Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TOYS R US INC | d878130d8k.htm |

EASY

EXPERT

FAIR

J.P.

Morgan

Global

High

Yield

&

Leveraged

Finance

Conference

February

2015

Exhibit 99.1

* * * * * * * |

EASY

EXPERT

FAIR

2

FORWARD LOOKING STATEMENTS

PRELIMINARY ESTIMATES

The

financial

information

for

the

fourth

quarter

and

full

year

fiscal

2014

contained

in

this

presentation

are

preliminary

estimates

and

are

derived

from

preliminary

internal

financial

reports

and

are

subject

to

revision

based

on

the

completion

of

year-end

accounting

and

financial

reporting

processes.

Accordingly,

our

actual

results

may

differ

from

these

estimates

and

such

differences

may

be

material.

This presentation and the documents filed by TOYS“R”US, INC. with the Securities and

Exchange Commission contain “forward looking” statements within the meaning of

the federal securities laws and such statements are intended to be covered by the safe harbors

created thereby. These forward looking statements reflect our current views with respect

to, among other things, our operations and financial performance. All statements herein or therein that are not historical facts, including statements

about our beliefs or expectations, are forward-looking statements. We generally identify

these statements by words or phrases, such as “anticipate,” “estimate,” “plan,”

“project,” “expect,” “believe,” “intend,”

“foresee,” “forecast,” “will,” “may,” “outlook” or the negative version of these words or other similar words or phrases. These

statements discuss, among other things, our strategy, store openings, integration and

remodeling, the development, implementation and integration of our Internet business,

future financial or operational performance, projected sales for certain periods, comparable store net sales from one period to another, cost savings, results of

store closings and restructurings, outcome or impact of pending or threatened litigation,

domestic or international developments, amount and allocation of future capital

expenditures, growth initiatives, inventory levels, cost of goods, selection and type of

merchandise, marketing positions, implementation of safety standards, future

financings, estimates regarding future effective tax rates, and other goals and targets and

statements of the assumptions underlying or relating to any such statements. These

statements are subject to risks, uncertainties and other factors, including, among others, the seasonality of our business, competition in the retail industry, changes

in our product distribution mix and distribution channels, general economic factors in the

United States and other countries in which we conduct our business, consumer spending

patterns, live birth trends, our ability to implement our strategy, including implementing initiatives for season, our ability to recognize cost savings, marketing

strategies, the availability of adequate financing, access to trade credit, changes in

consumer preferences, changes in employment legislation, our dependence on key vendors

for our merchandise, political and other developments associated with our international operations, costs of goods that we sell, labor costs, transportation costs,

domestic and international events affecting the delivery of toys and other products to our

stores, product safety issues including product recalls, the existence of adverse

litigation, changes in laws that impact our business, our substantial level of indebtedness

and related debt-service obligations, restrictions imposed by covenants in our debt

agreements and other risks, uncertainties and factors set forth under Item 1A entitled “RISK FACTORS” of TOYS“R”US, INC.’s Annual Report on Form 10-K for the fiscal

year ended February 1, 2014 and in its other reports and documents filed with the Securities

and Exchange Commission. In addition, we typically earn a disproportionate part of our

annual operating earnings in the fourth quarter as a result of seasonal buying patterns and these buying patterns are difficult to forecast with certainty. These

factors should not be construed as exhaustive, and should be read in conjunction with the

other cautionary statements that are included in those reports and documents. We

believe that all forward-looking statements are based on reasonable assumptions when made; however, we caution that it is impossible to predict actual results or

outcomes or the effects of risks, uncertainties or other factors on anticipated results or

outcomes and that, accordingly, one should not place undue reliance on these

statements. Forward-looking statements speak only as of the date they were made, and we

undertake no obligation to update these statements in light of subsequent events or

developments unless required by the Securities and Exchange Commission’s rules and regulations. Actual results and outcomes may differ materially from

anticipated results or outcomes discussed in any forward-looking statement.

|

EASY

EXPERT

FAIR

3

FULL YEAR AND Q4 UPDATE

FY 2014 Highlights

Note: See appendix for reconciliation of Adjusted EBITDA

1

Excludes

($51M)

charge

in

Q4

2013

(+1.0%

impact

–

INC;

+1.4%

impact

–

DEL)

and

Full

Year

2013

(+0.4%

impact

–

INC;

+0.6%

impact

–

DEL),

as

well

as

an

($8M)

charge

(+0.1%

impact –

INC; +0.1% impact –

DEL)

in Full Year 2014 related to excess and obsolete inventory identified in Q4 2013

2

Excludes $1M benefit (negligible impact to INC and DEL) in Full Year 2013 related to a dotcom

prior period sales adjustment •

Results reflect the successful execution of our

strategic plan

•

Gross margin rate improved by 51 bps; Gross margin

dollars

includes

a

negative

FX

impact

of

$83

million

1,2

•

Estimated Adjusted EBITDA improved by

approximately $57 million

•

Ended the year with clean inventory, improved

customer perception and global liquidity of $1,772

million

•

Strong international sales performance highlighted by

2.2% comparable store net sales growth

•

Continued improvement in gross margin rate as

compared to the prior year

•

Estimated Adjusted EBITDA improved by

approximately $22 million

Q4 2014 Highlights

Q4

$'s in billions unless otherwise stated

2013

2014

B/(P)

Toys"R"Us, Inc.

Net Sales

$5.3

$5.0

(5.4%)

Net Sales (2014 excl. FX impact)

5.3

5.2

(1.8%)

Gross Margin %

1,2

32.7%

33.9%

115 bps

Adjusted EBITDA ($'s in millions)

$505

$522-532

3.4%-5.3%

Toys-Delaware

Total Revenues

$3.6

$3.4

(5.3%)

Total Revenues (2014 excl. FX impact)

3.6

3.5

(4.6%)

Gross Margin %

1,2

31.5%

33.3%

175 bps

Full Year

$'s in billions unless otherwise stated

2013

2014

B/(P)

Toys"R"Us, Inc.

Net Sales

$12.5

$12.4

(1.5%)

Net Sales (2014 excl. FX impact)

12.5

12.6

0.5%

Gross Margin %

1,2

35.4%

35.9%

51 bps

Adjusted EBITDA

($'s in millions)

$583

$635-645

8.9%-10.6%

Toys-Delaware

Total Revenues

$8.6

$8.5

(2.0%)

Total Revenues (2014 excl. FX impact)

8.6

8.5

(1.3%)

Gross Margin %

1,2

34.6%

35.2%

59 bps |

EASY

EXPERT

FAIR

4

ADJUSTED EBITDA

…Excluding Bonus and FX Impact

Adjusted EBITDA

Grew 9.8%...

$142M Year-over-Year Improvement

$57M Year-over-Year Improvement

1

1

2

Note:

See

appendix

for

reconciliation

of

Adjusted

EBITDA

1

Represents

the

mid-point

of

fiscal

2014

Adjusted

EBITDA

range

2

Estimate |

EASY

EXPERT

FAIR

5

2014 STRATEGIC PRIORITIES

Transform the Customer

Experience

1

Develop High Performing, Highly

Engaged Teams

2

Become Fit for Growth

3

Enhancing the experience across

all customer touch points online

and in-store:

•

Price Perception

•

Optimize eCommerce

Experience

•

Supply Chain

•

Marketing Initiatives

•

Store Experience

•

Merchandising Initiatives

Recalibrate expectations for high

performing, highly engaged talent;

structure for customer focus,

flexibility and rapid change:

•

Organizational Structure

•

Strengthen Talent

•

Productivity Tracking

•

Training

•

Culture & Engagement

•

Rewards & Recognition

•

Strengthen Specialization of

Babies“R”Us and Toys“R”Us

Talent

Deciding where we will invest for

growth; reduce low ROI expenses

and invest for future growth:

•

Growth and Innovation

•

Margin Control & Forecasting

•

Holiday Planning

•

Expense Control and Process

Improvement

•

End-to-End Process

•

Digital Experience

•

Marketing Effectiveness

•

Store Experience |

EASY

EXPERT

FAIR

6

TOYS“R”US CUSTOMER SATISFACTION SCORES IMPROVED YEAR-OVER-YEAR

1

Ratings are based on a scale of 1-10, the year-over-year change compares those

customers who rated us either a 9 or 10 in 2014 vs. 2013 Source: Internal company

survey 2014 vs. 2013

Categories

In-Stocks

Clean & Bright

Checkout Speed

Knowledgeable Team

Greet & Assist

Overall Satisfaction

Customer Satisfaction Metrics

5.0%

% Point Improvement

6.0%

2.7%

4.6%

4.6%

3.6% |

EASY

EXPERT

FAIR

7

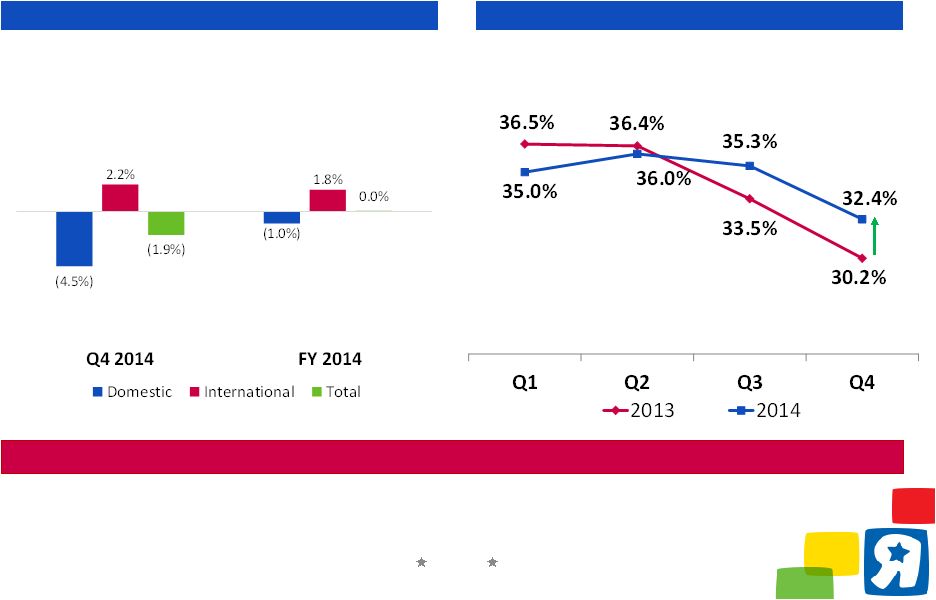

ANNUAL SALES STABILIZATION AND SIGNIFICANT MARGIN IMPROVEMENT

1

Excludes

($51M)

charge

in

Q4

2013

(+1.5%

impact),

$11M

benefit

in

Q1

2014

(-0.7%

impact)

and

($19M)

charge

in

Q2

2014

(+1.3%

impact)

related

to

excess

and

obsolete

inventory

identified

in

Q4

2013

2

Includes $2M benefit in Q1 2013 (+0.1% impact) related to unrecognized dotcom sales, and

excludes $3M recorded in Q2 2013 (-0.2% impact) related to a dotcom prior period

sales adjustment Domestic

Gross

Margin

Rate

1,2

Comparable Store Net Sales

Disciplined

promotion

strategy

leading

to

220

bps

improvement

in

Domestic

Gross

Margin

Continued focus on margin |

EASY

EXPERT

FAIR

8

UPDATE ON COST SAVINGS INITIATIVES

•

Potential cost savings of $150-$200 million communicated

to investment community in September 2014

•

Estimate primarily focused on Domestic business

•

Achievable in run rate by 2016

•

Split between SG&A and Cost of Goods

•

Overall cost savings of over $100 million achieved in fiscal

year 2014

•

Driven by savings in store and procurement SG&A,

marketing effectiveness and life cycle management

•

Savings partially offset in EBITDA by increased

compensation expense resulting from bonus

normalization

•

$50-$75 million additional cost savings opportunities

subsequently identified in International Operations

•

Savings may require additional investments (e.g.

capex on systems)

Target Cost Reductions

Cost Savings Achieved

$’s in millions

$200 -

$275

Dashed bars represent high-end of range |

EASY

EXPERT

FAIR

9

CAPITALIZATION AND GLOBAL LIQUIDITY

As of January 31, 2015

1

European Debt includes UK, France and Spain

Global Liquidity

Capitalization

1

Toys-Delaware ABL Excess Availability is presented net of the $125

minimum excess availability covenant

Q4

($'s in millions)

2014

Toys-Delaware

Toys-Delaware ABL Excess Availability

1

$848

Toys-Delaware Cash

121

Total Toys-Delaware Liquidity

969

International

Euro ABL/Japan Revolver Excess Availability

226

Non Toys-Delaware Cash

577

Total Inc/Int'l Liquidity

803

Total ABL/Revolver Excess Availability

1,074

Total Cash

698

Total Global Liquidity

$1,772

Debt Presented at Face Value

Q4

($'s in millions)

Rate

Maturity

O/S

Cash

$698

Inc. Notes

2017 Senior Notes

10.375%

8/15/2017

450

2018 Senior Notes

7.375%

10/15/2018

400

Propco II Senior Secured Notes

8.500%

12/1/2017

725

B-2/B-3 Term Loans

L + 3.75%

5/25/2018

202

North American ABL Facility

L + 1.50%

3/21/2019

--

FILO Term Loan

L + 7.25%

10/24/2019

280

B-4 Term Loan

L + 8.75%

4/24/2020

1,026

8 ¾% Debentures

8.750%

9/1/2021

22

International Loans

Japan Debt

Various

Various

63

European Debt

1

Various

Various

483

Other

Propco I Term Loan

L + 5.00%

8/21/2019

973

Capital Leases / Other

Various

Various

202

Total Debt

$4,826

Net Debt

$4,128

Toys-Delaware Notes and Loans |

EASY

EXPERT

FAIR

10

APPENDIX |

EASY

EXPERT

FAIR

11

TOYS“R”US INC. –

ADJUSTED EBITDA RECONCILIATION

1

The impact of these one-time adjustments are excluded from the Gross Margin balances in

this presentation ($'s in millions)

2/1/2014

1/31/2015

2/1/2014

1/31/2015

Operating (loss) income

($91)

$411-421

($350)

$185-195

Add:

Non-controlling interest

(3)

(2)

(3)

(4)

Depreciation and amortization

101

92

388

377

EBITDA

7

501-511

35

558-568

Adjustments:

Obsolete inventory clearance

1

51

--

51

8

Prior period adjustments

1

--

--

(1)

--

Sponsors’

management and advisory fees

5

4

22

18

Litigation expense

3

(8)

23

(8)

Severance

--

1

13

17

Store closure costs

2

--

2

5

Impairment of long-lived assets

37

5

44

13

Net gains on sales of properties

--

--

(8)

(5)

Compensation expense

2

5

3

20

Property losses, net of insurance recoveries

--

--

--

(9)

Obsolete inventory clearance

--

--

--

1

Prior period adjustments

17

--

17

--

Certain legal and accounting transaction costs

--

12

1

13

Non-controlling interest

3

2

3

4

Goodwill impairment

378

--

378

--

Adjusted EBITDA

$505

$522-532

$583

$635-645

Q4

Full Year |

EASY

EXPERT

FAIR

12

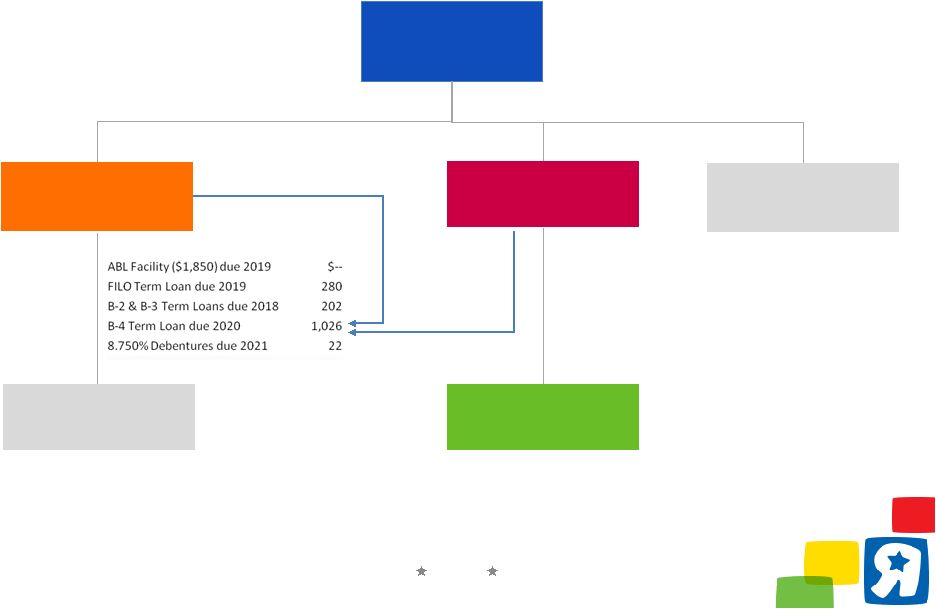

SIMPLIFIED ORGANIZATIONAL STRUCTURE

Toys“R”Us,

Inc.

Toys“R”Us

International

Entities

Guaranty of

B-4 Term Loan

Toys“R”Us

Property

Company

II,

LLC

(“PropCo

II”)

8.500% Senior Secured Notes due 2017 $725

Term Loan due

2019 $973

Total Funded Debt¹

Revolving Credit Facilities

$546

--

10.375% Senior Notes due 2017

$450

7.375% Senior Notes due 2018

400

Note: Chart has been simplified and does not include all entities; debt balances

presented at face value and excludes capital leases and finance obligations associated

with capital projects 1

Includes Spanish PropCo Loan, French PropCo Loan, UK PropCo Loans, Japan Bank Loans and Toys

Asia Debt Wayne

Real

Estate

Parent

Company,

LLC

Toys“R”Us

Property

Company

I,

LLC

(“PropCo

I”)

Toys“R”Us-Delaware,

Inc.

(Toys-Delaware)

65% Pledge of Canadian

Subsidiary Stock

$’s in millions | as of January 31, 2015 |