Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Epcylon Technologies, Inc. | Financial_Report.xls |

| EX-31.1 - EXHIBIT 31.1 - Epcylon Technologies, Inc. | exhibit31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Epcylon Technologies, Inc. | exhibit31-2.htm |

| EX-32.2 - EXHIBIT 32.2 - Epcylon Technologies, Inc. | exhibit32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Epcylon Technologies, Inc. | exhibit32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: May 31, 2014

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE EXCHANGE ACT OF 1934

For the transition period from _________to _________

Commission File Number: 000-53770

EPCYLON TECHNOLOGIES INC.

(Exact Name of Registrant as Specified in its Charter)

| Nevada | 27-0156048 |

| (State of other jurisdiction of | (IRS Employer Identification |

| incorporation or organization) | Number) |

131 Bloor Street, Suite 200/372

Toronto,

Ontario, Canada M5S 1R8

(Address of principal executive

offices)

(416) 479-0880

(Registrant’s telephone

number)

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act: Common Stock, par value $.0001 per share

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [

] No [X]

Indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or 15(d) of the Exchange Act.

Yes

[ ] No [X]

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Exchange Act during

the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

Yes [X] No

[ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K: [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer [ ] | Accelerated Filer [ ] |

| Non-Accelerated Filer [ ] | Smaller Reporting Company [X] |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act).

Yes [

] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal year: $16,847,622 at November 30, 2013.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: The Issuer had 168,476,221 shares issued at August 30, 2014.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements in this Report may be “forward-looking statements,” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which can be identified by the use of terminology such as "estimates," "projects," "plans," "believes," "expects," "anticipates," "intends," or the negative or other variations, or by discussions of strategy that involve risks and uncertainties. However, as the Company intends to issue “penny stock,” as such term is defined in Rule 3a51-1 promulgated under the Exchange Act, the Company is ineligible to rely on these safe harbor provisions. Forward-looking statements include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions. These statements are based on current expectations, estimates and projections about our business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may, and are likely to, differ materially from what is expressed or forecasted in the forward-looking statements due to numerous factors, including those described above and those risks discussed from time to time in this Report, including the risks described under “Risk Factors,” “Management’s Discussion and Analysis” and “Our Business.”

There are important factors that could cause our actual results to differ materially from those in the forward-looking statements. These factors, include, without limitation, the following: our ability to develop our technology platform and our products; our ability to protect our intellectual property; the risk that we will not be able to develop our technology platform and products in the current projected timeframe; the risk that our products will not achieve performance standards in tests; the risk that the testing process will take longer than projected; the risk that our products will not receive regulatory approval; the risk that the regulatory review process will take longer than projected; the risk that we will not be unsuccessful in implementing our strategic, operating and personnel initiatives; the risk that we will not be able to commercialize our products; any of which could impact sales, costs and expenses and/or planned strategies. Additional information regarding factors that could cause results to differ can be found in this Report and in our other filings with the Securities and Exchange Commission.

The Company disclaims any obligation to update any such factors or to announce publicly the results of any revisions of the forward-looking statements contained or incorporated by reference herein to reflect future events or developments, except as required by the Exchange Act. Unless otherwise provided in this Report, references to the “Company,” “Epcylon,” the “Registrant,” the “Issuer,” “we,” “us,” and “our” refer to Epcylon Technologies Inc.

PART I

ITEM 1: BUSINESS

Introduction

Epcylon Technologies, Inc., formerly known as Mobile Integrated Systems, Inc., is a development stage technology company that operates within the financial services industry and the broader gaming industry. We are engaged, through our Stealth branded products, in the business of researching, developing and maintaining proprietary algorithmic securities trading systems. Furthermore, through our MOBI branded products, we develop software and interactive games for use by charitable organizations and government regulated lotteries.

Our technologies are at various levels of development. To date, we have minimal revenues. It is anticipated that each of our lines of business will generate revenue through software licensing arrangements.

Corporate Development and business summary

We were incorporated in the State of Nevada on April 22, 2009, our subsidiary Mobilotto was incorporated in the province of Ontario in September 2008, our subsidiary Delite Americas Inc. was incorporated in Ontario, Canada on July 8, 2013, and our subsidiary Omega Smartbuild Americas Inc. was incorporated in Ontario, Canada on July 8, 2013. On May 13, 2009 we acquired all of the issued and outstanding shares of Mobilotto (including all of the intellectual property of the mobile lottery software application).

Amendment to Articles of Incorporation

Effective as of August 5, 2013, our Articles of Incorporation were amended as follows:

| 1. |

Article 1 of our Articles of Incorporation was amended to read: “Name of Corporation: Epcylon Technologies Inc.” We changed our name as part of an effort to re-brand ourselves. |

Effective as of April 3, 2014, our Articles of Incorporation were amended as follows:

| 1. |

Article 3 of the Articles of Incorporation was amended by to creating and authorizing 15,000,000 shares of blank check preferred stock, par value $0.001, in connection with our proposed restructure. See "Item 5. |

Stealth Products - Quantitative Alpha Trading, Inc.

On August 21, 2012, we and Quantitative Alpha Trading, Inc. (“QAT”) announced the execution of an arrangement agreement dated August 20, 2012 (the “Arrangement Agreement”), providing that we would acquire all of the outstanding common shares of QAT on the basis of 0.2222 of a share of our common stock in exchange for each outstanding share of QAT. The parties also announced the execution of a perpetual worldwide licensing and commercialization agreement to develop and market all of QAT’s products. We later agreed with QAT to extend the outside closing date of our acquisition of QAT to June 30, 2013. This extended period was intended to allow us and QAT time to focus our respective combined resources on the continued integration of the businesses and the further development and commercialization of QAT's software.

On August 20, 2012, we entered into a bridge loan agreement with QAT to ensure that QAT had sufficient funds to commercialize all of their products. We provided a non-revolving term credit facility in a maximum aggregate principal amount not to exceed CDN $800,000. The bridge loan carried an annual interest rate of 12% and was secured by first fixed and specific mortgage on the QAT assets.

On March 15, 2013, we announced that we had terminated the Arrangement Agreement as a result of QAT being in breach of certain of its covenants under the agreement. Due to QAT being in default of its obligations under the first priority secured bridge loan, we took steps to enforce our security interests under such loan. We became the owner of all of the intellectual property of QAT, including the Stealth products for proprietary algorithmic securities trading systems.

We are marketing the acquired Stealth software to securities traders. This software provides an algorithmic stock signals intelligence system that predicts future stock behavior. It is our intention to license our financial software to financial organizations and individuals as a primary source of revenue. Our financial software is expected to be distributed through software app stores and distribution agreements.

Our Stealth branded products have been commercialized for both institutional traders and retail traders alike. To date the products are available on Bloomberg terminals worldwide via the Bloomberg App Portal. Furthermore, we are in discussions to make the Stealth product suite available to various institutions via integration with in-house technologies.

Our Stealth trading platform offers a suite of software applications designed to encourage better customer interaction and help brokerages to modernize. Stealth Analytics is a mathematical and cognitive psychology based market visualization instrument that filters complex market data to vividly and explicitly depict the sentiment and perception of market participants.

During the prior year, Stealth became a member of the Bloomberg Application Portal, a participant in the Interactive Brokers marketplace and signed a distribution agreement with PCQuote Canada.

The inclusion of the Stealth Platform in the Bloomberg Application Portal presents us with the opportunity to sell our products to our target audience. The Bloomberg Application Portal is a relatively new function on the Bloomberg Terminal created to deliver highly vetted and secure 3rd party applications. These applications cover the entire workflow of a firm’s users from technical charting to portfolio management and are available only to Bloomberg Terminal customers. The applications offered within the Application Portal are completely integrated with Bloomberg Professional data and functions. In addition, each application launches directly from the Bloomberg Terminal and runs very similarly to a Bloomberg Launch pad component.

Bloomberg, the global business and financial information and news leader, gives influential decision makers a critical edge by connecting them to a dynamic network of information, people and ideas. Our strength – delivering data, news and analytics through innovative technology (including through the Stealth Platform), quickly and accurately- is at the core of the Bloomberg Professional service, which provides real time financial information to more than 310,000 subscribers globally. Bloomberg’s enterprise solutions build on our core strength, leveraging technology to allow customers to access, integrate, distribute and manage data and information across organizations more efficiently and effectively.

Stealth is a member of The Marketplace@IB, a self-service community that brings together third parties who have products and services to offer with Interactive Brokers (IB) customers and traders who are looking to fill a specific need. IB is a low cost provider of trade execution and clearing services for individuals, advisors, proprietary trading groups, brokers and hedge funds. IB’s premier technology provides direct access to stocks, options, futures, forex, bonds and funds on over 100 markets worldwide from a single IB Universal account.

Interactive Brokers (IB) is a low cost provider of trade execution and clearing services for individuals, advisors, prop trading groups, brokers and hedge funds. IB’s premier technology provides direct access to stocks, options, futures, forex, bonds and funds on over 100 markets worldwide from a single IB Universal account.

Our three core software products consist of Stealth Analytics, Stealth Professional, and Stealth Market Sentiment Navigator. These core products will be augmented with additional products and services that will include but not be limited to the following:

- Monthly subscription to a market newsletter including a daily trade sheet.

- A comprehensive education program for new, intermediate, and experienced traders based on auction logic and our proprietary methodologies.

- A live trade room with real time market analysis and trading ideas.

- An alert service for trades via the mobile application, email, and text.

- Trading workshops.

- Shadow Trading Accounts.

- Trading “combines” to train and identify traders for an online proprietary trading shop.

- Creation of a reseller channel made up of mentors using our trading methodology and education curriculum.

These additional products and/or services will be phased in over time based on available capital, resources, and manpower. These new offerings create multiple revenue streams that will also drive software sales, grow our client base and offer a complete end-to-end trading solution.

Our MOBI branded products are currently being customized for various charitable organizations to integrate the product suite with in-house technologies.

Our MOBI branded products aim to become a leading developer of global mobile engagement services - mobile marketing, mobile commerce and mobile gaming. Through the MOBI branded products, the Company focuses on social good and its contribution towards charity. The product suite utilizes efficient and highly interactive broad-based participation games (such as draw based lotteries) to promote responsible play and support charitable causes. The brand continues to have exploratory discussions with various charities to seek partnerships.

Our goal is to provide lottery operators worldwide with a complete solution to enable consumers to play lottery and other games of chance and skill via mobile devices. For the players, the solution makes mobile-play much more exciting and convenient compared to paper ticket play. For the operator, MOBI can deploy in 60 days, without capital costs, and expand revenues by reaching mobile savvy players and analytically-enriched in-game marketing.

The key element of the solution is the player Launch Pad which allows convenient, exciting, secure and private play of the broadest range of games. The player also gets tools to track their playing activity and to help them play responsibly.

Technologies developed and owned by the MOBI division include GameCore and GeoLoc. While GameCore is the collection of MOBI Interactive intellectual property for crafting and delivering solutions to make high-transaction, real-time and often analytical enriched applications available on mobile devices, GeoLoc ensures jurisdictional play and helps with target marketing and nearest retailer referral. It detects the location of a user even if their phone has no GPS capability.

An important aspect is also security in technology. In order to meet customer requirements, MOBI Interactive deploys sophisticated security methods in their network, server, and client software components using advanced firewall and intrusion prevention systems, industry certified encryption techniques, as well as a thorough personnel screening and oversight programs.

In order to support responsible gaming MOBI Interactive solutions provide various functions, including legal age verification and validation including a credit check during the registration process, jurisdiction confirmation via the geo-locater that employs both cell tower positioning and GPS data, combined with customer registration data to confirm the customer’s location during time of purchase, as well as customer-spend limits.

Our unique features allow operators to design and launch game modifications and new games with just a few clicks. The GameCore technology includes analytically-enriched opt-in messaging and the capability to communicate with and cross-sell players. Messages and ads include convenient hot keys to support common functions – such as purchase ticket, learn more, donate and close.

Player actions are tracked and analyzed to ensure effective marketing. GameCore is a complete platform for mobile play of lottery, sports products, and scratch cards. GameCore also features location verification to ensure a player is in jurisdiction, which is a necessity for many regulated lottery operators.

The MOBI products have two main target groups. The first such group for MOBI Interactive solutions are lottery operators. These operators have a pressing need to expand into new sales and distribution channels but generally are hampered by their expensive retail-terminal networks that need a high density of players to be cost-effective. MOBI GameCore solves this issue by enabling lottery ticket play via mobile devices. Consequently, there is no need for a player to go to a lottery retail outlet. Operators can now reach anyone that has a mobile device in the jurisdiction.

Charitable funds represent the second target group for MOBI. Charitable lotteries are an excellent way to contribute to the ever-growing needs of a community. MobiCharity is a customizable lottery solution that supports fund raising events that involve tickets or pledges. Player functions include registration, pledging, payment, social messaging and notifications. Operator functions feature donor management and support, campaign design and execution and reporting. Besides the convenient features for the purchaser, the charity can sell more tickets at a faster rate. This speeds the close out of the fund raising effort and helps reduce promotion costs.

In the prior year, we launched a mobile lottery application in Canada for the Princess Margaret Hospital Foundation (http://www.pmhf.ca). The solution expanded the convenience for ticket ordering to mobile savvy potential-donors. Furthermore, the solution complied with the challenge that the Ontario Lottery and Gaming Commission requires the lottery operator to have a process to verify that ticket purchasers are physically in Ontario when placing their ticket orders. Additionally, the application supports all popular mobile devices and interface with the existing back-office payment-processing system, potential donor and ticket purchaser databases and the marketing communications systems that are used to notify potential donors and ticket purchasers about lottery event details such as prize information, early-bird promotions, deadlines, prize winners, rules and regulations. The application was able to help to speed the sell-through of tickets and therefore reduce the large expense of traditional print and broadcast media.

Marketing Plan

Our marketing plan is a combination of branding, communication, presentations, and meetings with potential customers, public messaging, and partnership initiatives with other corporate entities. Specifically, our plan calls for:

| 1. |

Face to face sales to potential corporate customers. |

| 2. |

Internet sales through search engine optimization (SEO), banner ads and press work. |

| 3. |

Implement a demand generation engine that will provide the technical infrastructure to sell our software direct to users on our website. |

| 4. |

Through a variety of social media, email, Broker partners, and media campaigns, we will drive traffic to weekly webinars in our live trade room and multiple trading community sites promoting the Stealth Analytics and our other products and services. |

Competitive Advantages and Disadvantages

Competitive Advantages – Stealth

| • |

Stealth Analytics is positioning to gain market share within the financial education and on line trading industry due to its technology and auction logic foundation that varies from indicator based systems currently offered by our competitors. | |

| • |

With the focus on real time volume at price and proprietary psychological mathematical algorithms which give traders a definitive edge with confidence, we quickly attract the early adopters and active traders/investors in search of superior trading signals/ software. |

| • |

We believe that our software offers the first real opportunity for the true gamification of the trading industry. We will harness the early adopters that are attracted to our software due to its success rate, and build out a strong support system that is not just focused on education, but on the actual routines and processes that are necessary for traders to succeed as on-line trader. | |

| • |

Our training and education will not be reiterations of the same principles and concepts that are regurgitated in various forms by our competitors. We are developing new concepts and practices not seen currently within the financial market place. |

Competitive Advantages - MOBI

| 1. | Our mobile technologies function as an application which facilitates the following: |

| • | Controlled end-user experience interactive graphical user interface (GUI), matched to phone capabilities; | |

| • | Includes secure interface standards; | |

| • | Enhanced eCommerce capabilities; and | |

| • | Low cost per message. |

| 2. |

Our product has the ability to identify the geographical location of players. This patent-pending process limits out of region play for purposes of controlling compliance with jurisdictional legal requirements. |

| 3. |

Our application has been tested on a number of different phone types: |

| • | A development plan is underway to cover most of the popular smart model cellular telephones; | |

| • | Current development is underway to enable Windows Mobile platforms; and | |

| • | Non-smart phones using conventional technologies have development potential. |

| 4. |

Our application has been built to integrate with existing on-line offerings without duplicating processes or databases to create an efficient, seamless mobile and on-line gaming experience. |

| 5. |

We believe that Phase 2 gaming (including pro-line, sports select, and multiplayer games) could be developed and accommodated on our system. |

| 6. |

Our product provides the lottery operator with a non-intrusive, 2-way communication capability which includes screen pop-ups, device start-up screen, and survey capability, as well as enhanced personalized marketing opportunities. |

| 7. |

We provide full screen notification of lottery results. |

| 8. |

Our application icon resides on the mobile device and application upgrades are automatic. |

| 9. |

Our working demonstration models are developed and are currently operable for assessment by lottery operators. |

Player Experience Advantages:

| 10. |

Our product requires few key strokes (as the process is menu driven), which provides for simple and easy play. |

| 11. |

All functionality and processes can be built onto the mobile device (full mobile solution for player registration, PIN access, lottery purchase, settlement, winning ticket notification, and customer communication). |

| 12. |

Our application has design and play concepts based on replicating, emulating and interfacing with existing web-based lottery operator offerings for consistency of the lottery experience using a mobile device. |

The Competitive Risks Associated with Our Technology And Business

| • |

We are a development stage company, with limited resources to continue to develop our business; | |

| • |

We have only developed the software for lottery game selection, lottery number picking and lottery number authorization components of our system; | |

| • |

Our system still requires the software development of the player registration, financial settlement and player messaging components; | |

| • |

We will be dependent on third-party software development companies to develop the remaining components for our full feature system; | |

| • |

There is no assurance that our products will operate in the manner for which it is intended; | |

| • |

The cost of development and realization of the additional components to our software applications may be greater than we anticipate; | |

| • |

There is no assurance that our mobile lottery software will be certified for use by the Gaming Standards Association or lottery operators; | |

| • |

There is no assurance that we will be able to market and sell our software applications; | |

| • |

There is no assurance that our mobile lottery software will be acceptable to lottery operators; and | |

| • |

Larger suppliers in the industries that we operate who have more resources than we do could decide to enter the businesses and compete more effectively for market share. |

We expect to compete in the global market on the basis of being able to provide a full feature mobile lottery application that we have designed to include the following components: secure player registration and authorization, number selection, settlement, winning number notification and direct-to-customer messaging capability for enhanced marketing opportunities. There are some competitors who are currently offering and developing mobile lottery applications, however, we are not aware of any who are offering solutions with the same full feature characteristics as our product. We are not yet in a competitive position in the global market because we have not completed the development of all components of our full featured mobile lottery software application. We expect to complete our full featured mobile lottery software application within approximately nine months from instructing our software development partner to commence work. We anticipate that lottery operators will make their selection of vendors and service providers on the basis of considerations involving security, product performance, ease of use by the lottery operator and by end-users, as well as ongoing service support for the lottery operator and end-users. Upon completion of our full feature mobile lottery application, we believe that we will be able to compete globally in a manner which will be competitively attractive to lottery operators, however, the need for continuing development of our software application and the plans for commercial sale of our product are subject to many uncertainties that present material risks to investors.

Industry Overview

Stealth - Trading Industry Overview

The online trading market comprises of investors with a wide range of trading activities, demographic profiles, and risk tolerances. We can define investors in the following three categories:

- Traditional investors. Long-term investors with sporadic trading activity (<3 trades per month). This defines the largest proportion of self-directed investors.

- Active investors. Investors trading between 3 and 10 trades per month. Active investors tend to use a wider range of tools as compared to traditional investors.

- Active traders. Investors trading over 10 trades per month. This group of investors tends to be more directed and is less interested in advice. Occasionally, firms will define a fourth segment for those trade hundreds of times per month. These “hyperactive traders” tend to consist of individuals who trade a living or may trade on family accounts.

Over the past several years, the number of trading platforms has expanded, leading to a fragmented market. Since 2010, a number of firms targeting the active investors and active traders have emerged. There are now a number of firms focused specifically on options, futures, and equities trading, including eOption, OptionsHouse, OptionsXpress (now owned by Schwab), and TradeMonster. Additionally, a number of bank brokers, insurance groups, mutual fund providers, and private wealth managers have enhanced their online trading capabilities to supplement their other wealth management services. These firms use their online trading capabilities to target their existing customer base and try to capture assets previously held at stand-alone discount brokers via cross-selling into different accounts. These online services are also aimed at banking customers with too \few assets to hold advisory-based accounts. The goal is to capture these customers early, allow their wealth to grow, and then cross-sell into fee-based accounts once they have more wealth.

The online trading industry can be further broken down into to 2 main categories.

| 1. |

Online Brokerage companies with execution capabilities. | |

| 2. |

Online trading education companies with charting/indicator based software without execution capabilities. |

The first category of online brokerage companies with trade execution capabilities main revenue is derived from commissions and fees from trade execution. The second category of trading education companies with charting/indicator software derive their revenue from trading courses/service and/or monthly software as a service subscription models.

Relevant Market Size

The industry estimates that the US self-directed investment market reached just over 40 million investors in 2012. The number of self-directed accounts continues to increase, despite challenging market conditions for retail investors. Over the past year, the market has grown at a moderate pace of 5%. Traditional investors make up the bulk of the self-directed population (52%), although this population continues to rebalance towards active investors and active traders.

Traditional investor growth of 3% in 2012 represents a modest rate as compared to active investors and active traders. The active trader segment continues to witness the most aggressive growth rates of 14% and 12% over the last two years. However, this market remains a small segment of the total self-directed population, comprising only 6%. The active investor market has demonstrated growth rates of 7% and 6%, respectively, over the past two years. By end 2012, the active investor market reached nearly 17 million investors, making up 42% of the self-directed market. Both active investors and active traders present a significant opportunity for firms, with aggressive growth rates as compared to the traditional investors.

Overall the US self-directed market represents a fraction of the global market share of investors with retail investment holdings in the trillions. The fact that the industry worldwide is so fragmented is that the industry itself is so large with continued annual exponential growth.

The research is clear. The number of self-directed accounts continues to increase, despite challenging market conditions for retail investors. Investors want greater control over their investments and as a result, a self-directed channel is no longer an option for firms hoping to attract new clients or retain existing ones.

The convergence of services and products within the online trading market have changed the way investors view banking and investments. Investors have become much more active with their investment portfolio. This has implications for the industry as a whole; there is a predominant shift from traditional advisor-based firms, to online brokerages and banking institutions. How do you differentiate an online trading firm? Our research indicates a core driver within the convergence remains a focus on client retention and customer experience.

A few key statistics for reference:

- The US self-directed market reached over 40 million investors in 2012 and the active investor market alone is now made up of nearly 17 million individuals (42%), growing at a rate of 7% and 6% over the last two years, respectively. Active traders witnessed the most significant progress with 15% and 12% growth.

- Among online brokers, mobile trades via mobile apps have more than doubled since the beginning of 2011, and have grown 50-70% from year-end 2011 to year-end 2012.

- The online brokerage channel became an important business segment for full service brokers and bank- brokers who are integrating online brokerage platform to match business’ strategy and enhance their offering by providing unique branding and trading experience that differentiate themselves from the competition

Competitive analysis

Over the past several years, retail investors have demanded an increasingly diverse set of products to trade with. Equities, mutual funds, ETFs, and fixed income products are common, trading options products has also become increasingly common.

For example, a number of online brokerage firms have entered the FX market so as to compete with the traditional FX online brokers. Active trader firms such as TradeStation, Lightspeed, and Interactive Brokers have allowed customers to trade currencies alongside other products from a single account. In order to gain traction in the FX market, TradeStation purchased IBFX in November 2011. Increasingly, firms with predominantly traditional and active investor clients, but who are looking to gain greater traction in the active trader market, are offering FX as well. For example, Fidelity, E*Trade, and TradeKing now offer currency trades to their customers. In addition, Schwab has introduced its Global Trading Account where investors can trade stocks on foreign markets in their local currencies. The account also provides real-time quotes during foreign market hours.

As has been noted, many of the larger brokers with considerable size, scale, and a branch presence are expanding their product selection to offer fee-based products such as model portfolios and managed accounts. Firms offering these products are taking advantage of technology to offer a “hybrid” version of service and advice. To complement these products, firms are offering a greater number of tools around portfolio analysis and retirement planning, among others.

The following is an overview of Stealth Analytics competitors. There is a vast array of companies that service this industry with new companies entering the space continually. They are essentially broken down into two main categories, although both generally will offer a cross section of products and services. Basically they can be separated by those with executions platforms and those with software/services/education without execution platforms.

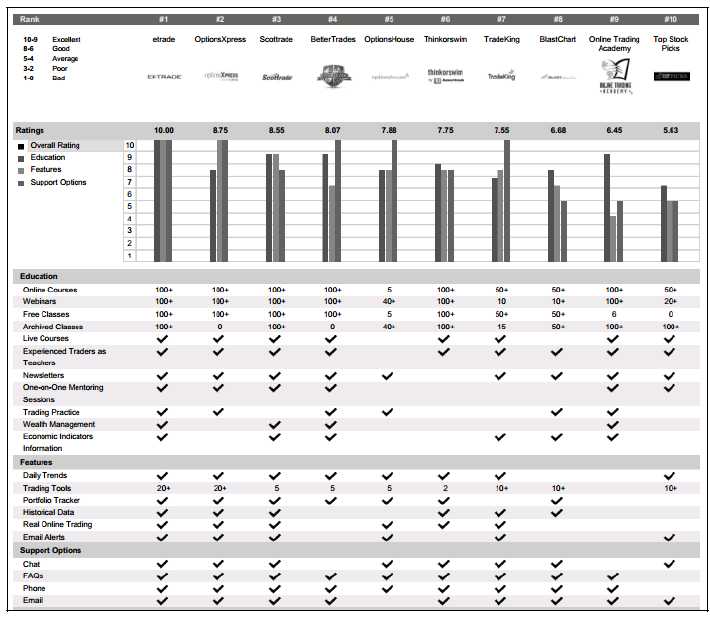

Below is a comparison chart of products and services of the top competitors within the industry as rated by users at www.TopTenReviews.com . Due to the vast number of competitors within the industry, we feel that this list constitutes the largest competitors.

Competitors:

Intellectual Property

We have Intellectual Property that gives us an advantage over our competitors. Our IP includes real time psychological mathematical algorithms that measure market participant’s sentiment, perception, and commitment on the electronic order book.

Research and product development

Stealth Analytics© is the first real-time market sentiment and traders' perception cockpit. Based on a unique algorithm that analyzes the bid ask flow rate and other trading activities for a given security.

Over a period of 13 years, under the guidance of Dr. Alex Bogdan, a team of up to 60 developers created a number of unique mobile solutions. Stealth Analytics© was developed as a unique platform for professional traders and investment houses.

The Stealth© system quantitatively measures tick by tick changes throughout the trading day in the electronic order book of any security that trades with an electronic order book.

The Stealth© platform is a unique way of presenting current market information using the flow rate of buy/sell orders placed in real time by all traders on the Exchange Electronic Trading Book. These orders are weighted by their proximity to Inside Bid/Ask levels, their size, and the time elapsed since the order origination.

Mindful of the pace of modern electronic markets, our software programmers sought to develop a system that would enable a trader to anticipate changes in market sentiment instantly and profit by reacting immediately.

Stealth© provides information, in a proprietary format, that a trader requires and provides that information in a context that allows that trader to quickly draw better conclusions than he would ordinarily using traditional numbers and charts and indicators.

Stealth Development and History:

- 1992 - 1993 Concept of the sentiment tracking has been developed. This ground-breaking discovery has forever changed the way the markets are analyzed. In addition to Technical and Fundamental analysis the third, equally important type of market analysis has been established - Sentiment Analysis.

- 1993-1994 The 3-D graph of the trader’s sentiment was designed and tested in real market conditions. This analysis tool has been tested on the currency trading floor of the Royal Bank and exhibited high level of accuracy. The floor traders called it the “night goggle” as the Sentiment Indicator allowed them to see the market moves that the traders have not been able to see before.

- 1994 - 1995 Formulas for Bid/Ask, Thrust and Head-Room gauges was developed. These three essential indicators allowed looking at dynamic characteristics of the sentiment development from a totally different angle enhancing the dynamic picture of the Sentiment Analysis.

- 1995-1996 The first real-time market navigator was built and implemented for trading. It could only analyze one stock at the time; however, it was the first complete system for the real time sentiment analysis combined with the ability of on-line execution and position tracking

- 1996 - 1999 The system for simultaneous trading of up to 10 stocks was designed and tested in trading of NASDAQ stocks. This milestone development paved the way for all the systems that Market Guidance Systems, Inc. develops today. Its innovative design, cockpit like interface and all its real time gauges were extremely accurate and reliable. This system has been tested by over 100 professional traders and earned the reputation of a 'spitfire' due to its active style of trading

- 1999-2000 The software for connecting the RTN system to a direct access trading platform has was conceded, designed and built. The first application interface has enabled traders to place their order directly to the markets via variety of brokers. This feature has dramatically enhanced the efficiency of RTN and opened the door for the very high order execution reliability.

- 2000 - 2001 Trading Zone, Commitment Gauge, Wizard, Scanner, Multiple Time Frame Sentiment Gauges was developed. This product has market a completely new class of RTN products equipped with all necessary support systems pulling together all the information needed for a comprehensive market analysis including Technical, Fundamental and Sentiment gauges. The visual interface theme has been changed to better much the style suitable for institutional trading.

- 2001 - 2002 A proprietary Direct Access execution platform was developed and connected to RTN via one integrated screen. The partnership with Interactive Brokers - one of the pioneers of universal high-speed electronic trading platforms enabled the development of a high level order management system that became a standard for all latest versions of RTN.

- 2002-2003 RTN with Autopilot and Variance Gauge was designed and deployed in real trading. Market Guidance Systems, Inc. has been formed. With more developers on staff and significantly increase amount of research equipment it became possible to design and build an artificial intelligence driven robotic system that took away 90% of routine operation performed by traders. The efficiency of the system has been significantly increased and trading of company's funds has begun. The returns produced by the new system led the way to further development and established the basis for undisputable credibility of the RTN system

- 2003-2004 The version of RTN utilizing combined stocks and option trading facility has been developed and implemented. This next milestone in our history came as a result of our unprecedented discovery of the revolutionary trading strategy never explored by anybody else. This strategy implements elaborated multi- option constructions in combination with the underlying security to achieve a very high level of immunity to ever changing market conditions.

- 2004-2005 The first multi-screen (24 screens) RTN trading platform was built and deployed for trading.

- 2005-2007 A in-house trading floor with over 150 screens and 6 servers has been built and deployed for trading. This system has a capacity of up to $2 billion. Master controller with remote access and redundant trading systems located in New Jersey and Toronto have been built and released for trading. Seven different robotic systems enhancing the RTN performance have been designed and implemented. Automatic alert and accounting systems were implemented as well.

- 2007 - 2008 RTN Stealth was built. This product featured an optimized interface and did not include a robotic trading algorithm. An improved historical market simulator was included that featured an improved trade simulation algorithm and significantly smaller data files (via a proprietary market data compression algorithm). Historical data files could be downloaded from remote servers and installed directly from within the program.

- 2008 - 2009 SPYder was launched. SPYder was the second internal automated trading system developed, employing innovations coming from the RTN Stealth system. It is the first system designed by the company that uses a full risk regulator, allowing for entry of long or short positions, or of both sides at a time. Several unique automated trading algorithms were employed by the system. Supporting this program was a distributed system of automated back-testers that ran simulations with a variety of different algorithmic variables. This system allowed for the optimization of the automated trading algorithms included in SPYder by using a broad spectrum of Monte-Carlo runs. Back-testing simulation included the simulation of individual fills according to bid/ask and last data as well as slippage for market orders and trading commissions paid. The primary indicator calculations were highly optimized for this system to allow for the maximum number of simulations to run with the computing resources available. A master system controlled the parameters of each run and analyzed the results for current use by SPYder and future optimization runs.

- 2012 - Market Sentiment Navigator was released. MSNav is a mobile application designed to display proprietary stock and securities analysis to help investors choose the best time at which to make a trade. This system allows registered users to save and maintain a portfolio of up to 15 securities from a list of the top 200+ most liquid securities on the NASDAQ, New York Stock Exchange, ETFs, and currency pairs.

Lottery Industry Overview

Lotteries are generally regulated and licensed by governmental authorities in over 200 jurisdictions globally. Currently, most U.S. states and four Canadian regions operate lotteries. In 2009, lottery and instant game revenues approximated $60 Billion in North America. According to LaFleurs 2010 World Lottery Almanac, global lottery, instant and other game revenues approximated $240 billion.

Although many different types of lottery games exist worldwide, they may generally be categorized into two main groups: instant ticket and traditional draw type lotteries. An instant ticket game is usually played by removing a coating from a pre-printed ticket to determine whether the ticket is a winner. With draw type lottery games, such as the Canadian Lotto6/49, winning is based on a purchaser matching numbers with those randomly selected by the lottery operator. Outside of North America, various types of sports betting are also popular. All of these game types can be simulated on mobile devices.

Lottery Operational Overview

Our technology can provide location-aware gaming solutions for government-sponsored lotteries and privately operated lotteries. Our solutions include mobile integration with existing online lottery systems, turnkey mobile gaming systems, custom developed traditional and interactive games, as well as ongoing support, maintenance, and management for each of our solutions.

Our lottery application utilizes proprietary technology to locate, authorize, or restrict game play based on the lottery license holder’s authorized jurisdiction. When an authorized player leaves the authorized jurisdiction for a game, new game play and additional game features may be disabled.

Lottery Contract Procurement

Government authorized lotteries in the U.S. and Canada typically operates under local government mandated public procurement regulations. Lotteries generally select suppliers by issuing a request for proposal, or RFP, which outlines contractual obligations as well as products and services to be delivered. An evaluation committee frequently comprised of key lottery staff evaluates responses based on various criteria. These criteria usually include quality of product and/or technical solutions, security plan and features, experience in the industry, quality of personnel and services to be delivered, and price. We believe that our product functionality, game content, the quality of our personnel, our technical expertise and our demonstrated ability to help the lotteries increase their revenues may provide us with advantages relative to the competition when responding to government lottery RFP's. However, some lotteries still award the contract to the qualified vendor offering the lowest price, regardless of factors other than price. Contract awards by lottery authorities are sometimes challenged by unsuccessful competitors, which can result in protracted legal proceedings. Internationally, lottery authorities do not always utilize such a formal bidding process, but rather negotiate with one or more potential vendors.

Most lottery contracts typically have an initial term of three to five years and frequently include multiple renewal options, which may be exercised for additional periods ranging from one to five years. The length of these lottery contracts, together with their renewal options, limits the number of lottery contracts available for bidding in any given year.

Research and Product Development

Our wholly-owned subsidiary, Mobilotto, has developed a ready to deploy SMS system. Working models of our application version are ready to demonstrate operation of various lottery games through commercially available mobile phones currently including IOS and RIM.

We believe our ability to attract new lottery customers and retain existing customers will depend in part on our ability to continue to incorporate technological advances into, and to improve our products, systems and communication abilities with lottery purchaser end-users of our systems. We intend to maintain a development program focusing on systems development as well as improvement and refinement of our present products as well as the expansion of uses and applications.

We intend to invest in new gaming technologies and new game delivery methods. We will endeavor to continually improve our existing application as well as research, innovate, and implement new solutions. Through continual development, we believe that we can attract new players for our customers and grow our company by attracting new lottery operators and potential partners to our company and our technologies.

Intellectual Property

We hold U.S. Provisional Patent 61/106,988 which has established our international priority date as of October 21, 2008. We are proceeding with the filing of the patent. Certain technology material to our lottery application products, processes and systems are the subject of patent applications currently pending, in the U.S. and certain other countries. In our business for instance, we intend to utilize our patent-pending technology for the jurisdictional validation and distribution of lottery tickets.

In July 2010, we received confirmation that our wave design logo as well as the phrase “THE FUTURE OF LOTTERY IS IN YOUR HAND” has been allowed by the Canadian Trade-marks Office. We previously applied for a U.S. Trademark from the United States Patent and Trademark Office (the “USPTO”). This application was not granted. We intend to re-apply for such U.S. Trademark as soon as reasonably possible. Trademark protection continues in some countries, including the U.S., for as long as the mark is used and in other countries for as long as it is registered. Registrations generally are for fixed, but renewable, terms.

Should we become aware of any potential infringement of our intellectual property or trade names by competitors and other third parties, we will consider what action, if any, to take in that regard, including, where appropriate, litigation.

Production Processes, Sources and Availability of Components

Our mobile application process is specifically designed to produce secure lottery game tickets for government sanctioned lotteries and promotional games, and to specifically ensure the jurisdiction of play and rules regarding play are complied with, along with meeting social responsibility mandates. Our application is designed for efficient, timely, mobile and secure production of game tickets and storage of game tickets and notification of winning ticket results. Games are delivered consistent with and ready for play with the lottery authority within the jurisdiction of play.

Competition: Mobile Lottery Products

Our lottery gaming business competes with a variety of suppliers from various international markets. There are numerous short message service (SMS) mobile lottery companies that have emerged globally over the past few years. Due to heavy regulation in Europe and North America the majority of these companies have set their sights on less regulated emerging markets. These markets are of significant interest to mobile lottery and gaming vendors due to their high population density and the relatively low access to online internet services and traditional convenience store lottery retailers.

Principal direct competitors exist in such emerging markets as India, Mexico, China and Europe where lottery vendors provide access to national lotteries and sports betting through mobile SMS messaging capabilities. To date the percentage of individuals who use the mobile device sales channel for lottery has remained low. The need to purchase prepaid cards from retailers and incompatible handsets still remain a challenge for these vendors. Furthermore, these have an apparent inherent weakness as they lack security and do not identify the user’s location.

Additional competition exists within European markets as lottery regulation continues to evolve. The market for mobile lottery is in its infancy as vendors address both security and regulatory restrictions; however sports betting over mobile devices is common in many European countries.

We have engineered our mobile lottery application with both location-based technology and superior cryptology which allows us to meet stringent government regulations.

The existing lottery terminal manufacturers, with GTech, Scientific Games, Intralot, Wincor, and Sagam Securite being the largest, have not publicly announced plans to develop mobile gaming solutions, but could develop a mobile offering. In addition, lottery operators could contract with software development and / or mobile software development firms to satisfy their mobile needs.

Employees

We currently have three full-time employees, two full-time contractors and one part-time contractor. We expect to hire additional full time employees as necessities dictate. We have engaged additional consultants for accounting, legal, and other part-time and occasional services.

ITEM 1A. RISK FACTORS

Our business is subject to numerous risks. We caution you that the following important factors, among others, could cause our actual results to differ materially from those expressed in forward-looking statements made by us or on our behalf in filings with the SEC, press releases, communications with investors and oral statements. Any or all of our forward-looking statements in this and in any other public statements we make may turn out to be wrong. They can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties. Many factors mentioned in the discussion below will be important in determining future results. Consequently, no forward-looking statement can be guaranteed. Actual future results may vary materially from those anticipated in forward-looking statements. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised, however, to consult any further disclosure we make in our reports filed with the SEC.

Risks Related To Our Operations And Financial Condition

We are a development stage company and we may never generate revenues which could cause our business to fail.

We are a development stage company and we have not generated any material revenues as of the date of this Report. From the inception of our activities on September 16, 2008 through the fiscal year ended May 31, 2014, the Company has incurred losses of $6,419,061. We expect to operate with net losses within the current fiscal year-ending May 31, 2014 or longer. We cannot predict the extent of these future net losses, or when we may attain profitability, if at all. If we are unable to generate significant revenue or attain profitability, we will not be able to sustain operations and will have to curtail significantly or cease operations.

We are a development stage company with significant capital resources deficiencies and we may not be able to raise adequate capital which could materially and adversely affect our ability to conduct business.

As a development stage company, we have a capital deficiency and limited operating resources. From inception through May 31, 2014, the Company raised $5,107,478 in initial funding and private placements of restricted common stock. The money raised in the initial funding and our private placements will not be sufficient to meet our projected cash flow deficits from operations and will not be sufficient to fund the continuation of the development of our technology and products. The Company will need to raise additional capital as needed to operate as planned. Even if we are able to obtain third party financing, the terms and condition of financing could have a material adverse affect on our business, results of operations, liquidity and financial condition. Any investment in our shares is subject to the significant risk that we will not be able to adequately capitalize our Company to enable us to continue to develop and implement our business model. Even if we are able to raise adequate capital, the cost of such capital may be burdensome and may materially impair our ability to fully implement our business plan.

The administrative costs of public company regulatory compliance could become burdensome and consume a significant amount of our cash resources which could materially and adversely affect our business.

We will incur significant costs and expenses in connection with assuring compliance with all laws, rules and regulations applicable to us as a public company. We anticipate that our ongoing costs and expenses of complying with our public reporting company obligations will be approximately $75,000 annually. Our reporting and compliance costs and expenses may increase substantially if we are able to deploy our business model on an international basis, which will add significant cross-border jurisdictional complexity to our regulatory compliance and our accounting controls and procedures. Our compliance costs and expenses could also increase substantially if we apply for trading of our securities on a national stock exchange which may have listing requirements that engender additional administration and compliance costs. We have assigned a high priority to establishing and maintaining controls, procedures, corporate compliance and public company reporting; however, there can be no assurance that we will have sufficient cash resources available to satisfy our public company reporting and compliance obligations. If we are unable to cover the cost of proper administration of our public company compliance and reporting obligations, we could become subject to sanctions, fines and penalties, our stock could be barred from trading in public capital markets and we may have to cease doing business.

We operate in highly competitive industries and our success depends on our ability to effectively compete with numerous domestic and foreign businesses. If we are unable to compete effectively our business could fail.

We face competition from a number of domestic and foreign businesses, some of which have substantially greater financial resources than we do, which could adversely affect our ability to enter into contracts with lottery operators. We operate in a period of intense price-based competition which could adversely affect the number and the profitability of contracts we may be able to obtain. We currently do not have any contracts and due to competition and the nature of the lottery industry, we do not know when or if we will be able to enter into any contracts. Intense competition could result in pricing pressures, lower sales, reduced margins, and lower market share. Our ability to compete successfully will depend on a number of factors, both within and outside our control.

We expect these factors to include the following:

-

our success in designing, testing and delivering new features, including incorporating new technologies on a timely basis;

-

our ability to address the needs of end-users and the quality of services for customers of the lottery operators;

-

the quality, performance, reliability, features, ease of use and pricing of our application;

-

successful implementation and expansion of our application’s capabilities;

-

our efficiency of production, and ability to deliver the application to the lottery operators and to end-users;

-

the rate at which commercially available smart phone equipment manufactures provide a technologically accessible format for incorporation of our solutions into their devices;

-

the market acceptance of our application; and

-

product or technology introductions by our competitors.

Our competitive position could be damaged if one or more potential lottery operators decide to develop their own solution or utilize a third party solution using alternative software and hardware technologies. Our prospective lottery operator customers may be reluctant to rely on a relatively small company such as our company. In addition, contract awards by lottery operators are sometimes challenged by unsuccessful bidders which can result in costly and protracted legal proceedings that can result in delayed implementation or cancellation of the contract. We cannot assure you that we will be able to compete successfully against current and future competition, and the failure to do so would have a materially adverse effect upon our business, operating results and financial condition and our business. If we do not compete effectively, our business could fail and investors could lose their entire investment.

The market for mobile lottery services is in the early stages of development, and if the market for our services does not develop as we anticipate, it will have a material adverse effect on our business, prospects, financial condition and results of operations.

Mobile lottery services, in general, are in the early stages of development. Our future revenue and profits are substantially dependent upon the widespread acceptance, growth, and use of mobile as an effective sales and purchasing medium. Most lotteries have generally relied upon more traditional forms of consumer sales of tickets through a variety of third-party owned stores, and most lottery operators have no, or only limited, experience on sales through mobile devices. Mobile lottery services are still in an early stage of development and may not be accepted by consumers or lottery operators for many reasons. If either the consumers or lottery operators reject our services, the commercial utility of our technology and services may not develop as we anticipate. If the market for mobile lottery services does not develop as we anticipate, our business could be materially and adversely affected.

Risks Related To Our Intellectual Property

We are only at the initial stage of development of our software. If we are not able to further develop our software our business could fail.

As of the date of this Annual Report, our mobile lottery software application has now been completed according to our stage 1 targets. It has been internally tested and reviewed is ready for commercial deployment for SMS and limited smart phone customers. It has not yet been commercially tested or utilized by any lottery operators and we have not yet generated any revenues from our technology. We have advanced our working demonstrations of our lottery and sports betting application (which is currently operable on most Blackberry smart phones including the Pearl, the Curve, the Bold, and 8800 series and soon IOS or apple platforms such as IPhones and IPads), as well as a scratch card game that is operating on Android devices. Our current lottery software solution includes four of the six components that together will constitute our full mobile lottery application. The completed components include lottery game selection, lottery number picking, lottery number authorization, lottery player registration and some aspects of player messaging functions. The two components remaining to be developed for a complete system include financial settlement and some remaining player messaging functions, which will be completed upon contracting.

Failure to adequately protect our intellectual property and proprietary rights could harm our competitive position and adversely affect our ability to conduct business which could result in loss of your entire investment in our Company.

Our success is substantially dependent upon our proprietary technology, which relates to a variety of business, security, and transactional processes associated with our mobile lottery services technology. We expect to rely on a combination of patent, trademark, copyright and trade secret laws to protect our proprietary rights. Although we have filed for certain patent protection over aspects of our technology, much of our proprietary information and processes may not be patentable. We cannot assure you that any pending patent applications will be issued or that their scope is broad enough to provide us with meaningful protection. Although we will file applications for registered trademarks covering certain of the marks we use in our business, we cannot assure you that we will be able to secure significant protection for these marks. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our technology and/or services or to obtain and use information that we regard as proprietary. We cannot assure you that our means of protecting our proprietary rights will be adequate or that our competitors will not independently develop similar technology or duplicate our services or design around patents issued to us or our other intellectual property rights. If we are unable to adequately protect our intellectual property and proprietary rights, our business and our operations could be materially and adversely affected.

We may be subject to intellectual property claims that create uncertainty about ownership of technology essential to our business and divert our managerial and other resources which could have a material adverse affect on our business.

There has been a substantial amount of litigation in the technology industry regarding intellectual property rights. Our success depends, in part, on our ability to protect our intellectual property and to operate without infringing on the intellectual property rights of others in the process. There can be no guarantee that any of our intellectual property will be adequately safeguarded, or that it will not be challenged by third parties. We may be subject to patent or trademark infringement claims or other intellectual property infringement claims that would be costly to defend and could limit our ability to use certain critical technologies. We may also become subject to interference proceedings conducted in the patent and trademark offices of various countries to determine the priority of inventions.

Any patent litigation or interference proceedings could have a negative effect on our business by diverting resources and management attention away from other aspects of our business and adding uncertainty as to the ownership of technology and services that we view as proprietary and essential to our business. Furthermore, because of the substantial amount of discovery required in connection with intellectual property litigation, there is a risk that some of our confidential information could be compromised by disclosure during this type of litigation. In addition, during the course of this kind of litigation, there could be public announcements of the results of hearings, motions or other interim proceedings or developments in the litigation. If investors perceive these results to be negative, it could have an adverse effect on the trading price of our common stock.

In addition, a successful claim of patent or trademark infringement against us and our failure or inability to obtain a license for the infringed or similar technology or trademark on reasonable terms, or at all, could have a material adverse effect on our business and the value of any investment in us. Also, an adverse determination of any litigation or defense proceedings could cause us to pay substantial damages, including treble damages if we are found to have willfully infringed, and, also, could put our patent applications at risk of not being issued.

The intellectual property may not be appropriately protected and we may be infringing upon the proprietary rights of third parties.

We depend on our ability to protect the core proprietary software technologies we have developed or acquired. In this regard, we rely on a combination of trade secrets, technical complexity, common law copyright and trademark protection, licensing agreements, password protection and software encryption schemes, as well as on the physical security of the source code. Despite these measures and precautions, it may be possible for an unauthorized third-party to copy our core technologies and either offer them to the marketplace as its own, or to use them without paying. To date, we have not sought to obtain patent protection for any of its software products, though we may do so in the future. There can be no assurance, however, that such registration will be granted if applied for. Also, certain aspects of the software products are not subject to intellectual property protection in law, and to the extent such protection might be available, practical and legal distinctions may apply in different jurisdictions. In addition, there can be no assurance that competitors will not develop similar technology, products and services, and if they do, this could reduce the value of our proprietary technology and our ability to effectively compete. Although we believe that we have the right to use all of the intellectual property incorporated in our software products, third parties may claim that our software products violate their proprietary rights, including copyrights and patents. The cost of litigation necessary to defend our right to use the intellectual property incorporated in its software products may be prohibitive. If any such claims are made and found to be valid or we determine it prudent to settle any such claims, we may have to re-engineer our software products or obtain licenses from third parties to continue offering the software products or cease using such technology, in whole or in part. Any efforts to re-engineer our software products or obtain licenses from third parties or cease using such technology may not be successful and could substantially increase its costs and have a material adverse effect on our business, financial condition and results of operations.

If we are not able to respond to the rapid technological change characteristic of our industry, our products and services may cease to be competitive and our business could fail and cause the entire loss of your entire investment in our Company.

The mobile industry is characterized by rapid change in business models and technological infrastructure, and we will need to constantly adapt to changing markets and technologies to provide new and competitive products and services. If we are unable to ensure that our users, lottery operators, and distribution partners have a high-quality experience with our services, then they may become dissatisfied and stop using our products and services. Accordingly, our future success will depend, in part, upon our ability to develop and offer competitive products and services. We may not, however, be able to successfully do so, and our competitors may develop innovations that render our products and services obsolete or uncompetitive. If we are not able to compete effectively, our business could fail which could result in the loss of your entire investment in our Company.

Our technical systems are vulnerable to interruption and damage that may be costly and time-consuming to resolve and may harm our business and reputation which could materially and adversely affect the value of your investment in our Company.

Our systems and operations are vulnerable to damage or interruption from fire, floods and other natural disasters. Furthermore, network failures, hardware failures, software failures, power loss, telecommunications failures, break-ins, terrorism, war or sabotage, computer viruses, penetration of our network by unauthorized computer users and “hackers” and other similar events, and other unanticipated problems all pose serious threats to our success. We may not have developed or implemented adequate protections or safeguards to overcome any of these events. We also may not have anticipated or addressed many of the potential events that could threaten or undermine our technology network. In addition, if a person is able to circumvent our security measures, he or she could destroy or misappropriate valuable information or disrupt our operations. Any of these occurrences could cause material interruptions or delays in our business, result in the loss of data or render us unable to provide services to our customers which could have the further result of materially and adversely affecting the value of your investment in our Company.

Our business depends on the protection of our intellectual property and proprietary information. If we are unable to adequately protect our intellectual property and proprietary information our business and your investment our Company could be materially and adversely affected.

We believe that our success depends, in part, on protecting our intellectual property in those countries in which we will do business. Our intellectual property includes certain pending patents and trademarks relating to our mobile technology and jurisdictional validation as well as proprietary or confidential information that is not subject to patent or similar protection. Our intellectual property protects the integrity of the systems, products and services, which is a core value of the industries in which we operate. For example, our intellectual property is designed to ensure the security of the distribution of the lottery tickets we provide as well as simple and secure validation of our lottery tickets sold. Competitors may independently develop similar or superior products, software, systems or business models. In cases where our intellectual property is not protected by an enforceable patent, such independent development may result in a significant diminution in the value of our intellectual property.

There can be no assurance that we will be able to protect our intellectual property. We expect to enter into confidentiality or license agreements with our employees, vendors, consultants, and, to the extent legally permissible, our customers. We intend to generally control access to, and the distribution of, our game systems and other software documentation and other proprietary information, as well as the designs, systems and other software documentation and other information we license from others. Despite our efforts to protect these proprietary rights, unauthorized parties may try to copy our gaming technology, business models or systems, use certain of our confidential information to develop competing products, or develop independently or otherwise obtain and use our gaming products or technology, any of which could have a material adverse effect on our business. Policing unauthorized use of our technology is difficult and expensive, particularly because of the global nature of our operations. The laws of other countries may not adequately protect our intellectual property.

There can be no assurance that our business activities, products and systems will not infringe upon the proprietary rights of others, or that other parties will not assert infringement claims against us. Any such claim and any resulting litigation, should it occur, could subject us to significant liability for damages and could result in invalidation of our proprietary rights, distract management, and/or require us to enter into costly and burdensome royalty and licensing agreements. Such royalty and licensing agreements, if required, may not be available on terms acceptable to us, or may not be available at all. In the future, we may also need to file lawsuits to defend the validity of our intellectual property rights and trade secrets, or to determine the validity and scope of the proprietary rights of others. Such litigation, whether successful or unsuccessful, could result in substantial costs and diversion of resources. If we are unable to adequately protect our intellectual property and proprietary information, our business and your investment our Company could be materially and adversely affected.

Risks Related To Our Business

Competitive environment

We currently faces competition from software providers and websites that also offer trading tools. Our challenge is to successfully differentiate ourselves from our competitors. The software industry is a rapidly changing environment with constant competition and many new product introductions. Our ability to achieve market success and a competitive advantage will depend on our capability for ongoing research and development and the integration of any technological advances into its products.

Product sustainability

We develop proprietary software based on the market behavior and trading algorithms comprised of a number of changing variables. Over time, those algorithms may prove to be obsolete and their underlying performance may be compromised by unforeseen market changes, which may adversely affect the value of our Software.

Our success will depend heavily on our management. If we fail to hire and retain qualified management and other key personnel, the implementation of our business plan will be materially and adversely affected.