Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - REGIS CORP | ex-31_2.htm |

| EX-32 - EX-32 - REGIS CORP | ex-32.htm |

| EX-21 - EX-21 - REGIS CORP | ex-21.htm |

| EX-31.1 - EX-31.1 - REGIS CORP | ex-31_1.htm |

| EX-23.1 - EX-23.1 - REGIS CORP | ex-23_1.htm |

| EX-23.2 - EX-23.2 - REGIS CORP | ex-23_2.htm |

| EXCEL - IDEA: XBRL DOCUMENT - REGIS CORP | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) | ||

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended June 30, 2014 | ||

OR | ||

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to | ||

Commission file number 1-12725

Regis Corporation

(Exact name of registrant as specified in its charter)

Minnesota State or other jurisdiction of incorporation or organization | 41-0749934 (I.R.S. Employer Identification No.) | |

7201 Metro Boulevard, Edina, Minnesota (Address of principal executive offices) | 55439 (Zip Code) | |

(952) 947-7777

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, par value $0.05 per share | New York Stock Exchange | |

Preferred Share Purchase Rights | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o | |||

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the voting common equity held by non-affiliates computed by reference to the price at which common equity was last sold as of the last business day of the registrant's most recently completed second fiscal quarter, December 31, 2013, was approximately $670,414,816. The registrant has no non-voting common equity.

As of August 15, 2014, the registrant had 55,641,456 shares of Common Stock, par value $0.05 per share, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive Proxy Statement for the annual meeting of shareholders to be held on October 28, 2014 (the "2014 Proxy Statement") (to be filed pursuant to Regulation 14A within 120 days after the registrant's fiscal year-end of June 30, 2014) are incorporated by reference into Part III.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report, as well as information included in, or incorporated by reference from, future filings by the Company with the Securities and Exchange Commission and information contained in written material, press releases and oral statements issued by or on behalf of the Company contains or may contain "forward-looking statements" within the meaning of the federal securities laws, including statements concerning anticipated future events and expectations that are not historical facts. These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements in this document reflect management's best judgment at the time they are made, but all such statements are subject to numerous risks and uncertainties, which could cause actual results to differ materially from those expressed in or implied by the statements herein. Such forward-looking statements are often identified herein by use of words including, but not limited to, "may," "believe," "project," "forecast," "expect," "estimate," "anticipate," and "plan." In addition, the following factors could affect the Company's actual results and cause such results to differ materially from those expressed in forward-looking statements. These factors include the impact of significant initiatives, changes in our management and organizational structure and our ability to attract and retain our executive management team; negative same-store sales; the success of our stylists and our ability to attract, train and retain talented stylists; changes in regulatory and statutory laws; the effect of changes to healthcare laws; our ability to protect the security of sensitive information about our guests, employees, vendors or Company information; the Company's reliance on management information systems; the continued ability of the Company to implement cost reduction initiatives; reliance on external vendors; changes in distribution channels of manufacturers; compliance with debt covenants; financial performance of our franchisees; competition within the personal hair care industry; changes in economic conditions; failure to standardize operating processes across brands; the ability of the Company to maintain satisfactory relationships with certain companies and suppliers; financial performance of our investment with Empire Education Group; changes in interest rates and foreign currency exchange rates; changes in consumer tastes and fashion trends; or other factors not listed above. Additional information concerning potential factors that could affect future financial results is set forth under Item 1A of this Form 10-K. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. However, your attention is directed to any further disclosures made in our subsequent annual and periodic reports filed or furnished with the SEC on Forms 10-Q and 8-K and Proxy Statements on Schedule 14A.

2

REGIS CORPORATION

FORM 10-K

FOR THE FISCAL YEAR ENDED JUNE 30, 2014

INDEX

Page(s) | |||

3

PART I

Item 1. Business

General:

Regis Corporation owns, franchises and operates beauty salons. The Company is listed on the NYSE under the ticker symbol "RGS." Unless the context otherwise provides, when we refer to the "Company," "we," "our," or "us," we are referring to Regis Corporation, the Registrant, together with its subsidiaries.

As of June 30, 2014, the Company owned, franchised or held ownership interests in 9,674 locations worldwide. The Company's locations consist of 9,456 company-owned and franchised salons and 218 locations in which we maintain a non-controlling ownership interest of less than 100%. Each of the Company's salon concepts generally offer similar salon products and services and serve the mass marketplace.

The major services supplied by the Company's salons are haircutting and styling (including shampooing and conditioning), hair coloring and other services. The percentage of company-owned service revenues in each fiscal year 2014, 2013 and 2012 attributable to haircutting and styling, hair coloring and other services were 72%, 19% and 9%, respectively.

During the second quarter of fiscal year 2014, the Company redefined its operating segments to reflect how the chief operating decision maker evaluates the business as a result of restructuring the Company's North American field organization. The Company now reports its operations in three operating segments: North American Value, North American Premium and International. Prior to this change in organizational structure, the Company had two reportable operating segments: North American salons and International salons.

The Company's North American Value salon operations are comprised of 6,116 company-owned salons and 2,179 franchised salons operating in the United States, Canada, and Puerto Rico. The Company's North American Premium salon operations are comprised of 801 company-owned salons operating in the United States, Canada, and Puerto Rico. The Company's International operations are comprised of 360 company-owned salons in the United Kingdom. The Company's salons operate primarily under the trade names of SmartStyle, Supercuts, MasterCuts, Regis Salons, and Cost Cutters, and they generally serve two categories within the industry. SmartStyle, Supercuts, MasterCuts, Cost Cutters, and other regional trade names are generally within the value category, offering high quality, convenience, and affordably priced hair care and beauty services and retail products. Regis Salons, among other trade names, are in the premium category offering upscale hair care and beauty services and retail products. The Company's North American Value business is located mainly in strip center locations and Walmart Supercenters and the North American Premium business is primarily in mall based locations. During fiscal years 2014 and 2013, the number of guest visits at the Company's company-owned salons approximated 79 and 85 million, respectively. Concurrent with the change in reportable operating segments, the Company revised its prior period financial information to conform comparable financial information to the new segment structure. Historical financial information presented herein reflects this change.

Financial information about our segments and geographic areas for fiscal years 2014, 2013, and 2012 are included in Note 14 to the Consolidated Financial Statements in Part II, Item 8, of this Form 10-K.

Since fiscal year 2012, the Company has been evaluating its portfolio of assets, investments, and businesses, with the strategic objective of simplifying our business model, focusing on our core business of operating beauty salons, improving our long-term profitability and maximizing shareholder value. This evaluation led to several disposals during fiscal year 2013. In April 2013, the Company sold Hair Club for Men and Women (Hair Club) for $164.8 million. See Note 2 to the Consolidated Financial Statements for further discussion on Hair Club. In September 2012, the Company sold its 46.7% equity interest in Provalliance for $103.4 million. See Note 5 to the Consolidated Financial Statements for further discussion on Provalliance. As the Company continues this strategic evaluation, future sales of non-core assets could impact our operations by decreasing total revenues, operating expenses, and income or loss from equity method investments.

Industry Overview:

The hair salon market is highly fragmented, with the vast majority of locations independently owned and operated. However, the influence of salon chains, both franchised and company-owned, continues to grow within this market. Management believes that salon chains will continue to have significant influences on this market and will continue to increase their presence.

In every area in which the Company has a salon, there are competitors offering similar hair care services and products at similar prices. The Company faces competition from smaller chains of salons such as Great Clips, Fantastic Sams, and Sport Clips, independently owned salons and department store salons located within malls.

4

At the individual salon level, barriers to entry are low; however, barriers exist for chains to expand nationally due to the need to establish systems and infrastructure, to recruit experienced field and salon management and stylists, and to lease quality sites. The principal factors of competition in the hair care category are quality, consistency and convenience. The Company continually strives to improve its performance in each of these areas and to create additional points of differentiation versus the competition.

Mission and Strategies:

The Company's long-term mission is to create guests for life. To successfully achieve our mission and build a winning organization, we must help our stylists have successful and satisfying careers, which will drive great guest experiences and in turn, guests for life. Over the last year we simplified and focused the way we delineate our key strategies, our priorities and efforts around them remain the same and are well aligned, focusing on people, processes and metrics to drive execution and performance. Our key strategies follow:

1. | Earn the Hearts and Minds of Our Team |

2. | Develop Positive, Professional and High Performing Salon Leaders |

3. | Drive Guest Trial and Loyalty |

4. | Standardize Operating Procedures Across Brands |

Our stylists' ability to serve our guests in a professional, courteous, and friendly manner is the most critical element of our service model in cultivating strong guest relationships. Great stylists, coupled with high quality service, convenience, affordability, an inviting salon appearance and atmosphere, and comprehensive retail assortments create guests for life. We are committed to providing an outstanding guest experience that drives guest loyalty and repeat business. To that end, we are investing in a number of areas focused on delivering that promise and helping our stylists have successful careers, including investments in organization, training and technology.

Stylists

Creating an organization where stylists can have successful and satisfying careers leads to improved execution, and in turn, great guest experiences.

Field Leadership. In fiscal year 2014, we completed the reorganization of our field organization to enable localized mentoring and decision making, improve geographic proximity and increase local market efficiency. Development of our field leaders is a high priority because stylists depend on their salon and field leaders for coaching, mentoring and motivation. We developed training curriculum to serve as the foundation for ongoing leadership development. Role clarity and talent assessments help us identify ways to develop and upgrade field leadership. Execution disciplines are used to drive accountability, execution and business performance. Incentives are designed to align field interests with those of the Company's shareholders by rewarding behaviors focused on profitable revenue growth. This new organization structure also provides a clear career path for our people who desire to ascend within the Company.

Training. Our training program will become a key point of difference in attracting and retaining stylists. Stylists place a tremendous amount of importance in ongoing development of their craft. They deliver a superior experience for our guests when they are well trained technically and experiencially. We employ technical trainers who provide new hire training for stylists joining the Company from beauty schools and training for all stylists in current beauty care and styling trends. We supplement internal training with targeted vendor training and external trainers who bring specialized expertise to our stylists. We have begun to utilize training materials to help all levels of field employees navigate the running of a salon. Our experiential training program will provide stylists with essential elements of guest service training within the context of brand positions.

Recruiting. Ensuring we keep our salons fully staffed with great stylists is critical to our success. To that end, we are enhancing our recruiting efforts across all levels within our organization. We are in the process of proactively cultivating a pipeline of field leaders through succession planning and recruitment venues from within and outside the salon industry. We are also leveraging beauty school relationships and participating in job fairs and industry events.

Technology. The recent installation of a new point-of-sale (POS) systems and salon workstations throughout North America enables communication with salons and stylists, delivery of online and digital training to stylists, real-time salon level analytics on guest retention, wait times, stylist productivity, and salon performance. We are also using technology to provide asset protection dashboards and analytics to help prioritize efforts against our most compelling opportunities to reduce loss in our salons.

5

Guests

Great stylists, coupled with high quality service, convenience, affordability, an inviting salon appearance and atmosphere, and comprehensive retail assortments, create guests for life.

Convenience. Our different salon concepts enable our guests to select different service scheduling options based upon their preference. In the value category, the ability to serve walk-in appointments and minimize guest wait times is an essential element in delivering upon convenience. We have invested in staffing by increasing stylists' hours and have begun to optimize schedules and leverage recently installed point-of-sale systems to help us balance stylist hours with guest traffic and manage guest wait times. In the premium category, our salons generally schedule appointments in advance of service. Our salons are located in high-traffic strip centers, Walmart Supercenters and shopping malls, with guest parking and easy access, and are generally open seven days per week, offering guests a variety of convenient ways to fulfill their beauty needs.

Affordability. The Company strives to offer an exceptional value for its services. In the value category, our guests expect outstanding service at affordable prices. These expectations are met with average service transactions ranging from $16 to $20. In the premium category, our guests expect upscale, full service beauty services at reasonable prices. Average service transactions approximate $45 in this category. Pricing decisions are considered on a market-by-market basis and established based on local conditions.

Salon Appearance and Atmosphere. The Company's salons range from 500 to 5,000 square feet, with the typical salon approximating 1,200 square feet. Our salon repairs and maintenance program is designed to ensure we invest annually in salon cleanliness and safety, as well as in maintaining the normal operation of our salons. Our annual capital expenditures include funds to refresh the appeal and comfort of our salons.

Retail Assortments. The Company's salons sell nationally recognized hair care and beauty products, as well as a complete assortment of own-branded products. Retail products offered by the Company are intended to be sold only through professional salons, and complement its salon services business. The Company's stylists are compensated and regularly trained to sell hair care and beauty products to their guests. Additionally, guests are encouraged to purchase products after stylists demonstrate their efficacy by using them in the styling of our guests' hair. The top selling brands within the Company's retail assortment include Biolage, Paul Mitchell, Regis designLINE, Redken, Nioxin, Tigi, It's a 10, Sexy Hair Concepts, Kenra, and Moroccanoil.

Technology. The new POS systems increase our ability to collect guest and transactional data and enable the Company to invest in Guest Relationship Management, gaining insights into guest behavior, communicating with guests and incenting return visits. Leveraging this technology allows us to monitor guest retention and to survey our guests for feedback on improving the guest experience, and allows guests to use mobile apps to schedule appointments, view wait times and interact in other ways with salons.

Marketing. The Company is focused on driving local traffic at the most efficient cost. This includes leveraging media, guest relationship management programs, digital channels, local tactical efforts (e.g., couponing) among other programs. Traffic driving efforts are targeted vs. a one-size-fits all approach. Annual traffic plans are based on seasonality, consumer mindset, competitive positioning and return on investment. The Company continually reallocates marketing investments into vehicles with known, strong returns.

Salon Support

Our corporate headquarters is referred to as Salon Support. This acknowledges that creating guests for life mandates a service-oriented, guest-focused mentality in supporting our field organization to grow our business profitably.

Organization. In addition to investments made by the Company to reorganize the field organization and to help our stylists develop professionally, Salon Support and associated priorities are aligned to our new field structure to enhance the effectiveness and efficiency of the service provided to our field organization. During fiscal year 2014, we enhanced Salon Support capabilities in several areas. We created a human resources organization to help transform the Company into an organization where stylists can have successful and satisfying careers. We enhanced our asset protection capabilities by building a strong asset protection team and establishing standard operating procedures to support field and salon leaders.

Simplification. Since fiscal year 2012, the Company has been evaluating its portfolio of assets, investments, and businesses, with the strategic objective of simplifying our business model, focusing on our core business of operating beauty salons and improving our long-term profitability and maximizing shareholder value. This evaluation led to the sale of our Hair Club and Provalliance businesses during fiscal year 2013. The Company also standardized retail plan-o-grams and eliminated products in an effort to simplify and manage our ongoing retail inventory assortment. Simplification and standardization reduces inventory management time in our salons and throughout our supply chain and enables distribution efficiencies.

6

Ongoing simplification focuses on improving the way we plan and execute across our many brands. Standardizing processes and procedures around scheduling, day to day salon execution and reporting will make it easier to lead and execute in a multi-unit organization.

Our organization also remains focused on identifying and driving cost saving and profit enhancing initiatives.

Salon Concepts:

The Company's salon concepts focus on providing high quality hair care services and professional products, primarily to the mass market. A description of the Company's salon concepts are listed below:

SmartStyle. SmartStyle salons offer a full range of custom styling, cutting, and hair coloring, as well as professional hair care products and are located exclusively in Walmart Supercenters. SmartStyle has a walk-in guest base with value pricing. Service revenues represent approximately 69% of total company-owned SmartStyle revenues. Additionally, the Company has 126 franchised Cost Cutters salons located in Walmart Supercenters.

Supercuts. Supercuts salons provide consistent, high quality hair care services and professional products to its guests at convenient times and locations at value prices. This concept appeals to men, women, and children. Service revenues represent approximately 91% of total company-owned Supercuts revenues. Additionally, the Company has 1,213 franchised Supercuts locations.

MasterCuts. MasterCuts salons are a full service, mall based salon group which focuses on the walk-in consumer who demands moderately priced hair care services. MasterCuts salons emphasize quality hair care services, affordable prices, and time saving services for the entire family. These salons offer a full range of custom styling, cutting and hair coloring services, as well as professional hair care products. Service revenues comprise approximately 82% of the concept's total revenues.

Other Value. Other Value salons are made up of acquired regional company-owned salon groups operating under the primary concepts of Hair Masters, Cool Cuts for Kids, Style America, First Choice Haircutters, Famous Hair, Cost Cutters, BoRics, Magicuts, Holiday Hair, Head Start, Fiesta Salons, and TGF, as well as other concept names. Most concepts offer a full range of custom hairstyling, cutting and coloring services, as well as hair care products. Hair Masters offers moderately-priced services, while the other concepts primarily cater to time-pressed, value-oriented families. Service revenues represent approximately 90% of total company-owned Other Value salons revenues. Additionally, the Company has 840 franchised locations of Other Value salons. Other Value salons were previously referred to as Promenade salons.

Regis Salons. Regis Salons are primarily mall based, full service salons providing complete hair care and beauty services aimed at moderate to upscale, fashion conscious consumers. At Regis Salons both appointments and walk-in guests are common. These salons offer a full range of custom styling, cutting and hair coloring services, as well as professional hair care products. Service revenues represent approximately 82% of the concept's total revenues. Regis Salons compete in their existing markets primarily by providing high quality services. Included within the Regis Salon concept are various other trade names, including Carlton Hair, Sassoon, Hair by Stewarts, Hair Excitement, and Renee Beauty.

International Salons. The Company's International salons are comprised of company-owned salons operating in the United Kingdom primarily under the Supercuts, Regis, and Sassoon concepts. These salons offer similar levels of service as our North American salons. Sassoon is one of the world's most recognized names in hair fashion and appeals to women and men looking for a prestigious full service hair salon. Salons are usually located in prominent high-traffic locations and offer a full range of custom hairstyling, cutting and coloring services, as well as professional hair care products. Service revenues comprise approximately 75% of total company-owned international locations.

The tables on the following pages set forth the number of system wide locations (company-owned and franchised) and activity within the various salon concepts.

7

System-wide location counts(1)(2)

June 30, | |||||||||

2014 | 2013 | 2012 | |||||||

Company-owned salons: | |||||||||

SmartStyle/Cost Cutters in Walmart stores | 2,574 | 2,490 | 2,441 | ||||||

Supercuts | 1,176 | 1,210 | 1,228 | ||||||

MasterCuts | 505 | 532 | 569 | ||||||

Other Value | 1,846 | 1,990 | 2,133 | ||||||

Regis | 816 | 862 | 953 | ||||||

Total North American salons(3) | 6,917 | 7,084 | 7,324 | ||||||

Total International salons(4) | 360 | 351 | 398 | ||||||

Total, Company-owned salons | 7,277 | 7,435 | 7,722 | ||||||

Franchised salons: | |||||||||

SmartStyle/Cost Cutters in Walmart stores | 126 | 123 | 122 | ||||||

Supercuts | 1,213 | 1,116 | 1,040 | ||||||

Other Value | 840 | 843 | 854 | ||||||

Total North American salons | 2,179 | 2,082 | 2,016 | ||||||

Total International salons(4) | — | — | — | ||||||

Total, Franchised salons | 2,179 | 2,082 | 2,016 | ||||||

Ownership interest locations: | |||||||||

Equity ownership interest locations(5) | 218 | 246 | 2,811 | ||||||

Grand Total, System-wide | 9,674 | 9,763 | 12,549 | ||||||

Constructed Locations (net relocations)

Fiscal Years | |||||||||

2014 | 2013 | 2012 | |||||||

Company-owned salons: | |||||||||

SmartStyle/Cost Cutters in Walmart stores | 85 | 51 | 49 | ||||||

Supercuts | 13 | 45 | 56 | ||||||

MasterCuts | 1 | 3 | 2 | ||||||

Other Value | 4 | 39 | 43 | ||||||

Regis | 1 | 3 | 3 | ||||||

Total North American salons(3) | 104 | 141 | 153 | ||||||

Total International salons(4) | 23 | 12 | 13 | ||||||

Total, Company-owned salons | 127 | 153 | 166 | ||||||

Franchised salons: | |||||||||

SmartStyle/Cost Cutters in Walmart stores | 3 | 1 | 2 | ||||||

Supercuts | 94 | 70 | 65 | ||||||

Other Value | 37 | 47 | 37 | ||||||

Total North American salons | 134 | 118 | 104 | ||||||

Total International salons(4) | — | — | — | ||||||

Total, Franchised salons | 134 | 118 | 104 | ||||||

8

Closed Locations

Fiscal Years | |||||||||

2014 | 2013 | 2012 | |||||||

Company-owned salons: | |||||||||

SmartStyle/Cost Cutters in Walmart stores | (1 | ) | (2 | ) | (1 | ) | |||

Supercuts | (44 | ) | (49 | ) | (48 | ) | |||

MasterCuts | (27 | ) | (40 | ) | (21 | ) | |||

Other Value | (126 | ) | (179 | ) | (174 | ) | |||

Regis | (47 | ) | (94 | ) | (73 | ) | |||

Total North American salons(3) | (245 | ) | (364 | ) | (317 | ) | |||

Total International salons(4) | (14 | ) | (59 | ) | (16 | ) | |||

Total, Company-owned salons | (259 | ) | (423 | ) | (333 | ) | |||

Franchised salons: | |||||||||

SmartStyle/Cost Cutters in Walmart Stores | — | — | — | ||||||

Supercuts | (19 | ) | (11 | ) | (12 | ) | |||

Other Value | (44 | ) | (58 | ) | (39 | ) | |||

Total North American salons(3) | (63 | ) | (69 | ) | (51 | ) | |||

Total International salons(4) | — | — | — | ||||||

Total, Franchised salons | (63 | ) | (69 | ) | (51 | ) | |||

Conversions (including net franchisee transactions)(6)

Fiscal Years | |||||||||

2014 | 2013 | 2012 | |||||||

Company-owned salons: | |||||||||

SmartStyle/Cost Cutters in Walmart stores | — | — | — | ||||||

Supercuts | (3 | ) | (14 | ) | 61 | ||||

MasterCuts | (1 | ) | — | — | |||||

Other Value | (22 | ) | (3 | ) | (57 | ) | |||

Regis | — | — | — | ||||||

Total North American salons(3) | (26 | ) | (17 | ) | 4 | ||||

Total International salons(4) | — | — | — | ||||||

Total, Company-owned salons | (26 | ) | (17 | ) | 4 | ||||

Franchised salons: | |||||||||

SmartStyle/Cost Cutters in Walmart Stores | — | — | — | ||||||

Supercuts | 22 | 17 | — | ||||||

Other Value | 4 | — | (4 | ) | |||||

Total North American salons(3) | 26 | 17 | (4 | ) | |||||

Total International salons(4) | — | — | — | ||||||

Total, Franchised salons | 26 | 17 | (4 | ) | |||||

_______________________________________________________________________________

(1) | In April 2013, the Company sold Hair Club, which operated 98 locations as of June 30, 2012. These locations are excluded from system-wide location counts presented. |

(2) | During fiscal 2012, the Company acquired two locations that were categorized within the Supercuts (one location) and International (one location) salon concepts and a franchise network of 31 locations that was categorized within the Other Value salon concept. No salons were acquired in fiscal 2013 and 2014. |

9

(3) | The North American Value operating segment is comprised primarily of the SmartStyle, Supercuts, MasterCuts and Other Value salon brands. The North American Premium operating segment is comprised primarily of the Regis salon brands. |

(4) | Canadian and Puerto Rican salons are included in the North American salon totals. |

(5) | On September 27, 2012, the Company sold its equity interest in Provalliance. |

(6) | During fiscal years 2014, 2013, and 2012, the Company acquired two, zero, and 11 salon locations, respectively, from franchisees. During fiscal years 2014, 2013, and 2012, the Company sold 28, 17, and seven salon locations, respectively, to franchisees. |

Salon Franchising Program:

General. The Company has various franchising programs supporting its 2,179 franchised salons as of June 30, 2014, consisting mainly of Supercuts, Cost Cutters, First Choice Haircutters, and Magicuts. These salons have been included in the discussions regarding salon counts and concepts.

The Company provides its franchisees with a comprehensive system of business training, stylist education, site approval and lease negotiation, construction management services, professional marketing, promotion, and advertising programs, and other forms of support designed to help the franchisee build a successful business.

Standards of Operations. The Company does not control the day to day operations of its franchisees, including employment, benefits and wage determination, establishing prices to charge for products and services, business hours, personnel management, and capital expenditure decisions. However, the franchise agreements afford certain rights to the Company, such as the right to approve locations, suppliers and the sale of a franchise. Additionally, franchisees are required to conform to the Company's established operational policies and procedures relating to quality of service, training, salon design and decor, and trademark usage. The Company's field personnel make periodic visits to franchised salons to ensure that they are operating in conformity with the standards for each franchising program. All of the rights afforded to the Company with regard to franchised operations allow the Company to protect its brands, but do not allow the Company to control the franchise operations or make decisions that have a significant impact on the success of the franchised salons. The Company’s franchise agreements do not give the Company any right, ability or potential to determine or otherwise influence any terms and/or conditions of employment of franchisees’ employees (except for those, if any, that are specifically related to quality of service, training, salon design, decor, and trademark usage), including, but not limited to, franchisees’ employees’ wages, employee benefits, hours of work, scheduling, leave programs, seniority rights, promotional or transfer opportunities, layoff/recall arrangements, grievance and dispute resolution procedures, uniforms, and/or discipline and discharge.

Franchise Terms. Pursuant to a franchise agreement with the Company, each franchisee pays an initial fee for each store and ongoing royalties to the Company. In addition, for most franchise concepts, the Company collects advertising funds from franchisees and administers the funds on behalf of the concept. Franchisees are responsible for the costs of leasehold improvements, furniture, fixtures, equipment, supplies, inventory, payroll costs and certain other items, including initial working capital. The majority of franchise agreements provide the Company a right of first refusal if the store is to be sold and the franchisee must obtain the Company's approval in all instances where there is a sale of a franchise location.

Additional information regarding each of the major franchised brands is listed below:

Supercuts

Supercuts franchise agreements have a perpetual term, subject to termination of the underlying lease agreement or termination of the franchise agreement by either the Company or the franchisee. All new franchisees enter into development agreements, which give them the right to enter into a defined number of franchise agreements. These franchise agreements are site specific. The development agreement provides limited territorial protection for the stores developed under those franchise agreements. Older franchisees have grandfathered expansion rights which allow them to develop stores outside of development agreements and provide them with greater territorial protections in their markets. The Company has a comprehensive impact policy that resolves potential conflicts among Supercuts franchisees and/or the Company's Supercuts locations regarding proposed store sites.

Cost Cutters, First Choice Haircutters, and Magicuts

The majority of existing Cost Cutters franchise agreements have a 15 year term with a 15 year option to renew (at the option of the franchisee), while the majority of First Choice Haircutters franchise agreements have a ten year term with a five year option to renew. The majority of Magicuts franchise agreements have a term equal to the greater of five years or the

10

current initial term of the lease agreement with an option to renew for two additional five year periods. The current franchise agreement is site specific. Franchisees may enter into development agreements with the Company which provide limited territorial protection.

Franchisee Training. The Company provides new franchisees with training, focusing on the various aspects of store management, including operations, personnel management, marketing fundamentals, and financial controls. Existing franchisees receive training, counseling and information from the Company on a continuous basis. The Company provides store managers and stylists with extensive technical training for Supercuts franchises.

Salon Markets and Marketing:

Company-Owned Salons

The Company utilizes various marketing vehicles for its salons, including traditional advertising, guest relationship management, digital channels and promotional/pricing based programs. A predetermined allocation of revenue is used for such programs. Most marketing vehicles including radio, print, online and television advertising are developed and supervised at the Company's Salon Support headquarters; however, the majority of advertising is created for our local markets. The Company reviews its brand strategy with the intent to create more clear communication platforms, identities and differentiation points for our brands to drive consumer preference.

Franchised Salons

Most franchise concepts maintain separate advertising funds that provide comprehensive marketing and sales support for each system. The Supercuts advertising fund is the Company's largest advertising fund and is administered by a council consisting of primarily franchisee representatives. The council has overall control of the advertising fund's expenditures and operates in accordance with terms of the franchise operating and other agreements. All stores, company-owned and franchised, contribute to the advertising funds, the majority of which are allocated to the contributing market for media placement and local marketing activities. The remainder is allocated for the creation of national advertising and system-wide activities.

Affiliated Ownership Interests:

The Company maintains ownership interests in beauty schools and salons. The primary ownership interest is a 54.5% interest in Empire Education Group, Inc. (EEG), which is accounted for as an equity method investment. See Note 1 to the Consolidated Financial Statements. EEG operates accredited cosmetology schools. Contributing the Company's beauty schools in fiscal year 2008 to EEG leveraged EEG's management expertise, while enabling the Company to maintain a vested interest in the beauty school industry. Additionally, we utilize our EEG relationship to recruit stylists straight from beauty school.

In addition, the Company has a 27.1% ownership interest in MY Style, which is accounted for as a cost method investment. MY Style operates salons in Japan.

Corporate Trademarks:

The Company holds numerous trademarks, both in the United States and in many foreign countries. The most recognized trademarks are "SmartStyle," "Supercuts," "MasterCuts," "Regis Salons," "Cost Cutters," "Hair Masters," "First Choice Haircutters," and "Magicuts."

"Sassoon" is a registered trademark of Procter & Gamble. The Company has a license agreement to use the Sassoon name for existing salons and academies and new salon development.

Corporate Employees:

During fiscal year 2014, the Company had approximately 49,000 full and part-time employees worldwide, of which approximately 43,000 employees were located in the United States. None of the Company's employees is subject to a collective bargaining agreement and the Company believes that its employee relations are amicable.

11

Executive Officers:

Information relating to Executive Officers of the Company follows:

Name | Age | Position | |||

Daniel Hanrahan | 57 | President and Chief Executive Officer | |||

Eric Bakken | 47 | Executive Vice President, Chief Administrative Officer and General Counsel | |||

Jim Lain | 50 | Executive Vice President, Chief Operating Officer | |||

Steven Spiegel | 52 | Executive Vice President and Chief Financial Officer | |||

Heather Passe | 43 | Senior Vice President and Chief Marketing Officer | |||

Doug Reynolds | 58 | Senior Vice President and Chief Information Officer | |||

Carmen Thiede | 47 | Senior Vice President and Chief Human Resources Officer | |||

Daniel Hanrahan has served as President and Chief Executive Officer since August 2012. He most recently served as President of Celebrity Cruises, a subsidiary of Royal Caribbean Cruises Ltd., from February 2005 to July 2012, and as its President and Chief Executive Officer since September 2007. Mr. Hanrahan has served on the Board of Directors of Cedar Fair, L.P., an amusement-resort operator, since 2012 and is a member of its Audit Committee and Compensation Committee.

Eric Bakken has served as Executive Vice President, Chief Administrative Officer and General Counsel since April 2013. He served as Executive Vice President, General Counsel and Business Development and Interim Corporate Chief Operating Officer from 2012 to April 2013, and performed the function of principal executive officer between July 2012 and August 2012, Executive Vice President from 2010 to 2012, Senior Vice President from 2006 to 2009, General Counsel from 2004 to 2006, as Vice President, Law from 1998 to 2004 and as a lawyer to the Company from 1994 to 1998.

Jim Lain has served as Executive Vice President and Chief Operating Officer since November 2013.

Steven Spiegel has served as Executive Vice President and Chief Financial Officer since December 2012.

Heather Passe has served as Senior Vice President and Chief Marketing Officer since July 2012.

Doug Reynolds has served as Senior Vice President and Chief Information Officer since May 2012.

Carmen Thiede has served as Senior Vice President and Chief Human Resources Officer since October 2013.

Governmental Regulations:

The Company is subject to various federal, state, local and provincial laws affecting its business as well as a variety of regulatory provisions relating to the conduct of its beauty related business, including health and safety.

In the United States, the Company's franchise operations are subject to the Federal Trade Commission's Trade Regulation Rule on Franchising (the FTC Rule) and by state laws and administrative regulations that regulate various aspects of franchise operations and sales. The Company's franchises are offered to franchisees by means of an offering circular/disclosure document containing specified disclosures in accordance with the FTC Rule and the laws and regulations of certain states. The Company has registered its offering of franchises with the regulatory authorities of those states in which it offers franchises and in which such registration is required. State laws that regulate the franchisor-franchisee relationship presently exist in a substantial number of states and, in certain cases, apply substantive standards to this relationship. Such laws may, for example, require that the franchisor deal with the franchisee in good faith, may prohibit interference with the right of free association among franchisees and may limit termination of franchisees without payment of reasonable compensation. The Company believes that the current trend is for government regulation of franchising to increase over time. However, such laws have not had, and the Company does not expect such laws to have, a significant effect on the Company's operations.

In Canada, the Company's franchise operations are subject to franchise laws and regulations in the provinces of Ontario, Alberta, Manitoba, New Brunswick and Prince Edward Island. The offering of franchises in Canada occurs by way of a disclosure document, which contains certain disclosures required by the applicable provincial laws. The provincial franchise laws and regulations primarily focus on disclosure requirements, although each requires certain relationship requirements such as a duty of fair dealing and the right of franchisees to associate and organize with other franchisees.

The Company believes it is operating in substantial compliance with applicable laws and regulations governing all of its operations.

12

The Company maintains an ownership interest in EEG. Beauty schools derive a significant portion of their revenue from student financial assistance originating from the U.S. Department of Education's Title IV Higher Education Act of 1965. For the students to receive financial assistance at the school, the beauty schools must maintain eligibility requirements established by the U.S. Department of Education.

Financial Information about Foreign and North American Operations

Financial information about foreign and North American markets is incorporated herein by reference to Management's Discussion and Analysis of Financial Condition and Results of Operations in Part II, Item 7 and segment information in Note 14 to the Consolidated Financial Statements in Part II, Item 8 of this Form 10-K.

Available Information

The Company is subject to the informational requirements of the Securities and Exchange Act of 1934 (Exchange Act). The Company therefore files periodic reports, proxy statements and other information with the Securities and Exchange Commission (SEC). Such reports may be obtained by visiting the Public Reference Room of the SEC at 100 F Street NE, Washington, DC 20549, or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an internet site (http://www.sec.gov) that contains reports, proxy and information statements and other information.

Financial and other information can be accessed in the Investor Information section of the Company's website at www.regiscorp.com. The Company makes available, free of charge, copies of its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after filing such material electronically or otherwise furnishing it to the SEC.

Item 1A. Risk Factors

The significant initiatives we have implemented and recent changes in our management and organizational structure may continue to adversely impact our operating results.

During fiscal year 2013, the Company began executing upon a number of significant foundational initiatives to support and focus on its business strategies to return the Company to sustainable long-term growth and profitability. The Company has since rolled out new POS systems and salon workstations in all of its North American salons, restructured the Company’s North American field organization, standardized plan-o-grams and simplified its retail product assortments, and enhanced its asset protection capabilities. In addition, the Company’s management engaged in a strategic review of non-core assets to focus on our core business of operating beauty salons, improving long-term profitability and maximizing shareholder value.

These initiatives correspond with changes in our executive management team over the last two years. These changes have driven change in our business and our mid-level leadership, which will take time to produce consistent results. In addition, now that our new executive management team is substantially in place, it could be disruptive to our business if one of our executive management members left the Company with little notice.

During fiscal year 2014, our operating results were negatively impacted as a result of the foundational changes the Company implemented in the fourth quarter of fiscal year 2013. During the twelve months ended June 30, 2014, our same-store sales declined 4.8% from the comparable prior period. During the fiscal year ended June 30, 2014, we recorded a non-cash goodwill impairment charge of $34.9 million associated with the Regis salon concept, non-cash long-lived asset impairment charges of $18.3 million and $84.4 million of non-cash charges to establish a valuation allowance against the United States (U.S.) and United Kingdom (U.K.) deferred tax assets. If we are unable to reverse these trends and effectively execute upon our foundational initiatives, our financial results may continue to be negatively affected and we may be required to take future impairment charges. Such impairments could be material to our consolidated balance sheet and results of operations.

If we continue to have negative same-store sales our business and results of operations may be affected.

Our success depends, in part, upon our ability to improve sales, as well as both cost of service and product and operating margins. Comparable same-store sales are affected by average ticket and same-store guest visits. A variety of factors affect same-store guest visits, including the guest experience, fashion trends, competition, current economic conditions, changes in our product assortment, the effectiveness of marketing programs and weather conditions. These factors may cause our comparable same-store sales to differ materially from prior periods and from our expectations. Our comparable same-store sales results for fiscal year 2014 declined 4.8% compared to fiscal year 2013. If negative same-store sales continue and we are unable to offset the impact with operational savings, our financial results may be further affected and we may be required to take impairment charges. Such impairments could be material to our consolidated balance sheet and results of operations. During fiscal years 2014 and 2012, we recorded goodwill impairment charges of $34.9 and $67.7 million, respectively, both

13

associated with our Regis salon concept. During fiscal years 2014, 2013 and 2012, we recorded fixed asset impairment charges of $18.3, $8.2 and $6.6 million, respectively.

Our business is based on the success of our salons which is driven by the success of our stylists. It is important for us to attract, train and retain talented stylists.

Guest loyalty is highly dependent upon the stylist who is providing services to our guests. Our main objective is to have our guests leave feeling satisfied and wanting to return. To ensure our guests are receiving the best possible care, we need to focus on attracting, training and retaining highly qualified stylists. To continue to be successful in the future we will need to continue to offer competitive wages, benefits and education and training programs to attract and retain talented stylists. Any shortcomings by stylists or the training and guidance they receive, particularly an issue affecting the quality of the guest service experience or compliance with safety and health regulations, may be attributed to the Company as a whole, thus damaging our reputation and brand equity and potentially affecting our results of operations.

Changes in regulatory and statutory laws, such as increases in the minimum wage and changes that make collective bargaining easier, may result in increased costs to our business.

With 9,674 locations and approximately 49,000 employees worldwide, our financial results can be adversely impacted by regulatory or statutory changes in laws. Due to the number of people we employ, laws that increase minimum wage rates, employment taxes or increase costs to provide employee benefits may result in additional costs to our Company.

A number of states and cities in which we do business have recently increased or are considering increasing the minimum wage, with increases generally phased over several years depending upon the size of the employer. Minimum wage rate increases could significantly increase our costs, and our ability to offset increases in minimum wage rates through price increases is limited. In addition, changes in labor laws could increase the likelihood of some or all of our employees being subjected to greater organized labor influence. If a significant portion of our employees were to become unionized, it could have an adverse effect on our business and financial results.

Increases in the minimum wage and unionization could also have an adverse effort on the performance of our franchisees, especially if our franchisees are treated as a "joint employer" with us by the National Labor Relations Board (NLRB) or as a large employer under minimum wage statues because of their affiliation with us. With respect to the NLRB, it is anticipated that its current standard for joint employer relationships may become more lenient and, as such,we may face an increased risk of being alleged to be a joint employer with our franchisees. In addition, we must comply with state employment laws, including the California Labor Code, which has stringent requirements and penalties for non-compliance.

We are also subject to the federal laws and regulations affecting public companies and governing the franchisor-franchisee relationship, among others. Compliance with new, complex and changing laws may cause our expenses to increase. In addition, any non-compliance with laws or regulations could result in penalties, fines, product recalls and enforcement actions or otherwise restrict our ability to market certain products, which could adversely affect our business, financial condition and results of operations.

Changes to healthcare laws in the U.S. may increase the number of employees who participate in our healthcare plans, which may significantly increase our healthcare costs and negatively impact our operating results.

We offer comprehensive healthcare coverage to eligible employees in the United States. Historically, a majority of our eligible employees do not participate in our healthcare plans. Due to recent changes to healthcare laws in the United States pursuant to the Affordable Care Act (ACA), it is possible that enrollment in the Company’s healthcare plans may increase as a result of provisions regarding automatic enrollment of new eligible employees. Furthermore, potential fees and or penalties may be assessed as a result of individuals either not being offered healthcare coverage within a limited timeframe or if coverage offered does not meet minimum care and affordability standards. An increase in the number of employees who elect to participate in our healthcare plans or if the Company fails to comply with one or more provisions of ACA may significantly increase our healthcare-related costs and negatively impact our operating results.

If we fail to protect the security of sensitive information about our guests, employees, vendors or company, we could be subject to negative publicity, costly government enforcement actions or private litigation and our reputation could suffer.

The nature of our business involves processing, transmission and storage of personal information about our guests as well as employees, vendors and our Company. Cyber-attacks designed to gain access to sensitive information by breaching mission critical systems of large organizations are constantly evolving, and high profile electronic security breaches leading to unauthorized release of sensitive guest information have occurred recently at a number of large U.S. companies. Our efforts to protect sensitive guest and employee information may not be successful in preventing a breach in our systems. As a result of a breach in our systems, our guests could lose confidence in our ability to protect their personal information, which could cause

14

them to stop visiting our salons altogether. Such events could lead to lost future sales and adversely affect our results of operations. In addition, as the regulatory environment relating to retailers and other companies' obligation to protect sensitive data becomes stricter, a material failure on our part to comply with applicable regulations could subject us to fines or other regulatory sanctions and potentially to lawsuits. These laws are changing rapidly and vary between jurisdictions. In addition, while our franchisees are independently responsible for data security at franchised locations, a breach of guest or vendor data at a franchised location could also negatively affect public perception of our brands.

We rely heavily on our management information systems. If our systems fail to perform adequately or if we experience an interruption in their operation, our results of operations may be affected.

The efficient operation of our business is dependent on our management information systems. We rely heavily on our management information systems to collect daily sales information and guest demographics, generate payroll information, monitor salon performance, manage salon staffing and payroll costs, inventory control and other functions. Certain of our management information systems are developed and maintained by external vendors, including our POS system. The failure of our management information systems to perform as we anticipate, or to meet the continuously evolving needs of our business, could disrupt our business and may adversely affect our operating results.

Failure to control costs may adversely affect our operating results.

We must continue to control our expense structure. Failure to manage our cost of product, labor and benefit rates, advertising and marketing expenses, operating lease costs, other store expenses or indirect spending could delay or prevent us from achieving increased profitability or otherwise adversely affect our operating results.

We rely on external vendors.

We rely on various external vendors for products and services critical to our operations. Our dependence on vendors exposes us to reputational, financial, and compliance risk. Our vendors are also responsible for the security of certain Company data. In the event that one of our key vendors becomes unable to continue to provide products and services, or their systems fail or are compromised, we may suffer operational difficulties and financial loss.

Changes in manufacturers' choice of distribution channels may negatively affect our revenues.

The retail products we sell are licensed to be carried exclusively by professional salons. The products we purchase for sale in our salons are purchased pursuant to purchase orders, as opposed to long-term contracts and generally can be terminated by the producer without much advance notice. Should our product manufacturers decide to utilize other distribution channels, such as large discount retailers, it could negatively impact product sales revenue. In addition as e-commerce evolves and expands, our product sales could negatively be impacted if we are unable to sell retail products in a similar fashion.

If we fail to comply with any of the covenants in our financing arrangements, we may not be able to access our existing revolving credit facility, and we may face an accelerated obligation to repay our indebtedness.

We have several financing arrangements that contain financial and other covenants. If we fail to comply with any of the covenants, it may cause a default under one or more of our financing arrangements, which could limit our ability to obtain additional financing under our existing credit facility, require us to pay higher levels of interest or accelerate our obligations to repay our indebtedness.

Our continued success depends in part on the success of our franchisees, who operate independently.

As of June 30, 2014, approximately 23% of our salons are franchised locations. We derive revenues associated with our franchised locations from royalties, service fees and product sales to franchised locations. Our financial results are therefore dependent in part upon the operational and financial success of our franchisees. As we increase our focus on our franchise business, our dependence on our franchisees grows.

We have limited control over how our franchisees’ businesses are run. Though we have established operational standards and guidelines, they own, operate and oversee the daily operations of their salon locations. If franchisees do not successfully operate their salons in compliance with our standards, our brand reputation and image could be harmed and our financial results could be affected.

In addition, our franchises are subject to the same general economic risks as our Company, and their results are influenced by competition, market trends, and disruptions in their markets due to severe weather and other external events. They may also be limited in their ability to open new locations by an inability to secure adequate financing, especially since many of them are small businesses with much more limited access to financing than our Company, or by the limited supply of favorable real estate for new salon locations. A deterioration in the financial results of our franchisees, or a failure of our

15

franchisees to renew their franchise agreements, could adversely affect our operating results through decreased royalty payments, fees and product revenues.

If we are not able to successfully compete in our business markets, our financial results may be affected.

Competition on a market by market basis remains challenging as many smaller chain competitors are franchise systems with local operating strength in certain markets. Therefore, our ability to attract guests, raise prices and secure suitable locations in certain markets can be adversely impacted by this competition. If we are not able to successfully compete, our ability to grow same-store sales and increase our revenue and earnings may be impaired.

Changes in the general economic environment may impact our business and results of operations.

Changes to the U.S., Canadian and United Kingdom economies have an impact on our business. General economic factors that are beyond our control, such as interest rates, exchange rates, recession, inflation, deflation, tax rates and policy, energy costs, unemployment trends, extreme weather patterns, other casualty events and other matters that influence consumer confidence and spending, may impact our business. In particular, visitation patterns to our salons can be adversely impacted by increases in unemployment rates and decreases in discretionary income levels.

Failure to simplify and standardize our operating processes across our brands could have a negative impact on our financial results.

Standardization of operating processes across our brands, marketing and products will enable us to simplify our operating model and decrease our costs. Failure to do so could adversely impact our ability to grow revenue and realize further efficiencies within our results of operations.

Changes in our key relationships may adversely affect our operating results.

We maintain key relationships with certain companies, including Walmart. In particular, we have 2,700 SmartStyle/Cost Cutters salons within Walmart locations, including 88 salons opened during fiscal year 2014. The continued operation and growth of this business is dependent on our relationship with Walmart. In addition, our company-owned locations are concentrated with leases with certain major regional and national landlords. Termination or modification of any of these relationships could significantly reduce our revenues and have a material and adverse impact on our business, our operating results and our ability to grow.

If our investment with Empire Education Group is unsuccessful, our financial results may be affected.

We have a joint venture arrangement with Empire Education Group (EEG), an operator of accredited cosmetology schools. If EEG is unwilling or unable to devote their financial resources or marketing and operational capabilities to our joint venture, or if our joint venture is terminated, we may not be able to realize anticipated profits and our business could be materially adversely affected. In addition, regulatory changes in the for-profit secondary educational market have had negative business impacts including declines in enrollment, revenues and profitability. If our joint venture arrangement with EEG is not successful, we may have a limited ability to terminate or modify this arrangement. If our joint venture with EEG is terminated, there can be no assurance that we will be able to attract new joint venture partners to continue the activities or to operate that business independently.

During fiscal years 2013 and 2012, we recorded noncash impairments of $17.9 and $19.4 million, respectively, related to our investment in EEG. Due to economic, regulatory and other factors, including declines in enrollment, revenue and profitability in the for-profit secondary educational market, we may be required to take additional noncash impairment charges related to our investments and such noncash impairments could be material to our consolidated balance sheet and results of operations. During fiscal years 2014, 2013, and 2012, we recorded our share of pre-tax noncash impairment charges recorded by EEG for goodwill and fixed and intangible assets of $21.2, $2.1 and $8.9 million, respectively. EEG may be required to take additional noncash impairment charges related to long-lived assets and goodwill or establish valuation allowances against certain of its deferred tax assets and our share of such noncash impairment charges or valuation allowances could be material to our consolidated balance sheet and results of operations. EEG does not have any goodwill recorded as of June 30, 2014. As of June 30, 2014, our share of EEG's deferred tax assets was $7.8 million.

Changes to interest rates and foreign currency exchange rates may impact our results from operations.

Changes in interest rates and foreign currency exchange rates will have an impact on our expected results from operations. Historically, we have managed the risk related to fluctuations in these rates through the use of fixed rate debt instruments and other financial instruments.

Changes in fashion trends may impact our revenue.

16

Changes in consumer tastes and fashion trends can have an impact on our financial performance.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

The Company's corporate offices are headquartered in a 170,000 square foot, three building complex in Edina, Minnesota that is owned by the Company.

The Company also operates small offices in Edina, Minnesota; New York, New York; Toronto, Canada; Coventry and London, England; and Chattanooga, Tennessee. These offices are occupied under long-term leases.

The Company owns distribution centers located in Chattanooga, Tennessee and Salt Lake City, Utah. The Chattanooga facility currently utilizes 230,000 square feet while the Salt Lake City facility utilizes 210,000 square feet. The Salt Lake City facility can be expanded to 290,000 square feet to accommodate future growth.

The Company operates all of its salon locations under leases or license agreements. Substantially all of its North American locations in regional malls are operating under leases with an original term of at least ten years. Salons operating within strip centers and Walmart Supercenters have leases with original terms of at least five years, generally with the ability to renew, at the Company's option, for one or more additional five year periods. Salons operating within department stores in Canada and Europe operate under license agreements, while freestanding or shopping center locations in those countries have real property leases comparable to the Company's North American locations.

The Company also leases the premises in which approximately 80% of our franchisees operate and has entered into corresponding sublease arrangements with the franchisees. These leases have a five year initial term and one or more five year renewal options. All lease costs are passed through to the franchisees. Remaining franchisees who do not enter into sublease arrangements with the Company negotiate and enter into leases on their own behalf.

None of the Company's salon leases are individually material to the operations of the Company and the Company expects that it will be able to renew its leases on satisfactory terms as they expire or identify and secure other suitable locations. See Note 8 to the Consolidated Financial Statements.

Item 3. Legal Proceedings

The Company is a defendant in various lawsuits and claims arising out of the normal course of business. Like certain other large retail employers, the Company has been faced with allegations of purported class-wide consumer and wage and hour violations. Litigation is inherently unpredictable and the outcome of these matters cannot presently be determined. Although the actions are being vigorously defended, the Company could in the future incur judgments or enter into settlements of claims that could have a material adverse effect on its results of operations in any particular period.

In addition, the Company was a nominal defendant, and nine current and former directors and officers of the Company were named defendants, in a shareholder derivative action in Minnesota state court. The derivative shareholder action alleged that the individual defendants breached their fiduciary duties to the Company in connection with their approval of certain executive compensation arrangements and certain related party transactions. The Board of Directors appointed a Special Litigation Committee to investigate the claims and allegations made in the derivative action, and to decide on behalf of the Company whether the claims and allegations should be pursued. In April 2014, the Special Litigation Committee issued a report and concluded the claims and allegations should not be pursued, and in June 2014 the Special Litigation Committee filed a motion requesting the court dismiss the shareholder derivative action.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Repurchase of Equity Securities |

Regis common stock is listed and traded on the New York Stock Exchange under the symbol "RGS."

17

The accompanying table sets forth the high and low closing bid quotations for each quarter during fiscal years 2014 and 2013 as reported by the New York Stock Exchange (under the symbol "RGS"). The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not necessarily represent actual transactions.

As of August 12, 2014, Regis shares were owned by approximately 17,000 shareholders based on the number of record holders and an estimate of individual participants in security position listings. The common stock price was $14.46 per share on August 12, 2014.

Fiscal Years | ||||||||||||||||

2014 | 2013 | |||||||||||||||

Fiscal Quarter | High | Low | High | Low | ||||||||||||

1st Quarter | $ | 17.97 | $ | 14.50 | $ | 19.54 | $ | 16.26 | ||||||||

2nd Quarter | 16.15 | 13.99 | 19.59 | 15.79 | ||||||||||||

3rd Quarter | 14.64 | 11.48 | 18.69 | 16.34 | ||||||||||||

4th Quarter | 14.20 | 12.62 | 19.14 | 16.04 | ||||||||||||

The Company paid dividends of $0.06 per share per quarter during fiscal year 2013 and the first and second quarters of fiscal year 2014. In December 2013, the Company announced a new capital allocation policy. As a result of this policy, the Board of Directors elected to discontinue declaring regular quarterly dividends.

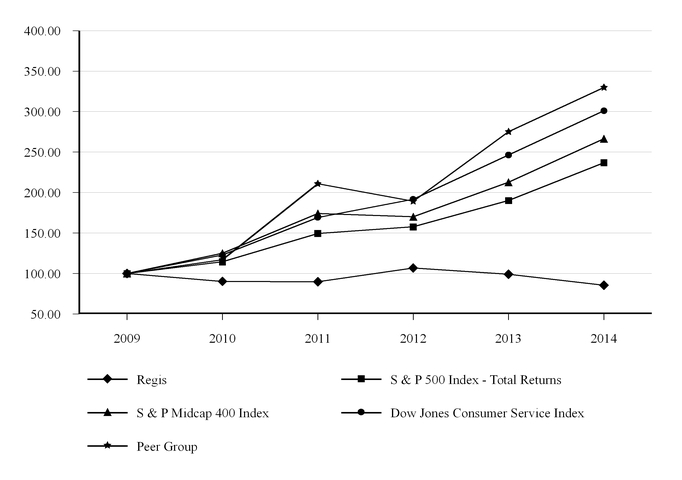

The following graph compares the cumulative total shareholder return on the Company's stock for the last five years with the cumulative total return of the Standard and Poor's 500 Stock Index and the cumulative total return of a peer group index (the Peer Group) constructed by the Company. In addition, the Company has included the Standard and Poor's 400 Midcap Index and the Dow Jones Consumer Services Index in this analysis because the Company believes these two indices provide a comparative correlation to the cumulative total return of an investment in shares of Regis Corporation.

The Peer Group consists of the following companies: Advance Auto Parts, Inc., Boyd Gaming Corp., Brinker International, Inc., Outerwall, Inc. (formerly Coinstar, Inc.), Cracker Barrel Old Country Store, DineEquity, Inc., Fossil Group, Inc., Fred's, Inc., Keurig Green Mountain, Inc., H&R Block, Inc., Jack in the Box, Inc., Panera Bread Co., Penn National Gaming, Inc., Revlon, Inc., Sally Beauty Holdings, Inc., Service Corporation International, The Cheesecake Factory, Inc. and Ulta Salon, Cosmetics & Fragrance Inc. The Peer Group is a self-constructed peer group of companies that have comparable annual revenues, the guest service element is a critical component to the business and a target of moderate guests in terms of income and style, excluding apparel companies. The Peer Group is the same group of companies the Company utilized as its peer group for executive compensation purposes in fiscal years 2014 and 2013. Information regarding executive compensation will be set forth in the 2014 Proxy statement.

The comparison assumes the initial investment of $100 in the Company's Common Stock, the S&P 500 Index, the Peer Group, the S&P 400 Midcap Index and the Dow Jones Consumer Services Index on June 30, 2009 and that dividends, if any, were reinvested.

18

Comparison of 5 Year Cumulative Total Return

Assumes Initial Investment of $100

June 2014

June 30, | ||||||||||||||||||||||||

2009 | 2010 | 2011 | 2012 | 2013 | 2014 | |||||||||||||||||||

Regis | $ | 100.00 | $ | 90.29 | $ | 89.85 | $ | 106.87 | $ | 99.03 | $ | 85.58 | ||||||||||||

S & P 500 | 100.00 | 114.43 | 149.55 | 157.70 | 190.18 | 236.98 | ||||||||||||||||||

S & P 400 Midcap | 100.00 | 124.93 | 174.13 | 170.07 | 212.90 | 266.63 | ||||||||||||||||||

Dow Jones Consumer Service Index | 100.00 | 122.92 | 169.26 | 191.77 | 246.31 | 301.09 | ||||||||||||||||||

Peer Group | 100.00 | 117.07 | 210.96 | 189.19 | 275.21 | 329.90 | ||||||||||||||||||

In May 2000, the Company's Board of Directors (Board) approved a stock repurchase program. Originally, the program authorized up to $50.0 million to be expended for the repurchase of the Company's stock. The Board elected to increase this maximum to $100.0 million in August 2003, to $200.0 million on May 3, 2005 and to $300.0 million on April 26, 2007. The timing and amounts of any repurchases will depend on many factors, including the market price of the common stock and overall market conditions. Historically, repurchases to date have been made primarily to eliminate the dilutive effect of shares issued in conjunction with acquisitions, restricted stock grants and stock option exercises. All repurchased shares become authorized but unissued shares of the Company. This repurchase program has no stated expiration date. As of June 30, 2014, a total accumulated 7.7 million shares have been repurchased for $241.3 million. As of June 30, 2014, $58.7 million remained outstanding under the approved stock repurchase program.

19

The Company repurchased the following common stock through its share repurchase program:

Fiscal Years | |||||||||||

2014 | 2013 | 2012 | |||||||||

Repurchased shares | — | 909,175 | — | ||||||||

Average Price (per share) | $ | — | $16.32 | $ | — | ||||||

Price range (per share) | $ | — | $15.99 - $16.84 | $ | — | ||||||

Total | $ | — | $14.9 million | $ | — | ||||||

Item 6. Selected Financial Data

Beginning with the period ended September 30, 2012 the Hair Restoration Centers operations were accounted for as discontinued operations. All periods presented reflect the Hair Restoration Centers as discontinued operations.

The following table sets forth selected financial data derived from the Company's Consolidated Financial Statements in Part II, Item 8. The table should be read in conjunction with Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations", and Item 8, "Financial Statements and Supplementary Data", of this Report on Form 10-K.

Fiscal Years | ||||||||||||||||||||

2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

(Dollars in thousands, except per share data) | ||||||||||||||||||||

Revenues | $ | 1,892,437 | $ | 2,018,713 | $ | 2,122,227 | $ | 2,180,181 | $ | 2,216,648 | ||||||||||

Operating (loss) income(a) | (33,990 | ) | 12,326 | (2,167 | ) | (14,282 | ) | 76,881 | ||||||||||||

(Loss) income from continuing operations(a) | (137,080 | ) | 4,166 | (51,743 | ) | (20,939 | ) | 25,728 | ||||||||||||

(Loss) income from continuing operations per diluted share | (2.43 | ) | 0.07 | (0.91 | ) | (0.37 | ) | 0.46 | ||||||||||||

Dividends declared, per share | 0.12 | 0.24 | 0.24 | 0.20 | 0.16 | |||||||||||||||

June 30, | ||||||||||||||||||||

2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

(Dollars in thousands) | ||||||||||||||||||||

Total assets, including discontinued operations | $ | 1,415,949 | $ | 1,390,492 | $ | 1,571,846 | $ | 1,805,753 | $ | 1,919,572 | ||||||||||

Long-term debt and capital lease obligations, including current portion | 293,503 | 174,770 | 287,674 | 313,411 | 440,029 | |||||||||||||||

_______________________________________________________________________________