Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - ARC Group Worldwide, Inc. | arc-8k_081114.htm |

Investor Presentation August 2014 www.ARCGroupWorldwide.com | NASDAQ: ARCW

Safe Harbor This presentation contains forward - looking statements, as defined by federal and state securities laws . Forward - looking statements include statements concerning plans, objectives, goals, strategies, expectations, intentions, projections, developments, future events, performance or products, underlying assumptions, and other statements which are other than statements of historical facts . In some cases , you can identify forward - looking statements by terminology such as ''may,'' ''will,'' ''should,'' “hope,'' "expects,'' ''intends,'' ''plans ,'‘ ' 'anticipates,'' "contemplates," ''believes,'' ''estimates,'' ''predicts,'' ''projects,'' ''potential,'' ''continue,'' and other similar terminology or the negative of these terms . From time to time, we may publish or otherwise make available forward - looking statements of this nature . All such forward - looking statements, whether written or oral, and whether made by us or on our behalf, are expressly qualified by the cautionary statements described herein, including those set forth below . In addition, we undertake no obligation to update or revise any forward - looking statements to reflect events, circumstances, or new information after the date of the information or to reflect the occurrence or likelihood of unanticipated events, and we disclaim any such obligation . Forward - looking statements are only expectations that relate to future events or our future performance and are subject to known and unknown risks, uncertainties, assumptions, and other factors, many of which are beyond our control, that may cause actual results, outcomes , levels of activity, performance, developments, or achievements to be materially different from any future results, outcomes, levels of activity, performance, developments, or achievements expressed, anticipated, or implied by these forward - looking statements . As a result, we cannot guarantee actual future results, outcomes, levels of activity, performance, developments, or achievements, and there can be no assurance that our expectations, intentions, anticipations, beliefs, or projections will be achieved or accomplished . These forward - looking statements are made as of the date hereof and are based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management . ARC Group Worldwide’s actual results could differ materially from those stated or implied in forward - looking statements . Past performance is not necessarily indicative of future results . We do not intend to update these forward looking statements even though our situation may change in the future . Further, we encourage you to review the risks that we face and other information about us in our filings with the SEC, including our Annual Report on Form 10 - K . These are available at www . SEC . gov . 2

Prototype - to - Production Mission Statement & Core Strengths 3 Accelerating Innovation in Manufacturing through the Adoption and Integration of Technology 30+ Years of Experience | 400+ Existing Customers | Global Facilities | 800+ Employees | ISO & Industry Certified Speed with Precision Innovation Through Partnership

ARC is Laser Focused on Accelerating Disruptive Changes in Global Manufacturing Macro Thesis 4 ▪ Manufacturing Returning to United States & Developed World − Driven by innovation — 3D printing, automation , robotics, software, and the continued evolution of the internet — and lower domestic energy prices − Mitigates low labor cost country arbitrage ▪ Speed - to - Market is Critical for OEM Product Launch Cycle − Competitive pressure to routinely launch new products and upgrades − Perpetual “race to market” creates competitive advantage for those fastest to market ▪ Highly Inefficient and Fragmented Supply Chain − Existing global supply chain is highly inefficient : one - off suppliers, long lead times, and production bottlenecks − OEMs are consolidating supply chains — winners will embrace technology and widen breadth of offerings Technology is Driving a Manufacturing Revolution

Growth Pillars 5 Holistic Manufacturing Approach ▪ Fabrication industry highly fragmented and inefficient ▪ ARC’s full suite of products and services maximizes customer “wallet share” − ‘One - stop shop’ provides material cross - selling opportunities across existing and acquired customer bases ▪ ARC’s core ability to produce technically difficult, complex components creates unique barrier to entry ▪ ARC will continue to acquire strategic companies that deliver incremental, complementary products and technologies ‘Speed - to - Market’ ▪ Accelerate adoption of technology and innovation to unlock bottlenecks in the production process ▪ Offer ‘under o ne r oof’ prototyping - to - production services with related efficiency ▪ ARC’s innovation is focused on: − Automation and Robotics − Proprietary Automatic Online Quoting Software − In - House Tooling/Rapid Tooling − Metal/Plastic 3D Printing and RapidMIM − Prototype/Short - run Production Offerings − Rapid Full - run Production Services ARC’s Growth is Based Upon Innovating Around Two Fundamental Themes Through Innovation, ARC is a Full Solution Provider

Differentiated Business Model Production Focus Speed ▪ R eputation built on high - quality , highly complex , full run production components ▪ Continuing focus on accelerating innovation and technology adoption in full production manufacturing ▪ Focused on speed — not just prototyping and short run production, but, rapid full run production, the future of manufacturing Prototyping And Beyond ▪ Prototyping is important, but is only one small link in the chain ▪ Established leader in prototyping and short run production; true opportunity is bridging gap from prototyping to full run production 6 ARC’s Holistic Production Solution and Entrenched Customer Base are Game Changers ARC i s Positioned t o be the Leader in Rapid Production Disruption Evolution ▪ 3D printing will significantly displace traditional manufacturing techniques ▪ ARC will capitalize on this disruption through our first mover advantage and established, diverse customer base

Investment Highlights 7 ‘The’ Prototype - to - Production Solution Leading Speed - to - Market Innovator Pioneering 3D Utilization Global Leader in Expanding MIM Industry Compelling Growth Profile with Solid Cash Flow Generation Experienced Management Team

8 ‘The’ Prototype - to - Production Solution

9 ▪ 30 + year operating history with unparalleled reputation, exemplary track record, and multi - decade, blue chip customer relationships ▪ Consistently manufactured the most critical, most technically precise components for our customers Proven Historical Performance ‘The’ Prototype - to - Production Solution ▪ Global manufacturers focused on innovation, not supply chain management ▪ Opportunity to diversify into additional products and services given historical performance ▪ Win / win for ARC and customers − ARC is a ‘known quantity’ for customers and enables vendor consolidation − ARC benefits from increase in customer ‘wallet share ’ ▪ Robust pipeline of acquisition opportunities — will continue to focus on ‘bolt - on’ complementary capabilities Established, Holistic Manufacturing Solution Meeting Increased Demand for Holistic Solution

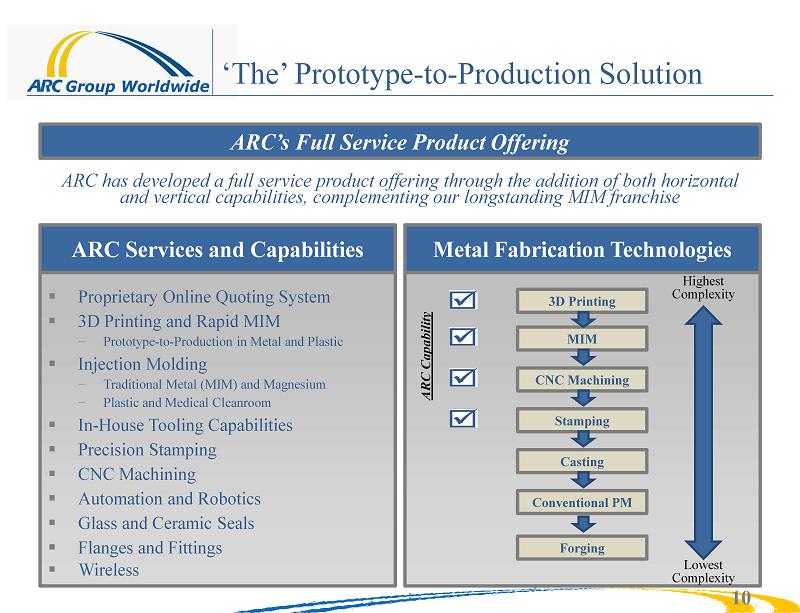

ARC’s Full Service Product Offering 10 ARC has developed a full service product offering through the addition of both horizontal and vertical capabilities, complementing our longstanding MIM franchise Metal Fabrication Technologies ARC Services and Capabilities ▪ Proprietary Online Quoting System ▪ 3D Printing and Rapid MIM − Prototype - to - Production in Metal and Plastic ▪ Injection Molding − Traditional Metal (MIM) and Magnesium − Plastic and Medical Cleanroom ▪ In - House Tooling Capabilities ▪ Precision Stamping ▪ CNC Machining ▪ Automation and Robotics ▪ Glass and Ceramic Seals ▪ Flanges and Fittings ▪ Wireless ‘The’ Prototype - to - Production Solution MIM CNC Machining Stamping Casting Forging ARC Capability Highest Complexity Lowest Complexity 3D Printing Conventional PM

ARC Supplements MIM and 3D Printing with Complementary Technologies 11 Advanced Tooling Plastic Injection Molding Stamping Secondary Operations ‘The’ Prototype - to - Production Solution

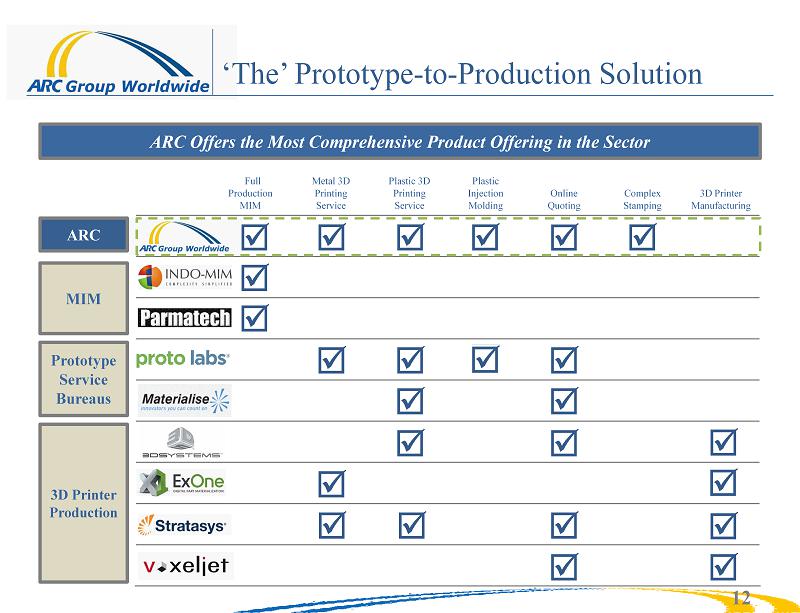

ARC Offers the Most Comprehensive Product Offering in the Sector 12 Full Production MIM Metal 3D Printing Service Plastic 3D Printing Service Plastic Injection Molding Online Quoting Complex Stamping 3D Printer Manufacturing ‘The’ Prototype - to - Production Solution MIM 3D Printer Production Prototype Service Bureaus ARC

13 Leading Speed - to Market Innovator

14 Partnering with Customers to Deliver Products with Greater Speed, Flexibility, and Precision Leading Speed - to - Market Innovator OEM’s Continually Seek to Launch the Next Generation of Their Product… …To Avoid Being Marginalized in the Marketplace ARC’s market - leading technologies provide our customers with the highest quality products in the shortest possible time

15 Leading Speed - to - Market Innovator “The Past” Quoting Tooling Production Process Lead Time Traditional Paradigm 1 – 2 Weeks 8 - 1 2 Weeks 12 - 16 Weeks ▪ Manual quoting system, requiring administrative processing and engineering review ▪ Design specification sent to 3rd party manufacturer; generally multiple iterations and retooling common ▪ Iterative testing of prototypes/short - run production items; severe time lag during each iteration Quoting Tooling Production Process Lead Time Instant 2 – 3 Weeks 3 - 4 Weeks ▪ First phase of proprietary online quoting interface launched in FY14, significantly reduced process times; automated system recently implemented ▪ In - house tool - making = single source efficiency with real - time adjustments ▪ Unique r apid t ooling solutions ▪ 3D/RapidMIM: Overnight prototypes to production products; dramatically improves iterative design process and turnaround times Disruptive Innovation “The Future” Condensing the Supply Chain Through Technology and Innovation

16 Supply Chain Inefficiencies are ARC Opportunities Case Study: Large Medical Device Manufacturer ARC Implications ▪ End - to - end solution enables increased ARC wallet share ▪ Margin enhancement opportunities through improved pricing and process efficiency Leading Speed - to - Market Innovator Targeted Supply Chain Current Supply Chain ▪ 25,000+ suppliers ▪ Limited process transparency ▪ Long lead times ▪ P roduction bottlenecks ▪ Dedicated supply chain / procurement employees and related costs ▪ < 8,000 suppliers; relationship focused ▪ Value solutions and transparency over cost ▪ Consolidation improves speed - to - market ▪ Reduced company - wide resources

Leading Speed - to - Market Innovator Industry - Leading 3D Printing Launching Online Quoting Platform “SEO”/“SEM” Focus ▪ Early adopter of 3D printing with significant investment/capabilities ▪ One of the few experts in m etal 3D printing ▪ Ability to source metal 3D feedstock at substantial discounts ARC has Positioned I tself to Benefit from the Evolving G lobal M anufacturing Ecosystem ▪ Initial phases already materially reducing quoting times ▪ Additional expansions scheduled for 2H14 ▪ Embracing social media with substantial investment in SEO / SEM ▪ Often limited/no online presence by peers beyond basic web site Creating Sales / Marketing Culture ▪ Evolving to ‘Sales & Marketing’ culture from ‘Engineering’ basis ▪ Expanding into new, ‘ripe’ geographies ▪ Sizeable cross - selling opportunities via recent acquisitions

18 Pioneer in 3D Utilization

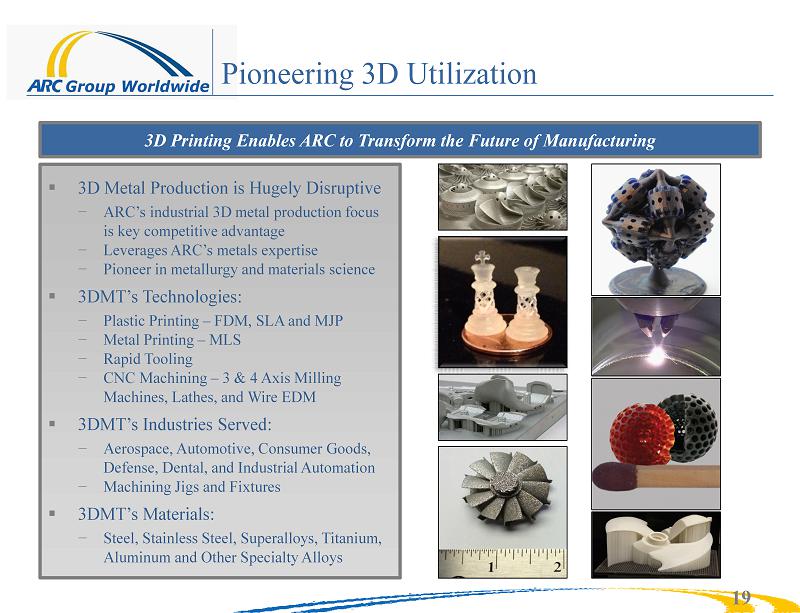

19 Pioneering 3D Utilization 3D Printing Enables ARC to Transform the Future of Manufacturing ▪ 3D Metal Production is Hugely Disruptive − ARC’s industrial 3D metal production focus is key competitive advantage − Leverages ARC’s metals expertise − Pioneer in metallurgy and materials science ▪ 3DMT’s Technologies: − Plastic Printing – FDM, SLA and MJP − Metal Printing – MLS − Rapid Tooling − CNC Machining – 3 & 4 Axis Milling Machines, Lathes, and Wire EDM ▪ 3DMT’s Industries Served: − Aerospace, Automotive, Consumer Goods, Defense, Dental, and Industrial Automation − Machining Jigs and Fixtures ▪ 3DMT’s Materials: − Steel, Stainless Steel, Superalloys, Titanium , Aluminum and Other Specialty Alloys

20 Pioneering 3D Utilization ARC’s Holistic 3D / Rapid Production Services Plastic Metal RapidMIM Short Run Production Advanced / Rapid Tooling

21 Pioneering 3D Utilization New Materials, Speed, and Design Freedom are the Future of Industrial 3D Printing Significant Metallurgy Background Focus on Material Science and R&D

22 Largest MIM Provider in Rapidly Growing Sector

23 Global Leader in Expanding MIM Industry What is MIM? We are the largest MIM operator in the world, using powder metal, wax and plastic to make highly precise, technically challenging parts Compounding Molding Debinding Sintering Fine metal powders, thermoplastics, and other proprietary ingredients are mixed Conventional injection molding machines are used to mold green parts Green parts are processed through a closed loop solvent system to remove t he binder material Debound parts are sintered in vacuum furnaces

24 Global Leader in Expanding MIM Industry Who Uses MIM? Diversified, high quality customer base in fast growing industries Medical & Dental Devices Aerospace & Defense Auto & Engineering

25 Compelling Growth Profile with Solid Cash Flow Generation

$0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 FYE 06/30/12 FYE 06/30/13 LTM 12/31/13 FYE 06/30/12 FYE 06/30/13 LTM 12/31/13 $M $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 FYE 06/30/12 FYE 06/30/13 LTM 12/31/13 FYE 06/30/12 FYE 06/30/13 LTM 12/31/13 $M $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 FYE 06/30/12 FYE 06/30/13 LTM 12/31/13 FYE 06/30/12 FYE 06/30/13 LTM 03/30/14 $M 26 Compelling Growth Profile with Solid Cash Flow Generation Revenue Gross Profit Actual Pro Forma (1) CAGR: 5.8% CAGR: 11.4% Adjusted EBITDA Pro Forma (1) Actual CAGR: 14.6% CAGR: 23.9% Actual Pro Forma (1) CAGR: 32.3% CAGR: 34.4% (1) Historical result revised to include ATC, Kecy, and Thixoforming financial performance.

(1) Common Equity (BV) as of March 30, 2014. 27 Despite Recent Acquisitions, ARC Boasts a Conservative Capital Structure and Modest Leverage Flexible, low cost capital structure and robust cash flow from operations have, and will continue to, facilitate strategic acquisitions and high ROIC capital improvements. Compelling Growth Profile with Solid Cash Flow Generation ($ in thousands) Estimated as of June 30, 2014 (1) $ % Cash and Cash Equivalents $8,448 Capitalization Rev. Credit Facility ($20mm Avail.) $8,310 7.3% New Term Loan 45,000 39.6% Delayed Draw Term Loan ($25mm Avail.) 23,700 20.8% Equipment Financing 5,726 5.0% Total Sr. Debt $82,736 72.8% Common Equity (BV) (1) 30,939 27.2% Total Capitalization $113,675 100.0% Net Sr. Debt $74,289 65.4%

28 Experienced Management Team

▪ Joined ARC in 2008 as Chairman & CEO ▪ Managing Director at Quadrant Management since 2005 ▪ Chairman of Yola, Inc . since 2011 ▪ Formerly h eld p rincipal i nvesting and investment b anking p ositions at Merrill Lynch & Co . ▪ Extensive global manufacturing experience ▪ Significant ARC shareholder Experienced Management Team 29 Jason T. Young Chairman & CEO Drew M. Kelley CFO Senior Management Team Brings Strong Skill S et, Proven Track Record, Drive, and Shareholder Alignment ▪ Joined ARC in 2013 as CFO & Director ▪ Formerly held i nvestment b anking and equity r esearch positions Jefferies, LLC, Bear , Stearns & Co. Inc., and Merrill Lynch & Co . ▪ Extensive capital market, acquisition, and financial experience

30 Strong Sponsorship and Support From Proven Business Builder Quadrant’s long - term, unwavering investment in ARC provides management with significant alignment with the Company’s shareholder base Experienced Management Team ▪ Quadrant Management − Family office with 35+ year track record of successfully building businesses − $ 3+ billion in capital under management − Deep value, cash flow, and ROIC focus − Hands – on, entrepreneurial approach with deep operating knowledge and extensive deal experience − 75+ successfully executed transactions ▪ Quadrant is long - term, majority ARC shareholder ▪ Ability for ARC to leverage Quadrant’s global resources and network

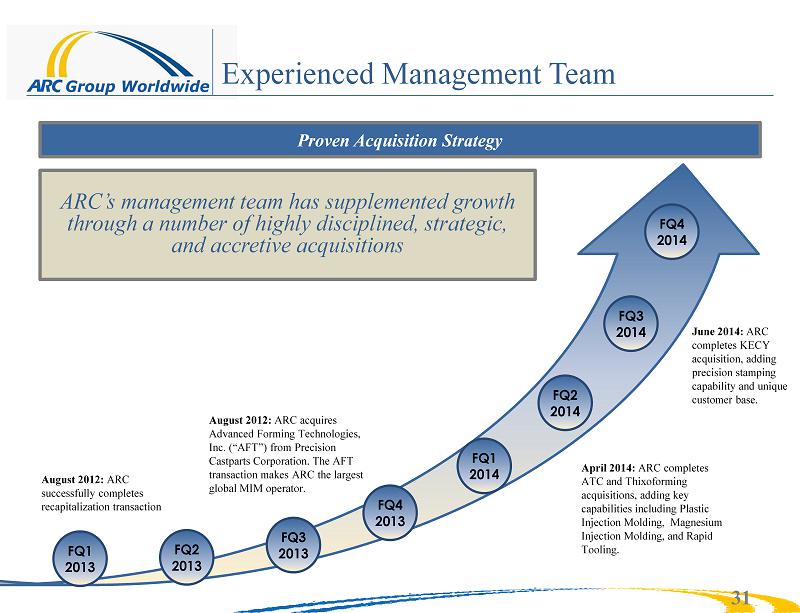

31 Experienced Management Team Proven Acquisition Strategy FQ1 2013 FQ2 2013 FQ3 2013 FQ4 2013 FQ1 2014 FQ2 2014 FQ3 2014 August 2012: ARC successfully completes recapitalization transaction April 2014: ARC completes ATC and Thixoforming acquisitions, adding key capabilities including Plastic Injection Molding, Magnesium Injection Molding, and Rapid Tooling . August 2012: ARC acquires Advanced Forming Technologies, Inc. (“AFT”) from Precision Castparts Corporation. The AFT transaction makes ARC the largest global MIM operator. ARC’s management team has supplemented growth through a number of highly disciplined, strategic, and accretive acquisitions FQ4 2014 June 2014: ARC completes KECY acquisition, adding precision stamping capability and unique customer base.

Transaction Closed: August 2012 Purchase Price: $43.0M Comments: Further expands ARC’s Metal Injection Molding capabilities Transaction Closed: June 2014 Purchase Price: $26.0M Comments: Adds key Precision Metal Stamping capabilities Transaction Closed: April 2014 Purchase Price: $24.0M Comments: Adds key Tooling and Plastic Injection Molding capabilities Transaction Closed: April 2014 Purchase Price: Undisclosed Comments: Adds key Magnesium Injection Molding capabilities 32 Experienced Management Team Selected Case Studies – Accretive Acquisition Strategy

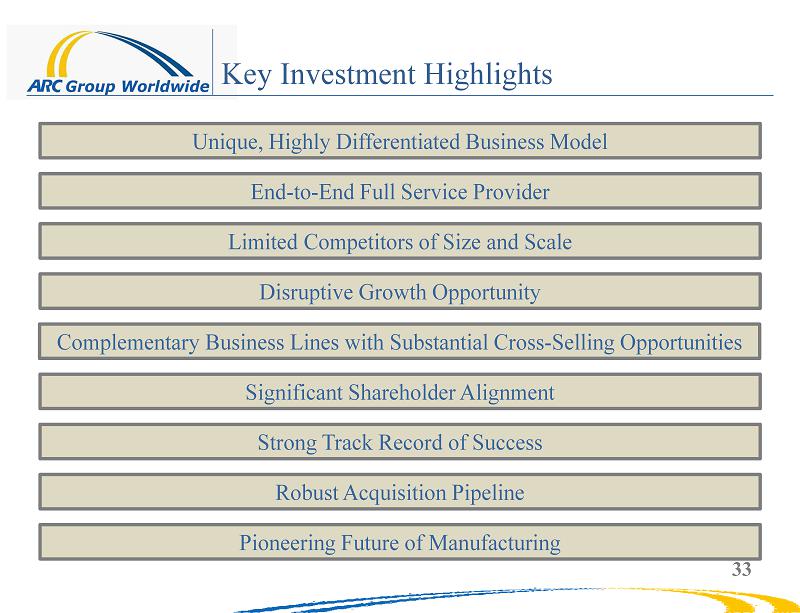

Key Investment Highlights 33 Limited Competitors of Size and Scale Unique, Highly Differentiated Business M odel End - to - End Full Service Provider Complementary Business Lines with Substantial Cross - Selling Opportunities Disruptive Growth Opportunity Significant Shareholder Alignment Strong Track Record of Success Robust Acquisition Pipeline Pioneering Future of Manufacturing

Thank You The Leader in Rapid Production www.ARCGroupWorldwide.com | NASDAQ: ARCW