Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WESBANCO INC | d811498d8k.htm |

| EX-2.1 - EX-2.1 - WESBANCO INC | d811498dex21.htm |

| EX-99.2 - EX-99.2 - WESBANCO INC | d811498dex992.htm |

| EX-2.2 - EX-2.2 - WESBANCO INC | d811498dex22.htm |

Exhibit 99.1 |

Forward-Looking Statements

2

Matters set forth in this filing contain certain forward-looking statements, including certain

plans, expectations, goals, and projections, and including statements about the benefits of the

proposed Merger between WesBanco and ESB, which are subject to numerous assumptions, risks, and

uncertainties. Actual results could differ materially from those contained or implied by such

statements for a variety of factors including: the businesses of WesBanco and ESB may not be

integrated successfully or such integration may take longer to accomplish than expected; the

expected cost savings and any revenue synergies from the proposed Merger may not be fully

realized within the expected timeframes; disruption from the proposed Merger may make it more

difficult to maintain relationships with clients, associates, or suppliers; the required

governmental approvals of the proposed Merger may not be obtained on the expected terms and

schedule; WesBanco’s shareholders may not approve the issuance of shares of WesBanco

common stock in connection with the Merger; ESB’s shareholders may not approve the

proposed Merger; changes in economic conditions; movements in interest rates; competitive

pressures on product pricing and services; success and timing of other business strategies; the

nature, extent, and timing of governmental actions and reforms; and extended disruption of vital

infrastructure; and other factors described in WesBanco’s 2013 Annual Report on Form

10-K, ESB’s 2013 Annual Report on Form 10-K, and documents subsequently filed by

WesBanco and ESB with the Securities and Exchange Commission, including both companies’

Form 10-Qs as of March 31 and June 30, 2014 and both companies’ Form 8-K regarding

its net income for the quarter ended September 30, 2014. All forward-looking statements

included in this filing are based on information available at the time of the release. Neither

WesBanco nor ESB assumes any obligation to update any forward-looking statement.

|

Transaction

Highlights

3

Compelling

Strategic

Rationale

Strong

Financial

Results

(1)

Significantly

expands

presence

in

large

attractive

Pittsburgh

market

-

top

10

player

in

Pittsburgh

MSA

(1)

Roughly 30% of pro forma WesBanco franchise in Pittsburgh/Western PA

Builds on prior acquisition of Fidelity in Pittsburgh through greater penetration

in market Highly experienced Pittsburgh market management team

Leverages WesBanco platform product suite through ESB’s distribution

Last standing sizable franchise left in market with desirable branch

locations Voted again as top 10 performing thrift for 2013 by SNL

Similar disciplined risk cultures and customer focus

Proven track record of acquisitions

Expected

to

be

3%

accretive

to

2015

EPS

excluding

one-time

charges

Run

rate

EPS

accretion

of

9-10%

in

2016

and

beyond

Internal rate of return in the high teens

Tangible book value dilution of 7.4% with restructuring charges

Remain

well

in

excess

of

“Well

Capitalized”

guidelines

on

pro

forma

basis

Earn-back of dilution of 2.4 years using incremental retained earnings method

and 5.4 years using crossover method reflecting all merger-related

expenses, purchase accounting adjustments and cost savings

Pittsburgh MSA deposit market share rankings exclude

Bank of New York Mellon.

Incremental retained earnings method defined as the number of years required to earn back the tangible

book value per share dilution at close using estimated incremental retained earnings (defined as

ESB earnings, synergies, and purchase accounting adjustments minus dividends paid on new shares

issued). Crossover method defined as the number of years for projected pro forma tangible book

value per share to exceed projected stand-alone tangible book value per share.

|

Summary

of Key Terms (1)

Based on 18,378,111 of ESBF shares outstanding on a fully diluted basis and fifteen

day average closing price of WSBC common stock of $31.66 as of 10/27/2014.

Transaction Value:

Implied

consideration of $17.65 per ESBF common share or $324.4 million in aggregate

(1)

Form of Consideration:

90% stock / 10% cash, or 0.502 WSBC shares using a fixed exchange ratio plus

$1.76 in cash for each share of ESBF common stock

(1)

Walkaway

Provision:

“Double-trigger”

provision:

15% or greater decline in WSBC stock and

15% or greater decline in WSBC’s stock price relative to the NASDAQ Bank

Stock Index Expected Closing:

First or second quarter 2015

Required Approvals:

Customary regulatory

and shareholder approval of both companies

Due Diligence:

Completed

Financing:

Existing cash on hand

Board of Directors:

2 ESBF Board Seats granted to Charlotte Zuschlag and another director of ESB or

ESB Bank to be mutually agreed upon prior to the effective merger

date Pro Forma Ownership:

77% WSBC / 23% ESBF

4 |

Franchise Comparison

(1) Reflects new branch opening in Southpointe, Washington County on

11/3/2014. Financial data as of 9/30/2014 or for the nine months ended

9/30/2014. Source: SNL Financial.

($ in Millions)

WesBanco, Inc.

ESB Financial Corporation

Assets

$6,278

$1,945

Deposits

$5,102

$1,337

Loans / Deposits

79.1%

53.4%

Tangible Common Equity

$472

$165

Net Income

$53.5

$13.6

Net Interest Margin

3.62%

2.80%

Efficiency Ratio

59.3%

56.7%

Cost of Total Deposits

0.34%

0.53%

ROAA

1.15%

0.93%

ROAE

9.2%

9.1%

Headquarters

Wheeling, WV

Ellwood City, PA

Branches

120

(1)

23

Top 5 Counties

Ohio & Wood (WV),

Franklin & Belmont (OH),

Allegheny (PA)

Beaver, Allegheny,

Lawrence, Butler

(All in PA)

Balance Sheet

Operational

Franchise

5

ROATCE

16.0%

11.8% |

Acquisition

of

ESB

Would

Make

WSBC

Top 10 Player in Pittsburgh MSA

6

WesBanco Deposit Market Share Over Time

in the Pittsburgh MSA

2012

PF 2012

PF 2014

Pittsburgh expansion key to WesBanco continued

transformation

Pittsburgh is the 2

nd

largest MSA in Pennsylvania and

serves as an engine of loan growth for WesBanco

Current loans to deposits in Pittsburgh / Western

PA of 103%

(2)

With ESB, WesBanco can leverage greater footprint

to substantially grow franchise in Pittsburgh

Revenue opportunity from fee income businesses

including trust and wealth management overlay not

factored in current analysis

Deposit market share excludes Bank of New York Mellon.

Rank

Institution

Branches

Deposits

($MM)

Market

Share

1

PNC Financial Services Group

152

49,740

50.6%

2

Royal Bank of Scotland Group

129

7,505

7.6%

3

F.N.B. Corp.

86

4,030

4.1%

4

Dollar Bank FSB

37

3,656

3.7%

5

First Niagara Financial Group

59

2,752

2.8%

6

Huntington Bancshares Inc.

38

2,487

2.5%

7

First Commonwealth Financial

61

2,400

2.4%

8

TriState Capital Holdings Inc.

2

2,274

2.3%

9

S&T Bancorp Inc.

26

1,735

1.8%

10

WesBanco (post acquisition of Fidelity and ESB)

35

(1)

1,478

1.5%

…

13

WesBanco (post acquisition of Fidelity)

15

556

0.6%

…

39

WesBanco (without Fidelity or ESB)

2

81

0.1%

Source: SNL Financial.

(2)

Financial data as of 6/30/2014.

(1)

Does not include the anticipated closing of two branches.

|

Complementary Pro Forma Branch Map in

Pittsburgh MSA / Western Pennsylvania

7

ESBF

Loans / Deposits

53%

WSBC Western PA

Loans / Deposits

(1)

103%

ESBF

financial

data

as

of

9/30/2014.

Includes

new

branch

opening

in

Southpointe.

(1)

WSBC deposit and loan total of $509MM and $526MM, respectively, as of 6/30/14.

Source: SNL Financial, company financials.

ESBF

WSBC |

In

Addition, ESB Further Reinforces WesBanco Footprint in Marcellus/Utica Shale

Play 8

Marcellus/Utica Shale Regional Coverage

WSBC (120)

ESBF (23)

94% of pro forma bank franchise is located within the Marcellus/Utica Shale

region |

Post

Acquisition, Pittsburgh / Western PA Would Comprise Almost 30% of WesBanco’s

Franchise Note: Loan and deposit data as of 6/30/14. Pro forma does not

include purchase accounting adjustments. Source: SNL Financial, company

financials. ESBF (23)

WSBC (120)

9 |

Pittsburgh Continues to be a Vibrant Market

10

Source: SNL, ESRI, Bureau of Labor Statistics, RealtyTrac and FHFA.

Pittsburgh

Commercial

Market

–

Continued

Opportunity

Pittsburgh MSA Economic Indicators

Projected Median Household

Income 5-Year CAGR (2014-2019)

Home Price Index Change

Since First Quarter 2009

Retail CRE Vacancy Rate

Second Quarter 2014

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

20-500 Employees

Businesses

500+ Employees

Middle Market and Corporate

Pittsburgh MSA

Pennsylvania MSA Average

National MSA Average

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

<20 Employees

Small Businesses

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

Detroit

Indianapolis

Cleveland

Milwaukee

Charlotte

Richmond

Minneapolis

Benchmark Avg

Denver

Cincinnati

St. Louis

US Average

Kansas City

Philadelphia

Boston

Baltimore

Pittsburgh

(5.0%)

0.0%

5.0%

10.0%

15.0%

20.0%

Indianapolis

Cleveland

Milwaukee

Cincinnati

St. Louis

Detroit

Kansas City

Benchmark Avg

Minneapolis

Charlotte

Denver

US Average

Richmond

Philadelphia

Pittsburgh

Boston

Baltimore

(5.0%)

5.0%

15.0%

25.0%

35.0%

Milwaukee

Richmond

Baltimore

Philadelphia

St. Louis

Charlotte

Cincinnati

Kansas City

Cleveland

US Average

Benchmark Avg

Boston

Minneapolis

Indianapolis

Detroit

Denver

Pittsburgh |

Pro

Forma Financial Impact 11

Attractive financial returns:

2015 EPS accretion of 3% excluding one-time charges and 9-10% accretion in

2016 and beyond 7.4%

dilution

of

tangible

book

value

per

share

(1)

with

earn-back

of

2.4

years

using

incremental

retained

earnings

method and 5.4 years using crossover method

Internal rate of return in the high teens

Price

to

tangible

book

value

per

share

of

191%

and

price

to

last

twelve

months

earnings’

ended

September

30,

2014 of 18.1x

Key Assumptions:

Approximately 50% cost savings (56% phased in during 2015 and 100% thereafter)

inclusive of 2 branch closures Conservative

gross

loan

credit

mark

of

$16.2

million;

validated by

3

party

credit

review by big 4 accounting firm

Interest rate loan mark up of $6.2 million and deposit mark up of $5.6

million Write-down of fixed assets, OREO and other assets of $2.2

million Core

deposit

intangibles

of

1.3%

amortized

over

10

years

using

sum-of-years’

digits

One-time pre-tax restructuring charge of $26 million

Goodwill at closing anticipated to be $160

-

165 million

Assumes 9.0 million shares of WSBC and $40 million of cash (excluding restructuring

charges) issued to ESB shareholders

(1) Includes restructuring charges.

rd |

Cost

Savings Largely Driven By Elimination of Executive Officers, Back-Office

Synergies and Branch Closures 12

Approximately $16 million in expected pre-tax cost savings

Approximately 50% cost savings (56% phased in during 2015 and 100%

thereafter) All twelve executive officers eliminated from combination

Assumes consolidation of 2 branches with nearby WesBanco offices

Cost Savings Detail

Estimated Cost Savings

Approximate Amount (MM)

Executive Officer Compensation & Benefits

$7.0

Employee Compensation & Benefits

4.7

Data Processing

1.7

Other

2.6

Total Estimated Cost Savings

$16.0 |

Pro

Forma Capital Ratios Remain Strong 13

(1)

Assumes transaction closed 9/30/2014 for illustrative purposes. Also assumes the

redemption of $36 million of ESB trust preferred securities. (2)

Assumes WSBC actual ratios at 9/30/2014 plus FactSet Street Estimates, ESB

transaction closing, and continuation of current quarterly cash dividend through 3/31/2015.

Also assumes the redemption of $36 million of ESB trust preferred securities.

WSBC

9/30/2014

Pro Forma

9/30/2014

(1)

Projected at

Closing

(2)

Tangible Common Equity/Tangible Assets

7.9%

7.3%

7.6%

Tier 1 Common Ratio

11.0%

10.8%

11.2%

Tier 1 Risk-Based Capital

13.6%

12.8%

13.1%

Tier 1 Leverage Ratio

9.7%

8.6%

9.1%

Total 1 Risk-Based Capital

14.6%

13.7%

14.0% |

Pricing

In Line With Relevant Deals 14

(1) ESB’s ROAA and ROAE were 0.94% and 9.0% for the three months ended

9/30/2014. (2) Parkvale Financial Corporation‘s LTM core earnings of $8.3

million used for LTM EPS, LTM ROAA and Deal Metrics

Announcement Date

10/29/2014

9/8/2014

6/15/2011

Deal Value

$324.4

$367.4

$163.0

Price/ Book

1.52x

1.90x

1.38x

Price/ Tangible Book

1.91x

2.16x

1.98x

Price/ LTM EPS

18.1x

17.4x

18.6x

(2)

Target Financials (MM)

Total Assets

$1,945

$1,858

$1,801

Total Deposits

$1,337

$1,573

$1,481

Branches

23

32

47

Deposits per Branch

$58

$49

$32

ROAA (LTM)

0.91%

1.14%

0.46%

(2)

ROAE (LTM)

9.0%

11.5%

6.7%

(2)

LTM ROAE vs. actual net income of $(15.2 million).

Source: SNL Financial, MRQ available.

(1)

(1) |

Summary

15

Strategic

continued

expansion

into

Pittsburgh

-

Top

10

player in Pittsburgh MSA

(1)

ESB is a sizable franchise with desirable branch locations

with similar disciplined risk culture and customer focus –

Top 10 performing thrift

WesBanco is focused on targeted M&A opportunities

within its existing franchise and also upon opportunities in

urban markets contingent to its existing franchise

History of successful consolidations with a seasoned

management team, technology/back office support and

capital/liquidity strength

Compelling financial results

(1) Pittsburgh

MSA

deposit

market

share

rankings

exclude

Bank

of

New

York

Mellon. |

Appendix |

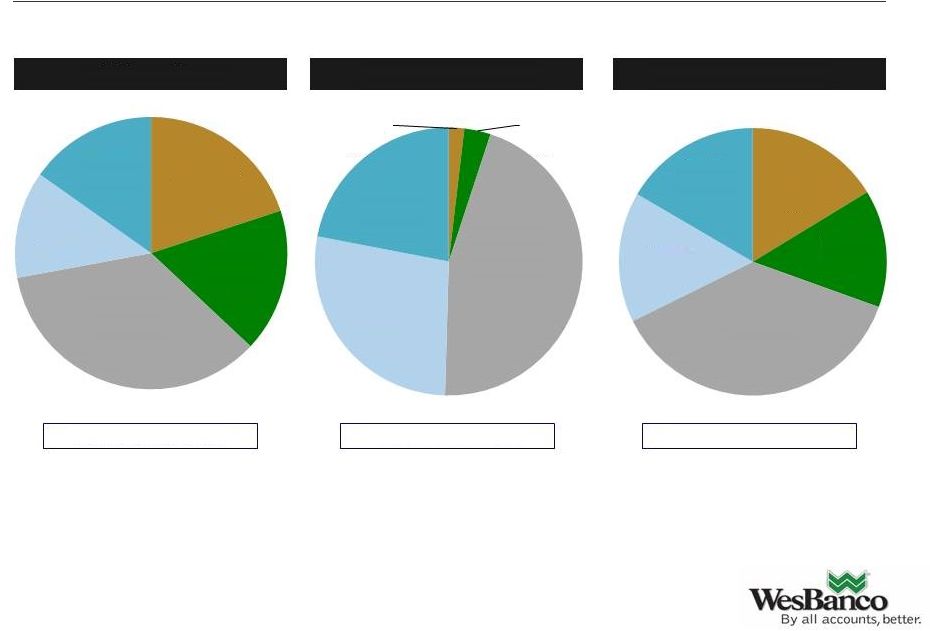

Pro

Forma Deposit Composition 17

WesBanco, Inc.

ESB Financial Corporation

Combined

Cost of Deposits: 0.34%

Cost of Deposits: 0.52%

Cost of Deposits: 0.38%

Source: SNL Financial. Represents regulatory deposit composition as of

6/30/2014. Jumbo deposits represent time deposits greater than $100,000.

Does not include any purchase accounting adjustments. 1. Core deposits equal

total deposits minus jumbo deposits and brokered deposits. Noninterest

-bearing

20%

NOW &

Other

17%

Savings &

MMDAs

35%

Retail

13%

Jumbo

15%

Noninterest

-bearing

2%

NOW &

Other

3%

Savings &

MMDAs

45%

Retail

28%

Jumbo

22%

Noninterest

-bearing

16%

NOW &

Other

14%

Savings &

MMDAs

37%

Retail

16%

Jumbo

17% |

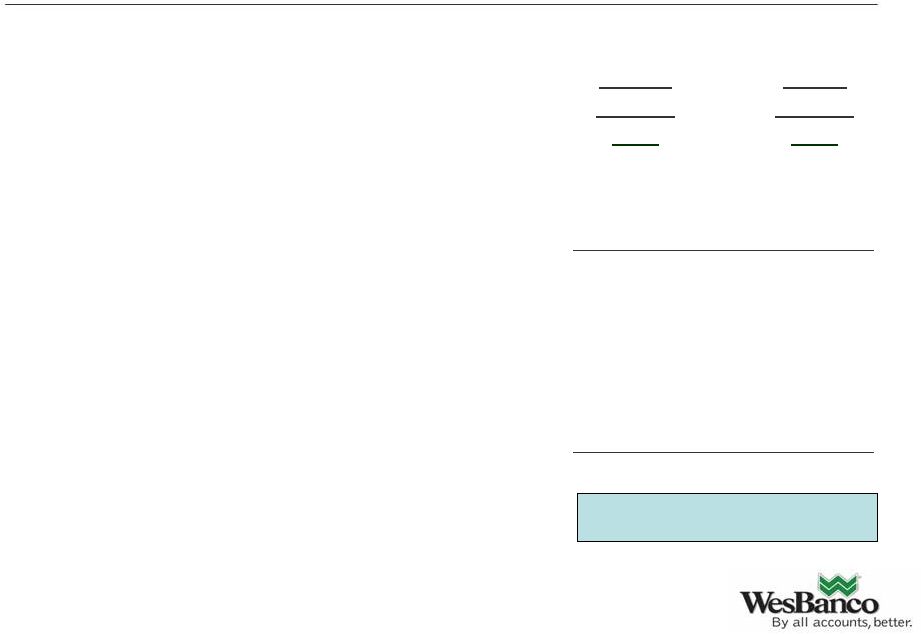

Pro

Forma Loan Composition 18

WesBanco, Inc.

ESB Financial Corporation

Combined

Yield on Loans: 4.38%

Yield on Loans: 4.57%

Yield on Loans: 4.41%

Construction

7%

Single

Family

34%

Multifamily

7%

Commercial

Real Estate

32%

C&I

10%

Consumer

5%

Other

5%

Construction

5%

Single

Family

60%

Multifamily

6%

Commercial

Real Estate

12%

C&I

2%

Consumer

8%

Other

7%

Construction

6%

Single

Family

38%

Multifamily

7%

Commercial

Real Estate

29%

C&I

9%

Consumer

6%

Other

5%

Source: SNL Financial. Represents regulatory loan composition as of 6/30/2014. Does not include any

purchase accounting adjustments. |

WSBC

9/30/14

YTD

ESBF

9/30/14

YTD

Non-interest Expense

$120,810

$22,609

Less: Amortization of Intangibles and Goodwill

1,454

85

Non-interest Expense Excluding Amortization of Intangibles and

Goodwill

$119,356

$22,524

Net interest income (on a fully taxable equivalent basis)

$149,754

$35,197

Non-interest income

51,406

4,562

Total income

$201,160

$39,759

Non-interest expense / total income (efficiency ratio)

59.3%

56.7%

Non-GAAP Financial Measures

Efficiency Ratio

19

Source: SNL Financial.

($ in thousands) |

WSBC

3Q’14

ESBF

3Q’14

Total common shareholder’s equity

$788,784

$206,400

Less: goodwill & other intangible assets, net of def. tax liabilities

(317,217)

(41,632)

Tangible common equity

$471,567

$164,678

Total assets

$6,278,494

$1,945,398

Less: goodwill & other intangible assets, net of def. tax liabilities

(317,217)

(41,632)

Tangible assets

$5,961,277

$1,903,766

Tangible common equity to tangible assets

7.9%

8.7%

Non-GAAP Financial Measures

Tangible Common Equity to Tangible Assets

20

Source: SNL Financial.

($ in thousands) |

WSBC

9/30/14

YTD

ESBF

9/30/14

YTD

Net income*

$71,478

$18,167

Plus: amortization of intangibles* (tax effected at 35%)

1,264

74

Net income before amortization of intangibles*

$72,742

$18,240

Average

total

common

shareholders’

equity

$773,294

$196,701

Less: average goodwill & other intangibles, net of def. tax

liabilities

(317,217)

(41,671)

Average tangible common equity

$455,616

$155,030

Return on average tangible common equity

16.0%

11.8%

Non-GAAP Financial Measures

Return on Average Tangible Common Equity

21

Source: SNL Financial.

* Annualized

($ in thousands) |

|