Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - InspireMD, Inc. | v392504_ex99-1.htm |

| EX-10.2 - EXHIBIT 10.2 - InspireMD, Inc. | v392504_ex10-2.htm |

| EX-10.1 - EXHIBIT 10.1 - InspireMD, Inc. | v392504_ex10-1.htm |

| 8-K - FORM 8-K - InspireMD, Inc. | v392504_8k.htm |

Exhibit 99.2

October 2014 NYSE MKT: NSPR

2 This presentation contains “forward - looking statements . ” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential” or similar words . Forward - looking statements are not guarantees of future performance, are based on certain assumptions and are subject to various known and unknown risks and uncertainties, many of which are beyond the control of InspireMD, Inc . (the “Company”), and cannot be predicted or quantified and consequently, actual results may differ materially from those expressed or implied by such forward - looking statements . Such risks and uncertainties include, without limitation, risks and uncertainties associated with (i) market acceptance of the Company’s existing and new products, (ii) negative clinical trial results or lengthy product delays in key markets, (iii) an inability to secure regulatory approvals for the sale of the Company’s products, (iv) intense competition in the medical device industry from much larger, multi - national companies, (v) product liability claims, (vi) product malfunctions, (vii) the Company’s limited manufacturing capabilities and reliance on subcontractors for assistance, ( viii) insufficient or inadequate reimbursement by governmental and other third party payors for the Company’s products, (ix) the Company’s efforts to successfully obtain and maintain intellectual property protection covering its products, which may not be successful, (x ) legislative or regulatory reform of the healthcare system in both the U . S . and foreign jurisdictions, ( xi) the Company’s reliance on single suppliers for certain product components, ( xii ) the fact that the Company will need to raise additional capital to meet its business requirements in the future and that such capital raising may be costly, dilutive or difficult to obtain, (xiii ) the fact that the Company conducts business in multiple foreign jurisdictions, exposing it to foreign currency exchange rate fluctuations, logistical and communications challenges, burdens and costs of compliance with foreign laws and political and economic instability in each jurisdiction and (xiv) the escalation of hostilities in Israel, which could impair the Company’s ability to manufacture its products . More detailed information about the Company and the risk factors that may affect the realization of forward - looking statements are set forth in the Company’s filings with the Securities and Exchange Commission, including the Company’s Transition Report on Form 10 - K/T and its quarterly reports on Form 10 - Q . Investors and security holders are urged to read these reports free of charge on the Securities and Exchange Commission’s web site at www . sec . gov . The Company assumes no obligation to publicly update or revise its forward - looking statements as a result of new information, future events or otherwise . Forward - Looking Statements

3 Leadership EXECUTIVE TEAM BOARD OF DIRECTORS Alan Milinazzo, President, CEO & Director • Medtronic • Boston Scientific Craig Shore, CFO • Pfizer • General Electric Dr. James Barry, COO • Boston Scientific • Howmedica Division of Pfizer Eli Bar, CTO • Nicast Gwen Bame, VP Corporate Development • Boston Scientific • Covidien David Blossom, VP Global Marketing & Strategy • Boston Scientific • Covidien Rick Olson, VP Sales • Boston Scientific • eV3/Covidien Dr. Sol Barer, Chairman • Former Chairman and CEO, Celgene Alan Milinazzo, President, CEO & Director • Medtronic • Boston Scientific Dr. James Barry • SVP Corporate Technology Development at Boston Scientific • Howmedica Division of Pfizer Michael Berman • Pres. Boston Scientific/Scimed • Founder, Velocimed and Lutonix James Loughlin • KPMG • Celgene Audit Chair Paul Stuka • Founder, Osiris • Fidelity Management and Research Dr. Campbell Rogers • CMO, Heartflow • CSO, Cordis/JNJ • Associate Professor, Harvard School of Medicine

5 Global Market Values • Current stents not specifically designed for AMI • Distal embolization occurs in up to 73 % of cases* • Majority of AMI market is outside of the U . S . (~ 60 % ) Source : Health Research International, 2011 * JAMA, March 2 , 2005 — Vol 293 , No . 9 1063 Gregg W . Stone • Current stents not specifically designed for embolic protection • Mesh covered stent category believed to be emerging as immediate opportunity Source : JMP Securities, 2014 Stable Angina $4.2 AMI $1.7 Global Coronary: $5.9B ROW $200 US $300 Global Carotid: $ 500M

5 Technology MGuard Embolic Protection System Combines stent and embolic protection in a single device • Reduces risk of embolization by capturing potentially harmful debris against the artery wall • MicroNet acts as safety net by offering greater surface area coverage to prevent large debris flow • Allows perfusion to vessel wall MicroNet Platform • Proprietary circular knitted mesh wraps around stent to protect patient from plaque debris flowing downstream upon deployment • Made of a single fiber from a biocompatible polymer, widely used in medical implantations • Flexible structure • Does not promote thrombosis

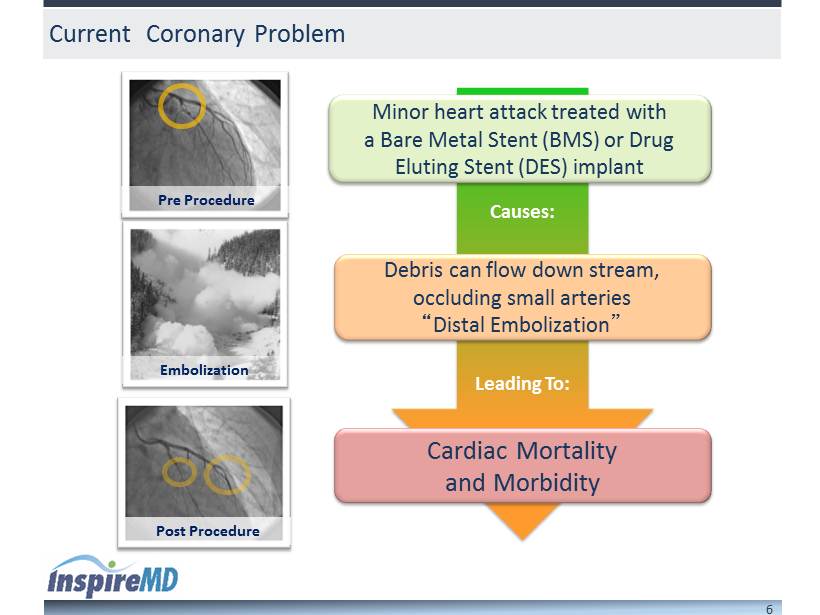

6 Current Coronary Problem Pre Procedure Embolization Post Procedure Minor heart attack treated with a Bare Metal Stent (BMS) or Drug Eluting Stent (DES) implant Debris can flow down stream, occluding small arteries “ Distal Embolization ” Cardiac Mortality and Morbidity Leading To: Causes:

7 Randomized – STEMI • MICAMI (n=40) • MASTER ( n=433) Single Arm – Vein Grafts & Native Vessels • FIM (n=41) • INSPIRE (n=30) Single Arm – STEMI (& ACS) • MAGICAL (n=60) • PISCIONE(n=105) • WEERACKODY (n=51) • PREIS (n=24) • ROMAGUERA (n=56) • ANTHOPOULOS (n=73) • iMOS Prime (n=97) MGuard Clinical Experience * Majority with MGuard – 12% MGuard Prime in MASTER EPS arm ** Not statistically significant • Achieved primary end point ▪ Superiority in ST Resolution – 57.8% vs. 44.7% (p - value = 0.008) • Reduction in mortality rate at 12 - months** ▪ Occurred in 2/217 (1.0%) patients with MGuard ▪ Occurred in 7/216 (3.3%) patients with BMS or DES • Reduced Infarct size (60 Patients Sub - Study) ▪ 17.1gm (MGuard) vs 22.3gm (BMS/DES) Over 1,200 Patients Studied MASTER I Trial Highlights ( 433 Patients Studied*)

8 MASTER I: All Cause Mortality at 12 Months Death (%) 0 1 2 3 4 5 Months 0 1 2 3 4 5 6 7 8 9 10 11 12 HR : 0.28 [95% CI: 0.06, 1.36] P= 0.09 1.0 % 3.3 % 0% vs 1.8% (P=0.06) at 30 Days MGuard BMS/DES

10 MASTER II Update ▪ Enrollment discontinued in this US FDA registration trial; evaluating 30 day results ▪ Protracted FDA review on manufacturing process change delayed time to complete ▪ Enrollment was dominated by higher than anticipated DES usage ▪ Analysis of key 30 day end point data from 310 patients treated is validating ▪ Preliminary data analysis of MASTER II pooled with MASTER I is encouraging ▪ MASTER II and MASTER I&II pooled data to be presented late Q1 2015 ▪ Focus will turn to developing and commercializing a MicroNet covered drug - eluting stent with two partners

10 MASTER - OCT - In collaboration with St. Jude Medical STATUS • Ethics Committee approvals to be complete Oct. 2014 • First patient to be enrolled in Nov. 2014 OBJECTIVE • Demonstrate increased Minimal Flow Area (MinFA) with the MGuard Prime compared to a non - mesh control stent (BMS/DES ) • Visualize thrombus protrusion PRIMARY ENDPOINT • Minimal Flow Area post stent procedure DESIGN • Multi - center (15 sites) • Poland, Germany and UK • Randomized POPULATION • 234 STEMI patients randomized 1:1 vs. BMS or DES PIs • Ori Ben Yehuda, M.D., CRF • Simon Eccleshall, M.D ., Norfolk & Norwich Hospital

11 Coronary Drug Eluting Stent Development Strategy Develop two s trategic p artnerships to attach MicroNet to clinically proven FDA and/or CE marked DES . Phase I – Complete Q1 - Q2 2014 - Technical Testing And Feasibility Phase II Q4 2014 - Animal Testing (1 st candidate scheduled ) Phase III Q3 2015 - Clinical Strategy* TIMELINE 2014 2015 2016 2017 R&D Pre - Clinical Regulatory Clin. Study* * Clinical trial will be dependent on CE Mark requirement

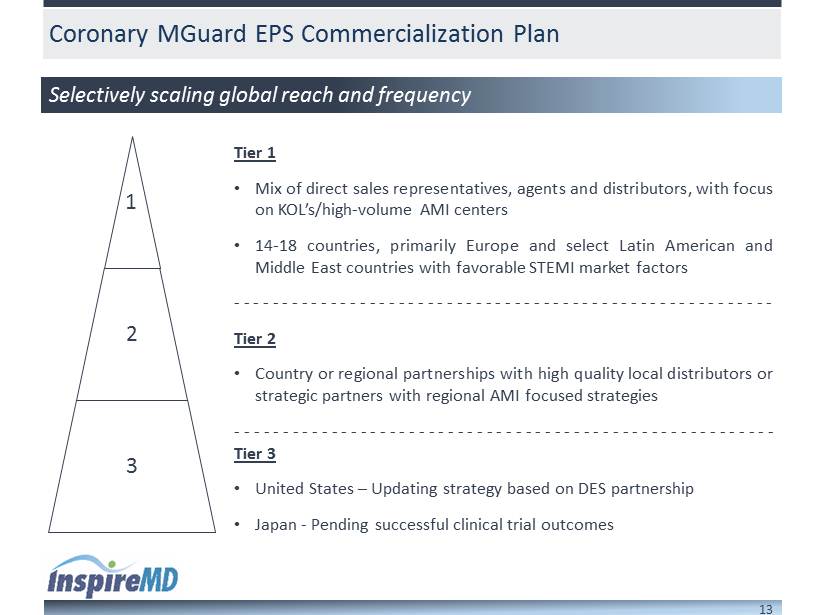

13 • 2013 revenue of $6.1 million, a 56% increase over prior year • 2014 implemented a hybrid sales strategy with direct reps in key European markets to support full re - launch of MGuard Prime in 2015 • Sales force of industry experienced professionals put into place (15 new hires in 2014) • Expanded direct coverage to Germany, Switzerland, France, Poland, Austria and UK • Momentum coming out of the VFA supported by eMASTER registry with 66 planned sites across Europe Coronary MGuard EPS Commercialization Plan The E mbolic P rotection S ystem A new stent category as the preferred solution for STEMI patients

Tier 1 • Mix of direct sales representatives, agents and distributors, with focus on KOL’s/high - volume AMI centers • 14 - 18 countries, primarily Europe and select Latin American and Middle East countries with favorable STEMI market factors - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - Tier 2 • Country or regional partnerships with high quality local distributors or strategic partners with regional AMI focused strategies - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - Tier 3 • United States – Updating strategy based on DES partnership • Japan - Pending successful clinical trial outcomes 13 Coronary MGuard EPS Commercialization Plan 1 2 3 Selectively scaling global reach and frequency

15 Carotid Stent Market • Current stents not specifically designed for embolic protection • Mesh covered stent category believed to be emerging as immediate opportunity • Commercialization activity beginning Q4 2014 ROW $200 US $300 Global Carotid Market : $ 500M Source: JMP Securities, 2014

15 Carotid Solution • Reduces risk of embolization by trapping potential plaque debris and emboli against the artery wall • MicroNet acts as safety net by offering greater plaque scaffolding to prevent prolapse related to late embolization • Allows perfusion to vessel wall, does not inhibit endothelialization • CE marked • Self - expanding nitinol stent • Global market valued at $ 500 M* • Strong CARENET data released September 2014 • First commercial orders received October 2014 CGuard Embolic Prevention System Combines stent and embolic protection in a single device * Health Research International, 2011

16 CGuard Carotid Clinical Experience * Patients not included in CARENET • Achieved primary end point • 100 % procedural success • Z ero MACE at 30 days • 50 % fewer new ischemic lesions compared to historical non - mesh carotid artery stenting data • Average lesion volume per patient 10 times smaller compared to historical non - mesh carotid artery stenting data • Manuscript is being submitted to JACC (Journal of American College of Cardiology) CARENET Design (CARotid Embolic protection using microNET) CARENET Highlights: Results Announced at TCT 2014 • Safety and efficacy clinical trial • Prospective, multi - center, multispecialty, non - randomized single arm study • 7 operators from Germany, Poland, and Belgium each performed test cases* • 4 operators enrolled 30 patients in CARENET • Diffusion weighted MRI follow ups at 48hrs and 30 days for “ gold - standard ” neurological analysis

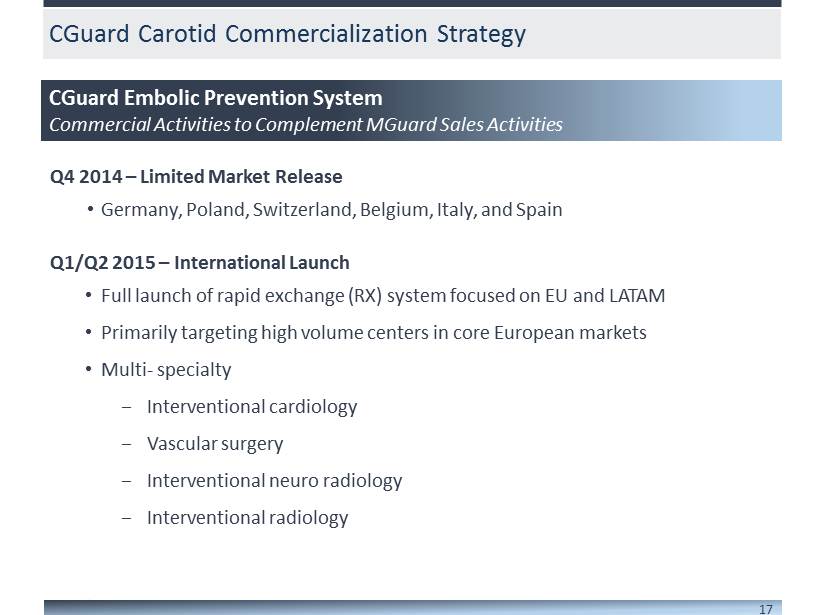

17 CGuard Carotid Commercialization Strategy CGuard Embolic Prevention System Commercial Activities to Complement MGuard Sales Activities Q4 2014 – Limited Market Release • Germany, Poland, Switzerland, Belgium, Italy, and Spain Q1/Q2 2015 – International Launch • Full launch of rapid exchange (RX) system focused on EU and LATAM • Primarily targeting high volume centers in core European markets • Multi - s pecialty ‒ Interventional cardiology ‒ Vascular surgery ‒ Interventional neuro radiology ‒ Interventional radiology

19 Therapeutic Area Stage of Development Market Size CORONARY • CE marked • MASTER I 12M data released • FDA trial halted (Q2 2014) • Second phase of DES strategy initiated $1.7B (AMI segment) CAROTID • CE marked • CARENET I data released • Limited market release 10/2014 • Global launch (ex - US) Q1 2015 • CARENET II FDA trial planning phase $500M (Stent segment) NEUROVASCULAR • Exploring market opportunities for: ‒ Flow diverter ‒ Intra - cranial stent $1.3B - $1.4B* PERIPHERAL • Exploring market opportunity $1.6B** (Stent segment) RENAL • Exploring market opportunity $177M** MicroNet Product Development Pipeline *Source: Cowen and Company, 2014 and Morgan Stanley, MUFG, 2014 ** Source: Global Data, Peripheral Vascular Devices, 2011

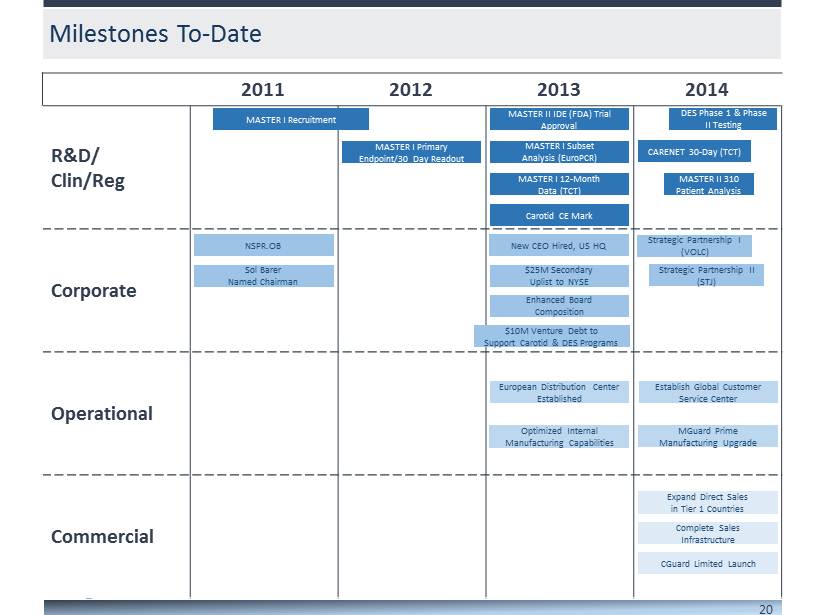

20 2011 2012 2013 2014 R&D/ Clin/Reg Corporate Operational Commercial Milestones To - Date MASTER I Recruitment MASTER I Primary Endpoint/30 Day Readout Carotid CE Mark MASTER II IDE (FDA) Trial Approval MASTER I Subset Analysis (EuroPCR) MASTER I 12 - Month Data (TCT) NSPR.OB Sol Barer Named Chairman New CEO Hired, US HQ $25M Secondary Uplist to NYSE $10M Venture Debt to Support Carotid & DES Programs European Distribution Center Established Enhanced Board Composition Optimized Internal Manufacturing Capabilities DES Phase 1 & Phase II Testing CARENET 30 - Day (TCT ) Strategic Partnership I (VOLC) Strategic Partnership II (STJ) Establish Global Customer Service Center MGuard Prime Manufacturing Upgrade Expand Direct Sales in Tier 1 Countries Complete Sales Infrastructure CGuard Limited Launch MASTER II 310 Patient Analysis

20 2015 2016 2017 R&D/Clin/Reg Corporate Operational Commercial Targeted Future Milestones Strategic Partnership III Strategic Partnership V Outsourced Manufacturing Facility Strategic Partnership IV Complete MGuard Prime EPS Re - Launch DES CE Mark Achieve Targeted COGS OCT Study Enrollment OCT Study Primary Endpoint CARENET I 12M FU CGuard RX Launch Carotid Market Expansion MASTER II Interim Analysis eMASTER Enrollment

21 Investment Summary • Large interventional markets with favorable dynamics for new technology adoption • Proprietary platform technology addressing the multi - billion dollar global stent market with advanced integrated design – 2014 added carotid platform and enhanced coronary product platform – Early positive clinical results with carotid platform – DES partnership headlines product portfolio expansion • Pivotal 12 - month clinical data released Oct 29 , 2013 for the MASTER I trial – Achieved primary endpoint of favorable complete ST - segment resolution – Showed sustained mortality benefit at 30 days, 6 months and 12 months – MASTER OCT and eMASTER to substantiate clinical benefits of MGuard – CARENET FIM reported 0 % MACE at 30 days with CGuard • Commercialization : – Full re - launch of MGuard Prime in Q 1 2015 – Entering carotid market with strong FIM data, Full Market Release Q 2 2015