Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CIMPRESS plc | d770599d8k.htm |

Vistaprint N.V.

Investor Day 2014

Webcast will begin at 8:30am ET

August 6, 2014

Investor Day 2014

Exhibit 99.1 |

Welcome

Meredith Burns

Vice President, Investor Relations

Investor Day 2014 |

Agenda and Presenters

3 |

Housekeeping Items

Restrooms are located outside the

room and to the right

Please use the rear doors when

entering and exiting the room

Please silence all mobile devices

4 |

Safe

Harbor Statement 5

Today’s presentations contain statements about our future expectations, plans

and prospects of our business that constitute forward-looking statements

for purposes of the safe harbor provisions under the Private Securities Litigation

Reform Act of 1995, including but not limited to our expectations for the growth,

development, and profitability of our business, products, markets, and

acquisitions, and our financial outlook and guidance for fiscal year 2015.

Forward- looking projections and expectations are inherently uncertain,

are based on assumptions and judgments by management, and may turn out to be

wrong. Our actual results may differ materially from those indicated by these forward-looking

statements as a result of various important factors, including but not limited to

flaws in the assumptions and judgments upon which our forecasts are based;

our failure to execute our strategy; our inability to make the investments in our

business that we plan to make; the failure of our strategy, investments, and

efforts to reposition the Vistaprint brand to have the effects that we

expect; our failure to promote and strengthen our brands; our failure to acquire new customers

and enter new markets, retain our current customers and sell more products to

current and new customers; our failure to identify and address the causes of

our revenue weakness; our failure to manage the complexity of our business and

expand our operations; costs and disruptions caused by acquisitions and strategic

investments; the failure of the businesses we acquire or invest in,

including People & Print Group and Pixartprinting, to perform as expected; difficulties

or higher than anticipated costs in integrating the systems and operations of our

acquired businesses into our systems and operations; the willingness of

purchasers of marketing services and products to shop online; the failure of our current

and new marketing channels to attract customers; our failure to manage growth and

changes in our organization; currency fluctuations that affect our revenues

and costs including the impact of currency hedging strategies and

intercompany transactions; unanticipated changes in our markets,

customers, or business; competitive pressures;

interruptions in or failures of our websites, network infrastructure or

manufacturing operations; our failure to retain key employees; our failure

to maintain compliance with the financial covenants in our revolving credit

facility or to pay our debts when due; costs and judgments resulting from

litigation; changes in the laws and regulations or in the interpretations of

laws or regulations to which we are subject, including tax laws, or the institution of new laws or

regulations that affect our business; general economic conditions; and other

factors described in our Form 10-Q for the

fiscal quarter ended March

31, 2014 and the other documents we periodically file with the U.S. Securities and

Exchange Commission. |

Introduction & Overview

Robert Keane

President and Chief Executive Officer

Investor Day 2014 |

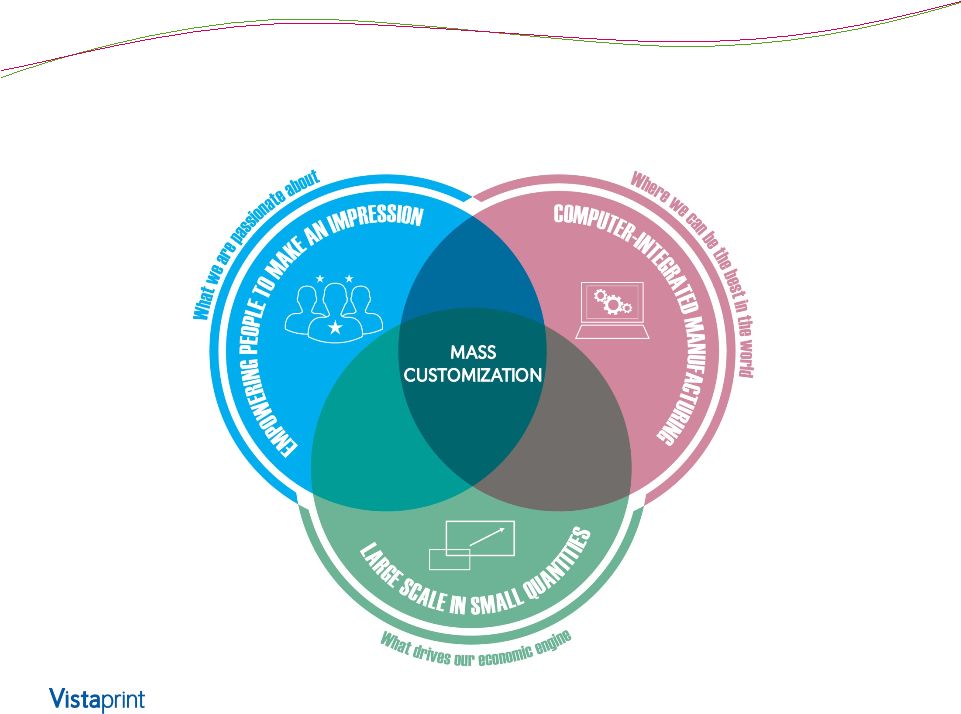

Our

Focus 7

What we are

What we are

passionate

passionate

about

about

Where we can

Where we can

be the best in

be the best in

the world

the world

What drives

What drives

our economic

our economic

engine

engine |

What

we are passionate about 8

Empowering people to make an impression

Empowering people to make an impression |

Where we can be the best in the world

Where we can be the best in the world

9

Computer-Integrated Manufacturing

Computer-Integrated Manufacturing |

Vistaprint

Volume

Low Volume Markets

High Volume

Markets

What drives our economic engine

10

Large scale in small quantities |

Our

Focus: Mass Customization 11 |

12

Mass customization is about producing, with

the reliability, quality

and affordability of

mass production, small individual orders

where each and every one embodies the

personal relevance inherent to customized

physical products. |

Focus on Scale Advantage

Focus on Scale Advantage

13 |

14

Shared

Computer-Integrated Manufacturing

Platform

New

Geographies |

Driving Financial Returns

15

•

Strive to maximize intrinsic value per share (i.e. DCF/share)

o

Present value of free cash flow per share over the long-term, not

for the near-term or for a specific point in time

•

We seek to achieve this through thoughtful combination of

revenue growth, margin expansion, capital expenditures, M&A

& share buybacks

•

As anticipated, FY14 was a turning point year for us in which

we balanced investments in future growth and margin

expansion appropriately given revenue headwinds

•

Expect continued margin expansion, EPS and FCF growth in

FY15 |

What You Will Hear Today

Steadfast in our move to reposition the Vistaprint brand

Even though it continues to create revenue headwinds, we believe

it is

important to long-term value creation

Manufacturing investments are driving significant value with

improvements to cost, productivity, quality and product selection

Scale drives competitive advantage and we believe thoughtful M&A

can drive further advantage for us

Anticipate continued improvements in profitability

As always, goal of building a transformational, enduring business

institution that will drive long-term returns for customers, employees

and long-term shareholders

16 |

Investor Day 2014 |

Vistaprint Brand

Trynka Shineman

President, Vistaprint Business Unit

Investor Day 2014 |

Vistaprint Brand Overview

19

Context for our performance and brand evolution

FY 2014 investment examples

Why we are confident |

A

great deal of opportunity to gain share in the $30B microbusiness

market* 20

Price

Primary

Higher

Expectations

Locally

Focused

* All segment views are illustrative only; not a precise view of

market sizes |

Re-centering our target, widening our bulls-eye

Price Primary

(PP) Micro

Businesses

Higher

Expectations

(HE)

Micro

Businesses

Locally

Focused

Micro

Businesses

21 |

HEs

tend to market themselves more, but many of the qualities of PP

and HE are similar Demographics of

Business

Products

Purchased

Purchase

Frequency/

Channel

PP-centric

Common

HE-centric

More Part-time

Businesses

A sub-segment only

buys business cards

1-3 per year

Online

Common in business

tenure, industry and

business size

Both purchase a

variety of business

cards and marketing

products

More Full-time

businesses

Additionally tend to

purchase a more

complex marketing

products

4+ per year

Online and Offline

22 |

We’ve expanded our focus from PP to

also include HE; significant commonalities

Customer

Comms

PP-centric

Common

HE-centric

•

Promotions/

Deals

•

Low quantities

•

Basic products

•

Relevant marketing

•

Basic customer support

•

e-commerce standard

site experience

•

Design Help

•

Great value

•

Category credibility

•

Delivered quality

•

Reputable provider

•

Value-Added

Services

•

Broader assortment

within categories

•

Faster shipping

•

Low entry prices

•

Lower shipping prices

•

Pricing consistency

•

Lower prices on

higher quantities

End-to-End

Experience

(Site and Service)

Product

offering

Pricing

23 |

24

Brand evolution video |

Vistaprint Brand Overview

25

Context for our performance and brand evolution

FY 2014 investment examples

Why we are confident |

Improving every aspect of our customer

experience

26

Customer

Communications

End-to-End

Experience

(Site and Service)

Product offering

Pricing |

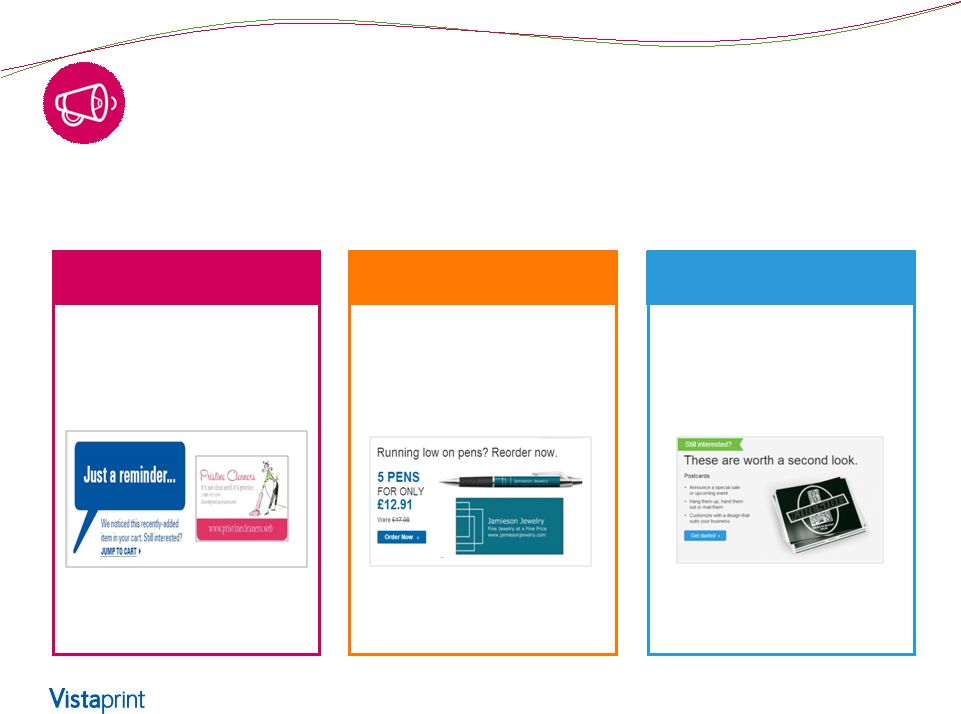

Communications Evolution: Personalized Content

Showing relevant products in our mass email communications proves

significant increases in $/customer and purchase rate

Lifts

$/customer: 5%

Purchase Rate: 4%

Dynamically rendering the

products and designs in a

customers cart with a goal to close

the sale

Dynamically rendering a

purchased product to drive a

replenishment order and upselling

additional product options

Promoting a product that a

customer has recently browsed

while showcasing content that

matches a previous designed

product

Lifts

$/customer: 11%

Purchase Rate: 10%

Lifts

$/customer: 9%

Purchase Rate: 6%

Product in Cart

Replenishment

Browsed

27 |

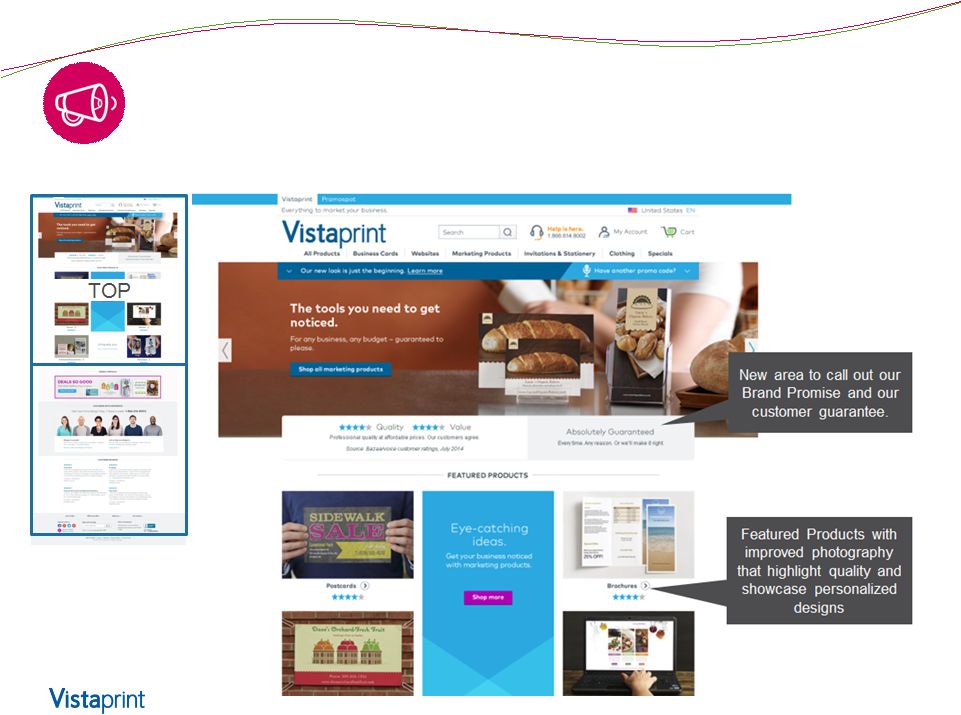

Communications Evolution: More

Brand-Forward Site

28 |

Communications Evolution: More

Brand-Forward Site

29 |

Customers want and need Design Help

30

Received Design Assistance

(DIWH or DIFY) in the L12M

They lack the skill, both artistic and

technical, and time to do it themselves

“If I have to do it

myself, I’m not a pro

and I don’t know how to

do the technical things

like uploads and layout”

Claudia, HE, Germany

They want a customized design,

even

with DIY templates

“I want the design to be

unique to me….

I see even templates as

a starting point for

customization”

Various, HE/PP, US and EU |

DIY

Templates and Build a Design

DIWH-

Recreation Services

DIFY-

Custom Design

Design Services: Examples across the continuum

31 |

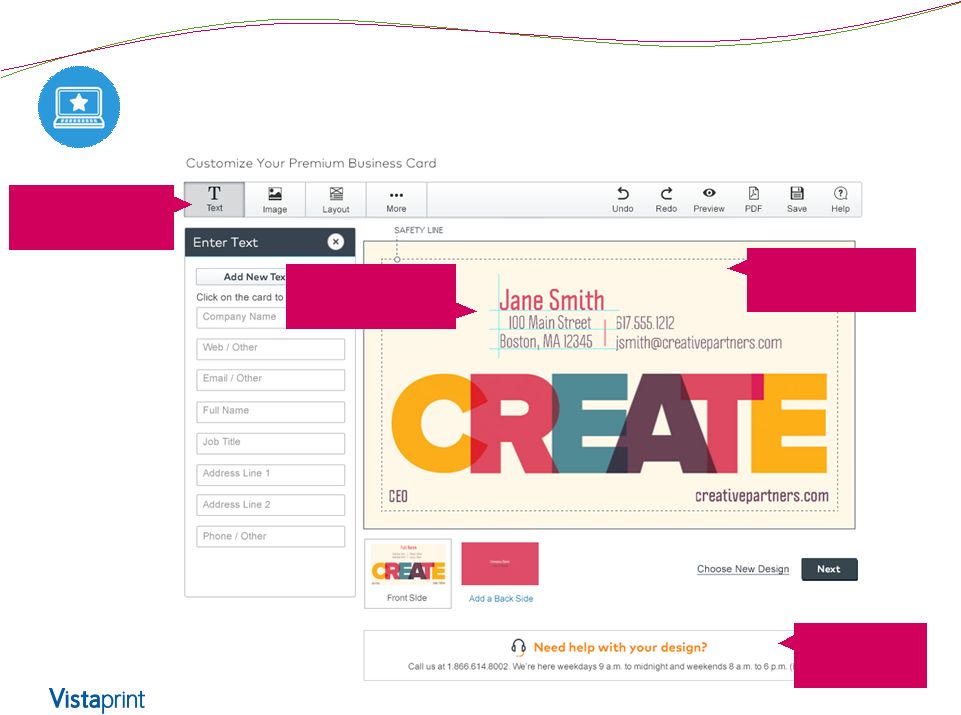

Website Experience: New Design Studio

32

Smart guides for

easy alignment

Tablet-friendly

user interface

Error detection

Access to

support |

Website Experience: Product Rendering

33

33

Our new rendering technology allows customers to see their personalized

product in a real-life context. We measured a significant conversion rate

increase and reduced design complaint rates with these photo-realistic

previews. Spot Gloss Animation

Dynamic Image Preview

Standard Product Preview |

34

Easy Process

Before & After |

Product Offering Evolution: Delivered Quality

35

Planned initiatives to improve

Delivered Quality:

1.

Pre-printing design checks

2.

DIY error detection

Only half of customer dissatisfaction with quality is Vistaprint

controllable

Vistaprint

Controlled

Unknown

Customer

Design

Errors |

Product Offering Evolution: Expanded

assortment to increase category credibility

36

36

From

a limited selection

per category

To

credible

assortment |

Product

Offering

Evolution:

Digital -Physical

Innovation

37

Facebook Postcard Distribution

Use your postcard design to generate

a matching Facebook ad

Turn nearby Facebook users into

customers

Quick and easy way to trial social

media marketing

Strong take rate during vapor testing

indicated customer demand

37 |

Pricing

Evolution:

Rationale

for

“

Reinvents”

38

•

Customers did not like our high shipping

prices; we weren’t e-commerce standard with our shipping

as a % of order value •

Too proactive up-

and cross-selling hurt customer trust and

satisfaction, especially charging for digital items like image

uploads •

We were encouraging a focus on price with the

inconsistency in pricing across

channels –

we trained customers to hunt for the lowest prices

•

Customers were flocking to paid channels, where

the prices were often the lowest (most competitive), creating less

acquisition efficiency |

Pricing Evolution: maintaining PP leadership

39

Introducing lower quantities for our lead offer at a lower face price

|

Pricing Evolution: balancing segment needs

40

Targeting HE vs. PP with different quantities/price points to increase

relevance |

Vistaprint Brand Overview

41

Context for our performance and brand evolution

FY 2014 investment examples

Why we are confident |

Canada’s growth has been driven by a

number

of

KPIs,

some

of

which

we’

re

starting to see in other, reinvented countries

42

Promising

trends in profit

per customer

Improved spend

leverage

Improvements

in customer

satisfaction

Better retention |

Signs of Progress -

Canada

43

Better retention

Improved spend leverage

Improvements in customer satisfaction

Promising trends in profit per customer

YoY

change |

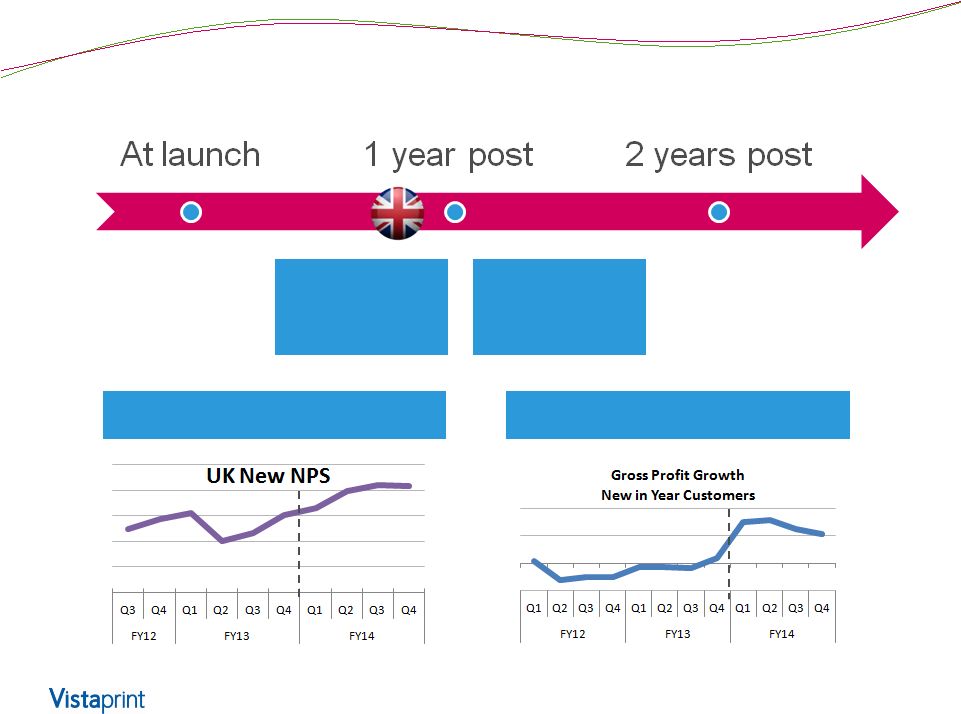

Promising

trends in profit

per customer

Signs of Progress -

UK

44

Improvements

in customer

satisfaction

Improvements in customer

satisfaction

Promising trends in profit per

customer |

Signs of Progress –

U.S. and Germany

45

Improvements

in customer

satisfaction |

Why

do the Pricing Reinvents take so long to see improvements to Repeat

Rates? 46 |

47

•

Higher quality customers

•

More efficient advertising

•

Stronger brand loyalty

What we expect to see long term with this

strategy |

Real, Unscripted Customers

48 |

Investor Day 2014 |

Manufacturing and

Supply Chain (M+S)

Don Nelson

President, Software and Manufacturing Platform

Investor Day 2014 |

Manufacturing

+

Supply

Chain

Overview

51

Current State of M+S

o

Our network and capabilities

o

Scale advantage through operational excellence

•

Superior quality and conformance

•

Low COGS

Changes to support our strategy

o

M+S and the Orion fulfillment system

o

Expanded selection

o

Commitment to conformance

o

Transferring scale advantage through PMI |

Manufacturing + Supply Chain: Who we are

52

•

M+S is a unit deeply committed to providing distinctive

speed and value to our customers while operating with

best-in-class internal costs and maintaining a highly safe

and nurturing workplace for our employees

Manufacturing & Supply Chain

Manufacturing operations (COGS)

>1,000

FTE

Manufacturing + SC capabilities

(OPEX)

>160

FTE |

M+S

operates a global delivery organization with > $1 billion in

output 53

Prod. plant

Windsor, CA

>500,000 ft

2

Software

Development

Lexington, MA

Prod. plant

Ypenburg, NL

Albumprinter

> 64,000 ft2

Prod. plant

Venlo, NL

>320,000 ft2

Design/Tech

Center

Winterthur, CH

>160 FTE

Prod. Plant

Treviso, IT

Pixartprinting

170,000 ft2

Asia Sourcing

Hong Kong

Prod. plant

Bhiwandi, IN

(Mumbai)

Launched Sept

2012

>27,000 ft2

Prod. plant

Deer Park, AU

>110,000 ft2

Vistaprint M&S globally 2014:

•

9 locations

•

~$1.1 billion output

•

Serves major worldwide markets |

Manufacturing –

Capturing scale advantage

•

M+S is concluding a 3-year program that

greatly improved our operational

capabilities and performance

•

This has reinforced our unique

competitive advantage of combining scale

and

operational

excellence

in

a

mass

customization environment

•

As a result, we have improved our

delivery of customer value while capturing

significant reductions to key areas of

COGS

54 |

We

have driven operational improvements in many key customer

facing areas 55

Improved speed,

quality, consistency,

and efficiency assure

excellent

conformance

to

customer expectations

at low cost

-72%

-38%

Quality Complaints

Production Throughput Time

2010

2014

2010

2014

2010

2014

Late Deliveries

-62%

+48%

Direct Labor Productivity

2010

2014

(-10% YOY Q4 FY14)

(+12% YOY Q4 FY14)

(-14% YOY Q4 FY14)

(-10% YOY Q4 FY14) |

Combining scale advantage in ways others

cannot match

56

>5.5 billion business cards,

4 million

signs, 5.6 million

garments per year

>90,000

orders shipped per

average day with a focus on

lean manufacturing

>$1.2 billion

output/yr from

>1 million ft

2

of plant space,

with 24 hour operation

Very little direct labor

per order shipped

Excellent shipping rates

and service through

scale-based relationships

Very Low material costs

and waste levels |

This scale and performance optimization has a

material impact on COGS and margin

57

Savings are

deployed to

fund

investments

in quality,

offset

inflation, or

increase

gross margin

•

ROIC:

increasing levels of volume and

revenue flowing across equipment and

facilities with 24 hours of daily

production

•

Shipping:

channeling

the

power

of

90,000 shipments per day to get the

best rates and service

•

Raw

material:

using

the

scale

advantage from 150,000 lbs. of daily

usage to drive superior material prices

•

Direct

labor:

using

proprietary

scheduling along with lean production

to significantly improve labor efficiency |

Next Wave: Product Diversity

58

•

Even as we offer costs well below

competitors

•

3 to 5 year project similar in scope

and ambition as just finished

•

Includes:

o

Product types –

breadth and depth

o

Delivery options

o

Decoration method

o

Quantity available

Today we offer 8 colors of Men’s

embroidered polo

shirts.

In the future, we want much higher

selection across

multiple

product categories. |

Manufacturing + Supply Chain Overview

59

Current State of M+S

o

Our network and capabilities

o

Scale advantage through operational excellence

•

Superior quality and conformance

•

Low COGS

Changes to support our strategy

o

M+S and the Orion fulfillment system

o

Expanded selection

o

Commitment to conformance

o

Transferring scale advantage through PMI |

M+S

is

now

part

of

Orion,

a

platform

that

is

creating

scale

advantage

through

selection,

cost,

and

conformance

60

•

Multiple customer facing brands all leveraging mass

customization through shared computer integrated

manufacturing platform

Shared Computer-Integrated

Manufacturing Platform

New

Geographies |

Why

this is difficult 61

•

SKU management without

inventory proliferation

•

Data systems to manage

massive increase in substrates

•

Off-the-shelf equipment either

o

Small job shop –

unreliable,

high unit costs

o

Mass volume –

high set up

costs not economic for small

order volumes

•

We want to do it differently

o

Innovative use of digitally

driven equipment

o

Proprietary production

methods developed in

over past 3 years –

all

capable of extremely low

units

o

E.g., embroidery |

…

Platform to move toward a “long tail”

selection

62

Product line (category)

…

…

…

Traditional

Vistaprint

Conceptual

Flexible

Automation

Product & delivery platform

Product and Delivery Platform

Fringe products

Not offered

Outsourcing,

potentially in-sourced

decoration for low quantity |

Dramatically increasing SKU selection

63

~600

~1800

~3300

~5700

Vistaprint

SKUs, start

of FY14

SKUs of

acquired

companies in

FY14

SKUs of

apparel, soft

goods and

other

products

planned in

FY15 (in

Beta phase)

Total potential

SKUs

M+S is increasing

selection by

>800% with Orion,

and we plan to

increase even

further over time |

Example: Signage from acquired companies

64

Before

After

We will materially expand our signage offering for the Vistaprint

brand starting in H2 FY15 with knowledge from People & Print

Group and Pixartprinting

•

10 –

15 banner sizes

•

New substrates

•

New features like reinforced

grommets, roll-up banner stands

•

Plus, signage extensions in posters,

signs, decals and more! |

Example: radical increase to apparel & soft

goods selection

65 |

Distinctive internal M+S capabilities will drive

our entry in the apparel & soft goods market

66

By Q3 of FY15 we plan to make a large portion of the (currently

beta) product line available starting at QUANTITIES OF ONE

Traditionally high file processing and setup costs mean that the

market does not effectively serve small customized quantities –

therefore most logo apparel and soft goods products were out of

reach for the micro-business market

Multi-year manufacturing capabilities and supply chain strategies

we are making are designed to break this constraint |

Large Scale in Small Quantities

67

Quantity of custom decorated items in a given order

Low Volume

High Volume

Vistaprint

(currently in

development)

Traditional resellers

of apparel & soft

goods importers

and decorators

Asian and other

LCC suppliers to

apparel & soft

goods importers |

The

conformance lever: we will have great consistency while

expanding selection 68

As we further

develop our unique

approach to mass

customization, we

are building the

capability to

improve

conformance while

simultaneously

increasing

selection

Customization & Selection Level

VPNV today*

Our planned trajectory

* Conformance has actually been improving while selection is increasing

Traditional Manufacturing Approaches

Level of Conformance

Few, standard products

Many, custom products |

We

leverage our scale advantage & capabilities as we greatly

expand selection 69

Level of advantage when offering high selection levels

Automated file

preparation software

Specialized lean direct

labor optimization

Fully automated high-

volume processing

lines

Volume material cost

advantage

Volume shipping cost

advantage

Equipment / facility

utilization advantage

No cost

advantage

Limited cost

advantage

Significant cost

advantage

Great cost

advantage |

Cost: We are transferring our capabilities

and scale advantages to new acquisitions

and partners

70

Two pillars of transferrable cost advantage:

Orion makes these

advantages modular

and

easy to transfer.

Example: Albumprinter

achieved post-acquisition:

•

Reduction in cost of

purchased materials

•

Increased labor

productivity

•

Lower production

throughput time

Unique Capabilities

brought by VPNV:

•

Proprietary software

•

Patented scheduling

approach

•

Lean application in

mass customization

•

Proprietary

production platforms

Improved Scale from

joining with VPNV:

•

Production scale

•

Material purchasing

scale

•

Supply chain &

logistics scale

•

Engineering scale |

Summary

71

•

Established history of technology-enabled operational

advantage has led to improvements in quality, cost, reliability

and throughput time

•

Proactively investing to further traditional advantages

•

Building new capabilities that likewise break traditional

constraints of low-volume production while maintaining low

costs

•

All in support of goal to build a common back-end platform

where scale drives advantages to conformance, selection and

cost |

Investor Day 2014 |

Long-Term Financial Strategy

Ernst Teunissen

EVP and Chief Financial Officer

Investor Day 2014 |

Long

-Term

Financial

Strategy

74

•

Maximize long-term intrinsic value per share

(DCF/share)

•

In our core business return to pre-FY12 margins, while

continuing to invest for long-term health and growth

•

Use cash flow and balance sheet to drive DCF/share

beyond core business:

o

Synergistic M&A

o

Share repurchases

•

Prioritize by comparing cash returns between the above

levers |

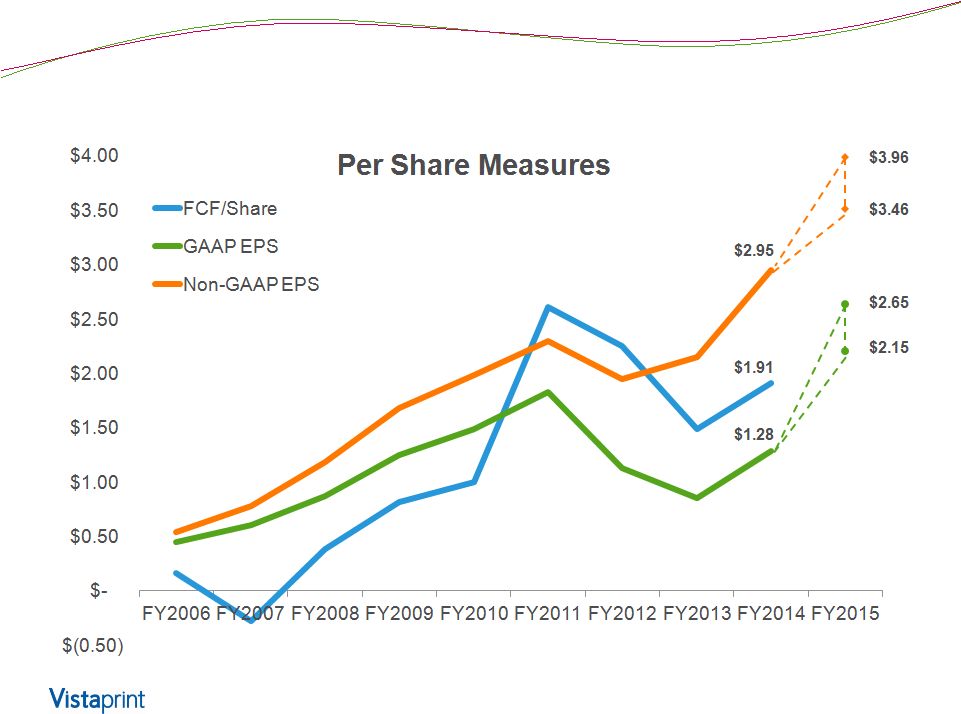

Still early in our journey

75

FY15 GAAP and non-GAAP EPS guidance as of July 30, 2014

Please see non-GAAP reconciliation at the end of this deck

|

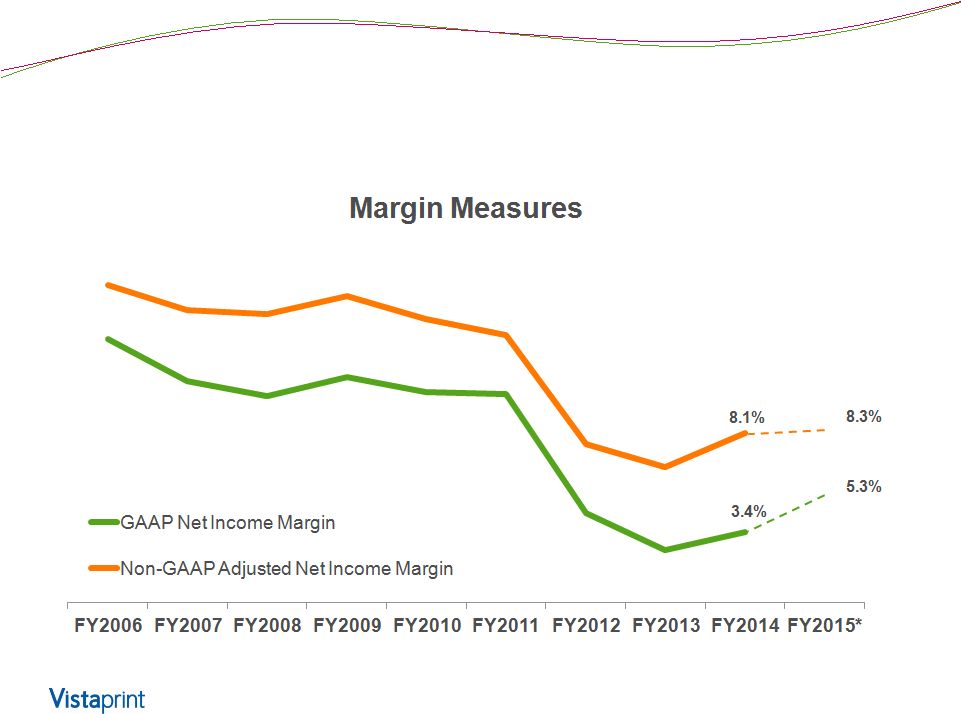

After

two

years

of

investment

in

advertising

and

opex,

increasing

margins

in

FY13 -15

76

*Midpoint Net Income margin guidance for fiscal year 2015 provided on July 30,

2014 |

Margins improving most in advertising and G&A

77

P&L line items as a percent of revenue |

Expect to continue margin expansion in FY15

Select P&L

Line Items

(as % of

revenue)

FY2014

Actual

FY2015

Midpoint

Guidance

Comments:

Expectations excluding

Recent Acquisitions*

Comments:

Expected Impact of

Recent Acquisitions*

Gross Margin

64.5%

~60% -

62%

Increased manufacturing

productivity, offset by investments

in product quality and selection,

Significant impact from lower GM of

acquired companies

Advertising

21.1%

~20%

Opportunity for slight investment for

Vistaprint brand if we believe

returns are there

Lower ad spend at acquired

companies more than offsets any

investments in Vistaprint brand

Other

Operating

Expense

36.6%

~34% -

35%

Drive for efficiencies in G&A

functions partially offset by targeted

Technology investments

Integration costs related to

acquisitions

Operating

Income

6.8%

Slightly

higher

Slowing down headcount growth,

drive for efficiencies

Accretive to OI $, but dilutive to OI

margin

Net Income

3.4%

~5.3%

Nonrecurrence of Namex losses

lifts FY15 margin

Increased interest expense from

recent borrowing partially offsets

Namex lift

Slower OI expansion than FY14, but FY14 was greater than originally planned;

Acquisitions disrupt margin distribution

*People & Print Group, Pixartprinting and FotoKnudsen

|

Significant investments: Vistaprint brand

79

•

Continued upgrades to product substrates, formats and

shipping options

•

Pricing and marketing changes in remaining European

markets

•

Opportunity to increase advertising as a percent of

revenue for Vistaprint brand

•

Design service expansions |

Significant investment: new capabilities

80

Additional investments beyond those we are making to reposition the

“Vistaprint” brand.

New Product Capabilities

Platform to Support

Multiple Front Ends

New Geographies |

M&A Approach

81

•

As discussed for years, scale matters in our business model

o

Lower unit costs (supply chain, production focus & automation)

o

Expansion of product breadth and delivery options

o

Quality and engineering systems

•

Increasing interest in pursuing M&A to accelerate scale

o

Brands that are differentiated from our “Vistaprint”

brand

o

Yet which can benefit from and add to a common operational

platform to drive scale-based competitive advantages

•

Determined to be disciplined, only pursue opportunities that meet

o

Strategically clear objectives

o

Risk-adjusted IRR better than alternative investments (& WACC)

|

Share Repurchases can be a powerful driver

of FCF per share

82

We

have

reduced

our

share

count

by

26%

since

the

end

of

FY10;

we

compare

any

allocation

of

capital

for

M&A

or

the

business

against

additional

share

repurchases

FY10

FY11

FY12

FY13

FY14

Shares

outstanding (MM)

43.9

43.1

34.1

32.8

32.3

Shares

purchased (MM)

-

1.3

9.9

1.9

1.0

Average cost per

share

-

$42.91

$31.28

$34.77

$40.24

Total purchase

spend ($MM)

-

$56.9

$309.7

$64.4

$42.0

Cumulative

Accretion to

FCF/share*

$0.04

$0.33

$0.39

$0.54

*Accretion

to

FCF/share

does

not

take

into

account

the

increased

interest

expense

from

funding

the

repurchases.

It

is

calculated

by

comparing

actual

FCF/share

to

a

hypothetical

FCF/share,

in

which

the

weighted

share

count

for

each

period

is

adjusted

(increased)

by

the

weighted

cumulative

effect

of

repurchases

up

to

that

date.

See

non-GAAP

reconciliations

at

the

end

of

this

presentation. |

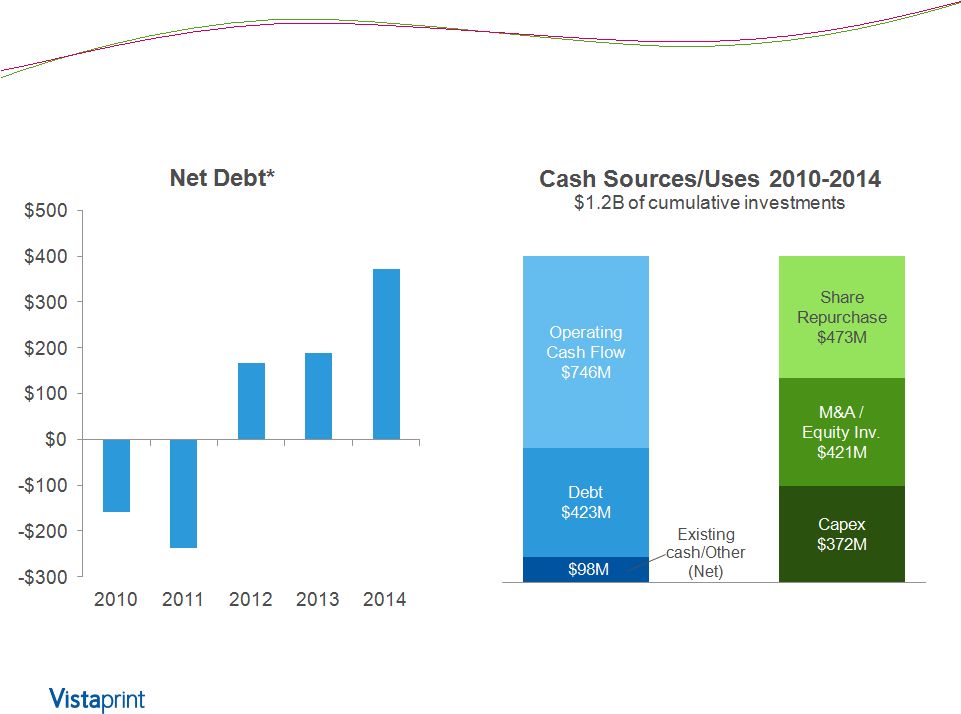

Sources and Uses of Capital

83

* Net debt defined as bank debt less cash and cash equivalents

|

Financial Leverage

84

•

June 30, 2014 bank debt of $448M

o

Committed credit facility $794M

($640M revolver, $154M term loan A)

o

Floating rate debt at 1.81% (2.06% including swaps)

o

Leverage (Debt/TTM EBITDA) at 2.5x pro forma*

•

Total leverage covenant currently 3.25x

o

Q1 FY15 additional borrowing capacity limited to $153M pro

forma*

•

Total leverage covenant for M&A and share repurchases

currently 2.75x on proforma basis (additional limits can apply)

* Proforma includes impact of July 1, 2014 acquisition of Fotoknudsen AS

|

Capital Structure Philosophy and Outlook

85

•

Given cost of borrowing we believe medium/long-term

leverage levels as allowed in credit facility are attractive

assuming we continue to find high-returning

opportunities to invest in

o

If opportunities are not there, FCF generated will

naturally decrease our leverage by paying down Revolver

o

For the right opportunities we could see leverage

temporarily go up

•

We will continue to evaluate various instruments,

including longer-term debt (not included in guidance)

|

Summary

86

•

We continue to have multiple levers for driving long-term

profit and cash flow growth

•

We have demonstrated profit margin and FCF growth

and expect to continue this focus over a multi-year

period

•

We believe the investment options we have created by

leveraging our balance sheet are creating long-term

shareholder value |

Investor Day 2014 |

Closing Remarks

Robert Keane

President and Chief Executive Officer

Investor Day 2014 |

89 |

Our

Focus: Mass Customization 90 |

Vistaprint means different things to different

stakeholders

91

•

Increasing divergence between Vistaprint the brand and

customer value proposition and Vistaprint the

corporation

•

Strategy to preserve the differentiation and

independence of acquired company brands, as well as

the Vistaprint brand

Compelling reasons to change the name

of the corporate parent company |

92 |

93 |

Next Steps

94

•

This is a corporate name change, not a change to any

customer-facing brands

•

As a Dutch company, a name change requires

shareholder approval

•

This proposal will be on the ballot for our 2014 Annual

Meeting in November

•

We would expect the name change to take effect along

with a corresponding change to our ticker symbol shortly

after the Annual Meeting |

Our

Big Picture Steadfast in our belief that we can drive excellent

long-term returns by consolidating our industry

•

Vistaprint brand

•

Thoughtful M&A

•

Shared CIM platform

We are committed to growing DCF per share

95 |

Investor Day 2014 |

Non-GAAP Reconciliation and

Reference Information

Investor Day 2014 |

About

non-GAAP financial measures

To

supplement

Vistaprint’s

consolidated

financial

statements

presented

in

accordance

with

U.S.

generally

accepted

accounting

principles,

or

GAAP,

Vistaprint

has

used

the

following

measures

defined

as

non-

GAAP financial measures by Securities and Exchange Commission, or SEC, rules:

non-GAAP adjusted net income, non-GAAP adjusted net income per

diluted share, free cash flow, trailing twelve month return on invested

capital, constant-currency revenue growth and constant-currency revenue growth excluding

revenue from fiscal 2014 acquisitions. Please see the next slide for definitions

of these items. The presentation of non-GAAP financial information is

not intended to be considered in isolation or as a substitute for the

financial information prepared and presented in accordance with GAAP. For more

information on these non-GAAP financial measures, please see the tables

captioned “Reconciliations of Non-GAAP Financial

Measures” included at the end of this release. The tables have more

details on the GAAP financial measures that are most directly comparable to

non-GAAP financial measures and the related reconciliation between these

financial measures. Vistaprint’s management believes that these

non-GAAP financial measures provide meaningful supplemental information

in assessing our performance and liquidity by excluding certain items that may

not be indicative of our recurring core business operating results, which could be

non-cash charges or discrete cash charges that are infrequent in

nature. These non-GAAP financial measures also have facilitated

management’s internal comparisons to Vistaprint’s historical performance and our competitors’

operating results.

98 |

Non-GAAP Financial Measures Definitions

99

Non-GAAP Measure

Definition

Non-GAAP Net

Income/EPS

The items excluded from the non-GAAP adjusted net income measurements are

share-based compensation expense and its related tax effect,

amortization of acquisition-related intangibles, tax charges related to the

alignment

of

acquisition-related

intellectual

property

with

global

operations,

changes

in

unrealized

gains

and

losses on currency forward contracts, unrealized currency transaction gains and

losses on intercompany financing arrangements and the related tax effect,

the charge for the disposal of our minority investment in China, and the

change in fair-value estimate of our potential acquisition-related earn-outs.

Non-GAAP weighted average shares outstanding excludes the impact of

unamortized share-based compensation included in the calculation of

GAAP diluted weighted average shares outstanding. Free Cash Flow

FCF = Cash Flow from Operations –

Capital Expenditures –

Purchases of Intangible assets not related to

acquisitions –

Capitalized Software Expenses

Trailing Twelve Month

Return on Invested Capital

ROIC = NOPAT / (Debt + Equity –

Excess Cash)

Net operating profit after taxes (NOPAT)

Excess cash is cash and investments of 5% of last twelve month revenues

Operating leases have not been converted to debt

Non-GAAP TTM ROIC excludes share-based compensation expense and its

related tax effect, amortization of acquired intangibles, charges related

to the alignment of Webs IP with our global operations, changes in

unrealized gains and losses on currency forward contracts, and unrealized currency

transaction gains and losses on intercompany financing arrangements and the

related tax effect Excess cash definition updated in period ending

03/31/2013 and for prior periods. Constant-Currency

Revenue Growth

Constant-currency revenue growth is estimated by translating all non-U.S.

dollar denominated revenue generated in the current period using the prior

year period’s average exchange rate for each currency to the U.S.

dollar and excludes the impact of gains and losses on effective currency hedges

recognized in revenue in the prior year periods.

Constant Currency

Revenue Growth, excluding

FY14 Acquisitions

Constant-currency revenue growth excluding revenue from fiscal 2014

acquisitions excludes the impact of currency as defined above and revenue

from People & Print Group and Pixartprinting. |

Reconciliation:

GAAP

to

Non-GAAP

Results

Net

Income

(Loss)

–

Annual

($ in thousands)

FY 2006

FY 2007

FY 2008

FY 2009

FY2010

FY2011

FY2012

FY2013

FY2014

GAAP Net Income

$19,234

$27,143

$39,831

$55,686

$67,741

$82,109

$43,994

$29,435

$43,696

Share-based compensation

and related tax effect

$4,850

$8,765

$15,275

$20,177

$23,156

$22,400

$26,060

$33,662

$28,520

Amortization of acquired

intangible assets

-

-

-

-

-

-

$5,754

$10,361

$12,187

Tax Impact of Webs IP

transfer

-

-

-

-

-

-

$1,235

$2,387

$2,320

Changes in unrealized (gain)

loss on currency forward

contracts included in net

income

$425

Unrealized currency

transaction loss (gain) on

intercompany loan and the

related tax effect

$585

Loss on disposal of Namex

investment

$12,681

Change in fair value of

contingent consideration

$2,192

Non-GAAP

Adjusted Net Income

$23,146

$35,908

$55,106

$75,863

$90,897

$104,509

$77,043

$75,845

$102,606

Revenue

$152,149

$255,933

$400,657

$515,826

$670,035

$817,009

$1,020,269

$1,167,478

$1,270,236

GAAP Net Income as a

percent of revenue

12.6%

10.6%

9.9%

10.8%

10.1%

10.0%

4.3%

2.5%

3.4%

Non-GAAP Net Income as a

percent of revenue

15.2%

14.0%

13.8%

14.7%

13.6%

12.8%

7.6%

6.5%

8.1%

100 |

Reconciliation: GAAP to Non-GAAP Results

Diluted Earnings Per Share -

Annual

FY 2006

FY 2007

FY 2008

FY 2009

FY2010

FY2011

FY2012

FY2013

FY2014

GAAP Net Income per share

$0.45

$0.60

$0.87

$1.25

$1.49

$1.83

$1.13

$0.85

$1.28

Share-based Compensation

and related tax effect per

share

$0.09

$0.18

$0.31

$0.43

$0.49

$0.47

$0.65

$0.95

$0.82

Amortization of acquired

intangible assets per share

-

-

-

-

-

-

$0.14

$0.29

$0.35

Tax Impact of Webs IP

Transfer per share

-

-

-

-

-

-

$0.03

$0.06

$0.06

Changes in unrealized (gain)

loss on currency forward

contracts included in net

income per share

$0.01

Unrealized currency

transaction loss (gain) on

intercompany loan and the

related tax effect per share

$0.01

Loss on disposal of Namex

investment

$0.36

Change in fair value of

contingent consideration

$0.06

Non-GAAP Adjusted Net

Income per share

$0.54

$0.78

$1.18

$1.68

$1.98

$2.30

$1.95

$2.15

$2.95

Weighted average shares

used in computing Non-

GAAP EPS

(millions)

42.651

45.825

46.780

45.099

45.989

45.448

39.426

35.201

34.793

101 |

Reconciliation: GAAP to Non-GAAP Results

Free Cash Flow-

Annual

($ in thousands, except share and per share amounts and as noted)

FY 2006

FY 2007

FY 2008

FY 2009

FY2010

FY2011

FY2012

FY2013

FY2014

Net cash provided by

operating activities

$34,637

$54,240

$ 87,731

$120,051

$153,701

$162,634

$140,641

$140,012

$148,580

Purchase of property, plant,

and equipment

($24.929)

($62,845)

($62,740)

($76,286)

($101,326)

($37,405)

($46,420)

($78,999)

($72,122)

Purchases of intangible

assets not related to

acquisitions

-

-

($1,250)

-

-

($205)

($239)

($750)

($253)

Capitalization of software

and website development

costs

($2,656)

($4,189)

($5,696)

($7,168)

($6,516)

($6,290)

($5,463)

($7,667)

($9,749)

Free Cash Flow

$7,052

($12,794)

$18,045

$ 36,597

$45,859

$118,734

$ 88,519

$52,596

$66,456

Weighted average shares

used in computing Non-

GAAP EPS*

(millions)

42,651

45,825

46,780

45,099

45,989

45,448

39,426

35,201

34,793

Free cash flow per share

$ 0.17

($0.28)

$0.39

$0.81

$1.00

$2.61

$2.25

$1.49

$1.91

*GAAP weighted average/diluted shares for the full year used in FY 2006 and FY

2007 calculations, as Non-GAAP share count is not available.

102 |

Reconciliation:

Constant-Currency/ex. Acquisition Revenue Growth Rates

Quarterly

ASIA-PACIFIC

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

Q3 FY13

Q4 FY13

Q1 FY14

Q2 FY14

Q3 FY14

Q4 FY14

Reported revenue growth

67%

41%

47%

28%

28%

26%

6%

4%

(11%)

(5%)

(3%)

3%

Currency impact

(22%)

(4%)

(7%)

5%

2%

(3%)

4%

4%

13%

11%

13%

5%

Revenue growth in constant

currency

45%

37%

40%

33%

29%

24%

10%

8%

2%

6%

10%

8%

EUROPE

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

Q3 FY13

Q4 FY13

Q1 FY14

Q2 FY14

Q3 FY14

Q4 FY14

Reported revenue growth

31%

36%

29%

18%

12%

11%

8%

3%

6%

1%

(4%)

50%

Currency impact

(10%)

1%

5%

12%

11%

2%

0%

(1%)

(4%)

(3%)

(3%)

(7%)

Revenue growth in constant

currency

21%

37%

34%

30%

23%

14%

8%

2%

2%

(2%)

(7%)

43%

Impact of FY14 acquisitions

(45%)

Revenue growth in constant

currency ex. FY14 acquisitions

(2%)

103 |

Reconciliation:

Constant-Currency/ex. Acquisition Revenue Growth Rates

Quarterly

NORTH AMERICA

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

Q3 FY13

Q4 FY13

Q1 FY14

Q2 FY14

Q3 FY14

Q4 FY14

Reported revenue growth

17%

20%

23%

20%

22%

20%

15%

18%

14%

13%

2%

6%

Currency impact

0%

0%

0%

0%

0%

0%

0%

0%

1%

1%

1%

1%

Revenue growth in constant

currency

17%

20%

23%

21%

22%

20%

15%

18%

15%

14%

3%

7%

TOTAL COMPANY

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

Q3 FY13

Q4 FY13

Q1 FY14

Q2 FY14

Q3 FY14

Q4 FY14

Reported revenue growth

25%

28%

26%

20%

18%

16%

12%

12%

9%

6%

(1%)

21%

Currency impact

(5%)

0%

2%

5%

5%

1%

0%

0%

0%

0%

0%

(2%)

Revenue growth in constant

currency

20%

28%

28%

25%

23%

17%

12%

12%

9%

6%

(1%)

19%

Impact of FY14 acquisitions

(15%)

Revenue growth in constant

currency ex. FY14 acquisitions

4%

104 |

Reconciliation:

Constant-Currency /ex. Acquisition Revenue Growth Rates

Annual

FY2010

FY2011

FY2012

FY2013

FY2014

Reported revenue growth

30%

22%

25%

14%

9%

Currency impact (favorable)/unfavorable

(2%)

-

0%

2%

(1%)

Revenue growth in constant currency

28%

22%

25%

16%

8%

Impact of FY14 acquisitions to growth in constant currency

(favorable)/unfavorable

-

-

-

-

(4%)

Revenue growth rate, ex FY2014 acquisitions, in constant

currency

28%

22%

25%

16%

4%

105 |

FY2014

North America

Europe

Asia-Pacific

Total Company

Reported revenue growth

9%

11%

(4%)

9%

Currency impact (favorable)/unfavorable

-

(4%)

10%

(1%)

Revenue growth in constant currency

9%

7%

6%

8%

Impact of FY14 acquisitions to growth in constant

currency (favorable)/unfavorable

-

(10%)

-

(4%)

Revenue growth rate, ex 2014 acquisitions, in

constant currency

9%

(3%)

6%

4%

Reconciliation:

Constant-Currency/ex. Acquisition Revenue Growth Rates by Region

Annual

106 |

Revenue and EPS Guidance*

(as of July 30, 2014)

The

Company

is

providing

the

following

assumptions

to

facilitate

non-GAAP

adjusted

net

income

per

diluted

share

comparisons

that

exclude

share-based

compensation

related

expenses,

amortization

of

acquired

intangible

assets,

tax

charges

related

to

the

alignment

of

IP

with

our

global

operations,

changes

in

the

fair-value

estimate

of

acquisition-related

earn-outs,

changes

in

unrealized

gains

and

losses

on

currency

forward

contracts,

and

unrealized

currency

transaction

gains

and

losses

on

intercompany

financing

arrangements:

FY15

ending 06/30/2015

Revenue

$1,470 -

$1,540

Revenue growth from FY 2014 period

16% -

21%

Constant currency revenue growth estimate

15% -

20%

GAAP EPS

$2.15 -

$2.65

EPS growth from FY 2014 period

68% -107%

GAAP share count

33.3 million

FY15

ending 06/30/2015

Non-GAAP adjusted EPS

$3.46 -

$3.96

EPS growth from FY 2014 period

17% –

34%

Non-GAAP share count

33.8 million

Non-GAAP exclusions

$45.4

* Millions, except share and per share amounts and as noted

107

Consolidate

d |

Capital Expenditures Guidance

(as of July 30, 2014)

Expressed as percent of revenue

Actuals

Guidance

$63M

$63M

$76M

$100M

$80M

$101M

$37M

Consolidate

d

$46M

$79M

$72M

108 |