Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Image International Group, Inc. | Financial_Report.xls |

| EX-31.1 - EXHIBIT 31.1 - Image International Group, Inc. | ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - Image International Group, Inc. | ex32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Image International Group, Inc. | ex32-2.htm |

| EX-31.2 - EXHIBIT 31.2 - Image International Group, Inc. | ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 333-189359

OWLHEAD MINERALS CORP.

(Exact name of registrant as specified in its charter)

| Nevada | 20-3204968 | |

| (State

or other jurisdiction of incorporation or organization) |

(IRS

Employer Identification No.) |

250 H Street #123

Blaine, Washington 98230

(Address of principal executive offices, including zip code.)

(518) 638-8192

(Registrant’s telephone number, including country code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

Indicate by check mark if the Registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act): YES [ ] NO [X]

Check whether the issuer is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act YES [ ] NO [X]

Check whether the Issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (s. 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Check if no disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is contained herein, and no disclosure will be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by Checkmark whether the registrant is a Shell Company (as defined in Rule 126-2 of the Exchange Act YES [ ] NO [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity: As of September 30, 2013, the aggregate market value of the voting and non-voting common equity was $1,405,900.

The number of shares outstanding of each of the issuer’s classes of common equity: As of September 2, 2014, there were 14,059,000 shares of Common Stock outstanding.

FORWARD LOOKING STATEMENT

We make forward-looking statements in this document. Our forward-looking statements are subject to risks and uncertainties. You should note that many factors, some of which are described in this section or discussed elsewhere in this document, could affect our company in the future and could cause our results to differ materially from those expressed in our forward-looking statements. Forward-looking statements include those regarding our goals, beliefs, plans or current expectations and other statements regarding matters that are not historical facts. For example, when we use the words “believe,” “expect,” “anticipate” or similar expressions, we are making forward-looking statements. We are not required to release publicly the results of any revisions to these forward-looking statements we may make to reflect future events or circumstances.

This annual report on Form 10-K contains predictions, projections and other statements about the future that are intended to be forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (collectively, forward-looking statements). Forward-looking statements involve risks and uncertainties. A number of important factors could cause actual results to differ materially from those in the forward-looking statements. In assessing forward-looking statements contained in this annual report on Form 10-K, readers are urged to read carefully all cautionary statements, including those contained in other sections of this annual report on Form 10-K. Among such risks and uncertainties is the risk that the Company will not complete its proposed Business Plan, that its management is adequate to carry out its Business Plan and that there will be adequate capital. Since the Company is a ‘penny stock’ company, the safe harbor for forward-looking statements contained in the private securities litigation reform act, as amended, does not apply to the Company.

| 2 |

| 3 |

ITEM 1. DESCRIPTION OF BUSINESS

General

Owlhead Minerals Corp. (“Owlhead” or the “Company”) was incorporated in the state of Nevada on July 25, 2005 under the name Eardley Ventures. It is in the process of applying to become a trading company listed on the OTCBB venue in the United States. On April 21, 2008, the name was changed to Owlhead Minerals Corp. in order to more appropriately reflect the Company’s business plan. In April 2008, the Company began examining 14 mineral claims located in the province of Quebec, Canada. After careful due diligence, Management decided that these claims were not of high enough quality and therefore did not fit the Company’s requirements. Management examined a number of other potential opportunities in Africa and North and South America.

In December 2012, the Company was presented with a group of claims (“cells”) known as the Teako property. The Teako cells are located half way between Terrace and Smithers, British Columbia and are near the original gold rush town of Hazelton B.C. which was founded in 1866, the site of the original gateway and staging area for the famous Omineca Gold rush days of 1869-1873.

Initially, a total of 20 cells were acquired totaling 296 hectares (approx. 730 acres). After preliminary examination of the area, the Company came to the conclusion that the area appeared to have significant potential. Therefore, Company management requested that the Prospector/Vendor, Mr. John Kemp, stake more cells adjacent or adjoining the original claim group on behalf of the Company. An additional 778 hectares (approx. 1922 acres) were staked, bringing our land package to a total of 1074 hectares, or about 2652 acres. In early November 2013, following the assay of a series of chip and grab samples taken by Mr. Kemp and a second visit to the area by our geologist, Linda Caron, M.Sc., P. Eng., an additional 112 claims were staked adding 4442.992 acres to our holdings bringing the total acreage to 7,098.122. The cells have good access to many miles of new logging roads that have recently been opened up in the area.

The Company acquired the initial cells for a cash payment of Cdn$10,000 and 1,500,000 restricted shares. The shares are to be issued pursuant to key events as follows:

| (a) | 150,000 shares issued in the name of the Optionor, John Kemp or his assignees upon the completion of a satisfactory initial geological report on the claims by a qualified and independent geologist engaged by Owlhead Minerals Corp. |

| (b) | 150,000 shares issued in the name of John Kemp or his assignees upon completion of initial work program of up to $50,000 and the completion of a satisfactory 43-101 report on the claims conducted or supervised by a qualified and independent geologist. |

| (c) | 200,000 shares issued in the name of the John Kemp or his assignees upon the completion of a work program costing up to $200,000 showing satisfactory results on the claims by a qualified and independent geologist engaged by Owlhead Minerals Corp. |

| (d) | 1,000,000 shares issued in the name of the John Kemp or his assignees upon the successful results of a ten hole drilling program. |

All the additional cells were staked on behalf of the Company.

Our plan to initiate the exploration phase of our business plan is based on the success of this offering and a specific timetable. Our business office is located at 250 H Street #123, Blaine, WA 98230. Our fiscal year end is March 31. As of March 31, 2014, Owlhead had raised $105,501 through the sale of common stock. There is $16,376 of cash on hand and in the corporate bank account. Owlhead currently has outstanding liabilities of $94,085 for expenses accrued during the start-up of the corporation. As of the date of this annual report we have not yet generated or realized any revenues from our business operations.

| 4 |

Website

We currently maintain a website at www.owlheadminerals.com.

Revenues

Currently we have no revenue generating assets.

Competition

We have numerous small and large mining competitors.

Employees

We administer our business through consulting arrangements with our company’s officers, directors, other individuals.

Consultants

During the year ended March 31, 2014, the Company spent $39,504 on geological consultants for sampling, assays, line cutting, and other geological work respecting our mining exploration program for the claim in British Columbia, Canada.

Offices

We maintain no formal office.

Risks Related to Our Business

Investment in our common stock involves very significant risks.

An investment in our common stock involves a number of very significant risks. You should carefully consider the following known material risks and uncertainties in addition to other information in this annual report in evaluating our company and its business before purchasing shares of our company’s common stock. Our business, operating results and financial condition could be seriously harmed due to any of the following known material risks. You could lose all or part of your investment due to any of these risks.

We will require additional financing in order to commence and sustain exploration.

We will require significant additional financing in order to maintain an exploration program and an assessment of any commercial viability of our mineral properties. As our mineral properties do not contain any reserves or any known body of economic mineralization, we may not discover commercially exploitable quantities of ore on our mineral properties that would enable us to enter into commercial production, achieve revenues, and recover the money we spend on exploration. Exploration activities on our mineral properties may not be commercially successful, which could lead us to abandon our plans to develop the property and its investments in exploration. Additionally, future cash flows and the availability of financing will be subject to a number of variables, including potential production and the market prices of various minerals including gold, silver and copper. Further, debt financing could lead to a diversion of cash flow to satisfy debt-servicing obligations and create restrictions on business operations.

| 5 |

We have not begun the initial stages of exploration of our claims, and thus have no way to evaluate the likelihood whether we will be able to operate our business successfully.

We are a new entrant into the precious minerals exploration and development industry without profitable operating history. We were incorporated on July 25, 2005 and to date have been involved primarily in organizational activities and obtaining our claims. As a result, there is only limited historical financial and operating information available on which to base your evaluation of our performance. We have not earned any revenues and we have never achieved profitability as of the date of this annual report. Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in the light of problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration and additional costs and expenses that may exceed current estimates. We have no history upon which to base any assumption as to the likelihood that our business will prove successful, and we can provide no assurance to investors that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks our business will likely fail and you will lose your entire investment in this offering.

We have received a going concern opinion from our independent auditors’ report accompanying our March 31, 2013 and 2014 consolidated financial statements.

The independent auditors’ report accompanying our March 31, 2013 and 2014 consolidated financial statements contains an explanatory paragraph expressing substantial doubt about our ability to continue as a going concern. The financial statements have been prepared assuming that the Company will continue as a “going concern”, which contemplates that we will realize our assets and satisfy our liabilities and commitments in the ordinary course of business. Our ability to continue as a going concern is dependent on raising additional capital to fund our operations and ultimately on generating future profitable operations. There can be no assurance that we will be able to raise sufficient additional capital or eventually have positive cash flow from operations to address all of our cash flow needs. If we are not able to find alternative sources of cash or generate positive cash flow from operations, our business will be materially and adversely affected and our shareholders will lose their entire investment.

If we are unable to obtain additional funding, our business operations will be harmed and if we do obtain additional financing, our then existing shareholders may suffer substantial dilution.

There is no assurance that we will not incur debt in the future, that we will have sufficient funds to repay any indebtedness or that we will not default on our debt obligations, jeopardizing our business viability. We are continually at risk of default on obligations to and on behalf of our creditors, requiring ongoing funding, on a monthly basis, to avoid these defaults. Furthermore, we may not be able to borrow or raise additional capital in the future to meet our needs or to otherwise provide the capital necessary to conduct our business. There can be no assurance that financing will be available in amounts or on terms acceptable to us, if at all. The inability to obtain additional capital will restrict our ability to grow and may reduce our ability to continue to conduct business operations. If we are unable to obtain additional financing, we will likely be required to curtail our marketing and development plans and without adequate financing or revenue generation, possibly cease our operations. Any additional equity financing may involve substantial dilution to our then existing shareholders.

We may need to raise additional capital, which may not be available on acceptable terms or at all.

We may be required to raise additional funds, particularly if we are unable to generate positive cash flow as a result of our operations. We estimate that our capital requirements in the next twelve months will be approximately $250,000. There can be no assurance that financing will be available in amounts or on terms acceptable to us, if at all. The inability to obtain additional capital may reduce our ability to continue to conduct business operations. If we are unable to obtain additional financing, we will likely be required to curtail our research and development plans. Any additional equity financing may involve substantial dilution to our then-existing shareholders.

| 6 |

We currently expect a shortfall in funding of up to $250,000.

The Company currently expects a shortfall in funding of up to $250,000. Our business depends on raising additional capital to fund ongoing operations. There can be no assurance that the Company will be able to obtain adequate financing in the future or that the terms of such financing will be favorable. Failure to obtain such financing could result in a material adverse effect, delay or indefinite postponement of further exploration and development of our projects with the possible loss of such assets. Further, any additional financing by the Company may subject existing shareholders to substantial dilution. If the Company is forced to sell some of its assets in a situation of distress, it may not recover their full value. Each project involves minimum lease payments and work commitments. In the event the Company is unsuccessful in raising funds in a timely fashion there is a risk project leases will terminate

We plan to acquire additional mineral exploration properties, which may create substantial risks.

As part of our growth strategy, we intend to acquire additional minerals exploration properties. Such acquisitions may pose substantial risks to our business, financial condition, and results of operations. In pursuing acquisitions, we will compete with other companies, many of which have greater financial and other resources to acquire attractive properties. Even if we are successful in acquiring additional properties, some of the properties may not produce revenues at anticipated levels, or failure to develop such prospects within specified time periods may cause the forfeiture of the lease in that prospect. There can be no assurance that we will be able to successfully integrate acquired properties, which could result in substantial costs and delays or other operational, technical, or financial problems. Further, acquisitions could disrupt ongoing business operations. If any of these events occur, it would have a material adverse effect upon our operations and results from operations.

If we do not find a joint venture partner for the continued development of our claims, we may not be able to advance exploration work.

If the initial results of an exploration program are successful, we may try to enter a joint venture agreement with a partner for the further exploration and possible production of our claims. We would face competition from other junior mineral resource exploration companies who have properties that they deem to be the most attractive in terms of potential return and investment cost. In addition, if we entered into a joint venture agreement, we would likely assign a percentage of our interest in the claims to the joint venture partner. If we are unable to enter into a joint venture agreement with a partner, or raise additional financing, we may fail and you will lose your entire investment in this offering.

Because of the speculative nature of mineral property exploration, there is substantial risk that no commercially exploitable minerals will be found and our business will fail.

Exploration for minerals is a speculative venture necessarily involving substantial risk. We can provide investors with no assurance that our claims contain commercially exploitable reserves. The exploration work that we intend to conduct on the claims may not result in the discovery of commercial quantities of gold, silver, copper or other minerals. Problems such as unusual and unexpected rock formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan and you would lose your entire investment in this offering.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. If a hazard were to occur, the costs of rectifying the hazard may exceed our asset value and cause us to liquidate all our assets resulting in the loss of your entire investment in this offering.

| 7 |

The potential profitability of mining gold properties if economic quantities of gold are found is dependent upon many factors and risks beyond our control, including, but not limited to:

| ● | unanticipated ground and water conditions and adverse claims to water rights; |

| ● | geological problems; |

| ● | metallurgical and other processing problems; |

| ● | the occurrence of unusual weather or operating conditions and other force majeure events; |

| ● | lower than expected ore grades; |

| ● | accidents; |

| ● | delays in the receipt of or failure to receive necessary government permits; |

| ● | delays in transportation; |

| ● | labor disputes; |

| ● | claims by First Nations or other indigenous organizations; |

| ● | government permit restrictions and regulation restrictions; |

| ● | unavailability of materials and equipment; and |

| ● | the failure of equipment or processes to operate in accordance with specifications or expectations. |

The risks associated with exploration and development and if applicable, mining as described above could cause personal injury or death, environmental damage, delays in mining, monetary losses and possible legal liability. We are not currently engaged in mining operations because we are in the exploration phase and have not yet any proved mineral reserves. We do not presently carry property and liability insurance nor do we expect to get such insurance for the foreseeable future. Cost effective insurance contains exclusions and limitations on coverage and may be unavailable in some circumstances.

Because access to our claims is sometimes restricted by inclement weather, we may be delayed in our exploration and any future mining efforts.

Access to the claims may be restricted to the period between March and November of each year due to snow in the area. As a result, any attempts to visit, test, or explore the property may be limited to these months of the year when weather permits such activities. These limitations can result in delays in exploration efforts, as well as mining and production in the event that commercial amounts of minerals are found. Such delays can result in our inability to meet deadlines for exploration expenditures. This could cause our business venture to fail and the loss of your entire investment in this offering unless we can meet deadlines.

The gold exploration and mining industry is highly competitive and there is no assurance that we will be successful in acquiring additional claims or leases.

The gold exploration and mining industry is intensely competitive, and we compete with other companies that have greater resources. Many of these companies not only explore for and produce gold or other minerals, but also market gold and other products on a regional, national or worldwide basis. These companies may be able to pay more for productive gold properties and exploratory prospects or define, evaluate, bid for and purchase a greater number of properties and prospects than our financial or human resources permit. In addition, these companies may have a greater ability to continue exploration activities during periods of lower gold market prices. Our larger competitors may be able to absorb the burden of present and future federal, provincial state, local and other laws and regulations more easily than we can, which would adversely affect our competitive position. Our ability to acquire additional properties and to discover productive prospects in the future will be dependent upon our ability to evaluate and select suitable properties and to consummate transactions in a highly competitive environment. In addition, because we have fewer financial and human resources than many companies in our industry, we may be at a disadvantage in bidding for exploratory prospects and producing gold properties.

| 8 |

The marketability of natural resources will be affected by numerous factors beyond our control.

The marketability of natural resources which may be acquired or discovered by us will be affected by numerous factors beyond our control. These factors include market fluctuations in commodity pricing and demand, the proximity and capacity of natural resource markets and processing equipment, governmental regulations, land tenure, land use, regulation concerning the importing and exporting of gold and environmental protection regulations. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in us not receiving an adequate return on invested capital to be profitable or viable.

Gold mining operations are subject to comprehensive regulation, which may cause substantial delays or require capital outlays in excess of those anticipated.

If economic quantities of gold are found on any claims owned by the Company in sufficient quantities to warrant mining operations, such mining operations are subject to federal, provincial, state and local laws relating to the protection of the environment, including laws regulating removal of natural resources from the ground and the discharge of materials into the environment. Mining operations are also subject to federal, provincial, state, and local laws and regulations which seek to maintain health and safety standards by regulating the design and use of mining methods and equipment. Various permits from government bodies are required for mining operations to be conducted; no assurance can be given that such permits will be received. Environmental standards imposed by federal, provincial, or local authorities may be changed and any such changes may have material adverse effects on our activities. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus resulting in an adverse effect on the Company. Additionally, we may be subject to liability for pollution or other environmental damages which we may elect not to insure against due to prohibitive premium costs and other reasons. To date we have not been required to spend material amounts on compliance with environmental regulations. However, we may be required to do so in future and this may affect our ability to expand or maintain our operations.

Our ability to function as an operating mining company is dependent on our ability to mine our properties at a profit.

Our ability to operate on a positive cash flow basis is dependent on mining sufficient quantities of gold at a profit sufficient to finance our operations and for the acquisition and development of additional mining properties.

Because we have limited capital, inherent mining risks pose a significant threat to us.

Because we are small with limited capital, we are unable to withstand significant losses that can result from inherent risks associated with mining, including environmental hazards, industrial accidents, flooding, interruptions due to weather conditions and other acts of nature. Such risks could result in damage to or destruction of any infrastructure or production facilities we may develop, as well as to adjacent properties, personal injury, environmental damage and delays, causing monetary losses and possible legal liability.

| 9 |

More stringent federal, provincial or state regulations could adversely affect our business.

If we are unable to obtain or maintain permits or water rights for development of our properties or otherwise fail to manage adequately future environmental issues, our operations could be materially and adversely affected. Mining and mining exploration companies in the Province of British Columbia, Canada are governed by Chapter 53: Part 5 (Remediation of Mineral Exploration Sites of the British Columbia Environment Management Act. The Act covers all aspects of mining and related activities and establishes strict environmental protection codes over these activities. Essentially, the Act requires mine owners and operators to prevent the release of any substance into the land air or water that might be deleterious to the environment and requires the remediation of all mineral exploration sites and mines by the mine owner or operator. We have spent a considerable amount of managerial and consultant time to ascertain what is required, to comply with environmental protection laws, regulations and permitting requirements and we anticipate that we will be required to continue to do so in the future. Although we believe our properties comply in all material respects with all relevant permits, licenses and regulations pertaining to worker health and safety as well as those pertaining to the environment and the historical trend toward stricter environmental regulation may continue.

The volatility of gold prices makes our business uncertain.

The volatility of gold prices makes long-range planning uncertain and raising capital difficult. The price of gold is affected by numerous factors beyond our control, including political and economic conditions, legislation and costs of production of our competitors.

Our inability to obtain insurance would threaten our ability to continue in business.

We currently have do not liability and property damage insurance. It should be noted that if we decide to obtain such insurance, the insurance industry is undergoing change and premiums are being increased. If premiums should increase to a level we cannot afford, we could be forced to discontinue business.

If we cannot add reserves to replace future production, we would not be able to remain in business.

Our future gold production if any, cash flow and income are dependent upon our ability to mine our current properties and acquire and develop additional reserves. There can be no assurance that our properties will be placed into production or that we will be able to continue to find and develop or acquire additional reserves.

Competition from better-capitalized companies affects prices and our ability to acquire properties and personnel.

There is global competition for gold properties, capital, customers and the employment and retention or qualified personnel. In the production and marketing of gold there are numerous major producing entities, some of which are government controlled and all of which are significantly larger and better capitalized than we are.

Mineral exploration, development and mining are subject to environmental regulations which may prevent or delay the commencement or continuance of our operations.

Mineral exploration and development and future potential gold mining operations are or will be subject to federal, provincial, state, and local laws and regulations relating to improving or maintaining environmental quality. Our operations are also subject to many environmental protection laws. Environmental laws often require parties to pay for remedial action or to pay damages regardless of fault. Environmental laws also often impose liability with respect to divested or terminated operations, even if the operations were terminated or divested of many years ago. Future potential gold mining operations and current exploration activities are or will be subject to extensive laws and regulations governing prospecting, development, production, exports, taxes, labor standards, occupational health, waste disposal, protection and remediation of the environment, protection of endangered and protected species, mine safety, toxic substances and other matters.

| 10 |

Mining is subject to risks and liabilities associated with pollution of the environment and disposal of waste products occurring as a result of mineral exploration and production.

Mining is also subject to risks and liabilities associated with pollution of the environment and disposal of waste products occurring as a result of mineral exploration and production. Compliance with these laws and regulations will impose substantial costs on us and will subject us to significant potential liabilities. Costs associated with environmental liabilities and compliance are expected to increase with the increasing scale and scope of operations and we expect these costs may increase in the future. We believe that our operations comply, in all material respects, with all applicable environmental regulations. However, we are not fully insured against possible environmental risks at the current date.

Any change to government regulation or administrative practices may have a negative impact on our ability to operate and potential profitability.

The laws, regulations, policies or current administrative practices of any government body, organization or regulatory agency in Canada or the United States or any other applicable jurisdiction, may be changed, applied or interpreted in a manner which will fundamentally alter our ability to carry on business. The actions, policies or regulations, or changes thereto, of any government body or regulatory agency, or other special interest groups, may have a detrimental effect on us. Any or all of these situations may have a negative impact on our ability to operate and/or our profitably.

We may be unable to retain key employees or consultants or recruit additional qualified personnel.

Our limited personnel means that we would be required to spend significant sums of money to locate and train new employees in the event any of our employees resign or terminate their employment with us for any reason. Further, we do not have key man life insurance on any of our employees. We may not have the financial resources to hire a replacement if any of our officers were to die. The loss of service of any of these employees could therefore significantly and adversely affect our operations.

Our officers and directors may be subject to conflicts of interest involving their available time.

Two of our executive officers and directors Mr. Armstrong and Mr. King serve on a full time basis. Mr. Low, the Company’s Chief Financial Officer and a Director works as a Chief Financial Officer for other companies. From time to time, Mr. Armstrong, the Company’s President, Secretary and a Director may occasionally devote part of his working time in a part-time, short-term advisory relationship with other corporate entities and will have short-term, part-time responsibilities to these other entities. In Mr. Armstrong’s case, such responsibilities will include the preparation of and assistance with the preparation of corporate documents and agreements, assistance with legal and regulatory documents, assistance with required legal and regulatory filings, assistance with the preparation and filing of quarterly and annual reports, disclosure forms and news releases. Mr. Low’s possible duties as CFO to other companies will include working as the bookkeeper assisting with the keeping of the books of account and assisting with the preparation of financial statements These potential relationships do not include advising or making decisions on business opportunities that might conflict with the Company’s business. None of our executive officers and directors is engaged in other businesses that present any potential for conflict of interest.

Under Nevada law, our articles of incorporation and our Bylaws permit us broad indemnification powers.

Under Nevada law, our articles of incorporation and our Bylaws permit us broad indemnification powers to all persons against all damages incurred in connection with our business to the fullest extent provided or allowed by law. The exculpation provisions may have the effect of preventing stockholders from recovering damages against our officers and directors caused by their negligence, poor judgment or other circumstances. The indemnification provisions may require us to use our limited assets to defend our officers and directors against claims, including claims arising out of their negligence, poor judgment, or other circumstances.

| 11 |

Risks Related to Our Common Stock

We are not listed or quoted on any exchange and we may never obtain such a listing or quotation.

There may never be a market for our stock and shares held by our shareholders may have little or no value.

There is presently no public market in our shares. While we intend to contact an authorized OTC Bulletin Board market maker for sponsorship of our securities, we cannot guarantee that such sponsorship will be approved and our stock listed and quoted for sale. Even if our shares are quoted for sale, buyers may be insufficient in numbers to allow for a robust market, it may prove impossible to sell your shares.

Even if we obtain a listing on an exchange and a market for our shares develops, sales of a substantial number of shares of our common stock into the public market by certain stockholders may result in significant downward pressure on the price of our common stock and could affect your ability to realize the current trading price of our common stock.

The trading price of our common stock may fluctuate significantly and stockholders may have difficulty reselling their shares.

Additional issuances of equity securities may result in dilution to our existing stockholders. Our Articles of Incorporation authorize the issuance of 100,000,000 shares of common stock.

Our common stock is subject to the “penny stock” rules of the SEC.

Our common stock is subject to the “penny stock” rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

Because our stock is not traded on a stock exchange or on the NASDAQ National Market or the NASDAQ Small Cap Market and because the market price of the common stock is less than $5.00 per share, the common stock is classified as a “penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

That a broker or dealer approve a person’s account for transactions in penny stocks; and

The broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

Obtain financial information and investment experience objectives of the person; and

Make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

| 12 |

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, which:

| ● | Sets forth the basis on which the broker or dealer made the suitability determination; and; | |

| ● | That the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and may cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

A decline in the future price of our common stock could affect our ability to raise further working capital and adversely impact our operations.

A majority of our directors and officers reside outside the United States, with the result that it may be difficult for investors to enforce within the United States any judgments obtained against us or any of our directors or officers.

Investing in our Common Stock will provide you with an equity ownership in a mineral resource company. As one of our stockholders, you will be subject to risks inherent to our business. The trading price of your shares will be affected by the performance of our business relative to, among other things, competition, market conditions and general economic and industry conditions. The value of your investment may decrease, resulting in a loss. You should carefully consider the following factors as well as other information contained in this annual report before deciding to invest in shares of our common stock.

The factors identified below are important factors that could cause actual results to differ materially from those expressed in any forward-looking statement made by, or on behalf of, the Company. Where any such forward-looking statement includes a statement of the assumptions or bases underlying such forward-looking statement, we caution that, while we believe such assumptions or bases to be reasonable and make them in good faith, assumed facts or bases almost always vary from actual results, and the differences between assumed facts or bases and actual results can be material, depending upon the circumstances. Where, in any forward-looking statement, the Company, or its management, expresses an expectation or belief as to the future results, such expectation or belief is expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the statement of expectation or belief will result, or be achieved or accomplished. Taking into account the foregoing, the following are identified as important risk factors that could cause actual results to differ materially from those expressed in any forward-looking statement made by, or on behalf of, the Company.

We are an “emerging growth company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

The JOBS Act permits “emerging growth companies” like us to rely on some of the reduced disclosure requirements that are already available to companies having a public float of less than $75 million, for as long as we qualify as an emerging growth company. During that period, we are permitted to omit the auditor’s attestation on internal control over financial reporting that would otherwise be required by the Sarbanes-Oxley Act. Companies with a public float of $75 million or more must otherwise procure such an attestation beginning with their second annual report after their initial public offering. For as long as we qualify as an emerging growth company, we are also excluded from the requirement to submit “say-on-pay”, “say-on-pay frequency” and “say-on-parachute” votes to our stockholders and may avail ourselves of reduced executive compensation disclosure compared to larger companies. In addition, as described in the following risk factor, as an emerging growth company we can take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies.

Until such time as we cease to qualify as an emerging growth company, investors may find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

| 13 |

As an “emerging growth company” we may take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies.

Section 107 of the JOBS Act also provides that, as an emerging growth company, we can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. We can therefore delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we have not elected to take advantage of the benefits of this extended transition period.

At such time as we cease to qualify as an “emerging growth company” under the JOBS Act, the costs and demands placed upon management will increase.

We will continue to be deemed an emerging growth company until the earliest of (i) the last day of the fiscal year during which we had total annual gross revenues of $1,000,000,000 (as indexed for inflation), (ii) the last day of the fiscal year following the fifth anniversary of the date of the first sale of common stock under a registration statement under the Securities Act ; (iii) the date on which we have, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or (iv) the date on which we are deemed to be a ‘large accelerated filer’ as defined by the SEC, which would generally occur upon our attaining a public float of at least $700 million. Once we lose emerging growth company status, we expect the costs and demands placed upon management to increase, as we would have to comply with additional disclosure and accounting requirements, particularly if our public float should exceed $75 million.

We will incur significant costs as a result of becoming a reporting public company, and our management will be required to devote substantial time to new compliance requirements, including establishing and maintaining internal controls over financial reporting, and we may be exposed to potential risks if we are unable to comply with these requirements.

As a reporting public company, we will incur significant legal, accounting and other expenses under the Sarbanes-Oxley Act of 2002, together with rules implemented by the Securities and Exchange Commission and applicable market regulators. These rules impose various requirements on public companies, including requiring certain corporate governance practices. Our management and other personnel will need to devote a substantial amount of time to these requirements. Moreover, these rules and regulations will increase our legal and financial compliance costs and will make some activities more time-consuming and costly.

The Sarbanes-Oxley Act requires, among other things, that we maintain effective internal controls for financial reporting and disclosure controls and procedures. In particular, we must perform system and process evaluations and testing of our internal controls over financial reporting to allow management to report on the effectiveness of our internal controls over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act. Compliance with Section 404 may require that we incur substantial accounting expenses and expend significant management efforts. Our testing may reveal deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses. In the event we identify significant deficiencies or material weaknesses in our internal controls that we cannot remediate in a timely manner, the market price of our stock could decline if investors and others lose confidence in the reliability of our financial statements and we could be subject to sanctions or investigations by the SEC or other applicable regulatory authorities.

| 14 |

87.2% of our shares of Common Stock are controlled by Principal Stockholders and Management.

87.2% of our Common Stock is controlled by four stockholders of record. This figure includes stock controlled by our directors and officers who are the beneficial owners of about 84% of our Common Stock. Such ownership by the Company’s principal shareholders, executive officers and directors may have the effect of delaying, deferring, preventing or facilitating a sale of the Company or a business combination with a third party.

Our auditors have expressed substantial doubt about our ability to continue as a going concern.

The accompanying consolidated financial statements have been prepared assuming that we will continue as a going concern. As discussed in Note 1 to the financial statements, we were incorporated on July 25, 2005, we have a working capital deficiency and we accumulated losses since inception. As a result, our auditors have expressed substantial doubt about our ability to continue as a going concern. Continued operations are dependent on our ability to complete equity or debt financings or generate profitable operations. Such financings may not be available or may not be available on reasonable terms. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty.

ITEM 2. DESCRIPTION OF PROPERTY

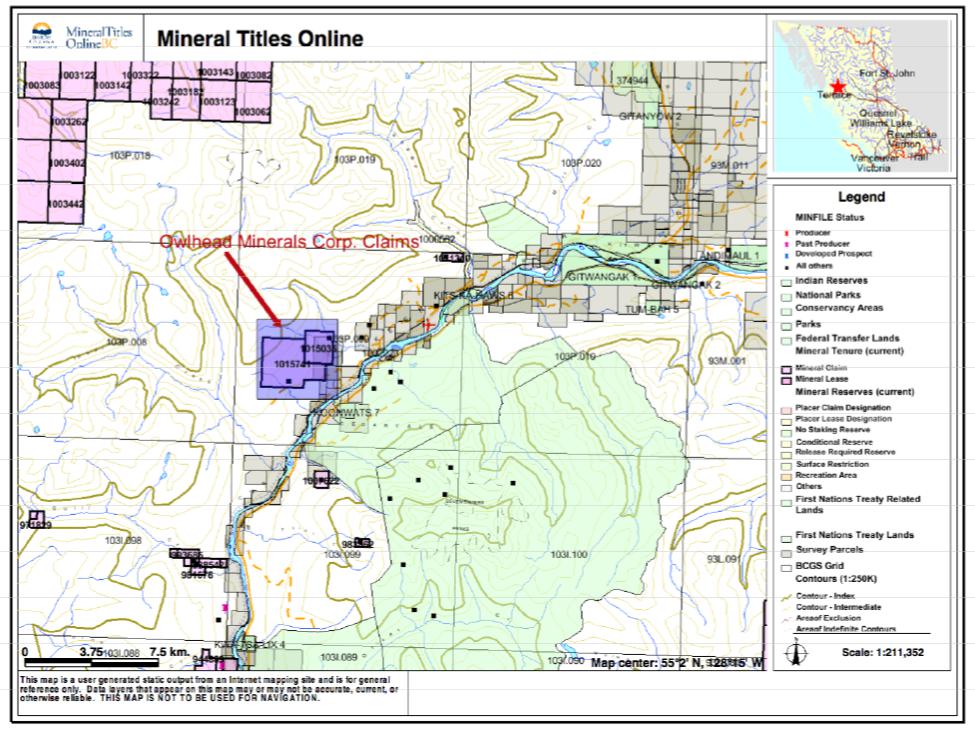

In December 2012, the Company was presented with a group of claims (“cells”) known as the Teako property. The Teako cells are located half way between Terrace and Smithers, British Columbia, Canada and are near the original gold rush town of Hazelton B.C. which was founded in 1866, the site of the original gateway and staging area for the famous Omineca Gold rush days of 1869-1873.

Initially, a total of 20 cells were acquired totaling 296 hectares (approx. 730 acres). After preliminary examination of the area, the Company came to the conclusion that the area is worth further examination and exploration. Therefore, Company management requested that the Prospector/Vendor stake more cells adjacent or adjoining the original claim group on behalf of the Company. An additional 778 hectares (approx. 1,922 acres) were staked, bringing our land package to a total of 1,074 hectares, or about 2,652 acres. The cells have good access to many miles of new logging roads that have recently been opened up in the area. It should be noted, however, that any proposed program is exploratory in nature and that the property is without known reserves

The Company acquired the initial cells for a cash payment of Cdn$10,000 and 1,500,000 restricted shares based on certain key events as previously noted. The additional cells were staked on behalf of the Company.

The property is centered at latitude 55° 02’ 30” N and longitude 128° 20’ 00” W and covers a total area of approximately 1075 hectares. As listed below in Table 1, the property is comprised of 5 MTO claims situated on Mineral Titles map sheets 103P.009.

| 15 |

| Tenure Number | Claim Name | Area (Ha) | Good To Date | |||

| 1015035 | Teako | 296.49 | 2014/Dec/4 | |||

| 1015741 | Owl | 778.46 | 2015/Jan/6 | |||

| 1023887 | Surprise | 277.6273 | 2014/Nov/19 | |||

| 1023888 | Lucky Dawg | 1205.1729 | 2014/Nov/19 | |||

| 1023889 | Little Dawg | 592.8458 | 2014/Nov/19 | |||

| Big Dawg |

Owlhead Minerals (BC) Corp., the 100% owned subsidiary of Owlhead Minerals Corp., holds under-surface rights only to the property. The property is almost entirely covered by crown land. There are two small areas in the extreme eastern part of the property that have privately held surface rights. Under-surface (mineral) rights to these privately owned lands are held by Owlhead’s mineral claims which overlie them. Access to the lands with privately held surface rights, for mineral exploration purposes, is provided under Section 19 of the Mineral Tenure Act.

THE AREA

Canada’s richest gold mine was a discovery by the late Murray Pezim: Eskay Creek which is located a couple of hundred kilometers to the north. To the south and east of our Teako property is the world famous Barkerville Gold Rush area, which to this day has producing gold mines.

The area’s topography is moderate with forest covering consisting of recently logged spruce, pine, cedar, with some initial regeneration in logged areas.

Other projects/companies in the area are: The Kalam project by Eagle Plains Exploration - polymetallic veins & porphyry Mo-Au; The Louise Lake Project held by Victory Mountain Ventures - porphyry Cu-Mo-Au; and the Pitman Project - porphyry Mo-Cu-Au.

GEOLOGY

Intermontane Belt, Stikine Arch, Bowser Terrane. The area is underlain by brown to black Argillite, Siltstone, Greywacke, and minor Pebble Conglomerate of the Middle to Upper Jurassic Bowser Lake Group.

The Teako property is centered about 20 kilometres southwest of the community of Kitwanga, in northwestern British Columbia. The Company’s wholly-owned subsidiary, Owlhead Minerals (BC) Corp. recently acquired the property for the purpose of mineral exploration but other than initial reports and preliminary examinations made on the current and previously rejected claims the Company has not yet carried out detailed or extensive exploration on the claims.

The property occurs in a region which is rich in mineral endowment, one which is known both for the number and the variety of mineral deposits, and which is home to a number of important active and past-producing mines. The area has a history of exploration that dates to the discovery of placer gold in the late 1800’s. The property itself is an early-stage exploration property. It was acquired on the basis of new discoveries of mineralization, alteration and veining by the vendor, which have no previous exploration.

The claims are underlain by sediments of the Bowser Lake Group. In the southwest part of the claim block, the Bowser Lake sediments are in contact with a northeast-trending fault-bounded block of sediments belonging to the younger Skeena Group. The Bowser Lake and Skeena Group sediments are intruded by, and hornfelsed by, intrusives of the Coast Plutonic Complex and/or perhaps other ages. The northern contact of the Skeena Group sediments is a major northeast trending fault, which appears to be an important regional control to zones of mineralization in the area.

| 16 |

In 2012, prospector John Kemp discovered a 50 metre wide stockwork/breccia zone on the Teako property. Disseminated sulfides (pyrite, chalcopyrite, galena) are present within the stockwork zone, which is accompanied by a large zone of carbonate-sericite alteration. In a separate area of the property, Mr. Kemp discovered an area of epithermal veining. He also discovered widespread quartz veining and massive sulfides (pyrite, pyrrhotite, chalcopyrite) within sediments on the claims.

Based on the regional setting and on these new discoveries, the property almost certainly warrants further work. The original report was written in February 2013. The author of the report, geologist Linda Caron, M. Sc., P. Eng., has revisited the property as of November 11, 2013.

From October 1, 2013 to October 11, 2013 John Kemp, the original owner, who will be assisting our geologist to assess the claims, visited the property to cut approximately 3km of lines and take 21 chip and grab samples for analysis. The samples have been sent to Acme Analytical Laboratories in Vancouver, Canada for analysis. The analytical report will be sent to our geologist. Linda Caron who visited the site on November 11 and 12, 2013 in order to verify Mr. Kemp’s work. She took additional samples and examined the site in more detail than her previous visit with the view to making specific recommendations regarding the scope or details for further work which would include property-wide prospecting, stream sampling, geological mapping, additional line cutting, rock sampling and possible soil sampling. Her summary report has been filed as an exhibit to this filing.

Based on the additional work done by Mr. Kemp and the summary report submitted by our geologist, the Company has staked an additional 112 cells (claims) adding 4442.992 acres for a current total of 7098.122 acres.

On the additional set of cells, the Company has also received positive news. The cells are scattered with visible epithermal veins. Geologically, this indicates these cells are potentially sitting on a formation that could be productive, though there is no assurance that any gold or other valuable minerals are present. The Company will pursue this area with a small to medium size exploration program.Our plan of operation is to conduct exploration work on the claims in order to ascertain whether they possess economic quantities of gold or other minerals. There can be no assurance that economic mineral deposits or reserves exist on the claims until appropriate exploration work is done and an economic evaluation based on such work concludes that production of minerals from the property is economically feasible. Economic feasibility refers to an evaluation completed by an engineer or geologist whereby he or she analyses whether profitable mining operations can be undertaken on the property. Mineral property exploration is generally conducted in phases. Each subsequent phase of exploration work is analyzed and recommended by a geologist based on the results from the most recent phase of exploration.

| 17 |

OWLHEAD MINERALS CORP. CLAIMS

As of the date of this report, we know of no legal proceedings to which we are a party or to which any of our property is the subject, which are pending, threatened or contemplated or any unsatisfied judgments against us.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| 18 |

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is not traded on any market at this time. As our stock is not traded as yet, the high and low bid information of our common stock is not available.

As of August 12, 2014, we had approximately 32 shareholders of record.

Dividend Policy

We have never paid cash dividends on our capital stock and do not anticipate paying any cash dividends in the foreseeable future.

Recent Sales of Unregistered Securities

On July 10, 2013, the Company issued 554,000 shares of common stock to a company controlled by the Chief Financial Officer of the Company to settle a debt of $138,500. On July 10, 2013, the Company also issued 680,000 shares of common stock to a company controlled by the President of the Company to settle a debt of $170,000.

Section 15(g) of the Securities Exchange Act of 1934

Our company's shares are covered by Section 15(g) of the Securities Exchange Act of 1934, as amended that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser's written agreement to the prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary market.

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one-page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important to in understanding of the function of the penny stock market, such as "bid" and "offer" quotes, a dealers "spread" and broker/dealer compensation; the broker/dealer compensation, the broker/dealers duties to its customers, including the disclosures required by any other penny stock disclosure rules; the customers rights and remedies in causes of fraud in penny stock transactions; and, the NASD's toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker/dealers and their associated persons.

Transfer agent

Our transfer agent is Transfer Online, Inc., 317 SW Alder Street, 2nd Floor, Portland, OR 97204.

| 19 |

ITEM 7. MANAGEMENT DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This section of the report includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this report. These forward-looking states are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions.

Plan of Operation

We are an exploration stage company and have not yet generated or realized any revenues from our current business operations. We are not going to buy any significant equipment during the next twelve months. We do not expect significant changes in the number of employees.

Teako Property

On December 18, 2012, the Company entered into an agreement to acquire a 100% interest in 16 mineral claims located in British Columbia, Canada for Cdn$10,000 in cash and 1,500,000 in common shares.

To earn this interest, the Company must make a payment of Cdn$10,000 (paid) and issue a total of 1,500,000 shares of common stock as follows:

| ● | 150,000 shares of common stock upon the completion of a satisfactory initial geological report on the claims by a qualified and independent geologist (issued with a fair value of $15,000); | |

| ● | 150,000 shares of common stock on upon completion of an initial work program of up to Cdn$50,000 and the completion of a satisfactory 43-101 report on the claims; | |

| ● | 200,000 shares of common stock upon completion of a work program costing up to Cdn$200,000 showing satisfactory results; and | |

| ● | 1,000,000 shares of common stock upon the successful results of a ten-hole drilling program. |

The option or retains a 2.5% net smelter royalty of which it can be purchased for $1,000,000 by the Company.

On November 20, 2013, the Company staked additional mineral claims adjacent to the area for $3,545.

As at March 31, 2014, we had cash of $16,376. For the next twelve months, we have insufficient funds for our proposed exploration program and meet the costs associated with our ongoing reporting obligations. Accordingly, we will require additional financing to meet these costs. There is no assurance we will be successful in raising such funding or on terms that are acceptable to us. Since inception, we have been dependent on investment capital and debt financing from related parties as our primary source of liquidity. We anticipate continuing to rely on sales of shares of our common stock and loans in order to continue to fund our business operations. Issuances of additional shares will result in further dilution of our existing shareholders.

Results of Operations

For the year ended March 31, 2014, the Company incurred a net loss of $319,287 (2013 - $142,349). Consulting fees for the year ended March 31, 2013 were $160,144 (2013 - $40,792) and mineral exploration costs were of $39,504 (2013 - $15,924).

Management fees were $90,000 in the year ended March 31, 2014 (2013 - $81,000).

Professional fees for the year ended March 31, 2014 were $22,407 (2013 - $1,525) due to audit and legal fees relating to the S-1 filing.

For the year ended March 31, 2014, $185,144 of operating costs (2013 - $51,209) were non-cash and paid for via prior issuance of shares, amortized over one-to-two years depending on the contract.

| 20 |

Liquidity and Capital Resources

As of March 31, 2014, we had cash of $16,376 and a working capital deficit of $76,451. During the year ended, March 31, 2014, we issued 1,234,000 shares to settle related party debt of $308,500.

The Company requires additional financing in order to continue to pursue our plan of operations over the next 12 months. There is no assurance that additional funding will be successfully completed. The Company has no employees other than officers and uses consultants as and when necessary.

Off-Balance Sheet Arrangements

None.

Critical Accounting Policies

Our consolidated financial statements and accompanying notes have been prepared in accordance with U.S. generally accepted accounting principles applied on a consistent basis. The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods.

We regularly evaluate the accounting policies and estimates that we use to prepare our consolidated financial statements. In general, management’s estimates are based on historical experience, on information from third party professionals, and on various other assumptions that are believed to be reasonable under the facts and circumstances. Actual results could differ from those estimates made by management.

We believe that our critical accounting policies and estimates include the following:

Mineral Property Costs

The Company has been in the exploration stage since its inception and has not yet realized any revenues from its planned operations. It is primarily engaged in the acquisition and exploration of mining properties. Mineral property acquisition costs are capitalized as incurred. Exploration and evaluation costs are expensed as incurred until proven and probable reserves are established. The Company assesses the carrying costs for impairment under ASC 360, “Property, Plant, and Equipment” at each fiscal quarter end. When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves, the costs then incurred to develop such property, are capitalized. Such costs will be amortized using the units-of-production method over the estimated life of the probable reserve. If mineral properties are subsequently abandoned or impaired, any capitalized costs will be charged to operations.

Long-lived Assets

In accordance with ASC 360, “Property Plant and Equipment”, the Company tests long-lived assets or asset groups for recoverability when events or changes in circumstances indicate that their carrying amount may not be recoverable. Circumstances which could trigger a review include, but are not limited to: significant decreases in the market price of the asset; significant adverse changes in the business climate or legal factors; accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of the asset; current period cash flow or operating losses combined with a history of losses or a forecast of continuing losses associated with the use of the asset; and current expectation that the asset will more likely than not be sold or disposed significantly before the end of its estimated useful life. Recoverability is assessed based on the carrying amount of the asset and its fair value which is generally determined based on the sum of the undiscounted cash flows expected to result from the use and the eventual disposal of the asset, as well as specific appraisal in certain instances. An impairment loss is recognized when the carrying amount is not recoverable and exceeds fair value.

Stock-based Compensation

The Company records stock-based compensation in accordance with ASC 718, “Compensation – Stock Compensation” and ASC 505, “Equity Based Payments to Non-Employees”, using the fair value method. All transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably measurable.

| 21 |

OWLHEAD MINERALS CORP.

(An Exploration Stage Company)

March 31, 2014

(Expressed in U.S. dollars)

Index

| 22 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Owlhead Minerals Corp.

(An Exploration Stage Company)

We have audited the accompanying consolidated balance sheets of Owlhead Minerals Corp. (An Exploration Stage Company) as of March 31, 2014 and 2013, and the related consolidated statements of operations and comprehensive loss, stockholders’ equity (deficit), and cash flows for the years then ended and accumulated from July 25, 2005 (date of inception) to March 31, 2014. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. An audit includes consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Company as of March 31, 2014 and 2013, and the results of its operations and its cash flows for the years then ended and accumulated from July 25, 2005 (date of inception) to March 31, 2014, in conformity with accounting principles generally accepted in the United States.

The accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 1 to the consolidated financial statements, the Company has not generated any revenues, has a working capital deficit, and has incurred operating losses since inception. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to these matters are also discussed in Note 1 to the consolidated financial statements. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

| /s/ SATURNA GROUP CHARTERED ACCOUNTANTS LLP | |

| Saturna Group Chartered Accountants LLP | |

| Vancouver, Canada | |

| June 25, 2014 |

| F-1 |

Owlhead Minerals Corp.

(An Exploration Stage Company)

(Expressed in U.S. dollars)

| March 31, 2014 | March 31, 2013 | |||||||

| $ | $ | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash | 16,376 | 56,563 | ||||||

| Amounts receivable | 258 | 340 | ||||||

| Prepaid expenses and deposits | 1,000 | 4,500 | ||||||

| Total Current Assets | 17,634 | 61,403 | ||||||

| Mineral property acquisition costs (Note 3) | 29,919 | 26,374 | ||||||

| Total Assets | 47,553 | 87,777 | ||||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||

| Current Liabilities | ||||||||

| Accounts payable and accrued liabilities | 7,085 | – | ||||||

| Due to related parties (Note 4) | 87,000 | 308,666 | ||||||

| Total Liabilities | 94,085 | 308,666 | ||||||

| Nature of operations and continuance of business (Note 1) | ||||||||

| Commitments (Note 6) | ||||||||

| Stockholder’s Deficit | ||||||||

| Common stock, 100,000,000 shares authorized, $0.001 par value 14,059,000 and 12,825,000 shares issued and outstanding, respectively | 14,059 | 12,825 | ||||||

| Additional paid-in capital | 784,941 | 477,675 | ||||||

| Deferred compensation (Note 5) | (133,647 | ) | (318,791 | ) | ||||

| Deficit accumulated during the exploration stage | (711,885 | ) | (392,598 | ) | ||||

| Total Stockholder’s Deficit | (46,532 | ) | (220,889 | ) | ||||

| Total Liabilities and Stockholder’s Deficit | 47,553 | 87,777 | ||||||

| F-2 |

Owlhead Minerals Corp.

(An Exploration Stage Company)

Consolidated Statements of Operations and Comprehensive Loss

(Expressed in U.S. dollars)

| Accumulated from | ||||||||||||

| July 25, 2005 | ||||||||||||

| (date of inception) | ||||||||||||

| Year Ended | Year Ended | to | ||||||||||

| March 31, 2014 | March 31, 2013 | March 31, 2014 | ||||||||||

| $ | $ | $ | ||||||||||

| Revenue | – | – | – | |||||||||

| Expenses | ||||||||||||

| Consulting fees (Note 5) | 160,144 | 40,792 | 234,436 | |||||||||

| Foreign exchange loss | 275 | 680 | 955 | |||||||||

| General and administrative | 6,957 | 2,428 | 12,109 | |||||||||

| Management fees (Note 4) | 90,000 | 81,000 | 384,000 | |||||||||

| Mineral exploration costs (Note 3) | 39,504 | 15,924 | 55,428 | |||||||||

| Professional fees | 22,407 | 1,525 | 24,957 | |||||||||

| Total Expenses | 319,287 | 142,349 | 711,885 | |||||||||

| Net Loss and Comprehensive Loss | (319,287 | ) | (142,349 | ) | (711,885 | ) | ||||||

| Net Loss Per Share, Basic and Diluted | (0.02 | ) | (0.01 | ) | ||||||||

| Weighted Average Shares Outstanding | 13,511,307 | 9,645,479 | ||||||||||

| F-3 |

OWLHEAD MINERALS CORP.

(An Exploration Stage Company)

Consolidated Statements of Stockholders’ Equity (Deficit)

For the Period from July 25, 2005 (Date of Inception) to March 31, 2014

(Expressed in U.S. dollars)

| Deficit | ||||||||||||||||||||||||

| Accumulated | ||||||||||||||||||||||||

| Additional | During the | |||||||||||||||||||||||

| Common Stock | Paid-in | Deferred | Exploration | |||||||||||||||||||||

| Shares | Amount | Capital | Compensation | Stage | Total | |||||||||||||||||||

| # | $ | $ | $ | $ | $ | |||||||||||||||||||

| Balance, July 25, 2005 (Date of Inception) and March 31, 2006 | – | – | – | – | – | – | ||||||||||||||||||

| Net loss for the year | – | – | – | – | (3,500 | ) | (3,500 | ) | ||||||||||||||||

| Balance, March 31, 2007 | – | – | – | – | (3,500 | ) | (3,500 | ) | ||||||||||||||||

| Net loss for the year | – | – | – | – | (42,000 | ) | (42,000 | ) | ||||||||||||||||

| Balance, March 31, 2008 | – | – | – | – | (45,500 | ) | (45,500 | ) | ||||||||||||||||

| Net loss for the year | – | – | – | – | (42,000 | ) | (42,000 | ) | ||||||||||||||||

| Balance, March 31, 2009 | – | – | – | – | (87,500 | ) | (87,500 | ) | ||||||||||||||||

| Net loss for the year | – | – | – | – | (45,158 | ) | (45,158 | ) | ||||||||||||||||

| Balance, March 31, 2010 | – | – | – | – | (132,658 | ) | (132,658 | ) | ||||||||||||||||

| Common stock issued for cash at $0.10 per share | 8,000,000 | 8,000 | – | – | – | 8,000 | ||||||||||||||||||

| Net loss for the year | – | – | – | – | (55,186 | ) | (55,186 | ) | ||||||||||||||||

| Balance, March 31, 2011 | 8,000,000 | 8,000 | – | – | (187,844 | ) | (179,844 | ) | ||||||||||||||||

| Net loss for the year | – | – | – | – | (62,405 | ) | (62,405 | ) | ||||||||||||||||

| Balance, March 31, 2012 | 8,000,000 | 8,000 | – | – | (250,249 | ) | (242,249 | ) | ||||||||||||||||

| Common stock issued pursuant to mineral property option agreement | 150,000 | 150 | 14,850 | – | – | 15,000 | ||||||||||||||||||

| Common stock issued for services | 3,700,000 | 3,700 | 366,300 | (318,791 | ) | – | 51,209 | |||||||||||||||||

| Common stock issued for cash at $0.10 per share | 975,000 | 975 | 96,525 | – | – | 97,500 | ||||||||||||||||||

| Net loss for the year | – | – | – | – | (142,349 | ) | (142,349 | ) | ||||||||||||||||

| Balance, March 31, 2013 | 12,825,000 | 12,825 | 477,675 | (318,791 | ) | (392,598 | ) | (220,889 | ) | |||||||||||||||

| Common stock issued to settle related party debt | 1,234,000 | 1,234 | 307,266 | – | – | 308,500 | ||||||||||||||||||

| Stock-based compensation charged to operations | – | – | – | 185,144 | – | 185,144 | ||||||||||||||||||

| Net loss of the year | – | – | – | – | (319,287 | ) | (319,287 | ) | ||||||||||||||||

| Balance, March 31, 2014 | 14,059,000 | 14,059 | 784,941 | (133,647 | ) | (711,885 | ) | (46,532 | ) | |||||||||||||||

| F-4 |

OWLHEAD MINERERALS CORP.

(An Exploration Stage Company)