Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HANCOCK WHITNEY CORP | d808245d8k.htm |

Exhibit 99.1

For Immediate Release

October 23, 2014

For More Information

Trisha Voltz Carlson

SVP, Investor Relations Manager

504.299.5208

trisha.carlson@hancockbank.com

Hancock reports third quarter 2014 financial results

Operating E.P.S. flat linked-quarter; core E.P.S. up 6.5%

GULFPORT, Miss. (October 23, 2014) — Hancock Holding Company (Nasdaq: HBHC) today announced its financial results for the third quarter of 2014. Net income for the third quarter of 2014 was $46.6 million, or $.56 per diluted common share, compared to $40.0 million, or $.48 in the second quarter of 2014 and $33.2 million, or $.40 in the third quarter of 2013.

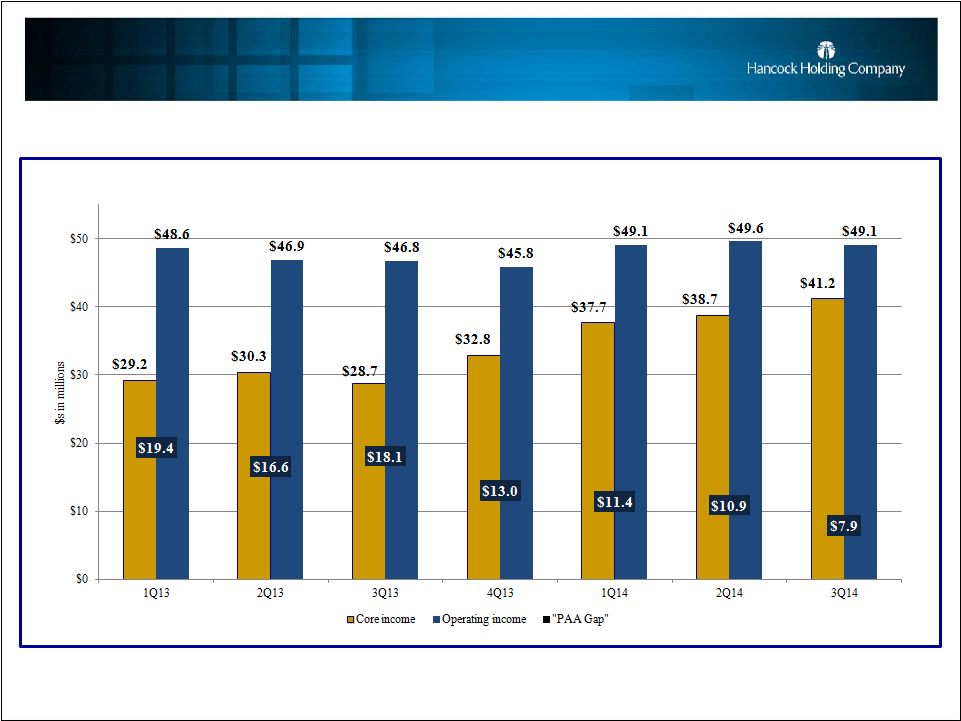

Operating income for the third quarter of 2014 was $49.1 million, or $.59 per diluted common share, compared to $49.6 million, or $.59, in the second quarter of 2014. Operating income was $46.8 million, or $.56, in the third quarter of 2013. We define our operating income as net income excluding tax-effected securities transactions gains or losses and nonoperating expense items. Nonoperating expenses totaled $3.9 million and $12.1 million (pre-tax), in the third and second quarters of 2014, respectively, and $20.9 million (pre-tax) in the third quarter of 2013. Management believes that operating income is a useful measure of financial performance that helps investors compare the company’s fundamental operational performance from period to period. The financial tables include a reconciliation of net income to operating income.

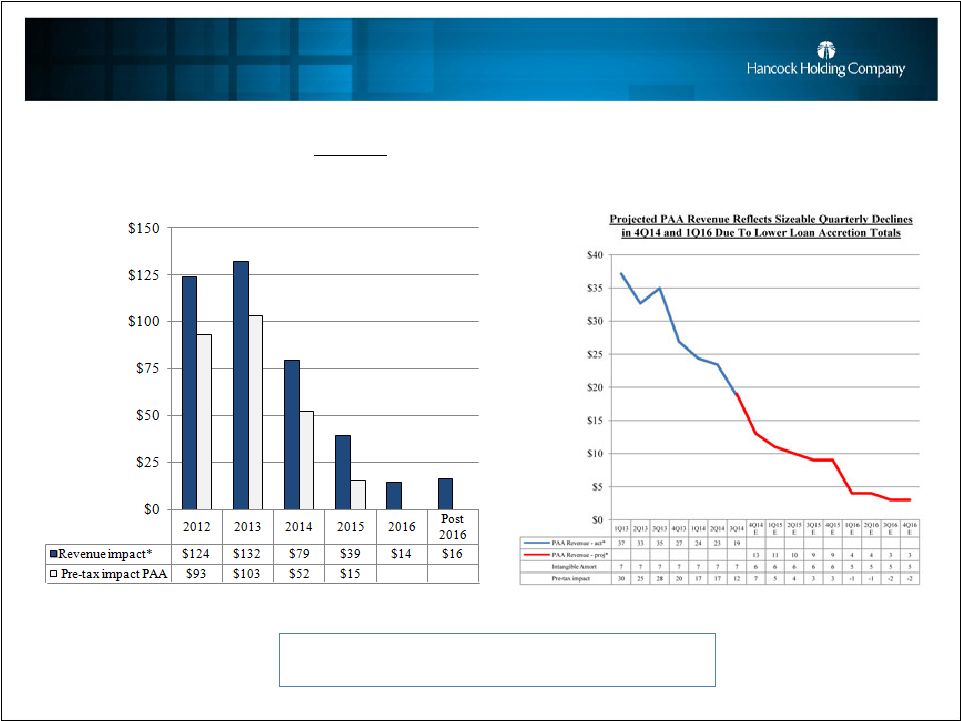

Over the past several quarters we have disclosed our strategic initiatives designed to replace declining levels of purchase accounting income from recent acquisitions with improvement in core income, which the company defines as operating income (defined above) excluding tax-effected purchase accounting adjustments. This effort should improve the overall quality of the Company’s earnings. Management believes that consistent reporting of core income helps investors recognize the pace of management successfully executing its strategic initiatives. Our core income for the third quarter of 2014 was $41.2 million or $.49 per diluted common share, compared to $38.7 million, or $.46 in the second quarter of 2014 and $28.7 million, or $.34, in the third quarter of 2013. The financial tables include a reconciliation of net income to core income.

“The combination of our successful expense reduction initiative and investments in revenue-generating initiatives, along with our emphasis on loan and deposit growth across our footprint, is allowing us to gradually replace declining purchase accounting income with solid core results,” said Hancock’s President and Chief Executive Officer Carl J. Chaney. “Our success in

1

Hancock reports third quarter 2014 financial results

October 23, 2014

growing core revenue this quarter has narrowed the gap between operating and core results, with core E.P.S. growing 6.5% linked-quarter. I am very proud of what we have been able to accomplish so far, and look forward to continuing our success in future quarters.”

Highlights of the company’s third quarter of 2014 results:

| • | Net loan growth of $488 million, or 16% linked-quarter annualized; approximately $1.7 billion, or 15%, year-over-year loan growth (each excluding the FDIC-covered portfolio) |

| • | Net deposit growth of $491 million, or 13% linked-quarter annualized; completely funding the loan growth in the third quarter |

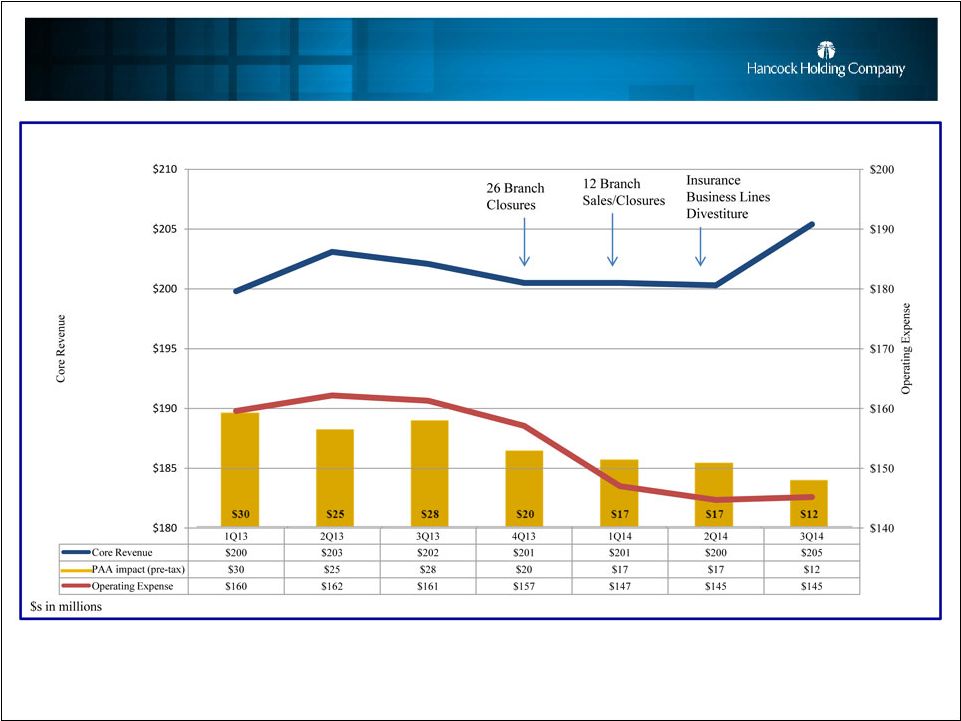

| • | An increase of $5 million in core revenue offset a $5 million decline in purchase accounting revenue |

| • | Operating expenses remained relatively stable and remain below the targeted expense goal of $147 million for the fourth quarter of 2014 |

| • | Solid capital levels with a tangible common equity (TCE) ratio of 9.10%; approximately $10 million of capital used to repurchase stock during the quarter |

| • | Return on average assets (ROA) (operating) of 1.00% down from 1.04%; core ROA up 2bps; total assets grew to $20 billion from second quarter of 2014 |

Loans

Total loans at September 30, 2014 were $13.3 billion, up $465 million from June 30, 2014. Excluding the FDIC-covered portfolio, which declined $23 million during the third quarter of 2014, total loans increased $488 million, or 4% linked-quarter. The growth in deposits, noted in the section below, fully funded the loan growth in the third quarter of 2014.

All markets across the franchise reported net loan growth during the quarter, with south Louisiana, Houston and central Florida generating over half of the increase. Mortgage and indirect lending generated approximately 30% of the quarter’s net loan growth.

Average loans totaled $13.1 billion for the third quarter of 2014, up $421 million, or 3%, from the second quarter of 2014.

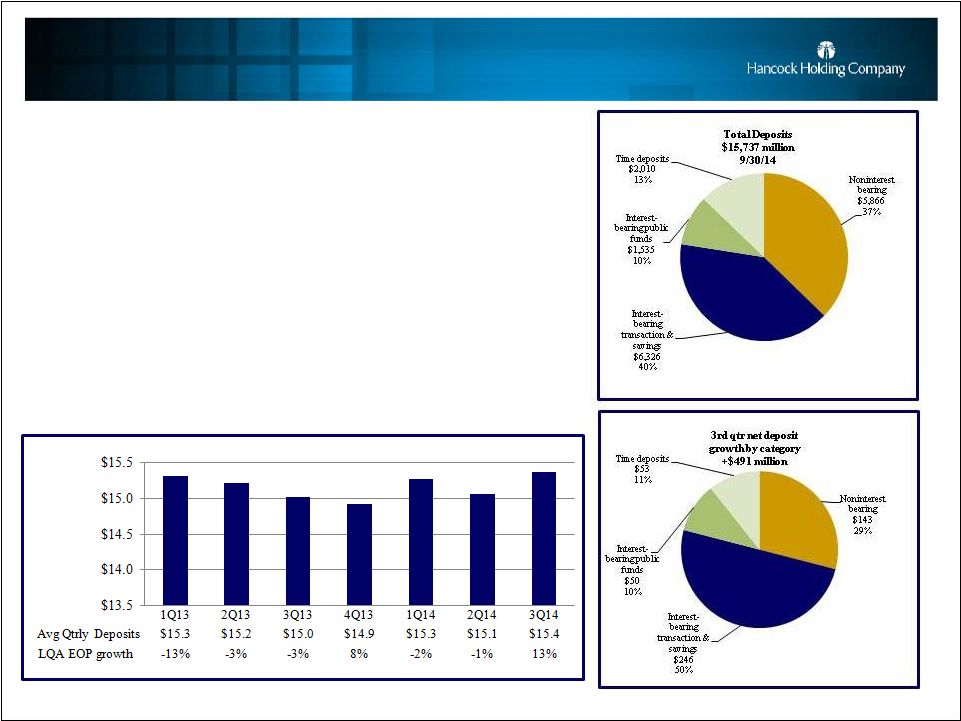

Deposits

Total deposits at September 30, 2014 were $15.7 billion, up $491 million, or 3%, from June 30, 2014. Average deposits for the third quarter of 2014 were $15.4 billion, up $311 million, or 2%, from the second quarter of 2014. Initiatives were put in place recently with a focus on growing deposits in order to fund the Company’s loan growth. Previously the loan growth had been funded primarily through runoff in the securities portfolio.

Noninterest-bearing demand deposits (DDAs) totaled $5.9 billion at September 30, 2014, up $143 million, or 2.5%, compared to June 30, 2014. DDAs comprised 37% of total period-end deposits at September 30, 2014.

Interest-bearing transaction and savings deposits totaled $6.3 billion at the end of the third quarter of 2014, up $246 million, or 4%, from June 30, 2014. Time deposits (CDs) and interest-bearing public fund deposits totaled $3.5 billion at September 30, 2014, up $103 million, or 3%, from June 30, 2014.

2

Hancock reports third quarter 2014 financial results

October 23, 2014

Asset Quality

Nonperforming assets (NPAs) totaled $147.2 million at September 30, 2014, down $10.3 million from June 30, 2014. During the third quarter of 2014, total nonperforming loans declined $6.7 million, and foreclosed and surplus real estate (ORE) and other foreclosed assets decreased $3.6 million. Nonperforming assets as a percent of total loans, ORE and other foreclosed assets was 1.10% at September 30, 2014, down 12 bps from June 30, 2014.

The total allowance for loan losses was $125.6 million at September 30, 2014, down $3.1 million from June 30, 2014. The ratio of the allowance for loan losses to period-end loans was .94% at September 30, 2014, compared to 1.00% at the end of the second quarter of 2014. The change in the allowance during the third quarter reflects a $3.4 million increase in the allowance maintained on the noncovered portion of the loan portfolio, offset by a $6.5 million reduction in the allowance on covered loans.

Net charge-offs from the noncovered loan portfolio were $6.4 million, or 0.19% of average total loans on an annualized basis in the third quarter of 2014, up from $4.1 million, or 0.13% of average total loans in the second quarter of 2014.

During the third quarter of 2014, Hancock recorded a total provision for loan losses of $9.5 million, up $2.8 million from the second quarter of 2014, primarily related to the noncovered portion of the allowance. The increase in the loan loss provision was primarily related to the growth in loans during the third quarter.

Net Interest Income and Net Interest Margin

Net interest income (TE) for the third quarter of 2014 was $166.2 million, down $1.1 million from the second quarter of 2014. The impact of purchase accounting items on net interest income was $21.5 million, down $5.2 million linked-quarter. Excluding the impact from purchase accounting items, core net interest income increased $4.1 million linked-quarter. Average earning assets were $17.3 billion for the third quarter of 2014, up $533 million, or 3%, from the second quarter of 2014.

The reported net interest margin (TE) was 3.81% for the third quarter of 2014, down 18 bps from the second quarter of 2014. The core net interest margin (reported net interest income (TE) excluding total net purchase accounting adjustments, annualized, as a percent of average earning assets) declined 3 bps to 3.32% during the third quarter of 2014. Declines in the core loan yield (-3 bps) and securities portfolio yield (-7 bps) were partly offset by an improved earning asset mix and a lower cost of funds (-1 bp).

Noninterest Income

Noninterest income, including securities transactions, totaled $57.9 million for the third quarter of 2014, up $1.5 million, or 3%, from the second quarter of 2014. Included in the total is a reduction of $2.8 million related to the amortization of the indemnification asset, compared to a reduction of $3.3 million in the second quarter of 2014. Excluding the impact of this item, core noninterest income increased by approximately $1.0 million linked-quarter.

3

Hancock reports third quarter 2014 financial results

October 23, 2014

Service charges on deposits totaled $20.0 million for the third quarter of 2014, up $0.7 million, or 4%, from the second quarter of 2014. Bank card and ATM fees totaled $11.6 million, virtually unchanged from the second quarter of 2014.

Investment and annuity fees totaled $5.5 million, up $0.4 million, or 8%, linked-quarter. Trust fees totaled $11.5 million, unchanged from the second quarter of 2014.

Fees from secondary mortgage operations totaled $2.3 million for the third quarter of 2014, up $0.6 million, or 32%, linked-quarter. A slightly higher percentage of the mortgage loans originated during the quarter were sold in the secondary market compared to the second quarter of 2014.

Other noninterest income totaled $7.7 million, down $.9 million, or 10%, from $8.6 million in the second quarter of 2014. The decline reflects the impact from $0.5 million of additional miscellaneous income in the second quarter of 2014.

Noninterest Expense & Taxes

Noninterest expense for the third quarter of 2014 totaled $149.1 million and included $3.9 million of nonoperating expenses. The nonoperating expenses were mainly related to the Company’s ongoing expense and efficiency initiative. Excluding these costs, operating expense totaled $145.2 million in the third quarter of 2014, up $0.5 million, or less than 1%, linked-quarter. (The details of the changes in the noninterest expense categories noted below exclude the impact of nonoperating items.)

Total personnel expense was $80.0 million in the third quarter of 2014, up $0.5 million, or less than 1%, from the second quarter of 2014. Occupancy and equipment expense totaled $15.3 million in the third quarter of 2014, up $0.4 million, or 3%, from the second quarter of 2014.

Net gains on ORE dispositions exceeded ORE expense in the third quarter of 2014 by $104,000, compared to $84,000 of net expense in the second quarter of 2014. Management does not expect this low level of ORE expense to be sustainable in future quarters.

Other operating expense totaled $43.3 million in the third quarter of 2014, virtually unchanged from the second quarter of 2014.

The effective income tax rate for the third quarter of 2014 was 26%, down from 31% in the second quarter of 2014. The second quarter’s higher rate included certain nonoperating items noted last quarter primarily related to the divestiture of selected insurance lines of business. Management expects the effective income tax rate to approximate 27% for the remainder of 2014. The effective income tax rate continues to be less than the statutory rate of 35% due primarily to tax-exempt income and tax credits.

4

Hancock reports third quarter 2014 financial results

October 23, 2014

Capital

Common shareholders’ equity at September 30, 2014 totaled $2.5 billion. The tangible common equity (TCE) ratio was 9.10%, down 19 bps from June 30, 2014. The decline in the TCE ratio reflects organic growth in the balance sheet and the repurchase of common shares during the quarter. Assets totaled $20 billion at September 30, 2014, up $637 million from June 30, 2014. In July of 2014, the Board of Directors authorized a new common stock repurchase program for up to 5%, or approximately 4 million shares, of the Company’s common stock. During the third quarter, the Company repurchased 305,263 shares of its common stock at an average price of $32.65. Shares may be repurchased in the open market or in privately negotiated transactions from time to time, depending upon market conditions and other factors, and in accordance with applicable regulations of the Securities and Exchange Commission. The repurchase authorization will expire December 31, 2015. Additional capital ratios are included in the financial tables.

Conference Call and Slide Presentation

Management will host a conference call for analysts and investors at 9:00 a.m. Central Time on Friday, October 24, 2014 to review the results. A live listen-only webcast of the call will be available under the Investor Relations section of Hancock’s website at www.hancockbank.com. Additional financial tables and a slide presentation related to third quarter results are also posted as part of the webcast link. To participate in the Q&A portion of the call, dial (877) 564-1219 or (973) 638-3429. An audio archive of the conference call will be available under the Investor Relations section of our website. A replay of the call will also be available through October 31, 2014 by dialing (855) 859-2056 or (404) 537-3406, passcode 13265311.

About Hancock Holding Company

Hancock Holding Company is a financial services company with regional business headquarters and locations throughout a growing Gulf South corridor. The company’s banking subsidiary provides a comprehensive network of full-service financial choices through Hancock Bank locations in Mississippi, Alabama, and Florida and Whitney Bank offices in Louisiana and Texas, including traditional and online banking; commercial and small business banking; energy banking; private banking; trust and investment services; certain insurance services; mortgage services; and consumer financing. More information and online banking are available at www.hancockbank.com and www.whitneybank.com.

Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of section 27A of the Securities Act of 1933, as amended, and section 21E of the Securities Exchange Act of 1934, as amended, and we intend such forward-looking statements to be covered by the safe harbor provisions therein and are including this statement for purposes of invoking these safe-harbor provisions. Forward-looking statements provide projections of results of operations or of financial condition or state other forward-looking information, such as expectations about future conditions and descriptions of plans and strategies for the future. Forward-looking statements that we may make include, but may not be limited to, comments with respect to future levels of economic activity in our markets, loan growth, deposit trends, credit quality trends, net interest margin trends, future expense levels, success of revenue-generating initiatives, projected tax rates, future profitability, improvements in expense to revenue (efficiency) ratio, purchase accounting impacts such as accretion levels, the impact of the branch rationalization process, details of the common stock buyback, possible repurchases of shares under stock buyback programs, and the financial impact of regulatory requirements. Hancock’s ability to accurately project results or predict the effects of future plans or strategies is inherently limited. Although Hancock believes that the expectations reflected in its forward-looking statements are based on reasonable assumptions, actual results and performance could differ materially from those set forth in the forward-looking

5

Hancock reports third quarter 2014 financial results

October 23, 2014

statements. Factors that could cause actual results to differ from those expressed in Hancock’s forward-looking statements include, but are not limited to, those risk factors outlined in Hancock’s public filings with the Securities and Exchange Commission, which are available at the SEC’s internet site (http://www.sec.gov).

You are cautioned not to place undue reliance on these forward-looking statements. Hancock does not intend, and undertakes no obligation, to update or revise any forward-looking statements, whether as a result of differences in actual results, changes in assumptions or changes in other factors affecting such statements, except as required by law.

6

HANCOCK HOLDING COMPANY

FINANCIAL HIGHLIGHTS

(Unaudited)

| Three Months Ended | Nine Months Ended | |||||||||||||||||||

| (amounts in thousands, except per share data) |

9/30/2014 | 6/30/2014 | 9/30/2013 | 9/30/2014 | 9/30/2013 | |||||||||||||||

| INCOME STATEMENT DATA |

||||||||||||||||||||

| Net interest income |

$ | 163,541 | $ | 164,778 | $ | 171,530 | $ | 493,881 | $ | 514,724 | ||||||||||

| Net interest income (TE) (a) |

166,230 | 167,332 | 174,112 | 501,759 | 522,675 | |||||||||||||||

| Provision for loan losses |

9,468 | 6,691 | 7,569 | 24,122 | 25,404 | |||||||||||||||

| Noninterest income excluding securities transactions |

57,941 | 56,398 | 63,057 | 171,038 | 187,141 | |||||||||||||||

| Securities transactions gains |

— | — | — | — | — | |||||||||||||||

| Noninterest expense (excluding nonoperating expense items) |

145,192 | 144,727 | 161,318 | 436,901 | 483,170 | |||||||||||||||

| Nonoperating expense items |

3,887 | 12,131 | 20,887 | 16,018 | 20,887 | |||||||||||||||

| Net income |

46,553 | 39,962 | 33,202 | 135,630 | 128,640 | |||||||||||||||

| Operating income (b) |

49,079 | 49,575 | 46,779 | 147,769 | 142,217 | |||||||||||||||

| Core income (c) |

41,176 | 38,736 | 28,678 | 117,654 | 88,253 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PERIOD-END BALANCE SHEET DATA |

||||||||||||||||||||

| Loans |

$ | 13,348,574 | $ | 12,884,056 | $ | 11,734,472 | $ | 13,348,574 | $ | 11,734,472 | ||||||||||

| Investment securities |

3,913,370 | 3,677,229 | 4,124,202 | 3,913,370 | 4,124,202 | |||||||||||||||

| Earning assets |

17,748,600 | 17,023,990 | 16,339,431 | 17,748,600 | 16,339,431 | |||||||||||||||

| Total assets |

19,985,950 | 19,349,431 | 18,801,846 | 19,985,950 | 18,801,846 | |||||||||||||||

| Noninterest-bearing deposits |

5,866,255 | 5,723,663 | 5,479,696 | 5,866,255 | 5,479,696 | |||||||||||||||

| Total deposits |

15,736,694 | 15,245,227 | 15,054,871 | 15,736,694 | 15,054,871 | |||||||||||||||

| Common shareholders’ equity |

2,509,342 | 2,492,582 | 2,356,442 | 2,509,342 | 2,356,442 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| AVERAGE BALANCE SHEET DATA |

||||||||||||||||||||

| Loans |

$ | 13,102,108 | $ | 12,680,861 | $ | 11,805,330 | $ | 12,723,409 | $ | 11,632,166 | ||||||||||

| Investment securities (d) |

3,780,089 | 3,716,563 | 4,135,348 | 3,810,186 | 4,163,436 | |||||||||||||||

| Earning assets |

17,324,444 | 16,791,744 | 16,384,635 | 16,954,320 | 16,467,030 | |||||||||||||||

| Total assets |

19,549,947 | 19,039,264 | 18,796,027 | 19,216,585 | 18,989,197 | |||||||||||||||

| Noninterest-bearing deposits |

5,707,523 | 5,505,735 | 5,415,303 | 5,571,843 | 5,359,325 | |||||||||||||||

| Total deposits |

15,371,209 | 15,060,581 | 15,021,685 | 15,234,018 | 15,180,847 | |||||||||||||||

| Common shareholders’ equity |

2,489,948 | 2,463,385 | 2,338,945 | 2,463,302 | 2,396,941 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| COMMON SHARE DATA |

||||||||||||||||||||

| Earnings per share - diluted |

$ | 0.56 | $ | 0.48 | $ | 0.40 | $ | 1.62 | $ | 1.51 | ||||||||||

| Operating earnings per share - diluted (b) |

0.59 | 0.59 | 0.56 | 1.76 | 1.67 | |||||||||||||||

| Core earnings per share - diluted (c) |

0.49 | 0.46 | 0.34 | 1.40 | 1.04 | |||||||||||||||

| Cash dividends per share |

$ | 0.24 | $ | 0.24 | $ | 0.24 | $ | 0.72 | $ | 0.72 | ||||||||||

| Book value per share (period-end) |

$ | 30.76 | $ | 30.45 | $ | 28.70 | $ | 30.76 | $ | 28.70 | ||||||||||

| Tangible book value per share (period-end) |

21.44 | 21.08 | 19.04 | 21.44 | 19.04 | |||||||||||||||

| Weighted average number of shares - diluted |

81,942 | 82,174 | 82,205 | 82,204 | 83,496 | |||||||||||||||

| Market data |

||||||||||||||||||||

| High sales price |

$ | 36.47 | $ | 37.86 | $ | 33.85 | $ | 38.50 | $ | 33.85 | ||||||||||

| Low sales price |

31.25 | 32.02 | 29.00 | 31.25 | 25.00 | |||||||||||||||

| Period-end closing price |

32.05 | 35.32 | 31.38 | 32.05 | 31.38 | |||||||||||||||

| Trading volume |

25,553 | 27,432 | 29,711 | 84,239 | 97,779 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PERFORMANCE RATIOS |

||||||||||||||||||||

| Return on average assets |

0.94 | % | 0.84 | % | 0.70 | % | 0.94 | % | 0.91 | % | ||||||||||

| Return on average assets (operating) (b) |

1.00 | % | 1.04 | % | 0.99 | % | 1.03 | % | 1.00 | % | ||||||||||

| Return on average common equity |

7.42 | % | 6.51 | % | 5.63 | % | 7.36 | % | 7.18 | % | ||||||||||

| Return on average common equity (operating) (b) |

7.82 | % | 8.07 | % | 7.93 | % | 8.02 | % | 7.93 | % | ||||||||||

| Return on average tangible common equity |

10.70 | % | 9.47 | % | 8.54 | % | 10.72 | % | 10.80 | % | ||||||||||

| Return on average tangible common equity (operating) (b) |

11.28 | % | 11.75 | % | 12.03 | % | 11.68 | % | 11.94 | % | ||||||||||

| Tangible common equity ratio (e) |

9.10 | % | 9.29 | % | 8.68 | % | 9.10 | % | 8.68 | % | ||||||||||

| Net interest margin (TE) (a) |

3.81 | % | 3.99 | % | 4.23 | % | 3.95 | % | 4.24 | % | ||||||||||

| Average loan/deposit ratio |

85.24 | % | 84.20 | % | 78.70 | % | 83.52 | % | 76.80 | % | ||||||||||

| Efficiency ratio (f) |

61.84 | % | 61.67 | % | 64.95 | % | 61.91 | % | 64.93 | % | ||||||||||

| Allowance for loan losses as a percent of period-end loans |

0.94 | % | 1.00 | % | 1.18 | % | 0.94 | % | 1.18 | % | ||||||||||

| Annualized net charge-offs to average loans |

0.19 | % | 0.13 | % | 0.18 | % | 0.15 | % | 0.22 | % | ||||||||||

| Allowance for loan losses to non-performing loans + accruing loans 90 days past due |

128.44 | % | 126.26 | % | 94.69 | % | 128.44 | % | 94.69 | % | ||||||||||

| Noninterest income excluding securities transactions as a percent of total revenue (TE) (a) |

25.85 | % | 25.21 | % | 26.59 | % | 25.42 | % | 26.36 | % | ||||||||||

| (a) | Tax-equivalent (TE) amounts are calculated using a federal income tax rate of 35%. |

| (b) | Net income less tax-effected securities transactions and nonoperating expense items. Management believes that operating income provides a useful measure of financial performance that helps investors compare the Company’s fundamental operations over time. |

| (c) | Operating income excluding tax-effected purchase accounting adjustments. Management believes that reporting on core income provides a useful measure of financial performance that helps investors determine whether management is successfully executing its strategic initiatives. |

| (d) | Average securities does not include unrealized holding gains/losses on available for sale securities. |

| (e) | The tangible common equity ratio is common shareholders’ equity less intangible assets divided by total assets less intangible assets. |

| (f) | The efficiency ratio is noninterest expense to total net interest (TE) and noninterest income excluding amortization of purchased intangibles, nonoperating expense items, and securities transactions. |

7

HANCOCK HOLDING COMPANY

QUARTERLY HIGHLIGHTS

(Unaudited)

| Three Months Ended | ||||||||||||||||||||

| (amounts in thousands, except per share data) |

9/30/2014 | 6/30/2014 | 3/31/2014 | 12/31/2013 | 9/30/2013 | |||||||||||||||

| INCOME STATEMENT DATA |

||||||||||||||||||||

| Net interest income |

$ | 163,541 | $ | 164,778 | $ | 165,562 | $ | 166,007 | $ | 171,530 | ||||||||||

| Net interest income (TE) (a) |

166,230 | 167,332 | 168,198 | 168,466 | 174,112 | |||||||||||||||

| Provision for loan losses |

9,468 | 6,691 | 7,963 | 7,331 | 7,569 | |||||||||||||||

| Noninterest income excluding securities transactions |

57,941 | 56,398 | 56,699 | 58,894 | 63,057 | |||||||||||||||

| Securities transactions gains |

— | — | — | 105 | — | |||||||||||||||

| Noninterest expense (excluding nonoperating expense items) |

145,192 | 144,727 | 146,982 | 157,097 | 161,318 | |||||||||||||||

| Nonoperating expense items |

3,887 | 12,131 | — | 17,116 | 20,887 | |||||||||||||||

| Net income |

46,553 | 39,962 | 49,115 | 34,716 | 33,202 | |||||||||||||||

| Operating income (b) |

49,079 | 49,575 | 49,115 | 45,773 | 46,779 | |||||||||||||||

| Core income (c) |

41,176 | 38,736 | 37,742 | 32,847 | 28,678 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PERIOD-END BALANCE SHEET DATA |

||||||||||||||||||||

| Loans |

$ | 13,348,574 | $ | 12,884,056 | $ | 12,527,937 | $ | 12,324,817 | $ | 11,734,472 | ||||||||||

| Investment securities |

3,913,370 | 3,677,229 | 3,797,883 | 4,033,124 | 4,124,202 | |||||||||||||||

| Earning assets |

17,748,600 | 17,023,990 | 16,622,104 | 16,651,295 | 16,339,431 | |||||||||||||||

| Total assets |

19,985,950 | 19,349,431 | 19,004,170 | 19,009,251 | 18,801,846 | |||||||||||||||

| Noninterest-bearing deposits |

5,866,255 | 5,723,663 | 5,613,872 | 5,530,253 | 5,479,696 | |||||||||||||||

| Total deposits |

15,736,694 | 15,245,227 | 15,274,774 | 15,360,516 | 15,054,871 | |||||||||||||||

| Common shareholders’ equity |

2,509,342 | 2,492,582 | 2,462,534 | 2,425,069 | 2,356,442 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| AVERAGE BALANCE SHEET DATA |

||||||||||||||||||||

| Loans |

$ | 13,102,108 | $ | 12,680,861 | $ | 12,379,316 | $ | 11,903,603 | $ | 11,805,330 | ||||||||||

| Investment securities (d) |

3,780,089 | 3,716,563 | 3,935,616 | 4,070,657 | 4,135,348 | |||||||||||||||

| Earning assets |

17,324,444 | 16,791,744 | 16,740,353 | 16,376,587 | 16,384,635 | |||||||||||||||

| Total assets |

19,549,947 | 19,039,264 | 19,055,107 | 18,739,091 | 18,796,027 | |||||||||||||||

| Noninterest-bearing deposits |

5,707,523 | 5,505,735 | 5,499,993 | 5,483,918 | 5,415,303 | |||||||||||||||

| Total deposits |

15,371,209 | 15,060,581 | 15,269,143 | 14,915,677 | 15,021,685 | |||||||||||||||

| Common shareholders’ equity |

2,489,948 | 2,463,385 | 2,435,980 | 2,355,768 | 2,338,945 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| COMMON SHARE DATA |

||||||||||||||||||||

| Earnings per share - diluted |

$ | 0.56 | $ | 0.48 | $ | 0.58 | $ | 0.41 | $ | 0.40 | ||||||||||

| Operating earnings per share - diluted (b) |

0.59 | 0.59 | 0.58 | 0.55 | 0.56 | |||||||||||||||

| Core earnings per share - diluted (c) |

0.49 | 0.46 | 0.45 | 0.39 | 0.34 | |||||||||||||||

| Cash dividends per share |

$ | 0.24 | $ | 0.24 | $ | 0.24 | $ | 0.24 | $ | 0.24 | ||||||||||

| Book value per share (period-end) |

$ | 30.76 | $ | 30.45 | $ | 29.93 | $ | 29.49 | $ | 28.70 | ||||||||||

| Tangible book value per share (period-end) |

21.44 | 21.08 | 20.47 | 19.94 | 19.04 | |||||||||||||||

| Weighted average number of shares - diluted |

81,942 | 82,174 | 82,534 | 82,220 | 82,205 | |||||||||||||||

| Market data |

||||||||||||||||||||

| High sales price |

$ | 36.47 | $ | 37.86 | $ | 38.50 | $ | 37.12 | $ | 33.85 | ||||||||||

| Low sales price |

31.25 | 32.02 | 32.66 | 30.09 | 29.00 | |||||||||||||||

| Period-end closing price |

32.05 | 35.32 | 36.65 | 36.68 | 31.38 | |||||||||||||||

| Trading volume |

25,553 | 27,432 | 31,328 | 27,816 | 29,711 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PERFORMANCE RATIOS |

||||||||||||||||||||

| Return on average assets |

0.94 | % | 0.84 | % | 1.05 | % | 0.74 | % | 0.70 | % | ||||||||||

| Return on average assets (operating) (b) |

1.00 | % | 1.04 | % | 1.05 | % | 0.97 | % | 0.99 | % | ||||||||||

| Return on average common equity |

7.42 | % | 6.51 | % | 8.18 | % | 5.85 | % | 5.63 | % | ||||||||||

| Return on average common equity (operating) (b) |

7.82 | % | 8.07 | % | 8.18 | % | 7.71 | % | 7.93 | % | ||||||||||

| Return on average tangible common equity |

10.70 | % | 9.47 | % | 12.04 | % | 8.79 | % | 8.54 | % | ||||||||||

| Return on average tangible common equity (operating) (b) |

11.28 | % | 11.75 | % | 12.04 | % | 11.59 | % | 12.03 | % | ||||||||||

| Tangible common equity ratio (e) |

9.10 | % | 9.29 | % | 9.24 | % | 9.00 | % | 8.68 | % | ||||||||||

| Net interest margin (TE) (a) |

3.81 | % | 3.99 | % | 4.06 | % | 4.09 | % | 4.23 | % | ||||||||||

| Average loan/deposit ratio |

85.24 | % | 84.20 | % | 81.20 | % | 79.93 | % | 78.70 | % | ||||||||||

| Efficiency ratio (f) |

61.84 | % | 61.67 | % | 62.23 | % | 65.94 | % | 64.95 | % | ||||||||||

| Allowance for loan losses as a percent of period-end loans |

0.94 | % | 1.00 | % | 1.02 | % | 1.08 | % | 1.18 | % | ||||||||||

| Annualized net charge-offs to average loans |

0.19 | % | 0.13 | % | 0.13 | % | 0.17 | % | 0.18 | % | ||||||||||

| Allowance for loan losses to non-performing loans + accruing loans 90 days past due |

128.44 | % | 126.26 | % | 112.64 | % | 111.97 | % | 94.69 | % | ||||||||||

| Noninterest income excluding securities transactions as a percent of total revenue (TE) (a) |

25.85 | % | 25.21 | % | 25.21 | % | 25.90 | % | 26.59 | % | ||||||||||

| (a) | Tax-equivalent (TE) amounts are calculated using a federal income tax rate of 35%. |

| (b) | Net income less tax-effected securities transactions and nonoperating expense items. Management believes that operating income provides a useful measure of financial performance that helps investors compare the Company’s fundamental operations over time. |

| (c) | Operating income excluding tax-effected purchase accounting adjustments. Management believes that reporting on core income provides a useful measure of financial performance that helps investors determine whether management is successfully executing its strategic initiatives. |

| (d) | Average securities does not include unrealized holding gains/losses on available for sale securities. |

| (e) | The tangible common equity ratio is common shareholders’ equity less intangible assets divided by total assets less intangible assets. |

| (f) | The efficiency ratio is noninterest expense to total net interest (TE) and noninterest income excluding amortization of purchased intangibles, nonoperating expense items, and securities transactions. |

8

HANCOCK HOLDING COMPANY

INCOME STATEMENT

(Unaudited)

| Three Months Ended | Nine Months Ended | |||||||||||||||||||

| (dollars in thousands, except per share data) |

9/30/2014 | 6/30/2014 | 9/30/2013 | 9/30/2014 | 9/30/2013 | |||||||||||||||

| NET INCOME |

||||||||||||||||||||

| Interest income |

$ | 172,701 | $ | 174,001 | $ | 181,639 | $ | 521,842 | $ | 546,560 | ||||||||||

| Interest income (TE) |

175,390 | 176,555 | 184,221 | 529,720 | 554,511 | |||||||||||||||

| Interest expense |

9,160 | 9,223 | 10,109 | 27,961 | 31,836 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income (TE) |

166,230 | 167,332 | 174,112 | 501,759 | 522,675 | |||||||||||||||

| Provision for loan losses |

9,468 | 6,691 | 7,569 | 24,122 | 25,404 | |||||||||||||||

| Noninterest income excluding securities transactions |

57,941 | 56,398 | 63,057 | 171,038 | 187,141 | |||||||||||||||

| Securities transactions gains |

— | — | — | — | — | |||||||||||||||

| Noninterest expense |

149,079 | 156,858 | 182,205 | 452,919 | 504,057 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income taxes |

62,935 | 57,627 | 44,813 | 187,878 | 172,404 | |||||||||||||||

| Income tax expense |

16,382 | 17,665 | 11,611 | 52,248 | 43,764 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 46,553 | $ | 39,962 | $ | 33,202 | $ | 135,630 | $ | 128,640 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| ADJUSTMENTS FROM NET TO OPERATING INCOME |

||||||||||||||||||||

| Securities transactions gains |

— | — | — | — | — | |||||||||||||||

| Nonoperating expense items |

||||||||||||||||||||

| Impact of insurance business lines divestiture |

— | (9,101 | ) | — | (9,101 | ) | — | |||||||||||||

| FDIC settlement |

— | 10,268 | — | 10,268 | — | |||||||||||||||

| Expense and efficiency initiatives and other items |

3,887 | 7,503 | 20,887 | 11,390 | 20,887 | |||||||||||||||

| Early debt redemption |

— | 3,461 | — | 3,461 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total nonoperating expense items |

3,887 | 12,131 | 20,887 | 16,018 | 20,887 | |||||||||||||||

| Taxes on adjustments at marginal tax rate |

1,361 | 2,518 | 7,310 | 3,879 | 7,310 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total adjustments (net of taxes) |

2,526 | 9,613 | 13,577 | 12,139 | 13,577 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income (g) |

$ | 49,079 | $ | 49,575 | $ | 46,779 | $ | 147,769 | $ | 142,217 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Purchase accounting adjustments (net of taxes) |

7,903 | 10,839 | 18,101 | 30,115 | 53,964 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Core income (h) |

$ | 41,176 | $ | 38,736 | $ | 28,678 | $ | 117,654 | $ | 88,253 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NONINTEREST INCOME AND NONINTEREST EXPENSE |

||||||||||||||||||||

| Service charges on deposit accounts |

$ | 20,000 | $ | 19,269 | $ | 20,519 | $ | 57,981 | $ | 59,398 | ||||||||||

| Trust fees |

11,530 | 11,499 | 9,477 | 33,267 | 27,972 | |||||||||||||||

| Bank card and ATM fees |

11,641 | 11,596 | 12,221 | 33,806 | 34,678 | |||||||||||||||

| Investment & annuity fees |

5,506 | 5,097 | 5,186 | 15,555 | 14,955 | |||||||||||||||

| Secondary mortgage market operations |

2,313 | 1,758 | 2,467 | 6,036 | 10,989 | |||||||||||||||

| Insurance fees |

1,979 | 1,888 | 3,661 | 7,611 | 12,500 | |||||||||||||||

| Amortization of FDIC loss share receivable |

(2,760 | ) | (3,321 | ) | (590 | ) | (9,989 | ) | (590 | ) | ||||||||||

| Other income |

7,732 | 8,612 | 10,116 | 26,771 | 27,239 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Noninterest income excluding securities transactions |

57,941 | 56,398 | 63,057 | 171,038 | 187,141 | |||||||||||||||

| Securities transactions gains |

— | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total noninterest income including securities transactions |

$ | 57,941 | $ | 56,398 | $ | 63,057 | $ | 171,038 | $ | 187,141 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Personnel expense |

$ | 80,043 | $ | 79,506 | $ | 86,850 | $ | 240,981 | $ | 262,372 | ||||||||||

| Occupancy expense (net) |

10,798 | 10,840 | 12,369 | 32,905 | 37,099 | |||||||||||||||

| Equipment expense |

4,542 | 4,059 | 5,120 | 12,875 | 15,340 | |||||||||||||||

| Other real estate owned expense (net) |

(104 | ) | 84 | 2,439 | 1,757 | 6,502 | ||||||||||||||

| Other operating expense |

43,343 | 43,494 | 47,234 | 128,031 | 139,565 | |||||||||||||||

| Amortization of intangibles |

6,570 | 6,744 | 7,306 | 20,352 | 22,292 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expense |

145,192 | 144,727 | 161,318 | 436,901 | 483,170 | |||||||||||||||

| Nonoperating expense items |

3,887 | 12,131 | 20,887 | 16,018 | 20,887 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total noninterest expense |

$ | 149,079 | $ | 156,858 | $ | 182,205 | $ | 452,919 | $ | 504,057 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| COMMON SHARE DATA |

||||||||||||||||||||

| Earnings per share: |

||||||||||||||||||||

| Basic |

$ | 0.56 | $ | 0.48 | $ | 0.40 | $ | 1.62 | $ | 1.51 | ||||||||||

| Diluted |

0.56 | 0.48 | 0.40 | 1.62 | 1.51 | |||||||||||||||

| Operating earnings per share: |

||||||||||||||||||||

| Basic |

$ | 0.59 | $ | 0.59 | $ | 0.56 | $ | 1.77 | $ | 1.67 | ||||||||||

| Diluted |

0.59 | 0.59 | 0.56 | 1.76 | 1.67 | |||||||||||||||

| Core earnings per share: |

||||||||||||||||||||

| Basic |

$ | 0.49 | $ | 0.46 | $ | 0.34 | 1.40 | $ | 1.04 | |||||||||||

| Diluted |

0.49 | $ | 0.46 | $ | 0.34 | 1.40 | $ | 1.04 | ||||||||||||

| (g) | Net income less tax-effected securities transactions and nonoperating expense items. Management believes that operating income provides a useful measure of financial performance that helps investors compare the Company’s fundamental operations over time. |

| (h) | Operating income excluding tax-effected purchase accounting adjustments. Management believes that reporting on core income provides a useful measure of financial performance that helps investors determine whether management is successfully executing its strategic initiatives. |

9

HANCOCK HOLDING COMPANY

INCOME STATEMENT

(Unaudited)

| Three months ended | ||||||||||||||||||||

| (dollars in thousands) |

9/30/2014 | 6/30/2014 | 3/31/2014 | 12/31/2013 | 9/30/2013 | |||||||||||||||

| Interest income |

$ | 172,701 | $ | 174,001 | $ | 175,140 | $ | 175,650 | $ | 181,639 | ||||||||||

| Interest income (TE) |

175,390 | 176,555 | 177,776 | 178,109 | 184,221 | |||||||||||||||

| Interest expense |

9,160 | 9,223 | 9,578 | 9,643 | 10,109 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income (TE) |

166,230 | 167,332 | 168,198 | 168,466 | 174,112 | |||||||||||||||

| Provision for loan losses |

9,468 | 6,691 | 7,963 | 7,331 | 7,569 | |||||||||||||||

| Noninterest income excluding securities transactions |

57,941 | 56,398 | 56,699 | 58,894 | 63,057 | |||||||||||||||

| Securities transactions gains |

— | — | — | 105 | — | |||||||||||||||

| Noninterest expense |

149,079 | 156,858 | 146,982 | 174,213 | 182,205 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income taxes |

62,935 | 57,627 | 67,316 | 43,462 | 44,813 | |||||||||||||||

| Income tax expense |

16,382 | 17,665 | 18,201 | 8,746 | 11,611 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 46,553 | $ | 39,962 | $ | 49,115 | $ | 34,716 | $ | 33,202 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| ADJUSTMENTS FROM NET TO OPERATING INCOME |

||||||||||||||||||||

| Securities transactions gains |

— | — | — | 105 | — | |||||||||||||||

| Total nonoperating expense items |

3,887 | 12,131 | — | 17,116 | 20,887 | |||||||||||||||

| Taxes on adjustments at marginal tax rate |

1,361 | 2,518 | — | 5,954 | 7,310 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjustments (net of taxes) |

2,526 | 9,613 | — | 11,057 | 13,577 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income (g) |

$ | 49,079 | $ | 49,575 | $ | 49,115 | $ | 45,773 | $ | 46,779 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Core income (h) |

$ | 41,176 | $ | 38,736 | $ | 37,742 | $ | 32,847 | $ | 28,678 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NONINTEREST INCOME AND NONINTEREST EXPENSE |

||||||||||||||||||||

| Service charges on deposit accounts |

$ | 20,000 | $ | 19,269 | $ | 18,712 | $ | 19,605 | $ | 20,519 | ||||||||||

| Trust fees |

11,530 | 11,499 | 10,238 | 10,214 | 9,477 | |||||||||||||||

| Bank card and ATM fees |

11,641 | 11,596 | 10,569 | 11,261 | 12,221 | |||||||||||||||

| Investment & annuity fees |

5,506 | 5,097 | 4,952 | 4,619 | 5,186 | |||||||||||||||

| Secondary mortgage market operations |

2,313 | 1,758 | 1,965 | 1,554 | 2,467 | |||||||||||||||

| Insurance fees |

1,979 | 1,888 | 3,744 | 3,304 | 3,661 | |||||||||||||||

| Amortization of FDIC loss share receivable |

(2,760 | ) | (3,321 | ) | (3,908 | ) | (1,649 | ) | (590 | ) | ||||||||||

| Other income |

7,732 | 8,612 | 10,427 | 9,986 | 10,116 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Noninterest income excluding securities transactions |

57,941 | 56,398 | 56,699 | 58,894 | 63,057 | |||||||||||||||

| Securities transactions gains |

— | — | — | 105 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total noninterest income including securities transactions |

$ | 57,941 | $ | 56,398 | $ | 56,699 | $ | 58,999 | $ | 63,057 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Personnel expense |

$ | 80,043 | $ | 79,506 | $ | 81,432 | $ | 84,912 | $ | 86,850 | ||||||||||

| Occupancy expense (net) |

10,798 | 10,840 | 11,266 | 11,613 | 12,369 | |||||||||||||||

| Equipment expense |

4,542 | 4,059 | 4,274 | 4,679 | 5,120 | |||||||||||||||

| Other real estate owned expense (net) |

(104 | ) | 84 | 1,777 | 1,535 | 2,439 | ||||||||||||||

| Other operating expense |

43,343 | 43,494 | 41,195 | 47,180 | 47,234 | |||||||||||||||

| Amortization of intangibles |

6,570 | 6,744 | 7,038 | 7,178 | 7,306 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expense |

145,192 | 144,727 | 146,982 | 157,097 | 161,318 | |||||||||||||||

| Nonoperating expense items |

3,887 | 12,131 | — | 17,116 | 20,887 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total noninterest expense |

$ | 149,079 | $ | 156,858 | $ | 146,982 | $ | 174,213 | $ | 182,205 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (g) | Net income less tax-effected securities transactions and nonoperating expense items. Management believes that operating income provides a useful measure of financial performance that helps investors compare the Company’s fundamental operations over time. |

| (h) | Operating income excluding tax-effected purchase accounting adjustments. Management believes that reporting on core income provides a useful measure of financial performance that helps investors determine whether management is successfully executing its strategic initiatives. |

10

HANCOCK HOLDING COMPANY

PERIOD-END BALANCE SHEET

(Unaudited)

| Three Months Ended | ||||||||||||||||||||

| (dollars in thousands) |

9/30/2014 | 6/30/2014 | 3/31/2014 | 12/31/2013 | 9/30/2013 | |||||||||||||||

| ASSETS |

||||||||||||||||||||

| Commercial non-real estate loans |

$ | 5,587,137 | $ | 5,393,691 | $ | 5,198,029 | $ | 5,064,224 | $ | 4,625,315 | ||||||||||

| Construction and land development loans |

1,095,902 | 1,040,656 | 978,798 | 915,541 | 920,408 | |||||||||||||||

| Commercial real estate loans |

3,100,834 | 3,056,263 | 3,069,316 | 3,042,841 | 2,914,969 | |||||||||||||||

| Residential mortgage loans |

1,858,490 | 1,771,271 | 1,720,307 | 1,720,614 | 1,695,197 | |||||||||||||||

| Consumer loans |

1,706,211 | 1,622,175 | 1,561,487 | 1,581,597 | 1,578,583 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total loans |

13,348,574 | 12,884,056 | 12,527,937 | 12,324,817 | 11,734,472 | |||||||||||||||

| Loans held for sale |

15,098 | 22,017 | 15,911 | 24,515 | 18,444 | |||||||||||||||

| Securities |

3,913,370 | 3,677,229 | 3,797,883 | 4,033,124 | 4,124,202 | |||||||||||||||

| Short-term investments |

471,558 | 440,688 | 280,373 | 268,839 | 462,313 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earning assets |

17,748,600 | 17,023,990 | 16,622,104 | 16,651,295 | 16,339,431 | |||||||||||||||

| Allowance for loan losses |

(125,572 | ) | (128,672 | ) | (128,248 | ) | (133,626 | ) | (138,223 | ) | ||||||||||

| Goodwill |

621,193 | 621,193 | 625,675 | 625,675 | 625,675 | |||||||||||||||

| Other intangible assets, net |

139,256 | 145,825 | 152,734 | 159,773 | 167,116 | |||||||||||||||

| Other assets |

1,602,473 | 1,687,095 | 1,731,905 | 1,706,134 | 1,807,847 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 19,985,950 | $ | 19,349,431 | $ | 19,004,170 | $ | 19,009,251 | $ | 18,801,846 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| LIABILITIES |

||||||||||||||||||||

| Noninterest-bearing deposits |

$ | 5,866,255 | $ | 5,723,663 | $ | 5,613,872 | $ | 5,530,253 | $ | 5,479,696 | ||||||||||

| Interest-bearing transaction and savings deposits |

6,325,671 | 6,079,837 | 6,118,150 | 6,162,959 | 6,008,042 | |||||||||||||||

| Interest-bearing public fund deposits |

1,534,678 | 1,484,188 | 1,451,430 | 1,571,532 | 1,240,336 | |||||||||||||||

| Time deposits |

2,010,090 | 1,957,539 | 2,091,322 | 2,095,772 | 2,326,797 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total interest-bearing deposits |

9,870,439 | 9,521,564 | 9,660,902 | 9,830,263 | 9,575,175 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total deposits |

15,736,694 | 15,245,227 | 15,274,774 | 15,360,516 | 15,054,871 | |||||||||||||||

| Short-term borrowings |

1,171,809 | 1,063,664 | 712,634 | 657,960 | 782,779 | |||||||||||||||

| Long-term debt |

376,452 | 374,991 | 380,001 | 385,826 | 376,664 | |||||||||||||||

| Other liabilities |

191,653 | 172,967 | 174,227 | 179,880 | 231,090 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities |

17,476,608 | 16,856,849 | 16,541,636 | 16,584,182 | 16,445,404 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| COMMON SHAREHOLDERS’ EQUITY |

||||||||||||||||||||

| Common stock and capital surplus |

1,832,529 | 1,838,931 | 1,837,461 | 1,832,282 | 1,827,551 | |||||||||||||||

| Retained earnings |

703,506 | 676,942 | 657,062 | 628,166 | 613,662 | |||||||||||||||

| Accumulated other comprehensive income |

(26,693 | ) | (23,291 | ) | (31,989 | ) | (35,379 | ) | (84,771 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total common shareholders’ equity |

2,509,342 | 2,492,582 | 2,462,534 | 2,425,069 | 2,356,442 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities & shareholders’ equity |

$ | 19,985,950 | $ | 19,349,431 | $ | 19,004,170 | $ | 19,009,251 | $ | 18,801,846 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| CAPITAL RATIOS |

||||||||||||||||||||

| Tangible common equity |

$ | 1,748,828 | $ | 1,725,489 | $ | 1,684,037 | $ | 1,639,524 | $ | 1,563,542 | ||||||||||

| Tier 1 capital (i) |

1,784,653 | 1,758,178 | 1,725,947 | 1,685,058 | 1,656,497 | |||||||||||||||

| Common equity (period-end) as a percent of total assets (period-end) |

12.56 | % | 12.88 | % | 12.96 | % | 12.76 | % | 12.53 | % | ||||||||||

| Tangible common equity ratio |

9.10 | % | 9.29 | % | 9.24 | % | 9.00 | % | 8.68 | % | ||||||||||

| Leverage (Tier 1) ratio (i) |

9.48 | % | 9.61 | % | 9.43 | % | 9.34 | % | 9.10 | % | ||||||||||

| Tier 1 risk-based capital ratio (i) |

11.68 | % | 11.83 | % | 11.90 | % | 11.76 | % | 12.07 | % | ||||||||||

| Total risk-based capital ratio (i) |

12.76 | % | 12.96 | % | 13.20 | % | 13.11 | % | 13.52 | % | ||||||||||

(i) Estimated for most recent period-end.

11

HANCOCK HOLDING COMPANY

AVERAGE BALANCE SHEET

(Unaudited)

| Three Months Ended | Nine Months Ended | |||||||||||||||||||

| (dollars in thousands) |

9/30/2014 | 6/30/2014 | 9/30/2013 | 9/30/2014 | 9/30/2013 | |||||||||||||||

| ASSETS |

||||||||||||||||||||

| Commercial non-real estate loans |

$ | 5,485,982 | $ | 5,298,978 | $ | 4,718,931 | $ | 5,292,464 | $ | 4,556,481 | ||||||||||

| Construction and land development loans |

1,070,763 | 1,005,025 | 970,411 | 1,010,136 | 976,702 | |||||||||||||||

| Commercial real estate loans |

3,070,821 | 3,051,193 | 2,891,830 | 3,058,804 | 2,893,923 | |||||||||||||||

| Residential mortgage loans |

1,814,186 | 1,744,313 | 1,653,813 | 1,760,056 | 1,615,694 | |||||||||||||||

| Consumer loans |

1,660,356 | 1,581,352 | 1,570,345 | 1,601,949 | 1,589,366 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total loans |

13,102,108 | 12,680,861 | 11,805,330 | 12,723,409 | 11,632,166 | |||||||||||||||

| Loans held for sale |

16,885 | 14,681 | 16,065 | 16,916 | 27,079 | |||||||||||||||

| Securities (j) |

3,780,089 | 3,716,563 | 4,135,348 | 3,810,186 | 4,163,436 | |||||||||||||||

| Short-term investments |

425,362 | 379,639 | 427,892 | 403,809 | 644,349 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earning assets |

17,324,444 | 16,791,744 | 16,384,635 | 16,954,320 | 16,467,030 | |||||||||||||||

| Allowance for loan losses |

(129,734 | ) | (126,887 | ) | (137,936 | ) | (130,412 | ) | (137,624 | ) | ||||||||||

| Goodwill and other intangible assets |

763,652 | 770,294 | 796,300 | 771,728 | 803,676 | |||||||||||||||

| Other assets |

1,591,585 | 1,604,113 | 1,753,028 | 1,620,949 | 1,856,115 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 19,549,947 | $ | 19,039,264 | $ | 18,796,027 | $ | 19,216,585 | $ | 18,989,197 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

||||||||||||||||||||

| Noninterest-bearing deposits |

$ | 5,707,523 | $ | 5,505,735 | $ | 5,415,303 | $ | 5,571,843 | $ | 5,359,325 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Interest-bearing transaction and savings deposits |

6,160,911 | 6,078,115 | 5,919,709 | 6,104,039 | 5,955,711 | |||||||||||||||

| Interest-bearing public fund deposits |

1,547,513 | 1,450,312 | 1,302,425 | 1,508,222 | 1,463,750 | |||||||||||||||

| Time deposits |

1,955,262 | 2,026,419 | 2,384,248 | 2,049,914 | 2,402,061 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total interest-bearing deposits |

9,663,686 | 9,554,846 | 9,606,382 | 9,662,175 | 9,821,522 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total deposits |

15,371,209 | 15,060,581 | 15,021,685 | 15,234,018 | 15,180,847 | |||||||||||||||

| Short-term borrowings |

1,139,694 | 957,386 | 820,500 | 962,014 | 791,641 | |||||||||||||||

| Long-term debt |

375,914 | 380,151 | 385,203 | 380,660 | 391,712 | |||||||||||||||

| Other liabilities |

173,182 | 177,761 | 229,694 | 176,591 | 228,056 | |||||||||||||||

| Common shareholders’ equity |

2,489,948 | 2,463,385 | 2,338,945 | 2,463,302 | 2,396,941 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities & shareholders’ equity |

$ | 19,549,947 | $ | 19,039,264 | $ | 18,796,027 | $ | 19,216,585 | $ | 18,989,197 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (j) | Average securities does not include unrealized holding gains/losses on available for sale securities. |

12

HANCOCK HOLDING COMPANY

AVERAGE BALANCE AND NET INTEREST MARGIN SUMMARY

(Unaudited)

| Three Months Ended | ||||||||||||||||||||||||||||||||||||

| 9/30/2014 | 6/30/2014 | 9/30/2013 | ||||||||||||||||||||||||||||||||||

| (dollars in millions) |

Volume | Interest | Rate | Volume | Interest | Rate | Volume | Interest | Rate | |||||||||||||||||||||||||||

| AVERAGE EARNING ASSETS |

||||||||||||||||||||||||||||||||||||

| Commercial & real estate loans (TE) |

$ | 9,627.6 | $ | 108.2 | 4.46 | % | $ | 9,355.2 | $ | 108.2 | 4.64 | % | $ | 8,581.2 | $ | 109.4 | 5.06 | % | ||||||||||||||||||

| Residential mortgage loans |

1,814.2 | 20.0 | 4.41 | % | 1,744.3 | 21.0 | 4.83 | % | 1,653.8 | 24.8 | 5.99 | % | ||||||||||||||||||||||||

| Consumer loans |

1,660.4 | 24.0 | 5.74 | % | 1,581.4 | 23.6 | 5.99 | % | 1,570.3 | 25.7 | 6.51 | % | ||||||||||||||||||||||||

| Loan fees & late charges |

— | 0.4 | 0.00 | % | — | 0.8 | 0.00 | % | — | 0.7 | 0.00 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total loans (TE) |

13,102.2 | 152.6 | 4.63 | % | 12,680.9 | 153.6 | 4.86 | % | 11,805.3 | 160.6 | 5.41 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Loans held for sale |

16.9 | 0.1 | 4.66 | % | 14.7 | 0.1 | 4.14 | % | 16.1 | 0.2 | 4.38 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| US Treasury and government agency securities |

184.8 | 0.7 | 1.47 | % | 0.0 | 0.0 | 0.00 | % | 5.6 | 0.0 | 2.34 | % | ||||||||||||||||||||||||

| CMOs and mortgage backed securities |

3,379.2 | 19.2 | 2.27 | % | 3,490.9 | 20.1 | 2.30 | % | 3,874.1 | 20.3 | 2.10 | % | ||||||||||||||||||||||||

| Municipals (TE) |

203.7 | 2.4 | 4.62 | % | 205.8 | 2.4 | 4.63 | % | 247.1 | 2.7 | 4.39 | % | ||||||||||||||||||||||||

| Other securities |

12.3 | 0.1 | 2.21 | % | 19.8 | 0.1 | 1.19 | % | 8.5 | 0.1 | 2.51 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total securities (TE) (j) |

3,780.0 | 22.4 | 2.36 | % | 3,716.5 | 22.6 | 2.43 | % | 4,135.3 | 23.1 | 2.24 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total short-term investments |

425.3 | 0.3 | 0.23 | % | 379.6 | 0.2 | 0.22 | % | 427.9 | 0.3 | 0.23 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Average earning assets yield (TE) |

$ | 17,324.4 | 175.4 | 4.02 | % | $ | 16,791.7 | 176.5 | 4.21 | % | $ | 16,384.6 | 184.2 | 4.47 | % | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| INTEREST-BEARING LIABILITIES |

||||||||||||||||||||||||||||||||||||

| Interest-bearing transaction and savings deposits |

$ | 6,160.9 | 1.6 | 0.11 | % | $ | 6,078.1 | 1.5 | 0.10 | % | $ | 5,919.7 | 1.4 | 0.09 | % | |||||||||||||||||||||

| Time deposits |

1,955.3 | 3.1 | 0.64 | % | 2,026.4 | 3.0 | 0.60 | % | 2,384.3 | 3.7 | 0.61 | % | ||||||||||||||||||||||||

| Public funds |

1,547.5 | 1.1 | 0.27 | % | 1,450.3 | 0.7 | 0.21 | % | 1,302.4 | 0.7 | 0.23 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total interest-bearing deposits |

9,663.7 | 5.8 | 0.24 | % | 9,554.8 | 5.2 | 0.22 | % | 9,606.4 | 5.8 | 0.24 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Short-term borrowings |

1,139.7 | 0.2 | 0.08 | % | 957.4 | 0.9 | 0.34 | % | 820.5 | 1.1 | 0.52 | % | ||||||||||||||||||||||||

| Long-term debt |

375.9 | 3.2 | 3.27 | % | 380.2 | 3.1 | 3.32 | % | 385.2 | 3.2 | 3.28 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total borrowings |

1,515.6 | 3.4 | 0.87 | % | 1,337.6 | 4.0 | 1.19 | % | 1,205.7 | 4.3 | 1.40 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total interest-bearing liabilities cost |

11,179.3 | 9.2 | 0.33 | % | 10,892.4 | 9.2 | 0.34 | % | 10,812.1 | 10.1 | 0.37 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net interest-free funding sources |

6,145.1 | 5,899.3 | 5,572.5 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total cost of funds |

17,324.4 | 9.2 | 0.21 | % | 16,791.7 | 9.2 | 0.22 | % | 16,384.6 | 10.1 | 0.24 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net Interest Spread (TE) |

$ | 166.2 | 3.69 | % | $ | 167.3 | 3.87 | % | $ | 174.1 | 4.10 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net Interest Margin (TE) |

$ | 17,324.4 | $ | 166.2 | 3.81 | % | $ | 16,791.7 | $ | 167.3 | 3.99 | % | $ | 16,384.6 | $ | 174.1 | 4.23 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| (j) | Average securities does not include unrealized holding gains/losses on available for sale securities. |

13

HANCOCK HOLDING COMPANY

AVERAGE BALANCE AND NET INTEREST MARGIN SUMMARY

(Unaudited)

| Nine Months Ended | ||||||||||||||||||||||||

| 9/30/2014 | 9/30/2013 | |||||||||||||||||||||||

| (dollars in millions) |

Volume | Interest | Rate | Volume | Interest | Rate | ||||||||||||||||||

| AVERAGE EARNING ASSETS |

||||||||||||||||||||||||

| Commercial & real estate loans (TE) |

$ | 9,361.4 | $ | 324.4 | 4.63 | % | $ | 8,427.0 | $ | 326.0 | 5.17 | % | ||||||||||||

| Residential mortgage loans |

1,760.1 | 62.4 | 4.73 | % | 1,615.7 | 77.4 | 6.36 | % | ||||||||||||||||

| Consumer loans |

1,601.9 | 70.8 | 5.91 | % | 1,589.4 | 78.8 | 6.63 | % | ||||||||||||||||

| Loan fees & late charges |

— | 1.9 | 0.00 | % | — | 2.5 | 0.00 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total loans (TE) |

12,723.4 | 459.5 | 4.82 | % | 11,632.1 | 484.7 | 5.56 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Loans held for sale |

16.9 | 0.5 | 4.29 | % | 27.1 | 0.8 | 3.72 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| US Treasury and government agency securities |

93.1 | 1.2 | 1.73 | % | 3.8 | 0.1 | 1.81 | % | ||||||||||||||||

| CMOs and mortgage backed securities |

3,493.5 | 60.5 | 2.31 | % | 3,918.9 | 59.6 | 2.03 | % | ||||||||||||||||

| Municipals (TE) |

208.8 | 7.2 | 4.60 | % | 232.5 | 7.9 | 4.53 | % | ||||||||||||||||

| Other securities |

14.8 | 0.2 | 2.22 | % | 8.3 | 0.2 | 2.42 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total securities (TE) (j) |

3,810.2 | 69.1 | 2.42 | % | 4,163.5 | 67.8 | 2.17 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total short-term investments |

403.8 | 0.7 | 0.23 | % | 644.3 | 1.2 | 0.24 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Average earning assets yield (TE) |

$ | 16,954.3 | 529.8 | 4.17 | % | $ | 16,467.0 | 554.5 | 4.50 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| INTEREST-BEARING LIABILITIES |

||||||||||||||||||||||||

| Interest-bearing transaction and savings deposits |

$ | 6,104.0 | 4.6 | 0.10 | % | $ | 5,955.7 | 4.6 | 0.10 | % | ||||||||||||||

| Time deposits |

2,049.9 | 9.3 | 0.60 | % | 2,402.1 | 11.6 | 0.64 | % | ||||||||||||||||

| Public funds |

1,508.2 | 2.5 | 0.23 | % | 1,463.8 | 2.6 | 0.24 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total interest-bearing deposits |

9,662.1 | 16.4 | 0.23 | % | 9,821.6 | 18.8 | 0.26 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Short-term borrowings |

962.0 | 2.1 | 0.29 | % | 791.6 | 3.4 | 0.58 | % | ||||||||||||||||

| Long-term debt |

380.7 | 9.4 | 3.31 | % | 391.7 | 9.6 | 3.28 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total borrowings |

1,342.7 | 11.5 | 1.15 | % | 1,183.3 | 13.0 | 1.47 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total interest-bearing liabilities cost |

11,004.8 | 27.9 | 0.34 | % | 11,004.9 | 31.8 | 0.39 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net interest-free funding sources |

5,949.5 | 5,462.1 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total cost of funds |

16,954.3 | 27.9 | 0.22 | % | 16,467.0 | 31.8 | 0.26 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net Interest Spread (TE) |

$ | 501.9 | 3.83 | % | $ | 522.7 | 4.11 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net Interest Margin (TE) |

$ | 16,954.3 | $ | 501.9 | 3.95 | % | $ | 16,467.0 | $ | 522.7 | 4.24 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (j) | Average securities does not include unrealized holding gains/losses on available for sale securities. |

14

HANCOCK HOLDING COMPANY

ASSET QUALITY INFORMATION

(Unaudited)

| Three Months Ended | Nine Months Ended | |||||||||||||||||||

| (dollars in thousands) |

9/30/2014 | 6/30/2014 | 9/30/2013 | 9/30/2014 | 9/30/2013 | |||||||||||||||

| Nonaccrual loans (k) |

$ | 83,154 | $ | 89,901 | $ | 119,749 | $ | 83,154 | $ | 119,749 | ||||||||||

| Restructured loans - still accruing |

7,944 | 7,868 | 10,605 | 7,944 | 10,605 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total nonperforming loans |

91,098 | 97,769 | 130,354 | 91,098 | 130,354 | |||||||||||||||

| ORE and foreclosed assets |

56,081 | 59,732 | 85,560 | 56,081 | 85,560 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total nonperforming assets |

$ | 147,179 | $ | 157,501 | $ | 215,914 | $ | 147,179 | $ | 215,914 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Nonperforming assets as a percent of loans, ORE and foreclosed assets |

1.10 | % | 1.22 | % | 1.83 | % | 1.10 | % | 1.83 | % | ||||||||||

| Accruing loans 90 days past due |

$ | 6,667 | $ | 4,142 | $ | 15,620 | $ | 6,667 | $ | 15,620 | ||||||||||

| Accruing loans 90 days past due as a percent of loans |

0.05 | % | 0.03 | % | 0.13 | % | 0.05 | % | 0.13 | % | ||||||||||

| Nonperforming assets + accruing loans 90 days past due to loans, ORE and foreclosed assets |

1.15 | % | 1.25 | % | 1.96 | % | 1.15 | % | 1.96 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| ALLOWANCE FOR LOAN LOSSES |

||||||||||||||||||||

| Beginning Balance |

$ | 128,672 | $ | 128,248 | $ | 137,969 | $ | 133,626 | $ | 136,171 | ||||||||||

| Net provision for loan losses - covered loans |

(391 | ) | (73 | ) | 1,024 | (766 | ) | 7,987 | ||||||||||||

| Provision for loan losses - noncovered loans |

9,859 | 6,764 | 6,545 | 24,888 | 17,417 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net provision for loan losses |

9,468 | 6,691 | 7,569 | 24,122 | 25,404 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (Decrease) increase in FDIC loss share receivable |

(6,695 | ) | (1,022 | ) | (1,379 | ) | (14,570 | ) | 1,497 | |||||||||||

| Net charge-offs - covered |

(566 | ) | 1,181 | 506 | 3,125 | 5,754 | ||||||||||||||

| Charge-offs - noncovered |

8,482 | 7,309 | 8,698 | 23,273 | 31,386 | |||||||||||||||

| Recoveries - noncovered |

(2,043 | ) | (3,245 | ) | (3,268 | ) | (8,792 | ) | (12,291 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net charge-offs |

5,873 | 5,245 | 5,936 | 17,606 | 24,849 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ending Balance |

$ | 125,572 | $ | 128,672 | $ | 138,223 | $ | 125,572 | $ | 138,223 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Allowance for loan losses as a percent of period-end loans |

0.94 | % | 1.00 | % | 1.18 | % | 0.94 | % | 1.18 | % | ||||||||||

| Allowance for loan losses to nonperforming loans + accruing loans 90 days past due |

128.44 | % | 126.26 | % | 94.69 | % | 128.44 | % | 94.69 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET CHARGE-OFF INFORMATION |

||||||||||||||||||||

| Net charge-offs - noncovered: |

||||||||||||||||||||

| Commercial/real estate loans |

$ | 2,451 | $ | 1,148 | $ | 1,267 | $ | 4,991 | $ | 9,405 | ||||||||||

| Residential mortgage loans |

558 | 587 | 541 | 1,292 | 891 | |||||||||||||||

| Consumer loans |

3,430 | 2,329 | 3,622 | 8,198 | 8,799 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total net charge-offs - noncovered |

$ | 6,439 | $ | 4,064 | $ | 5,430 | $ | 14,481 | $ | 19,095 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net charge-offs - noncovered to average loans: |

||||||||||||||||||||

| Commercial/real estate loans |

0.10 | % | 0.05 | % | 0.06 | % | 0.07 | % | 0.15 | % | ||||||||||

| Residential mortgage loans |

0.12 | % | 0.13 | % | 0.13 | % | 0.10 | % | 0.07 | % | ||||||||||

| Consumer loans |

0.82 | % | 0.59 | % | 0.92 | % | 0.68 | % | 0.74 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total net charge-offs - noncovered to average loans |

0.19 | % | 0.13 | % | 0.18 | % | 0.15 | % | 0.22 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (k) | Nonaccrual loans and accruing loans past due 90 days or more do not include acquired credit-impaired loans which were written down to fair value upon acquisition and accrete interest income over the remaining life of the loan. Included in nonaccrual loans are $9.9 million, $11.5 million, and $19.1 million at 09/30/14, 06/30/14 and 09/30/13, respectively, in nonaccruing restructured loans. |

15

HANCOCK HOLDING COMPANY

ASSET QUALITY INFORMATION

(Unaudited)

| Three months ended | ||||||||||||||||||||

| (dollars in thousands) |

9/30/2014 | 6/30/2014 | 3/31/2014 | 12/31/2013 | 9/30/2013 | |||||||||||||||

| Nonaccrual loans |

$ | 83,154 | $ | 89,901 | $ | 101,400 | $ | 99,711 | $ | 119,749 | ||||||||||

| Restructured loans - still accruing |

7,944 | 7,868 | 8,459 | 9,247 | 10,605 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total nonperforming loans |

91,098 | 97,769 | 109,859 | 108,958 | 130,354 | |||||||||||||||

| ORE and foreclosed assets |

56,081 | 59,732 | 69,813 | 76,979 | 85,560 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total nonperforming assets |

$ | 147,179 | $ | 157,501 | $ | 179,672 | $ | 185,937 | $ | 215,914 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Nonperforming assets as a percent of loans, ORE and foreclosed assets |

1.10 | % | 1.22 | % | 1.43 | % | 1.50 | % | 1.83 | % | ||||||||||

| Accruing loans 90 days past due |

$ | 6,667 | $ | 4,142 | $ | 3,998 | $ | 10,387 | $ | 15,620 | ||||||||||

| Accruing loans 90 days past due as a percent of loans |

0.05 | % | 0.03 | % | 0.03 | % | 0.08 | % | 0.13 | % | ||||||||||

| Nonperforming assets + accruing loans 90 days past due to loans, ORE and foreclosed assets |

1.15 | % | 1.25 | % | 1.46 | % | 1.58 | % | 1.96 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Allowance for loan losses |

$ | 125,572 | $ | 128,672 | $ | 128,248 | $ | 133,626 | $ | 138,223 | ||||||||||

| Allowance for loan losses as a percent of period-end loans |

0.94 | % | 1.00 | % | 1.02 | % | 1.08 | % | 1.18 | % | ||||||||||

| Allowance for loan losses to nonperforming loans + accruing loans 90 days past due |

128.44 | % | 126.26 | % | 112.64 | % | 111.97 | % | 94.69 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Provision for loan losses |

$ | 9,468 | $ | 6,691 | $ | 7,963 | $ | 7,331 | $ | 7,569 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||