Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - LinnCo, LLC | Financial_Report.xls |

| EX-31.1 - CERTIFICATION OF CEO SECTION 302 - LinnCo, LLC | exhibit311lnco2014.htm |

| EX-31.2 - CERTIFICATION OF CFO SECTION 302 - LinnCo, LLC | exhibit312lnco2014.htm |

| EX-32.2 - CERTIFICATION OF CFO SECTION 906 - LinnCo, LLC | exhibit322lnco2014.htm |

| EX-32.1 - CERTIFICATION OF CEO SECTION 906 - LinnCo, LLC | exhibit321lnco2014.htm |

| EX-99.1 - LINN ENERGY, LLC'S 2014 FORM 10-K - LinnCo, LLC | exhibit991linnform10-k2014.htm |

| EX-23.1 - CONSENT OF DEGOLYER AND MACNAUGHTON - LinnCo, LLC | exhibit231lnco2014.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the transition period from _______________ to _______________

Commission file number: 001-35695

LinnCo, LLC

(Exact name of registrant as specified in its charter)

Delaware | 45-5166623 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

600 Travis, Suite 5100 Houston, Texas | 77002 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code

(281) 840-4000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Shares Representing Limited Liability Company Interests | The NASDAQ Global Select Market | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check-mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No x

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant was approximately $4.0 billion on June 30, 2014, based on $31.29 per share, the last reported sales price of the shares on the NASDAQ Global Select Market on such date.

As of January 31, 2015, there were 128,544,174 common shares outstanding.

Documents Incorporated By Reference:

Annual Report on Form 10-K of Linn Energy, LLC for the year ended December 31, 2014.

Certain information called for in Items 10, 11, 12, 13 and 14 of Part III are incorporated by reference from the registrant’s definitive proxy statement for the annual meeting of shareholders expected to be held on April 21, 2015.

TABLE OF CONTENTS

Page | ||

i

Part I

Item 1. Business

This Annual Report on Form 10-K contains forward-looking statements based on expectations, estimates and projections as of the date of this filing. These statements by their nature are subject to risks, uncertainties and assumptions and are influenced by various factors. As a consequence, actual results may differ materially from those expressed in the forward-looking statements. For more information, see “Cautionary Statement Regarding Forward-Looking Statements” included at the end of this Item 1. “Business” and see also Item 1A. “Risk Factors.”

References

In this report, unless the context requires otherwise, references to “we,” “us,” “our,” the “Company,” or “LinnCo” are intended to refer to LinnCo, LLC. The reference to a “Note” herein refers to the accompanying Notes to Financial Statements contained in Item 8. “Financial Statements and Supplementary Data.” References to “shares” in this report refer to the Company’s common shares representing limited liability company interests.

Overview

LinnCo is a Delaware limited liability company formed on April 30, 2012, under the Delaware Limited Liability Company Act. LinnCo’s initial sole purpose was to own units representing limited liability company interests (“units”) in its affiliate, Linn Energy, LLC (“LINN Energy”). In connection with the acquisition of Berry Petroleum Company, now Berry Petroleum Company, LLC (“Berry”) (see Note 2), LinnCo amended its limited liability company agreement to permit, among other things, the acquisition and subsequent transfer of assets to LINN Energy for consideration received. As of December 31, 2014, LinnCo had no significant assets or operations other than those related to its interest in LINN Energy. LINN Energy is an independent oil and natural gas company that trades on the NASDAQ Global Select Market under the symbol “LINE.”

LinnCo’s success is dependent upon the operation and management of LINN Energy and its resulting performance. Therefore, LINN Energy’s Annual Report on Form 10-K for the year ended December 31, 2014, has been included in this filing as Exhibit 99.1 and incorporated herein by reference. At December 31, 2014, the Company owned approximately 39% of LINN Energy’s outstanding units. At December 31, 2014, LINN Energy owned 100% of the Company’s sole voting share and all of the Company’s common shares were held by the public.

The Company has elected to be treated as a corporation for United States (“U.S.”) federal income tax purposes. Because it is treated as a corporation for U.S. federal income tax purposes, an owner of LinnCo shares will not report on its U.S. federal income tax return any of the Company’s items of income, gain, loss and deduction relating to an investment in it.

Within five business days after receiving a cash distribution related to its interest in LINN Energy units, LinnCo is required to pay the cash received, net of reserves for its income tax liability (“tax reserve”), if any, as dividends to its shareholders. The amount of the tax reserve is calculated on a quarterly basis and is determined based on the estimated tax liability for the entire year. The current tax reserve can be increased or reduced, at Company management’s discretion, to account for the over/(under) tax reserve previously recorded. Because the tax reserve is an estimate, upon filing the annual tax returns, if the actual amount of tax due is greater or less than the total amount of tax reserved, the subsequent tax reserve, at Company management’s discretion, could be adjusted accordingly. Any such adjustments are subject to approval by the Company’s board of directors.

LINN Energy has agreed to provide to LinnCo, or to pay on LinnCo’s behalf, any legal, accounting, tax advisory, financial advisory and engineering fees, printing costs or other administrative and out-of-pocket expenses incurred by LinnCo, along with any other expenses incurred in connection with any public offering of shares in LinnCo or incurred as a result of being a publicly traded entity. These expenses include costs associated with annual, quarterly and other reports to holders of LinnCo shares, tax return and Form 1099 preparation and distribution, NASDAQ listing fees, printing costs, independent auditor fees and expenses, legal counsel fees and expenses, limited liability company governance and compliance expenses and registrar and transfer agent fees. In addition, LINN Energy has agreed to indemnify LinnCo and its officers and directors for damages suffered or costs incurred (other than income taxes payable by LinnCo) in connection with carrying out LinnCo’s activities. Because all general and administrative expenses and certain offering costs are actually paid by LINN Energy on LinnCo’s behalf, no cash is disbursed by LinnCo for these expenses and costs.

1

Item 1. Business - Continued

Recent Developments

In January 2015, LINN Energy’s board of directors approved a reduction of LINN Energy’s distribution to $1.25 per unit, from the previous level of $2.90 per unit, on an annualized basis, and in February 2015 approved a revised 2015 budget which includes a 61% reduction in capital expenditures to approximately $600 million, from approximately $1.6 billion spent in 2014. The 2015 budget contemplates a significantly lower oil price than in 2014, and the reduction of the distribution and capital budget are intended to solidify LINN Energy’s financial position and regain a useful cost of capital. The dividends LinnCo pays are dependent on the cash distributions it receives from LINN Energy; therefore, LinnCo’s board of directors also reduced LinnCo’s dividend to $1.25 per share.

Employees

LinnCo has no employees. The Company has entered into an agreement with LINN Energy to provide the Company with the necessary services and support personnel. For more information, see Note 1 and LINN Energy’s Annual Report on Form 10-K for the year ended December 31, 2014, included in this filing as Exhibit 99.1 and incorporated herein by reference.

Principal Executive Offices

The Company is a Delaware limited liability company with headquarters in Houston, Texas. The principal executive offices are located at 600 Travis, Suite 5100, Houston, Texas 77002. The main telephone number is (281) 840-4000.

Company Website

The Company’s internet website is www.linnco.com. The Company makes available free of charge on or through its website Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after the Company electronically files such material with, or furnishes it to, the Securities and Exchange Commission (“SEC”). Information on the Company’s website should not be considered a part of, or incorporated by reference into, this Annual Report on Form 10-K.

The SEC maintains an internet website that contains these reports at www.sec.gov. Any materials that the Company files with the SEC may be read or copied at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information concerning the operation of the Public Reference Room may be obtained by calling the SEC at (800) 732-0330.

Cautionary Statement Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond the Company’s control. Because substantially all of LinnCo’s assets consist of its interest in LINN Energy’s units, these risks and uncertainties primarily relate to LINN Energy’s business which include the following:

• | business strategy; |

• | acquisition strategy; |

• | financial strategy; |

• | effects of legal proceedings; |

• | ability to maintain or grow distributions; |

• | drilling locations; |

• | oil, natural gas and natural gas liquids (“NGL”) reserves; |

• | realized oil, natural gas and NGL prices; |

• | production volumes; |

• | capital expenditures; |

• | economic and competitive advantages; |

• | credit and capital market conditions; |

• | regulatory changes; |

• | lease operating expenses, general and administrative expenses and development costs; |

2

Item 1. Business - Continued

• | future operating results, including results of acquired properties; |

• | plans, objectives, expectations and intentions; |

• | taxes; and |

• | integration of acquired businesses and operations, which may take longer than anticipated, may be more costly than anticipated as a result of unexpected factors or events and may have an unanticipated adverse effect on LINN Energy’s business. |

All of these types of statements, other than statements of historical fact included in this Annual Report on Form 10-K, are forward-looking statements. These forward-looking statements may be found in Item 1. “Business;” Item 1A. “Risk Factors;” Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other items within this Annual Report on Form 10-K. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” “continue,” the negative of such terms or other comparable terminology.

The forward-looking statements contained in this Annual Report on Form 10-K are largely based on LINN Energy and Company expectations, which reflect estimates and assumptions made by LINN Energy and Company management. These estimates and assumptions reflect management’s best judgment based on currently known market conditions and other factors. Although the Company believes such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties beyond its control. In addition, management’s assumptions may prove to be inaccurate. The Company cautions that the forward-looking statements contained in this Annual Report on Form 10-K are not guarantees of future performance, and it cannot assure any reader that such statements will be realized or the events will occur. Actual results may differ materially from those anticipated or implied in forward-looking statements due to factors listed in the “Risk Factors” section and elsewhere in this Annual Report on Form 10-K. The forward-looking statements speak only as of the date made, and other than as required by law, the Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Item 1A. Risk Factors

Our business has many risks. Factors that could materially adversely affect our business, financial condition, operating results or liquidity and the trading price of our shares are described below. This information should be considered carefully, together with other information in this report and other reports and materials we and LINN Energy file with the SEC. Because our only significant assets are the units issued by LINN Energy, our success is dependent solely upon the operation and management of LINN Energy and its resulting performance. The risk factors that affect LINN Energy also affect LinnCo; see “Risk Factors” within LINN Energy’s Annual Report on Form 10-K for the year ended December 31, 2014, included in this filing as Exhibit 99.1 and incorporated herein by reference.

Our cash flow consists exclusively of distributions from LINN Energy.

Our only significant assets are LINN Energy units representing limited liability company interests in LINN Energy that we own. Our cash flow will be therefore completely dependent upon the ability of LINN Energy to make distributions to its unitholders. The amount of cash that LINN Energy can distribute to its unitholders, including us, each quarter principally depends upon the amount of cash it generates from its operations, which will fluctuate from quarter to quarter based on, among other things:

• | produced volumes of oil, natural gas and NGL; |

• | prices at which oil, natural gas and NGL production is sold; |

• | level of its operating costs; |

• | payment of interest, which depends on the amount of its indebtedness and the interest payable thereon; and |

• | level of its capital expenditures. |

In addition, the actual amount of cash that LINN Energy will have available for distribution will depend on other factors, some of which are beyond its control, including:

• | availability of borrowings on acceptable terms under its credit facility to pay distributions; |

• | the costs of acquisitions, if any; |

3

Item 1A. Risk Factors - Continued

• | fluctuations in its working capital needs; |

• | timing and collectibility of receivables; |

• | restrictions on distributions contained in its credit facility and the indentures governing its senior notes; |

• | prevailing economic conditions; |

• | access to credit or capital markets; and |

• | the amount of cash reserves established by its board of directors for the proper conduct of its business. |

Because of these factors, LINN Energy may not have sufficient available cash each quarter to pay a distribution at the current level or at all. Furthermore, the amount of cash that LINN Energy has available for distribution depends primarily upon its cash flow, including cash flow from financial reserves and working capital borrowings, and is not solely a function of profitability, which will be affected by noncash items. As a result, LINN Energy may be able to make cash distributions during periods when it records net losses and may not be able to make cash distributions during periods when it records net income. Please see “Risk Factors” within LINN Energy’s Annual Report on Form 10-K for the year ended December 31, 2014, included in this filing as Exhibit 99.1 and incorporated herein by reference, for a discussion of risks relating to LINN Energy’s business, including factors that could cause LINN Energy to have insufficient cash to make distributions to its unitholders.

LINN Energy may not have sufficient net cash provided by operating activities to pay its distribution at the current distribution level, or at all, and as a result, future dividends to our shareholders may be reduced, suspended or eliminated.

While LINN Energy’s board of directors makes discretionary adjustments to net cash provided by operating activities when declaring a distribution for the current period, if LINN Energy generates insufficient net cash provided by operating activities for a sustained period of time and/or forecasts demonstrate expectations of continued future insufficiencies, LINN Energy’s board of directors may determine to reduce, suspend or eliminate its distribution to its unitholders. Any such reduction in distributions may cause us to reduce, suspend or eliminate our dividends, and the trading price of our shares may decline. Factors that may cause LINN Energy to generate net cash provided by operating activities that is insufficient to pay its current distribution to its unitholders include, among other things, the following:

• | Unhedged oil production: LINN Energy’s expected oil production for 2015 is approximately 70% hedged at approximately $94 per Bbl and 2016 is approximately 65% hedged at approximately $90 per Bbl. As a result, a meaningful portion of LINN Energy’s expected oil production for 2015 and 2016 remains unhedged and subject to fluctuating market prices. If LINN Energy is ultimately unable to hedge additional expected oil production volumes for 2015 and beyond, it will be subject to further potential commodity price volatility, which may result in lower than expected net cash provided by operating activities. Consequently, LINN Energy’s board of directors may determine to reduce, suspend or eliminate future distributions to its unitholders. |

• | Reduced capital expenditures: As previously announced, LINN Energy has approved a 2015 budget which includes a 61% reduction in capital expenditures to approximately $600 million, from approximately $1.6 billion spent in 2014. If LINN Energy’s capital program continues to be limited or is further reduced in the future, its production volumes and revenues may be lower than expected, net cash provided by operating activities could be insufficient to pay its current distribution to unitholders, and LINN Energy’s board of directors may determine to reduce, suspend or eliminate future distributions to its unitholders. |

• | Liquidity position: LINN Energy’s liquidity is dependent on many factors, including availability under its credit facilities, and cost and access to capital and credit markets, which are affected by the price and performance of its equity and debt securities. If the borrowing bases under LINN Energy’s credit facilities are reduced and it is otherwise unable to maintain its current liquidity position, LINN Energy may no longer have the financial flexibility to manage its business, including funding its planned capital expenditures, and LINN Energy’s board of directors may determine to reduce, suspend or eliminate future distributions to its unitholders. |

• | Ability to consummate accretive acquisitions: Accretive acquisitions are an integral component of LINN Energy’s business strategy. When cash flows are expected to be lower as a result of weak commodity prices on unhedged volumes, under-performance of assets, or declining contract prices on hedged volumes, LINN Energy seeks to make accretive acquisitions of oil and natural gas properties to cover potential shortfalls in net cash provided by operating activities in order to maintain its distribution level. As a result of the effect of weakened commodity prices on the |

4

Item 1A. Risk Factors - Continued

price of its equity and debt securities, LINN Energy may be limited in its ability to access the capital markets at an acceptable cost or at all; thus, its ability to make accretive acquisitions may be limited, in which case LINN Energy’s board of directors may determine to reduce, suspend or eliminate future distributions to its unitholders.

As a result of these and other factors, the amount of cash LINN Energy may distribute to its unitholders in the future may be significantly less than the current distribution level or the distribution may be reduced, suspended or eliminated. Further, if LINN Energy reduces its distributions to its unitholders, our board of directors will be required by our limited liability company agreement to reduce the cash dividend to our shareholders to be equal to 100% of such distribution, net of reserves for income taxes payable by us as determined by our board of directors.

The borrowing bases under LINN Energy’s credit facilities are subject to redetermination and any reduction in either borrowing base may result in LINN Energy having to repay indebtedness under its credit facilities earlier than anticipated, potentially causing future distributions to its unitholders to be reduced, suspended or eliminated.

Each of LINN Energy’s credit facilities is subject to scheduled redeterminations of its borrowing base, based primarily on reserve reports using lender commodity price expectations at such time, semi-annually in April and October. Additionally the lenders under LINN Energy’s credit facilities have the ability to request an interim redetermination of the borrowing base once per calendar year or once between scheduled redeterminations, depending on the credit facility. If current low commodity prices continue through such redetermination events, the borrowing base under either of LINN Energy’s credit facilities may be reduced. Upon any such potential reduction, any outstanding indebtedness in excess of the new borrowing base may become due within a short time span or LINN Energy must pledge other properties as additional collateral. LINN Energy currently has limited unpledged properties.

In particular, because one of LINN Energy’s credit facilities is effectively fully drawn, any such reduction in that credit facility’s borrowing base may require LINN Energy to make mandatory prepayments under the credit facility to the extent existing indebtedness under the credit facility exceeds the new borrowing base or LINN Energy may choose to post restricted cash on its subsidiary’s behalf, reducing its liquidity position. If LINN Energy is required to repay indebtedness under either of its credit facilities earlier than anticipated due to a borrowing base redetermination, it may be necessary to use cash that would otherwise be available for capital expenditures or distributions to its unitholders to repay such indebtedness. As a result of this, future distributions to its unitholders may be reduced, suspended or eliminated. Further, if LINN Energy reduces its distributions to its unitholders, our board of directors will be required by our limited liability company agreement to reduce the cash dividend to our shareholders to be equal to 100% of such distribution, net of reserves for income taxes payable by us as determined by our board of directors. In addition, any failure of LINN Energy to repay indebtedness in excess of its borrowing bases would constitute an event of default under its credit facilities, and could cause a cross-default under its other outstanding indebtedness.

If LINN Energy is unable to replace declines in production, proved developed producing reserves and cash flow from discretionary reductions for a portion of its oil and natural gas development costs, its net cash provided by operating activities could be reduced, which could adversely affect its ability to pay a distribution at the current level or at all.

In determining the amount of cash that LINN Energy distributes to unitholders, LINN Energy’s board of directors establishes at the end of each year an amount of capital expenditures for the next year (which it refers to as discretionary reductions for a portion of oil and natural gas development costs) with the objective of replacing proved developed producing reserves, current production and cash flow, taking into consideration its overall commodity mix. LINN Energy’s management evaluates all of these objectives as part of the decision-making process to determine the discretionary reductions for a portion of oil and natural gas development costs for the year, although every objective may not be met in each year. Furthermore, there may be certain years in which commodity prices and other economic conditions do not merit capital spending at a level sufficient to accomplish any of these objectives.

In determining this portion of oil and natural gas development costs (which may include estimated drilling and development costs associated with projects to convert a portion of non-producing reserves to producing status but does not include the historical cost of acquired properties as those amounts have already been spent in prior periods and were financed primarily with external sources of funding), LINN Energy’s management evaluates historical results of its drilling and development activities based on periodically revised and updated information from past years to assess the costs, adequacy and effectiveness of such activities and future assumptions regarding cost trends, production and decline rates and reserve

5

Item 1A. Risk Factors - Continued

recoveries. However, LINN Energy’s management does not conduct an analysis to evaluate historical amounts of capital actually spent on such drilling and development activities. LINN Energy’s ability to pursue projects with the intent to replace proved developed producing reserves, current production and cash flow through drilling and development activities is limited to its inventory of development opportunities on its existing acreage position. LINN Energy’s management’s estimate of this discretionary portion of its oil and natural gas development costs does not include the historical acquisition cost of projects pursued during the year or the acquisition of new oil and natural gas reserves. Moreover, LINN Energy’s assumptions regarding costs, production and decline rates and reserve recoveries may prove incorrect. After establishing the amount of discretionary reductions for a portion of oil and natural gas development costs, if LINN Energy does not fully replace proved developed producing reserves, current production and cash flow, its net cash provided by operating activities could be reduced, which could adversely affect its ability to pay a distribution at the current level or at all. Furthermore, LINN Energy’s existing reserves, inventory of drilling locations and production levels will decline over time as a result of development and production activities. Consequently, if LINN Energy were to limit its total capital expenditures to this discretionary portion of its oil and natural gas development costs and not complete acquisitions of new reserves, total reserves would decrease over time, resulting in an inability to sustain production at current levels, which could adversely affect its ability to pay a distribution at the current level or at all, and consequently our ability to pay a dividend at the current level or at all.

We will incur corporate income tax liabilities on income allocated to us by LINN Energy with respect to LINN Energy units we own, which may be substantial.

We are classified as a corporation for U.S. federal income tax purposes and, in most states in which LINN Energy does business, for state income tax purposes. Under current law, we will be subject to U.S. federal income tax at rates of up to 35% (and a 20% alternative minimum tax in certain cases), and to state income tax at rates that vary from state to state, on the net income allocated to us by LINN Energy with respect to the LINN Energy units we own. The amount of cash available for distribution to you will be reduced by the amount of any such income taxes payable by us for which we establish reserves.

The amount of income taxes payable by us depends on a number of factors including LINN Energy’s earnings from its operations, the amount of those earnings allocated to us and the amount of the distributions paid to us by LINN Energy. Our income tax liabilities could be substantial if any of the following occurs:

• | LINN Energy significantly decreases its drilling activity; |

• | an issuance of significant additional units by LINN Energy without a corresponding increase in the aggregate tax deductions generated by LINN Energy; |

• | tax carryforwards available become subject to further limitations on their annual usage; |

• | proposed legislation is enacted that eliminates the current deduction of intangible drilling costs and other tax incentives to the oil and natural gas industry; or |

• | there is a significant increase in oil and natural gas prices. |

We entered into a contribution agreement with LINN Energy with respect to the issuance of LINN Energy units to us in connection with the transfer by us of Berry Petroleum Company, now Berry Petroleum Company, LLC (“Berry”) to LINN Energy. Under the contribution agreement, at the end of calendar year 2015, we and LINN Energy will work in good faith to evaluate whether, in addition to any distribution to which we are entitled with respect to LINN Energy units we own, LINN Energy will make one or more special distributions to us solely out of funds available to make “operating cash flow distributions” (as such term is defined in Treasury Regulations Section 1.707-4(b)(2)) to reasonably compensate us for the actual increase in tax liability to us, if any, resulting from the allocation of depreciation, depletion and amortization and other cost recovery deductions using the “remedial allocation method” pursuant to Treasury Regulations Section 1.704-3(d), with respect to the assets acquired in the transfer. The transaction is not currently expected to give rise to any additional tax liability for us over and above our current estimates.

The total tax liabilities generated from the remedial allocation will be recognized over the remaining life of the underlying assets, which could extend beyond 50 years. The total deferred income tax liabilities impact from the transactions is estimated to be approximately $882 million (included in the total approximate $14 million of net deferred income tax liabilities shown on the balance sheet at December 31, 2014). These tax liabilities will be partially deferred when considering the tax shield that we receive with respect to the LINN Energy units we currently own. If we were to sell or otherwise liquidate the LINN Energy units acquired, the deferred tax liabilities of approximately $882 million would be payable.

6

Item 1A. Risk Factors - Continued

We are subject to statutory tax audits of our income tax returns and our income tax liabilities could be substantially higher than we project after such audits.

We and LINN Energy are subject to statutory tax audits pursuant to federal and state regulations, in particular for tax positions taken by Berry in prior fiscal years. After such audits, the tax authorities may disagree with and disallow certain tax positions that we and LINN Energy have inherited from Berry in the 2013 Berry acquisition. If we and LINN Energy are unable to prevail in an administrative or court proceeding to sustain some or all of the positions taken by Berry, we may be subject to substantial income tax liabilities and corresponding penalties and interest, which may be immediately due. Any adverse decision by the tax authorities or in an administrative or court proceeding may result in our reducing or eliminating our cash dividend for a period of time, which could be lengthy, to reserve cash to fund any such potential or actual income tax liabilities.

If the assumptions we used to estimate income taxes are incorrect, our income tax liabilities could be substantially higher than we project.

Events inconsistent with our assumptions could cause our income tax liabilities to be substantially higher than estimated and could therefore cause our dividends to be substantially lower than the distributions on LINN Energy units. For example, distributions that we receive with respect to our LINN Energy units that exceed the net income allocated to us by LINN Energy with respect to those units decrease our tax basis in those units. When our tax basis in our LINN Energy units is reduced to zero and any loss or other carryovers are fully utilized, the distributions we receive from LINN Energy in excess of net income allocated to us by LINN Energy will effectively be fully taxable to us, without any deductions.

Changes to current U.S. federal tax laws may affect our ability to take certain tax deductions.

Substantive changes to the existing U.S. federal income tax laws have been proposed that, if adopted, would affect, among other things, our ability to take certain deductions related to LINN Energy’s operations, including deductions for intangible drilling costs and deductions for costs associated with U.S. production activities. We are unable to predict whether any changes, or other proposals to such laws, ultimately will be enacted. Any such changes could negatively impact the value of an investment in our shares.

Our shareholders are only able to indirectly vote on matters on which LINN Energy unitholders are entitled to vote, and our shareholders are not entitled to vote to elect our directors.

Our shareholders will only be able to indirectly vote on matters on which LINN Energy unitholders are entitled to vote, and our shareholders are not entitled to vote to elect our directors. Therefore, you will only be able to indirectly influence the management and board of directors of LINN Energy, and you will not be able to directly influence or change our management or board of directors. If our shareholders are dissatisfied with the performance of our directors, they have no ability to remove the directors and have no right on an annual or ongoing basis to elect our board of directors. Rather, our board of directors is appointed by the holder of our sole voting share, which is LINN Energy. Our limited liability company agreement also contains provisions limiting the ability of holders of our shares to call meetings or to obtain information about our operations, as well as other provisions limiting the ability of holders of our shares to influence the manner or direction of management.

LINN Energy may issue additional units without your approval or other classes of units, and we may issue additional shares, which would dilute our direct and your indirect ownership interest in LINN Energy and your ownership interest in us.

LINN Energy’s limited liability company agreement does not limit the number of additional limited liability company interests, including interests that rank senior to the LINN Energy units, that it may issue at any time without the approval of its unitholders. The issuance by LINN Energy of additional units or other equity securities of equal or senior rank will have the following effects:

• | our proportionate ownership interest in LINN Energy will decrease; |

• | the amount of cash available for distribution on each LINN Energy unit may decrease, resulting in a decrease in the amount of cash available to pay dividends to you; |

7

Item 1A. Risk Factors - Continued

• | the relative voting strength of each previously outstanding unit, including the LINN Energy units we hold and vote in accordance with the vote of our shareholders, will be diminished; and |

• | the market price of the LINN Energy units may decline, resulting in a decline in the market price of our shares. |

In addition, our limited liability company agreement does not limit the number of additional shares that we may issue at any time without your approval. The issuance by us of additional shares will have the following effects:

• | your proportionate ownership interest in us will decrease; |

• | the relative voting strength of each previously outstanding share you own will be diminished; and |

• | the market price of our shares may decline. |

Your shares are subject to limited call rights that could result in your having to involuntarily sell your shares at a time or price that may be undesirable. Shareholders who are not “Eligible Holders” will not be entitled to receive distributions on or allocations of income or loss on their shares and their shares will be subject to redemption.

If LINN Energy or any of its affiliates owns 80% or more of our outstanding shares, LINN Energy has the right, which it may assign to any of its affiliates, to purchase all of our remaining outstanding shares, at a purchase price not less than the greater of the then-current market price of our shares and the highest price paid for our shares by LINN Energy or one of its affiliates during the prior 90 days. If LINN Energy exercises any of its rights to purchase our shares, you may be required to sell your shares at a time or price that may be undesirable, and you could receive less than you paid for your shares. Any sale of our shares, to LINN Energy or otherwise, for cash will be a taxable transaction to the owner of the shares sold. Accordingly, a gain or loss will be recognized on the sale equal to the difference between the cash received and the owner’s tax basis in the shares sold.

In addition, if at any time a person owns more than 90% of the outstanding LINN Energy units, such person may elect to purchase all, but not less than all, of the remaining outstanding LINN Energy units at a price equal to the higher of the current market price (as defined in LINN Energy’s limited liability company agreement) and the highest price paid by such person or any of its affiliates for any LINN Energy units purchased during the 90-day period preceding the date notice was mailed to the LINN Energy unitholders informing them of such election. In this case, we will be required to tender all of our outstanding LINN Energy units and distribute the cash we receive, net of income taxes payable by us, to our shareholders. Following such distribution, we will dissolve and wind up our affairs. Thus, upon the election of a holder of 90% of the outstanding LINN Energy units, you may receive a distribution that is effectively less than the price at which you would prefer to sell your shares.

In order to comply with U.S. laws with respect to the ownership of interests in oil and natural gas leases on federal lands, we have adopted certain requirements regarding those investors who may own our shares. As used herein, an Eligible Holder means a person or entity qualified to hold an interest in oil and natural gas leases on federal lands. As of the date hereof, Eligible Holder means: (1) a citizen of the U.S.; (2) a corporation organized under the laws of the U.S. or of any state thereof; or (3) an association of U.S. citizens, such as a partnership or limited liability company, organized under the laws of the U.S. or of any state thereof, but only if such association does not have any direct or indirect foreign ownership, other than foreign ownership of stock in a parent corporation organized under the laws of the U.S. or of any state thereof. For the avoidance of doubt, onshore mineral leases or any direct or indirect interest therein may be acquired and held by aliens only through stock ownership, holding or control in a corporation organized under the laws of the U.S. or of any state thereof and only for so long as the alien is not from a country that the U.S. federal government regards as denying similar privileges to citizens or corporations of the U.S. Shareholders who are not persons or entities who meet the requirements to be an Eligible Holder will not be entitled to receive distributions in kind on their shares in a liquidation and they run the risk of having their shares redeemed by us at the then-current market price.

The terms of our shares may be changed in ways you may not like, because our board of directors has the power to change the terms of our shares in ways our board determines are not materially adverse to you.

As an owner of our shares, you may not like the changes made to the terms of our shares, if any, and you may disagree with our board of directors’ decision that the changes are not materially adverse to you as a shareholder. Your recourse if you disagree is limited because our limited liability company agreement gives broad latitude and discretion to our board of directors and limits the fiduciary duties that our officers and directors otherwise would owe to you.

8

Item 1A. Risk Factors - Continued

Our limited liability company agreement limits the fiduciary duties owed by our officers and directors to our shareholders, and LINN Energy’s limited liability company agreement limits the fiduciary duties owed by LINN Energy’s officers and directors to its unitholders, including us.

Our limited liability company agreement has modified, waived and limited the fiduciary duties of our directors and officers that would otherwise apply at law or in equity and replaced such duties with a contractual duty requiring our directors and officers to act in good faith. For purposes of our limited liability company agreement, a person shall be deemed to have acted in good faith if the person subjectively believes that the action or omission of action is in, or not opposed to, the best interests of LinnCo. In addition, any action or omission shall be deemed to be in, or not opposed to, the best interests of LinnCo and our shareholders if the person making the determination subjectively believes that such action or omission of action is in, or not opposed to, the best interest of LINN Energy and all its unitholders, taken together, and such person may take into account the totality of the relationship between LINN Energy and us. In addition, when acting in any capacity other than as one of our directors or officers, including when acting in their individual capacities or as officers or directors of LINN Energy or any affiliate of LINN Energy, our directors and officers will not be required to act in good faith and will have no obligation to take into account our interests or the interests of our shareholders.

The above modifications of fiduciary duties are expressly permitted by Delaware law. Thus, we and our shareholders will only have recourse and be able to seek remedies against our board of directors if they breach their obligations pursuant to our limited liability company agreement. Furthermore, even if there has been a breach of the obligations set forth in our limited liability company agreement, that agreement provides that our directors and officers will not be liable to us or our shareholders, except for acts or omissions not in good faith.

These provisions restrict the remedies available to our shareholders for actions that without those limitations might constitute breaches of duty, including fiduciary duties. In addition, LINN Energy’s limited liability company agreement also limits the fiduciary duties owed by LINN Energy’s officers and directors to its unitholders, including us.

Our limited liability company agreement prohibits a shareholder who acquires 15% or more of our shares or voting power with respect to 15% or more of the outstanding LINN Energy units without the approval of our or LINN Energy’s board of directors from engaging in a business combination with us or with LINN Energy for three years. This provision could discourage a change of control of us or of LINN Energy that our shareholders may favor, which could negatively affect the price of our shares.

Our limited liability company agreement effectively adopts Section 203 of the Delaware General Corporation Laws, or the DGCL. Section 203 of the DGCL as it applies to us prevents an interested shareholder, defined as a person who owns 15% or more of our outstanding shares or voting power with respect to 15% or more of the outstanding LINN Energy units, from engaging in business combinations with us or with LINN Energy for three years following the time such person becomes an interested shareholder. Section 203 broadly defines “business combination” to encompass a wide variety of transactions with or caused by an interested shareholder, including mergers, asset sales and other transactions in which the interested shareholder receives a benefit on other than a pro rata basis with other shareholders. This provision of our limited liability company agreement could have an anti-takeover effect with respect to transactions not approved in advance by our board of directors, including discouraging takeover attempts that might result in a premium over the market price for our shares or LINN Energy’s units.

Our shares may trade at a substantial discount to the trading price of LINN Energy units.

We cannot predict whether our shares will trade at a discount or premium to the trading price of LINN Energy units. If we incur substantial corporate income tax liabilities on income allocated to us by LINN Energy with respect to LINN Energy units we own, the cash dividends you receive per share will be substantially less than the cash distributions per unit that we receive from LINN Energy. In addition, in the event of a merger, tender offer, going private transaction or sale of all or substantially all of our assets (“Terminal Transaction”) the net proceeds you receive from us per share may, as a result of our corporate income tax liabilities on the transaction and other factors, be substantially lower than the net proceeds per unit received by a direct LINN Energy unitholder. As a result of these considerations, our shares may trade at a substantial discount to the trading price of LINN Energy units.

9

Item 1A. Risk Factors - Continued

We are a “controlled company” within the meaning of the NASDAQ rules and rely on exemptions from various corporate governance requirements.

Our shares are listed on the NASDAQ Global Select Market. A company of which more than 50% of the voting power for the election of directors is held by an individual, a group or another company is a “controlled company” within the meaning of the NASDAQ rules. A “controlled company” may elect not to comply with various corporate governance requirements of NASDAQ, including the requirement that a majority of its board of directors consist of independent directors, the requirement that its nominating and governance committee consist of all independent directors and the requirement that its compensation committee consist of all independent directors.

We are a “controlled company” because LINN Energy holds our sole voting share and has the sole power to elect our board of directors. Because we rely on certain of the “controlled company” exemptions and do not have a compensation committee or a nominating and corporate governance committee, you do not have the same corporate governance advantages afforded to stockholders of companies that are subject to all of the corporate governance requirements of NASDAQ.

LINN Energy may experience difficulties in integrating assets it acquires from third parties, which could cause LINN Energy to fail to realize many of the anticipated potential benefits of those acquisitions.

As part of LINN Energy’s previously announced plan to divest certain of its higher decline, capital intensive properties for more mature, long-life oil and natural gas properties with lower decline rates, LINN Energy acquired oil and natural gas properties throughout its various operating regions. Achieving the anticipated benefits of these acquisitions will depend in part on whether LINN Energy is able to integrate these assets in an efficient and effective manner. LINN Energy may not be able to accomplish this integration process smoothly or successfully. The difficulties of integrating these assets with its business potentially will include, among other things, the necessity of coordinating geographically separated assets and addressing possible differences incorporating cultures and management philosophies of employees associated with these assets, and the integration of certain operations, data systems and processes, which may require the dedication of significant management resources and which may temporarily distract LINN Energy management’s attention from its day-to-day business.

An inability to realize the full extent of the anticipated benefits of these acquisitions, as well as any delays encountered in the transition process, could have an adverse effect on the revenues, level of expenses and operating results of LINN Energy, which may affect its cash available for distribution, and consequently our ability to pay a dividend at the current level or at all.

LINN Energy may be unable to retain key employees.

Our future success and the success of LINN Energy will depend in part on LINN Energy’s ability to retain key employees. During 2014, LINN Energy acquired several new properties and hired employees associated with those properties. Additionally, in the fourth quarter of 2014, commodity prices decreased significantly. Key employees of LINN Energy may depart because of issues relating to the uncertainty and difficulty of integration or during times of commodity price volatility. Accordingly, no assurance can be given that LINN Energy will be able to retain key employees to the same extent as in the past.

Tax Risks to Shareholders

Upon a Terminal Transaction, we may be entitled to a smaller distribution per LINN Energy unit we own than other LINN Energy unitholders, and we may incur substantial corporate income tax liabilities in the transaction or upon the distribution of the proceeds from the transaction to you, in which case the net proceeds you receive from us per share may be substantially lower than the net proceeds per unit received by a direct LINN Energy unitholder.

Upon a liquidation of LINN Energy, LINN Energy unitholders will receive distributions in accordance with the positive balances in their respective capital accounts in their units. As a result of the underwriting discount and offering expenses incurred in connection with the initial public offering (“IPO”), we acquired LINN Energy units at a price lower than the market price of LINN Energy units at the time of the IPO. Therefore, our capital account in the LINN Energy units that we own is lower than the capital accounts of other LINN Energy unitholders. Therefore, we would be entitled upon a dissolution

10

Item 1A. Risk Factors - Continued

of LINN Energy to a smaller distribution per LINN Energy unit we own than other LINN Energy unitholders, unless adjustments are made to our capital accounts in the LINN Energy units that we own.

Each time LINN Energy issues or redeems units, it is required to adjust the capital accounts in all outstanding LINN Energy units upward to the extent of the “unrealized gains” in LINN Energy’s assets or downward to the extent of the “unrealized losses” in LINN Energy’s assets immediately prior to such issuance or redemption. In general, the difference between the fair market value of each such asset and its adjusted tax basis equals the unrealized gain (if the fair market value exceeds the adjusted tax basis) or the unrealized loss (if the adjusted tax basis exceeds the fair market value). Unrealized gains and unrealized losses generally are allocated among the LINN Energy unitholders in the same manner as other items of LINN Energy income, gain, deduction or loss.

The board of directors of LINN Energy, however, is authorized to make disproportionate allocations of income and deductions, including allocations of unrealized gains and unrealized losses, to the extent necessary to cause the capital accounts of all LINN Energy units to be the same. We anticipate that there will be sufficient unrealized gains or unrealized losses in connection with future issuances or redemptions of LINN Energy units in order for LINN Energy to allocate to us sufficient unrealized gains, or to allocate sufficient unrealized losses to other holders of LINN Energy units, to cause the capital accounts in the LINN Energy units that we own to be the same as the capital accounts of all other LINN Energy units and result in our being entitled upon the dissolution of LINN Energy to the same distribution per LINN Energy unit we own as other LINN Energy unitholders. However, there can be no assurance that such adjustments will occur or that any adjustments that do occur will be sufficient to eliminate the difference between our capital account in the LINN Energy units that we own and the capital accounts of other LINN Energy unitholders in their LINN Energy units.

We are classified as a corporation for U.S. federal income tax purposes and, in most states in which LINN Energy does business, for state income tax purposes. Upon a Terminal Transaction, we will be required to liquidate and distribute the net after-tax proceeds of the transaction to you. We may incur substantial corporate income tax liabilities upon such a transaction or upon our distribution to you of the proceeds of the transaction. The tax liability we incur will depend in part upon the amount by which the value of the LINN Energy units we own exceeds our tax basis in the units. We expect our tax basis in our LINN Energy units to decrease over time as we receive distributions that exceed the net income allocated to us by LINN Energy with respect to those units. As a result, we may incur substantial income tax liabilities upon such a transaction even if LINN Energy units decrease in value after we purchase them. The amount of cash or other property available for distribution to you upon our liquidation will be reduced by the amount of any such income taxes paid by us.

As a result of these factors, upon a Terminal Transaction, the net proceeds you receive from us per share may be substantially lower than the net proceeds per unit received by a direct LINN Energy unitholder.

Your tax gain on the disposition of our shares could be more than expected, or your tax loss on the disposition of our shares could be less than expected.

If you sell your shares, or you receive a liquidating distribution from us, you will recognize a gain or loss for U.S. federal income tax purposes equal to the difference between the amount realized and your tax basis in those shares. Because distributions in excess of your allocable share of our earnings and profits decrease your tax basis in your shares, the amount, if any, of such prior excess distributions with respect to the shares you sell or dispose of will, in effect, become taxable gain to you if you sell such shares at a price greater than your tax basis in those shares, even if the price you receive is less than your original cost.

If you are a U.S. holder of our shares, the IRS Forms 1099-DIV that you receive from your broker may over-report your dividend income with respect to our shares for U.S. federal income tax purposes, and failure to over-report your dividend income in a manner consistent with the IRS Forms 1099-DIV that you receive from your broker may cause the IRS to assert audit adjustments to your U.S. federal income tax return. If you are a non-U.S. holder of our shares, your broker or other withholding agent may overwithhold taxes from dividends paid to you, in which case you would have to file a U.S. tax return if you wanted to claim a refund of the overwithheld tax.

Dividends we pay with respect to our shares will constitute “dividends” for U.S. federal income tax purposes only to the extent of our current and accumulated earnings and profits. Dividends we pay in excess of our earnings and profits will not be treated as “dividends” for U.S. federal income tax purposes; instead, they will be treated first as a tax-free return of capital

11

Item 1A. Risk Factors - Continued

to the extent of your tax basis in your shares and then as capital gain realized on the sale or exchange of such shares. We may be unable to timely determine the portion of our distributions that is a “dividend” for U.S. federal income tax purposes.

If you are a U.S. holder of our shares, we may be unable to persuade brokers to prepare the IRS Forms 1099-DIV that they send to you in a manner that is consistent with our determination of the amount that constitutes a “dividend” to you for U.S. federal income tax purposes or you may receive a corrected IRS Form 1099-DIV (and you may therefore need to file an amended federal, state or local income tax return). We will attempt to timely notify you of available information to assist you with your income tax reporting (such as posting the correct information on our web site). However, the information that we provide to you may be inconsistent with the amounts reported to you by your broker on IRS Form 1099-DIV, and the IRS may disagree with any such information and may make audit adjustments to your tax return.

If you are a non-U.S. holder of our shares, “dividends” for U.S. federal income tax purposes will be subject to withholding of U.S. federal income tax at a 30% rate (or such lower rate as may be specified by an applicable income tax treaty) unless the dividends are effectively connected with your conduct of U.S. trade or business. Because we may be unable to timely determine the portion of our distributions that is a “dividend” for U.S. federal income tax purposes or we may be unable to persuade your broker or withholding agent to withhold taxes from distributions in a manner consistent with our determination of the amount that constitutes a “dividend” for such purposes, your broker or other withholding agent may overwithhold taxes from distributions paid to you. In such a case, you would have to file a U.S. tax return to claim a refund of the overwithheld tax.

If LINN Energy were subject to a material amount of entity-level income taxes or similar taxes, whether as a result of being treated as a corporation for U.S. federal income tax purposes or otherwise, the value of LINN Energy units would be substantially reduced and, as a result, the value of our shares would be substantially reduced.

The anticipated benefit of an investment in LINN Energy units depends largely on the assumption that LINN Energy will not be subject to a material amount of entity-level income taxes or similar taxes, and the anticipated benefit of an investment in our shares depends largely upon the value of LINN Energy units.

LINN Energy may be subject to material entity-level U.S. federal income tax and state income taxes if it is treated as a corporation, rather than as a partnership, for U.S. federal income tax purposes. Because LINN Energy’s units are publicly traded, Section 7704 of the Internal Revenue Code requires that LINN Energy derive at least 90% of its gross income each year from the marketing of oil and natural gas, or from certain other specified activities, in order to be treated as a partnership for U.S. federal income tax purposes. We believe that LINN Energy has satisfied this requirement and will continue to do so in the future, so we believe LINN Energy is and will be treated as a partnership for U.S. federal income tax purposes. However, we have not obtained a ruling from the U.S. Internal Revenue Service regarding LINN Energy’s treatment as a partnership for U.S. federal income tax purposes. Moreover, current law or the business of LINN Energy may change so as to cause LINN Energy to be treated as a corporation for U.S. federal income tax purposes or otherwise subject LINN Energy to material entity-level U.S. federal income taxes, state income taxes or similar taxes. For example, one recent proposal would be to tax publicly traded partnerships with qualifying income from fossil fuels activities as a corporation. Any modification to current law or interpretations thereof may or may not be applied retroactively and could make it more difficult or impossible to meet the requirements for partnership status, affect or cause LINN Energy to change its business activities, change the character or treatment of portions of LINN Energy’s income and adversely affect our investment in LINN Energy units.

If LINN Energy were treated as a corporation for U.S. federal income tax purposes, it would be subject to U.S. federal income tax at rates of up to 35% (and a 20% alternative minimum tax in certain cases), and to state income tax at rates that vary from state to state, on its taxable income. Distributions from LINN Energy would generally be taxed again as corporate distributions, and no income, gain, loss, deduction or credit would flow through to LINN Energy unitholders. Any income taxes or similar taxes imposed on LINN Energy as an entity, whether as a result of LINN Energy’s treatment as a corporation for U.S. federal income tax purposes or otherwise, would reduce LINN Energy’s cash available for distribution to its unitholders. Any material reduction in the anticipated cash flow and after-tax return to LINN Energy unitholders would reduce the value of the LINN Energy units we own and the value of our shares. In addition, if LINN Energy were treated as a corporation for U.S. federal income tax purposes, that would constitute a Terminal Transaction.

12

Item 1A. Risk Factors - Continued

Also, because of widespread state budget deficits and other reasons, several states are evaluating ways to subject partnerships and limited liability companies to entity level taxation through the imposition of state income, franchise or other forms of taxation. For example, LINN Energy may pay Texas franchise tax on its total revenue apportioned to Texas at a maximum effective rate of 0.7%. Imposition of a tax on LINN Energy by any other state would reduce the amount of cash available for distribution to us.

Item 1B. Unresolved Staff Comments

None

Item 2. Properties

LinnCo has no properties. Its assets consist of a small amount of working capital and the LINN Energy units that it owns. See Item 1. “Business” for additional information.

Item 3. Legal Proceedings

In 2013, several class action complaints were filed and ultimately consolidated in the United States District Court, Southern District of New York (the “Federal Actions”) against LINN Energy, LinnCo, certain of their officers and directors and the various underwriters for LinnCo’s initial public offering. These cases collectively asserted claims based on allegations that LINN Energy made false or misleading statements relating to its (i) hedging strategy, (ii) the cash flow available for distribution to unitholders, and (iii) LINN Energy’s energy production in its Exchange Act filings; and additional claims based on alleged misstatements relating to these issues in the prospectus and registration statement for LinnCo’s initial public offering. Several derivative actions were also filed in federal and state court in Texas, and in the Delaware Court of Chancery (the “Derivative Actions”) asserting derivative claims on behalf of LINN Energy against the individual officers and directors for alleged breaches of fiduciary duty, waste of corporate assets, mismanagement, abuse of control, and unjust enrichment based on factual allegations similar to those in the Federal Actions.

In July 2014, the Court dismissed the claims of the plaintiffs in the Federal Actions with prejudice, concluding that the plaintiffs failed to demonstrate any material misstatement or omission by LINN Energy or LinnCo, or their officers and directors. The plaintiffs in the Federal Actions did not appeal the Court’s dismissal, and the appeals deadline has now passed. The plaintiffs in the Derivative Actions subsequently have dismissed their claims without prejudice.

Item 4. Mine Safety Disclosures

Not applicable

13

Part II

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

The Company’s shares are listed on the NASDAQ Global Select Market (“NASDAQ”) under the symbol “LNCO” and began trading on October 12, 2012, after pricing of its initial public offering. At the close of business on January 31, 2015, there were approximately 213 shareholders of record.

The following sets forth the range of high and low last reported sales prices per share, as reported by NASDAQ, for the period indicated. In addition, dividends declared during the period are presented.

Share Price Range | Cash Dividends Declared Per Share (1) | ||||||||||||

Period | High | Low | |||||||||||

2014: | |||||||||||||

October 1 - December 31 | $ | 28.79 | $ | 9.16 | $ | 0.725 | |||||||

July 1 - September 30 | $ | 31.45 | $ | 28.84 | $ | 0.725 | |||||||

April 1 - June 30 | $ | 31.29 | $ | 26.91 | $ | 0.725 | |||||||

January 1 - March 31 | $ | 32.87 | $ | 26.35 | $ | 0.725 | |||||||

2013: | |||||||||||||

October 1 - December 31 | $ | 33.36 | $ | 28.01 | $ | 0.725 | |||||||

July 1 - September 30 | $ | 37.07 | $ | 25.18 | $ | 0.725 | |||||||

April 1 - June 30 | $ | 42.84 | $ | 34.84 | $ | 0.725 | |||||||

January 1 - March 31 | $ | 40.16 | $ | 36.66 | $ | 0.71 | (2) | ||||||

(1) | In April 2013, LINN Energy’s and LinnCo’s boards of directors approved a change in the distribution and dividend policy that provides a distribution and dividend with respect to any quarter may be made, at the discretion of the boards of directors, (i) within 45 days following the end of each quarter or (ii) in three equal installments within 15, 45 and 75 days following the end of each quarter. The first monthly dividend was paid in July 2013. |

(2) | This amount is net of the tax reserve of $0.015 per common share. |

Dividends

Within five business days after receiving a cash distribution related to its interest in LINN Energy units, LinnCo is required to pay the cash received, net of reserves for its income tax liability (“tax reserve”), if any, as dividends to its shareholders. The amount of the tax reserve is calculated on a quarterly basis and is determined based on the estimated tax liability for the entire year. The current tax reserve can be increased or reduced, at Company management’s discretion, to account for the over/(under) tax reserve previously recorded. Because the tax reserve is an estimate, upon filing the annual tax returns, if the actual amount of tax due is greater or less than the total amount of tax reserved, the subsequent tax reserve, at Company management’s discretion, could be adjusted accordingly. Any such adjustments are subject to approval by the Company’s board of directors.

14

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities - Continued |

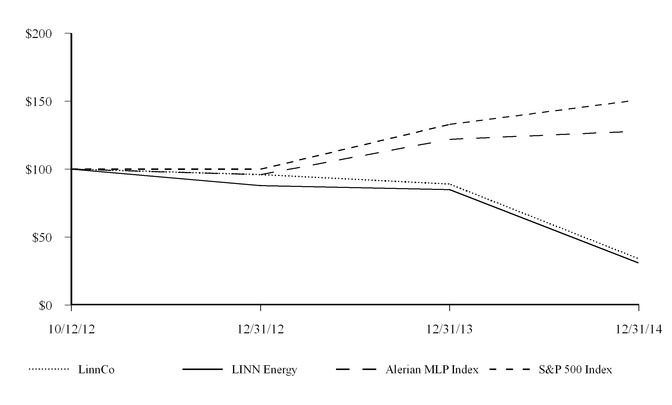

Shareholder Return Performance Presentation

The performance graph below compares the total shareholder return on the Company’s shares, with the total return of the Standard & Poor’s 500 Index (the “S&P 500 Index”) and the Alerian MLP Index, a weighted composite of 50 prominent energy master limited partnerships. Total return includes the change in the market price, adjusted for reinvested dividends or distributions, for the period shown on the performance graph and assumes that $100 was invested in the Company on October 12, 2012, and LINN Energy, the S&P 500 Index and the Alerian MLP Index on the same date. The results shown in the graph below are not necessarily indicative of future performance.

October 12, 2012 | December 31, 2012 | December 31, 2013 | December 31, 2014 | ||||||||||||

LinnCo | $ | 100 | $ | 96 | $ | 89 | $ | 34 | |||||||

LINN Energy | $ | 100 | $ | 88 | $ | 85 | $ | 31 | |||||||

Alerian MLP Index | $ | 100 | $ | 96 | $ | 122 | $ | 128 | |||||||

S&P 500 Index | $ | 100 | $ | 100 | $ | 133 | $ | 151 | |||||||

Notwithstanding anything to the contrary set forth in any of the Company’s previous or future filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate this Annual Report on Form 10-K or future filings with the Securities and Exchange Commission (“SEC”), in whole or in part, the preceding performance information shall not be deemed to be “soliciting material” or to be “filed” with the SEC or incorporated by reference into any filing except to the extent this performance presentation is specifically incorporated by reference therein.

Issuer Purchases of Equity Securities

In August 2014, the board of directors of the Company authorized the repurchase of up to $250 million of the Company’s outstanding shares from time to time on the open market or in negotiated purchases. The repurchase plan does not obligate the Company to acquire any specific number of shares and may be discontinued at any time. The Company did not repurchase any shares during the year ended December 31, 2014, and as of December 31, 2014, the entire amount remained available for share repurchase under the program.

15

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities - Continued |

There are no securities authorized for issuance under equity compensation plans and no sales of unregistered equity securities during the periods covered by this report.

Item 6. | Selected Financial Data |

The selected financial data set forth below should be read in conjunction with Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 8. “Financial Statements and Supplementary Data.”

Year Ended December 31, | April 30, 2012 (Inception) To December 31, 2012 | ||||||||||

2014 | 2013 | ||||||||||

(in thousands, except per share amounts) | |||||||||||

Statement of operations data: | |||||||||||

Equity income (loss) from investment in Linn Energy, LLC | $ | (1,964,999 | ) | $ | (244,189 | ) | $ | 34,411 | |||

General and administrative expenses | (2,818 | ) | (42,089 | ) | (1,230 | ) | |||||

Gain (loss) on transfer of Berry | 13,673 | (718,249 | ) | — | |||||||

Income tax (expense) benefit | 734,684 | 92,080 | (12,528 | ) | |||||||

Net income (loss) | (1,219,460 | ) | (912,447 | ) | 20,653 | ||||||

Net income (loss) per share, basic and diluted | (9.49 | ) | (23.46 | ) | 1.92 | ||||||

Dividends declared per share | 2.90 | 2.88 | 0.71 | ||||||||

Weighted average shares outstanding | 128,526 | 38,896 | 10,747 | ||||||||

Cash flow data: | |||||||||||

Net cash provided by (used in): | |||||||||||

Operating activities | $ | 376,869 | $ | 100,870 | $ | 25,221 | |||||

Investing activities | — | — | (1,212,627 | ) | |||||||

Financing activities | (371,370 | ) | (100,348 | ) | 1,187,929 | ||||||

Balance sheet data: | |||||||||||

Total assets (1) | $ | 1,368,022 | $ | 3,665,519 | $ | 1,222,340 | |||||

(1) | The decrease in 2014 primarily reflects the impairment of LinnCo’s investment in LINN Energy. The increase in 2013 primarily reflects the value of additional LINN Energy units acquired in exchange for the transfer of Berry to LINN Energy. |

Selected financial data of LINN Energy is found in Part II, Item 6. “Selected Financial Data” of LINN Energy’s Annual Report on Form 10-K, which is included in this filing as Exhibit 99.1 and incorporated herein by reference as the Company’s results of operations, financial position and cash flows are dependent on the results of operations, financial position and cash flows of LINN Energy.

16

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with the financial statements and notes to the financial statements, which are included in this Annual Report on Form 10-K in Item 8. “Financial Statements and Supplementary Data.” The following discussion contains forward-looking statements that reflect the Company’s future plans, estimates, beliefs and expected performance. The forward-looking statements are dependent upon events, risks and uncertainties that may be outside the Company’s control. The Company’s actual results could differ materially from those discussed in these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those factors discussed below and elsewhere in this Annual Report on Form 10-K, particularly in Item 1A. “Risk Factors.” In light of these risks, uncertainties and assumptions, the forward-looking events discussed may not occur.

The reference to a “Note” herein refers to the accompanying Notes to Financial Statements contained in Item 8. “Financial Statements and Supplementary Data.”

General

LinnCo, LLC (“LinnCo” or the “Company”) is a Delaware limited liability company formed on April 30, 2012, under the Delaware Limited Liability Company Act, that has elected to be treated as a corporation for U.S. federal income tax purposes. Linn Energy, LLC (“LINN Energy”), an independent oil and natural gas company that trades on the NASDAQ Global Select Market under the symbol “LINE,” owns LinnCo’s sole voting share.

LinnCo’s success is dependent upon the operation and management of LINN Energy and its resulting performance. Therefore, LINN Energy’s Annual Report on Form 10-K for the year ended December 31, 2014, has been included in this filing as Exhibit 99.1 and incorporated herein by reference.

Business

At no time after LinnCo’s formation and prior to the initial public offering (“IPO”) did LinnCo have any operations or own any interest in LINN Energy. After the IPO, LinnCo’s initial sole purpose was to own units representing limited liability company interests (“units”) in its affiliate, LINN Energy. In connection with the acquisition of Berry Petroleum Company, now Berry Petroleum Company, LLC (“Berry”) (see Note 2), LinnCo amended its limited liability company agreement to permit, among other things, the acquisition and subsequent transfer of assets to LINN Energy for consideration received. As of December 31, 2014, LinnCo had no significant assets or operations other than those related to its interest in LINN Energy.

Berry Acquisition

On December 16, 2013, the Company completed the transactions contemplated by the merger agreement between the Company, LINN Energy and Berry under which LinnCo acquired all of the outstanding common shares of Berry and the contribution agreement between the Company and LINN Energy, under which the Company transferred Berry to LINN Energy in exchange for LINN Energy units. Under the merger agreement, as amended, Berry’s shareholders received 1.68 LinnCo common shares for each Berry common share they owned, totaling 93,756,674 LinnCo common shares valued at approximately $2.7 billion. Under the contribution agreement, LinnCo transferred Berry to LINN Energy after which Berry became an indirect wholly owned subsidiary of LINN Energy. As consideration for the transfer of Berry to LINN Energy, the Company acquired 93,756,674 newly issued LINN Energy units, valued at approximately $2.8 billion and equal to the number of LinnCo shares issued as consideration for Berry.

Recent Developments

In January 2015, LINN Energy’s board of directors approved a reduction of LINN Energy’s distribution to $1.25 per unit, from the previous level of $2.90 per unit, on an annualized basis, and in February 2015 approved a revised 2015 budget which includes a 61% reduction in capital expenditures to approximately $600 million, from approximately $1.6 billion spent in 2014. The 2015 budget contemplates a significantly lower oil price than in 2014, and the reduction of the distribution and capital budget are intended to solidify LINN Energy’s financial position and regain a useful cost of capital. The dividends LinnCo pays are dependent on the cash distributions it receives from LINN Energy; therefore, LinnCo’s board of directors also reduced LinnCo’s dividend to $1.25 per share.

17