Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Biopower Operations Corp | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - Biopower Operations Corp | v305524_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Biopower Operations Corp | v305524_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - Biopower Operations Corp | v305524_ex32-1.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended November 30, 2011

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________________ to __________________

Commission File Number 000-53274

BioPower Operations Corporation

(Exact name of registrant as specified in its charter)

| Nevada | 27-4460232 | |

| (State or other jurisdiction of | (IRS Employer | |

| incorporation or organization) | Identification No.) |

1000 Corporate Drive, Suite 200, Fort Lauderdale, Florida 33334

(Address of principal executive offices)

Issuer’s telephone number, including area code: +1 954 607 2800

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was Required to submit and post such files). þ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. (as defined in Rule 12b-2 of the Exchange Act). Check one:

| Large accelerated filer | ¨ | Non-accelerated filer | ¨ | |

| Accelerated Filer | ¨ | Smaller reporting company | þ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

As of March 9, 2012, the last day of the Registrant’s most recently completed first fiscal quarter, the aggregate market value of the shares of the Registrant’s common stock held by non-affiliates (based upon the closing stock price of $0.55 as per the close on Friday, February 17, was approximately $31,262,000. Shares of the Registrant’s common stock held by each executive officer and director and by each person who owns 10 percent or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates of the Registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 9, 2012, there were outstanding 90,340,000 shares of the registrant’s common stock, $.0001 par value.

Documents incorporated by reference: None.

BioPower Operations Corporation

Form 10-K

Table of Contents

| Page | ||||

| PART I | 3 | |||

| Item 1. | Business | 3 | ||

| Item 1A. | Risk Factors | 7 | ||

| Item 1B. | Unresolved Staff Comments | 14 | ||

| Item 2. | Description of Property | 14 | ||

| Item 3. | Legal Proceedings | 15 | ||

| Item 4. | Mine Safety Disclosure | 15 | ||

| PART II | 15 | |||

| Item 5. | Market for Common Equity and Related Stockholder Matters | 15 | ||

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 16 | ||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 21 | ||

| Item 8. | Financial Statements and Supplementary Data | 22 | ||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 22 | ||

| Item 9A | Controls and Procedures | 22 | ||

| Item 9B. | Other Information | 23 | ||

| PART III | 23 | |||

| Item 10. | Directors and Executive Officers | 23 | ||

| Item 11. | Executive Compensation | 25 | ||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 26 | ||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 27 | ||

| Item 14. | Principal Accountant Fees and Services | 29 | ||

| PART IV | 30 | |||

| Item 15. | Exhibits | 30 | ||

| Signatures | 31 | |||

| Financial Statements | F-1 | |||

| 2 |

FORWARD LOOKING STATEMENTS AND ASSOCIATED RISK

Certain statements in this Report, and the documents incorporated by reference herein, constitute forward looking statements. Such forward looking statements involve known and unknown risks, uncertainties and other factors which may cause deviations in actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied. Such factors include, but are not limited to: market and customer acceptance and demand for our products; our ability to market our products; the impact of competitive products and pricing; the ability to develop and launch new products on a timely basis; the regulatory environment, including government regulation in the United States; our ability to obtain the requisite regulatory approvals to commercialize our products; fluctuations in operating results, including spending for development and marketing activities; and other risks detailed from time-to-time in our filings with the U.S. Securities and Exchange Commission (the “SEC”).

The words "believe, expect, anticipate, intend and plan" and similar expressions identify predictive statements. These statements are subject to risks and uncertainties that cannot be known or quantified and, consequently, actual results may differ materially from those expressed or implied by such predictive statements. Readers are cautioned not to place undue reliance on these predictive statements, which speak only as of the date they are made.

Unless otherwise noted, all currency figures in this filing are in U.S. dollars.

PART I

ITEM 1. BUSINESS

Overview

BioPower Operations Corporation ("we," "our," “BioPower”, “BIO” or the “Company") was organized in Nevada on January 5, 2011. The Company and its subsidiaries intend to grow biomass crops coupled with processing and/or conversion facilities to produce oils, biofuels, electricity and other biomass products.

Corporate History

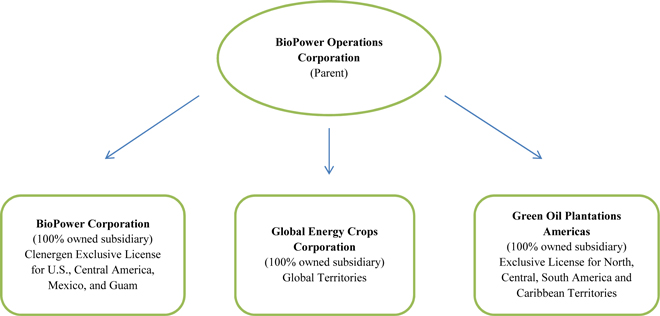

On January 6, 2011, we acquired 100% of BioPower Corporation (“BC”), a Florida corporation incorporated on September 13, 2010, by our CEO and Director contributing 100% of the outstanding shares to the Company. As a result, BC became a wholly-owned subsidiary of the Company.

On November 30, 2010, an exclusive license agreement was signed between BC and Clenergen Corporation (www.clenergen.com). BC has the exclusive license for the United States, Central America, Guam and Mexico to utilize Clenergen’s biomass growing technologies.

On January 14, 2011, we formed Global Energy Crops Corporation (“GECC”), a 100% wholly-owned subsidiary for the future development of global business opportunities.

On January 27, 2011, an agreement was signed between Green Oil Plantations Ltd. (www.greenoilplantations.com) and their affiliates (“Green Oil”) and the Company for the exclusive fully paid up license for fifty (50) years to utilize Green Oil’s licensed technologies and turnkey model for growing energy crops in North America, South America, Central America and the Caribbean. The Company formed Green Oil Plantations Americas, Inc., as the operating company for this exclusive license.

On August 1, 2011, the SEC declared our S-1 effective.

The Company and its subsidiaries, have never declared bankruptcy, have never been in receivership, and have never been involved in any legal action or proceedings.

| 3 |

Neither the Company nor its subsidiaries, nor our officers, directors, promoters or affiliates, has had preliminary contact or discussions with, nor do we have any present plans, proposals, arrangements or understandings with any representatives of the owners of any business or company regarding the possibility of an acquisition or merger. Since incorporation, we have not made any material purchase or sale of assets outside the ordinary course of business.

We are not a blank check registrant as that term is defined in Rule 419(a) (2) of Regulation C of the Securities Act of 1933, since we have a specific business plan or purpose.

Our Business

The Company is a development stage company and intends to grow biomass crops coupled with processing and/or conversion facilities to produce oils, biofuels, electricity and other biomass products.

Biomass is all plant and animal matter on the Earth's surface. Harvesting biomass such as crops, trees or dung and using it to generate energy such as heat, electricity or motion, is bioenergy. Biomass is a very broad term which is used to describe material of recent biological origin that can be used either as a source of energy or for its chemical components. As such, it includes trees, crops, algae and other plants, as well as agricultural and forest residues. It also includes many materials that are considered as wastes by our society including food and drink manufacturing effluents, sludge, manures, industrial (organic) by-products and the organic fraction of household waste.

Initially we developed a strategy to license and grow long-term biomass products that take five to seven years to reach maturation. After commencing development activities we recognized that the economic climate for lending and investment is focused on shorter term returns of two to three years. Therefore, BioPower analyzed various shorter term biomass technologies and market niche opportunities. As a result, we developed short term plans to produce and sell biomass products which we call our Castor project. We have deferred our plans for the development of our long-term, licensed biomass products until specific funding can be obtained for such projects.

BioPower intends to create a special purpose entity (“SPE”) company for each biomass project. Every SPE must have a sustainable, biomass growing project with facilities to process the biomass into saleable products possibly coupled with an end use agreement. This end use agreement may enable the SPE to obtain financing based upon the potential profitability of each project. The Company intends to offer ownership in our initial SPEs to joint venture partners who can provide land and money. The role BioPower will fulfill in each SPE is executive and general management, procurement of funding and development of markets for the sale of biomass and biomass products. The initial focus for biomass business opportunities will be in the United States of America, Caribbean, South America and Central America.

The Company also intends to investigate and license and/or joint venture with the most promising, emerging biomass products and processes.

Business Environment

BioPower has two business drivers. The primary business driver is the need for environmentally friendly, profitable and sustainable products. A second driver is the search for energy alternatives focused on replacement of hydrocarbon based products, which is one of the concerns of governments, scientists and businesses worldwide.

| 4 |

Castor Project

The Company has begun the process to obtain financing for a castor plantation and milling operation to supply castor oil to the U.S.A. marketplace. We have identified growing protocols that also may enhance the yield of seed and, thus, castor oil, by weight compared to industry standard protocols. We have identified engineering firms to prepare both general and site specific engineering for permitting and construction purposes. We have identified the mill equipment to process the seed into oil and the agricultural equipment required to facilitate the growing protocols that have been identified. We are currently working on the development of a long-term (greater than one year) purchase agreement for the sale of castor oil. Although we have discussed various potential sites in the center of Florida, we have not made a final determination of the specific location.

The U.S.A. currently imports almost 100% of the castor oil used as a feedstock into the personal care, pharmaceuticals, polymers and plastics, adhesives, coatings and other specialty chemical markets. The Company proposes to develop a project in Florida to grow hybrid castor which we believe can be harvested within 110 days per crop. Given the rainfall, the temperature profile and the nature of the soil, it is anticipated that the land when developed will produce 2.6 to 3.0 metric tons of oil seeds per acre based on two crops per year. We anticipate that we will process the seeds into oil (43% of seed weight) with our own, vertically integrated mill which we consider critical to this project.

Based on our ability to obtain financing in this fiscal year, we expect to realize revenues and profits from this operation in 2013.

India is the major supplier of castor oil and castor oil by-products into the U.S.A. markets and, competitors from India could present a major competitive threat to the success of this castor project.

In addition, at this time we are also in discussions for a potential biomass project in South America.

There can be no assurance the castor project can be successfully implemented or that, if implemented, that profitability of the castor project will be achieved.

| 5 |

Long-Term Products

BioPower has developed and licensed multiple long-term crops that our licensors have represented can be produced in large, sustainable quantities. The licensed biomass crops include:

| · | Millettia Pinnata is a green oil producing biofuel species that is resistant to adverse climatic conditions, is tolerant to poor soil conditions, has carbon fixing qualities that qualify it for carbon credits, and has a significant yield with a single tree producing anywhere from 800 to 1,000 kilograms of seed per year. |

| · | Silver Leaf (Yellow Horn) is a green oil-producing tree and a primary energy crop for the production of biofuels. It can be grown in colder climates and can produce a variety of products that range from green oil to organic fertilizer. |

| · | Marjestica is a tree ideally suited for tropical plantations that can grow up to 26 feet in its first year of planting. It has a low water requirement and is an ideal energy crop because it develops several stems after the first harvest and can yield approximately 40 tonnes per acre over an 8 year period before replanting is necessary. |

| · | Beema Bamboo – There are various products that can be produced from bamboo. The Company has a license for the unique, high density Beema bamboo from India. |

We have deferred our plans for the development of our long-term, licensed biomass products until specific funding can be obtained for such projects. If such funding is obtained, we would seek joint ventures with land owners and investors, work with municipalities, federal and state government agencies and Native American Tribes.

Distribution methods of the long-term biomass products

Biomass feedstock, wood chips and wood pellets may be sold to manufacturers and electric generation companies in the U.S.A and Europe. In addition, with long-term products we may also generate carbon credits.

Competitive business conditions and the smaller reporting company's competitive position in the industry and methods of competition

The energy crop growing industry is fragmented worldwide with Universities and energy crop production labs spending the last 15-20 years doing research and development on the best energy crop yields. The renewable energy industry is extremely competitive in general, with competitors ranging from the largest tree growing company, International Paper; utilities such as Exelon, Southern Cos., Duke; large oil companies such as BP and Exxon; and smaller technology companies and early stage renewable energy companies.

There can be no assurance that our plans relating to long-term products and processes will ever be achieved.

Regulation

The Company will comply with all U.S.A. and foreign laws and regulations that apply to our agricultural production, mill operation, safety and environmental standards or are otherwise applicable to our business, processes and products.

Business Development

We are focused on the elements necessary to initiate our castor project. These elements include financing for the project, a long-term contract for the sale of bio oils, execution of agreements with engineering and construction contractors, procurement of mill and farming equipment, and purchase of land for the mill and leases for the land for agricultural operations.

Our experienced management team will continue to search for biomass products and processes that we believe will provide short term revenue and profitability for the Company. We will review business plans and technologies to determine if they meet with our short term goals and criteria.

| 6 |

Patents, trademarks, licenses, franchises, concessions, royalty agreements or labor contracts, including duration

We have an exclusive license from Clenergen Corporation in perpetuity for the exclusive territory of the United States, Central America, Mexico and Guam for the use of certain Clenergen Corporation technologies, including their own developed strains of biomass energy crops which yield up to 40% greater biomass feedstock over most other biomass energy crops to date. This license is for long-term tropical biomass products.

We have an exclusive, fully-paid license from Green Oil for fifty (50) years for the exclusive territory of North America, Central America, South America, Caribbean and U.S. territories for the use of certain Green Oil’s technologies and turnkey proprietary growing systems, including their own developed strains of biomass energy crops. This license is for long-term biomass products.

Effect of existing or probable governmental regulations on the business

The U.S. Department of Agriculture and other foreign, U.S., state and local agencies have regulations for growing biomass crops. We intend to use biomass crops that have been approved or can be approved by governmental agencies for growing in the U.S.A. or other countries in the Americas. We are aware that we must obtain permits from the appropriate governmental agencies to implement our business model. We will operate in the same regulatory environment as all other biomass crop growing operations that are dealing with governmental regulations. There can be no assurance that we would receive such permits or licenses.

Estimate of the amount spent during each of the last two fiscal years on research and development activities, and if applicable, the extent to which the cost of such activities is borne directly by customers

As a recently incorporated company, we have not undertaken any R&D activities, nor do we intend to have R&D activities. Our intention is to have third parties provide all R&D services.

Costs and effects of compliance with environmental laws (foreign, federal, state and local)

While we anticipate costs for compliance with environmental laws, which will typically be for licensing or permitting growing operations, these are part of the normal and customary costs for every growing operation. These costs generally vary by state, are not significant as relates to the total project cost, and are part of the business model costs for each growing operation.

Number of total employees and number of full-time employees

We presently have four employees, Robert Kohn, our Chairman and Chief Executive Officer, Dale Shepherd, our President and Chief Operating Officer, Bonnie Nelson, Director of Business Strategy, an executive assistant and various consultants and advisors. We intend to hire additional employees for project development and to manage and staff our operations as we raise capital and complete specific milestones that would require these employees. Each specific special purpose entity that is created for each biomass project will hire its own employees and staff for growing and milling operations. In the meantime, we will rely on present management, consultants and advisors to direct our business. Robert Kohn developed extensive experience in biomass and the electric utility industry while he was President of Entrade at Exelon. Dale Shepherd spent eighteen years with General Electric Company.

ITEM 1A. RISK FACTORS

An investment in our securities should be considered highly speculative due to various factors, including the nature of our business and the present stage of our development. An investment in our securities should only be undertaken by persons who have sufficient financial resources to afford the total loss of their investment. In addition to the usual risks associated with investment in a business, you should carefully consider the following known material risk factors described below and all other information contained in this report before deciding to invest in our Common Stock. If any of the following risks occur, our business, financial condition and results of operations could be materially and adversely affected.

| 7 |

Risks Relating to our Business

We are subject to a going concern opinion from our independent auditors.

Our independent auditors have added an explanatory paragraph to their audit issued in connection with the financial statements for the period ended November 30, 2011, relative to our ability to continue as a going concern. We had a working capital deficit of ($537,566) and we had a deficit accumulated during the development stage of ($969,989), as at November 30, 2011. Because our auditors have issued a going concern opinion, it means there is substantial uncertainty we will continue operations in which case you could lose your investment. The financial statements do not include any adjustments that might result from the uncertainty about our ability to continue our business. As such we may have to cease operations and investors could lose their entire investment.

We have had no operations to date and revenues generated subsequent to year end that are not part of our planned and principal operations.

We have had no operations to date. In February 2012, our CEO entered into an advisory agreement which paid BioPower an advisory fee of $120,000, which was paid in stock from the public company. (See subsequent events in footnotes). This revenue is not part of our planned and principal operations. We expect to incur losses in the coming fiscal year, and possibly beyond, due to significant costs associated with our business development activities. There can be no assurance that we will be able to successfully implement our business plan, or that our business development activities will ever lead to us generating sufficient revenues to fund our continuing operations or that we will ever generate positive cash flow from our operations. Further, we can give no assurance that we will attain or thereafter sustain profitability in any future period. Since our resources are presently very limited, insufficient future revenues would result in termination of our operations, as we cannot sustain unprofitable operations unless additional equity or debt financing is obtained.

We have had no operations to date, and are competing with well-established companies in our business sector, and may never achieve profitability.

To date the Company has been focused on raising money, filing a registration statement and business development activities. We are faced with all of the risks associated with a company in the early stages of development. Our business is subject to numerous risks associated with a relatively new, undercapitalized company engaged in our business sector. Such risks include, but are not limited to, competition from well-established and well-capitalized companies and unanticipated difficulties regarding the marketing and sale of our products. There can be no assurance that we will ever generate significant commercial sales or achieve profitability. Should this be the case, our common stock could become worthless and investors in our common stock or other securities could lose their entire investment.

We need to obtain a significant amount of debt and/or equity capital to commence our castor project, build milling operations and operate plantations, which we may not be able to obtain on acceptable terms or at all.

We will require additional capital to fund our business and development plan, including the acquisition of land and planting and management of biomass crops (“biomass operations”) and milling operations. In addition, once these farms have been planted, we will have to fund the start-up costs of these biomass operations until, if ever, the biomass products are sold and generate sufficient cash flow. We may also encounter unforeseen costs that could also require us to seek additional capital. As a result, we expect to seek to raise additional debt and/or equity funding. The full and timely development and implementation of our business plan and growth strategy will require significant additional resources, and we may not be able to obtain the funding necessary to implement our growth strategy on acceptable terms or at all. An inability to obtain such funding would prevent us from planting any plantations. Furthermore, our plantation strategy may not produce revenues even if successfully funded. We have not yet identified the sources for the additional financing we require and we do not have commitments from any third parties to provide this financing. We might not succeed, therefore, in raising additional equity capital or in negotiating and obtaining additional and acceptable financing. Our ability to obtain additional capital will also depend on market conditions, national and global economies and other factors beyond our control. We might not be able to obtain required working capital, the need for which is substantial given our business and development plan. The terms of any future debt or equity funding that we may obtain may be unfavorable to us and to our stockholders.

We have limited financial and management resources to pursue our growth strategy.

Our growth strategy may place a significant strain on our management, operational and financial resources. We have negative cash flow from our development stage activities and continue to seek additional capital. We will have to obtain additional capital either through debt or equity financing to continue our business and development plan. There can be no assurance, however, that we will be able to obtain such financing on terms acceptable to our company.

| 8 |

If we raise additional funds through the issuance of equity or convertible securities, these new securities may contain certain rights, preferences or privileges that are senior to those of our common shares. Additionally, the percentage of ownership of our company held by existing shareholders will be reduced.

Our long-term products may be adversely affected if one or both of our license agreements with Clenergen Corporation and Green Oil Plantations, Ltd. is terminated.

Although we believe our relationships with our licensors are very good, our license agreements do provide that the licensors may terminate such agreements. In the Green Oil Plantations, Ltd. License agreement, the licensor, after two years, can give notice of termination in the event that certain events occur. Such events include but are not limited to, our failure to perform or observe any of our obligations or our filing of bankruptcy. In the Clenergen Corporation license agreement, Clenergen has the right to terminate the agreement immediately by providing notice in writing in the event of our failure to perform or observe any of our obligations, our filing of bankruptcy or the licensee challenging the validity of any of Clenergen’s licensed technologies.

In the event that one or both of the license agreements are terminated by the licensors as provided in the license agreements, our long-term products may be materially and adversely affected.

We will be dependent on third parties for expertise in the management of our Biomass plantations and any loss or impairment of these relationships could cause delay and added expense. In addition, we currently have no binding definitive agreements with such parties and their failure to perform could hinder our ability to generate revenues.

The number of biomass plantation management companies with the necessary expertise to manage the biomass plantations is limited. We will be dependent on our relationships with third parties for their expertise. Any loss of, or damage to, these relationships, particularly during the planting and start-up period for the plantations, may significantly delay or even prevent us from continuing operations at these plantations and result in the failure of our business. The time and expense of locating new plantation management companies could result in unforeseen expenses and delays. Unforeseen expenses and delays may reduce our ability to generate revenue and significantly damage our competitive position in the industry.

We will be required to hire and retain skilled technical and managerial personnel.

Personnel qualified to operate and manage our future plantations and product sales are in great demand. Our success depends in large part on our ability to attract, train, motivate and retain qualified management and skilled employees, particularly managerial, technical, sales and marketing personnel, technicians, and other critical personnel. Any failure to attract and retain the highly-trained managerial and technical personnel may have a negative impact on our operations, which would have a negative impact on our future revenues. There can be no assurance that we will be able to attract and retain skilled persons; and, the loss of skilled technical personnel would adversely affect our company.

We are dependent upon our officers for management and direction, and the loss of any of these persons could adversely affect our operations and results.

We are dependent upon our officers for execution of our business plan, especially Mr. Robert Kohn, our Chief Executive Officer, Secretary and a Director. The loss of Mr. Kohn or any of our other officers could have a material adverse effect upon our results of operations and financial position. We do not maintain “key person” life insurance for any of our officers. The loss of any of our officers could delay or prevent the achievement of our business objectives.

Delays or defects could result in delays in our proposed future production and sale of energy and other products from Biomass and negatively affect our operations and financial performance.

Projects often involve delays for a number of reasons including delays in obtaining permits, delays due to weather conditions, or other events. Also, any changes in political administrations at each level that result in policy changes towards energy and other products produced from Biomass could also cause delays. If it takes us longer to plant our proposed plantations, our ability to generate revenues could be impaired. In addition, there can be no assurance that defects in materials and/or workmanship will not occur. Such defects could delay the commencement of operations of the plantation or cause us to halt or discontinue the plantation’s operation or reduce the intended production capacity. Halting or discontinuing plantation operations could delay our ability to generate revenues.

| 9 |

Our proposed plantation sites may have unknown environmental problems that could be expensive and time consuming to correct which may delay or halt planting and delay our ability to generate revenue.

Liability costs associated with environmental cleanups of contaminated sites historically have been very high as have been the level of fines imposed by regulatory authorities upon parties deemed to be responsible for environmental contamination. If contamination should take place for which we are deemed to be liable, potentially liable or a responsible party, the resulting costs could have a material effect on our business.

We may encounter hazardous conditions at or near each of our proposed facility sites that may delay or prevent planting at a particular location. If we encounter a hazardous condition at or near a site, work may be suspended and we may be required to correct the condition prior to continuing the plantation. The presence of a hazardous condition would likely delay or prevent planting at a particular location and may require significant expenditure of resources to correct the condition. If we encounter any hazardous condition during planting, estimated sales and profitability may be adversely affected.

Changes in environmental regulations or violations of the regulations could be expensive and hinder our ability to operate profitably.

We are and will continue to be subject to extensive air, water and other environmental regulations and will need to maintain a number of environmental permits to plant and operate our future plantations. If for any reason, any of these permits are not granted, costs for the plantations may increase, or the plantations may not be planted at all. Additionally, any changes in environmental laws and regulations could require us to invest or spend considerable resources in order to comply with future environmental regulations. Violations of these laws and regulations could result in liabilities that affect our financial condition and the expense of compliance alone could be significant enough to reduce profits.

Our joint ventures and strategic alliances may not achieve their goals.

We expect to rely on joint ventures and strategic alliances for land acquisition and development, plantation, planting, growing and management, sale and marketing of products, funding of projects and project development. Even if we are successful in forming these alliances, they may not achieve their goals.

Dependence upon our officers without whose services Company Operations could cease.

At this time two of our officers in particular, Robert Kohn and Dale Shepherd, both of whom have extensive experience in the energy and fuels business, are primarily responsible for the development and execution of our business plan. Both individuals have long-term employment contracts with the Company commencing January and February 2011, respectively, however after five years and two years, respectively, these contracts may be terminated by the officers. If either of our two officers should choose to leave us for any reason before we have hired additional personnel, our operations may fail. Even if we are able to find additional personnel, it is uncertain whether we could find qualified management who could develop our business along the lines described herein or would be willing to work for compensation the Company could afford. Without such management, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment. We do not maintain “key person” life insurance for any of our officers.

We do not have a traditional credit facility with a financial institution. This absence may adversely impact our operations.

We do not have a traditional credit facility with a financial institution, such as a working line of credit. The absence of a facility could adversely impact our operations, as it may constrain our ability to have the working capital for inventory purchases or other operational requirements. If adequate funds are not otherwise available, we may be required to delay, scale back or eliminate portions of our business development efforts. Without credit facilities, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment.

Our inability to successfully achieve a critical mass of sales could adversely affect our financial condition.

No assurance can be given that we will be able to successfully achieve a critical mass of sales in order to cover our operating expenses and achieve sustainable profitability. Without such critical mass of sales, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment.

| 10 |

Other companies with greater resources and operating experience offer products similar to or the same as the products we sell.

We intend to operate in a very competitive industry with many established and well-recognized competitors. These competitors range from large, international oil companies such as Shell, Exxon-Mobil and BP who have announced plans to create renewable energy projects and International Paper to smaller renewable energy companies and tree growing companies. Most of our competitors (including all of the competitors named above) have substantially greater market leverage, distribution networks, and vendor relationships, longer operating histories and industry experience, greater financial, technical, sales, marketing and other resources, more name recognition and larger customer bases than we do and potentially may react strongly to our marketing efforts. Other competitive responses might include, without limitation, intense and aggressive price competition and offers of employment to our key marketing or management personnel. We may not be successful in the face of increasing competition from existing or new competitors, or the competition may have a material adverse effect on our business, financial condition and results of operations. If we are not successful in competing with our competitors, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment.

Our Castor project sales and marketing efforts may not lead to a long-term purchase commitment.

We have not executed a long-term purchase agreement with a buyer of castor oil at this time. We believe we may have to establish further elements of our Castor project in order to accomplish this goal. We also believe we will have to establish our Castor project in order to expand our sales contracts for a larger amount of quantity of bio oils guaranteed to be purchased by the Purchaser. There can be no assurance that we will be able to expand our efforts to the extent we believe necessary or that any such efforts, if undertaken, will be successful in achieving substantial sales of our products. If we are unable to expand our sales and marketing efforts, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment.

The average selling prices of our products, and our gross margins resulting from the sale of such products, may decline as a result of industry trends, competitive pressures and other factors.

Castor oil has experienced significant price volatility over the last three to five years due to a number of factors, particularly competitive and macroeconomic pressures and timing of oil supply. Suppliers in India are increasing production of castor oil and castor products each year. This may result in lower sales prices from time to time in order to gain market share or create more demand. We may have to reduce the sales prices of our products in response to such pricing competition, which could cause our gross margins to decline and may adversely affect our business, operating results or financial condition. If we cannot maintain adequate profit margins on the sales of our products, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment.

Our failure to manage growth effectively could impair our success.

In order for us to expand successfully, management will be required to anticipate the changing demands of a growth in operations, should such growth occur, and to adapt systems and procedures accordingly. There can be no assurance that we will anticipate all of the changing demands that a potential expansion in operations might impose. If we were to experience rapid growth, we might be required to hire and train a large number of sales and support personnel, and there can be no assurance that the training and supervision of a large number of new employees would not adversely affect the high standards that we seek to maintain. Our future will depend, in part, on our ability to integrate new individuals and capabilities into our operations, should such operations expand in the future, and there can be no assurance that we will be able to achieve such integration. Failure to manage growth effectively during an expansion in our operations (should such an expansion occur) could adversely affect our business, financial condition and results of operations.

Changes in generally accepted accounting principles could have an adverse effect on our business, financial condition, cash flows, revenue and results of operations.

We are subject to changes in and interpretations of financial accounting matters that govern the measurement of our performance. Based on our reading and interpretations of relevant guidance, principles or concepts issued by, among other authorities, the American Institute of Certified Public Accountants, the Financial Accounting Standards Board, and the United States Securities and Exchange Commission, our management believes that our current contract terms and business arrangements have been properly reported. However, there continue to be issued interpretations and guidance for applying the relevant standards to a wide range of contract terms and business arrangements that are prevalent in the industries in which we operate. Future interpretations or changes by the regulators of existing accounting standards or changes in our business practices could result in future changes in our revenue recognition and/or other accounting policies and practices that could have a material adverse effect on our business, financial condition, cash flows, revenue and results of operations.

| 11 |

The Company is controlled by its officers and directors and new investors will not have any voice in our management, which could result in decisions adverse to them.

Our directors and officers collectively own or have the right to vote approximately 37.08% of our outstanding Common Shares. In addition, on January 28, 2011, the Company filed with the Secretary of State of the State of Nevada a Certificate of Designation of Series A Preferred Stock. The Certificate was approved by the Board and did not require shareholder vote. The Certificate created a new class of preferred stock known as Series A Preferred Stock. There is one share designated as Series A Preferred Stock. One share of Series A Preferred Stock is entitled to 50.1% of the outstanding votes on all shareholder voting matters. Series A Preferred Stock has no dividend rights and no rights upon a liquidation event. On January 31, 2011, the Company issued one share of Series A Preferred Stock to China Energy Partners, LLC, an entity controlled by Mr. Robert Kohn, our Chief Executive Officer and a Director and Ms. Bonnie Nelson, a Director, with each owning 50% of that entity. Through this entity, Mr. Kohn and Ms. Nelson are empowered with supermajority voting rights despite the amount of outstanding voting securities they each own.

As a result they will have the ability to control substantially all matters submitted to our stockholders for approval including:

| - | election of our board of directors; |

| - | removal of any of our directors; |

| - | amendment of our Articles of Incorporation or By-laws; and |

| - | adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us. |

In addition, sales of significant amounts of shares held by selling stockholders, or the prospect of these sales, could adversely affect the market price of our Common Shares. Preferred stock and common stock ownership of our principal stockholders and our officers and directors may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of BioPower, which, in turn, could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

We will incur significant increased costs as a result of operating as a public company, and our management will be required to devote substantial time to new compliance initiatives.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. The Sarbanes-Oxley Act of 2002, as well as rules subsequently implemented by the Securities and Exchange Commission (the “SEC”), have imposed various requirements on public companies, including requiring establishment and maintenance of effective disclosure and financial controls and changes in corporate governance practices. Our management and other personnel will need to devote a substantial amount of time to these new compliance initiatives. Moreover, these rules and regulations will increase our legal and financial compliance costs and will make some activities more time consuming and costly. We expect these rules and regulations to make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to incur substantial costs to maintain the same or similar coverage.

Section 404 of the Sarbanes-Oxley Act of 2002 requires, among other things, that we maintain effective internal control over financial reporting and disclosure controls and procedures. As a smaller reporting company, while we are not required to obtain the attestation of our accounting firm regarding the effectiveness of our internal control over financial reporting, our management is still required to assess the effectiveness of such internal controls. If we are unable to comply with the requirements of Section 404 in a timely manner or if we are not able to remediate any deficiencies, we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

| 12 |

Risks Relating to our Common Shares and the Trading Market

We may, in the future, issue additional Common Shares which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorize the issuance of 500,000,000 Common Shares with par value of $0.0001 per share and 10,000 shares of Preferred Stock with par value of $1.00 per share. The future issuance of our authorized Common Shares and Preferred Stock, to the extent that it is convertible into shares of common stock, may result in substantial dilution in the percentage of our Common Shares held by our then existing stockholders. The issuance of Common Shares in the future for cash, future services or acquisitions or other corporate actions may have the effect of diluting the value of the Common Shares held by our investors, and might have an adverse effect on any trading market for our Common Shares.

Because of the early stage of development and the nature of our business, our securities are considered highly speculative.

Our securities must be considered highly speculative, generally because of the nature of our business and the early stage of its development. We are seeking to commence a new business in the highly competitive renewable energy industry, and we have yet to establish or operate our first planned energy crop growing operation. Accordingly, we have not generated any revenues nor have we realized a profit from our operations to date, and there is little likelihood that we will generate any revenues or realize any profits in the short to medium term. Any profitability in the future from our business will be dependent upon our successfully implementing our business plan, which itself is subject to numerous risk factors as set forth herein. Since we have not generated any revenues, we will have to raise additional monies through the sale of our equity securities or debt in order to undertake our business operations.

There is no established trading market for our securities and purchasers of our securities may have difficulty selling their shares.

Our stock began to trade on the OTC QB market February 17, 2012. An active trading market in our securities may not develop or, if developed, may not be sustained and purchasers of the Common Shares may have difficulty selling their shares should they desire to do so.

Our Common Shares are subject to the “Penny Stock” Rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The SEC has adopted regulations that generally define a "penny stock" to be any equity security other than a security excluded from such definition by Rule 3a51-1 under the Securities Exchange Act of 1934, as amended. For the purposes relevant to our Company, it is any equity security that has a market price of less than $5.00 per share, subject to certain exceptions.

Our Common Shares will be regarded as a “penny stock”, since our shares aren’t to be listed on a national stock exchange or quoted on the NASDAQ Market within the United States, to the extent the market price for our shares is less than $5.00 per share. The penny stock rules require a broker-dealer to deliver a standardized risk disclosure document prepared by the SEC, to provide the customer with additional information including current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, monthly account statements showing the market value of each penny stock held in the customer's account, and to make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. To the extent these requirements may be applicable they will reduce the level of trading activity in the secondary market for the Common Shares and may severely and adversely affect the ability of broker-dealers to sell the Common Shares.

United States securities laws may limit secondary trading, which may restrict the states in which and conditions under which you can sell the shares offered by this Offering.

Secondary trading in Common Shares sold in this Offering will not be possible in any state in the U.S.A. unless and until the Common Shares are qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in such state. There can be no assurance that we will be successful in registering or qualifying the Common Shares for secondary trading, or identifying an available exemption for secondary trading in our Common Shares in every state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of the Common Shares in any particular state, the Common Shares could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our Common Shares, the market for the Common Shares could be adversely affected.

| 13 |

We have not and do not intend to pay any cash dividends on our Common Shares, and consequently our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We have not, and do not, anticipate paying any cash dividends on our Common Shares in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them.

The elimination of monetary liability against the Company’s directors, officers and employees under Nevada law and the existence of indemnification rights to the Company’s directors, officers and employees may result in substantial expenditures by the Company and may discourage lawsuits against the Company’s directors, officers and employees.

The Company’s certificate of incorporation contains a specific provision that eliminates the liability of directors for monetary damages to the Company and the Company’s stockholders; further, the Company is prepared to give such indemnification to its directors and officers to the extent provided by Nevada law. The Company may also have contractual indemnification obligations under its employment agreements with its executive officers. The foregoing indemnification obligations could result in the Company incurring substantial expenditures to cover the cost of settlement or damage awards against directors and officers, which the Company may be unable to recoup. These provisions and resultant costs may also discourage the Company from bringing a lawsuit against directors and officers for breaches of their fiduciary duties and may similarly discourage the filing of derivative litigation by the Company’s stockholders against the Company’s directors and officers even though such actions, if successful, might otherwise benefit the Company and its stockholders.

If we do not comply with the state regulations in regard to the sale of these securities or find an exemption therefrom there may be potential limitations on the resale of your stock.

With few exceptions, every offer or sale of a security must, before it is offered or sold in a state, be registered or exempt from registration under the securities, or blue sky laws, of the state(s) in which the security is offered and sold. Similarly, every brokerage firm, every issuer selling its own securities and an individual broker or issuer representative (i.e., finder) engaged in selling securities in a state, must also be registered in the state, or otherwise exempt from such registration requirements. Most states securities laws are modeled after the Uniform Securities Act of 1956. To date, approximately 40 states use the Uniform Securities Act of 1956 as the basis for their state blue sky laws.

However, although most blue sky laws are modeled after the Uniform Securities Act of 1956 blue sky statutes, they vary widely and there is very little uniformity among state securities laws. Therefore, it is vital that each state's statutes and regulations be reviewed before embarking upon any securities sales activities in a state to determine what is permitted, or not permitted, in a particular state. While we intend to review the blue sky laws before the distribution of any securities in a particular state, should we fail to properly register the securities as required by the respective states or find an exemption from registration, then you may not be able to resell your stock once purchased.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. DESCRIPTION OF PROPERTY

On March 18, 2011, the Company entered into a twenty-six month lease at $4,150 monthly that commenced on April 1, 2011, and expires on May 31, 2013. The office space is approximately 2,000 square feet and includes five executive offices, a lunchroom and conference room. The lease also includes fully furnished offices with executive furniture and equipment.

| 14 |

ITEM 3. LEGAL PROCEEDINGS

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have a material adverse effect on our business, financial condition or operating results. We know of no pending proceedings to which any director, member of senior management, or affiliate is either a party adverse to us.

ITEM 4. MINE SAFETY PROCEDURES.

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market for Our Common Stock

Our common stock is presently listed on the OTC QB market. On August 1, 2011, the SEC declared our registration statement on form S-1 effective. We were notified by FINRA on Friday, February 10, 2012, that we were approved to commence trading under the stock symbol BOPO. We commenced trading on Friday, February 17, 2012. There can be no assurance that a market for our common stock will be sustained. Therefore, purchasers of our shares may be unable to sell their securities, because there may not be a sustainable public market for our securities. As a result, you may find it more difficult to dispose of, or obtain accurate quotes of our common stock. Any purchaser of our securities should be in a financial position to bear the risks of losing their entire investment. At March 9, 2012, there were 90,340,000 shares of our Common Stock outstanding. Our shares of Common Stock are held by approximately 75 stockholders of record. The number of record holders was determined from the records of our transfer agent.

Notwithstanding, certain shareholders have each entered into a lockup agreement with the Company effectively restricting them from transferring some or all of their common stock for a period of time without the prior written consent of the Company, which consent may be unreasonably withheld. The selling stockholders named in the S-1 prospectus are subject to a one-year lockup for some of their shares and our officers and directors are subject to a two-year lockup on all of their shares. Subsequent to the lockup period, the stockholder may sell its common stock every calendar quarter in an amount equal to no more than one percent (1%) of the Company’s issued and outstanding shares of common stock; provided, however, that the stockholder shall not be permitted to make any transfer, or portion thereof, that would exceed twenty percent (20%) of the average weekly reported volume of trading of the Company’s common stock on all national securities exchanges and/or reported through the automated quotation system of a registered securities association during the calendar week preceding the transfer. Moreover, as per the lockup agreement, prior to any transfer, the stockholder must first offer its shares of common stock to be sold to the Company and allow the Company to purchase such shares at a price that is ninety percent (90%) of the average closing price for the Company’s Common Stock, as reported or quoted on its principal exchange or trading market, for the consecutive five (5) trading days prior to the transfer notice given to the Company.

All of the remaining 74,000,000 shares of common stock are restricted securities as such term is defined under Rule 144 promulgated by the SEC, in that they were issued in private transactions not involving a public offering.

Dividends

We have not paid dividends on our common stock and do not anticipate paying such dividends in the foreseeable future.

| 15 |

Sale of Unregistered Securities

On January 11, 2011, the Company issued 4,150,000 shares to a consultant for investor relations, consulting and IT services. The foregoing issuance of the shares was effectuated pursuant to the exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), provided by Section 4(2) of the Securities Act.

As of January 18, 2011, the Company sold 83,900,000 shares of our common stock at par value $0.0001, for $8,390, comprised of 33,500,000 shares of common stock to officers and directors of the Company, and the balance of 50,400,000 common shares of stock to ten (10) related parties of officers and directors totaling 39,850,000 common shares of stock of which the officers and directors disclaim beneficial ownership. The foregoing issuance of the shares was effectuated pursuant to the exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), provided by Section 4(2) of the Securities Act.

On January 27, 2011, the Company issued 1,000,000 shares to Green Oil Plantations for an exclusive license for North, South, Central America and the Caribbean.

The Company accepted subscription agreements on February 2, 2011, for sales of 1,200,000 shares of our common stock at a price of $0.25 per share with no commissions paid, for total proceeds of $300,000. The foregoing issuance of the shares was effectuated pursuant to the exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), provided by Section 4(2) of the Securities Act.

On August 26, 2011, the Company sold 30,000 shares of our common stock for $0.50 per share under the effective registration statement. The foregoing issuance of the shares was effectuated pursuant to the exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), provided by Section 434(b) of the Securities Act.

Securities authorized for issuance under equity compensation plans

As of the date of this Annual Report, we do not have any securities authorized for issuance under any equity compensation plans and we do not have any equity compensation plans.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

SPECIAL NOTE OF CAUTION REGARDING FORWARD-LOOKING STATEMENTS

Statements made in this 10-K that are not historical or current facts are “forward-looking statements” made pursuant to the safe harbor provisions of Section 27A of the of the Securities Act of 1933 (the “Act”) and Section 21E of the Securities Exchange Act of 1934. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "intends", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential", or "continue" or the negative of these terms or other comparable terminology. We intend that such forward-looking statements be subject to the safe harbors for such statements. We wish to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Any forward-looking statements represent management’s best judgment as to what may occur in the future. However, forward-looking statements are subject to risks, uncertainties and important factors beyond our control that could cause actual results and events to differ materially from historical results of operations and events and those presently anticipated or projected. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statement or to reflect the occurrence of anticipated or unanticipated events.

Unless the context otherwise requires, The "Company", "we," "us," and "our," refer to (i) BioPower Operations Corporation.; (ii) BioPower Corporation (“BC”), (iii) Green Oil Plantations Americas, Inc. (“GOP”), and (iv) Global Energy Crops Corporation (GECC) .

Overview

BioPower Operations Corporation was incorporated in Nevada on January 5, 2011. On January 6, 2011, we acquired 100% of BioPower Corporation (“BC”), a Florida corporation incorporated on September 13, 2010, by our CEO and Director contributing 100% of the outstanding shares to the Company. As a result, BC became a wholly-owned subsidiary of the Company.

| 16 |

On November 30, 2010, an exclusive license agreement was signed between BC and Clenergen Corporation. BC has the exclusive license for the United States, Central America, Guam and Mexico to utilize Clenergen’s biomass growing technologies.

On January 14, 2011, we formed Global Energy Crops Corporation (“GECC”), a 100% wholly-owned subsidiary for the future development of global business opportunities.

On January 27, 2011, an agreement was signed between Green Oil Plantations Ltd. and their affiliates (“Green Oil”) and the Company for the exclusive fully paid up license for fifty (50) years to utilize Green Oil’s licensed technologies and turnkey model for growing energy crops in North America, South America, Central America and the Caribbean. The Company formed Green Oil Plantations Americas, Inc., as the operating company for this exclusive license.

On August 1, 2011, the SEC declared our S-1 effective.

We are a development stage company and have not yet generated or realized any revenues from business operations. Our auditors have issued a going concern opinion. This means there is substantial doubt that we can continue as an on-going business for the next twelve (12) months unless we obtain additional capital to pay our bills. This is because we have not generated any revenues and no revenues are anticipated until we begin marketing our products to customers. Accordingly, we must raise cash from sources other than revenues generated such as from the proceeds of loans, sale of common shares and advances from related parties.

From inception (September 13, 2010) to November 30, 2011, the company's business operations have primarily been focused on developing our business plan, developing potential products and a biomass project, preparing the S-1 and raising money.

Castor project

The Company has begun the process to obtain financing for a castor plantation and milling operation to supply castor oil to the U.S.A. marketplace. We have identified unique growing protocols that also may enhance the yield of seed thus oil by weight compared to industry standard protocols. We have identified engineering firms to prepare both general and site specific engineering for permitting and construction purposes. We have identified the mill equipment to process the seed into oil and the agricultural equipment required to facilitate the growing protocols that have been identified. We are currently working on the development of a long-term (greater than one year) purchase agreement for the sale of castor oil. Although we have discussed various potential sites in the center of Florida, we have not made a final determination of the specific location.

The U.S.A. currently imports almost 100% of the castor oil used as a feedstock into the personal care, pharmaceuticals, polymers and plastics, adhesives, coatings and other specialty chemical markets. The Company proposes to develop a project in Florida to grow proven hybrid castor which can be harvested within 110 days per crop. Given the rainfall, the temperature profile and the nature of the soil, it is anticipated that the land when developed will produce 2.6 to 3.0 metric tons of oil seeds per acre based on two crops per year. We will process the seeds into oil (43% of seed weight) with our own, vertically integrated mill which we consider critical to this project.

Based on our ability to obtain financing in this fiscal year, we hope to realize revenues and profits from this operation in 2013.

In addition, at this time we are also in discussions for a potential biomass project in South America.

There can be no assurance the above Castor project will ever be achieved.

PLAN OF OPERATION

Since inception (September 13, 2010) to November 30, 2011, the Company has spent a total of $968,655 on the general and administrative costs. We have not yet generated any revenue from business operations.

| 17 |

Since inception (September 13, 2010), the majority of the company's time has been spent refining its business plan, conducting industry research, developing potential projects, licensing biomass opportunities, reviewing technologies, preparing an S-1and preparing for additional financing, funding of operations and funding of projects.

The Company is a development stage company focused on growing biomass crops coupled with processing and/or conversion facilities to produce oils, biofuels, electricity and other biomass products.

BioPower is focused on a short term strategy for growing a biomass crop that can be converted into bio oils, biofuels and steam. The Company has begun the process to obtain financing for a castor plantation and milling operation to supply castor oil to the U.S.A. marketplace. We are currently in discussions of a long-term (greater than one year) purchase agreement. The U.S.A. currently imports almost 100% of the castor oil used as a feedstock into the personal care, pharmaceuticals, polymers and plastics, adhesives, coatings and other specialty chemical markets. The Company proposes to develop a project in Florida to grow proven hybrid castor which can be harvested within 110 days per crop. Given the rainfall, the temperature profile and the nature of the soil, it is anticipated that the land when developed will produce 2.6 to 3.0 tons of oil seeds per acre based on two crops per year. We will process the seeds into oil (43% of seed weight) with our own, vertically integrated mill which we consider critical to this project.

In addition, we have been in discussions for a similar potential biomass project in South America.

Our experienced management team also continually searches for biomass products and processes that we believe will provide short term revenue and profitability for the Company. We review business plans and technologies to determine if they meet our potential short-term goals and criteria.

Biomass is all plant and animal matter on the Earth's surface. Harvesting biomass such as crops, trees or dung and using it to generate energy such as heat, electricity or motion, is bioenergy. Biomass is a very broad term which is used to describe material of recent biological origin that can be used either as a source of energy or for its chemical components. As such, it includes trees, crops, algae and other plants, as well as agricultural and forest residues. It also includes many materials that are considered as wastes by our society including food and drink manufacturing effluents, sludge, manures, industrial (organic) by-products and the organic fraction of household waste.

Our long-term strategy, when economic conditions permit, is to grow long-term biomass crops that can be converted into biofuels, oils or electricity. We intend to operate our Company through three wholly-owned subsidiaries, BioPower Corporation, Global Energy Crops Corporation and Green Oil Plantations Americas Inc. Other subsidiaries may be formed as required to operate the Company. BioPower Corporation has an exclusive license for the United States, Central America, Guam, and Mexico from Clenergen Corporation to utilize their biomass growing technologies. Clenergen Corporation is a public company which utilizes genetics applied to selected tree species, namely, Marjestica, Melia dubia and Bamboo. Green Oil Plantations Americas has the exclusive license for North, Central, South America and the Caribbean from Green Oil Plantations Ltd. and their affiliates to utilize their biomass growing technologies and turnkey plantation management to grow biomass energy crops.

We estimate our maximum operating expenses and working capital requirements for the next twelve month period to be as follows:

| Business development costs for biomass operations | $ | 3,250,000 | ||

| Management and Consulting | 825,000 | |||

| General and Administrative | 925,000 | |||

| Total | $ | 5,000,000 |

We anticipate that we will be required to raise additional funds through private sales of debt or equity securities of our company, to fund our operations and execute our business plan. There is no assurance that the financing will be completed on terms advantageous to us, or at all. If we are not successful in raising additional funding, we may be forced to curtail or cease some of all of our operations and/or curtail or elect not to proceed with certain aspects of our business plan.

We may also encounter unforeseen costs that could also require us to seek additional capital. As a result, we will need to raise additional debt and/or equity funding. However, no assurance can be given that we will be able to sell any of such securities. An inability to obtain such funding would prevent us from developing any biomass feedstock plantations. Our ability to obtain additional capital also will depend on market conditions, national and global economies and other factors beyond our control. The terms of any future debt or equity funding that we may obtain may be unfavorable to us and to our stockholders.

| 18 |

If we are successful and we are able to raise the entire $5,000,000, we will have sufficient funds to meet business development activity costs for the current fiscal year, and we will be able to implement key aspects of our business plan, including business development costs for our energy growing operations. We would have a total of $1,700,000 remaining for working capital. We expect these amounts will be sufficient to initiate and sustain our business development activities for one year.

Upon having been successful in raising $2,500,000, the salary obligation to our CEO, President and Director of Business Strategy will come into effect, and any amounts accrued to date, and monthly amounts going forward, will be payable for a period up to one year including accruals. The initial annual amounts are $200,000, $150,000 and $125,000 respectively. $403,328 has been accrued and unpaid to date.

The amount and timing of additional funds that might be required cannot be definitively stated as at the date of this report and will be dependent on a variety of factors, including the success of our initial operations and the rate of future expansion that we might plan to undertake. If we were to determine that additional funds are required, we would be required to raise additional capital either by way of loans or equity, which, in the case of equity, would be potentially dilutive to existing stockholders. The Company cannot be certain that we will be able to raise any additional capital to fund our operations or expansion past the current fiscal year.

OUR CHALLENGES

Our ability to successfully operate our business and achieve our goals and strategies is subject to numerous challenges and risks as discussed more fully in the section titled "Risk Factors," including for example:

| · | any failure to develop our projects and our inability to sufficiently meet our customers' demands for our products; |

| · | any inability to effectively manage rapid growth; |

| · | risks associated with future joint ventures, strategic alliances or acquisitions; |

| · | economic, political, regulatory, legal and foreign risks associated with alternative energy; and, |

| · | any loss of key members of our three (3) management. |

You should read and consider the information set forth in "Risk Factors" and all other information set forth in this filing.

Regulation

The Company will comply with all U.S.A. and foreign regulations and laws where they apply to agricultural production, mill operation, safety and environmental standards.

Business Development

We are focused on the elements necessary to initiate our castor project. This includes: financing for the project; a long-term contract for the sale of bio oils; execution of agreements with engineering and construction contractors; procurement of mill and farming equipment; and purchase of land for the mill and leases for the land for agricultural operations.

Our experienced management team also continually searches for biomass products and processes that we believe will provide short term revenue and profitability for the Company. We review business plans and technologies to determine if they meet with our potential short-term goals and criteria.

There can be no assurance the above will ever be achieved.

| 19 |

Results of Operations

We did not have any revenues during the year ended November 30, 2011, or since inception in September of 2010.

We incurred operating expenses of $968,655 and $1,334 for the year ended November 30, 2011, and since inception in 2010, respectively. Our operating expenses primarily consisted of development, accounting, audit and legal, consulting, employee accrued salaries and administrative expenses.

The Company realized a net loss from continuing operations of $968,655 and $1,334 for the year ended November 30, 2011, and since inception in 2010, respectively.

Liquidity and Capital Resources

The Company does not currently have sufficient resources to cover on-going expenses and expansion. As of November 30, 2011, the Company had cash of $6,111 and current liabilities of $550,031. Our current liabilities include accrued salaries of $403,328. Our operations used $319,520 in cash since inception in September 2010. We have historically financed our operations primarily through private placements of common stock and loans from our Officers.

We plan on raising additional funds from investors to implement our business model. In the event we are unsuccessful, this will have a negative impact on our operations.