a subsidiary of the Company, acquired certain oil, gas and mineral leases in Wood County Texas (the “Coke Field Acquisition”). In September 2014, we closed on the acquisition of a 74.8% net revenue interest in three producing leases and approximately 136.5 gross acres at the Coke Field from a private seller for $2 million. The leases contain two wells which had an initial production rate at acquisition of 27 barrels net of oil per day and one water injection well.

Etzold

We acquired a 100% Working Interest in the Etzold Field in October 2010, with our leasehold position located in Seward County, Kansas. We held approximately 760 gross (760 net) acres as of December 31, 2014, all of which are developed and either producing from or prospective for the Etzold Field.

Other

We paid out lease bonuses during 2014 in Texas in the amount of approximately $200,000 for the prospective rights to mineral operations consisting of 1,068 gross acres.

12

Gross, Developed and Undeveloped Acreage

The following table sets forth information as of December 31, 2014 relating to Glori’s gross, developed and undeveloped leasehold acreage:

Developed Acreage (1) | Undeveloped Acreage (2) | Total Acreage | |||||||||||||||

Gross (3) | Net (4) | Gross (3) | Net (4) | Gross (3) | Net (4) | ||||||||||||

Etzold Field | 760 | 760 | — | — | 760 | 760 | |||||||||||

Coke Field | 2,667 | 2,587 | — | — | 2,667 | 2,587 | |||||||||||

Other | — | — | 1,068 | 488 | 1,068 | 488 | |||||||||||

Total | 3,427 | 3,347 | 1,068 | 488 | 4,495 | 3,835 | |||||||||||

(1) | Developed acres are acres spaced or assigned to productive wells and does not include undrilled acreage held by production under the terms of the lease. Developed acres are determined on surface acres. |

(2) | Undeveloped acres are acres on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of oil or natural gas, regardless of whether such acreage contains proved reserves. |

(3) | A gross acre is an acre in which a Working Interest is owned. The number of gross acres is the total number of acres in which a Working Interest is owned. |

(4) | A net acre is deemed to exist when the sum of the fractional ownership Working Interests in gross acres equals one. |

The Coke Field

On March 14, 2014, Glori Energy Production Inc. closed the acquisition of the Coke Field Assets for a purchase price of approximately $40 million as described in detail in NOTE 4 in Item 15 in Part IV of this Annual Report on Form 10-K. The Coke Field Assets are in the East Texas Basin, located in Wood County, Texas, and include an average Working Interest percentage of 98.7% (average of Producing well Working Interest). As of January 1, 2015, the net proved developed producing oil and natural gas reserves associated with the Coke Field Assets based upon estimates provided by William M. Cobb & Associates, Inc. were 1,396 MBoe (approximately 99% oil and 1% natural gas). For December 2014 the average net daily production associated with the Coke Field Assets was 505 Boe per day (approximately 99% oil and 1% natural gas).

The Coke Field Assets are comprised of the majority of the Coke Field along with three leases in the Quitman Field. All leases are operated by Glori as of March 14, 2014. The Coke Field is a salt dome structure discovered in 1942. The primary oil producing zone has been the upper Paluxy formation at about 6,300 ft. which has a natural water drive. Glori’s Working Interest is 100% in all the Paluxy wells. The Sub-Clarksville formation occurs at about 4,100 ft and a unit has been formed across the whole field. Glori’s Working Interest in the Sub-Clarksville unit is 87.82%. Glori’s Working Interest is 100% in the three Quitman Field leases.

The Etzold Field

In the fourth quarter of 2010, Glori acquired the North Etzold field, a non-producing oil field in Seward County, Kansas as a greenfield lab for our AERO technology science team. This oil field has served as a controlled environment to implement revisions in technology and surface systems to accelerate development and adoption of Glori’s AERO System technology. Collarini Associates, one of Glori’s independent petroleum engineering firms, has estimated that as of January 1, 2015, proved reserves net to Glori’s interest in its property was approximately 15 MBoe, all of which were classified as PDP.

At December 31, 2014, the Etzold property was being assessed for long-term economic viability, with specific attention to reducing direct operating expenses primarily by continuing the initiative commenced in the second quarter of 2014 to reducing the number of wells being operated. These considerations included historical direct operating expenses and production history of each producing well. As a result of this effort, the direct production costs for the property have been reduced from approximately $76 per barrel in 2013 to approximately $56 per barrel in 2014, primarily due to significantly reduced electricity use as many of our previously uneconomic well were shut in. Etzold continued its intended role of providing a controlled environment for AERO implementation strategies, especially with respect to the quality of water used in the injection process.

As of December 31, 2014, no wells were in the process of being drilled (including wells temporarily suspended), and no waterfloods were in process of being installed.

13

Title to Properties

Prior to completing an acquisition of producing oil and natural gas leases, Glori performs title reviews on the most significant leases and, depending on the materiality of properties, it may obtain a title opinion, obtain an updated title review or opinion or review previously obtained title opinions. Glori’s oil and natural gas properties are subject to customary royalty and other interests, liens for current taxes and other burdens which it believes do not materially interfere with the use of or affect its carrying value of the properties.

Glori believes that it has satisfactory title to all of its material assets. Although title to these properties is or may be subject to encumbrances in some cases, such as customary interests generally retained in connection with the acquisition of real property, customary royalty interests and contract terms and restrictions, liens under operating agreements, liens related to environmental liabilities associated with historical operations, liens for current taxes and other burdens, easements, restrictions and minor encumbrances customary in the oil and natural gas industry, Glori believes that none of these liens, restrictions, easements, burdens and encumbrances will materially detract from the value of these properties or from its interest in these properties or materially interfere with its use of these properties in the operation of its business. In addition, Glori believes that it has obtained sufficient rights-of-way grants and permits from public authorities and private parties for it to operate its business in all material respects as described in this Annual Report on Form 10-K.

Facilities

Glori’s leases its headquarters in Houston, Texas, which comprises approximately 7,800 square feet and is leased through September 2016. Glori also leases its laboratory and warehouse facility which comprises approximately 17,000 square feet and is leased through May 2017. Glori believes its current facilities are adequate for its current needs and for the foreseeable future.

Item 1A. Risk Factors

Risk Factors Relating to our Business

Our business is difficult to evaluate due to its limited operating history.

Since our inception in November 2005, the majority of our resources have been dedicated to our research development and testing efforts, and we have only recently begun to transition into the early stages of (i) commercializing the AERO System and (ii) acquiring, restoring and operating mature oil fields that fit our criteria for the AERO System. In addition, we do not have a stable operating history that you can rely on in connection with your evaluation of our current business and future business prospects. Our business and prospects must be carefully considered in light of the limited history of the AERO System and our acquisition of mature oil fields, and the many business risks, uncertainties and difficulties that are typically encountered by companies that have uncertain revenues and are committed to focusing on research, development and technology testing for an indeterminate period of time.

Our proposed business strategies described in this Annual Report on Form 10-K incorporate our management’s current analysis of potential markets, opportunities and difficulties that we face.

We cannot assure you that our underlying assumptions accurately reflect current trends and conditions in our industry that the AERO System will be successful or that we will be able to profitably operate any oil fields that we acquire. Our business strategies may change substantially from time to time or may be abandoned as our management reassesses opportunities and reallocates resources. If we are unable to develop or implement these strategies, or if the AERO System becomes not economically viable, we may never achieve profitability. Even if we do achieve profitability, we cannot predict the level of such profitability, and it may not be sustainable.

We have incurred substantial losses to date, may continue to incur losses in the future and may never achieve or sustain profitability.

We have incurred substantial net losses since inception, including net losses of $11.9 million, $10.6 million and $18.7 million for the years ended December 31, 2012, 2013 and 2014 respectively, and these losses may continue. As of December 31, 2014, we had an accumulated deficit of $64.1million. We expect to incur additional costs and expenses related to the continued development and expansion of our business, including our research and development operations, the commercialization of the AERO System and the acquisition, restoration and operation of additional mature oil fields. Our ability to achieve profitability depends on our success in increasing industry acceptance of the AERO System and the completion and successful integration of oil property acquisitions. There can be no assurance that we will achieve profitability.

14

The AERO System has only been applied to a limited number of reservoirs, and the viability of the AERO System in a broader range of reservoirs is still uncertain.

Our AERO System has only been applied in a limited number of sandstone reservoirs to date. The future success of our business depends on our ability (i) to demonstrate that the AERO System has the ability to increase oil recovery on a more widespread basis, on a larger scale and on attractive economic terms and (ii) to profitably restore and operate any oil fields we may acquire. Reservoir characteristics differ and, consequently, certain elements of our services are specifically engineered for each reservoir. As a result, we may not be able to achieve results in other reservoirs consistent with those we have thus far achieved in the reservoirs where the AERO System has successfully been applied. For example, as discussed in detail below, in 2010, we acquired a non-producing oil field in Kansas known as the North Etzold field, which was to be used primarily as a field laboratory for the AERO System. The North Etzold field consisted of 14 shut-in wells which had been stripped of wellbore tubulars, artificial lift equipment and the associated oil and water processing and storage facilities. While the Phase 1 Recompletion resulted in a 45% increase in the daily production rate from the primary production well after implementation of the AERO System, the Phase 2 Recompletion, which was done simultaneously with the implementation of the AERO System, did not result in oil production sufficient to cover the direct production costs. Consequently, implementation of the AERO System could yield less favorable oil production rates and overall oil recovery results than those thus far achieved where the AERO System has successfully been applied.

The AERO System may not be commercially viable in marginally producing wells if the base and incremental production does not support the cost of operating such wells. Accordingly, the incremental oil associated with implementation of the AERO System will also continue only as long as oil can continue to be produced economically. Any inability to broaden our customer base and increase commercialization of the AERO System applications effectively or to realize sufficiently favorable oil recovery results in a significant number of other reservoirs, including those we may acquire, will limit the commercial acceptance and viability of the AERO System, which would materially harm our business, financial condition and results of operations.

The success of the AERO System is dependent upon the information we receive.

The success of an application of the AERO System to a particular reservoir is dependent upon information that we receive regarding the reservoir characteristics and geology. If this information is inaccurate, we may not be able to achieve results in such a reservoir consistent with those we have thus far achieved in the reservoirs where the AERO System has been applied successfully. With respect to our customers, because of the uniqueness of our technology and the early stage of its development, we must educate potential customers on our technology in order to be able to generate business. New customers generally prefer to initially test our technology in a small portion of their lowest-priority oil field.

Since our test only includes a small portion of the injection wells and production wells in the oil field, it is important that the customer be able to identify which injection wells are servicing the production wells in the test area. For example, on a recent project one of the customer’s production wells was subsequently determined to be outside of the sand-body structure, and therefore not directly connected to the reservoir, so any waterflooding or application of the AERO System could not be effective for that production well since water could not flow from the injection well to the production well.

We may have difficulties gaining market acceptance and successfully marketing the AERO System to our potential customers.

A primary component of our business strategy is to market the AERO System to oil producers. To gain market acceptance and successfully market the AERO System to oil producers, we must effectively demonstrate the commercial advantages of using the AERO System as an alternative to, or in addition to, other enhanced oil recovery methods. We must prove that the AERO System is a cost effective method of significantly increasing the amount of oil that can be recovered from a reservoir. If we are unable to demonstrate this to oil producers, we will not be able to penetrate this market, generate new business or retain existing customers. In addition, until the efficacy of our technology is more widely demonstrated we are likely to experience long sales cycles and long test cycles, which may harm our business, financial condition and results of operations.

Our revenue to date has been derived from a limited number of customers, and the loss of any of these customers could materially harm our business, financial condition and results of operations.

We have a limited number of customers. For the year ended December 31, 2014, all of our service revenue was generated from 15 customers. If any of these customers terminates or significantly reduces its business with us, or if we fail to generate new business, our business, financial condition and results of operations could be materially harmed. However, we intend to mitigate this risk by continuing to diversify our revenue stream by acquiring, restoring and operating mature oil fields that fit our criteria for the AERO System.

15

Oil prices are volatile, and a decline in the price of oil could harm our business, financial condition and results of operations.

Our results of operations and future growth will depend on the level of activity for oil development and production. Demand for the AERO System depends on our customers’ willingness to make operating and capital expenditures for waterflooding procedures and the AERO System. Our business will suffer if these expenditures decline. The recent decline in oil prices and the uncertainty about future oil prices may adversely affect the prices we can obtain from our customers or prevent us from obtaining new customers for our services. The decline in oil prices will result in a decrease in revenues from the Coke Field and from other oil fields we acquire and make it more difficult to acquire other oil fields. Our customers’ willingness to develop and produce oil using waterflooding and the AERO System is highly dependent on prevailing market conditions and oil prices that are influenced by numerous factors over which we have no control, including:

• | changes in the supply of or the demand for oil; |

• | the condition of the United States and worldwide economies; |

• | market uncertainty; |

• | the level of consumer product demand; |

• | the actions taken by foreign oil producing nations; |

• | domestic and foreign governmental regulation and taxes; |

• | political conditions or hostilities in oil producing nations; |

• | the price and availability of alternate fuel sources; |

• | terrorism; and |

• | the availability of pipeline or other takeaway capacity. |

Oil prices have historically been volatile and cyclical. A prolonged reduction in the price of oil will likely affect oil production levels and therefore affect demand for our services. In addition, a prolonged significant reduction in the price of oil could make it more difficult for us to collect outstanding account receivables from our customers. A material decline in oil prices or oil development or production activity levels could materially harm our business, financial condition and results of operations.

Oil fields, once acquired, may not be appropriate for our purposes or may have environmental or other liabilities associated with them that may negatively affect our business, financial condition and results of operations.

In addition to marketing the AERO System, we intend to acquire mature fields and implement the AERO System. We cannot assure you that the oil fields we acquire will result in commercially viable projects.

The potential of a given property to continue to produce oil or resume production of oil and to be adaptable to the AERO System cannot be determined with a high level of precision prior to our acquisition of the property. We will continue to perform due diligence reviews of the properties we seek to acquire in a manner that we believe is both consistent with practices in the industry and necessary to determine the characteristics of such properties and the viability of the oil fields for the application of the AERO System. However, these reviews are inherently incomplete and cannot assure us of the quality of the oil fields or of the likelihood of success of the AERO System in enhancing their production of oil. It is generally not possible for us to test a property or conduct an in-depth review of its related records as part of its acquisition. Even if we are able to complete an in-depth review and sampling of these properties, such a review may not reveal existing or potential problems or permit us to become sufficiently familiar with the properties to fully assess their potential for successful application of the AERO System.

Even when problems are identified, it may be necessary for us to assume known or unknown environmental and other risks and liabilities to complete the acquisition of such properties. In addition, since the properties we are targeting are older, mature oil fields, their existing infrastructure may be out of date, damaged, in need of repair or removed, and we could incur unanticipated costs to repair or replace this infrastructure. The discovery of any unanticipated material liabilities or remediation costs or the incurrence of any unanticipated costs associated with our oil field acquisitions could harm our results of operations and financial condition.

If water that is not toxic to microbes is not available at a well site, the AERO System will not work or will require additional costs either to clean the water or bring in non-toxic water to the AERO System to perform correctly and, therefore, may not be a viable option for some oil fields.

The AERO System requires non-toxic water to support microbial activity in the reservoir. The water used in waterflooding does not have to be potable water, but if suitable water is not being used, the AERO System will not work unless additional costs are expended to clean the water or to bring in water that is non-toxic. These additional costs may make the AERO System less cost effective or not cost effective for some oil fields. For example, in a recent implementation of the AERO System, the salinity of the produced water used in the waterflood operations was very high, making it toxic to most microbes.

16

While our customer began using water from an existing nearby water well to provide a better environment for the microbes, which made the AERO System more effective, we may not be able to provide non-toxic water to some oil fields, eliminating these oil fields as candidates for the AERO System.

The AERO System is currently usable only in oil reservoirs with specific characteristics, which limits the potential market for our services.

For an oil reservoir to be suitable for the AERO System, the reservoir must be waterflooded or a candidate for waterflooding, must be composed of sandstone, must have permeability greater than 75 milli-darcies and must have a suitable water source. This limits the potential market for our services, which may negatively impact our results of operations and profitability.

Our operations involve operating hazards, which, if not insured or indemnified against, could harm our results of operations and financial condition.

Our operations are subject to hazards inherent in our technology, including exposure to pressurized air that may be used in the AERO System equipment and pressurized fluids that may be associated with the water injection system, and to hazards typically associated with oil field service operations, oil field development and oil production activities, including fire, explosions, blowouts, spills and damage or loss from natural disasters, each of which could result in substantial damage to the oil producing formations and oil wells, production facilities, other property, equipment and the environment or in personal injury or loss of life.

These hazards could also result in the suspension of operations or in claims by employees, customers or third parties which could have a material adverse effect on our financial condition. Operations also may be suspended because of equipment breakdowns and failure of subcontractors to perform or supply goods or services.