Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MONITRONICS INTERNATIONAL INC | a8-kxmonixlwpres.htm |

A S C E N T CAPITAL GROUP INC Acquisition Overview March 2, 2015

ASCENT CAPITAL GROUP INC March 2015 2 Forward Looking Statements This presentation contains or may contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements about our consolidated performance after giving effect to the integration of LiveWatch Security, LLC, market potential in the DIY alarm space, consumer demand for home automation systems, lead generation for Monitronics' dealers, business strategies, our ability to perform well in a challenging competitive environment, future financial performance, the growth and development of our core business and other matters that are not historical facts. These forward-looking statements involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements, including, without limitation, the actual growth potential of the LiveWatch business, continued productivity of LiveWatch's internal sales force, competitive issues, subscriber preferences, continued access to capital on terms acceptable to Ascent and Monitronics, general market conditions and regulatory issues. These forward looking statements speak only as of the date hereof, and Ascent expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in Ascent's or Monitronics' expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. This presentation will discuss certain non-GAAP financial measures, including Adjusted EBITDA and Pre-Creation Adjusted EBITDA. As companies often define non-GAAP financial measures differently, Adjusted EBITDA as calculated by us may not be comparable to similarly titled measures reported by other companies. Please see Ascent Capital's Annual Report on Form 10-K for the twelve months ended December 31, 2014 filed with the Securities and Exchange Commission (“SEC”) on February 27, 2015. For additional information regarding non-GAAP measures, please see Ascent Capital’s press release dated February 26, 2015, which is available on our website at www.ascentcapitalgroupinc.com.

• Leading Do-It-Yourself (“DIY”) home security provider ‒ Professionally monitored service, like Monitronics Customized and installed by the customer ‒ Complementary to Monitronics dealer program Establishes a new marketing channel • Over 32,000 subscribers and $905K of RMR at closing • Rapid growth despite capital constraints ‒ >60% RMR CAGR since 2010; generated $97K of RMR from ~3,000 new subscribers in last 3 months • Exceptional management team ‒ Strong track record of success in the direct-to-consumer marketing space • Asset-light business model that fits well with Monitronics • Differentiated go-to-market strategy through direct response TV, internet and radio that provides account generation diversification for Monitronics Business Overview March 2015 3

• Ascent Capital’s subsidiary Monitronics’ acquisition of LiveWatch, a Do-It- Yourself (“DIY”) home security firm, offering professionally monitored security services through a direct-to-consumer sales channel ‒ Purchase price of $67 million including $6 million of retention bonuses to be paid on the 2nd anniversary of closing Bulk account acquisition of $905K of RMR and 32,000 accounts represented well over half of the enterprise value Growth engine/direct-to-consumer sales platform that will continue to generate new accounts and RMR ‒ 60% annualized RMR growth since YE 2010 ‒ Funded through $38 million of Monitronics revolver borrowings under the credit facility, which was recently expanded by $90 million, and $23 million of cash from Ascent ‒ LiveWatch will continue to operate as a standalone subsidiary under current management with principal operations in central Kansas Management team signed 5-year employment agreements which include performance-based incentive compensation based on the success of the business, payable after 4 years Transaction Overview March 2015 4

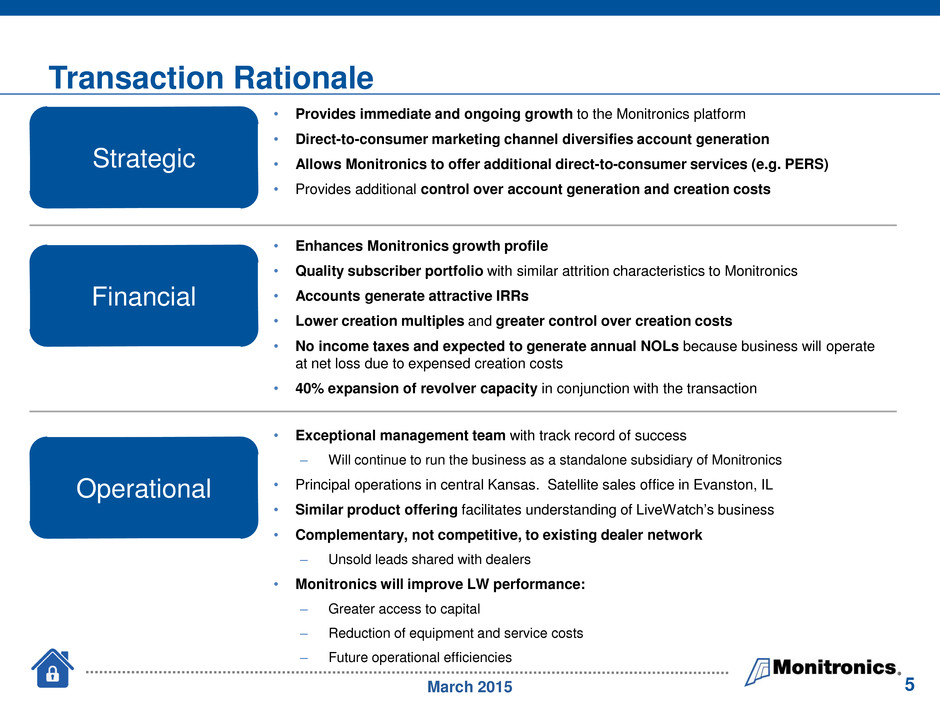

Transaction Rationale Strategic Financial Operational • Exceptional management team with track record of success ‒ Will continue to run the business as a standalone subsidiary of Monitronics • Principal operations in central Kansas. Satellite sales office in Evanston, IL • Similar product offering facilitates understanding of LiveWatch’s business • Complementary, not competitive, to existing dealer network ‒ Unsold leads shared with dealers • Monitronics will improve LW performance: ‒ Greater access to capital ‒ Reduction of equipment and service costs ‒ Future operational efficiencies • Provides immediate and ongoing growth to the Monitronics platform • Direct-to-consumer marketing channel diversifies account generation • Allows Monitronics to offer additional direct-to-consumer services (e.g. PERS) • Provides additional control over account generation and creation costs • Enhances Monitronics growth profile • Quality subscriber portfolio with similar attrition characteristics to Monitronics • Accounts generate attractive IRRs • Lower creation multiples and greater control over creation costs • No income taxes and expected to generate annual NOLs because business will operate at net loss due to expensed creation costs • 40% expansion of revolver capacity in conjunction with the transaction March 2015 5

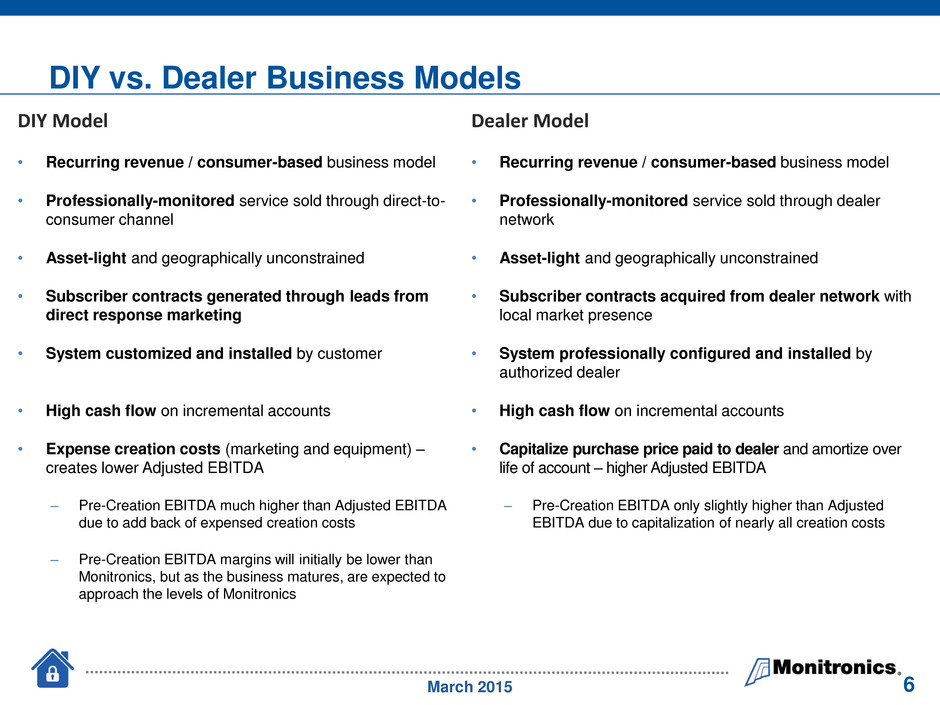

Dealer Model • Recurring revenue / consumer-based business model • Professionally-monitored service sold through dealer network • Asset-light and geographically unconstrained • Subscriber contracts acquired from dealer network with local market presence • System professionally configured and installed by authorized dealer • High cash flow on incremental accounts • Capitalize purchase price paid to dealer and amortize over life of account – higher Adjusted EBITDA ‒ Pre-Creation EBITDA only slightly higher than Adjusted EBITDA due to capitalization of nearly all creation costs DIY Model • Recurring revenue / consumer-based business model • Professionally-monitored service sold through direct-to- consumer channel • Asset-light and geographically unconstrained • Subscriber contracts generated through leads from direct response marketing • System customized and installed by customer • High cash flow on incremental accounts • Expense creation costs (marketing and equipment) – creates lower Adjusted EBITDA ‒ Pre-Creation EBITDA much higher than Adjusted EBITDA due to add back of expensed creation costs ‒ Pre-Creation EBITDA margins will initially be lower than Monitronics, but as the business matures, are expected to approach the levels of Monitronics DIY vs. Dealer Business Models March 2015 6

Key Assumptions Dealer DIY ARPU $46 $32 Creation Multiple 36X 28X Illustrative Accounting Dealer DIY Annual Monitoring Revenue $550,000 $380,000 Operating Costs ($180,000) ($150,000) Expensed Creation Costs $0 ($270,000) Adj. EBITDA $370,000 ($40,000) Adj. EBITDA % 67% (11%) Expensed Creation Costs Add Back $0 $270,000 Pre-Creation Adj. EBITDA $370,000 $230,000 Theoretical Pre-Creation Adj. EBITDA % 67% 60% Theoretical Unlevered IRR 14-15% 17-18% Illustrative Financial and Accounting Comparisons(1) (1) Included for illustrative purposes only. Not intended to reflect management’s projections or guidance. DIY accounts achieve higher IRRs due to the relatively lower creation multiples, despite lower ARPUs and associated lower margins than traditional security accounts March 2015 7 • Hypothetical Dealer and DIY businesses intended to illustrate: ‒ Differences in accounting treatment ‒ Similarities in cash flow and return characteristics • Intended to approximate Monitronics and LiveWatch on ARPU, margins (as the business matures in the case of LW) and creation multiples ‒ Included for illustrative purposes only and not intended to reflect management’s projections or guidance • Key assumptions include: ‒ Snapshot of one year ‒ Assumed to be similarly sized businesses of approximately 1,000 average subscribers for the year ‒ 300 accounts added ratably during the year ‒ Margins based on a mature business