Attached files

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[ X ]ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

[ ]TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Commission File No. 0-18348

B/E AEROSPACE, INC.

(Exact name of registrant as specified in its charter)

|

Delaware (State or other jurisdiction of incorporation or organization) |

06-1209796 (I.R.S. Employer Identification No.) |

1400 Corporate Center Way

Wellington, Florida 33414

(Address of principal executive offices)

(561) 791-5000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class Common Stock, $.01 Par Value |

Name of each exchange on which registered NASDAQ Stock Market LLC (NASDAQ Global Select Market) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [X] No [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [X] Accelerated filer [ ] Non-accelerated filer (do not check if a smaller reporting company) [ ]

Smaller reporting company [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

The aggregate market value of the registrant's voting stock held by non-affiliates was approximately $7,102 million on June 30, 2014 based on the closing sales price of the registrant's common stock as reported on the NASDAQ Global Select Market as of such date, which is the last business day of the registrant's most recently completed second fiscal quarter. Shares of common stock held by executive officers and directors have been excluded since such persons may be deemed affiliates. This determination of affiliate status is not a determination for any other purpose. The number of shares of the registrant's common stock, $.01 par value, outstanding as of February 23, 2015 was 105,963,213 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Certain sections of the registrant's Proxy Statement to be filed with the Commission in connection with the 2015 Annual Meeting of Stockholders are incorporated by reference in Part III of this Form 10-K. With the exception of those sections that are specifically incorporated by reference in this Annual Report on Form 10-K, such Proxy Statement shall not be deemed filed as part of this Report or incorporated by reference herein.

1

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements to encourage companies to provide prospective information to investors. This Annual Report on Form 10-K (Form “10-K”) includes forward-looking statements that reflect our current expectations and projections about our future results, performance, prospects, payment of dividends and repurchase of shares. Forward-looking statements include all statements that are not historical in nature or are not current facts. We have tried to identify these forward-looking statements by using words including “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “should,” “will” and similar expressions. These forward-looking statements are subject to a number of risks, uncertainties, assumptions and other factors that could cause our actual results, performance, prospects and ability to pay dividends to differ materially from those expressed in, or implied by, these forward-looking statements. These factors include the risks, uncertainties, assumptions and other factors discussed under the headings “Item 1A. Risk Factors,” as well as “Item 1. Business,” “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this Form 10-K, including: future events that may have the effect of reducing our available operating income and cash balances, such as unexpected operating losses, the impact of rising fuel prices on our airline customers, outbreaks in national or international hostilities, terrorist attacks, prolonged health and environmental issues that reduce air travel demand, delays in, or unexpected costs associated with, the integration of our acquired businesses, conditions in the airline industry, conditions in the business jet industry, problems meeting customer delivery requirements, our success in winning new or expected refurbishment contracts from customers, capital expenditures, increased leverage, possible future acquisitions, facility closures, product transition costs, labor disputes involving us, our significant customers’ suppliers or airframe manufacturers, the impact of a prolonged global recession, the possibility of a write-down of intangible assets, delays or inefficiencies in the introduction of new products, fluctuations in currency exchange rates or our inability to properly manage our rapid growth.

In light of these risks and uncertainties, you are cautioned not to unduly rely on such forward-looking statements when evaluating the information presented herein. These statements should be considered only after carefully reading this entire Form 10-K. Except as required under the federal securities laws and rules and regulations of the Securities and Exchange Commission (“SEC”), we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Additional risks that we may currently deem immaterial or that are not presently known to us could also cause the forward-looking events discussed in this Form 10-K not to occur.

Unless otherwise indicated, the industry data contained in this Form 10-K is from the January/February 2015 issue of the Airline Monitor, December 2014 reports of the International Air Transport Association (“IATA”), the Boeing Current Market Outlook 2014, “The ACAS Database” or the Airbus and The Boeing Company (“Boeing”) corporate websites.

2

Our Company

General

Based on our experience in the industry, we believe we are the world’s largest manufacturer of cabin interior products for commercial aircraft and for business jets. We sell our products and provide our services directly to virtually all of the world’s major airlines and aerospace manufacturers. Also, based on our experience, we believe that we have achieved leading global market positions in each of our major product categories, which include:

|

· |

commercial aircraft seats, including an extensive line of super first class, first class, business class, tourist class and regional aircraft seats; |

|

· |

a full line of aircraft food and beverage preparation and storage equipment, including coffee and espresso makers, water boilers, beverage containers, refrigerators, freezers, chillers and a line of ovens that includes microwave, high efficiency convection and steam ovens; |

|

· |

modular lavatory systems, waste water management systems and galley systems; |

|

· |

both chemical and gaseous aircraft oxygen storage, distribution and delivery systems, protective breathing equipment and a broad range of lighting products; and |

|

· |

business jet and general aviation interior products, including an extensive line of executive aircraft seats, direct and indirect overhead lighting systems, passenger and crew oxygen systems, air valve systems and high-end furniture and cabinetry. |

We provide comprehensive aircraft cabin interior reconfiguration, program management and certification services. In addition, we also design, engineer and manufacture customized fully integrated thermal and power management solutions.

Since our organization as a corporation in Delaware in 1987, we have substantially expanded the size, scope and nature of our business as a result of a number of acquisitions. Between 1989 and 2011, we completed 28 acquisitions, for an aggregate purchase price of approximately $1.2 billion. We believe these acquisitions enabled us to position ourselves as a preferred global supplier to our customers. During this period we consolidated facilities and product lines, implemented lean manufacturing and continuous improvement programs and invested in our information technology. All of these efforts allowed us to continually improve our productivity and expand our operating margins.

In June 2014, the Company acquired the outstanding shares of the Emteq, Inc. group of companies, a domestic provider of aircraft interior and exterior lighting systems, as well as aircraft cabin management and power systems for a purchase price of $256.3 million, net of cash acquired. The Company also acquired the outstanding shares of the F+E Fischer + Entwicklungen GmbH & Co. KG group of companies, a leading Europe-based manufacturer of seating products for civilian helicopters for a purchase price of $212.3 million, net of cash acquired. During the second quarter, the Company also acquired the outstanding shares of Wessex Advanced Switching Products Ltd., a company engaged in the production of lighting, control units and switches, based in Europe for a purchase price of $63.0 million, net of cash acquired. These acquisitions are included in the business jet segment.

On June 10, 2014, we announced a plan to spin-off our Consumables Management Segment into a separate publicly traded company. To accomplish the spin-off, we formed a new company, KLX Inc. (“KLX”).

3

On December 16, 2014 (the “Distribution Date”), we completed the spin-off of KLX by means of the transfer of our Consumables Management Segment to KLX and the subsequent distribution to our stockholders of all of the outstanding shares of KLX common stock. As part of the spin-off, we also entered into several related agreements with KLX including a separation and distribution agreement (the “Separation and Distribution Agreement”) and a tax sharing and indemnification agreement (the “Tax Sharing and Indemnification Agreement”). The historical operating results of the Consumables Management Segment prior to the spin-off are excluded from Earnings from Continuing Operations and are presented as Earnings from Discontinued Operations in our consolidated statements of earnings and comprehensive income. Discontinued Operations include the results of KLX’s business except for certain corporate overhead costs and certain costs associated with transition services that will be provided by us to KLX. Discontinued Operations also include other costs incurred by us to spin-off KLX. The assets, liabilities, and cash flows of the Consumables Management Segment are included in our consolidated balance sheet and our consolidated statements of cash flows for periods prior to the Distribution Date.

Our principal executive offices and corporate headquarters are located at 1400 Corporate Center Way, Wellington, Florida 33414-2105 and our telephone number is 561-791-5000.

Industry Overview

The commercial and business jet aircraft cabin interior products industries encompass a broad range of products and services, including aircraft seating, passenger entertainment and service systems, food and beverage preparation and storage systems, galley systems, passenger and crew oxygen storage, oxygen distribution and delivery systems, lavatory systems, wastewater management systems, lighting systems, evacuation equipment and overhead bins, as well as interior reconfigurations and a variety of other engineering, design, integration, installation, retrofit and certification services, such as passenger-to-freighter conversions.

Historically, the airline cabin interior products industry has derived revenues from five sources:

|

· |

New installation programs in which airlines purchase new equipment directly from interior equipment manufacturers to outfit these newly purchased aircraft; |

|

· |

Retrofit programs in which airlines purchase new interior furnishings to upgrade the interiors of aircraft already in service; |

|

· |

Refurbishment programs in which airlines purchase components and services to improve the appearance and functionality of their cabin interior equipment; |

|

· |

Equipment to upgrade the functionality or appearance of the aircraft interior; and |

|

· |

Replacement spare parts. |

The retrofit and refurbishment cycles for commercial aircraft cabin interior products differ by product category. Aircraft seating typically has a refurbishment cycle of one to two years and a retrofit cycle of four to eight years. Food and beverage preparation and storage equipment is periodically upgraded or repaired, and requires a continual flow of spare parts, but may be retrofitted only once or twice during the useful life of an aircraft.

Based on industry sources and studies, we estimate that during 2014, the global commercial and business jet cabin interior products industry, for the principal products of the type which we manufacture, exclusive of service revenues, had annual sales of approximately $4.4 billion. We estimate that the total worldwide installed base of commercial and general aviation aircraft cabin interior products for the principal products of the type which we manufacture, valued at replacement prices, was approximately $26.6 billion as of December 31, 2014.

4

During 2014, global air traffic increased by 5.5% as compared with global traffic increases of 5.7% in 2013 and 4.8% in 2012. The increases in global traffic demand from 2012 through 2014 reflect the global macroeconomic environment. The Airline Monitor 2015 forecast calls for a global passenger traffic increase of approximately 5.8% and capacity growth of approximately 5.5%.

IATA expects the global airline industry to generate a profit of approximately $19.9 billion in 2014, an increase of 88% compared to 2013. Overall performance in 2014 has been positively impacted by strong passenger traffic growth of approximately 5.5%, near record load factors of about 80% and a modest reduction in yields as compared with 2013. For 2015 IATA expects global profits to improve to $25.0 billion, or 26% higher than 2014.

The airlines have substantially strengthened their balance sheets over the past several years through operating profits and by accessing capital markets. As a result, we believe airline balance sheets are much stronger than in any time in the past ten years.

Approximately 710 business jets were delivered in 2014 versus 678 business jets in 2013 and 672 business jets in 2012.

Other factors expected to affect the industries we serve include the following:

Wide-Body Aircraft Deliveries. Deliveries of wide-body, long-haul aircraft constitute an increasing share of total new aircraft deliveries and are an increasing percentage of the worldwide fleet. Wide-body aircraft represented approximately 26% of all new commercial aircraft (excluding regional jets) delivered over the four-year period ended December 31, 2014. According to the Airline Monitor, 377 new wide-body aircraft were delivered in 2014 and approximately 390 are expected to be delivered in 2015. Over the 2015-2018 period, 1,730 wide-body aircraft deliveries are expected, averaging approximately 433 such aircraft per year, or a 15% higher delivery level as compared with 2014 and representing approximately 28% of total deliveries. The Airline Monitor also predicts that nearly 5,090 twin-aisle aircraft will be delivered over the 2015-2025 timeframe or approximately 463 wide-body and super wide-body aircraft per year, which is 23% higher, on average, as compared to 2014 deliveries. According to the Airline Monitor, wide-body aircraft deliveries are expected to grow at a 7% compounded annual growth rate (“CAGR”) over the four-year period ending 2018.

Long-Term Growth in Worldwide Fleet. According to the Airline Monitor, new deliveries of large commercial aircraft increased to 1,352 aircraft in 2014, as compared to 1,274 aircraft in 2013 and 1,189 in 2012. According to the Airline Monitor, new aircraft deliveries are expected to total 1,430 in 2015 and 1,470 in 2016. Worldwide air traffic is expected to grow by approximately 5.8% in 2015 and the Airline Monitor has forecasted revenue passenger miles to increase at a CAGR of approximately 5.3% during the 2014-2029 period, increasing from 3.7 trillion miles in 2014 to approximately 8.0 trillion miles by 2029. As a result, the Airline Monitor expects the worldwide fleet of commercial jet aircraft to increase by approximately 74% from approximately 23,868 regional, single-aisle and twin-aisle aircraft at December 31, 2014 to approximately 41,582 aircraft at December 31, 2029.

Existing Installed Base. According to industry sources, the world's active commercial passenger aircraft fleet consisted of approximately 23,868 aircraft as of December 31, 2014. Additionally, based on industry sources, there are approximately 19,007 business jets currently in service. Based on such fleet numbers, we estimate that the total worldwide installed base of commercial and general aviation aircraft cabin interior products for the principal products of the type which we manufacture, valued at replacement prices, was approximately $26.6 billion as of December 31, 2014. The size of the installed base is expected to increase as a result of the growth in the world-wide fleet and is expected to generate additional and continued demand for retrofit, refurbishment and spare parts.

Engineering Services Markets. Historically, the airlines have relied primarily on their own in-house engineering resources to provide engineering, design, integration and installation services, as well as services

5

related to repairing or replacing cabin interior products that have become damaged or otherwise non-functional. As cabin interior product configurations have become increasingly sophisticated and the airline industry increasingly competitive, the airlines have begun to outsource certain of these services in order to increase productivity and reduce costs.

Outsourced services include:

|

· |

Engineering, design, integration, project management, installation and certification services; |

|

· |

Modifications and reconfigurations for commercial aircraft including passenger-to-freighter conversions and related kits; and |

|

· |

Services related to the support of product upgrades. |

Competitive Strengths

We believe that we have a strong competitive position attributable to a number of factors, including the following:

Large Installed Base. We have a large installed base of commercial and general aviation aircraft cabin interior products for the principal products of the type which we manufacture, valued at replacement prices, of approximately $10.9 billion as of December 31, 2014. Based on our experience in the industry, we believe our installed base is substantially larger than that of our competitors. We believe that our large installed base is a strategic advantage, as airlines tend to purchase aftermarket products and services, including spare parts, retrofit and refurbishment programs, from the original supplier. As a result, we expect our large installed base to generate continued aftermarket revenue as airlines continue to maintain, evolve and reconfigure their aircraft cabin interiors.

Increasing Content of B/E Aerospace Products in Individual Aircraft Platforms Through Development and Sales of Seller Furnished Equipment (“SFE”). Traditionally, we, and our competitors, have sold customized cabin interior products directly to the airlines. Approximately six years ago we began a campaign to develop a range of new aircraft interior products and to market certain interior systems directly to Boeing and Airbus. During 2011, we were awarded one of the most important new business programs in our history when Boeing selected us as the exclusive manufacturer of modular lavatory systems for Boeing’s 737 NG family of airplanes, as well as the Boeing 737 MAX. The award was initially valued in excess of $800 million, exclusive of retrofit orders. This innovative SFE system will become standard equipment on these aircraft. Our proprietary lavatory systems create the opportunity to add up to six incremental passenger seats on each new 737 NG airplane.

We have also been selected by Boeing to manufacture our light-emitting-diode (“LED”) cabin lighting systems for the Boeing 737 Sky Interior aircraft. This has facilitated our growth on lighting retrofits for both narrow-body and wide-body aircraft where we have won several awards as we continue to offer all-LED lighting throughout the cabin into the existing worldwide fleet of aircraft. To date, we have been selected by Boeing to manufacture our patented Pulse OxygenTM system and passenger service units for the B787 and B747-8, and we have been selected by Airbus to manufacture our next generation galley systems and our patented passenger oxygen delivery system for the A350 XWB. Additionally, we have been selected by major business jet manufacturers to provide vacuum wastewater systems. As of December 31, 2014, the SFE programs we have won are currently expected to generate approximately $5.0 billion in revenues over time, and are expected to significantly increase our content per aircraft type; however, only a small portion of these programs are included in our reported backlog as of December 31, 2014. This effort to develop and market new interior systems directly to the original equipment manufacturers (“OEMs”) is important to us as it represents a significant potential increase in the dollar value of our products on each such aircraft type.

6

Focus on Innovation and New Product Development. Our aircraft cabin interior products businesses are engaged in extensive product development and marketing efforts for both new features on existing products and new products. We believe, based on our experience in the industry, that we are a technological leader, with the largest research and development organization in the cabin interior products industry. The success of these and other new product development efforts are expected to increase demand for our products in both newly purchased aircraft and in aftermarket retrofits and it has allowed us to grow our backlog and improve the product mix of our current backlog. Newly introduced products include a broad range of amenities such as luxurious first class cabins (offering high privacy and high density seats) with appointments such as lie-flat seating, mini-bars, closets, flat screen TVs, digital LED mood lighting, electric lie-flat first and business class seats, Pulse Oxygen™ gaseous passenger oxygen systems for the Boeing 787 and Airbus A350 XWB, next-generation galley systems for the Airbus A350 XWB, electric fully berthing business jet seating, lightweight, lower maintenance wastewater systems for business and commercial jets and a full range of business and executive jet seating. We recently introduced our new patented Pinnacle® main cabin seating platform, which we believe is the industry’s lightest full-featured seat that significantly reduces cost of ownership, simplifies maintenance and increases overall passenger living space. We also introduced our digital LED lighting system for the Boeing 737 Sky Interior aircraft. This innovative, lightweight LED system features adjustable lighting with full spectrum color capabilities, providing superior cabin ambiance and unprecedented lighting control. Market acceptance of our LED lighting systems has continued to gain strength, and since 2012 we have been receiving orders from various airlines to retrofit their Boeing 737, 757, 767 and 777 aircraft with our LED lighting systems.

As of December 31, 2014, we had 2,296 employees in engineering, research and development and program management. We believe our engineering, research and development efforts and our on-site technicians at both the airlines and airframe manufacturers enable us to play a leading role in developing and introducing innovative products to meet emerging industry trends, and thereby gain early entrant advantages.

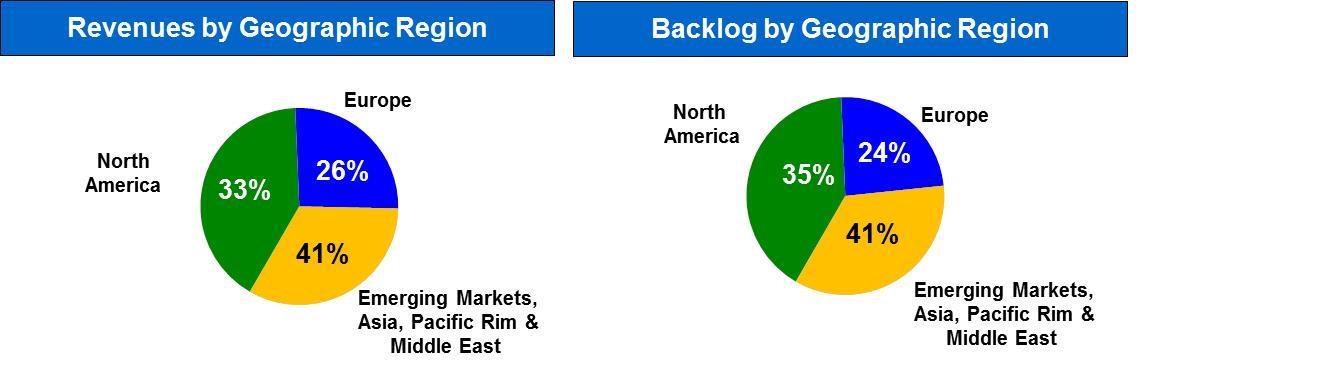

Exposure to International Markets. Revenues and booked backlog by geographic region are set forth in the following charts:

We believe this geographic diversification makes us less susceptible to a downturn in a specific geographic region and allows us to take advantage of regional growth trends.

Diverse Product Offering and Broad Customer Base. We provide a comprehensive line of products and services to a broad customer base. During the year ended December 31, 2014, Boeing accounted for 12% of our consolidated revenues (no other customer represented more than 10% of consolidated revenues). Our commercial aircraft and business jet segments have a broad range of over 350 principal customers, including all of the world’s major airlines, commercial aircraft and business jet manufacturers and completion centers. During the year ended December 31, 2014, our sales to Boeing and Airbus together represented approximately 18% of our total sales. We believe that our broad product offering and large customer base make us less vulnerable to the loss of any one customer or program. We have continued to expand our available products and services based on our belief that the airline industry increasingly will seek an

7

integrated approach to the design, development, integration, installation, testing and sourcing of aircraft cabin interior equipment.

Experience with a Complex Regulatory Environment. The airline industry is heavily regulated. The Federal Aviation Administration (the “FAA”) prescribes standards and licensing requirements for manufacturers and sellers of many aircraft components, including virtually all commercial airline and general aviation cabin interior products, and licenses component repair stations within the United States. Comparable agencies, such as the European Aviation Safety Agency (the “EASA”), the Japanese Civil Aviation Board (the “JCAB”), and the Civil Aviation Administration of China (the “CAAC”), prescribe standards, establish licensing requirements and regulate these matters in other countries. In addition, designing new products to meet existing regulatory requirements and retrofitting products to comply with new regulatory requirements can be both expensive and time consuming. We have a long history and extensive experience with the complex regulatory environments in which we operate and believe this enables us to efficiently obtain the required approvals for new products and services.

Growth Opportunities

We believe that we will benefit from the following industry trends:

Growth of Wide-Body Aircraft Fleet. New aircraft deliveries of wide-body aircraft are expected to continue to grow over the long term, reflecting the expected growth in revenue passenger miles over the 2015-2029 period. The trend toward a global fleet with a higher percentage of wide-body aircraft is significant to us because wide-body aircraft require up to six-to-ten times the dollar value content of the principal products of the type which we manufacture as compared to narrow-body aircraft. For example, wide-body aircraft carry up to three or four times the number of seats as narrow-body aircraft and have multiple classes of service, including super first class compartments and first class and business class configurations. In addition, aircraft cabin crews on wide-body aircraft flights may make and serve between 300 and 900 meals and may brew and serve more than 2,000 cups of coffee and serve more than 200 glasses of wine on a single flight, thereby generating substantial demand for seating products and food and beverage preparation and storage equipment, as well as extensive oxygen storage, distribution and delivery systems and lighting systems.

Worldwide Aircraft Fleet Creates Demand for Aftermarket Products. The size of the worldwide aircraft fleet is important to us since the proper maintenance of the fleet generates ongoing demand for spare parts and refurbishment retrofits. Our substantial existing installed base of products typically generates continued retrofit, replacement, upgrade, refurbishment, repair and spare parts revenue as airlines maintain their aircraft interiors. For the years ended December 31, 2014 and 2013, approximately 40% and 40%, respectively, of our revenues were derived from the aftermarket. In addition, aftermarket revenues are generally driven by aircraft usage, and as such, have historically tended to recover more quickly than revenues from OEMs. As used in this Form 10-K, aftermarket sales include sales to support existing commercial and business jet fleets. We believe that there are substantial growth opportunities for retrofit programs for the wide-body aircraft that service international routes and that the major global airlines will need to invest in cabin interiors for their international fleets or face the prospect of losing market share on their international routes. Additionally, the expected growth in the worldwide fleet will serve to increase the size of our installed base.

Backlog Aided by Aftermarket Demand from International Airlines Retrofitting Existing Fleets. We believe that many major international airlines are in the process of reinitiating or planning to reinitiate previously deferred cabin interior upgrade programs. This activity is expected to continue to be driven by both the age of the existing cabin interiors as well as the desire by many of the leading international carriers to achieve a competitive advantage by investing in cabin interior products that incorporate leading comfort amenities, thereby improving passenger loads and yields, or that reduce airline operating costs by reducing maintenance costs and/or providing lower weight and fuel burn. We believe that as international traffic continues to grow, the life cycle of premium products, such as lie-flat international business class seats and the products comprising our super first class suites, will continue to compress as airlines seek greater competitive advantage through state-of-the-art cabin interior products.

8

Growth in New Aircraft Introductions Leads to New Cabin Interior Product Introductions and Major Retrofit Opportunities. According to Airbus, 18 customers have placed orders for 317 of the new Airbus A380 super wide-body aircraft and 40 customers have placed 780 orders for the new A350 XWB. According to Boeing, through December 31, 2014, 58 customers have placed orders for 1,071 of the new B787 wide-body aircraft. Six customers have placed 286 orders for the B777X. We believe the airlines often use the occasion of introduction into service of a new aircraft fleet type to introduce next generation cabin interior products. In such cases, we believe airlines will also invest in programs to retrofit their existing fleets to incorporate these new interior products and configurations in order to enhance their revenue and/or cost advantages realized on the new fleets and to maintain product and service commonality.

Long-Term Growth in Business Jet and VIP Aircraft Markets. Business jet deliveries were up 4.7% in 2014 at 710 aircraft as compared to 2013 after remaining flat in 2013 as compared to 2012. According to industry sources, new business jet deliveries in 2015 are expected to begin to increase and average annual deliveries of new business jets are expected to continue to expand over the four-year period ending December 31, 2018.

Business Strategy

Our business strategy is to maintain a leadership position and to best serve our customers by:

|

· |

Offering the broadest and most innovative products and services in the industry; |

|

· |

Offering a broad range of engineering services including design, integration, installation and certification services and aircraft reconfiguration; |

|

· |

Pursuing the highest level of quality and safety in every facet of our operations, from the factory floor to customer support; |

|

· |

Aggressively pursuing continuous improvement initiatives in all facets of our business, and in particular our manufacturing operations, to reduce cycle time, lower costs, improve quality and expand our margins; and |

|

· |

Pursuing a worldwide marketing and product support approach focused by airline and general aviation airframe manufacturers, encompassing our entire product line. |

Products and Services

We conduct our operations through strategic business units that have been aggregated under two reportable segments: commercial aircraft (“CAS”) and business jet (“BJS”).

The following is a summary of revenues for our reportable segments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|||||||||||||

|

|

|

2014 |

|

2013 |

|

2012 |

|

|||||||||

|

|

|

|

|

|

% of |

|

|

|

|

% of |

|

|

|

|

% of |

|

|

|

|

Revenues |

|

Revenues |

|

Revenues |

|

Revenues |

|

Revenues |

|

Revenues |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial aircraft |

|

$ |

2,058.9 |

|

79.2 |

% |

$ |

1,784.7 |

|

81.0 |

% |

$ |

1,551.2 |

|

81.0 |

% |

|

Business jet |

|

|

540.1 |

|

20.8 |

% |

|

418.6 |

|

19.0 |

% |

|

363.1 |

|

19.0 |

% |

|

Total revenues |

|

$ |

2,599.0 |

|

100.0 |

% |

$ |

2,203.3 |

|

100.0 |

% |

$ |

1,914.3 |

|

100.0 |

% |

9

Commercial Aircraft Segment

Seating Products. We believe, based on our experience in the industry, that we are the world's leading manufacturer of aircraft seats, offering a wide selection of first class, business class, tourist class and regional aircraft seats. A typical seat manufactured and sold by us includes the seat frame, cushions, armrests, tray table and a variety of optional features such as adjustable lumbar supports, electrical actuation systems, footrests, reading lights, head/neck supports, and other comfort amenities. We also integrate a wide variety of in-flight entertainment equipment into our seats, which is supplied to us by our customers or third-party suppliers.

First and Business Class Seats. Based upon major airlines' program selection and our backlog, we believe we are the leading worldwide manufacturer of premium class seats. Our line of first class lie-flat seats incorporates full electric actuation, an electric ottoman, privacy panels and sidewall-mounted tables. Our business class seats incorporate features developed over 25 years of seating design. The business class seats include electrical or mechanical actuation, PC power ports, iPod connectivity, telephones, individual video monitors, leg rests, adjustable lumbar cushions, four-way adjustable headrests and fiber optic reading lights. The first and business class products are substantially more expensive than tourist class seats due to these luxury appointments.

Tourist Class and Regional Jet Seats. We believe, based on our installed base, that we are a leading worldwide manufacturer of tourist class seats and regional aircraft seats. We believe our Spectrum® coach class seat has become the industry's most popular seat platform for single-aisle aircraft since its launch in late 2002. We believe the seat improves comfort and offers significantly improved passenger living space as well as benefiting the airlines with simplified maintenance and spare parts purchasing. Spectrum® was engineered for use across the entire single-aisle aircraft fleet, including regional jets. In 2010, we introduced our new patented Pinnacle® main cabin seating platform, which we believe is the industry’s lightest full-featured seat. The Pinnacle® seat platform utilizes advanced proprietary technologies that we believe significantly reduce cost of ownership, simplify maintenance and increase overall passenger living space and comfort. Since its launch, the Pinnacle® seating platform has received awards to equip more than 2,000 new or existing aircraft, surpassing the Spectrum® in popularity and making the Pinnacle® the most successful new product launch in our history and of the whole seating industry, as measured by the number of contract awards. These awards are valued at approximately $1.4 billion and are for both narrow-body and wide-body aircraft.

Spares. Aircraft seats require regularly scheduled maintenance in the course of normal passenger use. Airlines depend on seat manufacturers and secondary suppliers to provide spare parts and kit upgrade programs. As a result, a significant market exists for spare parts and kit upgrades.

Oxygen Delivery Systems. We believe, based on our experience in the industry, that we are the leading manufacturer of oxygen storage, distribution and delivery systems for both commercial and business jet aircraft. We have the capability to both produce all required components and to fully integrate overhead passenger service units with either chemical or gaseous oxygen equipment. Our oxygen equipment has been approved for use on all Boeing and Airbus aircraft and is also found on essentially all general aviation and VIP aircraft. The Boeing 787 was the first aircraft equipped with a passenger oxygen system using our advanced Pulse OxygenTM and passenger service unit technology. Airbus has also selected us to provide similar technology for its passenger and crew oxygen systems for the A350 XWB. We have also been selected by both Boeing and Airbus to provide installed lavatory oxygen as their preferred line-fit solution for all platforms.

Coffee Makers/Water Boilers, Ovens, and Refrigeration Equipment. We believe, based on our experience in the industry, that we are the leading manufacturer of aircraft coffee and beverage makers. We manufacture a broad line of coffee makers, including the Endura® beverage maker, coffee warmers and water boilers, and a Combi Unit® which will both brew coffee and boil water for tea while utilizing 25% less electrical power than traditional 5,000-watt water boilers. We also manufacture a cappuccino/espresso maker. We believe, based on our experience in the industry, that we are the leading manufacturer of a broad line of specialized ovens,

10

including high efficiency convection ovens, steam ovens and warming ovens. Our DS Steam OvenTM uses a method of preparing in-flight food by maintaining constant temperature and moisture in the food. Our DS Steam OvenTM addresses the airlines' need to provide a wider range of food offerings than can be prepared by convection ovens. We believe, based on our experience in the industry, that we are the worldwide industry leader in the design, manufacture and supply of commercial aircraft refrigeration equipment. We manufacture self-contained wine and beverage chillers, refrigerators/freezers and galley air chilling systems.

Modular Lavatory, Wastewater and Galley Systems. We recently entered the modular lavatory systems market. Our modular lavatory system utilizes our patented Spacewall® technology, which frees up floor space in the cabin, creating the opportunity to add up to six incremental passenger seats on each airplane. The modular lavatory systems integrate our technologically advanced Aircraft Ecosystems® vacuum toilet, long-life LED lighting and tamper proof state-of-the-art lavatory oxygen system. We believe our Aircraft Ecosystems® vacuum toilets have 25% greater reliability than existing systems and allow components to be replaced in a few minutes, as compared to up to an hour for existing systems. We have been selected by Boeing to become the exclusive manufacturer of the modular lavatory systems for Boeing’s Next-Generation 737 airplane. Our innovative SFE system will become standard equipment on all Boeing 737 NG’s, as well as the 737 MAX which enters service later this decade. We believe that retrofit demand for our lavatory systems could be substantial. We have also entered the vacuum wastewater system market. Our vacuum wastewater system incorporates a proprietary design which we believe eliminates the primary cause of failure which plagues other vacuum systems. In addition, we believe our systems include advanced proprietary components and systems that will significantly lower the overall cost of ownership, simplify maintenance and improve lavatory hygiene as our system is rolled out to additional commercial and business jet platforms. We believe the cost of ownership savings will be achieved through weight savings and reliability improvements as a result of combining our proprietary composite components with optimized integrated systems. Our wastewater systems are configurable so savings can be realized on both new aircraft and existing in-service aircraft. We believe the design modularity will reduce airframe corrosion issues and provide for simplified, faster maintenance and ease of removal, resulting in up to a 60% reduction in service time. Our innovative, modular approach to the design of galley systems allows the airlines to select galley positions and configurations for their specific operational needs, while minimizing total aircraft system weight. We have been selected by Airbus to provide next generation galley systems for the Airbus A350 aircraft, which is designed to accommodate the aircraft’s “flex zones” allowing airlines to select from a wide range of galley configurations.

Engineering, Design, Integration, Installation and Certification Services. We believe, based on our experience in the industry, that we are a leading supplier of engineering, design, integration, installation and certification services for commercial aircraft passenger cabin interiors. We also offer our customers’ in-house capabilities to design, manage, integrate, test and certify reconfigurations and modifications for commercial aircraft and to manufacture related products, including engineering kits and interface components. We provide a broad range of interior reconfiguration services which enable airlines to modify the cabin layout, install telecommunications and entertainment equipment, and relocate galleys, lavatories, overhead bins, and crew rest compartments.

We estimate that, as of December 31, 2014, we had an aggregate installed base of products produced by our commercial aircraft segment, valued at replacement prices, of approximately $9.3 billion.

Business Jet Segment

We believe, based on our experience in the industry, that we are a leading manufacturer of a broad product line of furnishings for business jets. Our products include a complete line of business jet seating and sofa products, including electric fully berthing lie-flat seats, direct and indirect lighting, air valves and oxygen delivery systems as well as sidewalls, bulkheads, credenzas, closets, galley structures, lavatories, wastewater systems and tables. We have the capability to provide complete interior packages for business jets and executive VIP or head-of-state aircraft interiors, including design services, interior components and

11

program management services. Our product portfolio also includes premium lightweight helicopter seats for double engine helicopter airframes.

Our business jet segment, which has had decades of experience in equipping executive, VIP and head-of-state aircraft, is the leading manufacturer of super first class cabin interior products for commercial wide-body aircraft. Super first class products incorporate a broad range of amenities such as luxurious first class cabins with appointments such as lie-flat seating, mini-bars, closets, flat screen televisions and mood lighting, which, until recently, were found only in VIP and head-of-state aircraft. We also produce lightweight seats for helicopters that help drive the longest range of operation.

We estimate that, as of December 31, 2014, we had an aggregate installed base of business jet and super first class equipment, valued at replacement prices, of approximately $1.6 billion.

Research, Development and Engineering

We work closely with commercial airlines, business jet and aerospace manufacturers and global leasing companies to improve existing products and identify customers' emerging needs. Our expenditures in research, development and engineering totaled $284.3 million, $220.9 million and $191.7 million for the years ended December 31, 2014, 2013 and 2012, respectively, representing 10.9%, 10.0% and 10.0% of revenues, respectively, for each of those years. We employed 2,296 professionals in engineering, research and development and program management as of December 31, 2014. We believe, based on our experience in the industry, that we have the largest engineering organization in the cabin interior products industry, with mechanical, electrical, electronic and software design skills, as well as substantial expertise in program management, materials composition and custom cabin interior layout design and certification.

Customers, Competition and Marketing

The commercial aircraft cabin interior products market is relatively fragmented, with a number of competitors in each of the individual product categories. Due to the global nature of the commercial aerospace industry, competition comes from both U.S. and foreign manufacturers. However, as aircraft cabin interiors have become increasingly sophisticated and technically complex, airlines have demanded higher levels of engineering support and customer service than many smaller cabin interior products suppliers can provide. At the same time, airlines have recognized that cabin interior product suppliers must be able to integrate a wide range of products, including sophisticated electronic components, such as video and live broadcast TV, particularly in wide-body aircraft. We believe that the airlines' increasing demands will result in a continuing consolidation of suppliers. We have participated in this consolidation through strategic acquisitions and we intend to continue to participate in the consolidation.

We market and sell our commercial aircraft products directly to virtually all of the world's major airlines, aircraft leasing companies and airframe manufacturers. Airlines select manufacturers of cabin interior products primarily on the basis of custom design capabilities, product quality and performance, on-time delivery, after-sales customer service, product support and price. We market our thermal and power management products and services directly to first tier defense manufacturers, aerospace OEMs, their suppliers and the airlines.

We believe that airlines prefer our integrated worldwide marketing approach, which is focused by airline and encompasses our entire product line. Led by senior executives, teams representing each product line serve designated airlines that together account for the vast majority of the purchases of products manufactured by our commercial aircraft segment, including our super first class products. Our teams have developed customer-specific strategies to meet each airline's product and service needs. We also staff "on-site" customer engineers at major airlines and airframe manufacturers to represent our entire product line and to work closely with customers to develop specifications for each successive generation of products required by the airlines. These engineers help customers integrate our wide range of cabin interior products and assist in obtaining the applicable regulatory certification for each particular product or cabin configuration. Through

12

our on-site customer engineers, we expect to be able to more efficiently design and integrate products that address the requirements of our customers. We provide program management services, integrating all on-board cabin interior equipment and systems, including installation and FAA certification, allowing airlines to substantially reduce costs. We believe that we are the only supplier in the commercial aircraft cabin interior products industry with the size, resources, breadth of product line and global product support capability to operate in this manner.

Traditionally, we, and our competitors, have sold customized cabin interior products directly to the airlines. Approximately six years ago we began a campaign to develop a range of new aircraft interior products and to market certain interior systems directly to Boeing and Airbus, thereby potentially increasing our content per aircraft. During 2011, Boeing selected us as the exclusive manufacturer of modular lavatory systems for Boeing’s 737 airplane, in a program initially valued in excess of $800 million, exclusive of retrofit orders, which we believe could be substantial. This innovative SFE system will become standard equipment on all Boeing 737 NG’s and the Boeing 737 MAX. We have also been selected by Boeing to manufacture our LED cabin lighting for the next generation Boeing 737 Sky Interior aircraft. To date, we have also been selected by Boeing to manufacture our patented Pulse OxygenTM system and passenger service units for the B787 and B747-8, by Airbus to manufacture our next generation galley systems and our patented passenger oxygen delivery system for the A350 XWB and by several major business jet manufacturers to provide vacuum wastewater systems. As of December 31, 2014, the SFE programs we have won are currently expected to generate approximately $5.0 billion in revenues over time, and are expected to significantly increase our content per aircraft type. We believe we were successful in our initiative as a result of our extensive experience with other cabin interior products, and our continuous focus on new product development.

Our program management approach assigns a program management team to each significant contract. The program management team leader is responsible for all aspects of the specific contract and profitability, including managing change orders, negotiating related upfront engineering charges and monitoring the progress of the contract through its delivery dates. We believe that our customers benefit substantially from our program management approach, including better on-time delivery and higher service levels. We also believe our program management approach results in higher customer satisfaction.

We believe that our large installed base, our timely responsiveness in connection with custom design, manufacture, delivery and after-sales customer service and product support, our broad product line and stringent customer and regulatory requirements, all present barriers to entry for potential new competitors in the cabin interior products and thermal and power management markets. Our principal competitors for our commercial aircraft segment are Groupe Zodiac Aerospace S.A., Recaro Aircraft Seating GmbH & Co. KG, Diehl Aerosystems Holding GmBH and Jamco America, Inc.

We market our business jet products directly to all of the world's general aviation airframe manufacturers, completion centers and operators. Business jet owners typically rely upon the airframe manufacturers and completion centers to coordinate the procurement and installation of their interiors. Business jet owners select manufacturers of business jet products on a basis similar to commercial aircraft interior products: custom design capabilities, product quality and performance, on-time delivery, after-sales customer service, product support and price. Barriers to entry include regulatory requirements, our large installed product base, our custom design capability, manufacturing capability, delivery, after-sales customer service, product support and our broad product line. The market for business jet products is highly fragmented, consisting of numerous competitors including a wholly-owned subsidiary of United Technologies Corp.

As of December 31, 2014, our direct sales, marketing and product support organizations consisted of 457 employees. In addition, we currently retain 64 independent sales representatives. Our sales to non-U.S. customers were approximately $1.7 billion and $1.4 billion during the years ended December 31, 2014 and 2013, respectively, which represents approximately 67% and 64% of revenues, respectively. Approximately 68% of our total revenues were derived from airlines, aircraft leasing companies, maintenance, repair and overhaul providers (“MROs”), and other commercial aircraft operators during each of the two years ended

13

December 31, 2014. Approximately 40% and 40% of our revenues during the years ended December 31, 2014 and 2013, respectively, were from the aftermarket.

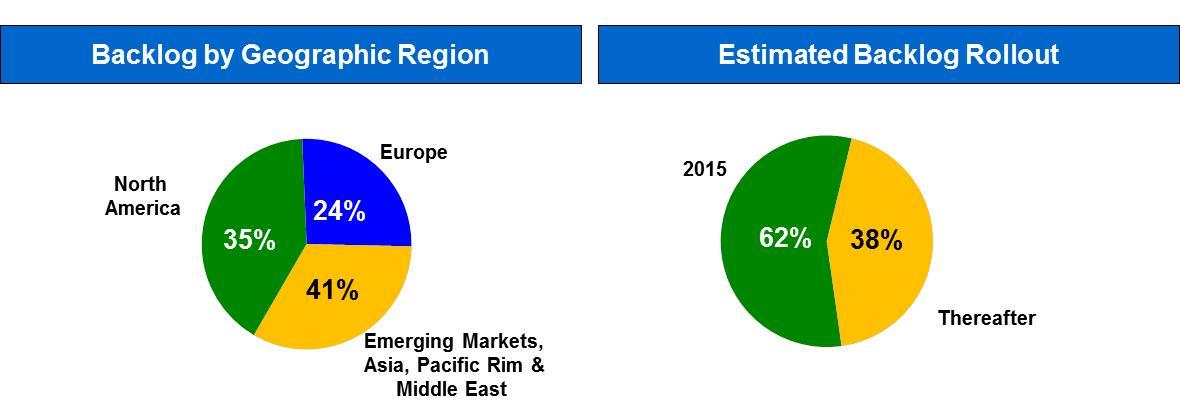

Backlog

Our booked backlog at December 31, 2014 was $3.0 billion, as compared with booked backlog of $2.8 billion as of December 31, 2013 and $2.8 billion as of December 31, 2012. The charts below reflect information related to booked backlog by geographic region and the expected roll-out of booked backlog.

We record backlog when we enter into a definitive order for the delivery of products to our customers in the future. Within backlog, we differentiate between booked backlog and awarded but unbooked backlog. For manufacturing programs, generally if there are definitive delivery dates then the backlog is considered booked. When we receive the delivery date specificity in writing from our customers on these long-term contracts, we include such amount in booked backlog. If a contract does not provide that level of specificity, the production requirements are generally provided to us through purchase orders issued against the underlying contracts at which point the amount of the purchase orders is classified as booked. The remaining portion of the underlying contract is considered awarded but unbooked.

As of December 31, 2014, we had a record booked backlog of $3.0 billion. While the expected delivery dates of our backlog varies from year to year, generally about 60% of the backlog is deliverable in the following 12 months, with the balance generally deliverable over approximately the next two years. As an example, we believe approximately 62% of our December 31, 2014 booked backlog will be delivered during 2015. As of December 31, 2014, approximately 77% of booked backlog is related to CAS and 23% is related to BJS. The quality of our backlog has continued to improve as a result of partnering with key long-term customers, outstanding engineering, global sourcing and program management capabilities resulting in superior products which we believe are the most innovative cabin interior products solutions for our customers. We believe the quality of our backlog has continued to improve and we expect to continue to improve our margins as a result of our current backlog, scheduled deliveries of new aircraft, our ongoing operational excellence initiatives, including lean activities, global sourcing, program management, quality, and engineering excellence initiatives. While we do operate in a cyclical industry, program cancellations are the exception, not the norm; historically, backlog cancellations have not been significant. This is due to the fact that airlines seek fleet commonality once they begin to outfit their fleets with a particular cabin interior product or configuration. This is important to an airline due to customer expectations for a certain level of service, particularly on international routes as well as complexities that arise from maintaining multiple layouts and products with spare parts on a global basis, and other similar considerations. As a result, these programs tend to be deferred to later periods, rather than being cancelled. As an example in 2008 following the global credit crisis, our airline customers experienced a significant contraction in demand, which resulted in the deferral of a number of programs from delivery in the 2008-2009 period to 2009-2011. Despite the negative impacts on our customers from this severe global recession, no significant retrofit programs were cancelled. For a more detailed discussion on risks associated with our backlog, see Item 1A. Risk Factors – We have a significant backlog that may be deferred or may not be entirely realized.

14

SFE program awards will be added to booked backlog when we receive purchase orders or otherwise are provided with specificity regarding delivery dates. At December 31, 2014, we estimate the value of these awards at $5.0 billion, substantially all of which relates to CAS programs.

Total backlog, both booked and awarded but unbooked, expanded to a record $8.0 billion, an increase of 2.6% from December 31, 2013.

Customer Service

We believe that our customers place a high value on customer service and product support and that this service level is a critical differentiating factor in our industry. The key elements of such service include:

|

· |

Rapid response to requests for engineering, design, proposals and technical specifications; |

|

· |

Flexibility with respect to customized features; |

|

· |

On-time delivery; |

|

· |

Immediate availability of spare parts for a broad range of products; and |

|

· |

Prompt attention to customer problems, including on-site customer training. |

Customer service is particularly important to the airlines due to the high costs associated with late delivery, malfunctions and other problems.

Warranty and Product Liability

We warrant our products, or specific components thereof, for periods ranging from one to ten years, depending on product and component type. We establish reserves for product warranty expense after considering relevant factors such as our stated warranty policies and practices, historical frequencies of claims to replace or repair products under warranty and recent sales and claims trends. Actual warranty costs reduce the warranty reserve as they are incurred. We periodically review the adequacy of accrued product warranty reserves and revisions of such reserves are recognized in the period in which such revisions are determined.

We also carry product liability insurance. We believe that our insurance is sufficient to cover product liability claims.

Manufacturing and Raw Materials

Our manufacturing operations consist of both the in-house manufacturing of component parts and sub-assemblies and the assembly of our designed component parts that are purchased from outside vendors. We maintain up-to-date facilities, and we have an ongoing strategic manufacturing improvement plan utilizing lean manufacturing processes. We constantly strive for continuous improvement from implementation of these plans for each of our product lines. We have implemented common information technology platforms company-wide, as appropriate. These activities should lower our production costs, shorten cycle times and reduce inventory requirements and at the same time improve product quality, customer response and profitability. We do not believe we are materially dependent on any single supplier or assembler for any of our raw materials or specified and designed component parts and, based upon the existing arrangements with vendors, our current and anticipated requirements and market conditions, we believe that we have made adequate provisions for acquiring raw materials.

15

Government Regulation

The FAA prescribes standards and licensing requirements for aircraft components, and licenses component repair stations within the United States. Comparable agencies regulate such matters in other countries. We hold several FAA component certificates and perform component repairs at a number of our U.S. facilities under FAA repair station licenses. We also hold an approval issued by the EASA to design, manufacture, inspect and test aircraft seating products in Leighton Buzzard, England and to manufacture and ship from our Kilkeel, Northern Ireland facility. We also have the necessary approvals to design, manufacture, inspect, test and repair our interior systems products in Nieuwegein, the Netherlands. Additionally we hold EASA/LBA (Luftfahrtbundesamt, the National German Aviation Authority) approval to manufacture, inspect, test and repair our commercial life support systems equipment and the approval of the German Federal Office of Defense and Procurement (BWB) to design, manufacture and repair military aviation equipment in Lübeck, Germany.

In March 1992, the FAA adopted Technical Standard Order C127, or TSO-C127, which provides a design approval that the FAA may issue to seat manufacturers for seats tested dynamically to meet the requirements of 14 CFR 25.562 (commonly referred to as “16G”). We believe we have developed and certified more seat models that meet the requirements of TSO-C127 than our competitors. The FAA and EASA also prescribe that seats meet certain flammability and electrical interference specifications. In October 2005, the FAA adopted regulation 14 CFR 121.311(j), which requires dynamic testing of all seats installed in all new aircraft certified after January 1,1988 and produced after October 27, 2009. The EASA is expected to establish a similar rule. Our large installed base of 16G seats demonstrates our industry leadership in seat certification requirements.

In November 2002, our seating group became the first passenger seating supplier to sign a Partnership for Safety Plan (“PSP”) with the FAA. Based on established qualifications of personnel and systems, the PSP provides us with increased authority to approve test plans and reports and to witness tests. The PSP provides us with a number of business benefits including greater planning flexibility, simplified scheduling and greater program control and eliminates variables such as FAA workload and priorities.

In May 2009, our Structures and Integration Group in Marysville, WA was granted FAA Organization Designation Authorization (“ODA”) that includes delegated authority to issue Supplemental Type Certificates (“STC”) and produce parts under a FAA Production Certificate (“PC”). Our ODA STC allows us to reconfigure the interior of airplanes, install crew rests, install satellite communications and perform passenger-to-freighter conversions on all major transport category aircraft types. Under our ODA STC we can approve the design of an aircraft modification and the parts that go into it, and issue the STC in support of the return to service of the modified airplane. This authorization allows us to install new and prototype parts on the aircraft and upon STC issuance add these parts to our PC and designate them as airworthy approved production parts.

Environmental Matters

Our operations are subject to extensive and changing federal, state and foreign laws and regulations establishing health and environmental quality standards, including those governing discharges of pollutants into the air and water and the management and disposal of hazardous substances and wastes. We may be subject to liabilities or penalties for violations of those standards. We are also subject to laws and regulations, such as the Federal Superfund Law and similar state statutes, governing remediation of contamination at facilities that we currently or formerly owned or operated or to which we send hazardous substances or wastes for treatment, recycling or disposal. We believe that we are currently compliant, in all material respects, with applicable environmental laws and regulations. However, we could become subject to future liabilities or obligations as a result of new or more stringent interpretations of existing laws and regulations. In addition, we may have liabilities or obligations in the future if we discover any environmental contamination or liability relating to our facilities or operations.

16

Patents

We currently hold 349 U.S. patents and 513 foreign patents, as well as 253 U.S. patent applications and 594 foreign patent applications covering a variety of products. We believe that the termination, expiration or infringement of one or more of such patents would not have a material adverse effect on us.

Employees

As of December 31, 2014, we had approximately 9,617 employees. Approximately 62% of our employees are engaged in manufacturing/distribution operations, quality and purchasing, 24% in engineering, research and development and program management, 5% in sales, marketing and product support and 9% in finance, human resources, information technology, legal and general administration. Unions represent approximately 16% of our worldwide employees. One domestic labor contract, representing approximately 5% of our employees, expires in May 2015. The labor contract with the only other domestic union, which represents 1% of our employees, expires in October 2017. The remaining portion of our unionized employees are located in the United Kingdom and the Netherlands, which tend to have government mandated union organizations. We consider our employee relations to be good and we have not experienced a business disruption due to labor relations.

Financial Information About Segments and Foreign and Domestic Operations

Financial and other information by segment and relating to foreign and domestic operations for the years ended December 31, 2014, 2013 and 2012, is set forth in note 13 to our consolidated financial statements.

Available Information

Our filings with the SEC, including this Form 10-K, our Quarterly Reports on Form 10-Q, our Proxy Statement, Current Reports on Form 8-K and amendments to any of those reports are available free of charge on our website as soon as reasonably practicable after they are filed with, or furnished to, the SEC. Our internet website is located at http://www.beaerospace.com. Information included in or connected to our website is not incorporated by reference in this annual report.

17

You should carefully consider the following risks and uncertainties, along with the other information contained in or incorporated by reference in this Form 10-K. If any of the following events actually occur, our business, financial condition and financial results could be materially adversely affected. Additional risks and uncertainties that we do not presently know about or currently believe are not material may also adversely affect our business and operations.

See "Cautionary Statement Regarding Forward-Looking Statements."

Risks Relating to Our Industry

The airline industry is heavily regulated and failure to comply with applicable laws could reduce our sales, or require us to incur additional costs to achieve compliance, which could negatively impact our results of operations and financial condition.

The FAA prescribes standards and licensing requirements for aircraft components, including virtually all commercial airline and general aviation cabin interior products and licenses component repair stations within the United States. Comparable agencies, such as the EASA, the CAAC and the JCAB, regulate these matters in other countries. If we fail to obtain a required license for one of our products or services or lose a license previously granted, the sale of the subject product or service would be prohibited by law until such license is obtained, reinstated or renewed. In addition, designing new products to meet existing regulatory requirements and retrofitting installed products to comply with new regulatory requirements can be both expensive and time consuming.

From time to time, these regulatory agencies propose new regulations. These new regulations generally cause an increase in costs to comply with these regulations. For example, the FAA dynamic testing requirements originally established in 1988 under 14 CFR 25.562 are currently required for certain new generation aircraft types. The enactment of 14 CFR 121.311(j) will require dynamic testing of all seats installed in all new aircraft produced after October 27, 2009. The EASA is expected to establish a similar rule. Compliance with this rule may require industry participants to expand engineering, plant and equipment to ensure that all products meet this rule. Smaller seating companies may not have the resources, financial or otherwise, to comply with this rule and may be required to sell their business or cease operations. To the extent the FAA implements rule changes in the future, we may incur additional costs to achieve compliance.

The airline industry is subject to extensive health, safety and environmental regulations, any violation of which could subject us to significant liabilities and penalties.

We are subject to extensive and changing federal, state and foreign laws and regulations establishing health, safety and environmental quality standards, and may be subject to liabilities or penalties for violations of those standards. We are also subject to laws and regulations governing remediation of contamination at facilities currently or formerly owned or operated by us or to which we have sent hazardous substances or waste for treatment, recycling or disposal. We may be subject to future liabilities or obligations as a result of new or more stringent interpretations of existing laws and regulations. In addition, we may have liabilities or obligations in the future if we discover any environmental contamination or liability at any of our facilities, or at facilities we may acquire.

Risks Relating to Our Business

We are directly dependent upon the conditions in the airline and business jet industries and a continued economic downturn could negatively impact our results of operations and financial condition.

Although the economy has exhibited signs of recovery, global financial markets have experienced extreme volatility and disruption, which, at times, reached unprecedented levels as a result of the financial

18

crisis affecting the banking system and participants in the global financial markets. Concerns over the tightening of the corporate credit markets, inflation, energy costs and the dislocation of the residential real estate and mortgage markets have contributed to the volatility in the global financial markets and, together with the global financial crisis, have created uncertainties for global economic conditions in the future. The airline and business jet industries are sensitive to changes in economic conditions. In 2008 and 2009, the airline industry parked aircraft, delayed new aircraft purchases and deliveries of new aircraft, deferred retrofit programs and depleted existing inventories. The business jet industry was also severely impacted by both the recession and by declining corporate profits.

Unfavorable economic conditions have also caused reduced spending for both leisure and business travel, which has negatively affected the airline and business jet industries. According to IATA, the economic downturn, combined with the high fuel prices experienced during most of 2009, contributed to the worldwide airline industry’s loss of approximately $4.6 billion in 2009. In addition, as a result of the decline in both traffic and airfares following the September 11, 2001 terrorist attacks and threats of future terrorist attacks, SARS and H1N1 outbreaks, the conflicts in Iraq and Afghanistan, as well as other factors, such as increases in fuel costs and heightened competition from low-cost carriers, the world airline industry lost a total of approximately $52.8 billion during the period from 2001 to 2009, which caused a significant number of airlines worldwide to declare bankruptcy or cease operations during this period.

While the global airline industry has experienced a significant rebound, generating profits of approximately $10.6 billion in 2013 and an estimated $19.9 billion in 2014, due to a number of factors beyond our control, the commercial and business jet industries could experience a difficult operating environment. As an example, the operating environment would be negatively impacted by increasing fuel prices, consolidation in the industry, changes in regulation, terrorism, safety, environmental and health concerns and labor issues. Many of these factors could have a negative impact on air travel, which could materially adversely affect our operating results.

We may be materially adversely affected by high fuel prices.

Fluctuations in the global supply of crude oil and the possibility of changes in government policy on jet fuel production, transportation and marketing make it impossible to predict the future availability and price of jet fuel. In the event there is an outbreak or escalation of hostilities or other conflicts or significant disruptions in oil production or delivery in oil-producing areas or elsewhere, there could be reductions in the production or importation of crude oil and significant increases in the cost of jet fuel. If there were major reductions in the availability of jet fuel or significant increases in its cost, commercial airlines will face increased operating costs. Due to the competitive nature of the airline industry, airlines are often unable to pass on future increases in fuel prices to customers by increasing fares. As a result, an increase in jet fuel could result in a decrease in net income from either lower margins or, if airlines increase ticket fares, less revenue from reduced airline travel. Decreases in airline profitability could decrease the demand for new commercial aircraft, resulting in delays of or reductions in deliveries of commercial aircraft equipped with our cabin interior products and, as a result, our financial condition, results of operations and cash flows could be materially adversely affected.

We operate in cyclical industries and a continued economic downturn could negatively impact our results of operations and financial condition.

We operate in cyclical industries. During periods of economic expansion, when capital spending normally increases, the Company generally benefits from greater demand for its products. During periods of economic contraction, when capital spending normally decreases, we generally are adversely affected by declining demand for our products and services. The impact of declining demand can be exacerbated by oversupply built during periods of expansion as there is a lag in suppliers’ reactions to contraction. Industry conditions are impacted by numerous factors over which we have no control, including political, regulatory, economic and military conditions, environmental concerns, weather conditions and fuel pricing. Any prolonged cyclical downturn could have an adverse impact on our operating results.

19

There are risks inherent in international operations that could have a material adverse effect on our business operations.

While the majority of our operations are based domestically, we have significant manufacturing operations based internationally with facilities in the United Kingdom, the Netherlands, Germany and the Philippines. In addition, we sell our products to airlines all over the world. Our customers are located primarily in North America, Europe, Asia, the Pacific Rim, South America and the Middle East. As a result, 67% and 64% of our revenues for the years ended December 31, 2014 and 2013, respectively, were to customers located outside the United States. Volatile international economic, political and market conditions may have a negative impact on our operating results and our ability to achieve our goals.