Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Trinseo S.A. | d829224d8k.htm |

| EX-99.1 - EX-99.1 - Trinseo S.A. | d829224dex991.htm |

™

Trademark

Citi

Basic Materials

Conference

December 2, 2014

Exhibit 99.2 |

2

Introductions & Disclosure Rules

Disclosure Rules

The forward looking statements contained in this presentation involve risks and

uncertainties that may affect the Company's operations, markets, products,

services, prices and other factors. These risks and uncertainties include,

but are not limited to, economic, competitive, legal, governmental and technological

factors. Accordingly, there is no assurance that the Company's expectations

expressed in such forward looking statements will be realized. The Company

assumes no obligation to provide revisions to any forward looking statements

in this presentation should circumstances change. This presentation contains

financial measures that are not in accordance with generally accepted

accounting principles in the US (“GAAP”) including Adjusted EBITDA.

We believe these measures provide relevant and meaningful information to

investors and lenders about the ongoing operating results of the Company.

Such measures when referenced herein should not be viewed as an alternative to GAAP

measures of performance. We have provided a reconciliation of Adjusted EBITDA

in the Appendix section of this presentation.

Introductions

Chris Pappas, President & CEO

David Stasse, Vice President, Treasury & Investor Relations

|

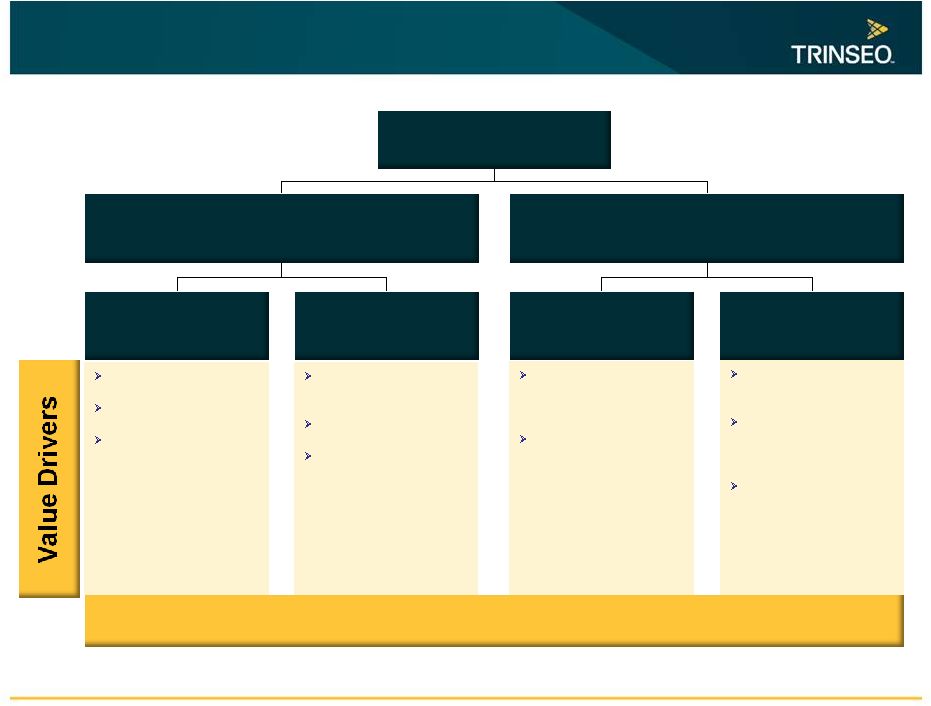

Investment Thesis

3

Engineered Polymers

Styrenics

Emulsion Polymers

Revenue: $1,928MM

Adj EBITDA: $252MM

Plastics

Revenue: $3,323MM

Adj EBITDA: $149MM

Synthetic Rubber

Q3’14 LTM Revenue: $5,251MM

Q3’14 LTM Adj EBITDA: $323MM

Latex

Consistent performance

Strong cash generation

Growth in Asia, carpet,

performance latex

Leveraged to high growth,

performance tire market

Incremental capacity

Favorable mix shift

Higher operating rate

leading to improved

margins

Capacity rationalization

Growing compounding

business

$35MM polycarbonate

restructuring savings in

2015

Cyclical upside to

improving polycarbonate

market

Note:

Division

and

Segment

EBITDA

excludes

Corporate

unallocated

Q3

’14

LTM

Adjusted

EBITDA

of

$(79)MM.

Totals

may

not

sum

due

to

rounding.

Deleveraging, Refinancing to Meaningfully Reduce Cash Interest

|

4

Latex

Consistent results

Three areas of focus: paper & board,

carpet, and performance latex

Growing carpet, paper board, Asia

paper, performance latex

Challenged paper markets in NA and

Europe

Additional TSE capacity in China in

mid-2015

Cost advantaged technologies

Volume / EBITDA

0

5

10

15

20

25

30

35

100

150

200

250

300

350

Q4 12

Q1 13

Q2 13

Q3 13

Q4 13

Q1 14

Q2 14

Q3 14

Volume

Adj EBITDA |

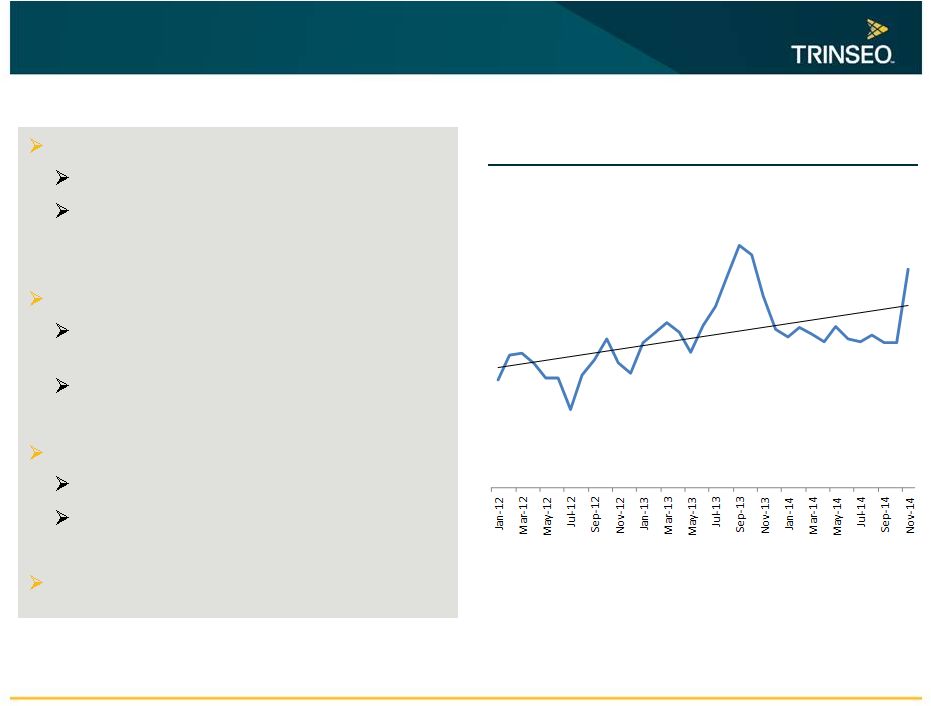

5

Synthetic Rubber

Focused on high growth, performance tire

market

Technology leader in SSBR

Provides superior tread properties such as wet grip,

low rolling resistance, reduced noise

Mix shift toward higher end products

Investing in growth

Purchased 25kt of capacity rights from JSR

Converting Ni-PBR train to Nd-PBR to address

demand for high performance tire walls

Trialing Generation 4 enhanced SSBR |

6

Engineered Polymers

Source: IHS

Growing demand for high-tech plastics focused

on automotive and other growth markets

Sustainable, long-standing relationships with

automotive industry leaders

Manufacturing facilities across four continents

Focused on weight reduction, interior aesthetics

Highly engineered compounds and blends

Serves consumer electronics, medical, and

electrical / lighting markets (CEM)

Polycarbonate

2014 YTD global demand growth up 5%

Operating rates approaching 80%

Polycarbonate

74%

79%

78%

76%

75%

77%

80%

60%

65%

70%

75%

80%

85%

2009

2010

2011

2012

2013

2014

2015

Operating Rate

European Margins |

7

Styrenics

Evolving industry structure

New players focused on SM and PS margins

Capacity rationalization and cyclical recovery

will increase operating rates

Styrenic polymers business with global scale

Focused on appliances, packaging, and

constructions

Number 3 polystyrene globally

Tightening styrene operating rates

Leading to higher styrene margins

Margin upside with outage-driven spikes

Americas Styrenics provided $35mm in LTM

dividends

Source: IHS

Europe Styrene Spread Over Raw Materials |

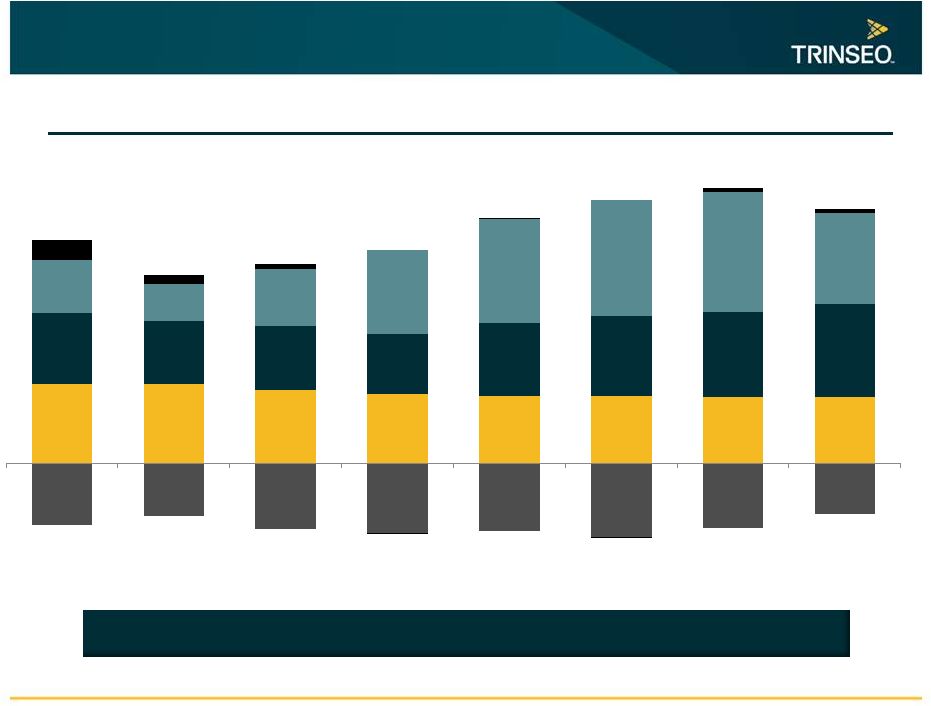

LTM Q4 2012

LTM Q1 2013

LTM Q2 2013

LTM Q3 2013

LTM Q4 2013

LTM Q1 2014

LTM Q2 2014

LTM Q3 2014

$255

$214

$211

$225

$278

$297

$333

$323

8

Financial Overview

Source: see appendix for reconciliation to nearest GAAP metric

Historical Quarterly Adjusted EBITDA

Strong earnings momentum driven by growth in Synthetic Rubber,

stable Latex business; full $35MM Polycarbonate savings in 2015

Styrenics

Synthetic

Rubber

Latex

Corp.

Eng

Polymers

(millions) |

9

Cash Generation / Balance Sheet

Consistent cash generation

Focus on deleveraging

Modest capex

Growth opportunities to be pursued

selectively

Ability to refinance up to $1.193 billion

of Senior Notes

Potential to significantly lower interest costs

(currently 8.75% coupon)

Strong balance sheet with no long-

term debt maturities until 2019

$631 million liquidity as of Q3 end

Cash ($152MM), Revolver ($293MM), AR

Facility ($186MM)

143

223

242

4.7x

2012

2013

Q3 14 LTM

Adj EBITDA less Capex ($MM)

Leverage Ratio |

Value

Drivers Structural

•

Polycarbonate restructuring

•

Deleveraging and refinancing

•

Consolidation and capacity rationalization

Profitable Growth

•

Additional SSBR capacity

•

New SSBR and neodymium-PBR technology

•

China latex expansion

•

Automotive and CEM compounding

Cyclical

•

Rising operating rates in styrene, polystyrene, polycarbonate

•

Macro recovery

10 |

Appendix

™

Trademark |

12

US GAAP to Non-GAAP Reconciliation

Note: totals may not sum due to rounding

Adj EBITDA and Net Income Reconciliation

(in $millions, unless noted)

Q4'12 LTM

Q1'13 LTM

Q2'13 LTM

Q3'13 LTM

Q4'13 LTM

Q1'14 LTM

Q2'14 LTM

Q3'14 LTM

Net Income (Loss)

30.3

(9.4)

(39.5)

(33.3)

(22.2)

4.5

(12.0)

(27.0)

Interest expense, net

110.0

116.6

123.7

128.0

132.0

132.5

131.4

128.6

Provision for (benefit from) income taxes

17.5

(7.7)

0.6

(3.7)

21.9

34.7

38.0

35.6

Depreciation and amortization

85.6

88.5

90.6

93.8

95.3

95.1

98.3

102.9

EBITDA

243.4

187.9

175.3

184.7

226.9

266.8

255.7

240.1

Loss on extinguishment of long-term debt

-

20.7

20.7

20.7

20.7

-

-

7.4

Other non-recurring items

(0.7)

0.5

0.5

1.1

0.7

(0.4)

32.1

34.0

Restructuring and other charges

7.4

(0.4)

6.0

9.0

10.8

11.3

7.0

5.2

Net (gains) / losses on dispositions of businesses and assets

-

-

3.2

4.2

4.2

4.2

1.0

0.0

Fees paid pursuent to advisory agreement

4.6

4.7

4.7

4.8

4.7

4.7

27.8

26.6

Asset impairment charges or write-offs

-

-

0.7

0.7

9.9

9.9

9.2

9.2

Adjusted EBITDA

254.8

213.5

211.2

225.3

278.1

296.8

332.8

322.5 |

13

Selected Segment Information

Note: totals may not sum due to rounding

(in $millions, unless noted)

Q1'12

Q2'12

Q3'12

Q4'12

Q1'13

Q2'13

Q3'13

Q4'13

Q1'14

Q2'14

Q3'14

2012

2013

2014 YTD

Latex

330

317

327

301

307

305

310

288

299

295

309

1,275

1,210

904

Synthetic Rubber

125

106

116

130

137

125

128

133

155

142

136

477

523

433

Styrenics

664

652

679

614

669

679

644

597

686

689

671

2,608

2,588

2,047

Engineered Polymers

218

201

194

192

199

203

200

199

204

201

199

804

801

603

Trade Volume (MMLbs)

1,337

1,275

1,316

1,237

1,311

1,311

1,282

1,218

1,344

1,327

1,315

5,165

5,122

3,986

Latex

398

422

375

351

357

345

332

308

326

321

328

1,545

1,341

975

Synthetic Rubber

193

175

155

179

176

156

142

148

177

165

155

702

622

497

Styrenics

528

538

542

541

602

597

576

530

594

590

561

2,149

2,305

1,745

Engineered Polymers

278

274

255

249

256

263

259

260

262

266

261

1,056

1,038

788

Net Sales

1,396

1,409

1,327

1,320

1,392

1,362

1,309

1,245

1,359

1,341

1,305

5,452

5,307

4,006

Latex

27

39

33

27

27

29

27

24

26

27

26

125

106

79

Synthetic Rubber

44

24

19

24

31

28

13

42

43

37

27

111

113

107

Styrenics

49

(9)

24

19

25

21

67

52

42

27

22

83

165

91

Engineered Polymers

16

2

13

0

(1)

(3)

2

2

(2)

5

2

32

0

5

Corporate

(26)

(11)

(30)

(29)

(13)

(31)

(37)

(27)

(21)

(17)

(15)

(96)

(107)

(52)

Adjusted EBITDA

111

46

58

41

69

43

72

93

88

79

62

255

278

229

Inventory Revaluation

(52)

9

2

2

(0)

26

26

(12)

(6)

(3)

1

(38)

40

(7)

Adjusted EBITDA excl Inv Reval

59

55

60

43

69

70

98

81

83

77

62

217

318

222 |