Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CMS ENERGY CORP | a14-20523_18k.htm |

Exhibit 99.1

|

|

CMS Autumn Meeting September 7, 2014 Content 1-2 How it Works 3 Upsides 4-5 Partners 6-7 Investment |

|

|

This presentation is made as of the date hereof and contains “forward-looking statements” as defined in Rule 3b-6 of the Securities Exchange Act of 1934, Rule 175 of the Securities Act of 1933, and relevant legal decisions. The forward-looking statements are subject to risks and uncertainties. All forward-looking statements should be considered in the context of the risk and other factors detailed from time to time in CMS Energy’s and Consumers Energy’s Securities and Exchange Commission filings. Forward-looking statements should be read in conjunction with “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections of CMS Energy’s and Consumers Energy’s Form 10-K for the year ended December 31, 2013 and as updated in subsequent 10-Qs. CMS Energy’s and Consumers Energy’s “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections are incorporated herein by reference and discuss important factors that could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements. CMS Energy and Consumers Energy undertake no obligation to update any of the information presented herein to reflect facts, events or circumstances after the date hereof. The presentation also includes non-GAAP measures when describing CMS Energy’s results of operations and financial performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is included in the appendix and posted on our website at www.cmsenergy.com. CMS Energy provides historical financial results on both a reported (Generally Accepted Accounting Principles) and adjusted (non-GAAP) basis and provides forward-looking guidance on an adjusted basis. Management views adjusted earnings as a key measure of the company’s present operating financial performance, unaffected by discontinued operations, asset sales, impairments, regulatory items from prior years, or other items. These items have the potential to impact, favorably or unfavorably, the company's reported earnings in future periods. Investors and others should note that CMS Energy and Consumers Energy post important financial information using the investor relations section of the CMS Energy website, www.cmsenergy.com and Securities and Exchange Commission filings. |

|

|

(Page intentionally left blank) |

|

|

Perspective |

|

|

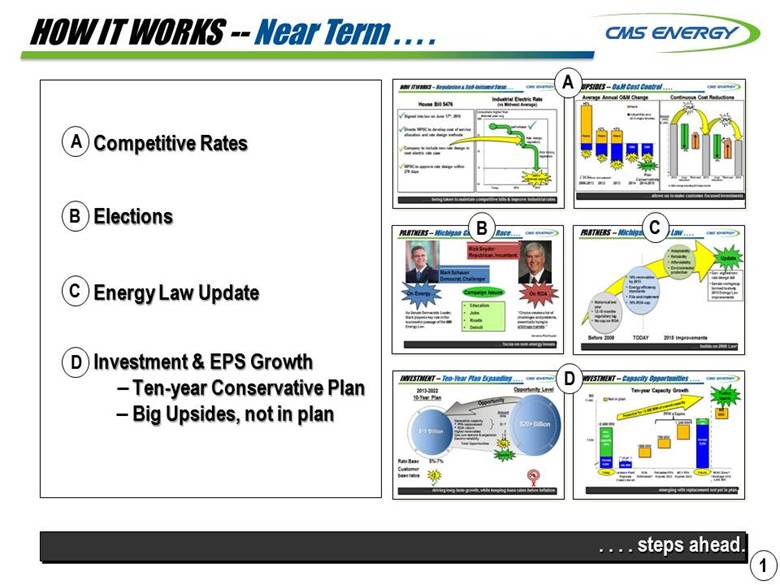

HOW IT WORKS -- Near Term . . . . . . . . steps ahead. Investment & EPS Growth Ten-year Conservative Plan Big Upsides, not in plan Competitive Rates Elections A B C D Energy Law Update 1 D C B A |

|

|

Detail |

|

|

HOW IT WORKS -- Regulation & Self-Initiated Steps . . . . Self-initiated Rate design, regulatory ROA Policy, legislation Consumers higher than Midwest peer avg Below Midwest peers . . . . being taken to maintain competitive bills & improve industrial rates. House Bill 5476 Industrial Electric Rate (vs Midwest Average) Signed into law on June 17th, 2014 Directs MPSC to develop cost of service allocation and rate design methods Company to include new rate design in next electric rate case MPSC to approve rate design within 270 days 2 |

|

|

Detail |

|

|

UPSIDES -- O&M Cost Control . . . . . . . . allows us to make customer-focused investments. Average Annual O&M Change +6% -2% -2% _ _ _ _ _ a -8% Before reinvestment +2% Peers Peers CMS CMS Peers -1% Upside? _ _ _ _ _ a O&M change excluding 2013 major storms Amount (mils) 2012 2013 2014 Cost reduction Reinvest Cost reduction Reinvest $1,050 Continuous Cost Reductions +5% Plan Conservatively 3 CMS CMS CMS |

|

|

Engagement |

|

|

PARTNERS -- Michigan Governor’s Race . . . . . . . . focus on non-energy issues. Mark Schauer Democrat, Challenger Campaign Issues Education Jobs Roads Detroit On Energy “Choice creates a lot of challenges and problems, essentially trying to arbitrage markets.” -Governor Rick Snyder 4 Rick Snyder Republican, Incumbent On ROA As Senate Democratic Leader, Mark played a key role in the successful passage of the 2008 Energy Law. |

|

|

Alignment |

|

|

PARTNERS -- Michigan Energy Law . . . . Historical test year 12-18 months regulatory lag No cap on ROA 10% renewables by 2015 Energy efficiency standards File-and-implement 10% ROA cap Adaptability Reliability Affordability Environmental protection Before 2008 TODAY 2015 Improvements . . . . builds on 2008 Law! Gov. signed new rate design bill Senate workgroup formed to study 2015 Energy Law improvements Update 5 |

|

|

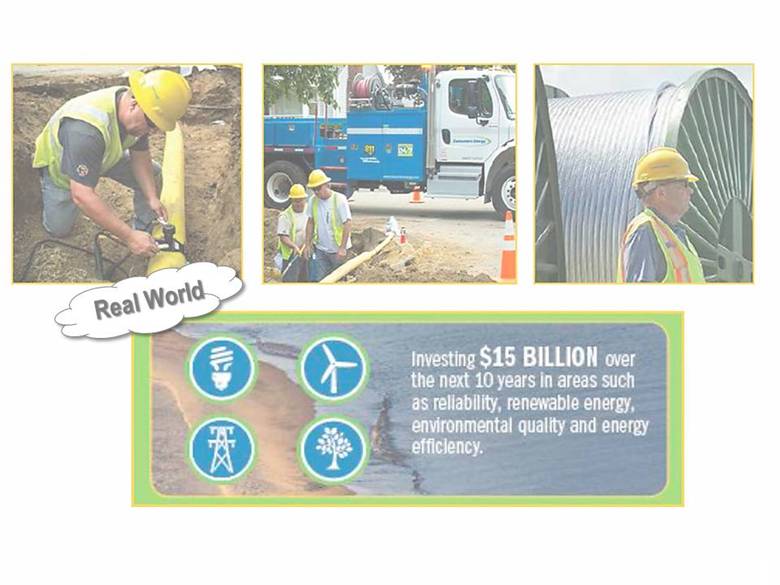

Real World |

|

|

INVESTMENT -- Ten-Year Plan Expanding . . . . . . . . driving long-term growth, while keeping base rates below inflation. 2013-2022 10-Year Plan Opportunity Level $15 Billion $15 Billion X Rate Base 5%-7% Customer base rates <2 >4 $20+ Billion Opportunity Amount (bils) Generation capacity PPA replacement $1.7 ROA return Higher renewables .3 Gas conversions & expansion 1.0 Electric reliability 2.0 Total Opportunities $5.0 Upside? 6 |

|

|

Smart |

|

|

INVESTMENT -- Capacity Opportunities . . . . . . . . emerging with replacement not yet in plan. Ten-year Capacity Growth ~800 MW 1,240 MW MW PPA 2,600 capacity ~30% ~8,600 MW 540 MW 410 MW Shortfall Owned 6,000 780 MW 900 MW Potential for ~3,000 MW of owned capacity 2,000 MW 11,000 Further Upside PPA’s Expire Owned 8,820 PPA 580 Not in plan 7 |

|

|

[LOGO] |