Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Sunworks, Inc. | ex99-2.htm |

| EX-99.3 - EX-99.3 - Sunworks, Inc. | ex99-3.htm |

| 8-K - 8-K - Sunworks, Inc. | solar3d8k031015.htm |

Exhibit 99.1

Dear Fellow Solar3D Shareholder,

We have accomplished much in recent months here at Solar3D. The acquisition of SUNworks and MD Energy has helped us create a stronger revenue producing entity. We expect 2014 to close out with $19.5 – $20.5 million in revenues with positive adjusted EBITDA. We believe we are on the path to more than double that revenue figure for 2015 and we believe that positions us for continued growth and visibility.

As many of you know, in late February and early March, we completed a series of transactions that resulted in a listing on NASDAQ. These transactions were necessary to meet NASDAQ-listing standards. The reverse split helped meet the share price requirement and the public offering of $12.5 million raised capital and helped us meet the shareholders’ equity requirement. The purpose of the NASDAQ listing and offering is designed to take our company to a new level of competitive strength. Today, Solar3D is a well-capitalized, NASDAQ-listed company with a strong model for growth. We are highly confident that, as we continue to execute our business plan, we will remain well positioned to attract more attention and investments from institutional investors and analysts. We have taken these actions after careful consideration and in the belief that they are in the best interest of Solar3D and all of its shareholders.

One of our priorities for 2015 is to provide periodic updates to you on our progress and strategy. Our recent acquisitions, the appointment of a new Chief Financial Officer, and initiatives that further drive our sales and overall growth have had a positive impact on our business. Combined, they provide us with a distinct competitive advantage over other players in our space, and they substantiate the reasons why the Solar3D story is a compelling investment in the solar industry, which is experiencing explosive growth.

Solar Industry Poised for Explosive Growth in 2015

The solar market is vibrant, untapped and virtually unlimited. We believe Solar3D is on the forefront of a powerful market trend, one that is growing rapidly and possesses significant growth opportunities. Distributed solar has penetrated less than 1% of its total [addressable] market in the residential and commercial sectors. Our SUNworks operating division has gained brand popularity throughout California due to its commitment to excellent customer service and the ability to provide flexible cost savings to large commercial organizations. More recently, SUNworks has been contracted to perform commercial solar design and installation programs for two large-scale California-based companies, Innovative Produce, Inc. and Heidrick & Heidrick Properties, L.P.

There are many reasons supporting the meteoric rise of solar implementation on both the commercial and residential fronts. A recent article from Renewable Energy World, cited several factors contributing to the growth which include financial incentives available from federal, state and local governments, lower prices, a renewed emphasis on the reduction of greenhouse emissions, President Obama’s pro-green agenda, widespread adoption from utility providers, and a driven consumer base.

SLTD Shareholder Letter

Page 2 of 3

Growth-by-Acquisition

We are proud to announce the completion of the acquisition of another profitable solar energy systems energy provider, MD Energy (MDE), based in Rancho Cucamonga in Southern California. After several weeks of due diligence from both management teams, we have been able to successfully close this transaction to better capture the commercial market for the Southern California region. Similar to SUNworks, MD Energy designs, finances, monitors and maintains solar energy systems but outsources the physical construction of its projects. In 2014, MD Energy installed 14 solar energy systems totaling 3.35MW in capacity translating in a projected $6.5-7.0 million in revenues while generating a profit. We’re excited by this acquisition because it directly adds to our top line growth. and the acquisition also fills a unique niche with the general engineering skills, general building knowledge, and electrical contracting licenses that we’ve acquired. In 2015, California will become a global leader in solar power penetration, and we are well positioned to capitalize on that market. With the solar industry being highly fragmented with high demand in the California region, we continue to focus on acquisitions in California and Nevada so that we can obtain critical mass in the market.

Executive Appointments

On the management side, Tracy Welch recently joined the Company as Chief Financial Officer. Tracy possesses a reputation for strong financial leadership and expertise in completing and integrating acquisitions, which makes him a perfect fit for our growth-by-acquisition model. Tracy joins us after holding CFO and Treasurer roles at several large private and publicly held companies, including multi-billion dollar energy companies KN Energy and Smith International, and food giant Schwan’s. During his career, he has completed 36 transactions ranging in size from $10 million to $500 million, and brings invaluable experience in this space to Solar3D. His role at Solar3D will ultimately be to drive revenue and profit optimization.

Uplisting Onto A Major Exchange

As I mentioned, we took some major steps forward with our listing on NASDAQ. To achieve the listing, we raised $12.5 million in new equity capital. This equity capital provided us with the shareholders’ equity needed to meet NASDAQ’s listing standard. Without this funding, Solar3D would not have been able to uplist its shares at this time. As an added benefit, the equity raised has strengthened our balance sheet and better positioned the Company to execute our plan to accelerate growth. We believe this uplisting will enable Solar3D to attract a broader range of institutional investors, strengthen our financing flexibility, and provide greater liquidity for our shareholders.

Sales Initiatives for Growth

We’ve reported on the growing market opportunity due to widespread adoption of solar energy in the farming industry. The agricultural industry is no longer simply exploring solar as a potential means of saving energy costs, but actively pursuing the best options for their business. This commitment from farmers represents a substantial shift in the traditional way of thinking, and represents a significant sales opportunity for Solar3D. Additionally, our SUNworks operating division also announced the launch of the proprietary PowerPlay Plan, which is a customer service portal allowing individual users to review their current systems, access monitoring sites and, most importantly, submit and track referrals. Given the simplicity of this system, we believe it will drive organic growth and also retain our existing customers.

SLTD Shareholder Letter

Page 3 of 3

We are pleased with our operational and financial growth and reiterate our anticipated 2014 revenue to be approximately $20 million with revenue in 2015 projected to be $40-45 million based on existing and anticipated orders. Our business momentum remains stronger than ever and we are growing at a rate that is much faster than the current market, as we continue to consolidate and gain market share.

Given our management know-how and expertise, we are able to reduce our cost of customer acquisition to about half of the industry average which drives our share gain. What provides us with a distinct advantage is that we have a superior management team, a focus on optimizing customer economics, and a remarkable reputation for doing quality work. We are actively pursuing acquisitions and that, too, differentiates us from the competitors in the space.

For our future outlook, we believe this year will be another record revenue year for Solar3D and that we are on the path to building the next solar powerhouse. On behalf of the management team, we encourage you to pay close attention as we continue to execute on driving sales with our customers and creating value for our shareholders. Thank you for your continued support.

Warm Regards,

Jim Nelson, CEO, Solar3D

Forward Looking Statements

Matters discussed in this shareholder letter contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. When used in this press release, the words "anticipate," "believe," "estimate," "may," "intend," "expect" and similar expressions identify such forward-looking statements. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements contained herein. These forward-looking statements are based largely on the expectations of the Company and are subject to a number of risks and uncertainties. These risks include, but are not limited to, risks and uncertainties associated with: the impact of economic, competitive and other factors affecting the Company and its operations, markets, products, and prospects for sales, failure to commercialize our technology, failure of technology to perform as expected, failure to earn profit or revenue, higher costs than expected, persistent operating losses, ownership dilution, inability to repay debt, failure of acquired businesses to perform as expected, the impact on the national and local economies resulting from terrorist actions, and U.S. actions subsequently; and other factors detailed in reports filed by the Company.

|

Solar3D, Inc.

26 West Mission Street

Suite #8

Santa Barbara, CA 93101

(805) 690-9000

www.solar3d.com

|

Executive Summary

Solar3D, Inc. (NASDAQ: SLTD) is a leading provider of photovoltaic (PV) /solar power systems and solutions and the developer of a proprietary high efficiency solar cell. Solar3D's subsidiaries, through SUNworks and recent acquisition of MD Energy, Solar3D focuses on the design, installation and management of solar power systems for commercial, agricultural and residential customers. SUNworks is one of the fastest growing solar systems providers in California and has delivered hundreds of 2.5 kilowatt to 1-megawatt commercial systems and has the capability of providing systems as large as 25 megawatts. Solar3D is also developing a patent-pending 3-dimensional solar cell technology to maximize the conversion of sunlight into electricity. The Company's mission is to further the widespread adoption of solar power by deploying affordable, state-of-the-art systems and developing breakthrough new solar technologies. Solar3D empowers the customer through affordable ownership programs which offer many benefits over leasing by applying all available government incentives and flexible financing options. Solar3D has a successful business model that differentiates itself from its competitors and builds on a system that identifies and implements a profitable consolidation strategy to accelerate acquisitions to build Solar3D into the next solar powerhouse in an untapped industry. On March 4, 2015, Solar3D completed a public offering with help of Cowen and Company, LLC and raised $12.5 million and uplisted to Nasdaq.

|

Company Statistics

Ticker: SLTD (NASDAQ)

State of Incorporation: Delaware

Price: (3/04/15) $3.10*

52 Week Range: $0.05 - $3.75

Avg. Daily Volume (90 day): 1,656,260

Shares Outstanding: 17.7 M*

Market Cap: $54.8 M

* Effected a 1-26 reverse stock split on 2-25-2015 & Pricing of Public Offering 3-4-2015

Price & volume quotes from Yahoo! Finance and other reliable sources

Company Highlights

· 2014 - Completed acquisition of a Northern California solar installer in January 2014

· 2014 - Sales were approximately $20MM with positive adjusted operating profit and cash flow

· 2015 - Completed acquisition of a Southern California solar installer in February 2015

· 2015 - Sales are forecast to be $40-45MM, with positive cash flow in current subsidiaries

· Strong sales backlog and pipeline for 2015

· Actively speaking with acquisition candidates

· 2015 – Uplisted to NASDAQ March 2015

· 2015 – Public Offering raised $12.5 million

|

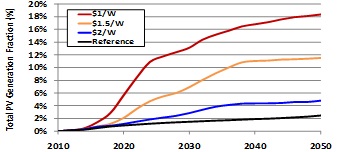

Investment Catalysts

Market Opportunity – Capturing an Unlimited Energy Source

The solar panel, or photovoltaic (PV), industry grew at a compound annual rate of 35% from 2000-2009, in spite of the global recession, PV installations grew by 73% in 2010, and by 65% in 2011. 2014 installations are forecast to be up 39% over 2013. Even with solar going mainstream and generating over 15 million MWh annually with an astounding growth rate, solar power still accounts for less than 1% of global electricity generation and only 0.38% of the total U.S electricity. According to Solar Energy Industries Association (SEIA), annual installation forecasts to be over 12 GW, or over $36 billion of annual PC industry revenue in the U.S. in 2016. CleanTechnica predicts that the global solar market is estimated to reach $137 billion in 2020. The market offers enormous potential and is virtually untapped and unlimited. According to GTM research/SEIA, about 47.5% of installation in Q3, 2014 were in California, by far the most of any state. California is the leading solar market in the U.S. and is poised to become a global leader in the coming years. Declining solar energy system costs and increasing retail electricity prices have made distributed solar energy a cost effective power source for both homeowners and business in an increasing number of markets. Solar provides an unlimited renewable energy source that saves money, reduces pollutions, and protects the environment. The solar market is growing rapidly and possess significant growth opportunities as compared to the total U.S. electricity market. Solar3D believes that there is a significant opportunity for distributed solar energy to increasingly displace traditional retail electricity generated from fossil fuels. Solar3D is on the fore-front of this powerful market trend with a growth strategy to acquire fast-growing regional solar providers and build a national solar company focused on the customer.

Superior Management Team

Solar3D is led by experienced industry veterans with extensive knowledge in energy, construction, clean-tech, private equity, global marketing and strategy, and much more. Solar3D’s executives and its subsidiary leaders have held high-level positions in top organizations and their involvement has included the expansion of multi-billion dollar companies, overseeing the raising of billions in capital, running their own successful companies and contributing to the expansion of the energy market. The team has extensive experience in acquiring companies and is positioned to provide the infrastructure for growth taking over back office support including purchasing, supplier relations, accounting, human resources, and other basic functions, to realize cost and strategic synergy, with a common approach to administration.

|

|

Management Team

James Nelson, Chairman & CEO

Mr. Nelson has 20+ years working in the private equity industry as a capital partner and operating CEO to portfolio companies. He began his career at Bain and Company, the premier business strategy consulting firm in the world, where he managed teams of consultants on four continents solving CEO-level programs for global companies. Formerly a General Partner at Peterson Partners and Millennial Capital Partners and has served on numerous boards of companies. Former VP of Marketing at Banana Republic/The Gap and managed company-wide marketing, and international expansion for Banana Republic. Former VP of Marketing and Corporate Development at Saga Corporation, a multi-billion dollar food service company. Mr. Nelson holds an MBA from Brigham Young University.

Tracy Welsh, Chief Financial Officer

A financial veteran with extensive energy industry experience. Has held CFO and Treasurer roles at large private and publicly held companies, including multi-billion dollar energy companies KN Energy and Smith International, and food giant, Schwan’s. During his career he has overseen the successful raise of billions in capital through private and public offerings and has completed 30+ transactions ranging from $10 million to $500 million.

Abe Emard, Subsidiary CEO & Co-founder, SUNworks

Abe is actively engaged in the design, installation and management of solar energy solutions for commercial, agricultural and residential customers. Former VP of Business Development at Emard Electric, Inc. Abe holds a construction management degree from UC Davis. He holds a Journeyman State Certified License and is a certified installer for Canadian Solar, Sharp, AE Solaron and PV Powered.

Daniel Mitchell, Subsidiary CEO & Founder, MD Energy

Daniel has over 28 years of extensive multi-discipline construction experience. He previously served as COO, Partner and Director for Fullmer Construction with over $2 Billion in gross sales for the last decade. Daniel has a wide ranging project portfolio in medial, manufacturing, warehouse, office, industrial and renewable energy. With 20 years as an electrical contractor and 14 years in general engineering and building, Daniel is ideal to serve the budding energy market.

Investor Relations Contact:

Andrew Haag

IRTH Communications

Phone: +1-866-976-4784

sltd@irthcommunications.com

Disclaimer: This fact sheet contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such statements are valid only as of today, and we disclaim any obligation to update this information. Actual results may differ significantly from management’s expectations.

|

Company Acquisitions

Solar3D has identified a growth-strategy that includes strategic acquisitions as being the most efficient model to fuel growth. The Company acquired Roseville-based SUNworks in Q1 2014 and added it to a subsidiary role capacity where in generated $8.5 million revenue in 2013 and is projected $20 million in revenue for 2014. In Q4 2014, Solar3D signed a definitive purchase agreement to acquire 100% of MD Energy (MDE), a Rancho Cucamonga-based company that is projected to bring in $6.5 million in revenue for 2014. In February 2015 Solar3D finalized the deal and completed acquisition of MD Energy.

Solar3D’s strategy for growth is to continue to expand the reach and penetration of our existing businesses as well as to acquire companies that are financially stable, quality oriented, profitable, and have a management team that is compatible with the Company’s existing team. The solar installations market is highly fragmented and Solar3D believes that there is an ideal opportunity to consolidate strong regional solar installers into a national publicly-traded powerhouse, which will create wealth for shareholders and installers and take advantage of a rapidly growing U.S. solar market, which is expected to exceed 200 gigawatts by the end of 2015, a 300% increase since 2011.

Uplisted to NASDAQ

In December 2014, Solar3D announced that it had retained Sichenzia Ross Friedman Ference LLP (SRFF), a top-ranked NYC-based securities law firm to advise on general securities matters, as well as a potential uplisting to a senior exchange. Solar3D completed a 1-26 reverse stock split on February 25, 2015 in preparation for uplisting onto Nasdaq. In March 2015, Solar3D announced pricing of public offering of units with the help of Cowen and Company, LLC which brought in approximately $12.5 million not including any future proceeds for the exercise of warrants. Solar3D uplisted to Nasdaq with its first day of trading on March 4, 2015.

Competitive Advantages

Beyond Solar3D’s strong business strategy and top management team, it also holds many direct advantages to its competitors.

· Customer acquisition: The cost for Solar3D to acquire a customer is about 30-44% lower than the industry average. Solar3D is excellent at canvassing and lead generation but really excels with informing the customer about solar technology, products through its “Smart Energy” Radio show and showing great detail and knowledge during presentations that result in a superior closing percentage. Solar3D has growing lists of commercial and industrial market to access and turn into sales leads.

· Reputation: Solar3D has a sterling reputation in the industry for having high integrity, great work ethic, and standing behind its work. Solar3D prides itself of delivering what it believes to be the highest quality installation at any price offering better quality and customer service by a substantial margin. Because of Solar3D’s customer-centric focus, its customers essentially sell for them with strong repeat clients and an active and loyal referral network.

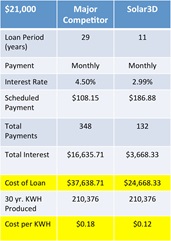

· Affordability: Solar3D empowers the customer through ownership programs by applying all available government incentives and flexible financing options. Owning as opposed to leasing offers many advantages as there are many leasing risks and challenges such as defaults, ownership change, renegotiations and more. The Company has been awarded contracts over even the largest competitors due to its subsidiary’s local presence and comparatively superior knowledge of complex and customized solar systems and financing options.

Example Financing Comparison

Loan Amount

|