Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TOYS R US INC | d827929d8k.htm |

EASY

EXPERT

FAIR

Bank of America Merrill Lynch

Leveraged Finance Conference 2014

Exhibit 99.1 |

EASY

EXPERT

FAIR

2

This

presentation

and

the

documents

filed

by

TOYS“R”US,

INC.

with

the

Securities

and

Exchange

Commission

contain

“forward

looking”

statements

within

the

meaning

of

the

federal

securities

laws

and

such

statements

are

intended

to

be

covered

by

the

safe

harbors

created

thereby.

These

forward

looking

statements

reflect

our

current

views

with

respect

to,

among

other

things,

our

operations

and

financial

performance.

All

statements

herein

or

therein

that

are

not

historical

facts,

including

statements

about

our

beliefs

or

expectations,

are

forward-looking

statements.

We

generally

identify

these

statements

by

words

or

phrases,

such

as

“anticipate,”

“estimate,”

“plan,”

“project,”

“expect,”

“believe,”

“intend,”

“foresee,”

“forecast,”

“will,”

“may,”

“outlook”

or

the

negative

version

of

these

words

or

other

similar

words

or

phrases.

These

statements

discuss,

among

other

things,

our

strategy,

store

openings,

integration

and

remodeling,

the

development,

implementation

and

integration

of

our

Internet

business,

future

financial

or

operational

performance,

projected

sales

for

certain

periods,

comparable

store

net

sales

from

one

period

to

another,

cost

savings,

results

of

store

closings

and

restructurings,

outcome

or

impact

of

pending

or

threatened

litigation,

domestic

or

international

developments,

amount

and

allocation

of

future

capital

expenditures,

growth

initiatives,

inventory

levels,

cost

of

goods,

selection

and

type

of

merchandise,

marketing

positions,

implementation

of

safety

standards,

future

financings,

estimates

regarding

future

effective

tax

rates,

and

other

goals

and

targets

and

statements

of

the

assumptions

underlying

or

relating

to

any

such

statements.

These

statements

are

subject

to

risks,

uncertainties

and

other

factors,

including,

among

others,

the

seasonality

of

our

business,

competition

in

the

retail

industry,

changes

in

our

product

distribution

mix

and

distribution

channels,

general

economic

factors

in

the

United

States

and

other

countries

in

which

we

conduct

our

business,

consumer

spending

patterns,

live

birth

trends,

our

ability

to

implement

our

strategy,

including

implementing

initiatives

for

season,

our

ability

to

recognize

cost

savings,

marketing

strategies,

the

availability

of

adequate

financing,

access

to

trade

credit,

changes

in

consumer

preferences,

changes

in

employment

legislation,

our

dependence

on

key

vendors

for

our

merchandise,

political

and

other

developments

associated

with

our

international

operations,

costs

of

goods

that

we

sell,

labor

costs,

transportation

costs,

domestic

and

international

events

affecting

the

delivery

of

toys

and

other

products

to

our

stores,

product

safety

issues

including

product

recalls,

the

existence

of

adverse

litigation,

changes

in

laws

that

impact

our

business,

our

substantial

level

of

indebtedness

and

related

debt-service

obligations,

restrictions

imposed

by

covenants

in

our

debt

agreements

and

other

risks,

uncertainties

and

factors

set

forth

under

Item

1A

entitled

“RISK

FACTORS”

of

TOYS“R”US,

INC.’s

Annual

Report

on

Form

10-K

for

the

fiscal

year

ended

February

1,

2014

and

in

its

other

reports

and

documents

filed

with

the

Securities

and

Exchange

Commission.

In

addition,

we

typically

earn

a

disproportionate

part

of

our

annual

operating

earnings

in

the

fourth

quarter

as

a

result

of

seasonal

buying

patterns

and

these

buying

patterns

are

difficult

to

forecast

with

certainty.

These

factors

should

not

be

construed

as

exhaustive,

and

should

be

read

in

conjunction

with

the

other

cautionary

statements

that

are

included

in

those

reports

and

documents.

We

believe

that

all

forward-looking

statements

are

based

on

reasonable

assumptions

when

made;

however,

we

caution

that

it

is

impossible

to

predict

actual

results

or

outcomes

or

the

effects

of

risks,

uncertainties

or

other

factors

on

anticipated

results

or

outcomes

and

that,

accordingly,

one

should

not

place

undue

reliance

on

these

statements.

Forward-looking

statements

speak

only

as

of

the

date

they

were

made,

and

we

undertake

no

obligation

to

update

these

statements

in

light

of

subsequent

events

or

developments

unless

required

by

the

Securities

and

Exchange

Commission’s

rules

and

regulations.

Actual

results

and

outcomes

may

differ

materially

from

anticipated

results

or

outcomes

discussed

in

any

forward-looking

statement.

FORWARD LOOKING STATEMENTS

PRELIMINARY ESTIMATES

The

financial

information

for

the

third

quarter

of

fiscal

2014

contained

in

this

presentation

are

preliminary

estimates

and

are

derived

from

preliminary

internal

financial

reports

and

are

subject

to

revision

based

on

the

completion

of

quarter-end

accounting

and

financial

reporting

processes.

Accordingly,

our

actual

results

may

differ

from

these

estimates

and

such

differences

may

be

material. |

EASY

EXPERT

FAIR

3

•

Promotional discipline reflected in revenues of

$2.5 billion

•

(1.0%) decrease in Domestic SFS sales

•

1.1% increase in International SFS sales

•

Successful refinancing of Toys “R”

Us-Delaware,

Inc. (“Toys Delaware”) 2016 maturities and a

significant portion of 2018 maturities provides the

management team runway to execute on its

operating strategy

•

Next large debt tower in 2017

•

Disciplined approach to promotions reflected in

Q3 margins

•

Gross margin of $908 million up $12 million or 96

bps from previous year

•

Positive adjusted EBITDA in Q3 reflecting a $43

million improvement

•

Global liquidity of $1,407 million

Q3 UPDATE

Continued Progress in Q3

Focus on Margin

1

See reconciliation of Adjusted EBITDA to Operating loss of $140 million and $93 million for Q3

2013 and Q3 2014, respectively provided in the Appendix Consistent with our past practices

we will not be commenting on any post Q3 2014 events or results Toys"R"Us

Inc. Q3

($'s in millions)

2013

2014

B/(P)

(bps)

Sales

$2,491

$2,459

(128)

Gross Margin

896

908

134

Adjusted EBITDA

1

(37)

6

n/a

Margin %

36.0%

36.9%

96

Adjusted EBITDA %

(1.5%)

0.2%

173 |

EASY

EXPERT

FAIR

4

Q3 SNAPSHOT -

DOMESTIC

1

Adjusted for an out of period item. Previously reported comparable store net sales were

(8.4%), (3.5%), (4.1%) and 4.0% for Q1 2013, Q2 2013, Q4 2013 and Q1 2014,

respectively

2

Excludes ($51M) charge (+1.5% impact) in Q4 2013, $11M benefit (-0.7% impact) in Q1 2014

and ($19M) charge (+1.3% impact) in Q2 2014 related to excess and obsolete inventory

identified in Q4 2013 Domestic Margin Rate²

Domestic Comparable Store Net Sales¹

“TRU Transformation”

Disciplined

promotion

strategy

leading

to

180bps

improvement

in

domestic

gross

margin

Initiatives drove margin |

EASY

EXPERT

FAIR

5

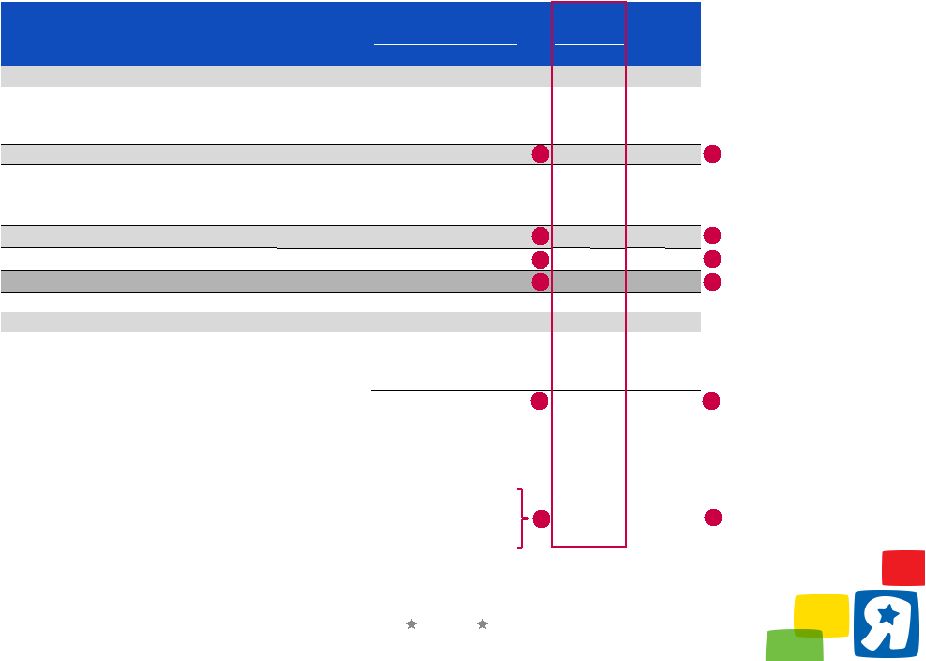

DEBT MATURITIES AND GLOBAL LIQUIDITY

$’s in millions | as of November 1, 2014

Excludes North American ABL, European and Australian ABL, Japan

Committed Credit Lines, and Uncommitted Credit Lines related to the Asia

JV as well as capital lease and finance obligations associated with capital

projects; face values as of Q3 2014

Global Liquidity

Funded Debt Maturities

1

Toys Delaware ABL Excess Availability is presented net of the $125

minimum excess availability covenant

Q3

($'s in millions)

2014

Toys Delaware

Toys Delaware ABL Excess Availability

1

$777

Toys Delaware Cash

151

Total Toys Delaware Liquidity

928

International

Euro ABL/Japan Revolver Excess Availability

224

Non-Toys Delaware Cash

255

Total Inc/Int'l Liquidity

479

Total ABL/Revolver Excess Availability

1,001

Total Cash

406

Total Global Liquidity

$1,407 |

EASY

EXPERT

FAIR

6

PROGRESS TO DATE

Realized Results

2014 Initiatives Taken

Store

Experience:

Digital &

Omnichannel:

Fair Prices &

Promotions:

Strengthening

Talent:

Inventory

Management:

•

Shortened customer checkout time

•

Enhanced lighting in approximately 218

domestic stores

•

Refreshed desktop site and cart to improve

conversion

•

Launched new tablet site in U.S.

•

Maintained competitive shipping offer

•

Refocused Key Value Items initiative

•

Integrated pricing and promotion strategy

•

Increased visibility of Price Match message

•

Recruited top talent for executive roles

•

Implemented separate field structures for

Toys“R”Us and Babies“R”Us stores

•

2014 obsolete clearance event successfully

completed

•

Focused on improving in-stocks

•

Instituted life cycle management process

Customer satisfaction for “checkout speed”

and

“clean and neat”

categories improved

Increase in Domestic eCommerce revenue

Continue to narrow the gap between our

average shelf price vs. competitors on KVIs

Filled key roles within executive team

In-stock position significantly improved

over

2011-2013 average |

EASY

EXPERT

FAIR

7

STRENGTHENING THE LEADERSHIP TEAM: KEY HIRES IN 2014

Mike Short

Executive Vice President,

Chief Financial Officer

AutoNation, Universal Orlando,

Seagram Inc.,

IBM Corporation

Experience

Senior Vice President,

Store Operations

Position

Name

Joe Venezia

Richard Lennox

Chetan Bhandari

Debbie Lentz

Senior Vice President,

Chief Supply Chain Officer

Senior Vice President,

Chief Marketing Officer

Senior Vice President,

Corporate Finance and Treasurer

GLC Advisors & Co. LLC,

Goldman Sachs & Co.,

UBS Securities LLC

Zales Corporation,

J. Walter Thompson

Kraft Foods Group,

Nabisco Foods Group

Walmart, The Pantry,

Wells Fargo Merchant Services,

Procter & Gamble

Senior Vice President, Human

Resources

Saks Incorporated,

AT&T Corporation

Christine Morena

Vice President, Procurement

The Great Atlantic &

Pacific Tea Company

Gary McQuillan |

EASY

EXPERT

FAIR

8

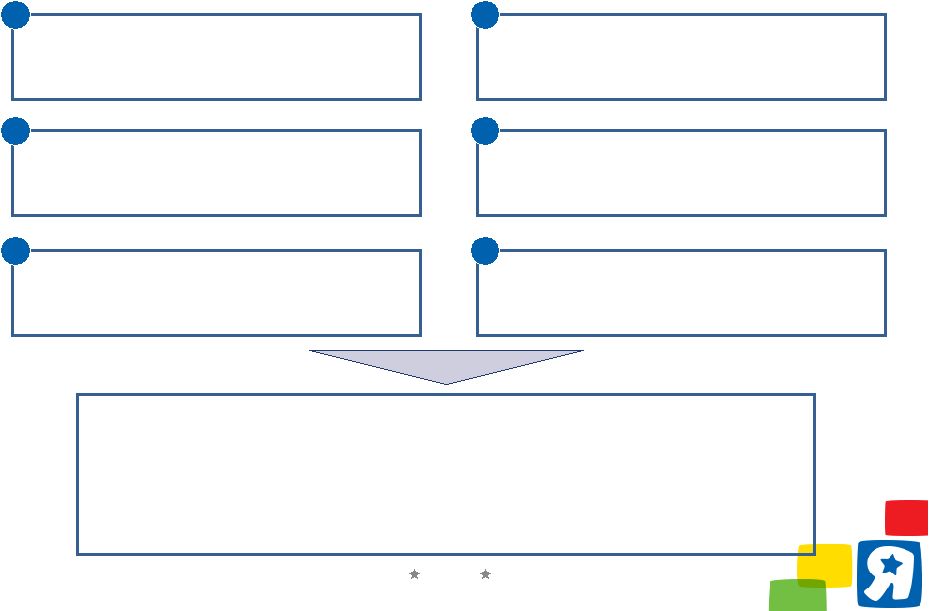

Assembled internal project management team

led by CFO and supported by sponsors to assist in

all phases of the initiative

Retained AlixPartners, an advisor with an

established track record in Retail operations

rationalization efforts

1

Benchmarked operations / headcount /

cost categories against TRU’s peer group to

identify high priority focus areas for cost reduction

2

3

Performed a six-week comprehensive study of

high priority focus areas with functional heads to

evaluate cost takeout potential

4

Identified specific areas for cost savings and

quantified the scope of the potential savings

•

Process with AlixPartners and TRU managers identified significant cost reduction

opportunities across both COGS and SG&A

•

Work plans in place; implementation underway

•

As

a

result,

we

are

targeting

at

least

$150

-

$200

million

in

annualized

cost

reduction,

which we expect will be fully achieved by the end of 2016

•

In addition, AlixPartners engaged to expand assignment internationally

5

Reviewed cost takeout estimates with TRU

departmental executives and reached agreement

on scope of cost reduction to be implemented

6

$150 –

$200 MILLION IN COST SAVINGS OPPORTUNITIES IDENTIFIED |

EASY

EXPERT

FAIR

9

KEY INITIATIVES OF COST REDUCTIONS

TOTAL COST REDUCTION BY 2016

AREAS OF OPPORTUNITY FOR COST REDUCTION

Private Label and

Other COGS:

Marketing

Effectiveness:

In-Store

Operations:

Not-For-Resale

Categories /

Other:

Supply Chain:

Inventory

Management:

Organizational

Effectiveness:

•

Consolidation of sourcing efforts for private label products at TRU

Shenzhen office

•

Improved promotion planning on catalogs / inserts to increase margins

•

Optimize digital vs traditional media mix

•

Back of house –

Improve forecast accuracy, truck deliveries to capitalize on

lower inventory levels and higher in-stocks to increase labor efficiency

•

Front of house –

Improve speed of checkout and pricing processes

•

Reducing marketing spend and other indirect purchasing costs (e.g.

professional services, operating supplies, travel and expenses)

•

Optimize frequency of outbound shipments, improve distribution center

labor efficiency

•

Implement product lifecycle management to reduce clearance margin risk

•

Improve seasonal forecast and ordering strategy for high risk items

•

Reposition organizational structure, reducing demand/work volume

and

streamlining activities

Cost Area

Selected Key Initiatives |

EASY

EXPERT

FAIR

10

Financial Data

Q3

Q3

($'s in millions)

2013

2014

B/(P)

LTM

Sales

Domestic

$1,461

$1,440

(1.4%)

$7,686

International

1,030

1,019

(1.1%)

4,959

Total Sales

2,491

2,459

(1.3%)

12,645

Gross Margin

Domestic

1

489

508

3.9%

2,554

International

407

400

(1.7%)

1,920

Total Gross Margin

1

896

908

1.3%

4,474

SG&A (Incl. Other Income & Non-Controlling Interest)

2

933

902

3.3%

3,861

Adjusted Inc. EBITDA

1,2

($37)

$6

n/a

$613

Other Data

Inventory

Domestic

$2,350

$2,168

7.7%

$2,168

International

1,229

1,156

5.9%

1,156

Total

$3,579

$3,324

7.1%

$3,324

Capex

$65

$53

18.5%

$202

Comp Store Sales Growth

Domestic

(5.2%)

(1.0%)

4.2%

n/a

International

(3.0%)

1.1%

4.1%

n/a

Gross Margin % of Sales

36.0%

36.9%

1.0%

35.4%

SG&A % of Sales

37.5%

36.7%

0.8%

30.5%

Adjusted EBITDA Margin

(1.5%)

0.2%

1.7%

4.8%

TOYS“R”US INC. FINANCIALS

1

Excludes

the

impact

of

one-time

adjustments

of

$59

in

Domestic

LTM;

including

the

impact

of

one-time

adjustments

Domestic

LTM

was

$2,495

and

Total

LTM

was $4,415

2

Excludes the impact of one-time adjustments of $11, $14 and $112 in Q3 2013, Q3 2014 and

LTM, respectively; including the impact of one-time adjustments LTM was $3,973. See

appendix for adjustments. Marginally

lower

sales

Higher

gross

margin

Reduced

SG&A

Results

in

positive

adjusted

EBITDA

Healthier

Inventory

Improved

margin

structure

1

1

2

2

3

3

4

4

5

5

6

6 |

EASY

EXPERT

FAIR

11

TOYS“R”US DELAWARE FINANCIALS

1

Excludes

the

impact

of

one-time

adjustments

of

$59

in

Domestic

LTM;

including

the

impact

of

one-time

adjustments

Domestic

LTM

was

$2,597

and

Total

LTM

was $2,919

2

Excludes the impact of one-time adjustments of $10, $15 and $87 in Q3 2013, Q3 2014 and

LTM, respectively; including the impact of one-time adjustments LTM was $2,809. See

appendix for adjustments. Marginally lower

sales

Higher gross margin

Reduced SG&A

Results in improved

adjusted EBITDA

Healthier Inventory

Improved margin structure

1

2

3

4

5

6

1

2

3

4

5

6

Financial Data

Q3

Q3

($'s in millions)

2013

2014

B/(P)

LTM

Sales

Domestic

$1,484

$1,462

(1.5%)

$7,789

Canada

185

171

(7.6%)

860

Total Sales

1,669

1,633

(2.2%)

8,649

Gross Margin

Domestic

1

513

529

3.1%

2,656

Canada

73

66

(9.6%)

322

Total Gross Margin

1

586

595

1.5%

2,978

SG&A (Incl. Other Income)

2

659

630

4.4%

2,722

Adjusted Delaware EBITDA

1,2

($73)

($35)

n/a

$256

Other Data

Inventory

Domestic

$2,350

$2,168

7.7%

$2,168

Canada

277

266

4.0%

266

Total

$2,627

$2,434

7.3%

$2,434

Capex

$45

$38

15.6%

$131

Comp Store Sales Growth

Domestic

(5.2%)

(1.0%)

4.2%

n/a

Canada

(0.4%)

(2.8%)

(2.4%)

n/a

Gross Margin % of Sales

35.1%

36.4%

1.3%

34.4%

SG&A % of Sales

39.5%

38.6%

0.9%

31.5%

Adjusted EBITDA Margin

(4.4%)

(2.1%)

2.2%

3.0% |

EASY

EXPERT

FAIR

12

APPENDIX |

EASY

EXPERT

FAIR

13

SIMPLIFIED ORGANIZATIONAL STRUCTURE

Guaranty of

B-4 Term Loan

8.500% Senior Notes due 2017 $725

PropCo I Term Loan due 2019 $975

Total Funded Debt¹

Revolving Credit Facilities

$631

125

10.375% Senior Notes due 2017

$450

7.375% Senior Notes due 2018

400

Note: Chart has been simplified and does not include all entities; debt balances

presented at face value and excludes capital leases and finance obligations associated

with capital projects 1

Includes Spanish PropCo Loan, French PropCo Loan, UK PropCo Loans, Japan Bank Loans and Toys

Asia Debt 65% Pledge of Canadian

Subsidiary Stock

$’s in millions | as of November 1, 2014 |

EASY

EXPERT

FAIR

14

TOYS“R”US INC. –

ADJUSTED EBITDA RECONCILIATION

1

The impact of these one-time adjustments are excluded from the Gross Margin balances on

Toys“R”Us Inc. financials 2

The impact of these one-time adjustments are excluded from the SG&A (Incl. Other

Income & Non-Controlling Interest) balances on Toys“R”Us Inc. financials

FYE

LTM

($'s in millions)

11/2/2013

11/1/2014

11/2/2013

11/1/2014

2/1/2014

11/1/2014

Operating Loss

($140)

($93)

($259)

($226)

($350)

($317)

Add:

Non-controlling interest

-

(1)

-

(2)

(3)

(5)

Depreciation and amortization

92

86

287

285

388

386

EBITDA

(48)

(8)

28

57

35

64

Adjustments:

Obsolete inventory clearance

1

-

-

-

8

51

59

Prior period adjustments

1

-

-

(1)

-

(1)

-

Sponsors’

management and advisory fees

2

6

2

17

14

22

19

Litigation expense

2

-

-

20

-

23

3

Severance

-

1

13

10

13

10

Store closure costs

-

3

-

7

2

9

Impairment of long-lived assets

2

4

1

7

8

44

45

Net gains on sales of properties

2

(1)

(2)

(8)

(5)

(8)

(5)

Compensation expense

2

2

10

1

15

3

17

Property losses, net of insurance recoveries

2

-

(2)

-

(9)

-

(9)

Prior period adjustments

2

-

-

-

-

17

17

Other

2

-

1

1

3

4

6

Goodwill Impairment

-

-

-

-

378

378

Adjusted EBITDA

($37)

$6

$78

$108

$583

$613

13 weeks ended

39 weeks ended

2

2 |

EASY

EXPERT

FAIR

15

TOYS“R”US DELAWARE –

ADJUSTED EBITDA RECONCILIATION

1

The impact of these one-time adjustments are excluded from the Gross Margin balances on

Toys“R”Us Delaware financials 2

The

impact

of

these

one-time

adjustments

are

excluded

from

the

SG&A

(Incl.

Other

Income)

balances

on

Toys“R”Us

Delaware

financials

FYE

LTM

($'s in millions)

11/2/2013

11/1/2014

11/2/2013

11/1/2014

2/1/2014

11/1/2014

Operating Loss

($142)

($105)

($233)

($253)

($489)

($509)

Add:

Depreciation and amortization

59

55

186

192

252

258

EBITDA

(83)

(50)

(47)

(61)

(237)

(251)

Adjustments:

Obsolete inventory clearance

1

-

-

-

8

51

59

Prior period adjustments

1

-

-

(1)

-

(1)

Sponsors’

management and advisory fees

2

3

2

11

13

15

17

Litigation expense

2

-

-

20

-

23

3

Severance

2

-

1

3

7

3

7

Store closure costs

2

5

7

7

11

13

17

Impairment of long-lived assets

2

2

-

3

6

20

23

Net gains on sales of properties

2

(1)

-

(2)

(1)

(2)

(1)

Compensation expense

2

1

7

3

11

4

12

Property losses, net of insurance recoveries

2

-

(2)

-

(9)

-

(9)

Prior period adjustments

2

-

-

-

-

17

17

Other

2

-

-

-

1

-

1

Goodwill Impairment

-

-

-

-

361

361

Adjusted EBITDA

($73)

($35)

($3)

($14)

$267

$256

13 weeks ended

39 weeks ended

- |