Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF KPMG LLP - MSG NETWORKS INC. | msgexhibit231consentofkpmg.htm |

| EX-32.1 - CERTIFICATION BY THE CEO PURSUANT TO SECTION 906 OF THE SARBANES OXLEY ACT OF 02 - MSG NETWORKS INC. | msgexhibit321certification.htm |

| EX-21.1 - SUBSIDIARIES OF THE REGISTRANT - MSG NETWORKS INC. | msgexhibit211subsidiarieso.htm |

| EX-31.1 - CERTIFICATION BY THE CEO PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 02 - MSG NETWORKS INC. | msgexhibit311certification.htm |

| EX-32.2 - CERTIFICATION BY THE CFO PURSUANT TO SECTION 906 OF THE SARBANES OXLEY ACT OF 02 - MSG NETWORKS INC. | msgexhibit322certification.htm |

| EXCEL - IDEA: XBRL DOCUMENT - MSG NETWORKS INC. | Financial_Report.xls |

| EX-31.2 - CERTIFICATION BY THE CFO PURSUANT TO SECTION 302 OF THE SARBANES OXLEY ACT OF 02 - MSG NETWORKS INC. | msgexhibit312certification.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2014

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 [NO FEE REQUIRED] |

For the transition period from ___________ to _____________

Commission File Number | Registrant; State of Incorporation; Address and Telephone Number | IRS Employer Identification No. | ||

1-34434 | The Madison Square Garden Company | 27-0624498 | ||

Delaware

Two Pennsylvania Plaza

New York, NY 10121

(212) 465-6000

Securities registered pursuant to Section 12(b) of the Act: Title of each class: | Name of each Exchange on which Registered: | |

Class A Common Stock | The NASDAQ Stock Market LLC | |

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant has been required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by a check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether each Registrant is a large accelerated filer, accelerated filer, non-accelerated filer or smaller reporting company. See definition of large accelerated filer and accelerated filer in Exchange Act Rule 12b-2.

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

Aggregate market value of the voting and non-voting common equity held by non-affiliates of The Madison Square Garden Company computed by reference to the price at which the common equity was last sold on The NASDAQ Stock Market LLC as of December 31, 2013, the last business day of the registrant's most recently completed second fiscal quarter, was approximately: $3,536,386,484.

Number of shares of common stock outstanding as of July 31, 2014:

Class A Common Stock — 63,606,819

Class B Common Stock — 13,588,555

Documents incorporated by reference — Certain information required for Part III of this report is incorporated herein by reference to the proxy statement for the 2014 annual meeting of the Company’s shareholders, expected to be filed within 120 days after the close of our fiscal year.

TABLE OF CONTENTS

Page | |

PART I

Item 1. Business

The Madison Square Garden Company is a Delaware corporation with our principal executive offices at Two Pennsylvania Plaza, New York, NY, 10121. Unless the context otherwise requires, all references to “we,” “us,” “our,” “Madison Square Garden” or the “Company” refer collectively to The Madison Square Garden Company, a holding company, and its direct and indirect subsidiaries through which substantially all of our operations are actually conducted. Our telephone number is 212-465-6000, our internet address is http://www.themadisonsquaregardencompany.com and the investor relations section of our web site is http://investor.msg.com. We make available, free of charge through the investor relations section of our web site, annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as well as proxy statements, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (“SEC”). References to our web site addressed in this report are provided as a convenience and the information contained on, or available through our web site is not part of this or any other report we file with or furnish to the SEC.

The Company was incorporated on July 29, 2009 as an indirect, wholly-owned subsidiary of Cablevision Systems Corporation (“Cablevision”). On January 12, 2010, Cablevision's board of directors approved the distribution of all of the outstanding common stock of the Company to Cablevision shareholders (the “Distribution”) and the Company thereafter acquired the subsidiaries of Cablevision that owned, directly and indirectly, all of the partnership interests in MSG Holdings, L.P. (“MSG L.P.”). MSG L.P. was the indirect, wholly-owned subsidiary of Cablevision through which Cablevision held the Madison Square Garden businesses until the Distribution occurred on February 9, 2010. MSG L.P. is now our wholly-owned subsidiary, through which we conduct substantially all of the business activities discussed in this Annual Report on Form 10-K.

3

Overview

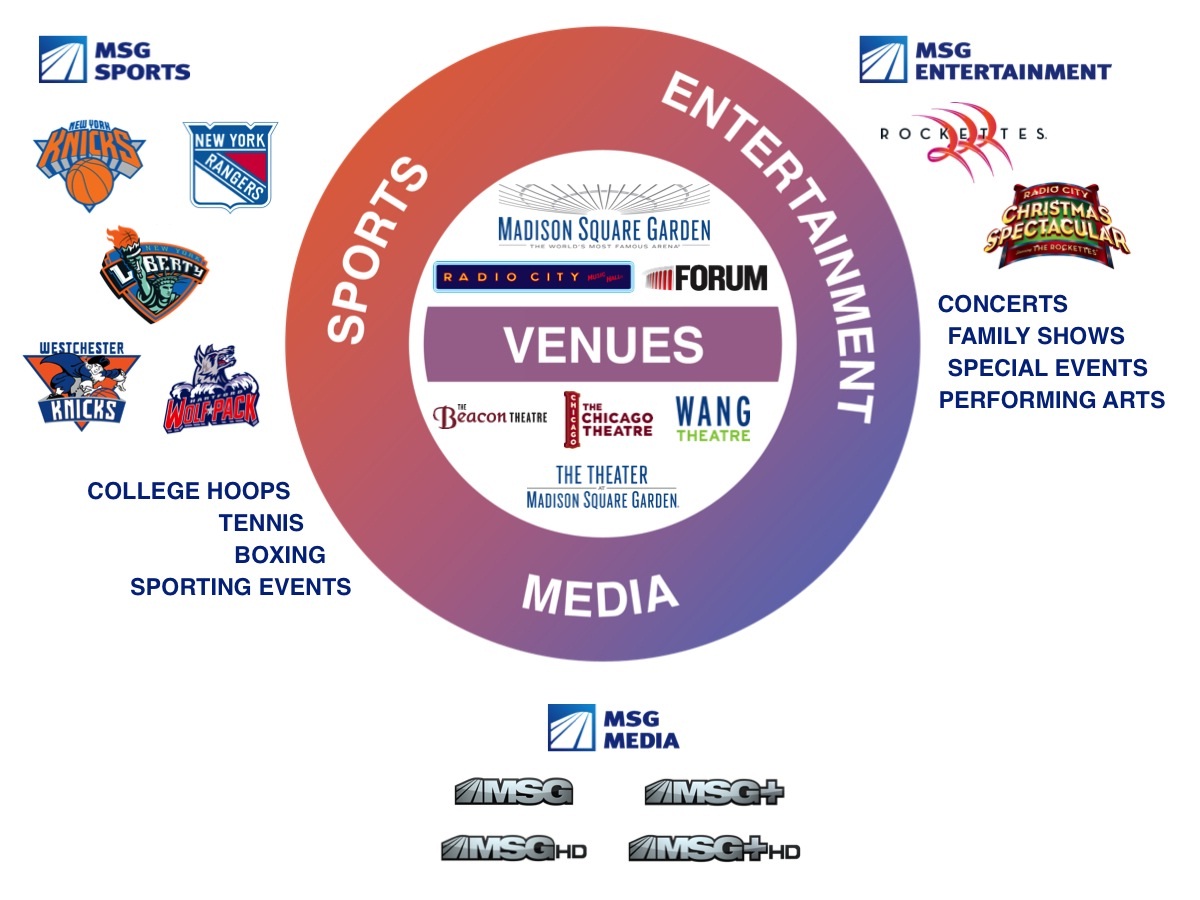

The Company is a fully integrated sports, entertainment and media business comprised of dynamic and powerful assets and brands. Madison Square Garden's business grew from the legendary venue widely known as “The World's Most Famous Arena.” Drawing on its celebrated history, the Company builds iconic brands that set the standard for excellence and innovation while forging deep connections with diverse and passionate audiences. With an unparalleled portfolio of strategically aligned venues, content and distribution channels, the Company's three business segments — MSG Sports, MSG Media and MSG Entertainment — work together to deliver exceptional experiences that endure for generations.

MSG Sports owns and operates the following sports franchises: the New York Knicks (the “Knicks”) of the National Basketball Association (the “NBA”), the New York Rangers (the “Rangers”) of the National Hockey League (the “NHL”), the New York Liberty (the “Liberty”) of the Women's National Basketball Association (the “WNBA”) and the Hartford Wolf Pack of the American Hockey League (the “AHL”). In March 2014, the Company acquired the rights to own and operate an NBA Development League (the “NBADL”) team, named the Westchester Knicks, which will launch its first season in November 2014. In addition, MSG Sports promotes, produces and/or presents a broad array of other live sporting events outside of Knicks, Rangers and Liberty games.

MSG Media is a leader in production and content development for multiple distribution platforms, including content originating from the Company's venues and is comprised of our regional sports networks, MSG Network and MSG+, collectively the “MSG Networks.” For all periods presented MSG Media also included Fuse, a national television network dedicated to music. On July 1, 2014, the Company completed the sale of Fuse to SiTV Media, Inc. for $226 million, subject to a working capital adjustment, and a 15 percent equity interest in SiTV Media, Inc., with the equity interest subject to potential reduction based on certain performance goals.

MSG Entertainment presents or hosts live entertainment events, including concerts, family shows, performing arts and special events, in our diverse collection of venues. Those venues include the Madison Square Garden Arena (which we also refer to as “The Garden”), The Theater at Madison Square Garden, Radio City Music Hall, the Beacon Theatre, The Chicago Theatre and the Wang Theatre. After purchasing the Forum in Inglewood, CA in 2012, the Company completed a successful renovation of the famed arena, which re-opened its doors in January 2014, adding yet another world-class venue to our portfolio. MSG

4

Entertainment also creates, produces and/or presents live productions, including the Radio City Christmas Spectacular, featuring the Radio City Rockettes (the “Rockettes”), that are performed in the Company's and other venues.

Our Strengths

Our key strengths are:

• | Owned sports franchises; |

• | Media assets, including affiliation agreements with distributors and exclusive sports programming rights; |

• | Iconic venues in top live entertainment markets; |

• | Diverse collection of marquee brands and content, including the Radio City Christmas Spectacular and the Rockettes; |

• | Powerful presence in the New York City metropolitan area with established core assets and expertise for strategic expansion; |

• | Unique ability to provide artists and productions with multiple distribution platforms to develop and promote their businesses; |

• | Strong industry relationships that create opportunities for new content and brand extensions; |

• | Deep connection with loyal and passionate fan bases that span a wide demographic mix; |

• | Extensive range of proprietary marketing assets, including an industry leading customer database that allows us to drive ticket sales and engagement with our brands; and |

• | Strong and seasoned management team. |

Our Strategy

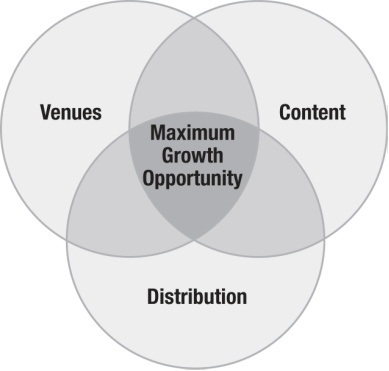

The Madison Square Garden Company pursues opportunities that capitalize on the combination of our iconic venues, our popular sports franchises, the distribution of our programming networks and our exclusive sports and entertainment content, as well as our marketing and sales expertise.

The core of MSG Sports' strategy is to develop teams that consistently compete for championships in their respective leagues. Leveraging the strength of its fan bases and the popularity of its teams, MSG Sports seeks to expand through the creation and/or acquisition of substantial, enduring sports properties and events that can be presented either inside or outside The Garden. Our extensive fan bases provide broad access to growth opportunities and new revenue streams.

Building on our iconic venues and the hallmark Radio City Christmas Spectacular and Rockettes brands, MSG Entertainment is focused on enhancing our existing productions, developing new productions and creating a network of venues in which we can deliver high-quality live content and increased bookings. We are pursuing a strategy of opportunistically acquiring, building or obtaining control of venues in key live entertainment markets. We own the Forum in Inglewood, CA and The Chicago Theatre in Chicago, and have a long-term booking agreement with respect to the Wang Theatre in Boston, which expands our geographic footprint outside of the New York City metropolitan area and provides multiple distribution outlets for our live entertainment content. Controlling and booking venues allows us to leverage our unique brands and marketing assets and increase utilization by working with artists and promoters to provide multi-market and multi-night engagements.

MSG Media has a strong foundation of recurring revenue streams supported by our ownership of Knicks, Rangers and Liberty rights, our multi-year rights for live-event coverage of the New York Islanders (the “Islanders”), the New Jersey Devils (the “Devils”), the Buffalo Sabres (the “Sabres”) and the New York Red Bulls (the “Red Bulls”), and our affiliation agreements for distribution of our programming networks. MSG Media's programming networks serve as powerful platforms through which athletes, artists and performers are connected to the nation's largest television market.

The Company believes that its competitive strength stems from combining opportunities across more than one of our segments and aligning these businesses to provide what no other organization can: sports and entertainment content derived from games and performances at our iconic venues and distributed through our programming networks.

5

Our ability to offer both marquee live performance venues and extensive public exposure through our significant marketing expertise and media platforms attracts world-class artists, performers and athletes to our businesses, and allows us to create with them relationships built on mutual benefit. We obtain quality sports and entertainment content, while the artists, performers and athletes gain unique opportunities to develop their brands. We have an expansive view of the power of this integrated approach and believe no other organization can offer athletes, artists, performers, fans and business partners comparable opportunities or experiences.

Examples of how we believe we have effectively implemented this integrated approach are:

• | Our MSG Sports and MSG Media businesses naturally complement each other — with MSG Sports providing valuable content and MSG Media serving as a vital distribution system and promotional platform. MSG Media, through MSG Networks, telecasts games of our Knicks, Rangers and Liberty teams, and we are continually exploring opportunities to enhance the relationship between MSG Sports and MSG Media through new events, both at our venues and elsewhere. In June 2014, in the weeks leading up to The Garden’s sold-out championship bout between Miguel Cotto and Sergio Martinez, MSG Network promoted the fight by featuring Cotto in a brand new episode of its original series, “The Game 365.” To generate excitement about the Men’s National Collegiate Athletic Association (“NCAA”) Basketball Tournament returning to The Garden for the first time in more than 50 years, MSG Network telecast an original program, “Hoopla: 80 Years of College Basketball at The Garden,” followed by three classic college basketball games held at Madison Square Garden. Additionally, in March 2014, these two segments paired up to, once again, take advantage of the interest and excitement of the BNP Paribas Showdown at The Garden by airing this event, featuring a match-up between top ranked tennis superstars Andy Murray and Novak Djokovic. |

• | MSG Media continues to seek opportunities to collaborate with MSG Entertainment to deliver programming that increases exposure of the Company’s brands, while differentiating our media offerings in a diverse and competitive environment. This includes MSG Network’s documentary on the historic transformation of The Garden. MSG Network already captured the first two phases of the three-year project in “The Garden Transformed: Year One” and Year Two and in December 2013, premiered the third and final installment of this original, award-winning series that takes a behind-the-scenes look at Madison Square Garden’s unprecedented, three-year, top-to-bottom transformation. January 2014 marked the start of monthly performances by the legendary Billy Joel at The Garden, with all currently announced shows running through December 2014 already sold out. MSG Network is helping to drive continued excitement and promotion for this partnership with programming throughout the summer that includes historic Billy Joel concerts, and a 30-minute special that gives fans a backstage pass to Billy Joel’s shows at The Garden, including interviews with Billy Joel and his band. This winter, MSG Network plans to unveil “The Garden’s Defining Moments,” 20, half-hour episodes that feature the iconic Garden moments currently on display in the arena as part of the newly transformed Garden, including “The Concert for New York City” and “12-12-12, The Concert for Sandy Relief.” |

• | Our integrated approach to the sale of marketing partnerships allows us to use and sell our broad array of assets in a complementary manner in order to maximize their collective value, both for the Company and for our marketing partners. Our “Marquee” marketing partnership with JPMorgan Chase and our “Signature” marketing partnerships with several other blue-chip companies integrate the assets of our venues and our three business segments. This ability to offer compelling, broad-based, integrated marketing platforms that we believe are unparalleled in sports and entertainment has enabled us to attract world-class partners, such as JPMorgan Chase, Anheuser-Busch, Coca-Cola, Delta Airlines, Kia Motors America, Lexus and SAP. |

6

• | We continue to forge deep direct-to-consumer relationships with customers and fans, with a focus on understanding how consumers interact with every aspect of the Company. A key component of this strategy is our large and growing proprietary customer database which drives revenue and engagement across segments, benefiting the Company through ticket sales, merchandise sales, sponsorship activation and viewership on television and online. This database provides us a greater opportunity to cross-promote our products and services, introducing customers to our wide range of assets and brands. For example, we have used our database to cross-promote MSG Networks' programming to fans of MSG Entertainment and MSG Sports, including the networks coverage of the Knicks, Rangers and Liberty, and its lineup of Billy Joel programming. We also continue to use our database to cross-promote events between MSG Entertainment and MSG Sports, including driving ticket sales to the Radio City Christmas Spectacular from fans of the Knicks, Rangers and Liberty. |

Our commitment to strengthening our core assets is also exemplified by the transformation of The Garden into a state-of-the-art facility (the “Transformation”) that enhances the experience of our customers, partners, athletes and entertainers and is designed to attract even more marquee events to the building, while enhancing our revenue streams (the Transformation is discussed in greater detail under “— Our Venues — The Madison Square Garden Arena Transformation”). The Transformation is designed to ensure The Garden's continued and lasting prominence as a sports and entertainment venue.

We believe the Company's unique combination of assets and integrated approach, the depth of our relationships within the sports, media and entertainment industries and strong connection with our diverse and passionate audiences, sets the Company apart in the industry and represents a substantial opportunity for growth.

At the same time, we continue to look externally for strategic opportunities to add compelling assets and brands that resonate with our customers and partners, fit with our core competencies and allow new opportunities for growth.

Our Business

MSG Sports

MSG Sports owns and operates sports franchises, as well as promotes, produces and/or presents a broad array of other live sporting events.

Our Sports Franchises

The Knicks and Rangers are two of the most recognized franchises in professional sports, with storied histories and passionate, multi-generational fan bases. These teams are major occupants of The Garden as they traditionally play a combined total of 82 regular season home games, often to at or near capacity attendance. The number of home games increases if our teams qualify for the playoffs. We did not host any preseason Rangers games in fiscal year 2014 at The Garden due to the final stage of the Transformation. The Liberty have historically played 17 regular season home games at The Garden. However, due to the final phase of the Transformation, they played their 2013 season at the Prudential Center in Newark, New Jersey before returning to The Garden for their 2014 season.

In addition to being valuable stand-alone businesses, the Knicks and Rangers provide core content for our MSG Media segment, with a total of 159 preseason, regular season and playoff games (both home and away) telecast on MSG Networks during the 2013-14 season, and generate significant audience demand for wrap-around and themed programming. As part of both team and league marketing and telecasts, our sports teams provide both regional and national visibility for the Company.

New York Knicks

As an original franchise of the NBA, the Knicks have a rich history that includes eight trips to the NBA Finals and two NBA Championships, as well as some of the greatest athletes to ever play the game. The Knicks are focused on continuing to field a championship contending team, while playing their exciting, energetic and entertaining style of basketball. The Knicks enjoy the fierce allegiance of generations of passionate and knowledgeable fans. In March 2014, Phil Jackson, who has an extraordinary history of success that includes 13 NBA championships, was named president of the Knicks. This was followed in June by Derek Fisher, a five-time NBA champion, being hired as the team's new head coach. The Knicks ranked in the top three in the NBA for ticket sales receipts for the 2013-14 regular season, which marked the fourth consecutive year that Knicks season tickets sold out.

New York Rangers

The Rangers hockey club is one of the “original six” franchises of the NHL. Winners of four Stanley Cup Championships, the Rangers have won eleven conference titles over their history. For the 2013-14 season, the Rangers, led by new coach Alain Vigneault, qualified for the playoffs for the eighth time in the last nine years and, after an inspirational run, ended the playoffs

7

as Eastern Conference Champions, having gone to the Stanley Cup Finals for the first time in twenty years. The Rangers are known to have one of the most passionate, loyal and enthusiastic fan bases in all of sports and ranked in the top three in the NHL for ticket sales receipts for the 2013-14 regular season.

New York Liberty

The Liberty was established in October 1996, when New York was selected as one of eight charter members of the WNBA. The Liberty have won three conference championships and appeared in the playoffs twelve times. The Liberty have a well-known tradition of on-court competitiveness supported by an enthusiastic and loyal fan base.

Westchester Knicks

In March 2014, the Company acquired the right to own and operate an NBADL team, which has been named the Westchester Knicks. The new team, which is the NBADL's 18th franchise, serves as the exclusive affiliate of the New York Knicks and will debut in the 2014-15 season, playing its home games at the Westchester County Center in White Plains, New York.

Hartford Wolf Pack

The Hartford Wolf Pack, a minor-league hockey team, is a player development team for the Rangers, and is also competitive in its own right in the AHL. The Rangers send draft picks and other players to the Hartford Wolf Pack for skill development and injury rehabilitation, and can call up players as needed for the Rangers roster to enhance the team's competitiveness. The Hartford Wolf Pack have reached the playoffs fourteen times out of seventeen seasons.

The Role of the Leagues in Our Operations

As franchises in professional sports leagues, our teams are members of their respective leagues and, as such, may be subject to certain limitations, under certain circumstances, on the control and management of their affairs. The respective league constitutions, under which each league is operated, together with the collective bargaining agreements (“CBAs”) each league has signed with its players' association, contain numerous provisions that, as a practical matter in certain circumstances, could impact the manner in which we operate our businesses. In addition, under the respective league constitutions, the commissioner of each league, either acting alone or with the consent of a majority (or, in some cases, a supermajority) of the other teams in the league, may be empowered in certain circumstances to take certain actions felt to be in the best interests of the league, whether or not such actions would benefit our teams and whether or not we consent or object to those actions.

While the precise rights and obligations of member teams vary from league to league, the leagues have varying degrees of control exercisable under certain circumstances over the length and format of the playing season, including preseason and playoff schedules; the operating territories of the member teams; national and international media and other licensing rights; admission of new members and changes in ownership; franchise relocations; indebtedness affecting the franchises; and labor relations with the players' associations, including collective bargaining, free agency, and rules applicable to player transactions, luxury taxes and revenue sharing. See “Part II — Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations — Business Overview — MSG Sports — Expenses.” From time to time, we may disagree with or challenge actions the leagues take or the power and authority they assert, although the leagues' governing documents and our agreements with the leagues purport to limit the manner in which we may challenge decisions and actions by a league commissioner or the league itself.

Other Sports Properties

MSG Sports also promotes, produces and/or presents a broad array of live sporting events outside of Knicks, Rangers and Liberty games. These events include, for example, professional boxing, college basketball, professional bull riding, tennis, and college wrestling. Our sports business includes events that have been among the most popular in our history, as well as perennial highlights on our annual calendar, and also features some of Madison Square Garden's longest-running associations.

Professional boxing, beginning with John L. Sullivan in 1882, has had a long association with The Garden, which has included hosting Muhammad Ali's and Joe Frazier's 1971 “Fight of the Century,” considered among the greatest sporting events in modern history, as well as bouts featuring dozens of other boxing greats. These have included Jack Dempsey, Roberto Duran, George Foreman, Emile Griffith, Willie Pep, Oscar De La Hoya, Sugar Ray Leonard, Lennox Lewis, Joe Louis, Rocky Marciano, Sugar Ray Robinson, Felix Trinidad, Roy Jones, Jr., Mike Tyson, Evander Holyfield and Miguel Cotto, who in June 2014 won his fourth world title at The Garden in front of approximately 20,000 fans.

College basketball has been a mainstay at The Garden for decades, with the sport's longest running holiday showcase, the Holiday Festival, first tipping off over 50 years ago. In addition to St. John's University calling The Garden its home away from home, the popular Big East Tournament celebrated its 32nd anniversary at The Garden in 2014. Popular college basketball

8

events also include visits from Duke University's Blue Devils, the annual Jimmy V Classic and the post-season NIT Finals. In March 2014, the East Regional Finals of The NCAA Division I Men's Basketball Championship returned to The Garden for the first time in more than 50 years. In February 2015, The Garden will welcome the 64th NBA All-Star Game, marking the fifth time the arena has hosted the illustrious professional basketball event. Additionally, The Garden hosts the annual BNP Paribas Showdown tennis event, which, since debuting in 2009, has featured tennis luminaries such as Pete Sampras, Roger Federer, Rafael Nadal, Novak Djokovic, Serena and Venus Williams and Maria Sharapova.

MSG Entertainment

Our MSG Entertainment business is one of the country's leaders in live entertainment. MSG Entertainment presents or hosts live entertainment events, including concerts, family shows, performing arts events and special events, in our diverse collection of venues. It also creates, produces and/or presents live productions that are performed in the Company's and other venues. This includes the Radio City Christmas Spectacular, featuring the Rockettes, which is the top grossing live holiday family show in North America. The venues we own or operate include The Garden, Radio City Music Hall, The Theater at Madison Square Garden, the Beacon Theatre, the Forum and The Chicago Theatre. In addition, we have a long-term exclusive booking agreement with respect to the Wang Theatre. The scope of our collection of venues enables us to showcase acts that cover a wide spectrum of genres and popular appeal. MSG Entertainment focuses on delivering unforgettable memories through spectacular productions, live events and unrivaled experiences in exceptional settings, creating demand for an association with our brands by artists and premier companies, and for our productions by the public. With a foundation of world-class expertise in live entertainment, including the historic traditions of The World's Most Famous Arena and Radio City Music Hall, as well as our other venues, MSG Entertainment has a proven ability to utilize the strength of its industry relationships, marketing assets, customer database and live event expertise, as well as the reach of MSG Media, to create performance, promotion and distribution opportunities for artists, events and productions, and to increase utilization of our venues.

Our Bookings and Other Entertainment Business Activities

MSG Entertainment is an established industry leader responsible for booking a wide variety of live entertainment events in our venues, which perennially include some of the biggest names in music and entertainment. Over the last several years, our venues have hosted artists such as Billy Joel, the Eagles, Madonna, Phish, Elton John, Eric Clapton, The Allman Brothers Band, Bruce Springsteen, Maroon 5, Taylor Swift, Justin Timberlake, Ed Sheeran, Armin Van Buuren, Sting and Paul Simon, Coldplay, One Direction, Jerry Seinfeld and Dave Chappelle; family shows such as Sesame Street Live, Yo Gabba Gabba Live and Disney Junior Live; special events such as the Tony Awards, “America's Got Talent” and appearances by His Holiness the Dalai Lama, along with graduations, upfronts and product launches; and theatrical productions such as A Christmas Story, How The Grinch Stole Christmas! and Cirque du Soleil's Zarkana.

Although we primarily license our venues to third-party promoters for a fee, we also promote or co-promote shows in which case we have economic risk relating to the event. MSG Entertainment currently does not promote or co-promote events outside of our venues other than our productions discussed below.

Our Productions

One of MSG Entertainment's core properties, the Radio City Christmas Spectacular, has been performed at Radio City Music Hall for 81 years and during the 2013 holiday season more than one million tickets were sold for performances there. Featuring the world-famous Rockettes, the critically acclaimed Radio City Christmas Spectacular features show-stopping performances, festive holiday scenes and state-of-the-art special effects. As part of our strategic commitment to invest in our core assets, the Company continues to seek opportunities to enhance the Radio City Christmas Spectacular. These enhancements include a new finale added in the 2013 holiday season, and the planned return of a fan favorite scene to the show in 2014.

Based on the success of the Radio City Christmas Spectacular at Radio City Music Hall, in 1994 the Radio City Christmas Spectacular franchise was expanded outside of New York City. During the 2014 holiday season, we expect to present the theater version of the show in targeted markets, including Omaha, Houston and, for the 13th year, at the Grand Ole Opry House in Nashville.

Since its inception, the Radio City Christmas Spectacular has played to over 70 million people in over 70 different cities. We acquired the rights to the Radio City Christmas Spectacular in 1997, and those rights are separate from, and do not depend on the continuation of, our lease of Radio City Music Hall. We also hold rights to the Rockettes in the same manner.

We continue to strengthen and broaden our Rockettes brand, targeting the most prominent and effective vehicles that elevate their visibility and underscore their reputation as beloved American cultural icons. The Rockettes have appeared or performed at high profile events, including Presidential Inaugurations, the annual Macy's Thanksgiving Day Parade, the New Year's Eve Times Square Ball Drop, the Super Bowl XLV numeral unveil, the Major League Baseball Home Run Derby, television shows

9

(“America's Got Talent,” “Project Runway,” “The Today Show,” “The Colbert Report,” “Late Night with Jimmy Fallon” and Home Shopping Network), and fashion events (Michael Kors Fashion's Night Out and Capezio Anniversary Gala), among many others. The Rockettes have established national partnerships with Zumba Fitness and Norwegian Cruise Lines, where the Rockettes were named Godmothers for the new 4,000 passenger ship, Norwegian Breakaway. In addition, the Rockettes continue to focus on dance education and training through programs in New York and other markets, including the Rockettes Summer Intensive and The Rockettes Experience. We continue to pursue carefully considered brand extension opportunities including television and public appearances, strategic partnerships, dance education and new merchandising lines.

We are investing in a new large-scale theatrical production for Radio City Music Hall featuring the Rockettes, which is expected to debut in the Spring of 2015.

MSG Media

MSG Media is a leader in production and content development for multiple distribution platforms and is comprised of our regional sports networks, MSG Network and MSG+, collectively the “MSG Networks.” These two regional networks provide a distribution outlet for content created, produced and/or presented by MSG Sports and MSG Entertainment, and thereby play a critical role in supporting, promoting and enhancing those businesses.

Over the past seven years, MSG Network has won 99 New York Emmy awards for live sports and original programming, more than any other single network or station in the region. MSG Network, MSG+ and msg.com have a combined total of 113 New York Emmy wins over the past seven years.

MSG Networks are home to seven professional sports teams, as well as critically acclaimed original programming. In addition to the Company's ownership of Knicks, Rangers and Liberty rights, MSG Networks have multi-year rights agreements with the Islanders, Devils, Sabres and Red Bulls. MSG Network and MSG+ are among the nation's largest regional cable networks and together typically telecast approximately 700 live sporting events and over 2,500 hours of live original programming each year, as well as college football and college basketball from top conferences, including the Atlantic Coast Conference (football and basketball), Big 12 (football and basketball), Conference USA (football and basketball) and the Big East (basketball).

MSG Networks continues to produce original programming that increases exposure for the Company's brands and builds on our library of compelling content. Examples include:

• | Special series such as “The Garden Transformed” and “The Garden’s Defining Moments,” which is planned to debut this winter; |

• | Critically acclaimed MSG Originals series, including “Four Courses with JB Smoove,” “Beginnings,” “The Game 365” and “The Lineup” and; |

• | Programming relating to the Knicks and Rangers, such as Knicks and Rangers coach’s shows, “MSG Profiles”, “Hockey Night Live” and dedicated pre- and post-game shows, all of which allow us to capitalize on the extraordinary enthusiasm of our teams' fans. |

MSG Network is also the official regional sports network of the New York Giants, delivering exclusive, special non-game coverage of the National Football League team, including Head Coach Tom Coughlin’s live weekly press conference. Additional programming on MSG+ includes a lineup of select NCAA college football and basketball games, the New York Racing Association horse racing, and international sports content such as Union of European Football Association league soccer, as well as original programming related to the network's professional teams. The average of the combined reach of MSG Network and MSG+ is approximately 7.8 million viewing subscribers, primarily in New York, New Jersey, and Connecticut.

Our Interactive Initiatives

The Company has a collection of web sites and mobile, video on demand and digital platforms, which are housed throughout Madison Square Garden's business segments. These interactive initiatives include more than 20 web sites, social networking sites and mobile applications for our properties. Web sites include msg.com, thegarden.com, radiocity.com, beacontheatre.com, fabulousforum.com, chicagotheatre.com, radiocitychristmas.com and rockettes.com, as well as sites dedicated to our sports teams (nyknicks.com, newyorkrangers.com, knicksnow.com, blueshirtsunited.com and newyorkliberty.com). Like our MSG Sports business, the online operations relating to our sports teams may, in certain circumstances, be subject to certain agreements, rules, policies, regulations and directives of the leagues in which the respective team operates. See “— Regulation — Regulation of Our Media Business.” These interactive properties also include the MSG Insider email, alert and mobile platform and a series of Madison Square Garden social network sites. This interactive business generates revenue for all of the

10

Company's segments via the sale of advertising and sponsorships on these digital properties. Additionally, it offers a strategic marketing asset that creates opportunities to market directly to our fans and cross-promote across our businesses.

Our Venues

The Company operates a mix of iconic venues that continue to build on their historic prominence as destinations for unforgettable experiences and events. Individually, these venues are each premier showplaces, with a passionate and loyal following of fans, performers and events. Taken together, we believe they represent an outstanding collection of venues.

We own or operate under long-term leases a total of six venues in New York City, Chicago and Inglewood, CA and have a long-term booking agreement with respect to the Wang Theatre in Boston. Our New York City venues are the Madison Square Garden Complex (which includes both The Garden and The Theater at Madison Square Garden), Radio City Music Hall and the Beacon Theatre. We also own the Forum in Inglewood, CA and the landmark Chicago Theatre.

Madison Square Garden Arena

The Madison Square Garden Arena has been a celebrated center of New York life since it first opened its doors in 1879. Over its 135-year history, there have been four Garden buildings, each known for showcasing the best of the era's live entertainment offerings. We believe that The Garden has come to epitomize the power and passion of live sports and entertainment to people around the world, with an appearance at The Garden often representing a pinnacle of an athlete's or performer's career. Known as “The World's Most Famous Arena,” The Garden has been the site of some of the most memorable events in sports and entertainment, and, along with The Theater at Madison Square Garden, has hosted hundreds of events and millions of visitors this past year. In 2009, Billboard Magazine ranked The Garden the number one venue of the decade in its respective class based upon gross ticket sales. Billboard Magazine also ranked The Garden the second highest-grossing entertainment venue of its size in the world based on the magazine's 2014 mid-year rankings. Music industry subscribers of the trade magazine Pollstar have voted The Garden “Arena of the Year” 18 out of the last 22 years.

The Garden is home to the Knicks, Rangers, and Liberty and is associated with countless “big events,” inspired performances and one-of-a-kind moments. The Garden's highlights include “The Fight of the Century” between Muhammad Ali and Joe Frazier in 1971 (considered among the greatest sporting events in history); the 1970 Knicks' NBA Championship; the Rangers' 1994 Stanley Cup Championship; three Democratic National Conventions and one Republican National Convention; a landmark visit from Pope John Paul II; Marilyn Monroe's famous birthday serenade to President John F. Kennedy; Frank Sinatra's “Main Event” concert in 1974; Elton John's record 64 performances; the only U.S. concerts from the reunited Cream; and the 25th Anniversary Rock and Roll Hall of Fame concerts. The Garden has also hosted four prominent benefit concerts, which galvanized the public to respond to national and global crises, including the first of its kind, The Concert for Bangladesh in 1972, as well as “The Concert for New York City,” following the events of 9/11; “From the Big Apple to the Big Easy”, held after Hurricane Katrina in 2005; and “12-12-12, The Concert for Sandy Relief”, in 2012.

January 2014 marked the start of monthly performances by the legendary Billy Joel at The Garden, with all currently announced shows running through December 2014 already sold out. Since Billy Joel’s first show at The Garden in 1978, the internationally acclaimed, six-time Grammy-winning New Yorker has played an important role in the venue’s iconic history that has included a record-breaking, sold-out run of 12 consecutive shows in 2006, and moving performances at both the “The Concert for New York City” and “12-12-12, The Concert for Sandy Relief” benefit concerts.

The current Madison Square Garden Complex, located between 31st and 33rd Streets and Seventh and Eighth Avenues on Manhattan's West Side, opened on February 11, 1968 with a salute to the U.S.O. hosted by Bob Hope and Bing Crosby. From a structural standpoint, the construction of the current Garden was considered an engineering wonder for its time, including its famous circular shape and unique, cable-supported ceiling, which contributes to its intimate feel. It was the first large structure built over an active railroad track. The builder, R.E. McKee, had a national reputation and was later recognized as a “Master Builder” by the construction industry. Architect Charles Luckman had one of the largest firms in the country and designed such buildings as the Prudential Tower in Boston, NASA's flight center in Houston and the Forum in Inglewood, CA.

We own the Madison Square Garden Complex, the platform on which it is built and development rights (including air rights) above our property. Madison Square Garden sits atop Pennsylvania Station, a major commuter hub in Manhattan, which is owned by the National Railroad Passenger Corporation (Amtrak). While the development rights we own would permit us to expand in the future, any such use of development rights would require various approvals from the City of New York. With the successful completion of the Transformation in October 2013, The Garden, once again, seats up to approximately 21,000 spectators for sporting and entertainment events. The Garden, along with The Theater at Madison Square Garden, contains approximately 1,100,000 square feet of floor space over 11 levels.

11

The Madison Square Garden Arena Transformation

October 25, 2013 marked the debut of a fully transformed Madison Square Garden Arena. The completion of The Garden’s three-year, top-to-bottom Transformation is driving growth across several categories, including tickets, suites, sponsorships, food, beverage and merchandise sales and will continue to have multiple benefits, including:

• | Providing a state-of-the-art venue that can continue to attract concerts, as well as other large, high-profile sports, entertainment and other special events which benefit our customers, as well as the New York City economy; |

• | Improving the experience of customers from the first row to the last; |

• | Increasing our attractiveness to free agents in basketball and hockey; |

• | Supporting our efforts to maximize our season ticket sales for our teams; |

• | Increasing the breadth of VIP offerings and venue-based opportunities available to marketing partners; |

• | Augmenting revenue streams; and |

• | Providing a new point of origination for programming for our MSG Networks studios. |

The Transformation is an example of our strategic commitment to invest in our core assets and continue to provide the kind of historic, unforgettable experiences that have long been a key component of our business. Focused on the total fan experience, the Transformation is designed to benefit everyone in attendance, whether they are first time visitors, season ticket subscribers, athletes, suite holders or marketing partners. Our customers now have access to a full list of amenities including: improved sightlines; additional entertainment and dining options; new concourses; upgraded hospitality areas; new technology; and a completely transformed interior, where the intimacy of the arena bowl and The Garden's world famous ceiling have been maintained. The Transformation of The Garden is intended to ensure that attending an event at The Garden is unlike anywhere else and is specifically highlighted by:

• | The new Chase Square Seventh Avenue entrance, which is nearly double the size of the previous entrance and features interactive kiosks, retail space, climate-controlled space, and broadcast area; |

• | Public concourses that are double or triple in width, some with spectacular city views; |

• | A new wide selection of food and beverage options, including exclusive food offerings from our MSG Signature Collection, featuring some of New York's top chefs; |

• | Improved upper bowl sightlines that put patrons over 17 degrees closer to the action; |

• | New bridges that provide one-of-a-kind views of the arena floor and offer a unique perspective for fans, which we refer to as the Chase Bridges; |

• | State-of-the-art lighting, sound and LED video systems in high definition, and new fiber-optic cabling throughout the building; |

• | Improved locker rooms, dressing rooms, green rooms and production offices; |

• | Additional restrooms with 50 percent more capacity; |

• | Unique exhibits throughout the building that celebrate the Garden’s storied history, including our Garden 366 visual retrospective and the Defining Moments exhibit on the Madison and Garden Concourse levels; and |

• | Corporate offerings that include: |

◦ | 21 Event Level suites that offer a lounge/entertaining atmosphere; |

◦ | 58 Madison Level suites that are 40 percent larger than our previous suite offerings and located as close as 23 rows up from the arena floor; |

◦ | 18 transformed 9th floor Signature Level suites; and |

12

◦ | Three new club spaces: the 1879 Club presented by J.P. Morgan, the Delta SKY360 Club on the Event Level and the Madison Club presented by Foxwoods on the 7th floor of The Garden. |

The Theater at Madison Square Garden

The Theater at Madison Square Garden, which has approximately 5,600 seats, opened as part of the fourth Madison Square Garden Complex in 1968, with seven nights of performances by Judy Garland. Since then, some of the biggest and most exciting names in live entertainment have played the theater, including The Who, Bob Dylan, Diana Ross, Elton John, James Taylor, Macklemore & Ryan Lewis, Ellie Goulding, Ricky Gervais, Neil Young, Radiohead, Jerry Seinfeld and Van Morrison. The Theater at Madison Square Garden has also hosted boxing events and the NBA Draft; award shows such as The Daytime Emmys and the Essence Awards; and other special events including Wheel of Fortune and audition shows for “America's Got Talent.” We also host a variety of theatrical productions, family shows and other special events in The Theater, including A Christmas Story, How The Grinch Stole Christmas!, Sesame Street Live and Disney's Phineas and Ferb. The Theater at Madison Square Garden is the fifth highest-grossing entertainment venue of its size in the world, based on Billboard Magazine's 2014 mid-year rankings.

Radio City Music Hall

Radio City Music Hall has a rich history as a national theatrical and cultural mecca since it was first built by theatrical impresario S.L. “Roxy” Rothafel in 1932. Known as “The Showplace of the Nation,” it was the first building in the Rockefeller Center complex and, at the time, the largest indoor theater in the world. Perhaps best known as home to the country's number one live holiday family show, the Radio City Christmas Spectacular, starring the world-famous Rockettes, Radio City Music Hall also hosts concerts, family shows and special events. See “— MSG Entertainment — Our Productions.” In 2009, Billboard Magazine ranked Radio City Music Hall the number one venue of the decade in its respective class based upon gross ticket sales. In 2013, Billboard Magazine presented Radio City Music Hall with the Top Venue (under 10,000 seats) award at its annual Billboard Touring Awards. Radio City Music Hall is the highest-grossing entertainment venue of its size in the world, based on Billboard Magazine's 2014 mid-year rankings.

In 1978, Radio City Music Hall was designated a New York City landmark by the NYC Landmarks Preservation Commission and a national landmark on the National Register of Historic Places. We acquired the lease in 1997, and in 1999, in another example of our commitment to invest in our core assets to help drive our long-term business, we invested in a complete restoration that returned the legendary theater to its original grandeur. Our acclaimed restoration included burnishing the ceilings of Radio City Music Hall with 720,000 sheets of gold and aluminum leaf, replacing the existing stage curtain with a new 112-foot wide golden silk curtain, and replacing its approximately 6,000 seats. All furniture, wall fabric, carpeting, lighting fixtures and appointments were cleaned, repaired or remade, and the three-story tall mural “The Fountain of Youth,” by Ezra Winter, which looms above the grand staircase, was cleaned of decades of grime, varnish and polyurethane. State-of-the-art sound systems, lighting and HDTV capabilities were also installed.

We lease Radio City Music Hall, located at Sixth Avenue and 50th Street in Manhattan, pursuant to a long-term lease agreement. The lease on Radio City Music Hall expires in 2023. We have the option to renew the lease for an additional ten years by providing two years' notice prior to the initial expiration date.

The Beacon Theatre

In November 2006, we entered into a long-term lease agreement to operate the legendary Beacon Theatre, a venue with approximately 2,800 seats, which sits on the corner of Broadway and 74th Street in Manhattan. The Beacon Theatre was conceived of by S. L. “Roxy” Rothafel and is considered the “older sister” to Radio City Music Hall. Designed by Chicago architect Walter Ahlschlager, the Beacon Theatre opened in 1929 as a forum for vaudeville acts, musical productions, drama, opera, and movies. The Beacon Theatre was designated a New York City landmark by the NYC Landmarks Preservation Commission in 1979 and a national landmark on the National Register of Historic Places in 1982. Over its history, the Beacon Theatre has been a venerable rock and roll room for some of the greatest names in music including The Allman Brothers Band, Steely Dan, Coldplay, Crosby Stills & Nash, Jackson Browne, Elton John, Tom Petty and the Heartbreakers and Eddie Vedder. The Beacon Theatre has also hosted film premieres and comedy events, including a five-night run from Eddie Izzard in 2014, along with numerous luminaries such as His Holiness the Dalai Lama in 2009 and 2013, and President Bill Clinton in 2006, when the Rolling Stones played a private concert in honor of his 60th birthday.

In order to ensure that we could deliver a first-class experience to customers and performers, in August of 2008 we closed the Beacon Theatre for a seven-month restoration project to return the theater to its original 1929 grandeur. The restoration of the Beacon Theatre focused on all historic, interior public spaces of the building, backstage and back-of-house areas, and was based on extensive historic research, as well as detailed, on-site examination of original, decorative painting techniques that had been covered by decades-old layers of paint. The Beacon Theatre has won several architectural awards recognizing its

13

outstanding restoration. The widely acclaimed, comprehensive restoration was similar to our restoration of Radio City Music Hall, and reflects our commitment to New York City. The Beacon Theatre was the second highest-grossing entertainment venue of its size in the world, based on Billboard Magazine's 2013 full year rankings.

Our lease on the Beacon Theatre expires in 2026.

The Forum

In June 2012, we expanded our geographic footprint even further with the purchase of the Forum in Inglewood, CA, which serves the Greater Los Angeles area. Following an extensive renovation of the historic venue, on January 15, 2014, the Forum re-opened with the first of six concerts by the legendary Eagles and is once again a thriving destination for both artists and music fans. The acquisition of the Forum establishes a significant West Coast presence for our Company and provides us with iconic arenas in each of the country's two largest entertainment markets.

With the successful completion of an extensive renovation, the Forum is now the only arena-sized venue in the country dedicated to music and entertainment, and offers something exceptional for everyone — artists, promoters, music fans, VIP customers and marketing partners. Architecturally, the interior of the bowl has been completely modernized and features superior acoustics, along with flexible seating that ranges from 7,000 seats to 17,800 seats — allowing the venue to accommodate a wide variety of premier events. Fans seated on the floor have access to one of the largest general admission floors in the country, with approximately 8,000 square feet of new event level hospitality offerings, including food and beverage, merchandise and restrooms. The new Forum also offers exclusive spaces for VIP customers, including the historic Forum Club, which has been completely re-imagined with thematic music-inspired detailing.

For artists, the Forum delivers a first-class experience that includes seven, star-caliber dressing rooms with upgraded amenities. Among the key features that were resurrected in an effort to replicate the original design is the exterior color of the venue, which has returned to the 1960's “California sunset red,” and is now officially known as “Forum Red.” Other outdoor features include the addition of a distinct and iconic Forum marquee that reflects the architecture of the venue and a 40,000 square foot terrace that surrounds the perimeter of the building and offers upgraded food and beverage amenities, elevating the guest experience.

The original Forum was designed by renowned architect, Charles Luckman, who also designed the Madison Square Garden Arena that opened in 1968. The historic West Coast venue, which opened in 1967, has played host to some of the greatest musical performers of all time, including The Rolling Stones, The Jackson 5, Bob Dylan, Led Zeppelin, Madonna, Van Halen, Foo Fighters, Coldplay and many others. In addition, the Forum was home to the Los Angeles Lakers and Los Angeles Kings until 1999.

Since re-opening in 2014, the Forum has hosted an impressive lineup of entertainers, including: the Eagles, Justin Timberlake, Paul Simon and Sting, Aerosmith, Queen with Adam Lambert, Steely Dan, Arcade Fire and Kings of Leon as well as His Holiness the Dalai Lama. In May 2014, the Forum also hosted its first boxing match since 2004, featuring Juan Manuel Marquez and Mike Alvarado, and looks forward to hosting the MTV Video Music Awards on August 24, 2014.

The Chicago Theatre

In October 2007, to extend our presence outside of New York and provide us with an anchor for content and distribution in a key market in the Midwest, we purchased the legendary Chicago Theatre, a venue with approximately 3,600 seats. The Chicago Theatre, which features its famous six-story-high “C-H-I-C-A-G-O” marquee, was built in 1921 and designed in the French Baroque style by architects Cornelius W. Rapp and George L. Rapp. It is the oldest surviving example of this architectural style in Chicago today, and was designated a Chicago landmark building in 1983 by the Mayor of Chicago and the Chicago City Council.

Today, The Chicago Theatre has become a highly attractive destination for concerts, comedy shows and other live events, hosting a wide range of entertainers, including Bob Dylan, Mumford & Sons, David Byrne, Neil Young, Steve Winwood, Jerry Seinfeld, The National, Kanye West, Conan O'Brien, Aziz Ansari, Barry Manilow and Steely Dan. The venue has also hosted theatrical tours, including A Christmas Story. The Chicago Theatre was ranked the ninth highest-grossing entertainment venue of its size in the world, based on Billboard Magazine's 2014 mid-year rankings.

The Wang Theatre

Since August 2008, we have had a booking agreement with respect to the historic Wang Theatre in Boston. Under the booking agreement, we have been utilizing our diverse relationships and experience in event production and entertainment marketing to maximize the quantity and diversity of performances staged at the Wang Theatre. These performances include theatrical productions and family shows, such as MSG Entertainment's Radio City Christmas Spectacular, Yo Gabba Gabba!, A Christmas Story, How The Grinch Stole Christmas! and concerts, such as multi-night runs by Steely Dan, Sting, Jerry Seinfeld,

14

and Furthur and performances from Leonard Cohen, Wilco, Tegan and Sara, John Legend and The Shins. The Wang Theatre seats approximately 3,600.

Our booking agreement expires in 2019. We have the option to renew the agreement at that time for an additional ten years.

Other Investments

We continue to explore additional opportunities to expand our presence and provide opportunities for growth beyond our core businesses and venues. In September 2013, the Company acquired a 50% interest in Azoff MSG Entertainment LLC (“Azoff-MSG”). The Azoff-MSG entity owns and operates businesses in the entertainment industry and is currently focused on music management, performance rights, comedy and productions, and strategic marketing.

In August 2013, the Company, in a new partnership with the owners of Brooklyn Bowl, invested in building a new venue in Las Vegas. Modeled after the successful Brooklyn Bowl destination in New York, the new Brooklyn Bowl Las Vegas opened in March 2014, bringing together live music, bowling, and a restaurant with food by the acclaimed Blue Ribbon Restaurant Group.

In March 2014, the Company announced that it purchased a 50 percent interest in Tribeca Enterprises LLC (“Tribeca Enterprises”), the company that owns and operates the acclaimed Tribeca Film Festival. The annual Festival supports and promotes both emerging and established directors and has attracted an international audience of more than 4.5 million attendees since it was founded in 2002. Tribeca Enterprises’ businesses also include Tribeca Digital Studios, a branded entertainment content business; Tribeca Cinemas, a unique event space; and Tribeca Film, an independent film distribution label.

On July 1, 2014, the Company completed the previously announced sale of Fuse to SiTV Media, Inc., the parent company of NUVOtv. NUVOtv is an English language entertainment network created for modern Latinos. As part of the transaction the Company received a 15% equity interest in SiTV Media, Inc., which is subject to potential reduction based on certain performance goals.

Garden of Dreams Foundation

Madison Square Garden has a close association with the Garden of Dreams Foundation, a non-profit charity. This foundation is dedicated to making dreams come true for children and their families facing obstacles. Working with 22 organizations in New York, New Jersey and Connecticut, including hospitals, wish organizations, homeless shelters, foster care organizations and community-based organizations, the Garden of Dreams Foundation utilizes the power and magic of The Madison Square Garden Company and its venues to bring joy and happiness to children who are facing everything from homelessness and extreme poverty, to illness and foster care. Through unique and unforgettable on-going events and programs, the foundation develops strong, long-term relationships that truly change lives. The Garden of Dreams Foundation activities include events with the Knicks, Rangers, Liberty and MSG Network; special celebrations and event attendance at The Garden, Radio City Music Hall and the Beacon Theatre; visits by Madison Square Garden celebrities; the Garden of Dreams Talent Show, where children perform on the Great Stage at Radio City Music Hall; a “Dream Week,” where children experience all areas of The Garden during a week in the summer; toy and coat drives; and the “Make A Dream Come True Program,” where children enjoy unforgettable experiences with celebrities and at events. Additionally, MSG Media hosts “classroom” programs that teach teens the inner workings of the television industry.

The depth of The Madison Square Garden Company's relationship with the Garden of Dreams Foundation, which is actively integrated with each of our business segments, reflects our commitment to positively impact our community. Since its inception in 2006 through fiscal year 2014, the Garden of Dreams Foundation and Madison Square Garden have created once-in-a-lifetime experiences for more than 250,000 tri-state area children facing obstacles.

Regulation

Regulation of Our Sports and Entertainment Businesses

Our sports and entertainment businesses are subject to legislation governing the sale and resale of tickets and consumer protection statutes generally.

In addition, many of the events produced or promoted by our sports and entertainment businesses are presented in our venues which are, like all public spaces, subject to building and health codes and fire regulations imposed by the state and local governments in the jurisdictions in which our venues are located. These venues are also subject to zoning and outdoor advertising regulations, which restrict us from making certain modifications to our facilities as of right or from operating certain types of businesses. These venues also require a number of licenses in order for us to operate, including occupancy permits, exhibition licenses, food and beverage permits, liquor licenses and other authorizations. In addition, our venues are

15

subject to the federal Americans with Disabilities Act, which requires us to maintain certain accessibility features at each of our facilities. See “Item 1A. Risk Factors — General Risks — We Are Subject to Extensive Governmental Regulation and Our Failure to Comply with These Regulations May Have a Material Negative Effect on Our Business and Results of Operations.”

The professional sports leagues in which we operate, primarily the NBA and NHL, claim the right under certain circumstances to regulate important aspects of our sports business and our team-related interactive businesses. See “— Our Business — MSG Sports — The Role of the Leagues in Our Operations.”

Regulation of Our Media Business

The Federal Communications Commission (“FCC”) imposes regulations directly on programming networks and also imposes regulations on cable television operators and satellite operators that affect programming networks indirectly. In addition, cable television programming networks, such as our MSG Networks, are also regulated by the FCC in certain respects because they are affiliated with a cable television operator like Cablevision. The rules, regulations, policies and procedures affecting our media business are subject to change.

Closed Captioning

Our programming networks must provide closed captioning of video programming for the hearing impaired. The FCC recently amended its closed captioning rules to provide for captioning quality standards and best practices regarding captioning that will become effective no earlier than January 15, 2015. We are also required to provide closed captioning on certain video content delivered via the Internet.

Commercial Loudness

FCC rules require multichannel video programming distributors to ensure that all commercials comply with specified volume standards, and certain of our affiliation agreements require us to certify compliance with such standards.

Advertising Restrictions on Children's Programming

Any of our programming and associated Internet web sites intended primarily for children under 12 years of age must comply with certain limits on commercial matter.

Obscenity Restrictions

Cable operators and other distributors are prohibited from transmitting obscene programming, and our affiliation agreements generally require us to refrain from including such programming on our networks.

Violent Programming

Some members of Congress have expressed concerns about the alleged effects of violent programming, which could lead to a renewal of interest in limiting the availability of such programming or prohibiting it.

Program Access

The “program access” provisions of the Federal Cable Act generally require satellite-delivered video programming in which a cable operator holds an attributable interest, as that term is defined by the FCC, to be made available to all multichannel video programming distributors, including satellite providers and telephone companies, on nondiscriminatory prices, terms and conditions, subject to certain exceptions specified in the statute and the FCC's rules. For purposes of these rules, the common directors and officers, and the five percent or greater stockholders of Cablevision and the Company are deemed to be cable operators with attributable interests in Madison Square Garden. As long as we continue to have common directors and major stockholders with Cablevision, our satellite-delivered video programming services will remain subject to the program access provisions.

In 2010, the FCC extended the program access rules to terrestrially-delivered programming by entities deemed affiliated with cable operators under those rules. The rules compel the licensing of such programming on nondiscriminatory price, terms and conditions in response to a complaint by a multichannel video programming distributor if the complainant can demonstrate that the lack of such programming, undue influence by the cable operator affiliate, or discrimination in the price, terms, or conditions for such programming constitutes an unfair act that significantly hinders or prevents the distributor from providing satellite cable programming.

The FCC allowed the rules that prohibited us from entering into exclusive contracts with cable operators for distribution of our satellite-delivered video programming services to sunset, and replaced them with a rule establishing a case-by-case consideration of exclusive contracts under the standard described above applicable to terrestrially-delivered programming. The

16

FCC also has solicited comment on whether its rules should be modified to address (i) treatment of volume price discounts under its anti-discrimination rules, (ii) uniform price increases by cable-affiliated programmers under its program access rules, (iii) buying group eligibility to file program access complaints, and (iv) a rebuttable presumption that certain practices engaged in by cable-affiliated programmers constitute an “unfair act.” The Company submitted its comments to the FCC in respect of the foregoing.

Program Carriage

In 2011, the FCC sought comment on proposed changes to the rules governing carriage agreements between cable programming networks and cable operators or other multichannel video distributors. Some of these changes could give an advantage to cable programming networks that are not affiliated with any distributor and make it easier for those programming networks to challenge a distributor's decision to terminate a carriage agreement or to decline to carry a network in the first place.

Wholesale “A La Carte”

The FCC has periodically considered whether cable programming networks require programming distributors to purchase and carry undesired programming in return for the right to carry desired programming and, if so, whether such arrangements should be prohibited. In May 2013, legislation was introduced in Congress that seeks to require, among other things, programmers to offer programming distributors the right to carry individual programming networks without the obligation to also carry other programming networks as part of a wholesale bundle. No action was taken on the proposed legislation.

Effect of “Must-Carry” Requirements

The FCC's implementation of the statutory “must-carry” obligations requires cable and satellite operators to give broadcasters preferential access to channel space. This may reduce the amount of channel space that is available for carriage of our networks by cable television systems and satellite operators.

Satellite Carriage

All satellite carriers must under federal law offer their service to deliver our and our competitors' programming networks on a nondiscriminatory basis (including by means of a lottery). A satellite carrier cannot unreasonably discriminate against any customer in its charges or conditions of carriage.

Media Ownership Restrictions

FCC rules set media ownership limits that restrict, among other things, the number of daily newspapers and radio and TV stations in which a single entity may hold an attributable interest as that term is defined by the FCC. The fact that the common directors and five percent or greater voting stockholders of Cablevision and the Company currently hold attributable interests in each of the companies for purposes of these rules means that these cross ownership rules may have the effect of limiting the activities or strategic business alternatives available to us, at least for as long as we continue to have common directors and major stockholders with Cablevision.

Web sites and Mobile Application Requirements

We maintain various web sites and mobile applications that provide information and content regarding our businesses, offer merchandise and tickets for sale and make available sweepstakes and/or contests. The operation of these web sites and applications may be subject to a range of federal, state and local laws such as privacy, accessibility for persons with disabilities and consumer protection regulations. The online and mobile operations relating to our sports teams may, in certain circumstances, be subject to certain agreements, rules, policies, regulations and directives of the leagues in which the respective team operates. See “— Our Business — MSG Sports — The Role of the Leagues in Our Operations.”

Competition

Competition in Our Sports Business

Our sports business operates in a market in which numerous sports and entertainment opportunities are available. In addition to the NBA, NHL and WNBA teams that we own and operate, the New York City metropolitan area is home to two Major League Baseball teams (the Yankees and the Mets), two National Football League teams (the Giants and the Jets), two additional NHL teams (the Islanders and the Devils), a second NBA team (the Nets) and two Major League Soccer franchises (the Red Bulls, and, beginning in 2015, the NYC FC). In addition, there are a number of other amateur and professional teams that compete in other sports, including at the collegiate and minor league levels. New York is also home to the U.S. Open tennis event each summer, as well as many other non-sports related entertainment options.

17

As a result of the large number of options available, we face strong competition for the general New York area sports fan. We must compete with these other sporting events in varying respects and degrees, including on the basis of the quality of the teams we field, their success in the leagues in which they compete, our ability to provide an entertaining environment at our games and the prices we charge for our tickets. In addition, for fans who prefer the unique experience of NHL hockey, we must compete with the Islanders and Devils as well as, in varying respects and degrees, with other NHL hockey teams and the NHL itself. Similarly, for those fans attracted to the equally unique experience of NBA basketball, we must compete with the Nets as well as, in varying respects and degrees, with other NBA teams and the NBA itself. In addition, we also compete to varying degrees with other productions and live entertainment events for advertising and sponsorship dollars.

See “Item 1A. — Risk Factors — Risks Relating to Our Sports Business — Our Sports Business Faces Intense and Wide-Ranging Competition, Which May Have a Negative Material Effect on Our Business and Results of Operations.”

Competition in Our Entertainment Business

Our entertainment business competes, in certain respects and to varying degrees, with other live performances, sporting events, movies, home entertainment (including the Internet and online services, television, home video and gaming devices) and the large number of other entertainment and public attraction options available to members of the public. Our businesses, such as our live productions and our sporting events, typically represent alternative uses for the public's entertainment dollar. The primary geographic area in which we operate, New York City, is among the most competitive entertainment markets in the world, with the world's largest live theater industry and extensive performing arts venues, twelve major professional sports teams, numerous museums, galleries and other attractions, and numerous movie theaters available to the public. In September 2012, a 19,000 seat arena opened in Brooklyn, New York. Our venues outside of New York City similarly compete with other entertainment options in their respective markets and elsewhere. We compete with these other entertainment options on the basis of the quality of our productions and the public's interest in our content, as well as on the price of our tickets and the quality and location of our venues.

We compete for bookings with a large number of other venues both in the cities in which our venues are located and in alternative locations capable of booking the same productions and events. Generally, we compete for bookings on the basis of the size, quality, expense and nature of the venue required for the booking.

In addition to competition for ticket sales and bookings, we also compete to varying degrees with other productions and sporting events for advertising and sponsorship dollars.

See “Item 1A. Risk Factors — Risks Relating to Our Entertainment Business — Our Entertainment Business Faces Intense and Wide-Ranging Competition Which May Have a Material Negative Effect on Our Business and Results of Operations.”

Competition in Our Media Business

Distribution of Programming Networks

The business of distributing programming networks to cable television systems and satellite, telephone and other multichannel video programming distributors (“Distributors”) is highly competitive. Our programming networks face competition from other programming networks for the right to be carried by a particular Distributor, and for the right to be carried on the service tier that will attract the most subscribers. Once our programming network is carried by a Distributor, that network competes for viewers not only with the other channels available through the Distributor, but also with television, pay-per-view channels and video on demand channels, as well as Internet and online services, mobile applications, radio, print media, motion picture theaters, DVDs, and other sources of information, sporting events and entertainment. Important to our success in each area of competition MSG Media faces are the prices we charge for our programming networks; the quantity, quality and variety of programming offered on our networks; and the effectiveness of our networks' marketing efforts.

Our ability to successfully compete with other programming networks for distribution may be hampered because the Distributors through which distribution is sought may be affiliated with other programming networks. In addition, because such affiliated Distributors may have a substantial number of subscribers, the ability of such programming networks to obtain distribution on affiliated Distributors may lead to increased subscriber and advertising revenue for such networks because of their increased penetration compared to our programming networks. Even if such affiliated Distributors carry our programming networks, there is no assurance that such Distributors would not place their affiliated programming network on a more desirable tier, thereby giving the affiliated programming network a competitive advantage over our own.

New or existing programming networks that are owned by or are affiliates of broadcast networks like NBC, ABC, CBS or FOX may also have a competitive advantage over our networks in obtaining distribution through the “bundling” of agreements to carry those programming networks with the agreements giving the cable system or other Distributor the right to carry a broadcast station affiliated with the network.

18