Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FEDERAL SIGNAL CORP /DE/ | august2014investorpresenta.htm |

Disciplined Growth Investor Presentation August 2014

Safe Harbor Statement 2 This presentation contains unaudited financial information and forward-looking statements. Statements that are not historical are forward-looking statements and may contain words such as “may”, “will”, “believe”, “expect”, “anticipate”, “intend”, “plan”, “project”, “estimate”, and “objective” or similar terminology, concerning the company’s future financial performance, business strategy, plans, goals and objectives. These expressions are intended to identify forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information concerning the Company’s possible or assumed future performance or results of operations and are not guarantees. While these statements are based on assumptions and judgments that management has made in light of industry experience as well as perceptions of historical trends, current conditions, expected future developments and other factors believed to be appropriate under the circumstances, they are subject to risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements to be materially different. Such risks and uncertainties include, but are not limited to, economic conditions, product and price competition, supplier and raw material prices, foreign currency exchange rate changes, interest rate changes, increased legal expenses and litigation results, legal and regulatory developments and other risks and uncertainties described under Item 1A, Risk Factors, in the Company’s Annual Report on Form 10-K and in other filings with the Securities and Exchange Commission. Such forward-looking statements are made as of the date hereof and we undertake no obligation to update these forward-looking statements regardless of new developments or otherwise. This presentation also contains certain measures that are not in accordance with U.S. generally accepted accounting principles (“GAAP”). The non-GAAP financial information presented herein should be considered supplemental to, and not a substitute for, or superior to, financial measures calculated in accordance with GAAP. The Company has provided this supplemental information to investors, analysts, and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the reconciliations, and to provide an additional measure of performance which management considers in operating the business. A reconciliation of these items to the most comparable GAAP measures is provided in our filings with the SEC and in the Appendix to this presentation.

Agenda • Management • Company overview • Investment case • Performance trends • Growth strategy • Segments and products • Corporate focus, goals and initiatives • Financial results and outlook 3

Experienced Management Team Dennis Martin, President and Chief Executive Officer President and Chief Executive Officer since October 2010 Previously served as Chairman, President and CEO of General Binding Corporation 35+ years operational and leadership experience, primarily at Illinois Tool Works and Ingersoll-Rand 4 Brian Cooper, SVP and Chief Financial Officer Appointed Chief Financial Officer May 28, 2013 Chief Financial Officer of Westell Technologies, Inc. from 2009-2013 Previously with Fellowes, Inc. (CFO), United Stationers, Borg-Warner Security and Amoco Strong treasury, financial, M&A and strategic background Jennifer Sherman, SVP and Chief Operating Officer Appointed Chief Operating Officer April 29, 2014 Previously Chief Administrative Officer, Secretary and General Counsel, with operating responsibilities for the Company’s Safety and Security Systems Group Joined Federal Signal in 1994 as Corporate Counsel

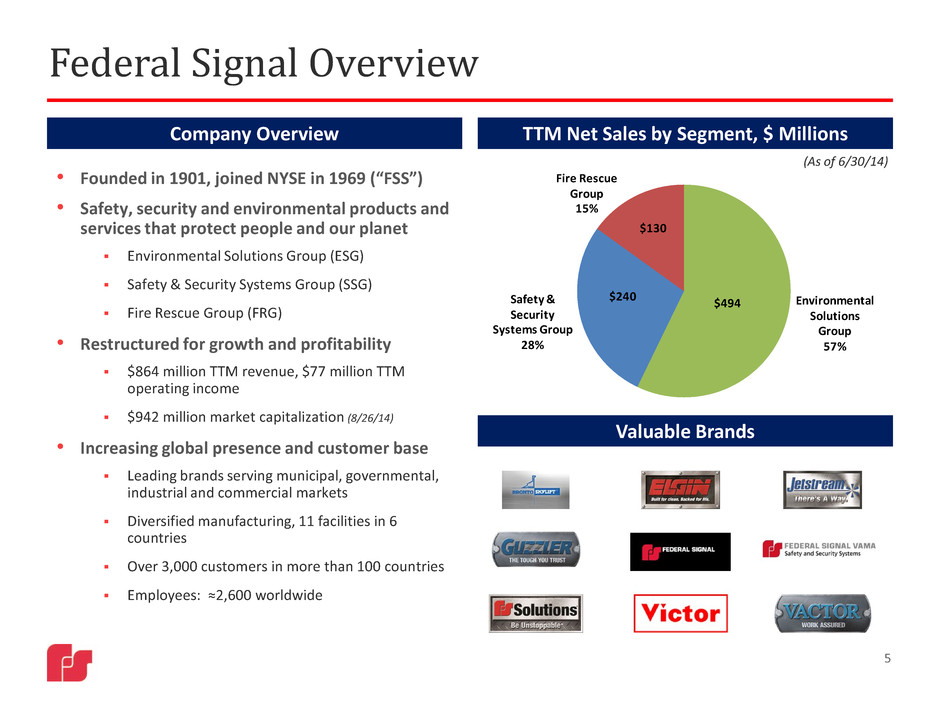

Federal Signal Overview • Founded in 1901, joined NYSE in 1969 (“FSS”) • Safety, security and environmental products and services that protect people and our planet Environmental Solutions Group (ESG) Safety & Security Systems Group (SSG) Fire Rescue Group (FRG) • Restructured for growth and profitability $864 million TTM revenue, $77 million TTM operating income $942 million market capitalization (8/26/14) • Increasing global presence and customer base Leading brands serving municipal, governmental, industrial and commercial markets Diversified manufacturing, 11 facilities in 6 countries Over 3,000 customers in more than 100 countries Employees: ≈2,600 worldwide 5 Company Overview TTM Net Sales by Segment, $ Millions $494$240 $130 Environmental Solutions Group 57% Safety & Security Systems Group 28% Fire Rescue Group 15% Valuable Brands (As of 6/30/14)

Investment Case • Leading positions in niche governmental and industrial markets • Valuable brands, high quality products, well-established distribution • Flexible manufacturing capacity to leverage profits • Favorable market dynamics Improving municipal spend Growing higher-margin industrial markets Multiple product categories serving a robust oil & gas sector Security solutions addressing man-made and natural disasters • Solid execution, results and outlook Company culture steadfastly focused on “80/20” and continuous improvement Management depth in sales, marketing, engineering and operations Organic and inorganic opportunities to grow shareholder value Strengthening balance sheet, profitability and free cash flow 6

Performance Levers and Progress • 2010: Introduced 80/20 and continuous improvement focus Prioritized customers and suppliers Tackled proactive pricing improvements Streamlined product offerings Streamlined management structure Drove lean manufacturing efficiencies • 2012: Major repositioning with sale of FSTech • 2013: Debt refinancing to reduce interest costs • 2012-14: Investments to promote growth and innovation Additional space and engineering resources at Jetstream Paint and cutting systems and new lines at Vactor New plant layouts and other lean improvements at Bronto and Elgin Innovations and product development initiatives ⇒ Significant turnaround in financial performance 7

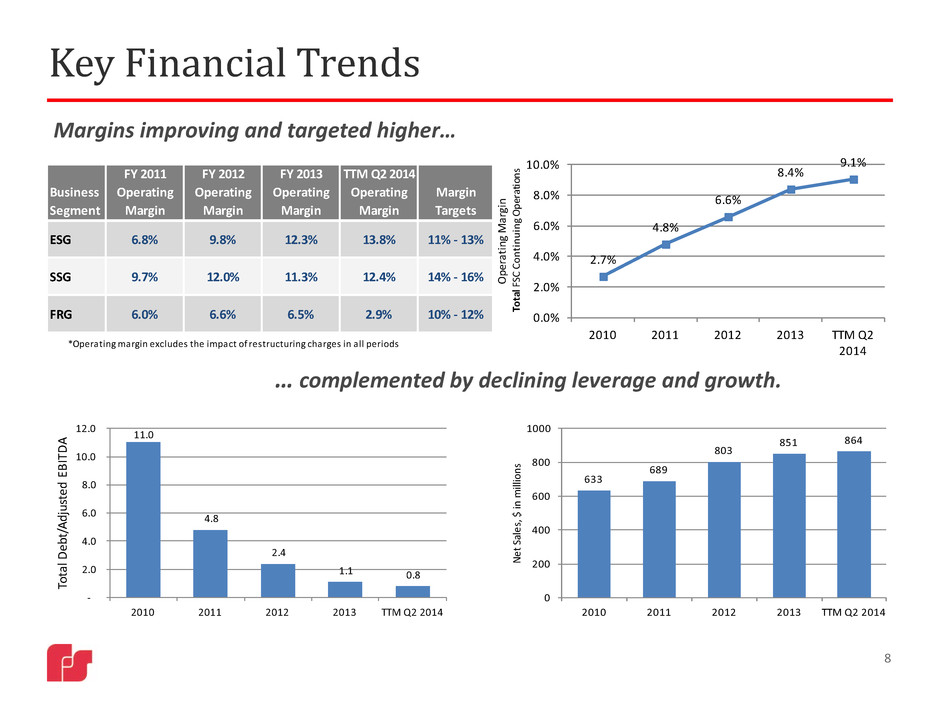

Key Financial Trends 8 2.7% 4.8% 6.6% 8.4% 9.1% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 2010 2011 2012 2013 TTM Q2 2014 O pe ra ti ng M ar gi n To ta l F SC C on ti nu in g O pe ra tio ns 11.0 4.8 2.4 1.1 0.8 - 2.0 4.0 6.0 8.0 10.0 12.0 2010 2011 2012 2013 TTM Q2 2014 To ta l D eb t/ A dj us te d EB IT D A Margins improving and targeted higher… … complemented by declining leverage and growth. Business Segment FY 2011 Operating Margin FY 2012 Operating Margin FY 2013 Operating Margin TTM Q2 2014 Operating Margin Margin Targets ESG 6.8% 9.8% 12.3% 13.8% 11% - 13% SSG 9.7% 12.0% 11.3% 12.4% 14% - 16% FRG 6.0% 6.6% 6.5% 2.9% 10% - 12% *Operating margin excludes the impact of restructuring charges in all periods 633 689 803 851 864 0 200 400 600 800 1000 2010 2011 2012 2013 TTM Q2 2014 N et S al es , $ in m ill io ns

Growth Strategy 9 Geographic Expansion • Jetstream and Industrial Systems in the Asia Pacific and Middle East • Export markets from U.S. • Bronto in North America New Markets for Existing Products • Waterblasting • Hydro-excavation • Security systems New Product Development and Acquisitions • Innovation program • Leverage use of established platforms

Growth Markets and Opportunities • Developing growth product areas Vactor (hydro-excavation, vacuum loading and sewer cleaning) Jetstream (waterblasting) Global Systems (integrated communication safety systems) These predominantly industrial areas aggregate to ≈50% of total revenue* • Growth opportunities U.S. and other industrial uses for high-reach lifts (Bronto) Recovering U.S. municipal spending (Elgin, among others) Recovering government spending in Europe (Bronto, Vama) Expanding industrial energy and utility use (Jetstream, Vactor) International waterblasting market share (Jetstream) Oil-field environmental protection and clean-up (Vactor) Price-competitive product introductions in police, fire, ambulance and other safety markets (Safety and Security Systems Group) 10 * (as of 12/31/13)

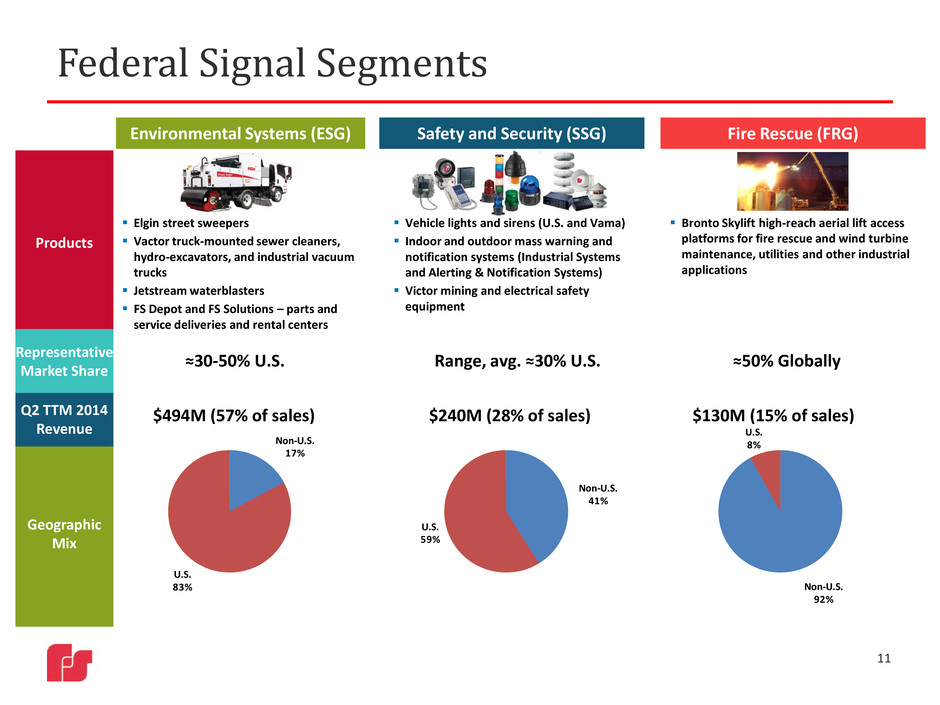

11 Federal Signal Segments Environmental Systems (ESG) Products Geographic Mix Q2 TTM 2014 Revenue Elgin street sweepers Vactor truck-mounted sewer cleaners, hydro-excavators, and industrial vacuum trucks Jetstream waterblasters FS Depot and FS Solutions – parts and service deliveries and rental centers $494M (57% of sales) $240M (28% of sales) $130M (15% of sales) Fire Rescue (FRG) Bronto Skylift high-reach aerial lift access platforms for fire rescue and wind turbine maintenance, utilities and other industrial applications Safety and Security (SSG) Vehicle lights and sirens (U.S. and Vama) Indoor and outdoor mass warning and notification systems (Industrial Systems and Alerting & Notification Systems) Victor mining and electrical safety equipment Non-US 20% ≈30-50% U.S. Range, avg. ≈30% U.S. ≈50% Globally Representative Market Share Non-U.S. 17% U.S. 83% Non-U.S. 92% U.S. 8% Non-U.S. 41% U.S. 59%

Environmental Solutions Group 12

Safety and Security Group 13

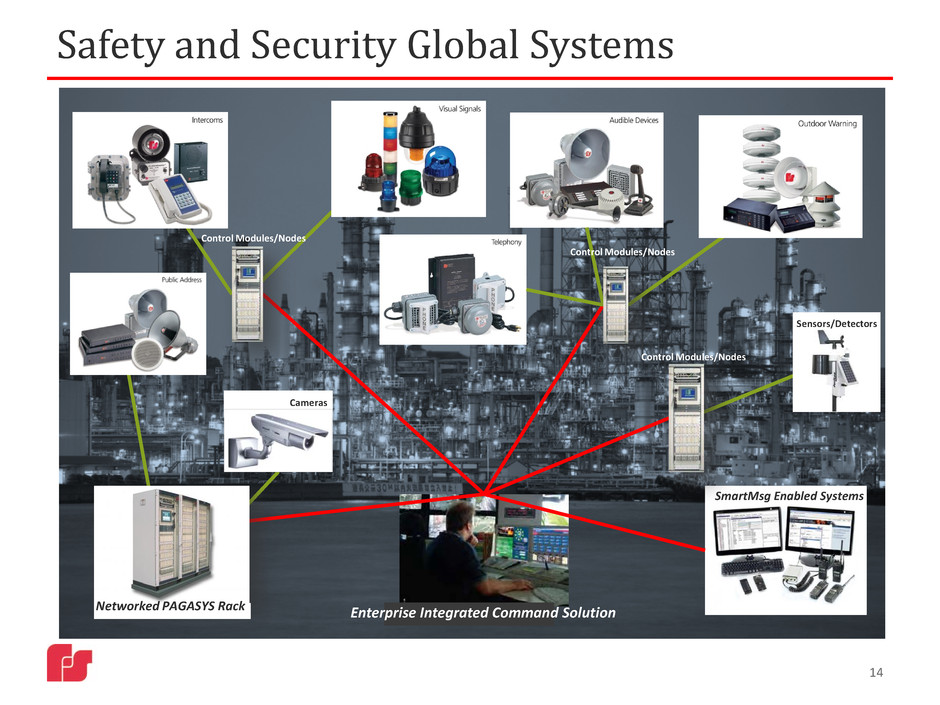

Safety and Security Global Systems 14 SmartMsg Enabled Systems Enterprise Integrated Command Solution Sensors/Detectors Cameras Networked PAGASYS Rack Control Modules/Nodes Control Modules/Nodes Control Modules/Nodes

Fire Rescue Group 15

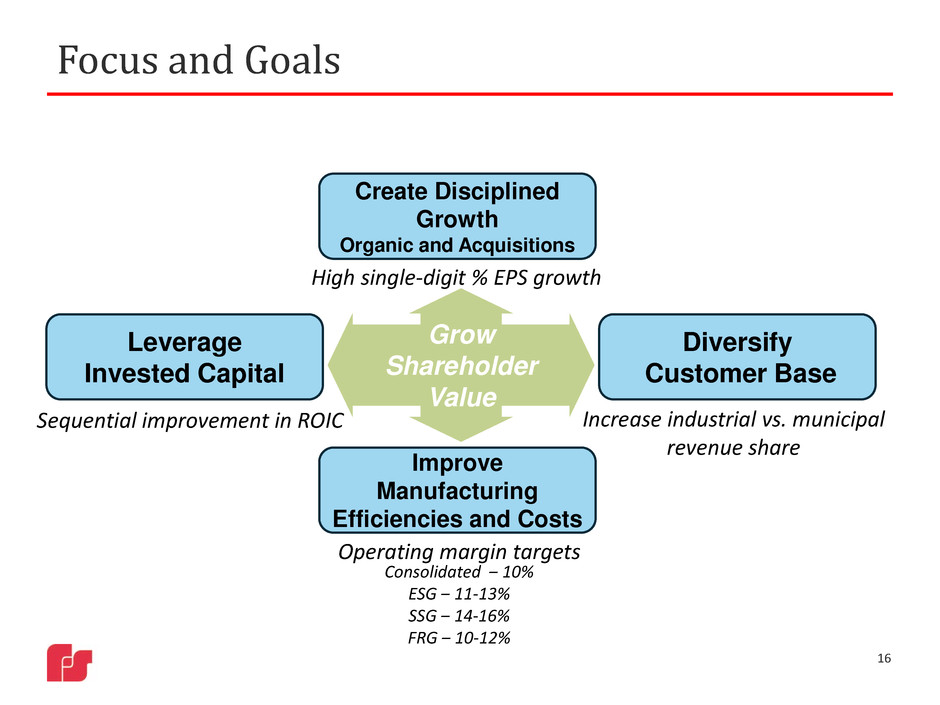

Focus and Goals 16 Create Disciplined Growth Organic and Acquisitions Diversify Customer Base Leverage Invested Capital Improve Manufacturing Efficiencies and Costs Operating margin targets High single-digit % EPS growth Consolidated ‒ 10% ESG ‒ 11-13% SSG ‒ 14-16% FRG ‒ 10-12% Increase industrial vs. municipal revenue share Sequential improvement in ROIC Grow Shareholder Value

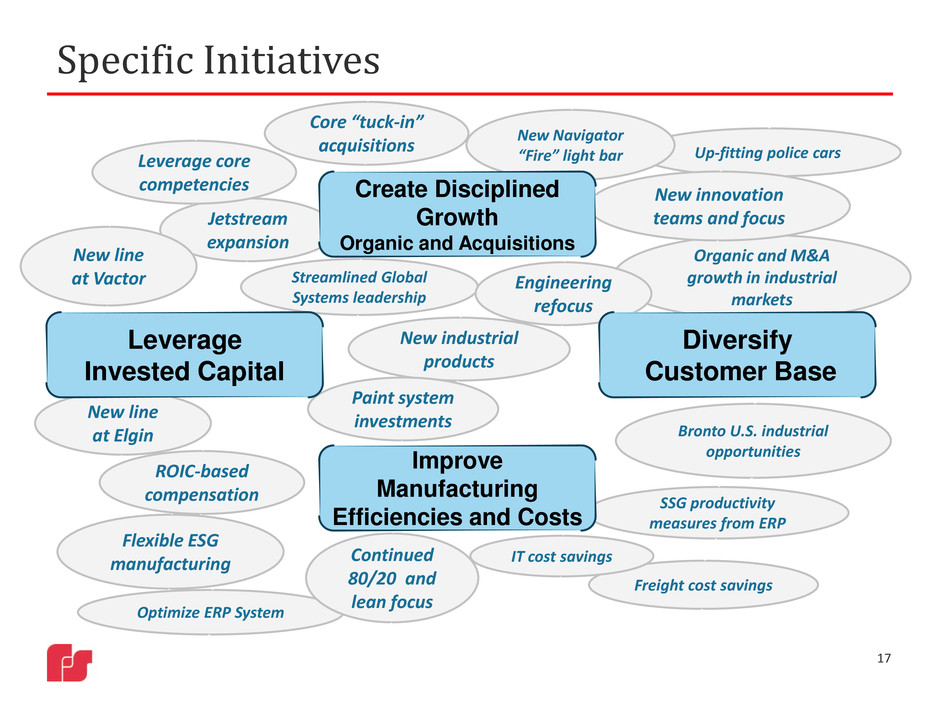

Optimize ERP System Organic and M&A growth in industrial markets Freight cost savings Jetstream expansion Bronto U.S. industrial opportunities Flexible ESG manufacturing Up-fitting police cars New Navigator “Fire” light bar Specific Initiatives 17 New innovation teams and focus New line at Vactor New line at Elgin Leverage core competencies ROIC-based compensation Streamlined Global Systems leadership Engineering refocus IT cost savings SSG productivity measures from ERP New industrial products Core “tuck-in” acquisitions Continued 80/20 and lean focus Paint system investments Diversify Customer Base Leverage Invested Capital Improve Manufacturing Efficiencies and Costs Create Disciplined Growth Organic and Acquisitions

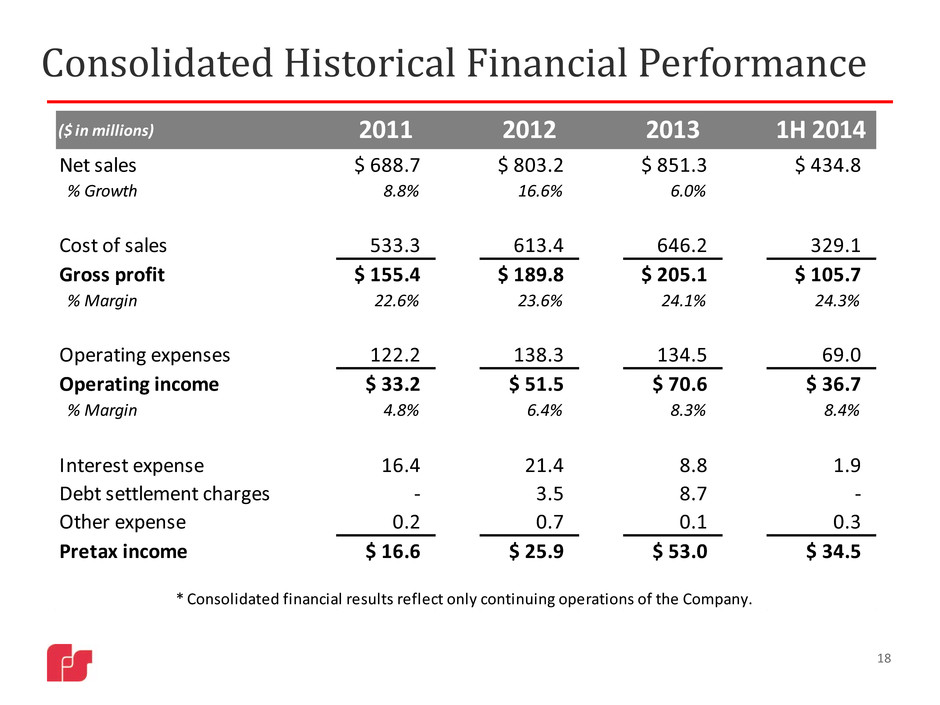

Consolidated Historical Financial Performance 18 ($ in millions) 2011 2012 2013 1H 2014 Net sales $ 688.7 $ 803.2 $ 851.3 $ 434.8 % Growth 8.8% 16.6% 6.0% Cost of sales 533.3 613.4 646.2 329.1 Gross profit $ 155.4 $ 189.8 $ 205.1 $ 105.7 % Margin 22.6% 23.6% 24.1% 24.3% Operating expenses 122.2 138.3 134.5 69.0 Operating income $ 33.2 $ 51.5 $ 70.6 $ 36.7 % Margin 4.8% 6.4% 8.3% 8.4% Interest expense 16.4 21.4 8.8 1.9 Debt settlement charges - 3.5 8.7 - Other expense 0.2 0.7 0.1 0.3 Pretax income $ 16.6 $ 25.9 $ 53.0 $ 34.5 * Consolidated financial results reflect only continuing operations of the Company.

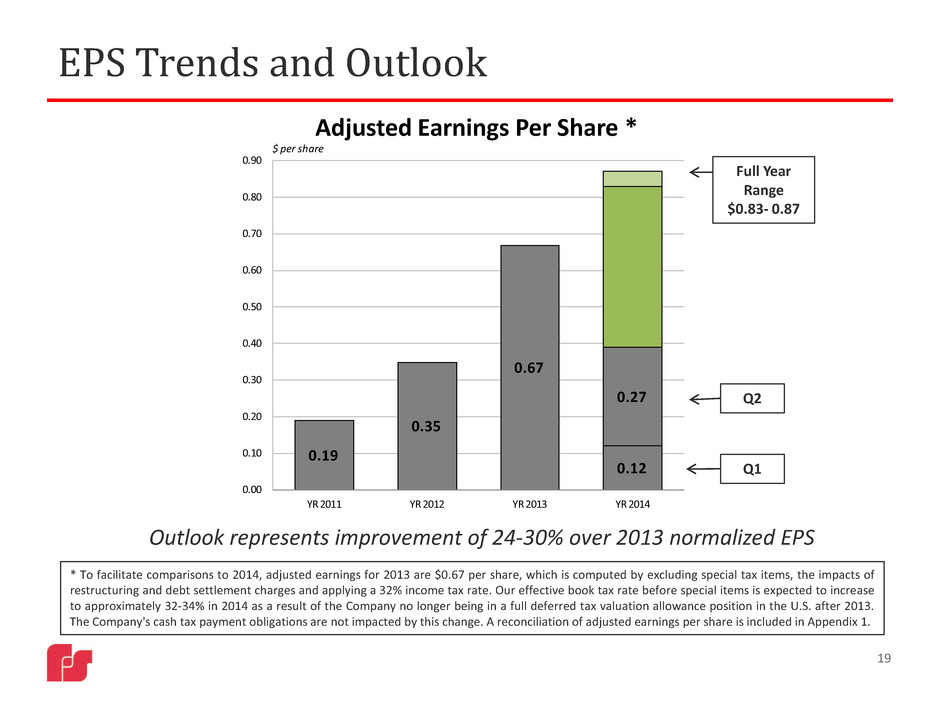

0.19 0.35 0.67 0.12 0.27 0.00 0.10 0.20 0.30 0.40 0.50 0.60 0.70 0.80 0.90 YR 2011 YR 2012 YR 2013 YR 2014 $ per share EPS Trends and Outlook 19 Adjusted Earnings Per Share * * To facilitate comparisons to 2014, adjusted earnings for 2013 are $0.67 per share, which is computed by excluding special tax items, the impacts of restructuring and debt settlement charges and applying a 32% income tax rate. Our effective book tax rate before special items is expected to increase to approximately 32-34% in 2014 as a result of the Company no longer being in a full deferred tax valuation allowance position in the U.S. after 2013. The Company's cash tax payment obligations are not impacted by this change. A reconciliation of adjusted earnings per share is included in Appendix 1. Q1 Outlook represents improvement of 24-30% over 2013 normalized EPS Q2 Full Year Range $0.83- 0.87

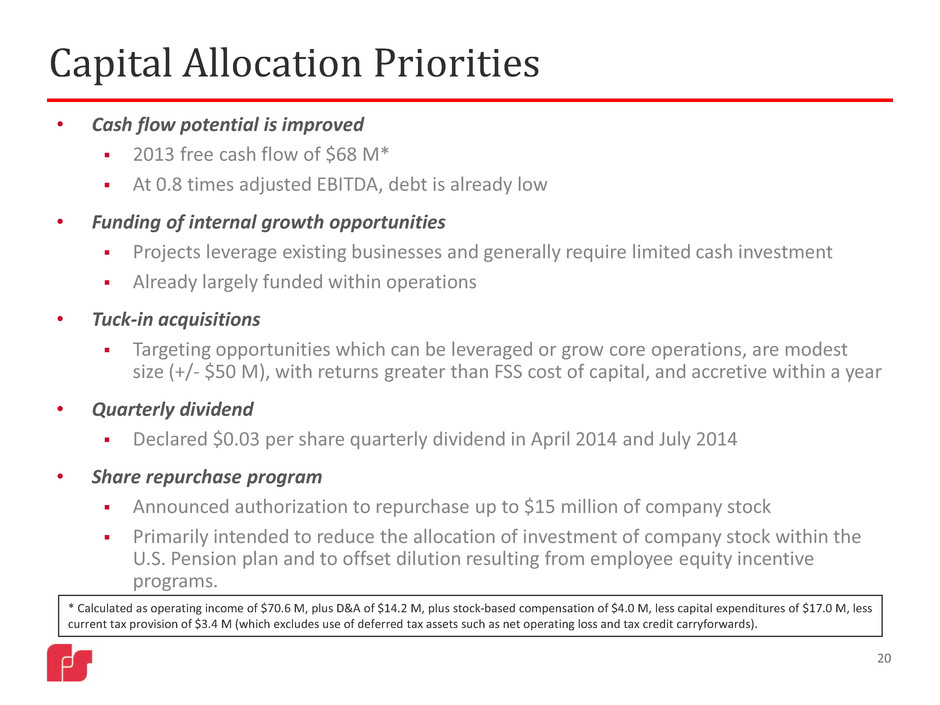

Capital Allocation Priorities • Cash flow potential is improved 2013 free cash flow of $68 M* At 0.8 times adjusted EBITDA, debt is already low • Funding of internal growth opportunities Projects leverage existing businesses and generally require limited cash investment Already largely funded within operations • Tuck-in acquisitions Targeting opportunities which can be leveraged or grow core operations, are modest size (+/- $50 M), with returns greater than FSS cost of capital, and accretive within a year • Quarterly dividend Declared $0.03 per share quarterly dividend in April 2014 and July 2014 • Share repurchase program Announced authorization to repurchase up to $15 million of company stock Primarily intended to reduce the allocation of investment of company stock within the U.S. Pension plan and to offset dilution resulting from employee equity incentive programs. 20 * Calculated as operating income of $70.6 M, plus D&A of $14.2 M, plus stock-based compensation of $4.0 M, less capital expenditures of $17.0 M, less current tax provision of $3.4 M (which excludes use of deferred tax assets such as net operating loss and tax credit carryforwards).

Building Equity in Our Brands 21

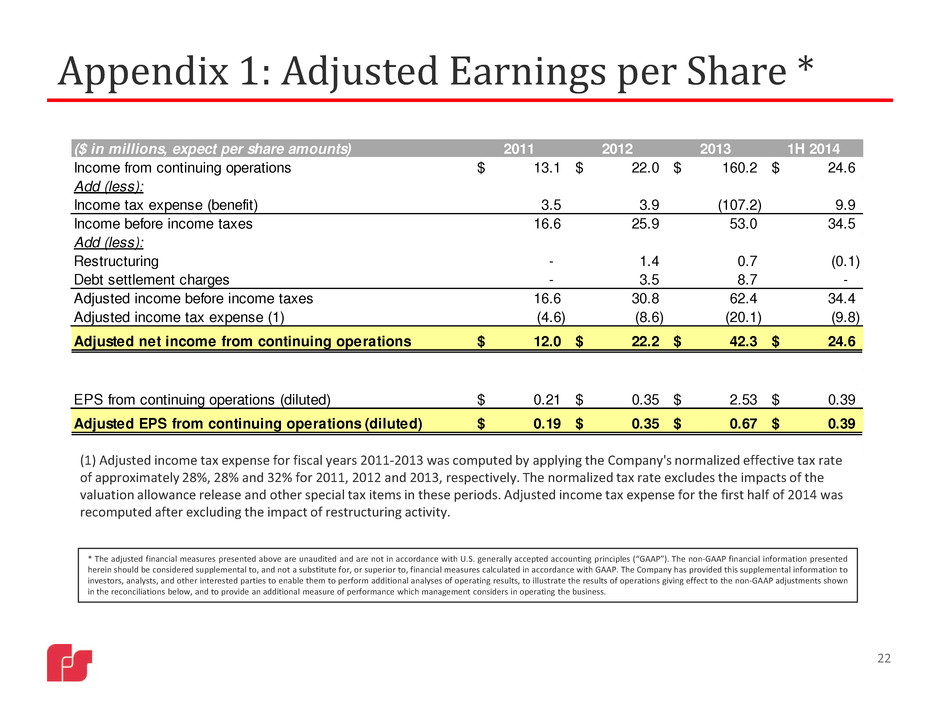

Appendix 1: Adjusted Earnings per Share * 22 * The adjusted financial measures presented above are unaudited and are not in accordance with U.S. generally accepted accounting principles (“GAAP”). The non-GAAP financial information presented herein should be considered supplemental to, and not a substitute for, or superior to, financial measures calculated in accordance with GAAP. The Company has provided this supplemental information to investors, analysts, and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the reconciliations below, and to provide an additional measure of performance which management considers in operating the business. ($ in millions, expect per share amounts) 2011 2012 2013 1H 2014 Income from continuing operations 13.1$ 22.0$ 160.2$ 24.6$ Add (less): Income tax expense (benefit) 3.5 3.9 (107.2) 9.9 Income before income taxes 16.6 25.9 53.0 34.5 Add (less): Restructuring - 1.4 0.7 (0.1) Debt settlement charges - 3.5 8.7 - Adjusted income before income taxes 16.6 30.8 62.4 34.4 Adjusted income tax expense (1) (4.6) (8.6) (20.1) (9.8) Adjusted net income from continuing operations 12.0$ 22.2$ 42.3$ 24.6$ EPS from continuing operations (diluted) 0.21$ 0.35$ 2.53$ 0.39$ Adjusted EPS from continuing operations (diluted) 0.19$ 0.35$ 0.67$ 0.39$ (1) Adjusted income tax expense for fiscal years 2011-2013 was computed by applying the Company's normalized effective tax rate of approximately 28%, 28% and 32% for 2011, 2012 and 2013, respectively. The normalized tax rate excludes the impacts of the valuation allowance release and other special tax items in these periods. Adjusted income tax expense for the first half of 2014 was recomputed after excluding the impact of restructuring activity.