Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Franklin Financial Network Inc. | d851655dex231.htm |

| EX-23.3 - EX-23.3 - Franklin Financial Network Inc. | d851655dex233.htm |

Table of Contents

Index to Financial Statements

As filed with the Securities and Exchange Commission on January 15, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

FRANKLIN FINANCIAL NETWORK, INC.

(Exact name of registrant as specified in its charter)

| Tennessee | 6022 | 20-8839445 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

722 Columbia Avenue

Franklin, Tennessee 37064

(615) 236-2265

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Richard E. Herrington

President and Chief Executive Officer

Franklin Financial Network, Inc.

722 Columbia Avenue

Franklin, Tennessee 37064

(615) 236-2265

(Name, address, including zip code, and telephone number, including area code of agent for service)

Copies to:

| Steven J. Eisen, Esq. Mark L. Miller, Esq. Baker, Donelson, Bearman, Caldwell & Berkowitz, PC 211 Commerce Street, Suite 800 Nashville, Tennessee 37201 (615) 726-5600 |

Edward F. Petrosky, Esq. Samir A. Gandhi, Esq. Sidley Austin LLP 787 Seventh Avenue New York, NY 10019 (212) 839-5300 |

Approximate date of commencement of the proposed sale of the securities to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price(1) |

Amount of registration fee(2) | ||

| Common Stock, no par value |

$50,000,000 | $5,810 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. Includes offering of additional shares that the underwriters have the option to purchase. |

| (2) | Calculated pursuant to Rule 457(o) under the Securities Act based on an estimate of the proposed maximum offering price. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

Table of Contents

Index to Financial Statements

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated January 15, 2015

PROSPECTUS

Shares

Franklin Financial Network, Inc.

Common Stock

This is Franklin Financial Network Inc.’s initial public offering. We are offering shares of our common stock.

We expect the public offering price to be between $ and $ per share. Currently, our shares of common stock trade on the over the counter bulletin board (“OTCBB”). After pricing of the offering, we expect that the shares will trade on the under the symbol “ .”

Investing in the common stock involves risks that are described in the “Risk Factors” section beginning on page 23 of this prospectus.

| Per Share |

Total |

|||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

The underwriters may also exercise their option to purchase up to an additional shares from us, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. Shares of our common stock are not savings or deposit accounts or other obligations of any bank or non-bank subsidiary of our company, and they are not insured by the Federal Deposit Insurance Corporation, the Deposit Insurance Fund, or any other governmental agency.

The shares will be ready for delivery on or about , 2015.

BofA Merrill Lynch

The date of this prospectus is , 2015.

Table of Contents

Index to Financial Statements

| 1 | ||||

| UNAUDITED PRO FORMA COMBINED CONDENSED FINANCIAL INFORMATION |

17 | |||

| 23 | ||||

| 40 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| 45 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

47 | |||

| 87 | ||||

| 104 | ||||

| 115 | ||||

| 123 | ||||

| 130 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

131 | |||

| 133 | ||||

| 135 | ||||

| 145 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS FOR NON-U.S. HOLDERS |

147 | |||

| 150 | ||||

| 157 | ||||

| 157 | ||||

| 157 | ||||

| F-1 |

i

Table of Contents

Index to Financial Statements

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus or in any free writing prospectus that we authorized to be delivered to you. We and the underwriters have not authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. We are not making an offer of these securities in any state, country or other jurisdiction where the offer is not permitted. You should assume that the information contained in this prospectus and any free writing prospectus we authorized to be delivered to you is accurate only as of their respective dates or the date or dates specified in those documents regardless of its time of delivery or the time of any sale of our common stock. Our business, financial condition, results of operations, cash flows and prospects may have changed since those dates.

For investors outside the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus outside the United States.

Market Data

This prospectus includes industry and trade association data, forecasts and information that we have prepared based, in part, upon data, forecasts and information obtained from independent trade associations, industry publications and surveys, government agencies and other information available to us, which information may be specific to particular markets or geographic locations. Some data is also based on our good faith estimates, which are derived from management’s knowledge of the industry and independent sources. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe these sources are reliable, we have not independently verified the information. Statements as to our market position are based on market data currently available to us. While we are not aware of any misstatements regarding our industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “RISK FACTORS” in this prospectus. Similarly, we believe our internal research is reliable, even though such research has not been verified by any independent sources.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). We will continue to be an emerging growth company until the earliest to occur of: (1) the end of the fiscal year following the fifth anniversary of the effectiveness of our Form S-4 filed with the Securities and Exchange Commission (the “SEC”) on May 14, 2014 in connection with our acquisition of MidSouth Bank (“MidSouth”), which registered our common stock issued in the acquisition of MidSouth under the Securities Act of 1933, as amended (the “Securities Act”), and resulted in us becoming an SEC reporting company under Section 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”); (2) the last day of the fiscal year in which we have more than $1.0 billion in annual revenues; (3) the date on which we are deemed to be a “large accelerated filer” under the Exchange Act; or (4) the date on which we have, during the previous three-year period, issued publicly or privately, more than $1.0 billion in non-convertible debt securities. Until we cease to be an emerging growth company, we may take advantage of specified reduced reporting and other regulatory requirements generally unavailable to other public companies. Among other things, those provisions allow us to present only two years of audited financial statements, discuss only our results of operations for two years in related Management’s Discussions and Analyses and provide less than five years of selected financial data in an

ii

Table of Contents

Index to Financial Statements

initial public offering registration statement; not to provide an auditor attestation of our internal control over financial reporting under the Sarbanes-Oxley Act of 2002, as amended; to choose not to adopt new or released financial accounting standards until such standards are applicable to private companies; to provide reduced disclosure regarding our executive compensation arrangements pursuant to the rules applicable to smaller reporting companies, which means we do not have to include a compensation discussion and analysis and certain other disclosure regarding our executive compensation; and not to seek a non-binding advisory vote on executive compensation or shareholder approval of golden parachute arrangements not previously approved. We may choose to take advantage of some or all of these reduced reporting and other regulatory requirements, including those reduced requirements pertaining to the periodic reports we file with the SEC and proxy statements we use to solicit proxies from our shareholders. We have elected in this prospectus to take advantage of the reduced disclosure requirements relating to executive compensation arrangements.

We have also elected not to take advantage of the extended transition period that allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies, which means that the financial statements included in this prospectus, as well as the financial statements we file in the future, will be subject to all new or revised accounting standards generally applicable to public companies. As a result, we will comply with new or revised accounting standards to the same extent that compliance is required for non-emerging growth companies. Our decision to opt out of the extended transition period under the JOBS Act is irrevocable.

iii

Table of Contents

Index to Financial Statements

This summary highlights information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in our shares of common stock. You should carefully read this prospectus in its entirety before making an investment decision. In particular, you should read the section entitled “RISK FACTORS” beginning on page 23, “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS” beginning on page 47 and our consolidated financial statements and notes related to those statements included elsewhere in this prospectus. As used in this prospectus, unless the context otherwise indicates, any reference to “Franklin Financial,” “our company,” “the company,” “us,” “we” and “our” refers to Franklin Financial Network, Inc. together with its consolidated subsidiaries (including Franklin Synergy), any reference to “FFN” refers to Franklin Financial Network, Inc. only and any reference to “Franklin Synergy” or the “Bank” refers to our banking subsidiary, Franklin Synergy Bank. We have applied to list our common stock on the under the symbol “ ”.

Unless otherwise indicated, the information included in this prospectus assumes (1) the sale of our common stock in this offering at an offering price of $ per shares of common stock, which is the mid-point of the pricing range set forth on the cover page of this prospectus and (2) that the underwriter has not exercised its option to purchase up to shares of common stock.

Company Overview

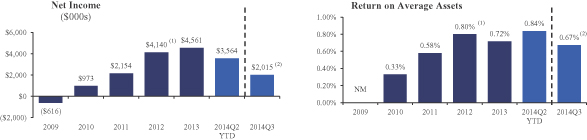

We are a bank holding company headquartered in Franklin, Tennessee. Through our wholly owned bank subsidiary, Franklin Synergy Bank, a Tennessee-chartered commercial bank and a member of the Federal Reserve System, we provide a full range of banking and related financial services with a focus on service to small businesses, corporate entities, local governments and individuals. We operate through 11 branches in the demographically attractive and growing Williamson and Rutherford Counties within the Nashville metropolitan area.

As of September 30, 2014, we had consolidated total assets of $1.24 billion, total loans, including loans held for sale, of $745 million, total deposits of $1.05 billion and total shareholders’ equity of $116 million. Our 2014 third quarter financial information gives effect to our acquisition of MidSouth, which was completed on July 1, 2014.

Our History and Growth

We were formed as a Tennessee corporation in April 2007 and commenced banking operations through the newly-formed Franklin Synergy Bank in November 2007. Our shareholders are predominantly comprised of individuals, many of whom are customers of the Bank and reside in our target markets. As of the date of this offering, individuals own over 85% of our outstanding common equity.

We were established with the objective of building a locally-managed commercial bank to service the needs of Franklin, Tennessee and the greater Williamson County area. Our mission statement is to build a legacy company by creating shareholder value, cultivating strong customer relationships and fostering an extraordinary team of directors, officers and employees. We were formed by a core management team of veteran bankers based in Middle Tennessee led by our Chairman and Chief Executive Officer, Richard Herrington. Many of our founders built Franklin Financial Corporation (not directly affiliated with our company), which was founded in 1988, and grew the newly-formed real estate-oriented bank to nine branches and $785 million in assets as of June 30, 2002, before announcing the sale of the bank to Fifth Third Bancorp in July 2002. Mr. Herrington and certain members of this management team subsequently joined Cumberland Bancorp (later renamed Civitas BankGroup, Inc. (“Civitas BankGroup”)), a troubled Tennessee-based bank holding company, in December

1

Table of Contents

Index to Financial Statements

2002, to lead its restructuring. The team led a dramatic improvement of Cumberland’s asset quality and profitability, by decreasing nonperforming loans to total loans from 2.25% in 2003 to 0.31% in 2006 and growing net income from $1.1 million in 2003 to $6.7 million in 2006, before it was acquired by Greene County Bancshares, Inc. in May 2007.

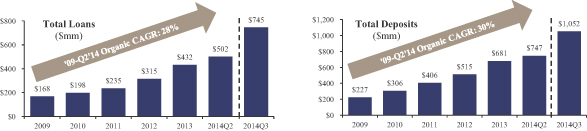

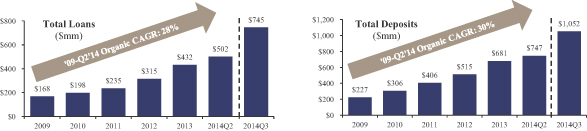

Since our inception and prior to acquiring MidSouth in July 2014, we have achieved significant and consistent organic growth. From December 31, 2009 to June 30, 2014 (one day before the MidSouth acquisition closed), we:

| • | grew our consolidated total assets by a compound annual growth rate (“CAGR”) of 30% from $272 million to $872 million as of June 30, 2014; |

| • | increased our total loans, including loans held for sale, by a CAGR of 28% from $168 million to $502 million as of June 30, 2014; |

| • | increased our total deposits by a CAGR of 30% from $227 million to $747 million as of June 30, 2014 and achieved a number one deposit market share in Williamson County based on deposits at June 30, 2014; |

| • | expanded our employee base from 70 full-time equivalent employees to 126 full-time equivalent employees as of June 30, 2014; and |

| • | added an additional four branches to expand our footprint to a total of six branches. |

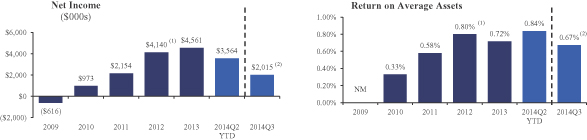

As we have grown, we have leveraged our infrastructure to improve our efficiency ratio from 93% in 2009 to 63% for the six months ended June 30, 2014. This improved efficiency has led to greater profitability, as we went from recording a loss of $0.6 million for the year ended December 31, 2009 to a profit of $5.9 million for the last twelve months ending June 30, 2014 and a 0.84% annualized return on average total assets for the six months ended June 30, 2014. In addition, from the year ended December 31, 2009 to the six months ended June 30, 2014, we increased our return on average equity from (2.8%) to 10.3%, and our return on average tangible common equity from (2.8%) to 12.1%.

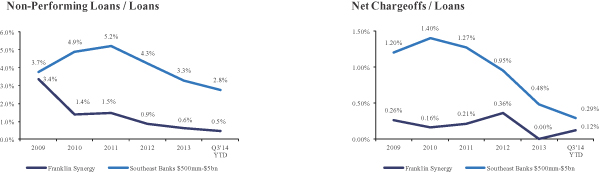

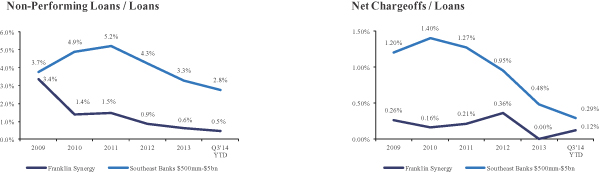

We have preserved our strong credit culture while growing steadily as evidenced by our low balance of nonperforming loans, which were 0.33% of our total loans as of June 30, 2014, and quarterly net charge-offs to average loans which have averaged 0.04% from January 1, 2009 through June 30, 2014.

MidSouth Acquisition

On July 1, 2014, we completed our acquisition of MidSouth which enabled us to increase our footprint in Middle Tennessee and in the Nashville metropolitan area, specifically in the attractive Rutherford County market. The acquisition also diversified our revenue mix by expanding our retail customer base and increasing our capacity to provide wealth management services, including trust powers, which we believe is a competitive advantage to drive new relationships with higher income customers. Headquartered in Murfreesboro, Tennessee and founded in 2004, MidSouth had five branches located throughout Rutherford County, which is adjacent to Williamson County. Although MidSouth operated in close proximity to us, there was no overlap of branch locations and MidSouth’s customer base complemented ours with minimal overlap.

Immediately prior to closing the acquisition, MidSouth had total assets of $281 million, total loans of $199 million, including loans held for sale, and total deposits of $244 million. MidSouth’s loan portfolio, like ours, was primarily comprised of real estate loans. For the six-month period ended June 30, 2014, MidSouth’s balance of nonperforming loans to total loans was 1.34% and net recoveries to average loans, on an annualized basis, was 0.17%.

2

Table of Contents

Index to Financial Statements

As a result of the MidSouth acquisition, and as of July 1, 2014, the Company, after giving effect to purchase accounting:

| • | grew our consolidated total assets from $872 million to $1.17 billion; |

| • | increased our total loans, including loans held for sale, from $502 million to $693 million; |

| • | increased our total deposits from $747 million to $992 million; and |

| • | expanded our employee base from 126 full-time equivalent employees to 227 full-time equivalent employees. |

Third Quarter 2014 and Organic Growth

In the quarter immediately following our completion of the MidSouth acquisition, we continued to achieve organic growth as a combined company. From July 1, 2014 (after giving effect to the MidSouth acquisition) to September 30, 2014, we:

| • | grew our consolidated total assets 6% from $1.17 billion to $1.24 billion as of September 30, 2014; |

| • | increased our total loans, including loans held for sale, 7% from $693 million to $745 million as of September 30, 2014; and |

| • | increased our total deposits 6% from $992 million to $1.05 billion as of September 30, 2014. |

The following charts show our growth in total loans, deposits and net income as well as our annualized return on average assets since 2009.

Note: Total loans and total deposits in millions. 2014 Q3 numbers include impact from MidSouth acquisition which closed July 1st.

| (1) | Includes $0.6 million gain of life insurance benefits. |

| (2) | Includes $0.6 million of expenses attributed to the acquisition of MidSouth. |

3

Table of Contents

Index to Financial Statements

Our Market Opportunity

Our Market

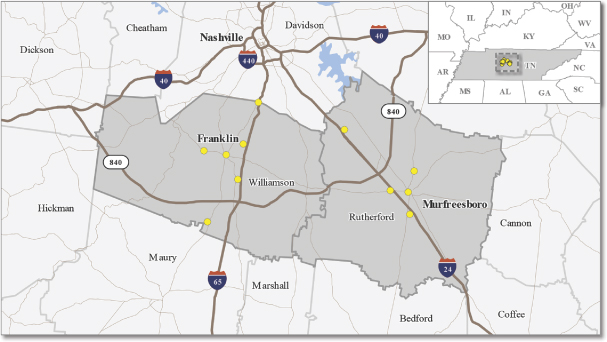

We operate 11 branches in Williamson and Rutherford Counties within the Nashville metropolitan area. Below is a map of our branch network:

4

Table of Contents

Index to Financial Statements

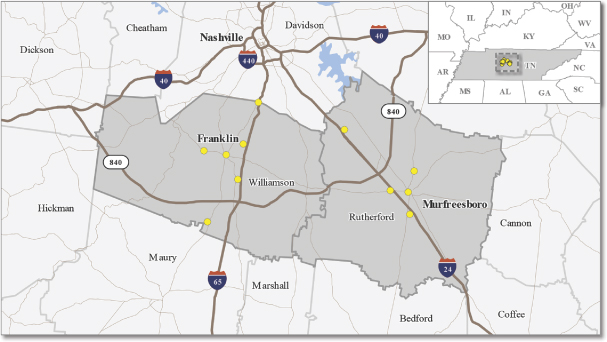

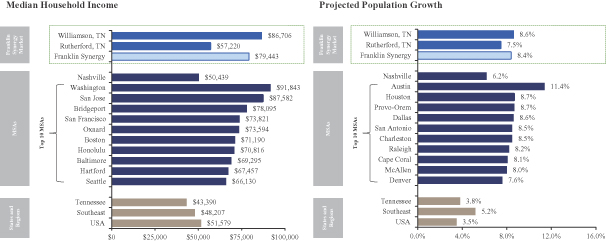

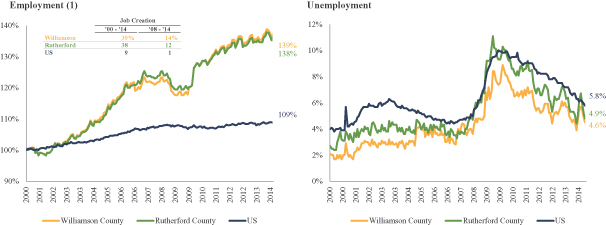

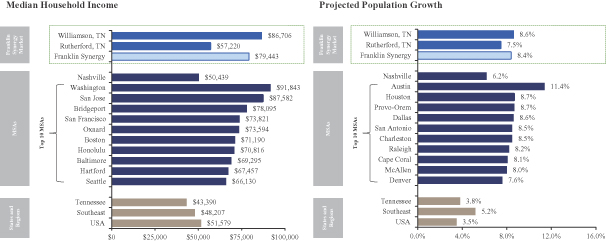

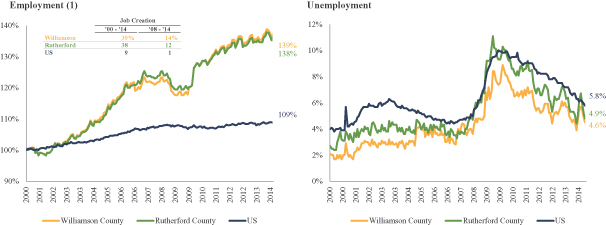

Our markets are among the most attractive, both in Tennessee and the Southeast, and compare favorably to some of the more well-known and higher-profile markets in the U.S., although our markets are not dependent on commodity pricing. We believe that our focus on, and success in, growing market share in Williamson and Rutherford Counties will enhance our long-term value and profitability compared to financial institutions of our size in other regions of the country. As the following charts demonstrate, the markets in which we operate are characterized by strong demographics including high incomes, increasing population, a growing workforce and unemployment that tends to be below the national rate.

| Source: | Bureau of Labor Statistics and SNL Financial. |

| Note: | Southeast includes AL, AR, FL, GA, MS, NC, SC, TN, VA and WV. Metrics weighted by population. |

| Note: | Projected figures calculated from 2014 to 2019. |

| Note: | Franklin Synergy refers to Williamson and Rutherford counties weighted by deposits. |

| (1) | Employment rate indexed against 2000 data. |

5

Table of Contents

Index to Financial Statements

Nashville

In 2013, Nashville was ranked by Forbes as one of the Best Cities for Business and Careers. Its leading industries are health care management, tourism, education, music and entertainment. Healthcare is the largest industry in Nashville, with healthcare companies contributing $30 billion per year and 200,000 jobs to the economy of Nashville and its surrounding areas according to the Nashville Health Care Council. The Nashville area contains 21 accredited four-year colleges and universities (including Vanderbilt University, which was most recently ranked by US News & World Report as 16th among national universities). Based on Census data, Nashville’s 2010 – 2013 net domestic migration rate of 2.5% ranked sixth among major metropolitan areas.1 Additionally, there is no state personal income tax on wages.

Jobs have been created at a robust rate, as civilian labor force employment in the Nashville Metropolitan Statistical Area (“MSA”) has grown since 2000 by 15% to approximately 810,000. Large companies continue to be attracted to the Nashville area and its favorable economic and business-friendly climate. For example, Amazon.com now employs 2,000 Nashville area residents and announced plans in July 2014 to build a new sorting center, creating another 100 jobs. In October 2014, Under Armour announced its plan to build a distribution center, bringing 1,500 new jobs. Furthermore, in November 2014, Bridgestone Americas announced that it will relocate its headquarters to Nashville, creating 600 new jobs for the city, and FedEx announced its plans to build a new distribution center in the area creating another 350 jobs.

Williamson County

Williamson County is the wealthiest county in Tennessee and one of the wealthiest in the U.S., with a median household income of $86,706. It is also the fastest-growing county in Tennessee, as its population, currently 199,481, increased by 8.9% from 2010 to 2014 and is projected to increase by 8.6% from 2014 through 2019. Civilian labor force employment in the county has grown since 2000 by 39% to approximately 96,000.

There has been successful regional economic development in Williamson County. There are currently 14 Fortune 1,000 companies with significant presences and/or regional headquarters in the county. Within the last seven years, Mars Petcare established a global innovation center; Nissan relocated its North American headquarters; and Verizon Wireless, Jackson National Life and Shelter Insurance relocated their regional or state headquarters, all within Williamson County. The county has only 4.6% unemployment and there are over 6,000 businesses. According to Metrostudy, the nation’s leading provider of primary and secondary market information to the housing, retail and related industries nationwide, new home sales in Williamson County are robust, with only 1.6 months of inventory of homes on the market and residential closings are up 9% over 2013 for the twelve months ended September 30, 2014.

Williamson County has three AAA-rated government entities: the county, the city of Franklin and the city of Brentwood. In September 2014, Franklin was designated by Money Magazine as one of the Top 50 places to live in the U.S., due to the area’s abundance of jobs, low cost of living, cultural/lifestyle considerations and top schools. Williamson County features the highest ranked public school district in Tennessee.

Rutherford County

Rutherford County is one of the wealthiest counties in Tennessee, with a median household income of $57,220. It is the fifth largest county in Tennessee with a population of 282,183, which has increased by 7.5% from 2010 to 2014 and is projected to increase by an additional 7.5% from 2014 through 2019.

| 1 | Per NewGeography.com. |

6

Table of Contents

Index to Financial Statements

Rutherford County features strong economic development and quality of life. Civilian employment in the county has grown since 2000 by 38% to almost 140,000. The drivers of expanding economic development in Rutherford County have been manufacturing, small businesses and the presence of the largest undergraduate university in Tennessee, Middle Tennessee State University. The county is home to one of Nissan’s U.S. manufacturing facilities, one of Bridgestone’s manufacturing facilities, and a General Mills production facility. The county has 4.9% unemployment. According to Metrostudy, there are 1.4 months of inventory of homes on the market and residential closings are up 5% over 2013 for the twelve months ended September 30, 2014.

Our Business Strategy

We consider ourselves to be bankers, not just lenders. Our core business strategy is to provide our banking customers with a full suite of financial services by cultivating strong long-term customer relationships and by developing an extraordinary team of officers and employees focused on the customer experience. We are focused on providing convenience and personal service to our customers that is superior to that of the out-of-state super-regional and national financial institutions operating in our markets, while simultaneously managing risk and profitability by remaining selective when expanding our customer base and making loans. We also prioritize our client’s financial security and privacy and assist the communities in which we do business through socially responsible leadership. Our unique culture is a cornerstone to our business and has resulted in substantial but stable growth and profitability.

By continuing to offer several value-added products and services within our core areas of strength, such as mortgage lending and wealth management, to invest in technology to improve our systems and the customer experience, and to leverage strong relationships with consumers, professionals, local governments and businesses within our community, we believe we can gain greater market share, which will improve our operational efficiency and increase profitability. As evidence of the success of our strategy, our deposit market share in Williamson County has increased from 3.4% in 2009 to a market-leading approximately 13.0% currently, despite the presence of more institutions competing for deposits.

The key components of our strategy include the following:

Real Estate Focus, with Enhanced Small Business Initiative

We are real estate bankers with a focus on Middle Tennessee. Our management team’s experience building a robust real estate lending platform at Franklin Financial Corporation from 1989 to 2002 formed the basis for our lending principles that have helped us grow profitably while managing credit and other risks. Our lending philosophy focuses on three principles: (1) we focus our underwriting and rely strongly on the credit of secondary sources of repayment (i.e., collateral), (2) the substantial majority of our collateral, by choice, is local in-market real estate and (3) we limit unsecured lending (which comprises less than 2% of our total loan portfolio).

Approximately ninety percent (90%) of our loan portfolio is secured by real estate. We are primarily focused on residential construction lending and office/warehouse commercial real estate lending, which limits our exposure to commitments to larger projects, such as multifamily projects and hospitality and leisure projects. Our real estate portfolio is fairly evenly divided among (1) short-term construction loans (primarily residential), (2) traditional commercial real estate, and (3) mortgage loans (many of which are business loans secured by local real estate). Thirty-one percent (31%) of our loan portfolio is in commercial real estate, 30% is in construction loans and 28% is in one-to-four family residential loans, with the average loan size for a project of less than $200,000. The construction loans and many of the other real estate loans in our lending portfolio have variable interest rates and the average maturity of our loan portfolio is 47 months, which we believe allows us to be well positioned in a rising rate environment.

7

Table of Contents

Index to Financial Statements

The average life of our construction loans is less than nine months, and we have averaged $20 million in construction loan pay-offs per month for the nine months ended September 30, 2014. Some of these construction loans lead to mortgage loans originated by our mortgage banking team and are subsequently sold into the secondary market. We have no significant concentration of builder or subdivision exposure within our construction loan portfolio. We have increased our focus on small business lending and have grown our commercial and industrial loans (“C&I loans”) by a CAGR of 37% from December 31, 2009 through June 30, 2014. As of September 30, 2014, C&I loans now represent 10% of our portfolio.

Continue to Prudently Manage Credit Risk

We do not avoid risk—we manage it prudently. We believe that our strong balance sheet and our enterprise risk management philosophy have been important in gaining and maintaining the confidence of our various constituencies and growing our business and footprint within the growing Middle Tennessee market. Our focus on asset quality is the foundation of our profitability and financial strength. The credit quality of our loan portfolio has continually improved, as nonperforming loans have decreased from 3.37% of our loan portfolio at December 31, 2009 to 0.45% at September 30, 2014. Further, our investment portfolio is mainly comprised of securities representing U.S. government agency mortgage-backed securities, which account for 91% of the fair value of our investment portfolio as of September 30, 2014, and the balance of the securities portfolio is comprised of other federal and municipal securities, such as U.S. Treasury securities.

Optimize Presence throughout Our Footprint

Our recent acquisition of MidSouth allowed us to expand selectively into Rutherford County; a contiguous market with long-term growth potential similar to Williamson County. We currently have the top position in the Williamson County deposit market, with 13% market share, and rank sixth in the Rutherford County deposit market, with 7% market share. The strong demographic profiles and economic momentum of Williamson and Rutherford Counties translate into what we believe to be significant organic growth potential over the next few years. We do not believe that we need to add a significant number of new branches or otherwise meaningfully increase our physical presence in order to realize the growth potential contained within these markets. We will evaluate opportunities to open new branches or ancillary offices (i.e., loan production or wealth management offices), as well as acquisitions, as they arise, but our strategy does not necessitate inorganic growth.

Diversification of Revenue

We are continuously expanding the products and services we offer to our customers. Our range of products and services diversifies our earnings stream, strengthens our balance sheet and provides greater flexibility to manage our business in volatile interest rate environments and amid shrinking interest rate margins in the U.S. banking industry. Recently, via the MidSouth acquisition, we have further invested in our mortgage banking division and expanded into wealth management. We will look to further grow these divisions in order to better provide a full suite of services to our customers, add more “touch points” that our customers have with the Bank and drive greater fee income and profitability. Rather than engaging in mass-market advertising, we typically attract new customers by utilizing existing customer relationships and maintaining our presence in our communities. This practice provides opportunities for our relationship managers to cross-sell other products and services to these clients. In addition, we offer our expertise and targeted service offerings for a variety of small businesses and non-profit organizations.

We believe that enhancing our cross-selling capabilities will enable us to generate higher revenues, increase our deposits and diversify our income stream.

8

Table of Contents

Index to Financial Statements

Our fee income businesses consist of the following:

| • | Mortgage Banking. Our mortgage banking business has generated 13.5% of our revenue (defined in accordance with the industry standard as net interest income plus noninterest income) for the nine months ended September 30, 2014. We sell the majority of loans that are originated in-house in the secondary market and we have the option to retain servicing rights. We are currently servicing 1,722 loans with an approximate aggregate principal balance of $398 million. For the nine months ended September 30, 2014, we originated $219 million of loans. Our efforts to expand our Mortgage Banking business have emphasized purchase loans versus attracting rate sensitive refinancing opportunities. Additionally, mortgage production has a natural tie-in to our residential construction business as a number of our newly originated loans are sourced from our construction loan relationships. |

| • | Wealth Management/Trust Services. Our wealth management business has $168 million in assets under management as of September 30, 2014. Leveraging MidSouth’s wealth management expertise into our selective customer base and the wealthy Williamson County market represents an attractive and unique opportunity. With the MidSouth acquisition, we acquired a trust business and we believe that our possession of a trust charter is a competitive advantage, enabling us to attract newer and wealthier customers and more “sticky” long term deposits. |

For the nine months ended September 30, 2014, noninterest income represented 21.8% of our revenue.

Enhance Deposit Base

We will look to attract more low-cost, high-quality and long-term retail deposits. Our cost of deposits for the nine months ended September 30, 2014 was 0.61%, compared to 1.88% in 2009, as a result of our increased ability to attract transactional accounts. During the twelve months ended September 30, 2014, we attracted $528 million of deposits. We are able to leverage existing relationships throughout our customer base by cross-selling services and incentivizing our bankers to bring in deposit relationships, in addition to loans. Local government deposits represent an attractive source of low-cost, seasonal but predictable deposits. As of September 30, 2014, public funds interest checking deposits had a balance of $122 million. We will look to increase the amount of municipal deposits in the future. We believe that the expansion of our small business loan portfolio will provide an attractive and growing source of low-cost deposits in the future.

Additionally, our investments in technology, which have resulted in a strong mobile banking platform and services such as remote deposit capture, enable us to attract and retain deposit customers in a competitive local environment. Furthermore, to expand our customer base, we have created retail banking products intended to appeal to a wide demographic of potential customers, such as our Synergy Cobalt Club, which provides retail banking services targeted to young professionals and our Pineapple Gold Club, which provides retail banking services targeted to people ages 50 and over. Finally, our treasury management services, which include Automated Clearing House (“ACH”) and lockbox product suites, also help to broaden our deposit base through their appeal to small business and commercial deposit customers.

Attract and Retain High Quality Employees

We employ many experienced loan officers with deep local market knowledge and long-term existing relationships. We have been successful in hiring talented employees due to our service-oriented culture and efficient decision making processes. On average, loan officers have 18 years of lending experience. Additionally, we are able to attract and retain talented officers through our incentive compensation plan, which rewards officers with stock options, restricted stock units and cash. All of our officers are shareholders through direct stock

9

Table of Contents

Index to Financial Statements

ownership, restricted stock and stock options. We believe that by compensating our officers in the form of equity, we align the interests of our team with those of our shareholders, and incentivize them to maximize shareholder value. Lastly, we invest continuously in our employee base. For example, we created a leadership program, “Leadership Franklin Synergy Bank,” where we train our employees not only to be better bankers, but also to be leaders in our communities.

Our Competitive Strengths

We believe that we have a unique operating culture that differentiates us from our competitors and enables us to organically grow our business and enhance shareholder value. This unique operating culture includes:

| • | a commitment to provide superior and personal service to our customers, both through our employees and via our continued investment in cutting edge technologies in areas of deposit taking, loan origination and risk management; |

| • | a focus on building long-term relationships with our customers; and |

| • | community leadership, as we look to engage with local civic, professional and charitable organizations and exhort our employees to do so as well. |

Our culture forms the basis for our competitive strengths, which we believe allow us to leverage our market opportunity and grow our business profitability. In particular, we believe that the following strengths differentiate us from our competitors and provide a strong foundation from which to deliver growth and profitability, all while enhancing shareholder value:

Well Positioned in Attractive Markets

We believe that we are well positioned to grow our business profitably in the demographically attractive and growing markets within the Nashville metropolitan area in which we operate. We believe that our target market segments, small to medium size for profit businesses and the consumer base working or living in and near our geographical footprint, demand the convenience and personal service that a smaller, independent financial institution such as we can offer. Currently, there are few Tennessee-headquartered banks with assets over $1 billion—there is only one public Middle Tennessee-based bank trading on a major exchange. We believe the heavy out-of-state banking presence (out-of-state super-regional and national financial institutions control approximately 59% of local deposits in the Nashville metropolitan area) provides an opportunity for a strong local bank like us to add greater market share from customers who are looking for more personal banking services and a more customer-friendly experience. Through our efforts to expand our deposit base, we currently have the largest market share of deposits in Williamson County.

10

Table of Contents

Index to Financial Statements

As demonstrated below, our local markets compare favorably to higher profile markets in almost all measures.

| MSA | County | |||||||||||||||||||||||||||||||||||

| Top 5 MSAs by Population Growth | ||||||||||||||||||||||||||||||||||||

| USA | Austin | Provo | Houston | Dallas | San Antonio | Nashville | Williamson | Rutherford | ||||||||||||||||||||||||||||

| Estimated Population Growth |

3.5% | 11.4% | 8.7% | 8.7% | 8.6% | 8.5% | 6.2% | 8.6% | 7.5% | |||||||||||||||||||||||||||

| Median Household Income |

$ | 51,579 | $ | 58,706 | $ | 58,735 | $ | 56,545 | $ | 56,739 | $ | 50,754 | $ | 50,439 | $ | 86,706 | $ | 57,220 | ||||||||||||||||||

| Unemployment |

5.8% | 4.3% | 4.6% | 4.5% | 4.6% | 4.3% | 5.1% | 4.6% | 4.9% | |||||||||||||||||||||||||||

| Home Price Y-O-Y |

5.8 | 6.6 | 7.3 | 8.8 | 5.9 | 5.5 | 5.2 | 7.6 | 6.2 | |||||||||||||||||||||||||||

| Housing Vacancy |

11.4 | 7.2 | 5.1 | 9.6 | 7.9 | 8.4 | 7.7 | 4.9 | 6.2 | |||||||||||||||||||||||||||

| % of Households w/ Income > 200k |

4.5 | 5.6 | 3.3 | 6.1 | 5.4 | 3.7 | 3.9 | 11.9 | 2.9 | |||||||||||||||||||||||||||

Note: Housing Vacancy Rate is calculated as Vacant Housing Units/Total Housing Units.

Source: SNL Financial and Moody’s Economy.

Experienced Management Team

We have an experienced management team with a history of working together in our target markets and a track record of delivering growth and shareholder value. Many members of our executive leadership team have been with us since inception and many have worked together at previous banks, including both large financial institutions and community banks. Our Chief Executive Officer, President, Chief Mortgage Officer, Chief Financial Officer, Chief Investment Officer and Chief Credit Officer have worked in our local market for an average of twenty-three years and experienced a variety of economic cycles. This deep local experience has given us the ability to understand and react to market changes and maintain strong profitability and growth without sacrificing asset quality. The MidSouth acquisition has bolstered our team, as several key managers have extensive experience working together in the Rutherford County market with MidSouth and other area banks.

Our management team has a proven track record of delivering shareholder value. Richard Herrington co-founded Franklin Financial Corporation (Franklin National Bank) in 1988, where he and his management team grew assets by a CAGR of 27.5% from 1995 – 2002 and positioned the bank to eventually be sold to Fifth Third, which was announced in 2002 and closed in 2004, for 5.4 times tangible book value. According to SNL Financial, this multiple represents the 9th highest price to book multiple for all bank transactions announced in the past 20 years where deal value was in excess of $50 million. He then served as Chief Executive Officer at Cumberland Bancorp (later renamed Civitas BankGroup, Inc.), where he and his team restructured the bank and significantly bolstered profitability, growing net income by a CAGR of 82% from 2003 – 2006, before selling the bank to Greene County Bancshares in 2007 for 3.0 times tangible book value.

The members of our Board of Directors have diverse industry experiences and have deep and long-term ties to the local community. We believe that we have an ideal blend of directors that have been with our management team at previous banks as well as directors that have joined our Board in recent years.

Local Real Estate Lending Expertise

We are real estate bankers that have focused on Middle Tennessee collateral since 1989. Our in-depth knowledge of the commercial customers, real estate development and credit in Williamson and Rutherford Counties gives us a competitive advantage in loan production, deposit attraction and ancillary revenue generation as we grow market share. Even when the local loan market gets competitive, we do not compromise on pricing and structuring of loan facilities, as our bankers are able to provide customized solutions delivered with a relatively quick turnaround time, as a result of the fact that our underwriting and banking operations occur locally.

With our firm principles of lending on Middle Tennessee collateral, our local real estate expertise and our localized delivery apparatus, we are poised to capture greater market share in the demographically-attractive and growing Williamson and Rutherford Counties.

11

Table of Contents

Index to Financial Statements

Successful Balance of Growth and Profitability

We understand the importance of successfully balancing growth and profitability with asset quality to enhance shareholder value. The following highlights the key aspects of our approach to maintaining this balance:

| • | Consistent, Strong and Disciplined Growth. Our approach balances both disciplined growth and profitability. Our community-focused business model has resulted in loan growth with a CAGR of 28% from December 31, 2009 to June 30, 2014. We have multiple lending opportunities to continue this trajectory and the MidSouth acquisition has provided us an immediate presence in the attractive Rutherford County market. Our lending momentum has continued, as loans have grown by 7% from July 1, 2014 to September 30, 2014. Additionally, we have increased focus on small business lending and grown our C&I loans, which represent approximately 10% of our portfolio at September 30, 2014, by a CAGR of 37% since 2009. We have grown our deposit market share in Williamson County and are now the top local institution with a market share of 13%. Our growth has resulted in improved profitability, as reflected by return on average assets increasing from negative in 2009 to 0.67% for the third quarter of 2014. |

| • | Disciplined Credit Risk Management. Our robust approach to risk management has enabled growth of our loan portfolio without compromising credit. Our credit risk management strategy is based on prudent underwriting criteria and local knowledge. Our lending decisions are centralized and committee-focused, with committees meeting multiple times per week. We are collateral lenders, with strong focus on secondary sources of repayment, especially collateral based in Williamson and Rutherford Counties. As a result of the implementation of our risk management strategy, less than 2% of our current total loans are unsecured. As the following charts demonstrate, our conservative credit culture has resulted in strong credit metrics as we have grown our business. |

Source: SNL Financial. Southeast Banks with assets between $500mm-$5bn. Based on regulatory financials.

We believe that by maintaining our consistent origination and underwriting strategy, we will be able to maintain our consistent growth across shifting market environments.

12

Table of Contents

Index to Financial Statements

Risks Related to Our Company

There are a number of risks that you should consider before investing in our common stock. These risks are discussed more fully in the section titled “RISK FACTORS,” beginning on page 23.

Our Corporate Information

Our principal executive office is located at 722 Columbia Avenue, Franklin, Tennessee 37064-2828, and our telephone number is (615) 236-2265. Our website is www.franklinsynergybank.com. The information contained on or accessible from our website does not constitute a part of this prospectus and is not incorporated by reference herein.

13

Table of Contents

Index to Financial Statements

The Offering

| Common stock offered by us |

shares. |

| Option to purchase additional shares of common stock |

shares. |

| Common stock to be outstanding after this offering |

shares ( shares if the underwriters exercise in full their option to purchase additional shares). |

| Use of proceeds |

Assuming an initial public offering price of $ per share, which is the midpoint of the offering price range set forth on the cover page of this prospectus, we estimate that the net proceeds to us from the sale of our common stock in this offering will be $ million (or $ million if the underwriters exercise in full their option to purchase additional shares), after deducting estimated underwriting discounts and offering expenses. |

| We intend to: |

| • | initially retain the net proceeds from this offering at our holding company and to use such proceeds to support our continued growth, including organic growth and potential future acquisitions and for general corporate purposes; and |

| • | use a portion of the net proceeds of this offering to redeem the outstanding shares of Senior Non-Cumulative Perpetual Preferred Stock, Series A, liquidation preference of $1,000 per share (“Series A Preferred Stock”) issued to the U.S. Treasury pursuant to our participation in the Small Business Lending Fund (“SBLF”) program, prior to March 2016, which is when the dividend rate on such Series A Preferred Stock increases to 9.0%. |

| See “USE OF PROCEEDS.” |

| Dividends |

We have not historically declared or paid cash dividends on our common stock and we do not expect to pay cash dividends on our common stock in the foreseeable future. Instead, we anticipate that all of our future earnings will be retained to support our operations and finance the growth and development of our business. Any future determination to pay dividends on our common stock will be made by our board of directors and will depend upon our results of operations, financial condition, capital requirements, regulatory and contractual restrictions, our business strategy and other factors that our board of directors deems relevant. See “DIVIDEND POLICY.” |

| Rank |

Our common stock is subordinate to our Series A Preferred Stock (which we plan to redeem with a portion of the net proceeds of this offering) with respect to the payment of dividends and the distribution of assets upon liquidation. |

14

Table of Contents

Index to Financial Statements

| Listing |

We have applied to list our common stock on the under the symbol “ .” |

| Risk factors |

Investing in our common stock involves risks. See “RISK FACTORS,” beginning on page 23, for a discussion of certain factors that you should carefully consider before making an investment decision. |

References in this section to the number of shares of our common stock outstanding after this offering are based on shares of our common stock issued and outstanding as of , 2015. Unless otherwise noted, these references exclude:

| • | shares of our common stock reserved for issuance upon conversion of our Series A Preferred Stock. See “DESCRIPTION OF CAPITAL STOCK—Preferred Stock”; |

| • | shares of our common stock reserved for issuance upon exercise of the 2010 Warrants, which were issued to subscribers in connection with stock offerings in 2007 and 2010. See “DESCRIPTION OF CAPITAL STOCK—2010 Warrants”; and |

| • | shares of our common stock reserved for issuance under the 2007 Omnibus Equity Incentive Plan. |

Unless otherwise indicated, the information contained in this prospectus is as of the date set forth on the cover page of this prospectus, assumes that the underwriters’ option to purchase additional shares is not exercised and assumes that the common stock to be sold in this offering is sold at $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus.

15

Table of Contents

Index to Financial Statements

Summary Consolidated Financial Data—Franklin Financial Network, Inc.

| (Amounts in thousands, except |

As of or for the Nine Months Ended September 30, |

As of or for the Year Ended December 31, | ||||||||||||||||||||||||||

| 2014 | 2013 | 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||||||||

| Income Statement Data: |

||||||||||||||||||||||||||||

| Interest Income |

$ | 29,690 | $ | 17,551 | $ | 24,982 | $ | 20,004 | $ | 16,092 | $ | 13,008 | $ | 10,978 | ||||||||||||||

| Interest Expense |

4,120 | 2,894 | 3,937 | 4,048 | 3,956 | 4,089 | 3,774 | |||||||||||||||||||||

| Net Interest Income |

25,570 | 14,657 | 21,045 | 15,956 | 12,136 | 8,919 | 7,204 | |||||||||||||||||||||

| Provision for Loan Losses |

1,489 | 457 | 907 | 1,548 | 680 | 1,268 | 1,407 | |||||||||||||||||||||

| Noninterest Income |

7,125 | 5,182 | 6,819 | 8,645 | 4,460 | 5,428 | 3,783 | |||||||||||||||||||||

| Noninterest Expense |

21,959 | 14,279 | 19,662 | 16,857 | 13,651 | 12,105 | 10,196 | |||||||||||||||||||||

| Net Income before Taxes |

9,247 | 5,103 | 7,295 | 6,196 | 2,265 | 973 | (616 | ) | ||||||||||||||||||||

| Provision for Taxes |

3,668 | 1,945 | 2,734 | 2,056 | 111 | — | — | |||||||||||||||||||||

| Net Income |

5,579 | 3,158 | 4,561 | 4,140 | 2,154 | 973 | (616 | ) | ||||||||||||||||||||

| Profitability (%) |

||||||||||||||||||||||||||||

| Return on Average Assets |

0.77 | % | 0.69 | % | 0.72 | % | 0.80 | % | 0.58 | % | 0.33 | % | — | |||||||||||||||

| Return on Average Equity |

8.8 | 8.2 | 8.2 | 8.4 | 5.6 | 3.3 | — | |||||||||||||||||||||

| Return on Average Tangible Common Equity1 |

10.3 | 10.2 | 10.1 | 10.5 | 6.1 | 3.4 | — | |||||||||||||||||||||

| Efficiency Ratio |

67.2 | 72.0 | 70.6 | 68.5 | 82.3 | 84.4 | 92.8 | |||||||||||||||||||||

| Net Interest Margin |

3.64 | 3.30 | 3.41 | 3.17 | 3.36 | 3.11 | 3.17 | |||||||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||||||||||

| Loans (including HFS) |

$ | 744,927 | $ | 387,428 | $ | 431,998 | $ | 314,838 | $ | 235,200 | $ | 197,648 | $ | 167,620 | ||||||||||||||

| Loan Loss Reserve |

5,883 | 4,432 | 4,900 | 3,983 | 3,413 | 3,177 | 2,189 | |||||||||||||||||||||

| Cash |

36,657 | 16,390 | 18,217 | 24,977 | 23,286 | 16,363 | 9,765 | |||||||||||||||||||||

| Securities2 |

408,392 | 240,147 | 328,122 | 222,191 | 197,026 | 127,957 | 87,239 | |||||||||||||||||||||

| Total Intangible Assets |

12,075 | 258 | 252 | 199 | 157 | 157 | 157 | |||||||||||||||||||||

| Assets |

1,238,579 | 659,905 | 796,374 | 577,762 | 465,123 | 349,877 | 271,720 | |||||||||||||||||||||

| Deposits |

1,051,558 | 523,674 | 681,300 | 514,643 | 405,606 | 306,008 | 226,577 | |||||||||||||||||||||

| Liabilities |

1,122,125 | 595,772 | 731,211 | 526,406 | 417,744 | 316,348 | 242,511 | |||||||||||||||||||||

| Common Equity |

106,454 | 54,133 | 55,163 | 41,356 | 37,379 | 33,529 | 29,209 | |||||||||||||||||||||

| Total Equity |

116,454 | 64,133 | 65,163 | 51,356 | 47,378 | 33,529 | 29,209 | |||||||||||||||||||||

| Asset Quality (%) |

||||||||||||||||||||||||||||

| Nonperforming Loans / Total Loans |

0.45 | % | 0.68 | % | 0.60 | % | 0.85 | % | 1.46 | % | 1.39 | % | 3.37 | % | ||||||||||||||

| Loan Loss Reserve / Loans (excluding HFS) |

0.82 | 1.17 | 1.16 | 1.33 | 1.49 | 1.65 | 1.36 | |||||||||||||||||||||

| Net Charge-offs (Recoveries) / Average Loans |

0.12 | 0.00 | (0.00 | ) | 0.36 | 0.21 | 0.16 | 0.26 | ||||||||||||||||||||

| Capital (%) |

||||||||||||||||||||||||||||

| Tangible Common Equity1 to Tangible Assets |

7.7 | % | 8.2 | % | 6.9 | % | 7.1 | % | 8.0 | % | 9.5 | % | 10.7 | % | ||||||||||||||

| Leverage Ratio3 |

8.8 | 10.3 | 9.8 | 9.3 | 10.8 | 10.1 | 11.0 | |||||||||||||||||||||

| Tier 1 Common Ratio3 |

11.2 | 12.6 | 11.8 | N/A | N/A | N/A | N/A | |||||||||||||||||||||

| Tier 1 Ratio3 |

12.4 | 14.9 | 13.8 | 14.3 | 16.3 | 15.3 | 15.2 | |||||||||||||||||||||

| Risk-based Capital Ratio3 |

13.1 | 15.9 | 14.8 | 15.5 | 17.6 | 16.6 | 16.5 | |||||||||||||||||||||

| 1 | “Tangible common equity” is defined as total shareholders’ equity at end of period less: (1) the liquidation preference value of the preferred stock; and (2) goodwill and other intangible assets. “Other intangible assets” is defined as the sum of core deposit intangible and Small Business Administration loan servicing rights. |

| 2 | “Securities” line item includes restricted equity securities. |

| 3 | Capital ratios prior to 2013 reflect capital ratios for Franklin Synergy Bank only. Holding company capital ratios are not available for periods prior to 2013 since consolidated regulatory reports were not required during those periods. |

16

Table of Contents

Index to Financial Statements

UNAUDITED PRO FORMA COMBINED CONDENSED FINANCIAL INFORMATION

The following unaudited pro forma combined condensed statements of income for the nine months ended September 30, 2014 and year ended December 31, 2013, are presented as if the acquisition of MidSouth had occurred on January 1, 2013. The historical consolidated financial information has been adjusted to reflect factually supportable items that are directly attributable to the acquisition and, expected to have a continuing impact on consolidated results of operations. Because the acquisition was completed on July 1, 2014, MidSouth’s results of operations for the first six months of 2014 are used for purposes of computing pro forma amounts for the nine months ended September 30, 2014.

The preparation of the unaudited pro forma combined condensed income statements and related adjustments required management to make certain assumptions and estimates. The assumptions underlying the pro forma adjustments are described in the accompanying notes, which should be read in conjunction with this unaudited pro forma combined condensed financial information. In the opinion of management, all adjustments and/or disclosures necessary for a fair statement of the pro forma data have been made. The unaudited pro forma combined condensed financial information is presented for illustrative purposes only and does not necessarily reflect what our results of operations and financial condition would have been if we had operated as a stand-alone company during all periods presented, and, accordingly, such information should not be relied upon as an indicator of our future performance. The unaudited pro forma combined condensed financial information also does not consider any potential impact of current market conditions on revenues, potential revenue enhancements, anticipated cost savings and expense efficiencies, among other factors.

These unaudited pro forma combined condensed financial information and the notes thereto should be read together with the following:

| • | the accompanying notes to the unaudited pro forma combined condensed financial information; |

| • | FFN’s unaudited consolidated financial statements and accompanying notes as of and for the nine months ended September 30, 2014 and audited consolidated financial statements and accompanying notes as of and for the year ended December 31, 2013, included elsewhere in this prospectus; |

| • | MidSouth’s unaudited financial statements and accompanying notes as of and for the six months ended June 30, 2014 and audited consolidated financial statements and accompanying notes as of and for the year ended December 31, 2013, included elsewhere in this prospectus; |

| • | the section entitled “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS,” included elsewhere in this prospectus. |

17

Table of Contents

Index to Financial Statements

Unaudited Pro Forma Combined Condensed Statement of Income

For the Nine Months Ended September 30, 2014

(in thousands, except per share data)

| FFN as Reported |

MidSouth as Reported for the six months ended June 30, 2014 |

MidSouth Account Reclassification |

Pro Forma Adjustments |

Pro Forma Combined |

||||||||||||||||

| Interest income: |

||||||||||||||||||||

| Loans, including fees |

$ | 22,466 | $ | 4,538 | $ | — | $ | (514 | )(b) | $ | 26,490 | |||||||||

| Investment securities |

6,992 | 840 | — | — | 7,832 | |||||||||||||||

| Federal funds sold and other |

232 | 39 | — | — | 271 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total interest income |

29,690 | 5,417 | — | (514 | ) | 34,593 | ||||||||||||||

| Interest expense: |

||||||||||||||||||||

| Deposits |

3,808 | 397 | — | 59 | (d) | 4,264 | ||||||||||||||

| FHLB advances and other borrowings |

312 | 4 | — | — | 316 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total interest expense |

4,120 | 401 | — | 59 | 4,580 | |||||||||||||||

| Net interest income |

25,570 | 5,016 | — | (573 | ) | 30,013 | ||||||||||||||

| Provision for loan losses |

1,489 | 350 | — | — | 1,839 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income after loan loss provision |

24,081 | 4,666 | — | (573 | ) | 28,174 | ||||||||||||||

| Non-interest income: |

||||||||||||||||||||

| Service charges on deposit accounts and other fees |

1,186 | 547 | — | — | 1,733 | |||||||||||||||

| Net gain on sale of loans |

4,226 | 1,012 | 227 | (g) | — | 5,465 | ||||||||||||||

| Gain on sale of investment securities, net |

93 | 115 | — | — | 208 | |||||||||||||||

| Other |

1,620 | 398 | — | — | 2,018 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total non-interest income |

7,125 | 2,072 | 227 | 9,424 | ||||||||||||||||

| Non-interest expense: |

||||||||||||||||||||

| Salaries and employee benefits |

13,494 | 3,616 | — | 114 | (e) | 17,224 | ||||||||||||||

| Occupancy and equipment |

3,238 | 617 | — | (56 | )(c) | 3,799 | ||||||||||||||

| All other expenses |

5,227 | 3,272 | 227 | (g) | (1,830 | )(a) | 6,896 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total non-interest expense |

21,959 | 7,505 | 227 | (1,772 | ) | 27,919 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income tax expense |

9,247 | (767 | ) | — | 1,199 | 9,679 | ||||||||||||||

| Income tax expense |

3,668 | — | — | 165 | (f) | 3,833 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

5,579 | (767 | ) | — | 1,034 | 5,846 | ||||||||||||||

| Dividends paid on Series A preferred stock |

(75 | ) | — | — | — | (75 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income available (loss allocated) to common shareholders |

5,504 | (767 | ) | — | 1,034 | 5,771 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic earnings (loss) available to common shareholders per share |

$ | 0.94 | $ | (0.20 | ) | $ | 0.75 | |||||||||||||

| Diluted earnings (loss) available to common shareholders per share |

$ | 0.91 | $ | (0.11 | ) | $ | 0.73 | |||||||||||||

| Weighted average common shares outstanding, including participating securities: |

||||||||||||||||||||

| Basic |

5,841 | 3,899 | 7,709 | |||||||||||||||||

| Diluted |

6,016 | 6,680 | 7,916 | |||||||||||||||||

See accompanying notes to Unaudited Pro Forma Combined Condensed Financial Information

18

Table of Contents

Index to Financial Statements

Unaudited Pro Forma Combined Condensed Statement of Income

For the Year Ended December 31, 2013

(in thousands, except per share data)

| FFN as Reported |

MidSouth as Reported |

MidSouth Account Reclassification |

Pro Forma Adjustments |

Pro Forma Combined |

||||||||||||||||

| Interest income: |

||||||||||||||||||||

| Loans, including fees |

$ | 20,094 | $ | 8,296 | $ | — | $ | 1,451 | (b) | $ | 29,841 | |||||||||

| Investment securities |

4,722 | 1,388 | — | — | 6,110 | |||||||||||||||

| Federal funds sold and other |

166 | 145 | — | — | 311 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total interest income |

24,982 | 9,829 | — | 1,451 | 36,262 | |||||||||||||||

| Interest expense: |

— | — | ||||||||||||||||||

| Deposits |

3,693 | 914 | — | (172 | )(d) | 4,435 | ||||||||||||||

| FHLB advances and other borrowings |

244 | 2 | — | — | 246 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total interest expense |

3,937 | 916 | — | (172 | ) | 4,681 | ||||||||||||||

| Net interest income |

21,045 | 8,913 | — | 1,623 | 31,581 | |||||||||||||||

| Provision for loan losses |

907 | — | — | — | 907 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income after loan loss provision |

20,138 | 8,913 | — | 1,623 | 30,674 | |||||||||||||||

| Non-interest income: |

||||||||||||||||||||

| Service charges on deposit accounts and other fees |

1,164 | 1,072 | — | — | 2,236 | |||||||||||||||

| Net gain on sale of loans |

4,403 | 1,413 | 408 | (g) | — | 6,224 | ||||||||||||||

| Gain on sale of investment securities, net |

88 | 2 | — | — | 90 | |||||||||||||||

| Other |

1,164 | 664 | — | — | 1,828 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total non-interest income |

6,819 | 3,151 | 408 | — | 10,378 | |||||||||||||||

| Non-interest expense: |

||||||||||||||||||||

| Salaries and employee benefits |

13,142 | 5,985 | — | 204 | (e) | 19,331 | ||||||||||||||

| Occupancy and equipment |

2,731 | 1,117 | — | (112 | )(c) | 3,736 | ||||||||||||||

| All other expenses |

3,789 | 3,458 | 408 | (g) | 269 | (a) | 7,924 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total non-interest expense |

19,662 | 10,560 | 408 | 361 | 30,991 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income tax expense |

7,295 | 1,504 | — | 1,262 | 10,061 | |||||||||||||||

| Income tax expense |

2,734 | — | — | 1,059 | (f) | 3,793 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

4,561 | 1,504 | 203 | 6,268 | ||||||||||||||||

| Dividends paid on Series A preferred stock |

(109 | ) | — | — | — | (109 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income available to common shareholders |

$ | 4,452 | $ | 1,504 | $ | — | $ | 203 | $ | 6,159 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic earnings available to common shareholders per share |

$ | 1.13 | $ | 0.39 | $ | 0.92 | ||||||||||||||

| Diluted earnings available to common shareholders per share |

$ | 1.10 | $ | 0.23 | $ | 0.89 | ||||||||||||||

| Weighted average common shares outstanding, including participating securities: |

||||||||||||||||||||

| Basic |

3,934 | 3,866 | 6,699 | |||||||||||||||||

| Diluted |

4,038 | 6,493 | 6,886 | |||||||||||||||||

See accompanying notes to Unaudited Pro Forma Combined Condensed Financial Information

19

Table of Contents

Index to Financial Statements

NOTES TO UNAUDITED PRO FORMA COMBINED CONDENSED FINANCIAL INFORMATION

(all amounts are in thousands, except per share data, unless otherwise indicated)

Note 1—Basis of Pro Forma Presentation

The unaudited pro forma combined condensed statement of income for the nine months ended September 30, 2014 and year ended December 31, 2013, are based on the historical financial statements of FFN and MidSouth after giving effect to the completion of the acquisition and the assumptions and adjustments described in the accompanying notes. Such financial statements do not reflect cost savings or operating synergies expected to result from the acquisition, or the costs to achieve these cost savings or operating synergies, or any anticipated disposition of assets that may result from the integration of the operations of the two companies. Certain historical financial information has been reclassified to conform to the current presentation.

The unaudited pro forma combined condensed financial information is presented solely for illustrative purposes and is not necessarily indicative of the combined results of income that might have been achieved for the periods or dates indicated, nor is it necessarily indicative of the future results of the combined company.

Note 2—Unaudited Pro Forma Accounting Adjustments

The following unaudited pro forma adjustments result from accounting for the acquisition, including the determination of fair value of the assets, liabilities, and commitments which FFN, as the acquirer, acquired from MidSouth. The descriptions related to the effect of these adjustments on the income statement are as follows.

Income Statements—the explanations and descriptions below are referenced to the Unaudited Pro Forma Combined Condensed Statements of Income for the nine months ended September 30, 2014 and year ended December 31, 2013.

Income Statements—Pro Forma Adjustments

| Pro Forma Adjusting entries (Income Statements) |

Nine Months Ended Sept 30, 2014 |

Year Ended Dec 31, 2013 |

||||||

| a Amortization expense of core deposit intangible |

$ | 282 | $ | 700 | ||||

| a Acquisition related transaction costs |

(2,112 | ) | (431 | ) | ||||

| b Adjustment for estimate of loan interest accretion |

(514 | ) | 1,451 | |||||

| c Adjustment for estimate of land improvements fair value adjustment amortization |

(56 | ) | (112 | ) | ||||

| d Adjustment for estimate of time deposits fair value adjustment amortization |

59 | (172 | ) | |||||

| e Amortization of retention bonuses |

114 | 204 | ||||||

| f Income tax expense of pro-forma adjustments |

165 | 1,059 | ||||||

| a | The core deposit intangible (“CDI”) was approximately $3,059 and will be amortized over a ten year period on an accelerated basis which is expected to increase amortization expense by approximately $282 and $700 of for the nine months ended September 30, 2014 and the year ended December 31, 2013, respectively. |

| Adjustment | to decrease non-interest expense for non-recurring costs incurred and included in the nine months ended September 30, 2014 and the year ended December 31, 2013 financial results of the combined entity. These costs (approximately $2,112 and $431, respectively) are transaction costs directly related to the acquisition. |

| b | Represents an estimate of interest income accretion related to the fair value adjustment of the loans acquired pursuant to the acquisition. The amount will be accreted as an increase to interest income on a level yield method based on the maturities of the underlying loans, which is expected to approximate 36 months. |

20

Table of Contents

Index to Financial Statements

| Estimates for the amount of income accretion related to the loans fair value adjustment total a decrease of $514 for the nine months ended September 30, 2014 and increase of $1,451 for the year ended December 31, 2013. For the nine months ended September 30, 2014, the pro forma adjustment for the income accretion related to the loans fair value adjustment is a decreasing value due to the amount of accretion currently recognized in the historical financial results of FFN compared to the projected accretion as if the acquisition had occurred effective January 1, 2013. |

| c | The land improvements on properties held by MidSouth were adjusted to fair value at the acquisition date. The fair value adjustment of these buildings and leasehold improvements was approximately $2,811. This amount will be amortized as a decrease to depreciation expense on a straight-line basis over an estimated useful life of 25 years. |

| d | The time deposits acquired from MidSouth were adjusted to fair value at the acquisition date. The preliminary estimate of the fair value adjustment at acquisition date was approximately $173. This amount will be amortized as a decrease to interest expense on a pro rata basis based on the maturities of the underlying time deposits. Adjustments to amortization for the nine months ended September 30, 2014 total a decrease of $59 and increase of $172 for the year ended December 31, 2013. |

| e | FFN provided retention bonuses of $1,025 to certain executive and non–executive officers of Mid-South. These bonuses are to be paid in 20% cash and 80% stock compensation (common stock and stock options), which vest over a period of 3 to 5 years. |

| f | Adjustment to reflect the income tax expense of the Pro Forma Combined entity using 38.29% as the incremental effective tax rate. Income tax expense reported for MidSouth was zero for the period presented in the Unaudited Pro Forma Combined Condensed Financial Statements as a result of the full valuation allowance related to net deferred tax assets. Therefore, the Pro Forma Adjustment for income tax expense considers the pretax net income (loss) of MidSouth and all other income statement Pro Forma Adjustments for the period. |

Income Statements—reclassifications

The following reclassifications adjusted MidSouth’s historical income statements to conform to FFN’s historical income statements.

| g | Mortgage origination expenses netted against fees on mortgage originations in MidSouth’s non-interest income have been reclassified to all other expenses to conform to FFN’s historical income statement. |