Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - CMS ENERGY CORP | a17-20671_1ex32d2.htm |

| EX-32.1 - EX-32.1 - CMS ENERGY CORP | a17-20671_1ex32d1.htm |

| EX-31.4 - EX-31.4 - CMS ENERGY CORP | a17-20671_1ex31d4.htm |

| EX-31.3 - EX-31.3 - CMS ENERGY CORP | a17-20671_1ex31d3.htm |

| EX-31.2 - EX-31.2 - CMS ENERGY CORP | a17-20671_1ex31d2.htm |

| EX-31.1 - EX-31.1 - CMS ENERGY CORP | a17-20671_1ex31d1.htm |

| EX-12.2 - EX-12.2 - CMS ENERGY CORP | a17-20671_1ex12d2.htm |

| EX-12.1 - EX-12.1 - CMS ENERGY CORP | a17-20671_1ex12d1.htm |

| EX-10.2 - EX-10.2 - CMS ENERGY CORP | a17-20671_1ex10d2.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

|

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES |

|

|

|

For the quarterly period ended September 30, 2017 |

|

|

|

OR |

|

|

|

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES |

|

For the transition period from_____to_____

|

Commission |

|

Registrant; State of Incorporation; |

|

IRS Employer |

|

File Number |

|

Address; and Telephone Number |

|

Identification No. |

|

1-9513 |

|

CMS ENERGY CORPORATION |

|

38-2726431 |

|

|

|

(A Michigan Corporation) |

|

|

|

|

|

One Energy Plaza, Jackson, Michigan 49201 |

|

|

|

|

|

(517) 788-0550 |

|

|

|

|

|

|

|

|

|

1-5611 |

|

CONSUMERS ENERGY COMPANY |

|

38-0442310 |

|

|

|

(A Michigan Corporation) |

|

|

|

|

|

One Energy Plaza, Jackson, Michigan 49201 |

|

|

|

|

|

(517) 788-0550 |

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

CMS Energy Corporation: Yes x No o |

Consumers Energy Company: Yes x No o |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

CMS Energy Corporation: Yes x No o |

Consumers Energy Company: Yes x No o |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

CMS Energy Corporation: |

|

|

Large accelerated filer x |

Accelerated filer o |

|

Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

|

Emerging growth company o |

|

|

Consumers Energy Company: |

|

|

Large accelerated filer o |

Accelerated filer o |

|

Non-accelerated filer x (Do not check if a smaller reporting company) |

Smaller reporting company o |

|

Emerging growth company o |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

CMS Energy Corporation: o |

Consumers Energy Company: o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

CMS Energy Corporation: Yes o No x |

Consumers Energy Company: Yes o No x |

Indicate the number of shares outstanding of each of the issuer’s classes of common stock at October 10, 2017:

|

CMS Energy Corporation: |

|

|

|

CMS Energy Common Stock, $0.01 par value |

|

|

|

(including 443,148 shares owned by Consumers Energy Company) |

|

282,083,585 |

|

Consumers Energy Company: |

|

|

|

Consumers Common Stock, $10 par value, privately held by CMS Energy Corporation |

|

84,108,789 |

CMS Energy Corporation

Consumers Energy Company

Quarterly Reports on Form 10-Q to the Securities and Exchange Commission for the Period Ended September 30, 2017

|

2 | ||

|

7 | ||

|

7 | ||

|

7 | ||

|

11 | ||

|

11 | ||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

71 | |

|

71 | ||

|

71 | ||

|

71 | ||

|

71 | ||

|

72 | ||

|

72 | ||

|

72 | ||

|

72 | ||

|

72 | ||

|

73 | ||

|

|

74 | |

Certain terms used in the text and financial statements are defined below.

2016 Energy Law

Comprehensive energy reform package enacted in Michigan in 2016

2016 Form 10-K

Each of CMS Energy’s and Consumers’ Annual Report on Form 10-K for the year ended December 31, 2016

ABATE

Association of Businesses Advocating Tariff Equity

AOCI

Accumulated other comprehensive income (loss)

ARO

Asset retirement obligation

ASU

Financial Accounting Standards Board Accounting Standards Update

Bay Harbor

A residential/commercial real estate area located near Petoskey, Michigan, in which CMS Energy sold its interest in 2002

bcf

Billion cubic feet

Cantera Gas Company

Cantera Gas Company LLC, a non-affiliated company, formerly known as CMS Field Services

Cantera Natural Gas, Inc.

Cantera Natural Gas, Inc., a non-affiliated company that purchased CMS Field Services

CCR

Coal combustion residual

CEO

Chief Executive Officer

CERCLA

Comprehensive Environmental Response, Compensation, and Liability Act of 1980

CFO

Chief Financial Officer

Clean Air Act

Federal Clean Air Act of 1963, as amended

Clean Water Act

Federal Water Pollution Control Act of 1972, as amended

CMS Capital

CMS Capital, L.L.C., a wholly owned subsidiary of CMS Energy

CMS Energy

CMS Energy Corporation and its consolidated subsidiaries, unless otherwise noted; the parent of Consumers and CMS Enterprises

CMS Enterprises

CMS Enterprises Company, a wholly owned subsidiary of CMS Energy

CMS Field Services

CMS Field Services, Inc., a former wholly owned subsidiary of CMS Gas Transmission Company, a wholly owned subsidiary of CMS Enterprises

CMS Land

CMS Land Company, a wholly owned subsidiary of CMS Capital

CMS MST

CMS Marketing, Services and Trading Company, a wholly owned subsidiary of CMS Enterprises, whose name was changed to CMS Energy Resource Management Company in 2004

Consumers

Consumers Energy Company and its consolidated subsidiaries, unless otherwise noted; a wholly owned subsidiary of CMS Energy

CSAPR

The Cross-State Air Pollution Rule

DB Pension Plan

Defined benefit pension plan of CMS Energy and Consumers, including certain present and former affiliates and subsidiaries

DB SERP

Defined Benefit Supplemental Executive Retirement Plan

DIG

Dearborn Industrial Generation, L.L.C., a wholly owned subsidiary of Dearborn Industrial Energy, L.L.C., a wholly owned subsidiary of CMS Energy

Dodd-Frank Act

Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010

EBITDA

Earnings before interest, taxes, depreciation, and amortization

EEI

Edison Electric Institute, an association representing all U.S. investor-owned electric companies

EnerBank

EnerBank USA, a wholly owned subsidiary of CMS Capital

energy waste reduction

The reduction of energy consumption through energy efficiency and demand-side energy conservation, as established under the 2016 Energy Law

Entergy

Entergy Corporation, a non-affiliated company

EPA

U.S. Environmental Protection Agency

EPS

Earnings per share

Exchange Act

Securities Exchange Act of 1934

FDIC

Federal Deposit Insurance Corporation

FERC

The Federal Energy Regulatory Commission

Forsite

Forsite Development, Inc. and its subsidiaries, each a non-affiliated company

FTR

Financial transmission right

GAAP

U.S. Generally Accepted Accounting Principles

Gas AMR

Consumers’ gas automated meter reading project, which involves the installation of communication modules to allow drive-by meter reading

GCR

Gas cost recovery

Genesee

Genesee Power Station Limited Partnership, a variable interest entity in which HYDRA-CO Enterprises, Inc., a wholly owned subsidiary of CMS Enterprises, has a 50-percent interest

kWh

Kilowatt-hour, a unit of energy equal to one thousand watt-hours

Ludington

Ludington pumped-storage plant, jointly owned by Consumers and DTE Electric Company, a non-affiliated company

MATS

Mercury and Air Toxics Standards, which limit mercury, acid gases, and other toxic pollution from coal-fueled and oil-fueled power plants

MD&A

Management’s Discussion and Analysis of Financial Condition and Results of Operations

MDEQ

Michigan Department of Environmental Quality

MGP

Manufactured gas plant

Michigan Mercury Rule

Michigan Air Pollution Control Rules, Part 15, Emission Limitations and Prohibitions – Mercury, addressing mercury emissions from coal-fueled electric generating units

MISO

Midcontinent Independent System Operator, Inc.

mothball

To place a generating unit into a state of extended reserve shutdown in which the unit is inactive and unavailable for service for a specified period, during which the unit can be brought back into service after receiving appropriate notification and completing any necessary maintenance or other work; generation owners in MISO must request approval to mothball a unit, and MISO then evaluates the request for reliability impacts

MPSC

Michigan Public Service Commission

MW

Megawatt, a unit of power equal to one million watts

MWh

Megawatt-hour, a unit of energy equal to one million watt-hours

NAAQS

National Ambient Air Quality Standards

NPDES

National Pollutant Discharge Elimination System, a permit system for regulating point sources of pollution under the Clean Water Act

NREPA

Part 201 of the Michigan Natural Resources and Environmental Protection Act, a statute that covers environmental activities including remediation

NSR

New Source Review, a construction-permitting program under the Clean Air Act

OPEB

Other Post-Employment Benefits

OPEB Plan

Postretirement health care and life insurance plans of CMS Energy and Consumers, including certain present and former affiliates and subsidiaries

Palisades

Palisades nuclear power plant, sold by Consumers to Entergy in 2007

PCB

Polychlorinated biphenyl

PPA

Power purchase agreement

PSCR

Power supply cost recovery

RCRA

The Federal Resource Conservation and Recovery Act of 1976

REC

Renewable energy credit

ROA

Retail Open Access, which allows electric generation customers to choose alternative electric suppliers pursuant to a Michigan statute enacted in 2000

SEC

U.S. Securities and Exchange Commission

securitization

A financing method authorized by statute and approved by the MPSC which allows a utility to sell its right to receive a portion of the rate payments received from its customers for the repayment of securitization bonds issued by a special-purpose entity affiliated with such utility

Smart Energy

Consumers’ Smart Energy grid modernization project, which includes the installation of smart meters that transmit and receive data, a two-way communications network, and modifications to Consumers’ existing information technology system to manage the data and enable changes to key business processes

T.E.S. Filer City

T.E.S. Filer City Station Limited Partnership, a variable interest entity in which HYDRA-CO Enterprises, Inc., a wholly owned subsidiary of CMS Enterprises, has a 50-percent interest

This combined Form 10-Q is separately filed by CMS Energy and Consumers. Information in this combined Form 10-Q relating to each individual registrant is filed by such registrant on its own behalf. Consumers makes no representation regarding information relating to any other companies affiliated with CMS Energy other than its own subsidiaries. None of CMS Energy, CMS Enterprises, nor any of CMS Energy’s other subsidiaries (other than Consumers) has any obligation in respect of Consumers’ debt securities and holders of such debt securities should not consider the financial resources or results of operations of CMS Energy, CMS Enterprises, nor any of CMS Energy’s other subsidiaries (other than Consumers and its own subsidiaries (in relevant circumstances)) in making a decision with respect to Consumers’ debt securities. Similarly, neither Consumers nor any other subsidiary of CMS Energy has any obligation in respect of debt securities of CMS Energy.

This report should be read in its entirety. No one section of this report deals with all aspects of the subject matter of this report. This report should be read in conjunction with the consolidated financial statements and related notes and with MD&A included in the 2016 Form 10-K.

CMS Energy’s internet address is www.cmsenergy.com. CMS Energy routinely posts important information on its website and considers the Investor Relations section, www.cmsenergy.com/investor-relations, a channel of distribution. Information contained on CMS Energy’s website is not incorporated herein.

FORWARD-LOOKING STATEMENTS AND INFORMATION

This Form 10-Q and other CMS Energy and Consumers disclosures may contain forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. The use of “might,” “may,” “could,” “should,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “projects,” “forecasts,” “predicts,” “assumes,” and other similar words is intended to identify forward-looking statements that involve risk and uncertainty. This discussion of potential risks and uncertainties is designed to highlight important factors that may impact CMS Energy’s and Consumers’ businesses and financial outlook. CMS Energy and Consumers have no obligation to update or revise forward-looking statements regardless of whether new information, future events, or any other factors affect the information contained in the statements. These forward-looking statements are subject to various factors that could cause CMS Energy’s and Consumers’ actual results to differ materially from the results anticipated in these statements. These factors include, but are not limited to, the following, all of which are potentially significant:

· the impact of new regulation by the MPSC, FERC, and other applicable governmental proceedings and regulations, including any associated impact on electric or gas rates or rate structures

· potentially adverse regulatory treatment or failure to receive timely regulatory orders affecting Consumers that are or could come before the MPSC, FERC, or other governmental authorities

· changes in the performance of or regulations applicable to MISO, Michigan Electric Transmission Company, LLC, pipelines, railroads, vessels, or other service providers that CMS Energy, Consumers, or any of their affiliates rely on to serve their customers

· the adoption of federal or state laws or regulations or challenges to federal or state laws or regulations, or changes in applicable laws, rules, regulations, principles, or practices, or in their interpretation, such as those related to energy policy and ROA, infrastructure integrity or security,

gas pipeline safety, gas pipeline capacity, energy waste reduction, the environment, regulation or deregulation, reliability, health care reforms (including comprehensive health care reform enacted in 2010), taxes, accounting matters, climate change, air emissions, renewable energy, potential effects of the Dodd-Frank Act, and other business issues that could have an impact on CMS Energy’s, Consumers’, or any of their affiliates’ businesses or financial results

· factors affecting operations, such as costs and availability of personnel, equipment, and materials; weather conditions; natural disasters; catastrophic weather-related damage; scheduled or unscheduled equipment outages; maintenance or repairs; environmental incidents; failures of equipment or materials; and electric transmission and distribution or gas pipeline system constraints

· increases in demand for renewable energy by customers seeking to meet sustainability goals

· the ability of Consumers to execute its cost-reduction strategies

· potentially adverse regulatory or legal interpretations or decisions regarding environmental matters, or delayed regulatory treatment or permitting decisions that are or could come before the MDEQ, EPA, and/or U.S. Army Corps of Engineers, and potential environmental remediation costs associated with these interpretations or decisions, including those that may affect Bay Harbor or Consumers’ routine maintenance, repair, and replacement classification under NSR regulations

· changes in energy markets, including availability and price of electric capacity and the timing and extent of changes in commodity prices and availability and deliverability of coal, natural gas, natural gas liquids, electricity, oil, and certain related products

· the price of CMS Energy common stock, the credit ratings of CMS Energy and Consumers, capital and financial market conditions, and the effect of these market conditions on CMS Energy’s and Consumers’ interest costs and access to the capital markets, including availability of financing to CMS Energy, Consumers, or any of their affiliates

· the investment performance of the assets of CMS Energy’s and Consumers’ pension and benefit plans, the discount rates used in calculating the plans’ obligations, and the resulting impact on future funding requirements

· the impact of the economy, particularly in Michigan, and potential future volatility in the financial and credit markets on CMS Energy’s, Consumers’, or any of their affiliates’ revenues, ability to collect accounts receivable from customers, or cost and availability of capital

· changes in the economic and financial viability of CMS Energy’s and Consumers’ suppliers, customers, and other counterparties and the continued ability of these third parties, including those in bankruptcy, to meet their obligations to CMS Energy and Consumers

· population changes in the geographic areas where CMS Energy and Consumers conduct business

· national, regional, and local economic, competitive, and regulatory policies, conditions, and developments

· loss of customer demand for electric generation supply to alternative electric suppliers, increased use of distributed generation, or energy waste reduction

· federal regulation of electric sales and transmission of electricity, including periodic re-examination by federal regulators of CMS Energy’s and Consumers’ market-based sales authorizations

· the impact of credit markets, economic conditions, and any new banking and consumer protection regulations on EnerBank

· the availability, cost, coverage, and terms of insurance, the stability of insurance providers, and the ability of Consumers to recover the costs of any insurance from customers

· the effectiveness of CMS Energy’s and Consumers’ risk management policies, procedures, and strategies, including strategies to hedge risk related to future prices of electricity, natural gas, and other energy-related commodities

· factors affecting development of electric generation projects and gas and electric transmission and distribution infrastructure replacement, conversion, and expansion projects, including factors related to project site identification, construction material pricing, schedule delays, availability of qualified construction personnel, permitting, acquisition of property rights, and government approvals

· potential disruption to, interruption of, or other impacts on facilities, utility infrastructure, or operations due to accidents, explosions, physical disasters, cyber incidents, vandalism, war, or terrorism, and the ability to obtain or maintain insurance coverage for these events

· changes or disruption in fuel supply, including but not limited to supplier bankruptcy and delivery disruptions

· potential costs, lost revenues, or other consequences resulting from misappropriation of assets or sensitive information, corruption of data, or operational disruption in connection with a cyber attack or other cyber incident

· technological developments in energy production, storage, delivery, usage, and metering

· the ability to implement technology successfully

· the impact of CMS Energy’s and Consumers’ integrated business software system and its effects on their operations, including utility customer billing and collections

· adverse consequences resulting from any past, present, or future assertion of indemnity or warranty claims associated with assets and businesses previously owned by CMS Energy or Consumers, including claims resulting from attempts by foreign or domestic governments to assess taxes on or to impose environmental liability associated with past operations or transactions

· the outcome, cost, and other effects of any legal or administrative claims, proceedings, investigations, or settlements

· the reputational impact on CMS Energy and Consumers of operational incidents, violations of corporate policies, regulatory violations, inappropriate use of social media, and other events

· restrictions imposed by various financing arrangements and regulatory requirements on the ability of Consumers and other subsidiaries of CMS Energy to transfer funds to CMS Energy in the form of cash dividends, loans, or advances

· earnings volatility resulting from the application of fair value accounting to certain energy commodity contracts or interest rate contracts

· changes in financial or regulatory accounting principles or policies

· other matters that may be disclosed from time to time in CMS Energy’s and Consumers’ SEC filings, or in other public documents

All forward-looking statements should be considered in the context of the risk and other factors described above and as detailed from time to time in CMS Energy’s and Consumers’ SEC filings. For additional details regarding these and other uncertainties, see Part I—Item 1. Financial Statements—MD&A—Outlook and Notes to the Unaudited Consolidated Financial Statements—Note 2, Regulatory Matters and Note 3, Contingencies and Commitments; and Part II—Item 1A. Risk Factors.

INDEX TO FINANCIAL STATEMENTS

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

12 | |

|

36 | ||

|

36 | ||

|

37 | ||

|

39 | ||

|

40 | ||

|

42 | ||

|

44 | ||

|

44 | ||

|

45 | ||

|

47 | ||

|

48 | ||

|

50 | ||

|

51 | ||

|

51 | ||

|

53 | ||

|

54 | ||

|

58 | ||

|

60 | ||

|

62 | ||

|

64 | ||

|

65 | ||

|

66 | ||

|

67 | ||

|

67 | ||

|

68 | ||

CMS Energy Corporation

Consumers Energy Company

Management’s Discussion and Analysis of Financial Condition and Results of Operations

This MD&A is a combined report of CMS Energy and Consumers.

EXECUTIVE OVERVIEW

CMS Energy is an energy company operating primarily in Michigan. It is the parent holding company of several subsidiaries, including Consumers, an electric and gas utility, and CMS Enterprises, primarily a domestic independent power producer. Consumers’ electric utility operations include the generation, purchase, transmission, distribution, and sale of electricity, and Consumers’ gas utility operations include the purchase, transmission, storage, distribution, and sale of natural gas. Consumers’ customer base consists of a mix of residential, commercial, and diversified industrial customers. CMS Enterprises, through its subsidiaries and equity investments, owns and operates power generation facilities.

CMS Energy and Consumers manage their businesses by the nature of services each provides. CMS Energy operates principally in three business segments: electric utility; gas utility; and enterprises, its non-utility operations and investments. Consumers operates principally in two business segments: electric utility and gas utility.

CMS Energy and Consumers earn revenue and generate cash from operations by providing electric and natural gas utility services; electric distribution, transmission, and generation; gas transmission, storage, and distribution; and other energy-related services. Their businesses are affected primarily by:

· regulation and regulatory matters

· economic conditions

· weather

· energy commodity prices

· interest rates

· their securities’ credit ratings

CMS Energy’s purpose is to achieve world class performance while delivering hometown service. CMS Energy is focused on the “triple bottom line” of people, planet, and profit, which is underpinned by performance. This purpose and focus enhance and are supported by CMS Energy’s and Consumers’ business strategy, whose key elements are safe and excellent operations, customer value, utility investment, fair and timely regulation, and consistent financial performance. The companies are committed to sustainable business practices and to a strong ethical culture. Consideration of climate change risk and other environmental risks are embedded in the companies’ strategy, business planning, and enterprise risk management processes. Consumers’ 2017 Sustainability Report, which is available to the public, describes the progress that Consumers has made in the four foundational areas of safe and excellent operations, environmental quality, social responsibility, and economic prosperity. In a 2016 report published by Sustainalytics, a global leader in sustainability research and analysis, CMS Energy scored the highest among 54 U.S. utilities in environmental, social, and governance performance.

Safe and Excellent Operations

The safety of employees, customers, and the general public remains a priority of CMS Energy and Consumers. Accordingly, CMS Energy and Consumers have worked to integrate a set of safety principles into their business operations and culture. These principles include complying with applicable safety, health, and security regulations and implementing programs and processes aimed at continually improving safety and security conditions. The number of recordable safety incidents in 2016 was the lowest in Consumers’ history and its incident rate was the lowest among its EEI peer group.

Customer Value

Consumers places a high priority on customer value. Consumers’ customer-driven investment program is aimed at improving safety and increasing electric and gas reliability, which has resulted in measureable improvements in customer satisfaction.

Additionally, Consumers has undertaken several initiatives to keep electricity and natural gas affordable for its customers. These initiatives include the adoption of a lean operating model that is focused on completing work safely and correctly the first time, thus minimizing rework and waste, while delivering services on time. Other cost-saving initiatives undertaken by Consumers include accelerated pension funding, employee and retiree health care cost sharing, replacement of coal-fueled generation with more efficient gas-fueled generation, targeted infrastructure investment, including the installation of smart meters, negotiated labor agreements, information and control system efficiencies, and productivity improvements. In addition, Consumers’ gas commodity costs declined by 68 percent from 2006 through 2016, due not only to a decrease in market prices but also to Consumers’ improvements to its gas infrastructure and optimization of its gas purchasing and storage strategy. These gas commodity savings are passed on to customers.

Utility Investment

Consumers expects to spend $18 billion on infrastructure upgrades and replacements and electric supply projects from 2017 through 2026. While it has substantially more investment opportunities that would add customer value, Consumers has prioritized its spending based on the criteria of enhancing public safety, increasing reliability, and maintaining affordability for its customers. Consumers’ investment program is expected to result in annual rate-base growth of six to eight percent. This rate-base growth, together with cost-control initiatives, should allow Consumers to maintain sustainable customer base rate increases (excluding PSCR and GCR charges) at or below the rate of inflation.

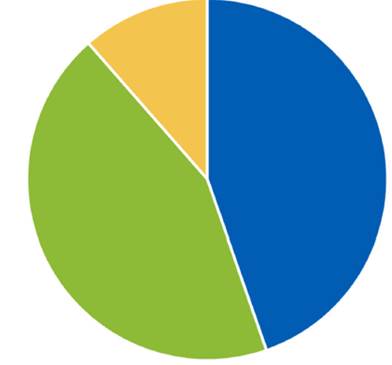

Presented in the following illustration are planned capital expenditures of $9.0 billion that Consumers expects to make from 2017 through 2021:

|

|

|

|

|

|

| |

|

|

| |

|

|

| |

|

|

Gas distribution | |

|

|

| |

|

|

Electric distribution | |

|

|

| |

|

|

Electric supply ($1.0 billion) | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Consumers’ plans to spend $8.0 billion over the next five years to maintain and upgrade its gas and electric distribution systems in order to enhance reliability and improve customer satisfaction. These infrastructure projects comprise $4.0 billion at the gas utility to sustain deliverability, enhance pipeline integrity and safety, replace mains and services, and enhance transmission and storage systems, and $4.0 billion at the electric utility to strengthen circuits and substations and replace poles. Consumers also expects to spend $1.0 billion on electric supply projects, representing new generation, including renewable generation, and environmental investments needed to comply with state and federal laws and regulations.

Regulation

Regulatory matters are a key aspect of CMS Energy’s and Consumers’ businesses, particularly Consumers’ rate cases and regulatory proceedings before the MPSC. Important regulatory events and developments are summarized below.

· Electric Rate Case: In March 2017, Consumers filed an application with the MPSC seeking an annual rate increase of $173 million, based on a 10.5 percent authorized return on equity. In September 2017, Consumers reduced its requested annual rate increase to $148 million. In October 2017, Consumers self-implemented an annual rate increase of $130 million, subject to refund with interest and potential penalties.

· Gas Rate Case: In August 2016, Consumers filed an application with the MPSC seeking an annual rate increase of $90 million, based on a 10.6 percent authorized return on equity. In January 2017, Consumers self-implemented an annual rate increase of $20 million.

The MPSC issued an order in July 2017, authorizing an annual rate increase of $29 million beginning in August 2017. The MPSC also approved an investment recovery mechanism that will provide for additional annual rate increases of $18 million beginning in 2018 and another $18 million beginning in 2019 for incremental investments that Consumers plans to make in those

years, subject to reconciliation. The investment recovery surcharge will remain in effect until rates are reset in a subsequent general rate case.

· Palisades PPA: In December 2016, Consumers and Entergy reached an agreement to terminate their PPA in May 2018, four years ahead of schedule, contingent on the MPSC’s approval of Consumers’ recovery of the negotiated termination payment in electric rates. In February 2017, Consumers requested authorization to recover the termination payment through securitization. In September 2017, the MPSC issued a securitization financing order authorizing Consumers to recover only a portion of the termination payment. As a result, Consumers and Entergy agreed not to terminate the PPA, which is now expected to continue until April 2022 under its original terms.

In December 2016, Michigan’s governor signed the 2016 Energy Law, which became effective in April 2017. Among other things, the 2016 Energy Law:

· raises the renewable energy standard from the present ten-percent requirement to 12.5 percent in 2019 and 15 percent in 2021

· establishes a goal of 35 percent combined renewable energy and energy waste reduction by 2025

· authorizes incentives for demand response programs and expands existing incentives for energy efficiency programs

· authorizes incentives for new PPAs with non-affiliates

· establishes an integrated planning process for new generation resources

· shortens from twelve months to ten months the time by which the MPSC must issue a final order in general rate cases, but prohibits electric and gas utilities from filing general rate cases for increases in rates more often than once every twelve months

· eliminates utilities’ self-implementation of rates under general rate cases

· requires the MPSC to implement equitable cost-of-service rates for customers participating in a net metering program

The 2016 Energy Law also establishes a path to ensure that forward capacity is secured for all electric customers in Michigan, including customers served by alternative electric suppliers under ROA. Under existing Michigan law, electric customers in Consumers’ service territory are allowed to buy electric generation service from alternative electric suppliers in an aggregate amount up to ten percent of Consumers’ weather-adjusted retail sales for the preceding calendar year. The 2016 Energy Law retains the ten percent cap on ROA, with certain exceptions. The new law also authorizes the MPSC to ensure that alternative electric suppliers have procured enough capacity to cover their anticipated capacity requirements for the four-year forward period. In March 2017, the MPSC indicated that it plans to achieve this objective through the use of a state reliability mechanism. Under the mechanism proposed by the MPSC, if an alternative electric supplier did not demonstrate that it had procured its capacity requirements for the four-year forward period, ROA customers could pay a charge to the utility for capacity that is not provided by the alternative electric supplier.

CMS Energy’s and Consumers’ operations are subject to various state and federal environmental and health and safety laws and regulations. The companies are monitoring numerous legislative and regulatory initiatives, including those to regulate greenhouse gases, and related litigation. They are also monitoring potential changes in policy under the Trump administration. While CMS Energy and Consumers cannot predict the outcome of these matters, they intend to continue to move forward with their clean energy plan, their carbon reduction goals, and their emphasis on supply diversity. Environmental statutes and regulations are expected to continue to have a material effect on CMS Energy and Consumers.

Financial Performance

For the nine months ended September 30, 2017, CMS Energy’s net income available to common stockholders was $463 million and diluted EPS were $1.65. This compares with net income available to common stockholders of $474 million and diluted EPS of $1.70 for the nine months ended September 30, 2016. In 2017, benefits from electric and gas rate increases and higher weather-adjusted electric and gas deliveries were offset by higher depreciation on increased plant in service and by the impacts of mild weather on electric and gas sales.

Consumers’ utility operations are seasonal. The consumption of electric energy typically increases in the summer months, due primarily to the use of air conditioners and other cooling equipment, while peak demand for natural gas occurs in the winter due to colder temperatures and the resulting use of natural gas as heating fuel. In addition, Consumers’ electric rates, which follow a seasonal rate design, are higher in the summer months than in the remaining months of the year. A more detailed discussion of the factors affecting CMS Energy’s and Consumers’ performance can be found in the Results of Operations section that follows this Executive Overview.

Consumers expects that continued economic growth in its service territory will drive its total electric deliveries to increase annually by about one-half percent on average through 2021, net of the impacts of energy waste reduction programs. Consumers is projecting that its gas deliveries will remain stable through 2021. This outlook reflects growth in gas demand offset by energy efficiency and conservation.

As Consumers seeks to continue to receive fair and timely regulatory treatment, delivering customer value will remain a key strategic priority. In order to minimize increases in customer base rates, Consumers will continue to pursue cost savings through its lean operations model, and will continue to give priority to infrastructure investments that increase customer value or lower costs.

Consumers expects to continue to have sufficient borrowing capacity to fund its investment-based growth plans. CMS Energy also expects its sources of liquidity to remain sufficient to meet its cash requirements. To identify potential implications for CMS Energy’s and Consumers’ businesses and future financial needs, the companies will continue to monitor developments in the financial and credit markets, as well as government policy responses to those developments.

RESULTS OF OPERATIONS

CMS Energy Consolidated Results of Operations

|

|

In Millions, Except Per Share Amounts |

| |||||||||||||||||

|

|

|

Three Months Ended |

|

Nine Months Ended |

| ||||||||||||||

|

September 30 |

|

2017 |

|

2016 |

|

Change |

|

2017 |

|

2016 |

|

Change |

| ||||||

|

Net Income Available to Common Stockholders |

|

$ |

172 |

|

$ |

186 |

|

$ |

(14 |

) |

$ |

463 |

|

$ |

474 |

|

$ |

(11 |

) |

|

Basic Earnings Per Share |

|

$ |

0.61 |

|

$ |

0.67 |

|

$ |

(0.06 |

) |

$ |

1.65 |

|

$ |

1.71 |

|

$ |

(0.06 |

) |

|

Diluted Earnings Per Share |

|

$ |

0.61 |

|

$ |

0.67 |

|

$ |

(0.06 |

) |

$ |

1.65 |

|

$ |

1.70 |

|

$ |

(0.05 |

) |

|

|

|

In Millions |

| ||||||||||||||||

|

|

|

Three Months Ended |

|

Nine Months Ended |

| ||||||||||||||

|

September 30 |

|

2017 |

|

2016 |

|

Change |

|

2017 |

|

2016 |

|

Change |

| ||||||

|

Electric utility |

|

$ |

176 |

|

$ |

191 |

|

$ |

(15 |

) |

$ |

394 |

|

$ |

395 |

|

$ |

(1 |

) |

|

Gas utility |

|

5 |

|

3 |

|

2 |

|

101 |

|

102 |

|

(1 |

) | ||||||

|

Enterprises |

|

8 |

|

8 |

|

- |

|

27 |

|

17 |

|

10 |

| ||||||

|

Corporate interest and other |

|

(17 |

) |

(16 |

) |

(1 |

) |

(59 |

) |

(40 |

) |

(19 |

) | ||||||

|

Net Income Available to Common Stockholders |

|

$ |

172 |

|

$ |

186 |

|

$ |

(14 |

) |

$ |

463 |

|

$ |

474 |

|

$ |

(11 |

) |

Presented in the following table are specific after-tax changes to net income available to common stockholders:

|

|

|

In Millions |

| ||||||||||

|

|

|

September 30, 2017 better/(worse) than 2016 |

| ||||||||||

|

Reasons for the change |

|

Three Months Ended |

|

Nine Months Ended |

| ||||||||

|

Consumers electric utility and gas utility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electric sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weather |

|

$ (37) |

|

|

|

|

|

$ (44) |

|

|

|

|

|

|

Non-weather |

|

4 |

|

$ (33) |

|

|

|

17 |

|

$ (27) |

|

|

|

|

Gas sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weather |

|

2 |

|

|

|

|

|

(12) |

|

|

|

|

|

|

Non-weather |

|

(3) |

|

(1) |

|

|

|

8 |

|

(4) |

|

|

|

|

Electric rate increase |

|

|

|

7 |

|

|

|

|

|

40 |

|

|

|

|

Gas rate increase |

|

|

|

2 |

|

|

|

|

|

8 |

|

|

|

|

State income tax benefit in 2017 |

|

|

|

16 |

|

|

|

|

|

16 |

|

|

|

|

Voluntary separation program costs in 2016 |

|

|

|

7 |

|

|

|

|

|

7 |

|

|

|

|

Property tax settlement in 2017 |

|

|

|

- |

|

|

|

|

|

7 |

|

|

|

|

Depreciation and amortization |

|

|

|

(5) |

|

|

|

|

|

(33) |

|

|

|

|

Other, including intercompany gain in 2017 |

|

|

|

(6) |

|

$ (13) |

|

|

|

(16) |

|

$ (2) |

|

|

Enterprises |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subsidiary earnings |

|

|

|

|

|

- |

|

|

|

|

|

10 |

|

|

Corporate interest and other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Elimination of intercompany gain in 2017 |

|

|

|

|

|

- |

|

|

|

|

|

(9) |

|

|

Michigan tax settlement in 2016 |

|

|

|

|

|

- |

|

|

|

|

|

(5) |

|

|

Other |

|

|

|

|

|

(1) |

|

|

|

|

|

(5) |

|

|

Total change |

|

|

|

|

|

$ (14) |

|

|

|

|

|

$ (11) |

|

Consumers Electric Utility Results of Operations

|

|

|

|

|

|

|

|

|

|

|

|

In Millions |

| |||||||

|

|

|

Three Months Ended |

|

Nine Months Ended |

| ||||||||||||||

|

September 30 |

|

2017 |

|

2016 |

|

Change |

|

2017 |

|

2016 |

|

Change |

| ||||||

|

Net Income Available to Common Stockholders |

|

$ |

176 |

|

$ |

191 |

|

$ |

(15 |

) |

$ |

394 |

|

$ |

395 |

|

$ |

(1 |

) |

|

Reasons for the change |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Electric deliveries and rate increases |

|

|

|

|

|

$ |

(45 |

) |

|

|

|

|

$ |

19 |

| ||||

|

Power supply costs and related revenue |

|

|

|

|

|

3 |

|

|

|

|

|

3 |

| ||||||

|

Maintenance and other operating expenses |

|

|

|

|

|

- |

|

|

|

|

|

(20 |

) | ||||||

|

Depreciation and amortization |

|

|

|

|

|

(9 |

) |

|

|

|

|

(39 |

) | ||||||

|

General taxes |

|

|

|

|

|

- |

|

|

|

|

|

7 |

| ||||||

|

Other income, net of expenses |

|

|

|

|

|

(2 |

) |

|

|

|

|

2 |

| ||||||

|

Interest charges |

|

|

|

|

|

(1 |

) |

|

|

|

|

(5 |

) | ||||||

|

Income taxes |

|

|

|

|

|

39 |

|

|

|

|

|

32 |

| ||||||

|

Total change |

|

|

|

|

|

$ |

(15 |

) |

|

|

|

|

$ |

(1 |

) | ||||

Following is a discussion of significant changes to net income available to common stockholders.

Electric Deliveries and Rate Increases: For the three months ended September 30, 2017, electric delivery revenues decreased $45 million compared with 2016. This change reflected a $61 million decrease in sales due primarily to milder summer weather, offset partially by a $12 million rate increase and a $4 million increase in energy efficiency program revenues. Deliveries to end-use customers were 10.0 billion kWh in 2017 and 10.7 billion kWh in 2016.

For the nine months ended September 30, 2017, electric delivery revenues increased $19 million compared with 2016. This change reflected a $66 million rate increase, a $12 million increase in energy efficiency program revenues, and a $2 million increase in other revenues. These increases were offset partially by a $61 million decrease in sales due primarily to milder summer weather. Deliveries to end-use customers were 28.2 billion kWh in 2017 and 28.9 billion kWh in 2016.

Maintenance and Other Operating Expenses: For the three months ended September 30, 2017, maintenance and other operating expenses were unchanged compared with 2016. A $6 million reduction in expenses reflected the absence, in 2017, of a 2016 voluntary separation plan. Additionally, postretirement benefit costs decreased $2 million, comprising a $5 million reduction associated with the early adoption of a new accounting standard, offset partially by $3 million of cost increases. For additional details on the implementation of this standard, see Note 1, New Accounting Standards. These decreases were offset fully by a $4 million increase in energy efficiency program costs and a $4 million increase in service restoration and other operating and maintenance expenses.

For the nine months ended September 30, 2017, maintenance and other operating expenses increased $20 million compared with 2016. This change reflected increases of $17 million in service restoration costs following severe storms, $12 million in energy efficiency program costs, $4 million in forestry expenses, and $5 million in other operating and maintenance expenses. Also contributing to the change was the absence, in 2017, of a $4 million benefit associated with a Michigan use tax settlement in 2016. These increases were offset partially by the absence, in 2017, of $8 million in expenses at the seven coal-fuel electric generating units that Consumers retired in April 2016, and $6 million associated with a 2016 voluntary separation plan. Additionally, postretirement benefit costs decreased $8 million, comprising a $15 million reduction associated with the early adoption of a new accounting standard, offset partially by

$7 million of cost increases. For additional details on the implementation of this standard, see Note 1, New Accounting Standards.

Depreciation and Amortization: For the three months ended September 30, 2017, depreciation and amortization expense increased $9 million compared with 2016, and for the nine months ended September 30, 2017, depreciation and amortization expense increased $39 million compared with 2016. These increases were due primarily to increased plant in service.

General Taxes: For the nine months ended September 30, 2017, general taxes decreased $7 million compared with 2016. This change was due to a $10 million benefit from the settlement of a property tax appeal related to Consumers’ Zeeland plant, offset partially by a $3 million increase in property taxes.

Other Income, Net of Expenses: For the three months ended September 30, 2017, other income, net of expenses, decreased $2 million compared with 2016. This change was due to a $4 million reduction in nonoperating retirement benefit credits associated with the early adoption of a new accounting standard, offset partially by a $2 million decrease in donations in 2017. For additional details on the implementation of this standard, see Note 1, New Accounting Standards.

For the nine months ended September 30, 2017, other income, net of expenses, increased $2 million compared with 2016. This change was due to a $9 million gain on a donation of CMS Energy stock by Consumers, which was eliminated on CMS Energy’s consolidated statements of income, and a $5 million increase due primarily to lower donations in 2017. These increases were offset partially by a $12 million reduction in nonoperating retirement benefit credits associated with the early adoption of a new accounting standard. For additional details on the implementation of this standard, see Note 1, New Accounting Standards.

Interest Charges: For the nine months ended September 30, 2017, interest charges increased $5 million compared with 2016, due primarily to higher average debt levels.

Income Taxes: For the three months ended September 30, 2017, income taxes decreased $39 million compared with 2016, and for the nine months ended September 30, 2017, income taxes decreased $32 million compared with 2016. These changes were attributable primarily to lower electric utility earnings, to a $6 million decrease associated with lower non-deductible lobbying expenses, and to the $12 million impact of a reduction in Consumers’ effective state income tax rate. For further details on this reduction in Consumers’ effective state tax rate, see Note 9, Income Taxes.

Consumers Gas Utility Results of Operations

|

|

|

|

|

|

|

|

|

|

|

|

In Millions |

| |||||||

|

|

|

Three Months Ended |

|

Nine Months Ended |

| ||||||||||||||

|

September 30 |

|

2017 |

|

2016 |

|

Change |

|

2017 |

|

2016 |

|

Change |

| ||||||

|

Net Income Available to Common Stockholders |

|

$ |

5 |

|

$ |

3 |

|

$ |

2 |

|

$ |

101 |

|

$ |

102 |

|

$ |

(1 |

) |

|

Reasons for the change |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Gas deliveries and rate increases |

|

|

|

|

|

$ |

2 |

|

|

|

|

|

$ |

8 |

| ||||

|

Maintenance and other operating expenses |

|

|

|

|

|

1 |

|

|

|

|

|

11 |

| ||||||

|

Depreciation and amortization |

|

|

|

|

|

- |

|

|

|

|

|

(15 |

) | ||||||

|

General taxes |

|

|

|

|

|

1 |

|

|

|

|

|

(3 |

) | ||||||

|

Other income, net of expenses |

|

|

|

|

|

(4 |

) |

|

|

|

|

(6 |

) | ||||||

|

Interest charges |

|

|

|

|

|

(1 |

) |

|

|

|

|

(2 |

) | ||||||

|

Income taxes |

|

|

|

|

|

3 |

|

|

|

|

|

6 |

| ||||||

|

Total change |

|

|

|

|

|

$ |

2 |

|

|

|

|

|

$ |

(1 |

) | ||||

Following is a discussion of significant changes to net income available to common stockholders.

Gas Deliveries and Rate Increases: For the three months ended September 30, 2017, gas delivery revenues increased $2 million compared with 2016. This change reflected a $4 million rate increase, and $2 million in higher sales, offset partially by a $4 million reduction in energy efficiency program revenues. Deliveries to end-use customers were 27 bcf in 2017 and 26 bcf in 2016.

For the nine months ended September 30, 2017, gas delivery revenues increased $8 million compared with 2016. This change reflected a $14 million rate increase, and a $4 million increase in other revenues, offset partially by a $10 million decrease in sales due primarily to milder winter weather. Deliveries to end-use customers were 189 bcf in 2017 and 196 bcf in 2016.

Maintenance and Other Operating Expenses: For the three months ended September 30, 2017, maintenance and other operating expenses decreased $1 million compared with 2016. This change reflected the absence, in 2017, of $4 million associated with a voluntary separation plan in 2016, a $4 million decrease in energy efficiency program costs, and a $2 million decrease in postretirement benefit costs, comprising a $4 million reduction associated with the early adoption of a new accounting standard, offset partially by $2 million of cost increases. For additional details on the implementation of this standard, see Note 1, New Accounting Standards. These decreases were offset largely by a $4 million increase in pipeline integrity expenses and $5 million in higher gas distribution and customer operations expense.

For the nine months ended September 30, 2017, maintenance and other operating expenses decreased $11 million compared with 2016. This change reflected a $6 million decrease in postretirement benefit costs, comprising an $11 million reduction associated with the early adoption of a new accounting standard, offset partially by $5 million of cost increases. For additional details on the implementation of this standard, see Note 1, New Accounting Standards. Also contributing to the change was the absence, in 2017, of $4 million associated with a 2016 voluntary separation plan, and a $3 million decline in uncollectible accounts expense. These reductions were offset partially by a $2 million increase in other gas operating and maintenance expenses.

Depreciation and Amortization: For the nine months ended September 30, 2017, depreciation and amortization expense increased $15 million compared with 2016, due primarily to increased plant in service.

Other Income, Net of Expenses: For the three months ended September 30, 2017, other income, net of expenses, decreased $4 million compared with 2016. This change was due to a $3 million reduction in nonoperating retirement benefit credits associated with the early adoption of a new accounting standard and a $1 million increase in other expenses. For additional details on the implementation of this standard, see Note 1, New Accounting Standards.

For the nine months ended September 30, 2017, other income, net of expenses, decreased $6 million compared with 2016. This change was due to an $8 million reduction in nonoperating retirement benefit credits associated with the early adoption of a new accounting standard and a $3 million decrease in other income, net of expenses. For additional details on the implementation of this standard, see Note 1, New Accounting Standards. These reductions were offset partially by a $5 million gain on a donation of CMS Energy stock by Consumers, which was eliminated on CMS Energy’s consolidated statements of income.

Income Taxes: For the three months ended September 30, 2017, income taxes decreased $3 million compared with 2016 and for the nine months ended September 30, 2017, income taxes decreased $6 million compared with 2016. These changes were attributable primarily to lower gas utility earnings and to the $4 million impact of a reduction in Consumers’ effective state income tax rate. For further details on this reduction in Consumers’ effective state tax rate, see Note 9, Income Taxes.

Enterprises Results of Operations

|

|

|

|

|

|

|

|

|

|

|

In Millions |

| ||||||||

|

|

|

Three Months Ended |

|

Nine Months Ended |

| ||||||||||||||

|

September 30 |

|

2017 |

|

2016 |

|

Change |

|

2017 |

|

2016 |

|

Change |

| ||||||

|

Net Income Available to Common Stockholders |

|

$ |

8 |

|

$ |

8 |

|

$ |

- |

|

$ |

27 |

|

$ |

17 |

|

$ |

10 |

|

For the nine months ended September 30, 2017, net income of the enterprises segment increased $10 million compared with 2016, due primarily to higher prices for capacity and demand revenue at DIG.

Corporate Interest and Other Results of Operations

|

|

|

|

|

|

|

|

|

|

|

In Millions |

| ||||||||

|

|

|

Three Months Ended |

|

Nine Months Ended |

| ||||||||||||||

|

September 30 |

|

2017 |

|

2016 |

|

Change |

|

2017 |

|

2016 |

|

Change |

| ||||||

|

Net Income (Loss) Available to Common Stockholders |

|

$ |

(17 |

) |

$ |

(16 |

) |

$ |

(1 |

) |

$ |

(59 |

) |

$ |

(40 |

) |

$ |

(19 |

) |

For the nine months ended September 30, 2017, corporate interest and other net expenses increased $19 million compared with 2016, due primarily to the absence, in 2017, of a settlement reached with the Michigan Department of Treasury that resulted in a $2 million after-tax reduction in general taxes and a $3 million reduction in income tax expense. Also contributing to the increase were $4 million of higher administrative and other corporate expenses, and $1 million of lower net earnings at EnerBank. For the nine months ended September 30, 2017, corporate interest and other net expenses also reflected the elimination in consolidation of a $9 million after-tax intercompany gain resulting from the donation of CMS Energy stock by Consumers.

CASH POSITION, INVESTING, AND FINANCING

At September 30, 2017, CMS Energy had $173 million of consolidated cash and cash equivalents, which included $31 million of restricted cash and cash equivalents. At September 30, 2017, Consumers had $85 million of consolidated cash and cash equivalents, which included $30 million of restricted cash and cash equivalents. For additional details, see Note 11, Cash and Cash Equivalents.

Operating Activities

Presented in the following table are specific components of net cash provided by operating activities for the nine months ended September 30, 2017 and 2016:

|

|

|

|

|

|

|

In Millions |

| |||

|

Nine Months Ended September 30 |

|

2017 |

|

2016 |

|

Change |

| |||

|

CMS Energy, including Consumers |

|

|

|

|

|

|

| |||

|

Net income |

|

$ |

464 |

|

$ |

475 |

|

$ |

(11 |

) |

|

Non-cash transactions1 |

|

928 |

|

870 |

|

58 |

| |||

|

Changes in core working capital2 |

|

18 |

|

62 |

|

(44 |

) | |||

|

Postretirement benefits contributions |

|

(9 |

) |

(6 |

) |

(3 |

) | |||

|

Changes in other assets and liabilities, net |

|

(202 |

) |

(160 |

) |

(42 |

) | |||

|

Net cash provided by operating activities |

|

$ |

1,199 |

|

$ |

1,241 |

|

$ |

(42 |

) |

|

Consumers |

|

|

|

|

|

|

| |||

|

Net income |

|

$ |

496 |

|

$ |

499 |

|

$ |

(3 |

) |

|

Non-cash transactions1 |

|

921 |

|

857 |

|

64 |

| |||

|

Changes in core working capital2 |

|

13 |

|

76 |

|

(63 |

) | |||

|

Postretirement benefits contributions |

|

(6 |

) |

(4 |

) |

(2 |

) | |||

|

Changes in other assets and liabilities, net |

|

(215 |

) |

(140 |

) |

(75 |

) | |||

|

Net cash provided by operating activities |

|

$ |

1,209 |

|

$ |

1,288 |

|

$ |

(79 |

) |

1 Non-cash transactions comprise depreciation and amortization, changes in deferred income taxes, and other non-cash operating activities and reconciling adjustments.

2 Core working capital comprises accounts receivable, notes receivable, accrued revenue, inventories, accounts payable, and accrued rate refunds.

For the nine months ended September 30, 2017, net cash provided by operating activities at CMS Energy decreased $42 million compared with 2016 and net cash provided by operating activities at Consumers decreased $79 million compared with 2016. At both CMS Energy and Consumers, the decrease was due primarily to gas purchases at higher prices, increased spending on environmental remediation activities, and lower gas sales as a result of milder weather, offset partially by higher collections from customers. The change at Consumers also reflected the absence, in 2017, of a reimbursement received from CMS Energy in 2016 for a prior-year postretirement benefits contribution.

Investing Activities

Presented in the following table are specific components of net cash used in investing activities for the nine months ended September 30, 2017 and 2016:

|

|

|

|

|

|

|

In Millions |

| |||

|

Nine Months Ended September 30 |

|

2017 |

|

2016 |

|

Change |

| |||

|

CMS Energy, including Consumers |

|

|

|

|

|

|

| |||

|

Capital expenditures |

|

$ |

(1,208 |

) |

$ |

(1,224 |

) |

$ |

16 |

|

|

Increase in EnerBank notes receivable |

|

(87 |

) |

(87 |

) |

- |

| |||

|

Proceeds from the sale of EnerBank notes receivable |

|

19 |

|

- |

|

19 |

| |||

|

Costs to retire property and other investing activities |

|

(78 |

) |

(87 |

) |

9 |

| |||

|

Net cash used in investing activities |

|

$ |

(1,354 |

) |

$ |

(1,398 |

) |

$ |

44 |

|

|

Consumers |

|

|

|

|

|

|

| |||

|

Capital expenditures |

|

$ |

(1,196 |

) |

$ |

(1,214 |

) |

$ |

18 |

|

|

Costs to retire property and other investing activities |

|

(82 |

) |

(87 |

) |

5 |

| |||

|

Net cash used in investing activities |

|

$ |

(1,278 |

) |

$ |

(1,301 |

) |

$ |

23 |

|

For the nine months ended September 30, 2017, net cash used in investing activities at CMS Energy decreased $44 million compared with 2016 and net cash used in investing activities at Consumers decreased $23 million compared with 2016. These changes were due primarily to lower capital expenditures at Consumers. The change at CMS Energy also reflected proceeds from the sale of EnerBank notes receivable in 2017.

Financing Activities

Presented in the following table are specific components of net cash provided by (used in) financing activities for the nine months ended September 30, 2017 and 2016:

|

|

|

|

|

|

|

In Millions |

| |||

|

Nine Months Ended September 30 |

|

2017 |

|

2016 |

|

Change |

| |||

|

CMS Energy, including Consumers |

|

|

|

|

|

|

| |||

|

Issuance of debt |

|

$ |

1,108 |

|

$ |

775 |

|

$ |

333 |

|

|

Issuance of common stock |

|

80 |

|

69 |

|

11 |

| |||

|

Net increase in EnerBank certificates of deposit |

|

40 |

|

64 |

|

(24 |

) | |||

|

Payment of dividends on common and preferred stock |

|

(282 |

) |

(260 |

) |

(22 |

) | |||

|

Retirement of debt |

|

(668 |

) |

(215 |

) |

(453 |

) | |||

|

Decrease in notes payable |

|

(168 |

) |

(174 |

) |

6 |

| |||

|

Payment of capital leases and other financing activities |

|

(39 |

) |

(22 |

) |

(17 |

) | |||

|

Net cash provided by financing activities |

|

$ |

71 |

|

$ |

237 |

|

$ |

(166 |

) |

|

Consumers |

|

|

|

|

|

|

| |||

|

Issuance of debt |

|

$ |

534 |

|

$ |

446 |

|

$ |

88 |

|

|

Stockholder contribution from CMS Energy |

|

|

450 |

|

|

275 |

|

|

175 |

|

|

Payment of dividends on common and preferred stock |

|

|

(348 |

) |

|

(362 |

) |

|

14 |

|

|

Retirement of debt |

|

|

(443 |

) |

|

(185 |

) |

|

(258 |

) |

|

Decrease in notes payable |

|

|

(168 |

) |

|

(174 |

) |

|

6 |

|

|

Payment of capital leases and other financing activities |

|

(23 |

) |

(8 |

) |

(15 |

) | |||

|

Net cash provided by (used in) financing activities |

|

$ |

2 |

|

$ |

(8 |

) |

$ |

10 |

|

For the nine months ended September 30, 2017, net cash provided by financing activities at CMS Energy decreased $166 million compared with 2016 and net cash provided by financing activities at Consumers increased $10 million compared with 2016. These changes reflected higher debt retirements offset

partially by higher debt issuances. At Consumers, the increase was due primarily to a larger stockholder contribution from CMS Energy.

CAPITAL RESOURCES AND LIQUIDITY

CMS Energy uses dividends and tax-sharing payments from its subsidiaries and external financing and capital transactions to invest in its utility and non-utility businesses, retire debt, pay dividends, and fund its other obligations. The ability of CMS Energy’s subsidiaries, including Consumers, to pay dividends to CMS Energy depends upon each subsidiary’s revenues, earnings, cash needs, and other factors. In addition, Consumers’ ability to pay dividends is restricted by certain terms included in its debt covenants and articles of incorporation and potentially by FERC requirements and provisions under the Federal Power Act and the Natural Gas Act. For additional details on Consumers’ dividend restrictions, see Note 4, Financings and Capitalization—Dividend Restrictions. For the nine months ended September 30, 2017, Consumers paid $347 million in dividends on its common stock to CMS Energy.

As a result of federal tax legislation passed in 2015 that extends bonus depreciation, CMS Energy expects to be able to extend the use of federal net operating loss carryforwards and, accordingly, defer its federal income tax payments through 2020. As a consequence, however, CMS Energy expects to receive lower tax-sharing payments from Consumers during that period. This may require CMS Energy to maintain higher levels of debt in order to invest in its businesses, pay dividends, and fund its general obligations. Despite this, CMS Energy does not anticipate a need for a block equity offering.

In March 2017, CMS Energy entered into an updated continuous equity offering program. Under this program, CMS Energy may sell, from time to time in “at the market” offerings, common stock having an aggregate sales price of up to $100 million. In June 2017, CMS Energy issued common stock under this program and received net proceeds of $70 million.

Consumers uses cash flows generated from operations and external financing transactions, as well as stockholder contributions from CMS Energy, to fund capital expenditures, retire debt, pay dividends, contribute to its employee benefit plans, and fund its other obligations. Accelerated pension funding in prior years and several initiatives to reduce costs have helped improve cash flows from operating activities. Consumers anticipates continued strong cash flows from operating activities for the remainder of 2017 and beyond.

Access to the financial and capital markets depends on CMS Energy’s and Consumers’ credit ratings and on market conditions. As evidenced by past financing transactions, CMS Energy and Consumers have had ready access to these markets. Barring major market dislocations or disruptions, CMS Energy and Consumers expect to continue to have ready access to the financial and capital markets. If access to these markets were to diminish or otherwise become restricted, CMS Energy and Consumers would implement contingency plans to address debt maturities, which could include reduced capital spending.

At September 30, 2017, CMS Energy had $549 million of its secured revolving credit facility available and Consumers had $893 million available. CMS Energy and Consumers use these credit facilities for general working capital purposes and to issue letters of credit. An additional source of liquidity is Consumers’ commercial paper program, which allows Consumers to issue, in one or more placements, up to $500 million in the aggregate in commercial paper notes with maturities of up to 365 days and that bear interest at fixed or floating rates. These issuances are supported by Consumers’ revolving credit facilities. While the amount of outstanding commercial paper does not reduce the available capacity of the revolving credit facilities, Consumers does not intend to issue commercial paper in an amount exceeding the available capacity. At September 30, 2017, $230 million of commercial paper notes were outstanding under this program. For additional details on CMS Energy’s and Consumers’ secured revolving credit facilities and commercial paper program, see Note 4, Financings and Capitalization.

Certain of CMS Energy’s and Consumers’ credit agreements, debt indentures, and other facilities contain covenants that require CMS Energy and Consumers to maintain certain financial ratios, as defined therein. At September 30, 2017, no default had occurred with respect to any financial covenants contained in CMS Energy’s and Consumers’ credit agreements, debt indentures, or other facilities. CMS Energy and Consumers were each in compliance with these covenants as of September 30, 2017, as presented in the following table:

|

|

|

|

| ||

|

|

|

September 30, 2017 |

| ||

|

Credit Agreement, Indenture, or Facility |

|

Limit |

|

Actual |

|

|

CMS Energy, parent only |

|

|

|

|

|

|

Debt to EBITDA1 |

|

< 6.0 to 1.0 |

|

4.4 to 1.0 |

|

|

Consumers |

|

|

|

|

|

|

Debt to Capital2 |

|

< 0.65 to 1.0 |

|

0.47 to 1.0 |

|

1 Applies to CMS Energy’s $550 million revolving and $180 million term loan credit agreements.

2 Applies to Consumers’ $650 million and $250 million revolving credit agreements and its $68 million, $35 million, and $30 million reimbursement agreements.

Components of CMS Energy’s and Consumers’ cash management plan include controlling operating expenses and capital expenditures and evaluating market conditions for financing and refinancing opportunities. CMS Energy’s and Consumers’ present level of cash and expected cash flows from operating activities, together with access to sources of liquidity, are anticipated to be sufficient to fund the companies’ contractual obligations for 2017 and beyond.

Off-Balance-Sheet Arrangements

CMS Energy, Consumers, and certain of their subsidiaries enter into various arrangements in the normal course of business to facilitate commercial transactions with third parties. These arrangements include indemnities, surety bonds, letters of credit, and financial and performance guarantees. Indemnities are usually agreements to reimburse a counterparty that may incur losses due to outside claims or breach of contract terms. The maximum payment that could be required under a number of these indemnity obligations is not estimable; the maximum obligation under indemnities for which such amounts were estimable was $153 million at September 30, 2017. While CMS Energy and Consumers believe it is unlikely that they will incur any material losses related to indemnities they have not recorded as liabilities, they cannot predict the impact of these contingent obligations on their liquidity and financial condition. For additional details on these and other guarantee arrangements, see Note 3, Contingencies and Commitments—Guarantees.

OUTLOOK

Several business trends and uncertainties may affect CMS Energy’s and Consumers’ financial condition and results of operations. These trends and uncertainties could have a material impact on CMS Energy’s and Consumers’ consolidated income, cash flows, or financial position. For additional details regarding these and other uncertainties, see Forward-Looking Statements and Information; Note 2, Regulatory Matters; Note 3, Contingencies and Commitments; and Part II—Item 1A. Risk Factors.

Consumers Electric Utility and Gas Utility Outlook and Uncertainties