Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Biopower Operations Corp | form8k.htm |

| EX-4.1 - EXHIBIT 4.1 - Biopower Operations Corp | ex4-1.htm |

| EX-10.1 - EXHIBIT 10.1 - Biopower Operations Corp | ex10-1.htm |

| EX-10.2 - EXHIBIT 10.2 - Biopower Operations Corp | ex10-2.htm |

SHARE EXCHANGE AGREEMENT

THIS SHARE EXCHANGE AGREEMENT (this “Agreement”) is entered into as of the date last written below, yet effective for all purposes as of October 24, 2014, by and between BIOPOWER OPERATIONS CORPORATION, a Nevada corporation (the “Company”), with offices at 1000 Corporate Dr., Ste. 200, Ft. Lauderdale, FL 33334, on the one hand, and, on the other, each of the shareholders set forth on Exhibit A (each a “G3P Shareholder”, and collectively, the “G3P Shareholders”) of GREEN³POWER HOLDINGS COMPANY, a Delaware corporation (“G3P Holdings”) having its office at 1000 Corporate Dr., Ste. 200, Ft. Lauderdale, FL 33334. The Company, and each of the G3P Shareholders may also be referred to herein as a “Party”, and, collectively, as the “Parties”.

WITNESSETH

WHEREAS, The Company is a publicly held corporation organized under the laws of the State of Nevada;

WHEREAS, G3P Holdings is a privately-held company owned by the G3P Shareholders in the proportions hereinafter set forth;

WHEREAS, The Company has agreed with the G3P Shareholders to obtain 100% of their interests in G3P Holdings (which represent 100% of its issued and outstanding capital stock) from them, as well as 100% of any other capital stock held by them or any of them in any other entities (except NTJB Power Technology, LLC (See, Section 1.03 hereof)) whose operations or business models are substantially similar with those of the G3P Entities, in exchange for (i) an aggregate number of shares of the Company’s common stock equaling TWENTY (20%) PERCENT of the number of shares of the Company’s common stock outstanding immediately prior to such exchange, plus (ii) that number of the Company’s $1 par value preferred stock, to be designated as Series B Preferred Stock, which shall be convertible into an aggregate number of shares of the Company’s common stock equaling FIFTY (50%) PERCENT of the number of shares of the Company’s common stock outstanding immediately prior to such exchange. On the Closing Date, the G3P Shareholders will incident to such exchange transaction become shareholders of the Company and G3P Holdings shall thereupon become a subsidiary of the Company, and the subsidiaries of G3P Holdings (discussed infra.) shall remain subsidiares of G3P Holdings (along with G3P Holdings, collectively, the “G3P Entities”);

WHEREAS, for federal income tax purposes, it is intended that the Exchange qualify as a reorganization under the provisions of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”); and

NOW THEREFORE, in consideration of the Parties’ agreements, covenants, representations and warranties set forth herein, and other good and valuable consideration the receipt and sufficiency or which are hereby acknowledged, it is hereby agreed as follows:

ARTICLE

I

REPRESENTATIONS, COVENANTS, AND WARRANTIES OF THE G3P SHAREHOLDERS

As an inducement to, and to obtain the reliance of the Company, except as set forth in the G3P Entity Schedules (as hereinafter defined), the G3P Shareholders represent and warrant to the Company that as of the date hereof and the Closing Date (as hereinafter defined), as follows:

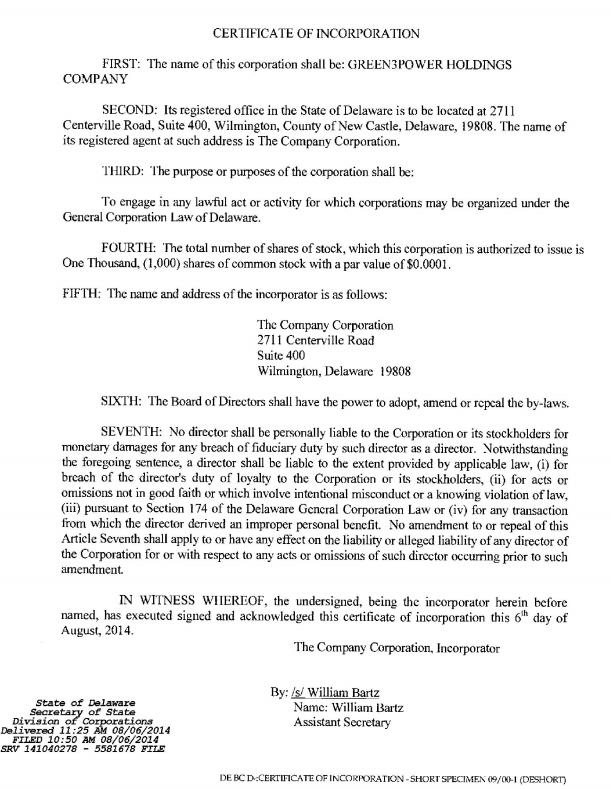

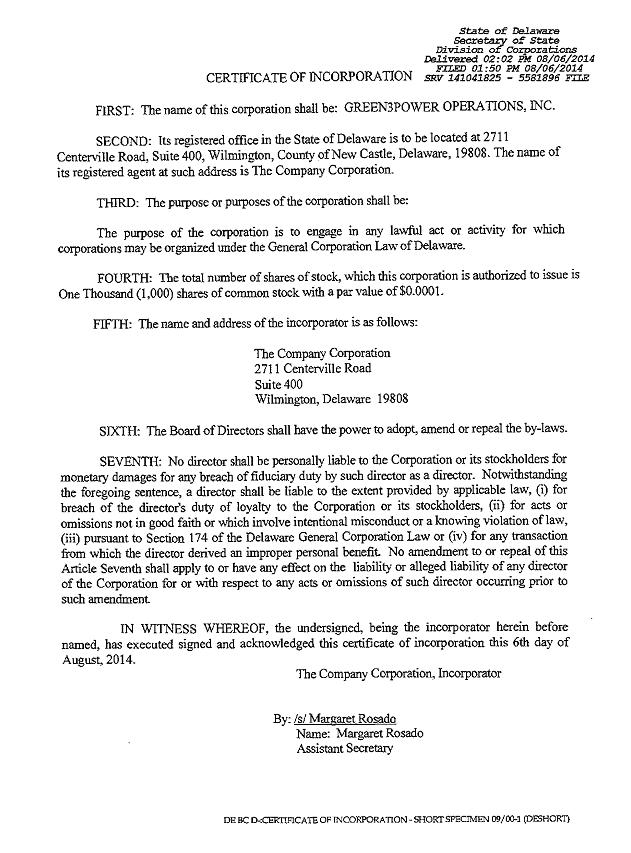

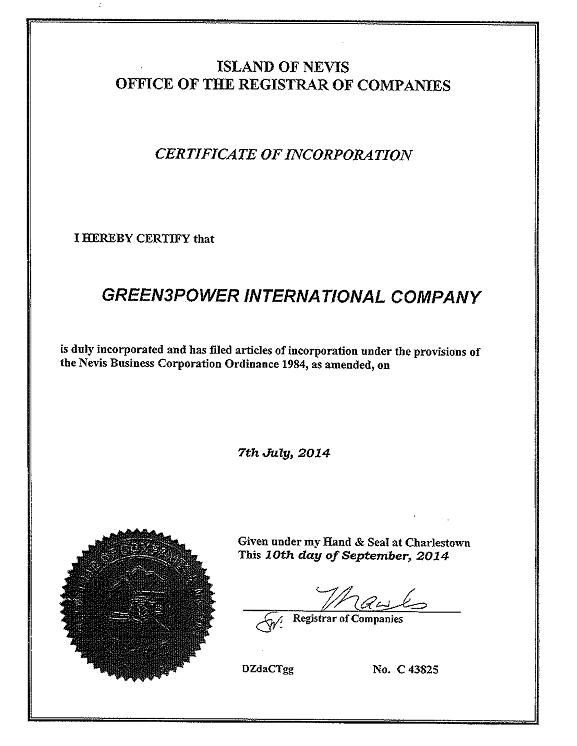

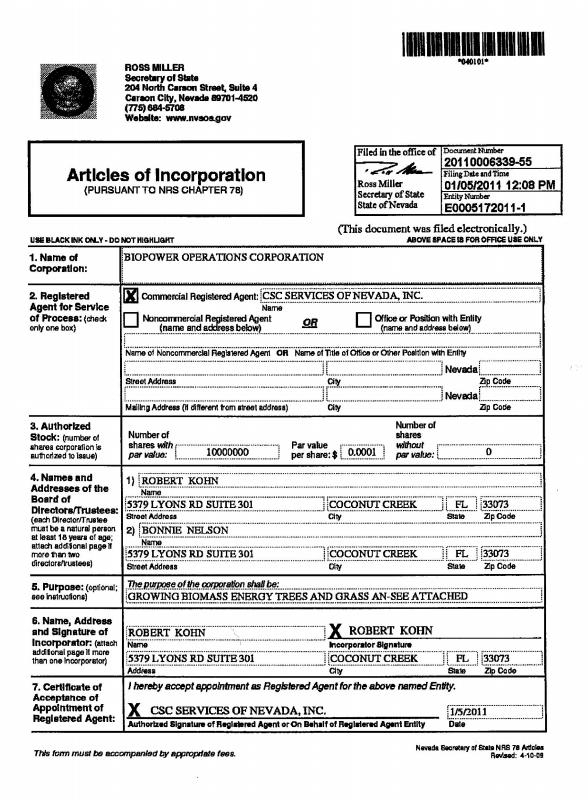

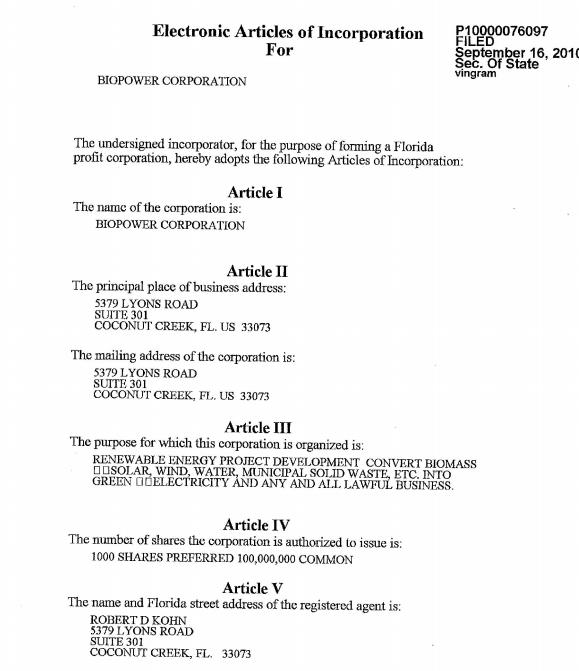

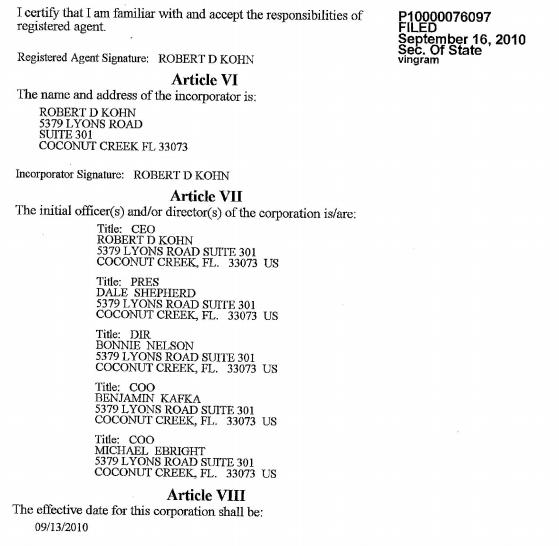

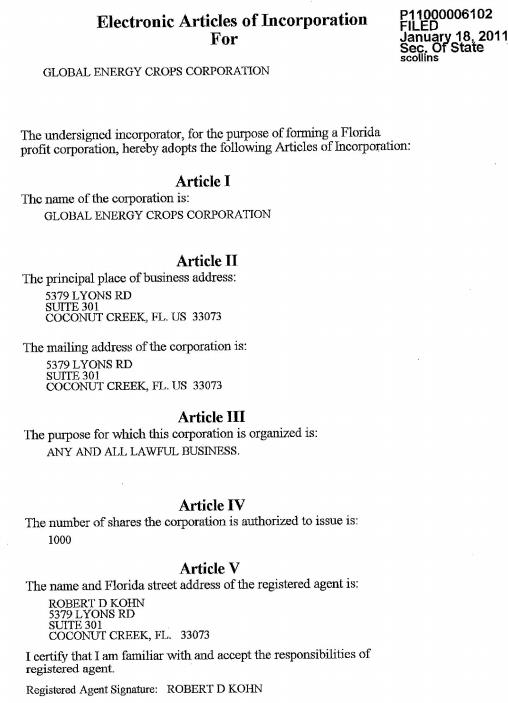

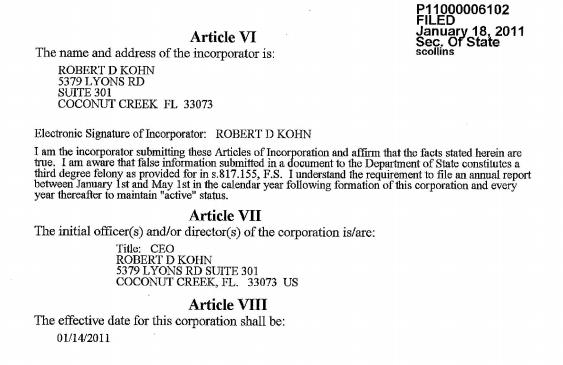

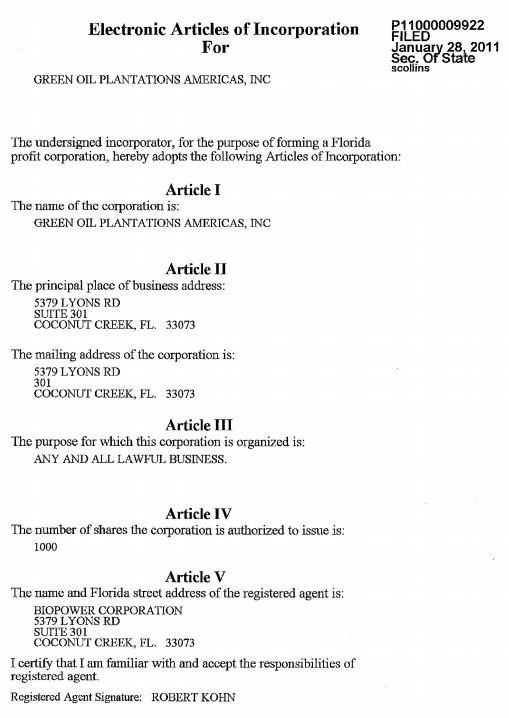

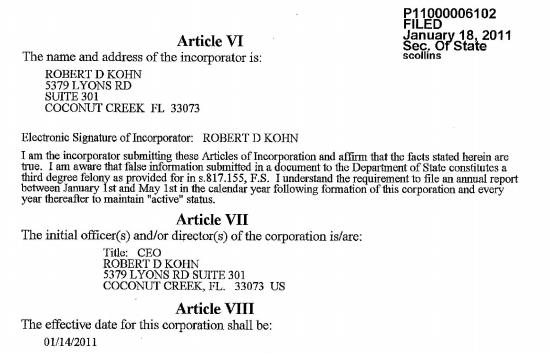

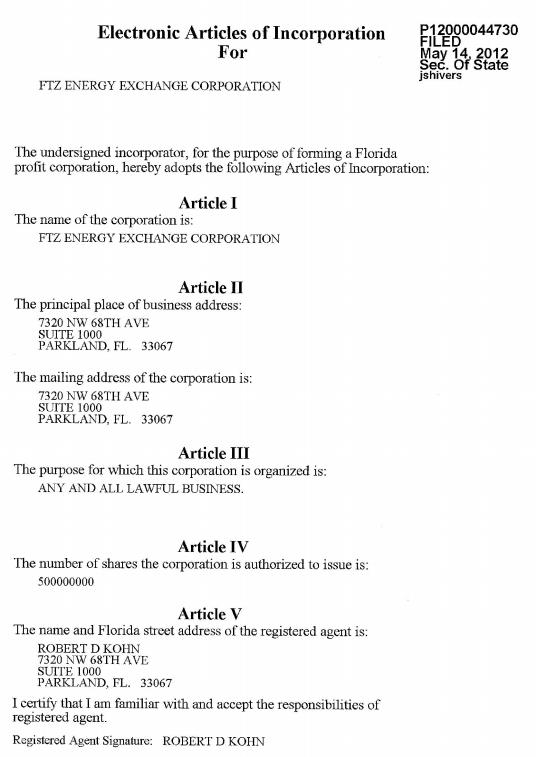

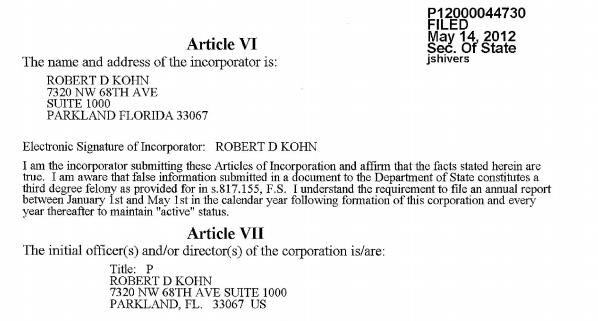

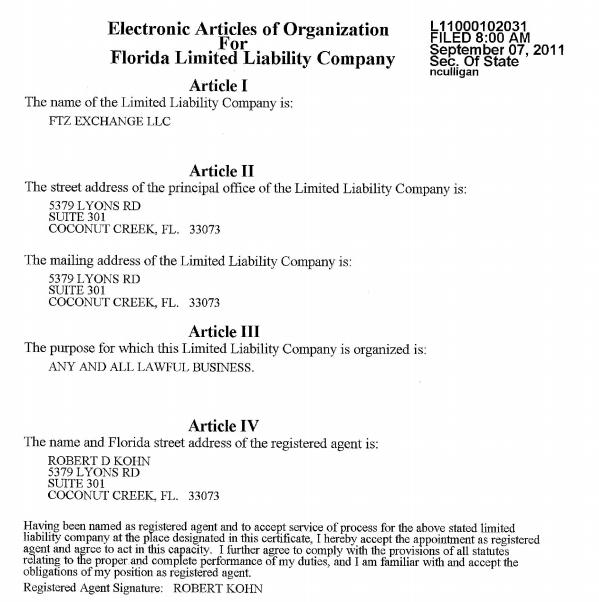

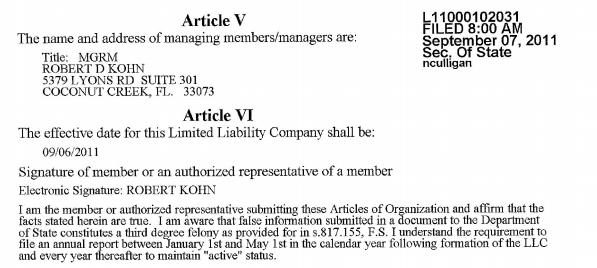

Section 1.01 Incorporation. The G3P Entities are companies duly organized, validly existing, and in good standing under the laws of the origins of their charters and have the corporate power and are duly authorized under all applicable laws, regulations, ordinances, and orders of public authorities to carry on their respective businesses in all material respects as they are now being conducted. Included in the G3P Entity Schedules are complete and correct copies of official documentation proving their proper organization under the jurisdictions of their charters as in effect as of the date hereof. The execution and delivery of this Agreement does not, and the consummation of the transactions contemplated hereby will not, violate any provision of any of the said G3P Entities’ charter documents.

| - 1 - |

Section 1.02 Authorized Shares and Capital. Information regarding the authorized numbers of capital shares of the G3P Entities as well as the numbers of each thereof issued, outstanding and held of record by the G3P Shareholders (collectively, the “G3P Entity Shares”) is also set forth in detail upon Exhibit “A”. All of the G3P Entity Shares are validly issued, fully paid, and non-assessable and are issued in a manner not in violation of preemptive or other rights therein of any other person.

Section 1.03 Subsidiaries, Predecessors, Joint Ventures and Strategic Alliances.

(a) G3P Holdings owns of record 100% of the capital stock interests in two subsidiaries, which subsidiaries of G3P Holdings, along with their said parent, have previously herein been defined collectively as the “G3P Entities.” Additionally, certain of the G3P Shareholders are also the members of a newly formed Delaware limited liability company (the “NTJB Power Techco Principals”) identified as “NTJB POWER TECHNOLOGY, LLC” (“NTJB Power Techco”). Acknowledging that NTJB Power Techco and each of the G3P Entities and the Company intend to enter into the licensing relationship referenced at Section 3.05 hereof, which is presently contemplated to end in the Company’s purchase of NTJB Power Techco or its intellectual property assets in connection with the specified licensing relationship, the Parties hereby agree that the share exchange transaction contemplated under this Agreement excludes the Company’s exchange of its common stock for the G3P Shareholders’ membership interest in, or the assets of, NTJB Power Techco and any interest of the G3P Shareholders in entities whose operations or business models are not substantially similar to those of the G3P Entities.

(b) Except as is disclosed above and upon Schedule 1.03 hereof, G3P Holdings does not have any other subsidiaries, and neither the G3P Shareholders nor any of the G3P Entities has any interest in any other entities, joint ventures, strategic alliances, special purpose vehicles, or are they beneficially or of record, holders of any other equity interests in any other entity whose operations or business models are substantially similar to those of the G3P Entities. For the avoidance of doubt, the Parties hereby reaffirmed their agreement that, with the exception of any entities or interests, directly or indirectly, held of record by the G3P Shareholders and disclosed in this Agreement as being excepted from the exchange transaction herein, it is their intention that all subsidiaries, all joint ventures and all special purpose entities with which any of the G3P Entities or the G3P Shareholders are affiliated in any manner in connection with the conduct of the business models of the G3P Entities, are intended to be within the scope of consideration to be exchanged by the G3P Shareholders with the Company in accordance with the Parties’ bargain contemplated under this Agreement and that the G3P Shareholders cannot perform the same services for any other company that they perform for our company.

Section 1.04 Financial Statements.

(a) Prior to Closing, the G3P Shareholders shall cause to be provided to the Company respective to each of the G3P Entities (i) the balance sheets of each G3P Entity and any of their subsidiaries, joint venture or any special purpose vehicle entity in which any may hold an interest, as of August 31, 2014 and the related statements of operations, stockholders’ equity and cash flows as to each said entity for the period ended August 31, 2014 (the “G3P Entity Financial Statements”).

(b) All such G3P Entity Financial Statements shall be prepared in accordance with generally accepted accounting principles consistently applied throughout the periods involved. The G3P Entity balance sheets shall be true and accurate and present fairly as of their respective dates the financial condition of the G3P Entities. As of the date of such balance sheets, except as and to the extent reflected or reserved against therein, no G3P Entity shall have any liabilities or obligations (absolute or contingent) which should be reflected in the balance sheets or the notes thereto prepared in accordance with generally accepted accounting principles, and all assets reflected therein will be properly reported and present fairly the value of the assets of each G3P Entity, in accordance with generally accepted accounting principles. The statements of operations, stockholders’ equity and cash flows will reflect fairly the information required to be set forth therein by generally accepted accounting principles.

| - 2 - |

(c) Each G3P Entity has duly and punctually paid all Governmental fees and taxation which it has become liable to pay and has duly allowed for all taxation reasonably foreseeable and is under no liability to pay any penalty or interest in connection with any claim for governmental fees or taxation and each G3P Entity has made any and all proper declarations and returns for taxation purposes and all information contained in such declarations and returns is true and complete and full provision or reserves have been made in its financial statements for all Governmental fees and taxation.

(d) The books and records, financial and otherwise, of each G3P Entity are in all material aspects complete and correct and have been maintained in accordance with good business and accounting practices.

(e) All of each G3P Entity’s assets are reflected on its financial statements, and, except as set forth in the G3P Entity Schedules or the financial statements of each G3P Entity, or the notes thereto, no G3P Entity has any material liabilities, direct or indirect, matured or unmatured, contingent or otherwise.

Section 1.05 Information. The information concerning the G3P Entities set forth in this Agreement and in the G3P Entity Schedules is complete and accurate in all material respects and does not contain any untrue statement of a material fact or omit to state a material fact required to make the statements made, in light of the circumstances under which they were made, not misleading. In addition, each G3P Entity has fully disclosed in writing to the Company (through this Agreement or the G3P Entity Schedules) all information relating to matters involving each of the G3P Entities or their respective assets or their respective present or past operations or activities which (i) indicated or may indicate, in the aggregate, the existence of a greater than $25,000 liability as to each, (ii) have led or may lead to a competitive disadvantage on the part of any of the G3P Entities or (iii) either alone or in aggregation with other information covered by this Section, otherwise have led or may lead to a material adverse effect on any of the G3P Entities, their respective assets, or their respective operations or activities as presently conducted or as contemplated to be conducted after the Closing Date, including, but not limited to, information relating to governmental, employee, environmental, litigation and securities matters and transactions with affiliates.

Section 1.06 Options or Warrants. here are no existing options, warrants, calls, or commitments of any character relating to the authorized and unissued stock of any of the G3P Entities.

Section 1.07 Absence of Certain Changes or Events. Since August 31, 2014 or such other date as provided for herein:

(a) there has not been any material adverse change in the business, operations, properties, assets, or condition (financial or otherwise) of any of the G3P Entities;

(b) None of the G3P Entities has (i) amended its Articles of Incorporation since August 4, 2014; (ii) declared or made, or agreed to declare or make, any payment of dividends or distributions of any assets of any kind whatsoever to stockholders or purchased or redeemed, or agreed to purchase or redeem, any of its shares; (iii) made any material change in its method of management, operation or accounting, (iv) entered into any other material transaction other than sales in the ordinary course of its business; or (v) made any increase in or adoption of any profit sharing, bonus, deferred compensation, insurance, pension, retirement, or other employee benefit plan, payment, or arrangement made to, for, or with its officers, directors, or employees; and

(c) None of the G3P Entities have (i) granted or agreed to grant any options, warrants or other rights for its stocks, bonds or other corporate securities calling for the issuance thereof, (ii) borrowed or agreed to borrow any funds or incurred, or become subject to, any material obligation or liability (absolute or contingent) except as disclosed herein and except liabilities incurred in the ordinary course of business; (iii) sold or transferred, or agreed to sell or transfer, any of its assets, properties, or rights or canceled, or agreed to cancel, any debts or claims; or (iv) issued, delivered, or agreed to issue or deliver any stock, bonds or other corporate securities including debentures (whether authorized and unissued or held as treasury stock) except in connection with this Agreement.

| - 3 - |

Section 1.08 Litigation and Proceedings. Except as disclosed on Schedule 1.08, there are no actions, suits, proceedings, or investigations pending or, to the knowledge of any of G3P Shareholders after reasonable investigation, threatened by or against any of the G3P Entities or affecting any of the G3P Entities or their applicable properties, at law or in equity, before any court or other governmental agency or instrumentality, domestic or foreign, or before any arbitrator of any kind. The G3P Shareholders do not have any knowledge of any material default on the part of any of the G3P Entities with respect to any judgment, order, injunction, decree, award, rule, or regulation of any court, arbitrator, or governmental agency or instrumentality or of any circumstances which, after reasonable investigation, would result in the discovery of such a default.

Section 1.09 Contracts.

(a) All “material” contracts, agreements, franchises, license agreements, debt instruments or other commitments to which any of the G3P Entities is a party or by which it or any of its assets, products, technology, or properties are bound other than those incurred in the ordinary course of business have been previously disclosed to the Company or the G3P Shareholders. A “material” contract, agreement, franchise, license agreement, debt instrument or commitment is one which (i) will remain in effect for more than six (6) months after the date of this Agreement or (ii) involves aggregate obligations of at least TWENTY-FIVE thousand dollars ($25,000);

(b) All contracts, agreements, franchises, license agreements, and other commitments to which G3P is a party or by which its properties are bound and which are material to the operations of any of the G3P Entities taken as a whole are valid and enforceable by the applicable of such G3P Entities in all respects, except as limited by bankruptcy and insolvency laws and by other laws affecting the rights of creditors generally; and

(c) Except as previously disclosed to the Company by the G3P Shareholders or reflected in the most recent of the G3P Entity balance sheets, none of the G3P Entities is a party to any oral or written (i) contract for the employment of any officer or employee; (ii) profit sharing, bonus, deferred compensation, stock option, severance pay, pension benefit or retirement plan, (iii) agreement, contract, or indenture relating to the borrowing of money, (iv) guaranty of any obligation; (vi) collective bargaining agreement; or (vii) agreement with any present or former officer or director of any of the G3P Entities.

Section 1.10 Compliance With Laws and Regulations. To the best of their collective knowledge, the G3P Shareholders believe each of the G3P Entities has complied with all applicable statutes and regulations of any federal, state, or other governmental entity or agency thereof, except to the extent that noncompliance would not materially and adversely affect the business, operations, properties, assets, or condition of the applicable one or more said G3P Entities or except to the extent that noncompliance would not result in the occurrence of any material liability for any one or more of the applicable G3P Entities.

Section 1.11 Approval of Agreement. This Agreement has been duly and validly authorized and executed and delivered on behalf of each of the G3P Entities by the G3P Shareholders and this Agreement constitutes a valid and binding agreement of each G3P Entity and the G3P Shareholders enforceable in accordance with its terms.

Section 1.12 G3P Entity Schedules. The G3P Shareholders have caused the G3P Entities to deliver to the Company the following schedules, which are collectively referred to as the “G3P Entity Schedules” and which consist of separate schedules dated as of the date of execution of this Agreement, all certified by the chief executive officer of each of the G3P Entities as complete, true, and correct as of the date of this Agreement in all material respects:

(a) a schedule containing complete and correct copies of the charter documentation of the creation of the G3P Entities and the bylaws, each as in effect as of the date of this Agreement;

(b) a schedule containing the financial statements of each of the G3P Entities identified in paragraph 1.04(a);

(c) a schedule setting forth any information, together with any required copies of documents, required to be disclosed in the Company Schedules by Sections 1.01 through 1.11.

| - 4 - |

The G3P Shareholders shall cause the G3P Entity Schedules and the instruments and data delivered to the Company hereunder to be promptly updated after the date hereof up to and including the Closing Date.

Section 1.13 Valid Obligation. This Agreement and all agreements and other documents executed by the G3P Shareholders in connection herewith constitute their valid and binding obligations, as well as those of the G3P Entities, enforceable against each of them in accordance with its or their terms, except as may be limited by bankruptcy, insolvency, moratorium or other similar laws affecting the enforcement of creditors’ rights generally and subject to the qualification that the availability of equitable remedies is subject to the discretion of the court before which any proceeding therefore may be brought.

Section 1.14 Investment Representations.

(a) Investment Purpose. As of the date hereof, the G3P Shareholders understand and agree that the consummation of this Agreement including the delivery of the Exchange Consideration (as hereinafter defined) to the G3P Shareholders in exchange for the G3P Shares as contemplated hereby constitutes the offer and sale of securities under the Securities Act of 1933, as amended (the “Securities Act “) and applicable state statutes and that the G3P Shares are being acquired for the G3P Shareholders’ own account and not with a present view towards the public sale or distribution thereof, except pursuant to sales registered or exempted from registration under the Securities Act.

(b) Accredited Investor Status. Each of the G3P Shareholders is an “accredited investor” as that term is defined in Rule 501(a) of Regulation D (an “Accredited Investor”).

(c) Reliance on Exemptions. Each of the G3P Shareholders understands that the Exchange Consideration is being offered and sold to the G3P Shareholders in reliance upon specific exemptions from the registration requirements of United States federal and state securities laws and that the Company is relying upon the truth and accuracy of, and the G3P Shareholders’ compliance with, the representations, warranties, agreements, acknowledgments and understandings of the G3P Shareholders set forth herein in order to determine the availability of such exemptions and the eligibility of the G3P Shareholders to acquire the Exchange Consideration.

(d) Information. The G3P Shareholders and their respective advisors, if any, have been furnished with all materials relating to the business, finances and operations of the Company and materials relating to the offer and sale of the Exchange Consideration which have been requested by the G3P Shareholders or their advisors. The G3P Shareholders and their advisors, if any, have been afforded the opportunity to ask questions of the Company. Notwithstanding the foregoing, the Company has not disclosed to the G3P Shareholders any material nonpublic information and will not disclose such information unless such information is disclosed to the public prior to or promptly following such disclosure to the G3P Shareholders. The G3P Shareholders understand that each of their respective investments in the Exchange Consideration involves a significant degree of risk. The G3P Shareholders are not aware of any facts that may constitute a breach of any of the Company’s representations and warranties made herein.

(e) Governmental Review. Each of the G3P Shareholders understands that no United States federal or state agency or any other government or governmental agency has passed upon or made any recommendation or endorsement of the Exchange Consideration.

| - 5 - |

(f) Transfer or Re-sale. Each of the G3P Shareholders understands that (i) the sale or re-sale of the Exchange Consideration has not been and is not being registered under the Securities Act or any applicable state securities laws, and the Exchange Consideration may not be transferred unless (a) the Exchange Consideration is sold pursuant to an effective registration statement under the Securities Act, (b) the Company will provide G3P Shareholders an opinion of counsel or an opinion from the Company if acceptable by the Transfer Agent, to the effect that the Exchange Shares to be sold or transferred may be sold or transferred pursuant to an exemption from such registration, which opinion shall be accepted by the Company, (c) the Exchange Consideration is sold or transferred to an “affiliate” (as defined in Rule 144 promulgated under the Securities Act (or a successor rule) (“Rule 144”)) of the G3P Shareholders who agree to sell or otherwise transfer the Exchange Consideration only in accordance with this Section and who is an Accredited Investor, (d) the Exchange Consideration is sold pursuant to Rule 144, or (e) the Exchange Consideration is sold pursuant to Regulation S under the Securities Act (or a successor rule) (“Regulation S”), and the G3P Shareholders shall have received from the Company, at the cost of the G3P Shareholders, an opinion of counsel that shall be in form, substance and scope customary for opinions of counsel in corporate transactions, which opinion shall be accepted by the Company; (ii) any sale of such Exchange Consideration made in reliance on Rule 144 may be made only in accordance with the terms of said Rule and further, if said Rule is not applicable, any re-sale of such Exchange Consideration under circumstances in which the seller (or the person through whom the sale is made) may be deemed to be an underwriter (as that term is defined in the Securities Act) may require compliance with some other exemption under the Securities Act or the rules and regulations of the SEC thereunder; and (iii) neither the Company nor any other person is under any obligation to register such Exchange Consideration under the Securities Act or any state securities laws or to comply with the terms and conditions of any exemption thereunder (in each case). Notwithstanding the foregoing or anything else contained herein to the contrary, the Exchange Consideration may be pledged as collateral in connection with a bona fide margin account or other lending arrangement.

(g) Legends. Each of the G3P Shareholders understand that the Exchange Shares (defined hereinafter) are unregistered, and, are therefore, restricted securities, and until such time as the Exchange Shares have been registered under the Securities Act or may be sold pursuant to Rule 144 or Regulation S without any restriction as to the number of securities as of a particular date that can then be immediately sold, the Exchange Shares may bear a restrictive legend in substantially the following form (and a stop-transfer order may be placed against transfer of the certificates for such Exchange Shares):

THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE BEEN ACQUIRED FOR INVESTMENT AND HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR ANY APPLICABLE STATE SECURITIES LAWS, EITHER PURSUANT TO APPLICABLE EXEMPTIONS OR BECAUSE THE SECURITIES ARE NOT SECURITIES. WITHOUT SUCH REGISTRATION, THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED, PLEDGED, HYPOTHECATED, ASSIGNED OR OTHERWISE TRANSFERRED IN THE UNITED STATES AT ANY TIME WHATSOEVER EXCEPT UPON DELIVERY TO THE COMPANY OF AN OPINION OF COUNSEL SATISFACTORY TO THE COMPANY OF AN OPINION THAT REGISTRATION IS NOT REQUIRED FOR SUCH TRANSFER OR THE SUBMISSION TO THE COMPANY OF SUCH OTHER EVIDENCE AS MAY BE SATISFACTORY TO THE COMPANY TO THE EFFECT THAT SUCH TRANSFER WILL NOT BE IN VIOLATION OF THE ACT OR OTHER APPLICABLE STATE OR FEDERAL SECURITIES LAWS OR ANY RULE OR REGULATION PROMULGATED THEREUNDER, INCLUDING RULE 144 OR RULE 144A UNDER SAID ACT. ADDITIONALLY, ANY SALE OR OTHER TRANSFER OF THESE SECURITIES IS SUBJECT TO CERTAIN RESTRICTIONS THAT ARE SET FORTH IN A SHAREHOLDERS AGREEMENT TO WHICH THE HOLDERS OF THESE SECURITIES ARE PARTIES.

The legend set forth above shall be removed and the Company shall issue a certificate without such legend to the holder of any Exchange Share upon which it is stamped, if, unless otherwise required by applicable state securities laws, (a) the Exchange Shares are registered for sale under an effective registration statement filed under the Securities Act or otherwise may be sold pursuant to Rule 144 or Regulation S without any restriction as to the number of securities as of a particular date that can then be immediately sold, or (b) such holder provides the Company with an opinion of counsel, in form, substance and scope customary for opinions of counsel in comparable transactions, to the effect that a public sale or transfer of such Exchange Shares may be made without registration under the Securities Act, which opinion shall be accepted by the Company so that the sale or transfer is affected. Each of the G3P Shareholders agrees to sell all Exchange Shares, including those represented by a certificate(s) from which the legend has been removed, in compliance with applicable prospectus delivery requirements, if any.

(h) Residency. Each of the G3P Shareholders is a resident of the jurisdiction set forth immediately below the G3P Shareholders’ name on the signature pages hereto or provided separately to the Company.

| - 6 - |

ARTICLE

II

REPRESENTATIONS, COVENANTS, AND WARRANTIES OF THE COMPANY

As an inducement to, and to obtain the reliance of G3P and the G3P Shareholders, except as set forth in the Company Schedules (as hereinafter defined) and in the Company’s filings with the Securities and Exchange Commission (“SEC”), the Company represents and warrants, as of the date hereof and as of the Closing Date, as follows:

Section 2.01 Organization. The Company is a corporation duly organized, validly existing, and in good standing under the laws of the State of Nevada and has the corporate power and is duly authorized under all applicable laws, regulations, ordinances, and orders of public authorities to carry on its business in all material respects as it is now being conducted. Included in the Company Schedules are complete and correct copies of the certificate of incorporation and bylaws of the Company as in effect on the date hereof. The execution and delivery of this Agreement does not, and the consummation of the transactions contemplated hereby will not, violate any provision of the Company’s certificate of incorporation or bylaws. The Company has taken all action required by law, its certificate of incorporation, its bylaws, or otherwise to authorize the execution and delivery of this Agreement, and the Company has full power, authority, and legal right and has taken all action required by law, its certificate of incorporation, bylaws, or otherwise to consummate the transactions herein contemplated.

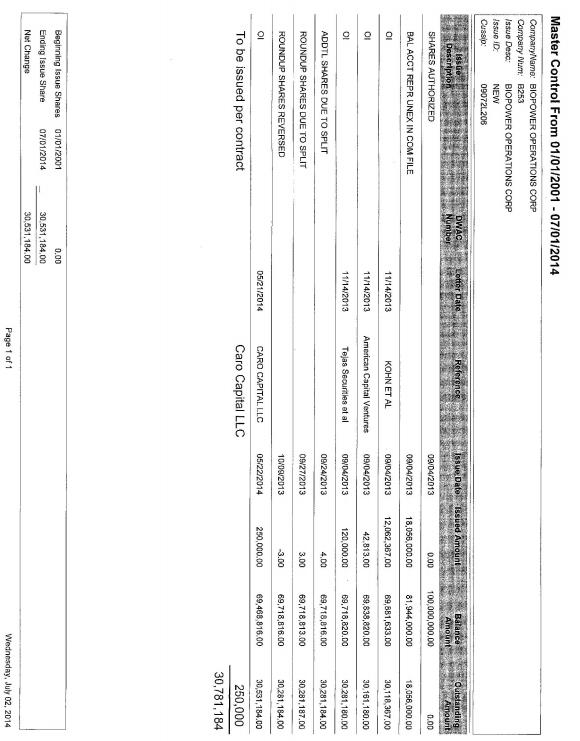

Section 2.02 Capitalization. The Company’s authorized capitalization consists of (a) 100,000,000 shares of common stock, par value $0.0001 per share (the “Company Common Stock”), of which 30,531,180 shares are issued and outstanding, and (b) 10,000 shares of preferred stock, par value $1.00 per share, ONE (1) of which, designated as Series A Preferred Stock, is issued and outstanding. All issued and outstanding shares are legally issued, fully paid, and non-assessable and not issued in violation of the preemptive or other rights of any person.

Section 2.03 Subsidiaries and Predecessor Corporations. The Company’s predecessor-in-interest, BioPower Corporation, a Nevada corporation, is a 100% owned subsidiary of the Company.

Section 2.04 SEC Reports. Except as to a single filing, the Company has filed all other reports required to be filed by it under the Securities Act and the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”), including pursuant to Section 13(a) or 15(d) of the Exchange Act, (the “SEC Reports”) on a timely basis or has received a valid extension of such time of filing and has filed any such SEC Reports prior to the expiration of any such extension. The SEC Reports and other filings with the SEC are filed of public record on the SEC’s Electronic Data Gathering and Retrieval system (“EDGAR”) on its website, www.sec.gov. G3P and the G3P Shareholders are encouraged to review all of such filings in connection with their deliberation of the completion of the transactions contemplated under this Agreement.

Section 2.05 Information. The information concerning the Company set forth in this Agreement, the Company Schedules and the SEC Reports is complete and accurate in all material respects and does not contain any untrue statements of a material fact or omit to state a material fact required to make the statements made, in light of the circumstances under which they were made, not misleading. In addition, the Company has fully disclosed in writing to the G3P Shareholders (through this Agreement, the Company Schedules or the SEC Reports) all information relating to matters involving the Company or its assets or its present or past operations or activities which (i) indicated or may indicate, in the aggregate, the existence of material liabilities except as presented in the financials, (ii) have led or may lead to a competitive disadvantage on the part of the Company or (iii) either alone or in aggregation with other information covered by this Section, otherwise have led or may lead to a material adverse effect on the Company, its assets, or its operations or activities as presently conducted or as contemplated to be conducted after the Closing Date, including, but not limited to, information relating to governmental, employee, environmental, litigation and securities matters and transactions with affiliates.

| - 7 - |

Section 2.06 Capital Matters. The details of capital-related items such as options, warrants, convertible securities, subscriptions, stock appreciation rights, phantom stock plans and stock equivalents and other rights, agreements, arrangements and commitments (contingent or otherwise) of any character issued or authorized by the Company relating to the issued or unissued capital stock of the Company (including, without limitation, rights the value of which is determined with reference to the capital stock or other securities of the Company) and any obligations of the Company to issue or sell any shares of capital stock of, or options, warrants, convertible securities, subscriptions or other equity interests in, the Company are disclosed in the SEC Reports and include those matters set forth on Schedule 2.06 hereof.

Other than referred to above, there are no other outstanding contractual obligations of the Company to repurchase, redeem or otherwise acquire any shares of the Company common stock of the Company or to pay any dividend or make any other distribution in respect thereof or to provide funds to, or make any investment (in the form of a loan, capital contribution or otherwise) in, any person.

Section 2.07 Absence of Certain Changes or Events. Since May 31, 2014 and except as disclosed in an SEC Report:

(a) there has not been (i) any material adverse change in the business, operations, properties, assets or condition of the Company or (ii) any damage, destruction or loss to the Company (whether or not covered by insurance) materially and adversely affecting the business, operations, properties, assets or condition of the Company;

(b) the Company has not (i) amended its certificate of incorporation or bylaws except as required by this Agreement; (ii) declared or made, or agreed to declare or make any payment of dividends or distributions of any assets of any kind whatsoever to stockholders or purchased or redeemed, or agreed to purchase or redeem, any of its capital stock; (iii) waived any rights of value which in the aggregate are outside of the ordinary course of business or material considering the business of the Company; (iv) made any material change in its method of management, operation, or accounting; (v) entered into any transactions or agreements other than in the ordinary course of business; (vi) made any accrual or arrangement for or payment of bonuses or special compensation of any kind or any severance or termination pay to any present or former officer or employee; (vii) increased the rate of compensation payable or to become payable by it to any of its officers or directors or any of its salaried employees whose monthly compensation exceed $1,000; or (viii) made any increase in any profit sharing, bonus, deferred compensation, insurance, pension, retirement, or other employee benefit plan, payment, or arrangement, made to, for or with its officers, directors, or employees;

(c) The Company has not (i) granted or agreed to grant any options, warrants, or other rights for its stock, bonds, or other corporate securities calling for the issuance thereof; (ii) borrowed or agreed to borrow, except for working capital loans from the shareholders from time to time in the ordinary course of business, any other funds, or incurred, or become subject to, any material obligation or liability (absolute or contingent) except liabilities incurred in the ordinary course of business; (iii) paid or agreed to pay any material obligations or liabilities (absolute or contingent) other than current liabilities reflected in or shown on the most recent the Company balance sheet and current liabilities incurred since that date in the ordinary course of business and professional and other fees and expenses in connection with the preparation of this Agreement and the consummation of the transaction contemplated hereby; (iv) sold or transferred, or agreed to sell or transfer, any of its assets, properties, or rights (except assets, properties, or rights not used or useful in its business which, in the aggregate have a value of less than $10,000), or canceled, or agreed to cancel, any debts or claims (except debts or claims which in the aggregate are of a value less than $1,000); (v) made or permitted any amendment or termination of any contract, agreement, or license to which it is a party if such amendment or termination is material, considering the business of the Company; or (vi) issued, delivered or agreed to issue or deliver, any stock, bonds or other corporate securities including debentures (whether authorized and unissued or held as treasury stock), except in connection with this Agreement; and

(d) to its knowledge, the Company has not become subject to any law or regulation which materially and adversely affects, or in the future, may adversely affect, the business, operations, properties, assets or condition of the Company.

| - 8 - |

Section 2.08 Litigation and Proceedings. There are no actions, suits, proceedings or investigations pending or, to the knowledge of the Company after reasonable investigation, threatened by or against the Company or affecting the Company or its properties, at law or in equity, before any court or other governmental agency or instrumentality, domestic or foreign, or before any arbitrator of any kind except as disclosed in the Company Schedules. The Company has no knowledge of any default on its part with respect to any judgment, order, writ, injunction, decree, award, rule or regulation of any court, arbitrator, or governmental agency or instrumentality or any circumstance which after reasonable investigation would result in the discovery of such default.

Section 2.09 Contracts. The Company is a party to such contracts as are disclosed in the SEC Reports, including those set forth on Schedule 2.09. Except as noted in the SEC Reports or as disclosed in Schedule 2.09: (i) the Company is not otherwise a party to, or its assets, products, technology and properties bound by, any leases, contract, franchise, license agreement, agreement, debt instrument, obligation, arrangement, understanding, instrument or other commitments, including (A) for the employment of any officer or employee; (B) profit sharing, bonus, deferred compensation, stock option, severance pay, pension benefit or retirement plan, (C) agreement, contract, or indenture relating to the borrowing of money, (D) guaranty of any obligation, (E) collective bargaining agreement; or (F) agreement with any present or former officer or director of the Company, whether such agreement is in writing or oral; or any charter or other corporate restriction, or any judgment, order, writ, injunction, decree, or award.

Section 2.10 No Conflict With Other Instruments. To its knowledge, the execution of this Agreement and the consummation of the transactions contemplated by this Agreement will not result in the breach of any term or provision of, constitute a default under, or terminate, accelerate or modify the terms of, any indenture, mortgage, deed of trust, or other material agreement or instrument to which the Company is a party or to which any of its assets, properties or operations are subject.

Section 2.11 Compliance With Laws and Regulations. To its knowledge, the Company has complied with all United States federal, state or local or any applicable foreign statute, law, rule, regulation, ordinance, code, order, judgment, decree or any other applicable requirement or rule of law (a “Law”) applicable to the Company and the operation of its business except for the following: consolidated tax returns have not been filed, but we intend to file within the next week and they show no tax obligation. This compliance includes, but is not limited to, the filing of all reports to date with federal and state securities authorities.

Section 2.12 Approval of Agreement. The Board of Directors of the Company has authorized the execution and delivery of this Agreement by the Company and has approved this Agreement and the transactions contemplated hereby.

Section 2.13 Material Transactions or Affiliations. Except as disclosed herein, the Company Schedules and the SEC Reports, there exists no contract, agreement or arrangement between the Company and any predecessor and any person who was at the time of such contract, agreement or arrangement an officer, director, or person owning of record or known by the Company to own beneficially, 5% or more of the issued and outstanding common stock of the Company and which is to be performed in whole or in part after the date hereof or was entered into not more than three years prior to the date hereof. Neither any officer, director, nor 5% Shareholders of the Company has, or has had since inception of the Company, any known interest, direct or indirect, in any such transaction with the Company which was material to the business of the Company. The Company has no commitment, whether written or oral, to lend any funds to, borrow any money from, or enter into any other transaction with, any such affiliated person.

| - 9 - |

Section 2.14 The Company Schedules. The Company has delivered to the G3P Shareholders the following schedules, which are collectively referred to as the “Company Schedules” and which consist of separate schedules, which are dated the date of this Agreement, all certified by the chief executive officer of the Company to be complete, true, and accurate in all material respects as of the date of this Agreement.

(a) a schedule containing complete and accurate copies of the certificate of incorporation and bylaws of the Company as in effect as of the date of this Agreement;

(b) a schedule setting forth any information, together with any required copies of documents, required to be disclosed in the Company Schedules by Sections 2.01 through 2.13.

The Company shall cause the Company Schedules and the instruments and data delivered to the G3P Shareholders hereunder to be promptly updated after the date hereof up to and including the Closing Date.

Section 2.15 Valid Obligation. This Agreement and all agreements and other documents executed by the Company in connection herewith constitute the valid and binding obligation of the Company, enforceable in accordance with its or their terms, except as may be limited by bankruptcy, insolvency, moratorium or other similar laws affecting the enforcement of creditors’ rights generally and subject to the qualification that the availability of equitable remedies is subject to the discretion of the court before which any proceeding therefore may be brought.

Section 2.16 OTC Marketplace Quotation. The Company’s registered common stock is quoted on the OTC Pink tier of the OTC Markets under the symbol “BOPO”. There is no action or proceeding pending or, to the Company’s knowledge, threatened against the Company by The Financial Industry Regulatory Authority, Inc. (“FINRA”) with respect to any intention by such entity to prohibit or terminate the quotation of the Company Common Stock on the OTC Pink tier.

ARTICLE

III

SHARE EXCHANGE AND OTHER TRANSACTION ELEMENTS

(a) On the terms and subject to the conditions set forth in this Agreement, on the Closing Date (as defined in Section 3.02), (i) the G3P Shareholders listed in Exhibit A, representing an aggregate of 876 shares of G3P Holdings common stock, upon their agreement, shall exchange with the Company, free and clear of all liens, pledges, encumbrances, charges, restrictions or known claims of any kind, nature, or description, all their shares of G3P Holdings held by them as set forth on Exhibit A; the objective of such share exchange (the “Exchange”) being the exchange by the Company for 100% of the issued and outstanding shares of G3P Holdings common stock in consideration of the Company’s delivery to the G3P Shareholders (i) an aggregate number of shares of the Company’s unregistered, restricted common stock (the “Exchange Common Shares”) equaling TWENTY (20%) PERCENT of the number of shares thereof outstanding immediately prior to such exchange (the “Pre-Transaction Number”), plus (ii) a number of the Company’s $1 par value preferred stock, to be designated as Series B Preferred Stock (the “Series B Preferred Shares”), as shall be convertible into an aggregate number of shares of the Company’s unregistered common stock equaling FIFTY (50%) PERCENT of the Pre-Transaction Number of shares of the Company’s common stock (the Exchange Common Shares and the Series B Preferred Shares, collectively, the “Exchange Shares”), in direct proportion to their relative interests in G3P Holdings (hereinafter referred to as the “Exchange Consideration”). At the Closing Date, the G3P Shareholders shall surrender all of their certificates representing their G3P shares to the Company, its registrar or transfer agent, and thereby be entitled to receive a certificate or certificates evidencing their ownership of the Exchange Shares.

(b) Except as provided below, the conversion feature of the Series B Preferred Shares shall be exercisable as of the date TWO (2) YEARS subsequent to Closing as follows (GAAP measurement):

(i) if the Company earns ZERO ($0) net cash flow (without regard to consolidated G3P Entity earnings) and G3P earns a minimum of ONE MILLION DOLLARS ($1,000,000) in cash flow, then the Series B Preferred Shares may be converted into up to FIFTY (50%) of the pre-exchange common stock, upon providing written notice to the Company of such intention;

(ii) if the Company and G3P earn a similar amount of net cash flow, then the Series B Preferred Shares may be converted into THIRTY (30%) PERCENT of the pre-exchange common stock, upon providing written notice to the Company of such intention; and

(iii) if G3P earns zero ($0) net cash flow, then the Series B Preferred Shares may not be converted into any pre-exchange common stock.

(iv) net cash flow shall be defined in accordance with US GAAP less all applicable taxes.

| - 10 - |

(c) Notwithstanding any provision of the above provisions of Section 3.02(b) to the contrary, the Company hereby grants the G3P Shareholders the right to defer the conversion of the Series B Preferred Shares from the TWO (2) year time period subsequent to Closing for such exercise as noted above, to the date THREE (3) years from the date of the Closing if and upon the condition that G3P Holdings provides evidence to the Company that one project is under construction or all contracts for the project are executed and funding is in place to commence construction.

(d) The Company covenants that, and the G3P Shareholders agree to cooperate to facilitate same, during the period the conversion right exists, the Company will reserve from its authorized and unissued Common Stock a sufficient number of shares, free from preemptive rights, to provide for the issuance of Common Stock upon the full conversion of the Series B Preferred Stock issued pursuant to this Agreement. The Company represents that upon issuance, such shares will be duly and validly issued, fully paid and non-assessable. In addition, if the Company shall issue any securities or make any change to its capital structure which would change the number of shares of Common Stock into which the Series B Preferred Shares shall be convertible, the Company shall at the same time make proper provision so that thereafter there shall be a sufficient number of shares of Common Stock authorized and reserved, free from preemptive rights, for conversion of the Series B Preferred Shares. The Company (i) covenants that it shall instruct its transfer agent to issue certificates for the Common Stock issuable upon conversion of the Series B Preferred, and (ii) agrees that this Section of this Agreement constitutes authorization sufficient for reliance by its officers and agents who are charged with the duty of executing stock certificates to execute and issue the necessary certificates for shares of Common Stock in accordance with the terms and conditions of this Agreement. This Section 3.01 shall survive the Closing for so long as necessary to enable the conversion mechanics set forth herein to be exercised.

Section 3.02 Two- Year Lock-Up Period. The G3P Shareholders hereby acknowledge that they will be required to hold the Exchange Shares, and each of ROBERT KOHN (“Kohn”) and BONNIE NELSON (“Nelson”) will be required to hold all their shares of Common Stock and ROBERT REINER (“Reiner”) will be required to hold 1,500,000 shares of his Common Stock, for a period of TWO (2) years subsequent to Closing pursuant to the terms of a lock-up agreement, in substantially the form thereof attached hereto as Exhibit “B” (“Lock-Up Agreement”).

Section 3.03 Cancellation of Series A Preferred Share. As of January 31, 2011, the Company issued ONE (1) share of its $1 par value preferred stock designated as Series A Preferred Stock (the “China Energy Preferred Share”) to China Energy Partners, LLC (“China Energy”). The China Energy Preferred Share is not convertible into shares of the Company’s common stock, but entitles China Energy the right to vote 50.1% of the total outstanding shares of Company common stock on matters as to which the shareholders of the Company have a right to vote. China Energy, by joinder to this Agreement, hereby agrees to tender the China Energy Preferred Share to the Company upon the occurrence of the G3P Shareholders’ conversion of the Series B Preferred Shares into Company common stock in accordance with this Agreement, in consideration of the Company’s payment to it of the amount of ONE DOLLAR ($1) therefor. This Section 3.03 shall survive the Closing for a time period sufficient to accommodate the mechanics of the provision of this Section.

Section 3.04 Post-Exchange Business Alignment/Officers and Directors. As of the Closing, the G3P Entities shall have become a wholly-owned subsidiaries of the Company and the engineering, waste and gasification to electricity and biofuels business divisions shall remain, or be re-aligned, as applicable, to be the business units of the applicable of the one or more G3P Entities. Additionally as of the Closing, the G3P Shareholders, in their then new capacities as shareholders of the Company and existing Company shareholder, China Energy, hereby agree to cause the votes of their shares in the Company to cause to the election of, or, as applicable, agree to vote, or their board designee to vote, as board members of the Company’s board of directors to appoint Dr. Neil Williams (“Williams”) to the board of directors of the Company. Additionally, the aforesaid G3P Shareholders in their new capacities as Company shareholders and China Energy also hereby agree to cause the Company’s G3P Entities to appoint Williams as the Chairman, CEO and President of the G3P Entities. Additionally, the Parties agree that they shall, as shareholders of the Company after the Closing, the vote their shares in the Company to elect, or, as applicable, to vote, or cause their board designee to vote as a board member of the Company’s board of directors to appoint, Reiner to the board of directors of the Company once the Company obtains directors’ and officers’ indemnity insurance.

| - 11 - |

Section 3.05 Licensing of Intellectual Property Rights of NTJB Power Techco.

(a) Effective as of the Closing, NTJB Power Techco, by joinder hereto, hereby grants a license to the G3P Entities for the worldwide exclusive use, and the Company, for the worldwide nonexclusive use, of its gasification and advanced biofuel production technologies, which grant of license shall be memorialized in substantially in the form of the Intellectual Property Licensing Agreement attached hereto as Exhibit “C” (the “Intellectual Property Licensing Agreement”).

(b) Among other terms thereof, the Intellectual Property Licensing Agreement shall grant to the G3P Entities and the Company the right to sublicense the intellectual property rights licensed hereunder and thereunder (the “Intellectual Property Rights”) to third parties and third party special purpose vehicle entities upon such terms as said licensees shall determine in their sole discretion. Additionally, the licensing fee/royalty arrangement thereof shall provide that once licensing fee/royalties aggregate TEN MILLION DOLLARS ($10,000,000), NTJB Power Techco shall thereupon convey to the Company or its designee, at its discretion, either 100% of the capital stock of NTJB Power Techco, or all right title and interest of NTJB Power Techco in all of its intellectual property rights and improvements of every description whatsoever in consideration of the payment by the Company for such capital stock or those assets, as applicable, the amount of ONE DOLLAR ($1).

(c) NTJB Power Techco acknowledges and reiterates its authorization to the G3P Entities and the Company to pursue such sublicensing arrangements of the Intellectual Properties rights with such third parties and special purpose vehicles as they in their sole discretion may determine.

Section 3.06 G3P Shareholders, Kohn and Nelson to Enter Into Shareholders Agreements.

(a) As of the Closing, each of the G3P Shareholders, Kohn and Nelson hereby agree to enter into a shareholders agreements having non-compete and non-solicitation provisions, substantially in the form of that attached hereto as Exhibit “D” (the “Shareholders Agreement”), which shall provide also, among other conventional terms, that each of them shall refrain from competing with the Company, or any of its subsidiaries, or from soliciting the clients, customers and employees of the Company, for a TWO (2) year period commencing as of the later of (i) the Closing Date or, as and if applicable, (ii) the date that the continued employment or any new employment of any of them by the Company, or their positions as officers or directors of the Company, shall terminate.

(b) The G3P Shareholders, Kohn and Nelson also agree to vote their Common Stock, or/and cast their votes as members of the Company’s board of directors, after Closing, to cause the G3P Entities boards of directors to be comprised of FOUR (4) G3P Shareholders as well as Kohn and Nelson.

Section 3.07 Follow-On Private Equity Capital Raise. Williams, Kohn and Nelson also hereby agree to vote their Common Stock, or/and cast their votes as members of the Company’s board of directors, after Closing, to cause the Company to adopt appropriate resolutions authorizing the undertaking of a private equity capital raise of up to TWENTY-FIVE MILLION DOLLARS ($25,000,000), consistent with the parameters set forth on the attached Exhibit “E” (the “Follow-On Capital Raise Transaction”). This Section 3.07 of this Agreement shall survive Closing for a period of up to two years for the applicable parties to complete the Follow-On Capital Raise Transaction.

| - 12 - |

Section 3.08 Management and Operations Agreement. The G3P Shareholders, Kohn and Nelson hereby agree that they shall vote the Common Stock or/and their votes on the board of directors of the Company and the G3P Entities (the “G3P Entities’ Boards”) to cause the Company to enter into a Management and Operations Agreement, the form of which is attached hereto as Exhibit “F” (the “Management and Operations Agreement”), which shall contain elements consistent with the following:

(i) the G3P Entities Boards shall be authorized to expend and invest net GAAP income, after tax and interest, as reduced by any dividends, and management fees in the ordinary course of business to the extent same exceeds TWENTY-FIVE MILLION DOLLARS ($25,000,000), with the G3P Entities Boards reserving the discretion to modify or amend said amount;

(ii) that authority for any corporate acquisitive transactions by the G3P Entities is subject to authorization by the Company’s board of directors and such due diligence processes as may be specified by that body;

(iii) that the G3P Entities are not and shall not be authorized to expend amounts or incur debt in excess of the $25 million amount budgeted unless from net GAAP income, after tax and interest, as reduced by any dividends paid;

(iv) that there shall be no joint venture of subcontract with known felons or persons who have been disqualified by the engineering board;

(v) that the G3P Entities shall comply with the Foreign Corrupt Practices Act and any analogues thereto;

(vi) ;

(vii) the Company reserves the authority to, and shall undertake, to perform all accounting and treasury functions respective to the G3P Entities; and

(viii) the Company may present future projects for consideration by the G3P Shareholders whereby same would be conducted as joint ventures in separate entities wherein benefits derived therefrom would be divided by the joint venture parties on a 50%/50% basis.

Section 3.09 Closing. The consummation of the transactions contemplated by this Agreement (“Closing”) shall occur following completion of the conditions set forth in Articles V and VI, and upon delivery of the Exchange Consideration as described in Section 3.01 herein. The Closing shall take place at a mutually agreeable time and place and is anticipated to close by no later than October 10, 2014, but in no event before this Agreement has been signed by G3P Shareholders holding 100% of the shares of each of the G3P Entities’ common stock outstanding (the “Closing Date”).

Section 3.10 Closing Events. At the Closing, the Company, and one, more of all of the G3P Shareholders shall execute, acknowledge, and deliver (or shall ensure to be executed, acknowledged, and delivered), any and all certificates, opinions, financial statements, schedules, agreements, resolutions, rulings or other instruments required by this Agreement to be so delivered at or prior to the Closing, together with such other items as may be reasonably requested by the parties hereto and their respective legal counsel in order to effectuate or evidence the transactions contemplated hereby.

Section 3.11 Termination. This Agreement may be terminated by each of the G3P Shareholders or the Company only in the event that the Company or the G3P Shareholders do not meet the conditions precedent set forth in Articles V and VI. If this Agreement is terminated pursuant to this section, this Agreement shall be of no further force or effect as to any party hereto, and no obligation, right or liability shall arise hereunder.

| - 13 - |

ARTICLE

IV

SPECIAL COVENANTS

Section 4.01 Access to Properties and Records. The Company and the G3P Shareholders will each afford to the officers and authorized representatives of the other full access to the properties, books and records of the Company or G3P Holdings, as the case may be, in order that each may have a full opportunity to make such reasonable investigation as it shall desire to make of the affairs of the other, and each will furnish the other with such additional financial and operating data and other information as to the business and properties of the Company or one or more of the G3P Entities, as the case may be, as the other shall from time to time reasonably request. Without limiting the foregoing, as soon as practicable after the end of each fiscal quarter (and in any event through the last fiscal quarter prior to the Closing Date), each party shall provide the other with quarterly internally prepared and unaudited financial statements.

Section 4.02 Delivery of Books and Records. At the Closing, G3P Holdings shall deliver to the Company, the originals of the corporate minute books, books of account, contracts, records, and all other books or documents of the G3P Entities now in the possession of G3P Holdings or its representatives.

Section 4.03 Third Party Consents and Certificates. The Company and G3P Holdings agree to cooperate with each other in order to obtain any required third party consents to this Agreement and the transactions herein contemplated.

Section 4.04 Actions Prior to Closing.

(a) From and after the date hereof until the Closing Date and except as set forth in the Company Schedules or G3P Entity Schedules or as permitted or contemplated by this Agreement, the Company (subject to paragraph (d) below) and G3P Holdings will each, and G3P Holdings will cause the C3P Entities to:

(i) carry on its and their businesses in substantially the same manner as it has heretofore and, as to the Company, as disclosed in the Company SEC Reports;

(ii) maintain and keep its and their properties in states of good repair and condition as at present, except for depreciation due to ordinary wear and tear and damage due to casualty;

(iii) maintain in full force and effect insurance comparable in amount and in scope of coverage to that now maintained by each of them;

(iv) perform in all material respects all of its and their obligations under material contracts, leases, and instruments relating to or affecting its and their assets, properties, and business;

(v) use its best efforts to maintain and preserve its business organization intact, to retain its and their key employees, and to maintain its and their relationship with its and their material suppliers and customers; and

(vi) fully comply with and perform in all material respects all obligations and duties imposed on them by all federal and state laws (including without limitation, the federal securities laws) and all rules, regulations, and orders imposed by federal or state governmental authorities.

(b) From and after the date hereof until the Closing Date, neither the Company nor G3P Holdings will, and G3P Holdings will cause the other G3P Entities to not:

(i) make any changes in their Articles of Incorporation, articles or certificate of incorporation or bylaws except as contemplated by this Agreement including a name change;

(ii) take any action described in Section 1.07 in the case of any of the G3P Entities or in Section 2.07, in the case of the Company (all except as permitted therein or as disclosed in the applicable party’s schedules);

| - 14 - |

(iii) enter into or amend any contract, agreement, or other instrument of any of the types described in such party’s schedules, except that a party may enter into or amend any contract, agreement, or other instrument in the ordinary course of business involving the sale of goods or services; or

(iv) sell any assets or discontinue any operations, sell any shares of capital stock or conduct any similar transactions other than in the ordinary course of business except as to the Company, as disclosed in the Company SEC Reports.

ARTICLE

V

CONDITIONS PRECEDENT TO OBLIGATIONS OF THE COMPANY

The obligations of the Company under this Agreement are subject to the satisfaction, at or before the Closing Date, of the following conditions:

Section 5.01 Accuracy of Representations and Performance of Covenants. The representations and warranties made by G3P Holdings and the G3P Shareholders in this Agreement were true when made and shall be true at the Closing Date with the same force and effect as if such representations and warranties were made at and as of the Closing Date (except for changes therein permitted by this Agreement). G3P Holdings shall have performed or complied with all covenants and conditions required by this Agreement to be performed or complied with by G3P Holdings prior to or at the Closing. The Company shall be furnished with a certificate, signed by a duly authorized executive officer of G3P Holdings and dated the Closing Date, to the foregoing effect.

Section 5.02 Officer’s Certificate. The Company shall have been furnished with a certificate dated the Closing Date and signed by a duly authorized officer of G3P Holdings to the effect that no litigation, proceeding, investigation, or inquiry is pending, or to the best knowledge of G3P Holdings threatened, which might result in an action to enjoin or prevent the consummation of the transactions contemplated by this Agreement, or, to the extent not disclosed in the G3P Entity Schedules, by or against any of the G3P Entities, which might result in any material adverse change in any of the assets, properties, business, or operations of and of the G3P Entities.

Section 5.03 Approval by the G3P Shareholders. The Exchange shall have been approved by the holders of 100% of the G3P Holdings common stock, including voting power, of G3P Holdings, unless a lesser number is agreed to by the Company.

Section 5.04 No Governmental Prohibition. No order, statute, rule, regulation, executive order, injunction, stay, decree, judgment or restraining order shall have been enacted, entered, promulgated or enforced by any court or governmental or regulatory authority or instrumentality which prohibits the consummation of the transactions contemplated hereby.

Section 5.05 Consents. All consents, approvals, waivers or amendments pursuant to all contracts, licenses, permits, trademarks and other intangibles in connection with the transactions contemplated herein, or for the continued operation of any of the G3P Entities after the Closing Date on the basis as presently operated shall have been obtained.

Section 5.06 Other Items.

(a) The Company shall have received a list containing the names, addresses, social security numbers or tax ID, phone numbers, and number of shares held by the G3P Shareholders as of the date of Closing, certified by an executive officer of G3P Holdings as being true, complete and accurate; and

(b) The Company shall have received such further opinions, documents, certificates or instruments relating to the transactions contemplated hereby as the Company may reasonably request.

(c) The Company shall have received the G3P Entities’ Financial Statements as provided for in Sections 1.04(a) and (b).

| - 15 - |

ARTICLE

VI

CONDITIONS PRECEDENT TO OBLIGATIONS OF THE G3P SHAREHOLDERS

The obligations of the G3P Shareholders under this Agreement are subject to the satisfaction of the Company, or each G3P Shareholder, as the case may be, at or before the Closing Date, of the following conditions:

Section 6.01 Accuracy of Representations and Performance of Covenants. The representations and warranties made by the Company in this Agreement were true when made and shall be true as of the Closing Date (except for changes therein permitted by this Agreement) with the same force and effect as if such representations and warranties were made at and as of the Closing Date. Additionally, the Company shall have performed and complied with all covenants and conditions required by this Agreement to be performed or complied with by the Company.

Section 6.02 Officer’s Certificate. The G3P Shareholders’ applicable designee shall have been furnished with certificates dated the Closing Date and signed by duly authorized executive officers of the Company, to the effect that no litigation, proceeding, investigation or inquiry is pending, or to the best knowledge of the Company threatened, which might result in an action to enjoin or prevent the consummation of the transactions contemplated by this Agreement or, to the extent not disclosed in the Company Schedules, by or against the Company, which might result in any material adverse change in any of the assets, properties or operations of the Company.

Section 6.03 Good Standing. The G3P Shareholders’ applicable designee shall have received a certificate of good standing from the Secretary of State of the jurisdictions of their charters, dated as of a date within ten days prior to the Closing Date certifying that the Company is in good standing as a corporation in the State of Nevada and has filed all tax returns required to have been filed by it to date and has paid all taxes reported as due thereon.

Section 6.04 No Governmental Prohibition. No order, statute, rule, regulation, executive order, injunction, stay, decree, judgment or restraining order shall have been enacted, entered, promulgated or enforced by any court or governmental or regulatory authority or instrumentality which prohibits the consummation of the transactions contemplated hereby.

Section 6.05 Approval by the Company Board of Directors and its Shareholders. The Company’s board of directors shall have approved the Exchange.

Section 6.06 Consents. All consents, approvals, waivers or amendments pursuant to all contracts, licenses, permits, trademarks and other intangibles in connection with the transactions contemplated herein, or for the continued operation of the Company after the Closing Date on the basis as presently operated shall have been obtained.

Section 6.07 Shareholder Report. The G3P Shareholders shall receive a shareholder’s report reflective of all the Company shareholder’s which does not exceed 30,531,180 common shares outstanding, and ONE (1) of Series A Preferred Stock outstanding as of the day prior to the Closing Date and no shares of preferred stock outstanding.

Section 6.08 Other Item.

(a) The G3P Shareholders shall have received further opinions, documents, certificates, or instruments relating to the transactions contemplated hereby as the G3P Shareholders may reasonably request.

(b) This Agreement shall have been executed by the holders of 100% of the shares of capital stock of the G3P Entities.

| - 16 - |

ARTICLE

VII

OTHER MATTERS

Section 7.01 Forgiveness of G3P Shareholder Loans. As of the Closing, the G3P Shareholders shall forgive the indebtedness of the one or more G3P Entities obligated to them for loans previously made to said borrowers. The G3P Shareholders shall deliver such documentation as the Company may request to sufficiently document such forgiveness.

Section 7.02 Standstill. From the date of this Agreement through the date that is SIXTY (60) days subsequent to the date of this Agreement or if earlier, the Closing Date, the Parties shall not enter into or seek to enter into any other undertaking, contract or venture that would in any way conflicts with the Parties’ transactions contemplated under this Agreement.

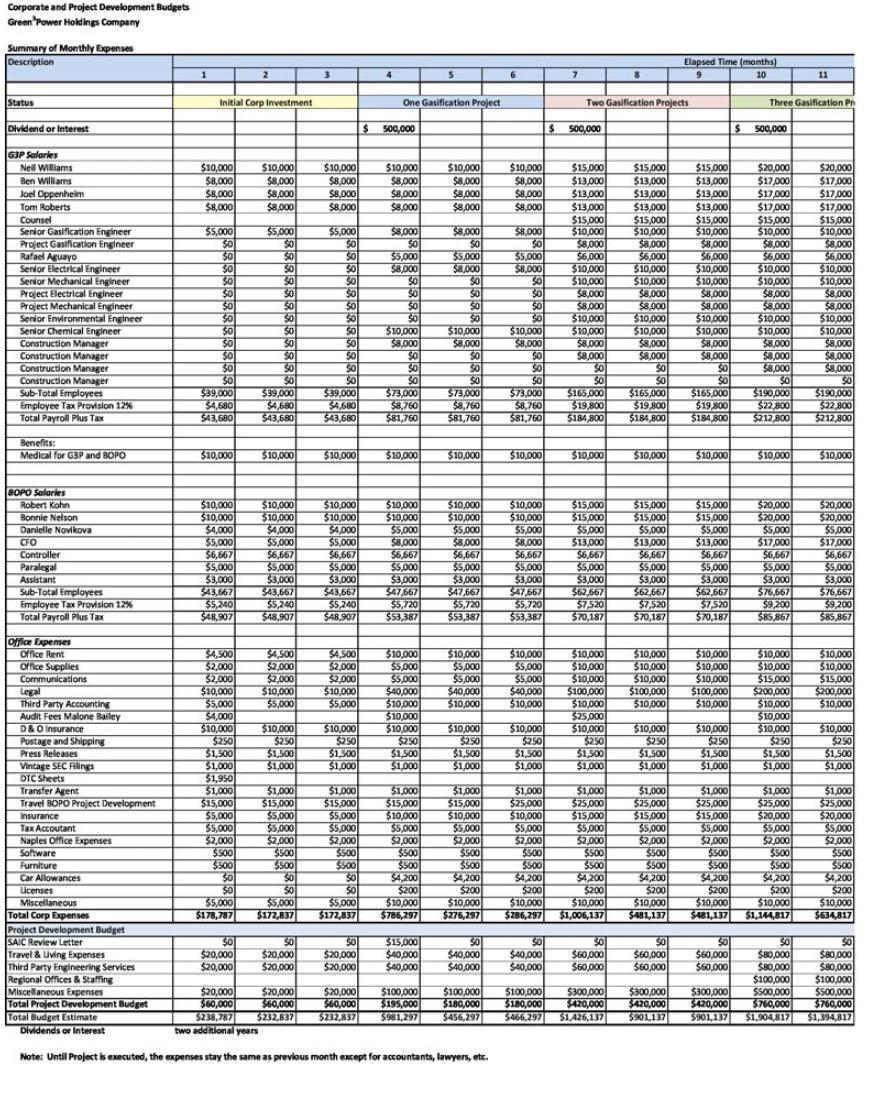

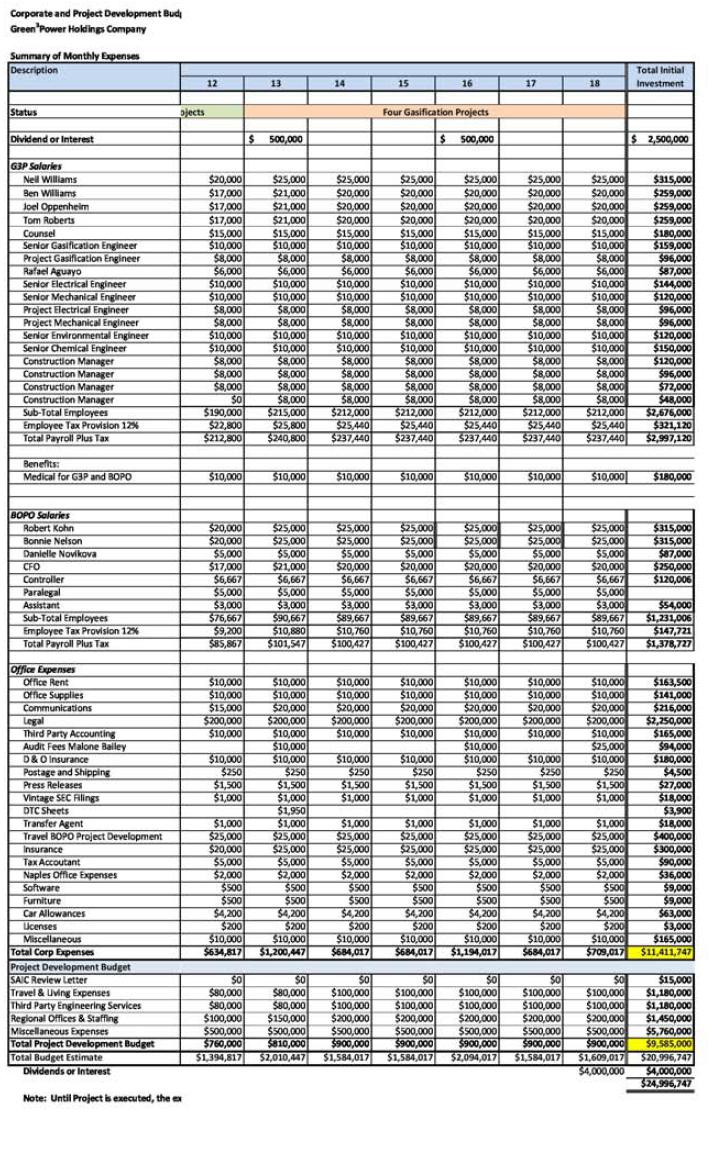

Section 7.03 Development of Budget. The Parties’ have developed a joint budget for combined working capital of the applicable one or more G3P Entities and for corporate overhead the details of which are attached hereto as Exhibit “G” the “Budget”).

Section 7.04 Employment Contracts. As of Closing, the G3P Shareholders, Kohn, Nelson shall cause G3P Holdings to hire the G3P Shareholders, and Rafael Aguayo, as employees pursuant to employment contracts substantially in the forms attached hereto as Composite Exhibit “H” (the “Employment Agreements”). As to the Employment Agreements of Neil Williams and Benjamin Williams, such contracts shall include appropriate exclusions from their duties thereunder as necessary to accommodate their performance of services under existing waste remediation consulting contracts.

Section 7.05 Prohibition on Nelson and Kohn Converting Deferred Salary. The Company shall not, and Kohn and Nelson agree to not convert any of their outstanding accrued salary into common stock of the Company.

ARTICLE

VIII

MISCELLANEOUS

Section 8.01 Brokers. The Company and G3P Shareholders agree that there were no finders or brokers involved in bringing the parties together or who were instrumental in the negotiation, execution or consummation of this Agreement. The Company and G3P Holdings each agree to indemnify the other against any claim by any third person other than those described above for any commission, brokerage, or finder’s fee arising from the transactions contemplated hereby based on any alleged agreement or understanding between the indemnifying party and such third person, whether express or implied from the actions of the indemnifying party.

Section 8.02 Governing Law. This Agreement shall be governed by, enforced, and construed under and in accordance with the laws of the State of Florida, without giving effect to the principles of conflicts of law thereunder. Each of the parties irrevocably consents and agrees that any controversy arising under and in connection with this Agreement and the transactions documented herein are to be submitted to binding arbitration in accordance with the arbitration rules of the International Chamber of Commerce (the “ICC Rules”), with an arbitrator to be selected in such circumstance by each of the opposite Parties, and a third arbitrator selected by the two previously chosen by the principals to the controversy. Such proceeding is to be heard in Broward County, Florida at location chosen among the Parties. Any judgment awarded by the arbitrators in such a case may be filed of record in the Circuit Court of Broward County, Florida. By execution and delivery of this Agreement, each party hereto irrevocably submits to and accepts, with respect to any such action or proceeding, generally and unconditionally, the jurisdiction of the aforesaid tribunal, and irrevocably waives any and all rights such party may now or hereafter have to object to such jurisdiction.

| - 17 - |

Section 8.03 Notices. Any notice or other communications required or permitted hereunder shall be in writing and shall be sufficiently given if personally delivered to it or sent by overnight courier or registered mail or certified mail, addressed as follows:

If to G3P Holdings, to:

Dr. Neil Williams, Chief Executive Officer

Designee of the G3P Shareholders

1000 Corporate Drive, Suite 200

Ft. Lauderdale, FL 33334

nwilliams@green3power.com

If to the Company, to:

Robert Kohn, Chairman CEO

BioPower Operations Corporation

1000 Corporate Drive, Suite 200

Ft. Lauderdale, FL 33334

rkohn@biopowercorp.com

or such other addresses as shall be furnished in writing by any party in the manner for giving notices hereunder, and any such notice or communication shall be deemed to have been given (i) upon receipt, if personally delivered, (ii) on the day after dispatch, if sent by overnight courier and signed for, and (iii) three (3) days after mailing, if sent by registered or certified mail and signed for.

Section 8.04 Attorney’s Fees. Except as to any claims or liabilities suffered by the Company or any of its officers, directors, shareholders or affiliates which arise out of or in connection with (i) any inaccuracy or breach of any covenant, representation, warranty of any of the G3P Shareholders or G3P Holdings contained in this Agreement, (ii) in connection with any of the G3P Entities or their respective affiliates’ employment-related matters, (iv) in connection with any federal income or other tax matter arising prior to the Closing Date, or (iv) any other material contingent liability of any of the G3P Entities or their respective affiliates that have not been disclosed under the Agreement or otherwise in connection with the transactions contemplated herein, in which event the G3P Shareholders hereby agree, jointly and severally, to indemnify, defend and hold harmless the Company and any of its applicable officers, directors, shareholders or affiliates against, in the event that either party otherwise institutes any arbitration to enforce this Agreement, to secure relief from any default hereunder or breach hereof, or other controversy arising hereunder, as is provided for herein, each of the parties shall bear their own costs, including reasonable attorney’s fees, incurred in connection therewith and in enforcing or collecting any judgment rendered therein.

Section 8.05 Confidentiality. Each party hereto agrees with the other that, unless and until the transactions contemplated by this Agreement have been consummated, it and its representatives will hold in strict confidence all data and information obtained with respect to another party or any subsidiary thereof from any representative, officer, director or employee, or from any books or records or from personal inspection, of such other party, and shall not use such data or information or disclose the same to others, except (i) to the extent such data or information is published, is a matter of public knowledge, or is required by law to be published; or (ii) to the extent that such data or information must be used or disclosed in order to consummate the transactions contemplated by this Agreement. In the event of the termination of this Agreement, each party shall return to the other party all documents and other materials obtained by it or on its behalf and shall destroy all copies, digests, work papers, abstracts or other materials relating thereto, and each party will continue to comply with the confidentiality provisions set forth herein.

Section 8.06 Public Announcements and Filings. Unless required by applicable law or regulatory authority, none of the parties will issue any report, statement or press release to the general public, to the trade, to the general trade or trade press, or to any third party (other than its advisors and representatives in connection with the transactions contemplated hereby) or file any document, relating to this Agreement and the transactions contemplated hereby, except as may be mutually agreed by the parties. Copies of any such filings, public announcements or disclosures, including any announcements or disclosures mandated by law or regulatory authorities, shall be delivered to each party at least one (1) business day prior to the release thereof.

| - 18 - |

Section 8.07 Schedules; Knowledge. Each party is presumed to have full knowledge of all information set forth in the other party’s schedules delivered pursuant to this Agreement.

Section 8.08 Third Party Beneficiaries. This contract is strictly between the Company, the G3P Shareholders and G3P Holdings, and, except as specifically provided, no director, officer, stockholder (other than the G3P Shareholders), employee, agent, independent contractor or any other person or entity shall be deemed to be a third party beneficiary of this Agreement.

Section 8.09 Expenses. Subject to Section 7.04 above, whether or not the Exchange is consummated, each of the Company and the G3P Entities will bear their own respective expenses, including legal, accounting and professional fees, incurred in connection with the Exchange or any of the other transactions contemplated hereby.

Section 8.10 Entire Agreement. This Agreement represents the entire agreement between the parties relating to the subject matter thereof and supersedes all prior agreements, understandings and negotiations, written or oral, with respect to such subject matter.

Section 8.11 Survival; Termination. The representations, warranties, and covenants of the respective parties shall survive the Closing Date and the consummation of the transactions herein contemplated for a period of two years.

Section 8.12 Counterparts. This Agreement may be executed in multiple counterparts, each of which shall be deemed an original and all of which taken together shall be but a single instrument.