Attached files

| file | filename |

|---|---|

| EX-31.01 - CERTIFICATION - STRAGENICS, INC. | f10k2013ex31i_stragenics.htm |

| EX-10.1 - TERMINATION AGREEMENT - STRAGENICS, INC. | f10k2013ex10i_stragenics.htm |

| EX-32.01 - CERTIFICATION - STRAGENICS, INC. | f10k2013ex32i_stragenics.htm |

| EX-21.01 - LIST OF SUBSIDIARIES - STRAGENICS, INC. | f10k2013ex21i_stragenics.htm |

| EXCEL - IDEA: XBRL DOCUMENT - STRAGENICS, INC. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x . ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2013

o . TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE EXCHANGE ACT

For the transition period from ________ to ______

STRAGENICS, INC.

(Exact name of registrant as specified in its charter)

| Florida | 333-157565 | 26-4065800 | ||

| (State or other jurisdiction | (Commission File Number) | (IRS Employer | ||

| of Incorporation) | Identification Number) | |||

|

100 Rialto Place, Suite 700 Melbourne, FL 32901 (Address of principal executive offices)

(321)-541-1216 (Registrant’s Telephone Number) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes o No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes o No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o | Accelerated filer | ☐ |

| Non-accelerated filer | o. (Do not check if a smaller reporting company) | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☒ No ☐

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 28, 2014 was $1,313,284 based upon the price ($0.10) at which the common stock was last sold as of the last business day of the most recently completed second fiscal quarter, multiplied by the approximate number of shares of common stock held by persons other than executive officers, directors and five percent stockholders of the registrant without conceding that any such person is an “affiliate” of the registrant for purposes of the federal securities laws. Our common stock is quoted on the OTCQB under the symbol “ASAB.”

As of September 29, 2014, there were 89,005,249 shares of the issuer’s $0.0001 par value common stock issued and outstanding.

Documents incorporated by reference: None

Table of Contents

| 2 |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

| ● | The availability and adequacy of our cash flow to meet our requirements; |

| ● | Economic, competitive, demographic, business and other conditions in our local and regional markets; |

| ● | Changes or developments in laws, regulations or taxes in our industry; |

| ● | Actions taken or omitted to be taken by third parties including our suppliers and competitors, as well as legislative, regulatory, judicial and other governmental authorities; |

| ● | Competition in our industry; |

| ● | The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business; |

| ● | Changes in our business strategy, capital improvements or development plans; |

| ● | The availability of additional capital to support capital improvements and development; and |

| ● | Other risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC. |

This report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Defined Terms

Except as otherwise indicated by the context, references in this Report to:

| ● | The “Company,” “we,” “us,” or “our,” are references to the combined business of Stragenics, Inc. and Allerayde SAB, Inc. |

| ● |

“UK” refer to the United Kingdom;

|

| ● |

“Stragenics,” formerly known as Allerayde SAB, Inc., refers to Stragenics, Inc., a company incorporated under the laws of the State of Florida, USA; |

| ● | “Allerayde” refers to Allerayde SAB Limited, a limited liability company incorporated under the laws of UK. |

| ● | “Pound” and “£” refers to the legal currency of the United Kingdom. According to the currency exchange website www.xe.com as of April 2, 2014, US$1.00= 0.601544 £; 1 Pound = US $1.66239; |

| ● |

“U.S. dollar,” “$” and “US$” refer to the legal currency of the United States; |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended; and |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

| 3 |

Recent Developments

The statements in this Annual Report on Form 10-K contained in the Business Section as well as the Managements’ Discussion and Analysis Section speak as of December 31, 2013. Since that date, as set forth in our Current Report on Form 8-K filed with the SEC on March 10, 2014, on March 4, 2014, Michael J. Rhodes, the Company’s former Chief Executive Officer, Secretary, Treasurer and director entered into a Stock Purchase Agreement (the “Agreement”), with Alan W. Grofe, an individual, to sell and transfer 75,872,411 restricted shares of our common stock (the “Shares”) owned by Mr. Rhodes to Mr. Grofe. In the Agreement, Mr. Rhodes agreed to transfer all 75,872,411 shares to Mr. Grofe, in a private transaction. As a result of the transfer of the Shares, which constitute 85.24% of the issued and outstanding common stock, a change in control of the Company occurred, with control transferring from Mr. Rhodes to Mr. Grofe. In addition, on March 4, 2014, the Board of Directors appointed Alan W. Grofe as a Director and Mr. Rhodes resigned from his positions as President and Chief Executive Officer, Secretary, Treasurer and as a director of the Company.

After accepting Mr. Rhodes resignation, the Board of Directors of the Company appointed Mr. Grofe to the positions of President and Chief Executive Officer, Secretary and Treasurer, to serve in each capacity until such time as his successor is named.

Mr. Grofe is an experienced executive and entrepreneur with more than 25 years of experience as a senior executive in both public and private corporations in the healthcare and information technology industries. Previously, he served as President of Healthnostics, Inc., a public medical and biotechnology analytics company. Prior to this position, he was a founder, President and COO of H-Quotient, Inc., where he directed strategic product development, sales, marketing and support. He also currently serves as President of the Ferde Grofé Foundation and was recently President of the Manassas Symphony Orchestra. He received his BA in Psychology from California State University, Dominguez Hills.

As reported in our Current Report on Form 8-K filed with the SEC on April 29, 2014, the Board of Directors adopted an amendment to the Company’s Certificate of Incorporation to change its name from Allerayde SAB, Inc. to Stragenics, Inc., (the “Name Change”). As a result of the Name Change, the Company’s new CUSIP Number is 862576105, while its trading symbol remains unchanged. The Amendment became effective on April 28, 2014.

After the filing of this report, the Company plans to divest the Allerayde business and pursue acquisitions of other business the Board of Directors may approve from time to time.

| 4 |

Overview

Stragenics, Inc., formerly Allerayde SAB, Inc. and Resource Exchange of America Corp. (the “Company”), was incorporated under the laws of the State of Florida on January 15, 2009. On March 21, 2013, the Company entered into a Share Exchange Agreement with Allerayde and Michael Rhodes, the sole member of Allerayde (the “Allerayde Stockholder”) (the “Share Exchange Agreement”), where the Allerayde Stockholder transferred 100% of the membership interests of Allerayde held by him, in exchange for an aggregate of 75,872,411 newly issued shares of our Common Stock (the “Share Exchange Transaction). As a result of the Share Exchange Transaction, Allerayde became a wholly-owned subsidiary of the Company, and the Company engaged in the business of developing and manufacturing allergy management products in the United Kingdom and other countries such as the U.S. and Canada.

On March 4, 2014, Michael J. Rhodes, Allerayde’s ’s former Chief Executive Officer, Secretary, Treasurer and director entered into a Stock Purchase Agreement (the “Agreement”), with Alan W. Grofe, an individual, to sell and transfer 75,872,411 restricted shares of our common stock (the “Shares”) owned by Mr. Rhodes to Mr. Grofe. In the Agreement, Mr. Rhodes agreed to transfer all 75,872,411 shares to Mr. Grofe, in a private transaction. As a result of the transfer of the Shares, which constitute 85.24% of the issued and outstanding common stock, a change in control of the Company occurred, with control transferring from Mr. Rhodes to Mr. Grofe, In addition, on March 4, 2014, the Board of Directors appointed Alan W. Grofe as a Director and Mr. Rhodes resigned from his positions as President and Chief Executive Officer, Secretary, Treasurer and as a director of the Company.

After the filing of this Report, Stragenics plans to divest the Allerayde business and pursue acquisitions of other business the Board of Directors may approve from time to time. This is being done because the Board of Directors has determined that the business of Allerayde is unlikely to be profitable or attractive to investors to be able to raise capital. Therefore, the Company will have no operations or assets unless it makes an acquisition of another business. The Company is currently reviewing due diligence on several private company acquisition candidates, however, there can be no assurance that the Company will successfully make an acquisition or that such acquisition will be successful for the Company and its shareholders.

Plan of Operations

GENERAL

The Company's current purpose is to seek, investigate and, if such investigation warrants, merge or acquire an interest in business opportunities presented to it by persons or companies who or which desire to seek the perceived advantages of a Securities Exchange Act of 1934 registered corporation. As of the date of this Report, the Company is reviewing due diligence for several acquisition candidates.

Pending negotiation and consummation of a combination, the Company anticipates that it will have, aside from carrying on its search for a combination partner, no business activities, and, thus, will have no source of revenue. Should the Company incur any significant liabilities prior to a combination with a private company, it may not be able to satisfy such liabilities as are incurred. If the Company's management pursues one or more combination opportunities beyond the preliminary negotiations stage and those negotiations are subsequently terminated, it is foreseeable that such efforts will exhaust the Company's ability to continue to seek such combination opportunities before any successful combination can be consummated. In that event, the Company's common stock will become worthless and holders of the Company's common stock will receive a nominal distribution, if any, upon the Company's liquidation and dissolution.

| 5 |

MANAGEMENT

The Company is in the development stage and currently has no full time employees. Mr. Alan Grofe is the Company’s sole officer and director and controlling shareholder. Mr. Grofe has been and will continue to devote a limited portion of his time to the activities of the Company without compensation. Potential conflicts may arise with respect to the limited time commitment by Mr. Grofe and the potential demands of the Company's activities. The amount of time spent by Mr. Grofe on the activities of the Company is not predictable. Such time may vary widely from an extensive amount when reviewing a target company to an essentially quiet time when activities of management focus elsewhere, or some amount in between.

INVESTIGATION AND SELECTION OF BUSINESS OPPORTUNITIES

To a large extent, a decision to participate in a specific business opportunity may be made upon management's analysis of the quality of the company's management and personnel, the anticipated acceptability of new products or marketing concepts, the merit of technological changes, the perceived benefit the business opportunity will derive from becoming a publicly held entity, and numerous other factors which are difficult, if not impossible, to analyze through the application of any objective criteria. In many instances, it is anticipated that the historical operations of a specific business opportunity may not necessarily be indicative of the potential for the future because of a variety of factors, including, but not limited to, the possible need to expand substantially, shift marketing approaches, change product emphasis, change or substantially augment management, raise capital and the like.

It is anticipated that the Company will not be able to diversify, but will essentially be limited to the acquisition of one business opportunity because of the Company's limited financing. This lack of diversification will not permit the Company to offset potential losses from one business opportunity against profits from another, and should be considered an adverse factor affecting any decision to purchase the Company's securities.

Certain types of business acquisition transactions may be completed without any requirement that the Company first submit the transaction to the stockholders for their approval. In the event the proposed transaction is structured in such a fashion that stockholder approval is not required, holders of the Company's securities (other than principal stockholders holding a controlling interest) should not anticipate that they will be provided with financial statements or any other documentation prior to the completion of the transaction. Other types of transactions may require prior approval of the stockholders. In the event a proposed business combination or business acquisition transaction requires stockholder approval, the Company will be required to prepare a Proxy or Information Statement describing the proposed transaction, file it with the Securities and Exchange Commission for review and approval, and mail a copy of it to all Company stockholders prior to holding a stockholders meeting for purposes of voting on the proposal. Minority shareholders may have the right, buy usually do not, in the event the transaction is approved by the required number of stockholders, to exercise statutory dissenter's rights and elect to be paid the fair value of their shares.

The analysis of business opportunities will be undertaken by or under the supervision of the Company's officers and directors, none of whom are professional business analysts (See Management). Although there are no current plans to do so, Company management may hire an outside consultant to assist in the investigation and selection of business opportunities, and may pay a finder's fee. Since Company’s management has no current plans to use any outside consultants or advisors to assist in the investigation and selection of business opportunities, no policies have been adopted regarding use of such consultants or advisors, the criteria to be used in selecting such consultants or advisors, the services to be provided, the term of service, or the total amount of fees that may be paid. However, due to the limited resources of the Company, it is likely that any such fee the Company agrees to pay would be paid in stock and not in cash.

In analyzing potential business opportunities, Company management anticipates that it will consider, among other things, the following factors: potential for growth and profitability indicated by new technology, anticipated market expansion, or new products; the Company's perception of how any particular business opportunity will be received by the investment community and by the Company's stockholders; whether, following the business combination, the financial condition of the significant prospect in the foreseeable future of becoming sufficient to enable the securities of the Company to qualify for listing on an exchange or on a national automated securities quotation system, so as to permit the trading of such securities to be exempt from the requirements of Rule 15g-9 adopted by the Securities and Exchange Commission.

Possible merger companies will be examined based on competitive position as compared to other companies of similar size and experience within the industry segment as well as within the industry as a whole; strength and diversity of existing management or management prospects that are scheduled for recruitment; the cost of participation by the Company as compared to the perceived tangible and intangible values and potential; and the accessibility of required management expertise, personnel, raw materials services, professional assistance, and other required items. In regard to the possibility that the shares of the Company would qualify for listing, potential investors must recognize that, because of the Company's limited capital available for investigation and management's limited experience in business analysis, the Company may not discover or adequately evaluate adverse facts about the opportunity to be acquired.

| 6 |

The Company is unable to predict when it may participate in a business opportunity. It expects, however, that the analysis of specific proposals and the selection of a business opportunity may take several months or more. Prior to making a decision to participate in a business opportunity, the Company will generally request that it be provided with written materials regarding the business opportunity containing as much relevant information as possible, including, but not limited to, such items as a description of products, services and Company history; management resumes; financial information; available projections with related assumptions upon which they are based; an explanation of proprietary products and services; evidence of existing patents, trademarks, or service marks, or rights thereto; present and proposed forms of compensation to management; a description of transactions between such Company and its affiliates during the relevant periods; a description of present and required facilities; an analysis of risks and competitive conditions; a financial plan of operation and estimated capital requirements; audited financial statements, or if they are not available, unaudited financial statements, together with reasonable assurance that audited financial statements would be able to be produced within a reasonable period of time not to exceed 60 days following completion of a merger or acquisition transaction; and the like. As part of the Company's investigation, the Company's executive officers and directors may meet personally with management and key personnel, may visit and inspect material facilities, obtain independent analysis or verification of certain information provided, check references of management and key personnel, and takes other reasonable investigative measures, to the extent of the Company's limited financial resources and management expertise.

It is possible that the range of business opportunities that might be available for consideration by the Company could be limited by the impact of Securities and Exchange Commission regulations regarding purchase and sale of penny stocks. The regulations would affect, and possibly impair, any market that might develop in the Company's securities until such time as they qualify for listing on NASDAQ or on an exchange which would make them exempt from applicability of the penny stock regulations. Company management believes that various types of potential merger or acquisition candidates might find a business combination with the Company to be attractive. These include acquisition candidates desiring to create a public market for their shares in order to enhance liquidity for current stockholders, acquisition candidates which have long-term plans for raising capital through public sale of securities and believe that the possible prior existence of a public market for their securities would be beneficial, and acquisition candidates which plan to acquire additional assets through issuance of securities rather than for cash, and believe that the possibility of development of a public market for their securities will be of assistance in that process. Acquisition candidates, who have a need for an immediate cash infusion, are not likely to find a potential business combination with the Company to be an attractive alternative.

FORM OF ACQUISITION

It is impossible to predict the manner in which the Company may participate in a business opportunity. Specific business opportunities will be reviewed as well as the respective needs and desires of the Company and the promoters of the opportunity and, upon the basis of the review and the relative negotiating strength of the Company and such promoters, the legal structure or method deemed by management to be suitable will be selected. Such structure may include, but is not limited to leases, purchase and sale agreements, licenses, joint ventures and other contractual arrangements. The Company may act directly or indirectly through an interest in a partnership, corporation or other form of organization. Implementing such structure may require the merger, consolidation or reorganization of the Company with other corporations or forms of business organization. In addition, the present management and stockholders of the Company most likely will not have control of a majority of the voting stock of the Company following a merger or reorganization transaction. As part of such a transaction, the Company's existing directors may resign and new directors may be appointed without any vote by stockholders.

It is likely that the Company will acquire its participation in a business opportunity through the issuance of Common Stock or other securities of the Company. Although the terms of any such transaction cannot be predicted it should be noted that in certain circumstances the criteria for determining whether or not an acquisition is a tax free reorganization under the Internal Revenue Code of 1986 as amended, depends upon the issuance to the stockholders of the acquired Company of a controlling interest (i.e., 80% or more) of the common stock of the combined entities immediately following the reorganization. If a transaction were structured to take advantage of these provisions provided under the Internal Revenue Code, the Company's current stockholders would retain in the aggregate 20% or less of the total issued and outstanding shares. This could result in substantial additional dilution in the equity of those who were stockholders of the Company prior to such reorganization. Any such issuance of additional shares might also be done simultaneously with a sale or transfer of shares representing a controlling interest in the Company by the current officers, directors and principal stockholders.

It is anticipated that any new securities issued in any reorganization would be issued in reliance upon one or more exemptions from registration under applicable federal and state securities laws to the extent that such exemptions are available. In certain transaction, the Company may agree to register such securities either at the time the transaction is consummated or under certain conditions at specified times thereafter. The issuance of substantial additional securities and their potential sale into any trading market that might develop in the Company’s securities may have a depressive effect upon such market.

The Company will participate in a business opportunity only after the negotiation and execution of a written agreement. Although the terms of such agreement cannot be predicted, generally such an agreement would require specific representations and warranties by all of the parties thereto, specify certain events of default, detail the terms of closing and the conditions which must be satisfied by each of the parties thereto prior to such closing, outline the manner of bearing costs if the transaction is not closed, set forth remedies upon default, and include miscellaneous other terms. As a general matter, the Company anticipates that it, and/or its principal stockholders will enter into a letter of intent with the management, principals or owners of a prospective business opportunity prior to signing a binding agreement. Such a letter of intent will set forth the terms of the proposed acquisition but will not bind any of the parties to consummate the transaction. Execution of a letter of intent will by no means indicate that consummation of an acquisition is probable. Neither the Company nor any of the other parties to the letter of intent will be bound to consummate the acquisition unless and until a definitive agreement is executed. Even after a definitive agreement is executed, it is possible that the acquisition would not be consummated should any party elect to exercise any right provided in the agreement to terminate it on specific grounds.

| 7 |

It is anticipated that the investigation of specific business opportunities and the negotiation, drafting and execution of relevant agreements, disclosure documents and other instruments will require substantial management time and attention and substantial costs for accountants, attorneys and others. If a decision is made not to participate in a specific business opportunity, the costs incurred in the related investigation would not be recoverable. Moreover, because many providers of goods and services require compensation at the time or soon after the goods and services are provided, such requirement may impact the specific business opportunity due to the likely inability of the Company to pay until a definitive agreement is executed.

Allerayde Business

Allerayde was incorporated on January 13, 2012 in United Kingdom by Michael Rhodes and was 100% owned by Mr. Rhodes. Mr. Rhodes was the Chief Executive Officer of Allerayde.

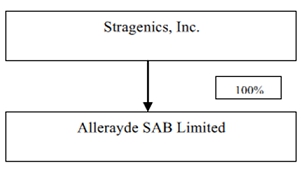

The following diagram sets forth the structure of the Company as of the date of this Report herein:

Product Offering

Allerayde is engaged in the business of developing and manufacturing an innovative anaphylaxis pen product and other consumer health care products for allergy and eczema patients.

AAAPen®

Allerayde’s principal product is the AAAPen®. The AAAPen® is a new anaphylaxis pen for the emergency treatment of anaphylaxis, the severe allergic shock, which may be identified by various rapid onset symptoms following exposure to certain allergens—such as insect venoms, peanuts, seafood, latex, etc.— that have caused symptoms from different leveled reactions. When the first signs of anaphylaxis are being experienced, that is when the AAAPen® shall be used.

Allerayde believes, the AAAPen®, avoids many of the technical shortcomings and high costs of manufacturing of other comparable devices delivering a higher level of reliability than existing products in the market at a selling price of approximately half of the current leader’s in the anaphylaxis treatment field. There are certain possible side effects associated with using the AAAPen® that patients shall be cautious about, including headache, nausea and vomiting, dizziness, paleness, sweating, anxiety and nervousness, shaking (usually of the hands), palpitations, tachycardia, arrhythmias, and difficulties with breathing. AAAPen® is a working prototype that is developed by Allerayde. An AAAPen® consists of the following three components: (i) an auto-injector unit, the drug delivery device, which is assembled with (ii) a syringe unit, which contains (iii) a generic drug, adrenaline. Adrenaline is a naturally occurring catecholamine secreted by the adrenal medulla in response to exertion or stress. It is a sympathomimetic amine which is a potent stimulant of both alpha and beta adrenergic receptors and its effects on target organs are complex. It is the medicinal product of choice to provide rapid relief of hypersensitivity reactions to allergies or to idiopathic or exercise induced anaphylaxis.

| 8 |

Below is a picture of an AAAPen® prototype.

Here is how an AAAPen® functions: in the event of anaphylaxis, the auto-injector in the AAAPen® will deliver a pre-set dose of adrenaline intra muscularly to the patient. The patient shall inject the AAAPen® only into the anterolateral aspect of the thigh. The injected area may be lightly massaged for 10 seconds following injection. Each AAAPen® is for single use only. Our initial plan is to develop and make available the AAAPen® with two dosages: 0.15mg of adrenaline in each AAAPen® for children and 0.3mg for adults, both delivered from a 1 in 1000 concentration solution. Our product will be prescribed by clinicians from hospital and family practice. In some markets, e.g. Spain, Portugal, Greece and Canada, our product will be available over the counter.

The AAAPen® has been developed with an improved performance and lower costs of manufacture and distribution than its competitors. The Company believes that AAAPen® has a strong list of features as follows:

| ☐ | Long Shelf Life--Expected to be 24 months from the date of manufacture (to be determined upon the test data) |

| ☐ | Low Failure Rate— Expected to be less than 1 in 1,000 persons |

| ☐ | Storable at a wide range of temperatures—Expected to be available for storage at 2-30 Celsius degrees |

| ☐ | No specific storage requirements |

| ☐ | Acceptable power of injection—Not too powerful nor too weak when patients are applying the AAAPen® and trying to penetrate outer clothing |

| ☐ | Toleration of significant shock-- The AAAPen® should be able to withstand the force of dropping, significant vibration and other shocks without loss of function such as breaking of seals, unplanned firing of the auto injector etc. |

| ☐ | Latest technology |

| ☐ | Not light sensitive – Adrenaline solutions are light sensitive. However, the auto-injector on the AAAPen® incorporates a closable viewing window which protects the adrenalin solution from the light when closed. |

| ☐ | Avoid Needle-stick injury – The needle of the auto-injector can be easily retracted after used, which will avoid the risk of infection from using the needle when patients fire the auto-injector. |

| 9 |

| ☐ | One concentration of adrenaline—The AAAPen® will have a single concentration of 1:1000, but only half of the volume will be used for children’s doses, resulting in a reduction in production cost and avoidance of potential wastage. The 1:1000 concentrations also has better stability in terms of a longer shelf life compared to other marketed products which have different concentrations for adult (typically 1:1000) and child (typically 1:2000) doses. |

| ☐ |

Possibility of extra dosage forms |

| ☐ | Short chain of distribution |

Allerayde believes that one significant advantage of the AAAPen® is the pricing advantage because Allerayde’s supplier of auto-injectors utilizes the latest automatic manufacturing techniques that enable a low production cost. The production cost of the AAAPen® is only about half of the nearest competitor’s (Epipen).

On the next stage of the development of the AAAPen®, Allerayde will make minor modifications to the auto-injector unit to accommodate a specific syringe as the most suitable device for achieving the best stability of the adrenaline by optimizing the formulation, filling the adrenaline in a none-oxygen atmosphere, and designing all syringe component parts, including the barrel and stoppers to be made of silicon.

Allergy, Asthma and Eczema Prevention and Treatment Products

Allerayde is also engaged in developing and manufacturing products for the prevention and relief of allergy, asthma and eczema. The products are available in the following categories: Barrier Covers, And Eczema Garments,

Competition

The Company expects to encounter substantial competition in its efforts to locate attractive business combination opportunities. The competition may in part come from business development companies, venture capital partnerships and corporations, small investment companies, brokerage firms, and the like. Some of these types of organizations are likely to be in a better position than the Company to obtain access to attractive business acquisition candidates either because they have greater experience, resources and managerial capabilities than the Company, because they are able to offer immediate access to limited amounts of cash, or for a variety of other reasons. The Company also will experience competition from other public companies with similar business purposes, some of which may also have funds available for use by an acquisition candidate.

Employees

The Company currently has no employees. Management of the Company expects to use consultants, attorneys and accountants as necessary, and does not anticipate a need to engage any full-time employees so long as it is seeking and evaluating business opportunities. The need for employees and their availability will be addressed in connection with the decision whether or not to acquire or participate in specific business opportunities.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

Allerayde owns an office for its research and development activities at European Space Agency Business Incubation Center, Harwell, Oxford, United Kingdom.

We know of no material, existing or pending legal proceedings against our Company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which our director, officer or any affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

ITEM 4. MINE SAFETY DISCLOSURE

Not applicable.

| 10 |

ITEM 5. MARKET FOR THE COMPANY’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Common Stock

While there is limited public trading market for our Common Stock, our Common Stock is currently quoted on the OTC Market Group, Inc.’s OTCQB under the trading symbol “ASAB." Trading in stocks quoted on the OTCQB is often thin and is characterized by wide fluctuations in trading prices due to many factors that may have little to do with a company’s operations or business prospects. The reported high and low bid and ask prices for the common stock are shown below for the year ended December 31, 2013 and 2012.

| Bid | ||||||||

| High | Low | |||||||

| 2012 Fiscal Year | ||||||||

| First Quarter | $ | 0.01 | $ | 0.00 | ||||

| Second Quarter | $ | 0.01 | $ | 0.00 | ||||

| Third Quarter | $ | 0.01 | $ | 0.00 | ||||

| Fourth Quarter | $ | 0.02 | $ | 0.00 | ||||

| Bid | ||||||||

| High | Low | |||||||

| 2013 Fiscal Year | ||||||||

| First Quarter | $ | 0.13 | $ | 0.00 | ||||

| Second Quarter | $ | 0.16 | $ | 0.05 | ||||

| Third Quarter | $ | 0.32 | $ | 0.10 | ||||

| Fourth Quarter | $ | 0.40 | $ | 0.10 | ||||

Record Holders

As of December 31, 2013, an aggregate of 89,005,249 shares of our common stock were issued and outstanding and were owned by approximately 11 holders of record, based on information provided by our transfer agent.

Recent Sales of Unregistered Securities

All unregistered sales of the Company’s securities have been disclosed on the Company’s current reports on Form 8-K and the Company’s quarterly reports on Form 10-Q.

Re-Purchase of Equity Securities

None.

Dividends

We have not paid any cash dividends on our common stock since inception and presently anticipate that all earnings, if any, will be retained for development of our business and that no dividends on our common stock will be declared in the foreseeable future. Any future dividends will be subject to the discretion of our Board of Directors and will depend upon, among other things, future earnings, operating and financial condition, capital requirements, general business conditions and other pertinent facts. Therefore, there can be no assurance that any dividends on our common stock will be paid in the future.

Securities Authorized for Issuance Under Equity Compensation Plans

None.

Transfer Agent

During the fiscal year 2013, the transfer agent for the Company's common stock was Vstock Transfer, LLC at 77 Spruce Street, Suite 201, Cedarhurst, NY 11516. Since April 1, 2014, the transfer agent for the Company's common stock was changed to Pacific Stock Transfer at 4045 South Spencer Street Suite 403 Las Vegas, NV 89119.

| 11 |

ITEM 6. SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION.

This Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) contains forward-looking statements that involve known and unknown risks, significant uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed, or implied, by those forward-looking statements. You can identify forward-looking statements by the use of the words may, will, should, could, expects, plans, anticipates, believes, estimates, predicts, intends, potential, proposed, or continue or the negative of those terms. These statements are only predictions. In evaluating these statements, you should consider various factors which may cause our actual results to differ materially from any forward-looking statements. Although we believe that the exceptions reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. We undertake no obligation to revise or update publicly any forward-looking statements for any reason.

RECENT DEVELOPMENTS

The statements in this Annual Report on Form 10-K contained in the Business Section as well as the Managements’ Discussion and Analysis Section speak as of December 31, 2013. Since that date, as set forth in our Current Report on Form 8-K filed with the SEC on March 10, 2014, on March 4, 2014, Michael J. Rhodes, the Company’s former Chief Executive Officer, Secretary, Treasurer and director entered into a Stock Purchase Agreement (the “Agreement”), with Alan W. Grofe, an individual, to sell and transfer 75,872,411 restricted shares of our common stock (the “Shares”) owned by Mr. Rhodes to Mr. Grofe. In the Agreement, Mr. Rhodes agreed to transfer all 75,872,411 shares to Mr. Grofe, in a private transaction. As a result of the transfer of the Shares, which constitute 85.24% of the issued and outstanding common stock, a change in control of the Company occurred, with control transferring from Mr. Rhodes to Mr. Grofe. In addition, on March 4, 2014, the Board of Directors appointed Alan W. Grofe as a Director and Mr. Rhodes resigned from his positions as President and Chief Executive Officer, Secretary, Treasurer and as a director of the Company.

After accepting Mr. Rhodes resignation, the Board of Directors of the Company appointed Mr. Grofe to the positions of President and Chief Executive Officer, Secretary and Treasurer, to serve in each capacity until such time as his successor is named.

Mr. Grofe is an experienced executive and entrepreneur with more than 25 years of experience as a senior executive in both public and private corporations in the healthcare and information technology industries. Previously, he served as President of Healthnostics, Inc., a public medical and biotechnology analytics company. Prior to this position, he was a founder, President and COO of H-Quotient, Inc., where he directed strategic product development, sales, marketing and support. He also currently serves as President of the Ferde Grofé Foundation and was recently President of the Manassas Symphony Orchestra. He received his BA in Psychology from California State University, Dominguez Hills.

As reported in our Current Report on Form 8-K filed with the SEC on April 29, 2014, the Board of Directors adopted an amendment to the Company’s Certificate of Incorporation to change its name from Allerayde SAB, Inc. to Stragenics, Inc., (the “Name Change”). As a result of the Name Change, the Company’s new CUSIP Number is 862576105, while its trading symbol remains unchanged. The Amendment became effective on April 28, 2014.

After the filing of this report, the Company plans to divest the business of Allerayde and pursue acquisitions of other business the Board of Directors may approve from time to time.

| 12 |

RESULTS OF OPERATIONS FOR THE ALLERAYVDE BUSINESS

Working Capital

| December 31, | December 31, | |||||||

| 2013 | 2012 | |||||||

| Current Assets | 0 | 16 | ||||||

| Current Liabilities | 3,060,602 | 3,096 | ||||||

| Working Capital Deficit | (3,060,602 | ) | (3,080 | ) | ||||

Cash Flows

Year Ended December 31, 2013 | Period Ended December 31, 2012 | |||||||

| Cash Flows provided by (used in) Operating activities | (82,771 | ) | 12 | |||||

| Cash Flows provided by Investing Activities | - | - | ||||||

| Cash Flows provided by Financing Activities | 81,909 | 15 | ||||||

| Exchange rate effect on cash | 846 | (11 | ) | |||||

| Net Increase (decrease) in Cash During Period | (16 | ) | 16 | |||||

For the year ended December 31, 2013

Operating Revenues

Operating revenues for the year ended December 31, 2013 were $16,289, which were proceeds from a grant.

Operating revenues for the year ended December 31, 2012 were $nil.

Operating Expenses Other Income (Expenses) and Net Loss

Operating expenses for the year ended December 31, 2013 were $136,580 which is comprised of consulting fees of $45,500, professional fees of $49,584, salaries and benefits of $8,184, office expense of $18,655, filing fees of $6,964, and general and administrative expenses of $7,693.

Other Income (Expenses) for the year ended December 31, 2013 were $468,155 which is comprised of interest expense of $107,198, amortization of debt discount of $34,215, change in the fair value of derivative liabilities of $336,242 and bad debt expense of $4,000, which were offset by $13,500 of debt forgiveness.

Operating expenses for the year ended December 31, 2012 were $3,084.

Net loss for the year ended December 31, 2013 was $588,446.

Net loss for the year ended December 31, 2012 was $3,084.

Liquidity and Capital Resources

As of December 31, 2013 and December 31, 2012, the Company’s cash balance (bank indebtedness) was $(409) and $16, respectively. As of December 31, 2013, the total asset balance was $nil.

As of December 31, 2013, the Company had total liabilities of $3,060,602 compared with total liabilities of $3,096 as of December 31, 2012. The increase in total liabilities is mainly attributed to the liabilities assumed pursuant to the Share Exchange Agreement, dated March 21, 2013, among the Company, Allerayde SAB Limited and the sole shareholder of Allerayde SAB Limited (the “Share Exchange Agreement”).

As of December 31, 2013, the Company had a working capital deficit of $3,060,602 compared to a deficit of $3,080 as of December 31, 2012.

| 13 |

It is the belief of management that sufficient working capital necessary to support and preserve the integrity of the corporate entity will be available. However, there is no legal obligation for management to provide additional future funding. Should Management fail to provide financing, the Company has not identified any alternative sources. Consequently, there is substantial doubt about the Company's ability to continue as a going concern.

The Company has no current plans, proposals, arrangements or understandings with respect to the sale or issuance of additional securities prior to the location of a merger or acquisition candidate. Accordingly, there can be no assurance that sufficient funds will be available to the Company to allow it to cover the expenses related to such activities. The Company’s need for capital may change dramatically as a result of any business acquisition or combination transaction. There can be no assurance that the Company will identify any such business, product, technology or company suitable for acquisition in the future. Further, there can be no assurance that the Company would be successful in consummating any acquisition on favorable terms or that it will be able to profitably manage the business, product, technology or company it acquires.

Regardless of whether the Company’s cash assets prove to be inadequate to meet the Company’s operational needs, the Company might seek to compensate providers of services by issuances of stock in lieu of cash.

Cash flows from Operating Activities

During the year ended December 31, 2013, the Company used cash of $82,771 of cash from operating activities compared to $12 of cash provided by operating activities during the year ended December 31, 2012.

Cash flows from Investing Activities

During the year ended December 31, 2013, the Company used $0 cash from investing activities compared to $0 for the year ended December 31, 2012.

Cash flows from Financing Activities

During the year ended December 31, 2013, the Company received $81,909 of cash from financing activities compared to $15 for the year ended December 31, 2012. During the year ended December 31, 2013, the Company converted debt of $ 92,500 and accrued interest of $30,965 into shares of common stock.

Going Concern

We have not attained profitable operations and are dependent upon obtaining financing to pursue any extensive activities. For these reasons, our auditors stated in their report on our audited financial statements that they have substantial doubt that we will be able to continue as a going concern without further financing.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

Future Financings

We will continue to rely on debt and equity sales of our common shares in order to continue to fund our business operations. Issuances of additional shares will result in dilution to existing stockholders. There is no assurance that we will achieve any additional sales of the equity securities or arrange for debt or other financing to fund our operations and other activities.

Critical Accounting Policies

Our financial statements and accompanying notes have been prepared in accordance with United States generally accepted accounting principles applied on a consistent basis. The preparation of financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods.

| 14 |

We regularly evaluate the accounting policies and estimates that we use to prepare our financial statements. A complete summary of these policies is included in the notes to our financial statements. In general, management's estimates are based on historical experience, on information from third party professionals, and on various other assumptions that are believed to be reasonable under the facts and circumstances. Actual results could differ from those estimates made by management.

Recently Issued Accounting Pronouncements

The Company has implemented all new accounting pronouncements that are in effect. These pronouncements did not have any material impact on the financial statements unless otherwise disclosed, and the Company does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The Company's consolidated financial statements, together with the report of the independent registered public accounting firm thereon and the notes thereto, are presented beginning at page F-1.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

Previous Independent Accountants

On May 9, 2013, in connection with the Company’s acquisition of the assets and operations of Allerayde and the related change in control of the Company, Board of Directors of the Company approved to terminate Bobbitt, Pittenger & Company, P.A. (“BPC”) as the Company’s independent registered public accounting firm.

The Company’s consolidated financial statements of the fiscal years ended December 31, 2012 and December 31, 2011 were audited by BPC’s reports on our financial statements, which did not contain an adverse opinion, a disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles.

During the fiscal years ended December 31, 2012 and 2011 and through May 9, 2013, (a) there were no disagreements with BPC on any matter of accounting principles or practices, financial statement disclosure, auditing scope or procedure, which disagreements, if not resolved to the satisfaction of BPC, would have caused it to make reference to the subject matter of the disagreement in connection with its report on the financial statements for such years and (b) there were no “reportable events” as described in Item 304(a)(1)(v) of Regulation S-K.

New Independent Registered Public Accounting Firm

On May 9, 2013, the Board of Directors of the Company ratified and approved the appointment of Silberstein Ungar, PLLC (“Silberstein Ungar”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013. Silberstein Ungar is located at 30600 Telegraph Road, Suite 2175, Bingham Farms, MI 48025.

For the period ending December 31, 2013 t neither the Company nor anyone on the Company's behalf consulted with Silberstein Ungar regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's financial statements or (ii) any matter that was either the subject of a disagreement or a reportable event as defined in Item 304(a)(1)(v) of Regulation S-K.

On August 11, 2014, Stragenics, Inc., (former known as Allerayde SAB, Inc., (the “Company”) was notified by Silberstein Ungar, PLLC (“Silberstein Ungar”), the Company’s independent registered accounting firm, via a letter dated August 4, 2014 that its employees had been hired by the accounting firm of KLJ & Associates, LLP (“KLJ & Associates”) and that Ronald Silberstein joined KLJ & Associates as a non-equity partner. As a result, on August 6, 2014, Silberstein Ungar resigned as the Company’s independent registered public accounting firm, for which the Company received notification on August 11, 2014. On August 11, 2014, the Company’s Board of Directors approved the engagement of KLJ & Associates as the Company’s independent registered public accounting firm.

| 15 |

During the fiscal years ended December 31, 2013 and December 31, 2012, and through the subsequent interim period preceding KLJ & Associates’ engagement, the Company did not consult with KLJ & Associates on either (1) the application of accounting principles to a specific transaction, either completed or proposed, the type of audit opinion that may be rendered on the Company’s financial statements, and KLJ & Associates did not provide a written report or oral advice to the Company that KLJ & Associates concluded was an important factor considered by the Company in reaching a decision as to an accounting, auditing or financial reporting issue; or (2) any matter that was either the subject of a disagreement, as defined in Item 304(a)(1)(iv) of Regulation S-K, or a reportable event, as defined in Item 304(a)(1)(v) of Regulation S-K.

ITEM 9A. CONTROLS AND PROCEDURES.

Disclosure Controls and Procedures

Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in our reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in our reports filed under the Exchange Act, is accumulated and communicated to management, including our principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure.

As required by Rule 13a-15 under the Exchange Act, we are required to carry out an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures as of the end of the period covered by this report. Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in Company reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms. Based on the Company’s evaluation, management concluded that the Company’s disclosure controls and procedures were not effective at a reasonable assurance level such that the information relating to us and our consolidated subsidiary required to be disclosed in our Exchange Act reports (i) is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms, and (ii) is accumulated and communicated to our management, including our principal executive officer and principal financial officer, as appropriate to allow timely decisions regarding required disclosure as of December 31, 2013.

Management’s Report on Internal Control Over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Exchange Act Rule 13a-15(f). The Company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Under the supervision and with the participation of management, including the Chief Executive Officer, the Company conducted an evaluation of the effectiveness of the Company’s internal control over financial reporting as of December 31, 2013 using the criteria established in “ Internal Control - Integrated Framework ” issued by the Committee of Sponsoring Organizations of the Treadway Commission ("COSO").

A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented or detected on a timely basis. In its assessment of the effectiveness of internal control over financial reporting as of December 31, 2013, the Company determined that there were control deficiencies that constituted material weaknesses, as described below.

|

1.

|

We have limited segregation of duties. – We have limited segregation of duties within our accounting and financial reporting functions. Segregation of duties within our company is limited due to the small number of employees that are assigned to positions that involve the processing of financial information. | |

| 2. | We do not have an Audit Committee – While not being legally obligated to have an audit committee, it is the management’s view that such a committee, including a financial expert member, is an utmost important entity level control over the Company’s financial statement. Currently the Board of Directors acts in the capacity of the Audit Committee, and does not include a member that is considered to be independent of management to provide the necessary oversight over management’s activities. |

| 16 |

| 3. | We did not maintain appropriate cash controls – As of December 31, 2013, the Company has not maintained sufficient internal controls over financial reporting for the cash process, including failure to segregate cash handling and accounting functions, and did not require dual signature on the Company’s bank accounts. Alternatively, the effects of poor cash controls were mitigated by the fact that the Company had limited transactions in their bank accounts. | |

| 4. | We did not implement appropriate information technology controls – As at December 31, 2013, the Company retains copies of all financial data and material agreements; however there is no formal procedure or evidence of normal backup of the Company’s data or off-site storage of the data in the event of theft, misplacement, or loss due to unmitigated factors. |

Accordingly, the Company concluded that these control deficiencies resulted in a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis by the company’s internal controls.

As a result of the material weaknesses described above, management has concluded that the Company did not maintain effective internal control over financial reporting as of December 31, 2013 based on criteria established in Internal Control—Integrated Framework issued by COSO.

Continuing Remediation Efforts to address deficiencies in Company’s Internal Control over Financial Reporting

Our Board of Directors, in particular and in connection with the aforementioned deficiencies, intends to establish the following remediation measures:

| 1. | Our Board of Directors will nominate an audit committee or a financial expert on our Board of Directors in fiscal year 2014. | |

| 2. | We will appoint additional personnel to assist with the preparation of the Company’s monthly financial reporting, including preparation of the monthly bank reconciliations. | |

Changes in Internal Control over Financial Reporting

On March 21, 2013, Mr. Mark Dresner resigned from all of his positions with Allerayde and Mr. Michael Rhodes was appointed as the CEO, President, Treasurer, Secretary and director of the Company. On March 6, 2014, Mr. Michael Rhodes resigned from all his positions with Allerayde and the Board of Directors appointed Mr. Alan W. Grofe as President, Chief Executive Officer, Secretary, Treasurer and a director of the Company.

Except for the foregoing, there has been no change in our internal control over financial reporting identified in connection with our evaluation we conducted of the effectiveness of our internal control over financial reporting as of December 31, 2013, that occurred during our fourth fiscal quarter that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

This annual report does not include an attestation report of the Company’s registered public accounting firm regarding internal control over financial reporting. Managements report was not subject to attestation by the Company’s registered public accounting firm pursuant to temporary rules of the SEC that permit the Company to provide only management’s report in this annual report.

None.

| 17 |

ITEM 10. DIRECTORS AND EXECUTIVE OFFICERS.

Identification of Directors and Executive Officers

Our current sole director and executive officer is as follows:

| Name and Age | Position(s) Held | Tenure | Other Public Company Directorships | ||||

| Alan W. Grofe, 70 | CEO, President, and Director | From March 6, 2014 to present | None |

Below is our former directors and officers during the fiscal year 2013:

| Name and Age | Position(s) Held | Tenure | Other Public Company Directorships | ||||

| Michael J. Rhodes, 59 | CEO, President, and Director | From March 21, 2013 to March 6, 2014 | None |

| Name and Age | Position(s) Held | Tenure | Other Public Company Directorships | ||||

| Mark Dresner, 59 | CEO, President, and Director | From December 12, 2012 to March 21, 2013 | None |

Background and Business Experience

Mr. Grofe is an experienced executive and entrepreneur with more than 25 years of experience as a senior executive in both public and private corporations in the healthcare and information technology industries. Previously he served as President of Healthnostics, Inc., a public medical and biotechnology analytics company. Prior to this position, he was a founder, President and COO of H-Quotient, Inc., where he directed strategic product development, sales, marketing and support. He also currently serves as President of the Ferde Grofé Foundation, Inc., officer and director of the Owl Conservancy, Inc. and was recently President of the Manassas Symphony Orchestra. He received his BA in Psychology from California State University, Dominguez Hills.

| 18 |

Director Qualifications

When considering whether directors and nominees have the experience, qualifications, attributes and skills to enable the Board of Directors to satisfy its oversight responsibilities effectively in light of the Company’s business and structure, the Board of Directors focuses primarily on the industry and transactional experience, and other background, in addition to any unique skills or attributes associated with a director.

We believe that Mr. Grofe should serve as a Director of the Company based on his extensive experience and knowledge of the healthcare industry.

Term of Office

The Board of Directors elects officers and their terms of office are at the discretion of the Board of Directors. Each of our officers serves until the earlier occurrence of the election of his or her successor at the next meeting of stockholders, death, resignation or removal by the Board of Directors. At the present time, members of the board of directors are not compensated for their services to the board. Each Director shall hold office until the next annual meeting of stockholders and until his/her successor shall have been duly elected and qualified.

Identification of Significant Employees

During fiscal year 2013, there were no other significant employees other than Michael Rhodes and Mark Dresner during their respective terms in office. Currently, other than Alan W. Grofe, we do not have any significant employees.

Family Relationships

There are no family relationships among our officers, directors or persons nominated for such positions.

Involvement in Certain Legal Proceedings

During the past ten years no director, executive officer, promoter or control person of the Company has been involved in the following:

(1) A petition under the Federal bankruptcy laws or any state insolvency law which was filed by or against, or a receiver, fiscal agent or similar officer was appointed by a court for the business or property of such person, or any partnership in which he was a general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer at or within two years before the time of such filing;

(2) Such person was convicted in a criminal proceeding or is a named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses);

(3) Such person was the subject of any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from, or otherwise limiting, the following activities:

i. Acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity;

ii. Engaging in any type of business practice; or

iii. Engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of Federal or State securities laws or Federal commodities laws;

(4) Such person was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any Federal or State authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described in paragraph (f)(3)(i) of this section, or to be associated with persons engaged in any such activity;

| 19 |

(5) Such person was found by a court of competent jurisdiction in a civil action or by the Commission to have violated any Federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated;

(6) Such person was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated;

(7) Such person was the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of:

i. Any Federal or State securities or commodities law or regulation; or

ii. Any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or

iii. Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

(8) Such person was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

Audit Committee and Audit Committee Financial Expert

The Company does not have an audit committee or an audit committee financial expert (as defined in Item 407 of Regulation S-K) serving on its Board of Directors. All current members of the Board of Directors lack sufficient financial expertise for overseeing financial reporting responsibilities. The Company has not yet employed an audit committee financial expert on its Board due to the inability to attract such a person.

The Company intends to establish an audit committee of the board of directors, which will consist of independent directors. The audit committee’s duties will be to recommend to the Company’s board of directors the engagement of an independent registered public accounting firm to audit the Company’s financial statements and to review the Company’s accounting and auditing principles. The audit committee will review the scope, timing and fees for the annual audit and the results of audit examinations performed by the internal auditors and independent registered public accounting firm, including their recommendations to improve the system of accounting and internal controls. The audit committee will at all times be composed exclusively of directors who are, in the opinion of the Company’s board of directors, free from any relationship which would interfere with the exercise of independent judgment as a committee member and who possess an understanding of financial statements and generally accepted accounting principles.

Nominating Committee

The Company does not have a separately designated nominating committee. The Company does not have such a committee because we currently believe that given our small size, the fact that a majority of the members of our Board are not currently considered “independent”, and because no Company securities are traded on a stock exchange, that such a committee is not currently necessary. Unless and until the Company establishes a separate nominating committee, when a board vacancy occurs, the remaining board members will participate in deliberations concerning director nominees. In the future the Company may determine that it is appropriate to designate a separate nominating committee of the board of directors comprised solely of independent directors.

To date, the Board of Directors has not adopted a formal procedure by which stockholders may recommend nominees to the board of directors. However, our bylaws set forth the procedure by which eligible stockholders may nominate a person to the Board of Directors, which in relevant part provides that:

The Board of Directors shall nominate candidates to stand for election as directors; and other candidates also may be nominated by any Corporation stockholder, provided that such other nomination(s) are submitted in writing to the Secretary of the Corporation no later than 90 days prior to the meeting of stockholders at which such directors are to be elected, together with the identity of the nominator and the number of shares of the Corporation's stock owned, directly or indirectly, by the nominator. The directors shall be elected at the annual meeting of the stockholders, except as provided in Section 3.4 of the Bylaws, and each director elected shall hold office until such director's successor is elected and qualified or until the director's earlier death, resignation or removal. Directors need not be stockholders.

| 20 |

Code of Ethics

Our Board of Directors anticipates adopting a new code of ethics that applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer and principal accounting officer. The new code will address, among other things, honesty and ethical conduct, conflicts of interest, compliance with laws, regulations and policies, including disclosure requirements under the federal securities laws, confidentiality, trading on inside information, and reporting of violations of the code.

Compliance with Section 16(a) of the Exchange Act

We do not yet have a class of equity securities registered under the Securities Exchange Act of 1934, as amended. Hence, compliance with Section 16(a) thereof by our officers and directors is not required.

ITEM 11. EXECUTIVE COMPENSATION

Summary Compensation Table

The table set forth below summarizes the annual and long-term compensation for services in all capacities to us payable to our executive officers during the years ending December 31, 2013 and 2012.

Summary Compensation Table

|

Name and principal position |

Year | Salary ($) |

Bonus ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Nonqualified Deferred Compensation Earnings |

All Other Compensation ($) |

Total ($) |

||||||||||||||

| Michael J. Rhodes, President, CEO and Director (1) |

2013 2012 |

$ $ |

nil nil |

nil nil |

nil nil |

$ $ |

nil nil |

nil nil |

nil nil |

$ $ |

nil nil |

$ $ |

nil nil |

||||||||||

|

Mark Dresner Former President, CEO (2) |

2013 2012 |

$ $ |

nil nil |

nil nil |

nil nil |

$ $ |

nil nil |

nil nil |

nil nil |

$ $ |

nil nil |

$ $ |

nil nil |

||||||||||

| Kenneth McBride Former President, CEO (3) | 2012 | $ | nil | nil | nil | $ | nil | nil | nil | $ | nil | $ | nil | ||||||||||

(1) Michael Rhodes was appointed as the Company’s CEO, President and director on May 1, 2012 but he resigned from all positions on December 12, 2012. He was re-elected as the Company’s CEO, President and director on March 21, 2013 and served the Company until March 6, 2014.

(2) Mark Dresner was the Company’s CEO and director from December 12, 2012 through March 21, 2013.

(3) Kenneth McBride served as the Company’s CEO, President and director from October 21, 2011 through May 1, 2012.

Narrative Disclosure to Summary Compensation Table

There are no employment contracts, compensatory plans or arrangements, including payments to be received from the Company with respect to any executive officer, that would result in payments to such person because of his or her resignation, retirement or other termination of employment with the Company, or its subsidiaries, any change in control, or a change in the person’s responsibilities following a change in control of the Company.

Outstanding Equity Awards at Fiscal Year-End

No named executive officer received any equity awards, or holds exercisable or non-exercisable options, as of the years ended December 31, 2013 and 2012.

Compensation of Directors

Our directors who are also our employees receive no extra compensation for their service on our board of directors.

Compensation Committee

We currently do not have a compensation committee of the Board of Directors. The Board of Directors as a whole determines executive compensation.

| 21 |

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS