Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CommunityOne Bancorp | a4q2014earningsrelease8-k.htm |

| EX-99.1 - EXHIBIT 99.1 - CommunityOne Bancorp | a4q2014earningsrelease.htm |

CommunityOne Bancorp January 30, 2015 Fourth Quarter 2014 Earnings Presentation

Presenters Bob Reid President / Chief Executive Officer David Nielsen Chief Financial Officer Neil Machovec Chief Credit Officer 2

Forward Looking Statements & Other Information Forward Looking Statements This presentation contains certain forward-looking statements within the safe harbor rules of the federal securities laws. These statements generally relate to COB’s financial condition, results of operations, plans, objectives, future performance or business. They usually can be identified by the use of forward-looking terminology, such as “believes,” “expects,” or “are expected to,” “plans,” “projects,” “goals,” “estimates,” “may,” “should,” “could,” “would,” “intends to,” “outlook” or “anticipates,” or variations of these and similar words, or by discussions of strategies that involve risks and uncertainties. Forward looking statements are subject to risks and uncertainties, including but not limited to, those risks described in COB’s Annual Report on Form 10-K for the year ended December 31, 2013 under the section entitled “Item 1A, Risk Factors,” and in the Quarterly Reports of Form 10-Q and other reports that are filed by COB with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which are subject to numerous assumptions, risks and uncertainties, and which change over time. These forward-looking statements speak only as of the date of this presentation. Actual results may differ materially from those expressed in or implied by any forward looking statements contained in this presentation. We assume no duty to revise or update any forward-looking statements, except as required by applicable law. Non-GAAP Financial Measures In addition to the results of operations presented in accordance with Generally Accepted Accounting Principles (GAAP), COB management uses and this presentation contains or references, certain non-GAAP financial measures, such as pre-credit and non-recurring (PCNR) earnings, PCNR noninterest income, PCNR noninterest expense, and tangible shareholders’ equity. COB believes these non-GAAP financial measures provide information useful to investors in understanding our underlying operational performance and our business and performance trends as they facilitate comparisons with the performance of others in the financial services industry; however, these non-GAAP financial measures should not be considered an alternative to GAAP. The non-GAAP financial measures contained within this presentation should be read in conjunction with the audited financial statements and analysis as presented in COB’s Annual Report on Form 10-K as well as the unaudited financial statements and analyses as presented in COB’s Quarterly Reports on Form 10-Q. A reconciliation of non-GAAP measures to the most directly comparable GAAP measure is included within tables in the presentation or with the appendix to this presentation. 3

Quarterly Operating Highlights 6th consecutive profitable quarter Net income of $144.6 million in 4Q – $2.1 million pre tax net income – $3.7 million pre tax net income net of $1.6 million in 4Q branch closure costs – PCNR earnings of $2.9 million, 44% increase over 3Q Release of $142.5 million of valuation allowance on DTA – $1.3 million remaining Strong loan growth across all lines of business – Portfolio grew $39.7 million, or 3%, in 4Q, a 12% annualized growth rate Robust deposit growth in 4Q – Deposits increased $35.5 million, or 8% annualized Continued positive credit trends – NPA’s fell to 2.1% of assets – Provision recovery of $1.3 million Net interest income grew 6% in 4Q – NIM of 3.49% vs. 3.38% in 3Q $25 million private placement 4 Quarterly Performance Metrics Dollars in thousands except per share data 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 Net income before taxes 1,241$ 1,300$ 3,028$ 1,497$ 2,141$ Net income 2,290 1,277 2,792 1,773 144,616 Net income per share - diluted 0.11 0.06 0.13 0.08 6.62 Return on average assets 0.45% 0.26% 0.56% 0.35% 28.10% Return on average equity 11.0% 6.2% 12.7% 7.6% 577.0% Net interest margin 3.52% 3.43% 3.40% 3.38% 3.49% PCNR noninterest expense to average assets 1 3.34% 3.59% 3.47% 3.55% 3.55% Loans held for investment 1,212,248$ 1,219,785$ 1,269,865$ 1,318,117$ 1,357,788$ Deposits 1,748,705 1,767,930 1,763,765 1,758,930 1,794,420 NPA's to total assets 3.2% 2.9% 2.7% 2.4% 2.1% 1 Non-GAAP measure. See page 9 for reconciliation to GAAP presentation. Quart rly Results Results of Op rations Dollars in thousands 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 N t interest income 16 464$ 15 479$ 15 18$ 15 848$ 16 7 1$ Recovery f provision (provision) for loan losses (1,8 0) 684 1,685 1,679 1,323 Noninterest income 4,147 3,943 4,893 3,985 4,543 Noninterest expense 17,550 18,806 19,268 20,015 20,446 Net income before tax 1,241 1,300 3,028 1,497 2,141 Income tax benefit (expense) 1,049 (23) (236) 276 142,475 Net income 2,290 1,277 2,792 1,773 144,616 PCNR earnings 1 3,808$ 1,642$ 2,551$ 2,013$ 2,906$ 1 Non-GAAP measure. See Appendix for reconciliation to GAAP presentation.

Annual Operating Highlights Net income of $150.5 million – $8.0 million pre tax income – Net income per share (diluted) of $6.88 per share in 2014 versus net loss per share (diluted) of $(0.07) in 2013 – PCNR earnings of $9.1 million Net interest margin stable at 3.43% Net charge-off ratio of 0.08% of average loans in 2014, improved from 0.26% in 2013 – Recovery of provision for loan losses of $5.4 million Noninterest expense fell $5.9 million, or 7%, in 2014 from $84.5 million in 2013 Loans held for investment grew 12%, or $145.5 million, in 2014 – New commercial LPOs in Raleigh and Winston-Salem, new origination team in Greensboro and expansion in Charlotte – New non-branch mortgage channel in Raleigh and Charlotte Deposits grew $45.7 million, or 3% – Noninterest bearing deposits grew $33.3 million, or 11% 5 Annual Performance Metrics Dollars in thousands except per share data 2012 2013 2014 Net income (loss) before taxes (41,017)$ (157)$ 7,966$ Net income (loss) (40,005) (1,483) 150,458 Net income (loss) per share - diluted (1.87) (0.07) 6.88 Return on average assets (1.74%) (0.07%) 7.50% Return on average equity (34.9%) (1.7%) 165.1% Net interest margin 2.95% 3.44% 3.43% PCNR noninterest expense to average assets 1 3.24% 3.50% 3.54% Loans held for investment 1,177,035$ 1,212,248$ 1,357,788$ Deposits 1,906,988 1,748,705 1,794,420 NPA's to total assets 6.6% 3.2% 2.1% 1 Non-GAAP measure. See Appendix for reconciliation to GAAP presentation. An ual Results Results of Op rations Dollars in thousands 2012 2013 2014 N t interest income 61,2 0$ 64,433$ 63,766$ Recovery f provision (provision) for loan losses (14,049) (5 3) 5,371 Noninterest income 21,958 20,414 17,364 Noninterest expense 110,206 84,481 78,535 Net income (loss) before tax (41,017) (157) 7,966 Income tax benefit (expense) & loss on discontinued operations 1,012 (1,326) 142,492 Net income (loss) (40,005) (1,483) 150,458 PCNR earnings 1 4,904$ 10,366$ 9,112$ 1 Non-GAAP measure. See Appendix for reconciliation to GAAP presentation.

6 Loans grew 12% in 2014, ahead of plan – Loans held for investment grew $145.5 million – Excluding purchased residential loans, organic loan growth was 15% – Loans to deposits ratio increased to 76%, also ahead of plan – Growth across all business lines, especially commercial and auto finance Grow loans Deposits increased $45.7 million, or 3% – Noninterest-bearing demand deposits increased $33.3 million, or 11% – Low cost core, consisting of non-CD deposits grew $39.7 million, or 3% – Deposit campaigns on CD’s and money market were successful in 4Q, while decreasing the cost of all deposits by 6 bps in 2014 Grow core deposits Credit resolution activities continued to improve asset quality in 2014 – Nonperforming assets fell $17.8 million, or 28%, to $45.8 million – OREO fell 28% to $20.4 million – Charge-offs to average loans fell to 0.08% in 2014, declining from 0.26% in 2013 – Classified asset ratio of 40% exceeded 45% goal Resolve remaining credit issues Noninterest expenses declined $5.9 million in 2014, or 7% – PCNR noninterest expenses fell $0.7 million, or 1%, while increasing origination footprint into Raleigh and Winston-Salem and adding C&I and CRE bankers in Charlotte and Greensboro – OREO and collection expenses lower by $5.1 million as asset quality improved – Treasury Management investments completed and driving 11% growth in noninterest-bearing deposits – Mobile deposits investments on track Invest in new businesses while maintaining focus on expenses Recap of 2014 Goals 6

Net Interest Income Net interest income grew 6% during the quarter Earning asset mix continued to improve – Average earning assets grew $38.2 million during 4Q 2014 on strong loan growth offset by securities sales – Average loans increased $51.2 million Net interest margin increased to 3.49%, an 11 bp increase from 3Q – $0.5 million increase in interest recoveries in 4Q drove increase in loan yield of 12 bps Earning asset yield increased 11 bps in 4Q on the improved loan yield – Securities yield was flat at 2.58% – Non cash accretion on PI loans was $0.7 million in 4Q 2014 vs. $0.8 million in 3Q 2014 4Q cost of interest bearing deposits fell 1 bp to 47 bps 7 Quarterly Loan and Securities Yields Quarterly Margin and Cost of Deposits 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 Yield on Loans Yield on Investment Securities 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 Cost of Interest Bearing Deposits N t Interest Margin Quarterly Results Average Balances, Yields and Net Interest Margin Dollars in thousands 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 Average loans (includes loans held for sale) 1,199,309$ 1,209,714$ 1,238,847$ 1,289,718$ 1,340,874$ Average yield 4.97% 4.73% 4.66% 4.58% 4.70% Average loans and securities 1,785,541 1,770,270 1,788,879 1,814,160 1,839,709 Average earning assets 1,859,379 1,830,822 1,855,092 1,862,479 1,900,647 Average yield 4.05% 3.98% 3.95% 3.92% 4.03% Average interest bearing liabilities 1,611,915 1,585,272 1,581,777 1,577,399 1,600,583 Average rate 0.61% 0.63% 0.65% 0.64% 0.63% Average cost of interest bearing deposits 0.50% 0.48% 0.48% 0.48% 0.47% Net interest margin 3.52% 3.43% 3.40% 3.38% 3.49% Net interest rate spread 3.44% 3.35% 3.31% 3.28% 3.39% Net interest income 16,464$ 15,479$ 15,718$ 15,848$ 16,721$

Noninterest Income Excluding securities gains, PCNR noninterest income increased $0.4 million during 4Q – Securities gains of $0.2 million in the quarter Mortgage income increased $35 thousand, or 17%, in 4Q on 14% increase in volume of loans originated for sale to Fannie Mae – Total origination volume of $39.5 million, down only 2% from 3Q Service charge income stable in 4Q 2014 at $1.6 million Cardholder and merchant services income $0.1 million higher on enhanced revenue sharing with third party vendor Wealth business fee income rose $50 thousand, or 15%, on increased annuity sales and investment management fees during the quarter 8 Quarterly Results Noninterest Income Dollars in thousands 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 Service charges on deposit accounts 1,798$ 1,564$ 1,619$ 1,583$ 1,585$ Mortgage loan income 235 174 261 205 241 Cardholder and merchant services income 1,127 1,113 1,209 1,183 1,298 Trust and investment services 341 358 399 344 394 Bank-owned life insurance 267 252 278 273 350 Other service charges, commissions and fees 356 352 332 290 366 Securities gains, net - - 720 34 220 Other income 23 130 75 73 89 Total noninterest income 4,147$ 3,943$ 4,893$ 3,985$ 4,543$ Less: Securities gains, net - - 720 34 220 PCNR noninterest income 1 4,147$ 3,943$ 4,173$ 3,951$ 4,323$ 1 Non-GAAP measure. Reconciliation included in this table.

Noninterest Expense 4Q noninterest expense (NIE) includes $1.6 million charge related to branches that will close in 1Q 2015 NIE rose by $0.4 million, or 2%, from 3Q 2014 – OREO expenses were $572 thousand in the quarter as a result of year-end OREO holding expenses PCNR NIE rose $0.4 million (2%) from 3Q on year-end incentive and benefit expense accruals and deposit promotional advertising Average FTE was unchanged from Q3 to Q4 – 5% (28) FTE reduction from a year ago from 2014 branch closures and other ongoing efficiency initiatives, offset by loan origination personnel hires 3Q personnel expenses include $2.1 million in CEO severance costs, and 4Q includes $0.2 million in branch personnel severance costs 9 Quarterly Results Noninterest Expense Dollars in thousands 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 Personnel expense 9,512$ 10,393$ 9,956$ 12,616$ 10,717$ Net occupancy expense 1,331 1,553 1,512 1,521 1,526 Furniture, equipment and data processing expense 2,126 2,003 2,047 2,208 2,078 Professional fees 625 633 467 699 671 Stationery, printing and supplies 135 162 173 149 162 Advertising and marketing 141 153 147 142 274 Other real estate owned expense (recovery) 21 261 954 (29) 572 Credit/debit card expense 618 595 604 520 568 FDIC insurance 663 639 595 412 422 Loan collection expense 548 657 551 198 170 Core deposit intangible amortization 351 352 352 352 351 Other expense 1,479 1,405 1,910 1,227 2,935 Total noninterest expense 17,550$ 18,806$ 19,268$ 20,015$ 20,446$ Less: Other real estate owned expense (recovery) 21$ 261$ 954$ (29)$ 572$ US Treasury sale expenses - - 409 - - Loan collection expense 548 657 551 198 170 Branch closure/restructuring expense (recovery) 178 183 7 - 1,566 Mortgage and litigation accrual (recovery) - (75) 7 - - CEO Severance expense - - - 2,060 - Rebranding expense - - - - - PCNR noninterest expense 1 16,803$ 17,780$ 17,340$ 17,786$ 18,138$ Average Quarterly FTE Employees 596 576 558 568 568 1 Non-GAAP measure. Reconciliation included in this table.

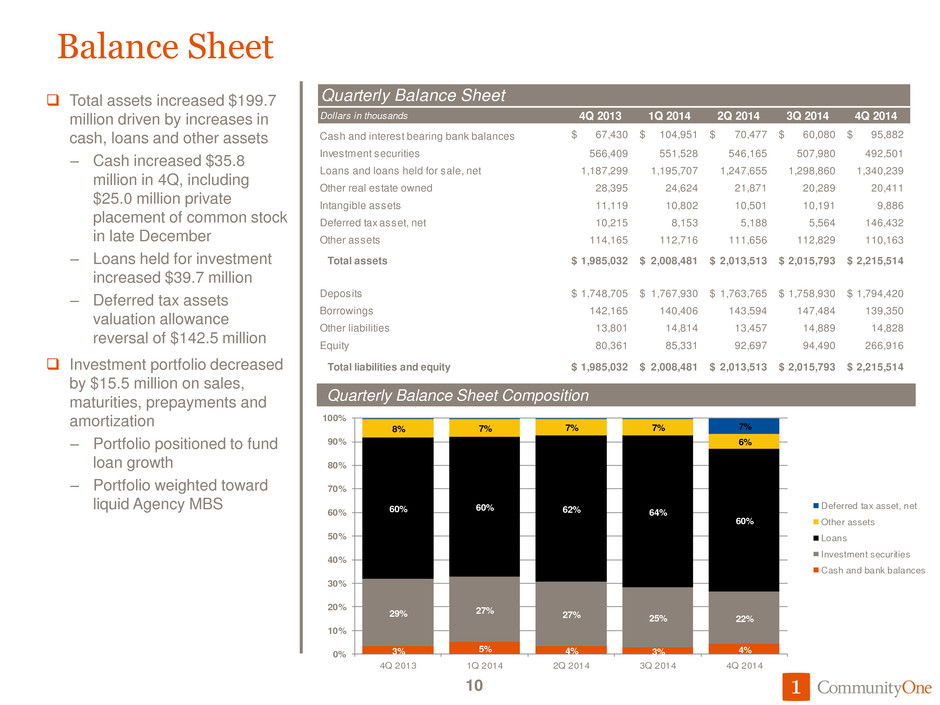

3% 5% 4% 3% 4% 29% 27% 27% 25% 22% 60% 60% 62% 64% 60% 8% 7% 7% 7% 6% 1% 0% 0% 0% 7% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 Deferred tax asset, net Other assets Loans Investment securities Cash and bank balances Balance Sheet Total assets increased $199.7 million driven by increases in cash, loans and other assets – Cash increased $35.8 million in 4Q, including $25.0 million private placement of common stock in late December – Loans held for investment increased $39.7 million – Deferred tax assets valuation allowance reversal of $142.5 million Investment portfolio decreased by $15.5 million on sales, maturities, prepayments and amortization – Portfolio positioned to fund loan growth – Portfolio weighted toward liquid Agency MBS 10 Quarterly Balance Sheet Composition Quarterly Balance Sheet Dollars in thousands 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 Cash and interest bearing bank balances 67,430$ 104,951$ 70,477$ 60,080$ 95,882$ Investment securities 566,409 551,528 546,165 507,980 492,501 Loans and loans held for sale, net 1,187,299 1,195,707 1,247,655 1,298,860 1,340,239 Other real estate owned 28,395 24,624 21,871 20,289 20,411 Intangible assets 11,119 10,802 10,501 10,191 9,886 Deferred tax asset, net 10,215 8,153 5,188 5,564 146,432 Other assets 114,165 112,716 111,656 112,829 110,163 Total assets 1,985,032$ 2,008,481$ 2,013,513$ 2,015,793$ 2,215,514$ Deposits 1,748,705$ 1,767,930$ 1,763,765$ 1,758,930$ 1,794,420$ Borrowings 142,165 140,406 143,594 147,484 139,350 Other liabilities 13,801 14,814 13,457 14,889 14,828 Equity 80,361 85,331 92,697 94,490 266,916 Total liabilities and equity 1,985,032$ 2,008,481$ 2,013,513$ 2,015,793$ 2,215,514$

Loan Portfolio Total loans held for investment grew $39.7 million in 4Q 2014; annualized growth rate of 12% – All lines of business grew loans during the quarter Organic loans (excluding purchased residential loans) grew $45.0 million; 16% annualized growth rate Total pass rated loans grew by $45.7 million; annualized growth rate of 15% Non-pass rated loans fell by $6.0 million, or 6% Loan portfolio composition balanced between consumer and commercial exposure 11 Quarterly Loan Portfolio Mix Loan Portfolio Growth Rates By Category Dollars in thousands 4Q 2013 3Q 2014 4Q 2014 $ % Annualized Commercial and Commercial Real Estate $374,938 $440,942 $467,432 26,489 6% 24% RE Construction 50,137 65,298 68,995 3,697 6% 23% Consumer/HELOC 186,899 207,038 217,258 10,220 5% 20% 1-4 Family Residential 244,803 281,089 291,712 10,623 4% 15% Pass Rated Organic Loans 856,778 994,368 1,045,397 51,029 5% 21% Purchased Resi Mortgage Loans 214,052 214,598 209,277 (5,320) -2% -10% Non Pass Rated Organic Loans 141,418 109,152 103,113 (6,038) (6%) (22%) Total Loans $1,212,248 $1,318,117 $1,357,788 39,671 3% 12% Total Organic Loans 998,196 1,103,519 1,148,511 44,991 4% 16% Total Pass Rated Loans 1,070,830 1,208,965 1,254,675 45,709 4% 15% 4Q Growth 1,212,248 1,219,785 1,269,865 1,318,117 1,357,788 -5.00% 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% $ $300,000 $600,000 $900,000 $1,200,000 $1,500,000 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 Commercial RE Construction Consumer/HELOC 1-4 Family Residential Purchased Residential Non pass loans Total Loans Organic Growth Rate Annualized

17% 18% 18% 18% 18% 20% 20% 19% 20% 20% 5% 5% 5% 5% 5% 26% 25% 24% 24% 24% 19% 18% 17% 17% 16% 2% 1% 3% 2% 2% 13% 13% 14% 14% 15% 0% 20% 40% 60% 80% 100% 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 Noninterest-bearing demand Interest-bearing demand Savings Money market Time deposits < $100,000 Brokered Time deposits > $100,000 Deposits Deposits increased by $45.7 million, or 3%, in 2014 – Continued focus in 2015 on deposit growth to support loan growth Deposit growth was very strong in 4Q 2014, with deposits up $35.5 million, or 2%, in the quarter – CD and MMDA promotions in 4Q Noninterest-bearing deposits increased $5.8 million, or 2%, in 4Q 2014 and $33.3 million, or 11%, in 2014 – Driven by commercial relationship acquisition and improved treasury management product set – Includes closure impact of 4 branches in 1Q 2014 Core deposits were stable at 83% of deposits Cost of interest bearing deposits dropped to 47 bps, and the cost of all deposits was flat at 39 bps 12 Quarterly Deposit Mix Co re N o n Co re Quarterly Deposits Dollars in thousands 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 Noninterest-bearing demand 290,461$ 315,515$ 321,829$ 317,981$ 323,776$ Interest-bearing demand 347,791 346,344 333,260 349,517 358,162 Savings 80,507 85,038 85,451 85,519 86,686 Money market 447,672 448,037 431,803 423,967 437,484 Brokered 29,218 25,468 47,783 37,673 38,378 Time deposits < $100,000 323,661 310,786 301,795 294,774 285,989 Time deposits > $100,000 229,395 236,742 241,844 249,499 263,945 Total deposits 1,748,705$ ,767,930$ 1,763,765$ 1,758,930$ 1,794,420$ Total Time Deposits 582,274$ 572,996$ 591,422$ 581,946$ 588,312$ Low Cost Core Deposits 1,166,431 1,194,934 1,172,343 1,176,984 1,206,108 Core Deposits 1,490,092 ,505,720 1,474,138 1,471,758 1,492,097

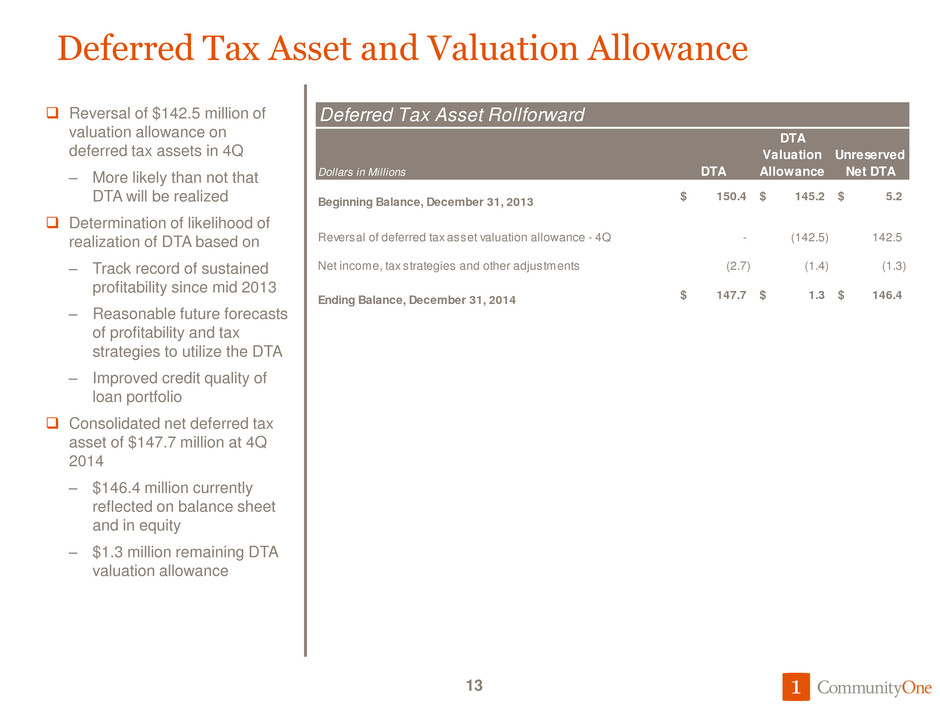

Deferred Tax Asset and Valuation Allowance Reversal of $142.5 million of valuation allowance on deferred tax assets in 4Q – More likely than not that DTA will be realized Determination of likelihood of realization of DTA based on – Track record of sustained profitability since mid 2013 – Reasonable future forecasts of profitability and tax strategies to utilize the DTA – Improved credit quality of loan portfolio Consolidated net deferred tax asset of $147.7 million at 4Q 2014 – $146.4 million currently reflected on balance sheet and in equity – $1.3 million remaining DTA valuation allowance 13 Deferred Tax Asset Rollforward Dollars in Millions DTA DTA Valuation Allowance Unreserved Net DTA Beginning Balance, December 31, 2013 150.4$ 145.2$ 5.2$ Reversal of deferred tax asset valuation allowance - 4Q - (142.5) 142.5 Net income, tax strategies and other adjustments (2.7) (1.4) (1.3) Ending Balance, December 31, 2014 147.7$ 1.3$ 146.4$

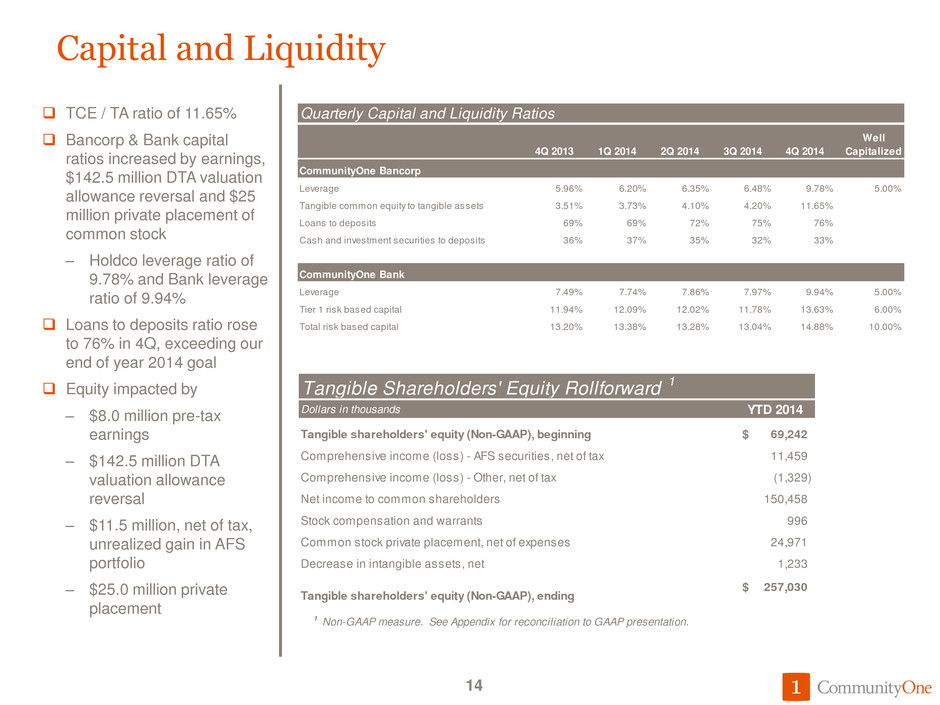

Capital and Liquidity TCE / TA ratio of 11.65% Bancorp & Bank capital ratios increased by earnings, $142.5 million DTA valuation allowance reversal and $25 million private placement of common stock – Holdco leverage ratio of 9.78% and Bank leverage ratio of 9.94% Loans to deposits ratio rose to 76% in 4Q, exceeding our end of year 2014 goal Equity impacted by – $8.0 million pre-tax earnings – $142.5 million DTA valuation allowance reversal – $11.5 million, net of tax, unrealized gain in AFS portfolio – $25.0 million private placement 14 Tangible Shareholders' Equity Rollforward 1 Dollars in thousands YTD 2014 Tangible shareholders' equity (Non-GAAP), beginning 69,242$ Comprehensive income (loss) - AFS securities, net of tax 11,459 Comprehensive income (loss) - Other, net of tax (1,329) Net income to common shareholders 150,458 Stock compensation and warrants 996 Common stock private placement, net of expenses 24,971 Decrease in intangible assets, net 1,233 Tangible shareholders' equity (Non-GAAP), ending 257,030$ 1 Non-GAAP measure. See Appendix for reconciliation to GAAP presentation. Quarterly Capital and Liquidity Ratios 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 Well Capitalized########## ########## CommunityOne Bancorp Leverage 5.96% 6.20% 6.35% 6.48% 9.78% 5.00% Tangible common equity to tangible assets 3.51% 3.73% 4.10% 4.20% 11.65% Loans to deposits 69% 69% 72% 75% 76% Cash and investment securities to deposits 36% 37% 35% 32% 33% mu ityO e Bank Leverag 7.49% 7.74% 7.86% 7.97% 9.94% 5.00% Tier 1 risk based capit l 11.94% 12.09% 12.02% 11.78% 13.63% 6.00% Total risk based capital 13.20% 13.38% 13.28% 13.04% 14.88% 10.00%

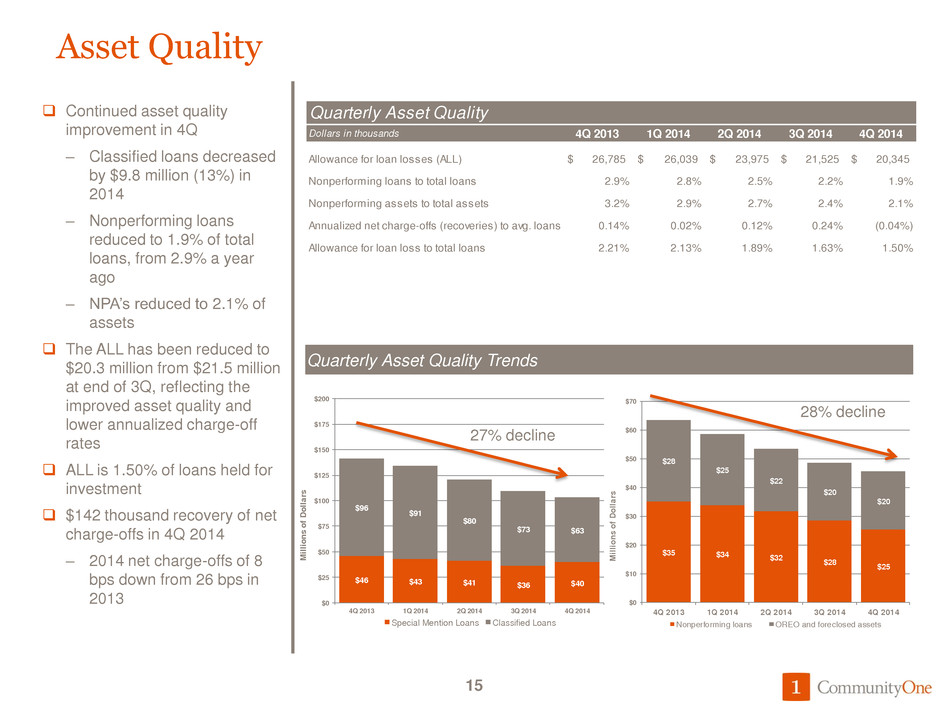

$35 $34 $32 $28 $25 $28 $25 $22 $20 $20 $0 $10 $20 $30 $40 $50 $60 $70 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 M ill io ns o f D ol la rs Nonperforming loans OREO and foreclosed assets $46 $43 $41 $36 $40 $96 $91 $80 $73 $63 $0 $25 $50 $75 $100 $125 $150 $175 $200 4Q 2013 1 2014 2 2014 3 2014 4 2014 M ill io ns o f D ol la rs Special Me tion Loa s Classified Loans Asset Quality 15 Quarterly Asset Quality Trends 27% decline 28% decline Quarterly Asset Quality Dollars in thousands 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 Allowance for loan losses (ALL) 26,785$ 26,039$ 23,975$ 21,525$ 20,345$ Nonperforming loans to total loans 2.9% 2.8% 2.5% 2.2% 1.9% Nonperforming assets to total assets 3.2% 2.9% 2.7% 2.4% 2.1% Annualized net charge-offs (recoveries) to avg. loans 0.14% 0.02% 0.12% 0.24% (0.04%) Allowance for loan loss to total loans 2.21% 2.13% 1.89% 1.63% 1.50% Continued asset quality improvement in 4Q – Classified loans decreased by $9.8 million (13%) in 2014 – Nonperforming loans reduced to 1.9% of total loans, from 2.9% a year ago – NPA’s reduced to 2.1% of assets The ALL has been reduced to $20.3 million from $21.5 million at end of 3Q, reflecting the improved asset quality and lower annualized charge-off rates ALL is 1.50% of loans held for investment $142 thousand recovery of net charge-offs in 4Q 2014 – 2014 net charge-offs of 8 bps down from 26 bps in 2013

$11.6 $10.2 $9.1 $8.8 $8.6 $18.4 $19.9 $19.4 $16.4 $13.5 $4.7 $3.4 $2.8 $2.9 $2.3 $0 $20 $40 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 $ i n Mi lli on s Consumer Real estate - construction RE - Commercial RE - 1-4 Family Commercial and agricultural Nonperforming Assets 16 Quarterly Nonperforming Loan Composition 28% decline Nonperforming Loans and OREO Dollars in thousands 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 Commercial and agricultural 516$ 450$ 400$ 351$ 608$ Real estate - construction 4,677$ 3,437$ 2,773$ 2,878$ 2,307$ Real estate - mortgage: 1-4 family residential 11,580$ 10,151$ 9,083$ 8,777$ 8,637$ Commercial 18,380$ 19,888$ 19,398$ 16,383$ 13,457$ Consumer 12$ 32$ 31$ 94$ 356$ Total nonperforming loans 35,165 33,958 31,685 28,483 25,365 OREO and other foreclosed assets 28,395$ 24,623$ 21,871$ 20,289$ 20,411$ Total nonperforming assets 63,560$ 58,581$ 53,556$ 48,772$ 45,776$ NPL / Total Loans Held For Investment 2.9% 2.8% 2.5% 2.2% 1.9% Non-performing assets fell by $3.0 million (6%) during the quarter, and $17.8 million (28%) since 4Q 2013 Nonperforming loans fell by $3.1 million (11%) in 4Q, and by $9.8 million (28%) since 4Q 2013 OREO dispositions were on par with foreclosure additions in 4Q 2014 – OREO essentially flat in 4Q and decreased by $8.0 million (28%) since 4Q 2013 As of year-end 2014, an additional $4.2 million of OREO (20%) was under contract for sale

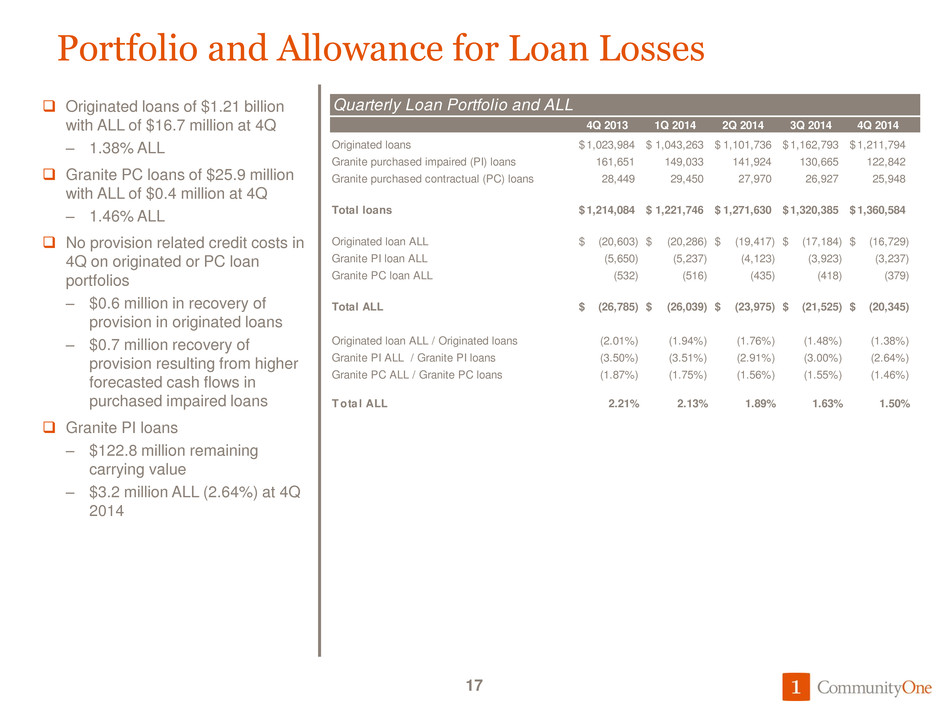

Portfolio and Allowance for Loan Losses 17 Quarterly Loan Portfolio and ALL 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 Originated loans 1,023,984$ 1,043,263$ 1,101,736$ 1,162,793$ 1,211,794$ Granite purchased impaired (PI) loans 161,651 149,033 141,924 130,665 122,842 Granite purchased contractual (PC) loans 28,449 29,450 27,970 26,927 25,948 Total loans 1,214,084$ 1,221,746$ 1,271,630$ 1,320,385$ 1,360,584$ Originated loan ALL (20,603)$ (20,286)$ (19,417)$ (17,184)$ (16,729)$ Granite PI loan ALL (5,650) (5,237) (4,123) (3,923) (3,237) Granite PC loan ALL (532) (516) (435) (418) (379) Total ALL (26,785)$ (26,039)$ (23,975)$ (21,525)$ (20,345)$ Originated loan ALL / Originated loans (2.01%) (1.94%) (1.76%) (1.48%) (1.38%) Granite PI ALL / Granite PI loans (3.50%) (3.51%) (2.91%) (3.00%) (2.64%) Granite PC ALL / Granite PC loans (1.87%) (1.75%) (1.56%) (1.55%) (1.46%) T ota l ALL 2.21% 2.13% 1.89% 1.63% 1.50% Originated loans of $1.21 billion with ALL of $16.7 million at 4Q – 1.38% ALL Granite PC loans of $25.9 million with ALL of $0.4 million at 4Q – 1.46% ALL No provision related credit costs in 4Q on originated or PC loan portfolios – $0.6 million in recovery of provision in originated loans – $0.7 million recovery of provision resulting from higher forecasted cash flows in purchased impaired loans Granite PI loans – $122.8 million remaining carrying value – $3.2 million ALL (2.64%) at 4Q 2014

18 Driven by loan growth – Total loan growth 10-12% – Efficient balance sheet fully invested – Expansion of non branch mortgage channel – Loans to deposits ratio in mid 80% range by year-end Earning asset growth Driven by core deposit growth – Commercial deposit growth based on treasury management products – Low cost core growth based on customer relationship expansion – Enhanced focus and disciplined deposit campaigns – Investments in Online and Mobile platform Continued deposit growth Pursue attractive M&A opportunities – EPS accretion – Minimal dilution Explore M&A opportunities Capitalize on 2014 efforts – NIE / average assets ratio of 3.1% for 2015 – Closing 6 branches in 1Q 2015 – Monetize vendor contract re-negotiations Monetize expense efforts 2015 Goals 18 Driven by mortgage channel – 10-12% growth – Expansion of non-branch mortgage channel – SBA business expansion – Wealth platform – Service charge income initiatives Enhanced fee income

Appendix 19

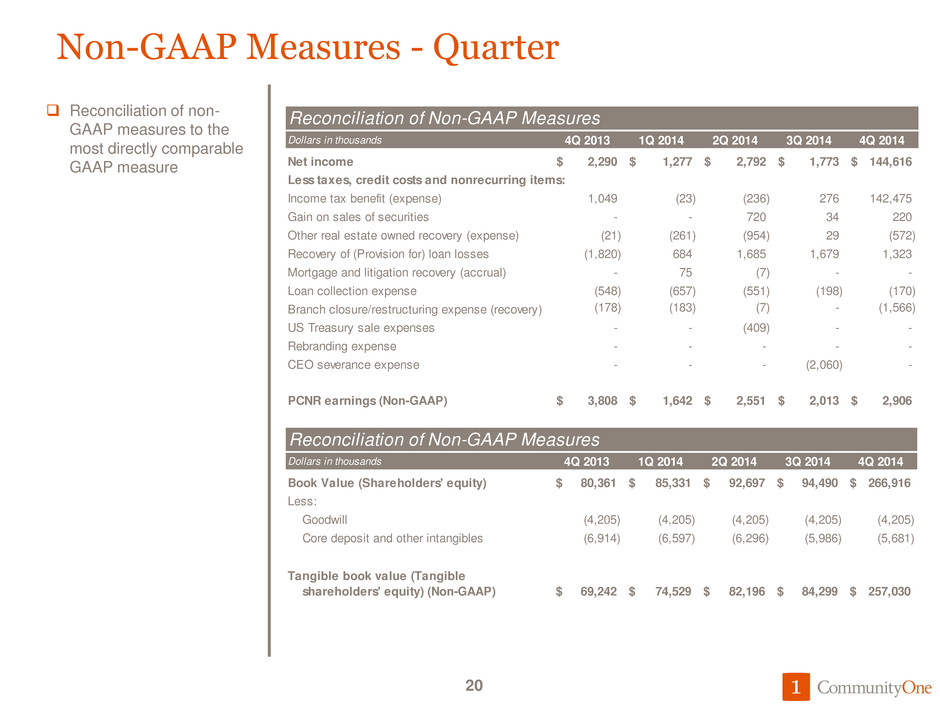

Non-GAAP Measures - Quarter Reconciliation of non- GAAP measures to the most directly comparable GAAP measure 20 Reconciliation of Non-GAAP Measures Dollars in thousands 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 Net income 2,290$ 1,277$ 2,792$ 1,773$ 144,616$ Less taxes, credit costs and nonrecurring items: Income tax benefit (expense) 1,049 (23) (236) 276 142,475 Gain on sales of securities - - 720 34 220 Other real estate owned recovery (expense) (21) (261) (954) 29 (572) Recovery of (Provision for) loan losses (1,820) 684 1,685 1,679 1,323 Mortgage and litigation recovery (accrual) - 75 (7) - - Loan collection expense (548) (657) (551) (198) (170) (178) (183) (7) - (1,566) US Treasury sale expenses - - (409) - - Rebranding expense - - - - - CEO severance expense - - - (2,060) - PCNR earnings (Non-GAAP) 3,808$ 1,642$ 2,551$ 2,013$ 2,906$ Branch closure/restructuring expense (recovery) Reconciliation of Non-GAAP Measures Dollars in thousands 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 Book Value (Shareholders' equity) 80,361$ 85,331$ 92,697$ 94,490$ 266,916$ Less: Goodwill (4,205) (4,205) (4,205) (4,205) (4,205) Core deposit and other intangibles (6,914) (6,597) (6,296) (5,986) (5,681) 69,242$ 74,529$ 82,196$ 84,299$ 257,030$ Tangible book value (Tangible shareholders' equity) (Non-GAAP)

Non-GAAP Measures - Annual Reconciliation of non- GAAP measures to the most directly comparable GAAP measure 21 Reconciliation of Non-GAAP Measures - Full Year Dollars in thousands 2012 2013 2014 Net income (loss) (40,005)$ (1,483)$ 150,458$ Less taxes, credit costs and nonrecurring items: Income tax benefit (expense) 1,039 (1,326) 142,492 Gain on sales of securities 4,121 2,772 974 Other real estate owned recovery (expense) (27,883) (4,138) (1,758) Recovery of (Provision for) loan losses (14,049) (523) 5,371 Mortgage and litigation recovery (accrual) (1,100) 487 68 Loan collection expense (3,274) (4,333) (1,576) Branch closure/restructuring expense (recovery) (96) (675) (1,756) US Treasury sale expenses - - (409) Rebranding expense (397) (616) - CEO severance expense - - (2,060) Merger-related expense (3,241) (3,498) - Loss from discontinued operations, net of tax (27) - - PCNR earnings (Non-GAAP) 4,902$ 10,367$ 9,112$ Rec nc liation of Non-GAAP Measures - Full Year Dollars in thousands 2012 2013 2014 Book Value (Shareholders' equity) 98 445 8 1 266 9 6 Less: Goodwill (4,205) (4,205) (4,205) Core deposit and other intangibles (7,495) (6,914) (5,681) 86,745$ 69,242$ 257,030$ Tangible book value (Tangible shareholders' equity) (Non-GAAP)

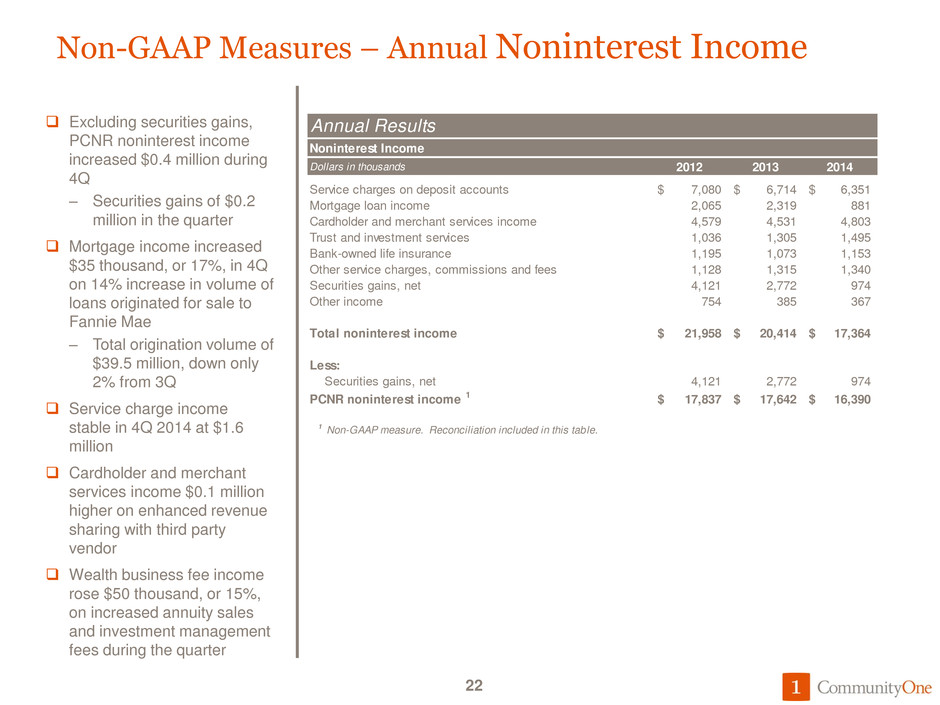

Non-GAAP Measures – Annual Noninterest Income Excluding securities gains, PCNR noninterest income increased $0.4 million during 4Q – Securities gains of $0.2 million in the quarter Mortgage income increased $35 thousand, or 17%, in 4Q on 14% increase in volume of loans originated for sale to Fannie Mae – Total origination volume of $39.5 million, down only 2% from 3Q Service charge income stable in 4Q 2014 at $1.6 million Cardholder and merchant services income $0.1 million higher on enhanced revenue sharing with third party vendor Wealth business fee income rose $50 thousand, or 15%, on increased annuity sales and investment management fees during the quarter 22 Annual Results Noninterest Income Dollars in thousands 2012 2013 2014 Service charges on deposit accounts 7,080$ 6,714$ 6,351$ Mortgage loan income 2,065 2,319 881 Cardholder and merchant services income 4,579 4,531 4,803 Trust and investment services 1,036 1,305 1,495 Bank-owned life insurance 1,195 1,073 1,153 Other service charges, commissions and fees 1,128 1,315 1,340 Securities gains, net 4,121 2,772 974 Other income 754 385 367 Total noninterest income 21,958$ 20,414$ 17,364$ Less: Securities gains, net 4,121 2,772 974 PCNR noninterest income 1 17,837$ 17,642$ 16,390$ 1 Non-GAAP measure. Reconciliation included in this table.

Non-GAAP Measures – Annual Noninterest Expense Reconciliation of non-GAAP measures to the most directly comparable GAAP measure 23 Annual Results PCNR Noninterest Expense Dollars in thousands 2012 2013 2014 Personnel expense 40,051$ 40,661$ 43,682$ Net occupancy expense 6,461 6,391 6,112 Furniture, equipment and data processing expense 8,721 8,638 8,336 Professional fees 5,266 3,100 2,470 Stationery, printing and supplies 637 644 646 Advertising and marketing 957 1,135 716 Other real estate owned expense 27,883 4,138 1,758 Credit/debit card expense 1,717 2,143 2,287 FDIC insurance 3,499 2,643 2,068 Loan collection expense 3,274 4,333 1,576 Merger-related expense 3,241 3,498 - Core deposit intangible amortization 1,407 1,407 1,407 Other expense 7,092 5,750 7,477 Total noninterest expense 110,206$ 84,481$ 78,535$ Less: Other real estate owned expense 27,883$ 4,138$ 1,758$ Merger-related expense 3,241 3,498 - US Treasury sale expenses - - 409 Loan collection expense 3,274 4,333 1,576 Branch closure/restructuring expense (recovery) 96 675 1,756 Mortgage and litigation accrual (recovery) 1,100 (487) (68) CEO Severance expense - - 2,060 Rebranding expense 397 616 - PCNR noninterest expense 1 74,215$ 71,708$ 71,044$