Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Northwest Bancshares, Inc. | a14-26172_18k.htm |

| EX-99.1 - EX-99.1 - Northwest Bancshares, Inc. | a14-26172_1ex99d1.htm |

| EX-99.2 - EX-99.2 - Northwest Bancshares, Inc. | a14-26172_1ex99d2.htm |

| EX-2.1 - EX-2.1 - Northwest Bancshares, Inc. | a14-26172_1ex2d1.htm |

| EX-99.4 - EX-99.4 - Northwest Bancshares, Inc. | a14-26172_1ex99d4.htm |

Exhibit 99.3

|

|

Welcome to Northwest |

|

|

2 Communications in this document do not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger, Northwest Bancshares, Inc. (“Northwest”) will file with the Securities and Exchange Commission (SEC) a Registration Statement on Form S-4 that will include a Proxy Statement of LNB Bancorp, Inc. (“LNB”), as well as other relevant documents concerning the proposed transaction. Shareholders are urged to read the Registration Statement and the Proxy Statement/Prospectus regarding the merger when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about Northwest and LNB, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Northwest at www.northwestsavingsbank.com under the tab “Investor Relations” and then under the heading “SEC Filings” or from LNB by accessing LNBs website at www.4lnb.com under the heading “Investor Relations” and then under the tab “LNB Bancorp” and then “SEC Filings” Northwest and LNB and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of LNB in connection with the proposed merger. Information about the directors and executive officers of Northwest is set forth in the proxy statement for Northwest’s 2014 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 5, 2014. Information about the directors and executive officers of LNB is set forth in the proxy statement for LNB’s 2014 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 11, 2014. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. Additional Information for Shareholders of LNB Bancorp, Inc. |

|

|

3 Forward-Looking Statement This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, descriptions of Northwest’s financial condition, results of operations, asset and credit quality trends and profitability and statements about the expected timing, completion, financial benefit and other effects of the proposed mergers. Forward-looking statements can be identified by the use of the words “anticipate,” “believe,” “expect,” “intend,” “could” and “should,” and other words of similar meaning. These forward-looking statements express management’s current expectations or forecasts of future events and, by their nature, are subject to risks and uncertainties and there are a number of factors that could cause actual results to differ materially from those in such statements. Factors that might cause such a difference include, but are not limited to: market, economic, operational, liquidity, credit and interest rate risks associated with Northwest’s ' business; competition; government legislation and policies (including the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act and its related regulations); ability of Northwest to execute its business plan, including the proposed acquisition of LNB Bancorp; changes in the economy which could materially impact credit quality trends and the ability to generate loans and gather deposits; failure or circumvention of Northwest’s internal controls; failure or disruption of our information systems; failure to adhere to or significant changes in accounting, tax or regulatory practices or requirements; new legal obligations or liabilities or unfavorable resolutions of litigations; other matters discussed in this presentation and other factors identified in Northwest’s Annual Report on Form 10-K and other periodic filings with the Securities and Exchange Commission. These forward-looking statements are made only as of the date of this presentation, and Northwest undertakes no obligation to release revisions to these forward-looking statements to reflect events or conditions after the date of this presentation. Non-GAAP Financial Measures These slides contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of the registrant's historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, Northwest has provided reconciliations within the slides, as necessary, of the non-GAAP financial measure to the most directly comparable GAAP financial measure. Disclosures |

|

|

Our Goals Today 4 Develop a comfort with Northwest’s culture, priorities and focus on employees and customers Build confidence in Northwest’s capabilities to compete and grow in Ohio Discuss the merits of our strategic alliance Present our vision for the future of our combined Ohio presence Present the merits of Northwest’s Employee Benefit Package Stimulate enthusiasm about joining the Northwest team |

|

|

ABOUT NORTHWEST 5 |

|

|

Northwest’s Culture Mission Statement “Building loyalty, trust and value among our Employees, Customers, Communities and Shareholders.” 6 |

|

|

Loyalty We believe that the most significant strength of our company is our employees. They are loyal, multi-tasking and customer-focused. They embrace our culture and support our philosophy. We believe that they care about our Company because our Company cares about them. 7 |

|

|

An Organization Built on Trust Our employees trust that the Board and Management will always do what is right for our employees, our customers and the Company. Our Board and Management trust that all Northwest employees will perform their duties to the best of their abilities. 8 |

|

|

Value 9 Northwest has demonstrated the ability to both safely leverage its capital and change its strategic direction when necessary. Leveraging Strategy Diversification & Profitability Strategy Asset Growth |

|

|

Value 10 Growth of our Franchise Since IPO About 50% of our balance sheet growth was organic. The other 50% was accomplished through mergers and acquisitions. Organic Growth 57 De Novo Branch Openings Merger and Acquisition activity: Branch Purchases – 11 acquisitions with 8 different banks from which we acquired 43 offices Whole Bank Acquisitions – 10 acquisitions from which we acquired 32 new offices We have also acquired an independent trust company, several wealth management companies, a retirement benefits consulting firm and several insurance benefit consulting firms Formed an Oil and Gas Advisory Group |

|

|

Northwest’s Current Footprint 11 Northwest Savings Bank Locations Northwest Consumer Discount Company Locations Pennsylvania 137 50 New York 19 0 Ohio 4 0 Maryland 4 0 TOTAL 164 50 |

|

|

Corporate Profile and Overview 164 retail banking locations 50 consumer finance 2,044 full-time equivalent employees Total assets of $7.82 billion Net loans of $5.88 billion Deposits of $5.71 billion 12 |

|

|

National Recognition 13 Loyalty For four of the last five years J.D. Power has recognized Northwest as having the highest customer satisfaction of any bank in the Mid-Atlantic Region Trust Named one of “Forbes 100 Most Trustworthy Companies” in 2009 and 2012 Named one of “Forbes 50 Most Trustworthy Financial Institutions” in 2013 Value For three consecutive years KBW named Northwest to its Bank Honor Roll for its financial performance over the past 10 years (only 30 to 40 banks recognized) Bank Directors’ Magazine “Top 50 (banks) Users of Capital in The Country” |

|

|

Value Price Performance Since IPO COMPARISON OF CUMULATIVE TOTAL RETURN* Among Northwest Bancshares, Inc., the S&P 500 Index and the SNL U.S. Bank Index * $100 invested on 12/31/08 in stock or index, including reinvestment of dividends. Fiscal year ending December 31. |

|

|

THE MERGER OF NORTHWEST BANK AND LORAIN NATIONAL BANK AN EXCITING OPPORTUNITY FOR BOTH COMPANIES 15 |

|

|

Keys to Success 16 A Focus on Our Employees and Customers Create an environment where Lorain National Bank employees are eager to join the Northwest team and contribute to our combined success Ensure a transition for LNB’s customers that is as seamless as possible |

|

|

Why Lorain National Bank? 17 Similar history, philosophies, culture and products and service mix LNB founded in 1905 – Northwest in 1894 Both institutions are true community banks Both have relatively simple and straightforward products and services Both focused on quality customer service Solid management team making great progress Good branches – good loan and deposit mixes Specialized indirect auto lending and SBA lending business lines would be new niches for Northwest and something we see as scalable Closer to our corporate offices than many of our existing regions |

|

|

Why Ohio? 18 Ohio is a natural extension of our market The bonds between eastern Ohio and western Pennsylvania will continue to strengthen with the ongoing development of the shale gas industry. Similarities in Midwest culture, values and work ethic Market similarities to Northwest’s best performing markets LNB’s presence in Lorain County, Ohio much like Northwest’s in Erie County, Pennsylvania (Number 2 in market share) Strong community presence and support Small towns in Ohio – small towns in Pennsylvania |

|

|

Northwest Regions 19 Northwest PA $1.80 billion Ohio $1.14 billion Southwest PA $1.03 billion Erie PA $800 million New York $617 million Central PA $599 million Eastern PA $485 million Maryland $270 million The addition of Lorain National Bank will make Northwest’s Ohio Region the bank’s second largest region. (by deposit size) |

|

|

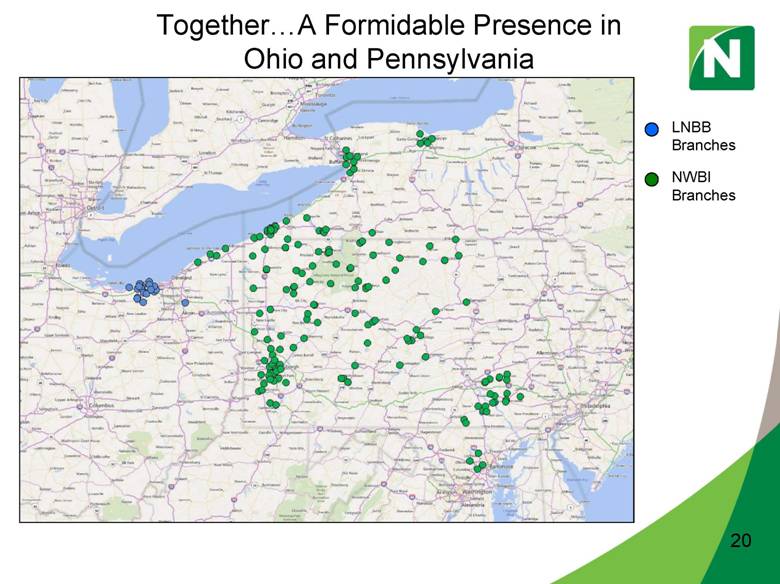

TogetherA Formidable Presence in Ohio and Pennsylvania 20 LNBB Branches NWBI Branches |

|

|

Our Vision for the Ohio Market LNB’s management team, led by Dan Klimas, will become Northwest’s management team for the Ohio Region and the foundation for future growth in this market. Regional headquarters will remain in Lorain. Northwest’s Ohio management team will have decision making authority supported by Northwest’s administrative and operations staff in Warren, PA. Northwest will continue LNB’s tradition of community support and involvement in the Ohio market. 21 |

|

|

What Should You Expect? Northwest has a longstanding tradition for compassion in its dealings with employees. Northwest currently has only a limited presence in Ohio and does not have a regional management team. Your institution will become the foundation for our future in Ohio. There will not be a significant loss of jobs compared to most mergers of this size and nature. Some displacement will occur. Opportunities in other areas may be available Career counseling will be provided Displaced employees will receive two weeks of pay for each year of service, with a maximum of 26 weeks and a minimum of four weeks. Medical insurance will continue to be provided for the same length of time. 22 |

|

|

Northwest Value to LNB Customers Exceptional Customer Service Ranked by J.D. Power and Associates for “Highest in Customer Satisfaction in the Mid-Atlantic Region,” four of the last five years Bankline, 24-hour automated telephone banking Northwest Direct live customer service Comprehensive Product and Service Offering Personal and Business Banking (Deposits and Loans) Cash Management Services Investment Management, Trust and Retirement Services Personal and Business Insurance Oil, Gas and Mineral Management Services 23 |

|

|

Northwest Customer Value, cont. Convenience 164 full-service offices (184 with merger) 269 ATMs throughout its footprint (297 with merger) 160 Northwest ATMs accept cash and check deposits 24/7 Freedom Alliance and Allpoint ATM networks - free access to more than 55,000 ATMs nationwide Northwest Visa Check Card with GO! Rewards Online Banking, Bill Pay and eStatementsPLUS Mobile Banking with Mobile Deposit 24 |

|

|

25 |

|

|

FULL-TIME EMPLOYEE BENEFITS 26 |

|

|

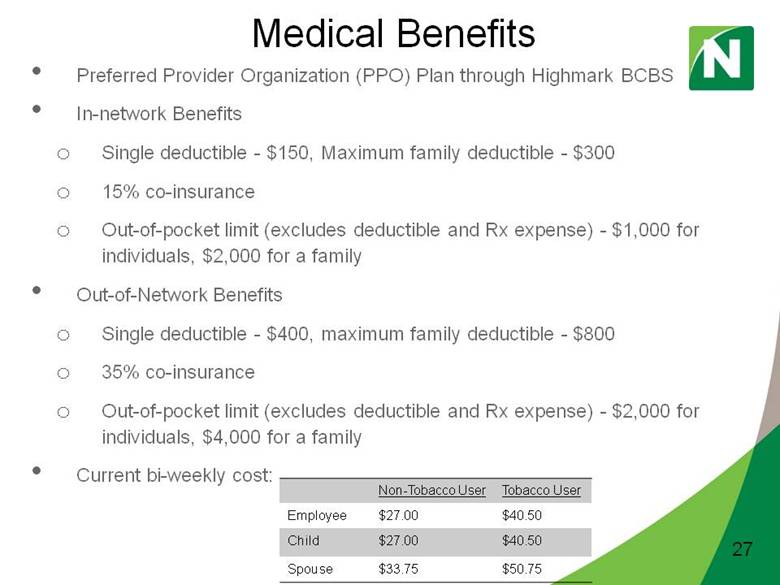

Non-Tobacco User Tobacco User Employee $27.00 $40.50 Child $27.00 $40.50 Spouse $33.75 $50.75 Medical Benefits Preferred Provider Organization (PPO) Plan through Highmark BCBS In-network Benefits Single deductible - $150, Maximum family deductible - $300 15% co-insurance Out-of-pocket limit (excludes deductible and Rx expense) - $1,000 for individuals, $2,000 for a family Out-of-Network Benefits Single deductible - $400, maximum family deductible - $800 35% co-insurance Out-of-pocket limit (excludes deductible and Rx expense) - $2,000 for individuals, $4,000 for a family Current bi-weekly cost: 27 |

|

|

Outpatient Prescription Drug Benefits 28 No deductible Generics – 5% co-insurance payment Brand drugs – 15% co-insurance payment |

|

|

Dental Benefits No network No deductible Co-insurance rate varies from 0-50% based on procedure performed Maximum benefit payment per calendar year is $1,000 Current bi-weekly cost: 29 Non-Tobacco User Tobacco User Employee $3.25 $4.75 Child $3.25 $4.75 Spouse $3.90 $5.85 |

|

|

Retirement Benefits 30 Pension Plan – no prior service credit Eligibility requirements – 21 or older, 1,000 hours or more worked in a calendar year Vesting – after receiving 5 years of credited service – 100% vested Basic calculation – 1% of base earnings for each year of credited service (1,000 hours or more) |

|

|

Retirement Benefits 31 401(k) Plan – vesting credit for service with LNB Eligibility requirements to contribute – age 21 or older Eligibility requirements to earn match – 21 or older and worked 1,000 hours or more in a calendar year Match - $0.50/$1.00 for the first 6% of base pay contributed 28 investment options Vesting – 6 year graduated schedule on match |

|

|

Retirement Benefits 32 Employee Stock Ownership Plan “ESOP” – no prior service credit Discretionary contributions are made in company stock and are distributed based on eligible base income Eligibility requirements – 21 or older, 1,000 hours or more worked in a calendar year Vesting – 6 year graduated schedule Average benefit – 1.5 – 2% of base earnings |

|

|

Paid Time Off 33 You will be given credit for prior years of service with LNB Vacation based on years of full-time service – maximum benefit is 5 weeks Sick Days – up to 6 days per calendar year Bank Holidays |

|

|

Life Insurance 34 Group Term Life Insurance Coverage Accidental Death & Dismemberment “AD&D” Coverage – Full-time Employees only Business Travel Accident Coverage |

|

|

Other Benefits 35 Discretionary Holiday Bonus – no prior service credit Typically 2% – 5% of eligible base salary Disability Benefits Employee Assistance Plan Flexible Spending Account Free or Discounted Bank Services |

|

|

Thank you for your attendance. We look forward to having you on our team. |