Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TRIBUNE MEDIA CO | d884227d8k.htm |

| EX-99.1 - EX-99.1 - TRIBUNE MEDIA CO | d884227dex991.htm |

Q4

& Full Year 2014 Performance Summary M

A

R

C

H

2

0

1

5

Exhibit 99.2 |

2

Cautionary Statement Regarding Forward Looking Statements

This presentation contains “forward-looking statements” within the

meaning of the federal securities laws. Forward-looking statements are subject to known and unknown risks

and uncertainties, many of which may be beyond our control.

Forward-looking statements may include, but are not limited to, statements concerning our financial outlook and

guidance, including our 2015 forecasted revenues, Adjusted EBITDA and other

consolidated and segment financial performance guidance, our expectations for Adjusted EBITDA

growth in 2016, our long-term outlook for WGN America and Tribune Studios

revenue and programming expenses as well as Digital and Data segment revenue growth and

Adjusted EBITDA margins, our expectation with respect to future cash dividends

on our common stock, the conditions in our industry, our operations, our economic performance

and financial condition, including, in particular, statements relating to our

business and growth strategy and product development efforts. Important factors that could cause

actual results, developments and business decisions to differ materially from

these forward-looking statements are uncertainties discussed below and in the “Risk Factors”

section of the Company’s Annual Report on Form 10-K filed with

the U.S. Securities and Exchange Commission on March 6, 2015. “Forward-looking statements” include all

statements that do not relate solely to historical or current facts, and can be

identified by the use of words such as “may,” “might,” “will,” “could” “should,” “estimate,” “project,”

“plan,” “anticipate,” “expect,”

“intend,” “outlook,” “seek,” “designed,” “assume,” “implied,” “believe” and other similar expressions. You are cautioned not to place undue reliance

on these forward-looking statements, which speak only as of their dates.

These forward-looking statements are based on estimates and assumptions by our management that,

although we believe to be reasonable, are inherently uncertain and subject to a

number of risks and uncertainties. The following list represents some, but not necessarily all, of the factors

that could cause actual results to differ from projected or historical results or those anticipated or predicted

by these forward-looking statements: competition and other economic

conditions including fragmentation of the media landscape and competition from other media alternatives;

changes in advertising demand and audience shares; changes in the overall

market for television advertising, including through regulatory and judicial rulings; our ability to protect

our intellectual property and other proprietary rights; availability and cost

of broadcast rights; our ability to adapt to technological changes; our ability to develop and grow our

online businesses; availability and cost of quality network, syndicated and

sports programming affecting our television ratings; the loss or modification of our network affiliation

agreements; our ability to renegotiate retransmission consent agreements; our

ability to expand our operations internationally; the incurrence of costs to address contamination

issues at sites owned, operated or used by our business; adverse results from

litigation, governmental investigations or tax-related proceedings or audits; our ability to settle

unresolved claims filed in connection with our and certain of our direct and

indirect wholly-owned subsidiaries’ Chapter 11 cases and resolve the appeals seeking to overturn the

bankruptcy court order confirming the Fourth Amended Joint Plan of

Reorganization for Tribune Company and its Subsidiaries; our ability to satisfy pension and other

postretirement employee benefit obligations; our ability to attract and retain

employees; the effect of labor strikes, lock-outs and labor negotiations; our ability to realize benefits or

synergies from acquisitions or divestitures or to operate our businesses

effectively following acquisitions or divestitures; the financial performance of our equity method

investments; the impairment of our existing goodwill and other intangible

assets; changes in accounting standards; our ability to pay cash dividends on our common stock;

increased interest rate risk due to our variable rate indebtedness; our

indebtedness and ability to comply with covenants applicable to our debt financing and other contractual

commitments; our ability to satisfy future capital and liquidity requirements;

our ability to access the credit and capital markets at the times and in the amounts needed and on

acceptable terms and other events beyond our control that may result in

unexpected adverse operating results. In addition, in light of these risks and uncertainties, the matters

referred to in the forward-looking statements contained in this

presentation may not in fact occur. Any forward-looking information presented herein is made only as of the date of

this presentation and we undertake no obligation to update or revise any

forward-looking statement as a result of new information, future events or otherwise, except as otherwise

required by law.

|

3

Non-GAAP Financial Measures

This presentation includes a discussion of Adjusted EBITDA for the Company and

our operating segments (Television and Entertainment, Digital and Data, and

Corporate and Other) and Broadcast Cash Flow for our Television and

Entertainment segment. Adjusted EBITDA and Broadcast Cash Flow are financial

measures that are not recognized under accounting principles generally accepted

in the U.S. (“GAAP”). Adjusted EBITDA for the Company is defined as net

income before income (loss) from discontinued operations, net of taxes, income

taxes, investment transactions, losses on the extinguishment of debt, interest

and dividend income, interest expense, pension expense (credit), equity income

and losses, depreciation and amortization, stock-based compensation, certain

special items (including severance), non-operating items, sales of real

estate and reorganization items. Adjusted EBITDA for the Company’s operating segments

is calculated as segment operating profit plus depreciation, amortization,

pension expense (credit), stock-based compensation and certain special items

(including severance). Broadcast Cash Flow for the Television and Entertainment

segment is calculated as Television and Entertainment Adjusted EBITDA plus

broadcast rights- amortization expense less broadcast rights- cash

payments. We believe that Adjusted EBITDA and Broadcast Cash Flow are measures

commonly used by investors to evaluate our performance with that of our

competitors. We also present Adjusted EBITDA because we believe investors, analysts

and rating agencies consider it useful in measuring our ability to meet our

debt service obligations. We further believe that the disclosure of Adjusted EBITDA

and Broadcast Cash Flow is useful to investors, as these non-GAAP measures

are used, among other measures, by our management to evaluate our

performance. By disclosing Adjusted EBITDA and Broadcast Cash Flow, we believe

that we create for investors a greater understanding of, and an enhanced

level of transparency into, the means by which our management operates our

company. Adjusted EBITDA and Broadcast Cash Flow are not measures presented

in accordance with GAAP, and our use of these terms may vary from that of

others in our industry. Adjusted EBITDA and Broadcast Cash Flow should not be

considered as an alternative to net income, operating profit, revenues, cash

provided by operating activities or any other measures derived in accordance with

GAAP as measures of operating performance or liquidity. The tables at the

end of this presentation include reconciliations of consolidated and segment

Adjusted EBITDA and Broadcast Cash Flow to the most directly comparable

financial measure calculated and presented in accordance with GAAP. No

reconciliation of the forecasted range for Adjusted EBITDA on a consolidated or

segment basis for fiscal 2015 is included in this presentation because we are

unable to quantify certain amounts that would be required to be included in the

GAAP measure without unreasonable efforts and we believe such reconciliations

would imply a degree of precision that would be confusing or misleading to

investors. |

4

Tribune Media

A diverse combination of media assets that meaningfully touch millions of people

every day, including compelling content in news and entertainment, significant

broadcast distribution, an emerging cable network, and a cutting-edge digital and

data business.

•

Broadcast: 42 owned or operated broadcast stations in major markets across

the

country.

•

WGN America: A national, general entertainment network airing high quality original

content and reaching approximately 73 million households.

•

Digital and Data: Growing global metadata business, powering some of the biggest

media brands in the world.

•

Real Estate and Investments: 77 real estate properties and

equity investments in a variety of media, online and other properties.

|

5

Q4 Financial Highlights

Consolidated operating revenues grew 85% over Q4’13 to $553.4 million.

Consolidated operating profit grew 276% over Q4’13 to $163.4 million.

Consolidated Adjusted EBITDA, which excludes cash distributions from equity investments,

grew 121% over Q4’13 to $211.0 million.

Diluted earnings per share from continuing operations of $3.14, as compared to $0.33 in

fourth quarter 2013.

Pro Forma

(1)

Television and Entertainment segment revenues grew 15% over Q4’13 to $479.1

million.

Pro Forma

(1)

Television and Entertainment Adjusted EBITDA grew 30% over Q4’13 to $202.6

million.

Digital and Data segment revenues increased 217% over Q4’13 to $61.2 million.

Digital and Data Adjusted EBITDA increased 220% over Q4’13 to $23.8 million.

(1)

Amounts

are

pro

forma

for

the

acquisition

of

Local

TV,

which

was

completed

on

December

27,

2013,

as

if

the

acquisition

had

occurred

as

of

the

beginning of fiscal 2013.

Pro forma operating expenses, depreciation and amortization for Local TV are based

on Local TV's historical basis of presentation and do not reflect the impact of purchase

accounting. |

6

Full Year 2014 Financial Highlights

Consolidated operating revenues grew 70% over 2013 to $1,949.3 million.

Consolidated operating profit grew 51% over 2013 to $301.1 million.

Consolidated Adjusted EBITDA, which excludes cash distributions from equity investments,

grew 74% over 2013 to $607.8 million.

Cash distributions from equity investments of $210.7 million.

Diluted earnings per share from continuing operations of $4.62, as compared to $1.62 in

2013.

Pro Forma

(1)

Television and Entertainment segment revenues grew 8.8% over 2013 to

$1,720.5 million.

Pro Forma

(1)

Television and Entertainment Adjusted EBITDA grew 7.4% over 2013 to $614.8

million.

Digital and Data segment revenues increased 120% over 2013 to $174.0 million.

Digital and Data Adjusted EBITDA increased 34% over 2013 to $38.6 million.

(1)

Amounts

are

pro

forma

for

the

acquisition

of

Local

TV,

which

was

completed

on

December

27,

2013,

as

if

the

acquisition

had

occurred

as

of

the

beginning

of

fiscal 2013.

Pro forma operating expenses, depreciation and amortization for Local TV are based

on Local TV's historical basis of presentation and do not reflect the impact of purchase

accounting. |

7

2014 Strategic Highlights

Successfully converted 50% of WGN America subscribers from a superstation to cable.

Successfully

launched

two

original

series

on

WGN

America,

Salem

and

Manhattan.

Completed

four

strategic

acquisitions

within

our

Digital

and

Data

segment

–

Gracenote,

What’s-ON,

Baseline and HWW.

Completed the spin-off of the Company’s publishing operations into an independent

publicly-traded company

In a series of transactions, monetized the company’s interest in Classified Ventures,

including Apartments.com and Cars.com, for total net proceeds after taxes of

approximately $525 million. Sold property in Baltimore for net proceeds after taxes and

transaction costs of approximately $30 million.

In the fourth quarter, repurchased approximately 1.1 million shares of Class A common stock

for approximately $68 million bringing cumulative repurchases through March 5, 2015, to

approximately 3.9 million shares for approximately $233 million.

Listed Tribune Media Company Class A common stock on the New York Stock Exchange.

|

8

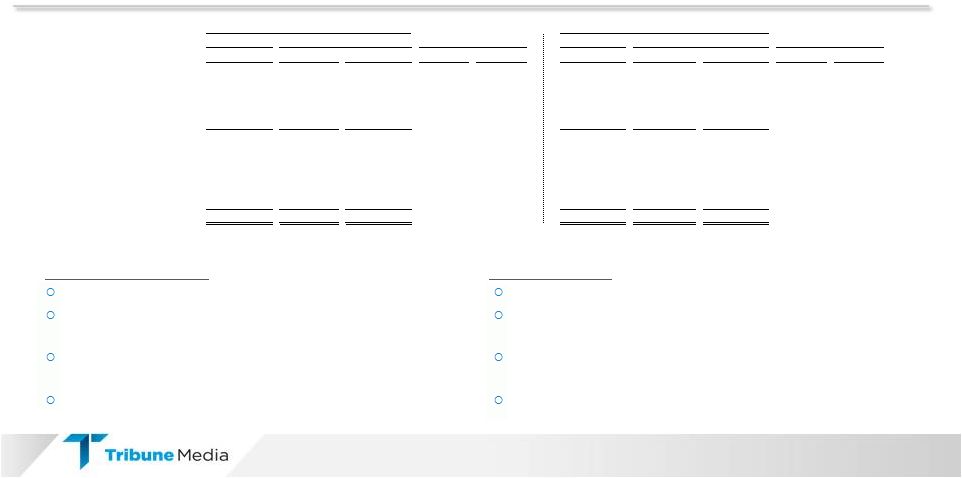

Previous Guidance vs. Actual Results

2014 Results Exceeded High End of Guidance

(USD millions)

Low

High

Low

High

Net Revenues

Television & Entertainment

1,720

$

1,650

$

1,700

$

4%

1%

Digital & Data

174

160

175

9%

-1%

Corporate & Other

55

50

55

10%

0%

Total Net Revenues

1,949

$

1,860

$

1,930

$

5%

1%

Adjusted EBITDA

Television & Entertainment

615

$

590

$

605

$

4%

2%

Digital & Data

39

30

35

30%

11%

Corporate & Other

(46)

(55)

(40)

-16%

15%

Total Adjusted EBITDA

608

$

565

$

600

$

8%

1%

Guidance

2014 Actuals

Variance |

9

Consolidated Financial Results

Dec. 28, 2014

Dec. 29, 2013

$

%

Dec. 28, 2014

Dec. 29, 2013

$

%

Operating Revenues

553,420

$

299,561

$

253,859

85%

1,949,359

$

1,147,240

$

802,119

70%

Operating Expenses

389,976

256,130

133,846

52%

1,648,177

948,200

699,977

74%

Operating Profit

163,444

43,431

120,013

*

301,182

199,040

102,142

51%

Adjusted EBITDA

211,005

$

95,286

$

115,719

*

607,783

$

348,919

$

258,864

74%

Adjusted EBITDA Margin

38.1%

31.8%

31.2%

30.4%

* Represents positive change in excess of 100%

Year ended:

Variance

Variance

Three months ended:

Significant revenue and margin improvement

(USD thousands) |

10

Television and Entertainment Segment

Operating Results

Revenues

Adjusted EBITDA

(1)

Amounts

are

pro

forma

for

the

acquisition

of

Local

TV,

which

was

completed

on

December

27,

2013,

as

if

the

acquisition

had

occurred

as

of the

beginning of fiscal 2013. Pro forma operating expenses, depreciation and

amortization for Local TV are based on Local TV's historical basis of

presentation and do not reflect the impact of purchase accounting.

(USD thousands)

Increase driven by higher retransmission revenues, and

Strong political advertising revenues.

Revenue

increases

drove

significant

increase

in

Adjusted

EBITDA,

partially

offset

by

increased

programming and promotional expenses associated with new programming at WGN America.

Dec. 28, 2014

Dec. 29, 2013

Dec. 28, 2014

Dec. 29, 2013

As Reported

Pro Forma (1)

$

%

As Reported

Pro Forma (1)

$

%

Operating Revenues

479,157

$

415,892

$

63,265

15%

1,720,536

$

1,581,205

$

139,331

9%

Operating Expenses

332,766

307,047

25,719

8%

1,383,615

1,182,268

201,347

17%

Operating Profit

146,391

108,845

37,546

34%

336,921

398,937

(62,016)

-16%

Adjusted EBITDA

202,650

$

155,268

$

47,382

31%

614,805

$

572,578

$

42,227

7%

Adjusted EBITDA Margin

42.3%

37.3%

35.7%

36.2%

Variance

Three months ended:

Year ended:

Variance |

11

Television and Entertainment Segment

Revenues

Full Year Revenues

(1)

Amounts

are

pro

forma

for

the

acquisition

of

Local

TV,

which

was

completed

on

December

27,

2013,

as

if

the

acquisition

had

occurred

as

of

the

beginning of

2013. Pro forma operating expenses, depreciation and amortization for Local TV are

based on Local TV's historical basis of presentation and do not reflect the

impact of purchase accounting.

Fourth Quarter Revenues

Dec. 28, 2014

Dec. 28, 2014

As Reported

Pro forma (1)

As Reported

Pro forma (1)

As Reported

As Reported

Pro forma (1)

As Reported

Pro forma (1)

As Reported

Advertising

Core (Local / National)

310,284

$

318,021

$

199,942

$

-2%

55%

1,186,165

$

1,226,389

$

776,601

$

-3%

53%

Political

54,845

5,428

2,055

*

*

90,209

15,747

7,009

*

*

Digital

12,595

10,032

4,070

26%

*

43,353

34,832

13,928

24%

*

Other

3,647

3,431

1,754

6%

*

16,237

16,431

12,194

-1%

33%

Total Advertising

381,371

$

336,912

$

207,821

$

13%

84%

1,335,964

$

1,293,399

$

809,732

$

3%

65%

Retransmission consent fees

58,447

34,774

14,741

68%

*

229,243

130,537

49,586

76%

*

Carriage fees

14,395

12,936

12,935

11%

11%

57,137

53,796

53,795

6%

6%

Barter/trade

9,257

11,253

8,651

-18%

7%

41,267

42,768

31,292

-4%

32%

Copyright royalties

7,104

10,689

10,689

-34%

-34%

27,161

32,954

32,954

-18%

-18%

Other

8,583

9,328

11,733

-8%

-27%

29,764

27,751

37,065

7%

-20%

Total operating revenues

479,157

$

415,892

$

266,570

$

15%

80%

1,720,536

$

1,581,205

$

1,014,424

$

9%

70%

* Represents positive change in excess of 100%

% Variance

Three months ended

Year ended

December 29, 2013

% Variance

December 29, 2013

(USD thousands)

Retransmission consent fees up 68% to $58.4 million.

Political revenues of $54.8 million (or $64.5 million on a

gross basis).

Core advertising down $7.7 million or 2.4%, primarily

attributable to displacement from political advertising.

Digital advertising up 26% to $12.6 million.

Retransmission consent fees up 76% to $229.2 million.

Political revenues of $90.2 million (or $106.1 million on a

gross basis).

Core advertising down $40.2 million or 3.3%, primarily

attributable to displacement from political advertising.

Digital advertising up 24% to $43.4 million. |

12

Television and Entertainment Segment

Adjusted EBITDA

Adjusted EBITDA

(1)

Amounts

are

pro

forma

for

the

acquisition

of

Local

TV,

which

was

completed

on

December

27,

2013,

as

if

the

acquisition

had

occurred

as

of the

beginning of fiscal 2013. Pro forma operating expenses, depreciation and

amortization for Local TV are based on Local TV's historical basis of

presentation and do not reflect the impact of purchase accounting.

Dec. 28, 2014

Dec. 29, 2013

Dec. 28, 2014

Dec. 29, 2013

As Reported

Pro forma (1)

$

%

As Reported

Pro forma (1)

$

%

Operating Profit

146,391

$

108,845

$

37,546

34%

336,921

$

398,937

$

(62,016)

-16%

Depreciation

12,057

14,444

(2,387)

-17%

50,262

53,715

(3,453)

-6%

Amortization

42,217

29,451

12,766

43%

197,054

114,056

82,998

73%

Stock-based compensation

2,063

792

1,271

*

8,800

2,578

6,222

*

Severance and related charges

229

302

(73)

-24%

2,098

1,641

457

28%

Transaction-related costs

(387)

181

(568)

*

1,894

229

1,665

*

Gain on sales of real estate

(103)

—

(103)

-

(103)

—

(103)

-

Contract termination cost

(646)

—

(646)

-

15,000

—

15,000

-

Other

829

1,275

(446)

-35%

2,755

1,508

1,247

83%

Pension (credit) expense

—

(22)

22

*

124

(86)

210

*

Adjusted EBITDA

202,650

$

155,268

$

47,382

31%

614,805

$

572,578

$

42,227

7%

Broadcast rights - Amortization

65,624

53,266

12,358

23%

268,797

239,835

28,962

12%

Broadcast rights - Cash Payments

(76,130)

(68,470)

(7,660)

11%

(321,335)

(279,273)

(42,062)

15%

Broadcast Cash Flow

192,144

$

140,064

$

52,080

37%

562,267

$

533,140

$

29,127

5%

* Represents positive or negative change in excess of 100%

Variance

Three months ended:

Year ended:

Variance

(USD thousands)

Full Year Adjusted EBITDA impacted by programming and marketing costs associated with new

original programming at WGN America.

Fourth

quarter

Adjusted

EBITDA

impacted

by

costs

associated

with

new

original

programming

at

WGN

America,

as

well

as

higher costs associated with new syndicated content, including the premiere of

syndicated series Blue Bloods. |

13

Digital and Data Segment

Summary of Operating Results

Revenues and Expenses

Dec. 28, 2014

Dec. 29, 2013

$

%

Dec. 28, 2014

Dec. 29, 2013

$

%

Operating Revenues

61,228

$

19,305

$

41,923

*

174,031

$

79,217

$

94,814

*

Operating Expenses

47,302

15,120

32,182

*

170,622

62,720

107,902

*

Operating Profit

13,926

4,185

9,741

*

3,409

16,497

(13,088)

-79%

Adjusted EBITDA

23,812

$

7,438

$

16,374

*

38,582

$

28,794

$

9,788

34%

Adjusted EBITDA Margin

38.9%

38.5%

22.2%

36.3%

* Represents positive change in excess of 100%

Year ended:

Variance

Variance

Three months ended:

(USD thousands)

Impacted by the acquisition of Gracenote, acquired January 2014.

Expect long-term net revenue growth of 10% to 12% annually.

Expect long-term EBITDA margins to grow to low 30% range. |

14

Digital and Data Segment

Revenues

Revenues

Dec. 28, 2014

Dec. 29, 2013

$

%

Dec. 28, 2014

Dec. 29, 2013

$

%

Video

25,849

$

17,758

$

8,091

46%

91,299

$

68,708

$

22,591

33%

Music

34,386

-

34,386

-

77,729

-

77,729

-

Entertainment websites

and other

993

1,547

(554)

-36%

5,003

10,509

(5,506)

-52%

Total operating revenues

61,228

$

19,305

$

41,923

*

174,031

$

79,217

$

94,814

*

* Represents positive change in excess of 100%

Three months ended:

Variance

Year ended:

Variance

(USD thousands)

Music revenues are fully attributable to the Gracenote acquisition.

•

Historically,

Gracenote’s

automotive

music

revenues

are

disproportionately

higher

in

the

fourth

quarter.

Video revenues increased primarily due to acquisitions of Gracenote in January 2014,

What’s- ON in July 2014, Baseline in August 2014 and HWW in October 2014

as well as organic growth

in the legacy core video business. |

15

Digital and Data Segment

Adjusted EBITDA

Adjusted EBITDA

Adjusted

EBITDA

impacted

by:

•

Operating costs incurred in connection with Newsbeat, which was shut down during the

third quarter of 2014

•

Costs associated with the establishment of the Digital and Data business infrastructure, and

•

Costs associated with the integration of acquired businesses.

Dec. 28, 2014

Dec. 29, 2013

$

%

Dec. 28, 2014

Dec. 29, 2013

$

%

Operating Profit

13,926

$

4,185

$

9,741

*

3,409

$

16,497

$

(13,088)

-79%

Depreciation

1,987

715

1,272

*

7,744

2,576

5,168

*

Amortization

6,425

2,316

4,109

*

21,233

9,191

12,042

*

Stock-based compensation

262

6

256

*

1,641

17

1,624

*

Severance and related charges

1,212

216

996

*

3,975

279

3,696

*

Other

—

—

-

-

580

234

346

*

Adjusted EBITDA

23,812

$

7,438

$

16,374

*

38,582

$

28,794

$

9,788

34%

* Represents positive change in excess of 100%

Variance

Variance

Three months ended:

Year ended:

(USD thousands) |

16

Corporate and Other

Revenues and Expenses

(USD thousands)

Dec. 28, 2014

Dec. 29, 2013

$

%

Dec. 28, 2014

Dec. 29, 2013

$

%

Operating Revenues

13,035

$

13,686

$

(651)

-5%

54,792

$

53,599

$

1,193

2%

Operating Expenses

(9,908)

(30,418)

20,510

-67%

(93,940)

(66,996)

(26,944)

40%

Operating Profit (Loss)

3,127

(16,732)

19,859

*

(39,148)

(13,397)

(25,751)

*

Depreciation

3,901

2,543

1,358

53%

12,181

8,664

3,517

41%

Stock-based compensation

3,463

1,514

1,949

*

15,750

3,556

12,194

*

Transaction-related costs

2,957

14,316

(11,359)

-79%

13,790

19,545

(5,755)

-29%

Gain on sales of real estate

(21,285)

-

(21,285)

*

(21,588)

(135)

(21,453)

*

Severance and Other

41

1,358

(1,317)

-97%

4,178

517

3,661

*

Pension (credit) expense

(7,661)

(8,673)

1,012

-12%

(30,767)

(34,694)

3,927

-11%

Adjusted EBITDA

(15,457)

$

(5,674)

$

(9,783)

*

(45,604)

$

(15,944)

$

(29,660)

*

* Represents positive or negative change in excess of 100%

Variance

Three months ended:

Year ended:

Variance

•

Higher

compensation

expenses

as

a

result

of

the

full

year

impact

in

2014

of

the

timing

of

hiring

of

new

management

team

in

2013.

•

Costs associated with the implementation of improved business and technology applications

expected to improve productivity and

increase

operating

efficiencies

resulting

in

associated

cost

savings

beginning

in

2016.

Revenues

represent

real

estate

rental

revenues

earned

from

third

parties,

including

Tribune

Publishing.

Real estate revenues were more than offset by: |

17

Cash Distributions from Equity Investments

TV Food Network 2014 distributions include a one-time distribution of $12.4 million.

Careerbuilder used cash to fund certain acquisitions in 2014 leading to a lower

year-over-year cash distribution.

In a series of transactions in 2014, the Company monetized its interests in Classified

Ventures, and therefore, will no longer receive cash distributions from this

investment. •

The

proceeds

from

the

sale

of

the

Company’s

interest

in

Classified

Ventures

are

not

reflected

in

the

table

above.

(USD millions)

2014

2013

TV Food Network

189.3

$

154.1

$

CareerBuilder

14.4

28.9

Classified Ventures

6.5

25.0

Other

0.5

-

Total Cash Distributions from Equity Investments

210.7

$

208.0

$

|

18

Debt and Cash

December 28, 2014

December 29, 2013

Cash and cash equivalents

1,455,183

$

640,697

$

Debt:

Term Loan Facility, due 2020

3,471,017

3,763,577

Dreamcatcher Credit Facility, due

2018 23,914

26,933

Other

54

174,674

Total Debt

3,494,985

$

3,965,184

$

Reduced debt with proceeds of dividend

from Tribune Publishing upon spinoff (USD thousands)

|

19

Focus on Shareholder Return

$400 million share repurchase program.

•

Since

inception

through

March

5,

2015,

repurchased

approximately

3.9

million

shares for

an aggregate purchase price of $233 million.

•

$167 million remains outstanding.

Announced one-time special dividend of approximately $650 million.

Adopted annual dividend policy.

•

The Company intends to begin payments of regular quarterly cash dividends of $0.25 per

share.

•

The Company expects the first dividend to be declared by the Board and paid in the

second fiscal quarter of 2015.

Strong Balance Sheet and Cash Generation Driving Capital Allocation Policy

|

20

Total Shareholder Distributions

Share Repurchase

~$233 million

Special Dividend

~$650 million

Anticipated Annual Dividend in 2015

~$ 75 million

Total

~$958 million

Total scheduled shareholder distributions through 2015, excluding additional share

repurchases which occur post March 6, 2015, if any.

Nearly $1 billion of shareholder distributions |

21

2015 Guidance

Consolidated

2015 Guidance Range

Implied Y-o-Y Change

Revenues

$2.00 billion to $2.03

billion

~ +2.5% to +4%

Adjusted EBITDA

$480 million to $495

million

~ (18.5)% to (21)% |

22

2015 Guidance

Television and Entertainment Segment

Guidance Range

Implied Y-o-Y

Change

Revenues

$1.75 billion to $1.77 billion

~ +2% to +3%

Core Advertising

Low to mid-single digit increases over 2014

Retransmission Revenues

$275 million to $277 million

~ +20%

Cable Network Carriage Fees

$85 million to $87 million

~ +50%

WGN America / Tribune Studios

Programming Expenses

Approximately $130 million

~ +40%

Adjusted EBITDA

$500 million to $515 million

~ (16)% to (18.5)% |

23

2015 Guidance

Digital and Data Segment

2015 Guidance Range

Implied Y-o-Y Change

Revenues

$200 million to $205 million

~ +15% to +18%

Adjusted EBITDA

$46 million to $48 million

~ +19% to +24.5% |

24

2015 Guidance

Corporate and Other

Guidance Range

Implied Y-o-Y Change

Real Estate Revenues

Approximately $50 million

~ (9)%

Real Estate Expenses

Approximately $(30) million

~ 22%

Corporate Expenses

(excluding

stock-based compensation)

$(86) million to $(88) million

~ 13.5% to 16%

Adjusted EBITDA

$(66) million to $(68) million

~ 45% to 49% |

25

2015 Guidance

Cash Flow

Guidance Range

Total Capital Expenditures

Approximately $100 million

(1)

Cash Taxes

$135 million -

$140 million

(2)

Cash Interest

Approximately $140 million

Depreciation & Amortization

Approximately $260 million

Stock-based Compensation

Approximately $35 million

(1)

The $100 million of expected capital expenditures includes approximately $50 million of

non-recurring capital expenditures.

(2)

Cash taxes guidance excludes approximately $252 million of taxes payable for the sale of the

Company’s interest in Classified Ventures, which was recorded as a liability on the

Company’s balance sheet as of December 28, 2014 and is expected to be paid in March 2015. |

26

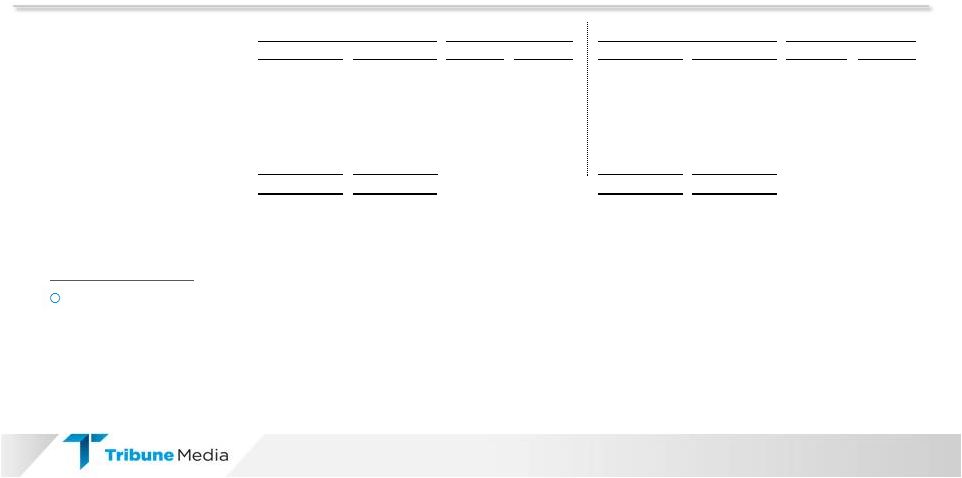

Long-Term Outlook

o

2016 Consolidated Adjusted EBITDA year-over-year growth of greater than

30%

The Company currently expects:

o

WGN America and Tribune Studios revenue growth to be greater than 20%

annually.

o

WGN America and Tribune Studios programming expenses approximating

50% of net revenues.

o

Digital and Data net revenue growth of 10% to 12% annually.

o

Digital and Data Adjusted EBITDA margins growing to low 30% range.

For the period 2016-2019: |

Non-GAAP Reconciliations

Quarterly 2013-2014 by Segment |

28

Consolidated

(USD thousands)

2014

2013

2014

2013

2014

2013

2014

2013

2014

2013

Revenue

446,102

$

274,156

$

474,979

$

292,915

$

474,858

$

280,608

$

553,420

$

299,561

$

1,949,359

$

1,147,240

$

Net Income

41,067

$

58,359

$

82,923

$

66,311

$

37,997

$

49,771

$

314,676

$

67,114

$

476,663

$

241,555

$

Income (loss) from discontinued operations, net of taxes

12,600

15,309

15,841

18,923

(14,889)

10,527

—

33,854

13,552

78,613

Income from Continuing Operations

28,467

43,050

67,082

47,388

52,886

39,244

314,676

33,260

463,111

162,942

Income tax expense

17,649

11,682

42,305

31,509

2,647

27,325

216,098

25,449

278,699

95,965

Reorganization items, net

2,216

7,331

2,165

4,502

1,594

1,708

1,293

3,390

7,268

16,931

Other non-operating (gain) loss, net

(157)

140

1,295

(386)

(68)

67

3,640

1,671

4,710

1,492

Write-down of investment

—

—

—

—

—

—

94

—

94

—

Gain on investment transactions, net

—

(29)

(700)

(17)

(2)

(104)

(371,783)

—

(372,485)

(150)

Loss on extinguishment of debt

—

—

—

—

—

—

—

28,380

—

28,380

Interest expense

40,519

9,396

39,146

9,575

39,150

9,558

39,051

10,605

157,866

39,134

Interest income

(171)

(93)

(147)

(102)

(363)

(100)

(687)

(118)

(1,368)

(413)

Income on equity investments, net

(38,263)

(16,441)

(118,953)

(37,695)

(40,559)

(31,899)

(38,938)

(59,206)

(236,713)

(145,241)

Operating Profit

50,260

55,036

32,193

54,774

55,285

45,799

163,444

43,431

301,182

199,040

Depreciation

16,711

9,018

17,540

10,131

17,991

10,558

17,945

11,480

70,187

41,187

Amortization

60,674

28,300

61,018

28,301

47,953

28,395

48,642

29,721

218,287

114,717

Stock-based compensation

8,449

—

6,121

1,366

5,833

1,870

5,788

2,181

26,191

5,417

Severance and related charges

2,439

134

712

541

1,974

727

1,484

1,154

6,609

2,556

Transaction-related costs

5,699

500

2,234

3,273

5,181

1,504

2,570

14,497

15,684

19,774

Gain on sales of real estate

—

(135)

—

—

(303)

—

(21,388)

—

(21,691)

(135)

Contract termination cost

—

—

15,646

—

—

—

(646)

—

15,000

—

Other

1,558

155

2,398

(606)

2,194

77

827

1,517

6,977

1,143

Pension (credit) expense

(7,804)

(8,266)

(7,518)

(9,125)

(7,660)

(8,694)

(7,661)

(8,695)

(30,643)

(34,780)

Adjusted EBITDA

137,986

$

84,742

$

130,344

$

88,655

$

128,448

$

80,236

$

211,005

$

95,286

$

607,783

$

348,919

$

First Quarter

Second Quarter

Third Quarter

Fourth Quarter

Full Year |

29

Television and Entertainment Segment

As Reported

(USD thousands)

2014

2013

2014

2013

2014

2013

2014

2013

2014

2013

Advertising

304,343

$

191,377

$

329,132

$

212,243

$

321,118

$

198,291

$

381,371

$

207,821

$

1,335,964

$

809,732

$

Retransmission consent fees

55,565

9,948

57,122

11,367

58,109

13,530

58,447

14,741

229,243

49,586

Carriage fees

14,128

13,733

14,591

13,719

14,023

13,408

14,395

12,935

57,137

53,795

Barter/trade

10,311

7,414

10,472

7,641

11,227

7,586

9,257

8,651

41,267

31,292

Copyright royalties

6,532

9,708

7,454

6,296

6,071

6,261

7,104

10,689

27,161

32,954

Other

7,535

6,979

7,025

9,233

6,621

9,120

8,583

11,733

29,764

37,065

Total Revenues

398,414

$

239,159

$

425,796

$

260,499

$

417,169

$

248,196

$

479,157

$

266,570

$

1,720,536

$

1,014,424

$

Operating Profit

64,153

$

46,979

$

52,248

$

50,596

$

74,129

$

42,387

$

146,391

$

55,978

$

336,921

$

195,940

$

Depreciation

12,376

6,463

13,136

7,465

12,693

7,797

12,057

8,222

50,262

29,947

Amortization

56,655

26,008

56,172

26,010

42,010

26,103

42,217

27,405

197,054

105,526

Stock-based compensation

2,523

—

2,113

464

2,101

719

2,063

661

8,800

1,844

Severance and related charges

1,414

109

108

504

347

726

229

302

2,098

1,641

Transaction-related costs

417

—

974

—

890

48

(387)

181

1,894

229

Gain on sales of real estate

—

—

—

—

—

—

(103)

—

(103)

—

Contract termination cost

—

—

15,646

—

—

—

(646)

—

15,000

—

Other

1,556

155

12

1

358

77

829

795

2,755

1,028

Pension (credit) expense

43

(69)

61

26

20

(21)

—

(22)

124

(86)

Adjusted EBITDA

139,137

$

79,645

$

140,470

$

85,066

$

132,548

$

77,836

$

202,650

$

93,522

$

614,805

$

336,069

$

Broadcast rights - Amortization

55,694

44,219

74,386

53,815

73,093

52,749

65,624

41,843

268,797

192,626 Broadcast rights - Cash Payments

(60,818)

(47,629)

(86,409)

(62,679)

(97,978)

(58,200)

(76,130)

(55,141)

(321,335) (223,650)

Broadcast Cash Flow

134,013

$

76,235

$

128,447

$

76,202

$

107,663

$

72,385

$

192,144

$

80,224

$

562,267

$

305,046

$

First Quarter

Second Quarter

Third Quarter

Fourth Quarter

Full Year |

30

Television and Entertainment Segment

Pro Forma

(1)

(1) Amounts

are

pro

forma

for

the

acquisition

of

Local

TV,

which

was

completed

on

December

27,

2013,

as

if

the

acquisition

had

occurred

as

of the beginning of fiscal 2013. Pro forma operating expenses, depreciation and

amortization for Local TV are based on Local TV's historical basis of

presentation and do not reflect the impact of purchase accounting. (USD

thousands) 2014

2013 PF (1)

2014

2013 PF (1)

2014

2013 PF (1)

2014

2013 PF (1)

2014

2013 PF (1)

Advertising

304,343

$

300,649

$

329,132

$

336,589

$

321,118

$

319,249

$

381,371

$

336,912

$

1,335,964

$

1,293,399

$

Retransmission consent fees

55,565

29,567

57,122

32,029

58,109

34,167

58,447

34,774

229,243

130,537

Carriage fees

14,128

13,733

14,591

13,719

14,023

13,408

14,395

12,936

57,137

53,796

Barter/trade

10,311

10,341

10,472

10,634

11,227

10,540

9,257

11,253

41,267

42,768

Copyright royalties

6,532

9,708

7,454

6,296

6,071

6,261

7,104

10,689

27,161

32,954

Other

7,535

5,306

7,025

6,710

6,621

6,407

8,583

9,328

29,764

27,751

Total Revenues

398,414

$

369,304

$

425,796

$

405,977

$

417,169

$

390,032

$

479,157

$

415,892

$

1,720,536

$

1,581,205

$

Operating Profit

64,153

$

89,273

$

52,248

$

106,387

$

74,129

$

94,432

$

146,391

$

108,845

$

336,921

$

398,937

$

Depreciation

12,376

12,264

13,136

13,408

12,693

13,599

12,057

14,444

50,262

53,715

Amortization

56,655

28,169

56,172

28,172

42,010

28,264

42,217

29,451

197,054

114,056

Stock-based compensation

2,523

200

2,113

663

2,101

923

2,063

792

8,800

2,578

Severance and related charges

1,414

109

108

504

347

726

229

302

2,098

1,641

Transaction-related costs

417

—

974

—

890

48

(387)

181

1,894

229

Gain on sales of real estate

—

—

—

—

—

—

(103)

—

(103)

—

Contract termination cost

—

—

15,646

—

—

—

(646)

—

15,000

—

Other

1,556

155

12

1

358

77

829

1,275

2,755

1,508

Pension (credit) expense

43

(69)

61

26

20

(21)

—

(22)

124

(86)

Adjusted EBITDA

139,137

$

130,101

$

140,470

$

149,161

$

132,548

$

138,048

$

202,650

$

155,268

$

614,805

$

572,578

$

Broadcast rights - Amortization

55,694

56,066

74,386

65,607

73,093

64,896

65,624

53,266

268,797

239,835

Broadcast rights - Cash Payments

(60,818)

(63,755)

(86,409)

(75,383)

(97,978)

(71,665)

(76,130)

(68,470)

(321,335)

(279,273)

Broadcast Cash Flow

134,013

$

122,412

$

128,447

$

139,385

$

107,663

$

131,279

$

192,144

$

140,064

$

562,267

$

533,140

$

First Quarter

Second Quarter

Third Quarter

Fourth Quarter

Full Year |

31

Digital and Data Segment

(1)

(1) The 2013 Digital and Data segment results shown above exclude the impact of the following

acquisitions, which occurred in 2014. -

Gracenote; Acquired January 2014

-

What’s-ON; Acquired July 2014

-

Baseline; Acquired August 2014

-

HWW; Acquired October 2014

(USD thousands)

2014

2013

2014

2013

2014

2013

2014

2013

2014

2013

Video

20,772

$

16,695

$

21,486

$

17,044

$

23,192

$

17,211

$

25,849

$

17,758

$

91,299

$

68,708

$

Music

10,713

—

12,222

—

20,408

—

34,386

—

77,729

—

Entertainment websites

and other

1,787

5,049

1,264

2,221

959

1,692

993

1,547

5,003

10,509

Total Revenues

33,272

$

21,744

$

34,972

$

19,265

$

44,559

$

18,903

$

61,228

$

19,305

$

174,031

$

79,217

$

Operating Profit (Loss)

(1,542)

$

4,218

$

(8,744)

$

3,755

$

(231)

$

4,339

$

13,926

$

4,185

$

3,409

$

16,497

$

Depreciation

1,813

573

1,909

623

2,035

665

1,987

715

7,744

2,576

Amortization

4,019

2,292

4,846

2,291

5,943

2,292

6,425

2,316

21,233

9,191

Stock-based compensation

649

—

688

4

42

7

262

6

1,641

17

Severance and related charges

632

25

504

37

1,627

1

1,212

216

3,975

279

Other

—

—

—

234

580

—

—

—

580

234

Adjusted EBITDA

5,571

$

7,108

$

(797)

$

6,944

$

9,996

$

7,304

$

23,812

$

7,438

$

38,582

$

28,794

$

First Quarter

Second Quarter

Third Quarter

Fourth Quarter

Full Year |

32

Corporate and Other

(USD thousands)

2014

2013

2014

2013

2014

2013

2014

2013

2014

2013

Total Revenues

14,416

$

13,253

$

14,211

$

13,151

$

13,130

$

13,509

$

13,035

$

13,686

$

54,792

$

53,599

$

Operating Profit (Loss)

(12,351)

$

3,839

$

(11,311)

$

423

$

(18,613)

$

(927)

$

3,127

$

(16,732)

$

(39,148)

$

(13,397)

$

Depreciation

2,522

1,982

2,495

2,043

3,263

2,096

3,901

2,543

12,181

8,664

Stock-based compensation

5,277

—

3,320

898

3,690

1,144

3,463

1,514

15,750

3,556

Severance and related charges

393

—

100

—

—

—

43

636

536

636

Transaction-related costs

5,282

500

1,260

3,273

4,291

1,456

2,957

14,316

13,790

19,545

Gain on sales of real estate

—

(135)

—

—

(303)

—

(21,285)

—

(21,588)

(135)

Other

2

—

2,386

(841)

1,256

—

(2)

722

3,642

(119)

Pension (credit) expense

(7,847)

(8,197)

(7,579)

(9,151)

(7,680)

(8,673)

(7,661)

(8,673)

(30,767)

(34,694)

Adjusted EBITDA

(6,722)

$

(2,011)

$

(9,329)

$

(3,355)

$

(14,096)

$

(4,904)

$

(15,457)

$

(5,674)

$

(45,604)

$

(15,944)

$

First Quarter

Second Quarter

Third Quarter

Fourth Quarter

Full Year |

M

A

R

C

H

2

0

1

5

Q4 & Full Year 2014 Performance Summary |