Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Zayo Group Holdings, Inc. | zayo-8k_20141107.htm |

| EX-99.1 - EX-99.1 - Zayo Group Holdings, Inc. | zayo-ex991_201411076.htm |

Zayo Group Holdings, Inc. Fiscal Year 2015 Q1 Supplemental Earnings Information Proprietary and Confidential Exhibit 99.2

Forward-Looking Statements Information contained in this supplemental presentation that is not historical by nature constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “believes,” “expects,” “plans,” “intends,” “estimates,” “projects,” “could,” “may,” “will,” “should,” or “anticipates” or the negatives thereof, other variations thereon or comparable terminology, or by discussions of strategy. No assurance can be given that future results expressed or implied by the forward-looking statements will be achieved and actual results may differ materially from those contemplated by the forward-looking statements. Such statements are based on management’s current expectations and beliefs and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, those relating to Zayo Group Holdings, Inc.’s (“the Company” or “ZGH”) financial and operating prospects, current economic trends, future opportunities, ability to retain existing customers and attract new ones, outlook of customers, and strength of competition and pricing. In addition, there is risk and uncertainty in the Company’s acquisition strategy including our ability to integrate acquired companies and assets. Specifically there is a risk associated with our recent acquisitions, and the benefits thereof, including financial and operating results and synergy benefits that may be realized from these acquisitions and the timeframe for realizing these benefits. Other factors and risks that may affect our business and future financial results are detailed in the “Risk Factors” section of our final prospectus dated October 17, 2014. We caution you not to place undue reliance on these forward-looking statements, which speak only as of their respective dates. We undertake no obligation to publicly update or revise forward-looking statements to reflect events or circumstances after releasing this supplemental information or to reflect the occurrence of unanticipated events, except as required by law.

Presentation of Certain Consolidated Pro-forma Financial Data Acquisitions have been, and are expected to continue to be, a component of the Company’s strategy. In this Supplemental Earnings Information under “Consolidated Financial Data,” the Company sets forth its pro-forma annualized revenue growth rate and pro-forma annualized Adjusted EBITDA growth rates for the fiscal quarters impacted by the Company’s acquisitions. These pro-forma measures are intended to provide additional information regarding such rates of growth on a more comparable basis than would be provided without such pro-forma adjustments. With regard to the recent acquisitions that impact the financial data reported within this supplemental earnings presentation (i.e. Core NAP, Corelink, Access, FiberLink, CoreXchange, Geo, Neo, and AtlantaNAP), the Company has calculated its pro-forma annualized revenue growth rate and pro-forma annualized Adjusted EBITDA growth rates as if the acquisitions occurred on the first day of the quarter preceding the respective quarter in which the acquisition closed. In making such adjustments, the Company made certain pro-forma adjustments to the revenue and Adjusted EBITDA of the acquired entities, which principally include an adjustment related to the estimated fair value of the acquired deferred revenue balance and the elimination of historical transactions between Zayo and the acquired company, but do not include cost savings and other synergies that were only realized following completion of the acquisitions. See “Pro-forma Growth Reconciliation” slides. The Company provides the pro-forma annualized revenue growth rate and pro-forma annualized Adjusted EBITDA growth rate for the fiscal quarters impacted by acquisitions on the slide entitled “Consolidated Financial Data.” Similarly, the Company presents pro-forma annualized revenue and pro-forma annualized Adjusted EBITDA growth rates for its operating segments. The calculation of the pro-forma growth rates includes both the impact of the aforementioned acquisitions and the impact of transfers between the segments. The pro-forma growth rates, if applicable to the reporting segments, are presented on slides entitled: “Zayo Physical Infrastructure Segment Financial Data”; “Zayo Lit Services Segment Financial Data”; and “Zayo Other Segment Financial Data” within the “Financial Data by Reporting Segment” section of this supplemental earnings presentation.

The Company provides financial measures that are not defined under generally accepted accounting principles in the United States, or GAAP, including Adjusted EBITDA, Adjusted EBITDA Margin, unlevered free cash flow, and levered free cash flow. Adjusted EBITDA is defined as earnings/(loss) from continuing operations before interest, income taxes, depreciation, and amortization (“EBITDA”), adjusted to exclude acquisition or disposal-related transaction costs, losses on extinguishment of debt, stock-based compensation, unrealized foreign currency gains on an intercompany loan, and impairment of cost method investment. Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by revenue. Unlevered free cash flow is defined as Adjusted EBITDA minus purchases of property and equipment, net of stimulus grants. Levered free cash flow is defined as operating cash flow minus purchases of property and equipment, net of stimulus grants. These measures are not measurements of our financial performance under GAAP and should not be considered in isolation or as alternatives to net income, net cash flows provided by operating activities, total net cash flows or any other performance measures derived in accordance with GAAP or as alternatives to net cash flows from operating activities or total net cash flows as measures of our liquidity. We use Adjusted EBITDA to evaluate our operating performance and liquidity, and we use levered free cash flow as a measure to evaluate cash generated through normal operating activities. In addition to Adjusted EBITDA, management uses unlevered free cash flow, which measures the ability of Adjusted EBITDA to cover capital expenditures. Adjusted EBITDA is a performance rather than cash flow measure. Correlating our capital expenditures to our Adjusted EBITDA does not imply that we will be able to fund such capital expenditures solely with cash from operations. In addition to these measures, we use levered free cash flow as a measure to evaluate cash generated through normal operating activities. These metrics are among the primary measures used by management for planning and forecasting future periods. We believe the presentation of Adjusted EBITDA is relevant and useful for investors because it allows investors to view results in a manner similar to the method used by management and make it easier to compare our results with the results of other companies that have different financing and capital structures. We believe that the presentation of levered free cash flow is relevant and useful to investors because it provides a measure of cash available to pay the principal on our debt and pursue acquisitions of businesses or other strategic investments or uses of capital. We also monitor Adjusted EBITDA because our subsidiaries have debt covenants that restrict their borrowing capacity that are based on a leverage ratio, which utilizes a modified EBITDA, as defined in our credit agreement and the indentures governing our notes. The modified EBITDA is consistent with our definition of Adjusted EBITDA; however, it includes the pro forma Adjusted EBITDA of and expected cost synergies from the companies acquired by us during the quarter for which the debt compliance certification is due. Adjusted EBITDA results, along with the quantitative and qualitative information, are also utilized by management and our Compensation Committee for purposes of determining bonus payments to employees. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation from, or as a substitute for, analysis of our results of operations and operating cash flows as reported under GAAP. For example, Adjusted EBITDA: does not reflect capital expenditures, or future requirements for capital and major maintenance expenditures or contractual commitments; does not reflect changes in, or cash requirements for, our working capital needs; does not reflect the interest expense, or the cash requirements necessary to service the interest payments, on our debt; and does not reflect cash required to pay income taxes. Non-GAAP Financial Measures

Unlevered free cash flow has limitations as an analytical tool and should not be considered in isolation from, or as a substitute for, analysis of our results as reported under GAAP. For example, levered free cash flow: does not reflect changes in, or cash requirements for, our working capital needs; does not reflect the interest expense, or the cash requirements necessary to service the interest payments, on our debt; and does not reflect cash required to pay income taxes. Levered free cash flow has limitations as an analytical tool and should not be considered in isolation from, or as a substitute for, analysis of our results as reported under GAAP. For example, levered free cash flow: does not reflect principal payments on debt; does not reflect principal payments on capital lease obligations; does not reflect dividend payments, if any; and does not reflect the cost of acquisitions. Our computation of Adjusted EBITDA, unlevered free cash flow, and levered free cash flow may not be comparable to other similarly titled measures computed by other companies because all companies do not calculate these measures in the same fashion. Because we have acquired numerous entities since our inception and incurred transaction costs in connection with each acquisition, borrowed money in order to finance our operations and acquisitions, and used capital and intangible assets in our business, and because the payment of income taxes is necessary if we generate taxable income after the utilization of our net operating loss carryforwards, any measure that excludes these items has material limitations. As a result of these limitations, these measures should not be considered as a measure of discretionary cash available to us to invest in the growth of our business or as a measure of our liquidity. See “Reconciliation of Non-GAAP Financial Measures” for a quantitative reconciliation of Adjusted EBITDA to net income/(loss) and for a quantitative reconciliation of unlevered free cash flow and levered free cash flow to net cash flows provided by operating activities. Annualized revenue and annualized Adjusted EBITDA are derived by multiplying the total revenue and Adjusted EBITDA, respectively, for the most recent quarterly period by four. Our computations of annualized revenue and annualized Adjusted EBITDA may not be representative of our actual annual results. Tables reconciling such non-GAAP measures are included in the Historical Financial Data & Reconciliations section of this presentation. A glossary of terms used throughout is available under the investor section of the Company’s website at http://www.zayo.com/investors. Non-GAAP Financial Measures (continued)

Other Notes Operating Measures This earnings supplement contains operating measures used by the Company in managing the business. Management believes that providing this information enables analysts, investors, and others to obtain a better understanding of the Company’s operating performance and to evaluate the efficacy of the methodology and information used by management to evaluate and measure such performance on a standalone and comparative basis. Certain supplemental information provided and related definitions may not be directly comparable to similarly titled items reported by other companies. Further, the Company may, from time to time, revise the calculation or presentation of certain operating measures. Revisions Certain prior period operating measures have been revised to reflect corrections or reclassifications of data. These revisions are not material and have no impact on the Company’s reported financial results. Estimates Certain operating measures presented herein are based on estimates. The measures are noted as estimates where presented and include: (1) estimated net new sales (bookings) less network expense; (2) estimated capital expenditures associated with net new sales (bookings); (3) estimated payback period on net new sales (bookings)(calculated); (4) estimated commitments of speculative capital expenditures; (5) estimated timing of service activation pipeline conversion; and (6) planned synergies. Rounding Components may not sum due to rounding.

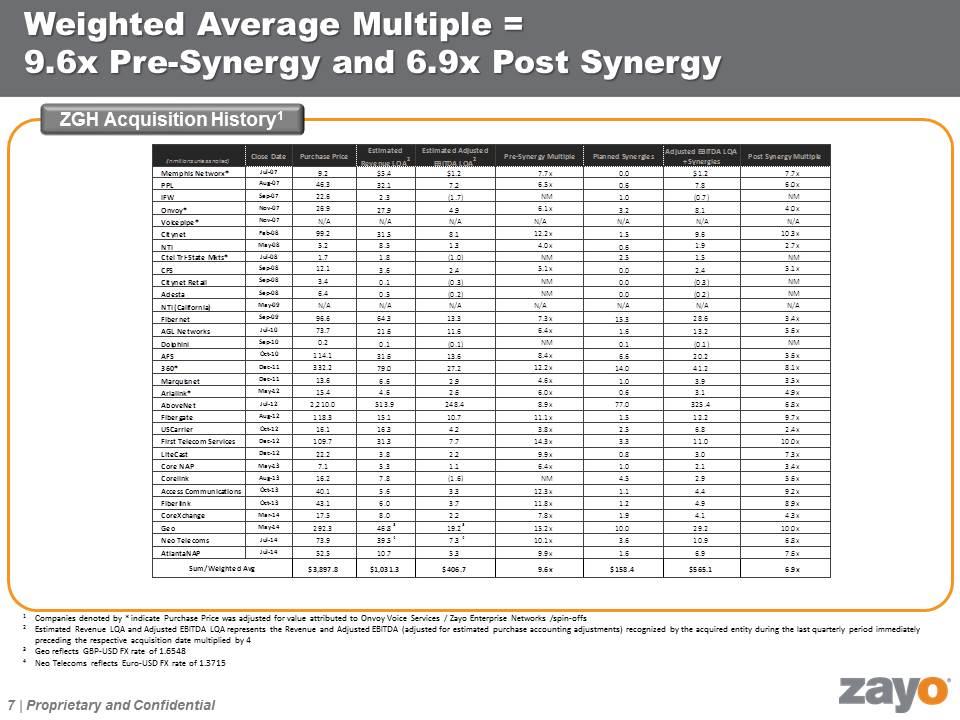

Weighted Average Multiple = 9.6x Pre-Synergy and 6.9x Post Synergy ZGH Acquisition History1 1 Companies denoted by * indicate Purchase Price was adjusted for value attributed to Onvoy Voice Services / Zayo Enterprise Networks /spin-offs 2Estimated Revenue LQA and Adjusted EBITDA LQA represents the Revenue and Adjusted EBITDA (adjusted for estimated purchase accounting adjustments) recognized by the acquired entity during the last quarterly period immediately preceding the respective acquisition date multiplied by 4 3 Geo reflects GBP-USD FX rate of 1.6548 4 Neo Telecoms reflects Euro-USD FX rate of 1.3715

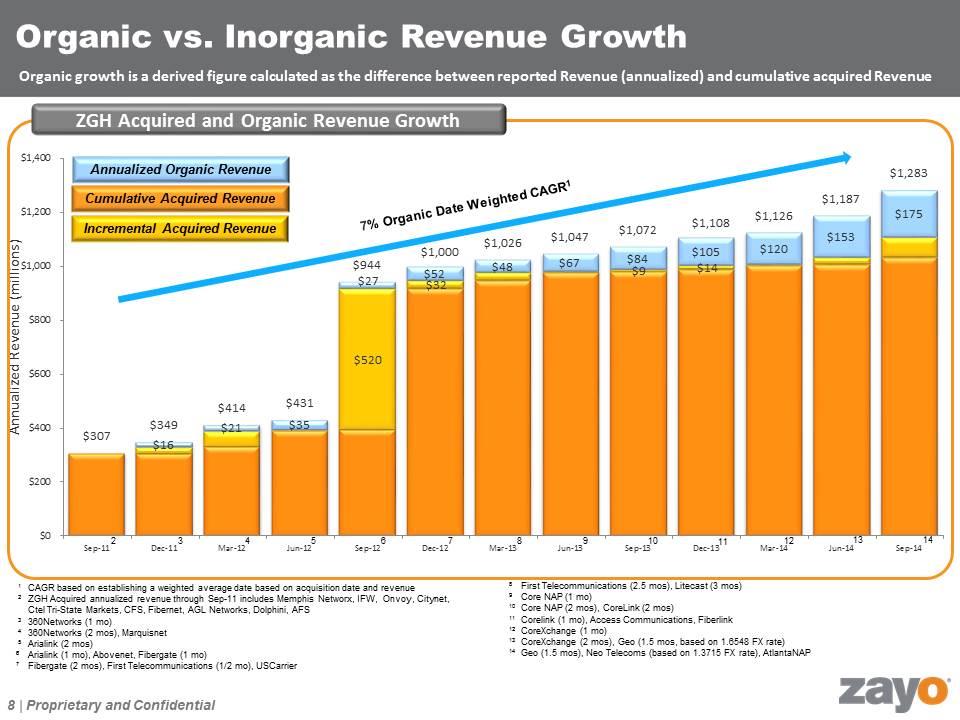

ZGH Acquired and Organic Revenue Growth Cumulative Acquired Revenue Annualized Organic Revenue Incremental Acquired Revenue 3 4 5 6 7 8 2 Organic vs. Inorganic Revenue Growth 10 11 Organic growth is a derived figure calculated as the difference between reported Revenue (annualized) and cumulative acquired Revenue 9 12 13 14 1CAGR based on establishing a weighted average date based on acquisition date and revenue 2 ZGH Acquired annualized revenue through Sep-11 includes Memphis Networx, IFW, Onvoy, Citynet, Ctel Tri-State Markets, CFS, Fibernet, AGL Networks, Dolphini, AFS 3360Networks (1 mo) 4360Networks (2 mos), Marquisnet 5 Arialink (2 mos) 6 Arialink (1 mo), Abovenet, Fibergate (1 mo) 7 Fibergate (2 mos), First Telecommunications (1/2 mo), USCarrier 8First Telecommunications (2.5 mos), Litecast (3 mos) 9Core NAP (1 mo) 10Core NAP (2 mos), CoreLink (2 mos) 11 Corelink (1 mo), Access Communications, Fiberlink 12 CoreXchange (1 mo) 13 CoreXchange (2 mos), Geo (1.5 mos, based on 1.6548 FX rate) 14 Geo (1.5 mos), Neo Telecoms (based on 1.3715 FX rate), AtlantaNAP

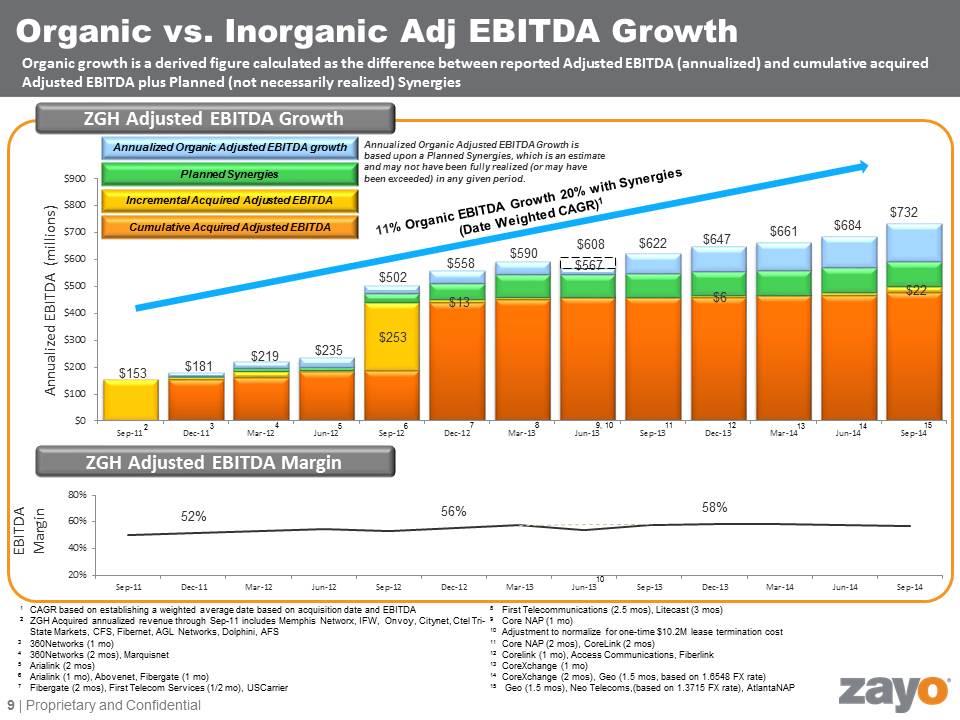

8First Telecommunications (2.5 mos), Litecast (3 mos) 9Core NAP (1 mo) 10 Adjustment to normalize for one-time $10.2M lease termination cost 11 Core NAP (2 mos), CoreLink (2 mos) 12 Corelink (1 mo), Access Communications, Fiberlink 13 CoreXchange (1 mo) 14 CoreXchange (2 mos), Geo (1.5 mos, based on 1.6548 FX rate) 15 Geo (1.5 mos), Neo Telecoms,(based on 1.3715 FX rate), AtlantaNAP ZGH Adjusted EBITDA Growth ZGH Adjusted EBITDA Margin Cumulative Acquired Adjusted EBITDA Annualized Organic Adjusted EBITDA growth Planned Synergies Incremental Acquired Adjusted EBITDA 1CAGR based on establishing a weighted average date based on acquisition date and EBITDA 2ZGH Acquired annualized revenue through Sep-11 includes Memphis Networx, IFW, Onvoy, Citynet, Ctel Tri-State Markets, CFS, Fibernet, AGL Networks, Dolphini, AFS 3360Networks (1 mo) 4360Networks (2 mos), Marquisnet 5 Arialink (2 mos) 6 Arialink (1 mo), Abovenet, Fibergate (1 mo) 7 Fibergate (2 mos), First Telecom Services (1/2 mo), USCarrier Organic vs. Inorganic Adj EBITDA Growth Organic growth is a derived figure calculated as the difference between reported Adjusted EBITDA (annualized) and cumulative acquired Adjusted EBITDA plus Planned (not necessarily realized) Synergies 2 3 4 5 6 7 8 11 9, 10 12 13 15 14 10 11% Organic EBITDA Growth 20% with Synergies (Date Weighted CAGR)1 Annualized Organic Adjusted EBITDA Growth is based upon a Planned Synergies, which is an estimate and may not have been fully realized (or may have been exceeded) in any given period.

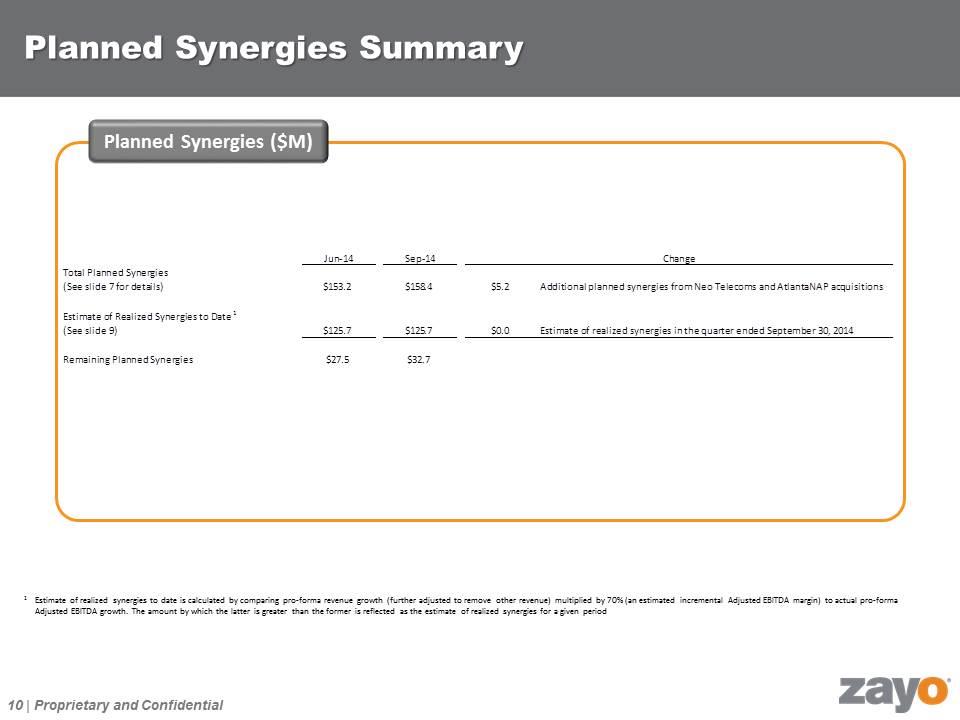

Planned Synergies Summary Planned Synergies ($M) 1Estimate of realized synergies to date is calculated by comparing pro-forma revenue growth (further adjusted to remove other revenue) multiplied by 70% (an estimated incremental Adjusted EBITDA margin) to actual pro-forma Adjusted EBITDA growth. The amount by which the latter is greater than the former is reflected as the estimate of realized synergies for a given period

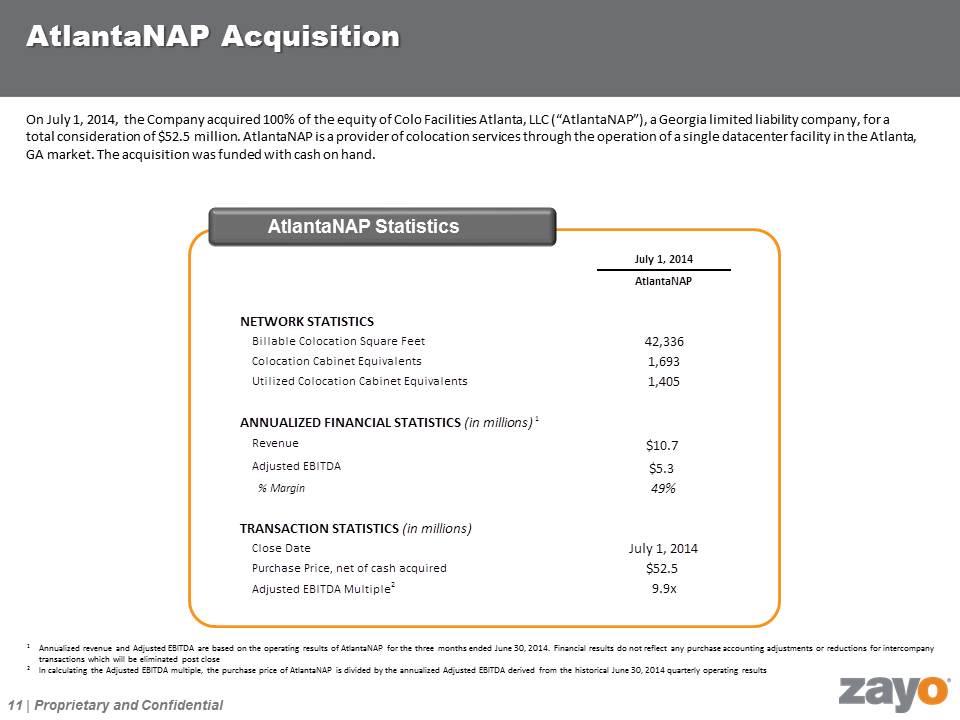

On July 1, 2014, the Company acquired 100% of the equity of Colo Facilities Atlanta, LLC (“AtlantaNAP”), a Georgia limited liability company, for a total consideration of $52.5 million. AtlantaNAP is a provider of colocation services through the operation of a single datacenter facility in the Atlanta, GA market. The acquisition was funded with cash on hand. AtlantaNAP Acquisition AtlantaNAP Statistics 1Annualized revenue and Adjusted EBITDA are based on the operating results of AtlantaNAP for the three months ended June 30, 2014. Financial results do not reflect any purchase accounting adjustments or reductions for intercompany transactions which will be eliminated post close 2In calculating the Adjusted EBITDA multiple, the purchase price of AtlantaNAP is divided by the annualized Adjusted EBITDA derived from the historical June 30, 2014 quarterly operating results

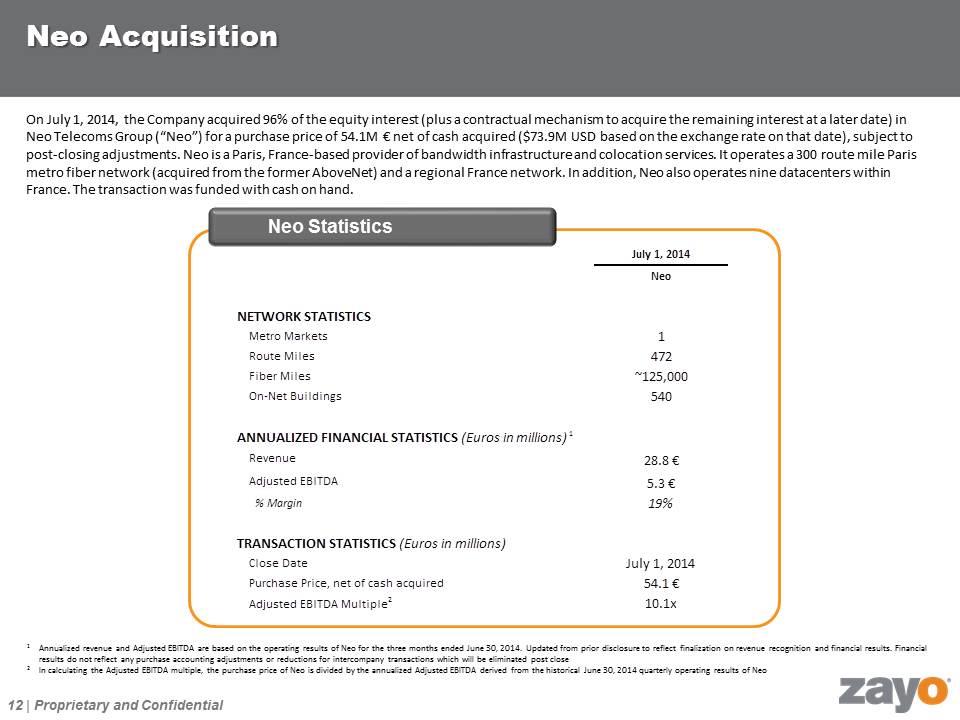

Neo Acquisition Neo Statistics On July 1, 2014, the Company acquired 96% of the equity interest (plus a contractual mechanism to acquire the remaining interest at a later date) in Neo Telecoms Group (“Neo”) for a purchase price of 54.1M € net of cash acquired ($73.9M USD based on the exchange rate on that date), subject to post-closing adjustments. Neo is a Paris, France-based provider of bandwidth infrastructure and colocation services. It operates a 300 route mile Paris metro fiber network (acquired from the former AboveNet) and a regional France network. In addition, Neo also operates nine datacenters within France. The transaction was funded with cash on hand. 1Annualized revenue and Adjusted EBITDA are based on the operating results of Neo for the three months ended June 30, 2014. Updated from prior disclosure to reflect finalization on revenue recognition and financial results. Financial results do not reflect any purchase accounting adjustments or reductions for intercompany transactions which will be eliminated post close 2In calculating the Adjusted EBITDA multiple, the purchase price of Neo is divided by the annualized Adjusted EBITDA derived from the historical June 30, 2014 quarterly operating results of Neo

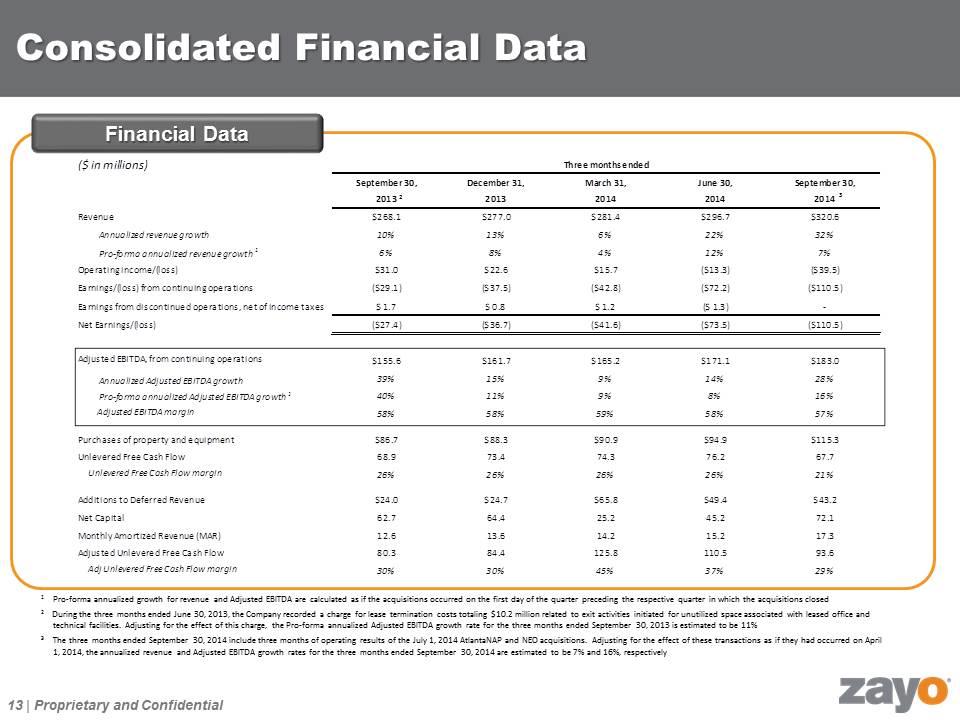

Consolidated Financial Data 1Pro-forma annualized growth for revenue and Adjusted EBITDA are calculated as if the acquisitions occurred on the first day of the quarter preceding the respective quarter in which the acquisitions closed 2 During the three months ended June 30, 2013, the Company recorded a charge for lease termination costs totaling $10.2 million related to exit activities initiated for unutilized space associated with leased office and technical facilities. Adjusting for the effect of this charge, the Pro-forma annualized Adjusted EBITDA growth rate for the three months ended September 30, 2013 is estimated to be 11% 3 The three months ended September 30, 2014 include three months of operating results of the July 1, 2014 AtlantaNAP and NEO acquisitions. Adjusting for the effect of these transactions as if they had occurred on April 1, 2014, the annualized revenue and Adjusted EBITDA growth rates for the three months ended September 30, 2014 are estimated to be 7% and 16%, respectively Financial Data 2 3

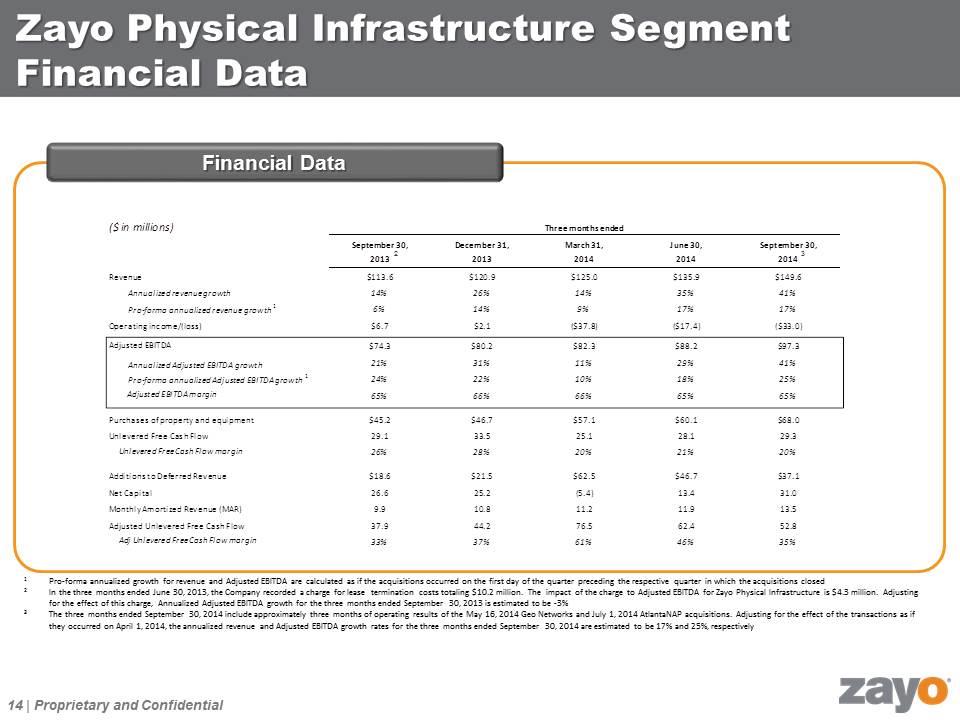

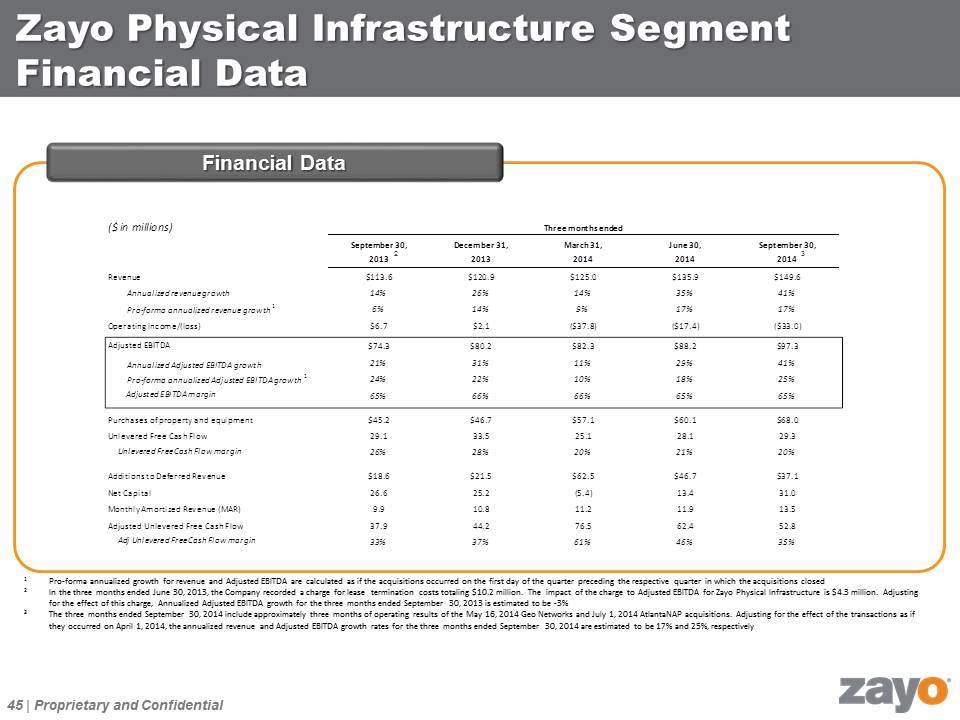

Zayo Physical Infrastructure Segment Financial Data 1 Pro-forma annualized growth for revenue and Adjusted EBITDA are calculated as if the acquisitions occurred on the first day of the quarter preceding the respective quarter in which the acquisitions closed 2 In the three months ended June 30, 2013, the Company recorded a charge for lease termination costs totaling $10.2 million. The impact of the charge to Adjusted EBITDA for Zayo Physical Infrastructure is $4.3 million. Adjusting for the effect of this charge, Annualized Adjusted EBITDA growth for the three months ended September 30, 2013 is estimated to be -3% 3 The three months ended September 30, 2014 include approximately three months of operating results of the May 16, 2014 Geo Networks and July 1, 2014 AtlantaNAP acquisitions. Adjusting for the effect of the transactions as if they occurred on April 1, 2014, the annualized revenue and Adjusted EBITDA growth rates for the three months ended September 30, 2014 are estimated to be 17% and 25%, respectively 2 3 Financial Data

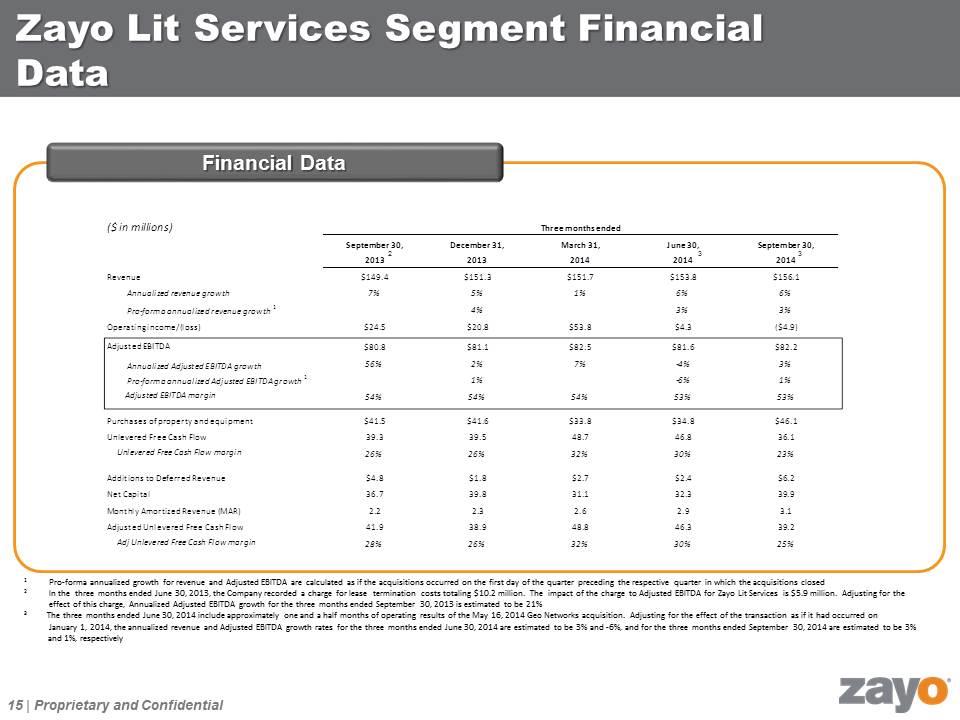

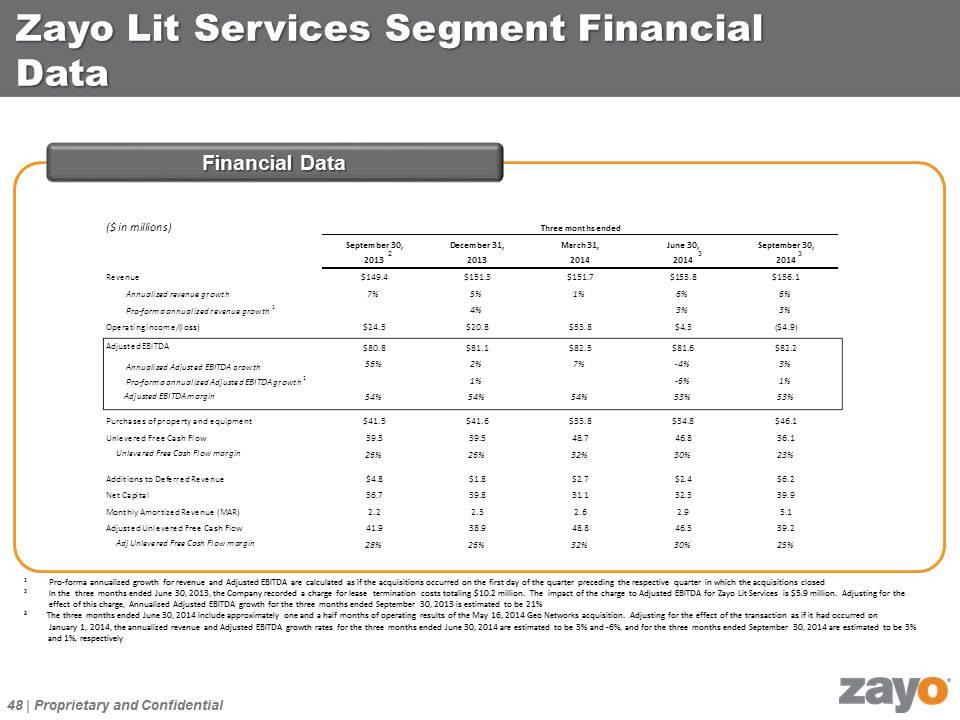

Zayo Lit Services Segment Financial Data Financial Data 1 Pro-forma annualized growth for revenue and Adjusted EBITDA are calculated as if the acquisitions occurred on the first day of the quarter preceding the respective quarter in which the acquisitions closed 2 In the three months ended June 30, 2013, the Company recorded a charge for lease termination costs totaling $10.2 million. The impact of the charge to Adjusted EBITDA for Zayo Lit Services is $5.9 million. Adjusting for the effect of this charge, Annualized Adjusted EBITDA growth for the three months ended September 30, 2013 is estimated to be 21% 3 The three months ended June 30, 2014 include approximately one and a half months of operating results of the May 16, 2014 Geo Networks acquisition. Adjusting for the effect of the transaction as if it had occurred on January 1, 2014, the annualized revenue and Adjusted EBITDA growth rates for the three months ended June 30, 2014 are estimated to be 3% and -6%, and for the three months ended September 30, 2014 are estimated to be 3% and 1%, respectively 2 3 3

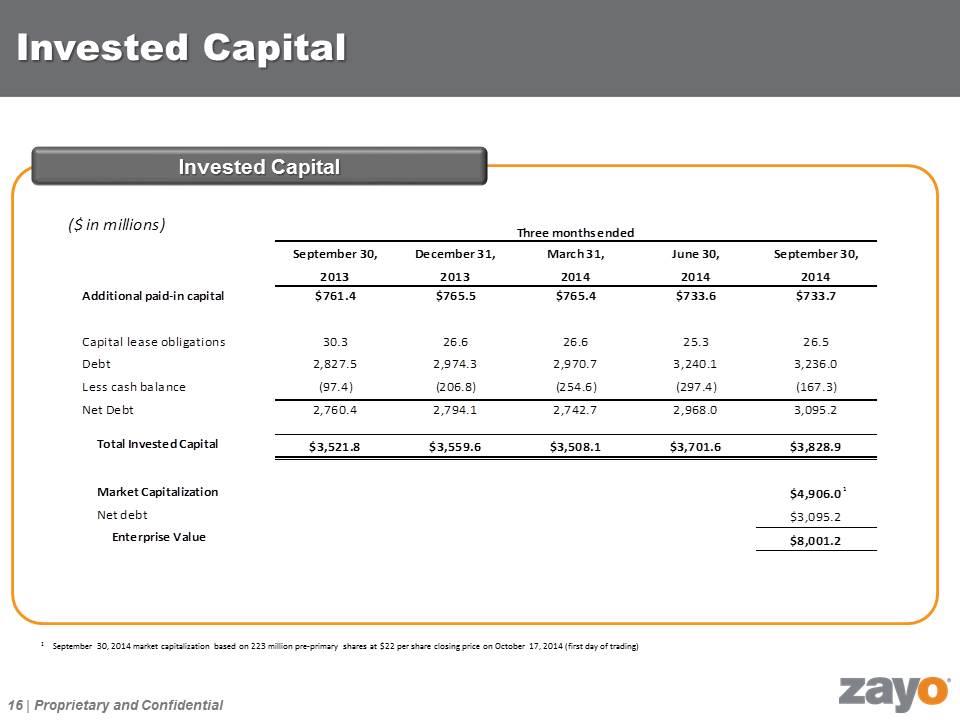

Invested Capital Invested Capital 1 1 September 30, 2014 market capitalization based on 223 million pre-primary shares at $22 per share closing price on October 17, 2014 (first day of trading)

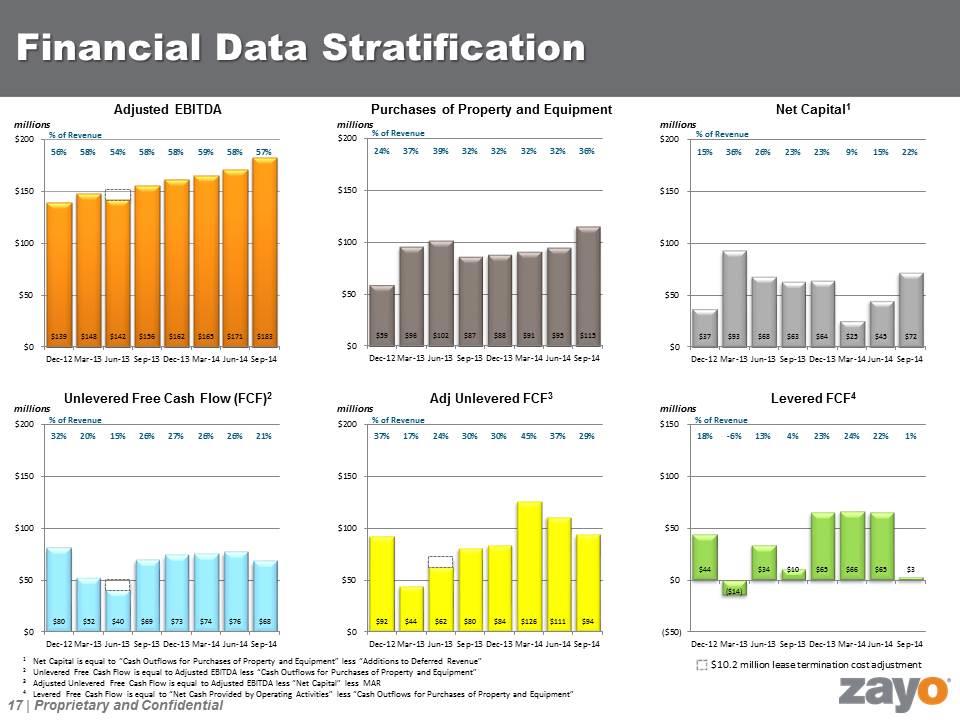

Financial Data Stratification % of Revenue millions Purchases of Property and Equipment % of Revenue millions Adjusted EBITDA % of Revenue millions Net Capital1 1 Net Capital is equal to “Cash Outflows for Purchases of Property and Equipment” less “Additions to Deferred Revenue” 2 Unlevered Free Cash Flow is equal to Adjusted EBITDA less “Cash Outflows for Purchases of Property and Equipment” 3 Adjusted Unlevered Free Cash Flow is equal to Adjusted EBITDA less “Net Capital” less MAR 4 Levered Free Cash Flow is equal to “Net Cash Provided by Operating Activities” less “Cash Outflows for Purchases of Property and Equipment” % of Revenue millions Adj Unlevered FCF3 % of Revenue millions Unlevered Free Cash Flow (FCF)2 % of Revenue millions Levered FCF4 $10.2 million lease termination cost adjustment

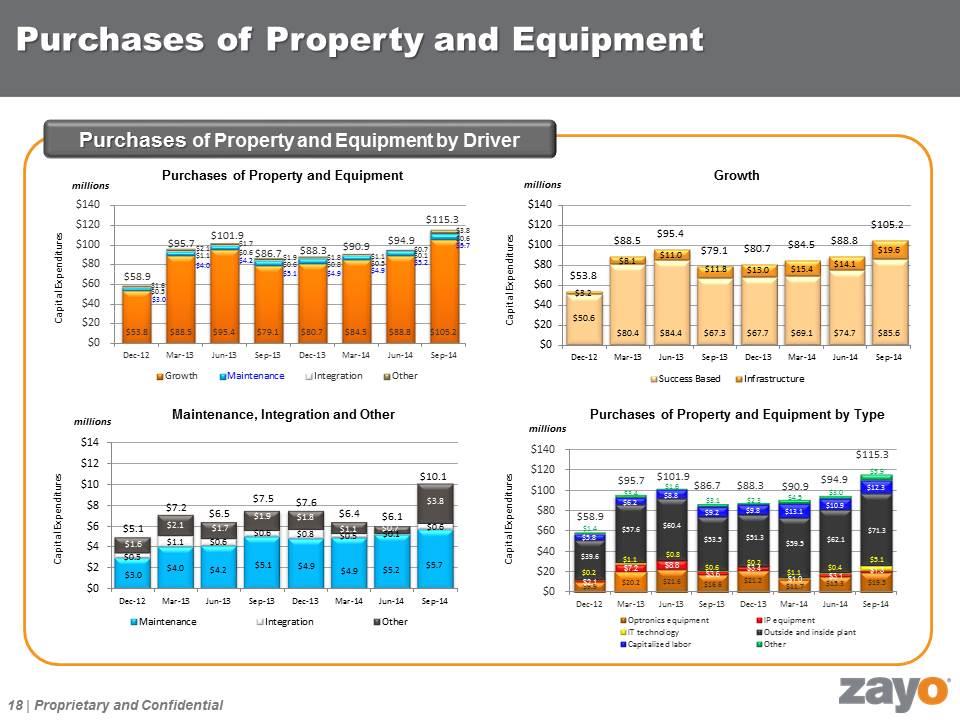

millions Purchases of Property and Equipment Purchases of Property and Equipment by Driver Capital Expenditures Purchases of Property and Equipment Maintenance, Integration and Other Growth Capital Expenditures Capital Expenditures Capital Expenditures millions millions millions Purchases of Property and Equipment by Type

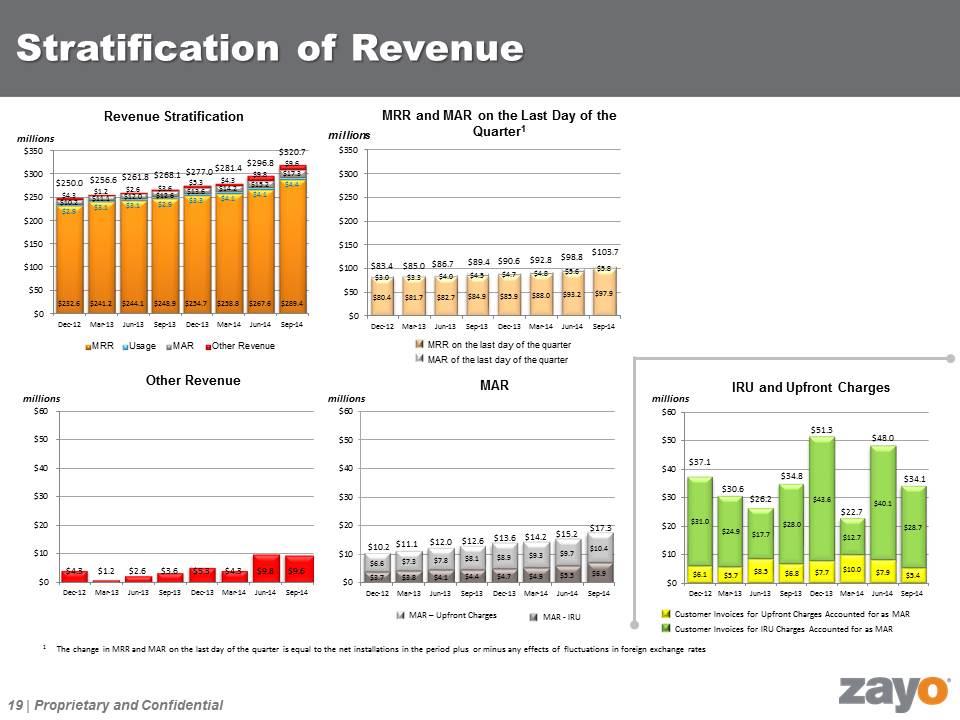

Stratification of Revenue millions millions millions millions MRR and MAR on the Last Day of the Quarter1 MRR on the last day of the quarter MAR of the last day of the quarter millions Revenue Stratification MAR – Upfront Charges MAR - IRU 1 The change in MRR and MAR on the last day of the quarter is equal to the net installations in the period plus or minus any effects of fluctuations in foreign exchange rates

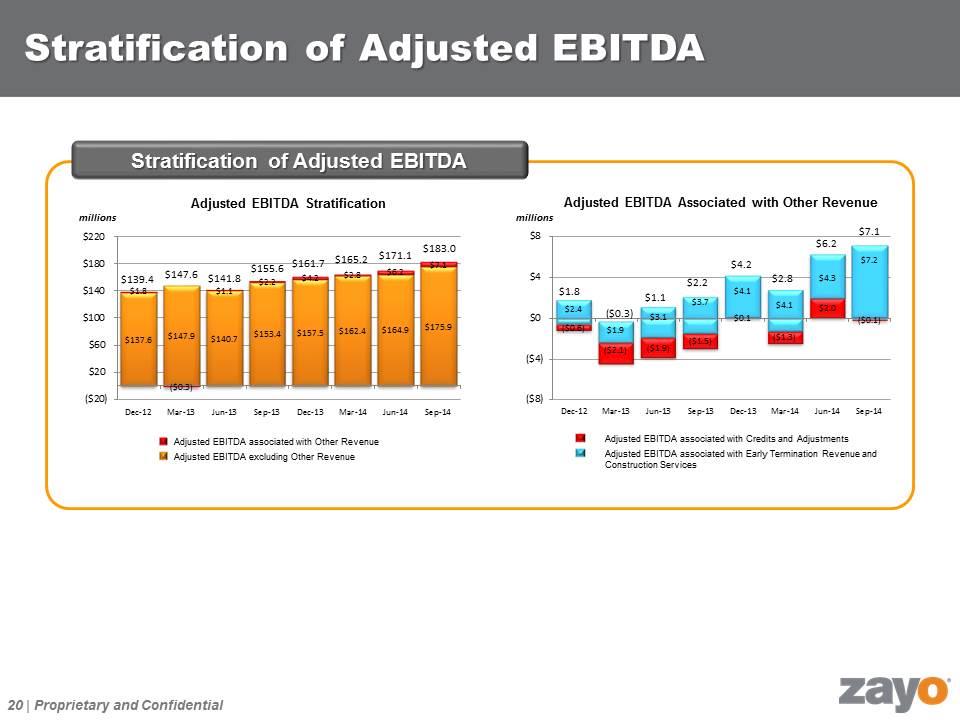

Stratification of Adjusted EBITDA millions millions Adjusted EBITDA Associated with Other Revenue Stratification of Adjusted EBITDA Adjusted EBITDA Stratification Adjusted EBITDA associated with Credits and Adjustments Adjusted EBITDA associated with Early Termination Revenue and Construction Services Adjusted EBITDA associated with Other Revenue Adjusted EBITDA excluding Other Revenue

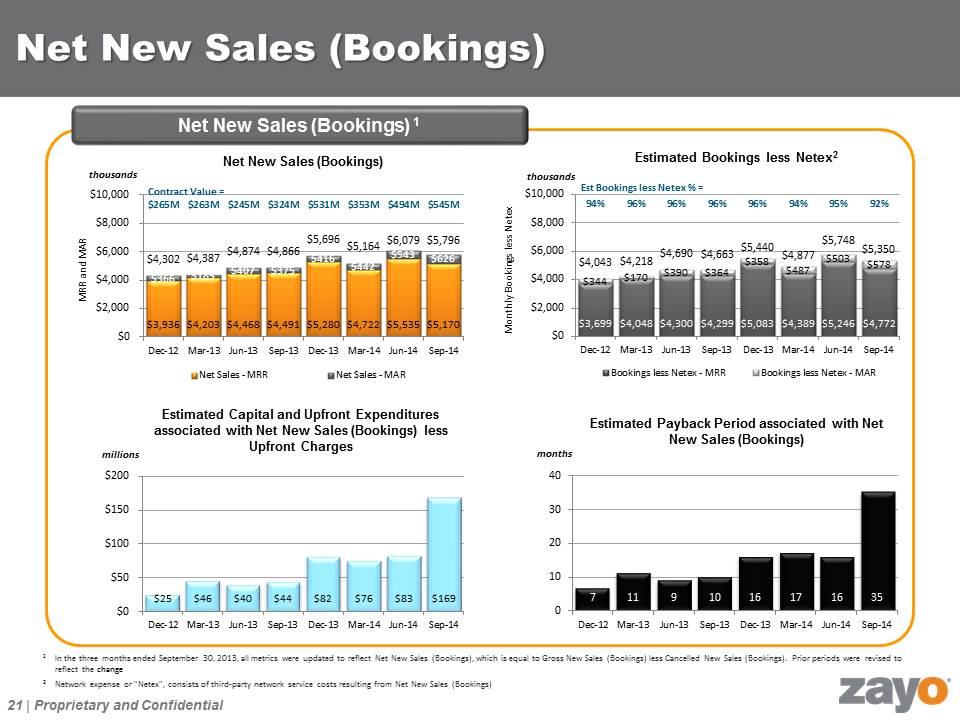

Estimated Bookings less Netex2 Net New Sales (Bookings) Net New Sales (Bookings) 1 Net New Sales (Bookings) Estimated Capital and Upfront Expenditures associated with Net New Sales (Bookings) less Upfront Charges thousands thousands millions months MRR and MAR Monthly Bookings less Netex Est Bookings less Netex % = Estimated Payback Period associated with Net New Sales (Bookings) 1 In the three months ended September 30, 2013, all metrics were updated to reflect Net New Sales (Bookings), which is equal to Gross New Sales (Bookings) less Cancelled New Sales (Bookings). Prior periods were revised to reflect the change 2 Network expense or "Netex", consists of third-party network service costs resulting from Net New Sales (Bookings)

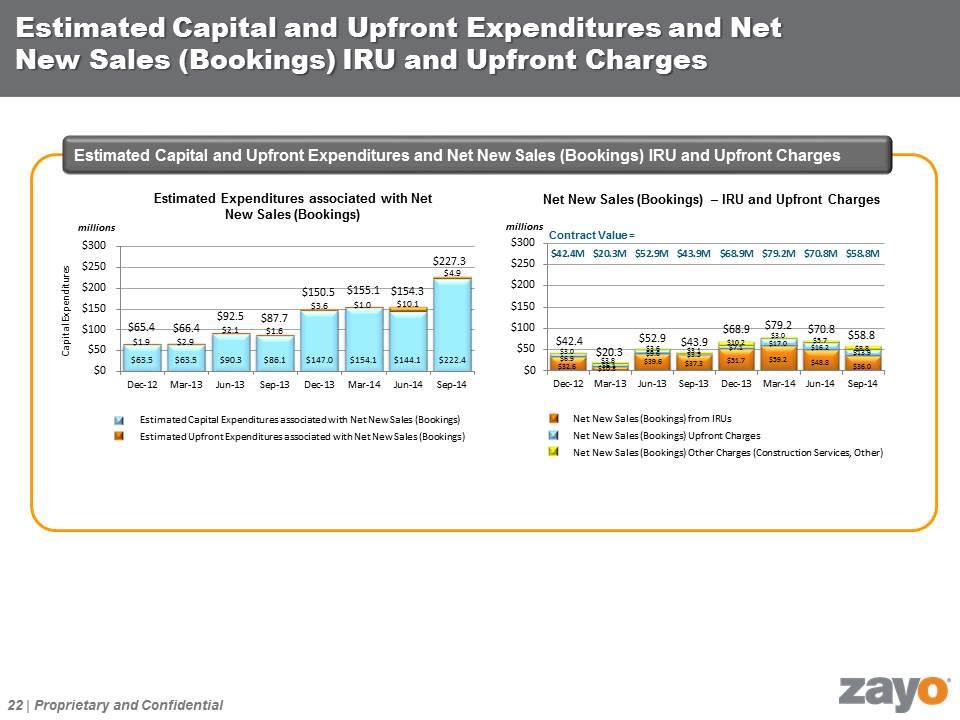

Estimated Capital and Upfront Expenditures and Net New Sales (Bookings) IRU and Upfront Charges Contract Value = Net New Sales (Bookings) – IRU and Upfront Charges Net New Sales (Bookings) from IRUs Net New Sales (Bookings) Upfront Charges Net New Sales (Bookings) Other Charges (Construction Services, Other) millions Estimated Expenditures associated with Net New Sales (Bookings) millions Capital Expenditures Estimated Capital and Upfront Expenditures and Net New Sales (Bookings) IRU and Upfront Charges Estimated Capital Expenditures associated with Net New Sales (Bookings) Estimated Upfront Expenditures associated with Net New Sales (Bookings)

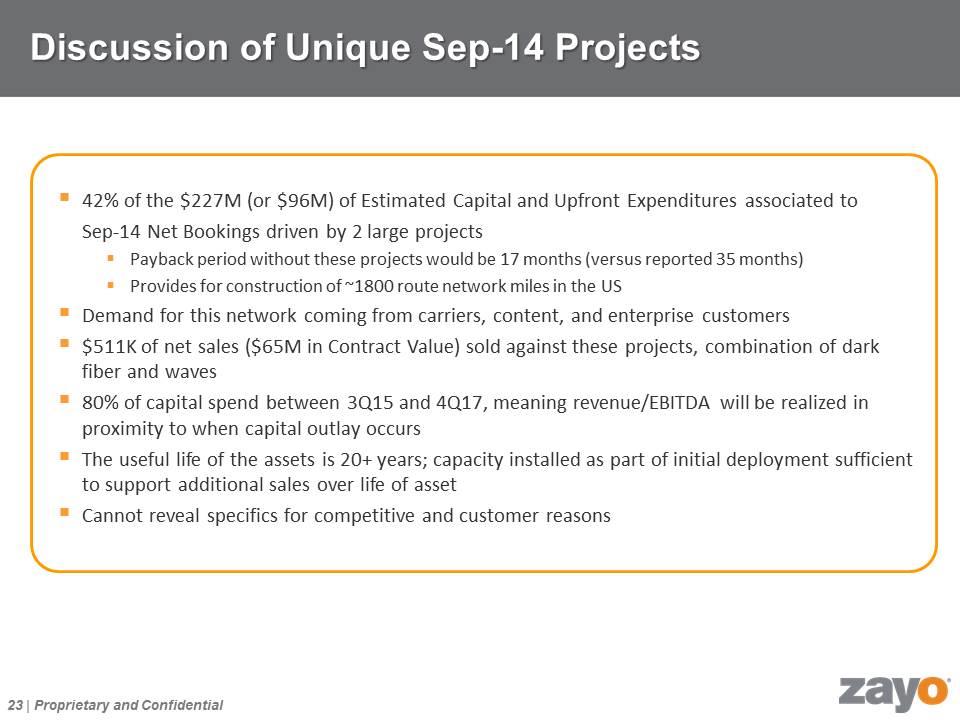

Discussion of Unique Sep-14 Projects 42% of the $227M (or $96M) of Estimated Capital and Upfront Expenditures associated to Sep-14 Net Bookings driven by 2 large projects Payback period without these projects would be 17 months (versus reported 35 months) Provides for construction of ~1800 route network miles in the US Demand for this network coming from carriers, content, and enterprise customers $511K of net sales ($65M in Contract Value) sold against these projects, combination of dark fiber and waves 80% of capital spend between 3Q15 and 4Q17, meaning revenue/EBITDA will be realized in proximity to when capital outlay occurs The useful life of the assets is 20+ years; capacity installed as part of initial deployment sufficient to support additional sales over life of asset Cannot reveal specifics for competitive and customer reasons

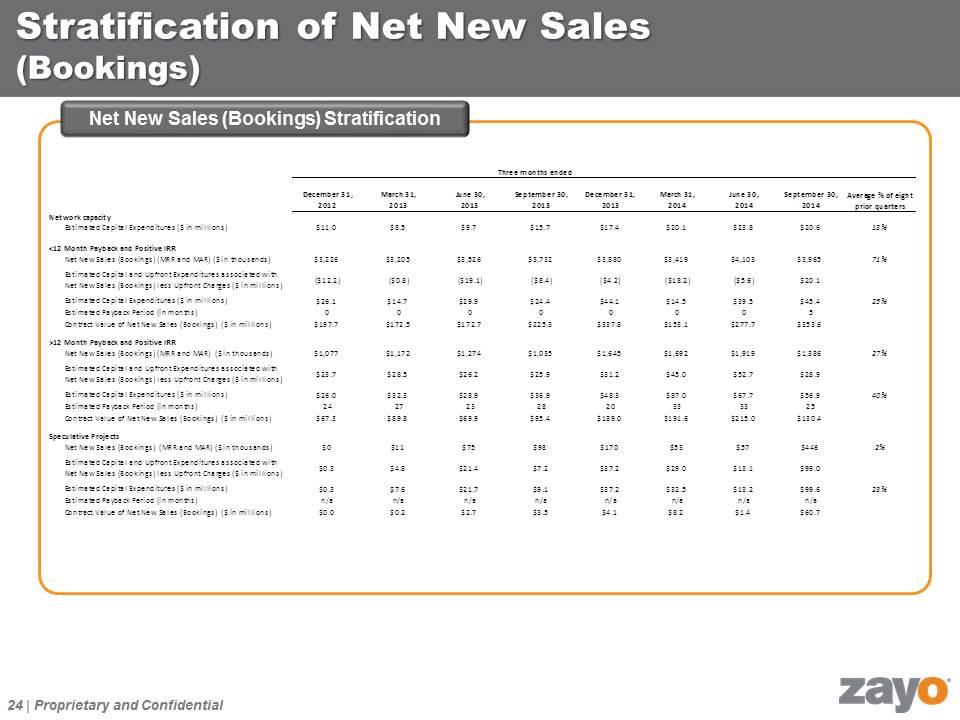

Stratification of Net New Sales (Bookings) Net New Sales (Bookings) Stratification

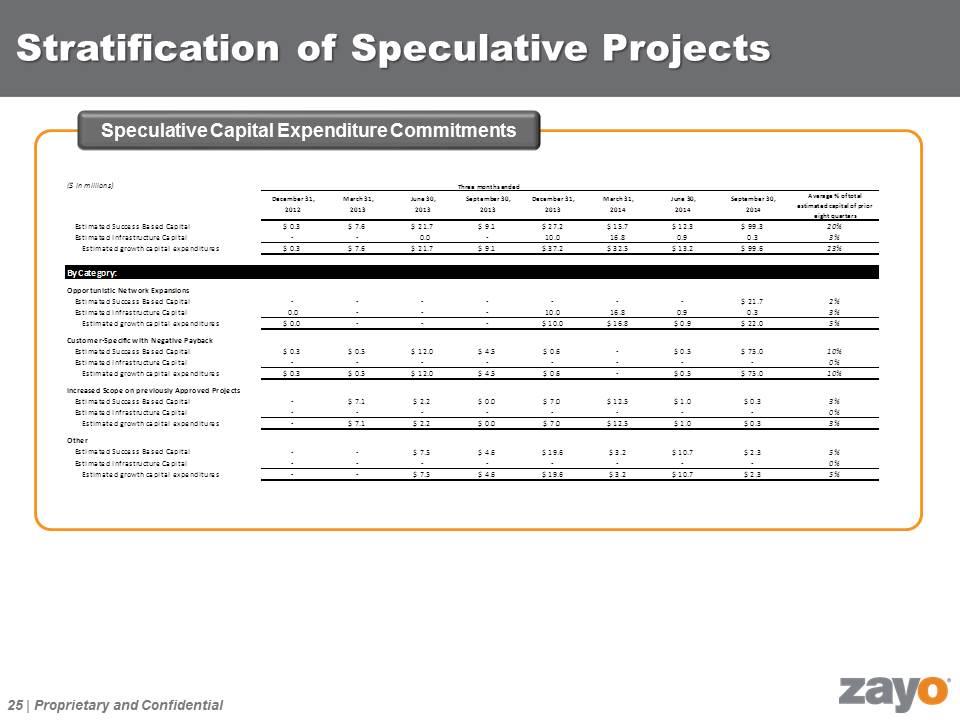

Stratification of Speculative Projects Speculative Capital Expenditure Commitments

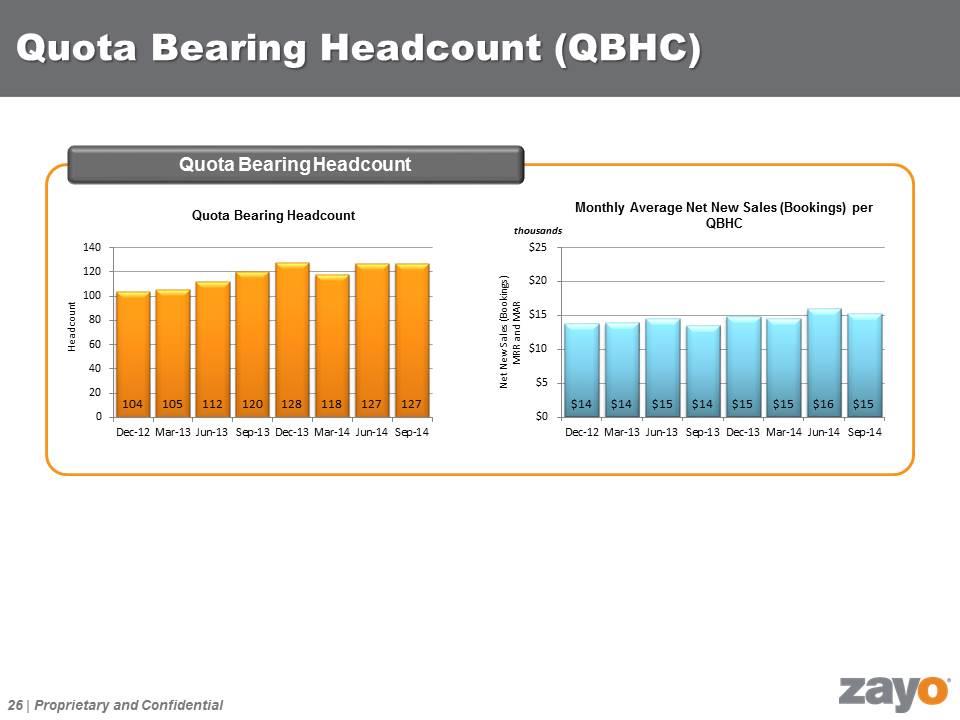

Quota Bearing Headcount (QBHC) Quota Bearing Headcount Quota Bearing Headcount Monthly Average Net New Sales (Bookings) per QBHC thousands Headcount Net New Sales (Bookings) MRR and MAR

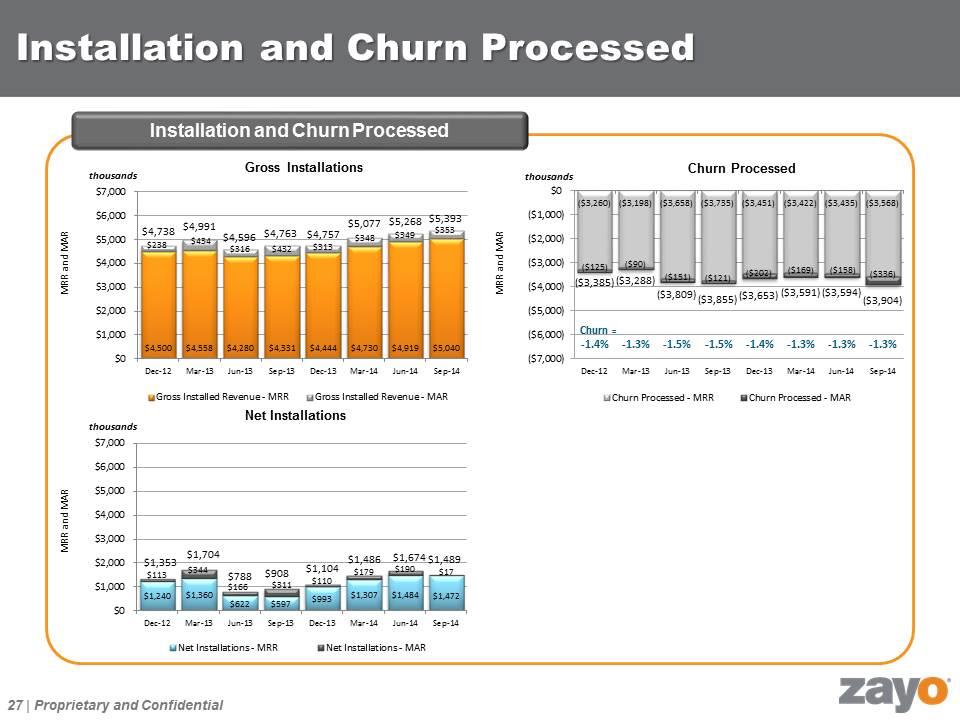

Installation and Churn Processed Installation and Churn Processed Net Installations thousands thousands thousands MRR and MAR MRR and MAR MRR and MAR Gross Installations Churn Processed Churn =

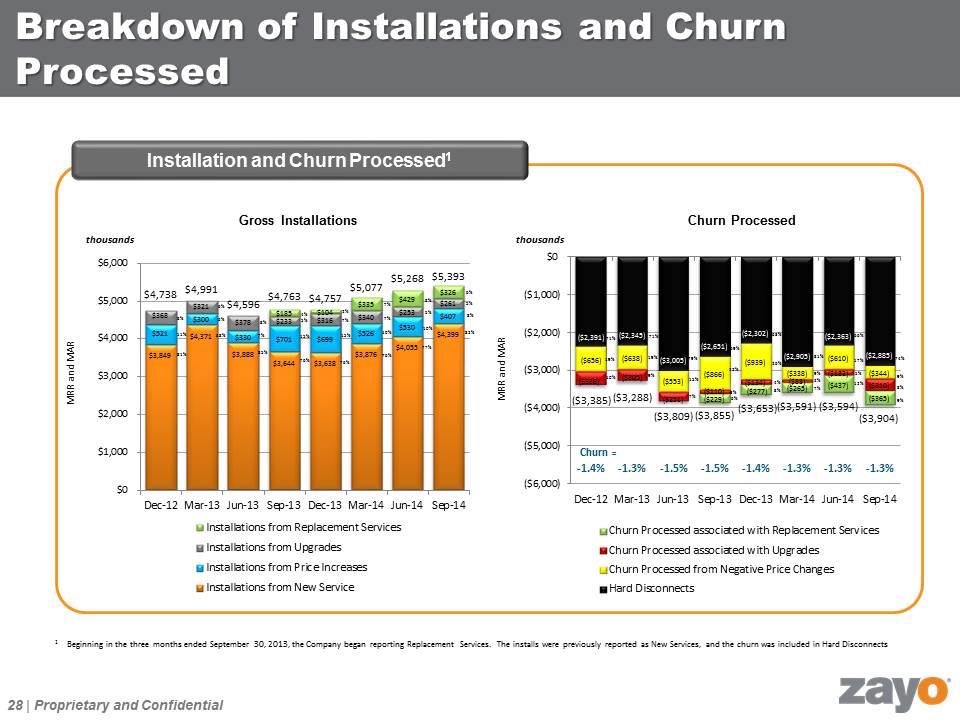

Breakdown of Installations and Churn Processed Installation and Churn Processed1 thousands thousands MRR and MAR MRR and MAR Churn = Gross Installations Churn Processed 1Beginning in the three months ended September 30, 2013, the Company began reporting Replacement Services. The installs were previously reported as New Services, and the churn was included in Hard Disconnects

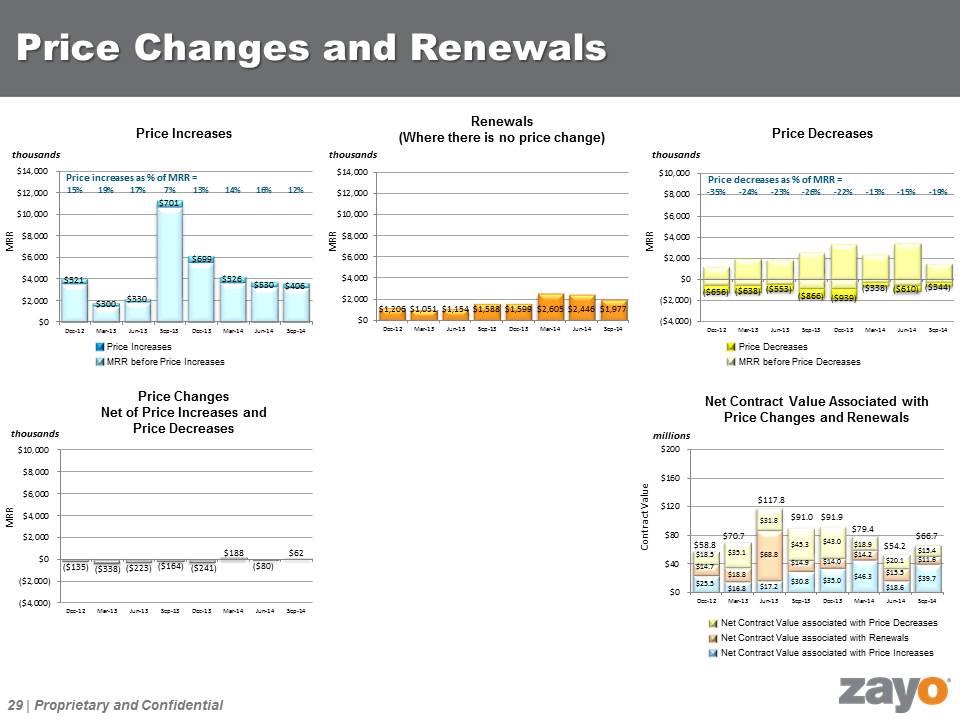

Price Changes and Renewals Price Increases Price Decreases thousands millions thousands MRR Contract Value MRR Price Changes Net of Price Increases and Price Decreases thousands MRR Price increases as % of MRR = Price decreases as % of MRR = Price Increases MRR before Price Increases Price Decreases MRR before Price Decreases Renewals (Where there is no price change) MRR Net Contract Value associated with Price Decreases Net Contract Value associated with Renewals Net Contract Value associated with Price Increases thousands Net Contract Value Associated with Price Changes and Renewals

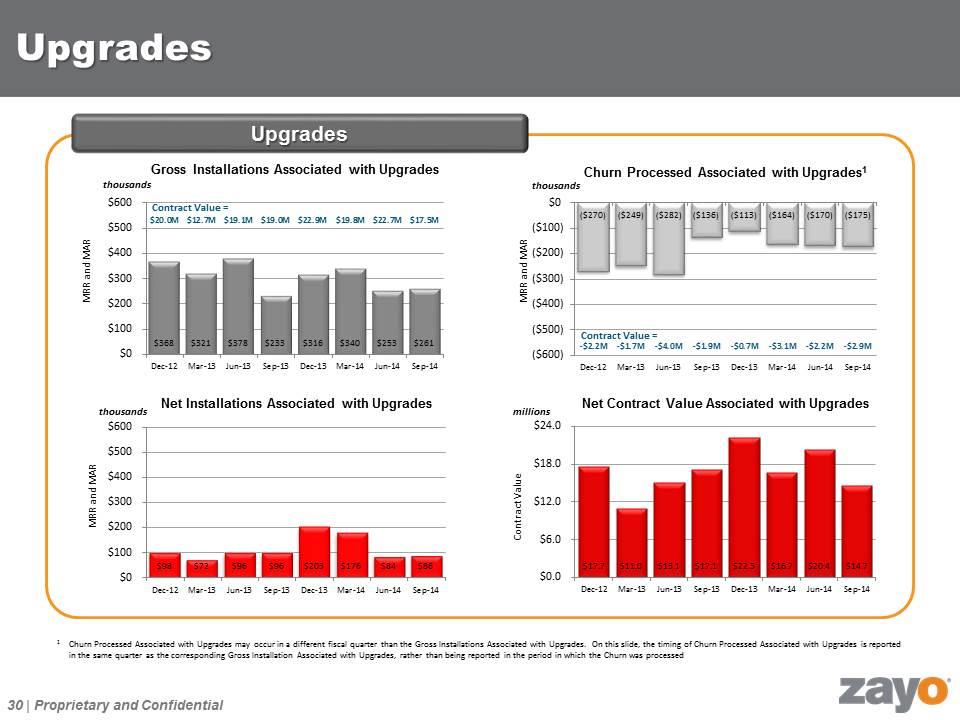

Upgrades Upgrades Gross Installations Associated with Upgrades thousands thousands Churn Processed Associated with Upgrades1 Net Installations Associated with Upgrades MRR and MAR MRR and MAR MRR and MAR Contract Value Contract Value = Contract Value = 1Churn Processed Associated with Upgrades may occur in a different fiscal quarter than the Gross Installations Associated with Upgrades. On this slide, the timing of Churn Processed Associated with Upgrades is reported in the same quarter as the corresponding Gross Installation Associated with Upgrades, rather than being reported in the period in which the Churn was processed Net Contract Value Associated with Upgrades millions thousands

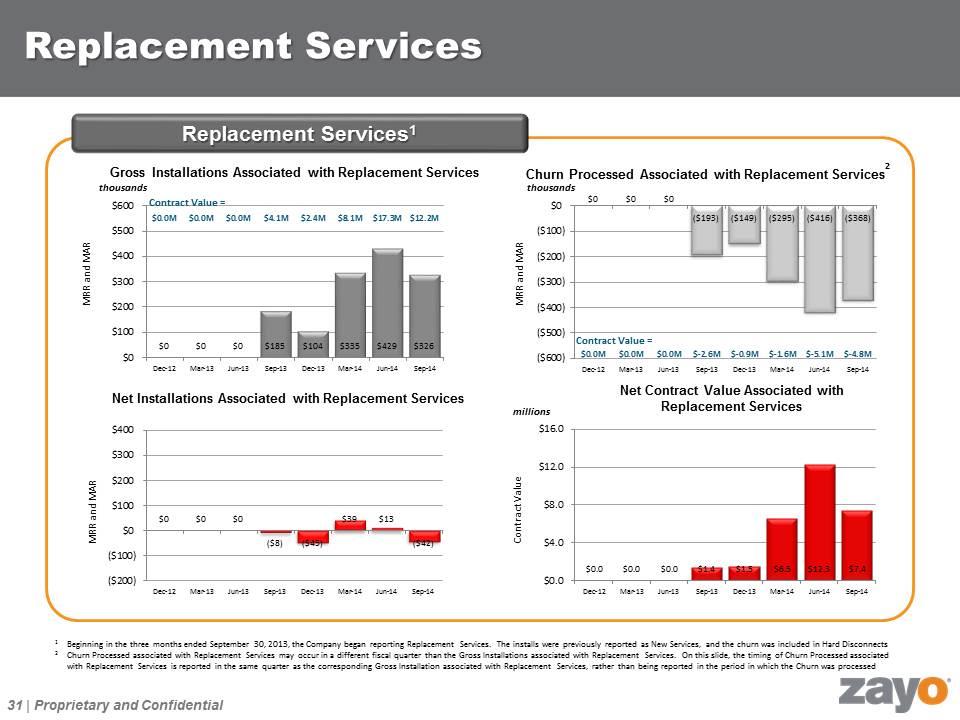

1Beginning in the three months ended September 30, 2013, the Company began reporting Replacement Services. The installs were previously reported as New Services, and the churn was included in Hard Disconnects 2 Churn Processed associated with Replacement Services may occur in a different fiscal quarter than the Gross Installations associated with Replacement Services. On this slide, the timing of Churn Processed associated with Replacement Services is reported in the same quarter as the corresponding Gross Installation associated with Replacement Services, rather than being reported in the period in which the Churn was processed Replacement Services Replacement Services1 Gross Installations Associated with Replacement Services thousands thousands Churn Processed Associated with Replacement Services Net Installations Associated with Replacement Services MRR and MAR MRR and MAR MRR and MAR Contract Value Contract Value = Contract Value = 2 Net Contract Value Associated with Replacement Services millions

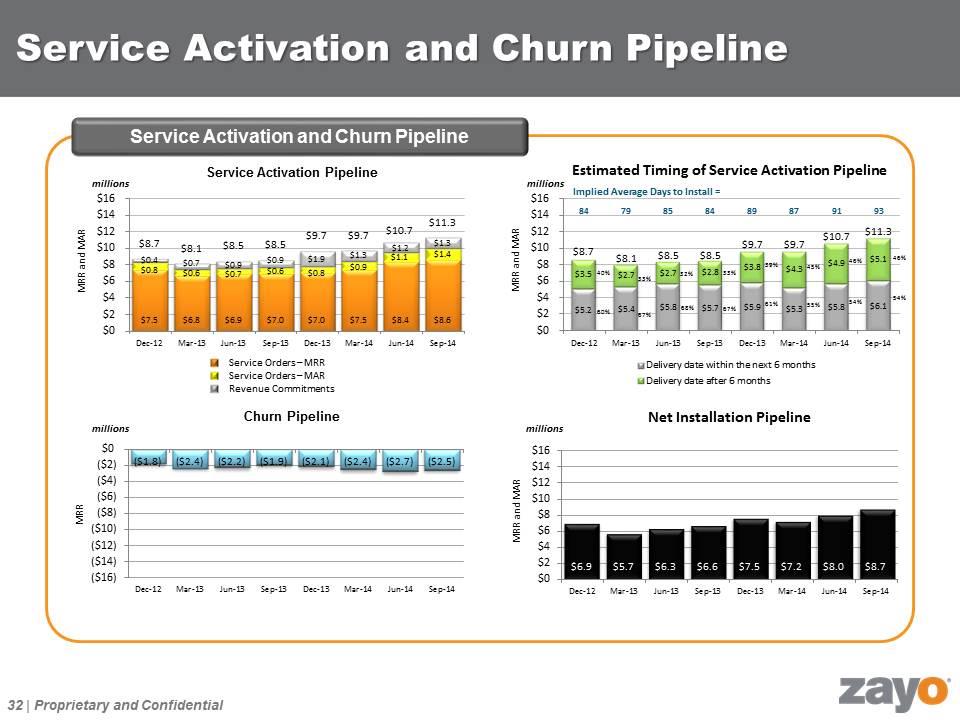

Service Activation and Churn Pipeline Service Activation and Churn Pipeline Service Activation Pipeline Estimated Timing of Service Activation Pipeline Churn Pipeline Net Installation Pipeline millions millions millions MRR and MAR MRR MRR and MAR millions Service Orders – MRR Service Orders – MAR Revenue Commitments Implied Average Days to Install = MRR and MAR

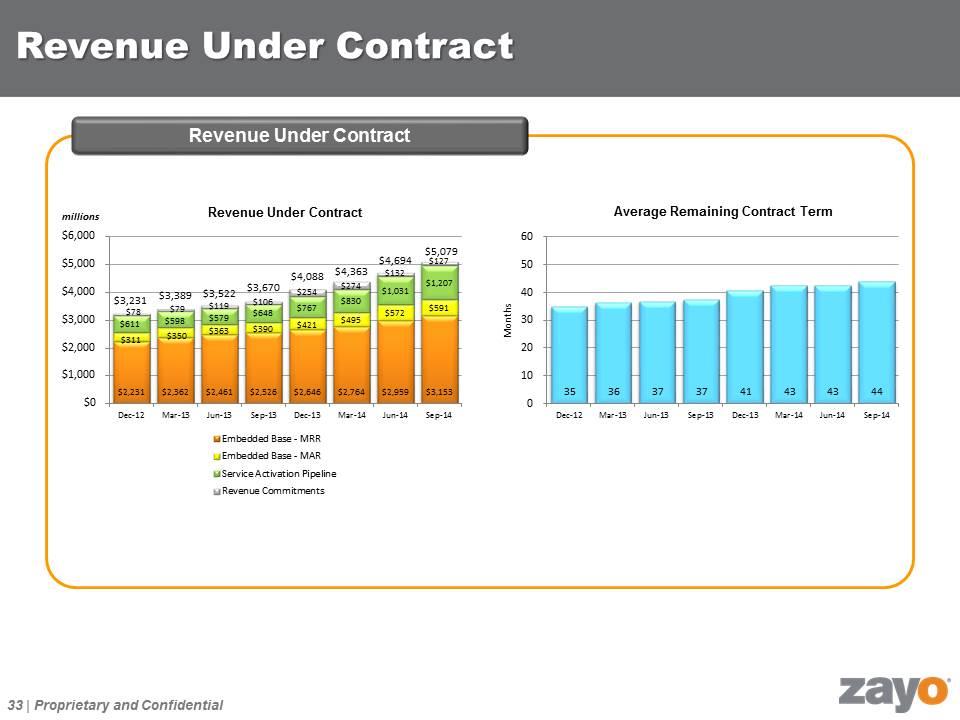

Revenue Under Contract Revenue Under Contract Revenue Under Contract millions Average Remaining Contract Term Months

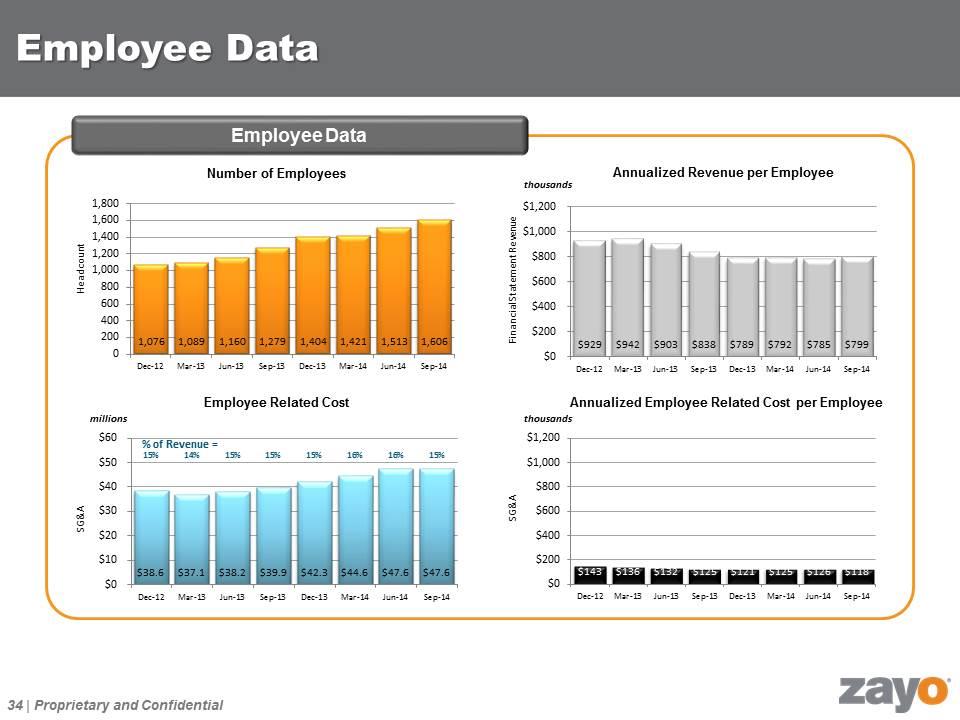

Employee Data Employee Data Number of Employees Employee Related Cost thousands millions thousands Headcount Financial Statement Revenue SG&A SG&A % of Revenue = Annualized Revenue per Employee Annualized Employee Related Cost per Employee

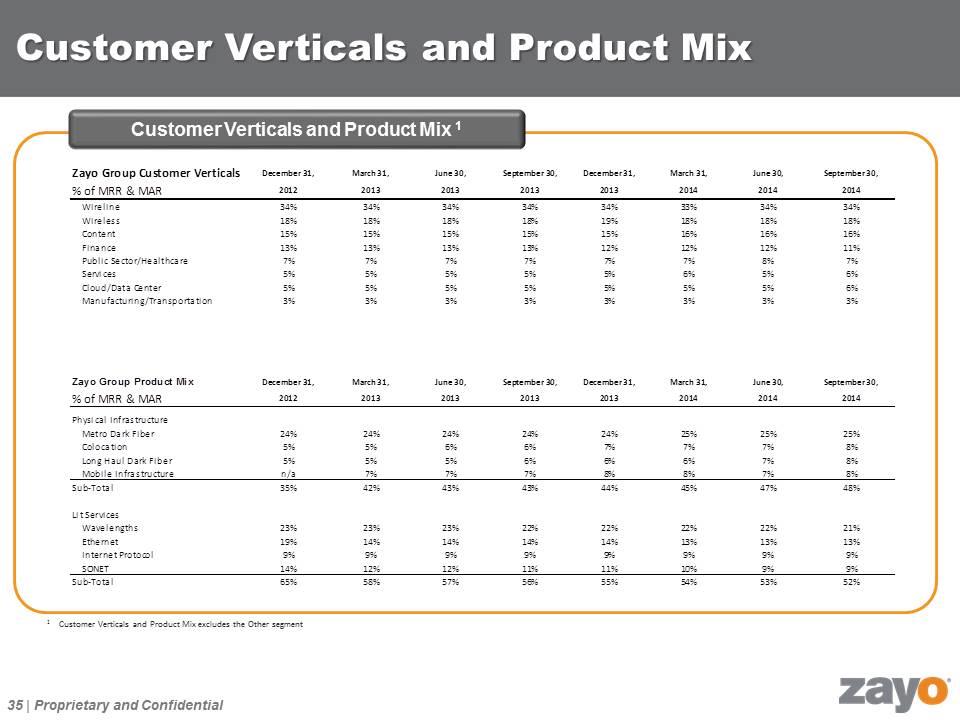

Customer Verticals and Product Mix Customer Verticals and Product Mix 1 1 Customer Verticals and Product Mix excludes the Other segment

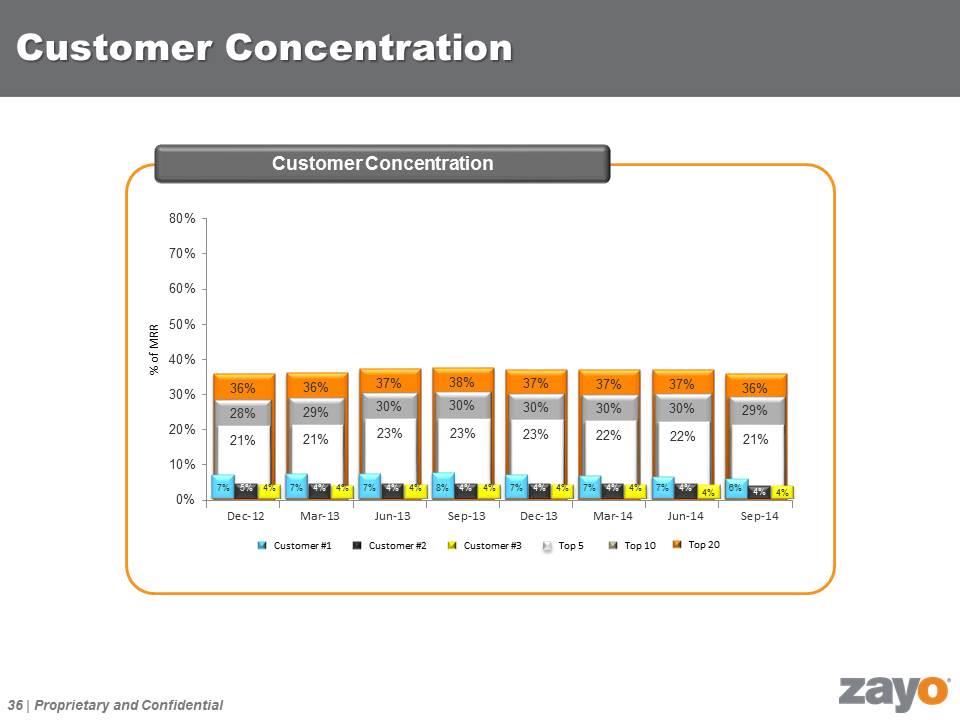

Customer Concentration Customer Concentration % of MRR Customer #1 Customer #2 Customer #3 Top 20 Top 10 Top 5

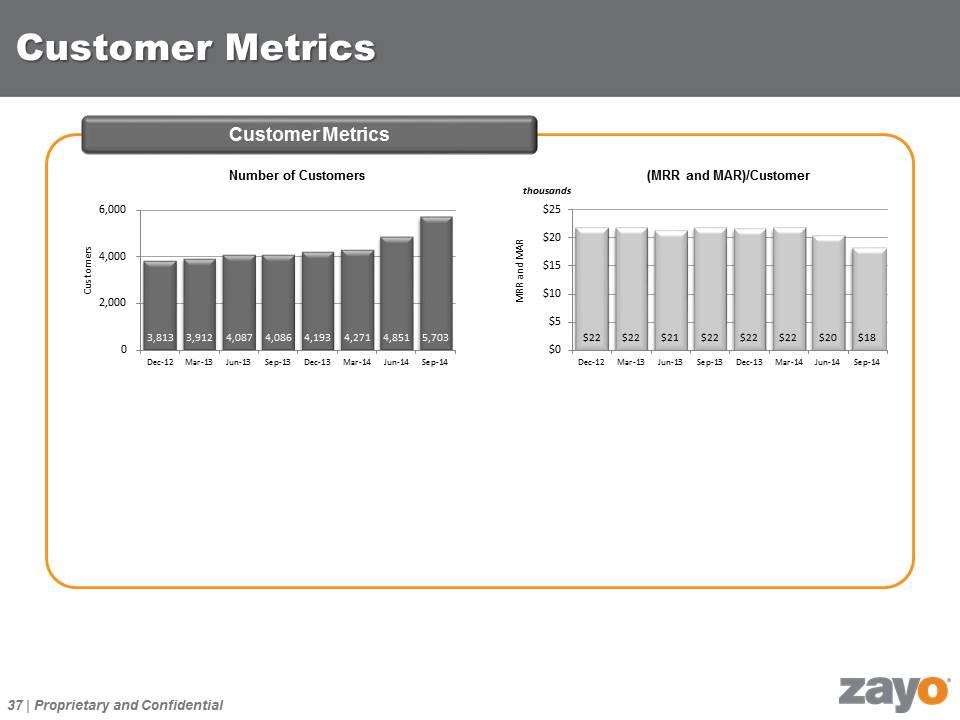

Customer Metrics Customer Metrics Number of Customers Customers MRR and MAR (MRR and MAR)/Customer thousands

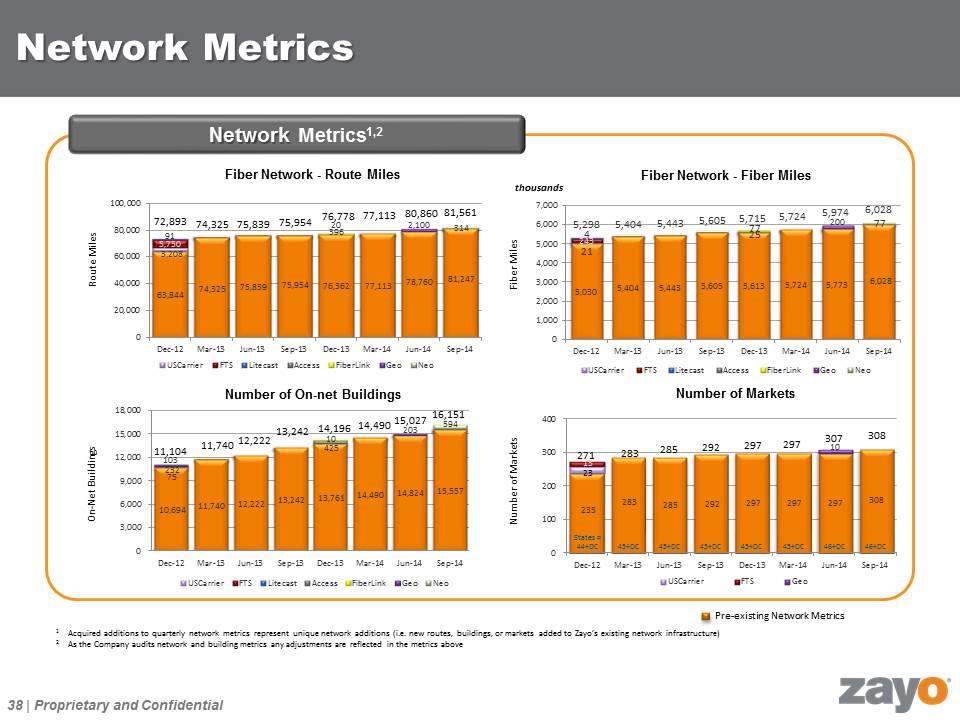

Network Metrics Network Metrics1,2 Fiber Network - Route Miles Route Miles Fiber Miles On-Net Buildings Number of Markets thousands States = Pre-existing Network Metrics Fiber Network - Fiber Miles Number of On-net Buildings Number of Markets 1 Acquired additions to quarterly network metrics represent unique network additions (i.e. new routes, buildings, or markets added to Zayo’s existing network infrastructure) 2 As the Company audits network and building metrics any adjustments are reflected in the metrics above

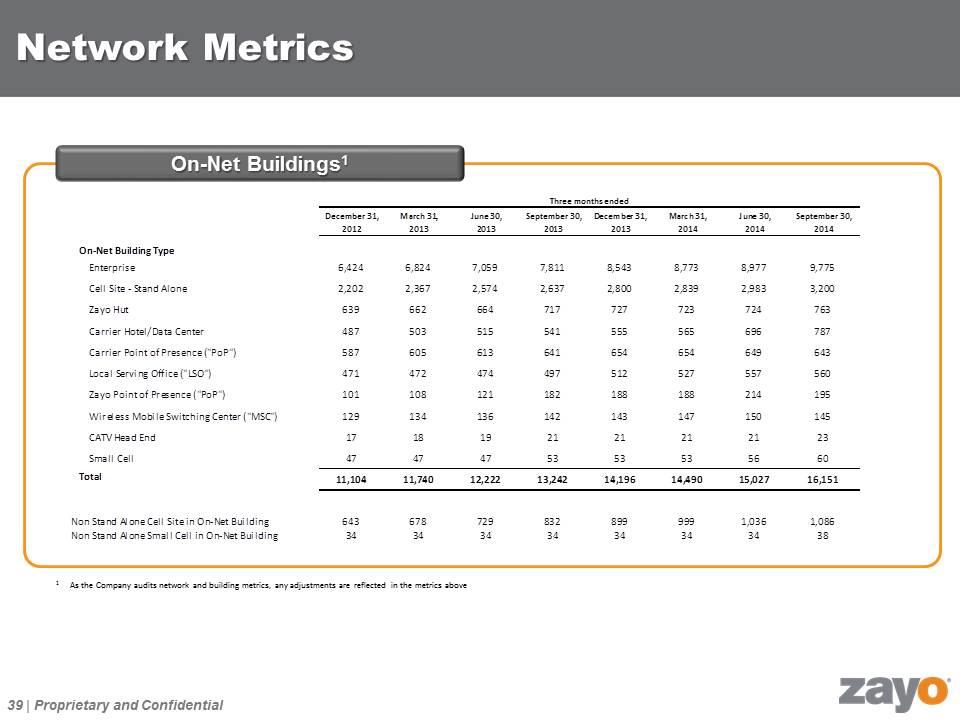

Network Metrics On-Net Buildings1 1 As the Company audits network and building metrics, any adjustments are reflected in the metrics above

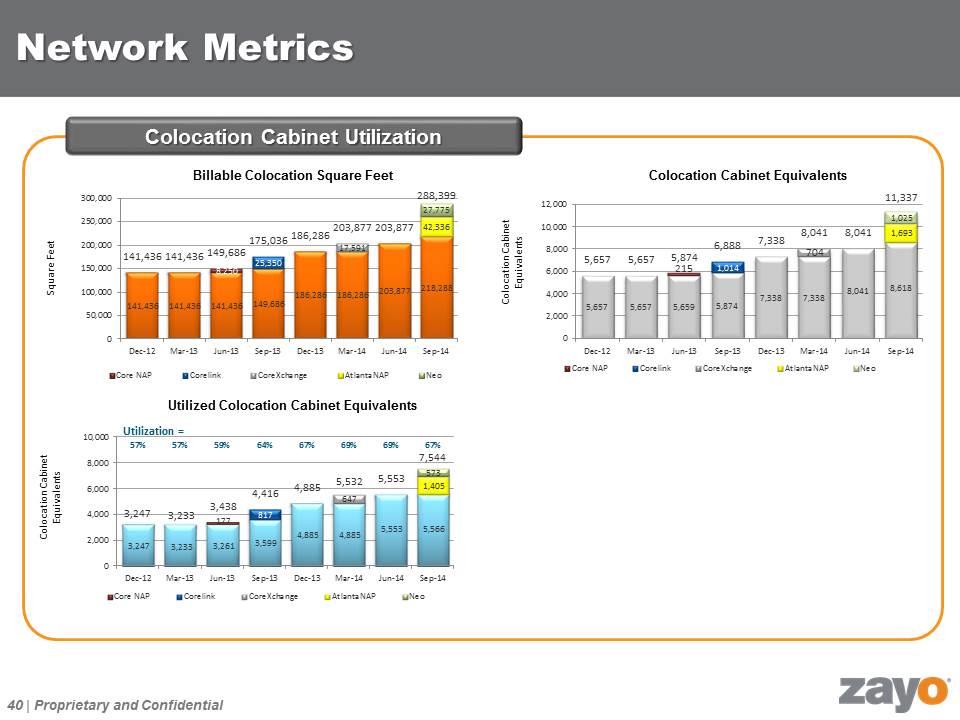

Network Metrics Colocation Cabinet Utilization Billable Colocation Square Feet Utilized Colocation Cabinet Equivalents Square Feet Colocation Cabinet Equivalents Colocation Cabinet Equivalents Utilization = Colocation Cabinet Equivalents

Fiber to the Tower

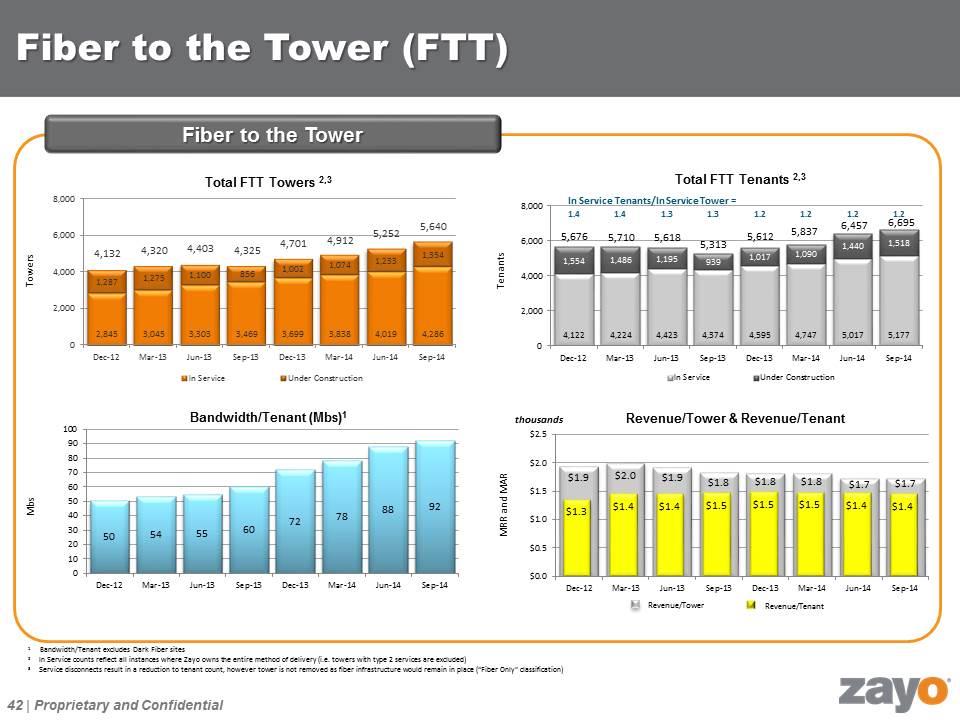

Total FTT Tenants 2,3 Revenue/Tower & Revenue/Tenant Revenue/Tower Revenue/Tenant Fiber to the Tower (FTT) Total FTT Towers 2,3 Bandwidth/Tenant (Mbs)1 thousands Towers Tenants MRR and MAR Mbs In Service Tenants/In Service Tower = 1Bandwidth/Tenant excludes Dark Fiber sites 2 In Service counts reflect all instances where Zayo owns the entire method of delivery (i.e. towers with type 2 services are excluded) 3 Service disconnects result in a reduction to tenant count, however tower is not removed as fiber infrastructure would remain in place (“Fiber Only” classification) Fiber to the Tower

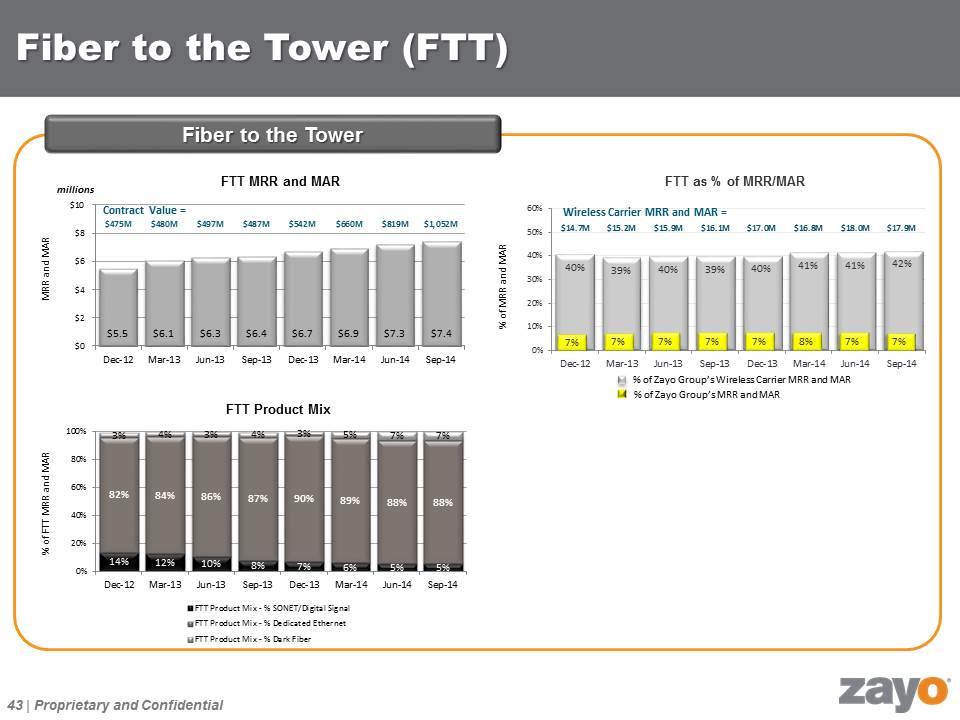

% of MRR and MAR % of Zayo Group’s Wireless Carrier MRR and MAR Fiber to the Tower (FTT) FTT MRR and MAR millions MRR and MAR % of FTT MRR and MAR % of Zayo Group’s MRR and MAR Contract Value = Fiber to the Tower FTT as % of MRR/MAR FTT Product Mix

Financial Data by Reporting Segment

Zayo Physical Infrastructure Segment Financial Data 1 Pro-forma annualized growth for revenue and Adjusted EBITDA are calculated as if the acquisitions occurred on the first day of the quarter preceding the respective quarter in which the acquisitions closed 2 In the three months ended June 30, 2013, the Company recorded a charge for lease termination costs totaling $10.2 million. The impact of the charge to Adjusted EBITDA for Zayo Physical Infrastructure is $4.3 million. Adjusting for the effect of this charge, Annualized Adjusted EBITDA growth for the three months ended September 30, 2013 is estimated to be -3% 3 The three months ended September 30, 2014 include approximately three months of operating results of the May 16, 2014 Geo Networks and July 1, 2014 AtlantaNAP acquisitions. Adjusting for the effect of the transactions as if they occurred on April 1, 2014, the annualized revenue and Adjusted EBITDA growth rates for the three months ended September 30, 2014 are estimated to be 17% and 25%, respectively 2 3 Financial Data

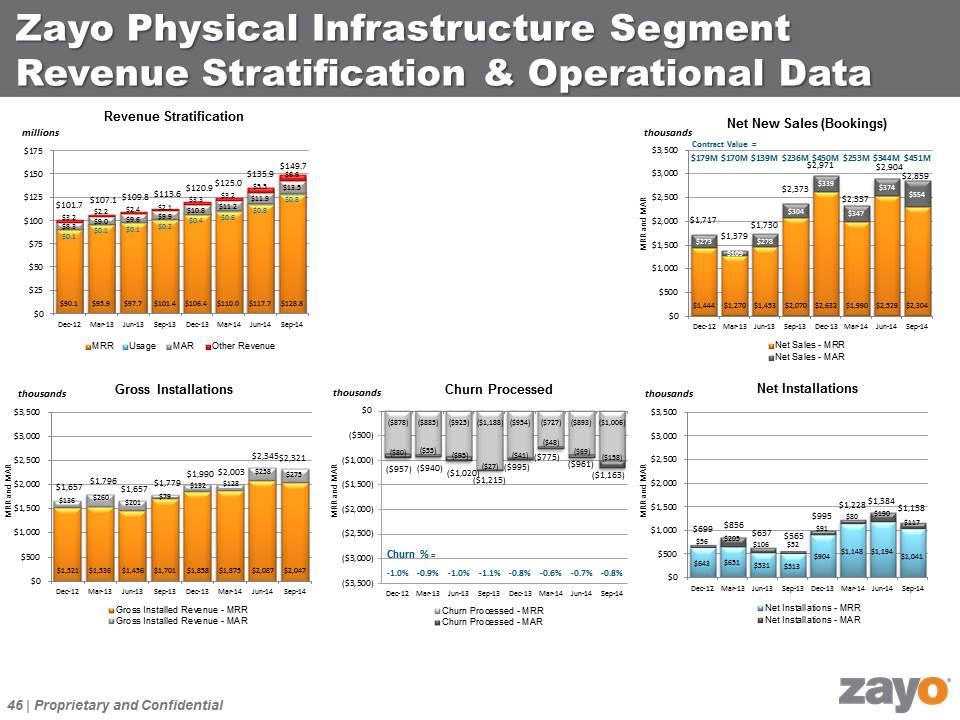

millions Revenue Stratification Net New Sales (Bookings) thousands MRR and MAR Zayo Physical Infrastructure Segment Revenue Stratification & Operational Data thousands Churn Processed Gross Installations MRR and MAR MRR and MAR thousands Net Installations thousands MRR and MAR Churn % =

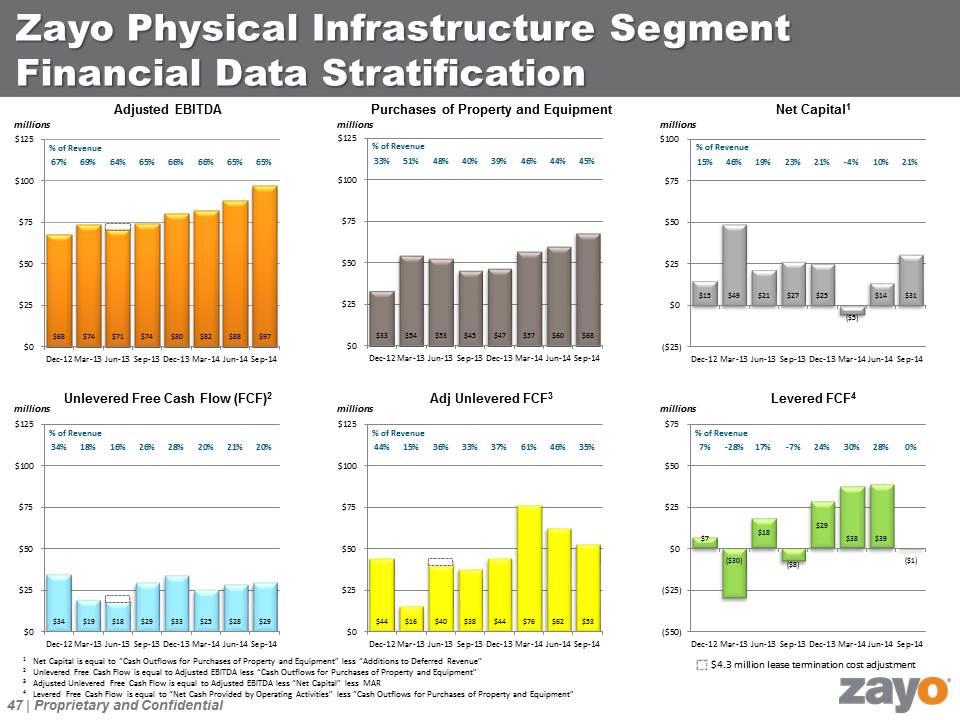

% of Revenue millions Purchases of Property and Equipment % of Revenue millions Adjusted EBITDA % of Revenue millions Net Capital1 % of Revenue millions Adj Unlevered FCF3 % of Revenue millions Unlevered Free Cash Flow (FCF)2 % of Revenue millions Levered FCF4 $4.3 million lease termination cost adjustment Zayo Physical Infrastructure Segment Financial Data Stratification 1 Net Capital is equal to “Cash Outflows for Purchases of Property and Equipment” less “Additions to Deferred Revenue” 2 Unlevered Free Cash Flow is equal to Adjusted EBITDA less “Cash Outflows for Purchases of Property and Equipment” 3 Adjusted Unlevered Free Cash Flow is equal to Adjusted EBITDA less “Net Capital” less MAR 4 Levered Free Cash Flow is equal to “Net Cash Provided by Operating Activities” less “Cash Outflows for Purchases of Property and Equipment”

Zayo Lit Services Segment Financial Data Financial Data 1 Pro-forma annualized growth for revenue and Adjusted EBITDA are calculated as if the acquisitions occurred on the first day of the quarter preceding the respective quarter in which the acquisitions closed 2 In the three months ended June 30, 2013, the Company recorded a charge for lease termination costs totaling $10.2 million. The impact of the charge to Adjusted EBITDA for Zayo Lit Services is $5.9 million. Adjusting for the effect of this charge, Annualized Adjusted EBITDA growth for the three months ended September 30, 2013 is estimated to be 21% 3 The three months ended June 30, 2014 include approximately one and a half months of operating results of the May 16, 2014 Geo Networks acquisition. Adjusting for the effect of the transaction as if it had occurred on January 1, 2014, the annualized revenue and Adjusted EBITDA growth rates for the three months ended June 30, 2014 are estimated to be 3% and -6%, and for the three months ended September 30, 2014 are estimated to be 3% and 1%, respectively 2 3 3

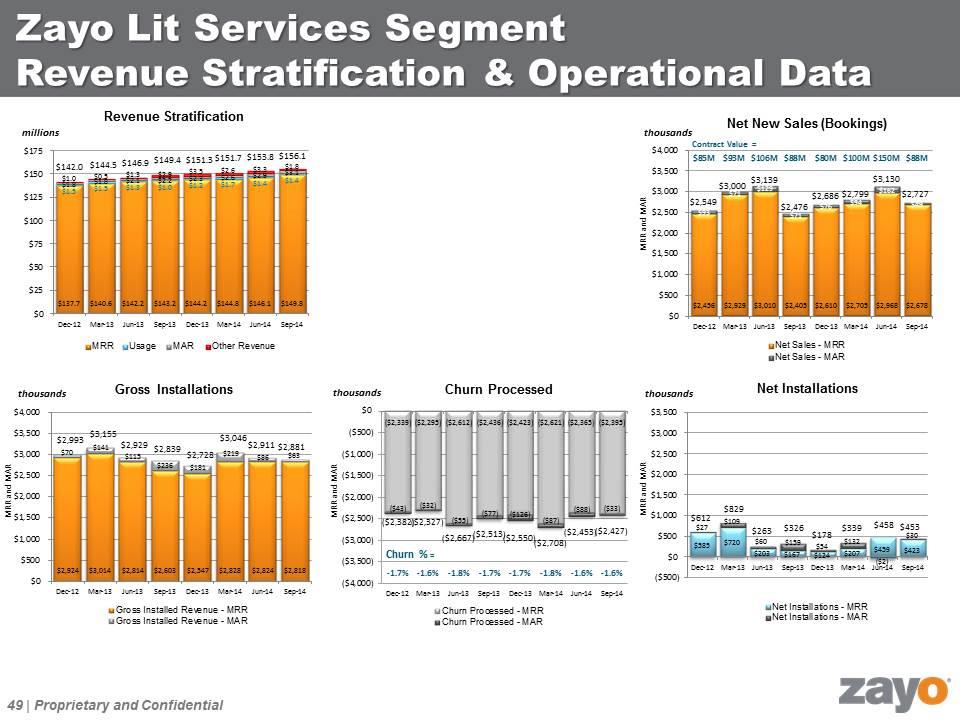

millions Revenue Stratification Net New Sales (Bookings) thousands MRR and MAR Zayo Lit Services Segment Revenue Stratification & Operational Data thousands Churn Processed Gross Installations MRR and MAR MRR and MAR thousands Net Installations thousands MRR and MAR Churn % =

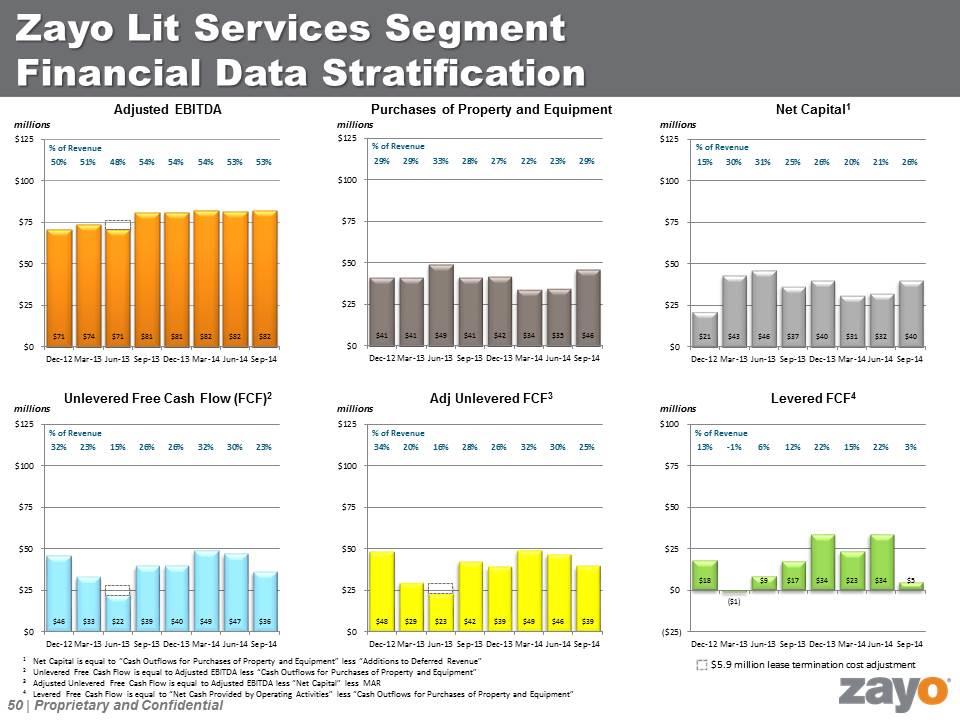

% of Revenue millions Purchases of Property and Equipment % of Revenue millions Adjusted EBITDA % of Revenue millions Net Capital1 % of Revenue millions Adj Unlevered FCF3 % of Revenue millions Unlevered Free Cash Flow (FCF)2 % of Revenue millions Levered FCF4 $5.9 million lease termination cost adjustment Zayo Lit Services Segment Financial Data Stratification 1 Net Capital is equal to “Cash Outflows for Purchases of Property and Equipment” less “Additions to Deferred Revenue” 2 Unlevered Free Cash Flow is equal to Adjusted EBITDA less “Cash Outflows for Purchases of Property and Equipment” 3 Adjusted Unlevered Free Cash Flow is equal to Adjusted EBITDA less “Net Capital” less MAR 4 Levered Free Cash Flow is equal to “Net Cash Provided by Operating Activities” less “Cash Outflows for Purchases of Property and Equipment”

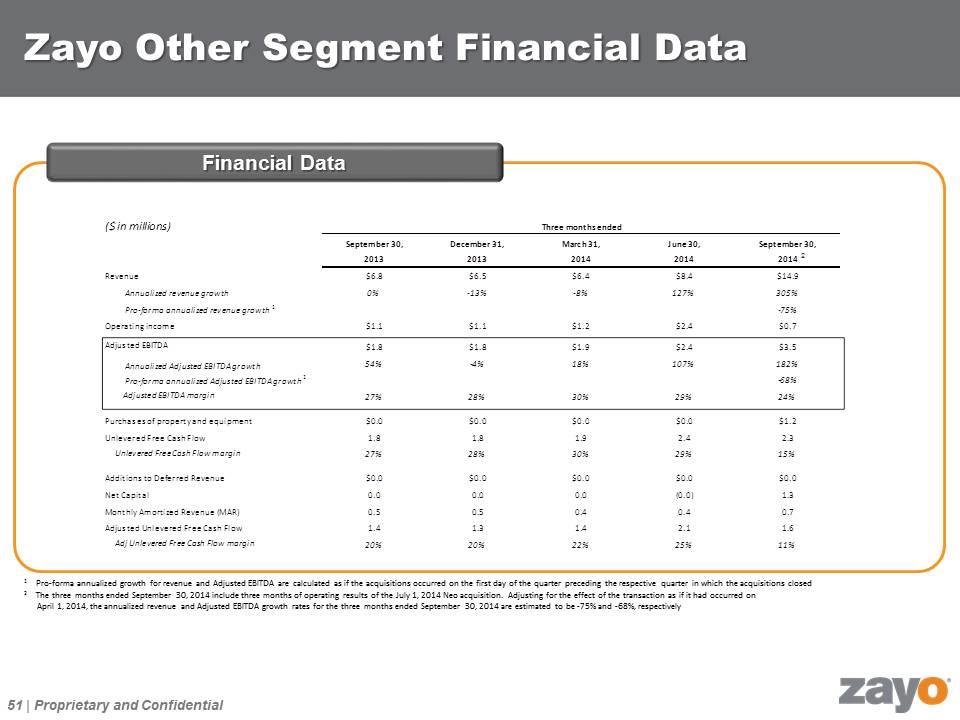

Zayo Other Segment Financial Data 1 Pro-forma annualized growth for revenue and Adjusted EBITDA are calculated as if the acquisitions occurred on the first day of the quarter preceding the respective quarter in which the acquisitions closed 2 The three months ended September 30, 2014 include three months of operating results of the July 1, 2014 Neo acquisition. Adjusting for the effect of the transaction as if it had occurred on April 1, 2014, the annualized revenue and Adjusted EBITDA growth rates for the three months ended September 30, 2014 are estimated to be -75% and -68%, respectively Financial Data 2

Segment Financial Data Rollup Segment Data Rollup

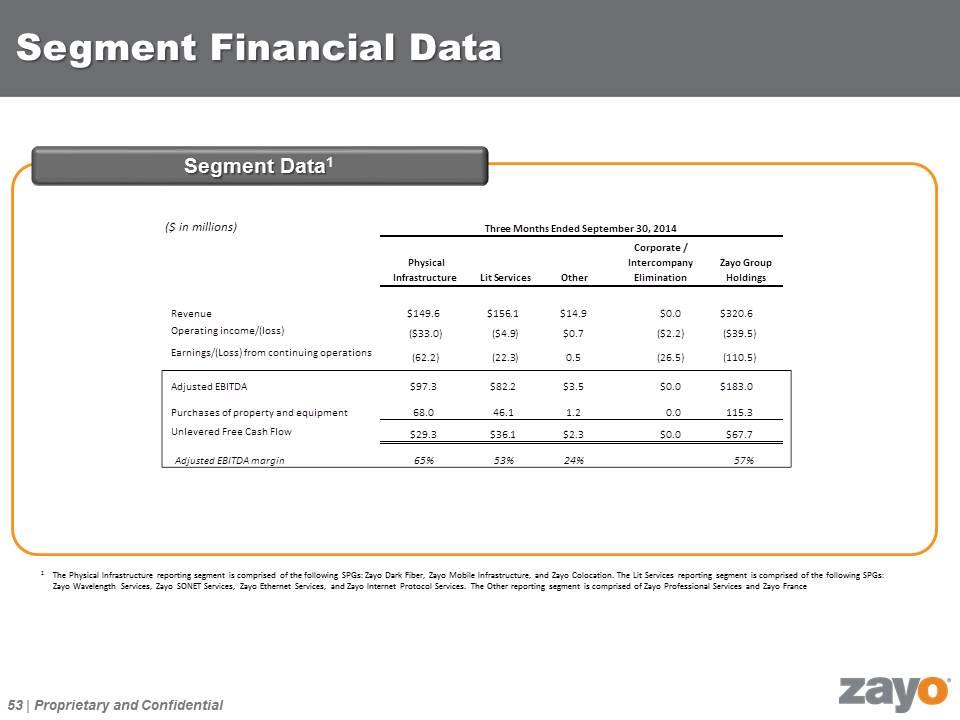

Segment Financial Data Segment Data1 1The Physical Infrastructure reporting segment is comprised of the following SPGs: Zayo Dark Fiber, Zayo Mobile Infrastructure, and Zayo Colocation. The Lit Services reporting segment is comprised of the following SPGs: Zayo Wavelength Services, Zayo SONET Services, Zayo Ethernet Services, and Zayo Internet Protocol Services. The Other reporting segment is comprised of Zayo Professional Services and Zayo France

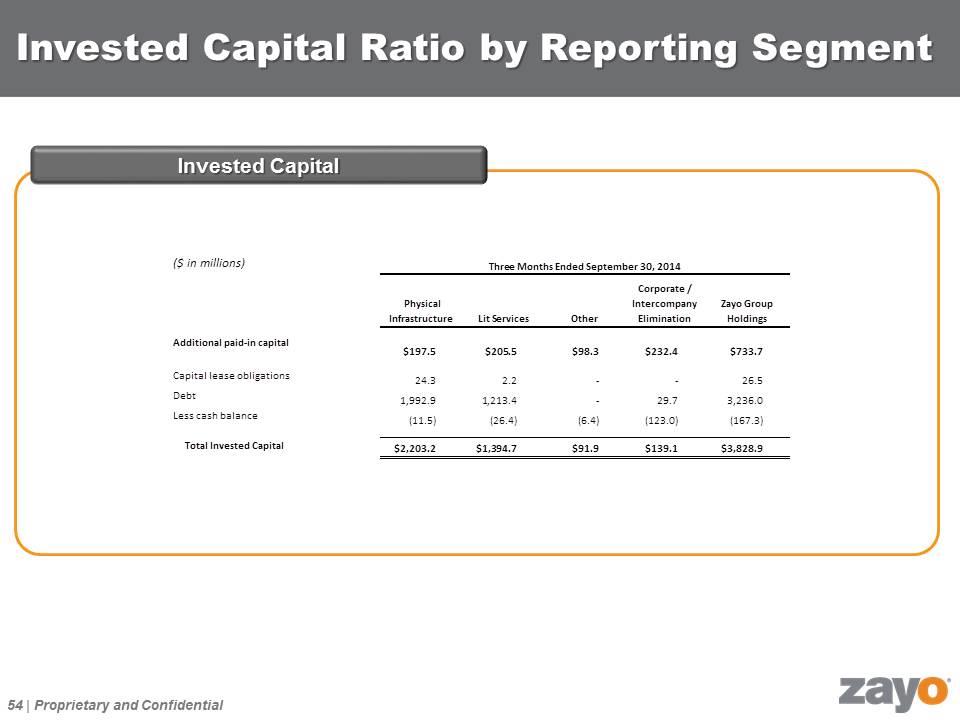

Invested Capital Ratio by Reporting Segment Invested Capital

Historical Financial Data & Reconciliations

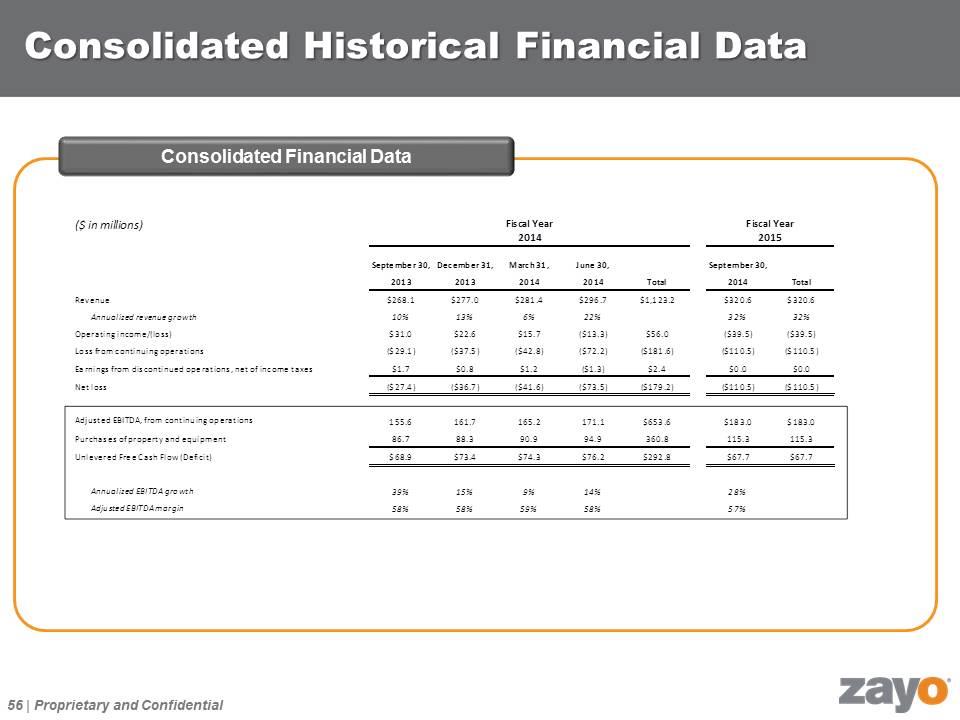

Consolidated Historical Financial Data Consolidated Financial Data

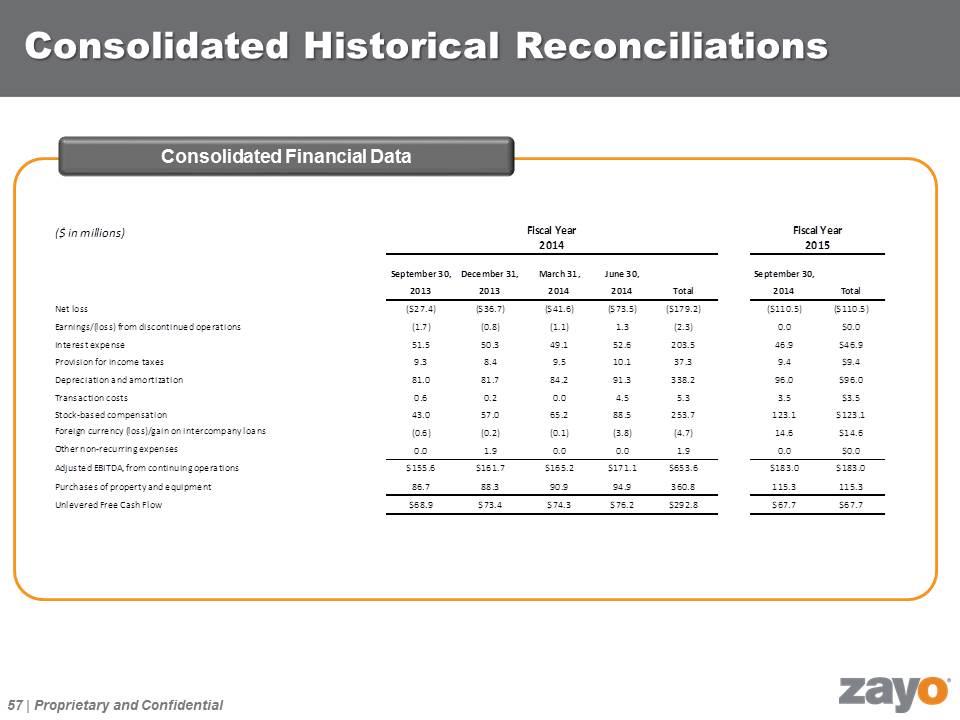

Consolidated Historical Reconciliations Consolidated Financial Data

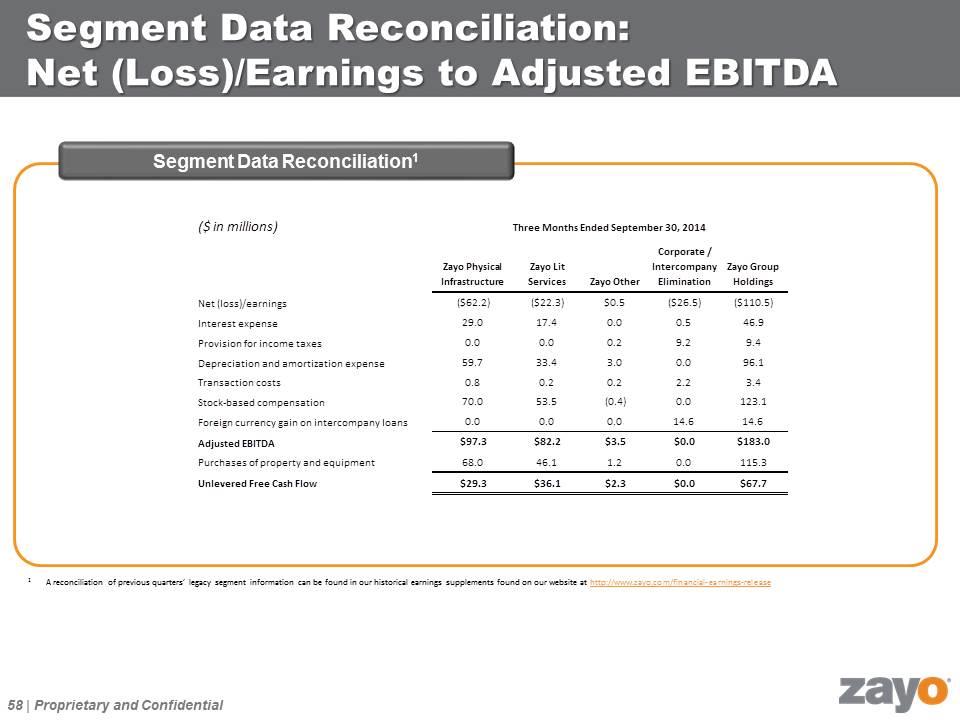

Segment Data Reconciliation: Net (Loss)/Earnings to Adjusted EBITDA Segment Data Reconciliation1 1A reconciliation of previous quarters’ legacy segment information can be found in our historical earnings supplements found on our website at http://www.zayo.com/financial-earnings-release

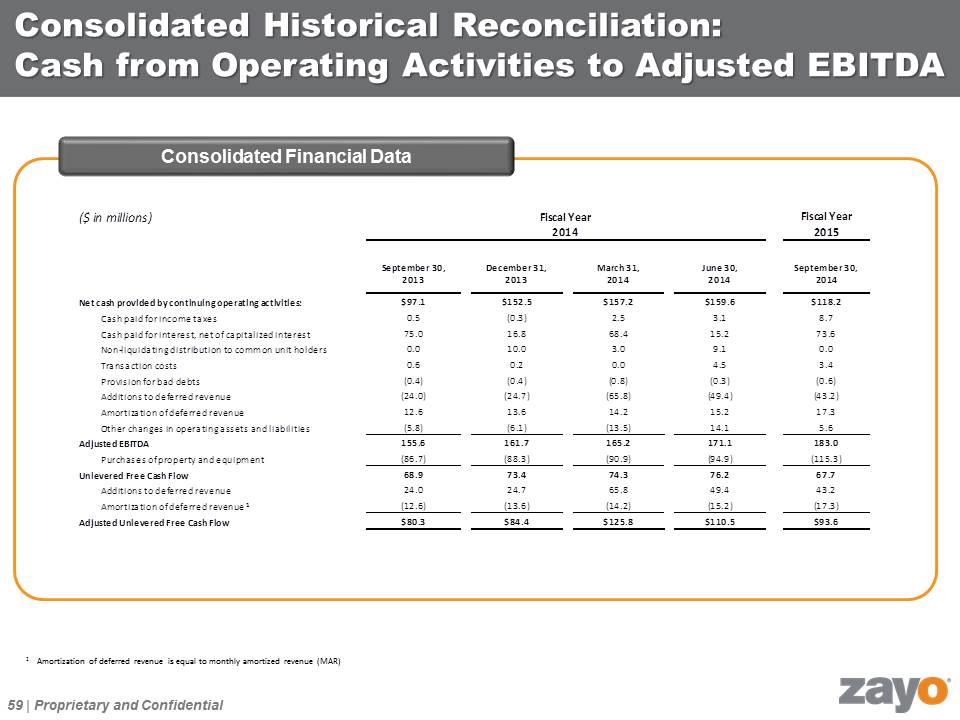

Consolidated Historical Reconciliation: Cash from Operating Activities to Adjusted EBITDA Consolidated Financial Data 1 1 Amortization of deferred revenue is equal to monthly amortized revenue (MAR)

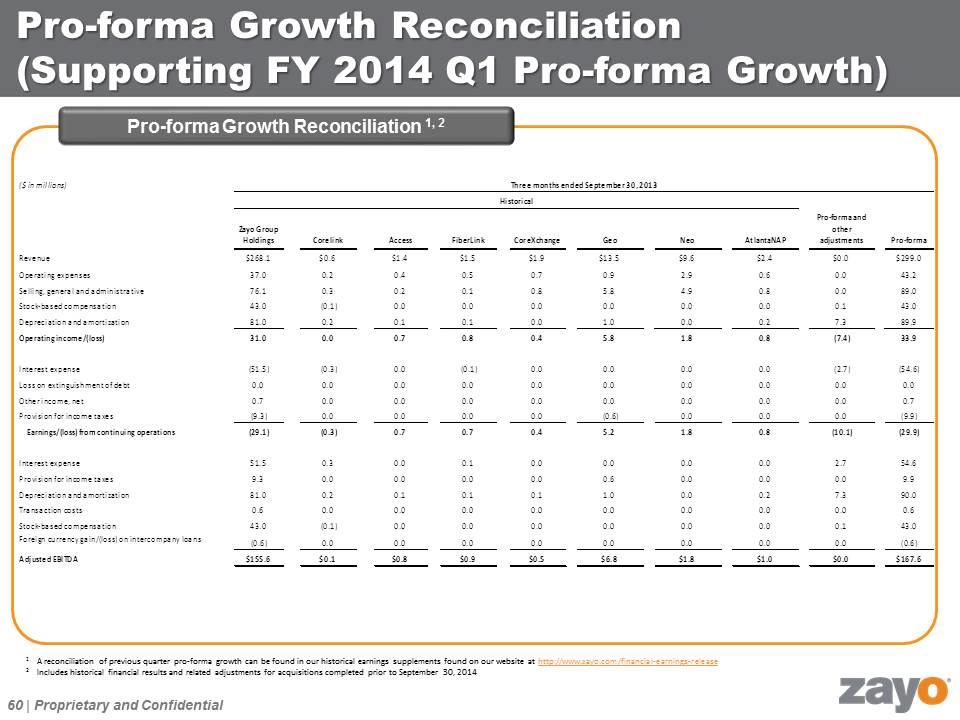

Pro-forma Growth Reconciliation (Supporting FY 2014 Q1 Pro-forma Growth) Pro-forma Growth Reconciliation 1, 2 1 A reconciliation of previous quarter pro-forma growth can be found in our historical earnings supplements found on our website at http://www.zayo.com/financial-earnings-release 2 Includes historical financial results and related adjustments for acquisitions completed prior to September 30, 2014

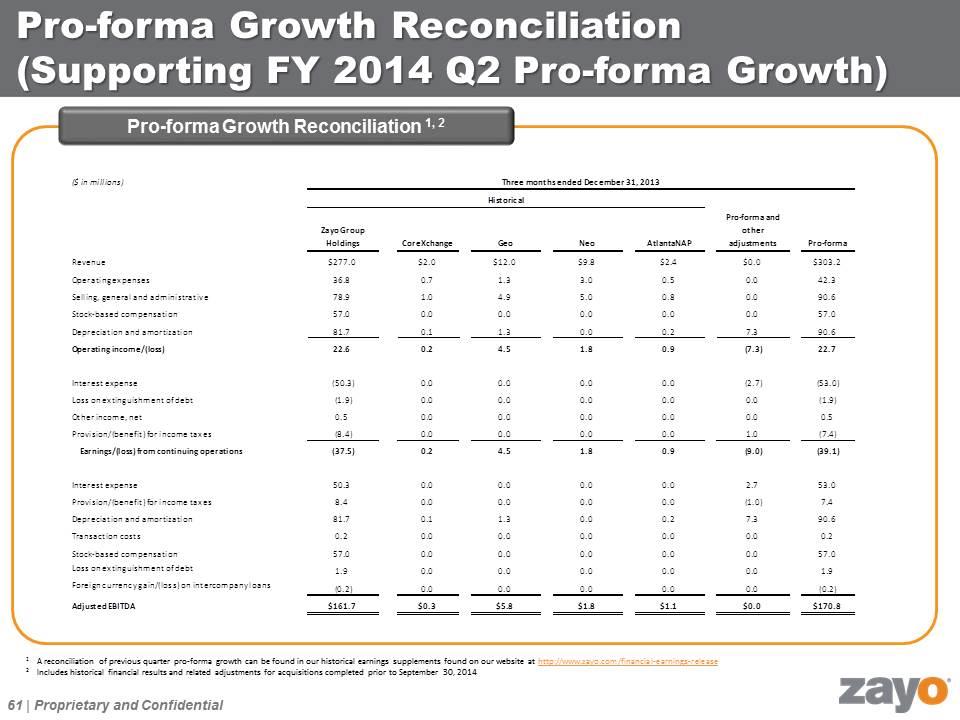

Pro-forma Growth Reconciliation (Supporting FY 2014 Q2 Pro-forma Growth) Pro-forma Growth Reconciliation 1, 2 1 A reconciliation of previous quarter pro-forma growth can be found in our historical earnings supplements found on our website at http://www.zayo.com/financial-earnings-release 2 Includes historical financial results and related adjustments for acquisitions completed prior to September 30, 2014

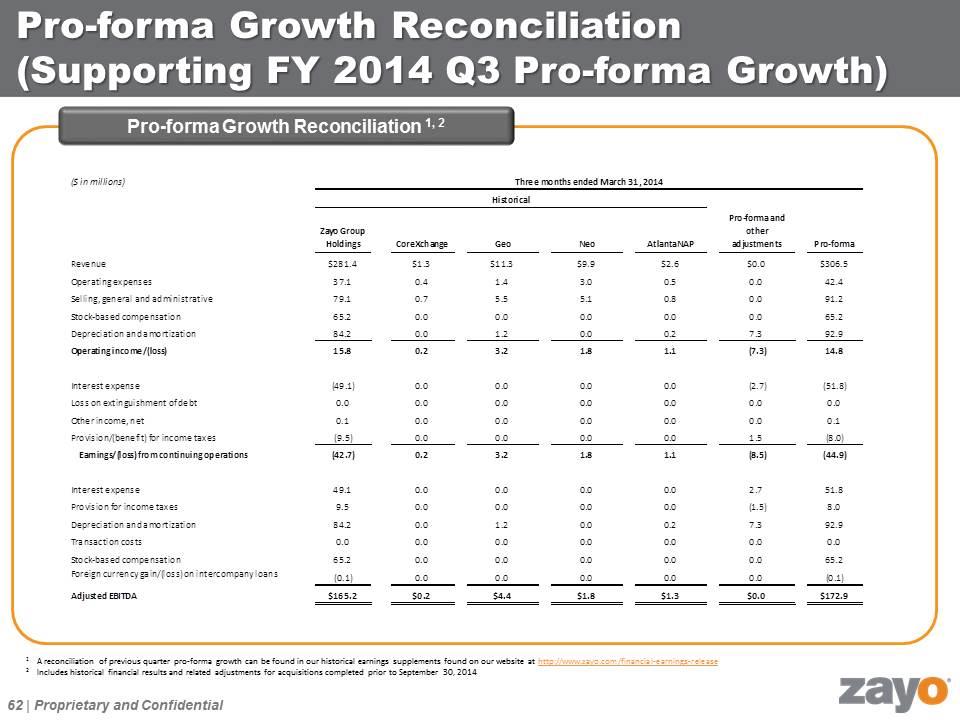

Pro-forma Growth Reconciliation (Supporting FY 2014 Q3 Pro-forma Growth) Pro-forma Growth Reconciliation 1, 2 1 A reconciliation of previous quarter pro-forma growth can be found in our historical earnings supplements found on our website at http://www.zayo.com/financial-earnings-release 2 Includes historical financial results and related adjustments for acquisitions completed prior to September 30, 2014

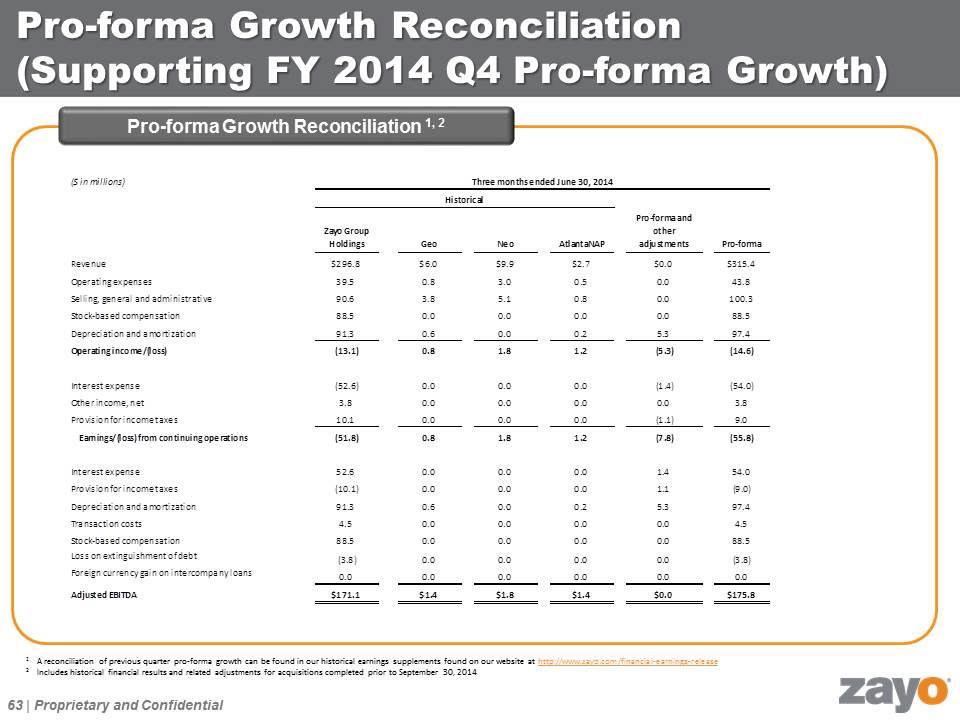

Pro-forma Growth Reconciliation (Supporting FY 2014 Q4 Pro-forma Growth) Pro-forma Growth Reconciliation 1, 2 1 A reconciliation of previous quarter pro-forma growth can be found in our historical earnings supplements found on our website at http://www.zayo.com/financial-earnings-release 2 Includes historical financial results and related adjustments for acquisitions completed prior to September 30, 2014

Price Per Unit Trends

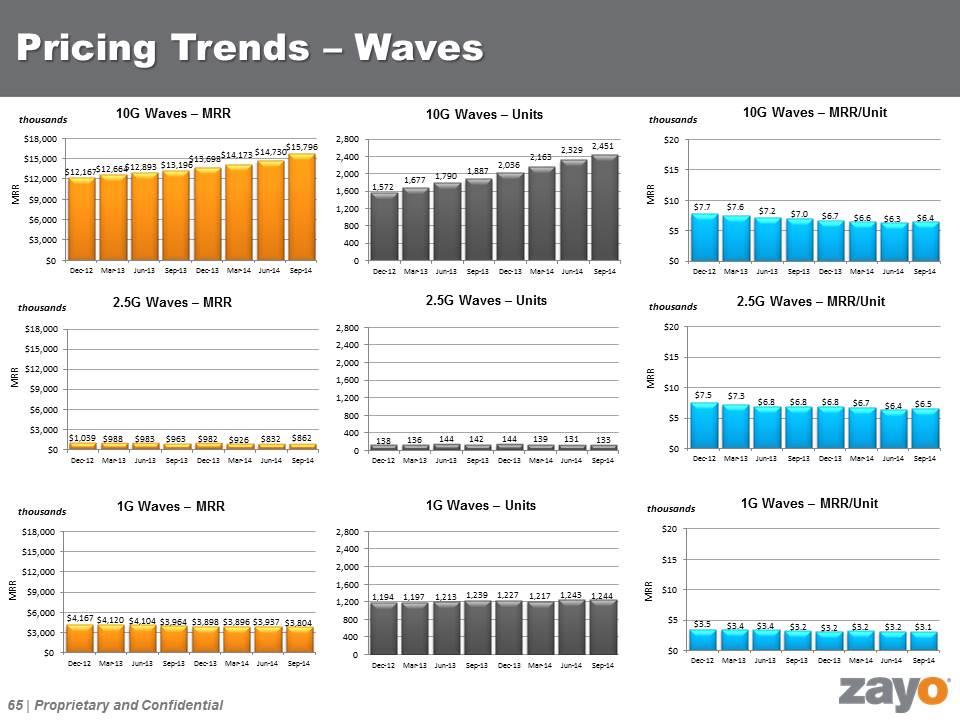

Pricing Trends – Waves thousands MRR MRR thousands thousands MRR MRR thousands thousands MRR MRR thousands

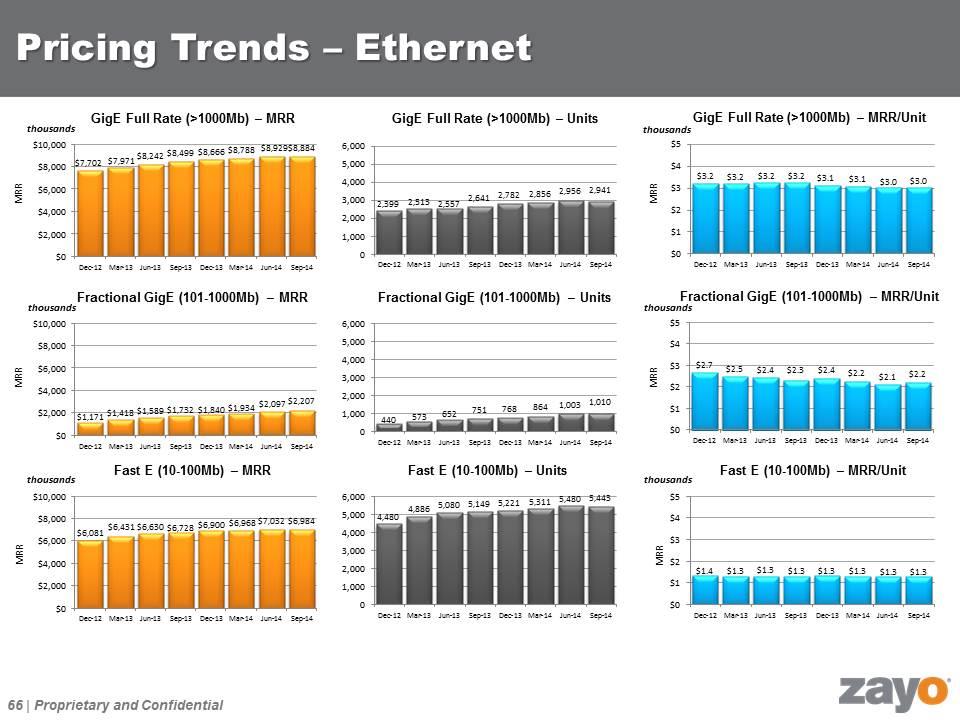

Pricing Trends – Ethernet thousands MRR MRR thousands thousands MRR MRR thousands thousands MRR MRR thousands GigE Full Rate (>1000Mb) – MRR/Unit Fractional GigE (101-1000Mb) – MRR/Unit

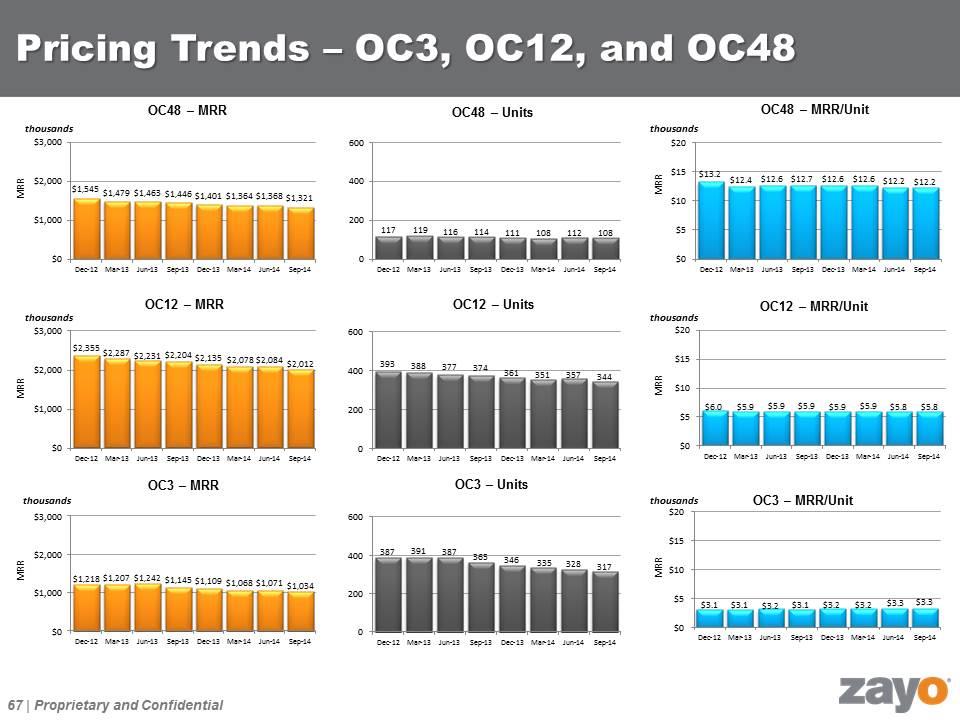

Pricing Trends – OC3, OC12, and OC48 thousands MRR MRR thousands thousands MRR MRR thousands thousands MRR MRR thousands

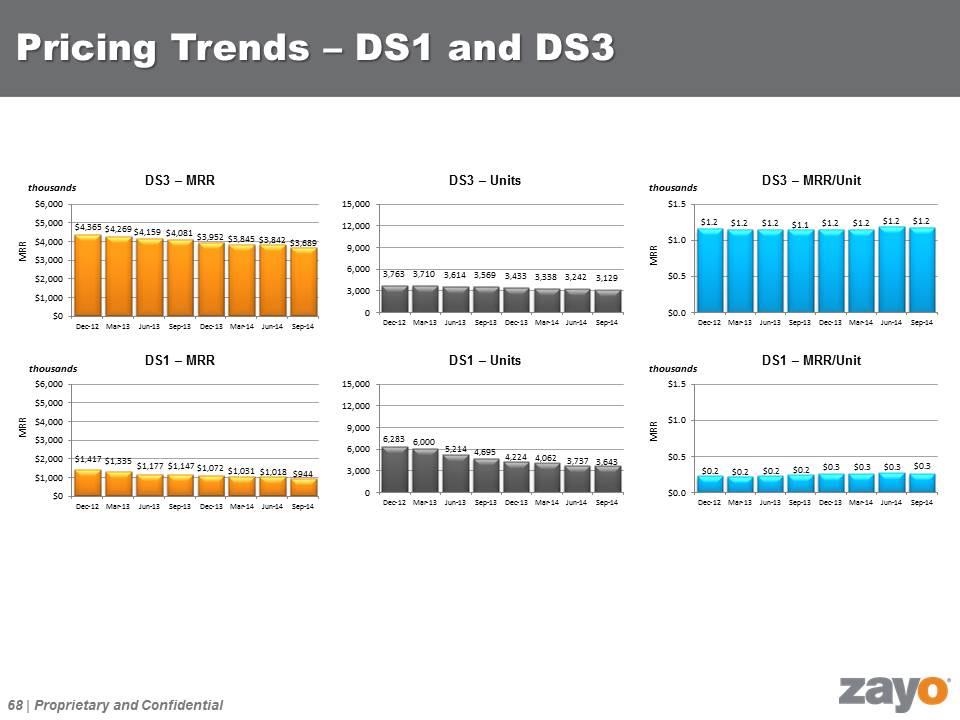

Pricing Trends – DS1 and DS3 thousands MRR MRR thousands thousands MRR MRR thousands