Attached files

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended June 30, 2014

o TRANSITION REPORT UNDER SECTION 13 OR 15 (d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Commission File Number: 000-51151

|

ENERGIZER RESOURCES INC.

|

|

(Name of small business issuer as specified in its charter)

|

|

Minnesota

|

20-0803515

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

520 – 141 Adelaide Street West, Toronto, Ontario, Canada M5H 3L5

(Address of principal executive offices)

(416) 364-4911

(Issuer’s telephone number)

_____________________________________________

(Former name or former address, if changed since last report)

Securities Registered under Section 12(b) of the Exchange Act:

None

Securities Registered Under Section 12(g) of the Exchange Act:

Common Stock, $0.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10K or any amendment to this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | x |

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter was $26,128,520. For purposes of the above statement only, all directors, executive officers and 10% shareholders are assumed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares outstanding of the registrant’s Common Stock, par value $0.01 per share (the "Common Stock"), as of September 19, 2014, was 269,198,956.

Documents Incorporated By Reference: None

Energizer Resources Inc.

|

PART I

|

|||||

|

ITEM 1.

|

Business

|

4 | |||

|

ITEM 1A.

|

Risk Factors

|

19 | |||

|

ITEM 1B.

|

Unresolved Staff Comments

|

26 | |||

|

ITEM 2.

|

Properties

|

26 | |||

|

ITEM 3.

|

Legal Proceedings

|

26 | |||

|

ITEM 4.

|

Mine Safety Disclosures

|

26 | |||

|

PART II

|

|||||

|

ITEM 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

27 | |||

|

ITEM 6.

|

Selected Financial Data

|

29 | |||

|

ITEM 7.

|

Management’s Discussion and Analysis of Financial Condition and of Results Operations

|

29 | |||

|

ITEM 7A.

|

Quantitative and Qualitative Disclosures about Market Risk

|

34 | |||

|

ITEM 8.

|

Financial Statements

|

34 | |||

|

ITEM 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

34 | |||

|

ITEM 9A.

|

Controls and Procedures

|

34 | |||

|

ITEM 9B.

|

Other Information

|

35 | |||

|

PART III

|

|||||

|

ITEM 10.

|

Directors, Executive Officers, and Corporate Governance

|

36 | |||

|

ITEM 11.

|

Executive Compensation

|

40 | |||

|

ITEM 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

47 | |||

|

ITEM 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

49 | |||

|

ITEM 14.

|

Principal Accounting Fees and Services

|

52 | |||

|

PART IV

|

|||||

|

ITEM 15.

|

Exhibits, Financial Statement Schedules

|

53 | |||

|

Signatures

|

54 | ||||

CERTIFICATIONS

| Exhibit 31 – | Management certification | ||||

| Exhibit 32 – | Sarbanes-Oxley Act |

2

FORWARD-LOOKING STATEMENTS

This Annual Report contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 ("PSLRA") regarding management’s plans and objectives for future operations including plans and objectives relating to our planned marketing efforts and future economic performance. The forward-looking statements and associated risks set forth in this Annual Report include or relate to, among other things, (a) our growth strategies, (b) anticipated trends in the mining industry, (c) our ability to obtain and retain sufficient capital for future operations, and (d) our anticipated needs for working capital. These statements may be found under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Description of Business,”. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors”. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this report will in fact occur.

The forward-looking statements herein are based on current expectations that involve a number of risks and uncertainties. Such forward-looking statements are based on assumptions described herein. The assumptions are based on judgments with respect to, among other things, future economic, competitive and market conditions, and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Accordingly, although we believe that the assumptions underlying the forward-looking statements are reasonable, any such assumption could prove to be inaccurate and therefore there can be no assurance that the results contemplated in forward-looking statements will be realized. In addition, as disclosed in “Risk Factors”, there are a number of other risks inherent in our business and operations, which could cause our operating results to vary markedly, and adversely from prior results or the results contemplated by the forward-looking statements. Management decisions, including budgeting, are subjective in many respects and periodic revisions must be made to reflect actual conditions and business developments, the impact of which may cause us to alter marketing, capital investment and other expenditures, which may also materially adversely affect our results of operations. In light of significant uncertainties inherent in the forward-looking information included in the report statement, the inclusion of such information should not be regarded as a representation by us or any other person that our objectives or plans will be achieved.

Any statement in this report that is not a statement of an historical fact constitutes a “forward-looking statement”. Further, when we use the words “may”, “expect”, “anticipate”, “plan”, “believe”, “seek”, “estimate”, “internal”, and similar words, we intend to identify statements and expressions that may be forward- looking statements. We believe it is important to communicate certain of our expectations to our investors. Forward-looking statements are not guarantees of future performance. They involve risks, uncertainties and assumptions that could cause our future results to differ materially from those expressed in any forward-looking statements. Many factors are beyond our ability to control or predict. You are accordingly cautioned not to place undue reliance on such forward-looking statements. Important factors that may cause our actual results to differ from such forward-looking statements include, but are not limited to, the risks outlined under “Risk Factors” herein. The reader is cautioned that our Company does not have a policy of updating or revising forward-looking statements and thus the reader should not assume that silence by management of our Company over time means that actual events are bearing out as estimated in such forward-looking statements.

All references to “dollars”, “$” or “US$” are to United States dollars and all references to “CAD$” are to Canadian dollars. United States dollar equivalents of Canadian dollar figures are based on the noon exchange rate as reported by the Bank of Canada on the applicable date. All references to “common shares” refer to the common shares in our capital stock.

3

PART I

FINANCIAL INFORMATION

As used in this report, “we”, “us”, “our”, “Energizer Resources”, “Energizer”, “Company” or “our Company” refers to Energizer Resources Inc. and all of its subsidiaries. The term NSR stands for Net Smelter Royalty.

ITEM 1. BUSINESS

BACKGROUND – COMPANY OVERVIEW

Energizer Resources Inc. (the "Company") was incorporated in the State of Nevada, United States of America on March 1, 2004 and reincorporated in the State of Minnesota on May 14, 2008. Our fiscal year end is June 30. The Company's principal business is the acquisition and exploration of mineral resources. During fiscal 2008, we incorporated Energizer Resources (Mauritius) Ltd., a Mauritius subsidiary and Energizer Resources Madagascar Sarl, a Madagascar subsidiary. During fiscal 2009, we incorporated THB Venture Ltd., a Mauritius subsidiary to hold the interest in Energizer Resources Minerals Sarl, a Madagascar subsidiary, which holds the Green Giant Property in Madagascar. During fiscal 2012, we incorporated Madagascar-ERG Joint Venture (Mauritius) Ltd., a Mauritius subsidiary and ERG (Madagascar) Sarl, a Madagascar subsidiary. ERG (Madagascar) Sarl is 100% owned by Madagascar-ERG Joint Venture (Mauritius) Ltd. which is owned 100% by Energizer Resources (Mauritius) Ltd. ERG (Madagascar) Sarl holds the Malagasy Joint Venture Ground (see note 7). During fiscal 2014, we incorporated 2391938 Ontario Inc. an Ontario, Canada subsidiary.

We have not had any bankruptcy, receivership or similar proceeding since incorporation. Except as described below, there have been no material reclassifications, mergers, consolidations or purchases or sales of any significant amount of assets not in the ordinary course of business since the date of incorporation.

Summary of Our Business

We are an exploration stage company engaged in the search for graphite, vanadium, gold, uranium and other minerals. We have an interest in properties located in the African country of Madagascar and Canada in the Province of Québec. None of the properties in which we hold an interest have known mineral reserves of any kind at this time. As such, the work programs planned by us are exploratory in nature.

Our executive offices are currently located at 520–141 Adelaide Street West, Toronto, Ontario, Canada M5H 3L5. Our telephone number is (416) 364-4911. We maintain a website at www.energizerresources.com (which website is expressly not incorporated by reference into this filing). These offices are leased on a month-to-month basis, and our monthly rental payments are currently CAD$10,000 per month.

UNTIL WE CAN VALIDATE OTHERWISE, THE PROPERTIES OUTLINED BELOW HAVE NO KNOWN MINERAL RESERVES OF ANY KIND AND WE ARE PLANNING PROGRAMS THAT ARE EXPLORATORY IN NATURE.

Further details regarding our properties, although not incorporated by reference, including the comprehensive geological report prepared in compliance with Canada’s National Instrument 43-101 on our Molo Graphite Project and our Green Giant Property in Madagascar can be found on our Company’s website: www.energizerresources.com (which website is expressly not incorporated by reference into this filing) or in our Company’s Canadian regulatory filings on www.sedar.com (which website and content is expressly not incorporated by reference into this filing).

Cautionary Note

Due to the nature of our business, we anticipate incurring operating losses for the foreseeable future. We base this expectation, in part, on the fact that very few mineral properties in the exploration stage ultimately develop into producing profitable mines. Our future financial results are also uncertain due to a number of factors, some of which are outside our control. These factors include, but are not limited to:

|

·

|

our ability to raise additional capital as required;

|

|

·

|

the market price for graphite, vanadium, gold, uranium and for any other minerals which we may find;

|

|

·

|

ongoing joint ventures;

|

|

·

|

the results of our proposed exploration programs on our mineral properties;

|

|

·

|

environmental regulations that may adversely impact cost and operations; and

|

|

·

|

our ability to find joint venture partners, as needed, for the development of our property interests.

|

4

If we are successful in completing an equity financing, as necessary, existing shareholders will experience dilution of their interest in our Company. In the event we are not successful in raising additional financing, we anticipate that we will not be able to proceed with our business plan. In such a case, we may decide to discontinue our current business plan and seek other business opportunities in the resource sector. During this period, should it ever arise, we will need to maintain our periodic filings with the appropriate regulatory authorities and, as such, will incur legal and accounting costs. In the event no other such opportunities are available and we cannot raise additional capital to sustain operations, we may be forced to discontinue our business altogether. We do not have any specific alternative business opportunities in mind and have not planned for any such contingency.

Due to our lack of operating history and present inability to generate revenues, our auditors have stated their opinion that there currently exists doubt as to our ability to continue as a going concern.

Properties

Cautionary Note Regarding Resource and Reserve Calculation – Energizer Resources Inc. reports reserve and mineralized material estimates in accordance with U.S. SEC Industry Guide 7. Canadian investors are cautioned that estimates of mineralized materials may differ from mineral resource estimates prepared in accordance with the standards of the Canadian Institute of Mining, Metallurgy and Petroleum referred to in Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”). Canadian investors should review the mineral resource estimates prepared in accordance with NI 43-101 standards found in section 14.10 of the Company’s NI 43-101 Molo Graphite Project technical report dated April 12, 2013.

Madagascar Properties

Molo Graphite Project, Southern Madagascar, Africa

On December 14, 2011, we entered into a Definitive Joint Venture Agreement ("JVA") with Malagasy Minerals Limited ("Malagasy"), a public company on the Australian Stock Exchange, to acquire a 75% interest to explore and develop a group of industrial minerals, including graphite, vanadium and approximately 25 other minerals. The land position covers 2,119 permits and 827.7 square kilometres and is mostly adjacent to the south and east of our 100% owned Green Giant Property. We paid $2,261,690 and issued 7,500,000 common shares valued at $1,350,000.

On October 24, 2013, the Company signed a Memorandum of Understanding ("MOU") with Malagasy to acquire the remaining 25% interest in land position. Upon execution of a signed purchase agreement, the share purchase agreement will supersede the MOU.

On April 16, 2014, we signed a Sale and Purchase Agreement and a Mineral Rights Agreement with Malagasy to acquire the remaining 25% interest. We made the following payments: CAD$400,000; issued 2,500,000 common shares subject to a 12 month voluntary vesting period and valued at $325,000; and issued 3,500,000 common share purchase warrants. We will make a cash payment of CAD$700,000 and issue 1,000,000 common shares within five days of completion of a bankable feasibility study (“BFS”) or the formal announcement of a decision to mine; and a cash payment of CAD$1,000,000 within five days of the commencement of commercial production. Malagasy retains a 1.5% net smelter return royalty ("NSR"). We also acquired a 100% interest to the industrial mineral rights on approximately 1-1/2 additional claim blocks comprising 10,811 hectares to the east and adjoining the Molo Graphite Project. We will continue to own a 100% interest in the industrial mineral rights, which includes our Canadian NI 43-101 compliant vanadium resource estimate, comprising an indicated resource of 49.5 million tonnes at an average grade of 0.693% vanadium pentoxide (V2O5) and an inferred resource of 9.7 million tonnes at an average grade of 0.632% V2O5 at a cut-off of 0.5% V2O5.

Green Giant Property, Madagascar

During 2007 we acquired a 75% interest in the property. We paid $765,000, issued 2,500,000 common shares and 1,000,000 now expired common share purchase warrants to enter into a joint venture agreement for the Green Giant Property with Madagascar Minerals and Resources Sarl ("MMR").

On July 9, 2009, we acquired the remaining 25% interest for $100,000. MMR retains a 2% NSR. The NSR can be purchased at our option, for $500,000 in cash or common shares for the first 1% and at a price of $1,000,000 in cash or common shares for the second 1%.

On April 16, 2014, we signed a Joint Venture Agreement with Malagasy, whereby Malagasy acquired a 75% interest for non-industrial minerals on the property. We retain remaining 25% and have a free carried interest through the BFS. No specific consideration was received for this transaction as it was part of the Molo Graphite Project transaction dated April 16, 2014.

5

Canadian Property

Sagar Property – Romanet Horst, Labrador Trough, Québec, Canada

During 2006, we purchased from Virginia Mines Inc. ("Virginia") a 100% interest in 382 claims located in northern Quebec, Canada. Virginia retains a 2% NSR on certain claims within this property with other unrelated vendors holding a 1% NSR on certain claims, and a 0.5% NSR on other claims. For the other vendor's NSR, we have the right to buy back half of the 1% NSR for $200,000 and half of the 0.5% NSR for $100,000.

On July 31, 2014 we revised our February 28, 2014 agreement with Honey Badger Exploration Inc. (“TUF”), a public company related by common management, to sell an interest in the Sagar Property. Under the revised agreement, in order for TUF to acquire an initial 35% interest in the property, we will receive CAD$150,000 and TUF will spend CAD$1,500,000 developing the property. TUF can earn further percentage interests up to 75% over a four year period by spending a total of CAD$9,000,000, paying the Company CAD$900,000 and issuing to us the lesser of 15% of its issued and outstanding shares or 35,000,000 shares. Once these commitments have been met, TUF can acquire the remaining interest by paying us an additional CAD$2,000,000 and issuing the lesser of 19.5% of TUF outstanding shares or up to 60,000,000 shares, including all previously issued shares.

Further details on exploration programs carried out on all our Company’s properties can be found below.

Competitive Conditions in our Industry

The mineral exploration and mining industry is competitive in all phases of exploration, development and production. We compete with a number of other entities and individuals in the search for, and acquisition of, attractive mineral properties. As a result of this competition, the majority of which is with companies with greater financial resources than us, we may not in the future be able to acquire attractive properties on terms our management considers acceptable. Furthermore, we compete with other resource companies, many of whom have greater financial resources and/or more advanced properties that are better able to attract equity investments and other capital. Factors beyond our control may affect the marketability of minerals mined or discovered by us.

Employees

As of September 19, 2014, we had 10 total employees, 7 full-time and 3 part-time employees. In addition to our full time employees, we engage consultants to serve several important managerial and non-managerial functions for us.

6

MADAGASCAR PROPERTIES

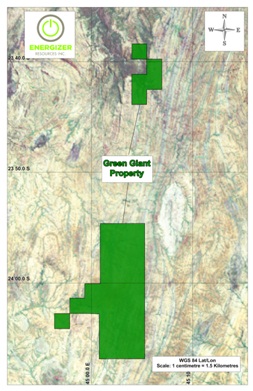

Green Giant Property Description and Location

The Green Giant Property is comprised of 6 mineral permits. The properties are located in the District of Toliara and are referenced as TN 12,306,P(R); TN 12,814, P(R); TN 12,887 P(R); TN 12,888 P(R); TN 13,020 P(R); TN 13,021 P(R) as issued by the Bureau de Cadastre Minier de Madagascar (“BCMM”) pursuant to the Mining Code 1999 (as amended) and its implementing decrees. The total land position is 225 sq. kilometres. This property can be accessed by both air and road.

7

Molo Graphite Property Description and Location

The “Molo Graphite Property” is comprised of a portion of or all of 40 mineral permits. The properties are located in the District of Toliara and are referenced as TN 3,432,P(R); TN 5,394, P(R); TN 13,064 P(R); TN 13,811 P(R); TN 14618 P(R), TN 14,619 P(R); TN 14,620 P(R); TN 14,622 P(R); TN 14,623 P(R); TN 16,747 P(R); TN 16,753 P(R); TN 19,003 P(R); TN 19,851 P(R); TN 19,932 P(R); TN 19,934 P(R); TN 19,935 P(R); TN 21,059 P(R); TN 21,060 P(R); TN 21,061 P(R); TN 21,062 P(R); TN 21,063 P(R); TN 21,064 P(R); TN 24,864 P(R); TN 25,605 P(R); TN 25,606 P(R); TN 28,340 P(R); TN 28,346 P(R); TN 28,347 P(R); TN 28,348 P(R); TN 28,349 P(R); TN 28,352 P(R); TN 28,353 P(R); TN 29,020 P(R); TN 31,734 P(R); TN 31,735 P(R); TN 38,323 P(R); TN 38,324 P(R); TN 38,325 P(R); TN 38,392 P(R); and TN 38,469 P(R) as issued by the Bureau de Cadastre Minier de Madagascar (“BCMM”) pursuant to the Mining Code 1999 (as amended) and its implementing decrees. The total land position is 940.2 sq. kilometres. This property can be accessed by both air and road.

Agreements

Molo Graphite Project, Southern Madagascar, Africa

On December 14, 2011, we entered into a Definitive Joint Venture Agreement ("JVA") with Malagasy Minerals Limited ("Malagasy"), a public company on the Australian Stock Exchange, to acquire a 75% interest to explore and develop a group of industrial minerals, including graphite, vanadium and approximately 25 other minerals. The land position covers 2,119 permits and 827.7 square kilometres and are mostly adjacent to the south and east of our 100% owned Green Giant Property. We paid $2,261,690 and issued 7,500,000 common shares valued at $1,350,000.

On April 16, 2014, we signed a Sale and Purchase Agreement and a Mineral Rights Agreement with Malagasy to acquire the remaining 25% interest. We made the following payments: CAD$400,000; issued 2,500,000 common shares subject to a 12 month voluntary vesting period and valued at $325,000; and issued 3,500,000 common share purchase warrants. We will make a cash payment of CAD$700,000 and issue 1,000,000 common shares within five days of completion of a BFS or the formal announcement of a decision to mine; and a cash payment of CAD$1,000,000 within five days of the commencement of commercial production. Malagasy retains a 1.5% net smelter return royalty ("NSR"). We also acquired a 100% interest to the industrial mineral rights on approximately 1-1/2 additional claim blocks comprising 10,811 hectares to the east and adjoining the Molo Graphite Project.

8

DRA Agreement Signed for Ability to Develop and Build Mine

During January 2012, we signed a formal agreement with South Africa's DRA Mineral Projects (“DRA”), a world-leading process engineering and mining project development management firm, for the development of our projects in Madagascar. Specific focus will be on the development of vanadium and graphite minerals. This partnership provides us with the ability to both build and manage a mining operation. It also provides DRA the option to purchase up to 5% of our Company through private placement at current market conditions.

Madagascar Historical Exploration Programs

The Green Giant Property displays extensive gossans outcroppings at surface. An examination of part of this property revealed several large areas covered with gossanous boulders, which are believed to overlie massive sulphide mineralization. Phases of the exploration projects were managed by our company’s President and COO, Craig Scherba, P. Geol., who at the time was one of our outside consultant geologists. We conducted a first phase of exploration from September to November 2007 that included the following activities:

|

·

|

Stream Sediment sampling of all stream on the property area

|

|

·

|

Detailed Geological mapping over selected startigraphic horizons

|

|

·

|

Reconnaissance geological mapping over the entire property

|

|

·

|

Soil sampling over selected target areas and prospecting over selected target areas

|

|

·

|

Limited trenching over selected targets

|

|

·

|

Construction of a cinder block base camp

|

|

·

|

Construction of a one kilometre long surfaced airstrip

|

|

·

|

Repair and surfacing of the access road from base camp to the airstrip

|

|

·

|

Airborne geophysical surveying

|

During March 2008-June 2008, a full field exploration program following up on the airborne geophysical survey and results of the 2007 exploration program was implemented. This exploration consisted of the following:

|

·

|

Infill stream sediment sampling

|

|

·

|

Detailed Geological mapping over selected stratigraphic horizons

|

|

·

|

Prospecting over selected target areas

|

|

·

|

Grid emplacement over selected target areas

|

|

·

|

Ground-based magnetometer and frequency domain EM surveys

|

|

·

|

Soil sampling over selected target areas

|

After reviewing the analytical data from the March 2008- June 2008 program, additional exploration was conducted from July 2008 to September 2008 to prepare for a drill program. This exploration consisted of the following:

|

·

|

Infill stream sediment sampling

|

|

·

|

Detailed geological mapping over selected stratigraphic horizons

|

|

·

|

Prospecting over selected target areas with the aid of a mobile XRF analyzer

|

Based on compiled analytical results obtained from the various exploration programs, a drill program was initiated on the property from September 2008-November 2008. This exploration program consisted of the following:

|

·

|

Prospecting over selected target areas with the aid of a mobile XRF analyzer

|

|

·

|

Ground-based scintillometer surveying over selected target areas

|

|

·

|

Diamond drilling of 31 holes over 4,073 metres

|

Based on early indications for vanadium on the property, another exploration program was initiated on the Green Giant Property during the spring of 2009. The program (completed between April 2009-July 2009) consisted of an extensive X-Ray Fluorescence analysis (XRF) soil sampling program coupled with mechanical trenching and scintillometer surveys over possible areas of vanadium enrichment and new areas, defined by the soil XRF survey.

We initiated a vanadium drill program during September 2009-December 2009 consisting of the following:

· XRF soil sample analyses (8,490 samples) on lines 200 metres apart covering 18 kilometre strike length

· Scintillometer surveying (112 line kilometres) on lines 200 metres apart over an 18 kilometre strike length

· Trenching (140 trenches for 17,105 metres)

· Diamond drilling of 54 diamond drill holes over 8,931 metres

9

The exploration programs to date resulted in the delineation of two vanadium pentoxide (V2O5) deposits (named the Jaky and Manga), characterized by two separate categories: oxide and primary.

Based on the results of the September 2009-December 2009 program, we conducted an additional exploration program on the property from April 2010-July 2010. This program consisted of the following activities:

|

·

|

Diamond drilling of 46 diamond drill holes over 8,952 metres

|

|

·

|

Prospecting over selected target areas with the aid of a mobile XRF analyzer (20 grab samples)

|

|

·

|

Geologic mapping over the Manga and Mainty deposits at 1:5000 scale

|

|

·

|

ERT ground geophysical survey (5.64 km)

|

|

·

|

MAG ground geophysical survey (169.53 km)

|

|

·

|

Gradient Array EM ground geophysical survey (128.82 km)

|

In 2011, the identification of graphite in the Manga, Jaky and Mainty zones led our geologists to conduct a reconnaissance exploration program (Phase I program) on the properties in September, 2011. The goal of this exploration program was to delineate new graphitic trends, and compare them to those associated with vanadium mineralization. This program consisted of the following activities:

|

·

|

Diamond drilling of 10 holes over 1,157.5 metres

|

|

·

|

Trenching (16 trenches for 1,912 metres)

|

|

·

|

Prospecting over selected target areas

|

An additional reconnaissance exploration program was conducted from November 2011-December, 2011 (Phase II program). The purpose of this program was to ascertain the industrial mineral potential on the Joint Venture Ground, and further drill testing of graphitic trends on the Green Giant Property. This program consisted of the following:

|

·

|

Diamond drilling of 20 holes over 2,842 metres

|

|

·

|

Prospecting over selected target areas

|

|

·

|

EM31 ground geophysical survey over selected target areas (160.5 km)

|

The discovery of graphite mineralization from the 2011 exploration programs resulted in the initiation of a resource delineation drill program from May 2012-August 2012. This program consisted of the following:

|

·

|

Trenching (18 trenches for 2,100 metres)

|

|

·

|

Diamond drilling of 41 diamond drill holes over 8,459 metres

|

The resource delineation drill program identified that graphite mineralization could be divided into a high grade zone (6 to 10% carbon) that produces small to large graphite flakes, and a low grade zone (4 to 6% carbon) that produces large to jumbo graphite flakes. A bulk sampling program was undertaken in May 2013 with the purpose of collecting two separate samples, in order to test the nature of the low-grade and high-grade deposits to see if they have different requirements. The two bulk samples were submitted for metallurgical test work, which is deemed to be representative of the future plant feed, and hence could be used for a Bankable Feasibility Study going forward. In order to be representative, an external geological consultant determined a sample size of 100 tonnes each was deemed sufficient.

The primary objectives for analyzing the bulk samples at a 'pilot plant scale' were as follows:

|

·

|

Confirm the robustness of the proposed metallurgical flow-sheet that was first developed on a laboratory scale under continuous conditions

|

|

·

|

Develop process design criteria for the Full Feasibility Study

|

|

·

|

Generate large samples of concentrate for evaluation by potential off take partners

|

The metallurgical results confirmed the proposed flow sheet, and that the graphite flakes from the Molo deposit can be upgraded to high-grade graphite concentrate by means of simple flotation.

Bulk sample highlights:

|

·

|

The average mass recovery into the large and extra-large flake category (greater than +80 mesh) was 43.5% based on the results of fifteen size fraction analyses of the combined concentrate;

|

|

·

|

The average grade of the extra-large flake (greater than +48 mesh) was 97.7%Ct (Total Carbon)

|

|

·

|

The average grade of the large flake (greater than +80 mesh) was 97.4%Ct;

|

|

·

|

The average grade of the medium flake (greater than +200 mesh) was 96.7% Ct; and

|

|

·

|

The majority of the impurities reported to the small flake size fractions (-400 mesh).

|

The average total carbon content of twelve pilot plant surveys was 93.7% Ct at an average carbon recovery of 90.3%. The average composition of the combined concentrate of fifteen size fraction analyses is shown in the table below.

10

Molo Average Flake Size Analysis

|

Size

mesh

|

Mass as Percentage of Total

Concentrate Mass in %

|

Grade

% C(t)

|

|

48

|

15.7

|

97.7

|

|

65

|

17.6

|

97.4

|

|

80

|

10.2

|

96.7

|

|

100

|

9.7

|

96.4

|

|

150

|

15.0

|

96.1

|

|

200

|

10.1

|

95.2

|

|

-200

|

21.6

|

88.2

|

A part of the full feasibility study, the Company conducted an infill resource delineation program from May 2014-June 2012. This program consisted of the following:

|

·

|

Trenching (9 trenches for 1,876 metres)

|

|

·

|

Diamond drilling of 32 diamond drill holes over 2,063 metres

|

Madagascar Infrastructure

· Road Access

Access to the Company’s Molo Graphite Deposit from Toliara, starts with a 70 km paved road to the village of Andranovory. From Andranovory, secondary all-season roads continue to Betioky, a distance of 93 km. From Betioky, the Molo Graphite Deposit can be reached from Ambatry to Fotadrevo, a distance of 105 km, for an overall total of 268 km, or from Betioky to Ejeda then onwards to Fotadrevo, a distance of 161 km, for an overall total of 324 km. The second route from Ejeda to Fotadrevo is used by heavy transport trucks and by all vehicles during portions of the rainy season, as the other route can become impassable. At the height of the rainy season, both routes to Fotadrevo may become impassable. From Fotadrevo, the Molo Graphite Deposit may be reached by a fairly well maintained dirt track. The map below shows the road access to the Molo Graphite Deposit from the town of Toliara.

11

Map of Road Structure from Toliara to Fotadrevo

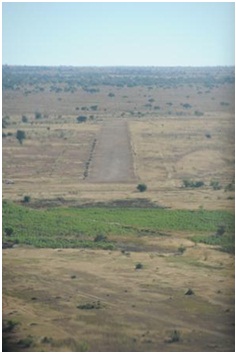

Air Access

With the upgrading of an existing airstrip at Fotadrevo to an all-weather airstrip during the 2008 exploration program, our Madagascar properties are accessible year-round by private aircraft out of Antananarivo, except under special circumstance caused by continuous or multiple days of heavy rain. Flying times to Fotadrevo are approximately 2.5 hours from Antananarivo and 45 minutes from Toliara.

Photo of the Landing Strip at Fotadrevo

Antananarivo is currently serviced by Air France (Paris), South African Airways (Johannesburg), and Air Mauritius (Mauritius). Air Madagascar also provides service to Paris, Johannesburg, Mauritius, Nairobi, and Réunion Island. Domestically, Air Madagascar has regularly scheduled jet and propjet flights throughout the country, including daily flights between Antananarivo and Toliara.

12

The village of Fotadrevo, where our Company has its base camp, is located to the west of the Molo Graphite Deposit. The village has been a labour source during our Company’s exploration programs, and will likely provide a portion of the workforce during future exploration and development. A few basic goods are commercially available in the village, however, the main centre for support of exploration and development are the cities of Toliara and Antananarivo. Two 40 kVA diesel-powered generators provide power to the camp facility.

A cellular telephone tower is located in Fotadrevo, which provides phone and internet coverage. No potable water is currently available within the project area. A well 123 millimetre in diameter has been drilled to a depth of 42 metres within the camp compound, which provides non-potable water for the camp.

Graphite Market and Pricing

Market Overview

According to Industrial Minerals magazine, the natural graphite market is 1,015,100 tonnes of which roughly 55% is flake and 45% is low grade amorphous (or 582,800 flake, 428,300 amorphous, 4,000 vein). Graphite is produced globally, however China currently accounts for most of the graphite production with a market share of 77%. Two tables listing the current major production countries of flake and amorphous graphite are below (Source: Natural Graphite Report 2012, Industrial Minerals, www.indmin.com):

|

Country

|

Flake output

|

|

China

|

380,000

|

|

Brazil

|

96,000

|

|

India

|

35,000

|

|

North Korea

|

30,000

|

|

Canada

|

21,000

|

|

Norway

|

8,000

|

|

Zimbabwe

|

5,000

|

|

Madagascar

|

4,000

|

|

Russia

|

2,000

|

|

Ukraine

|

1,500

|

|

Germany

|

300

|

|

Total

|

582,800

|

|

Country

|

Amorphous output

|

|

China

|

400,000

|

|

Austria

|

16,000

|

|

Mexico

|

12,000

|

|

Turkey

|

300

|

|

Total

|

428,300

|

China produces 77% of the world’s graphite, however most of its production is low grade amorphous. The graphite industry in China is undergoing fundamental reforms. China is protecting its domestic supply and has imposed a combined 37% export duty and value added tax. Furthermore, China is consolidating and closing a large number of mines, between 180-200, to preserve graphite resources and address environmental concerns.

Current Demand

Graphite has many wide-ranging uses from refractories to anodes in batteries (Source: Natural Graphite Report 2012, Industrial Minerals, www.indmin.com)

|

Refractories, foundry and crucibles

|

39 | % | ||

|

Metallurgy

|

28 | % | ||

|

Parts and components

|

10 | % | ||

|

Batteries

|

9 | % | ||

|

Lubricants

|

9 | % | ||

|

Other

|

5 | % |

Future Demand

Batteries alone is the fastest growing market for graphite with growth between 15-25% a year (Source: Industrial Minerals, 2012) and future demand for graphite is expected through the uptake of lithium-ion batteries (Li-ion). There is 11 times more graphite in a Li-ion battery than there is lithium and demand for graphite in Li-ion batteries, specifically from the growth of the electric vehicle market, is expected to be significant. Other future demand drivers include pebble bed nuclear reactors, fuel cells, large-scale energy storage and graphene.

13

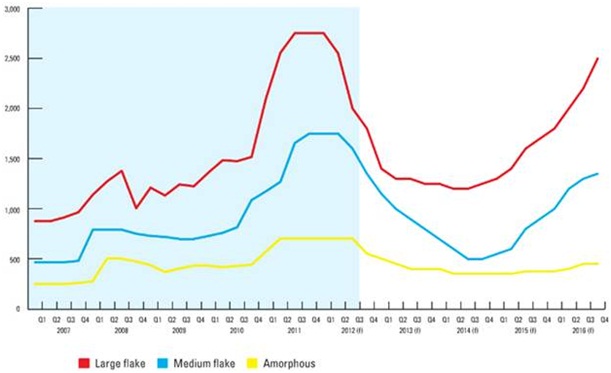

Graphite Pricing

Graphite pricing is a function of flake size and purity where larger flake and higher purity command premium pricing in the market. The three major categories for flake graphite are large, medium, and small (amorphous).

Graphite is not freely traded on an open market. This means determining its price is somewhat of an opaque market as prices are determined through contracts between buyers and sellers. Nevertheless, Industrial Minerals performs regular customer surveys tracking pricing trends and, from their analysis, overall graphite prices have substantially increased since 2007 due to increased demand and constrained supply. Recently however, graphite prices have decreased from their peak due to the slowdown in the global economy particularly in Europe and Asia. Despite this recent decline, future prices are predicted to remain strong as can be outlined in the graph below:

Source: Natural Graphite Report 2012, Industrial Minerals, www.indmin.com

Vanadium Market and Pricing

Source of this entire section: United States Geological Survey. Data in metric tons of vanadium content unless otherwise noted

Domestic Production and Use

Seven U.S. firms comprise most of the domestic vanadium industry produced ferrovanadium, vanadium pentoxide, vanadium metal and vanadium-bearing chemicals or specialty alloys by processing materials such as petroleum residues, spent catalysts, utility ash and vanadium-bearing pig iron slag. Metallurgical use, primarily as an alloying agent for iron and steel, accounted for about 93% of the U.S. vanadium consumption in 2011. Of the other uses for vanadium, the major non-metallurgical use was in catalysts for the production of maleic anhydride and sulfuric acid.

14

|

Salient Statistics—United States

|

2008

|

2009

|

2010

|

2011

|

2012est

|

|||||||||||||||

|

Production, mine, mill

|

520 | 230 | 1,060 | 590 | 270 | |||||||||||||||

|

Imports for consumption:

|

||||||||||||||||||||

|

Ferrovanadium

|

2,800 | 353 | 1,340 | 2,220 | 3,400 | |||||||||||||||

|

Vanadium pentoxide, anhydride

|

3,700 | 1,120 | 4,000 | 2,810 | 1,570 | |||||||||||||||

|

Oxides and hydroxides, other

|

144 | 25 | 167 | 886 | 1,210 | |||||||||||||||

|

Aluminum-vanadium master alloys (gross weight)

|

618 | 282 | 951 | 278 | 180 | |||||||||||||||

|

Ash and residues

|

1,040 | 791 | 521 | 1,420 | 1,500 | |||||||||||||||

|

Sulfates

|

2 | 16 | 48 | 42 | 40 | |||||||||||||||

|

Vanadates

|

187 | 214 | 158 | 303 | 320 | |||||||||||||||

|

Vanadium metal, including waste and scrap

|

5 | 22 | 10 | 44 | 110 | |||||||||||||||

|

Exports:

|

||||||||||||||||||||

|

Ferrovanadium

|

452 | 672 | 611 | 314 | 530 | |||||||||||||||

|

Vanadium pentoxide, anhydride

|

249 | 401 | 140 | 89 | 40 | |||||||||||||||

|

Oxides and hydroxides, other

|

1,040 | 506 | 1,100 | 254 | 190 | |||||||||||||||

|

Aluminum-vanadium master alloys (gross weight) 1,390

|

447 | 1,190 | 920 | 1,400 | ||||||||||||||||

|

Vanadium metal, including waste and scrap

|

57 | 23 | 21 | 102 | 10 | |||||||||||||||

|

Consumption:

|

||||||||||||||||||||

|

Apparent

|

5,820 | 1,040 | 5,190 | 6,963 | 6,400 | |||||||||||||||

|

Reported

|

5,170 | 4,690 | 5,030 | 5,120 | 5,200 | |||||||||||||||

|

Stocks, consumer, yearend

|

335 | 295 | 248 | 2185 | 2220 | |||||||||||||||

|

* Price, average, dollars per pound V2O5

|

$ | 12.92 | $ | 5.43 | $ | 6.46 | $ | 6.76 | $ | 6.52 | ||||||||||

|

Imports + exports + adjustments for government

|

||||||||||||||||||||

|

and industry stock changes as a percentage of

|

||||||||||||||||||||

|

apparent consumption

|

91 | % | 78 | % | 81 | % | 92 | % | 96 | % | ||||||||||

* Vanadium is not freely traded on an open market. This means determining prices for vanadium is somewhat of an opaque market as prices are determined through contracts between buyers and sellers.

Events, Trends, and Issues

U.S. apparent consumption of vanadium in 2012 decreased by 9% from its 2011 level; however, it was still almost six times higher than its level in 2009. Apparent consumption of vanadium declined dramatically in 2009 from that of 2008 owing to the global economic recession in 2009. Among the major uses for vanadium, production of carbon, full-alloy, and high-strength low-alloy steels accounted for 16%, 45%, and 33% of domestic consumption, respectively. U.S. imports for consumption of vanadium in 2012 increased 4% from those of the previous year. U.S. exports increased 29% from those of the previous year.

In the fourth quarter of 2011, vanadium pentoxide (V2O5) prices continued to decrease to a year-to-date low of $6.22 per pound of V2O5 in December 2011. In January 2012, prices continued to decrease to a year-to-date low of $5.83 per pound of V2O5 until February when prices began to slowly increase again. In August 2012, V2O5 prices averaged $6.60 per pound of V2O5, slightly more than average V2O5 prices in August 2011. In the fourth quarter of 2011, U.S. ferrovanadium (FeV) prices continued to slowly decrease to a year-to-date low of $13.19 per pound FeV (contained vanadium) in December 2011. In January 2012, prices continued to decrease until February 2012 when prices began to slowly increase. In August 2012, FeV prices averaged $15.60 per pound of FeV.

World Mine Production and Reserves

Production data for the United States were revised based on new company information.

|

Mine production

|

Reserves (thousand

|

|||||||||||

|

2011

|

2012est

|

metric tons)

|

||||||||||

|

China

|

23,000 | 23,000 | 5,100 | |||||||||

|

South Africa

|

22,000 | 22,000 | 3,500 | |||||||||

|

Russia

|

15,200 | 16,000 | 5,000 | |||||||||

|

United States

|

1,590 | 1,270 | 45 | |||||||||

|

Other countries

|

1,600 | 1,600 |

not applicable

|

|||||||||

|

World total (approximate)

|

63,390 | 63,870 | 14,000 | |||||||||

15

World Resources the Substitutes

World resources of vanadium exceed 63 million tons. Vanadium occurs in deposits of phosphate rock, titaniferous magnetite, and uraniferous sandstone and siltstone, in which it constitutes less than 2% of the host rock. Significant amounts are also present in bauxite and carboniferous materials, such as coal, crude oil, oil shale, and tar sands. Because vanadium is usually recovered as a byproduct or co-product, demonstrated world resources of the element are not fully indicative of available supplies. While domestic resources and secondary recovery are adequate to supply a large portion of domestic needs, a substantial part of U.S. demand is currently met by foreign material.

Steels containing various combinations of other alloying elements can be substituted for steels containing vanadium. Certain metals, such as manganese, molybdenum, niobium (columbium), titanium, and tungsten, are to some degree interchangeable with vanadium as alloying elements in steel. Platinum and nickel can replace vanadium compounds as catalysts in some chemical processes. There is currently no acceptable substitute for vanadium in aerospace titanium alloys.

Permitting in Madagascar

Companies in Madagascar first apply for an exploration mining permit with the Bureau de Cadastre Minier de Madagascar (“BCMM”), a government agency falling under the authority of the Minister of Mines. Permits are granted under usual circumstances are generally issued within a month. The 2014 fees per square within a mining permit range from approximately 92,500 Ariary to 500,000 Ariary (between $35 and $194 using a current exchange rate of 2,580 Madagascar Ariary = $1 USD). The number of squares varies widely by claim number. For the 2014 year, the Company paid approximately $400,000 to the BCMM to renew all of its claims in Madagascar. This fee covered both the 100% owned Green Giant Property (6 claims) and the Molo Graphite Property (39 claims). Each year the Company is required to pay a similar amount in order to maintain the claims in good standing.

The next step in the permitting process, which our Company has initiated, is to apply for an exploitation permit. Our Company has engaged a third party environmental study company in Madagascar to assist us with this process. In order to get an exploitation permit, an investment plan, exploitation work plan budget and specific ground mapping is submitted to the BCMM. This step is completed in conjunction with a submission of an environmental impact study for the BCMM. This environmental impact study includes, among other things, completion of a water study and a social impact study.

QA/QC Protocols

At all times during sample collection, storage, and shipment to the laboratory facility, the samples are in the control of our Company or parties that we have contracted to act as our agents.

When sufficient sample material (grab, trench or core) has been collected, the samples are flown or sent by truck to our storage location in Antananarivo, Madagascar. At all times samples are accompanied by an employee, consultant or agent of our Company. From there, samples are shipped to labs either in South Africa or Canada for ICP-MS analysis.

All analytical results are e-mailed directly by the lab to the Company’s project manager on site in Madagascar and to our Company’s geological and executive staff. Results are also posted on a secure website and downloaded by our Company’s personnel using a secure username and password. All of the labs that carried out the sampling and analytical work are independent of our Company.

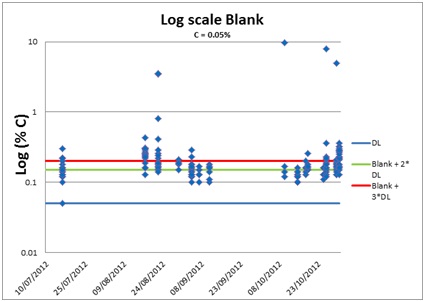

In order to carry out QA/QC protocols on the assays, blanks, standards and duplicates were inserted into the sample streams. This was done once in every 30 samples, representing an insertion rate of 3.33% of the total.

Since the 2009 Madagascar drill program, our Company has rigorously implemented a blank protocol. For the Molo Graphite Deposit a fine-grained quartz sand sourced from a hardware store in Antananarivo was used as the blank material for the sampling campaign. A total of 208 blank samples were used in this program. A detection limit of 0.05% Carbon was used for the purpose of this exercise. To verify the reliability of the blank samples, the detection limit and the blank + 2, and 3 times the detection limit were plotted against the date. The plot shows that there are a lot of blank samples that have concentrations that exceed the blank + 3 times detection limit threshold. This, coupled with the large spread of data points, would lead to the assumption that samples may have been contaminated during their preparation for analysis.

16

Blanks plot – Log %C versus the date of the analysis.

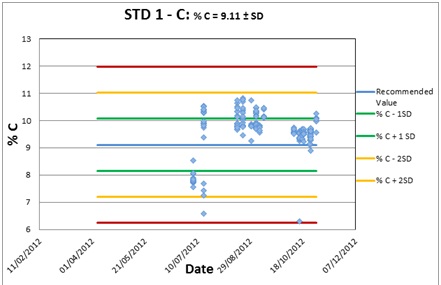

Since certified reference materials (“CRMs”) are essentially non-existent for graphite, our Company commissioned a third party lab in Canada to create a CRM from the remaining Molo Graphite Deposit drill core pulps from the 2011 program. As certified the third party lab standard (STD 1 C) a recommended value of 9.11 % Carbon.

To check the reliability of the standard, a plot of the recommended CRM value versus date was created. The upper and lower limits of one, two and three times the standard deviations of the recommended value are also included in the plot. All the results except for two fall within the acceptable limit of two times the standard deviation. It is however worth noting that there seems to be a negative bias towards lower concentrations in the first batch of samples that were submitted. As the campaign progressed the bias leant towards the positive side. This issue appears to have been sorted out towards the latter parts of the campaign as the data becomes less spread, and is closer to the recommended value.

Graph showing carbon concentration as analyzed in STD 1C.

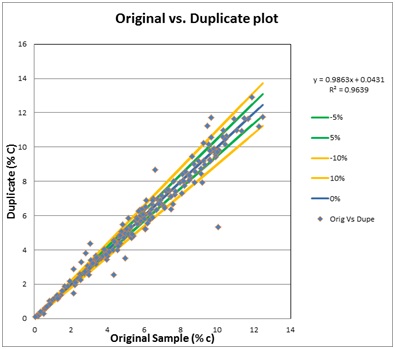

For the Molo Graphite Deposit, 205 field duplicates were prepared. To check how close these were to the original samples, a plot of the original samples with a zero, five, and ten per cent difference of the original samples was created. The majority of the samples were within the 10% difference limit. The plot also shows a good correlation between the original value and the duplicate, as is evident from the regression line with an R2 value of 0.96.

17

Original (“Orig”) versus Duplicate (“Dupe”) plots.

Next Steps

The Company is completing the full feasibility study for the Molo deposit, and anticipates this study to be completed in November, 2014. With this study, the Company will have the technical data to approach financiers and strategic partners for the funding of a mine.

Future Programs

The economic potential of the property rests upon the ability to extract graphite and/or vanadium using reasonable, potentially economic parameters. Initial metallurgical results indicate that an economic processing method is available to extract graphite. This will be determined within a full feasibility study anticipated for release in the fourth quarter of the calendar year of 2014. The results of this study will dictate how our management proceeds with project development.

Other Expenses

Management anticipates spending approximately $350,000 - $450,000 in ongoing general office and administration expenses and professional fees per quarter for the next twelve months. Expenses will vary in direct proportion with the level of activity relating to future acquisitions and exploration programs.

18

ITEM 1A. RISK FACTORS

Our business is subject to a variety of risks and uncertainties, including, but not limited to, the risks and uncertainties described below. If any of the risks described below, or elsewhere in this report on Form 10-K, or our Company’s other filings with the Securities and Exchange Commission (the "SEC"), were to occur, our financial condition and results of operations could suffer and the trading price of our common stock could decline. Additionally, if other risks not presently known to us, or that we do not currently believe to be significant, occur or become significant, our financial condition and results of operations could suffer and the trading price of our common stock could decline. You should carefully review the risk factors together with all other information contained in this Annual Report on Form 10-K, and in prior reports pursuant to the Securities Exchange Act of 1934, as amended and the Securities Act of 1933, as amended. Our risk factors, including but not limited to the risk factors listed below, are as follows:

SHOULD ONE OR MORE OF THE FOREGOING RISKS OR UNCERTAINTIES MATERIALIZE, OR SHOULD THE UNDERLYING ASSUMPTIONS OF OUR BUSINESS PROVE INCORRECT, ACTUAL RESULTS MAY DIFFER SIGNIFICANTLY FROM THOSE ANTICIPATED, BELIEVED, ESTIMATED, EXPECTED, INTENDED OR PLANNED.

The report of our independent registered public accounting firm contains explanatory language that substantial doubt exists about our ability to continue as a going concern.

The independent auditor’s report on our financial statements contains explanatory language that substantial doubt exists about our ability to continue as a going concern. Due to our lack of operating history and present inability to generate revenues, we have sustained operating losses since our inception. Since our inception, up to June 30, 2014, we had accumulated net losses of $86,254,224. If we are unable to obtain sufficient financing in the near term as required or achieve profitability, then we would, in all likelihood, experience severe liquidity problems and may have to curtail our operations. If we curtail our operations, we may be placed into bankruptcy or undergo liquidation, the result of which will adversely affect the value of our common shares.

We may not have access to sufficient capital to pursue our business and therefore would be unable to achieve our planned future growth.

We intend to pursue a strategy that includes development of our Company’s business plan. Currently we have limited capital, which is insufficient to pursue our plans for development and growth. Our ability to implement our Company’s plans will depend primarily on our ability to obtain additional private or public equity or debt financing. Such financing may not be available, or we may be unable to locate and secure additional capital on terms and conditions that are acceptable to us. Financing exploration plans through equity financing will have a dilutive effect on our common shares. Our failure to obtain additional capital will have a material adverse effect on our business.

Our primary exploration efforts are in the African country of Madagascar, where democratic elections occurred at the end of 2013.

Any adverse developments to the political situation in Madagascar could have a material effect on our Company’s business, results of operations and financial condition. Democratic elections in Madagascar occurred toward the end of 2013 as planned by the elections calendar jointly established between the UN and the Elections Commissions. To date, our Company has not experienced any disruptions or been placed under any constraints in our exploration efforts due to the political situation in Madagascar. Depending on future actions taken by the newly elected government, or any future government, our Company’s business operations could be impacted.

A roadmap, designed by the Southern African Development Community, and endorsed by the African Union, provided for a path for democratic elections. Presidential elections were held on October 25, 2013, while parliamentary elections and second-round presidential elections occurred on December 20, 2013. The newly elected President was inaugurated on January 25, 2014 and the lower house of Parliament took office in February 2014. A new Prime Minister was named on April 10, 2014 and a new government named on April 17, 2014.

We are actively monitoring the political climate in Madagascar and continue to hold meetings with representatives of the government and the Ministry of Mines. The transformation or amendment of exploration and research mining permits within the country continues to be suspended. Our Company has continued to pay taxes and administrative fees in Madagascar with respect to all the mining permits we hold. These payments have been acknowledged and accepted by the Madagascar government.

19

Our common shares have been subject to penny stock regulation in the United States of America.

Our common shares have been subject to the provisions of Section 15(g) and Rule 15g-9 of the (US) Securities Exchange Act of 1934, as amended (the “Exchange Act”), commonly referred to as the “penny stock” rule. Section 15(g) sets forth certain requirements for transactions in penny stocks and Rule 15g-9(d)(1) incorporates the definition of penny stock as that used in Rule 3a51-1 of the Exchange Act. The Commission generally defines penny stock to be any equity security that has a market price less than US$5.00 per share, subject to certain exceptions. Rule 3a51-1 provides that any equity security is considered to be penny stock unless that security is: registered and traded on a national securities exchange meeting specified criteria set by the Commission; issued by a registered investment company; excluded from the definition on the basis of price (at least US$5.00 per share) or the registrant’s net tangible assets; or exempted from the definition by the Commission. If our common shares are deemed to be “penny stock”, trading in common shares will be subject to additional sales practice requirements on broker/dealers who sell penny stock to persons other than established customers and accredited investors.

Financial Industry Regulatory Authority, Inc. (“FINRA”) sales practice requirements may limit a shareholder’s ability to buy and sell our common shares.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a client, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that client. Prior to recommending speculative low priced securities to their non-institutional clients, broker-dealers must make reasonable efforts to obtain information about the client’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some clients. FINRA requirements make it more difficult for broker-dealers to recommend that their clients buy our common shares, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

As a public company we are subject to complex legal and accounting requirements that will require us to incur significant expenses and will expose us to risk of non-compliance.

As a public company, we are subject to numerous legal and accounting requirements in both Canada and the United States of America that do not apply to private companies. The cost of compliance with many of these requirements is material, not only in absolute terms but, more importantly, in relation to the overall scope of the operations of a small company. Our relative inexperience with these requirements may increase the cost of compliance and may also increase the risk that we will fail to comply. Failure to comply with these requirements can have numerous adverse consequences including, but not limited to, our inability to file required periodic reports on a timely basis, loss of market confidence, delisting of our securities and/or governmental or private actions against us. We cannot assure you that we will be able to comply with all of these requirements or that the cost of such compliance will not prove to be a substantial competitive disadvantage vis-à-vis privately held and larger public competitors.

Compliance with changing regulation of corporate governance and public disclosure will result in additional expenses and pose challenges for our management.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules and regulations promulgated thereunder, the Sarbanes-Oxley Act and SEC regulations, have created uncertainty for public companies and significantly increased the costs and risks associated with accessing the U.S. public markets. Our management team needs to devote significant time and financial resources to comply with both existing and evolving standards for public companies, which will lead to increased general and administrative expenses and a diversion of management time and attention from revenue generating activities to compliance activities.

Changes in tax laws or tax rulings could materially affect our financial position and results of operations.

Changes in tax laws or tax rulings could materially affect our financial position and results of operations. For example, the current U.S. administration and key members of Congress have made public statements indicating that tax reform is a priority. Certain changes to U.S. tax laws, including limitations on the ability to defer U.S. taxation on earnings outside of the United States until those earnings are repatriated to the United States, could affect the tax treatment of our foreign earnings. In addition, many countries in the European Union, as well as a number of other countries and organizations such as the Organization for Economic Cooperation and Development, are actively considering changes to existing tax laws. Certain proposals could include recommendations that would significantly increase our tax obligations in many countries where we do business. Due to the large and expanding scale of our international business activities, any changes in the taxation of such activities may increase our worldwide effective tax rate and harm our financial position and results of operations.

20

Because we are quoted on the OTCQX instead of a national securities exchange in the United States, our U.S. investors may have more difficulty selling their stock or experience negative volatility on the market price of our stock in the United States.

In the United States, our common shares are quoted on the OTCQX. The OTCQX is marketed as an electronic exchange for high growth and early stage U.S. companies and a prospective “final step toward a NASDAQ or NYSE listing” (although no assurances can be provided that such change of market shall occur). Trades are settled and cleared in the U.S. similar to any NASDAQ or NYSE stock and trade reports are disseminated through Yahoo, Bloomberg, Reuters, and most other financial data providers. The OTCQX can be significantly illiquid, in part because it does not have a national quotation system by which potential investors can follow the market price of shares except through information received and generated by a limited number of broker-dealers that make markets in particular stocks. There is a greater chance of volatility for securities that trade on the OTCQX as compared to a national securities exchange in the United States, such as the New York Stock Exchange, the NASDAQ Stock Market or the NYSE Amex. This volatility may be caused by a variety of factors, including the lack of readily available price quotations, the absence of consistent administrative supervision of bid and ask quotations, lower trading volume, and market conditions. U.S. investors in our common shares may experience high fluctuations in the market price and volume of the trading market for our securities. These fluctuations, when they occur, have a negative effect on the market price for our common shares. Accordingly, our U.S. shareholders may not be able to realize a fair price from their shares when they determine to sell them or may have to hold them for a substantial period of time until the market for our common shares improves.

In addition to being quoted on the OTCQX, our common shares trade on the Toronto Stock Exchange (“TSX”), Canada’s national stock exchange, under the symbol EGZ and on the Frankfurt Exchange under the symbol YE5.

The price at which you purchase our common shares may not be indicative of the price that will prevail in the trading market. You may be unable to sell your common shares at or above your purchase price, which may result in substantial losses to you. The market price for our common shares is particularly volatile given our status as a relatively unknown company with a small and thinly traded public float, limited operating history and lack of profits which could lead to wide fluctuations in our share price.

The market for our common shares is characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer. The volatility in our share price is attributable to a number of factors. First our common shares, at times, are thinly traded. As a consequence of this lack of liquidity, the trading of relatively small quantities of shares by our shareholders may disproportionately influence the price of those shares in either direction. The price for our shares could, for example, decline precipitously in the event that a large number of our common shares are sold on the market without commensurate demand, as compared to a seasoned issuer which could better absorb those sales without adverse impact on its share price. Second, we are a speculative or “risky” investment due to our limited operating history, lack of profits to date and uncertainty of future market acceptance for our potential products. As a consequence, more risk-adverse investors may, under the fear of losing all or most of their investment in the event of negative news or lack of progress, be more inclined to sell their shares on the market more quickly and at greater discounts than would be the case with the stock of a seasoned issuer. Many of these factors are beyond our control and may decrease the market price of our common shares, regardless of our performance. We cannot make any predictions as to what the prevailing market price for our common shares will be at any time or as to what effect that the sale of shares or the availability of common shares for sale at any time will have on the prevailing market price.

Shareholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility of our share price.

21

Volatility in our common share price may subject us to securities litigation, thereby diverting our resources that may have a material effect on our profitability and results of operations.

The market for our common shares is characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may in the future be the target of similar litigation. This type of litigation could result in substantial costs and could divert management’s attention and resources.

Failure to achieve and maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) could have a material adverse effect on our business and our operating results.

If we fail to comply with the requirements of Section 404 of the Sarbanes-Oxley Act regarding internal control over financial reporting or to remedy any material weaknesses in our internal controls that we may identify, such failure could result in material misstatements in our financial statements, cause investors to lose confidence in our reported financial information and have a negative effect on the trading price of our common shares.

Pursuant to Section 404 of the Sarbanes-Oxley Act and current SEC regulations, we are required to prepare assessments regarding internal controls over financial reporting. In connection with our on-going assessment of the effectiveness of our internal control over financial reporting, we may discover “material weaknesses” in our internal controls as defined in standards established by the Public Company Accounting Oversight Board, or the PCAOB. A material weakness is a significant deficiency, or combination of significant deficiencies, that results in more than a remote likelihood that a material misstatement of the annual or interim financial statements will not be prevented or detected. The PCAOB defines “significant deficiency” as a deficiency that results in more than a remote likelihood that a misstatement of the financial statements that is more than inconsequential will not be prevented or detected.

In the event that a material weakness is identified, as it has been for this report, subject to expansion of the size of our Company and our finance department, we will employ qualified personnel and adopt and implement policies and procedures to address any material weaknesses that we identify. However, the process of designing and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company. We cannot assure you that the measures we will take will remediate any material weaknesses that we may identify or that we will implement and maintain adequate controls over our financial process and reporting in the future.

Any failure to complete our assessment of our internal control over financial reporting, to remediate any material weaknesses that we may identify or to implement new controls, or difficulties encountered in their implementation, could harm our operating results, cause us to fail to meet our reporting obligations or result in material misstatements in our financial statements. Any such failure could adversely affect the results of the management evaluations of our internal controls. Inadequate internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our common shares.

Should we lose the services of our key executives, our financial condition and proposed expansion may be negatively impacted.

We depend on the continued contributions of our executive officers to work effectively as a team, to execute our business strategy and to manage our business. The loss of key personnel, or their failure to work effectively, could have a material adverse effect on our business, financial condition, and results of operations. Specifically, we rely on Richard E. Schler, our Chief Executive Officer, Craig Scherba, our President and Chief Operating Officer and Peter Liabotis, our Chief Financial Officer. We do not maintain key man life insurance. Should we lose any or all of their services and we are unable to replace their services with equally competent and experienced personnel, our operational goals and strategies may be adversely affected, which will negatively affect our potential revenues.

Minnesota law and our articles of incorporation protect our directors from certain types of lawsuits, which could make it difficult for us to recover damages from them in the event of a lawsuit.

Minnesota law provides that our directors will not be liable to our Company or to our stockholders for monetary damages for all but certain types of conduct as directors. Our articles of incorporation require us to indemnify our directors and officers against all damages incurred in connection with our business to the fullest extent provided or allowed by law. The exculpation provisions may have the effect of preventing stockholders from recovering damages against our directors caused by their negligence, poor judgment or other circumstances. The indemnification provisions may require our Company to use its assets to defend our directors and officers against claims, including claims arising out of their negligence, poor judgment, or other circumstances.

22

We have not identified any mineral reserves or resources and due to the speculative nature of mineral property exploration, there is substantial risk that no commercially exploitable minerals will be found and our business will fail.