Attached files

| file | filename |

|---|---|

| EX-3.6 - EX-3.6 - Franklin Financial Network Inc. | d868096dex36.htm |

| EX-32 - EX-32 - Franklin Financial Network Inc. | d868096dex32.htm |

| EX-31.1 - EX-31.1 - Franklin Financial Network Inc. | d868096dex311.htm |

| EX-31.2 - EX-31.2 - Franklin Financial Network Inc. | d868096dex312.htm |

| EX-21.1 - EX-21.1 - Franklin Financial Network Inc. | d868096dex211.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Franklin Financial Network Inc. | Financial_Report.xls |

| EX-3.7 - EX-3.7 - Franklin Financial Network Inc. | d868096dex37.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 333-193951

FRANKLIN FINANCIAL NETWORK, INC.

(Exact name of registrant as specified in its charter)

| Tennessee | 20-8839445 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

722 Columbia Avenue, Franklin, Tennessee 37064

(Address of principal executive offices) (Zip Code)

615-236-2265

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of June 30, 2014 was $54,260,354 (computed on the basis of $12.90 per share).

The number of shares outstanding of the registrant’s common stock, no par value per share, as of February 28, 2015 was 7,817,385.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

-i-

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements regarding, among other things, our anticipated financial and operating results. Forward-looking statements reflect our management’s current assumptions, beliefs, and expectations. Words such as “anticipate,” “believe, “estimate,” “expect,” “intend,” “plan,” and similar expressions are intended to identify forward-looking statements. While we believe that the expectations reflected in our forward-looking statements are reasonable, we can give no assurance that such expectations will prove correct. Forward-looking statements are subject to risks and uncertainties that could cause our actual results to differ materially from the future results, performance, or achievements expressed in or implied by any forward-looking statement we make. Some of the relevant risks and uncertainties that could cause our actual performance to differ materially from the forward-looking statements contained in this report are discussed below under the heading “Risk Factors” and elsewhere in this Annual Report on Form 10-K. We caution investors that these discussions of important risks and uncertainties are not exclusive, and our business may be subject to other risks and uncertainties which are not detailed there. Investors are cautioned not to place undue reliance on our forward-looking statements. We make forward-looking statements as of the date on which this Annual Report on Form 10-K is filed with the Securities and Exchange Commission (“SEC”), and we assume no obligation to update the forward-looking statements after the date hereof whether as a result of new information or events, changed circumstances, or otherwise, except as required by law.

1

Table of Contents

| ITEM 1. | BUSINESS. |

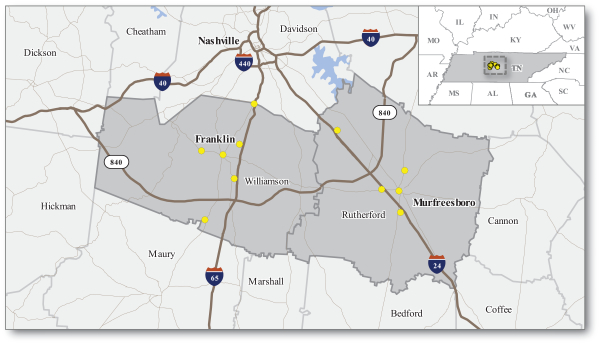

Company Overview

We are a bank holding company headquartered in Franklin, Tennessee. Through our wholly owned bank subsidiary, Franklin Synergy Bank, a Tennessee-chartered commercial bank and a member of the Federal Reserve System, we provide a full range of banking and related financial services with a focus on service to small businesses, corporate entities, local governments and individuals. We operate through 11 branches in the demographically attractive and growing Williamson and Rutherford Counties within the Nashville metropolitan area. As used in this report, unless the context otherwise indicates, any reference to “Franklin Financial,” “our company,” “the company,” “us,” “we” and “our” refers to Franklin Financial Network, Inc. together with its consolidated subsidiaries (including Franklin Synergy), any reference to “FFN” refers to Franklin Financial Network, Inc. only and any reference to “Franklin Synergy” or the “Bank” refers to our banking subsidiary, Franklin Synergy Bank.

As of December 31, 2014, we had consolidated total assets of $1.36 billion, total loans, including loans held for sale, of $806 million, total deposits of $1.17 billion and total shareholders’ equity of $122 million.

Our principal executive office is located at 722 Columbia Avenue, Franklin, Tennessee 37064-2828, and our telephone number is (615) 236-2265. Our website is www.franklinsynergybank.com. The information contained on or accessible from our website does not constitute a part of this report and is not incorporated by reference herein.

Our History and Growth

We were formed as a Tennessee corporation in April 2007 and commenced banking operations through the newly-formed Franklin Synergy Bank in November 2007. Our shareholders are predominantly comprised of individuals, many of whom are customers of the Bank and reside in our target markets. As of December 31, 2014, individuals own over 85% of our outstanding common equity.

We were established with the objective of building a locally-managed commercial bank to service the needs of Franklin, Tennessee and the greater Williamson County area. Our mission statement is to build a legacy company by creating shareholder value, cultivating strong customer relationships and fostering an extraordinary team of directors, officers and employees. We were formed by a core management team of veteran bankers based in Middle Tennessee led by our Chairman and Chief Executive Officer, Richard Herrington. Many of our founders built Franklin Financial Corporation (which is not directly affiliated with our company), which was founded in 1988, and grew the newly-formed real estate-oriented bank to nine branches and $785 million in assets as of June 30, 2002, before announcing the sale of the bank to Fifth Third Bancorp in July 2002. Mr. Herrington and certain members of this management team subsequently joined Cumberland Bancorp (later renamed Civitas BankGroup, Inc.), a troubled Tennessee-based bank holding company, in December 2002, to lead its restructuring. The team led a dramatic improvement of Cumberland’s asset quality and profitability, by decreasing nonperforming loans to total loans from 2.25% in 2003 to 0.31% in 2006 and growing net income from $1.1 million in 2003 to $6.7 million in 2006, before it was acquired by Greene County Bancshares, Inc. in May 2007.

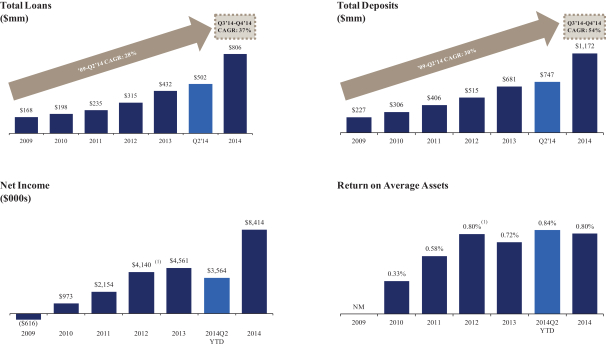

Since our inception and prior to acquiring MidSouth Bank (“MidSouth”) in July 2014, we have achieved significant and consistent organic growth. From December 31, 2009 to June 30, 2014 (one day before the MidSouth acquisition closed), we:

| • | grew our consolidated total assets by a compound annual growth rate (“CAGR”) of 30% from $272 million to $872 million as of June 30, 2014; |

2

Table of Contents

| • | increased our total loans, including loans held for sale, by a CAGR of 28% from $168 million to $502 million as of June 30, 2014; |

| • | increased our total deposits by a CAGR of 30% from $227 million to $747 million as of June 30, 2014 and achieved a number one deposit market share in Williamson County based on deposits at June 30, 2014; |

| • | expanded our employee base from 70 full-time equivalent employees to 126 full-time equivalent employees as of June 30, 2014; and |

| • | added four branches to expand our footprint to a total of six branches. |

As we have grown, we have leveraged our infrastructure to improve our efficiency ratio from 93% in 2009 to 63% for the six months ended June 30, 2014. This improved efficiency has led to greater profitability, as we went from recording a loss of $0.6 million for the year ended December 31, 2009 to a profit of $5.9 million for the last twelve months ending June 30, 2014 and a 0.84% annualized return on average total assets for the six months ended June 30, 2014. In addition, from the year ended December 31, 2009 to the six months ended June 30, 2014, we increased our return on average equity from (2.8%) to 10.3%, and our return on average tangible common equity from (2.8%) to 12.1%.

We have preserved our strong credit culture while growing steadily as evidenced by our low balance of nonperforming loans, which were 0.33% of our total loans as of June 30, 2014, and quarterly net charge-offs to average loans which have averaged 0.04% from January 1, 2009 through June 30, 2014.

MidSouth Acquisition

On July 1, 2014, we completed our acquisition of MidSouth which enabled us to increase our footprint in Middle Tennessee and in the Nashville metropolitan area, specifically in the attractive Rutherford County market. The acquisition also diversified our revenue mix by expanding our retail customer base and increasing our capacity to provide wealth management services, including trust powers which we believe is a competitive advantage to drive new relationships with higher income customers. Headquartered in Murfreesboro, Tennessee and founded in 2004, MidSouth had five branches located throughout Rutherford County, which is adjacent to Williamson County. Although MidSouth operated in close proximity to us, there was no overlap of branch locations and MidSouth’s customer base complemented ours with minimal overlap.

Immediately prior to closing the acquisition, MidSouth had total assets of $281 million, total loans of $199 million, including loans held for sale, and total deposits of $244 million. MidSouth’s loan portfolio, like ours, was primarily comprised of real estate loans. For the six-month period ended June 30, 2014, MidSouth’s balance of nonperforming loans to total loans was 1.34% and net recoveries to average loans, on an annualized basis, was 0.17%.

As a result of the MidSouth acquisition, and as of July 1, 2014, the Company, after giving effect to purchase accounting:

| • | grew our consolidated total assets from $872 million to $1.17 billion; |

| • | increased our total loans, including loans held for sale, from $502 million to $693 million; |

| • | increased our total deposits from $747 million to $992 million; and |

| • | expanded our employee base from 126 full-time equivalent employees to 227 full-time equivalent employees. |

3

Table of Contents

Second Half 2014 and Organic Growth

In the quarter immediately following our completion of the MidSouth acquisition, we continued to achieve organic growth as a combined company. From July 1, 2014 (after giving effect to the MidSouth acquisition) to December 31, 2014, we:

| • | grew our consolidated total assets 16% from $1.17 billion to $1.36 billion as of December 31, 2014; |

| • | increased our total loans, including loans held for sale, 16% from $693 million to $806 million as of December 31, 2014; and |

| • | increased our total deposits 18% from $992 million to $1.17 billion as of December 31, 2014. |

The following charts show our growth in total loans, deposits and net income as well as our annualized return on average assets since 2009.

| (1) | Includes $0.6 million gain of life insurance benefits. |

4

Table of Contents

Our Market Opportunity

Our Market

We operate 11 branches in Williamson and Rutherford Counties within the Nashville metropolitan area. Below is a map of our branch network:

5

Table of Contents

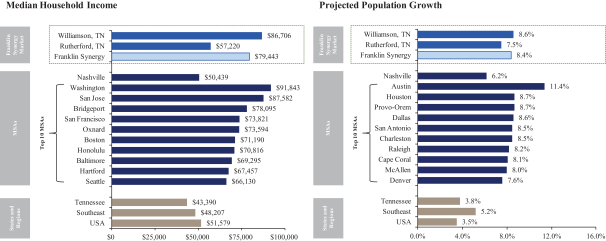

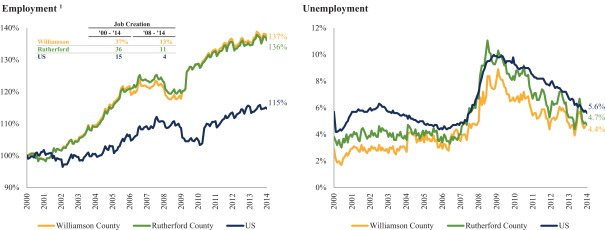

Our markets are among the most attractive, both in Tennessee, and the Southeast, and compare favorably to some of the more well-known and higher-profile markets in the U.S., although our markets are not dependent on commodity pricing. We believe that our focus on, and success in, growing market share in Williamson and Rutherford Counties will enhance our long-term value and profitability compared to financial institutions of our size in other regions of the country. As the following charts demonstrate, the markets in which we operate are characterized by strong demographics including high incomes, increasing population, a growing workforce and unemployment that tends to be below the national rate.

Source: Bureau of Labor Statistics and SNL Financial.

Note: Southeast includes AL, AR, FL, GA, MS, NC, SC, TN, VA and WV. Metrics weighted by population.

Note: Projected figures calculated from 2014 to 2019.

Note: Franklin Synergy refers to Williamson and Rutherford counties weighted by deposits.

| (1) | Employment rate indexed against 2000 data. |

6

Table of Contents

Nashville

In 2013, Nashville was ranked by Forbes as one of the Best Cities for Business and Careers. Its leading industries are health care management, tourism, education, music and entertainment. Healthcare is the largest industry in Nashville, with healthcare companies contributing $30 billion per year and 200,000 jobs to the economy of Nashville and its surrounding areas according to the Nashville Health Care Council. The Nashville area contains 21 accredited four-year colleges and universities (including Vanderbilt University, which was most recently ranked by US News & World Report as 16th among national universities). Based on Census data, Nashville’s 2010 – 2013 net domestic migration rate of 2.5% ranked sixth among major metropolitan areas.1 Additionally, there is no state personal income tax on wages.

Jobs have been created at a robust rate, as civilian labor force employment in the Nashville MSA has grown since 2000 by 15% to approximately 810,000. Large companies continue to be attracted to the Nashville area and its favorable economic and business-friendly climate. For example, Amazon.com now employs 2,000 Nashville area residents and announced plans in July 2014 to build a new sorting center, creating another 100 jobs. In October 2014, Under Armour announced its plan to build a distribution center, bringing 1,500 new jobs. Furthermore, in November 2014, Bridgestone Americas announced that it will relocate its headquarters to Nashville, creating 600 new jobs for the city, and FedEx announced its plans to build a new distribution center in the area creating another 350 jobs.

Williamson County

Williamson County is the wealthiest county in Tennessee and one of the wealthiest in the U.S., with a median household income of $86,706. It is also the fastest-growing county in Tennessee, as its population, currently 199,481, increased by 8.9% from 2010 to 2014 and is projected to increase by 8.6% from 2014 through 2019. Civilian labor force employment in the county has grown since 2000 by 39% to approximately 96,000.

There has been successful regional economic development in Williamson County. There are currently 14 Fortune 1,000 companies with significant presences and/or regional headquarters in the county. Within the last seven years, Mars Petcare established a global innovation center; Nissan relocated its North American headquarters; and Verizon Wireless, Jackson National Life and Shelter Insurance relocated their regional or state headquarters, all within Williamson County. The county has only 4.4% unemployment and there are over 6,000 businesses. According to Metrostudy, the nation’s leading provider of primary and secondary market information to the housing, retail and related industries nationwide, new home sales in Williamson County are robust, with only 1.3 months of inventory of homes on the market and residential closings are up 12.7% over 2013 for the twelve months ended December 31, 2014.

Williamson County has three AAA-rated government entities: the county, the city of Franklin and the city of Brentwood. In September 2014, Franklin was designated by Money Magazine as one of the Top 50 places to live in the U.S., due to the area’s abundance of jobs, low cost of living, cultural/lifestyle considerations and top schools. Williamson County features the highest ranked public school district in Tennessee.

Rutherford County

Rutherford County is one of the wealthiest counties in Tennessee, with a median household income of $57,220. It is the fifth largest county in Tennessee with a population of 282,183, which has increased by 7.5% from 2010 to 2014 and is projected to increase by an additional 7.5% from 2014 through 2019.

Rutherford County features strong economic development and quality of life. Civilian employment in the county has grown since 2000 by 38% to almost 140,000. The drivers of expanding economic development in Rutherford County have been manufacturing, small businesses and the presence of the largest undergraduate university in Tennessee, Middle Tennessee State University. The county is home to one of Nissan’s U.S.

| 1 | Per NewGeography.com. |

7

Table of Contents

manufacturing facilities, one of Bridgestone’s manufacturing facilities, and a General Mills production facility. The county has 4.7% unemployment. According to Metrostudy, there are 1.8 months of inventory of homes on the market and residential closings are up 14.8% over 2013 for the twelve months ended December 31, 2014.

Our Business Strategy

We consider ourselves to be bankers, not just lenders. Our core business strategy is to provide our banking customers with a full suite of financial services by cultivating strong long-term customer relationships and by developing an extraordinary team of officers and employees focused on the customer experience. We are focused on providing convenience and personal service to our customers that is superior to that of the out-of-state super-regional and national financial institutions operating in our markets, while simultaneously managing risk and profitability by remaining selective when expanding our customer base and making loans. We also prioritize our client’s financial security and privacy and assist the communities in which we do business through socially responsible leadership. Our unique culture is a cornerstone to our business and has resulted in substantial but stable growth and profitability.

By continuing to offer several value-added products and services within our core areas of strength, such as mortgage lending and wealth management, to invest in technology to improve our systems and the customer experience, and to leverage strong relationships with consumers, professionals, local governments and businesses within our community, we believe we can gain greater market share, which will improve our operational efficiency and increase profitability. As evidence of the success of our strategy, our deposit market share in Williamson County has increased from 3.4% in 2009 to a market-leading approximately 13.0% per the FDIC’s Summary of deposits report as of June 30, 2014, despite the presence of more institutions competing for deposits.

The key components of our strategy include the following:

Real Estate Focus, with Enhanced Small Business Initiative

We are real estate bankers with a focus on Middle Tennessee. Our management team’s experience building a robust real estate lending platform at Franklin Financial Corporation from 1989 to 2002 formed the basis for our lending principles that have helped us grow profitably while managing credit and other risks. Our lending philosophy focuses on three principles: (1) we focus our underwriting and rely strongly on the credit of secondary sources of repayment (i.e., collateral), (2) the substantial majority of our collateral, by choice, is local in-market real estate and (3) we limit unsecured lending (which comprises less than 2% of our total loan portfolio).

As of December 31, 2014, approximately eighty-nine percent (89%) of our loan portfolio is secured by real estate. We are primarily focused on residential construction lending and office/warehouse commercial real estate lending, which limits our exposure to commitments to larger projects, such as multifamily projects and hospitality and leisure projects. Our real estate portfolio is fairly evenly divided among (1) short-term construction loans (primarily residential), (2) traditional commercial real estate, and (3) mortgage loans (many of which are business loans secured by local real estate). Thirty-one percent (31%) of our loan portfolio is in commercial real estate, 30% is in construction loans and 27% is in one-to-four family residential loans, with the average real estate loan size being approximately $234,000. The construction loans and many of the other real estate loans in our lending portfolio have variable interest rates and the average maturity of our loan portfolio is 49 months, which we believe allows us to be well positioned in a rising rate environment.

The average life of our construction loans is less than nine months, and we have averaged $20 million in construction loan pay-offs per month for the year ended December 31, 2014. Some of these construction loans lead to mortgage loans originated by our mortgage banking team and are subsequently sold into the secondary market. We have no significant concentration of builder or subdivision exposure within our construction loan

8

Table of Contents

portfolio. We have increased our focus on small business lending and have grown our commercial and industrial (“C&I”) loans by a CAGR of 37% from December 31, 2009 through June 30, 2014. As of December 31, 2014, C&I loans represent 10% of our portfolio.

Continue to Prudently Manage Credit Risk

We do not avoid risk—we manage it prudently. We believe that our strong balance sheet and our enterprise risk management philosophy have been important in gaining and maintaining the confidence of our various constituencies and growing our business and footprint within the growing Middle Tennessee market. Our focus on asset quality is the foundation of our profitability and financial strength. The credit quality of our loan portfolio has continually improved, as nonperforming loans have decreased from 3.37% of our loan portfolio at December 31, 2009 to 0.15% at December 31, 2014. Further, our investment portfolio is mainly comprised of securities representing U.S. government agency mortgage-backed securities, which account for 85% of the fair value of our investment portfolio as of December 31, 2014, and the balance of the securities portfolio is comprised of other federal and municipal securities, such as U.S. Treasury securities.

Optimize Presence throughout Our Footprint

Our recent acquisition of MidSouth allowed us to expand selectively into Rutherford County; a contiguous market with long-term growth potential similar to Williamson County. We currently have the top position in the Williamson County deposit market, with 13% market share, and rank sixth in the Rutherford County deposit market, with 7% market share. The strong demographic profiles and economic momentum of Williamson and Rutherford Counties translate into what we believe to be significant organic growth potential over the next few years. We do not believe that we need to add a significant number of new branches or otherwise meaningfully increase our physical presence in order to realize the growth potential contained within these markets. We will evaluate opportunities to open new branches or ancillary offices (i.e., loan production or wealth management offices), as well as acquisitions, as they arise, but our strategy does not necessitate inorganic growth.

Diversification of Revenue

We are continuously expanding the products and services we offer to our customers. Our range of products and services diversifies our earnings stream, strengthens our balance sheet and provides greater flexibility to manage our business in volatile interest rate environments and amid shrinking interest rate margins in the U.S. banking industry. Recently, via the MidSouth acquisition, we have further invested in our mortgage banking division and expanded into wealth management. We will look to further grow these divisions in order to better provide a full suite of services to our customers, add more “touch points” that our customers have with the Bank and drive greater fee income and profitability. Rather than engaging in mass-market advertising, we typically attract new customers by utilizing existing customer relationships and maintaining our presence in our communities. This practice provides opportunities for our relationship managers to cross-sell other products and services to these clients. In addition, we offer our expertise and targeted service offerings for a variety of small businesses and non-profit organizations.

We believe that enhancing our cross-selling capabilities will enable us to generate higher revenues, increase our deposits and diversify our income stream.

Our fee income businesses consist of the following:

| • | Mortgage Banking. Our mortgage banking business has generated 13% of our revenue (defined in accordance with the industry standard as net interest income plus noninterest income) for the year ended December 31, 2014. We sell the majority of loans that are originated in-house in the secondary market and we have the option to retain servicing rights. As of December 31, 2014, we were servicing 1,809 loans with an approximate aggregate principal balance of $414 million. For the year ended |

9

Table of Contents

| December 31, 2014, we originated $291 million of loans. Our efforts to expand our Mortgage Banking business have emphasized purchase loans versus attracting rate sensitive refinancing opportunities. Additionally, mortgage production has a natural tie-in to our residential construction business as a number of our newly originated loans are sourced from our construction loan relationships. |

| • | Wealth Management/Trust Services. Our wealth management business has $178 million in assets under management as of December 31, 2014. Leveraging MidSouth’s wealth management expertise into our selective customer base and the wealthy Williamson County market represents an attractive and unique opportunity. With the MidSouth acquisition, we acquired a trust business and we believe that our possession of a trust charter is a competitive advantage, enabling us to attract newer and wealthier customers and more “sticky” long term deposits. |

For the year ended December 31, 2014, noninterest income represented 21% of our revenue.

Enhance Deposit Base

We will look to attract more low-cost, high-quality and long-term retail deposits. Our cost of deposits for the year ended December 31, 2014 was 0.59%, compared to 1.88% in 2009, as a result of our increased ability to attract transactional accounts. During the twelve months ended December 31, 2014, we increased deposits by $491 million. We are able to leverage existing relationships throughout our customer base by cross-selling services and incentivizing our bankers to bring in deposit relationships, in addition to loans. Local government deposits represent an attractive source of low-cost, seasonal but predictable deposits. As of December 31, 2014, public funds interest checking deposits had a balance of $211 million. We will look to increase the amount of municipal deposits in the future. We believe that the expansion of our small business loan portfolio will provide an attractive and growing source of low-cost deposits in the future.

Additionally, our investments in technology, which have resulted in a strong mobile banking platform and services such as remote deposit capture, enable us to attract and retain deposit customers in a competitive local environment. Furthermore, to expand our customer base, we have created retail banking products intended to appeal to a wide demographic of potential customers, such as our Synergy Cobalt Club, which provides retail banking services targeted to young professionals and our Pineapple Gold Club, which provides retail banking services targeted to people ages 50 and over. Finally, our treasury management services, which include ACH and lockbox product suites, also help to broaden our deposit base through their appeal to small business and commercial deposit customers.

Attract and Retain High Quality Employees

We employ many experienced loan officers with deep local market knowledge and long-term existing relationships. We have been successful in hiring talented employees due to our service-oriented culture and efficient decision making processes. On average, loan officers have 18 years of lending experience. Additionally, we are able to attract and retain talented officers through our incentive compensation plan, which rewards officers with stock options, restricted stock units and cash. All of our officers are shareholders through direct stock ownership, restricted stock and stock options. We believe that by compensating our officers in the form of equity, we align the interests of our team with those of our shareholders, and incentivize them to maximize shareholder value. Lastly, we invest continuously in our employee base. For example, we created a leadership program, “Leadership Franklin Synergy Bank,” where we train our employees not only to be better bankers, but also to be leaders in our communities.

10

Table of Contents

Distinguishing the Bank

We believe that the Bank distinguishes itself in the community because of the following initiatives:

| • | Service Culture. Every employee position has service goals and objectives. All customers are greeted by competent employees with a warm and friendly attitude, and a proactive approach in addressing customer service issues and challenges. |

| • | Technology. The Bank offers innovative Internet-based, mobile and electronic banking products and processes to supplement its traditional branch banking delivery system. |

| • | Empowerment. Employees are empowered with appropriate decision-making authority so that customer issues and requests can be resolved quickly. |

| • | Employee Community Involvement. Appropriate staff are leaders and active in the community. Activities include membership and leadership in various committees and organizations throughout the community. |

| • | Promotion and Advertising. The Bank engages in image and product promotion and advertising to promote itself as a bank uniting traditional bank values with newly evolving Internet and electronic delivery systems. |

| • | Sales Culture. The entire staff is active in bank marketing and sales campaigns and is compensated for performance. |

| • | Public and Community Relations. The Bank supports numerous community organizations and is seen as a leader in the Middle Tennessee Community. |

Our Competitive Strengths

We believe that we have a unique operating culture that differentiates us from our competitors and enables us to organically grow our business and enhance shareholder value. This unique operating culture includes:

| • | a commitment to provide superior and personal service to our customers, both through our employees and via our continued investment in cutting edge technologies in areas of deposit taking, loan origination and risk management; |

| • | a focus on building long-term relationships with our customers; and |

| • | community leadership, as we look to engage with local civic, professional and charitable organizations and exhort our employees to do so as well. |

Our culture forms the basis for our competitive strengths, which we believe allow us to leverage our market opportunity and grow our business profitability. In particular, we believe that the following strengths differentiate us from our competitors and provide a strong foundation from which to deliver growth and profitability, all while enhancing shareholder value:

Well Positioned in Attractive Markets

We believe that we are well positioned to grow our business profitably in the demographically attractive and growing markets within the Nashville metropolitan area in which we operate. We believe that our target market segments, small to medium size for profit businesses and the consumer base working or living in and near our geographical footprint, demand the convenience and personal service that a smaller, independent financial institution such as we can offer. Currently, there are few Tennessee-headquartered banks with assets over $1 billion—there are only two public Middle Tennessee-based banks trading on a major exchange. We believe the heavy out-of-state banking presence (out-of-state super-regional and national financial institutions control approximately 59% of local deposits in the Nashville metropolitan area) provides an opportunity for a strong

11

Table of Contents

local bank like us to add greater market share from customers who are looking for more personal banking services and a more customer-friendly experience. Through our efforts to expand our deposit base, we currently have the largest market share of deposits in Williamson County.

As demonstrated below, our local markets compare favorably to higher profile markets in almost all measures.

| MSA | County | |||||||||||||||||||||||||||||||||||

| Top 5 MSAs by Population Growth | ||||||||||||||||||||||||||||||||||||

| USA | Austin | Provo | Houston | Dallas | San Antonio | Nashville | Williamson | Rutherford | ||||||||||||||||||||||||||||

| Estimated Population Growth |

3.5 | % | 11.4 | % | 8.7 | % | 8.7 | % | 8.6 | % | 8.5 | % | 6.2 | % | 8.6 | % | 7.5 | % | ||||||||||||||||||

| Median Household Income |

$ | 51,579 | $ | 58,706 | $ | 58,735 | $ | 56,545 | $ | 56,739 | $ | 50,754 | $ | 50,439 | $ | 86,706 | $ | 57,220 | ||||||||||||||||||

| Unemployment |

5.6 | % | 3.8 | % | 4.0 | % | 4.1 | % | 4.0 | % | 3.8 | % | 5.1 | % | 4.4 | % | 4.7 | % | ||||||||||||||||||

| Home Price Y-O-Y |

5.8 | % | 6.6 | % | 7.3 | % | 8.8 | % | 5.9 | % | 5.5 | % | 5.2 | % | 7.6 | % | 6.2 | % | ||||||||||||||||||

| Housing Vacancy |

11.4 | % | 7.2 | % | 5.1 | % | 9.6 | % | 7.9 | % | 8.4 | % | 7.7 | % | 4.9 | % | 6.2 | % | ||||||||||||||||||

| % of Households w/ Income > 200k |

4.5 | % | 5.6 | % | 3.3 | % | 6.1 | % | 5.4 | % | 3.7 | % | 3.9 | % | 11.9 | % | 2.9 | % | ||||||||||||||||||

Note: Housing Vacancy Rate is calculated as Vacant Housing Units / Total Housing Units.

Source: SNL Financial and Moody’s Economy.

Experienced Management Team

We have an experienced management team with a history of working together in our target markets and a track record of delivering growth and shareholder value. Many members of our executive leadership team have been with us since inception and many have worked together at previous banks, including both large financial institutions and community banks. Our Chief Executive Officer, President, Chief Mortgage Officer, Chief Financial Officer, Chief Investment Officer and Chief Credit Officer have worked in our local market for an average of twenty-three years and experienced a variety of economic cycles. This deep local experience has given us the ability to understand and react to market changes and maintain strong profitability and growth without sacrificing asset quality. The MidSouth acquisition has bolstered our team, as several key managers have extensive experience working together in the Rutherford County market with MidSouth and other area banks.

Our management team has a proven track record of delivering shareholder value. Richard Herrington co-founded Franklin Financial Corporation (Franklin National Bank) in 1988, where he and his management team grew assets by a CAGR of 27.5% from 1995 – 2002 and positioned the bank to eventually be sold to Fifth Third, which was announced in 2002 and closed in 2004, for 5.4 times tangible book value. According to SNL Financial, this multiple represents the 9th highest price to book multiple for all bank transactions announced in the past 20 years where deal value was in excess of $50 million. He then served as Chief Executive Officer at Cumberland Bancorp (later renamed Civitas BankGroup, Inc.), where he and his team restructured the bank and significantly bolstered profitability, growing net income by a CAGR of 82% from 2003 – 2006, before selling the bank to Greene County Bancshares in 2007 for 3.0 times tangible book value.

The members of our Board of Directors have diverse industry experiences and have deep and long-term ties to the local community. We believe that we have an ideal blend of directors that have been with our management team at previous banks as well as directors that have joined our Board in recent years.

Local Real Estate Lending Expertise

We are real estate bankers that have focused on Middle Tennessee collateral since 1989. Our in-depth knowledge of the commercial customers, real estate development and credit in Williamson and Rutherford

12

Table of Contents

Counties gives us a competitive advantage in loan production, deposit attraction and ancillary revenue generation as we grow market share. Even when the local loan market gets competitive, we do not compromise on pricing and structuring of loan facilities, as our bankers are able to provide customized solutions delivered with a relatively quick turnaround time, as a result of the fact that our underwriting and banking operations occur locally.

With our firm principles of lending on Middle Tennessee collateral, our local real estate expertise and our localized delivery apparatus, we are poised to capture greater market share in the demographically-attractive and growing Williamson and Rutherford Counties.

Successful Balance of Growth and Profitability

We understand the importance of successfully balancing growth and profitability with asset quality to enhance shareholder value. The following highlights the key aspects of our approach to maintaining this balance:

| • | Consistent, Strong and Disciplined Growth. Our approach balances both disciplined growth and profitability. Our community-focused business model has resulted in loan growth with a CAGR of 28% from December 31, 2009 to June 30, 2014. We have multiple lending opportunities to continue this trajectory and the MidSouth acquisition has provided us an immediate presence in the attractive Rutherford County market. Our lending momentum has continued, as loans have grown by 16% from July 1, 2014 to December 31, 2014. Additionally, we have increased focus on small business lending and grown our C&I loans, which represent approximately 10% of our portfolio at December 31, 2014, by a CAGR of 48% since 2009. We have grown our deposit market share in Williamson County and are now the top local financial institution in the county by deposits with a market share of 13%. Our growth has resulted in improved profitability, as reflected by return on average assets increasing from negative in 2009 to 0.80% for 2014. |

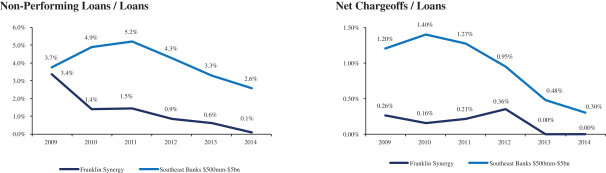

| • | Disciplined Credit Risk Management. Our robust approach to risk management has enabled growth of our loan portfolio without compromising credit. Our credit risk management strategy is based on prudent underwriting criteria and local knowledge. Our lending decisions are centralized and committee-focused, with committees meeting multiple times per week. We are collateral lenders, with strong focus on secondary sources of repayment, especially collateral based in Williamson and Rutherford Counties. As a result of the implementation of our risk management strategy, less than 2% of our current total loans are unsecured. As the following charts demonstrate, our conservative credit culture has resulted in strong credit metrics as we have grown our business. |

Source: SNL Financial. Southeast Banks with assets between $500mm-$5bn. Based on regulatory financials.

13

Table of Contents

We believe that by maintaining our consistent origination and underwriting strategy, we will be able to maintain our consistent growth across shifting market environments.

Products and Services

The Bank operates as a full-service financial institution for its customers in its expanded market area with a full line of financial products, including:

Commercial Banking

Traditional commercial banking services are the mainstay of the Bank. The Bank’s focus is to service small to medium-sized businesses and self-employed professionals. Certain not-for-profit and governmental entities also find the Bank’s services attractive.

The Bank’s focus in the commercial banking market is to provide high quality service for its customers supported by the latest bank technology. In the credit service area, the Bank endeavors to give its commercial customers access to a highly-trained team of credit and deposit service specialists who remain with the customer relationship for long periods of time. Credit decision-making is customized to meet the borrower’s financial needs and designed for rapid response. Credit judgments involve the Bank’s senior management and, where legally required, involve the directors of the Bank. Government guaranteed lending services such as the Small Business Administration (“SBA”) may be utilized as needed.

Consumer Banking

The Bank offers a broad range of financial services designed to meet the credit, savings, and transactional needs of local consumers. First mortgage real estate loans, home equity loans, and other personal loans are the focus of consumer lending. Consumer depository and transaction needs are met through dual delivery systems of traditional branches and the Internet, including mobile banking.

Mortgage Loans

Our mortgage loan department originates single-family, fixed rate residential mortgage loans that we sell in the secondary market. Construction loans also are available for residential and commercial purposes.

Deposits

The Bank’s deposit products include demand, negotiable order of withdrawal (“NOW”), money market accounts, certificates of deposit (“CDs”), municipal deposits, savings, and deposit accounts. CDs offer various maturities ranging from thirty days to five years. The Bank generates relationships by personal contacts within the conventional trading markets for such services by its officers, directors, and employees, who include persons with banking experience in these markets. The Bank also solicits local deposits through the Internet and offers Internet-only deposit accounts to supplement traditional depository accounts. Loan customers are encouraged to bring their deposit business to the Bank, including transaction accounts, CDs, and retirement accounts. This practice further increases the deposit base for the Bank and assists in controlling overall market costs related to deposit acquisition.

Wealth Management/Trust Services

As a result of the MidSouth acquisition, the Bank has increased its capacity to provide wealth management services, including trust services, as the Bank is now authorized to exercise trust powers, which provides the Bank with a competitive advantage.

14

Table of Contents

Other Products and Services

In order to meet all financial needs of the customers, the Bank offers retirement planning, financial planning, investment services and insurance products through its financial services department. Some of these products may be outsourced through relationships with other financial institutions.

Credit Underwriting

We apply consistent credit principles in our assessment of lending proposals, whether commercial real estate, residential and commercial construction, commercial and industrial, consumer or other lending. We are collateral-focused lenders, which means our assessment of any potential loan includes an analysis of whether the secondary source of repayment can generate sufficient cash flow to ensure the likelihood that the borrower’s repayment obligations to the Bank can be fully met. Additionally, our underwriting procedures include an assessment of the borrower’s cash flow sustainability, the acceptability of the borrowing purpose, the borrower’s liquidity, collateral quality and adequacy, industry dynamics, and management capability, integrity and experience. For consumer and other lending, our underwriting process is intended to assess the prospective borrower’s credit standing and ability to repay (which we analyze based on the borrower’s cash flow, liquidity, credit standing, employment history and overall financial condition) and the value and adequacy of any collateral.

We establish conservative collateral guidelines that recognize the potential effects of volatility or deterioration of the value of collateral we accept, the majority of which is real estate, as well as inventory, receivables and machinery. We manage this risk in a number of ways, including through advance rate guidelines for the various types of collateral we typically accept. In addition, where we take real estate as collateral, and for some other specialized assets, we require an assessment of value based on appropriate methodology and benchmarks. For our larger real estate commitments, this assessment can include an independent third party appraisal review and, where appropriate, additional reviews.

We also assess the presence and viability of one or more acceptable secondary sources of repayment to mitigate potential future borrower cash flow deterioration. We generally limit unsecured lending to situations, short-term in nature, involving long-standing customers of sound net worth and above-average liquidity with strong repayment ability. We have a delegated commitment authority framework that provides a conservative level of lending authority to our bankers commensurate with their role and lending experience. Commitments above these lending thresholds established for a banker require the approval, depending on the size of the commitment, of our regional credit managers, central credit senior managers, Chief Credit Officer or, for our largest commitments, our loan committee, with committees meeting multiple times per week. Loan analyses and decisions are documented and form part of the loan’s continual monitoring and relationship management record. We believe this framework provides the necessary separation of authority and independence in the credit underwriting process while providing flexibility to expedite appropriate credit decisions and provide competitive customer service.

Marketing

We market our products and services through a variety of distribution channels. Fundamentally, we focus on a relationship banking model and try to build long-term relationships with our customers. In our community banking markets, our lending officers actively solicit new and existing businesses in the communities we serve. Our management and loan officers are very active members of the communities in which we operate and leverage that involvement to develop customer relationships and brand recognition. Some of our other distribution channels include:

| • | online advertising through the Bank’s website and traditional print media outlets that include online advertising as part of their advertising package; |

15

Table of Contents

| • | social media channels, including Facebook and Twitter; |

| • | regular email blasts to the customer base are used for advertising purposes; |

| • | Bank events such as Customer Appreciation Day, holiday events, seasonal sports events with local speakers, educational seminars for local real estate professionals and builders, hosted art show in branches and Chamber After Hours events; |

| • | community events, including volunteer efforts as well as sponsorships and participation in numerous local community and civic clubs and non-profit organizations; |

| • | Pineapple Gold and Cobalt Clubs – Social events, educational offerings and travel clubs that target an older demographic (Pineapple Gold) as well as younger customers (Cobalt Club); and |

| • | traditional sources such as local radio and print advertising. |

Investment Portfolio

We manage our investments for the primary purpose of liquidity, with a secondary focus on returns. Substantially all of our investments in our portfolio are classified as available-for-sale and can be used to collateralize Federal Home Loan Bank (“FHLB”) borrowings, public funds deposits or other borrowings. Each investment portfolio consists of a variety of high-grade securities, including government agency securities, government/agency guaranteed mortgage-backed securities. We regularly evaluate the composition of our investment portfolio as changes occur with respect to the interest rate yield curve and may sell investment securities from time to time to adjust our exposure to changes in interest rates or to provide liquidity to meet loan demand.

Recent Trends

From a financial perspective, management believes the Bank has reached key milestones significantly faster than most banks in the United States during their first seven full years of operation. As of December 31, 2014, the Bank had $805.7 million in loans, including loans held for sale; assets of $1.4 billion, $1.2 billion in deposits, $121.8 million of shareholders’ equity, and achieved a number one deposit market share in Williamson County based on deposits at June 30, 2014. Challenges and expectations expand as the Bank becomes more mature. On January 15, 2014, FFN filed a registration statement on Form S-1 with the SEC relating to the proposed initial public offering of its common stock. The number of shares to be offered and the price range for the proposed offering has not yet been determined.

Management addresses changes in banking over recent years and embarks on new initiatives as appropriate. In the past, banks needed branches on every corner; today that is considered an outdated way of doing business. Many of the Bank’s customers like to visit with personnel at the Bank, and the Bank will continue to offer a welcoming environment. Other customers prefer to bank online and through mobile channels. The Bank provides a full range of banking products designed to attract all types of customers.

The Bank continues to enhance banking convenience by offering the option of opening accounts online and through mobile channels (savings accounts, checking accounts and CDs). Customers can access banking services at their convenience. The Bank’s remote deposit system allows consumers to deposit checks online without the need to come to a branch. Business customers enjoy this convenience as well.

Local businesses are important to the Bank. The Bank has many products that can help its corporate customers become more profitable, including sweep accounts, credit card processing, remote capture and automated lock box. A unique offering is workplace banking, which allows employers to offer a special banking benefits package to their employees. The Bank also can meet the borrowing needs of businesses through traditional working capital loans, as well as account receivable loans and business expansion loans. One of the Bank’s specialties is customizing services to the unique needs of the business.

16

Table of Contents

Competition

All phases of FFN’s and the Bank’s business are highly competitive. FFN and the Bank are subject to intense competition from various financial institutions and other companies or firms that offer financial services. the Bank competes for deposits with other commercial banks, savings and loan associations, credit unions and issuers of commercial paper and other securities, such as money-market and mutual funds. In making loans, the Bank competes with other commercial banks, savings and loan associations, consumer finance companies, credit unions, leasing companies, and other lenders. Information about specific competition in Williamson County and Rutherford County is included under “RISK FACTORS—Competition For Deposits and Loans is Expected To Be Intense, and No Assurance Can Be Given That We Will Be Successful in Our Efforts to Compete with Other Financial Institutions.”

The banking industry continues to see consolidation, and the Board of Directors believes the trend of having either extremely large regional banks or smaller community banks will continue. The successful implementation of our business plan and the growth of the target market should combine to produce opportunities for FFN and the Bank.

While the direction of recent and proposed federal legislation seems to favor increased competition between banks and different types of financial or other institutions for both deposits and loans, it is not possible to forecast the impact such developments may have on commercial banking in general or as to the Bank or FFN in particular. The Bank will continue to compete with these and other financial institutions, many of which have far greater assets and financial resources than the Bank and whose common stock may be more widely traded than that of FFN. See “BUSINESS—Supervision and Regulation.” No assurance can be given that the Bank will be successful in its efforts to compete with such other institutions.

Enterprise Risk Management

We place significant emphasis on risk mitigation as an integral component of our organizational culture. We believe that our emphasis on risk management is manifested in our solid asset quality statistics and our credit risk management procedures discussed above.

We also focus on risk management in numerous other areas throughout our organization, including with respect to asset/liability management, regulatory compliance and internal controls. We have implemented an extensive asset/liability management process aided by simulation models provided by reputable third parties. We engage in ongoing internal audit and review of all areas of our operations and regulatory compliance.

We are implementing management assessment and testing of internal controls consistent with the Sarbanes-Oxley Act and have engaged an experienced independent public accounting firm to assist us with respect to compliance.

Employees

Management employs officers who have substantial experience and proven records in the banking industry and proven histories in business and commerce, and pays competitive salaries to attract and retain such persons. It is not anticipated that we will experience any substantial difficulty in attracting and retaining the desired caliber of officers and other employees. We offer a typical health and disability insurance plan to our employees and those of our subsidiary, as well as a 401(k) Plan and officer stock incentive awards. See “EXECUTIVE COMPENSATION.”

FFN and the Bank have nine directors, and, as of December 31, 2014, we and our subsidiary had 216 full-time employees and four part-time employees. We consider our relationship with our employees to be excellent. Furthermore, we are not subject to any collective bargaining agreements.

17

Table of Contents

The executive officers are compensated consistent with their responsibilities and experience and comparable to local market norms. Compensation includes a base salary, eligibility for an annual bonus based on board approved performance criteria and health insurance. Officers may enter into employment agreements as competitive factors dictate and which might include appropriate severance, change in control payments, and non-compete agreements. Currently, there are 12 members of senior management that have entered into such employment agreements. We sponsor a qualified 401(k) savings plan that allows eligible employees to defer a portion of their salary. The plan provides for the Bank to make annual discretionary contributions to the plan, which generally are made in the form of employer securities.

Trademarks

We obtained registrations with the United States Patent and Trademark Office for the protection of the trademarks “FRANKLIN SYNERGY BANK®” and “FRANKLIN FINANCIAL NETWORK®.” Management does not believe these trademarks are confusingly similar to trademarks used by other institutions in the financial services business and intends to protect the use of these trademarks nationwide.

Policies and Procedures

The Board of Directors of the Bank has established a statement of lending policies and procedures being used by loan officers of the Bank when making loans. Asset quality is of utmost importance and an independent loan review process has been established to monitor the Bank’s lending function. It is imperative that the Board of Directors and management have an independent and objective evaluation of the quality of specific individual loans and of the overall quality of the total portfolio.

The Board of Directors of the Bank also has established an investment policy that guides the Bank officers in determining the investment portfolio of the Bank. Other policies include a code of ethics policy, audit policy, loan policy, fair lending, compliance, bank secrecy, personnel and information system policies.

Under the Community Reinvestment Act of 1977 (the “CRA”), the Federal Reserve evaluates the Bank’s record of helping to meet the credit needs of its community consistent with safe and sound operations. The Federal Reserve also takes this record into account when deciding on certain applications submitted by the Bank. The Bank’s assessment area is Williamson County, Rutherford County and Davidson County for business loans, mortgage, and general financial services.

The Bank is a fair and equal credit lender. Management’s lending objectives are to make credit products available to all segments of the Bank’s market and community. Williamson County has one moderate census tract, Davidson County has thirty-eight moderate income census tracts and twenty-nine low income tracts, and Rutherford County has seven moderate census tract and two low census tracts. Products are being developed and marketed to individuals and businesses located in those census tracts.

Supervision and Regulation

The following summaries of statutes and regulations affecting banks and their holding companies do not purport to be complete. Such summaries are qualified in their entirety by reference to the statutes and regulations described.

Bank Holding Company Regulation

FFN is a bank holding company within the meaning of the Bank Holding Company Act of 1956, as amended (the “Holding Company Act”), and is registered with the Federal Reserve. Banking subsidiaries of bank holding companies are subject to restrictions under federal law, which limit the transfer of funds by the subsidiary banks to their respective holding companies and non-banking subsidiaries, whether in the form of

18

Table of Contents

loans, extensions of credit, investments or asset purchases. Under Section 23A of the Federal Reserve Act, such transfers by any subsidiary bank to its holding company or any nonbanking subsidiary are limited in amount to 10% of the subsidiary bank’s capital and surplus and, with respect to FFN and all such non-banking subsidiaries, to an aggregate of 20% of such bank’s capital and surplus. Also, banking subsidiaries of bank holding companies are also subject to the provisions of Section 23B of the Federal Reserve Act, which, among other things, prohibits an institution from engaging in certain transactions with certain affiliates unless the transactions are on terms substantially the same, or at least as favorable to such institution or its subsidiaries, as those prevailing at the time for comparable transactions with nonaffiliated companies. Furthermore, such loans and extensions of credit are required to be secured in specified amounts. The Holding Company Act also prohibits, subject to certain exceptions, a bank holding company from engaging in or acquiring direct or indirect control of more than 5% of the voting stock of any company engaged in non-banking activities. An exception to this prohibition is for activities expressly found by the Federal Reserve to be so closely related to banking or managing or controlling banks as to be a proper incident thereto, such as consumer lending and other activities that have been approved by the Federal Reserve by regulation or order. Certain servicing activities are also permissible for a bank holding company if conducted for or on behalf of the bank holding company or any of its affiliates.

As a holding company, FFN is required to file with the Federal Reserve semi-annual reports and such additional information as the Federal Reserve may require. The Federal Reserve may also make examinations of FFN and its non-bank affiliates.

According to federal law and Federal Reserve policy, holding companies are expected to act as a source of financial and managerial strength to each of its subsidiary bank and to commit resources to support each such subsidiary. This support may be required at times when a holding company may not be able to provide such support. Furthermore, in the event of a loss suffered or anticipated by the FDIC—either as a result of default of a banking or thrift subsidiary of FFN or related to FDIC assistance provided to a subsidiary in danger of default—the other banking subsidiaries of FFN may be assessed for the FDIC’s loss, subject to certain exceptions.

Regulation Y generally requires persons acting directly or indirectly or in concert with one or more persons to give the Federal Reserve 60 days advanced written notice before acquiring control of a holding company. Under the regulation, control is defined as the ownership or control with the power to vote 25% or more of any class of voting securities of the holding company. The regulation also provides for a presumption of control if a person owns, controls, or holds with the power to vote 10% or more (but less than 25%) of any class of voting securities. A bank holding company may be limited to ownership of 5% ownership of voting securities. If the person or persons making the acquisition is a company, prior approval from the Federal Reserve may be required.

Various federal and state statutory provisions limit the amount of dividends subsidiary banks can pay to their holding companies without regulatory approval. The payment of dividends by any bank also may be affected by other factors, such as the maintenance of adequate capital for such subsidiary bank. In addition to the foregoing restrictions, the Federal Reserve has the power to prohibit dividends by holding companies if their actions constitute unsafe or unsound practices. The Federal Reserve has issued a policy statement on the payment of cash dividends by holding companies, which expresses the Federal Reserve’s view that a holding company experiencing earnings weaknesses should not pay cash dividends that exceed its net income or that could only be funded in ways that weaken the holding company’s financial health, such as by borrowing. The Federal Reserve may also order a bank holding company to terminate an activity or control of a non-bank subsidiary if such activity or control constitutes a significant risk to the financial safety, soundness, or stability of a subsidiary bank and is inconsistent with sound banking principles. Furthermore, the TDFI also has authority to prohibit the payment of dividends by a Tennessee bank when it determines such payment to be an unsafe and unsound banking practice.

A holding company and its subsidiaries are also prohibited from acquiring any voting shares of, or interest in, any banks located outside of the state in which the operations of the holding company’s subsidiaries are located, unless the holding company and its subsidiaries are well-capitalized and well managed.

19

Table of Contents

In approving acquisitions by holding companies of banks and companies engaged in the banking-related activities described above, the Federal Reserve considers a number of factors, including the expected benefits to the public such as greater convenience, increased competition, or gains in efficiency, as weighed against the risks of possible adverse effects such as undue concentration of resources, decreased or unfair competition, conflicts of interest, or unsound banking practices. The Federal Reserve is also empowered to differentiate between new activities and activities commenced through the acquisition of a going concern.

The Attorney General of the United States may, within 30 days after approval by the Federal Reserve of an acquisition, bring an action challenging such acquisition under the federal antitrust laws, in which case the effectiveness of such approval is stayed pending a final ruling by the courts. Failure of the Attorney General to challenge an acquisition does not, however, exempt the holding company from complying with both state and federal antitrust laws after the acquisition is consummated or immunize the acquisition from future challenge under the anti-monopolization provisions of the Sherman Act.

Capital Guidelines

The Federal Reserve has issued risk-based capital guidelines for bank holding companies and member banks. Under the guidelines, the minimum ratio of capital to risk-weighted assets (including certain off-balance sheet items, such as standby letters of credit) is 8%. To be considered a “well capitalized” bank or bank holding company under the guidelines, a bank or bank holding company must have a total risk-based capital ratio of 10% or greater. At least half of the total capital is to be comprised of common equity, retained earnings, and a limited amount of perpetual preferred stock, after subtracting goodwill and certain other adjustments (“Tier I capital”). The remainder may consist of perpetual debt, mandatory convertible debt securities, a limited amount of subordinated debt, other preferred stock not qualifying for Tier I capital, and a limited amount of loan loss reserves (“Tier II capital”). The Bank is subject to similar capital requirements adopted by the Federal Reserve. In addition, the Federal Reserve and the FDIC have adopted a minimum leverage ratio (Tier I capital to total assets) of 3% or 4% based on supervisory considerations. Generally, banking organizations are expected to operate well above the minimum required capital level of 3% unless they meet certain specified criteria, including that they have the highest regulatory ratings. Most banking organizations are required to maintain a leverage ratio of 3% or 4%, as applicable, plus an additional cushion of at least 1% to 2%. The guidelines also provide that banking organizations experiencing internal growth or making acquisitions are expected to maintain strong capital positions substantially above the minimum supervisory levels without significant reliance upon intangible assets.

In July 2013, the federal banking regulators, in response to the statutory requirements of Dodd-Frank, adopted regulations implementing the Basel Capital Adequacy Accord (“Basel III”), which had been approved by the Basel member central bank governors in 2010 as an agreement among the countries’ central banks and bank regulators on the amount of capital banks must hold as a cushion against losses and insolvency. The new minimum capital to risk-weighted assets (“RWA”) requirements are a common equity Tier 1 capital ratio of 4.5% and a Tier 1 capital ratio of 6.0%, and a total capital ratio of 8.0%. The minimum leverage ratio (Tier 1 capital to total assets) is 4.0%. The new rule also changes the definition of capital, mainly by adopting stricter eligibility criteria for regulatory capital instruments, and new constraints on the inclusion of minority interests, mortgage-servicing assets, deferred tax assets, and certain investments in the capital of unconsolidated financial institutions. In addition, the new rule requires that most regulatory capital deductions be made from common equity tier 1 capital.

Under the Basel III, in order to avoid limitations on capital distributions, including dividend payments and certain discretionary bonus payments to executive officers, a banking organization must hold a capital conservation buffer composed of common equity tier 1 capital above its minimum risk-based capital requirements. The buffer is measured relative to RWA. Phase-in of the capital conservation buffer requirements will begin on January 1, 2016 and the requirements will be fully phased in on January 1, 2019. A banking organization with a buffer greater than 2.5% once the capital conservation buffer is fully phased in would not be

20

Table of Contents

subject to limits on capital distributions or discretionary bonus payments; however, a banking organization with a buffer of less than 2.5% would be subject to increasingly stringent limitations as the buffer approaches zero. The new rule also prohibits a banking organization from making distributions or discretionary bonus payments during any quarter if its eligible retained income is negative in that quarter and its capital conservation buffer ratio was less than 2.5% at the beginning of the quarter. Effectively, the Basel III framework will require us to meet minimum capital ratios of (i) 7% for common equity Tier 1 capital, (ii) 8.5% Tier 1 capital, and (iii) 10.5% total capital. The eligible retained income of a banking organization is defined as its net income for the four calendar quarters preceding the current calendar quarter, based on the organization’s quarterly regulatory reports, net of any distributions and associated tax effects not already reflected in net income. When the new rule is fully phased in, the minimum capital requirements plus the capital conservation buffer will exceed the prompt corrective action (“PCA”) well-capitalized thresholds.

Under the new rule, mortgage-servicing assets and deferred tax assets are subject to stricter limitations than those applicable under the current general risk-based capital rule. More specifically, certain deferred tax assets arising from temporary differences, mortgage-servicing assets, and significant investments in the capital of unconsolidated financial institutions in the form of common stock are each subject to an individual limit of 10% of common equity tier 1 capital elements and are subject to an aggregate limit of 15% of common equity tier 1 capital elements. The amount of these items in excess of the 10% and 15% thresholds are to be deducted from common equity tier 1 capital. Amounts of mortgage-servicing assets, deferred tax assets, and significant investments in unconsolidated financial institutions that are not deducted due to the aforementioned 10% and 15% thresholds must be assigned a 250% risk weight. Finally, the new rule increases the risk weights for past-due loans, certain commercial real estate loans, and some equity exposures, and makes selected other changes in risk weights and credit conversion factors.

The new minimum capital requirements of Basel III are effective on January 1, 2015, whereas the capital conservation buffer and the deductions from common equity tier 1 capital phase in over time. Similarly, nonqualifying capital instruments phase out over time, except as described above.

Failure to meet statutorily mandated capital guidelines or more restrictive ratios separately established for a financial institution could subject a banking institution to a variety of enforcement remedies available to federal regulatory authorities, including issuance of a capital directive, the termination of deposit insurance by the FDIC, a prohibition on accepting or renewing brokered deposits, limitations on the rates of interest that the institution may pay on its deposits, and other restrictions on its business.

Tennessee Banking Act; Federal Deposit Insurance Act

The Bank is incorporated under the banking laws of the State of Tennessee and, as such, is subject to the applicable provisions of those laws. The Bank is subject to the supervision of the TDFI and to regular examination by that department. The Bank is a member of the Federal Reserve and therefore is subject to Federal Reserve regulations and policies and is subject to regular exam by the Federal Reserve. The Bank’s deposits are insured by the FDIC through DIF, and the Bank is, therefore, subject to the provisions of the Federal Deposit Insurance Act (“FDIA”).

The FDIC has adopted a risk-based assessment system for insured depository institutions that takes into account the risks attributable to different categories and concentrations of assets and liabilities. Under the Dodd-Frank Act, the FDIC was required to adopt regulations that would base deposit insurance assessments on total assets less capital rather than deposit liabilities and to include off-balance sheet liabilities of institutions and their affiliates in risk-based assessments. EESA (as defined below) provided for a temporary increase in the basic limit on federal deposit insurance coverage from $100,000 to $250,000 per depositor. This increased level of basic deposit insurance was made permanent by the Dodd-Frank Act. The Dodd-Frank Act also repealed the prohibition on paying interest on demand transaction accounts, but did not extend unlimited insurance protection for these accounts.

21

Table of Contents

The FDIC may terminate its insurance of deposits if it finds that the institution has engaged in unsafe and unsound practices, is in an unsafe or unsound condition to continue operations, or has violated any applicable law, regulation, rule, order or condition imposed by the FDIC.

Tennessee statutes and the federal law regulate a variety of the banking activities of the Bank, including required reserves, investments, loans, mergers and consolidations, issuances of securities, payments of dividends, and the establishment of branches. There are certain limitations under federal and Tennessee law on the payment of dividends by banks. A state bank, with the approval of the TDFI, may transfer funds from its surplus account to the undivided profits (retained earnings) account or any part of its paid-in-capital account. The payment of dividends by any bank is dependent upon its earnings and financial condition and, in addition to the limitations referred to above, is subject to the statutory power of certain federal and state regulatory agencies to act to prevent what they deem unsafe or unsound banking practices. The payment of dividends could, depending upon the financial condition of the Bank, be deemed to constitute such an unsafe or unsound practice. Also, without regulatory approval, a dividend only can be paid to the extent of the net income of the bank for that year plus the net income of the prior two years. The FDIA prohibits a state bank, the deposits of which are insured by the FDIC, from paying dividends if it is in default in the payment of any assessments due the FDIC.

State banks also are subject to regulation respecting the maintenance of certain minimum capital levels (see above), and the Bank is required to file annual reports and such additional information as the Tennessee Banking Act and Federal Reserve regulations require. The Bank also is subject to certain restrictions on loan amounts, interest rates, “insider” loans to officers, directors and principal shareholders, tie-in arrangements, privacy, transactions with affiliates, and many other matters. Strict compliance at all times with state and federal banking laws is required.

Tennessee law contains limitations on the interest rates that may be charged on various types of loans and restrictions on the nature and amount of loans that may be granted and on the types of investments which may be made. The operations of banks are also affected by various consumer laws and regulations, including those relating to equal credit opportunity and regulation of consumer lending practices. All Tennessee banks must become and remain insured banks under the FDIA. (See 12 U.S.C. § 1811, et seq.).