Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TRIMAS CORP | trs_123114x8k.htm |

| EX-99.1 - EXHIBIT 99.1 - TRIMAS CORP | trs_123114xexhibit991.htm |

Fourth Quarter and Full Year 2014 Earnings Presentation F e b r u a r y 2 5 , 2 0 1 5 NASDAQ • TRS

Forward-Looking Statements Any "forward-looking" statements contained herein, including those relating to market conditions or the Company's financial condition and results, expense reductions, liquidity expectations, business goals and sales growth, involve risks and uncertainties, including, but not limited to, risks and uncertainties with respect to the Company’s plans for successfully executing the Cequent spin-off within the expected timeframe or at all, the taxable nature of the spin-off, future prospects of the companies as independent companies, general economic and currency conditions, various conditions specific to the Company's business and industry, the Company’s ability to integrate Allfast and attain the expected synergies, and the acquisition being accretive, the Company's leverage, liabilities imposed by the Company's debt instruments, market demand, competitive factors, supply constraints, material and energy costs, technology factors, litigation, government and regulatory actions, the Company's accounting policies, future trends, and other risks which are detailed in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2014, and in the Company's Quarterly Reports on Form 10-Q. These risks and uncertainties may cause actual results to differ materially from those indicated by the forward-looking statements. All forward-looking statements made herein are based on information currently available, and the Company assumes no obligation to update any forward-looking statements. In this presentation, certain non-GAAP financial measures may be used. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measure may be found at the end of this presentation or in the earnings releases available on the Company’s website. Additional information is available at www.trimascorp.com under the “Investors” section. 2

Agenda • Opening Remarks • Financial Highlights • Segment Highlights • Outlook and Summary • Questions and Answers • Appendix 3

Opening Remarks • Record annual sales of approximately $1.5 billion – growth of 8% compared to 2013 – Sales increased in all six segments • Attained $1.92(1) full year EPS – within the previous outlook range and including costs related to the recent Allfast acquisition • Continued refinement of business portfolio in 2014 ‒ Strategic acquisitions in Packaging and Aerospace ‒ Disposition of defense business ‒ Announcement of Cequent spin-off • Focus on offsetting internal and external headwinds • Uncertainty in macro-economic environment ‒ Latest headwinds related to currency and declining oil prices Focus on what we can control – continue to mitigate external uncertainties. (1) Defined as diluted earnings per share from continuing operations attributable to TriMas Corporation, excluding “Special Items.” Special Items are provided in the Appendix. 4

Key Initiatives Update • Packaging – Global re-organization underway to better service customers; leveraging new, lower cost footprint to support global growth • Aerospace – Positioning as aerospace fastening system supplier of choice; leveraging and integrating four separate aerospace platforms • Energy – Footprint optimization and profit improvement initiatives • Cequent Spin-off Key initiatives to drive profitable growth, increase margins and optimize capital allocations – all of which enhance shareholder returns. 5

Cequent Spin-off Update • Spin-off will result in two independent, publicly traded companies with increased strategic flexibility • Value creation for shareholders, customers and employees: • Allows each company to pursue a more focused strategy that leverages its strengths • Optimizes the financial profiles of each company to pursue distinct investment, growth and capital allocation strategies • Provides two different and compelling investment opportunities that can be achieved in a tax efficient manner • Targeting completion in mid-2015 We believe a tax-free spin-off will create value for shareholders, customers and employees while accelerating TriMas’ strategic transformation. 6

Creating Two Strong Public Companies (Dollars in millions; from continuing operations – All figures are for Full Year 2014.) P A C K A G I N G Revenue: $337.7 Op. profit margin(1): 23.9% aa E N E R G Y Revenue: $206.7 Op. profit margin(1): 3.1% a A E R O S P A C E Revenue: $121.5 Op. profit margin(1): 15.2% E N G I N E E R E D C O M P O N E N T S Revenue: $221.4 Op. profit margin: 15.4% (1) Operating profit margin excludes “Special Items” and corporate expense. Special Items are provided in the Appendix. C E Q U E N T A M E R I C A S Revenue: $446.7 Op. profit margin(1): 7.8% Two independent publicly traded companies with unique characteristics. C E Q U E N T A P E A Revenue: $165.1 Op. profit margin(1): 5.3% New TriMas New “Cequent” • Revenue: $887 million • Segment Operating Profit(1): $140 million • Operating Margin(1) %: ~16% • President & CEO: Dave Wathen • CFO: Bob Zalupski • Revenue: $612 million • Segment Operating Profit(1): $43 million • Operating Margin(1) %: ~7% • Future President & CEO: Mark Zeffiro • Future CFO: David Rice 7

Cequent Spin-off Update • Naming determined – Horizon Global Corporation • Aligning organization and structure as one global company • Executing on new synergies as one company • Offsetting portions of stand-alone company costs and streamlining organization • Shifting organizational paradigms to enhance focus on strategic platforms • Aligning objectives to better deliver shareholder value • Prioritizing market opportunities within global OE, Latin America, China and e-commerce • Supporting margin expansion through focus on operational excellence • Intensifying transaction effort over next two months • Targeting to file initial registration statement at end of March Positioning Horizon to capitalize on global market opportunities. 8

Financial Highlights

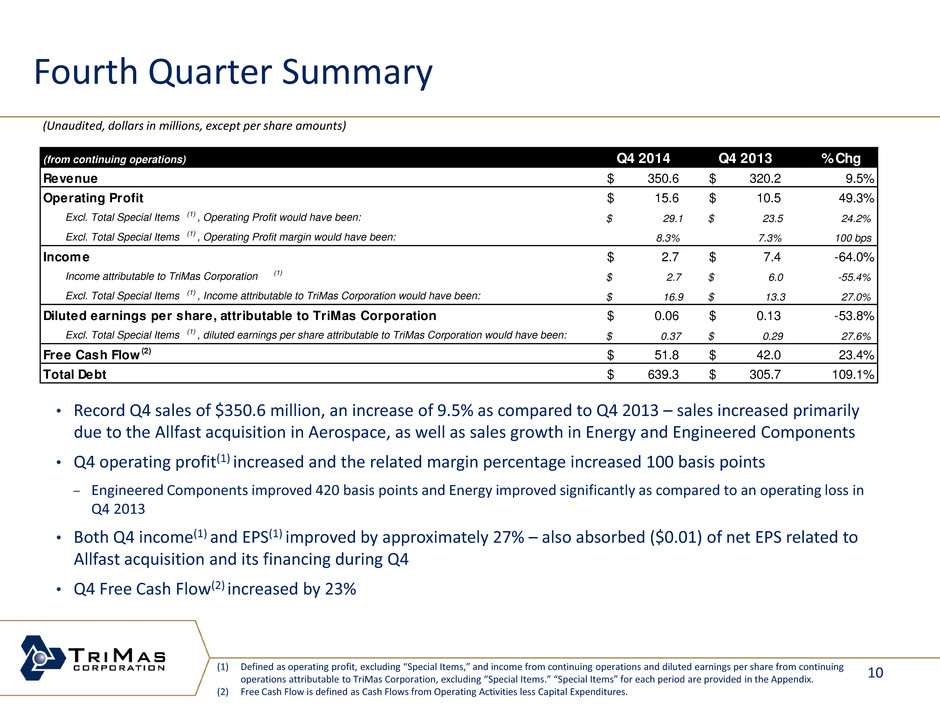

Fourth Quarter Summary • Record Q4 sales of $350.6 million, an increase of 9.5% as compared to Q4 2013 – sales increased primarily due to the Allfast acquisition in Aerospace, as well as sales growth in Energy and Engineered Components • Q4 operating profit(1) increased and the related margin percentage increased 100 basis points ‒ Engineered Components improved 420 basis points and Energy improved significantly as compared to an operating loss in Q4 2013 • Both Q4 income(1) and EPS(1) improved by approximately 27% – also absorbed ($0.01) of net EPS related to Allfast acquisition and its financing during Q4 • Q4 Free Cash Flow(2) increased by 23% (1) Defined as operating profit, excluding “Special Items,” and income from continuing operations and diluted earnings per share from continuing operations attributable to TriMas Corporation, excluding “Special Items.” “Special Items” for each period are provided in the Appendix. (2) Free Cash Flow is defined as Cash Flows from Operating Activities less Capital Expenditures. (Unaudited, dollars in millions, except per share amounts) (from continuing operations) Q4 2014 Q4 2013 % Chg Revenue 350.6$ 320.2$ 9.5% Operating Profit 15.6$ 10.5$ 49.3% Excl. Total Special Items (1) , Operating Profit would have been: 29.1$ 23.5$ 24.2% Excl. Total Special Items (1) , Operating Profit margin would have been: 8.3% 7.3% 100 bps Income 2.7$ 7.4$ -64.0% Income attributable to TriMas Corporation (1) 2.7$ 6.0$ -55.4% Excl. Total Special Items (1) , Income attributable to TriMas Corporation would have been: 16.9$ 13.3$ 27.0% Diluted earnings per share, attributable to TriMas Corporation 0.06$ 0.13$ -53.8% Excl. Total Special Items (1) , diluted earnings per share attributable to TriMas Corporation would have been: 0.37$ 0.29$ 27.6% Free Cash Flow (2) 51.8$ 42.0$ 23.4% Total Debt 639.3$ 305.7$ 109.1% 10

Full Year 2014 Summary • Sales increased 8% as compared to 2013 as a result of acquisitions and organic growth initiatives, offsetting the 2013 disposition of the Italian rings and levers business and the impact of unfavorable currency exchange – sales increased in all six segments • Operating profit(1) improved, while the related margin was relatively flat, as increased sales levels and productivity initiatives were partially offset by a less favorable product sales mix and inefficiencies in several of the businesses, as well as a gain on the 2013 disposition in Packaging that did not recur in 2014 • Income(1) increased despite significantly higher tax rate, while EPS(1) decreased due approximately 9.4% higher weighted average shares outstanding in 2014 as compared to 2013 • Free Cash Flow(2) exceeded the 2013 level by $41 million and Total Debt increased as a result of the October 2014 acquisition of Allfast (1) Defined as operating profit, excluding “Special Items,” and income from continuing operations and diluted earnings per share from continuing operations attributable to TriMas Corporation, excluding “Special Items.” “Special Items” for each period are provided in the Appendix. (2) Free Cash Flow is defined as Cash Flows from Operating Activities less Capital Expenditures. (Unaudited, dollars in millions, except per share amounts) (from continuing operations) FY 2014 FY 2013 % Chg Revenue 1,499.1$ 1,388.6$ 8.0% Operating Profit 124.6$ 119.6$ 4.1% Excl. Total Special Items (1) , Operating Profit would have been: 146.3$ 137.3$ 6.6% Excl. Total Special Items (1) , Operating Profit margin would have been: 9.8% 9.9% -10 bps Income 66.7$ 79.0$ -15.5% Income attributable to TriMas Corporation (1) 65.9$ 74.4$ -11.4% Excl. Total Special Items (1) , Income attributable to TriMas Corporation would have been: 87.1$ 84.7$ 2.8% Diluted earnings per share, attributable to TriMas Corporation 1.46$ 1.80$ -18.9% Excl. Total Special Items (1) , diluted earnings per share attributable to TriMas Corporation would have been: 1.92$ 2.05$ -6.3% Free Cash Flow (2) 89.0$ 48.1$ 84.9% Total Debt 639.3$ 305.7$ 109.1% 11

Segment Highlights

Packaging Q4 and FY 2014 Results: • Sales increased primarily as a result of specialty systems product sales gains — Increased demand from North American and Asian dispensing customers — Positive impact of July 2014 acquisition of Lion Holdings — Q4 sales were negatively impacted by the West Coast port delays • Increased demand for industrial closures in the U.S., offset by the sale of the Italian industrial rings and levers business during Q3 2013 • Solid operating profit margins throughout the year (Quarterly results unaudited, dollars in millions) Key Initiatives: • Target specialty dispensing and closure products in higher growth end markets — Beverage, food, nutrition, personal care and pharmaceutical • Reorganize globally to better service customers and end markets with product- focused manufacturing facilities • Continue ramp-up of manufacturing capabilities in Asia to improve cost structure and flexibility • Launch technology center in India to develop solutions focused on customer needs • Focus on Asian market and cultivate other emerging market opportunities (1) Excluding “Special Items” for each period which are provided in the Appendix. Net Sales Q4-13 Q4-14 $78.2 $80.7 3.2% 2013 2014 7.8% $313.2 $337.7 Operating Profit(1) Q4-13 Q4-14 $18.2 $20.4 23.3% 25.3% 12.0% 2013 2014 6.4% $75.9 $80.7 24.2% 23.9% 13

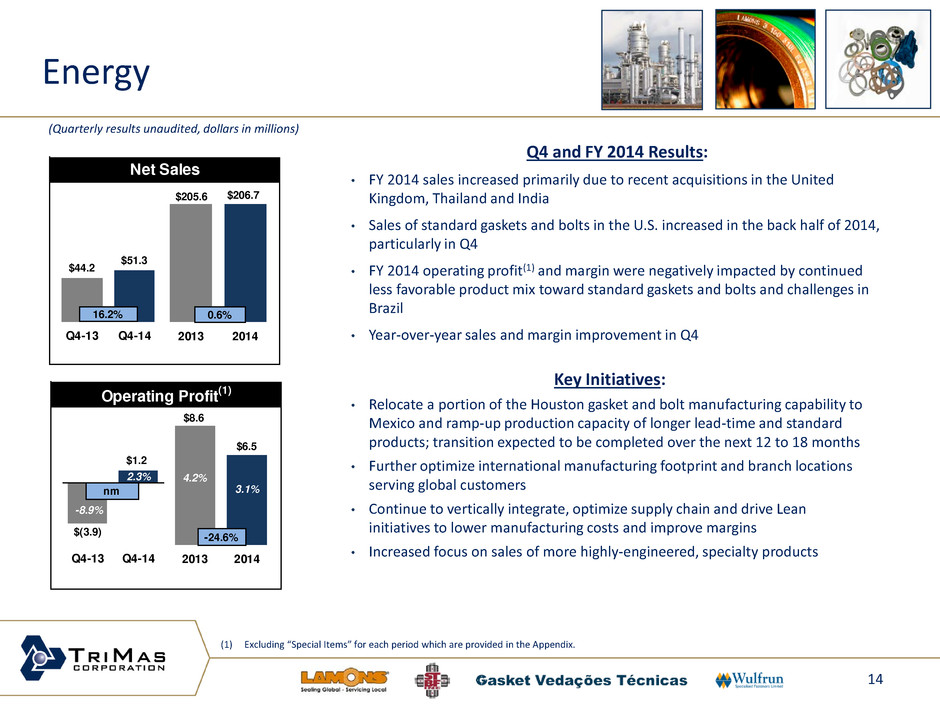

Energy Q4 and FY 2014 Results: • FY 2014 sales increased primarily due to recent acquisitions in the United Kingdom, Thailand and India • Sales of standard gaskets and bolts in the U.S. increased in the back half of 2014, particularly in Q4 • FY 2014 operating profit(1) and margin were negatively impacted by continued less favorable product mix toward standard gaskets and bolts and challenges in Brazil • Year-over-year sales and margin improvement in Q4 Key Initiatives: • Relocate a portion of the Houston gasket and bolt manufacturing capability to Mexico and ramp-up production capacity of longer lead-time and standard products; transition expected to be completed over the next 12 to 18 months • Further optimize international manufacturing footprint and branch locations serving global customers • Continue to vertically integrate, optimize supply chain and drive Lean initiatives to lower manufacturing costs and improve margins • Increased focus on sales of more highly-engineered, specialty products (Quarterly results unaudited, dollars in millions) (1) Excluding “Special Items” for each period which are provided in the Appendix. Net Sales Q4-13 Q4-14 $44.2 $51.3 16.2% 2013 2014 0.6% $205.6 $206.7 Operating Profit(1) Q4-13 Q4-14 2.3% -8.9% nm 2013 2014 -24.6% 4.2% 3.1% $(3.9) $8.6 $6.5 $1.2 14

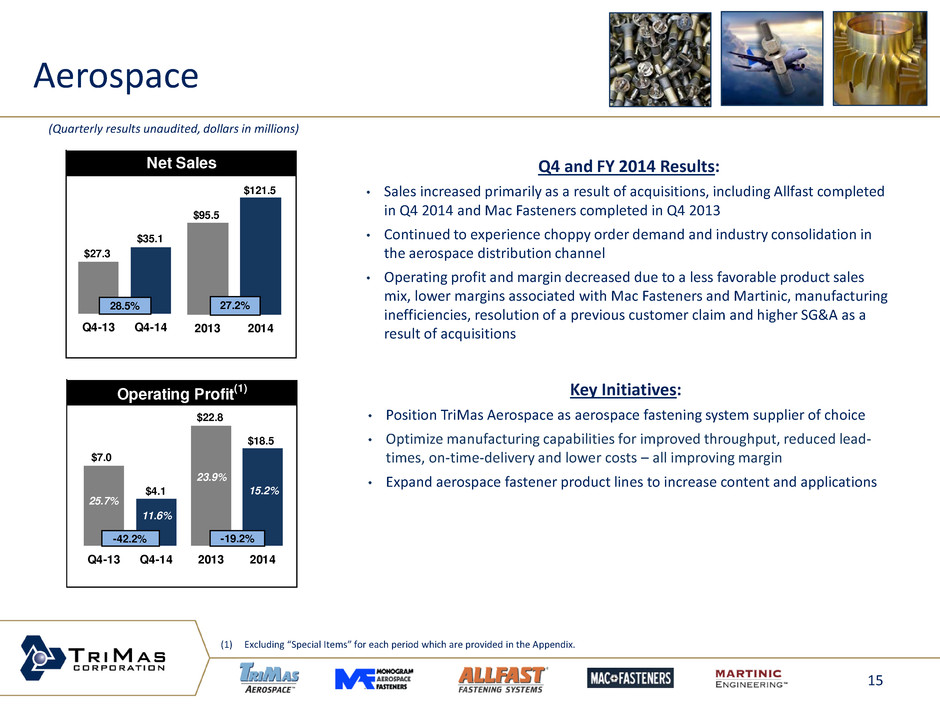

Aerospace Key Initiatives: • Position TriMas Aerospace as aerospace fastening system supplier of choice • Optimize manufacturing capabilities for improved throughput, reduced lead- times, on-time-delivery and lower costs – all improving margin • Expand aerospace fastener product lines to increase content and applications Q4 and FY 2014 Results: • Sales increased primarily as a result of acquisitions, including Allfast completed in Q4 2014 and Mac Fasteners completed in Q4 2013 • Continued to experience choppy order demand and industry consolidation in the aerospace distribution channel • Operating profit and margin decreased due to a less favorable product sales mix, lower margins associated with Mac Fasteners and Martinic, manufacturing inefficiencies, resolution of a previous customer claim and higher SG&A as a result of acquisitions (Quarterly results unaudited, dollars in millions) Net Sales Q4-13 Q4-14 $27.3 $35.1 28.5% 2013 2014 $95.5 $121.5 27.2% Operating Profit(1) Q4-13 Q4-14 25.7% 11.6% -42.2% 2013 2014 23.9% 15.2% -19.2% $7.0 $4.1 $22.8 $18.5 (1) Excluding “Special Items” for each period which are provided in the Appendix. 15

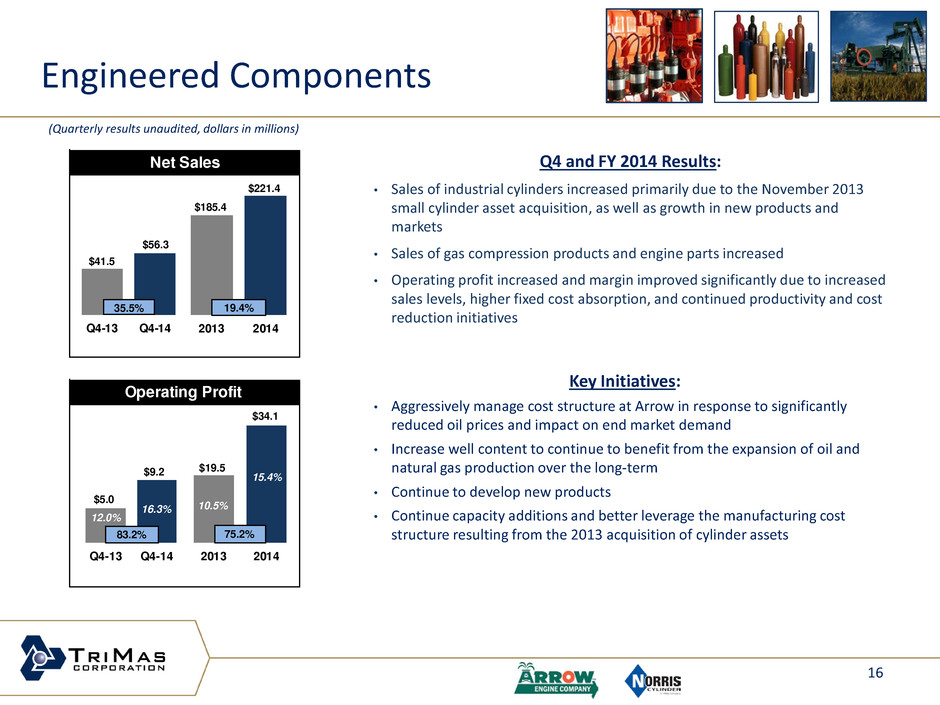

Engineered Components Key Initiatives: • Aggressively manage cost structure at Arrow in response to significantly reduced oil prices and impact on end market demand • Increase well content to continue to benefit from the expansion of oil and natural gas production over the long-term • Continue to develop new products • Continue capacity additions and better leverage the manufacturing cost structure resulting from the 2013 acquisition of cylinder assets Q4 and FY 2014 Results: • Sales of industrial cylinders increased primarily due to the November 2013 small cylinder asset acquisition, as well as growth in new products and markets • Sales of gas compression products and engine parts increased • Operating profit increased and margin improved significantly due to increased sales levels, higher fixed cost absorption, and continued productivity and cost reduction initiatives (Quarterly results unaudited, dollars in millions) Net Sales 2013 2014Q4-13 Q4-14 $41.5 $56.3 35.5% 19.4% $185.4 $221.4 Operating Profit Q4-13 Q4-14 12.0% 16.3% 83.2% 2013 2014 10.5% 15.4% 75.2% $5.0 $9.2 $19.5 $34.1 16

Cequent (APEA & Americas) $46.4 Q4 and FY 2014 Results: • Sales in Americas increased due to higher demand from the aftermarket and retail channels • Americas operating profit(1) and margin percentage was relatively flat as the benefits of the lower cost manufacturing facility were offset by higher freight costs related to footprint changes and increased input costs • FY 2014 APEA sales increased due to continued geographic expansion including the 2013 acquisitions in the United Kingdom and Germany • Q4 APEA sales declined primarily due to lower sales in Australia and Thailand, as well as the unfavorable impact of currency exchange • APEA operating profit(1) and margin percentage was impacted by a less favorable product and regional sales mix and an increase in SG&A Key Initiatives: • Optimize supply chain and productivity of lower-cost manufacturing facilities • Globalize product lines and brands for market share and cross-selling in new geographies in support of global customer needs • Improve manufacturing capabilities and go-to-market strategies of prior bolt-on acquisitions APEA Americas APEA Americas (1) Excluding “Special Items” for each period which are provided in the Appendix. (Quarterly results unaudited, dollars in millions) $40.3 $37.5 $151.6 $165.1 $88.7 $89.6 $437.3 $446.7 Net Sales Q4-13 Q4-14 $127.1 2013 2014 $588.9 $611.8 3.9% $129.0 -1.4% $4.6 $0.4 $13.9 $8.7 $0.8 $0.6 $34.4 $34.7 Operating Profit(1) Q4-13 Q4-14 $1.0 0.9% 0.6% 11.5% 1.1% 82.2% 2013 2014 9.2% 7.9% 5.3% 7.8% -10.2% $5.4 $48.3 $43.4 17

Outlook and Summary

2015 – Segment Assumptions 19 Drivers differ by segment, but actions in place for continued growth and higher margins. Segment Revenue Margin Packaging • Mid single-digit growth • 2% to 3% currency headwind • Maintain 22% to 24% operating profit Aerospace • Grows at 50%+ due to Allfast • Full year operating profit > 20% • Improving sequentially during year as actions implemented Energy • GDP growth • Uncertainty due to oil prices • Full year 150-250 basis point margin expansion • Improving sequentially during year as actions implemented Engineered Components • Oil prices expected to lower Arrow revenue ~ 25% to 35% • GDP growth for Norris, offset by lower exports due to stronger U.S. dollar • Operating profit in 13% to 15% range • Margin headwind due to declining oil prices Cequent • U.S. ~ GDP+ growth • Currency headwind of 10% for CAPEA • Full year 100 basis point margin expansion

2015 Outlook Full Year Outlook as of 2/25/15 Sales Growth 3% to 5% Earnings Per Share, diluted(1) $2.10 to $2.20 Free Cash Flow(2) $60 to $70 million (1) Defined as diluted earnings per share from continuing operations attributable to TriMas Corporation, excluding “Special Items.” (2) Defined as Cash Flow from Operating Activities less Capital Expenditures. 20 Midpoint of 2015 EPS outlook represents an approximate 12% increase as compared with 2014. Organic 3% to 4% Acquisitions 4% to 5% Oil Price Decline ~ (2%) Currency ~ (2%) I 3% to 5% Note: This guidance is reflective of a full year of TriMas Corporation as it operates today; if and when the proposed spin transaction of Cequent is completed, management will update guidance accordingly.

$1.92 $2.10 to $2.20 $(0.10) $(0.05) $0.03 $0.50 - $0.60 $(0.20) $1.70 $1.80 $1.90 $2.00 $2.10 $2.20 $2.30 $2.40 2014 EPS Interest expense Corp & LTI inflation/reset costs Tax rate Operations (ex oil & fx impact) Oil & foreign currency 2015 EPS Outlook Cequent Organic (less Cequent) Acquisitions Currency Oil Bridge from 2014 Reported to 2015 EPS(1) Guidance • 2015 EPS outlook growth of 9% to 15% as compared to 2014 • Interest expense higher due to financing related to the Allfast acquisition • Significant headwinds related to oil prices and the stronger U.S. Dollar Focus on capturing opportunities and mitigating risks. (1) Estimates provided exclude the impact of “Special Items.” For a detailed reconciliation of 2014 EPS, excluding “Special Items” please see the Appendix. 21

Summary • Revenue and income growth during 2014 – much more to accomplish going forward • Continuing the portfolio transformation in 2015 • Cequent spin-off • Leverage synergies of recent Aerospace and Packaging acquisitions • Focus on core margins of remaining business – Energy and Aerospace are high priority • Capitalize on profitable growth opportunities • Grow higher-margin platforms faster • Willing to exit lower margin products and geographies • Mitigate external headwinds • Uncertain macro-economic environment • Currency and oil prices Execution of strategic priorities in 2015. 22

Questions and Answers

Appendix

2015 Outlook – Additional Assumptions Full Year Outlook as of 2/25/15 Interest expense ~ $20 to $22 million Capital expenditures ~ 4% of sales Tax rate ~ 28% to 29% 25

Condensed Consolidated Balance Sheet (Dollars in thousands) December 31, December 31, 2014 2013 Assets Current assets: Cash and cash equivalents............................................................. 24,420$ 27,000$ Receivables, net............................................................................ 196,320 180,210 Inventories..................................................................................... 294,630 270,690 Deferred income taxes................................................................... 28,870 18,340 Prepaid expenses and other current assets...................................... 14,380 18,770 Total current assets.................................................................... 558,620 515,010 Property and equipment, net.............................................................. 232,650 206,150 Goodwill........................................................................................... 466,660 309,660 Other intangibles, net........................................................................ 363,930 219,530 Other assets.................................................................................... 39,890 50,430 Total assets............................................................................... 1,661,750$ 1,300,780$ Liabilities and Shareholders' Equity Current liabilities: Current maturities, long-term debt................................................... 23,860$ 10,290$ Accounts payable.......................................................................... 185,010 166,090 Accrued liabilities.......................................................................... 101,050 85,130 Total current liabilities................................................................. 309,920 261,510 Long-term debt................................................................................. 615,470 295,450 Deferred income taxes...................................................................... 55,290 64,940 Other long-term liabilities................................................................... 90,440 99,990 Total liabilities............................................................................ 1,071,120 721,890 Redeemable noncontrolling interests............................................ - 29,480 Total shareholders' equity............................................................ 590,630 549,410 Total liabilities and shareholders' equity........................................ 1,661,750$ 1,300,780$ 26

Consolidated Statement of Income Three months ended Twelve months ended 2014 2013 2014 2013 Net sales................................................................................................. 350,570$ 320,190$ 1,499,080$ 1,388,600$ Cost of sales............................................................................................ (269,040) (249,420) (1,114,140) (1,037,540) Gross profit........................................................................................... 81,530 70,770 384,940 351,060 Selling, general and administrative expenses............................................... (61,910) (61,740) (255,880) (243,230) Net gain (loss) on dispositions of property and equipment............................. (4,020) 1,420 (4,510) 11,770 Operating profit..................................................................................... 15,600 10,450 124,550 119,600 Other expense, net: Interest expense................................................................................... (4,750) (2,010) (15,020) (18,330) Debt financing and extinguishment costs................................................. (3,360) (2,460) (3,360) (2,460) Other expense, net................................................................................ (1,350) (2,280) (6,570) (1,720) Other expense, net............................................................................ (9,460) (6,750) (24,950) (22,510) Income from continuing operations before income tax expense...................... 6,140 3,700 99,600 97,090 Income tax benefit (expense)..................................................................... (3,460) 3,740 (32,870) (18,140) Income from continuing operations.............................................................. 2,680 7,440 66,730 78,950 Income (loss) from discontinued operations, net of income tax expense......... (1,210) 840 2,550 1,120 Net income............................................................................................... 1,470 8,280 69,280 80,070 Less: Net income attributable to noncontrolling interests.............................. - 1,430 810 4,520 Net income attributable to TriMas Corporation.............................................. 1,470$ 6,850$ 68,470$ 75,550$ Earnings (loss) per share attributable to TriMas Corporation - basic: Continuing operations............................................................................ $ 0.06 $ 0.13 $ 1.47 $ 1.82 Discontinued operations......................................................................... (0.03) 0.02 0.06 0.03 Net income per share............................................................................ $ 0.03 $ 0.15 $ 1.53 $ 1.85 Weighted average common shares - basic 44,938,675 44,698,948 44,881,925 40,926,257 Earnings (loss) per share attributable to TriMas Corporation - diluted: Continuing operations............................................................................ $ 0.06 $ 0.13 $ 1.46 $ 1.80 Discontinued operations......................................................................... (0.03) 0.02 0.05 0.03 Net income per share............................................................................ $ 0.03 $ 0.15 $ 1.51 $ 1.83 Weighted average common shares - diluted 45,384,460 45,159,205 45,269,409 41,395,706 December 31, December 31, (Unaudited, dollars in thousands, except for per share amounts) 27

Consolidated Statement of Cash Flow (Unaudited, dollars in thousands) 2014 2013 Cash Flows from Operating Activities: Net income......................................................................................................................... 69,280$ 80,070$ Adjustments to reconcile net income to net cash provided by operating activities, net of acquisition impact: Gain on dispositions of businesses and other assets.......................................................... (2,250) (11,770) Bargain purchase gain...................................................................................................... - (2,880) Depreciation.................................................................................................................... 32,770 30,810 Amortization of intangible assets....................................................................................... 23,710 19,770 Amortization of debt issue costs....................................................................................... 1,940 1,780 Deferred income taxes..................................................................................................... (8,620) (8,800) Non-cash compensation expense...................................................................................... 7,440 9,200 Excess tax benefits from stock based compensation.......................................................... (1,180) (1,550) Debt financing and extinguishment costs........................................................................... 3,360 2,460 Increase in receivables..................................................................................................... (13,290) (25,580) Increase in inventories...................................................................................................... (7,510) (10,690) (Increase) decrease in prepaid expenses and other assets.................................................. 5,410 (2,380) Increase in accounts payable and accrued liabilities........................................................... 14,050 7,800 Other, net....................................................................................................................... (1,710) (630) Net cash provided by operating activities, net of acquisition impact................................... 123,400 87,610 Cash Flows from Investing Activities: Capital expenditures........................................................................................................ (34,450) (39,490) Acquisition of businesses, net of cash acquired.................................................................. (382,880) (105,790) Net proceeds from disposition of businesses and other assets............................................. 7,240 14,940 Net cash used for investing activities.............................................................................. (410,090) (130,340) Cash Flows from Financing Activities: Proceeds from sale of common stock in connection with the Company's equity offering, net of issuance costs - 174,670 Proceeds from borrowings on term loan facilities................................................................. 446,420 359,470 Repayments of borrowings on term loan facilities................................................................ (180,810) (587,500) Proceeds from borrowings on revolving credit and accounts receivable facilities..................... 1,068,100 1,222,980 Repayments of borrowings on revolving credit and accounts receivable facilities..................... (993,090) (1,113,910) Debt financing fees.......................................................................................................... (3,840) (3,610) Distributions to noncontrolling interests.............................................................................. (580) (2,710) Payment for noncontrolling interests.................................................................................. (51,000) - Proceeds from contingent consideration related to disposition of businesses......................... - 1,030 Shares surrendered upon vesting of options and restricted stock awards to cover tax obligations…...………………………………………………………………………………………… (2,910) (4,440) Proceeds from exercise of stock options............................................................................ 640 1,620 Excess tax benefits from stock based compensation.......................................................... 1,180 1,550 Net cash provided by financing activities......................................................................... 284,110 49,150 Cash and Cash Equivalents: Increase (decrease) for the period...................................................................................... (2,580) 6,420 At beginning of period....................................................................................................... 27,000 20,580 At end of period........................................................................................................... 24,420$ 27,000$ Supplemental disclosure of cash flow information: Cash paid for interest................................................................................................... 10,870$ 16,750$ Cash paid for taxes...................................................................................................... 41,110$ 37,700$ Twleve months ended December 31, 28

Company and Business Segment Financial Information Three months ended 2014 2013 2014 2013 Packaging Net sales................................................................................................................................................ 80,710$ 78,220$ 337,710$ 313,220$ Operating profit........................................................................................................................................ 18,180$ 18,220$ 77,850$ 83,770$ Special Items to consider in evaluating operating profit: Severance and business restructuring costs........................................................................................... 2,220$ -$ 2,840$ -$ Release of historical translation adjustment related to the sale of Italian business...................................... -$ -$ -$ (7,910)$ Excluding Special Items, operating profit would have been................................................................... 20,400$ 18,220$ 80,690$ 75,860$ Energy Net sales................................................................................................................................................ 51,330$ 44,160$ 206,720$ 205,580$ Operating profit (loss)............................................................................................................................... (7,530)$ (3,910)$ (6,660)$ 8,620$ Special Items to consider in evaluating operating profit (loss): Severance and business restructuring costs........................................................................................... 7,460$ -$ 11,890$ -$ Release of historical translation adjustment related to the closure of Brazilian manufacturing facility............ 1,270$ -$ 1,270$ -$ Excluding Special Items, operating profit (loss) would have been.......................................................... 1,200$ (3,910)$ 6,500$ 8,620$ Aerospace Net sales................................................................................................................................................ 35,090$ 27,300$ 121,510$ 95,530$ Operating profit........................................................................................................................................ 3,440$ 7,020$ 17,830$ 22,830$ Special Items to consider in evaluating operating profit: Severance and business restructuring costs........................................................................................... 620$ -$ 620$ -$ Excluding Special Items, operating profit would have been................................................................... 4,060$ 7,020$ 18,450$ 22,830$ Engineered Components Net sales................................................................................................................................................ 56,300$ 41,540$ 221,360$ 185,370$ Operating profit........................................................................................................................................ 9,160$ 5,000$ 34,080$ 19,450$ Cequent APEA Net sales................................................................................................................................................ 37,550$ 40,290$ 165,110$ 151,620$ Operating profit (loss)............................................................................................................................... (70)$ 4,620$ 7,860$ 13,920$ Special Items to consider in evaluating operating profit (loss): Severance and business restructuring costs........................................................................................... 470$ -$ 850$ -$ Excluding Special Items, operating profit (loss) would have been.......................................................... 400$ 4,620$ 8,710$ 13,920$ Cequent Americas Net sales................................................................................................................................................ 89,590$ 88,680$ 446,670$ 437,280$ Operating profit (loss)............................................................................................................................... (220)$ (12,180)$ 31,090$ 8,850$ Special Items to consider in evaluating operating profit (loss): Severance and business restructuring costs........................................................................................... 790$ 13,000$ 3,590$ 25,570$ Excluding Special Items, operating profit (loss) would have been.......................................................... 570$ 820$ 34,680$ 34,420$ Corporate Expenses Operating loss......................................................................................................................................... (7,360)$ (8,320)$ (37,500)$ (37,840)$ Special Items to consider in evaluating operating loss: Cequent spin-off transaction costs......................................................................................................... 700$ -$ 700$ -$ Excluding Special Items, operating loss would have been.................................................................... (6,660)$ (8,320)$ (36,800)$ (37,840)$ Total Company Net sales................................................................................................................................................ 350,570$ 320,190$ 1,499,080$ 1,388,600$ Operating profit........................................................................................................................................ 15,600$ 10,450$ 124,550$ 119,600$ Total Special Items to consider in evaluating operating profit........................................................................ 13,530$ 13,000$ 21,760$ 17,660$ Excluding Special Items, operating profit would have been................................................................... 29,130$ 23,450$ 146,310$ 137,260$ December 31, December 31, Twelve months ended(Unaudited, dollars in thousands) 29

Additional Information Regarding Special Items Impacting Reported GAAP Financial Measures (Unaudited, dollars in thousands, except for per share amounts) Three months ended Twelve months ended December 31, December 31, 2014 2013 2014 2013 Income from continuing operations, as reported............................................................................................................................... 2,680$ 7,440$ 66,730$ 78,950$ Less: Net income attributable to noncontrolling interests.......................................................................................................................... - 1,430 810 4,520 Income from continuing operations attributable to TriMas Corporation........................................................................................................ 2,680 6,010 65,920 74,430 After-tax impact of Special Items to consider in evaluating quality of income from continuing operations: Release of historical translation adjustment related to the sale of Italian business and closure of Brazillian manufacturing facility……......... 1,270 - 1,270 (7,910) Severance and business restructuring costs....................................................................................................................................... 10,380 7,170 17,300 15,860 Cequent spin-off related costs............................................................................................................................................................ 440 - 440 - Debt financing and extinguishment costs............................................................................................................................................ 2,120 1,530 2,120 1,530 Net gain on termination of interest rate swaps..................................................................................................................................... - (1,410) - (1,410) Tax restructuring.............................................................................................................................................................................. - - - 2,200 Excluding Special Items, income from continuing operations attributable to TriMas Corporation would have been..................... 16,890$ 13,300$ 87,050$ 84,700$ Three months ended Twelve months ended December 31, December 31, 2014 2013 2014 2013 Diluted earnings per share from continuing operations attributable to TriMas Corporation, as reported.......................................... 0.06$ 0.13$ 1.46$ 1.80$ After-tax impact of Special Items to consider in evaluating quality of EPS from continuing operations: Release of historical translation adjustment related to the sale of Italian business and closure of Brazillian manufacturing facility............... 0.03 - 0.03 (0.19) Severance and business restructuring costs....................................................................................................................................... 0.23 0.16 0.38 0.38 Cequent spin-off related costs............................................................................................................................................................ 0.01 - 0.01 - Debt financing and extinguishment costs............................................................................................................................................ 0.04 0.03 0.04 0.04 Net gain on termination of interest rate swaps..................................................................................................................................... - (0.03) - (0.03) Tax restructuring.............................................................................................................................................................................. - - - 0.05 Excluding Special Items, EPS from continuing operations would have been................................................................................ 0.37$ 0.29$ 1.92$ 2.05$ Weighted-average shares outstanding for the three and twelve months ended December 31, 2014 and 2013.............................. 45,384,460 45,159,205 45,269,409 41,395,706 2014 2013 2014 2013 Operating profit (excluding Special Items)……………………….………................................................................................................ 29,130$ 23,450$ 146,310$ 137,260$ Corporate expenses (excluding Special Items)…………………………………………................................................................................ 6,660 8,320 36,800 37,840 Segment operating profit (excluding Special Items)…………………................................................................................................... 35,790$ 31,770$ 183,110$ 175,100$ Segment operating profit margin (excluding Special Items)…...……................................................................................................ 10.2% 9.9% 12.2% 12.6% December 31, December 31, Three months ended Twelve months ended 30

Current Debt Structure (Unaudited, dollars in thousands) As of December 31, 2014, TriMas had $216.4 million of cash and available liquidity under its revolving credit and accounts receivable facilities. December 31, December 31, 2014 2013 Cash and Cash Equivalents…………………………… 24,420$ 27,000$ Credit Agreement……………………………………… 559,530 246,130 Receivables facility and other………………………… 79,800 59,610 639,330 305,740 Total Debt………………………...…………………… 639,330$ 305,740$ Key Ratios: Bank LTM EBITDA……………………………………… 243,610$ 196,990$ Interest Coverage Ratio………………………………… 13.02 x 11.08 x Leverage Ratio………………………………………… 2.71 x 1.67 x Bank Covenants: Minimum Interest Coverage Ratio…………………… 3.00 x 3.00 x Maximum Leverage Ratio……………………………… 3.50 x 3.50 x 31

LTM Bank EBITDA as Defined in Credit Agreement (Unaudited, dollars in thousands) 69,280$ Interest expense, net (as defined)............................................................................................... 15,900 Income tax expense.................................................................................................................. 34,340 Depreciation and amortization.................................................................................................... 56,480 Non-cash compensation expense............................................................................................... 7,440 Other non-cash expenses or losses........................................................................................... 13,240 Non-recurring expenses or costs in connection with acquisition integration.................................... 7,320 Acquisition integration costs...................................................................................................... 9,600 Debt extinguishment costs........................................................................................................ 3,360 Permitted dispositions............................................................................................................... 910 Permitted acquisitions............................................................................................................... 23,980 Negative EBITDA from discontinued operations............................................................................ 1,760 243,610$ (1) As defined in the Credit Agreement dated October 16, 2013 Net income for the twelve months ended December 31, 2014 .......................................................... Bank EBITDA - LTM Ended December 31, 2014 (1)…………………………………………………………… 32