Attached files

| file | filename |

|---|---|

| EX-23 - EX-23 - SANDERSON FARMS INC | safm-20141031xex23.htm |

| EX-10.20 - EX-10.20 - SANDERSON FARMS INC | safm-20141031xex1020.htm |

| EXCEL - IDEA: XBRL DOCUMENT - SANDERSON FARMS INC | Financial_Report.xls |

| EX-32.2 - EX-32.2 - SANDERSON FARMS INC | safm-20141031xex322.htm |

| EX-31.1 - EX-31.1 - SANDERSON FARMS INC | safm-20141031xex311.htm |

| EX-31.2 - EX-31.2 - SANDERSON FARMS INC | safm-20141031xex312.htm |

| EX-32.1 - EX-32.1 - SANDERSON FARMS INC | safm-20141031xex321.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 10-K

___________________________

(Mark One)

x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

for the fiscal year ended October 31, 2014

¨ | Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

for the transition period from to

Commission file number: 1-14977

___________________________

SANDERSON FARMS, INC.

(Exact name of registrant as specified in its charter)

___________________________

Mississippi | 64-0615843 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

127 Flynt Road Laurel, Mississippi | 39443 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (601) 649-4030

Securities registered pursuant to Section 12(b) of the Act:

Title of each Class: | Name of exchange on which registered: |

Common stock, $1.00 par value per share | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

___________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. x Yes ¨ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | x | Accelerated filer | ¨ | |||

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

Aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant computed by reference to the closing sales price of the common equity in The NASDAQ Stock Market on the last business day of the Registrant’s most recently completed second fiscal quarter: $1,794,360,036.

Number of shares outstanding of the Registrant’s common stock as of December 12, 2014: 23,152,217 shares of common stock, $1.00 per share par value.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement filed or to be filed in connection with its 2015 Annual Meeting of Stockholders are incorporated by reference into Part III.

TABLE OF CONTENTS

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 4A. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

2

INTRODUCTORY NOTE

Definitions. This Annual Report on Form 10-K is filed by Sanderson Farms, Inc., a Mississippi corporation. Except where the context indicates otherwise, the terms “Registrant,” “Company,” “Sanderson Farms,” “we,” “us,” or “our” refer to Sanderson Farms, Inc. and its subsidiaries and predecessor organizations. The use of these terms to refer to Sanderson Farms, Inc. and its subsidiaries collectively does not suggest that Sanderson Farms and its subsidiaries have abandoned their separate identities or the legal protections given to them as separate legal entities. “Fiscal year” means the fiscal year ended October 31, 2014, which is the year for which this Annual Report is filed.

Presentation and Dates of Information. Except for Item 4A herein, the Item numbers and letters appearing in this Annual Report correspond with those used in Securities and Exchange Commission Form 10-K (and, to the extent that it is incorporated into Form 10-K, those used in SEC Regulation S-K) as effective on the date hereof, which specifies the information required to be included in Annual Reports to the SEC. Item 4A (“Executive Officers of the Registrant”) has been included by the Registrant in accordance with General Instruction G(3) of Form 10-K and Instruction 3 of Item 401(b) of Regulation S-K. The information contained in this Annual Report is, unless indicated to be given as of a specified date or for a specified period, given as of the date of this Report, which is December 18, 2014.

PART I

Item 1. | Business |

(a) GENERAL DEVELOPMENT OF THE REGISTRANT’S BUSINESS

The Registrant was incorporated in Mississippi in 1955, and is a fully-integrated poultry processing company engaged in the production, processing, marketing and distribution of fresh and frozen chicken products. In addition, the Registrant is engaged in the processing, marketing and distribution of prepared chicken through its wholly-owned subsidiary, Sanderson Farms, Inc. (Foods Division).

The Registrant sells ice pack, chill pack, bulk pack and frozen chicken, in whole, cut-up and boneless form, primarily under the Sanderson Farms® brand name to retailers, distributors, and casual dining operators principally in the southeastern, southwestern, northeastern and western United States, and to customers who resell frozen chicken into export markets. During its fiscal year ended October 31, 2014, the Registrant processed approximately 452 million chickens, or over 3.0 billion dressed pounds. According to 2014 industry statistics, the Registrant was the third largest processor of dressed chicken in the United States based on average weekly processed pounds.

The Registrant’s chicken operations presently encompass 8 hatcheries, 7 feed mills and 9 processing plants, and those figures do not include the facilities at its new Palestine, Texas complex. The Registrant began operations at the new Palestine hatchery in November 2014, and expects to begin processing chickens at the new processing plant in February 2015.

The Registrant has contracts with operators of approximately 609 grow-out farms that provide it with sufficient housing capacity for its current operations. The Registrant also has contracts with operators of 185 breeder farms.

The Company’s prepared chicken product line includes approximately 130 institutional and consumer packaged partially cooked or marinated chicken items that it sells nationally and regionally, primarily to distributors and food service establishments. A majority of the prepared chicken items are made to the specifications of food service users.

Since the Registrant completed the initial public offering of its common stock in May 1987, the Registrant has significantly expanded its operations to increase production capacity, product lines and marketing flexibility. Through 1997, this expansion included the expansion of the Registrant’s Hammond, Louisiana processing facility; the construction of new wastewater facilities at the Hammond, Louisiana and Collins and Hazlehurst, Mississippi processing facilities; the addition of second shifts at the Hammond, Louisiana and the Laurel, Hazlehurst, and Collins, Mississippi processing facilities; the expansion of freezer and production capacity at its prepared chicken facility in Flowood, Mississippi; the expansion of freezer capacity at its Hammond, Louisiana, and its Laurel and Collins, Mississippi processing facilities; the addition of deboning capabilities at all of the Registrant’s poultry processing facilities; the construction and start-up of its McComb, Mississippi and Bryan, Texas production and processing facilities, including a hatchery, a feed mill, a processing plant, and a wastewater treatment facility for each complex; and the expansion and renovation of the hatchery at its Hazlehurst, Mississippi production facilities.

3

In the fourth quarter of fiscal 2005, the Registrant began initial operations at a new poultry processing complex in southern Georgia. The complex consists of a feed mill, hatchery, processing plant and wastewater treatment facility. This plant has the capacity to process 1.25 million head of chickens per week for the retail chill pack market.

On August 6, 2007, the Company began initial operations at a new poultry processing complex in Waco and McLennan County, Texas. The complex consists of a hatchery, processing plant and wastewater treatment facility. This complex shares a feed mill located in Robertson County, Texas with our Bryan, Texas complex. The plant has the capacity to process 1.25 million head of chickens per week for the big bird deboning market.

In January 2011, the Company began initial operations at a new poultry processing complex in Kinston, North Carolina. The complex consists of a hatchery, feed mill, processing plant, and wastewater facility with the capacity to process 1.25 million chickens per week for the retail chill pack market. The facility reached near full capacity during March 2012.

On February 14, 2013, the Company announced the selection of sites in and near Palestine, Texas, for the construction of its next poultry complex, and construction of the complex began on or about October 1, 2013. The new complex will consist of a feed mill, hatchery, processing plant and wastewater facility with the capacity to process 1.25 million chickens per week for the big bird deboning market. Before the complex can become fully operational, we will need to enter into contracts with a sufficient number of growers and complete construction. See “The construction and potential benefits of our new facilities are subject to risks and uncertainties” in the Risk Factors Section of this Annual Report.

The Company changed its marketing strategy in 1997 to move away from the small bird markets serving primarily the fast food industry to concentrate its production in the retail and big bird deboning markets serving the retail grocery and food service industries. This market shift resulted in larger average bird weights of the chickens processed by the Company, and substantially increased the number of pounds processed by the Company. In addition, the Registrant continually evaluates internal and external expansion opportunities to continue its growth in poultry and/or related food products.

Capital expenditures for fiscal 2014 were funded by cash on hand at November 1, 2013, and cash provided by operations during fiscal 2014. On October 24, 2013, the Company entered into a new revolving credit facility to, among other things, increase the total committed credit from $500.0 million to $600.0 million. The new facility also increased the annual capital expenditure limitation to $65.0 million for fiscal years 2013 through 2018, plus, for each year, up to $10.0 million carryover from the preceding fiscal year, when it is not actually spent in that year. The capital expenditure limitation for fiscal 2014, with the permitted carry over, was $75.0 million. On October 29, 2014, the Company entered into an amendment to the existing agreement's capital expenditure covenants. The amendment increased the annual capital expenditure limitation to $75.0 million, and the allowable carryover to $15.0 million for fiscal years 2015 - 2018. The amendment also increases the amount the Company is allowed to spend on the construction of its new complex in Palestine, Texas. Under the original facility, the Company was allowed to spend up to $140.0 million each in capital expenditures on the construction of two new poultry complexes to be located anywhere in the United States, which expenditures are in addition to the annual overall capital expenditure limits. Under the amendment, the amount allowed to be spent on construction of the new Palestine, Texas complex is increased to $155.0 million, while the original $140.0 million covenant remains in place for construction of a second potential complex. Under the facility, the Company may not exceed a maximum debt to total capitalization ratio of 55% from the date of the agreement through October 30, 2014, and 50% thereafter. The Company has a one-time right, at any time during the term of the agreement, to increase the maximum debt to total capitalization ratio then in effect by five percentage points in connection with the construction of either of the two potential new poultry complexes for the four fiscal quarters beginning on the first day of the fiscal quarter during which the Company gives written notice of its intent to exercise this right. The Company has not exercised this right. The facility also sets a minimum net worth requirement that at October 31, 2014, was $613.6 million. The credit remains unsecured and, unless extended, will expire on October 24, 2018.

(b) FINANCIAL INFORMATION ABOUT INDUSTRY SEGMENTS

Not applicable.

(c) NARRATIVE DESCRIPTION OF REGISTRANT’S BUSINESS

General

The Registrant is engaged in the production, processing, marketing and distribution of fresh and frozen chicken and the preparation, processing, marketing and distribution of processed and prepared chicken items.

4

The Registrant sells chill pack, ice pack, bulk pack and frozen chicken, in whole, cut-up and boneless form, primarily under the Sanderson Farms® brand name to retailers, distributors and casual dining operators principally in the southeastern, southwestern, northeastern and western United States. During its fiscal year ended October 31, 2014, the Registrant processed approximately 452 million chickens, or over 3.0 billion dressed pounds. In addition, the Registrant purchased and further processed 5.1 million pounds of poultry products during fiscal 2014. According to 2014 industry statistics, the Registrant was the third largest processor of dressed chicken in the United States based on average weekly processed pounds.

The Registrant conducts its chicken operations through Sanderson Farms, Inc. (Production Division) and Sanderson Farms, Inc. (Processing Division), both of which are wholly-owned subsidiaries of Sanderson Farms, Inc. The production subsidiary, Sanderson Farms, Inc. (Production Division), which has facilities in Laurel, Collins, Hazlehurst and McComb, Mississippi; Bryan, Waco, Palestine, Freestone County, and Robertson County, Texas; Adel, Georgia and Kinston, North Carolina, is engaged in the production of chickens to the broiler stage. Sanderson Farms, Inc. (Processing Division), which has facilities in Laurel, Collins, Hazlehurst and McComb, Mississippi; Hammond, Louisiana; Bryan, Palestine, and Waco, Texas; Moultrie, Georgia and Kinston, North Carolina, is engaged in the processing, sale and distribution of chickens.

The Registrant conducts its prepared chicken business through its wholly-owned subsidiary, Sanderson Farms, Inc. (Foods Division), which has a facility in Flowood, Mississippi. The Foods Division is engaged in the processing, marketing and distribution of approximately 130 prepared chicken items, which it sells nationally and regionally, principally to distributors and national food service accounts.

Products

The Registrant has the ability to produce a wide range of processed chicken products and prepared chicken items.

Processed chicken is first salable as an ice packed, whole chicken. The Registrant adds value to its ice packed, whole chickens by removing the giblets, weighing, packaging and labeling the product to specific customer requirements and cutting and deboning the product based on customer specifications. The additional processing steps of giblet removal, close tolerance weighing and cutting increase the value of the product to the customer over whole, ice packed chickens by reducing customer handling and cutting labor and capital costs, reducing the shrinkage associated with cutting, and ensuring consistently sized portions.

The Registrant adds additional value to the processed chicken by deep chilling and packaging whole chickens in bags or combinations of fresh chicken parts, including boneless product, in various sized, individual trays under the Registrant’s brand name, which then may be weighed and pre-priced, based on each customer’s needs. This chill pack process increases the value of the product by extending shelf life, reducing customer weighing and packaging labor, and providing the customer with a wide variety of products with uniform, well designed packaging, all of which enhance the customer’s ability to merchandise chicken products.

To satisfy some customers’ merchandising needs, the Registrant freezes the chicken product, which adds value by meeting the customers’ handling, storage, distribution and marketing needs and by permitting shipment of product overseas where transportation time may be as long as 60 days.

5

The following table sets forth, for the periods indicated, the contribution, as a percentage of net sales dollars, of each of the Registrant’s major product lines.

Fiscal Year Ended October 31, | ||||||||||||||

2010 | 2011 | 2012 | 2013 | 2014 | ||||||||||

Registrant processed chicken: | ||||||||||||||

Value added: | ||||||||||||||

Chill pack | 28.5 | % | 32.5 | % | 33.1 | % | 34.4 | % | 36.0 | % | ||||

Fresh bulk pack | 54.5 | 48.5 | 49.0 | 50.5 | 48.3 | |||||||||

Frozen | 9.8 | 12.4 | 13.1 | 10.5 | 9.2 | |||||||||

Subtotal | 92.8 | 93.4 | 95.2 | 95.4 | 93.5 | |||||||||

Non-value added: | ||||||||||||||

Ice pack | 0.8 | 1.2 | 1.2 | 1.0 | 0.9 | |||||||||

Subtotal | 0.8 | 1.2 | 1.2 | 1.0 | 0.9 | |||||||||

Total Company processed chicken | 93.6 | 94.6 | 96.4 | 96.4 | 94.4 | |||||||||

Prepared chicken | 6.4 | 5.4 | 3.6 | 3.6 | 5.6 | |||||||||

Total | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | ||||

Market Segments and Pricing

The three largest market segments in the chicken industry are big bird deboning, chill pack and small birds.

The following table sets forth, for each of the Company’s poultry processing plants, the general market segment in which the plant participates, the weekly capacity of each plant at full capacity expressed in number of head processed, and the average industry size of birds processed in the relevant market segment.

Plant Location | Market Segment | Capacity Per Week | Industry Bird Size | ||||

Laurel, Mississippi | Big Bird Deboning | 625,000 | 8.55 | ||||

Hazlehurst, Mississippi | Big Bird Deboning | 625,000 | 8.55 | ||||

Hammond, Louisiana | Big Bird Deboning | 625,000 | 8.55 | ||||

Collins, Mississippi | Big Bird Deboning | 1,250,000 | 8.55 | ||||

Waco, Texas | Big Bird Deboning | 1,250,000 | 8.55 | ||||

McComb, Mississippi | Chill Pack Retail | 1,250,000 | 6.32 | ||||

Bryan, Texas | Chill Pack Retail | 1,250,000 | 6.32 | ||||

Moultrie, Georgia | Chill Pack Retail | 1,250,000 | 6.32 | ||||

Kinston, North Carolina | Chill Pack Retail | 1,250,000 | 6.32 | ||||

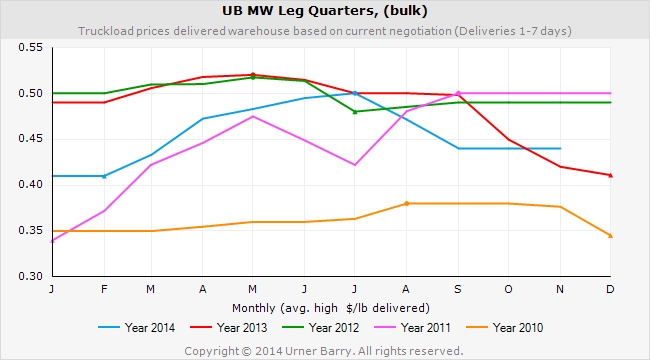

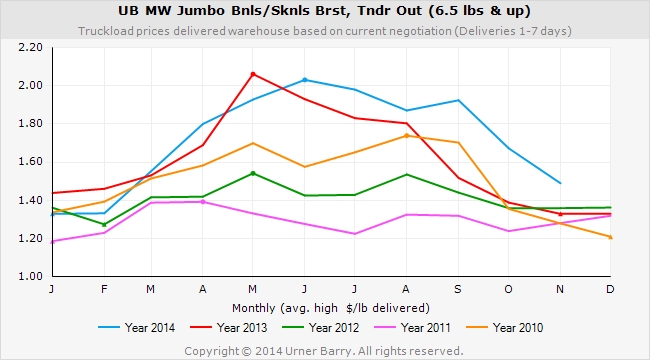

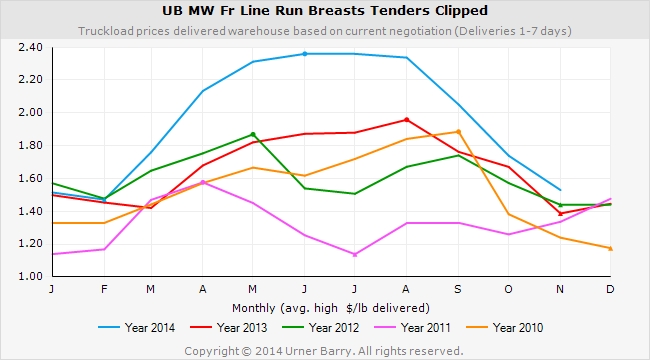

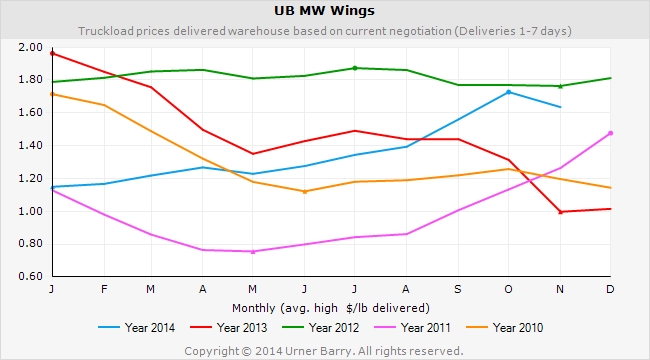

Those plants that target the big bird deboning market grow a relatively large bird. The dark meat from these birds is sold primarily as frozen leg quarters in the export market or as fresh whole legs to further processors. This dark meat is sold primarily at spot commodity prices, which prices exhibit fluctuations typical of commodity markets. The white meat produced by these plants is generally sold as fresh deboned breast meat, chicken tenders and whole or cut wings, and is likewise sold at spot commodity market prices for wings, tenders and boneless breast meat. As of October 31, 2014, the Company had the capacity to process 4.375 million head per week in its big bird deboning plants, and its results are materially impacted by fluctuations in the commodity market prices for leg quarters, boneless breast meat, chicken tenders and wings.

6

The Urner Barry spot market price for leg quarters, boneless breast meat, chicken tenders and whole wings for the past five calendar years is set forth below:

7

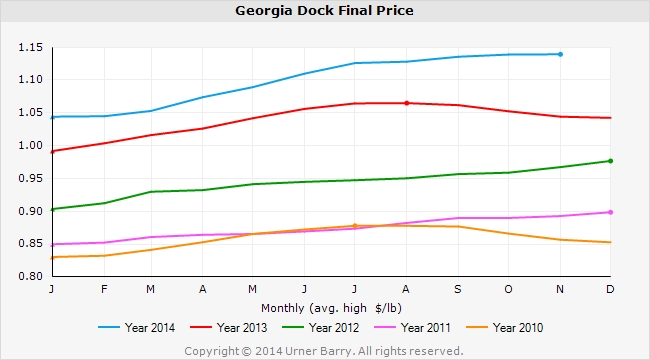

Those plants that target the chill pack retail grocery market grow a medium sized bird and cut and package the product in various sized individual trays to customers’ specifications. The trays are weighed and pre-priced primarily for customers to resell through retail grocery outlets. While the Company sells some of its chill pack product under store brand names, most of its chill pack production is sold under the Company’s Sanderson Farms® brand name. The Company has long term contracts (one to three years) with most of its chill pack customers, and the pricing of this product is based on a formula that uses the Georgia Dock whole bird price as its base. The Georgia Dock whole bird price is published each week by the Georgia Department of Agriculture and is based on its survey of prices and market conditions during the preceding week. As of October 31, 2014, the Company had the capacity to process 5.0 million head per week at its chill pack plants, and its results are materially impacted by fluctuations in the Georgia Dock price.

8

The Georgia Dock price for whole birds as published by the Georgia Department of Agriculture for the last five calendar years is set forth below:

Those companies with plants dedicated to the small bird market grow and process a relatively small chicken and market the finished product primarily to fast food and food service companies at negotiated flat prices, cost plus formulas or spot market prices. Based on benchmarking services used by the industry, this market segment has been the least profitable of the three primary market segments over most of the last ten years. The Company has no product dedicated to the small bird market.

Sales and Marketing

The Registrant’s chicken products are sold primarily to retailers (including national and regional supermarket chains and local supermarkets) and distributors located principally in the southeastern, southwestern, northeastern and western United States. The Registrant also sells its chicken products to casual dining operators and to United States based customers who resell the products outside of the continental United States. This wide range of customers, together with the Registrant’s product mix, provides the Registrant with flexibility in responding to changing market conditions in its effort to maximize profits. This flexibility also assists the Registrant in its efforts to reduce its exposure to market volatility, although its ability to do so is limited.

Sales and distribution of the Registrant’s chicken products are conducted primarily by sales personnel at the Registrant’s general corporate offices in Laurel, Mississippi, by customer service representatives at each of its processing complexes and one prepared chicken plant and through independent food brokers. Each complex has individual on-site distribution centers and uses the Registrant’s truck fleet, as well as contract carriers, for distribution of its products.

Generally, the Registrant prices much of its chicken products based upon weekly and daily market prices reported by the Georgia Department of Agriculture and by private firms. Consistent with the industry, the Registrant’s profitability is impacted by such market prices, which may fluctuate substantially and exhibit cyclical and seasonal characteristics. The Registrant will adjust base prices depending upon value added, volume, product mix and other factors. While base prices may change weekly and daily, the Registrant’s adjustments are generally negotiated from time to time with the Registrant’s customers. The Registrant’s sales are generally made on an as-ordered basis, and the Registrant maintains some long-term sales contracts with its customers.

From time to time, the Registrant may use television, radio and newspaper advertising, point of purchase material and other marketing techniques to develop consumer awareness of and brand recognition for its Sanderson Farms® products. The Registrant has achieved a high level of public awareness and acceptance of its products in its core markets. Brand awareness is an important element of the Registrant’s marketing philosophy, and it intends to continue brand name merchandising of its products. During calendar 2004, the Company launched an advertising campaign designed to distinguish the Company’s fresh chicken products from competitors’ products. The campaign noted that the Company’s product is a natural product free from salt, water and other additives that some competitors inject into their fresh chicken. The Company continues to use various media to communicate this message today.

9

The Registrant’s prepared chicken items are sold nationally and regionally, primarily to distributors and national food service accounts. Sales of such products are handled by sales personnel of the Registrant and by independent food brokers. Prepared chicken items are distributed from the Registrant’s plant in Flowood, Mississippi, through arrangements with contract carriers.

Production and Facilities

General. The Registrant is a vertically-integrated producer of fresh and frozen chicken products, controlling the production of hatching eggs, hatching, feed manufacturing, growing, processing and packaging of its product lines.

Breeding and Hatching. The Registrant maintains its own breeder flocks for the production of hatching eggs. The Registrant’s breeder flocks are acquired as one-day old chicks (known as pullets and cockerels) from primary breeding companies that specialize in the production of genetically designed breeder stock. As of October 31, 2014, the Registrant maintained contracts with 53 independent contract pullet producers for the grow-out of pullets (growing the pullet to the point at which it is capable of egg production, which takes approximately six months). Thereafter, the mature breeder flocks are transported by Registrant’s vehicles to breeder farms that are maintained, as of October 31, 2014, by 132 independent contractors under the Registrant’s supervision. Eggs produced on the farms of independent contract breeder producers are transported to Registrant’s hatcheries in Registrant’s vehicles.

The Registrant owns and operates eight hatcheries located in Mississippi, Texas, Georgia and North Carolina where eggs are incubated, vaccinated and hatched in a process requiring 21 days. The chicks are vaccinated against common poultry diseases and are transported by Registrant’s vehicles to independent contract grow-out farms. As of October 31, 2014, the Registrant’s hatcheries were capable of producing an aggregate of approximately 10.0 million chicks per week.

Grow-out. The Registrant places its chicks on the farms of 609 independent contract broiler producers, as of October 31, 2014, located in Mississippi, Texas, Georgia and North Carolina where broilers are grown to an age of approximately seven to nine weeks. The farms provide the Registrant with sufficient housing capacity for its operations, and are typically family-owned farms operated under contract with the Registrant. The farm owners provide facilities, utilities and labor; the Registrant supplies the day-old chicks, feed and veterinary and technical services. The farm owner is compensated pursuant to an incentive formula designed to promote production cost efficiency.

Historically, the Registrant has been able to accommodate expansion in grow-out facilities through additional contract arrangements with independent contract producers.

Feed Mills. An important factor in the grow-out of chickens is the rate at which chickens convert feed into body weight. The Registrant purchases primary feed ingredients on the open market. Ingredients include corn and soybean meal, which historically have been the largest cost components of the Registrant’s total feed costs. The quality and composition of the feed are critical to the conversion rate, and accordingly, the Registrant formulates and produces its own feed. As of October 31, 2014, the Registrant operated seven feed mills, four of which are located in Mississippi, one in Texas, one in Georgia and one in North Carolina. The Registrant’s annual feed requirements for fiscal 2014 were approximately 3,577,000 tons, and it has the capacity to produce approximately 4,773,600 tons of finished feed annually under current configurations.

Feed grains are commodities subject to volatile price changes caused by weather, size of the harvest, transportation and storage costs, domestic and export demand and the agricultural and energy policies of the United States and foreign governments. On October 31, 2014, the Registrant had the capacity to store approximately 2,989,000 bushels of corn at its feed mills, which was sufficient to store all of its weekly requirements for corn. Generally, the Registrant purchases its corn and other feed ingredients at current prices from suppliers and, to a limited extent, directly from farmers. Feed grains are available from an adequate number of sources. Although the Registrant has not experienced and does not anticipate problems in securing adequate supplies of feed grains, price fluctuations of feed grains have a direct and material effect upon the Registrant’s profitability. Although the Registrant attempts to manage the risk of volatile price changes in grain markets by sometimes purchasing grain at current prices for future delivery, it cannot eliminate the potentially adverse effect of grain price increases.

Processing. Once broilers reach processing weight, they are transported to the Registrant’s processing plants. These plants use modern, highly automated equipment to process and package the chickens. The Registrant’s McComb, Mississippi processing plant operates two processing lines on a double shift basis and had the capacity to process approximately 1,250,000 chickens per week on October 31, 2014. The Registrant’s Collins, Mississippi processing plant operates two processing lines on a double shift basis and had the capacity to process approximately 1,250,000 chickens per week on October 31, 2014. The Registrant’s Bryan, Texas processing plant operates two processing lines on a double shift basis and had the capacity to process approximately 1,250,000 chickens per week on October 31, 2014. The Registrant’s Laurel and Hazlehurst, Mississippi and

10

Hammond, Louisiana processing plants operate on a double shift basis and collectively had the capacity to process approximately 1,875,000 chickens per week on October 31, 2014. The Registrant’s Moultrie, Georgia processing plant operates two processing lines on a double shift basis and had the capacity to process approximately 1,250,000 chickens per week on October 31, 2014. The Registrant’s Waco, Texas processing plant operates two processing lines on a double shift basis and had the capacity to process approximately 1,250,000 chickens per week on October 31, 2014. The Registrant’s Kinston, North Carolina processing plant operates two processing lines on a double shift basis and had the capacity to process approximately 1,250,000 chickens per week on October 31, 2014. At October 31, 2014, the Company’s deboning facilities were operating on a double shifted basis and had the capacity to produce approximately 10.7 million pounds of big bird boneless breast product and 8.2 million pounds of chill pack boneless breast product each week.

Sanderson Farms, Inc. (Foods Division). The facilities of Sanderson Farms, Inc. (Foods Division) are located in Flowood, Mississippi in a plant with approximately 75,000 square feet of refrigerated manufacturing and storage space. The plant uses highly automated equipment to prepare, process and freeze food items.

Executive Offices; Other Facilities. The Registrant’s laboratory and corporate offices are located on separate sites in Laurel, Mississippi. The office building houses the Company’s corporate offices, meeting facilities and computer equipment and constitutes the corporate headquarters. As of October 31, 2014, the Registrant operated 11 automotive maintenance shops, which service approximately 967 Registrant over-the-road and farm vehicles. In addition, the Registrant has one child care facility located near its Collins, Mississippi processing plant, serving over 150 children on October 31, 2014.

Quality Control

The Registrant believes that quality control is important to its business and conducts quality control activities throughout all aspects of its operations. The Registrant believes these activities are beneficial to efficient production and in assuring its customers receive wholesome, high quality products.

From its company owned laboratory in Laurel, Mississippi, the Director of Technical Services supervises the operation of a modern, well-equipped laboratory which, among other things, monitors sanitation at the hatcheries, quality and purity of the Registrant’s feed ingredients and feed, the health of the Registrant’s breeder flocks and broilers, and conducts microbiological tests of live chickens, facilities and finished products. The Registrant conducts on-site quality control activities at each of the nine processing plants and the prepared chicken plant.

Regulation

The Registrant’s facilities and operations are subject to regulation by various federal and state agencies, including, but not limited to, the Federal Food and Drug Administration (“FDA”), the United States Department of Agriculture (“USDA”), the Environmental Protection Agency, the Occupational Safety and Health Administration and corresponding state agencies. The Registrant’s chicken processing plants are subject to continuous on-site inspection by the USDA. The Sanderson Farms, Inc. (Foods Division) prepared chicken plant operates under the USDA’s Total Quality Control Program, which is a strict self-inspection plan written in cooperation with and monitored by the USDA. The FDA inspects the production at the Registrant’s feed mills.

Compliance with existing regulations has not had a material adverse effect upon the Registrant’s earnings or competitive position in the past. Management believes that the Registrant is in substantial compliance with existing laws and regulations relating to the operation of its facilities and does not know of any major capital expenditures necessary to comply with such statutes and regulations.

The Registrant takes extensive precautions to ensure that its flocks are healthy and that its processing plants and other facilities operate in a healthy and environmentally sound manner. Events beyond the control of the Registrant, however, such as an outbreak of disease in its flocks or the adoption by governmental agencies of more stringent regulations, could materially and adversely affect its operations.

Competition

The Registrant is subject to significant competition from regional and national firms in all markets in which it competes. Some of the Registrant’s competitors have greater financial and marketing resources than the Registrant.

The primary methods of competition are price, product quality, number of products offered, brand awareness and customer service. The Registrant has emphasized product quality and brand awareness through its advertising strategy. See

11

“Business — Sales and Marketing”. Although poultry is relatively inexpensive in comparison with other meats, the Registrant competes indirectly with the producers of other meats and fish, since changes in the relative prices of these foods may alter consumer buying patterns.

One customer accounted for more than 10% of the Registrant’s consolidated sales for the years ended October 31, 2014, 2013 and 2012. Sales to that customer accounted for 15.9%, 14.2% and 13.0% of the Company’s consolidated net sales in fiscal 2014, 2013 and 2012, respectively. The Company does not believe the loss of any single customer would have a material adverse effect on the Company because it could sell poultry earmarked for any single customer to alternative customers at market prices.

Sources of Supply

During fiscal 2014, the Registrant purchased its pullets and cockerels from a single major breeder. The Registrant has found the genetic breeds or cross breeds supplied by this company produce chickens most suitable to the Registrant’s purposes. The Registrant has no written contracts with this breeder for the supply of breeder stock. Other sources of breeder stock are available, and the Registrant continually evaluates these sources of supply.

Should breeder stock from its present supplier not be available for any reason, the Registrant believes that it could obtain adequate breeder stock from other suppliers.

Other major raw materials used by the Registrant include feed grains and other feed ingredients, cooking ingredients and packaging materials. The Registrant purchases these materials from a number of vendors and believes that its sources of supply are adequate for its present needs. The Registrant does not anticipate any difficulty in obtaining these materials in the future.

Seasonality

The demand for the Registrant’s chicken products generally is greatest during the spring and summer months and lowest during the winter months.

Trademarks

The Registrant has registered with the United States Patent and Trademark Office the trademark Sanderson Farms®, which it uses in connection with the distribution of its prepared chicken and premium grade chill pack products. The Registrant considers the protection of this trademark to be important to its marketing efforts due to consumer awareness of and loyalty to the Sanderson Farms® label. The Registrant also has registered with the United States Patent and Trademark Office seven other trademarks that are used in connection with the distribution of chicken and other products and for other competitive purposes.

The Registrant, over the years, has developed important non-public proprietary information regarding product related matters. While the Registrant has internal safeguards and procedures to protect the confidentiality of such information, it does not generally seek patent protection for its technology.

Employee and Labor Relations

As of October 31, 2014, the Registrant had 11,461 employees, including 1,471 salaried and 9,990 hourly employees. A collective bargaining agreement with the United Food and Commercial Workers International Union covering 474 hourly employees who work at the Registrant’s processing plant in Hammond, Louisiana expires on November 30, 2016. This collective bargaining agreement has a grievance procedure and no strike-no lockout clauses that should assist in maintaining stable labor relations at the Hammond plant.

The production, maintenance and clean-up employees at the Company’s Bryan, Texas poultry processing facility are represented by the United Food and Commercial Workers Union Local #408, AFL-CIO. A collective bargaining agreement covering 1,248 employees expires on December 31, 2014, and negotiations are ongoing to extend this agreement. The collective bargaining agreement has a grievance procedure and no strike-no lockout clause that should assist in maintaining stable labor relations at the Bryan, Texas processing facility.

(d) FINANCIAL INFORMATION ABOUT GEOGRAPHIC AREAS

All of the Company’s operations are domiciled in the United States. All of the Company’s products sold in the Company’s fiscal years 2014, 2013 and 2012 were produced in the United States and all long-lived assets of the Company are

12

domiciled in the United States. Gross domestic sales for fiscal years 2014, 2013 and 2012 totaled approximately $2,556.7 million, $2,457.8 million and $2,126.5 million, respectively.

The Company sells certain of its products to foreign customers and customers who resell the product in foreign markets. These foreign markets are primarily Russia, Eastern Europe, China, Mexico and the Caribbean. These gross export sales for fiscal years 2014, 2013 and 2012 totaled approximately $282.3 million, $292.6 million and $318.7 million, respectively. The Company’s export sales are facilitated through independent food brokers located in the United States and the Company’s internal sales staff.

(e) AVAILABLE INFORMATION

Our address on the World Wide Web is http://www.sandersonfarms.com. The information on our web site is not a part of this document. Our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, and all amendments to those reports and the Company’s corporate code of conduct are available, free of charge, through our web site as soon as reasonably practicable after they are filed with the SEC. Information concerning corporate governance matters is also available on the website.

13

Item 1A. | Risk Factors |

In addition to the other information set forth in this report, you should carefully consider the following factors, which could materially affect our business, financial condition or results of operations in future periods. The risks described below are not the only risks facing our Company. Additional risks not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition or results of operations in future periods.

Industry cyclicality can affect our earnings, especially due to fluctuations in commodity prices of feed ingredients and chicken.

Profitability in the poultry industry is materially affected by the commodity prices of feed ingredients, chicken, and, to a lesser extent, alternative proteins. These prices are determined by supply and demand factors, and supply and demand factors in respect of feed ingredients and chicken may not correlate. As a result, the poultry industry is subject to wide fluctuations that are called cycles. For example, grain prices during 2011 were high, while prices for chicken products did not increase proportionally, and the Company lost money. During 2012 and 2013, grain prices remained high, but market prices for chicken also increased, and the Company was profitable. During fiscal 2014, grain prices declined while market prices for chicken increased, and the Company earned near record-high margins. Typically we do well when chicken prices are high and feed prices are low. We do less well, and sometimes have losses, when chicken prices are low and feed prices are high. It is very difficult to predict when these cycles will occur. All we can safely predict is that they do and will occur.

Various factors can affect the supply of corn and soybean meal, which are the primary ingredients of the feed we use. In particular, global weather patterns, including adverse weather conditions that may result from climate change, the global level of supply inventories and demand for feed ingredients, currency fluctuations and the agricultural and energy policies of the United States and foreign governments all affect the supply of feed ingredients. Weather patterns often change agricultural conditions in an unpredictable manner. A sudden and significant change in weather patterns could affect supplies of feed ingredients, as well as both the industry’s and our ability to obtain feed ingredients, grow chickens or deliver products. For example, historic drought conditions in the Midwestern United States in 2012 had a significant adverse effect on the supply and price of feed grains in fiscal 2012 and the first three quarters of 2013. In recent years, demand for corn from ethanol producers has resulted in sharply higher costs for corn and other grains.

Increases in the prices of feed ingredients will result in increases in raw material costs and operating costs. Because prices for our products are related to the commodity prices of chickens, which depend on the supply and demand dynamics of fresh chicken, we typically are not able to increase our product prices to offset these increased grain costs. We periodically enter into contracts to purchase feed ingredients at current prices for future delivery to manage our feed ingredient costs. This practice could reduce, but does not eliminate, the risk of increased operating costs from commodity price increases. In addition, if we are unsuccessful in our grain buying strategy, we could actually pay a higher cost for feed ingredients than we would if we purchased at current prices for current delivery.

Prepared chicken and poultry inventories, and inventories of feed, eggs, medication, packaging supplies and live chickens, are stated on our balance sheet at the lower of cost (first-in, first-out method) or market value. Our cost of sales is calculated during a period by adding the value of our inventories at the beginning of the period to the cost of growing, processing and distributing products produced during the period and subtracting the value of our inventories at the end of the period. If the market prices of our inventories are below the accumulated cost of those inventories at the end of a period, we would record adjustments to write down the carrying value of the inventory from cost to market value. These write-downs would directly increase our cost of sales by the amount of the write-downs. This risk is greatest when the costs of feed ingredients are high and the market value for finished poultry products is declining.

For example, for the fiscal year ended October 31, 2011, we recorded a charge of $9 million to lower the value of live broiler inventories on hand at that date from cost to estimated market value because the estimated market price for the products to be produced from those live chickens, when sold, was estimated to be below the estimated cost to grow, process and distribute those chickens. The $9 million adjustment to inventory on October 31, 2011, effectively absorbed into fiscal 2011 a portion of the costs to grow, process and distribute chickens that we would have otherwise incurred in the first quarter of fiscal 2012, thereby benefiting fiscal 2012. Any similar adjustments that we make in the future could be material, and could materially adversely affect our financial condition and results of operations. The Company made no such adjustment during fiscal 2014.

Outbreaks of avian disease, such as avian influenza, or the perception that outbreaks may occur, can significantly restrict our ability to conduct our operations and can significantly affect demand for our products.

14

We take reasonable precautions to ensure that our flocks are healthy and that our processing plants and other facilities operate in a sanitary and environmentally sound manner. Nevertheless, events beyond our control, such as the outbreak of avian disease, even if it does not affect our flocks, could significantly restrict our ability to conduct our operations or our sales. An outbreak of disease could result in governmental restrictions on the import and export of fresh and frozen chicken, including our fresh and frozen chicken products, or other products to or from our suppliers, facilities or customers, or require us to destroy one or more of our flocks. This could result in the cancellation of orders by our customers and create adverse publicity that may have a material adverse effect on our business, reputation and prospects. In addition, world-wide fears about avian disease, such as avian influenza, have, in the past, depressed demand for fresh chicken, which adversely impacted our sales.

In previous years there has been substantial publicity regarding a highly pathogenic Asian strain of avian influenza, or AI, known as H5N1, which has affected Asia since 2002 and which has been found in Europe, the Middle East and Africa. It is widely believed that this strain of AI is spread by migratory birds, such as ducks and geese. There have also been some cases where this strain of AI is believed to have passed from birds to humans as humans came into contact with live birds that were infected with the disease. During the first calendar quarter of 2013, there was also substantial publicity regarding a low pathogenic strain of avian influenza, known as H7N9, which affected eastern and northern China. It is widely believed that H7N9 circulates in wild birds and may have been transmitted to domestic poultry in live bird markets in and around Shanghai and Beijing. It is also believed that the virus has passed from live birds to humans as humans came into contact with live birds that were infected with the disease. Through May 2013, the virus was believed to have sickened at least 130 people and caused at least 33 deaths. There have been no reported incidents of the virus since May 2013. No human to human transmission of the disease has been proved, and there is no evidence to suggest that the consumption of properly prepared and cooked poultry could transmit the virus to humans. However, fear associated with this outbreak dampened demand for poultry, including our products, in the affected areas of China. A recurrence of this outbreak, or others similar to it, could have a material negative effect on world demand for poultry, including demand for our products.

Although the Asian strains of AI have not been identified in North America, there have been outbreaks of both low and high pathogenic strains of avian influenza in North America, including in the U.S. in 2002 and 2004 and in Mexico in 2005 and 2012. In addition, low pathogenic strains of the AI virus were detected in wild birds in the United States in 2006. During fiscal 2013, a highly pathogenic strain of avian influenza, known as H7N3, affected live poultry in several states in central Mexico. The Company has no operations in Mexico, and our live chickens have not been affected by this outbreak. However, in an effort to prevent the spread of the virus, the Mexican government and poultry industry reportedly culled approximately 27.5 million birds and undertook an extensive vaccination program in the affected areas of the country. These practices reduced the supply of available poultry in Mexico, and increased demand in Mexico for poultry produced in the United States, including our products. Although the outbreaks in North America have not generated the same level of concern, or received the same level of publicity or been accompanied by the same reduction in demand for poultry products in certain countries as that associated with the Asian strains, they have nevertheless impacted our sales. Accordingly, even if the Asian strains do not spread to North America, we cannot assure you that they will not materially adversely affect domestic or international demand for poultry produced in North America, and, if they were to spread to North America, we cannot assure you that they would not significantly affect our operations or the demand for our products, in each case in a manner having a material adverse effect on our business, reputation or prospects.

A decrease in demand for our products in the export markets could materially and adversely affect our results of operations.

Nearly all of our customers are based in the United States, but some of our product is sold directly to foreign customers, and some of our United States based customers resell poultry products in the export markets. Our chicken products are sold in Russia and other former Soviet countries, China and Mexico, among other countries. Approximately 10.0% of our gross sales in fiscal 2014 were to export markets, including approximately $91.2 million to Mexico, $62.1 million to China and $36.0 million to Russia. Any disruption to the export markets, such as trade embargoes, tariffs, import bans, duties or quotas could materially impact our sales or create an oversupply of chicken in the United States. This, in turn, could cause domestic poultry prices to decline. Any quotas or bans in the future could materially and adversely affect our sales and our results of operations.

On February 5, 2010, China announced that it would impose anti-dumping duties on U.S. chicken products beginning on February 13, 2010. The duty applicable to Sanderson Farms products was 64.5%. On April 28, 2010, China imposed countervailing duties on United States chicken products, raising the duty applicable to Sanderson Farms’ products by 6.1% to 70.6%. A challenge to China’s anti-dumping determination was filed by the U.S. Government with the World Trade Organization (WTO), which ruled in favor of the U.S. on September 25, 2013. China did not appeal the WTO ruling. On July 8, 2014, China announced that it had re-investigated charges that United States chicken exporters dump product in the China domestic market, causing substantial harm to the local industry. Despite the WTO’s findings, China announced that its re-investigation revealed that United States exporters continue to dump product into the local China market. While China announced lower anti-dumping tariffs on certain United States producers in its July 8, 2014 announcement, the tariffs actually

15

increased on most United States producers, including Sanderson Farms. The United States government continues to believe that the WTO ruling was correct and that China’s anti-dumping determination lacks merit. Accordingly, the United States government intends to challenge China’s most recent actions at the WTO, but no ruling from the WTO is expected for several months following the challenge.

On August 6, 2012, Mexico imposed anti-dumping duties on chicken drumstick and thigh imports from the United States, establishing the duty applicable to Sanderson Farms’ products at 25.7%. However, Mexico suspended the implementation of the duties amidst concerns that food inflation may occur as a result. While we do not know whether or when Mexico might impose the anti-dumping duties, their implementation could reduce our revenues and profits. On October 2, 2012, pursuant to the North American Free Trade Agreement (NAFTA), the U.S. poultry industry, including Sanderson Farms, Inc., filed a complaint challenging the anti-dumping determination issued by Mexico. The complaint is currently pending.

On August 8, 2014, Russia announced economic sanctions against countries that have imposed economic sanctions on Russia in response to Russia’s recent actions in Ukraine. The Russian sanctions include a ban on imports of chicken from the United States. During fiscal 2014, Sanderson Farms sold approximately 90.9 million pounds of chicken for approximately $36.0 million to customers who resold the product in Russia. Unlike previous Russian bans on United States poultry imports when Russia represented a much larger share of total industry exports, the current ban has had a relatively smaller impact because Russia represented only 7% of total United States exports of chicken during calendar 2013.

The poultry industry is highly competitive. Some of our competitors have greater financial and marketing resources than we have.

In general, the competitive factors in the U.S. poultry industry include:

• | price; |

• | product quality; |

• | brand identification; |

• | breadth of product line and |

• | customer service. |

Competitive factors vary by major markets. In the food service market, competition is based on consistent quality, product development, service and price. In the U.S. retail grocery market, we believe that competition is based on product quality, brand awareness, price and customer service. Our success depends in part on our ability to manage costs and be efficient in the highly competitive poultry industry.

The loss of our major customers could have a material adverse effect on our results of operations.

Our sales to our top ten customers represented approximately 50.8% of our net sales during the 2014 fiscal year. Our non-chill pack customers, with all of whom we do not have long-term contracts, could significantly reduce or cease their purchases from us with little or no advance notice, which could materially and adversely affect our sales and results of operations.

We must identify changing consumer preferences and develop and offer food products to meet their preferences.

Consumer preferences evolve over time and the success of our food products depends on our ability to identify the tastes and dietary habits of consumers and to offer products that appeal to their preferences. We introduce new products and improved products from time to time and incur significant development and marketing cost. If our products fail to meet consumer preference, then our strategy to grow sales and profits with new products will be less successful.

Inclement weather, such as excessive heat or storms, could hurt our flocks, which could in turn have a material adverse effect on our results of operations.

Extreme weather in the Gulf South and Mid-Atlantic regions where we operate, such as extreme temperatures, hurricanes or other storms, could impair the health or growth of our flocks or interfere with our hatching, production or shipping operations. Some scientists believe that climate change could increase the frequency and severity of adverse weather events. Extreme weather, regardless of its cause, could affect our business due to power outages; fuel shortages; damage to infrastructure from powerful winds, rising water or extreme temperatures; disruption of shipping channels; less efficient or non-

16

routine operating practices necessitated by adverse weather or increased costs of insurance coverage in the aftermath of such events, among other things. Any of these factors could materially and adversely affect our results of operations. We may not be able to recover through insurance all of the damages, losses or costs that may result from weather events, including those that may be caused by climate change.

We rely heavily on the services of key personnel.

We depend substantially on the leadership of a small number of executive officers and other key employees. We have employment agreements with only three of these persons (our Chairman of the Board and Chief Executive Officer, our President and Chief Operating Officer, and our Treasurer and Chief Financial Officer), and those with whom we have no agreement would not be bound by non-competition agreements or non-solicitation agreements if they were to leave us. The loss of the services of these persons could have a material adverse effect on our business, results of operations and financial condition. In addition, we may not be able to attract, retain and train the new management personnel we need for our new complexes, or do so at the pace necessary to sustain our significant company growth.

We depend on the availability of, and good relations with, our employees and contract growers.

We have approximately 11,461 employees, approximately 15.0% of which are covered by collective bargaining agreements. In addition, we contract with approximately 794 independent contract poultry producers in Mississippi, Texas, North Carolina and Georgia for the grow-out of our breeder and broiler stock and the production of broiler eggs. Our operations depend on the availability of labor and contract growers and maintaining good relations with these persons and with labor unions. If we fail to maintain good relations with our employees or with the unions, we may experience labor strikes or work stoppages. If we do not attract and maintain contracts with our growers, including new growers for our new poultry complexes, our production operations could be negatively impacted and/or our growth could be restrained.

Failure of our information technology infrastructure or software could adversely affect our day-to-day operations and decision making processes and have an adverse effect on our performance.

We depend on accurate and timely information and numerical data from key software applications to aid our day-to-day business, financial reporting and decision-making and, in many cases, proprietary and custom-designed software is necessary to operate equipment in our feed mills, hatcheries and processing plants. We have put in place disaster recovery plans for our critical systems. However, any disruption caused by the failure of these systems, the underlying equipment, or communication networks could delay or otherwise adversely impact our day-to-day business and decision making, could make it impossible for us to operate critical equipment, and could have a materially adverse effect on our performance, if our disaster recovery plans do not mitigate the disruption. Disruptions could be caused by a variety of factors, such as catastrophic events or weather, power outages, or cyber-attacks on our systems by outside parties.

Immigration legislation and enforcement may affect our ability to hire hourly workers.

Immigration reform continues to attract significant attention in the public arena and the United States Congress. If new immigration legislation is enacted at the federal level or in states in which we do business, such legislation may contain provisions that could make it more difficult or costly for us to hire United States citizens and/or legal immigrant workers. In such case, we may incur additional costs to run our business or may have to change the way we conduct our operations, either of which could have a material adverse effect on our business, operating results and financial condition. Also, despite our past and continuing efforts to hire only United States citizens and/or persons legally authorized to work in the United States, increased enforcement efforts with respect to existing immigration laws by governmental authorities may disrupt a portion of our workforce or our operations at one or more of our facilities, thereby negatively impacting our business. Officials with the Bureau of Immigration and Customs Enforcement have informally indicated an intent to focus their enforcement efforts on red meat and poultry processors.

If our poultry products become contaminated, we may be subject to product liability claims and product recalls.

Poultry products may contain disease-producing organisms, or pathogens, such as Listeria monocytogenes, Salmonella and generic E. coli. These pathogens are generally found in the environment and, as a result, there is a risk that they, as a result of food processing, could be present in our processed poultry products. These pathogens can also be introduced as a result of improper handling by our customers, consumers or third parties after we have shipped the products. We control these risks through careful processing and testing of our finished product, but we cannot entirely eliminate them. We have little, if any, control over proper handling once the product has been shipped. Nevertheless, contamination that results from improper handling by our customers, consumers or third parties, or tampering with our products by those persons, may be blamed on us.

17

Any publicity regarding product contamination or resulting illness or death could adversely affect us even if we did not cause the contamination and could have a material adverse effect on our business, reputation and future prospects. We could be required to recall our products if they are contaminated or damaged and product liability claims could be asserted against us.

We are exposed to risks relating to product liability, product recalls, property damage and injuries to persons, for which insurance coverage is expensive, limited and potentially inadequate.

Our business operations entail a number of risks, including risks relating to product liability claims, product recalls, property damage and injuries to persons. We currently maintain insurance with respect to certain of these risks, including product liability and recall insurance, property insurance, workers compensation insurance and general liability insurance, but in many cases such insurance is expensive and difficult to obtain. We cannot assure you that we can maintain on reasonable terms sufficient coverage to protect us against losses due to any of these events.

We would be adversely affected if we expand our business by acquiring other businesses or by building new processing plants, but fail to successfully integrate the acquired business or run a new plant efficiently.

We regularly evaluate expansion opportunities such as acquiring other businesses or building new processing plants. Significant expansion involves risks such as additional debt, integrating the acquired business or new plant into our operations, attracting and retaining growers, and identifying customers for the additional product we generate. In evaluating expansion opportunities, we carefully consider the effect that financing the opportunity will have on our financial condition. Successful expansion depends on our ability to integrate the acquired business or efficiently run the new plant. If we are unable to do this, expansion could adversely affect our operations, financial results and prospects.

Governmental regulation is a constant factor affecting our business.

The poultry industry is subject to federal, state, local and foreign governmental regulation relating to the processing, packaging, storage, distribution, advertising, labeling, quality and safety of food products. Unknown matters, new laws and regulations, or stricter interpretations of existing laws or regulations may materially affect our business or operations in the future. Our failure to comply with applicable laws and regulations could subject us to administrative penalties and civil remedies, including fines, injunctions and recalls of our products. Our operations are also subject to extensive and increasingly stringent regulations administered by the Environmental Protection Agency, which pertain to the discharge of materials into the environment and the handling and disposition of wastes. Failure to comply with these regulations can have serious consequences, including civil and administrative penalties and negative publicity.

The removal of federal meat and poultry inspectors from our plants due to federal government budget constraints, or any other reason, could materially and adversely affect our results of operations.

The Poultry Products Inspection Act prohibits the production, processing or interstate distribution of poultry meat without federal inspection. To implement this law, the United States Department of Agriculture (or USDA) stations inspectors at our poultry processing plants to observe our operations.

The Budget Control Act of 2011 mandates mandatory cuts in the budgets of many governmental agencies in the United States. Such cuts, commonly referred to as “sequestration,” took effect on March 1, 2013.

In a letter dated February 12, 2013, Thomas J. Vilsack, the U.S. Secretary of Agriculture, indicated that while furloughing food safety inspectors is the “last option” the USDA would implement to achieve necessary sequestration cuts, such action may be necessary in order to comply with the mandates of the Budget Control Act of 2011. Because applicable law would prohibit us from operating our poultry processing plants without the presence of federal inspectors, we would have to shut down our processing plants and our live chickens would continue to mature, possibly reaching weights that exceed the market standards demanded by our customers. In addition, live chickens would likely experience significantly higher mortality due to the higher live weights. Our inability to process chickens at our poultry processing plants for an extended period of time would materially disrupt our operations and our ability to deliver our product.

To date, funding for meat inspectors has been provided at levels adequate to allow uninterrupted operations. However, if funding for the USDA inspection program is not maintained, we could experience the material adverse effects described above.

Our stock price may be volatile.

18

The market price of our common stock could be subject to wide fluctuations in response to factors such as the following, many of which are beyond our control:

• | market cyclicality and fluctuations in the price of feed grains and chicken products, as described above; |

• | quarterly variations in our operating results, or results that vary from the expectations of securities analysts and investors; |

• | changes in investor perceptions of the poultry industry in general, including our competitors; and |

• | general economic and competitive conditions. |

In addition, purchases or sales of large quantities of our stock, or significant short positions in our stock, could have an unusual or adverse effect on our market price.

Anti-takeover provisions in our charter and by-laws, as well as certain provisions of Mississippi law, may make it difficult for anyone to acquire us without approval of our board of directors.

Our articles of incorporation and by-laws contain provisions that may discourage attempts to acquire control of our company without the approval of our board of directors. These provisions, among others, include a classified board of directors, advance notification requirements for stockholders to nominate persons for election to the board and to make stockholder proposals, and special stockholder voting requirements. These measures, and any others we may adopt in the future, as well as applicable provisions of Mississippi law, may discourage offers to acquire us and may permit our board of directors to choose not to entertain offers to purchase us, even offers that are at a substantial premium to the market price of our stock. Our stockholders may therefore be deprived of opportunities to profit from a sale of control of our company, and as a result, may adversely affect the marketability and market price of our common stock.

Weak national or global economic conditions could negatively impact our business.

Our business may be adversely affected by weak national or global economic conditions, including inflation, unfavorable currency exchange rates and interest rates, the lack of availability of credit on reasonable terms, changes in consumer spending rates and habits, unemployment and underemployment, and a tight energy supply and rising energy costs. Our business could be negatively impacted if efforts and initiatives of the governments of the United States and other countries to manage and stimulate the economy fail or result in worsening economic conditions. Deteriorating economic conditions could negatively impact consumer demand for protein generally or our products specifically, consumers’ ability to afford our products, or consumer habits with respect to how they spend their food dollars.

Disruptions in credit and other financial markets caused by deteriorating or weak national and international economic conditions could, among other things, make it more difficult for us, our customers or our growers or prospective growers to obtain financing and credit on reasonable terms, cause lenders to change their practice with respect to the industry generally or our company specifically in terms of granting credit extensions and terms, impair the financial condition of our customers, suppliers or growers making it difficult for them to meet their obligations and supply raw material, or impair the financial condition of our insurers, making it difficult or impossible for them to meet their obligations to us.

The construction and potential benefits of our new facilities are subject to risks and uncertainties.

In August 2009, we began construction of a poultry complex in Kinston, North Carolina. The Kinston, North Carolina, complex began initial operations during January 2011 and was at near full capacity in March 2012. On February 14, 2013, we announced the selection of sites in and near Palestine, Texas for the construction of a new poultry complex, and construction began on or about October 1, 2013. Our ability to complete its construction on a timely basis and within budget is subject to a number of risks and uncertainties described below. In addition, the new complex may not generate the benefits we expect if demand for the products to be produced by it is different from what we expect.

In order to complete construction of the new Palestine, Texas facility and begin operations, we will need to take a significant number of steps and obtain a number of approvals, none of which we can assure you will be obtained. In particular we need to:

• | identify and enter into contracts with a sufficient number of growers for the new complex; |

• | complete construction on time; and |

19

• | train our workforce. |

If we are unable to complete construction on schedule, attract growers, find customers for the additional product generated by the complex, run the complex efficiently, or otherwise achieve the expected benefits of our new facilities, our business could be negatively impacted.

We cannot assure you that we will be able to complete such steps on a timely basis, or at all, or on terms that are reasonable or consistent with our expectations.

Item 1B. | Unresolved Staff Comments |

Not applicable.

Item 2. | Properties |

The Registrant’s principal properties are as follows:

Use | Location (City, State) |

Poultry processing plant, hatchery and feedmill | Laurel, Mississippi |

Poultry processing plant, hatchery and feedmill | McComb, Mississippi |

Poultry processing plant, hatchery and feedmill | Hazlehurst and Gallman, Mississippi |

Poultry processing plant, hatchery and feedmill | Bryan and Robertson Counties, Texas |

Poultry processing plant, hatchery and feedmill | Moultrie and Adel, Georgia |

Poultry processing plant, hatchery and feedmill | Kinston and Lenoir County, North Carolina |

Poultry processing plant, hatchery and feedmill | Palestine and Freestone County, Texas |

Poultry processing plant and hatchery | Waco, Texas |

Poultry processing plant | Hammond, Louisiana |

Poultry processing plant, hatchery, child care facility and feedmill | Collins, Mississippi |

Prepared chicken plant | Flowood, Mississippi |

Corporate general offices and technical laboratory | Laurel, Mississippi |

The Registrant owns substantially all of its major operating facilities with the following exceptions: one processing plant and feed mill complex is leased on an annual renewal basis through 2063 with an option to purchase at a nominal amount at the end of the lease term. One processing plant complex is leased under four leases, which are renewable annually through 2061, 2063, 2075 and 2073, respectively. Certain infrastructure improvements associated with a processing plant are leased under a lease that expired in 2013 and is thereafter renewable annually through 2091. The lease has been renewed for 2015. All of the foregoing leases are capital leases.

There are no material encumbrances on the major operating facilities owned by the Registrant, except that, under the terms of the Company’s revolving credit agreement, the Registrant may not pledge any additional assets as collateral other than fixed assets not to exceed $5.0 million at any one time.

Management believes that the Company’s facilities are suitable for its current purposes, and believes that current renovations and expansions will enhance present operations and allow for future internal growth.

Item 3. | Legal Proceedings |

As reported in Item 3 of the Company’s Form 10-K for the fiscal year ended October 31, 2013, and in its Form 10-Q for the quarter ended January 31, 2014, two of our former employees filed a complaint on February 16, 2012, alleging violations of the federal and State of Georgia’s Racketeer Influenced and Corrupt Organizations (“RICO”) Acts against us and seven of our current and former employees in the United States District Court for the Middle District of Georgia. The plaintiffs contend in their complaint that the Company conspired to knowingly hire undocumented immigrants at the Moultrie plant to “save Sanderson millions of dollars in labor costs because illegal aliens will work for extremely low wages”. The action was brought

20

as a class action lawsuit on behalf of all legally authorized hourly employees who worked at the Moultrie plant in the four years before the filing of the case. The plaintiffs sued for money damages, injunctive relief and revocation of our license to conduct business in the State of Georgia.

On September 13, 2012, the Court entered an Order granting a motion to dismiss the Complaint. After an Amended Complaint was filed by the plaintiffs on October 5, 2012, the Company filed a motion to dismiss the Amended Complaint on October 29, 2012. On February 5, 2013, the Court granted the Company’s motion to dismiss and entered an Order dismissing the Amended Complaint with prejudice. The plaintiffs filed a notice of appeal with the United States Court of Appeals for the Eleventh Circuit on February 8, 2013. On March 7, 2014, the United States Court of Appeals for the Eleventh Circuit affirmed the dismissal of the suit.