Attached files

| file | filename |

|---|---|

| EX-32 - CERTIFICATION OF CEO/CFO PURSUANT TO SECTION 906 - UROLOGIX INC | urologix143355_ex32.htm |

| EX-31.1 - CERTIFICATION OF CEO PURSUANT TO SECTION 302 - UROLOGIX INC | urologix143355_ex31-1.htm |

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - UROLOGIX INC | urologix143355_ex23-1.htm |

| EX-31.2 - CERTIFICATION OF CFO PURSUANT TO SECTION 302 - UROLOGIX INC | urologix143355_ex31-2.htm |

| EXCEL - IDEA: XBRL DOCUMENT - UROLOGIX INC | Financial_Report.xls |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

|

|

|

|

||

|

FORM 10-K |

||

|

|

|

|

|

|

|

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the fiscal year ended June 30, 2014. |

|

|

OR |

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the transition period from ___________________ to ____________________. |

|

|

|

|

|

Commission File Number 0-28414 |

||

|

|

|

|

UROLOGIX, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Minnesota |

|

41-1697237 |

|

(State or other jurisdiction of |

|

(IRS Employer |

|

incorporation or organization) |

|

Identification No.) |

14405 21st Avenue North, Suite 110, Minneapolis, MN

55447

(Address of principal

executive offices)

Registrant’s telephone number, including area code: (763) 475-1400

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act: |

|

|

|

|

Common Stock, $.01 par value |

|

|

|

Series A Junior Participating Preferred Stock Purchase Rights |

|

Securities registered pursuant to Section 12(g) of the Act: None

|

|

|

|

|

|

Yes o |

No x |

|

|

|

|

|

|

Yes o |

No x |

|

|

|

|

|

|

Yes x |

No o |

|

|

|

|

|

|

|

|

Large Accelerated Filer o |

Accelerated Filer o |

Non-Accelerated Filer o |

Smaller Reporting Company x |

|

|

Yes o |

No x |

The aggregate value of the Company’s Common Stock held by non-affiliates of the Company was approximately $3,574,987 as of the last day of the Company’s most recently completed second fiscal quarter, December 31, 2013, when the last reported sales price was $0.18.

As of September 1, 2014, the Company had outstanding 21,655,906 shares of Common Stock, $.01 par value.

1

DOCUMENTS INCORPORATED BY REFERENCE

Certain information is incorporated into Part III of this report by reference to the definitive Proxy Statement for the Registrant’s 2014 Annual Meeting of Shareholders to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K.

2

3

Forward-Looking Statements

Statements included in this Annual Report on Form 10-K that are not historical or current facts are forward-looking statements. In addition, our officers may make forward-looking statements orally. We caution readers that these statements are not predictions of actual future results. Our actual results could differ materially from any such forward-looking statements as a result of risks and uncertainties, including those set forth below in Item 1A “Risk Factors” and in other documents we file from time to time with the Securities and Exchange Commission, including our Quarterly Reports on Form 10-Q. Any such forward-looking statements reflect information available to us as of the date of this Annual Report on Form 10-K, and we undertake no obligation to update any such forward-looking statements.

|

|

|

|

BUSINESS |

Overview

Urologix develops, manufactures, and markets non-surgical, office-based therapies for the treatment of the symptoms and obstruction resulting from non-cancerous prostate enlargement also known as benign prostatic hyperplasia (BPH). These therapies use proprietary technology in the treatment of BPH, a disease that affects more than 30 million men worldwide and is the most common prostate problem for men over 50. We market both the Cooled ThermoTherapy™ (CTT) product line and the Prostiva® Radio Frequency (RF) Therapy System (Prostiva). We acquired the exclusive worldwide license to the Prostiva RF Therapy System in September 2011. These two technologies are designed to be used by urologists in their offices without placing their patients under general anesthesia. CTT uses a flexible catheter to deliver targeted microwave energy combined with a unique cooling mechanism that protects healthy urethral tissue and enhances patient comfort to provide safe, effective, lasting relief from BPH voiding symptoms by the thermal ablation of hyperplastic prostatic tissue surrounding the urethra. The proprietary Prostiva RF Therapy System delivers radio frequency energy directly into the prostate through the use of insulated electrodes deployed from a transurethral scope, ablating targeted prostatic tissue under the direct visualization of the urologist. These focal ablations reduce constriction of the urethra, thereby relieving BPH voiding symptoms. These two proven technologies have slightly different, yet complementary, patient indications and providing them to our urologist customers enables them to treat a wide range of patients in their office. We believe that these office-based BPH therapies are efficacious, safe and low cost solutions for BPH as they have shown results clinically superior to those of daily BPH medication and without the complications and side effect profile inherent with surgical procedures.

Our goal is to strengthen our business by efficiently deploying our resources to support adoption of Cooled ThermoTherapy and Prostiva RF Therapy as the preferred therapeutic options considered by urologists for their BPH patients in the earlier stages of disease progression. Typically, these are patients who do not want to take chronic BPH medication or are unhappy with the side effects, costs or results. A urologist can choose between our two therapies based upon clinical criteria specific to the BPH patient’s presentation. Our business strategy to achieve this goal is to:

|

|

|

|

|

|

• |

Increase utilization of Cooled ThermoTherapy and Prostiva RF Therapy by urologists who already have access to a Cooled ThermoTherapy and/or Prostiva RF Therapy system, |

|

|

|

|

|

|

• |

Build upon the evidence supporting the cost effectiveness of our technologies and educate healthcare providers on the benefit to patients and the healthcare system of our in-office therapies, |

|

|

|

|

|

|

• |

Educate patients and urologists on the benefits of Cooled ThermoTherapy and Prostiva RF Therapy through educational and other market development efforts, and |

|

|

|

|

|

|

• |

Continue to partner with our European distributors to support the customers outside the United States. |

4

Benign Prostatic Hyperplasia (BPH)

The prostate is a walnut-sized gland surrounding the male urethra (the channel that carries urine from the bladder out of the body) that is located just below the bladder and adjacent to the rectum. BPH is a non-cancerous disease in which the prostate grows and constricts the urethra causing adverse changes in urinary voiding patterns. While the actual cause of BPH is not fully understood, it is known that as men reach middle age, cells within the prostate begin to grow at an increasing rate. As the prostate grows, it compresses or impinges on the urethra and bladder neck, thereby restricting the normal passage of urine. BPH patients typically suffer from a variety of troubling symptoms generally referred to as LUTS (Lower Urinary Tract Symptoms), which can have a significant impact on the quality of life of men suffering from BPH. LUTS caused by BPH includes frequent urination during the day and night, difficulty starting or stopping urination, urgency to urinate and painful urination. Delay in treatment may lead to serious consequences including complete obstruction (acute retention of urine), urinary tract infections, bladder stones, degeneration of bladder function and, in extreme cases, kidney failure.

Market Opportunity

While there are over 30 million men worldwide with symptomatic BPH, we are focused on growing our market penetration primarily in the U.S. The U.S. BPH market is large, underpenetrated and can be expected to continue to grow due to the general aging of the population as well as increasing life expectancies. BPH generally affects men after the age of 50. Epidemiological studies have shown that BPH will occur in a percentage of men roughly equivalent to the average age of the group studied. To illustrate this concept, on average, 70 year old men have a 70% chance of having BPH, while 60 year old men have a 60% incidence rate. Approximately half of men with BPH will have moderate to severe LUTS related to their disease as determined by the standard method of assessing symptoms. Patient claims analysis has shown that there are over 8.7 million men that are currently diagnosed with BPH in the U.S. Based on the aging of the population and the incidence of the disease, we estimate over 750,000 new patients each year will develop clinically significant BPH in the U.S. alone. Over the last few years chronic drug therapy as the primary course of treatment for these patients has increased its dominance in this market. Despite the demonstrable value proposition of our technology, we have penetrated only a small portion of the addressable population and the total procedure market for BPH, both surgical and office-based, has declined over the last few years. We believe our products could help improve the lives of a much larger patient population than currently receive our therapeutic options.

Treatment Options

Watchful Waiting

When a patient first presents with LUTS caused by BPH, physicians generally suggest drugs as the first treatment option, but ultimately leave the decision up to their patients. Due to the costs, side effects and complications associated with BPH drug therapies, many patients diagnosed with BPH choose to be regularly monitored by their urologists, but elect not to begin a drug regimen. The patients who opt out of therapy fall into a group referred to as “watchful waiting.” Historically, bothersome symptom persistence, symptom worsening or an acute urinary event such as retention is a trigger for the patient to move on to some other form of therapy for those in the “watchful waiting” group.

Chronic Drug Therapy

Drug therapy has historically been the first line of treatment and the drug therapy market has continued to grow. Over 4 million men in the U.S. are on some form of chronic BPH medication. The most rigorous studies have shown that approximately 20% of patients treated with drug therapy discontinue treatment within 24 months for various reasons including cost, ineffectiveness, side effects and the burdens of compliance. However, patients may try different BPH drugs when one fails or combinations of drugs to improve effectiveness. Combination drug therapy leads to a more costly treatment regimen and often an increased incidence of side effects. In addition, there is risk that men who continue to take BPH drugs for long periods of time may miss signs of degradation in their urinary function due to the drug(s) masking the disease progression.

5

Most BPH patients suffering from LUTS are initially given an alpha-blocker. Alpha-blockers are a class of drugs also used to treat high blood pressure and work by relaxing smooth muscle cells such as those found around the urethra. This results in easing many of the symptoms of LUTS, but does nothing to slow down the progression of prostate enlargement resulting from BPH.

When a patient is dissatisfied with his first drug for BPH, typically an alpha-blocker, and seeks additional therapy this is referred to as Complex BPH in the recently updated American Urological Association (AUA) Guidelines. At this point, the Guidelines recommend urologists discuss additional drugs, office-based procedures or surgery as an option and to come to a shared decision with the patient.

If a patient wants to continue with drug therapy, a physician may prescribe a second drug called a 5-ARI. Taking both an alpha-blocker and a 5-ARI is referred to as “combination therapy.” 5-ARIs are drugs that inhibit the conversion of testosterone into DHT. Reducing DHT is believed to slow the growth of the prostate. While prescribing both an alpha-blocker and a 5-ARI has shown better symptom improvement than taking either drug alone, there are also increased rates of side effects as patients experience side effects from both drug classes.

Surgical Therapy

There are two primary surgical procedures to treat BPH: TURP or laser. Traditionally, the “gold standard” surgical procedure has been Transurethral Resection of the Prostate (TURP), an invasive surgery in which portions of the prostatic urethra and surrounding tissue are removed, thereby widening the channel and improving urinary flow. While the patient is under general anesthesia, the urologist inserts a rigid scope into the urethra and then uses an electro-cautery device to core out sections of the prostate. Although TURP results in a dramatic improvement in urine flow and reduction in symptoms, the procedure can require a hospital stay and lengthy recovery time and is reported to have a higher rate of side effects and complications than other treatment options. Because the TURP procedure requires a highly skilled surgeon with extensive training, the outcomes and incidence of complications is affected by the experience of the surgeon performing the TURP. TURP currently accounts for approximately half of BPH surgical procedure volume.

The other half of the surgical procedure volume consists of laser vaporization or laser enucleation of the prostate performed in an operating room through a rigid cystoscope and is similar to a TURP. The patient is placed under general anesthesia before a rigid scope is inserted into the urethra. Then the prostatic and urethral tissues are removed using a laser fiber placed down the rigid scope to ablate the tissue or cut it out instead of using an electro-cautery device. Similar to the traditional TURP, the success and safety profile of these procedures is largely dependent on technique.

Urologix’s Office-Based Treatment Options

Urologix is focused on technologies that enable the treatment of patients in the safe, comfortable setting of a urologist’s office without general anesthesia. Office-based therapies provide significant advantages over other BPH treatment options. Compared to chronic drug therapy, it is a one-time treatment that provides lasting results in most patients without the ongoing risk of side effects and costs associated with long term daily medication. Compared to surgery, Urologix’s office-based technologies produce lasting results while avoiding many of the complications and costs associated with surgery.

Providing the option of two different therapies, CTT or Prostiva, allows urologists to select which device will provide the best outcome for each patient whom they treat for BPH. Because of the unique aspects of each of our technologies some patients may be indicated for one technology over the other. The FDA indications help with these treatment decisions. For example, the Prostiva technology is only indicated for patients with a prostate size between 20 grams and 50 grams, while the CTT system is approved for prostates up to 100 grams. In addition, there is a minimum prostatic urethral length which CTT can treat due to the length of the microwave antenna, while the Prostiva system does not have this requirement. Other prostate anatomy issues can also favor one technology versus the other. Therefore, by having both technologies as an option the urologist can select the device best suited for the patient. Many patients may be candidates for either procedure, in which case the urologist can discuss both options and come to a shared decision with their patients, a process that aligns with the American Urological Association guidelines.

6

We believe that both CTT and Prostiva provide incremental value to the patient, the urologist and the healthcare system overall. For the patients, they are able to have an effective and durable procedure that will relieve the majority of them from the burden of chronic medication without the risk of general anesthesia or the expense of having to pay for the hospital deductibles. For the urologists, they can make their patients happy and healthier with a technology that fits into their office clinical routine and is well reimbursed. The healthcare system benefits because the overall cost of these office-based procedures is substantially less than the total cost for any surgical option and is intended to save the costs of chronic medication. Our technologies account for the majority of office-based BPH procedures and should be well positioned for a healthcare system of the future that rewards cost effective technologies that provide value to all the constituents in the healthcare equation.

Cooled ThermoTherapy

Cooled ThermoTherapy (CTT) is a microwave energy treatment that provides effective, durable and safe relief from BPH symptoms. The CTT system consists of a CoolWave or prior generation Targis control unit and a proprietary, flexible catheter that targets energy into the transition zone of the prostate producing a temperature sufficient to cause cell death, while simultaneously cooling and protecting the healthy, pain-sensitive urethral tissue. Our Cooled ThermoTherapy catheter is the CTC Advance microwave catheter designed to improve ease of use and patient comfort compared to earlier generation devices.

|

|

|

|

|

|

|

|

|

During a Cooled ThermoTherapy procedure, a catheter is inserted into the urethra and anchored in the bladder, and a thermosensing unit is placed into the patient’s rectum. Chilled water is then circulated through the catheter to lower the temperature of the urethra and protect it from heat and discomfort during the treatment. Temperatures in the urethra and rectum are monitored continuously during the treatment while microwave energy is delivered into the prostatic tissue, ultimately resulting in a reduction in the size of the prostate and relief of symptoms as the body re-absorbs the destroyed tissue through its natural healing process following the treatment. The treatment cycle is completed in approximately 30 minutes, while the total room time with the patient is approximately an hour. |

|

|

Prostiva RF Therapy

Prostiva RF Therapy is a radio frequency needle ablation treatment for BPH. Prostiva therapy is conducted in offices without the need for general anesthesia. The Prostiva system consists of a hand piece with a specialized 18.5F (approximately 6mm) rigid cystoscope connected to a radio frequency generator. The urologist is able to visualize the therapy continuously through the use of the scope and they control irrigation of the urethra for cooling and tissue preservation during the therapy.

7

|

|

|

|

|

During a Prostiva procedure, a grounding pad is placed over the patient’s sacrum, and the RF ablation current is directed towards the grounding pad through the prostatic tissue. Precise tissue heating occurs due to electrical resistance of the prostate tissue as electrons flow from the active to the return electrode. The RF current is precisely delivered to the region immediately surrounding the active electrode, with accurate control of the tissue effect. Ablation volume is a function of the placement and depth of the electrode, as well as the power utilized and the treatment duration. Temperature in the urethra is monitored continuously during the treatment while RF energy is delivered into the prostatic tissue, ultimately resulting in targeted necrosis of the prostatic tissues and relief of symptoms as the body re-absorbs the destroyed tissue through its natural healing process following treatment. Treatment time varies depending on gland size but is approximately 20-25 minutes and total room time is approximately 1 hour, equivalent to Cooled ThermoTherapy. |

|

|

Clinical Studies

The safety, efficacy and durability of Cooled ThermoTherapy and Prostiva are supported by substantial clinical evidence, unlike most of the competitive in-office BPH therapies. There are over 100 published peer reviewed clinical articles that are supportive of these technologies. Numerous multi-center, prospective, clinical trials of Cooled ThermoTherapy and Prostiva RF Therapy have been conducted both in the United States and internationally.

Study objectives have included: collection of safety and efficacy data, support of new indications and marketing claims, generation of long-term durability data, and cost effectiveness data for Medicare and other reimbursement approvals in various markets. The results of these trials showed a majority of patients received significant long-term relief from the symptoms and obstruction caused by their BPH. BPH symptoms were measured using validated instruments, such as the American Urological Association Symptom Index (AUASI). Quality of life (QoL) was also measured using a validated scoring instrument where higher scores indicated a lower quality of life. Peak flow rates (Qmax) were measured in numerous studies where values were expressed in milliliters (mL) per second.

The AUASI utilizes a 35-point scale where the higher the score (American Urological Association Symptom Score, or AUASS) the more severe the BPH symptoms. An AUASS greater than 7 is considered moderate symptomatic BPH. The minimum threshold for clinically significant improvement in the AUASS is commonly viewed as a reduction of 4 or more points. Success in clinical studies is often determined by a reduction of 30% from the baseline AUASS.

Cooled ThermoTherapy

At the 2014 American Urological Association (AUA) annual meeting, data was presented on the comparative cost-effectiveness of both high-energy TUMT (TransUrethral Microwave Therapy) and low-energy TUMT. High energy TUMT included our CTT technology and resulted in lower total cost of care over time than the low-energy TUMT alternatives. The lower costs were achieved due to the durability, safety and effectiveness of the high-energy TUMT devices. We believe such society and professional presentations are important to underscore the efficacy, safety, durability and cost savings that Urologix technologies bring to patients, physicians, and payers.

At the 2011 North Central Sectional meeting of the AUA, a presentation on the comparative cost effectiveness of BPH treatment options showed that CTT was a cost-effective treatment option for BPH.

At the 2010 AUA annual meeting, we had two additional presentations at the sub-specialty meeting of the Geriatric Urological Society. The first presentation highlighted how the combination of cooling and high energy provided by Cooled ThermoTherapy enables delivery of a therapeutically effective treatment. The second demonstrated the five-year preservation of sexual function following Cooled ThermoTherapy; a significant concern for sexually active men considering the alternatives of chronic medication or surgery.

8

In April 2009 at the American Urological Association (AUA) annual meeting, two separate presentations highlighted our five-year durability data, and the ability of urologists using our Cooled ThermoTherapy system to customize the treatment for individual patients.

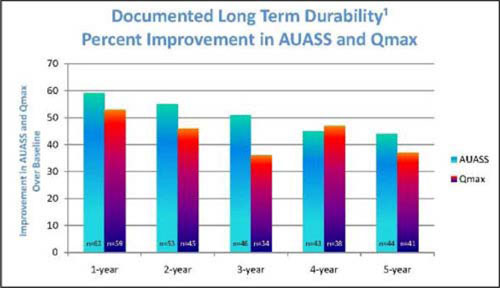

The most recent peer-reviewed journal publication of Cooled ThermoTherapy five-year data appeared in the Journal of Urology in May, 2011. Mynderse et al prospectively followed patients for five years during an FDA approved study of the Urologix Cooled ThermoCath® (CTC) Microwave Catheter. The results showed significant improvement in symptoms, Qmax and QoL, through the five-year time point. Participating clinical study sites included leading academic centers such as The Mayo Clinic, University of Texas Southwestern, Johns Hopkins and Duke University. In 2010, the AUA BPH Practice Guideline committee commented that the durability of high-energy transurethral microwave therapy (like Cooled ThermoTherapy) appeared to have improved due to the advent of higher energy, later generation devices. The figure below displays the sustained percentage improvement in AUASS and Qmax over the five-year follow-up period. The percent improvement over baseline for QoL followed a similar trend and was 41% better at year five.

|

|

|

|

|

1 5 Year Results of a Multi-Center Trial of a New Generation Cooled TUMT for BPH, Roehrborn, C. et al, Moderated Poster, AUA 2009. |

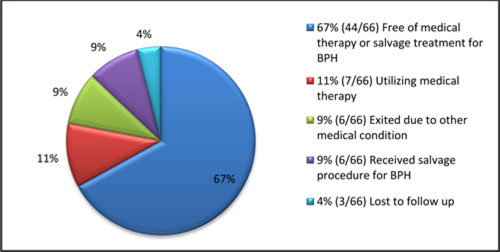

The effectiveness of the Cooled ThermoTherapy BPH treatment was further demonstrated by Mynderse et al, when examining retreatment rates and patient follow-up in the study and is summarized in the figure below:

9

The 5-year data described above are supported by multiple peer reviewed publications over the years showing the significant safety, effectiveness and durability of a CTT procedure. These published articles include:

|

|

|

|

|

|

1. |

In 2001 Djavan et al compared 51 patients treated with Cooled ThermoTherapy vs. 52 treated with alpha blocker BPH medication. Symptom improvement, urinary flow rate, and QoL were measured. |

|

|

|

|

|

|

2. |

In 2003 Thalmann et al, conducted a prospective trial where 200 patients were treated with Cooled ThermoTherapy. Symptom improvement and urodynamics were measured. |

|

|

|

|

|

|

3. |

In 2003 Osman et al, compared the one-year subjective vs. urodynamic changes in 40 Cooled ThermoTherapy patients. |

|

|

|

|

|

|

4. |

In 2003 Miller et al, studied the durability of Cooled ThermoTherapy over three centers in 150 patients for five years. |

|

|

|

|

|

|

5. |

In 2003 Berger et al, studied Cooled ThermoTherapy in 78 high risk patients with acute urinary retention with a mean follow-up of 34 months. |

|

|

|

|

|

|

6. |

In 2004 Kaplan et al, conducted the largest prospective Cooled ThermoTherapy study which involved 345 patients treated over nine institutions. |

Djavan and colleagues noted improvements in BPH symptoms, QoL and Qmax for both the medication and Cooled ThermoTherapy groups; however, the Cooled ThermoTherapy group demonstrated a significantly greater improvement. Thalmann and colleagues demonstrated that the Qmax rates of Cooled ThermoTherapy patients increased from 6 to 13 mL per second at 24 months and symptoms scores were decreased from a mean of 23 to 3. Osman and colleagues reported mean AUASS reductions from 20.5 to 9, and mean Qmax increases from 9.2 to 15 mL per second. Miller et al reported ≥ 50% improvement in symptom score in 63% to 68% of patients available for follow-up at years 1, 2 and 3 and 50% and 51% of patients at years 4 and 5, respectively. Berger and colleagues reported 87.1% of patients in retention before treatment were able to void after Cooled ThermoTherapy, though 7.3% experienced repeat retention within two years. Kaplan and colleagues demonstrated that 65% of Cooled ThermoTherapy patients showed a greater than 50% reduction in AUASS the first year, with a mean improvement of 11.1 points. In the 85 patients available for five-year follow-up, absolute symptom score improvement was maintained at 8.4 points. Qmax improved from 7.5 to 10.5 mL per second at three years.

In summary, since its introduction to the market in 1997, Urologix’ Cooled ThermoTherapy has been studied in numerous clinical trials; the results of which demonstrate significant and durable improvement in BPH symptoms, QoL, and urinary flow rate.

Prostiva RF Therapy

Prostiva is the newest generation of transurethral RF needle ablation of the prostate. This technology was first used in the early 1990s, with the first preliminary clinical trials published in 1993. The first human clinical studies in the United States began in 1994, and subsequent U.S. Food and Drug Administration (FDA) clearance of the device was granted in 1996.

Since FDA clearance of Prostiva RF Therapy, 4 randomized, prospective trials comparing it to transurethral resection of the prostate (TURP) have been published:

|

|

|

|

|

|

1. |

In 1999 Roehrborn et al, summarized outcomes of symptom improvement, QoL, bladder wall pressure and Qmax at 6 months; |

|

|

|

|

|

|

2. |

In 2001 Hindley et al, compared Prostiva RF to TURP in 50 patients over 2 years, reporting on symptom improvement, QoL, and urodynamics; |

10

|

|

|

|

|

|

3. |

In 2003 Cimentepe et al, also provided symptom improvement, QoL and urodynamics results after 18 months of follow-up on 59 patients; and |

|

|

|

|

|

|

4. |

In 2004 Hill and colleagues provided 5-year follow-up on same patient cohort as Roehrborn et al, 1999. Results included symptom improvement, QoL, and urodynamics in the same group of 121 patients. |

|

|

|

|

Roehrborn and colleagues (1999) found that symptom scores of Prostiva RF subjects were decreased by nearly 50% at six months. At 60 months Hill and colleagues (2004) reported symptom improvement for the same cohort of subjects was maintained. Hindley and colleagues (2001) reported symptoms were decreased by nearly 65% for Prostiva. QoL results followed a similar trend for Roehrborn and Hindley, and results were maintained at 5 years as reported by Hill et al. Cimentepe and colleagues (2003) found similar trends in symptom scores, QoL measures and urodynamics as reported by the other studies identified above. From these 4 studies, no significant short-term complications from Prostiva, including need for transfusion, were reported. In a confirmation of the results of the 4 randomized, prospective trials comparing Prostiva RF Therapy to TURP, the 2010 AUA BPH Practice Guidelines Committee concluded that: “… based on these reports, the symptom improvement is significant and sustained for both treatments, with somewhat greater improvement in the symptom score for TURP.”

In addition to the 4 randomized prospective trials detailed above, numerous single-group cohort studies of Prostiva RF Therapy have been published as well. Symptom score improvement, QoL, and Qmax improved in a fashion very similar to that reported in the randomized trials. Short-term complications, including the need for transfusion, were uncommon or nonexistent. Erectile dysfunction and retrograde ejaculation were more common with TURP than Prostiva RF Therapy, and generally Prostiva patients reported very few sexual side effects. In fact, in 2010 the AUA BPH Practice Guideline Committee concluded that Prostiva RF Therapy is an attractive BPH therapy due to its safety; low perioperative complications, and low to nonexistent rate of sexual dysfunction. The Committee also noted that improvements in symptoms, QoL and Qmax were significant for Prostiva RF.

In summary, since being introduced to the U.S. market, multiple prospective trials have established Prostiva RF Therapy’s significant clinical benefit as well as the attractive risk profile.

Sales and Marketing

Our goal is to establish our technologies as the first treatment choice for BPH patients looking to avoid daily medication or who are dissatisfied with symptom improvement, cost and/or side effects from chronic BPH drugs.

United States

We have a sales and marketing team consisting of sales management, marketing support, mobile application specialists, direct sales representatives, inside sales representatives, and customer service, all of whom are dedicated to marketing our Cooled ThermoTherapy and Prostiva RF Therapy products and our Urologix mobile service. In the fourth quarter of fiscal year 2014, we launched a new sales deployment that added capacity to our inside sales channel, reduced and realigned our direct sales representatives, and increased the role of our mobile application specialists. The deployment was designed using a number of factors including matching our sales team member’s skills and resources to the identifiable needs of our customer base. The new deployment enables us to cover the vast majority of our business with sales team members that can support customer’s continued access to our technologies in a manner they are traditionally used to with a significantly smaller sales team. Our sales and marketing team will continue to provide market-leading quality of service to our urology customers.

Urology customers access our Cooled ThermoTherapy and Prostiva capital equipment through a direct purchase, longer-term use basis, Urologix mobile service, or third party mobile service. Pricing for single-use CTC treatment catheters and Prostiva kits to direct customers and our Urologix mobile service varies based upon treatment volume.

Our Urologix mobile application specialists transport the CoolWave and Prostiva capital equipment, along with the disposables, primarily to urologist offices, ambulatory surgery centers and in some cases hospitals on a scheduled basis, making the treatment available to urologists and their patients on an efficient and economical basis. As of June 30, 2014, our mobile service offering included 10 mobile routes in select geographies across the United States. In addition to our direct sales channel and Urologix owned mobile service, we continue to partner with independent third-party mobile service providers to provide urologists with access to our Cooled ThermoTherapy and Prostiva treatment.

11

Our marketing and patient education efforts are focused on four goals: (i) increasing urologist adoption of our technologies and optimizing patient selection for maximum patient benefit and appropriate utilization; (ii) increasing patient awareness of office based treatment options; (iii) exposing urologists to the significant patient need for effective non-surgical alternatives to medical management; and (iv) providing new evidence to educate urologists, provider networks and payers as to the cost effectiveness of our technologies. We employ specific tools to support each of these goals. For the first, this includes developing a well trained clinically oriented sales team that can explain both technologies and patient selection criteria and arming them with the tools and knowledge to be successful. For the second and third, our primary platform for raising patient awareness and increasing urologist exposure to the patient need is through the “Think Outside the Pillbox” patient education campaign. We have had repeated success with this effort with strong patient responses to our call to action and urologists are impressed with the turnout at the educational events. The result of these activities on our business is that the accounts that participate in this program have increased utilization, measured by revenue per account, after the campaign compared to before. For the fourth, we are working with our healthcare partners to complete new research showing the cost effectiveness of our technologies.

As of June 30, 2014, we employed a total of 23 professionals in our sales and marketing departments and in our Urologix mobile service. The expenses for our Urologix mobile service are included in cost of goods sold.

International

Although our international sales efforts have historically been relatively modest, we believe that there is a potential market for Urologix products outside of the United States in certain, limited markets. In those regions outside of the U.S. where we sell our products, we utilize local distributors experienced in selling products to hospitals and urologists to assist us. During the second quarter of fiscal 2012, we assumed distribution responsibilities from Medtronic under the terms of the Transition Services and Supply Agreement for the distribution of the Prostiva RF Therapy system in Europe. We later entered into supply agreements with distributors in targeted countries within Europe for the sale of the Prostiva RF Therapy system. Our efforts have been directed at supporting existing users in markets with established reimbursement. Total international Prostiva sales for fiscal years 2014 and 2013 were $345,000 and $532,000, respectively.

Manufacturing

We assemble CoolWave control units and CTC Advance catheter procedure kits using materials and components supplied by various subcontractors and suppliers, as well as components we fabricate at our suburban Minneapolis facility. Several of the components used in our control units and procedure kits are currently available to us through a single vendor.

We became the legal manufacturer of the Prostiva RF Therapy system in April of 2013 and have agreements in place with third party manufacturing companies for the supply of the key components of the Prostiva RF Therapy system.

We continuously seek to develop alternative sources for critical components. However, when alternative sourcing is not possible, we may enter into supply agreements with each component provider. Nevertheless, failure to obtain components from these providers or delays associated with any future component shortages, particularly if we increase our manufacturing level, could have a material adverse effect on our business, our financial condition and our overall operating results.

Our manufacturing operations and the operations of our third-party suppliers must comply with the U.S. Food and Drug Administration’s (FDA) quality system regulation which includes, but is not limited to, the FDA’s Good Manufacturing Practices (GMP) requirements, and must comply with certain requirements of state, local and foreign governments for assuring quality by controlling components, processes and document traceability and retention, among other things.

12

The FDA periodically inspects our facility, documentation and quality systems. To date, the FDA has noted no significant deficiencies of GMP. Our facility will continue to be subject to periodic inspections by the FDA and by other auditors. We believe that our manufacturing and quality control procedures meet the requirements of the FDA and other regulators and that we have established training and internal audit systems designed to ensure compliance.

We have received and maintained ISO 13485 quality system certification indicating compliance of our manufacturing facilities with international standards for quality assurance and manufacturing process control. We also have received and maintain CE mark certification, which allows us to affix the CE Mark to our CoolWave, Targis and CTC Advance products and market them in the European Union.

As of June 30, 2014, we employed 22 individuals in our manufacturing department.

Research and Development

Our research and development efforts and goals are currently focused primarily on improving the features and functions of the technologies used in our Cooled ThermoTherapy and Prostiva RF Therapy procedures; improving the ease of use, patient comfort and clinical response to treatment; reducing the manufacturing cost of our products and expanding the evidence of the cost effectiveness of our technologies.

During the fiscal years ended June 30, 2014 and 2013, we spent $1.6 million and $2.3 million, respectively, on our research and development efforts. As of June 30, 2014, we employed 9 individuals in our research and development department.

Reimbursement

We believe that third-party reimbursement is essential to the continued adoption of Cooled ThermoTherapy and Prostiva RF Therapy, and that clinical efficacy, overall cost-effectiveness and physician advocacy will be keys to maintaining such reimbursement. We estimate that 70% to 80% of patients who receive Cooled ThermoTherapy and Prostiva RF Therapy treatment in the United States are eligible for Medicare coverage. The remaining patients are covered by either private insurers, including traditional indemnity health insurers and managed care organizations, or are private paying patients. As a result, Medicare reimbursement is particularly critical for widespread and ongoing market adoption of Cooled ThermoTherapy and Prostiva RF Therapy in the United States.

Each calendar year the Medicare reimbursement rates for all procedures, including Cooled ThermoTherapy and Prostiva RF Therapy, are determined by the Centers for Medicare and Medicaid Services (CMS). The Medicare reimbursement rate for physicians varies depending on the procedure type, site of service, wage indexes and geographic location. The national average reimbursement rate is the fixed rate for the year without any geographic adjustments, but does vary based on site of service. Cooled ThermoTherapy and Prostiva RF Therapy can be performed in the urologist’s office, an ambulatory surgery center (ASC), or a hospital as an outpatient procedure.

CMS published their final rule in November 2013 for implementation during calendar year 2014 and the government acted to keep the Sustainable Growth Rate (SGR) from taking effect. The final rule resulted in an average reimbursement rate in the physician office setting for calendar year 2014 of $2,063 for Cooled ThermoTherapy and $1,899 for Prostiva RF Therapy. Cooled ThermoTherapy and Prostiva RF Therapy procedures are also reimbursed when performed in an ASC or a hospital outpatient setting, but these are a small portion of our business and the CMS rates will not have a material effect on our financial performance.

Private insurance companies and HMOs make their own determinations regarding coverage and reimbursement based upon “usual and customary” fees. To date, we have received coverage and reimbursement from private insurance companies and HMOs throughout the United States. We intend to continue our efforts to maintain coverage and reimbursement across the United States. There can be no assurance that reimbursement determinations for either Cooled ThermoTherapy or Prostiva RF Therapy from these payers for amounts reimbursed to urologists to perform these procedures will be sufficient to compensate urologists for use of Urologix’ product and service offerings.

13

Internationally, reimbursement approvals for the Cooled ThermoTherapy and Prostiva procedures are awarded on an individual-country basis.

Medical Device Tax

As a result of recently enacted Federal health care reform legislation, substantial changes are anticipated in the United States health care system. Such legislation includes numerous provisions affecting the delivery of health care services, the financing of health care costs, reimbursement of health care providers and the legal obligations of health insurers, providers and employers. These provisions are currently slated to take effect at specified times over the next decade. Beginning in January 2013, the Federal health care reform legislation imposed significant new taxes on medical device manufacturers in the form of a 2.3% excise tax on all U.S. medical device sales. As a result, we have incurred approximately $223,000 and $106,000 in medical device excise tax for the 2014 and 2013 fiscal years, respectively. This significant increase in the tax burden on our industry could have a material, negative impact on our future results of operations and our cash flows.

Patents and Proprietary Rights

We currently own U.S. and international patents. We also intend to file additional patent applications in the future. In addition, we have licensed numerous patents and patent applications related to the Prostiva technology as part of our worldwide exclusive license from Medtronic.

Several of our United States patents claim methods and devices that we believe are critical to providing a safe and efficacious treatment for BPH. There can be no assurance that our patents, or any patents that may be issued as a result of existing or future applications, will offer any degree of protection from competitors or that any of our patents or applications will not be challenged, invalidated or circumvented in the future.

In addition to patents, we also rely on trade secrets and proprietary know-how that we intend to protect, in part, through proprietary information agreements with employees, consultants and other parties. Our proprietary information agreements with employees and most of our consultants contain provisions requiring that the individuals assign to us, without additional consideration, any inventions conceived or reduced to practice while employed by or under contract with us, subject to customary exceptions. Our officers and other key employees also agree not to compete with us for a period following termination.

Competition

Competition in the market for the treatment of BPH comes from drug therapy, other minimally invasive office-based treatments, and invasive surgical therapies, such as TURP and laser surgeries (Laser Vaporization or Laser Enucleation). There are multiple companies that market or distribute surgical products for either TURP or laser procedures including: Olympus, Karl Storz, Endo Pharmaceuticals (American Medical Systems), Boston Scientific, Lumenis, Lisa Laser and Biolitec.

There are eight well-recognized prescription drugs available in the United States for treating the symptoms of BPH: Flomax (Boehringer Ingelheim International GmbH), Hytrin (Abbott Laboratories), Cardura (Pfizer Inc.), UroXatral (Sanofi-Synthelabo), Rapaflo (Watson Pharmaceuticals, Inc.), Proscar (Merck & Co., Inc.), Jalyn (GlaxoSmithKline), and Avodart (GlaxoSmithKline), some of which are now also available as a generic preparation. Drug therapy is currently the first-line therapy prescribed by most physicians – both primary care physicians and urologists – in the United States for BPH. The drug companies have significant resources to educate urologists and patients through direct sales and direct to consumer marketing. We focus on educating urologists and their patients to the benefits of our Cooled ThermoTherapy in a targeted and efficient manner but we have far fewer resources than manufacturers of BPH drugs.

Competition in the market for minimally invasive office-based treatments for BPH also exists. Competitive devices include low energy microwave combined with balloon dilatation (Medifocus, previously Boston Scientific); non-cooled, low energy microwave (Endo Pharmaceuticals/American Medical Systems); high energy microwave with limited cooling (Prostalund); and mechanically bracing open the urethra (Neotract).

14

Additional competitors may enter the market. We believe our technologies offer a durable solution as shown in peer reviewed clinical trials with a very favorable safety profile and that new technologies must demonstrate competitive long-term clinical data. Our products are FDA-approved for the largest treatable patient population compared to other office-based BPH therapies. Because our technologies do not require general anesthesia or have risk of significant bleeding or other complications, they can be performed in the urologist’s office or other outpatient environments. Further, because Cooled ThermoTherapy and Prostiva RF Therapy both combine high temperatures with cooling, we can achieve a controlled pattern of necrosis that conforms to a desired shape within the prostate, destroying hyperplastic tissues to create lasting results while preventing damage to the urethra, enhancing patient comfort and reducing complications.

Government Regulation

Both domestic and international government regulation significantly affects the research and development, manufacturing and marketing of our products. Under the Federal Food, Drug and Cosmetic Act and the Public Health Service Act, the FDA holds the authority to regulate the manufacturing, distribution and sale of medical devices within the United States, while foreign sales are subject to governmental regulation and restrictions that vary by country.

Medical devices intended for human use in the United States are classified into one of three categories. Such devices are classified by regulation into either Class I (general controls), Class II (general controls and special controls) or Class III (general controls and pre-market approval (PMA)) depending upon the level of regulatory control required to provide reasonable assurance of the safety and effectiveness of the device. Good manufacturing practices, labeling, maintenance of records and filings with the FDA also apply to medical devices.

Our Cooled ThermoTherapy systems have received FDA approval for sale in the United States as a Class III medical device. We have obtained the CE Mark for our Cooled ThermoTherapy systems though we are not currently distributing in Europe and product registration for distribution in Canada, Australia, and New Zealand. The Prostiva RF Therapy System has received FDA clearance for sale in the United States as a Class II medical device. The Prostiva RF Therapy System has also received the CE Mark for distribution in Europe.

The FDA’s regulations require agency approval of a PMA supplement for Class III medical devices when certain changes are made to a product if the changes affect the safety and effectiveness of the device. Such changes include, but are not limited to, new indications for use; the use of a different facility or establishment to manufacture, process or package the device; changes in manufacturing methods or quality control systems; changes in vendors used to supply components of the device; changes in performance or design specifications; and certain labeling changes. Any such changes will require FDA approval of a PMA supplement prior to marketing of the device. There can be no assurance that the required approvals of PMA supplements for any changes will be granted on a timely basis or at all. Delays in receipt of, or failure to receive such approvals, or the loss of the approval of the PMA for our Cooled ThermoTherapy systems, or clearance for the Prostiva RF Therapy system would have a material adverse effect on our business.

The process of obtaining FDA and other required regulatory clearances or approvals is lengthy and expensive. There can be no assurance that we will be able to obtain or maintain the necessary clearances or approvals for clinical use or for manufacturing or marketing of our products. Failure to comply with applicable regulatory approvals can, among other things, result in warning letters, fines, suspensions of regulatory approvals, product recalls, operating restrictions and criminal prosecution. In addition, government regulation may be established that could prevent, delay, modify or rescind regulatory clearance or approval of our products.

Medical device laws are also in effect in many of the countries outside of the United States in which we do business. These laws range from comprehensive device approval and quality system requirements for some or all of our medical device products to simple requests for product data or certifications. The number and scope of these requirements are increasing. All medical devices sold in Europe must meet the European Medical Device Directive standards and receive CE Mark certification. CE Mark certification involves a comprehensive quality system program and submission of data on a product to the Notified Body in Europe.

15

Health Care Regulation

We regularly monitor developments in laws and regulations relating to our business. We may be required to modify our agreements, operations, marketing and expansion strategies from time to time in response to changes in the statutory and regulatory environment. Although we plan to structure all of our agreements, operations, marketing and strategies in accordance with applicable law, there can be no assurance that our arrangements will not be challenged successfully or that required changes will not have a material adverse effect on our operations or profitability.

Product Liability and Insurance

As a result of our exposure to product liability claims, we currently carry product liability insurance covering our products with policy limits per occurrence and in the aggregate that we have deemed to be sufficient. We cannot predict, however, whether this insurance will actually be sufficient, or if not, whether we will be able to obtain sufficient insurance to cover the risks associated with our business or whether such insurance will be available at premiums that are commercially reasonable. In addition, these insurance policies must be renewed annually. Although we have been able to obtain liability insurance, such insurance may not be available in the future on acceptable terms, if at all. A successful claim against us or settlement by us with respect to uninsured liabilities or in excess of our insurance coverage, or our inability to maintain insurance in the future, or any claim that results in significant costs or adverse publicity against us, could have a material adverse effect on our business, financial condition, results of operations and liquidity.

Employees

As of June 30, 2014, we employed 61 individuals on a full-time basis compared to 95 individuals at June 30, 2013. None of our employees are covered under a collective bargaining agreement.

Prostiva Related Agreements

On September 6, 2011, the Company entered into a License Agreement with Medtronic, Inc. (“Medtronic”) and its subsidiary, VidaMed, relating to the Prostiva RF Therapy. On September 6, 2011, the Company also entered into a related Transition Services and Supply Agreement with Medtronic, an Acquisition Option Agreement and Asset Purchase Agreement. These September 6, 2011 dated agreements with Medtronic are referred to as the “Transaction Documents.”

On June 28, 2013, we entered into a Restructuring Agreement and Amendment to Transaction Documents (the “Restructuring Agreement”) with Medtronic and Medtronic VidaMed, Inc. The Restructuring Agreement relates to $7.5 million of obligations owed to Medtronic under the Transaction Documents. Under the Restructuring Agreement, on June 28, 2013, the Company delivered to Medtronic a promissory note (the “Note”) in the original principal amount of $5,332,538 and paid Medtronic $1,965,975 in satisfaction of the $7.5 million then owed to Medtronic under the Transaction Documents. In connection with the Restructuring Agreement, the Company agreed to permit Medtronic to designate an observer to the Board for as long as any obligations under the Note remain outstanding.

The Note and the related security agreement are summarized below. In connection with the Restructuring Agreement, the Company also entered into an amendment to each of the License Agreement and the Transition and Services and Supply Agreement. The Transaction Documents, as amended by the Restructuring Agreement, are also each summarized below.

|

|

|

|

|

Note and Security Agreement: Interest on the principal amount of the Note will accrue at the annual rate of 6%, compounded annually. The Note requires that we make five equal annual payments of principal and accrued interest on March 31 of each year beginning March 31, 2015. All amounts under the Note are due and payable on March 31, 2019 or earlier upon a Change of Control (as defined in the Note). We may prepay the Note without penalty at any time. The Note also specifies certain customary events of default that will entitle Medtronic, after any required notice, to declare the outstanding obligations immediately due and payable. The Note contains customary representations, warranties and covenants by us. |

16

|

|

|

|

|

Pursuant to the terms of a Security Agreement dated as of June 28, 2013 by and between Urologix and Medtronic, our obligations under the Note are secured by a security interest in all of our assets, specifically excluding intellectual property (but including accounts receivable and proceeds of intellectual property). |

|

|

|

|

|

License Agreement: Under the License Agreement, Medtronic and VidaMed granted us an exclusive, worldwide license under patents, trademarks and other intellectual property to make, have made, develop, use, import, export, distribute, market, promote, offer for sale and sell the Prostiva® RF Therapy System in the field of the radio frequency treatment of the prostate, including the treatment of benign prostatic hyperplasia (BPH). |

|

|

|

|

|

In exchange for the license, we agreed to pay Medtronic a license fee of $1.0 million, of which $500,000 was paid upon the execution of the License Agreement. The remaining $500,000, less the $147,000 purchase price payable under the Asset Purchase Agreement and certain credits under the Transition Services and Supply Agreement, was due on September 6, 2012. The Asset Purchase Agreement and the Transition Services and Supply Agreement are described below. We are obligated to pay Medtronic royalties on net sales of product up to an annual maximum royalty amount. Beginning in the second contract year, we are obligated to pay Medtronic a minimum annual royalty amount. Earned royalties are payable thirty days following the end of each contract year. Beginning in the second contract year, additional amounts, if any, required to meet the minimum royalty obligations are payable ninety days following the end of each contract year. We are also obligated to pay an annual license maintenance fee of $65,000 on September 6 of each contract year beginning September 6, 2012. |

|

|

|

|

|

In addition, if total payments by us to Medtronic under the License Agreement (other than the license maintenance fee) and under the Asset Purchase Agreement (described below) reach an aggregate of $10 million, we will have no further payment obligations to Medtronic and will thereafter have a fully paid up, royalty-free and perpetual license. The term of the License Agreement is ten years or the earlier closing date of a purchase under the Acquisition Option Agreement described below. In addition, either party may terminate the License Agreement by written notice for breach after an opportunity to cure, Medtronic may terminate the License Agreement in the event of our bankruptcy or insolvency, and the license will automatically terminate concurrently with certain terminations of the Transition Services and Supply Agreement (described below). Upon termination of the License Agreement, all rights to the Prostiva intellectual property will revert back to Medtronic and the Transition Services and Supply Agreement and Acquisition Option Agreement will terminate. Further, upon termination of the License Agreement by Medtronic as a result of our breach or bankruptcy, and following our purchase of assets under the Asset Purchase Agreement, Medtronic will have the right to repurchase such assets from us for the same purchase price we previously paid. Medtronic and VidaMed also entered into sublicenses to grant us rights to certain intellectual property relating to the Prostiva treatment. |

|

|

|

|

|

Under the License Agreement, if a closing occurs under the Acquisition Option Agreement (described below), Medtronic and certain of its affiliates will be bound by a non-competition obligation for a two-year period following the closing of the transactions under the Acquisition Option Agreement, subject to certain exceptions. |

|

|

|

|

|

Acquisition Option Agreement: Under the Acquisition Option Agreement with Medtronic, we have the right to purchase and Medtronic has the right to require us to purchase the assets associated with the Prostiva treatment and the licenses and sublicenses granted by Medtronic and VidaMed. The transaction will be structured as a purchase by us of all of VidaMed’s common stock and any other Prostiva assets such as patents, trademarks and other intellectual property. |

17

|

|

|

|

|

In the case of our exercise of our option to purchase, the purchase price will be $10 million less license fees and royalty amounts (including, if applicable, minimum royalty amounts) previously paid under the License Agreement and the purchase price paid under the Asset Purchase Agreement. In the case of Medtronic’s exercise of its option to require us to purchase, the purchase price will be the price stated by Medtronic in its exercise notice, provided that price is accepted by us in our sole discretion. Our rights and Medtronic’s rights under the Acquisition Option Agreement may be exercised until the License Agreement expires or terminates or, if earlier, the date the other party’s notice of exercise is received in accordance with the Acquisition Option Agreement. Upon exercise of our call option or Medtronic’s put option, we will grant Medtronic an exclusive, royalty-free, irrevocable, transferrable, sublicensable, worldwide license to exploit the patents we acquire in the Acquisition Option Agreement outside of the field of the radio frequency treatment of the prostate, including the treatment of BPH. |

|

|

|

|

|

Transition Services and Supply Agreement: We entered into a Transition Services and Supply Agreement with Medtronic under which Medtronic provided us with transition services relating to manufacturing, sourcing, operations, compliance, quality, regulatory and other matters. Through the Transition Services and Supply Agreement, Medtronic appointed Urologix as its exclusive U.S. distributor (excluding Puerto Rico) of the Prostiva treatment until such time as we received the regulatory approvals necessary to allow us to sell the product in the U.S. Under the provisions of the Transition Services and Supply Agreement, the parties also agreed upon the handling of product warranty claims, agreed upon a transition plan for regulatory matters, and entered into a quality agreement. In addition, Medtronic assigned a supply agreement to us, will place orders with certain suppliers and sell those components to us at its cost, and will transfer certain other components to us. In April 2013, we received the regulatory approvals necessary to allow us to sell the product in the U.S. and accordingly, the parties have substantially completed their obligations under the Transition Services and Supply Agreement. |

|

|

|

|

|

Asset Purchase Agreement: We entered into an Asset Purchase Agreement through which Medtronic was required to sell to us, and we were required to purchase from Medtronic, certain tangible assets used in the Prostiva business for a purchase price of $147,000. |

|

|

|

|

|

Payment of the $1,965,975 in cash to Medtronic on the date of the Restructuring Agreement constituted payment in full of the following amounts: (i) earned royalties under the License Agreement as of September 6, 2012; (ii) $353,000 owing as the license fee under the License Agreement as of September 6, 2012; and (iii) $65,000 owing as the license maintenance fee under the License Agreement as of September 6, 2012; (iv) payment in full of the $147,000 purchase price under the Asset Purchase Agreement; (v) $52,500 for additional Prostiva generators purchased; and (vi) payment in full of $775,725 owing under outstanding invoices and $63,750 owing as monthly fees under the Transition Services and Supply Agreement. |

|

|

|

|

|

The issuance of the Note pursuant to the Restructuring Agreement satisfied in full the outstanding liabilities balance of $5,332,538 relating to outstanding invoices for inventory sold to us as part of the acquisition and under the Transition Services and Supply Agreement. |

|

|

|

|

RISK FACTORS |

The occurrence of any of the following risks could harm our business. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our operations. If any of these risks materialize, the trading price of our common stock could decline, and investors may lose all or part of their investment.

18

Risks Related to Our Financial Condition

As a result of our history of operating losses and inadequate operating cash flow, there is a substantial doubt about our ability to continue as a going concern.

We have experienced significant operating losses to date, including net losses of $7.6 million for fiscal year 2014 and $4.3 million in fiscal year 2013. As of June 30, 2014, we had approximately $718,000 in cash. Although we completed a secondary offering in the first quarter of fiscal 2013 which contributed approximately $3.8 million of net proceeds, as a result of our history of operating losses and negative cash flows from operations, as well as our need for working capital to support operations, there is substantial doubt about our ability to continue as a going concern. Our financial statements do not include any adjustments related to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that may be necessary as a result of this uncertainty. As a result of the substantial doubt about our ability to continue as a going concern, we may experience possible adverse effects from our customers, on our creditworthiness, or on investor confidence, any of which may have a material adverse effect on our business and the trading price of our common stock.

Our ability to continue as a going concern depends upon our ability to generate expected revenues both from sales of our Cooled ThermoTherapy and Prostiva products and our ability to generate positive cash flow from our business.

On April 10, 2014, management completed the implementation of a strategic restructuring plan which included deploying a new distribution model and operational structure to refocus the allocation of company resources and improve the Company’s ability to achieve profitability and generate positive cash flow from operations. The targeted annual savings from this restructuring total over $4 million annually compared to the first half of fiscal year 2014. These savings impact both cost of goods sold and operating expenses. However, there can be no assurance that we will be successful in improving our business or obtaining positive cash flows from operations.

We have a history of unprofitability and may not be able to generate sufficient cash flow to fund our operations.

We incurred an operating loss of $6.9 million for the year ended June 30, 2014 and $3.9 million for the year ended June 30, 2013. From our inception to June 30, 2014, we have incurred losses of approximately $126.6 million. Moreover, we have historically not generated sufficient operating cash flow to fund our operations. Based on our history of inadequate cash flow, we may not be able to fund our short-term capital needs through operating cash flow alone. To fund our long-term capital and liquidity needs, we must increase the revenues received from sales of our products to generate cash flow and operate in a profitable manner.

Our ability to execute our business plan and grow our business depends on our ability to generate sufficient cash flow from operations or our ability to obtain additional capital if we do not generate sufficient cash flow from operations. Our cash flow depends, in part, on our ability to generate significant revenue from existing and new customers, and manage expenses, as well as general economic conditions and other factors over which we have little control.

We cannot offer assurance that we will generate increases in our revenues, attain a level of profitable operations, or successfully implement our business plan or future business opportunities.

We may not realize the expected benefits from our strategic restructuring initiatives, and they may result in unintended adverse impacts to our business.

The Company made the strategic decision to restructure the organization, including deploying a new distribution model and operational structure to refocus the allocation of company resources and improve the Company’s ability to achieve profitability and generate positive cash flow from operations. On April 10, 2014, we completed the implementation of this plan. The strategic reorganization included implementing a leaner and more efficient sales team which will continue to support our customer base in a deployment designed to create a more profitable sales model. In addition, we have dedicated resources charged with pursuing new opportunities to expand our business by targeting large provider organizations such as ACOs and certain hospital systems which are highly-focused on cost-effective treatment alternatives like our in-office BPH technologies.

19

While the strategic restructuring is expected to generate over $4 million in annualized expense reductions beginning in the fourth quarter of fiscal year 2014 and to prove our ability as a Company to demonstrate our value proposition in this evolving healthcare system, we may not realize the expected benefits of our restructuring initiatives. In addition, these actions could yield unintended consequences, such as distraction of management and employees, business disruption, reduced employee morale and productivity and unexpected additional employee attrition, including the inability to attract or retain key personnel. These consequences could negatively affect our business, financial condition and results of operations. We cannot guarantee that these restructuring measures, or other expense reduction measures we take in the future, will result in the expected cost savings and additional operating efficiency intended.

We may need additional capital and any additional capital we seek may not be available in the amount or at the time we need it.

We used approximately $1.6 million of net cash for operating and investing activities in the year ended June 30, 2014 and ended our 2014 fiscal year with approximately $718,000 in cash. We believe the key factors to funding our long-term capital needs will be our ability to generate revenue and positive cash flow from the sale of our products. To fund our short-term capital needs if we are not able to immediately increase the revenues we receive from product sales, generate positive cash flow or operate in a profitable manner, we will need to raise funds in the future to execute our business plan and pursue our strategic goals.

If we raise funds in the future, we cannot assure you that additional financing will be available in the amount or at the time we need it, or that it will be available on acceptable terms or at all. We may obtain future additional financing by incurring indebtedness or from an offering of our equity securities or both. Our efforts to raise additional funds from the sale of equity may be hampered by depressed trading price of our common stock and the fact that our common stock is listed on the OTC Markets Group’s OTCQB Marketplace. Our efforts to raise funds by incurring additional indebtedness may be hampered by the fact that we have approximately $5.3 million in outstanding indebtedness to Medtronic and the challenges we may face in servicing our current indebtedness with cash flow from future operations, as well as the fact that all of our assets (other than our intellectual property) are pledged as collateral to secure our existing debt.

If we issue additional equity securities to raise funds, the ownership percentage of our existing shareholders would be reduced. New investors may demand rights, preferences or privileges senior to those of existing holders of common stock. If we raise additional funds by incurring debt, we could incur significant expense and become subject to covenants that could affect the manner in which we conduct our business. If we cannot timely raise any needed funds, we might be forced to make substantial reductions in our operating expenses, which could adversely affect our ability to implement our business plan and ultimately our viability as a company.

Our expected financing needs are based upon management estimates as to future revenue and expense. Our business plan and financing needs are subject to change based upon, among other factors, our ability to generate revenue from both the Prostiva RF Therapy System product and our Cooled ThermoTherapy products and our ability to effectively manage costs. If our estimate of our financing needs change, we may need additional capital more quickly than we expect or we may need a greater amount of capital.

Risks Related to Our Common Stock

Our common stock was transferred from The NASDAQ Capital Market (“NASDAQ”) to OTC Markets Group’s OTCQB Marketplace (“OTCQB”) which could impair our ability to raise capital and will likely hinder our investors’ ability to trade our common stock in the secondary market.

On June 5, 2013, our Board of Directors authorized the transfer of our common stock from The NASDAQ Capital Market (“NASDAQ”) and the subsequent transfer to OTC Markets Group’s OTCQB Marketplace (“OTCQB”). Beginning on June 7, 2013, our common stock is traded on the OTCQB tier of the OTC Markets, an inter-dealer, over-the-counter market. As compared to securities quoted on a national exchange such as NASDAQ, selling our common stock could be more difficult because smaller quantities of shares are likely to be bought and sold, transactions could be delayed, security analysts’ coverage of us may be reduced, and our common stock may trade at a lower market price than it otherwise would.

20

In addition, our common stock is now subject to the rules promulgated under the Securities Exchange Act of 1934 relating to “penny stocks.” These rules require brokers who sell securities that are subject to the rules, and who sell to persons other than established customers and institutional accredited investors, to complete required documentation, make suitability inquiries of investors and provide investors with information concerning the risks of trading in the security. Consequently, we believe an investor could find it more difficult to buy or sell our common stock in the open market.

We also believe that moving to the OTCQB Marketplace could impair our ability to raise any capital we may require in the future through an equity financing. There can be no assurance that our common stock may be sold without a significant negative impact on the price per share or that any market will continue to exist for our common stock.

Fluctuations in our future operating results may negatively affect the market price of our common stock.

Our operating results have fluctuated in the past and can be expected to fluctuate from time to time in the future. Some of the factors that may cause these fluctuations include but are not limited to:

|

|

|

|

|

|

• |

the timing, volume and pricing of customer orders for both control units and procedure kits; |

|

|

• |

the impact to the marketplace of competitive products and pricing; |

|

|

• |

the timing of expenses, including those relating to sales and marketing, and research and development; |

|

|

• |

product availability and cost; and |

|

|

• |

changes in or announcements regarding potential changes to the Centers for Medicare and Medicaid Services (CMS) reimbursement rates. |

If our operating results are below the expectations of securities analysts or investors, the market price of our common stock may fall abruptly and significantly.

Our stock price may be volatile and a shareholder’s investment could decline in value.

Our stock price has fluctuated in the past and may continue to fluctuate significantly, making it difficult for an investor to resell shares or to resell shares at an attractive price. The market prices for securities of technology companies have historically been highly volatile. Future events concerning us or our competitors could cause such volatility, including:

|

|

|

|

|

|

• |

actual or anticipated variations in our operating results; |

|

|

• |

technological innovations or new commercial products introduced by our competitors; |

|

|

• |

developments regarding government and third-party reimbursement; |

|

|

• |

changes in government regulation; |

|

|

• |

government investigation of us or our products; |

|

|

• |

result of regulatory process for approval of our devices; |

|

|

• |

changes in reimbursement rates or methods affecting our products; |

|

|

• |

developments concerning proprietary rights; |

|

|

• |

litigation or public concern as to the safety of our products or our competitors’ products; |

|

|

• |

investor perception of us and our industry; |

|

|

• |

general economic and market conditions including market uncertainty; |

|

|

• |

national or global political events; |

|

|

• |

difficulties with international expansion or operations; |

|

|

• |

public confidence in the securities markets and regulation by or of the securities markets; and |

|

|

• |

changes in senior management. |

21