Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - STAR GROUP, L.P. | Financial_Report.xls |

| EX-21 - EX-21 - STAR GROUP, L.P. | d785332dex21.htm |

| EX-31.1 - EX-31.1 - STAR GROUP, L.P. | d785332dex311.htm |

| EX-31.2 - EX-31.2 - STAR GROUP, L.P. | d785332dex312.htm |

| EX-10.7 - EX-10.7 - STAR GROUP, L.P. | d785332dex107.htm |

| EX-32.2 - EX-32.2 - STAR GROUP, L.P. | d785332dex322.htm |

| EX-32.1 - EX-32.1 - STAR GROUP, L.P. | d785332dex321.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended September 30, 2014 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission File Number: 001-14129

STAR GAS PARTNERS, L.P.

(Exact name of registrant as specified in its charter)

| Delaware | 06-1437793 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 9 West Broad Street, Stamford, Connecticut | 06902 | |

| (Address of principal executive office) | (Zip Code) | |

(203) 328-7310

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Units | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

¨ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” and “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Act (check one).

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s common units held by non-affiliates on March 31, 2014 was approximately $255,051,000. As of November 30, 2014, the registrant had 57,282,752 common units outstanding.

Documents Incorporated by Reference: None

Table of Contents

STAR GAS PARTNERS, L.P.

2014 FORM 10-K ANNUAL REPORT

| Page | ||||||

| PART I | ||||||

| Item 1. |

Business | 3 | ||||

| Item 1A. |

Risk Factors | 12 | ||||

| Item 1B. |

Unresolved Staff Comments | 23 | ||||

| Item 2. |

Properties | 23 | ||||

| Item 3. |

Legal Proceedings—Litigation | 23 | ||||

| Item 4. |

Mine Safety Disclosures | 23 | ||||

| Item 5. |

23 | |||||

| Item 6. |

Selected Historical Financial and Operating Data | 26 | ||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 28 | ||||

| Item 7A. |

Quantitative and Qualitative Disclosures about Market Risk | 46 | ||||

| Item 8. |

47 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 47 | ||||

| Item 9A. |

Controls and Procedures | 47 | ||||

| Item 9B. |

Other Information | 48 | ||||

| PART III | ||||||

| Item 10. |

Directors, Executive Officers and Corporate Governance | 49 | ||||

| Item 11. |

Executive Compensation | 53 | ||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management | 63 | ||||

| Item 13. |

Certain Relationships and Related Transactions | 64 | ||||

| Item 14. |

Principal Accounting Fees and Services | 65 | ||||

| PART IV | ||||||

| Item 15. |

Exhibits and Financial Statement Schedules | 66 | ||||

2

Table of Contents

Statement Regarding Forward-Looking Disclosure

This Annual Report on Form 10-K includes “forward-looking statements” which represent our expectations or beliefs concerning future events that involve risks and uncertainties, including those associated with the effect of weather conditions on our financial performance, the price and supply of the products that we sell, the consumption patterns of our customers, our ability to obtain satisfactory gross profit margins, our ability to obtain new customers and retain existing customers, our ability to make strategic acquisitions, the impact of litigation, our ability to contract for our current and future supply needs, natural gas conversions, future union relations and the outcome of current and future union negotiations, the impact of current and future governmental regulations, including environmental, health, and safety regulations, the ability to attract and retain employees, customer credit worthiness, counterparty credit worthiness, marketing plans, general economic conditions and new technology. All statements other than statements of historical facts included in this Report including, without limitation, the statements under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere herein, are forward-looking statements. Without limiting the foregoing, the words “believe,” “anticipate,” “plan,” “expect,” “seek,” “estimate,” and similar expressions are intended to identify forward-looking statements. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct and actual results may differ materially from those projected as a result of certain risks and uncertainties. These risks and uncertainties include, but are not limited to, those set forth in this Report under the heading “Risk Factors” and “Business Strategy.” Important factors that could cause actual results to differ materially from our expectations (“Cautionary Statements”) are disclosed in this Report. All subsequent written and oral forward-looking statements attributable to the Partnership or persons acting on its behalf are expressly qualified in their entirety by the Cautionary Statements. Unless otherwise required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this Report.

| ITEM 1. | BUSINESS |

Structure

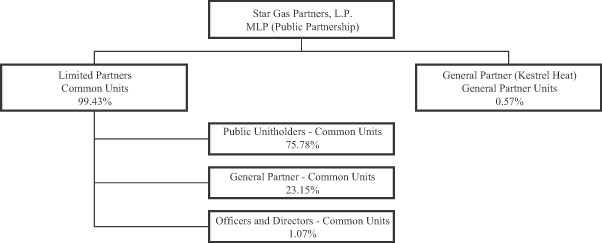

Star Gas Partners, L.P. (“Star Gas Partners,” the “Partnership,” “we,” “us,” or “our”) is a home heating oil and propane distributor and services provider with one reportable operating segment that principally provides services to residential and commercial customers to heat homes and buildings. Star Gas Partners is a Delaware limited partnership, which at November 30, 2014, had outstanding 57.3 million common partner units (NYSE: “SGU”) representing a 99.43% limited partner interest in Star Gas Partners, and 0.3 million general partner units, representing a 0.57% general partner interest in Star Gas Partners. Our general partner is Kestrel Heat, LLC, a Delaware limited liability company (“Kestrel Heat” or the “general partner”).

The following chart depicts the ownership of the partnership as of November 30, 2014:

3

Table of Contents

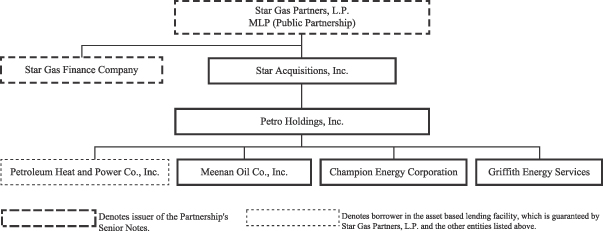

The Partnership is organized as follows:

| • | Our general partner is Kestrel Heat, LLC, a Delaware limited liability company (“Kestrel Heat” or the “general partner”). The Board of Directors of Kestrel Heat is appointed by its sole member, Kestrel Energy Partners, LLC, a Delaware limited liability company (“Kestrel”). |

| • | Our operations are conducted through Petro Holdings, Inc., a Minnesota corporation that is a wholly owned subsidiary of Star Acquisitions, Inc., and its subsidiaries. |

| • | Star Gas Finance Company is our 100% owned subsidiary. Star Gas Finance Company serves as the co-issuer, jointly and severally with us, of our $125.0 million principal amount of 8.875% Senior Notes, which are due in December 2017, that we sometimes refer to in this Report as the notes or the senior notes. We are dependent on distributions, including inter-company dividends and interest payments, from our subsidiaries to service our debt obligations. The distributions from our subsidiaries are not guaranteed and are subject to certain loan restrictions. Star Gas Finance Company has nominal assets and conducts no business operations. (See Note 11 of the Notes to the Consolidated Financial Statements—Long-Term Debt and Bank Facility Borrowings) |

We file annual, quarterly, current and other reports and information with the Securities and Exchange Commission, or SEC. These filings can be viewed and downloaded from the Internet at the SEC’s website at www.sec.gov. In addition, these SEC filings are available at no cost as soon as reasonably practicable after the filing thereof on our website at www.star-gas.com/sec.cfm. These reports are also available to be read and copied at the SEC’s public reference room located at Judiciary Plaza, 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. You may also obtain copies of these filings and other information at the offices of the New York Stock Exchange located at 11 Wall Street, New York, New York 10005. Please note that any Internet addresses provided in this Annual Report on Form 10-K are for informational purposes only and are not intended to be hyperlinks. Accordingly, no information found and/or provided at such Internet addresses is intended or deemed to be incorporated by reference herein.

Partnership Structure

The following chart summarizes our partnership structure as of September 30, 2014. Other than Star Gas Partners, L.P. all other entities in this structure are taxable as corporations for Federal and state income tax purposes.

4

Table of Contents

Business Overview

We are a home heating oil and propane distributor and service provider that principally serves residential and commercial customers in the Northeast and Mid-Atlantic regions to heat their homes and buildings. As of September 30, 2014, we sold home heating oil and propane to approximately 444,000 full service residential and commercial customers. We believe we are the largest retail distributor of home heating oil in the United States, based upon sales volume with a market share in excess of 5.5%. We also sell home heating oil, gasoline and diesel fuel to approximately 68,000 customers on a delivery only basis. We install, maintain, and repair heating and air conditioning equipment and to a lesser extent provide these services outside our customer base. In addition, we provide ancillary home services, including home security and plumbing, to approximately 22,000 customers, many who are also existing home heating oil and propane customers. During fiscal 2014, total sales were comprised approximately 74% from sales of home heating oil and propane; 12% from the installation and repair of heating and air conditioning equipment and ancillary services; and 14% from the sale of other petroleum products. We provide home heating equipment repair service 24 hours a day, seven days a week, 52 weeks a year. These services are an integral part of our business, and are intended to maximize customer satisfaction and loyalty.

We conduct our business through an operating subsidiary, Petro Holdings, Inc., utilizing over 30 local brand names such as Petro Home Services, Burke Heat, Atlas Glen-mor, and Griffith Energy Services, Inc. to name a few.

We also offer several pricing alternatives to our residential home heating oil customers, including a variable price (market based) option and a price-protected option, the latter of which either sets the maximum price or a fixed price that a customer will pay. Users choose which plan they feel best suits them increasing customer satisfaction. Approximately 96% of our full service residential and commercial home heating oil customers automatically receive deliveries based on prevailing weather conditions. In addition, we offer a “smart pay” budget payment plan in which homeowners’ estimated annual billings are paid for in a series of equal monthly installments. We use derivative instruments as needed to mitigate our exposure to market risk associated with our price-protected offerings and the storing of our physical home heating oil inventory. Given our size, we are able to realize benefits of scale and provide consistent, strong customer service.

5

Table of Contents

Currently, we have heating oil and/or propane customers in the following states, regions and counties:

| Maine York

New Hampshire Hillsborough Merrimack Rockingham Strafford

Vermont Bennington

Massachusetts Barnstable Bristol Essex Hampden Middlesex Norfolk Plymouth Suffolk Worcester

Rhode Island Bristol Kent Newport Providence Washington

Connecticut Fairfield Hartford Litchfield Middlesex New Haven New London Tolland Windham |

New York Albany Bronx Columbia Dutchess Fulton Greene Kings Montgomery Nassau New York Orange Putnam Queens Rensselaer Richmond Rockland Saratoga Schenectady Schoharie Suffolk Sullivan Ulster Warren Washington Westchester

Delaware Kent New Castle Sussex

Washington, D.C. District of Columbia |

New Jersey Atlantic Bergen Burlington Camden Cumberland Essex Gloucester Hudson Hunterdon Mercer Middlesex Monmouth Morris Ocean Passaic Salem Somerset Sussex Union Warren

Pennsylvania Adams Berks Bucks Chester Cumberland Dauphin Delaware Franklin Fulton Lancaster Lebanon Lehigh Monroe Montgomery Northampton Perry Philadelphia Schuylkill York |

Maryland Anne Arundel Baltimore Calvert Caroline Carroll Cecil Charles Dorchester Frederick Harford Howard Kent Montgomery Prince George’s Queen Anne St. Mary’s Talbot Washington

Virginia Arlington Clarke Fairfax Frederick Fauquier Loudoun Prince William Stafford Warren

West Virginia Berkeley Jefferson Morgan

North Carolina Union

South Carolina Bamberg Calhoun Chester Dorchester Fairfield Kershaw Lexington Orangeburg |

6

Table of Contents

Industry Characteristics

Home heating oil is primarily used as a source of fuel to heat residences and businesses in the Northeast and Mid-Atlantic regions. According to the U.S. Department of Energy—Energy Information Administration, 2009 Residential Energy Consumption Survey (the latest survey published), these regions account for 83% (5.7 million of 6.9 million) of the households in the United States where heating oil is the main space-heating fuel and 28% (5.7 million of 20.8 million) of the homes in these regions use home heating oil as their main space-heating fuel. In recent years, as the price of home heating oil increased, customers have tended to increase their conservation efforts, which has decreased their consumption of home heating oil.

The retail home heating oil industry is mature, with total market demand expected to decline in the foreseeable future due in part to conversions to natural gas. Our customer losses to natural gas conversions for fiscal years 2014, 2013, 2012, 2011 and 2010 were 2.2%, 2.4%, 2.0%, 1.5% and 1.1% respectively. Therefore, our ability to maintain our business or grow within the industry is dependent on the acquisition of other retail distributors as well as the success of our marketing programs. Conversions to natural gas have increased and we believe this may continue as natural gas has become significantly less expensive than home heating oil on an equivalent BTU basis. In addition, the states of New York, Connecticut and Pennsylvania are seeking to encourage homeowners to expand the use of natural gas as a heating fuel through legislation and regulatory efforts.

Propane is a by-product of natural gas processing and petroleum refining. Propane use falls into three broad categories: residential and commercial applications; industrial applications; and agricultural uses. In the residential and commercial markets, propane is used primarily for space heating, water heating, clothes drying and cooking. Industrial customers use propane generally as a motor fuel to power over-the-road vehicles, forklifts and stationary engines, to fire furnaces, as a cutting gas and in other process applications. In the agricultural market, propane is primarily used for tobacco curing, crop drying, poultry breeding and weed control.

It is common practice in our business to price products to customers based on a per gallon margin over wholesale costs. As a result, we believe distributors such as ourselves generally seek to maintain their per gallon margins by passing wholesale price increases through to customers, thus insulating their margins from the volatility in wholesale prices. However, distributors may be unable or unwilling to pass the entire product cost increases through to customers. In these cases, significant decreases in per gallon margins may result. The timing of cost pass-throughs can also significantly affect margins. The retail home heating oil industry is highly fragmented, characterized by a large number of relatively small, independently owned and operated local distributors. Some dealers provide full service, as we do, and others offer delivery only on a cash-on-delivery basis, which we also do to a significantly lesser extent. The industry is complex and costly due to regulations, working capital requirements and the cost to hedge for price-protected customers.

Business Strategy

Our business strategy is to increase Adjusted EBITDA and cash flow by effectively managing operations while growing and retaining our customer base as a retail distributor of home heating oil and propane and provider of ancillary products and services. The key elements of this strategy include the following:

Pursue select acquisitions. Our senior management team has developed expertise in identifying acquisition opportunities and integrating acquired customers into our operations. We continue to focus on acquiring profitable companies within and outside our current footprint.

While we still actively pursue home heating oil only companies, we have found that modestly sized dual fuel (home heating oil and propane) companies are a niche for us and can help us grow our propane business more rapidly.

The focus for our acquisitions is both within our current footprint, where we can leverage our existing operating structure to reduce costs, as well as outside of such areas if the target company is of adequate size to sustain profitability as a stand-alone operation. We have used this strategy to expand into several states over the past five years.

Deliver superior customer service. We are dedicated to providing the best customer service in our industry to maximize customer satisfaction and retention. To engage our employees and enhance their ability to provide superior customer service and reduce gross customer losses, our employees are encouraged to go through customer service training, supplemented by ongoing monitoring and guidance from management.

Additionally, we have established a technical training committee to ensure that our field personnel are properly educated on the latest technology while operating in a safe and efficient manner.

7

Table of Contents

Diversification of product and service offerings. In addition to expanding our propane operations, we continue to focus on expanding our suite of rationally related products and services in an effort to increase revenue and Adjusted EBITDA while improving retention of our existing home heating oil and propane customers. These offerings include, but are not limited to, the sales, service and installation of heating and air conditioning equipment, plumbing services, home security systems and standby home generators. In addition, we also repair and install natural gas heating systems. We place significant emphasis on growing a solid, credit-worthy customer base with a focus on recurring revenue in the form of annual service agreements.

Realizing we have historically been known primarily as a home heating oil provider, we are in the process of repositioning our larger brands to reflect a broader range of products and services and position us as a leading provider of such services within the markets where we operate.

The addition of these products and services gives us the ability to leverage our existing organizational structure and improve our sales penetration with current and potential customers, allowing us to retain our customers.

Geographic expansion

We utilize census-based demographic data as well as local field expertise to target areas contiguous to our geographic footprint for organic expansion in a strategic manner. We then operate in such areas using existing logistical resources and personnel, adding staff if required as the business demands.

We grow the business in a strategic fashion utilizing advertising and marketing initiatives to expand our presence while building an effective marketing database of prospects and customers.

Seasonality

Our fiscal year ends on September 30. All references to quarters and years respectively in this document are to fiscal quarters and years unless otherwise noted. The seasonal nature of our business results in the sale of approximately 30% of our volume of home heating oil and propane in the first fiscal quarter and 50% of our volume in the second fiscal quarter of each fiscal year, the peak heating season. As a result, we generally realize net income in our first and second fiscal quarters and net losses during our third and fourth fiscal quarters and we expect that the negative impact of seasonality on our third and fourth fiscal quarter operating results will continue. In addition, sales volume typically fluctuates from year to year in response to variations in weather, wholesale energy prices and other factors.

Competition

Most of our operating locations compete with numerous distributors, primarily on the basis of price, reliability of service and response to customer needs. Each such location operates in its own competitive environment.

We compete with distributors offering a broad range of services and prices, from full-service distributors, such as ourselves, to those offering delivery only. As do many companies in our business, we provide home heating and propane equipment repair service on a 24-hour-a-day, seven-day-a-week, 52 weeks a year basis. We believe that this level of service tends to help build customer loyalty. In some instances homeowners have formed buying cooperatives that seek a lower price than individual customers are otherwise able to obtain. Our business competes for retail customers with suppliers of alternative energy products, principally natural gas, propane (in the case of our home heating oil operations) and electricity.

Customer Attrition

We measure net customer attrition for our full service residential and commercial home heating oil and propane customers. Since fiscal 2011, we have included propane customers in this calculation as several of our acquisitions have included propane operations. Net customer attrition is the difference between gross customer losses and customers added through marketing efforts. Customers added through acquisitions are not included in the calculation of gross customer gains. However, additional customers that are obtained through marketing efforts at newly acquired businesses are included in these calculations. Customer attrition percentage calculations include customers added through acquisitions in the denominators of the calculations on a weighted average basis. Gross customer losses are the result of a number of factors, including price competition, move outs, credit losses and conversions to natural gas. (See Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Customer Attrition.)

8

Table of Contents

Customers and Pricing

Our full service home heating oil customer base is comprised of 95% residential customers and 5% commercial customers. Our residential customer receives on average 160 gallons per delivery and our commercial accounts receive on average 320 gallons per delivery. Typically, we make four to six deliveries per customer per year. Currently, 96% of our full service residential and commercial home heating oil customers have their deliveries scheduled automatically and 4% of our home heating oil customer base call from time to time to schedule a delivery. Automatic deliveries are scheduled based on each customer’s historical consumption pattern and prevailing weather conditions. Our practice is to bill customers promptly after delivery. We also offer a balanced payment plan in which a customer’s estimated annual billings are paid for in a series of equal monthly payments. Approximately 37% of our residential home heating oil customers have selected this billing option.

We offer several pricing alternatives to our residential home heating oil customers. Our variable pricing program allows the price to float with the home heating oil market and other factors. In addition, we offer price protected programs, which establish either a ceiling or a fixed price per gallon that the customer would pay over a defined period. The following chart depicts the percentage of the pricing plans selected by our residential home heating oil customers as of the end of the fiscal year.

| September 30, | ||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| Variable |

53.5 | % | 53.1 | % | 54.7 | % | 54.9 | % | 55.8 | % | ||||||||||

| Ceiling |

40.8 | % | 42.3 | % | 40.5 | % | 41.5 | % | 41.8 | % | ||||||||||

| Fixed |

5.7 | % | 4.6 | % | 4.8 | % | 3.6 | % | 2.4 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Sales to residential customers ordinarily generate higher per gallon margins than sales to commercial customers. Due to greater price sensitivity and hedging costs of residential price-protected customers, the per gallon margins realized from price protected customers generally are less than from variable priced residential customers.

Derivatives

We use derivative instruments in order to mitigate our exposure to market risk associated with the purchase of home heating oil for our price-protected customers, physical inventory on hand, inventory in transit and priced purchase commitments. Currently, the Partnership’s derivative instruments are with the following counterparties: Bank of America, N.A., Bank of Montreal, Cargill, Inc., Citibank, N.A., JPMorgan Chase Bank, N.A., Key Bank, N.A., Regions Financial Corporation, Societe Generale, and Wells Fargo Bank, N.A.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 815-10-05, Derivatives and Hedging, requires that derivative instruments be recorded at fair value and included in the consolidated balance sheet as assets or liabilities. To the extent derivative instruments designated as cash flow hedges are effective, as defined under this guidance, changes in fair value are recognized in other comprehensive income until the forecasted hedged item is recognized in earnings. We have elected not to designate our derivative instruments as hedging instruments under this guidance, and as a result, the changes in fair value of the derivative instruments during the holding period are recognized in our statement of operations. Therefore, we experience volatility in earnings as outstanding derivative instruments are marked to market and non-cash gains and losses are recorded prior to the sale of the commodity to the customer. The volatility in any given period related to unrealized non-cash gains or losses on derivative instruments can be significant to our overall results. However, we ultimately expect those gains and losses to be offset by the cost of product when purchased. Depending on the risk being hedged, realized gains and losses are recorded in cost of product, cost of installations and services, or delivery and branch expenses.

9

Table of Contents

Suppliers and Supply Arrangements

We purchase our product for delivery in either barge, pipeline, in place or truckload quantities, and as of September 30, 2014 had contracts with approximately 100 third-party terminals for the right to temporarily store petroleum products at their facilities. Home heating oil and propane purchases are made under supply contracts or on the spot market. We have entered into market price based contracts for approximately 87% of our expected retail home heating oil and propane requirements for the fiscal 2015 heating season. We also have market price based contracts for approximately 28% of our expected diesel and gasoline requirements for fiscal 2015.

During fiscal 2014, Global Companies LLC and NIC Holding Corp. provided approximately 17% and 11%, respectively, of our petroleum product purchases. No other single supplier provided more than 10% of our product supply during fiscal 2014. For fiscal 2015, we generally have supply contracts for similar quantities with Global Companies LLC and NIC Holding Corp. Supply contracts typically have terms of 6 to 12 months. All of the supply contracts provide for minimum quantities and in most cases do not establish in advance the price of home heating oil or propane. This price is based upon a published market index price at the time of delivery or pricing date plus an agreed upon differential. We believe that our policy of contracting for the majority of our anticipated supply needs with diverse and reliable sources will enable us to obtain sufficient product should unforeseen shortages develop in worldwide supplies.

Home Heating Oil Price Volatility

In recent years, the wholesale price of home heating oil has been extremely volatile, resulting in increased consumer sensitivity to heating costs and increased gross customer attrition. Like any other market commodity, the price of home heating oil is generally impacted by many factors, including economic and geopolitical forces. The price of home heating oil is closely linked to the price refiners pay for crude oil, which is the principal cost component of home heating oil. The volatility in the wholesale cost of home heating oil, as measured by the New York Mercantile Exchange (“NYMEX”) price per gallon for the fiscal years ended September 30, 2010 through 2014, on a quarterly basis, is illustrated by the following chart:

| Fiscal 2014 (1) (2) | Fiscal 2013 (1) | Fiscal 2012 | Fiscal 2011 | Fiscal 2010 | ||||||||||||||||||||||||||||||||||||

| Low | High | Low | High | Low | High | Low | High | Low | High | |||||||||||||||||||||||||||||||

| Quarter Ended |

||||||||||||||||||||||||||||||||||||||||

| December 31 |

$ | 2.84 | $ | 3.12 | $ | 2.90 | $ | 3.26 | $ | 2.72 | $ | 3.17 | $ | 2.19 | $ | 2.54 | $ | 1.78 | $ | 2.12 | ||||||||||||||||||||

| March 31 |

2.89 | 3.28 | 2.86 | 3.24 | 2.99 | 3.32 | 2.49 | 3.09 | 1.89 | 2.20 | ||||||||||||||||||||||||||||||

| June 30 |

2.85 | 3.05 | 2.74 | 3.09 | 2.53 | 3.25 | 2.75 | 3.32 | 1.87 | 2.35 | ||||||||||||||||||||||||||||||

| September 30 |

2.65 | 2.98 | 2.87 | 3.21 | 2.68 | 3.24 | 2.77 | 3.13 | 1.92 | 2.24 | ||||||||||||||||||||||||||||||

| (1) | Beginning April 1, 2013, the NYMEX contract specifications were changed from high sulfur home heating oil to ultra low sulfur diesel. |

| (2) | As of November 30, 2014, the price per gallon for ultra low sulfur diesel was $2.23. |

Acquisitions

Part of our business strategy is to pursue select acquisitions. During fiscal 2014, including the acquisition of Griffith Energy Services, Inc. (“Griffith”), the Partnership acquired three heating oil dealers with approximately 51,000 home heating oil and propane accounts for an aggregate purchase price of approximately $98.5 million. Of this total, $97.7 million pertained to the purchase price of Griffith, which was allocated $52.6 million to intangible assets, $17.3 million to fixed assets and $27.8 million to working capital (net of $4.2 million of cash acquired). The $0.8 million gross purchase price of our other two fiscal year 2014 acquisitions were allocated $1.1 million to intangible assets, $0.3 million to fixed assets and reduced by $0.6 million for working capital credits. Each acquired company’s operating results are included in the Partnership’s consolidated financial statements starting on its acquisition date. Customer lists, other intangibles and trade names are amortized on a straight-line basis over seven to twenty years.

During fiscal 2013, the Partnership acquired two heating oil dealers with approximately 2,000 home heating oil and propane accounts for an aggregate purchase price of approximately $1.4 million. The gross purchase price was allocated $1.3 million to intangible assets, $0.2 million to fixed assets and reduced by $0.1 million for working capital credits.

During fiscal 2012, the Partnership acquired seven heating oil and propane dealers with approximately 41,000 home heating oil and propane accounts for an aggregate purchase price of approximately $39.2 million. The gross purchase price was allocated $32.4 million to intangible assets, $8.0 million to fixed assets and reduced by $1.2 million for working capital credits.

10

Table of Contents

Employees

As of September 30, 2014, we had 2,958 employees, of whom 823 were office, clerical and customer service personnel; 888 were equipment technicians; 479 were fuel delivery drivers and mechanics; 451 were management and 317 were employed in sales. Of these employees 1,182 are represented by 49 different collective bargaining agreements with local chapters of labor unions. Some of these unions have union administered pension plans that have significant unfunded liabilities, a portion of which could be assessed to us should we withdraw from these plans. The Partnership does not expect to withdraw from these plans. Depending on the demands of the 2015 heating season, we anticipate that we will augment our current staffing levels from the 457 employees on leave (309 of whom are represented by collective bargaining agreements with labor unions indicated earlier). We are currently involved in union negotiations with two local bargaining units which cover 19 employees. There currently are four collective bargaining agreements that are expired, covering approximately 27 employees, and 10 more collective bargaining agreements which come up for renewal in fiscal 2015, covering approximately 205 employees. We believe that our relations with both our union and non-union employees are generally satisfactory.

Government Regulations

We are subject to various federal, state and local environmental, health and safety laws and regulations. Generally, these laws impose limitations on the discharge or emission of pollutants and establish standards for the handling of solid and hazardous wastes. These laws include the Resource Conservation and Recovery Act, the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), the Clean Air Act, the Occupational Safety and Health Act, the Emergency Planning and Community Right to Know Act, the Clean Water Act and comparable state statutes. CERCLA, also known as the “Superfund” law, imposes joint and several liabilities without regard to fault or the legality of the original conduct on certain classes of persons that are considered to have contributed to the release or threatened release of a hazardous substance into the environment. Products stored and/or delivered by us and certain automotive waste products generated by our fleet are hazardous substances within the meaning of CERCLA or otherwise subject to investigation and cleanup under other environmental laws and regulations. While we are currently not involved with any material CERCLA claims, and we have implemented programs and policies designed to address potential liabilities and costs under applicable environmental laws and regulations, failure to comply with such laws and regulations could result in civil or criminal penalties in cases of non-compliance or impose liability for remediation costs.

We have incurred and continue to incur costs to address soil and groundwater contamination at some of our locations, including legacy contamination at properties that we have acquired. A number of our properties are currently undergoing remediation, in some instances funded by prior owners or operators contractually obligated to do so. To date, no material issues have arisen with respect to such prior owners or operators addressing such remediation, although there is no assurance that this will continue to be the case. In addition, we have been subject to proceedings by regulatory authorities for alleged violations of environmental and safety laws and regulations. We do not expect any of these liabilities or proceedings of which we are aware to result in material costs to, or disruptions of, our business or operations.

In addition, transportation of our products by truck are subject to regulations promulgated under the Federal Motor Carrier Safety Act. These regulations cover the transportation of hazardous materials and are administered by the United States Department of Transportation or similar state agencies. We conduct ongoing training programs to help ensure that our operations are in compliance with applicable safety regulations. We maintain various permits that are necessary to operate some of our facilities, some of which may be material to our operations.

11

Table of Contents

| ITEM 1A. | RISK FACTORS |

You should consider carefully the risk factors discussed below, as well as all other information, as an investment in the Partnership involves a high degree of risk. We are subject to certain risks and hazards due to the nature of the business activities we conduct. The risks discussed below, any of which could materially and adversely affect our business, financial condition, cash flows, and results of operations, could result in a partial or total loss of your investment, and are not the only risks we face. We may experience additional risks and uncertainties not currently known to us or, as a result of developments occurring in the future, conditions that we currently deem to be immaterial may also materially and adversely affect our business, financial condition, cash flows and results of operations.

Our operating results will be adversely affected if we continue to experience significant net attrition in our home heating oil and propane customer base.

The following table depicts our gross customer gains, gross customer losses and net customer attrition from fiscal year 2010 to fiscal year 2014. Net customer attrition is the difference between gross customer losses and customers added through marketing efforts. Customers added through acquisitions are not included in the calculation of gross customer gains. However, additional customers that are obtained through marketing efforts at newly acquired businesses are included in these calculations. Customer attrition percentage calculations include customers added through acquisitions in the denominators of the calculations on a weighted average basis. Starting October 1, 2010, we have included propane customers in this calculation as several of our acquisitions since such date have included propane operations.

| Fiscal Year Ended September 30, | ||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 (a) | ||||||||||||||||

| Gross customer gains |

16.0 | % | 14.8 | % | 13.4 | % | 13.2 | % | 11.6 | % | ||||||||||

| Gross customer losses |

16.9 | % | 18.1 | % | 18.3 | % | 16.7 | % | 16.6 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net attrition |

(0.9 | %) | (3.3 | %) | (4.9 | %) | (3.5 | %) | (5.0 | %) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | Prior to fiscal 2011, we measured only home heating oil net customer attrition. |

The gain of a new customer does not fully compensate for the loss of an existing customer because of the expenses incurred during the first year to acquire a new customer. Customer losses are the result of various factors, including but not limited to:

| • | price competition; |

| • | customer relocations and home sales/foreclosures; |

| • | conversions to natural gas; and |

| • | credit worthiness. |

The continuing volatility in the energy markets has intensified price competition and added to our difficulty in reducing net customer attrition.

If we are not able to reduce the current level of net customer attrition or if such level should increase, it will have a material adverse effect on our business, operating results and cash available for distributions to unitholders. For additional information about customer attrition, see Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Customer Attrition.”

12

Table of Contents

Because of the highly competitive nature of our business, we may not be able to retain existing customers or acquire new customers, which would have an adverse impact on our business, operating results and financial condition.

Our business is subject to substantial competition. Most of our operating locations compete with numerous distributors, primarily on the basis of price, reliability of service and responsiveness to customer service needs. Each operating location operates in its own competitive environment.

We compete with distributors offering a broad range of services and prices, from full-service distributors, such as ourselves, to those offering delivery only. As do many companies in our business, we provide home heating equipment repair service on a 24-hour-a-day, seven-day-a-week, 52 weeks a year basis. We believe that this tends to build customer loyalty. In some instances homeowners have formed buying cooperatives that seek to purchase home heating oil from distributors at a price lower than individual customers are otherwise able to obtain. We also compete for retail customers with suppliers of alternative energy products, principally natural gas, propane (in the case of our home heating oil operations) and electricity. If we are unable to compete effectively, we may lose existing customers and/or fail to acquire new customers, which would have a material adverse effect on our business, operating results and financial condition.

The following table depicts our customer losses to natural gas conversions from fiscal year 2010 to fiscal year 2014. Conversions to natural gas have increased and we believe this may continue as natural gas has become significantly less expensive than home heating oil on an equivalent BTU basis. In addition, the states of New York, Connecticut and Pennsylvania are seeking to encourage homeowners to expand the use of natural gas as a heating fuel through legislation and regulatory efforts.

| Fiscal Year Ended September 30, | ||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| Customer losses to natural gas conversion |

(2.2 | )% | (2.4 | )% | (2.0 | )% | (1.5 | )% | (1.1 | )% | ||||||||||

In addition to our direct customer losses to natural gas competition, any conversion to natural gas by a heating oil or propane consumer in our geographic footprint reduces the pool of available customers from which we can gain new customers, and could have a material adverse effect on our business, operating results and financial condition.

Energy efficiency and new technology may reduce the demand for our products and adversely affect our operating results.

Increased conservation and technological advances, including installation of improved insulation and the development of more efficient furnaces and other heating devices, have adversely affected the demand for our products by retail customers. Future conservation measures or technological advances in heating, conservation, energy generation or other devices might reduce demand and adversely affect our operating results.

If we do not make acquisitions on economically acceptable terms, our future growth will be limited.

Our industry is not a growth industry because new housing generally uses natural gas when it is available, and competition has also increased from alternative energy sources. Accordingly, future growth will depend on our ability to make acquisitions on economically acceptable terms. We cannot assure that we will be able to identify attractive acquisition candidates in our sector in the future or that we will be able to acquire businesses on economically acceptable terms. Factors that may adversely affect our operating and financial results may limit our access to capital and adversely affect our ability to make acquisitions. Under the terms of our amended and restated revolving credit facility that we sometimes refer to in this Report as the revolving credit facility, we are restricted from making any individual acquisition in excess of $25.0 million without the lenders’ approval. In addition, to make an acquisition, we are required to have Availability (as defined in the revolving credit facility) of at least $40.0 million, on a historical pro forma and forward-looking basis. This covenant restriction may limit our ability to make acquisitions. Any acquisition may involve potential risks to us and ultimately to our unitholders, including:

| • | an increase in our indebtedness; |

| • | an increase in our working capital requirements; |

| • | an inability to integrate the operations of the acquired business; |

| • | an inability to successfully expand our operations into new territories; |

| • | the diversion of management’s attention from other business concerns; |

| • | an excess of customer loss or loss of key employees from the acquired business; and |

| • | the assumption of additional liabilities including environmental liabilities. |

In addition, acquisitions may be dilutive to earnings and distributions to unitholders, and any additional debt incurred to finance acquisitions may, among other things, affect our ability to make distributions to our unitholders.

High product prices can lead to customer conservation and attrition, resulting in reduced demand for our products.

Prices for our products are subject to volatile fluctuations in response to changes in supply and other market conditions. During periods of high product costs our prices generally increase. High prices can lead to customer conservation and attrition, resulting in reduced demand for our products.

13

Table of Contents

A significant portion of our home heating oil volume is sold to price-protected customers (ceiling and fixed) and our gross margins could be adversely affected if we are not able to effectively hedge against fluctuations in the volume and cost of product sold to these customers.

A significant portion of our home heating oil volume is sold to individual customers under an arrangement pre-establishing the ceiling sales price or a fixed price of home heating oil over a fixed period. When the customer makes a purchase commitment for the next period we currently purchase option contracts, swaps and futures contracts for a substantial majority of the heating oil that we expect to sell to these price-protected customers. The amount of home heating oil volume that we hedge per price-protected customer is based upon the estimated fuel consumption per average customer, per month. If the actual usage exceeds the amount of the hedged volume on a monthly basis, we could be required to obtain additional volume at unfavorable margins. In addition, should actual usage in any month be less than the hedged volume, (including, for example, as a result of early terminations by fixed price customers) our hedging losses could be greater. Currently, we have elected not to designate our derivative instruments as hedging instruments under FASB ASC 815-10-05 Derivatives and Hedging, and the change in fair value of the derivative instruments is recognized in our statement of operations. Therefore, we experience volatility in earnings as these currently outstanding derivative contracts are marked to market and non-cash gains or losses are recorded in the statement of operations.

Our risk management policies cannot eliminate all commodity risk, basis risk, or the impact of adverse market conditions which can adversely affect our financial condition, results of operations and cash available for distribution to our unitholders. In addition, any noncompliance with our risk management policies could result in significant financial losses.

While our hedging policies are designed to minimize commodity risk, some degree of exposure to unforeseen fluctuations in market conditions remains. For example, we change our hedged position daily in response to movements in our inventory. Any difference between the estimated future sales from inventory and actual sales will create a mismatch between the amount of inventory and the hedges against that inventory, and thus change the commodity risk position that we are trying to maintain. Also, significant increases in the costs of the products we sell can materially increase our costs to carry inventory. We use our credit facility as our primary source of financing to carry inventory and may be limited on the amounts we can borrow to carry inventory. Basis risk describes the inherent market price risk created when a commodity of certain grade or location is purchased, sold or exchanged as compared to a purchase, sale or exchange of a like commodity at a different time or place. Transportation costs and timing differentials are components of basis risk. For example, we use the NYMEX to hedge our commodity risk with respect to pricing of energy products traded on the NYMEX. Physical deliveries under NYMEX contracts are made in New York Harbor. To the extent we take deliveries in other ports, such as Boston Harbor, we may have basis risk. In a backward market (when prices for future deliveries are lower than current prices), basis risk is created with respect to timing. In these instances, physical inventory generally loses value as basis declines over time. Basis risk cannot be entirely eliminated, and basis exposure, particularly in backward or other adverse market conditions, can adversely affect our financial condition, results of operations and cash available for distribution to our unitholders.

We monitor processes and procedures to prevent unauthorized trading and to maintain substantial balance between purchases and sales or future delivery obligations. We can provide no assurance, however, that these steps will detect and/or prevent all violations of such risk management policies and procedures, particularly if deception or other intentional misconduct is involved.

Since weather conditions may adversely affect the demand for home heating oil and propane, our business, operating results and financial condition are vulnerable to warm winters.

Weather conditions in the Northeast and Mid-Atlantic regions in which we operate have a significant impact on the demand for home heating oil and propane because our customers depend on this product principally for space heating purposes. As a result, weather conditions may materially adversely impact our business, operating results and financial condition. During the peak-heating season of October through March, sales of home heating oil and propane historically have represented approximately 80% of our annual oil volume. Actual weather conditions can vary substantially from year to year or from month to month, significantly affecting our financial performance. Warmer than normal temperatures in one or more regions in which we operate can significantly decrease the total volume we sell and the gross profit realized and, consequently, our results of operations. In fiscal years 2012 and 2002 temperatures were significantly warmer than normal for the areas in which we sell our products, which adversely affected the amount of net income, EBITDA and Adjusted EBITDA that we generated during these periods.

To partially mitigate the adverse effect of warm weather on cash flows, we have used weather hedge contracts for a number of years. In general, such weather hedge contracts provide that we are entitled to receive a specific payment per heating degree-day shortfall, when the total number of heating degree-days in the hedge period is less than approximately 92.5% of the ten year average (the “Payment Threshold”). The hedge generally covers the period from November 1, through March 31, of a fiscal year taken as a whole, and has a maximum payout amount. Temperatures in fiscal year 2012, taken as a whole met the Payment Threshold, and the heating degree-day shortfall during this period resulted in our receiving the full $12.5 million payout, which was recorded as a reduction of expenses in the line item delivery and branch expenses in the statements of operations.

For fiscal years 2015, 2016 and 2017 we have a weather hedge contract with subsidiaries of Swiss Re under which we are entitled to receive a payment of $35,000 per heating degree-day shortfall, when the total number of heating degree-days in the hedge period is less than approximately 92.5% of the ten year average, the Payment Threshold. The hedge covers the period from November 1, through March 31, taken as a whole, for each respective fiscal year, and has a maximum payout of $12.5 million for each respective fiscal year. However, there can be no assurance that such weather hedge contract would fully or substantially offset the adverse effects of warmer weather on our business and operating results during such period.

14

Table of Contents

The increased costs of employer-sponsored health insurance premiums and incremental costs due to the Affordable Healthcare Act could materially and adversely affect the Company’s financial condition, results of operations, cash flows and ability to hire and retain employees.

In March 2010, the United States federal government enacted comprehensive health care reform legislation, which, among other things, includes guaranteed coverage requirements, eliminates pre-existing condition exclusions and annual and lifetime maximum limits, restricts the extent to which policies can be rescinded, and imposes new fees on health insurers, self-insured companies, and health care benefits. The legislation imposes implementation effective dates that began in 2010 and extend through 2020 with many of the changes requiring additional guidance and regulations from federal agencies. Possible adverse effects could include increased costs, exposure to expanded liability, and requirements for us to revise the ways in which healthcare and other benefits are provided to employees. Such future higher costs could have a material adverse effect on our financial condition, results of operations, and cash flows. Attempts to pass all the increased costs through to our customers could result in higher attrition. Mitigating those costs through reducing benefits to employees could impair our ability to hire and/or retain employees, as other potential employers may be able to either absorb the higher costs or be able to pass more of the increase through to their customers than we may be able to.

Our obligation to fund multi-employer pension plans to which we contribute may have an adverse impact on us.

We participate in a number of trustee-managed multi-employer pension plans for employees covered under collective bargaining agreements. Several factors could cause us to make significantly higher future contributions to these plans, including unfavorable investment performance, insolvency of participating employers, changes in demographics and increased benefits to participants. Some of these unions have union administered pension plans that have significant unfunded liabilities, a portion of which could be assessed to us should we withdraw from these plans, there be a mass withdrawal from these plans, or the plans become insolvent or otherwise terminate. While we currently have no intention of withdrawing from a plan and unfunded pension obligations have not significantly affected our operations in the past, there can be no assurance that we will not be required to make material cash contributions to one or more of these plans to satisfy certain underfunded benefit obligations in the future. Any termination of a multi-employer plan, or mass withdrawal or insolvency of contributing employers, could require us to contribute an amount under a plan of rehabilitation or surcharge assessment that would have a material adverse impact on our consolidated financial condition, results of operations and cash flows.

We rely on the continued solvency of our derivatives, insurance and weather hedge counterparties.

If counterparties to the derivative instruments that we use to hedge the cost of home heating oil sold to price-protected customers, physical inventory and our vehicle fuel costs were to fail, our liquidity, operating results and financial condition could be materially adversely impacted, as we would be obligated to fulfill our operational requirement of purchasing, storing and selling home heating oil and vehicle fuel, while losing the mitigating benefits of economic hedges with a failed counterparty. If one of our insurance carriers were to fail, our liquidity, results of operations and financial condition could be materially adversely impacted, as we would have to fund any catastrophic loss. If our weather hedge counterparty were to fail, we would lose the protection of our weather hedge contract. Currently, we have outstanding derivative instruments with the following counterparties: Bank of America, N.A., Bank of Montreal, Cargill, Inc., Citibank, N.A., JPMorgan Chase Bank, N.A., Key Bank, N.A., Regions Financial Corporation, Societe Generale, and Wells Fargo Bank, N.A. Our primary insurance carriers are American International Group and Federated Mutual Insurance Company, and our weather hedge counterparties are subsidiaries of Swiss Re.

Our operating results are subject to seasonal fluctuations.

Our operating results are subject to seasonal fluctuations since the demand for home heating oil and propane is greater during the first and second fiscal quarter of our fiscal year, which is the peak heating season. The seasonal nature of our business has resulted on average in the last five years in the sale of approximately 30% of our volume of home heating oil and propane in the first fiscal quarter and 50% of our volume in the second fiscal quarter of each fiscal year. As a result, we generally realize net income in our first and second fiscal quarters and net losses during our third and fourth fiscal quarters and we expect that the negative impact of seasonality on our third and fourth fiscal quarter operating results will continue. Thus any material reduction in the profitability of the first and second quarters for any reason, including warmer than normal weather, generally cannot be made up by any significant profitability improvements in the results of the third and fourth quarters.

15

Table of Contents

Our substantial debt and other financial obligations could impair our financial condition and our ability to fulfill our debt obligations.

At September 30, 2014, we had outstanding $125.0 million of senior notes due 2017 (the “notes”), zero borrowed under our revolving credit facility, which expires in January 2019 (if the Partnership has met the conditions of the facility termination date as defined in the agreement), $52.8 million of letters of credit issued, $14.9 million of hedge positions secured, and availability of $149.6 million under such revolving credit facility. During the last three fiscal years we have utilized as much as $253.8 million of our revolving credit facility in borrowings, letters of credit and hedging reserve. Our substantial indebtedness and other financial obligations could:

| • | impair our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions, unit repurchases or general partnership purposes; |

| • | have a material adverse effect on us if we fail to comply with financial and affirmative and restrictive covenants in our debt agreements and an event of default occurs that is not cured or waived; |

| • | require us to dedicate a substantial portion of our cash flow for interest payments on our indebtedness and other financial obligations, thereby reducing the availability of our cash flow to fund working capital and capital expenditures; |

| • | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; and |

| • | place us at a competitive disadvantage compared to our competitors that have proportionally less debt. |

If we are unable to meet our debt service obligations and other financial obligations, we could be forced to restructure or refinance our indebtedness and other financial transactions, seek additional equity capital or sell our assets. We might then be unable to obtain such financing or capital or sell our assets on satisfactory terms, if at all.

Increases in wholesale product costs may have adverse effects on our business, financial condition and results of operations.

Increases in wholesale product costs may have adverse effects on our business, financial condition and results of operations, including the following:

| • | customer conservation or attrition due to customers converting to lower cost heating products or suppliers; |

| • | reduced liquidity as a result of higher receivables, and/or inventory balances as we must fund a portion of any increase in receivables, inventory and hedging costs from our own resources, thereby tying up funds that would otherwise be available for other purposes; |

| • | higher bad debt expense and credit card processing costs as a result of higher selling prices; |

| • | higher interest expense as a result of increased working capital borrowing to finance higher receivables and/or inventory balances; and |

| • | higher vehicle fuel costs. |

The volatility in wholesale energy costs may adversely affect our liquidity.

Our business requires a significant amount of working capital to finance accounts receivable and inventory during the heating season. Under our revolving credit facility, we may borrow up to $300 million, which increases to $450 million during the peak winter months from December through April of each fiscal year. We are obligated to meet certain financial covenants under the revolving credit facility, including the requirement to maintain at all times either excess availability (borrowing base less amounts borrowed and letters of credit issued) of 12.5% of the revolving credit commitment then in effect or a fixed charge coverage ratio (as defined in the revolving credit facility agreement) of not less than 1.1.

If increases in wholesale product costs cause our working capital requirements to exceed the amounts available under our revolving credit facility or should we fail to maintain the required availability or fixed charge coverage ratio, we would not have sufficient working capital to operate our business, which could have a material adverse effect on our financial condition and results of operations.

We purchase synthetic call options and forward swaps with members of our lending group to manage market risk associated with our commitments to our customers, our physical inventory and fuel we use for our vehicles. These institutions have not required an initial cash margin deposit or any mark to market maintenance margin for these derivatives. Any mark to market exposure is reserved against our borrowing base and can thus reduce the amount available to us under our revolving credit facility. The highest mark to market reserve against our borrowing base for these derivative instruments with our lending group was $14.9 million, $13.8 million, and $16.1 million, during fiscal years 2014, 2013, and 2012, respectively.

We also purchase call options to hedge the price of the products to be sold to our price-protected customers which usually require us to pay an upfront cash payment. This reduces our liquidity, as we must pay for the option before any sales are made to the customer. We also purchase synthetic call options which require us to pay for these options as they expire.

16

Table of Contents

For certain of our supply contracts, we are required to establish the purchase price in advance of receiving the physical product. This occurs at the end of the month and is usually 20 days prior to receipt of the product. We use futures contracts or swaps to “short” the purchase commitment such that the commitment floats with the market. As a result, any upward movement in the market for home heating oil would reduce our liquidity, as we would be required to post additional cash collateral for a futures contract or our availability to borrow under our bank facility would be reduced in the case of a swap.

At December 31, 2014, we expect to have approximately 40 million gallons of purchase commitments and physical inventory shorted with a futures contract or swap. If the wholesale price of heating oil increased $1.00 per gallon, our near term liquidity in December would be reduced by $40 million.

At September 30, 2014, we had approximately 142,000 customers, or 37% of our residential customer base, on the balanced payment plan. Volatility in wholesale prices could reduce our liquidity if we failed to recalculate the balanced payments on a timely basis or if customers resist higher balanced payments. These customers could possibly owe us more in the future than we had budgeted. Generally, customer credit balances are at their low point after the end of the heating season and at their peak prior to the beginning of the heating season.

Sudden and sharp oil price increases that cannot be passed on to customers may adversely affect our operating results.

Our industry is a “margin-based” business in which gross profit depends on the excess of sales prices per gallon over supply costs per gallon. Consequently, our profitability is sensitive to changes in the wholesale product cost caused by changes in supply or other market conditions. These factors are beyond our control and thus, when there are sudden and sharp increases in the wholesale cost of home heating oil, we may not be able to pass on these increases to customers through increased retail sales prices. In an effort to retain existing accounts and attract new customers we may offer discounts, which will impact the net per gallon gross margin realized.

Significant declines in the wholesale price of home heating oil may cause price-protected customers to renegotiate or terminate their arrangements which may adversely impact our gross profit and operating results.

When the wholesale price of home heating oil declines significantly after a customer enters into a price protection arrangement, some customers attempt to renegotiate their arrangement in order to enter into a lower cost pricing plan with us or terminate their arrangement and switch to a competitor. As a result of significant decreases in the price of home heating oil following the summer of 2008, many price-protected customers attempted to renegotiate their agreements with us in fiscal 2009. It is our policy to bill a termination fee when customers terminate their arrangement with us. We believe that approximately 10,000 customers terminated their relationship with us as a result of being billed the termination fee in fiscal 2009.

Current economic conditions could adversely affect our results of operations and financial condition.

Uncertainty about current economic conditions poses a risk as our customers may reduce or postpone spending in response to tighter credit, negative financial news and/or declines in income or asset values, which could have a material negative effect on the demand for our equipment and services and could lead to increased conservation, as we have seen certain of our customers seek lower cost providers. Any increase in existing customers or potential new customers seeking lower cost providers and/or increase in our rejection rate of potential accounts because of credit considerations could increase our overall rate of net customer attrition. In addition, we could experience an increase in bad debts from financially distressed customers, which would have a negative effect on our liquidity, results of operations and financial condition.

We are subject to operating and litigation risks that could adversely affect our operating results whether or not covered by insurance.

Our operations are subject to all operating hazards and risks normally incidental to handling, storing, transporting and otherwise providing customers with our products. As a result, we may be a defendant in legal proceedings and litigation arising in the ordinary course of business.

We maintain insurance policies with insurers in amounts and with coverage and deductibles that we believe are reasonable. However, there can be no assurance that this insurance will be adequate to protect us from all material expenses related to potential future claims for remediation costs and personal and property damage or that these levels of insurance will be available in the future at economical prices.

17

Table of Contents

Our operations are subject to operational hazards and our insurance reserves may not be adequate to cover actual losses.

In providing services to our customers, our operations are subject to operational hazards such as natural disasters, adverse weather, accidents, fires, explosions, hazardous materials releases, mechanical failures and other events beyond our control. If any of these events were to occur, we could incur substantial losses because of personal injury or loss of life, severe damage to and destruction of property and equipment, and pollution or other environmental damage resulting in curtailment or suspension of our related operations.

As we self-insure workers’ compensation, automobile and general liability claims up to pre-established limits, we establish reserves based upon expectations as to what our ultimate liability will be for claims based on our historical developmental factors. We evaluate on an annual basis the potential for changes in loss estimates with the support of qualified actuaries. As of September 30, 2014, we had approximately $57.3 million of net insurance reserves and had issued $48.4 million in letters of credit for current and future claims. The ultimate settlement of these claims could differ materially from the assumptions used to calculate the reserves, which could have a material effect on our results of operations.

Our results of operations and financial condition may be adversely affected by governmental regulation and associated environmental and regulatory costs.

Our business is subject to a wide range of federal and state laws and regulations related to environmental and other matters. Such laws and regulations have become increasingly stringent over time. We may experience increased costs due to stricter pollution control requirements or liabilities resulting from noncompliance with operating or other regulatory permits. New regulations might adversely impact operations, including those relating to underground storage and transportation of the products that we sell. In addition, there are environmental risks inherently associated with home heating oil operations, such as the risks of accidental releases or spills. We have incurred and continue to incur costs to remediate soil and groundwater contamination at some of our locations. We cannot be sure that we have identified all such contamination, that we know the full extent of our obligations with respect to contamination of which we are aware, or that we will not become responsible for additional contamination not yet discovered. It is possible that material costs and liabilities will be incurred, including those relating to claims for damages to property and persons.

In addition, our financial condition, results of operations and ability to pay distributions to our unitholders may be negatively impacted by significant changes in federal and state tax law. For example, an increase in federal and state income tax rates will reduce the amount of cash to pay distributions.

There is increasing attention in the United States and worldwide concerning the issue of climate change and the effect of emissions of greenhouse gases (“GHG”), in particular from the combustion of fossil fuels. Federal, regional and state regulatory authorities in many jurisdictions have begun taking steps to regulate GHG emissions. In June 2014, the United States Environmental Protection Agency (“EPA”) issued its “Clean Power Plan” for regulation of GHG emissions. Under the Clean Power Plan, the EPA will set state-specific goals for GHG emissions reductions, leaving the states with flexibility to determine how to achieve such goals. While it is too early to predict how the states where we operate or from which we obtain our products will elect to control GHG emissions, it is likely that any regulatory program that caps emissions or imposes a carbon tax will increase costs for us and our customers, which could lead to increased conservation or customers seeking lower cost alternatives. However, we cannot yet estimate the compliance costs or business impact of potential national, regional or state greenhouse gas emissions reduction legislation, regulations or initiatives, since many such programs and proposals are still in development.

Our operations would be adversely affected if service at our third-party terminals or on the common carrier pipelines used is interrupted.

The products that we sell are transported in either barge, pipeline or in truckload quantities to third-party terminals where we have contracts to temporarily store our products. Any significant interruption in the service of these third-party terminals or on the common carrier pipelines used would adversely affect our ability to obtain product.

The products that we sell are transported in either barge, pipeline or in truckload quantities to third-party terminals where we have contracts to temporarily store our products. Any significant interruption in the service of these third-party terminals or on the common carrier pipelines used would adversely affect our ability to obtain product.

18

Table of Contents

The risk of global terrorism and political unrest may adversely affect the economy and the price and availability of the products that we sell and have a material adverse effect on our business, financial condition and results of operations.

Terrorist attacks and political unrest may adversely impact the price and availability of the products that we sell, our results of operations, our ability to raise capital and our future growth. The impact that the foregoing may have on our industry in general, and on our business in particular, is not known at this time. An act of terror could result in disruptions of crude oil supplies, markets and facilities, and the source of the products that we sell could be direct or indirect targets. Terrorist activity may also hinder our ability to transport our products if our normal means of transportation become damaged as a result of an attack. Instability in the financial markets as a result of terrorism could also affect our ability to raise capital. Terrorist activity could likely lead to increased volatility in the prices of our products.

The impact of hurricanes and other natural disasters could cause disruptions in supply and could also reduce the demand for the products that we sell, which would have a material adverse effect on our business, financial condition and results of operations.