Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - eFleets Corp | v386408_8-k.htm |

Exhibit 99.1

Company Presentation

2 Safe Harbor Statement: This presentation contains forward - looking statements as defined within Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. By their nature, forward - looking statements and forecasts involve risks and uncertainties because they relate to events and depend on circumstances that will occur in the near future. Those statements include statements regarding the intent, belief or current expectations of eFleets Corporation and members of their respective management as well as the assumptions on which such statements are based. Prospective investors are cautioned that any such forward - looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those contemplated by such forward - looking statements. eFleets Corporation undertakes no obligation to update or revise forward - looking statements to reflect changed conditions.

3 Offering Summary Issuer eFleets Corporation Symbol OTCQB: EFLT Offering Size Approximately $4,000,000 of Common Stock & Warrants (100% Primary) Over - Allotment 15% (100% Primary) Use of Proceeds Purchase capital equipment, to fund the purchase of inventory and for working capital and general corporate purposes. Sole Book - Runner Aegis Capital Corp.

4 All - Electric Light Weight Commercial Utility Vehicles

5 Essential Services: $5B Market Parking Enforcement Correctional Facilities Airports Seaports Universities Parks Warehouses / Fulfillment Centers Small Package Delivery (1) Source: Internal Company Estimates & Industry Reports

6 Business Economics (1) : Annual ESV Market – 100,000 Vehicle Replacement Market – 20% Per Year Annual Market Size – $600,000,000 Sales Growth – Target > 50% Year Over Year Gross Margins – Target 48% EBITDA – Target 15% Growing to > 20% (1) Source: Internal Company Estimates & Industry Reports

7 GO - 4 Interceptors Replaced By FireFly® ESV Reduces Operating Cost by > 85% Parking Enforcement:

8 Vehicle Comparison GO - 4 FireFly ® MSRP $25,267 $29,775 Operating Cost Per Mile $.24 (1) $.03 (2) Fuel Gas Electric Speed 40 MPH 50 MPH Manufacturer Warranty 1 Year 3 Year (1)Based on average gas price of $3.60/gallon (2)Based on average retail price of electricity $.0987/Kwhr

9 Case Study: Parking Enforcement Costs (15,000 Miles/Year) GO - 4 (1) FireFly (2) Savings Vehicle Purchase Price $25,267 $29,775 $(4,508) Operating & Maintenance $14,850 $840 $14,011 One Year Total Cost $40,117 $30,615 $9,502 Five Year Total Cost (3) $99,517 $33,975 $65,542 (2)Based on average retail price of electricity $.0987/Kwhr (1)Based on average gas price of $3.60/gallon and maintenance cost of $.75/mile

10 Correctional Facilities:

11 Case Study: Correctional Facilities Costs (42,000 Miles/Year) Chevy Pickup (1) FireFly ER (2) Savings Vehicle Purchase Price $22,000 $40,000 $(18,000) Operating & Maintenance $42,204 $1,484 $40,720 One Year Total Cost $64,204 $41,484 $22,720 Five Year Total Cost (3) $233,020 $47,420 $185,600 (2)Based on average retail price of electricity $.0987/Kwhr (3)FireFly purchase represents IRR of ~ 176% (1)Based on cost figures provided by Virginia Dept Corrections Fleet Supervisor. (Fuel~$36k, Maint~$6K)

12 Environmental Benefits: Zero Emissions Vehicle Reduction In Greenhouse Gases Reduction In Oil Dependence CO 2 Pollution Reduction: – Each Gallon of Gasoline Burned Produces ~ 19lb CO 2 – Each ICE Vehicle Produces ~ 19,000lb CO 2 Per Year – Fleet of 100 FireFly Vehicles Saves ~ 1.9m lb CO 2 /Yr

Domestic Market: Current & Future 13 Current purchase orders With Municipalities Current Sales Pipeline With Municipalities Future Prospects Replacement of all GO - 4 Vehicles

14 Growth Potential: Domestic Market: – US Postal Svc - 185,947 vehicles in fleet – FedEx/UPS – over 136,000 vehicles in fleets – GSA/DOD (excluding Post office) – 90,995 vehicles International Market - Distribution/Joint Venture Product Growth – 4 wheeled vehicle, power plant, Battery Management System

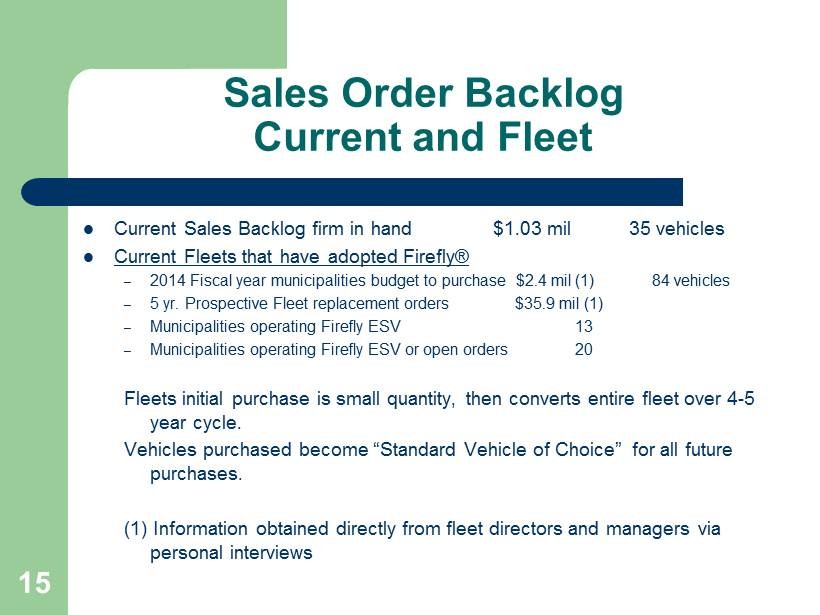

Sales Order Backlog Current and Fleet Current Sales Backlog firm in hand $1.03 mil 35 vehicles Current Fleets that have adopted Firefly® – 2014 Fiscal year municipalities budget to purchase $2.4 mil (1) 84 vehicles – 5 yr. Prospective Fleet replacement orders $35.9 mil (1) – Municipalities operating Firefly ESV 13 – Municipalities operating Firefly ESV or open orders 20 Fleets initial purchase is small quantity, then converts entire fleet over 4 - 5 year cycle. Vehicles purchased become “Standard Vehicle of Choice” for all future purchases. (1) Information obtained directly from fleet directors and managers via personal interviews 15

16 Firefly Vehicles Delivered to Clayton, MO and Seattle, WA

17 Fleet Deployments: Representative Seattle, Washington Clayton, Missouri Santa Monica, California Roanoke, Virginia San Francisco, California Chattanooga, Tennessee Hermosa Beach, California Huntington Park, CA

18 Sales Pipeline Orders (Representative): – Federal Bureau of Prisons, Terre Haute, IN – Huntington Park, California – San Francisco, California – Seattle, Washington – No Virginia University, Annandale, Virginia Qualified Prospects: – California, Washington, Oregon – 392 Vehicles – East Coast Cities – 668 Vehicles – Midwest/Other Cities – 123 Vehicles

19

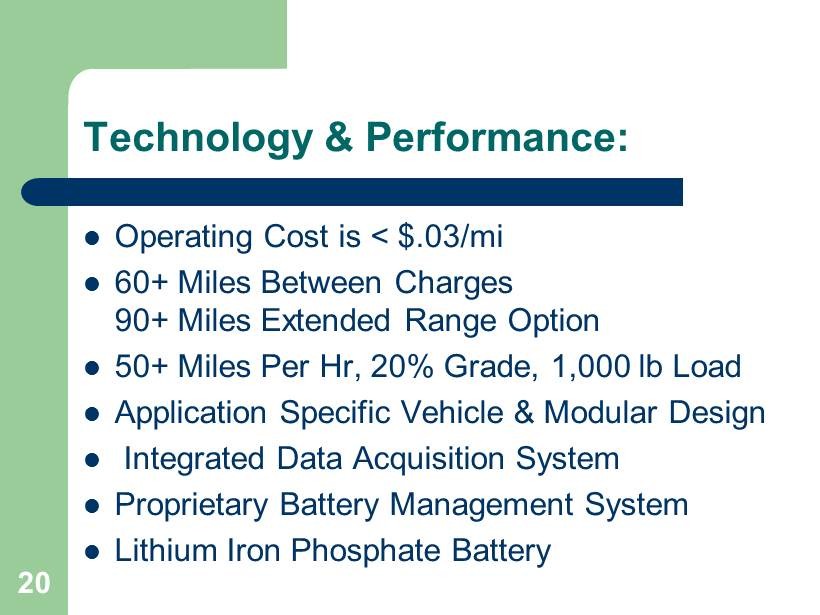

20 Technology & Performance: Operating Cost is < $.03/mi 60+ Miles Between Charges 90+ Miles Extended Range Option 50+ Miles Per Hr, 20% Grade, 1,000 lb Load Application Specific Vehicle & Modular Design Integrated Data Acquisition System Proprietary Battery Management System Lithium Iron Phosphate Battery

Management Team James Emmons, President & CEO Greg Horne, CTO Rob Stewart, VP Operations Todd Marcucci, VP R&D Eric Burmeister, Regional Sales Director 21

Board of Directors James Emmons, President & CEO Greg Horne, CTO and Secretary John Maguire Robert S. Kretschmar Julian Stourton 22

Use of Proceeds: Proceeds applied to Growth Drivers: – Inventory – volume purchases to drive cost down – Tooling/equipment – Execute Sales Orders – Add new dealers/sales personnel to accelerate sales growth 23

24 Summary: Large & Underserved Essential Services Market Profitable Business Model Growth Potential Efficient Use of Capital Application Specific Vehicle & Modular Design Proprietary Technology Experienced & Passionate Management Team

James Emmons, CEO (817) 616 - 3161