Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NEW JERSEY RESOURCES CORP | form8-kpenneast.htm |

| EX-99.1 - EXHIBIT 99.1 PENNEAST PRESS RELEASE - NEW JERSEY RESOURCES CORP | exhibit991penneastpressrel.htm |

Exhibit 99.2

Investor Fact Sheet |

NYSE: NJR |

NJR CONTACTS: | ||||

JOANNE FAIRECHIO, DIRECTOR, INVESTOR RELATIONS | 732-378-4967 | |||

DENNIS PUMA, DIRECTOR, INVESTOR RELATIONS | 732-938-1229 | |||

PATRICK MIGLIACCIO, TREASURER | 732-938-1114 | |||

August 12, 2014

NJR AND OTHERS FORM PENNEAST PIPELINE COMPANY, LLC TO SUPPLY MARCELLUS NATURAL GAS TO THE MID-ATLANTIC REGION

OVERVIEW

On August 11, 2014, NJR Pipeline Company, a midstream subsidiary of New Jersey Resources Corporation (NJR) and three others formed PennEast Pipeline Company, LLC (PennEast), with plans to construct a 100-mile pipeline extending from northeast Pennsylvania to western New Jersey. The pipeline is anticipated to cost almost $1 billion with the investment split among the four participants in the project: NJR Pipeline Company, South Jersey Industries, and subsidiaries of AGL Resources and UGI Corporation.

PROPOSED PIPELINE ROUTE AND CAPACITY

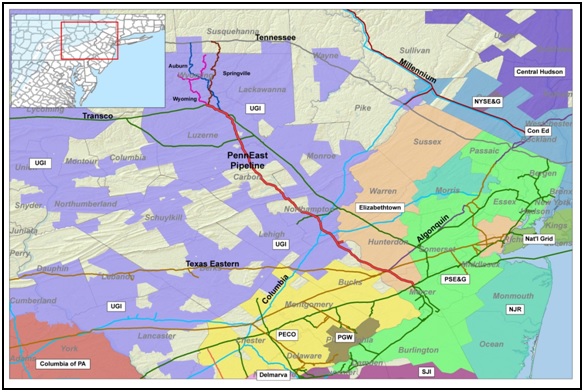

PennEast is designed to provide natural gas service to the equivalent of 4.7 million homes, or up to 1,000,000 dekatherms per day. The 30-inch pipeline will originate in Luzerne County in northeastern Pennsylvania and end at Transco’s Trenton-Woodbury interconnection in New Jersey. UGI Energy Services (UGIES) is project manager for the development of the project.

Exhibit 99.2

THE PRODUCTION AREA

Prior to the development of the Marcellus Shale, natural gas lines delivered natural gas primarily from the Gulf of Mexico region and Canada into the Northeast. According to the U.S. Energy Information Administration, Pennsylvania is the fastest growing natural gas producing state in the country. An estimated 5+ Bcf per day of natural gas is produced through various wells as illustrated below in the Marcellus region targeted by the project. The PennEast sponsors recognized the opportunity to use locally-produced gas to serve growing markets in the Mid-Atlantic Region.

PROPOSED TIMELINE

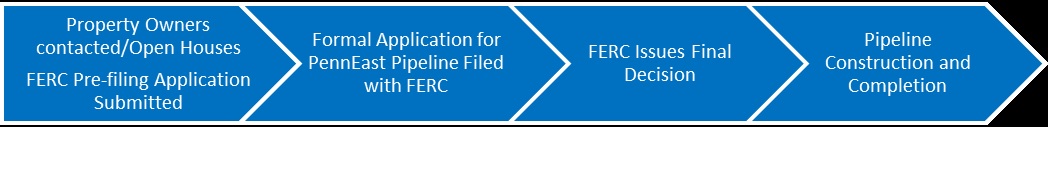

PennEast is completing preliminary engineering studies and plans to submit a formal application to the Federal Energy Regulatory Commission (FERC) in 2015. If all local, state and federal approvals are timely obtained, construction of the pipeline will begin in early 2017 with an in-service date of November 2017.

Exhibit 99.2

ABOUT NEW JERSEY RESOURCES

New Jersey Resources (NYSE: NJR) is a Fortune 1000 company that provides safe and reliable natural gas and clean energy services, including transportation, distribution and asset management. With annual revenues in excess of $3 billion, NJR is comprised of five primary businesses:

• | New Jersey Natural Gas is NJR’s principal subsidiary that operates and maintains 7,000 miles of natural gas transportation and distribution infrastructure to serve over half a million customers in New Jersey’s Monmouth, Ocean and parts of Morris and Middlesex counties. |

• | NJR Energy Services manages a diversified portfolio of natural gas transportation and storage assets and provides physical natural gas services and customized energy solutions to its customers across North America. |

• | NJR Clean Energy Ventures invests in, owns and operates solar and onshore wind projects with a total capacity in excess of 85 megawatts, providing residential and commercial customers with low-carbon solutions. |

• | NJR Midstream serves customers from local distributors and producers to electric generators and wholesale marketers through its equity ownership in a natural gas storage facility and transportation pipelines, including Steckman Ridge, a 5.53 percent stake in Iroquois Pipeline and the proposed PennEast Pipeline project. |

• | NJR Home Services provides heating, central air conditioning, standby generators, solar and other indoor and outdoor comfort products to residential homes and businesses throughout New Jersey and serves approximately 119,000 service contract customers. |

NJR and its more than 900 employees are committed to helping customers save energy and money by promoting conservation and encouraging efficiency through Conserve to Preserve® and initiatives such as The SAVEGREEN Project® and The Sunlight Advantage®.

FORWARD LOOKING STATEMENTS

This news release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. NJR cautions readers that the assumptions forming the basis for forward-looking statements include many factors that are beyond NJR’s ability to control or estimate precisely, such as estimates of future market conditions and the behavior of other market participants. Words such as “anticipates,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “intends,” “plans,” “believes,” “should” and similar expressions may identify forward-looking information and such forward-looking statements are made based upon management’s current expectations and beliefs, as of this date, concerning future developments and their potential effect upon NJR. There can be no assurance that future developments will be in accordance with management’s expectations or that the effect of future developments on NJR will be those anticipated by management. Forward-looking information in this release includes, but is not limited to, certain statements regarding the proposed PennEast pipeline, including those related to the size of NJR’s investment, the route and capacity of the pipeline, the economic benefits PennEast will provide to the local economy, the effect of PennEast on energy costs, and the proposed timeline for approval and construction of the pipeline.

Exhibit 99.2

The factors that could cause actual results to differ materially from NJR’s expectations include, but are not limited to, weather and economic conditions; volatility of natural gas and other commodity prices; changes in rating agency requirements and/or credit ratings and their effect on availability and cost of capital to the Company; the impact of volatility in the credit markets on our access to capital; commercial and wholesale credit risks, including the availability of creditworthy customers and counterparties and liquidity in the wholesale energy trading market; the ability to obtain governmental approvals and/or financing for the construction, development and operation of certain non-regulated energy investments; risks associated with the management of the company's joint ventures and partnerships;;operating risks incidental to handling, storing, transporting and providing customers with natural gas; risks related to our employee workforce, including a work stoppage; the regulatory and pricing policies of federal and state regulatory agencies; the costs of compliance with present and future environmental laws, including potential climate change-related legislation; risks related to changes in accounting standards; environmental-related and other litigation and other uncertainties; risks related to cyber-attack of failure of information technology systems; and the impact of natural disasters, terrorist activities, and other extreme events on our operations. The aforementioned factors are detailed in the “Risk Factors” sections of our Annual Report on Form 10-K filed on November 26, 2013, as filed with the Securities and Exchange Commission (SEC), which is available on the SEC’s website at sec.gov. Information included in this release is representative as of today only and while NJR periodically reassesses material trends and uncertainties affecting NJR's results of operations and financial condition in connection with its preparation of management's discussion and analysis of results of operations and financial condition contained in its Quarterly and Annual Reports filed with the SEC, NJR does not, by including this statement, assume any obligation to review or revise any particular forward-looking statement referenced herein in light of future