Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - US BANCORP \DE\ | d834362d8k.htm |

1

Goldman Sachs

U.S. Financial Services

Conference

December 10, 2014

Andrew Cecere

Vice Chairman, Chief Financial Officer

EXTENDING

THE ADVANTAGE

Exhibit 99.1 |

2

Forward-looking

Statements

and

Additional

Information

The

following

information

appears

in

accordance

with

the

Private

Securities

Litigation

Reform

Act

of

1995:

This

presentation

contains

forward-looking

statements

about

U.S.

Bancorp.

Statements

that

are

not

historical

or

current

facts,

including

statements

about

beliefs

and

expectations,

are

forward-looking

statements

and

are

based

on

the

information

available

to,

and

assumptions

and

estimates

made

by,

management

as

of

the

date

made.

These

forward-looking

statements

cover,

among

other

things,

anticipated

future

revenue

and

expenses

and

the

future

plans

and

prospects

of

U.S.

Bancorp.

Forward-looking

statements

involve

inherent

risks

and

uncertainties,

and

important

factors

could

cause

actual

results

to

differ

materially

from

those

anticipated.

A

reversal

or

slowing

of

the

current

moderate

economic

recovery

or

another

severe

contraction

could

adversely

affect

U.S.

Bancorp’s

revenues

and

the

values

of

its

assets

and

liabilities.

Global

financial

markets

could

experience

a

recurrence

of

significant

turbulence,

which

could

reduce

the

availability

of

funding

to

certain

financial

institutions

and

lead

to

a

tightening

of

credit,

a

reduction

of

business

activity,

and

increased

market

volatility.

Continued

stress

in

the

commercial

real

estate

markets,

as

well

as

a

delay

or

failure

of

recovery

in

the

residential

real

estate

markets,

could

cause

additional

credit

losses

and

deterioration

in

asset

values.

In

addition,

U.S.

Bancorp’s

business

and

financial

performance

is

likely

to

be

negatively

impacted

by

recently

enacted

and

future

legislation

and

regulation.

U.S.

Bancorp’s

results

could

also

be

adversely

affected

by

deterioration

in

general

business

and

economic

conditions;

changes

in

interest

rates;

deterioration

in

the

credit quality of its loan portfolios or in the value of the collateral securing

those loans; deterioration in the value of securities held in its investment

securities

portfolio;

legal

and

regulatory

developments;

increased

competition

from

both

banks

and

non-banks;

changes

in

customer

behavior

and

preferences;

breaches

in

data

security;

effects

of

mergers

and

acquisitions

and

related

integration;

effects

of

critical

accounting

policies

and

judgments;

and

management’s

ability

to

effectively

manage

credit

risk,

residual

value

risk,

market

risk,

operational

risk,

interest

rate

risk

and

liquidity

risk.

For

discussion

of

these

and

other

risks

that

may

cause

actual

results

to

differ

from

expectations,

refer

to

U.S.

Bancorp’s

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2013,

on

file

with

the

Securities

and

Exchange

Commission,

including

the

sections

entitled

“Risk

Factors”

and

“Corporate

Risk

Profile”

contained

in

Exhibit

13,

and

all

subsequent

filings

with

the

Securities

and

Exchange

Commission

under

Sections

13(a),

13(c),

14

or

15(d)

of

the

Securities

Exchange

Act

of

1934.

Forward-looking

statements

speak

only

as

of

the

date

they

are

made,

and

U.S.

Bancorp

undertakes

no

obligation

to

update

them

in

light

of

new

information

or

future

events.

This

presentation

includes

non-GAAP

financial

measures

to

describe

U.S.

Bancorp’s

performance.

The

calculations

of

these

measures

are

provided

within

or

in

the

appendix

of

the

presentation.

These

disclosures

should

not

be

viewed

as

a

substitute

for

operating

results

determined

in

accordance

with

GAAP,

nor

are

they

necessarily

comparable

to

non-GAAP

performance

measures

that

may

be

presented

by

other

companies.

EXTENDING

THE ADVANTAGE |

3

EXTENDING

THE ADVANTAGE

Agenda

Overview

Financial Management

Capital Management

4Q14 Update

Long-term Goals |

4

EXTENDING

THE ADVANTAGE

U.S. Bancorp Dimensions

Asset Size

$391 billion

Deposits

$273 billion

Loans

$246 billion

Customers

17.9 million

NYSE Traded

USB

Market Capitalization*

$81 billion

Founded

1863

Bank Branches

3,177

ATMs

5,026

3Q14 Dimensions

* As of 12/5/14 |

5

EXTENDING

THE ADVANTAGE

Industry Positions

Source: company reports, SNL and FactSet

Assets and deposits as of 9/30/14, market value as of 12/5/14

U.S.

U.S.

U.S.

Rank

Company

$ Billions

Rank

Company

$ Billions

Rank

Company

$ Billions

1

J.P. Morgan

$2,527

1

J.P. Morgan

$1,335

1

Wells Fargo

$285

2

Bank of America

2,124

2

Wells Fargo

1,131

2

J.P. Morgan

234

3

Citigroup

1,883

3

Bank of America

1,112

3

Bank of America

186

4

Wells Fargo

1,637

4

Citigroup

943

4

Citigroup

170

5

U.S. Bancorp

391

5

U.S. Bancorp

273

5

U.S. Bancorp

81

6

PNC

334

6

PNC

226

6

PNC

47

7

BB&T

187

7

SunTrust

137

7

BB&T

28

8

SunTrust

187

8

BB&T

131

8

SunTrust

21

9

Fifth Third

134

9

Fifth Third

97

9

Fifth Third

17

10

Regions

119

10

Regions

94

10

Regions

14

Assets

Deposits

Market Value |

6

EXTENDING

THE ADVANTAGE

Agenda

Overview

Financial Management

Capital Management

4Q14 Update

Long-term Goals |

7

EXTENDING

THE ADVANTAGE

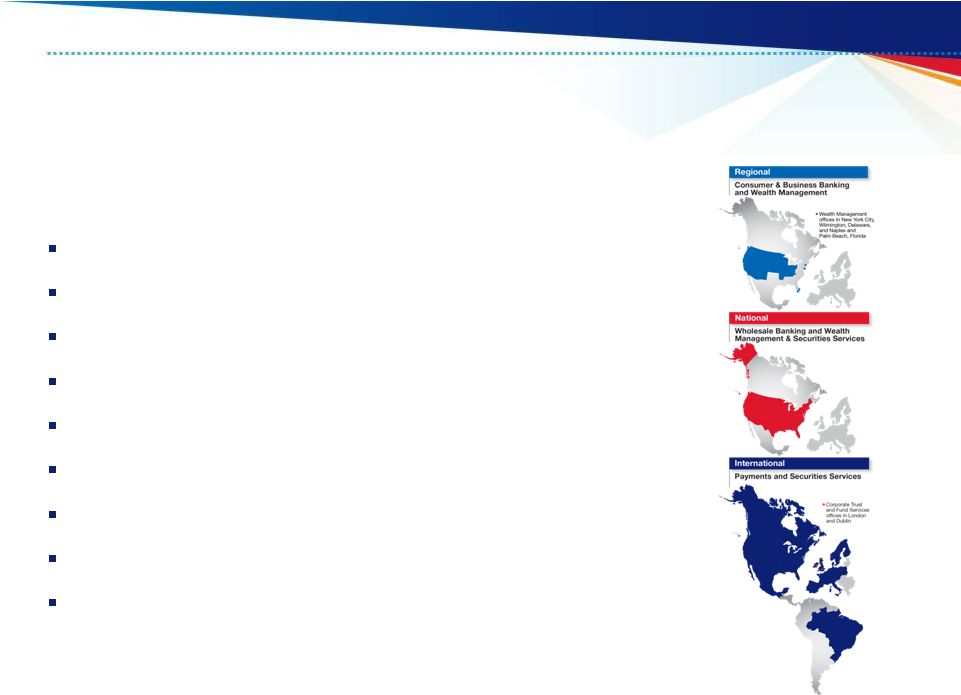

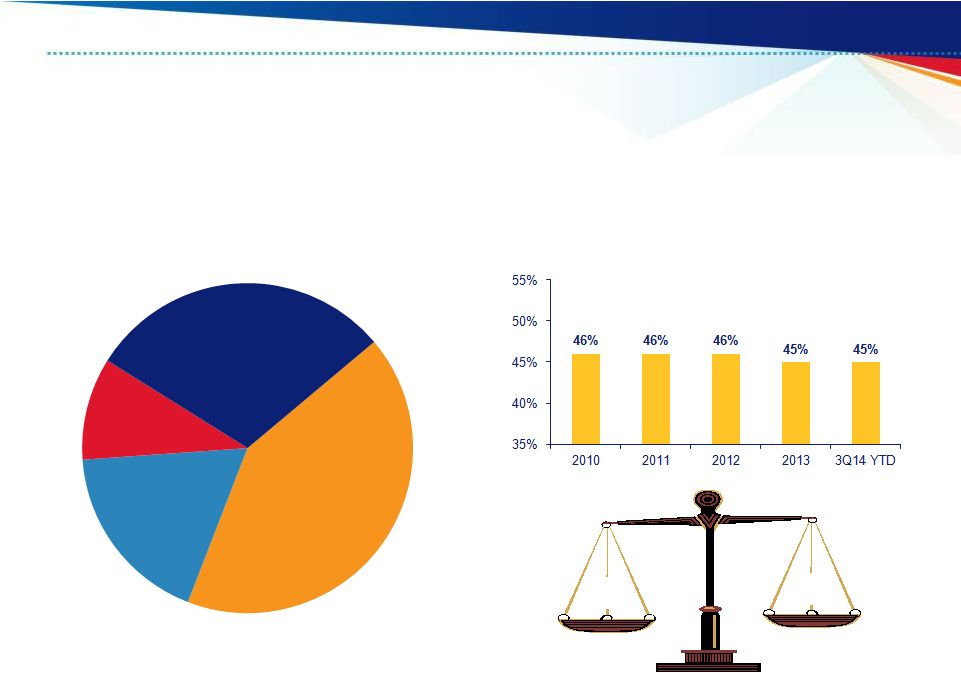

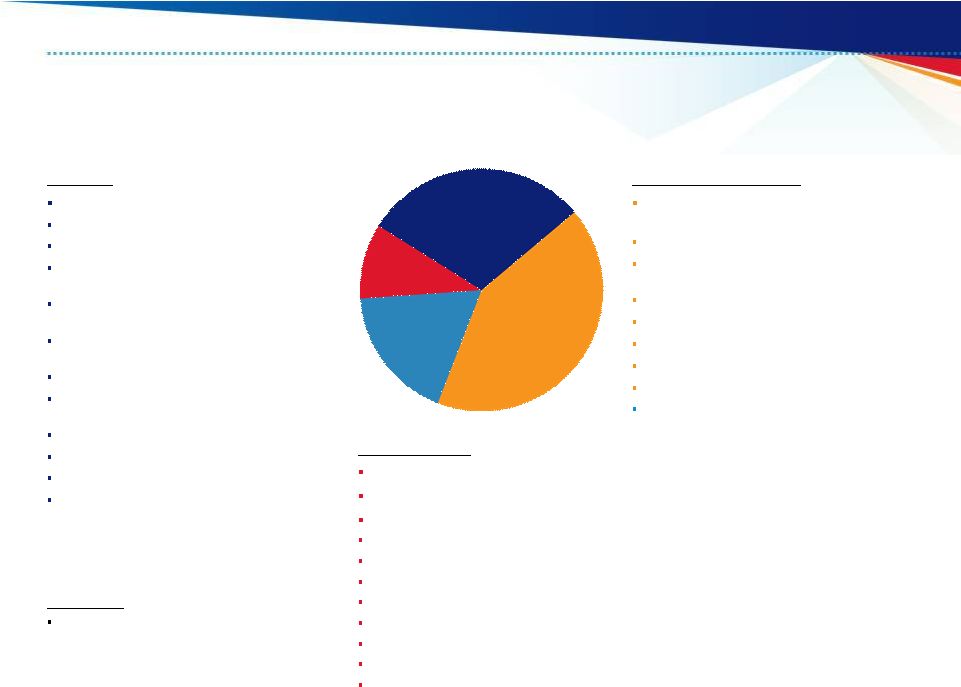

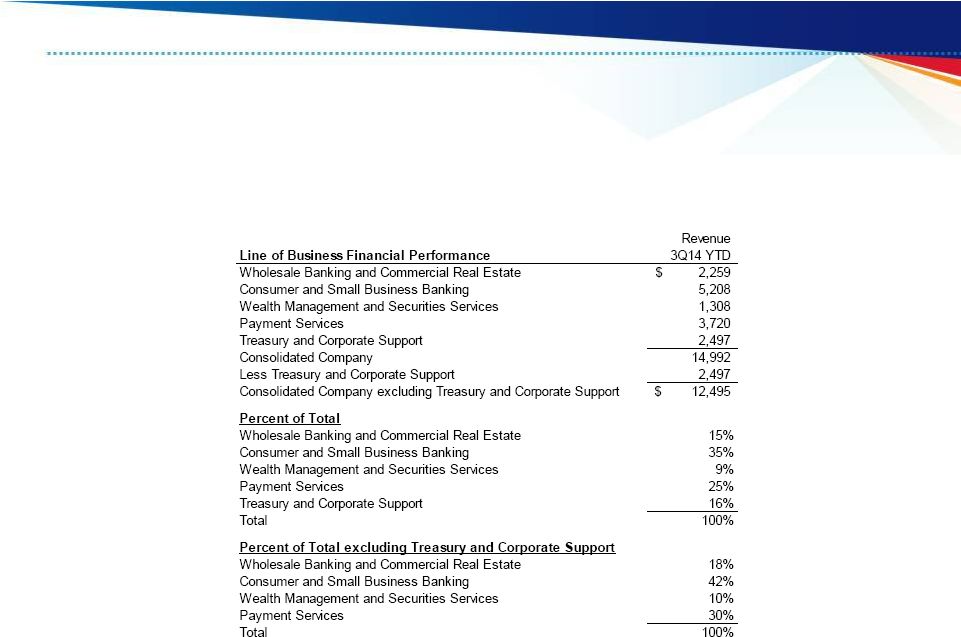

Revenue Mix

By Business Line

Fee Income / Total Revenue

3Q14 YTD, taxable-equivalent basis, excluding securities gains (losses) net;

2Q14 fee income excludes $214 million gain on sale of Visa Class B common stock

Revenue percentages exclude Treasury and Corporate Support, see Appendix for

calculation 55%

45%

Diversified Business Mix

Consumer and

Small Business

Banking

42%

Payment Services

30%

Wealth Mgmt and

Securities Services

10%

Wholesale

Banking and

Commercial

Real Estate

18% |

8

EXTENDING

THE ADVANTAGE

Peer Banks

Peer Bank Ticker Symbols

BAC

Bank of America

PNC

PNC

BBT

BB&T

RF

Regions

FITB

Fifth Third

STI

SunTrust

JPM

J.P. Morgan

USB

U.S. Bancorp

KEY

KeyCorp

WFC

Wells Fargo

Bank of America

SunTrust

Wells Fargo

KeyCorp

BBT

Fifth Third

Regions

PNC

J.P. Morgan

U.S. Bancorp |

9

EXTENDING

THE ADVANTAGE

Source: SNL and company reports; Peer banks: BAC, BBT, FITB, JPM, KEY, PNC, RF, STI

and WFC Efficiency

ratio

computed

as

noninterest

expense

divided

by

the

sum

of

net

interest

income

on

a

taxable-equivalent

basis

and

noninterest

income

excluding

securities

gains

(losses),

net

Industry Leading Returns

Return on

Average Assets

Return on Average

Common Equity

Efficiency Ratio

Full Year 2013

3Q14

NA |

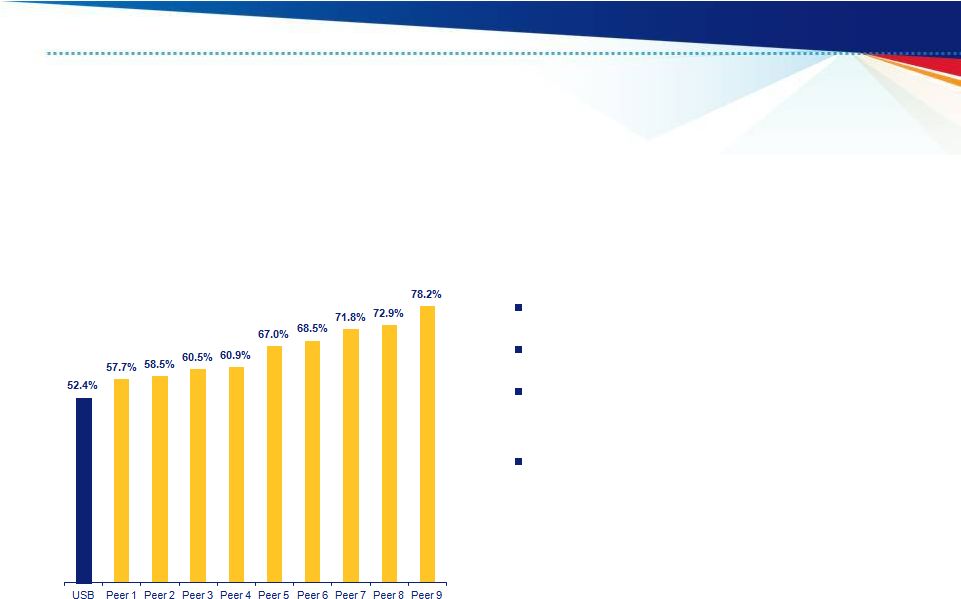

10

EXTENDING

THE ADVANTAGE

Efficient Expense Platform

Single processing platforms

Full consolidation of acquisitions

Operating scale in all significant

businesses

Business line monthly review

process

2013 Efficiency Ratio

Source of

Competitive Advantage

Source: SNL and company reports; Peer banks: BAC, BBT, FITB, JPM, KEY, PNC, RF, STI

and WFC Efficiency

ratio

computed

as

noninterest

expense

divided

by

the

sum

of

net

interest

income

on

a

taxable-equivalent

basis

and

noninterest

income

excluding

securities

gains

(losses),

net |

11

EXTENDING

THE ADVANTAGE

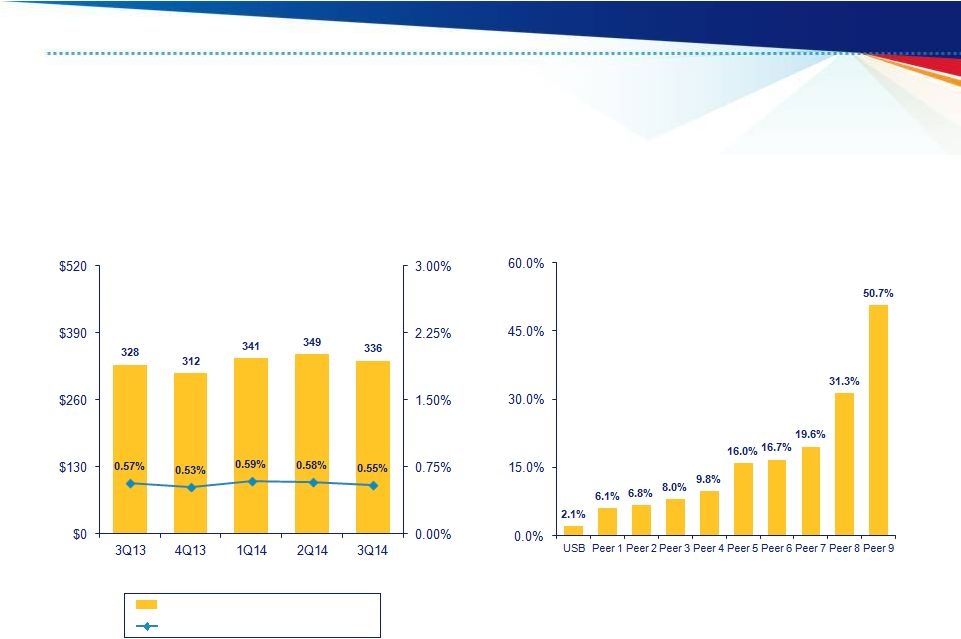

$ in millions

Prior 5 Years

Average Balances

Year-Over-Year Growth

12.2%

3.9%

4.4%

6.9%

5.6%

Prior 5 Quarters

Average Balances

Year-Over-Year Growth

5.7%

5.7%

6.0%

6.8%

6.3%

Loan Growth |

12

EXTENDING

THE ADVANTAGE

$ in millions

Prior 5 Years

Average Balances

Year-Over-Year Growth

23.2%

10.1%

15.4%

10.6%

6.3%

Prior 5 Quarters

Average Balances

Year-Over-Year Growth

5.5%

5.4%

5.1%

6.0%

7.4%

Deposit Growth |

13

EXTENDING

THE ADVANTAGE

$ in millions

Source: company reports; reserve release is calculated as net charge-offs less

provision for credit losses over the five-quarter period Net

Charge-offs Net Charge-offs (Left Scale)

NCOs to Avg Loans (Right Scale)

Credit Quality

Reserve Release / Net Income

(Prior 5 quarters) |

14

EXTENDING

THE ADVANTAGE

Debt ratings: holding company as of December 5, 2014

op=outlook positive

on=outlook negative

s=outlook stable

wn=watch negative

wp=watch positive

Flight to quality

Funding advantage

Advantages

Peer Debt Ratings

Top of Class Debt Ratings

Rating

Outlook

Rating

Outlook

Rating

Outlook

Rating

Outlook

USB

A1

s

A+

s

AA-

s

AA

s

WFC

A2

s

A+

on

AA-

s

AA

s

BBT

A2

on

A-

s

A+

s

A (high)

s

JPM

A3

s

A

on

A+

s

A (high)

s

PNC

A3

s

A-

s

A+

s

A (high)

s

FITB

Baa1

s

BBB+

s

A

s

A (low)

s

BAC

Baa2

s

A-

on

A

on

A (low)

s

STI

Baa1

s

BBB+

s

BBB+

op

A (low)

s

KEY

Baa1

s

BBB+

s

A-

s

BBB (high)

s

RF

Ba1

op

BBB

s

BBB

s

BBB

s

Moody's

S&P

Fitch

DBRS |

15

EXTENDING

THE ADVANTAGE

Agenda

Overview

Financial Management

Capital Management

4Q14 Update

Long-term Goals |

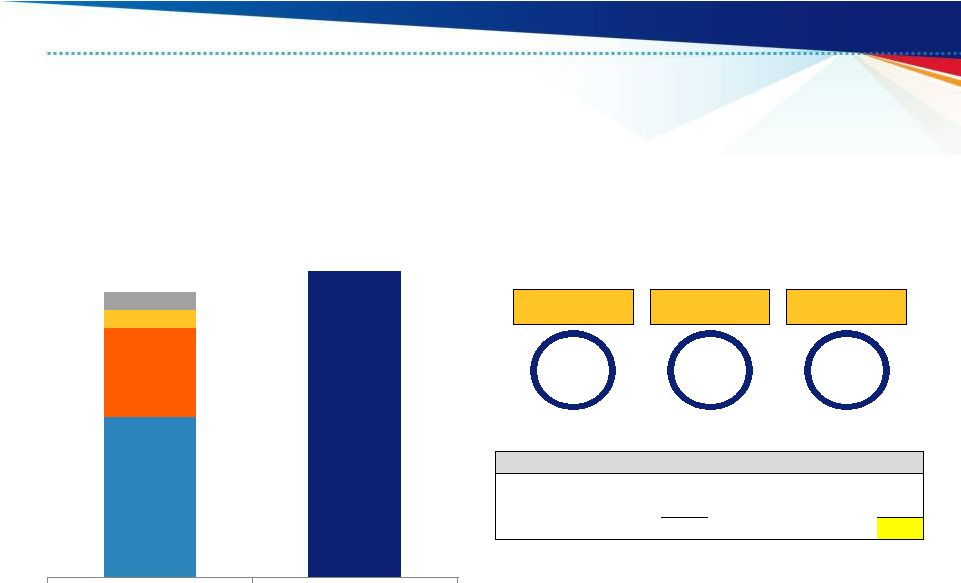

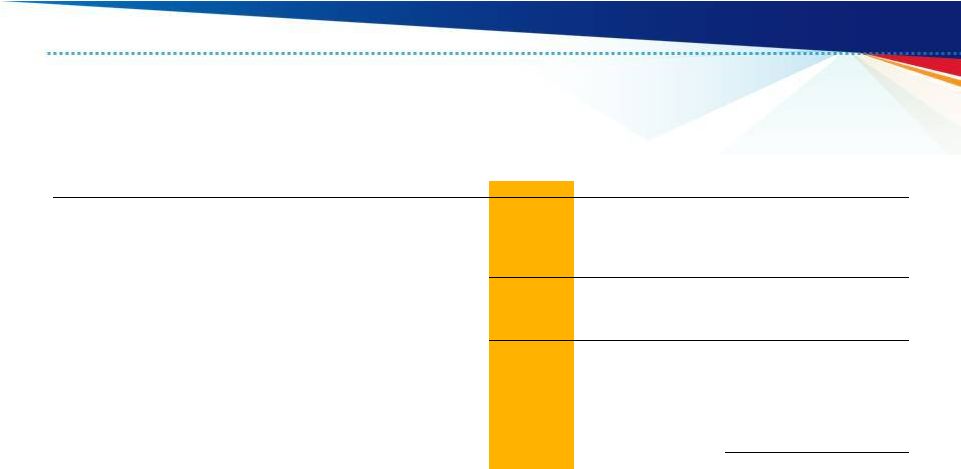

16

EXTENDING

THE ADVANTAGE

Capital Requirement

* Based on the final rules for the Basel III fully implemented standardized

approach Earnings Distribution Target

8.0%

0.5%

Volatility Buffer

0.5%

Potential

D-SIFI Buffer

2.5%

Capital

Conservation

Buffer

4.5%

Minimum

Capital

Requirement

9.0%*

Common Equity Tier 1

Basel III Target

USB 3Q14

Reported

Capital Management

Reinvest and

Acquisitions

Dividends

Share

Repurchases

20 -

40%

30 -

40%

30 -

40%

Dividends

30%

Reinvestment

30%

Share Repurchases

40%

Assumed ROTCE

20%

Discretionary Distributions

70%

Balance Sheet Growth

6%

Hypothetical Earnings Distribution Example |

17

EXTENDING

THE ADVANTAGE

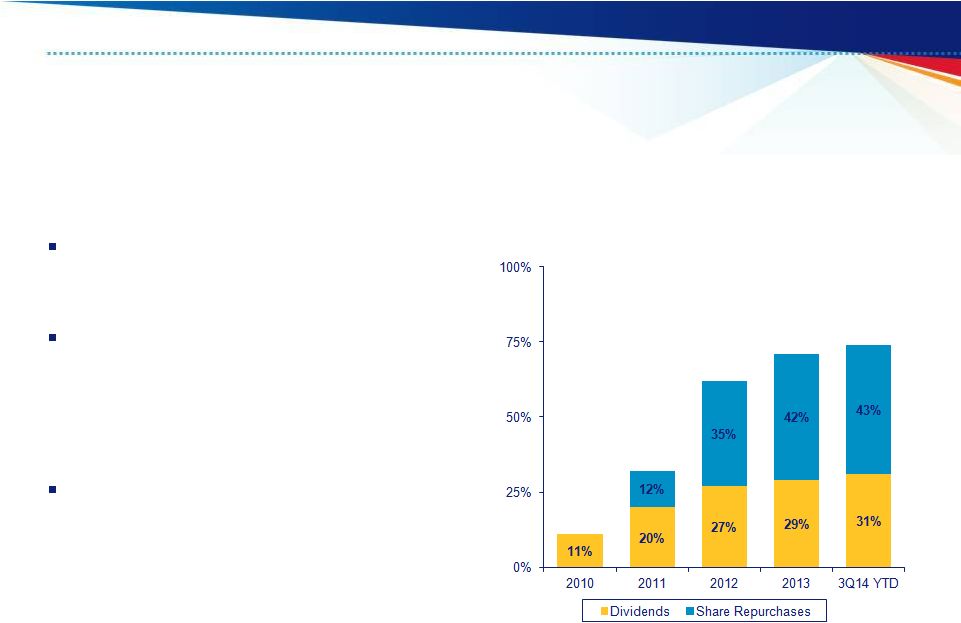

62%

11%

32%

Payout Ratio

71%

Capital Distributions

74%

Quarterly dividend increased 6.5%

in 2Q14 to $0.245 per share

One-year authorization to

repurchase up to $2.3 billion of

outstanding stock effective

April 1, 2014

Returned 78% of earnings to

shareholders during 3Q14 |

18

EXTENDING

THE ADVANTAGE

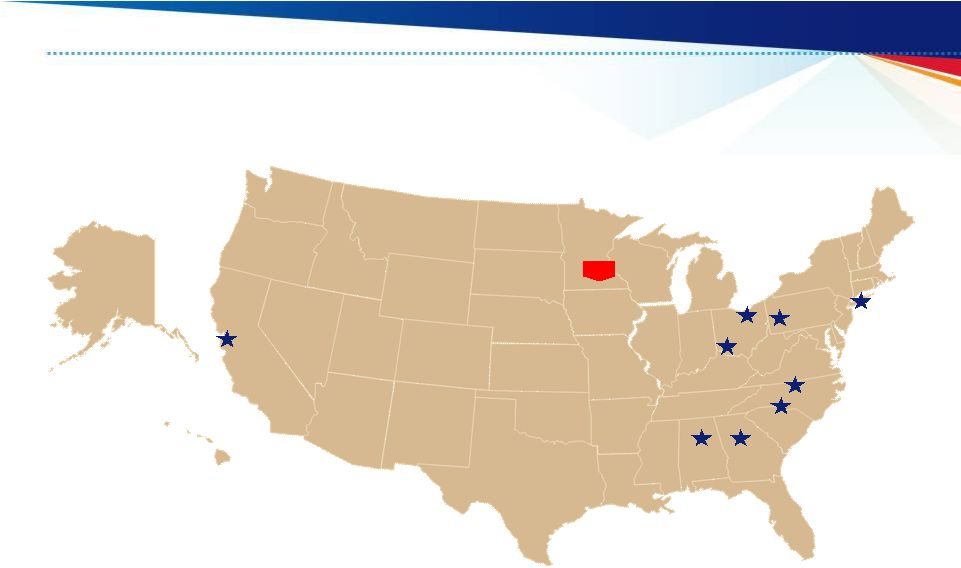

Payments

Collective Point of Sale Solutions Ltd

FSV Payment Systems

TransCard’s heavy truck fuel card network

Financial institutions credit card portfolio of FIA

Card Services

Merchant processing portfolio of

Santander-Mexico

Merchant processing portfolio of Citizens

National Bank

Credit card portfolios from Citi

Merchant processing portfolio of MB Financial

Bank

Credit card portfolio of Town North Bank

Southern DataComm

Numerous small portfolios

Joint ventures:

•

Spain merchant services joint venture with

Banco Santander

•

Brazil merchant services company

Consumer and Wholesale

Chicago banking operations of RBS

Citizens Financial Group

Banking operations of BankEast (Knoxville, TN)

Banking operations of First Community

Bank (NM)

Banking subsidiaries of FBOP Corporation

BB&T’s Nevada banking operations

First Bank of Idaho

Downey Savings & Loan Association

PFF Bank & Trust

Mellon 1

st

Business Bank

Trust Businesses

Document custodian business of Ally Bank

Quintillion Limited

U.S. municipal bond trustee business of Deutsche Bank

AIS Fund Administration

Institutional trust business of Union Bank

Indiana corporate trust business of UMB Bank

Bank of America’s securitization trust administration business

Corporate trust administration business of F.N.B. Corporation

Corporate trust business of AmeriServ Financial

Bond trustee business of First Citizens Bank

Mutual fund servicing division of Fiduciary Management, Inc

Divestitures

Divestiture of FAF Advisors long-term asset

management business

Consumer

and Small

Business

Banking

Payment Services

Wealth Mgmt and

Securities Services

Wholesale

Banking and

Commercial

Real Estate

Prudent Acquisition Strategy |

19

EXTENDING

THE ADVANTAGE

Agenda

Overview

Financial Management

Capital Management

4Q14 Update

Long-term Goals |

20

EXTENDING

THE ADVANTAGE

4Q14 Update

Business Climate

Loan Growth

Net Interest Margin

Credit Quality

Noninterest Income / Expense |

21

EXTENDING

THE ADVANTAGE

Agenda

Overview

Financial Management

Capital Management

4Q14 Update

Long-term Goals |

22

EXTENDING

THE ADVANTAGE

Long-term Goals

Optimal business line mix

Investments generating

positive returns

Profitability:

Capital distributions:

Current Status

Four simple and stable business lines

Mortgage, wealth management, corporate

banking, international payments, branch

technology, internet and mobile channels,

and select acquisitions

3Q14 YTD Profitability:

3Q14 YTD Capital distributions:

Long-term Goals

•

ROE 14.7%

•

ROA 1.56%

•

Efficiency Ratio 52.8%

•

Distributed 74% of earnings

(dividends 31%, share repurchases 43%)

•

ROE 16-19%

•

ROA 1.60-1.90%

•

Efficiency Ratio low 50s

•

Earnings distribution 60-80% |

23

EXTENDING

THE ADVANTAGE

Appendix |

24

EXTENDING

THE ADVANTAGE

Non-GAAP Financial Measures

(1) Includes

goodwill

related

to

certain

investments

in

unconsolidated

financial

institutions

per

prescribed

regulatory

requirements

beginning

March

31,

2014.

(2) Includes

net

losses

on

cash

flow

hedges

included

in

accumulated

other

comprehensive

income

and

other

adjustments.

(3) Beginning

March

31,

2014,

calculated

under

the

Basel

III

transitional

standardized

approach;

all

other

periods

calculated

under

Basel

I.

(4) Includes

higher

risk-weighting

for

unfunded

loan

commitments,

investment

securities,

residential

mortgages,

mortgage

servicing

rights

and

other

adjustments.

(5) Primarily

reflects

higher

risk-weighting

for

mortgage

servicing

rights.

$ in millions

3Q14

2Q14

1Q14

4Q13

3Q13

Total equity

43,829

$

43,386

$

42,743

$

41,807

$

41,552

$

Preferred stock

(4,756)

(4,756)

(4,756)

(4,756)

(4,756)

Noncontrolling interests

(688)

(686)

(689)

(694)

(1,420)

Goodwill (net of deferred tax liability) (1)

(8,503)

(8,548)

(8,352)

(8,343)

(8,319)

Intangible assets, other than mortgage servicing rights

(877)

(925)

(804)

(849)

(878)

Tangible common equity (a)

29,005

28,471

28,142

27,165

26,179

Tangible common equity (as calculated above)

29,005

28,471

28,142

27,165

26,179

Adjustments (2)

187

224

239

224

258

Common equity tier 1 capital estimated for the Basel III fully

implemented standardized and advanced approaches (b)

29,192

28,695

28,381

27,389

26,437

Tier 1 capital, determined in accordance with prescribed

regulatory requirements using Basel I definition

33,386

32,707

Preferred stock

(4,756)

(4,756)

Noncontrolling interests, less preferred stock not eligible for Tier 1

capital (688)

(686)

Tier 1 common equity using Basel I definition (c)

27,942

27,265 |

25

EXTENDING

THE ADVANTAGE

Non-GAAP Financial Measures

$ in millions

3Q14

2Q14

1Q14

4Q13

3Q13

Total assets

391,284

$

389,065

$

371,289

$

364,021

$

360,681

$

Goodwill (net of deferred tax liability) (1)

(8,503)

(8,548)

(8,352)

(8,343)

(8,319)

Intangible assets, other than mortgage servicing rights

(877)

(925)

(804)

(849)

(878)

Tangible assets (d)

381,904

379,592

362,133

354,829

351,484

Risk-weighted assets, determined in accordance with prescribed

regulatory requirements (3)(e)

311,914

309,929

302,841

297,919

293,155

Adjustments (4)

12,837

12,753

13,238

13,712

13,473

Risk-weighted assets estimated for the Basel III fully implemented

standardized approach (f)

324,751

322,682

316,079

311,631

306,628

Risk-weighted assets, determined in accordance with prescribed

transitional advanced approaches regulatory requirements

243,909

241,929

Adjustments (5)

3,443

3,383

Risk-weighted assets estimated for the Basel III fully implemented

247,352

245,312

advanced approaches (g)

Ratios

Tangible common equity to tangible assets (a)/(d)

7.6

%

7.5

%

7.8

%

7.7

%

7.4

%

Tangible common equity to risk-weighted assets (a)/(e)

9.3

9.2

9.3

9.1

8.9

Tier 1 common equity to risk-weighted assets using Basel I definition

(c)/(e) --

--

--

9.4

9.3

Common equity tier 1 capital to risk-weighted assets estimated for the

Basel III fully implemented standardized approach (b)/(f)

9.0

8.9

9.0

8.8

8.6

Common equity tier 1 capital to risk-weighted assets estimated for the

Basel III fully implemented advanced approaches (b)/(g)

11.8

11.7

(1) Includes goodwill related to certain investments in unconsolidated

financial institutions per prescribed regulatory requirements beginning March 31, 2014.

(2) Includes net losses on cash flow hedges included in accumulated

other comprehensive income and other adjustments. (3) Beginning

March 31, 2014, calculated under the Basel III transitional standardized approach; all other periods calculated under Basel I.

(4) Includes higher risk-weighting for unfunded loan commitments,

investment securities, residential mortgages, mortgage servicing rights and other adjustments.

(5) Primarily reflects higher risk-weighting for mortgage servicing

rights. |

26

EXTENDING

THE ADVANTAGE

$ in millions, taxable-equivalent basis, excluding securities gains (losses)

net Line of Business Financial Performance

Non-GAAP Financial Measures |

27

EXTENDING

THE ADVANTAGE

Goldman Sachs

U.S. Financial Services

Conference

December 10, 2014 |