Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DITECH HOLDING Corp | d771531d8k.htm |

| EX-99.1 - EX-99.1 - DITECH HOLDING Corp | d771531dex991.htm |

Second Quarter 2014 Earnings Presentation

August 11, 2014

Exhibit 99.2 |

Forward-Looking Statements

1

Certain statements in this report, constitute “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended,

or the Exchange Act. Statements that are not historical fact are forward-looking statements. Certain

of these forward-looking statements can be identified by the use of words such as “believes,” “anticipates,” “expects,” “intends,” “plans,”

“projects,” “estimates,” “assumes,” “may,” “should,”

“will,” or other similar expressions. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors, and our actual results, performance or

achievements could differ materially from future results, performance or achievements expressed in

these forward-looking statements. These forward-looking statements are based on our current beliefs, intentions and expectations. These

statements are not guarantees or indicative of future performance. Important assumptions and other

important factors that could cause actual results to differ materially from those forward-looking statements include, but are not limited to, those

factors, risks and uncertainties described below and in more detail in our Annual Report on Form

10-K for the year ended December 31, 2013 under the caption “Risk Factors,” in Part II, Item 1A. “Risk Factors” of our Quarterly Report on Form

10-Q for the quarter ended June 30, 2013 and in our other filings with the SEC.

In particular (but not by way of limitation), the following important factors, risks and uncertainties

could affect our future results, performance and achievements and could cause actual results, performance and achievements to differ materially

from those expressed in the forward-looking statements:

•

increased scrutiny and potential enforcement actions by federal and state agencies, including a pending

investigation by the CFPB and the FTC, the investigation by the Department of Justice and HUD, and the investigations by the state

attorneys general working group;

•

uncertainties related to our ability to meet increasing performance and compliance standards, such as

those of the National Mortgage Settlement, and reporting obligations and increases to the cost of doing business as a result thereof;

•

uncertainties related to inquiries from government agencies into collection, foreclosure, loss

mitigation, bankruptcy, loan servicing transfers and lender-placed insurance practices;

•

uncertainties relating to interest curtailment obligations and any related financial and litigation

exposure (including exposure relating to false claims);

•

unexpected losses resulting from pending, threatened or unforeseen litigation, arbitration or other

third-party claims against the Company;

•

changes in, and/or more stringent enforcement of, federal, state and local policies, laws and

regulations affecting our business, including mortgage and reverse mortgage originations and servicing and lender-placed insurance;

•

loss of our loan servicing, loan origination, insurance agency, and collection agency licenses, or

changes to our licensing requirements;

•

our ability to remain qualified as a GSE approved seller, servicer or component servicer, including the

ability to continue to comply with the GSEs’ respective loan and selling and servicing guides;

•

the substantial resources (including senior management time and attention) we devote to, and the

significant compliance costs we incur in connection with, regulatory compliance and regulatory examinations and inquiries, and any fines,

penalties or similar payments we make in connection with resolving such matters; •

our ability to earn anticipated levels of performance and incentive fees on serviced business; •

the ability of our customers, under certain circumstances, to terminate our servicing and

sub-servicing agreements, including agreements relating to our management and disposition of real estate owned properties for GSEs and investors;

•

a downgrade in our servicer ratings by one or more of the rating agencies that rate us as a residential

loan servicer; •

our ability to satisfy various GSE and other capital requirements applicable to our business; •

uncertainties relating to the status and future role of GSEs, and the effects of any changes to the

servicing compensation structure for mortgage servicers pursuant to programs of GSEs or various regulatory authorities;

•

changes to HAMP, HARP, the HECM program or other similar government programs; •

uncertainties related to the processes for judicial and non-judicial foreclosure proceedings,

including potential additional costs, delays or moratoria in the future or claims pertaining to past practices;

•

our ability to implement strategic initiatives, particularly as they relate to our ability to raise

capital and develop new business, including acquisitions of mortgage servicing rights, the development of our originations business and the

implementation of delinquency flow loan servicing programs, all of which are subject to customer demand

and various third-party approvals;

•

risks related to our acquisitions, including our ability to successfully integrate large volumes of

assets and servicing rights, as well as businesses and platforms, that we have acquired or may acquire in the future into our business, any delay

or failure to realize the anticipated benefits we expect to realize from such acquisitions, and our

ability to obtain approvals required to acquire and retain servicing rights and other assets in the future;

•

risks related to the financing incurred in connection with past or future acquisitions and operations,

including our ability to achieve cash flows sufficient to carry our debt and otherwise comply with the covenants of our debt;

•

risks related to the high amount of leverage we utilize in the operation of our business; •

our dependence upon third-party funding in order to finance certain of our businesses; •

the effects of competition on our existing and potential future business, including the impact of

competitors with greater financial resources and broader scopes of operation;

•

our ability to successfully develop our loan originations platforms; •

the occurrence of anticipated growth of the specialty servicing sector and the reverse mortgage sector;

•

local, regional, national and global economic trends and developments in general, and local, regional

and national real estate and residential mortgage market trends in particular;

•

continued uncertainty in the United States home sales market, including both the volume and pricing of

sales, due to adverse economic conditions or otherwise;

•

fluctuations in interest rates and levels of mortgage originations and prepayments; •

changes in regards to the rights and obligations of property owners, mortgagors and tenants; •

changes in public, client or investor opinion on mortgage origination, loan servicing and debt

collection practices;

•

the effect of our risk management strategies, including the management and protection of the personal

and private information of our customers and mortgage holders and the protection of our information systems from third-party

interference (cyber security);

•

changes in accounting rules and standards, which are highly complex and continuing to evolve in the

forward and reverse servicing and originations sectors;

•

the satisfactory maintenance of effective internal control over financial reporting and disclosure

controls and procedures;

•

our continued listing on the New York Stock Exchange; and •

the ability or willingness of Walter Energy, our prior parent, and other counterparties to satisfy

material obligations under agreements with us.

All of the above factors, risks and uncertainties are difficult to predict, contain uncertainties that

may materially affect actual results and may be beyond our control. New factors, risks and uncertainties emerge from time to time, and it is not

possible for our management to predict all such factors, risks and uncertainties or to assess the

effect of each such new factor, risk and uncertainty on our business.

Although we believe that the assumptions underlying the forward-looking statements contained herein

are reasonable, any of the assumptions could be inaccurate, and therefore any of these statements included herein may prove to be

inaccurate. In light of the significant uncertainties inherent in the forward-looking statements

included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions

described in such statements or our objectives and plans will be achieved. We make no commitment to

revise or update any forward-looking statements in order to reflect events or circumstances after the date any such statement is made,

except as otherwise required under the federal securities laws. If we were in any particular instance

to update or correct a forward-looking statement, investors and others should not conclude that we would make additional updates or

corrections thereafter except as otherwise required under the federal securities laws.

|

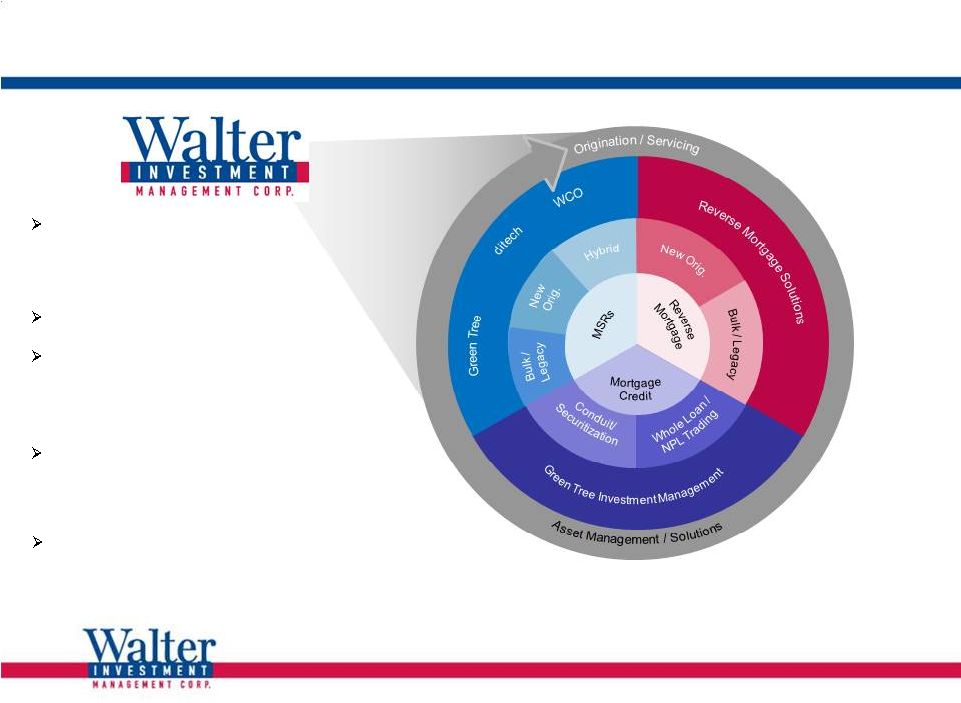

Walter

Investment Overview 2

Servicing &

Complementary

Businesses

Originations

Walter Capital

Opportunity Corp.

Please

refer

to

the

introductory

slides

of

this

presentation,

as

well

as

additional

disclosures

in

the

Appendix

and

in

our

Form

10-Q

for

the

quarter

ended

June

30,

2014 and other filings with the SEC, for important information regarding

Forward-Looking Statements and the use of Non-GAAP Financial Measures.

Diversified Business Centered in the Mortgage Servicing Sector

Value added business model designed to align interest

with owners of credit / GSEs and consumers

Focus on stable, recurring fee based-revenue streams

generated by servicing and complementary

businesses

Servicing platform and servicing quality highly rated

by S&P, Moody's, Fitch and FNMA

Complementary businesses leverage the 2.3 MN unit

servicing portfolio

Forward Originations business focused on retention

opportunity and build out of retail platform

Reverse Mortgage business a leading issuer and

highly regarded servicer in reverse mortgage sector

Investment Management business manages third-party

assets, driving fee-based revenue |

Significant Alignment Exists in the Specialty Servicing

Industry Between Key Constituencies

3

Walter is driving toward a best-in-class culture of compliance and consumer

experience Efficient servicing provides significant benefits to

homeowners: •

Nearly 123,000 modifications over the last 36 months

•

~14,000 modifications this quarter

•

Originated over 92,000 HARP loans since February 2013

Best-in-class performance will drive shareholder value

Please

refer

to

the

introductory

slides

of

this

presentation,

as

well

as

additional

disclosures

in

the

Appendix

and

in

our

Form

10-Q

for

the

quarter

ended

June

30,

2014 and other filings with the SEC, for important information regarding

Forward-Looking Statements and the use of Non-GAAP Financial Measures.

Best Practices in

Transfers

Accuracy of

Information

Managed

Counterparty Risk

Strong Portfolio

Performance

Regulators/Agencies

Reduces industry risks

Stability in industry

•

Lowers risk at agencies

•

Maximizes consumer

outcomes

Consumer/

Homeowner

Efficient/positive

experience

Efficient/positive

experience

Stability of servicer

•

Assistance through

HAMP/HARP/similar

programs

•

Consumer stays in home

Servicer

Improves servicing

efficiencies and lowers

reputational risk

Improves servicing

efficiencies and lowers

reputational risk

Prudent financial

management

•

Value-added

performance enhances

client relationships

•

Costs lowered /

shareholder returns

improved

Investor

Reduces expense;

improves portfolio

performance

Reduces expense;

improves portfolio

performance

Stability of servicer

•

Enhances returns

•

Performance

improvement through

HAMP/HARP/similar

programs

Reduces industry risks |

Q2

2014 Highlights & Recent Developments 4

Financial Highlights

Servicing, ARM &

Originations

Reverse Mortgage

Other

•

GAAP net loss of $12.9 MN, or ($0.34) per diluted share; $1.19 adjusted for charges

related to goodwill impairment

•

AEBITDA

Adjusted Earnings after tax of $1.86 per diluted share

•

$86 MN of AEBITDA; $39 MN of APTE

•Combined AEBITDA margin of 15 bps of Average UPB

Disappearance rate of 13.8% net of recapture

Acquired $3.3 BN of UPB for ARM business with flow agreement

$72 MN of AEBITDA; $71 MN of APTE

Funded $4.4 BN of UPB

Originated more than 16,000 HARP loans; nearly 340,000 “in the

money” HARP eligible accounts in the portfolio

$(3) MN of AEBITDA; $(4) MN of APTE

Issued $359 MN of HECM securitizations, ranking #1 for HMBS issuances

Originated approximately $299 MN of UPB

Blended cash margin of 376 bps, an increase of 13 bps over Q1 spreads

Initial funding of Walter Capital Opportunity and excess spread sale of

approximately $75 MN completed July 1, 2014

Investment Management earned $34 MN of performance fees

•

Strong performance on residual trusts

Insurance

(1)

and fair value markdowns

of $199 MN

•

•

•

•

•

•

•

•

•

•

•

•

(1)

Goodwill impairment charges are not deductible for tax purposes.

(2)

The Company no longer includes changes in valuation inputs as a component of its

Adjusted Pre-tax Earnings (“APTE," formerly known as “Core Earnings") calculation

and has reflected this change in all previously reported periods as disclosed

in this document. Please

refer

to

the

introductory

slides

of

this

presentation,

as

well

as

additional

disclosures

in

the

Appendix

and

in

our

Form

10-Q

for

the

quarter

ended

June

30,

2014 and other filings with the SEC, for important information regarding

Forward-Looking Statements and the use of Non-GAAP Financial Measures.

(2) |

Combined Servicing Margin / Review

(1)

5

YTD margin in line with management expectations

Continue

to

expect

combined

servicing

margins

in

the

14

-

18

bps

range

Decrease in Q1 to Q2 margins driven by:

Positive settlement of servicing fees in Q1

Increase in compensating interest resulting from continued HARP success

Increase of servicing costs due to addition of EverBank platform/employees and

on- boarding of new portfolios

Increased advance provisions

Expect future increases in regulatory and compliance expense to be mitigated by

efficiency gains and margin improvement as portfolios mature

Expect increase in ARM APTE from acquired portfolio ramp

Combined Servicing Margin Summary

(1)

Analysis of performance requires combination of Servicing, ARM and Insurance

for comparability to peers. (2)

Average UPB and AEBITDA for YTD 2014 and 1Q 2014 includes adjustments to reflect

MSR acquisitions closed during the quarter as though they were closed

January 1, 2014 as economics (cash flows) were actually recorded for the full period. Please refer

to the introductory slides of this presentation, as well as additional disclosures in the Appendix and in our Form 10-Q for the quarter ended June 30,

2014 and other filings with the SEC, for important information regarding Forward-Looking Statements

and the use of Non-GAAP Financial Measures.

AEBITDA

APTI

AEBITDA

APTI

AEBITDA

APTI

Servicing (MN)

67

$

21

$

113

$

74

$

180

$

95

$

ARM (MN)

6

6

4

4

10

10

Insurance (MN)

13

13

16

16

29

29

86

$

40

$

133

$

94

$

219

$

134

$

Combined servicing

margin (in bps) 15

7

22

16

18

11

Adjusted Average UPB Serviced (BN)

(2)

237

$

237

$

238

$

238

$

238

$

238

$

YTD 2014

Q2 2014

Q1 2014 |

Non-Recourse Liabilities ($11.4 BN) Comprise 66% of

Total Liabilities

6

$ in thousands

$270.8 MN of residual interest in legacy Walter

Investment portfolio

Net fair value liability of $43.5 MN associated

with mandatory clean-up call obligation in

Non-Residual Trusts

Net fair value liability of $99.1 MN in Reverse

Mortgage is a positive to tangible net worth

over time

$13.0 MN of equity in servicer advance trusts

Please

refer

to

the

introductory

slides

of

this

presentation,

as

well

as

additional

disclosures

in

the

Appendix

and

in

our

Form

10-Q

for

the

quarter

ended

June

30,

2014 and other filings with the SEC, for important information regarding

Forward-Looking Statements and the use of Non-GAAP Financial Measures.

Assets of $11.5 BN collateralize $11.4 BN of non-recourse liabilities

Reverse Mortgage

Residual Trusts

Non

-Residual Trusts

Servicer and Protective Advance Financing Facilities

Assets

1,430.4

$

Liabilities

1,159.6

$

Equity

270.8

$

Assets

608.3

$

Liabilities

651.8

$

Equity

(43.5)

$

Assets

9,373.6

$

Liabilities

9,472.7

$

Equity

(99.1)

$

Assets

114.4

$

Liabilities

101.4

$

Equity

13.0

$ |

Strategic Capabilities Position Walter for Continued

Growth

Sector fundamentals still strong

•

Significant

market

-

$3

-

$4

TN

of

credit

sensitive assets

•

Banks focus on core versus non-core

servicing

Improving economy improves credit quality

increasing servicing margin and asset values

Regulatory environment

•

Increased regulation/oversight

•

Creates barriers to entry

•

Scale, track record, and capital drive

success

Diversified methods to grow servicing

portfolio

•

Legacy product/acquisitions

•

Originations

•

Flow

Significant market opportunities tied to continued evolution of

mortgage sector

•

Need for non-prime market

•

Return of private label

•

Core competencies drive value to owners of credit

7

Please refer to the introductory slides of this presentation, as well as additional disclosures in the

Appendix and in our Form 10-Q for the quarter ended June 30, 2014 and other filings with the

SEC, for important information regarding Forward-Looking Statements and the use of Non-GAAP Financial Measures. |

8

Business Trends

Please

refer

to

the

introductory

slides

of

this

presentation,

as

well

as

additional

disclosures

in

the

Appendix

and

in

our

Form

10-Q

for

the

quarter

ended

June

30,

2014 and other filings with the SEC, for important information regarding

Forward-Looking Statements and the use of Non-GAAP Financial Measures.

Servicing, ARM &

Insurance

Originations

Reverse Mortgage

Other

•AEBITDA margin of 14 –18 bps of Average UPB on a

combined basis expected for remainder of year

•Value added model continues to improve portfolio performance

•Client dialogue active; markets transaction volume improving

•Active regulatory oversight continues

•Retention business strong as margins remain stable and recently

boarded portfolios are mined for HARP opportunity

•Significant agency support for HARP

•Continued focus on cost reductions

•Cautious build-out of retail channel given environment;

managing correspondent channel for profitability

•Revised strategy and operating model to fit new environment

•Focus on retail originations channels and refinement of servicing

platform •Managing servicing costs as platform is

updated •Mid-to-longer term

outlook remains positive given product enhancement and very strong

demographic trends •Investment Management focused on build out of

portfolio under management •Legacy Walter Investment

residual trusts continue to perform as expected

•Continue to review opportunities to extend core competencies

|

Key

Investment Highlights Walter Investment is achieving strong execution against

strategic initiatives

Depositories’

focus

on

“core”

clients

drives

movement

of

“non-

core”

assets

Originations business transitioning with retail and correspondent

channel build out and as additional products are explored

Expanding Investment Management business through focus on

portfolio build out

More

change

is

coming

to

the

sector

as

the

“new”

mortgage

market landscape is developed

Walter Investment is uniquely positioned to capitalize on the significant sector

opportunity. 9

1

2

3

4

5

Please refer to the introductory slides of this presentation, as well as additional disclosures in the

Appendix and in our Form 10-Q for the quarter ended June 30, 2014 and other filings with the

SEC, for important information regarding Forward-Looking Statements and the use of Non-GAAP Financial Measures.

|

Supplemental Information & Reconciliations |

Use of

Non-GAAP Measures and Definitions 11

Generally Accepted Accounting Principles ("GAAP") is the term used to refer to the standard

framework of guidelines for financial accounting. GAAP includes the standards, conventions, and

rules accountants follow in recording and summarizing transactions and in the preparation of financial statements. In addition to reporting financial results in

accordance with GAAP, the Company has provided the following non-GAAP financial measures in this

presentation: Adjusted Pre-tax Earnings, Adjusted EBITDA and Funds Generated in

Period. See the definitions below for a description of how these items are presented and see the Non-GAAP Reconciliations for a reconciliation of these measures to

the most directly comparable GAAP financial measures. Management considers

Adjusted Pre-tax Earnings, Adjusted EBITDA and Funds Generated in Period, each of which is a non-GAAP financial measure, to be important in the

evaluation of our business segments and of the Company as a whole, as well as for allocating capital

resources to our segments. Adjusted Pre-Tax Earnings, Adjusted EBITDA and Funds Generated

in Period are utilized to assess the underlying operational performance of the continuing operations of the business. In addition, analysts, investors, and creditors

may use these measures when analyzing our operating performance. Adjusted Pre-Tax Earnings,

Adjusted EBITDA and Funds Generated in Period are not presentations made in accordance with

GAAP and our use of these terms may vary from other companies in our industry.

These non-GAAP financial measures should not be considered as alternatives to (1) net income

(loss) or any other performance measures determined in accordance with GAAP or (2) operating

cash flows determined in accordance with GAAP. These measures have important limitations as analytical tools, and should not be considered in isolation or as substitutes

for analysis of the Company’s results as reported under GAAP.

is metric that is used by management as a supplemental metric to evaluate

our Company’s underlying key drivers and operating performance of the business. Adjusted

Pre-Tax Earnings is defined as net income (loss) before income taxes plus certain depreciation and amortization costs related to the increased basis in assets,

including servicing and sub-servicing rights, acquired within business combination transactions,

or step-up depreciation and amortization, transaction and integration costs, share-

based compensation expense, non-cash interest expense, the net impact of the Non-Residual

Trusts, fair value to cash adjustments for reverse loans, and certain other cash and non-

cash adjustments, primarily including severance expense and certain other non-recurring

start-up costs. Adjusted Pre-Tax Earnings excludes unrealized changes in fair value of MSRs

that are based on projections of expected future cash flows and prepayments. Adjusted Pre-Tax

Earnings includes both cash and non-cash gains from forward mortgage origination

activities. Non-cash gains are net of non-cash charges or reserves provided. Adjusted

Pre-Tax Earnings includes cash generated from reverse mortgage origination activities. Adjusted

Pre-Tax Earnings may also include other adjustments, as applicable based upon facts and

circumstances, consistent with the intent of providing investors a supplemental means of

eliminates the effects of financing, income taxes and depreciation and amortization. Adjusted EBITDA is defined as net income (loss) before income taxes,

depreciation and amortization, interest expense on corporate debt, transaction and integration

related costs, the net impact of the Non-Residual Trusts and certain other cash and non-

cash adjustments primarily including severance expense, the net provision for the repurchase of loans

sold and certain other non-recurring start-up costs. Adjusted EBITDA includes both cash

and non-cash gains from forward mortgage origination activities. Adjusted EBITDA excludes the impact of fair value option accounting on certain assets and liabilities and

includes cash generated from reverse mortgage origination activities. Adjusted EBITDA may also include

other adjustments, as applicable based upon facts and circumstances,

is calculated as Adjusted EBITDA, as described above,

less capital expenditures, cash paid for corporate debt interest expense and income taxes.

Management believes Funds Generated in Period is useful as a supplemental indicator of the cash

capable of being generated by the business during the relevant period and for that purpose

considers the values of the OMSRs created during the period as equivalent to cash on the assumption that such OMSRs could have been sold during the period for cash

equivalent to their fair value reflected in our books. There can be no assurance that the OMSRs

could have been sold during the period for cash equivalent to their fair value reflected in our

books. Funds Generated in Period does not represent residual cash flow and is not necessarily available for investment, as some or all of it may be required for debt service

Adjusted

Pre-tax Earnings Adjusted EBITDA

Funds Generated in Period

Please refer to the introductory slides of this presentation, as well as additional disclosures in the

Appendix and in our Form 10-Q for the quarter ended June 30, 2014 and other filings

with the SEC, for important information regarding Forward-Looking Statements and the use of Non-GAAP Financial Measures.

and other working capital needs.

consistent with the intent of providing investors a supplemental means of evaluating our

operating performance.

evaluating our operating performance. Amounts or metrics

that relate to future earnings projections are forward-looking and subject to significant business, economic, regulatory and competitive uncertainties, many of

which are beyond the control of Walter Investment and its management, and are based upon assumptions

with respect to future decisions, which are subject to change. Actual results will vary and

those variations may be material. Nothing in this presentation should be regarded as a representation by any person that any target will be achieved and the Company

undertakes no duty to update any target. Please refer to the introductory slides of this presentation,

as well as additional disclosures in this Appendix and in our Annual Report on Form 10-K

for the year ended December 31, 2013, our quarterly report on Form 10-Q for the quarter ended June 30, 2014 and our other filings with the SEC, for important information

regarding Forward Looking Statements and the use and limitations of Non-GAAP Financial Measures.

Because we do not predict special items that might occur in the future, and our outlook is

developed at a level of detail different than that used to prepare GAAP financial measures, we are not providing a reconciliation to GAAP of any forward-looking financial

measures presented herein.

|

GAAP

Financial Results (1)

12

$ in millions except per share amounts

($ in millions)

2Q14

1Q14

2Q13

Income Statement

Total revenues

413.7

$

369.9

$

596.0

$

Total expenses

(467.2)

(338.5)

(359.0)

Other gains (losses)

1.5

(2.5)

1.7

Income tax (expense) benefit

39.0

(11.6)

(95.3)

Net income (loss)

(12.9)

$

17.4

$

143.2

$

Net income (loss) per diluted share

(0.34)

$

0.45

$

3.75

$

As of

06/30/2014

As of

03/31/2014

As of

06/30/2013

Balance Sheet

Total Assets

18,386.0

$

17,484.3

$

16,930.2

$

Total Liabilities

17,200.8

$

16,292.1

$

15,856.2

$

Equity

1,185.2

$

1,192.1

$

1,074.0

$

(1) Note, columns in schedule may not foot due to rounding.

Please

refer

to

the

introductory

slides

of

this

presentation,

as

well

as

additional

disclosures

in

the

Appendix

and

in

our

Form

10-Q

for

the

quarter

ended

June

30,

2014 and other filings with the SEC, for important information regarding

Forward-Looking Statements and the use of Non-GAAP Financial Measures. |

Servicing Segment

Servicing Key Metrics

13

(1)

Average UPB and AEBITDA for 1Q 2014 and 4Q 2013 includes adjustments to reflect MSR

acquisitions closed during the quarter as though they were closed January 1, 2014 as

economics (cash flows) were actually recorded for the full period.

(2)

The

disappearance

rate

is

equal

to

the

proportion

of

the

principal

in

the

portfolio

that

is

paid

off

or

charged

off

in

the

period.

Recaptured

accounts

are

netted

in

the

principal

pay

offs to calculate a net disappearance rate.

Disappearance rates do not reflect the impact of assets which were sold by the

owner and transferred to another servicer. The disappearance rate

for 2Q 2013 was adjusted to reflect the timing of third party loans as if they were sent to third party, refinanced and returned to the GT portfolio in the same

month.

$ in millions

Please

refer

to

the

introductory

slides

of

this

presentation,

as

well

as

additional

disclosures

in

the

Appendix

and

in

our

Form

10-Q

for

the

quarter

ended

June

30,

2014 and other filings with the SEC, for important information regarding

Forward-Looking Statements and the use of Non-GAAP Financial Measures.

2Q14

1Q14

2Q13

Servicing fees

174.9

$

167.4

$

145.4

$

Incentive and performance fees

25.6

29.8

26.3

Ancillary and other fees

19.2

21.6

17.9

Servicing revenue and fees

219.7

$

218.8

$

189.6

$

Amortization of servicing rights

(9.5)

(10.4)

(10.3)

Realization of expected cash flows

(40.2)

(22.0)

(28.2)

Changes in valuation inputs

(43.4)

(25.6)

93.3

Net servicing revenue and fees

126.6

$

160.8

$

244.4

$

AEBITDA/average UPB

11 bps

19 bps

14 bps

Serviced UPB (in billions)

235.2

$

233.8

$

196.8

$

Serviced units (in millions)

2.2

2.2

1.9

Average

serviced

UPB

(in

billions)

(1)

236.7

$

237.6

$

201.6

$

Disappearance rate

(2)

13.8%

13.5%

20.6% |

Originations Segment

$ in billions

14

Originations Data by Channel

Consumer Lending Origination Economics

Capitalized MSR

(1)

Calculated on pull-through adjusted locked volume.

(2)

Calculated on funded volume.

Correspondent Lending Origination

Economics

$ in thousands

(1)

Calculated on pull-through adjusted locked volume.

(2)

Calculated on funded volume.

bps

2Q14

1Q14

2Q13

Gain on Sale

(1)

30

77

47

Fee Income

(2)

11

13

15

Direct Expenses

(2)

(46)

(74)

(89)

Margin

(5)

16

(27)

bps

2Q14

1Q14

2Q13

Gain on Sale

(1)

531

486

580

Fee Income

(2)

15

16

40

Direct Expenses

(2)

(202)

(225)

(164)

Margin

344

277

456

2Q14

1Q14

2Q13

Recapture Rate

(1)

39%

47%

36%

Applications

2Q14

%

1Q14

%

2Q13

%

Consumer Lending

4.0

$

50%

2.5

$

52%

5.3

$

58%

Correspondent Lending

4.0

50%

2.3

48%

3.8

42%

8.0

$

100%

4.8

$

100%

9.1

$

100%

Pull-Through Adjusted Locked Volume

2Q14

%

1Q14

%

2Q13

%

Consumer Lending

2.6

46%

1.9

$

53%

3.9

$

64%

Correspondent Lending

3.0

54%

1.7

47%

2.2

36%

5.6

$

100%

3.6

$

100%

6.1

$

100%

Funded Volume

2Q14

%

1Q14

%

2Q13

%

Consumer Lending

2.3

52%

1.8

$

51%

3.2

$

68%

Correspondent Lending

2.1

48%

1.7

49%

1.5

32%

4.4

$

100%

3.5

$

100%

4.7

$

100%

Sold Volume

2Q14

%

1Q14

%

2Q13

%

Consumer Lending

2.1

$

54%

2.0

$

51%

2.4

$

71%

Correspondent Lending

1.8

46%

1.9

49%

1.0

29%

3.9

$

100%

3.9

$

100%

3.4

$

100%

Please

refer

to

the

introductory

slides

of

this

presentation,

as

well

as

additional

disclosures

in

the

Appendix

and

in

our

Form

10-Q

for

the

quarter

ended

June

30,

2014 and other filings with the SEC, for important information regarding

Forward-Looking Statements and the use of Non-GAAP Financial Measures.

2Q14

1Q14

2Q13

Capitalized MSR (MN)

45,553

$

52,614

$

36,305

$

Base MSR (MN)

34,204

41,249

35,802

Excess MSR (MN)

11,349

11,365

503

Base MSR Multiple

3.87

4.23

4.26

Excess MSR Multiple

3.70

3.80

3.11

Loans sold

3,539,814

3,896,016

3,358,643

Loans sold with excess

1,710,760

1,834,547

279,391

(1) Recapture rate represents the percent of the UPB voluntarily paying

off from portfolio that we are able to refinance into new loans. |

Reverse Mortgage Segment

15

Reverse Mortgage Key Metrics

$ in millions

(1) Representative of servicing fee for on-balance sheet residential loans

serviced. (2) Cash generated by origination, purchase and securitization of

HECM loans. Please

refer

to

the

introductory

slides

of

this

presentation,

as

well

as

additional

disclosures

in

the

Appendix

and

in

our

Form

10-Q

for

the

quarter

ended

June

30,

2014 and other filings with the SEC, for important information regarding

Forward-Looking Statements and the use of Non-GAAP Financial Measures. 2Q14

1Q14

2Q13

Interest income

98.3

$

96.9

$

86.5

$

Interest expense

(91.5)

(90.6)

(79.5)

Net interest margin

(1)

6.8

$

6.3

$

7.0

$

Blended cash generated

(2)

14.2

15.6

36.6

Fair value of loans and HMBS securities

5.9

(4.7)

(16.9)

Fair value

26.9

$

17.2

$

26.7

$

Net servicing revenues and fees

8.8

7.6

6.6

Other

3.0

3.1

2.7

Total revenue

38.7

$

27.9

$

36.0

$

Funded volume

$299 MN

$245 MN

$693 MN

Securitized volume

$359 MN

$415 MN

$833 MN

Blended cash margin

376 bps

363 bps

335 bps

Serviced UPB (in billions)

16.9

$

16.3

$

14.4

$

Serviced units

103,544

100,141

86,795

|

Reconciliation of GAAP Income (Loss) Before Income

Taxes to Non-GAAP Adjusted EBITDA

16

(1)

For the Three Months Ended

For the Six Months Ended

For the Three Months Ended

For the Six Months Ended

June 30, 2014

June 30, 2014

June 30, 2013

June 30, 2013

Income (loss) before income taxes

(51.9)

$

(23.0)

$

238.6

$

285.1

$

Add:

Depreciation and amortization

18.4

37.0

17.6

33.9

Interest expense

38.5

76.0

30.7

56.9

EBITDA

5.0

90.0

286.9

375.9

Add/(Subtract):

Amortization and fair value adjustments of MSRs

93.7

152.5

(53.9)

(21.5)

Non-cash share-based compensation expense

4.8

8.3

3.9

6.5

Transaction and integration costs

3.5

5.1

3.7

15.3

Debt issuance costs not capitalized

-

-

0.3

5.0

Fair value to cash adjustments for reverse loans

(5.9)

(1.2)

16.9

20.4

Net impact of Non-Residual Trusts

(0.7)

3.4

-

(0.4)

Non-cash interest income

(3.9)

(7.9)

(4.6)

(9.1)

Provision for loan losses

1.5

0.5

0.1

1.8

Residual Trust cash flows

3.8

5.4

1.1

1.5

Servicing fee economics

-

9.7

-

-

Litigation and regulatory matters

13.2

13.2

-

-

Goodwill impairment

82.3

82.3

-

-

Other

2.1

5.9

7.7

6.7

Sub-total

194.4

277.2

(24.8)

26.2

Adjusted EBITDA

199.4

$

367.2

$

262.1

$

402.1

$

(1)

$ in millions

Please refer to the introductory slides of this presentation, as well as additional disclosures in the

Appendix and in our Form 10-Q for the quarter ended AEBITDA for YTD 2014 includes adjustments to reflect MSR acquisitions closed during the

quarter as though they were closed January 1, 2014 as economics (cash flows) were

actually realized for the full period. June 30, 2014 and other

filings with the SEC, for important information regarding Forward-Looking Statements and the use of Non-GAAP Financial Measures. |

For the Three Months

Ended

For the Six Months Ended

For the Three Months

Ended

For the Six Months Ended

June 30, 2014

June 30, 2014

June 30, 2013

June 30, 2013

Income (loss) before income taxes

(51.9)

$

(23.0)

$

238.6

$

285.1

$

Add back:

Step-up depreciation and amortization

11.3

23.2

12.8

25.7

Step-up amortization of sub-servicing rights (MSRs)

7.7

16.2

8.1

16.2

Non-cash interest expense

4.0

7.3

2.3

5.3

Non-cash share-based compensation expense

4.8

8.3

3.9

6.5

Transaction and integration costs

3.5

5.1

3.7

15.3

Debt issuance costs not capitalized

-

-

0.3

5.0

Fair value to cash adjustments for reverse loans

(5.9)

(1.2)

16.9

20.4

Fair value changes of MSRs due to changes in

valuation inputs and other assumptions

43.4

69.0

(93.3)

(89.3)

Net impact of Non-Residual Trusts

(0.7)

3.4

-

(0.4)

Litigation and regulatory matters

13.2

13.2

-

-

Goodwill impairment

82.3

82.3

-

-

Other

3.2

6.2

5.9

6.0

Adjusted pre-tax earnings

114.9

$

210.0

$

199.2

$

295.8

$

Adjusted earnings after tax (39%)

70.1

$

128.1

$

121.5

$

180.4

$

Adjusted earnings after tax per diluted common and

common equivalent share.

1.86

$

3.36

$

3.23

$

4.80

$

Reconciliation of GAAP Income (Loss) Before Income

Taxes to Non-GAAP Adjusted Pre-tax Earnings

(1)

($ in millions, except per share amounts)

17

(1)

The Company has elected to exclude changes in valuation inputs as a component of

its Adjusted Pre-Tax Earnings calculation and has reflected this change in all previously

reported periods disclosed in this document.

Please

refer

to

the

introductory

slides

of

this

presentation,

as

well

as

additional

disclosures

in

the

Appendix

and

in

our

Form

10-Q

for

the

quarter

ended

June 30,

2014 and other filings with the SEC, for important information regarding

Forward-Looking Statements and the use of Non-GAAP Financial Measures. |

Reconciliation of Funds Generated in Period to Net Increase in Cash

and Cash Equivalents

18

($ in millions)

(1)

Represents originated MSRs that have been capitalized upon transfer of loans.

(2)

Represents

originations

activity

including

purchases

and

originations

of

residential

loans

held

for

sale,

proceeds

from

sale

and

payments

on

residential

loans

held

for

sale,

net

change

in

master

repurchase

agreements

associated

with

residential

loans

held

for

sale

and

total

net

gains

on

sales

of

loans

less

gain

on

capitalized

servicing

rights.

(3)

Represents payments for acquisitions of businesses net of cash acquired,

acquisitions of servicing rights and transaction & integration costs incurred as a result.

(4)

Represents proceeds from issuance of debt net of debt issuance costs and payments

made during the period. Please

refer

to

the

introductory

slides

of

this

presentation,

as

well

as

additional

disclosures

in

the

Appendix

and

in

our

June

30,

2014

Form

10-Q

and

other filings with the SEC, for important information regarding Forward-Looking

Statements and the use of Non-GAAP Financial Measures. June 30, 2014

June 30, 2013

Adjusted EBITDA

199.4

$

262.1

$

Less:

Cash Interest Expense on Corporate Debt

(46.9)

(29.5)

Cash Taxes/Refund

(6.7)

(54.2)

Capital Expenditures

(8.5)

(12.1)

Funds Generated in Period

137.3

$

166.3

$

Investing and Financing activity and other uses of Funds Generated in Period:

Investment in retained OMSRs

(1)

(45.5)

(36.3)

Net investment in originations activity

(2)

(65.7)

(180.2)

Net activity for servicing advances

5.8

(185.1)

Net investment in reverse mortgage activity

(17.4)

(8.3)

Acquisitions, including related transaction costs

(3)

(306.4)

(234.9)

Net borrowings of corporate debt

(4)

(4.3)

179.1

Other working capital

36.8

207.3

CHANGE IN CASH

(259.4)

$

(92.1)

$

Cash flows provided by (used in) operating activities

(482.6)

(1,844.9)

Cash flows provided by (used in) investing activities

(510.6)

(934.5)

Cash flows provided by (used in) financing activities

733.8

2,687.3

Change in cash

(259.4)

$

(92.1)

$

For the three months ended |

Reconciliation of Funds Generated in Period to Net Increase in Cash

and Cash Equivalents

19

($ in millions)

Please

refer

to

the

introductory

slides

of

this

presentation,

as

well

as

additional

disclosures

in

the

Appendix

and

in

our

June

30,

2014

Form

10-Q

and

other filings with the SEC, for important information regarding Forward-Looking

Statements and the use of Non-GAAP Financial Measures. For the last

tweleve months

ended

For the six months

ended

For the year ended

For the six months

ended

June 30, 2014

June 30, 2014

December 31, 2013

June 30, 2013

Adjusted EBITDA

656.8

$

367.2

$

691.7

$

402.1

$

Less:

Cash Interest Expense on Corporate Debt

(121.2)

(67.1)

(100.7)

(46.6)

Cash Taxes/Refund

(23.6)

17.8

(96.8)

(55.4)

Capital Expenditures

(34.3)

(13.0)

(38.6)

(17.3)

Funds Generated in Period

477.7

$

304.9

$

455.6

$

282.8

$

Investing

and

Financing

activity

and

other

uses

of

Funds

Generated

in

Period:

Investment in retained OMSRs

(1)

(248.2)

(98.1)

(187.7)

(37.6)

Net investment in originations activity

(2)

102.6

(26.3)

(91.7)

(220.6)

Net activity for servicing advances

(103.3)

10.4

(160.3)

(46.6)

Net investment in reverse mortgage activity

(10.2)

(0.5)

(56.5)

(46.8)

Acquisitions, including related transaction costs

(3)

(618.7)

(341.0)

(1,303.6)

(1,025.9)

Net borrowings of corporate debt

(4)

344.9

(8.9)

1,322.3

968.5

Other working capital

(174.1)

(29.0)

71.7

216.8

Change in Cash

(229.3)

$

(188.5)

$

49.8

$

90.6

$

Cash flows provided by (used in)

operating activities 170.1

(73.8)

(1,810.5)

(2,054.4)

Cash flows provided by (used in) investing activities

(1,805.9)

(712.8)

(3,776.1)

(2,683.0)

Cash flows provided by (used in) financing activities

1,406.5

598.1

5,636.4

4,828.0

Change in cash

(229.3)

$

(188.5)

$

49.8

$

90.6

$

Represents originated MSRs that

have been capitalized upon transfer of loans. Represents

originations

activity

including

purchases

and

originations

of

residential

loans

held

for

sale,

proceeds

from

sale

and

payments

on

residential

loans

held

for

sale,

net

change

in

master

repurchase

agreements

associated

with

residential

loans

held

for

sale

and

total

net

gains

on

sales

of

loans

less

gain

on

capitalized

servicing

rights.

Represents payments for acquisitions of businesses net of cash acquired,

acquisitions of servicing rights and transaction & integration costs incurred as a result.

Represents proceeds from issuance of debt net of debt issuance costs and payments

made during the period. (1)

(2)

(3)

(4) |