Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ELAH Holdings, Inc. | sggh-8k_20141020.htm |

| EX-10.4 - EX-10.4 - ELAH Holdings, Inc. | sggh-ex104_2014102012.htm |

| EX-10.5 - EX-10.5 - ELAH Holdings, Inc. | sggh-ex105_201410206.htm |

| EX-10.1 - EX-10.1 - ELAH Holdings, Inc. | sggh-ex101_201410207.htm |

| EX-2.1 - EX-2.1 - ELAH Holdings, Inc. | sggh-ex21_201410208.htm |

| EX-10.2 - EX-10.2 - ELAH Holdings, Inc. | sggh-ex102_2014102010.htm |

CONFIDENTIAL

October 17, 2014

Signature Group Holdings, Inc.

You have advised the undersigned, funds managed or advised by Chatham Asset Management, LLC (“Chatham”) and Zell Credit Opportunities Master Fund L.P. (“ZCOF”) and such funds each, a “Purchaser” and collectively, the “Purchasers”, “we” or “us”), that you intend to enter into transactions as set forth that certain Purchase and Sale Agreement (the “Purchase Agreement”) attached hereto as Exhibit C to purchase the Global Recycling and Specification Alloys business of Aleris International, Inc. and its subsidiaries (collectively, the “Acquired Business”) pursuant to a series of transactions described in Attachment B (collectively, the “Transactions”). We submit this proposal to provide a portion of the financing for the Transactions. Capitalized terms used but not defined herein shall have the meanings assigned to them in the Term Sheets (as defined below).

You have further advised us that, in connection with the Transactions, Signature Group Holdings, Inc. (the “Company”) will (A)(i) conduct a Securities and Exchange Commission (“SEC”) registered pro rata rights offering (the “Rights Offering”) for shares of its common stock to raise an aggregate amount of approximately $125,000,000 (or, in the event that the Company has completed a primary issuance of its common stock in an SEC registered offering prior to such Rights Offering (the “Common Stock Offering”), $125,000,000 less the net proceeds received by the Company pursuant to the Common Stock Offering) and (ii) issue and sell shares of its preferred stock to Aleris Corporation, a Delaware corporation (“Aleris Parent”) or one of its wholly-owned subsidiaries yielding net proceeds of $30,000,000 (the “Preferred Stock Issuance”), and (B) to the extent that the Company is unable to raise net proceeds of $125,000,000 from the Rights Offering and the Common Stock Offering, (i) raise net proceeds of $125,000,000 (minus the aggregate amount of net cash proceeds raised from the Common Stock Offering and the Rights Offering) by issuing and selling shares of its common stock to the Purchasers yielding net proceeds of up to $45,000,000 (the “Equity Backstop”), subject to the terms and conditions set forth herein and in the Summary of Principal Terms attached as Exhibit B (the “Equity Term Sheet”), (ii) issuing and selling up to $30,000,000 of preferred stock to Aleris Parent or one of its wholly-owned subsidiaries (the “Preferred Backstop”), and (iii) issuing and selling up to $50,000,000 of two-year increasing rate secured notes (the “Backstop Notes”), subject

to the terms and conditions set forth herein and in the Summary of Principal Terms attached as Exhibit A (the “Notes Term Sheet” together with the Equity Term Sheet, the “Term Sheets”) to the Purchasers (it being understood that to the extent any amount of proceeds are received by the Company pursuant to the Rights Offering and the Common Stock Offering, 100% of such amount shall be applied first to reduce the amount of the Equity Backstop and, thereafter, if applicable, any additional proceeds shall reduce the Backstop Notes and Preferred Backstop pro rata (i.e. 62.5% to reduce the amount of the Backstop Notes and 37.5% to reduce the amount of the Preferred Backstop). Any cash proceeds from the sale of North American Breaker Co., LLC (“NABCO”) or any assets of NABCO shall be applied to reduce the amount of the Equity Backstop and thereafter, to reduce the amount of the Backstop Notes. The consummation of the purchase of the shares of common stock pursuant to the Equity Backstop in accordance with subsection (B)(i) and the Backstop Notes in accordance with subsection (B)(iii) is collectively referred to herein as the “Investment.”

In connection with the foregoing, each of Chatham and ZCOF (and their respective Purchasers) are pleased to advise you of their several and not joint commitment to purchase, in the aggregate, 50.0% of the Equity Backstop (with respect to each Purchaser, its “Equity Backstop Commitment”) and 50.0% of the Backstop Notes (with respect to each Purchaser, its “Backstop Note Commitment” and collectively with the Equity Backstop Commitments, the “Commitments”). Attachment A shall include for each Purchaser the name and the respective amounts of the commitments with respect to the Equity Backstop and the Backstop Notes, subject in each case to the conditions set forth or referred to in this commitment letter (including the Term Sheets, attachments and other exhibits hereto, this “Commitment Letter”).

Each Purchaser’s obligations hereunder are subject to the negotiation and execution of definitive documentation in form and substance reasonably acceptable to both parties containing the economic terms set forth in the applicable attached Term Sheets, the other conditions set forth herein and in the Term Sheets and such other terms and conditions as are customary to the proposed Investment. Please note that the Term Sheets do not purport to include all of the conditions, covenants, representations, warranties, defaults, definitions and other terms that would be included in the definitive documentation for the Investment, all of which must be reasonably satisfactory in form and substance to us and you prior to proceeding with the Investment.

Each of the Purchasers’ obligations to consummate the Investment in addition to those specified in the Term Sheets and elsewhere in this Commitment Letter, are conditioned on the following:

|

1. |

there shall have been no material adverse change to your business or to its assets, results of operations or financial conditions since the date of this letter; |

|

2. |

confirmation by the Company's board of directors to the effect that it has considered the transactions and the terms thereof set forth in this Commitment Letter, the strategic rationale of the transaction, the financial impact on the pro forma results of the Company, and reviewed the analysis prepared by the Company's financial advisors, and based on all of the foregoing the Company's board of directors believes that the transactions and the terms thereof set forth in this Commitment Letter are in the best interest of the Company and its stockholders; |

|

4. |

the commencement of the Rights Offering shall have occurred, in material compliance with the federal securities laws; |

|

5. |

any financial statements delivered pursuant to the Rights Offering shall have been delivered to us; |

|

9. |

(a)the execution and substantially concurrent funding of the senior secured facilities in accordance with the terms of the commitment letter by and between General Electric Capital Corporation, GE Capital Markets, Inc. and the Company, dated as of the date hereof (the “ABL Facility”), and (b)(i) the execution and funding of the senior secured facilities (the “Bridge Facility”) in accordance with the terms of the commitment letter by and between Goldman Sachs Bank USA, Deutsche Bank AG |

|

Cayman Islands Branch, Deutsche Bank Securities, Inc. and the Company, dated as the date hereof (the “Bridge Commitment Letter”) and/or (ii) the issuance of senior secured notes in lieu of all or a portion of the Bridge Facility as contemplated by the Bridge Commitment Letter (the “Secured Notes”; together with the Bridge Facility, the “Bridge Facility/Secured Notes”); and |

|

10. |

the Specified Representations (as defined below) shall be true and correct in all material respects. |

Notwithstanding anything in this Commitment Letter to the contrary, (a) the only representations relating to the Acquired Business the accuracy of which will be a condition to the making of the Investment at the Closing will be (i) the representations made by or with respect to the Acquired Business in the Purchase Agreement as are material to the interests of the Investors (but only to the extent that the Company or its affiliates have the right not to consummate the Acquisition, or to terminate their obligations (or otherwise do not have an obligation to close), under the Acquisition Agreement as a result of a failure of such representations in the Acquisition Agreement to be true and correct) and (ii) the Specified Representations (as defined below), and (b) the terms of the definitive documentation for the Backstop Notes will be such that they do not impair the availability of the Backstop Notes on the Closing Date if the conditions set forth herein and in Exhibit A hereto are satisfied (it being understood that (I) to the extent any security interest in the intended collateral (other than any collateral the security interest in which may be perfected by the filing of a UCC financing statement or intellectual property filings or the delivery of stock certificates (including in any event the delivery of stock certificates or otherwise obtaining a first priority perfected security interest in the equity of (i) NABCO, (ii) SGGH LLC, a Delaware limited liability company, and (iii) the wholly owned direct subsidiary of the Company that owns the domestic subsidiary and the German subsidiary, that, together, directly or indirectly purchases the Acquired Business, as contemplated by the Purchase Agreement (such wholly-owned subsidiary, “Aleris GRSA Holdco”), identified in the Notes Term Sheet, which will be required on the Closing Date)) is not perfected on the Closing Date after your use of commercially reasonable efforts to do so, the perfection of such security interest(s) will not constitute a condition precedent to the availability of the Backstop Notes on the Closing Date but such security interest(s) will be required to be perfected after the Closing Date pursuant to arrangements to be mutually agreed by the Investors and the Company and (II) nothing in the preceding clause (a) will be construed to limit the applicability of the individual conditions set forth herein or in Exhibit A). As used herein, “Specified Representations” means representations relating to incorporation or formation; organizational power and authority to enter into the documentation relating to the Investment; due execution, delivery and enforceability of such documentation; solvency; no conflicts with laws, charter documents or material agreements, including, without limitation, compliance in all respects with Article 8 of the Company’s bylaws; Federal Reserve margin regulations; the Investment Company Act; use of proceeds not in violation of OFAC, the PATRIOT Act, FCPA and other anti-terrorism laws; status of the Backstop Notes as senior secured debt; use of proceeds, and, subject to the limitations on perfection of security interests set forth in the

preceding sentence, the creation, perfection and priority of the security interests granted in the proposed collateral.

(a)Whether or not the Investment contemplated hereby is consummated, you agree to pay all of our reasonable out-of-pocket costs and expenses incurred in connection with the Transactions contemplated hereby, including, without limitation, the reasonable fees and charges of our legal counsel relating to due diligence investigations, the proposed investment structure and documentation, their review of other documents related to the Transactions contemplated hereby and any waivers, amendments or fees or costs in enforcing any Purchaser’s rights hereunder, and the reasonable fees and charges of our accountants and other advisors, if any.

(b)Whether or not the Investment contemplated hereby is consummated, as consideration for each Purchaser’s Commitment, you agree to pay (or cause to be paid) in cash (except as specifically noted below in clause 3), to each Purchaser for its own account, the following fees:

The proceeds from the Common Stock Offering, the Rights Offering, the Backstop Notes and the Equity Backstop shall be used as set forth in Schedule I attached hereto.

You hereby represent and covenant that:

(a)all written information and written data (other than projections, financial estimates, forecasts, and other forward-looking information – together, the “Projections” – and information of a general economic or industry-specific nature) (the “Information”) that has been or will be made available to the Purchasers prior to Closing by or on behalf of you or any of your representatives, when taken as a whole, will not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements contained therein not materially misleading under the circumstances (after giving effect to any supplements or updates thereto made prior to Closing relating to any matter arising after the date hereof); and

(b)the Projections that have been or will be made available to the Purchasers by or on behalf of you or any of your representatives have been, or will be, prepared in good faith based upon assumptions that you believed to be reasonable at the time made (it being understood that the Projections are not to be viewed as facts, that actual results may vary from such Projections, and that such variances may be material). You agree that if at any time prior to the Closing you become aware that any Information or Projections are incorrect in any material respect under the circumstances, then you will promptly supplement the Information and the Projections so that such representations and covenants in the preceding sentence will be correct in all material respects under the circumstances.

We shall be entitled to use and rely primarily on the Information and the Projections without responsibility for independent verification thereof.

None of the parties will without the consent of all of the other parties make any announcement about such transaction to the public, except as required, in such parties' reasonable judgment, by applicable securities law. Each of the parties hereby agrees that it shall not otherwise disclose any information concerning any other party or the Investment (the “Confidential Information”), without the prior written consent of the other party, provided, however, that Confidential Information shall not include information that was in the public domain (either prior to or after the receipt of such information) (other than as a result of the disclosure by a party in breach of this Commitment Letter), and provided, further, that nothing herein shall prevent (a) any party from disclosing Confidential Information to its officers, directors and employees, as well as those agents, representatives, accountants, counsel and affiliates and each of their respective directors, employees,

representatives, counsel or affiliates, if any, to whom the party desires to disclose such Confidential Information (collectively, “Representatives”) to the extent necessary to evaluate and/or to obtain requisite approvals for the consummation of the Investment or preparation of financial statements, (b) any party from disclosing Confidential Information that it is required by law or in the course of administrative or judicial proceedings to disclose and (c) you, from disclosing this Commitment Letter to the Acquired Business and its Representatives. Each of the parties shall (i) inform each of its Representatives of the confidential nature of the Confidential Information and the requirement that it not be used other than for the purposes described above, (ii) require that each of its Representatives agree to treat the Confidential Information as confidential, and (iii) in any event be responsible for any breach of this confidentiality obligation by any of its Representatives. Confidential Information shall not include information to the extent such information has become generally available to the public other than as a result of a breach of this obligation of confidentiality. Notwithstanding the foregoing, nothing in this letter shall prevent any party or its agents, representatives, lenders, accountants, counsel and affiliates from disclosing to any and all persons, without limitation of any kind, the tax treatment and tax structure of the transaction and all tax strategies, as well as all materials of any kind (including opinions or other tax analyses) that are provided relating to such tax treatment and tax structure. For this purpose, “tax structure” is limited to any facts relevant to the U.S. federal income tax treatment of the transaction and does not include information relating to the identity of the parties.

You agree to indemnify each of Chatham, ZCOF, each Purchaser, and their respective directors, officers, members, managers, advisors, employees, affiliates, agents, attorneys, accountants, consultants and controlling persons, and to hold each such person harmless from and against all losses, claims, damages, liabilities and expenses, joint or several, which any such person or entity may incur arising out of the matters referred to herein, the Term Sheets, the Investment, the use of proceeds of the Investment or any related transaction or any claim, litigation, investigation or proceeding relating to any of the foregoing (any of the foregoing, a “Proceeding”), and to reimburse each of such indemnified parties upon demand for their reasonable legal or other expenses incurred in connection with any of the foregoing; provided, however, that the foregoing indemnity will not, as to any proposed indemnified party, apply to losses, claims, damages, liabilities or related expenses to the extent they have resulted from the willful misconduct or gross negligence of such party, as determined by a final judgment of a court of competent jurisdiction. Neither (x) any indemnified person, nor (y) you shall be liable for any indirect or consequential damages (in the case of this clause (y), other than in respect of any such damages incurred or paid by an indemnified person to a third party) in connection with activities related to the proposed Investment. You shall not enter into any settlement of any Proceeding without the prior written consent of the affected indemnified person, unless such settlement (i) includes an unconditional release of such indemnified person from all liability or claims that are the subject matter of such Proceeding; and (ii) does not include any admission of liability by such indemnified person.

You acknowledge and agree that (a) no fiduciary, advisory, or agency relationship between Chatham, ZCOF, the Purchasers and you, your managers, stockholders, creditors, and affiliates is intended to be or has been created in respect of any of the Transactions, irrespective of whether Chatham, ZCOF or any of the Purchasers have advised or are advising you on other matters; (b) Chatham, ZCOF, and the Purchasers and you have an arms-length business relationship that does not directly or indirectly give rise to, nor do you rely on, any fiduciary duty on the part of Chatham, ZCOF, or any Purchaser; (c) you have been advised that Chatham, ZCOF, and the Purchasers are engaged in a broad range of transactions that may involve interests that differ from your interests and that Chatham, ZCOF, and the Purchasers have no obligation to disclose such transactions and interests to you by virtue of any fiduciary, advisory, or agency relationship; and (d) you are responsible for making your own independent judgment with respect to such transactions and the process leading thereto.

You acknowledge that Chatham, ZCOF, and the Purchasers are engaged, either directly or through its affiliates, in various activities, which may include securities trading, commodities trading, investment management, financing and related activities, financial planning, and benefits counseling for both companies and individuals. In the ordinary course of these activities, Chatham, ZCOF, and the Purchasers and its affiliates may actively engage in commodities trading or trade the debt, equity securities (or related derivative securities), and financial instruments (including bank loans and other obligations) of the Company, NABCO and other companies which may be the subject of the Transactions for its own account and for the accounts of its customers. Chatham, ZCOF, and the Purchasers or its affiliates may also co-invest with, make direct investments in, and invest or co-invest client monies in or with funds or other investment vehicles managed by other parties, and such funds or other investment vehicles may trade or make investments in securities of you or other companies which may be the subject of the Transactions or engage in commodities trading with any thereof.

This Commitment Letter and the commitments hereunder shall not be assignable by you without the prior written consent of the Purchasers. Any attempted assignment without such consent shall be null and void. Nothing in this Commitment Letter, express or implied, is intended to or shall confer upon any person other than you, any legal or equitable right, benefit or remedy of any nature whatsoever, under or by reason of this Commitment Letter. In no event shall this Commitment Letter or the Commitment hereunder be enforced by any person unless each of the other unfunded Commitments hereunder are being concurrently enforced by such person. Notwithstanding anything to the contrary in this Commitment Letter, the obligation of each Purchaser hereunder shall not exceed their respective Commitment set forth in Attachment A hereof and are expressly conditioned upon the performance of the other party.

Subject to applicable securities laws, any of the Purchasers’ affiliates or related parties may (x) perform, without limitation, any and all obligations and commitments of, and services to be provided by, the Purchasers hereunder and (y) exercise any and all rights of the Purchasers hereunder; provided that, with respect to the commitments, any assignment thereof to a non-affiliate or related party without your consent (not to be unreasonably withheld) will not relieve the Purchasers from any of their obligations hereunder unless and until the assignee shall have funded the portion of the commitment so assigned.

We hereby notify you that pursuant to the requirements of the USA PATRIOT Act (Title III of Pub. L. 107-56 (signed into law October 26, 2001) (the “PATRIOT Act”), the Purchasers may be required to obtain, verify, and record information that identifies you, which information may include your names and addresses and other information that will allow the Purchasers to identify you in accordance with the PATRIOT Act. This notice is given in accordance with the requirements of the PATRIOT Act and is effective for the Purchasers.

If the Investment is not consummated pursuant to the terms hereof, Sections 3, 6, and 7 of this Commitment Letter will survive. This Commitment Letter, the accompanying Term Sheets, Schedules and other exhibits and attachments, constitute the entire agreement among you, us and/or any of our respective affiliates, and supersedes all prior communications, agreements and understandings, written or oral, with respect to any investment in you by the Purchasers or their affiliates. This Commitment Letter may be signed in counterparts, all of which shall constitute the same agreement, shall be governed by the laws of the State of New York, and shall bind and inure to the benefit of the parties and their respective successors. Delivery of an executed counterpart of a signature page to this Commitment Letter by electronic transmission will be effective as delivery of a manually executed counterpart hereof. This letter may not be amended, and no provision hereof shall be waived or modified, except by an instrument in writing signed by the parties. This letter is solely for

the benefit of the parties hereto and shall not confer any benefits upon, or create any rights in favor of, any person other than the parties hereto. This Commitment Letter shall terminate, (A) unless countersigned by you and returned to us by 5:00 p.m. on October 17, 2014 or, (B) once executed, unless extended by written agreement of the parties, on January 31, 2015 (or such earlier date which is the earlier of (i) the date on which the Purchase Agreement is validly terminated by you in accordance with its terms and (ii) the date of the consummation of the Acquisition and payment of the consideration therefor (but not, for the avoidance of doubt, prior to the consummation thereof) without requiring the proceeds of the Investment), in the case of such termination, there shall be no further obligations under this letter except for your obligations under Sections 3, 6, and 7 hereof, which shall survive any such termination.

[REMAINDER OF THIS PAGE INTENTIONALLY LEFT BLANK]

|

Very truly yours, |

|

|

|

|

|

CHATHAM ASSET HIGH YIELD MASTER FUND, LTD. |

|

|

|

|

|

BY: CHATHAM ASSET MANAGEMENT ITS INVESTMENT ADVISOR |

|

|

|

|

|

By: |

/s/ James Ruggerio |

|

|

Name: James Ruggerio |

|

|

Title: Member and Chief Operating Officer |

Signature Page to Commitment Letter

|

ZELL CREDIT OPPORTUNITIES MASTER FUND L.P. |

|

|

|

|

|

By: Chai Trust Company, LLC, its General Partner |

|

|

|

|

|

By: |

/s/ Jon Wasserman |

|

|

Name: Jon Wasserman |

|

|

Title: President |

Signature Page to Commitment Letter

|

Accepted and agreed to as of the date first above written: |

|

|

|

|

|

SIGNATURE GROUP HOLDINGS, INC. |

|

|

|

|

|

By: |

/s/ Craig T. Bouchard |

|

Name: |

Craig T. Bouchard |

|

Title: |

CEO |

Signature Page to Commitment Letter

ATTACHMENT A

The following list of Purchasers is subject to reasonable update by Chatham and/or ZCOF, as the case may be, so long as the Totals match the requirements of Section 1 and each of Chatham’s and ZCOF’s Purchasers acquire 50% of the total amounts set forth in Section 1.

|

Purchaser |

Backstop Notes |

Common Stock |

|

Chatham Asset High Yield Master Fund, Ltd |

$25,000,000 |

$22,500,000 |

|

Signature Investors II, L.L.C. |

$25,000,000 |

$22,500,000 |

|

Totals |

$50,000,000 |

$45,000,000 |

Capitalized terms used herein but not otherwise defined shall have the meanings ascribed to them in that certain Commitment Letter, dated as of October 17, 2014, by and among Signature Group Holdings, Inc., Chatham Asset Management, LLC and Zell Credit Opportunities Master Fund L.P. (the “Commitment Letter”).

The Company has formed a new wholly-owned subsidiary, SGH Acquisition Holdco, Inc., a Delaware corporation (“Buyer”), to purchase (the “Acquisition”) the Acquired Business from Aleris Parent and certain of its subsidiaries pursuant to the Purchase Agreement attached to the Commitment Letter as Exhibit C.

The Acquisition will be financed from the following sources:

|

· |

cash on hand of the Company; |

|

· |

$300 million from the Secured Notes or, in the event some or all of the Secured Notes are unable to be issued at the time the Acquisition is consummated, borrowings under the Bridge Facility in an aggregate principal amount of $300 million less the gross proceeds from the sale of Secured Notes; |

|

· |

up to $70 million of borrowings under the ABL Facility and a factoring facility provided to Aleris Recycling (German Works) GmbH, a limited liability company organized under the laws of Germany; |

|

· |

approximately $125 million from the Rights Offering (or, in the event that the Company has completed the Common Stock Offering), $125 million less the net proceeds received by the Company pursuant to the Common Stock Offering); |

|

· |

to the extent the Company is unable to raise $125 million from the Rights Offering and the Common Stock Offering, $125 million (minus the amount raised from the Common Stock Offering and the Rights Offering) from the following, as further described in the Commitment Letter: |

|

o |

up to $45 million from the Equity Backstop; |

|

o |

up to $30 million from the Preferred Backstop; and |

|

o |

up to $50 million from the Backstop Notes. |

Pursuant to the Purchase Agreement, the Sellers (as defined in the Purchase Agreement) will receive $525 million, subject to adjustment according to the Purchase Agreement.

EXHIBIT A

EXHIBIT A to Commitment Letter

Signature Group Holdings, Inc.

Senior Secured Notes

Summary of Principal Terms

|

Issuer: |

Signature Group Holdings, Inc., a Delaware corporation (the “Company”). |

|

Purchasers: |

Funds advised or managed by each of Chatham or ZCOF (each, a “Purchaser”). |

|

Securities: |

Up to $50,000,0001 aggregate principal amount of senior notes (the “Notes”). The funding of the Notes will be referred to as the “Closing”. |

|

Closing Date: |

The date of the Closing, which is anticipated to occur on or before January 31, 2015, is referred to herein as the “Closing Date.” |

|

Use of Proceeds: |

The Company will use net proceeds of the sale of the Notes to fund the Transactions and the Notes Interest Reserve Account. |

|

Purchase Price: |

The Notes issued will be acquired at a purchase price equal to 97.0% of the principal amount of the Notes. |

|

Original Issue Discount: |

Three percent (3%) of the aggregate purchase price of the Notes. |

|

Maturity: |

The Notes will mature on the date that is 24 months following the Closing Date. |

|

|

1The aggregate principal amount of Notes will be $50,000,000 without gross-up for any fees or to account for the 3% OID and amounts necessary to fund the Note Interest Reserve Account.

|

Guarantors: |

The obligations of the Company in respect of the Notes will be guaranteed by each of the Company’s existing and newly acquired or created domestic U.S. subsidiaries, other than any other entity that is a borrower in respect of, or that guarantees the ABL Facility or the Bridge Facility/Secured Notes or any refinancing, extension, renewal, defeasance, amendment, modification, supplement, restructuring, replacement, refunding or repayment, in whole or in part, of the ABL Facility or the Bridge Facility/Secured Notes (subject to customary restrictions including that such refinancing indebtedness shall not have a greater principal amount than the principal amount of the refinanced indebtedness plus any existing and undrawn commitments plus accrued interest, capitalized interest, fees, premiums (if any) thereon, upfront fees, original issue discount and reasonable fees and expenses associated with the refinancing and a restriction that each of the ABL Facility and/or the Bridge Facility/Secured Notes will not be amended to have an average weighted life to maturity shorter than the average weighted life to maturity prior to such amendment) (a “Refinancing”), or any other subsidiary of the wholly owned direct subsidiary of the Company that owns the domestic subsidiary and the German subsidiary, that, together, directly or indirectly purchases the Acquired Business, as contemplated by the Purchase Agreement (such wholly-owned subsidiary, “Aleris GRSA Holdco”), for a period up to and including the date that is six months after the date that the ABL Facility and the Bridge Facility/Secured Notes and any Refinancing thereof are terminated in accordance with their terms (collectively, the “Guarantors”); provided that for the avoidance of doubt the only subsidiaries that will be providing guarantees of the Bridge Facility/Secured Notes will be Aleris GRSA Holdco and its domestic subsidiaries. For the avoidance of doubt, the Guarantors will be restricted from providing a guaranty in support of any indebtedness of Aleris Holdings and its subsidiaries. |

|

Security: |

The obligations in respect of the Notes will be secured by (i) a first priority lien on, and perfected security interest in, substantially all assets of the Company and Guarantors, except in the case of North American Breaker Co., LLC (“NABCO”) (ii) a pledge of the NABCO capital stock, (iii) a pledge of the Company’s equity interests in SGGH LLC (iv) a pledge of Aleris GRSA Holdco’s stock (structurally subordinate to any security interest for the benefit of the lenders under the ABL Facility, the lenders under the Bridge Facility, the holders of the Secured Notes or any Refinancing thereof), and (v) the Notes Interest Reserve Account (as defined below) and the cash and securities on deposit in such account (such assets, cash and securities in clause (i) through (v) referred to as the “Notes Collateral”). The Notes Collateral shall not secure any other obligations of the Company or its subsidiaries other than the Notes. |

|

Interest Rate: |

Interest on the Notes will accrue and be payable quarterly, in cash, at a rate per annum equal to the rate listed in the following table for such quarter: |

|

Quarter Ending:2 |

Coupon:3 |

|

|

4/15/2015 |

9.875 |

% |

|

7/15/2015 |

9.875 |

% |

|

10/15/2015 |

10.250 |

% |

|

1/15/2016 |

10.750 |

% |

|

4/15/2016 |

11.250 |

% |

|

7/15/2016 |

11.750 |

% |

|

10/15/2016 |

12.250 |

% |

|

1/15/2017 |

12.750 |

% |

|

|

Interest will be payable quarterly in arrears and calculated on the basis of a 360-day year consisting of twelve months, each having thirty days. |

|

Default Interest: |

Upon and during the continuance of an “Event of Default” (to be defined in the definitive documentation), additional interest of 2% per annum, payable quarterly in cash, will accrue and be payable on the Notes. |

|

Notes Interest Reserve Account: |

On the Closing Date, the Company shall deposit in an account in its name an amount sufficient to pay the sum of interest that is required to be paid in cash and that is expected to accrue on the Notes through the 24 month anniversary of the Closing Date (excluding default interest, if any) in a notes interest reserve account on terms satisfactory to the Purchasers (the “Notes Interest Reserve Account”). Payment of interest on the Notes shall be made from such account. Any prepayment of Notes shall be accompanied a pro rata decrease in the Notes Interest Reserve Account. |

|

Optional Redemption: |

The Notes may be redeemed at the option of the Company in minimum amounts and increments to be agreed, with prior written notice, at the applicable redemption price set out below: |

|

|

2 NTD: The coupon for the quarter ending 4/15/2015 shall apply to any dates for which the Bridge Facility/Secured Notes are outstanding prior to 1/15/2015 and the coupon for the quarter ending 1/15/2017 shall apply to any period the Bridge Facility/Secured Notes are outstanding following 1/15/2017 (and not in default).

3 NTD: Excess of the Bridge Facility/Secured Notes YTM above 8.75% will be added to each coupon period identified above.

|

- |

Prior to March 31, 2015, 101% of par; |

|

- |

After March 31, 2015 but prior to September 30, 2015, 102% of par; |

|

- |

After September 30, 2015 and up to and including the maturity date (and any time thereafter), 103% of par. |

|

Mandatory Prepayment: |

In the event of a Change of Control (to be defined), the Notes shall be subject to a put at a purchase price of 101% of par. |

|

|

The Notes will be subject to customary and appropriate mandatory prepayment events, including (i) prepayment events consistent with the ABL Facility and the Bridge Facility/Secured Notes (provided that, with respect to Aleris GRSA Holdco and its subsidiaries, the Notes will not be entitled to any distributions from Aleris GRSA Holdco or any of its subsidiaries unless and to the extent that such distributions are permitted under the ABL Facility, the Bridge Facility/Secured Notes and any Refinancing thereof)4 and (ii) the net proceeds of (a) any issuance of equity securities of the Company and its subsidiaries (other than the subsidiaries of Aleris GRSA Holdco) (in the same pro rata ratio with the Aleris Preferred Backstop) (b) any issuance of debt of the Company and its subsidiaries (other than the subsidiaries of Aleris GRSA Holdco and up to $10 million of incremental debt raised by NABCO) and (c) any asset sale, catastrophic event or extraordinary receipts of the Company and its subsidiaries (other than Aleris GRSA Holdco and its subsidiaries). Any mandatory prepayment and any payments upon acceleration shall be at the purchase price applicable to an optional redemption occurring on such date, plus accrued and unpaid interest. Any required prepayment shall be reduced by the amount that is applied to permanently reduce the ABL Facility and/or the Bridge Facility/Secured Notes (provided that, with respect to Aleris GRSA Holdco and its subsidiaries, the Notes will not be entitled to any distributions from Aleris GRSA Holdco or any of its subsidiaries unless and to the extent that such distributions are permitted under the ABL Facility, the Bridge Facility/Secured Notes and any Refinancing thereof); provided further that 100% of the net proceeds, after transaction costs and expenses, from the sale of certain assets of the Company, including any net proceeds from the sale of NABCO or any assets of NABCO (after payment of any outstanding senior indebtedness at NABCO), will be used to first prepay the Notes prior to any repayment of the ABL Facility or the Bridge Facility/Secured Notes). |

|

|

4 For absence of doubt, the Bridge/Secured Note facilities will not automatically permit the distribution of amounts on account of asset sales, even if those holders/lenders decline an asset sale offer. Any such distribution would be subject to the restricted payment covenant.

|

Representations and Warranties: |

The Notes documentation will contain customary and appropriate representations and warranties reasonable to the Purchasers, consistent with the representations and warranties contained in the ABL Facility and the Bridge Facility/Secured Notes, with appropriate adjustments to reflect the business and assets of the Company and the Guarantors. |

|

Covenants: |

The Notes documentation will contain customary and appropriate affirmative and negative covenants, consistent with the covenants contained in the ABL Facility and the Bridge Facility/Secured Notes documentation, with appropriate adjustments to reflect the business and assets of the Company and the Guarantors. |

|

|

The Notes documentation will also contain (a) a block on restricted payments by the Company and the Guarantors and (b) a covenant that limits restrictions on the ability of subsidiaries of the Company to make distributions to the Company in respect of their (and their subsidiaries) tax sharing arrangements, with exceptions for restrictions (i) in the case of tax sharing arrangements of Aleris GRSA Holdco and its subsidiaries, limitations consistent with those described in the draft commitment letters previously provided to you in connection with the ABL Facility and/or the Bridge Facility/Secured Notes documentation5, and (ii) in the case of tax sharing arrangements of NABCO and its subsidiaries, limitations consistent with those set forth in that certain Business Loan Agreement dated September 29, 2011 by and between NABCO and Pacifica Western Bank (as amended, restated, supplemented or otherwise modified), that certain Asset Based Business Loan Agreement, dated September 29, 2011 by and between NABCO and Pacific Western Bank (as amended, restated, supplemented or otherwise modified) and that certain Business Loan Agreement dated December 30, 2013 by and between NABCO and Pacific Western Bank (as amended, restated, supplemented or otherwise modified) (collectively, the “NABCO Financing documentation”). For the avoidance of doubt, any tax liabilities or expenses of the Company or any of its subsidiaries that are due and payable to government entities (i.e. no ability to use net operating loss carryforwards) will be paid in the normal course and not subject to any restrictions. |

|

|

5 Bridge/Note Facility will have limitations on these distributions, e.g., no default, compliance with fixed charge coverage ratio, etc.

|

|

In addition, the Notes documentation will include a fixed-dollar cap on the indebtedness of the Company, including the indebtedness of Aleris Holdings and its subsidiaries; provided that the Notes documentation will permit Refinancings of the ABL Facility and the Bridge Facility/Secured Notes.6 |

|

Transferability: |

The Notes will be freely assignable, in whole or in part, subject only to compliance with applicable securities laws. |

|

Expense Reimbursement: |

Reimbursement by the Company of all reasonable out-of-pocket expenses of Purchasers relating to the Notes, including legal documentation, due diligence and related fees and expenses, as more fully set forth in the Commitment Letter. |

|

Governing Law: |

The State of New York. |

|

|

6 To the extent applicable to Aleris GRSA Holdco and its subsidiaries, there should be some cushion to the baskets in the ABL Facility and the Bridge/Secured Note facility notes and this bridge should permit refinancings and sufficient working capital borrowings. The covenants in the Notes should not be more restrictive with respect to Aleris GRSA Holdco and its subsidiaries than the Bridge Facility/Secured Notes or the ABL Facility.

EXHIBIT B

SIGNATURE GROUP HOLDINGS, INC.

Equity Backstop Commitment Summary Of Principal Terms

|

Issuer: |

Signature Group Holdings, Inc., a Delaware corporation (the “Company” or the “Issuer”). |

|

Purchasers: |

Funds advised or managed by each of Chatham or ZCOF (each, a “Purchaser”). |

|

Offering Size: |

Up to $45,000,000.7 |

|

Type of Security: |

Common Stock, $0.001 par value (the “Common Shares”). The Common Stock shall, upon issuance, be registered for resale under the Securities Act of 1933, provided that if the Common Stock received by any purchaser shall not be freely tradeable (i.e. because of affiliate status or otherwise), the Company will, within 15 days after issuance of the Common Stock, file a registration statement with the SEC to register it for resale under the Securities Act of 1933. |

|

Funding Obligations: |

Equity Backstop Commitment will be reduced by the amount of net proceeds, if any, received by the Issuer in the Common Stock Offering and the Rights Offering and any net proceeds from the sale of North American Breaker Co., LLC (“NABCO”) or any assets of NABCO (as described in the Commitment Letter). |

|

Rights Offering: |

Issuer shall conduct a pro rata rights offering to Issuer’s stockholders of record on the record date (and for the avoidance of doubt excluding outstanding but unexercised warrants of Issuer for the purpose of calculating the offering size) of non-transferable rights to purchase an aggregate of approximately $125,000,000 of newly-issued Common Shares at the Offering Price (as hereinafter defined) less amounts raised in the Common Stock Offering or net proceeds from the sale NABCO or any assets of NABCO. |

|

Commitments: |

Chatham Purchaser(s) and ZCOF Purchaser(s), each 50% of Equity Backstop Commitment. |

|

|

7 The offering size represents net cash proceeds to the Company, and is subject to reduction as described in “Common Stock Offering” and “Rights Offering” herein.

|

Commitment Period: |

The Equity Backstop Commitment shall be for a period from the date of the Commitment Letter through and including January 31, 2015 (the “Initial Commitment Period”). Upon execution of the Commitment Letter, Purchasers shall be entitled to an Equity Backstop Commitment Fee equal to 5% of the Equity Backstop Commitment (without regard to future reductions). In the event that the Rights Offering is not consummated by January 31, 2015, the Issuer shall have the option to extend the Equity Backstop Commitment for an additional 30 days (an “Extended Commitment Period”) upon providing Purchasers with written notice of extension or prior to the end of the Initial Commitment Period or any Extended Commitment Period, as the case may be, which option may be exercised up to a total of three (3) times for a maximum extension of 90 days following the end of the Initial Commitment Period and for a fee of $112,500 per 30 day extension. Amounts earned by the Purchasers in consideration for the Equity Backstop Commitment shall be payable in cash and paid within five (5) business days of the earliest of (i) the failure to commence the Rights Offering by January 31, 2015, (ii) final termination of the Rights Offering, or (iii) the closing of the Rights Offering. |

|

Common Stock Offering: |

In the event that the Common Stock Offering does not raise at least $30,000,000 in net proceeds and reduce the Equity Backstop Commitment by at least such amount, then Issuer shall pay to the Purchasers an aggregate of $2,250,000 in the form, at the election of the Issuer, of cash or freely tradeable Common Shares provided that if the Common Shares received by any purchaser shall not be freely tradeable (i.e. because of affiliate status or otherwise), the Company will, within 15 days after issuance of the Common Shares, file a registration statement with the SEC to register it for resale under the Securities Act of 1933, with the number of Common Shares issuable determined by lesser of (a) $7.50 or (b) a 25% discount to the 10-day VWAP prior to the commencement of the Rights Offering, but in no event more than the price in the Common Stock Offering. |

|

Use of Proceeds: |

The Company will use the proceeds solely to effect the transactions in connection with the purchase of the Acquired Business, as further described in Attachment B to the Commitment Letter. |

|

Closing Date: |

Simultaneous with the closing of the purchase of the Acquired Business (“Closing”). |

|

Conditions: |

Customary conditions to the Closing, including the following: |

|

(a) |

Negotiation of the definitive Shareholders Agreement, Registration Rights Agreement and Purchase Agreement which shall be customary for such agreements and reasonably acceptable to all parties thereto. |

|

(b) |

Substantially concurrent receipt of the proceeds in connection with the debt financings described in Attachment B to the Commitment Letter which are in an aggregate amount sufficient to consummate the purchase of the Acquired Business. For the avoidance of doubt, it shall be a condition to the Closing that there be no financing at the Company senior to or pari passu with the Common Shares from sources other than those identified in Attachment B. |

|

(c) |

Confirmation by the Company's board of directors to the effect that it has considered the transactions and the terms thereof set forth in this Commitment Letter, the strategic rationale of the transaction, the financial impact on the pro forma results of the Company, and reviewed the analysis prepared by the Company's financial advisors, and based on all of the foregoing the Company's board of directors believes that the transactions and the terms thereof set forth in this Commitment Letter are in the best interest of the Company and its stockholders; and |

|

(d) |

Entry into the transactions and performance of all obligations thereunder are in compliance with the Company’s charter and bylaws, including, without limitation, Article 8 of the Company’s bylaws. |

|

Offering Price: |

Price per Common Share of the lesser of (a) $7.50 or (b) a 25% discount to the 10-day VWAP prior to the commencement of the Rights Offering, but in no event greater than the price offered in the Common Stock Offering. |

Mandatory Repurchase

|

Offer: |

Upon receipt of any proceeds from the Issuer’s sale of any equity securities following the Closing Date, the Issuer shall offer to repurchase the Common Shares purchased by the |

|

Purchasers pursuant to this Equity Backstop Commitment at a price not less than the Offering Price. Any such offerings shall be made on a pro rata basis to each Purchaser and be on customary terms and conditions for a repurchase offer of such type. |

|

Registration Rights: |

Issuer and Purchasers shall enter into a registration rights agreement providing the Purchasers with demand and piggyback registration rights with respect to all Common Shares issued to or held by Purchasers and their respective assigns (“Registrable Securities”). In addition, as soon as reasonably practicable Issuer shall register for resale the Registrable Securities on a Form S-3 resale shelf registration statement (“Resale Shelf S-3”), but in any event no later than 15 calendar days following issuance of such Common Shares (“Issuance Date”). |

|

Issuer shall use its commercially reasonable efforts to (i) have the Resale Shelf S-3 declared effective as promptly as practicable after filing thereof, but in no event later than (a) 60 days after the Issuance Date, or (b) if earlier, 5 business days after the date on which the SEC informs Issuer (I) that the SEC will not review the Resale Shelf S-3 or (II) that Issuer may request the acceleration of the effectiveness of the Resale Shelf S-3 and Issuer makes such request and (ii) cause the Resale Shelf S-3 to continue to be effective until the earlier to occur of the following (a) each Purchaser has sold all of the Registrable Securities, (b) all of the Registrable Securities covered by such Resale Shelf S-3 may be sold by the Stockholder without volume restrictions pursuant to Rule 144 of the Securities Act or (c) the third anniversary of the effectiveness of the Resale Shelf S-3 (the “Effectiveness Period”). |

|

If the Resale Shelf S-3 (i) is not filed, (ii) is not declared effective, or (iii) does not remain effective, by or for the respective dates set forth above, then, from such date, for each day that Issuer is not in compliance with its obligations hereunder, Issuer shall pay to Purchasers with respect to such failure, as liquidated damages and not as a penalty, an amount in cash equal to 0.25% of the amount of each Purchaser’s (and its assigns, if any) purchase of Common Shares pursuant to the Equity Backstop Commitment (collectively, the “Backstop Proceeds”) per calendar quarter or portion thereof that noncompliance persists up to a maximum amount of 0.75% of the Backstop Proceeds. |

|

Purchase Agreement: |

The purchase of Common Shares will be made pursuant to a Stock Purchase Agreement (the “Purchase Agreement”) to be drafted by the Purchasers’ counsels and customary for such transactions. The Purchase Agreement shall contain, among other things, customary representations and warranties, customary covenants and conditions to Closing all of which shall be substantially similar to the representations and warranties, covenants and conditions contained in the Purchase Agreement as regards the Acquired Business. |

|

Expense Reimbursement: |

Reimbursement by the Company of all reasonable out-of-pocket expenses of Purchasers related to the Rights Offering, including legal documentation, due diligence and related fees and expenses, as more fully set forth in the Commitment Letter. |

|

Governing Law: |

The State of New York. |

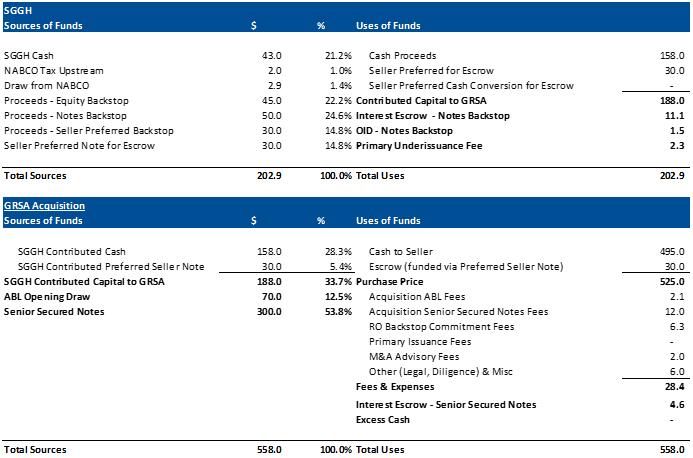

SCHEDULE I

SOURCES & USES (IN US$ MILLIONS)

Preliminary Cash Sources & Uses